Natural Language Processing (NLP) Market by Component (Solutions & Services), Application (Sentiment Analysis, Social Media Monitoring), Technology (IVR, OCR, Auto Coding), Vertical (BFSI, Retail & eCommerce, IT & ITES) & Region - Global Forecast to 2027

Natural Language Processing (NLP) Market Size, Share, Statistics

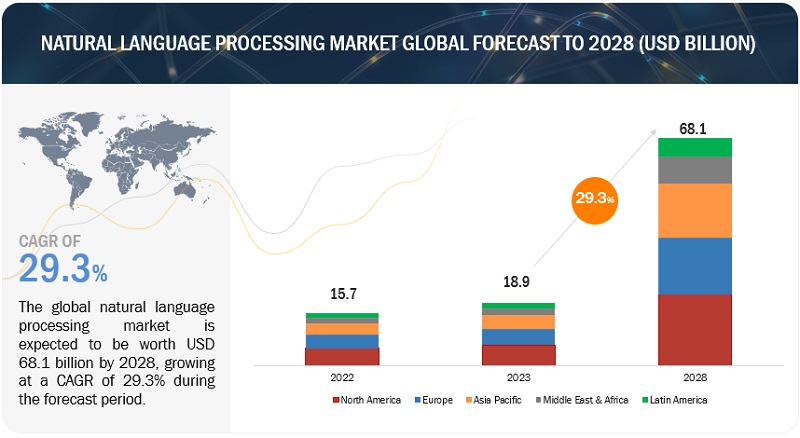

The global natural language processing (NLP) market was worth $15.7 billion in 2022. It is expected to grow to $49.4 billion by 2027, at a compound annual growth rate (CAGR) of 25.7%.

The component segment includes Solutions, and Services. The type segment includes Rule based, Statistical, and Hybrid. The technology segment includes Auto Coding, Text Analysis, Speech Analytics, OCR, IVR, and Image & pattern recognition. The application includes Sentiment Analysis, Text Classification and summarization, customer experience management, Virtual Assistants/ chatbots, Employee onboarding and recruiting , Social Media Monitoring , and others (branding & advertising, lead generation, and risk & compliance management). Various factors such as developments in text analyzing computer programs, increase in investments across healthcare sectors, and growing demand for enterprise solutions to streamline business operations for better customer experience are expected to drive the adoption of NLP.

To know about the assumptions considered for the study, Request for Free Sample Report

Key trends impacting NLP market

Advanced NLP techniques are now able to accurately assess in real-time the sentiment, toxicity, and hot topics of conversation occurring in a workplace. NLP solutions tools provide managers unprecedented real-time insight into an organization’s collaboration environment.

Utilizing NLP tools to assess brand sentiment can assist businesses in identifying areas for improvement, detecting negative comments on the fly (and responding proactively), and gaining a competitive advantage. With advances in NLP and rising customer service demand, firms can expect to see significant growth in the development of next generation of chatbots with self-improvements, hold more complex conversations, and capabilities to complete new tasks without prior training. NLP is also expected to become more common in areas that need to understand user intent such as intelligent chatbots and semantic search. Along with the growing use of deep learning as well as unsupervised and supervised machine learning, the NLP technology are expected to endure to form the communication capacity of cognitive computing.

Market Dynamics

Driver: Surging demand for cloud-based solutions for better scalability and enhanced security

The exponential growth in cloud services offers huge space for NLP vendors to grow and expand geographically. Cloud computing is proving to be beneficial for businesses of all sizes. Several solution providers are deploying the solution on demand for their customers, shifting the trend toward the cloud-based IT framework. The implementation and hardware costs for AI technologies are high, and not all retailers have dedicated IT resources and robust infrastructure. The high implementation cost is one of the major factors for businesses accessing NLP solutions through cloud-based deployments. Cloud-based solutions reduce the upfront costs and eliminate concerns related to the maintenance of servers. Hence, cloud-based AI solutions are useful as they improve scalability and are cost-effective for SMEs and large organizations that find on-premises solutions expensive. The increasing adoption of cloud-based technology and IoT is a great opportunity for AI solution providers, which would eliminate concerns related to expenditure and installation expenses.

Restraints: Limitations in the development of NLP technology using neural networks that may restrict the usage of cloud-based services

NLP is a technology that utilizes neural networks and deep learning techniques for sequential data, such as text, time series, financial data, speech, audio, and video. Neural networks and deep learning are the most advanced technologies that pave the way for NLP to gain traction in the market. However, the development of these technologies is expensive and requires a huge investment in terms of R&D capital as well as time, which is not easy for small or Startup companies that need to position themselves in the natural language processing market. The neural network facilitates accurate speech and voice recognition capabilities in NLP for higher capacity. It also computes the huge voice data generated by users to understand the context. However, neural network algorithms are expensive and complex and can only be managed by key players, such as Apple (US), Microsoft (US), and Google (US). These major companies are using NLP technology to market their products and access cloud services based on speech and voice recognition networks' neural networks. Small players in the NLP market may not be able to invest in developing neural networks due to the heavy infrastructure cost involved. Thus, it restricts the market growth as small players are unable to contribute sufficiently.

Opportunity: Rise in investments across healthcare sectors to analyse huge amount of patient’s data

The healthcare industry is generating a huge amount of data nowadays, with an increased pace of digitalization among hospitals and other healthcare premises. Healthcare organizations are betting high on such enormous useful data with the analytics-driven approach. However, such organizations are finding it difficult without sophisticated systems as it is challenging to analyse the text data. However, NLP has appeared as an important technology to extract meaningful insights from such a large volume of data. The consequent demand for effective data management and advanced data analytics has also seen a significant rise in the healthcare industry over the last ten years. Moreover, it is expected that there will be a huge scope of opportunities for NLP technologies in the healthcare industry in the next five years.

Personal Health Records (PHRs) are becoming widely accepted, and new initiatives have been taken to make it easier to download and share medical records with different medical and insurance providers. This market is expected to flourish with the growing trend of mobile superior data management and analytics apps further. NLP has enabled predictive analytics and helped minimize population health concerns. Moreover, the adoption of NLP in healthcare is rising because of its recognized potential to search, analyse, and interpret massive amounts of patient datasets. By means of advanced medical algorithms, ML, along with NLP technology, has the potential to harness relevant insights from data that was previously hidden in text form. In the current COVID-19 pandemic, organizations are using NLP to access the landscape of scientific papers relevant to the coronavirus pandemic. Adoption of NLP solutions in healthcare is still in the preliminary stage, although the industry is willing to put in the effort to make advancements. Semantic big data analytics and cognitive computing projects, which have foundations in NLP, are seeing significant investments in healthcare from some recognizable players.

Challenge: Regulatory and privacy concerns over data security

Data privacy has remained a major challenge in adopting AI among businesses. ML, deep learning, NLP, facial recognition, and emotion detection technologies feed on the stored data and provide meaningful extracts. According to a recent survey by Oracle, almost 80% of organizations are planning to use chatbots by 2020 and they need to reveal Personally Identifiable Information (PII), such as full name, birthdate, credit/debit card number, social security number, and bank accounts. This data reveals the confidential information of a customer, along with other crucial data, such as location and spending habits. Though NLP has provided several other benefits, such as automation and enhanced customer experience, the NLP-integrated systems pose serious security threats to confidential data. Such chatbots or virtual personal assistants are exposed to a variety of attacks, such as spoofing and tampering. Though there are various regulations pertaining to customer data security, emerging countries, such as India and South Africa, still lack such regulations. To maintain public trust and the ethical use of data by AI, various organizations, along with the governments of various countries, are working toward creating a robust AI-based framework.

The Employee Onboarding & Recruiting to register the highest CAGR during the forecast period

Based on applications, the natural language processing market is segmented into customer experience management, virtual assistants, social media monitors, sentiment analysis, text classification and summarization, employee onboarding and recruiting, and others. The employee onboarding & recruiting application is having the highest growth rate during the forecast period. The role of NLP in recruitment is about freeing time for meaningful human-to-human interactions. It revolves around streamlining processes, revealing valuable insights, and engaging participants.

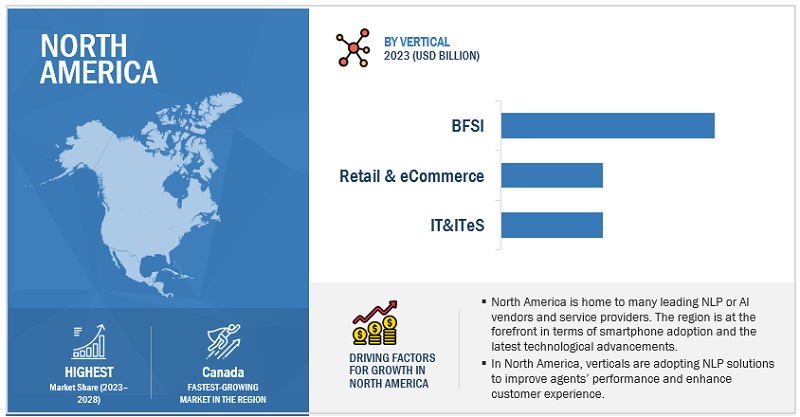

The BFSI vertical to account for the largest market size during the forecast period

The segmentation of the NLP market by the industrial vertical includes BFSI, IT and telecom, retail & eCommerce, healthcare & life sciences, transportation and logistics, government and public sector, media & entertainment, manufacturing, and others. Presently, The BFSI vertical leads in the terms of adoption of NLP as compared to the other verticals. Companies across the BFSI vertical need to retain customers, reduce costs, increase profits, and comply with the changing rules and regulations. NLP-based products help companies in the BFSI vertical mitigate risks through information retrieval, intent parsing, customer service, and compliance process automation.

North America to have largest market size during the forecast period

North America is expected to have the largest market share in the natural language processing market. Key factors favoring the growth of the NLP market in North America include the rapid innovation and advancements of AI technologies in the region. The growing number of NLP solution and service providers across the region is expected to further drive the market growth in North America. Morever, several innovations from leading companies such as Google, IBM,, Mocrosoft, Meta, NLP technology has witnessed progression in precision, speed, and even methods that are relied on by computer scientists to resolve complex problems.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The NLP solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the natural language processing market include IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Inbenta (US), Health Fidelity (US), LivePerson (US), SoundHound (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), and DheeYantra (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 15.7 Billion |

|

Revenue forecast in 2027 |

USD 49.4 Billion |

|

Growth rate |

CAGR of 25.7% |

|

Segments covered |

Component, Type, Deployment Mode, Organization Size, Application, Technology, Vertical, And Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Natural Language Processing Market Drivers |

|

|

Natural Language Processing Market Opportunities |

|

|

Companies covered |

IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Inbenta (US), Health Fidelity (US), LivePerson (US), SoundHound (US) and many more. |

This research report categorizes the NLP market based on component, type, deployment mode, organization size, application, technology, vertical, and region.

By Component:

- Solutions

- Platform

- Software Tools

- Services

- Professional Services

- Managed Services

By Type:

- Rule-based

- Statistical

- Hybrid

By Deployment Mode:

- On-premises

- Cloud

By Organization Size:

- Large Enterprises

- SMEs

By Application:

- Customer Experience Management

- Virtual Assistants/Chatbots

- Social Media Monitoring

- Sentiment Analysis

- Text Classification & Summarization

- Employee Onboarding & Recruiting

- Other applications (Root Cause Analysis, Spam Detection, Data Mining, and Data Exfiltration)

By Technology:

- Optical Character Recognition (OCR)

- Interactive Voice Response (IVR)

- Auto Coding

- Text Analysis

- Speech Analytics

- Image & Pattern Recognition

- Simulation & Modeling

By Verticals:

- BFSI

- IT and ITeS

- Retail and eCommerce

- Healthcare and Life Sciences

- Transportation & Logistics

- Government & Public Sector

- Media & Entertainment

- Manufacturing

- Other verticals (Education, Automotive, Travel & Hospitality, and Energy & Utilities)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East and Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2022, Apple announced plans to make available an open-source reference PyTorch implementation of the Transformer architecture, giving developers worldwide a way to seamlessly deploy Transformer models on Apple devices.

- In May 2022, Meta launched MyoSuite, a new AI platform developed to build realistic musculoskeletal simulations to help accelerate the development of prosthetics. It could also help build avatars that move more realistically in the metaverse. MyoSuite could help the company develop more realistic avatars for applications such as Horizon Worlds. Another more interesting use case could see researchers tapping the platform to develop new prosthetics and novel surgery and rehabilitation techniques.

- In December 2021, Baidu introduced PCL-BAIDU Wenxin (ERNIE 3.0 Titan), the world’s first knowledge-enhanced multi-hundred-billion model, a pre-training language model with 260 billion parameters. The model was trained on massive unstructured data and a gigantic knowledge graph, and it excelled at both NLU and NLG. ERNIE 3.0 Titan was also the world’s largest Chinese singleton model, with a dense model structure distinguishable from the sparse Mixture of Experts (MoE) system.

- In May 2020, AWS launched AWS Diagnostic Development Initiative, a program to support customers working to bring more accurate diagnostic solutions to the market for COVID-19. The program was established in response to COVID-19. AWS remained focused on funding diagnostic research projects with the potential to blunt future infectious disease outbreaks.

Frequently Asked Questions (FAQ):

What is the projected market value of the global natural language processing market?

The global market for natural language processing is projected to reach USD 49.4 billion.

What is the estimated growth rate (CAGR) of the global natural language processing market for the next five years?

The global natural language processing market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.7% from 2022 to 2027.

What are the major revenue pockets in the natural language processing market currently?

North America is expected to have the largest market share in the natural language processing market. Key factors favoring the growth of the NLP market in North America include the rapid innovation and advancements of AI technologies in the region. The growing number of NLP solution and service providers across the region is expected to further drive the market growth in North America. Morever, several innovations from leading companies such as Google, IBM,, Mocrosoft, Meta, NLP technology has witnessed progression in precision, speed, and even methods that are relied on by computer scientists to resolve complex problems.

Who are the key companies in the natural language processing market?

The key players in the natural language processing market include IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Inbenta (US), Health Fidelity (US), LivePerson (US), SoundHound (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), and DheeYantra (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 46)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 1 NATURAL LANGUAGE PROCESSING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 NLP MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): FLOWCHART USING REVENUE FROM NLP SOLUTIONS/SERVICES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL NLP SOLUTION/ SERVICE COMPANIES

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): REVENUES OF TOP PLAYERS AND SOURCES OF DATA

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE THROUGH OVERALL NLP SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 KEY COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 65)

TABLE 4 NATURAL LANGUAGE PROCESSING MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y)

TABLE 5 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y)

FIGURE 10 NATURAL LANGUAGE PROCESSING SOLUTIONS TO BE A LARGER MARKET IN 2022

FIGURE 11 SOFTWARE TOOLS TO ACCOUNT FOR A GREATER SHARE AMONG SOLUTIONS IN 2022

FIGURE 12 PROFESSIONAL SERVICES TO ACCOUNT FOR A LARGER SERVICE MARKET IN 2022

FIGURE 13 SYSTEM INTEGRATION & IMPLEMENTATION TO ACCOUNT FOR THE LARGEST PROFESSIONAL SERVICE SHARE IN 2022

FIGURE 14 STATISTICAL TYPE TO ACCOUNT FOR THE LARGEST MARKET IN 2022

FIGURE 15 IVR TECHNOLOGY TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2022

FIGURE 16 TEXT CLASSIFICATION & SUMMARIZATION TO ACCOUNT FOR THE LARGEST APPLICATION IN 2022

FIGURE 17 CLOUD DEPLOYMENT TO BE A LARGER MARKET IN 2022

FIGURE 18 LARGE ENTERPRISES TO BE A LARGER MARKET IN 2022

FIGURE 19 BFSI VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2022

FIGURE 20 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE NATURAL LANGUAGE PROCESSING MARKET

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE OPPORTUNITIES IN THE NATURAL LANGUAGE PROCESSING MARKET

FIGURE 21 SURGING DEMAND FOR CLOUD-BASED NLP SOLUTIONS TO REDUCE OVERALL COSTS AND ENHANCE SCALABILITY

4.2 MARKET: TOP 3 APPLICATIONS

FIGURE 22 EMPLOYEE ONBOARDING & RECRUITING APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY COMPONENT & KEY VERTICAL

FIGURE 23 SOLUTIONS AND BFSI VERTICAL TO ACCOUNT FOR THE LARGEST SHARES RESPECTIVELY IN 2022

4.4 MARKET: BY REGION

FIGURE 24 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 74)

5.1 INTRODUCTION

5.2 NATURAL LANGUAGE PROCESSING: EVOLUTION

FIGURE 25 NATURAL LANGUAGE PROCESSING MARKET EVOLUTION

5.3 NATURAL LANGUAGE PROCESSING: ARCHITECTURE

FIGURE 26 MARKET ARCHITECTURE

5.4 MARKET DYNAMICS

FIGURE 27 MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Advancements in computer programs that analyze text

5.4.1.2 Rise in need for enterprise solutions to streamline business operations for better customer experience

5.4.1.3 Surging demand for cloud-based NLP solutions to reduce overall costs and enhance scalability

5.4.1.4 Greater urge for predictive analytics to reduce risks and identify growth opportunities

5.4.2 RESTRAINTS

5.4.2.1 Lack of contextual understanding leading to ambiguity

5.4.2.2 Complexities due to the usage of code-mixed language while implementing NLP solutions

5.4.2.3 Limitations in the development of NLP technology using neural networks that may restrict the usage of cloud-based services

5.4.3 OPPORTUNITIES

5.4.3.1 Surge in the developments of big data technology for actionable business intelligence

5.4.3.2 Increase in investments across healthcare

5.4.4 CHALLENGES

5.4.4.1 Regulatory and privacy concerns over data security

5.4.4.2 Interoperability and reliability issues while deploying NLP algorithms

5.4.5 CUMULATIVE GROWTH ANALYSIS

5.5 VALUE CHAIN ANALYSIS

FIGURE 28 NATURAL LANGUAGE PROCESSING MARKET: VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 29 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 6 MARKET: SUPPLY CHAIN

5.7 CASE STUDY ANALYSIS

5.7.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.7.1.1 Case Study 1: National Bank of Greece Transformed with SAS Viya on Azure

5.7.1.2 Case Study 2: HSBC implemented LivePerson’s conversational AI solutions with intelligent automation

5.7.2 HEALTHCARE & LIFE SCIENCES

5.7.2.1 Case Study 3: Value-based care at Atrius Health with Linguamatics

5.7.2.2 Case Study 4: Huntsman Cancer Institute optimized research with Linguamatics NLP platform

5.7.2.3 Case Study 5: Humana, a leading health insurance provider, reduced costly pre-service calls with conversational AI

5.7.3 IT & ITES

5.7.3.1 Case Study 6: Telenor adapts to rapidly changing customer expectations using a hybrid cloud approach

5.7.4 RETAIL & ECOMMERCE

5.7.4.1 Case Study 7: schuh stepped up customer experience with AWS

5.7.5 GOVERNMENT & PUBLIC SECTOR

5.7.5.1 Case Study 8: Smart city uses analytics and IoT to predict and manage flood events

5.7.6 MEDIA & ENTERTAINMENT

5.7.6.1 Case Study 9: The Associated Press used NLG to automate NCAA Division I men’s basketball previews during the 2018 season

5.7.6.2 Case Study 10: Yahoo! Sports uses NLG to produce over 70 million reports and match recaps

5.7.7 TRAVEL & HOSPITALITY

5.7.7.1 Case Study 11: SAS gives Foxwoods Resort Casino a holistic view of resort operations

5.8 ECOSYSTEM

FIGURE 30 NATURAL LANGUAGE PROCESSING MARKET: ECOSYSTEM

5.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE NLP MARKET

FIGURE 31 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.10 TECHNOLOGY ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE

5.10.2 DEEP LEARNING

5.10.3 BIG DATA

5.10.4 BLOCKCHAIN

5.10.5 CYBERSECURITY

5.10.6 IOT

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2018–2021

5.11.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 32 ANNUAL NUMBER OF PATENTS GRANTED, 2018–2021

5.11.4 TOP APPLICANTS

FIGURE 33 TOP 10 PATENT APPLICANTS, 2019–2022

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 IMPACT OF EACH FORCE ON THE NATURAL LANGUAGE PROCESSING MARKET

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 THREAT FROM SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 REGULATORY IMPLICATIONS

5.13.1 GENERAL DATA PROTECTION REGULATION

5.13.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.13.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.13.4 SARBANES-OXLEY ACT OF 2002

5.13.5 SOC 2 TYPE II COMPLIANCE

5.13.6 ISO/IEC 27001

5.13.7 THE GRAMM–LEACH–BLILEY ACT

5.13.8 EUROPEAN UNION DATA PROTECTION REGULATION

5.13.9 CAN-SPAM ACT

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.15 PRICING ANALYSIS

TABLE 14 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED/PAY-AS-YOU-GO NLP SERVICES

5.16 KEY STAKEHOLDERS & BUYING CRITERIA

5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.16.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT (Page No. - 107)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

FIGURE 37 NATURAL LANGUAGE PROCESSING SOLUTIONS TO BE A LARGER MARKET DURING THE FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

TABLE 19 NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 20 NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 21 NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 PLATFORMS

TABLE 23 NATURAL LANGUAGE PROCESSING PLATFORMS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 NATURAL LANGUAGE PROCESSING PLATFORMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 SOFTWARE TOOLS

TABLE 25 NATURAL LANGUAGE PROCESSING SOFTWARE TOOLS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 NATURAL LANGUAGE PROCESSING SOFTWARE TOOLS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 28 NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 39 TRAINING & CONSULTING SERVICES TO BE FASTEST-GROWING DURING FORECAST PERIOD

TABLE 29 PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 30 PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Training & Consulting

TABLE 33 NATURAL LANGUAGE PROCESSING TRAINING & CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 NATURAL LANGUAGE PROCESSING TRAINING & CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 System Integration & Implementation

TABLE 35 NATURAL LANGUAGE PROCESSING SYSTEM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 NATURAL LANGUAGE PROCESSING SYSTEM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.3 Support & Maintenance

TABLE 37 NATURAL LANGUAGE PROCESSING SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 NATURAL LANGUAGE PROCESSING SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027(USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 39 MANAGED NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 MANAGED NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY REGION, 2022–2027(USD MILLION)

7 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE (Page No. - 121)

7.1 INTRODUCTION

7.1.1 TYPE: MARKET DRIVERS

FIGURE 40 HYBRID NATURAL LANGUAGE PROCESSING TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 41 MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 42 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 RULE-BASED

TABLE 43 RULED-BASED MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 RULED-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 STATISTICAL

TABLE 45 STATISTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 STATISTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 HYBRID

TABLE 47 HYBRID MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 HYBRID MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE (Page No. - 127)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 41 ON-PREMISE DEPLOYMENT TO EXPERIENCE HIGHER CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 50 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 ON-PREMISES

TABLE 51 ON-PREMISES DEPLOYMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 ON-PREMISES DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CLOUD

TABLE 53 CLOUD DEPLOYMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 CLOUD DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE (Page No. - 132)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 42 SMALL & MEDIUM-SIZED ENTERPRISES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

TABLE 55 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 56 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 SMALL & MEDIUM-SIZED ENTERPRISES

TABLE 57 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 SMALL & MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 LARGE ENTERPRISES

TABLE 59 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027(USD MILLION)

10 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION (Page No. - 137)

10.1 INTRODUCTION

10.1.1 APPLICATION: MARKET DRIVERS

FIGURE 43 EMPLOYEE ONBOARDING & RECRUITING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 61 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 62 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 CUSTOMER EXPERIENCE MANAGEMENT

TABLE 63 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 VIRTUAL ASSISTANTS/CHATBOTS

TABLE 65 VIRTUAL ASSISTANTS/CHATBOTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 VIRTUAL ASSISTANTS/CHATBOTS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 SOCIAL MEDIA MONITORING

TABLE 67 SOCIAL MEDIA MONITORING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 SOCIAL MEDIA MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 SENTIMENT ANALYSIS

TABLE 69 SENTIMENT ANALYSIS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 SENTIMENT ANALYSIS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 TEXT CLASSIFICATION & SUMMARIZATION

TABLE 71 TEXT CLASSIFICATION & SUMMARIZATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 TEXT CLASSIFICATION & SUMMARIZATION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 EMPLOYEE ONBOARDING & RECRUITING

TABLE 73 EMPLOYEE ONBOARDING & RECRUITING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 EMPLOYEE ONBOARDING & RECRUITING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHER APPLICATIONS

TABLE 75 OTHER APPLICATIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 OTHER APPLICATIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY (Page No. - 148)

11.1 INTRODUCTION

11.1.1 TECHNOLOGY: MARKET DRIVERS

FIGURE 44 IMAGE & PATTERN RECOGNITION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 77 MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 78 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

11.2 OPTICAL CHARACTER RECOGNITION

TABLE 79 OPTICAL CHARACTER RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 OPTICAL CHARACTER RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 INTERACTIVE VOICE RESPONSE

TABLE 81 INTERACTIVE VOICE RESPONSE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 82 INTERACTIVE VOICE RESPONSE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 AUTO CODING

TABLE 83 AUTO CODING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 84 AUTO CODING MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 TEXT ANALYTICS

TABLE 85 TEXT ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 86 TEXT ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 SPEECH ANALYTICS

TABLE 87 SPEECH ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 88 SPEECH ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 IMAGE & PATTERN RECOGNITION

TABLE 89 IMAGE & PATTERN RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 IMAGE & PATTERN RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 SIMULATION & MODELING

TABLE 91 SIMULATION & MODELING MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 92 SIMULATION & MODELING MARKET, BY REGION, 2022–2027 (USD MILLION)

12 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL (Page No. - 158)

12.1 INTRODUCTION

12.1.1 VERTICAL: MARKET DRIVERS

TABLE 93 MAJOR USE CASES, BY VERTICAL

FIGURE 45 HEALTHCARE & LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 94 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 95 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 96 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 97 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 IT & ITES

TABLE 98 IT & ITES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 99 IT & ITES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 RETAIL & ECOMMERCE

TABLE 100 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 101 RETAIL & ECOMMERCE VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 HEALTHCARE & LIFE SCIENCES

TABLE 102 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 103 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 TRANSPORTATION & LOGISTICS

TABLE 104 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 105 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.7 GOVERNMENT & PUBLIC SECTOR

TABLE 106 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 107 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.8 MEDIA & ENTERTAINMENT

TABLE 108 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 109 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.9 MANUFACTURING

TABLE 110 MANUFACTURING VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 111 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

12.10 OTHER VERTICALS

TABLE 112 OTHER VERTICALS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 113 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

13 NATURAL LANGUAGE PROCESSING MARKET, BY REGION (Page No. - 172)

13.1 INTRODUCTION

FIGURE 46 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 47 INDIA TO BE FASTEST-GROWING DURING FORECAST PERIOD

TABLE 114 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 115 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: REGULATIONS

13.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

13.2.2.2 Gramm–Leach–Bliley Act

13.2.2.3 Federal Information Security Management Act

13.2.2.4 Health Insurance Portability and Accountability Act of 1996

13.2.2.5 Health Level Seven (HL7)

13.2.2.6 Occupational Safety and Health Administration (OSHA)

13.2.2.7 California Consumer Privacy Act

FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

TABLE 116 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 119 NORTH AMERICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 123 NORTH AMERICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 NORTH AMERICA: NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.2.3 US

TABLE 138 US: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 139 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.2.4 CANADA

TABLE 140 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 141 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: MARKET DRIVERS

13.3.2 EUROPE: REGULATIONS

13.3.2.1 European Market Infrastructure Regulation

13.3.2.2 General Data Protection Regulation

13.3.2.3 European Committee for Standardization

13.3.2.4 European Technical Standards Institute

TABLE 142 EUROPE: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 143 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 144 EUROPE: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 145 EUROPE: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 146 EUROPE: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 147 EUROPE: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 148 EUROPE: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 149 EUROPE: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 EUROPE: NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 153 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 154 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 155 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 EUROPE: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 159 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 161 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 162 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 163 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.3 UK

TABLE 164 UK: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 165 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.3.4 GERMANY

TABLE 166 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 167 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.3.5 FRANCE

TABLE 168 FRANCE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 169 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.3.6 SPAIN

TABLE 170 SPAIN: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 171 SPAIN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 172 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: MARKET DRIVERS

13.4.2 ASIA PACIFIC: REGULATIONS

13.4.2.1 Privacy Commissioner for Personal Data

13.4.2.2 Act on the Protection of Personal Information

13.4.2.3 Critical Information Infrastructure

13.4.2.4 International Organization for Standardization 27001

13.4.2.5 Personal Data Protection Act

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 174 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 176 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 177 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 179 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 180 ASIA PACIFIC: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 181 ASIA PACIFIC: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

13.4.3 CHINA

TABLE 196 CHINA: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 197 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.4.4 JAPAN

TABLE 198 JAPAN: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 199 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.4.5 INDIA

TABLE 200 INDIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 201 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.4.6 ASEAN COUNTRIES

TABLE 202 ASEAN COUNTRIES: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 203 ASEAN COUNTRIES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 204 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.5 MIDDLE EAST & AFRICA

13.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

13.5.2 MIDDLE EAST & AFRICA: REGULATIONS

13.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

13.5.2.2 Cloud Computing Framework

13.5.2.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

13.5.2.4 Protection of Personal Information Act

13.5.2.5 Protection of Personal Information (POPI) Act

TABLE 206 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 217 MIDDLE & AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 224 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 226 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.3 KINGDOM OF SAUDI ARABIA

TABLE 228 KSA: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 229 KSA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.5.4 UNITED ARAB EMIRATES

TABLE 230 UAE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 231 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.5.5 SOUTH AFRICA

TABLE 232 SOUTH AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 233 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 234 REST OF MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 235 REST OF MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: REGULATIONS

13.6.2.1 Brazil Data Protection Law

TABLE 236 LATIN AMERICA: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 238 LATIN AMERICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 239 LATIN AMERICA: NATURAL LANGUAGE PROCESSING SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 240 LATIN AMERICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 241 LATIN AMERICA: NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 242 LATIN AMERICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 243 LATIN AMERICA: PROFESSIONAL NATURAL LANGUAGE PROCESSING SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 LATIN AMERICA: NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 251 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 252 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 253 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 254 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 255 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 256 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 257 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.6.3 BRAZIL

TABLE 258 BRAZIL: NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 259 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.6.4 MEXICO

TABLE 260 MEXICO: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 261 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.6.5 REST OF LATIN AMERICA

TABLE 262 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 263 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 240)

14.1 OVERVIEW

14.2 KEY PLAYER STRATEGIES

TABLE 264 OVERVIEW OF STRATEGIES ADOPTED BY KEY NLP VENDORS

14.3 REVENUE ANALYSIS

14.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 50 HISTORICAL REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021 (USD MILLION)

14.4 MARKET SHARE ANALYSIS

FIGURE 51 MARKET SHARE ANALYSIS, 2019–2022

TABLE 265 NATURAL LANGUAGE PROCESSING MARKET: DEGREE OF COMPETITION

14.5 MARKET EVALUATION FRAMEWORK

FIGURE 52 MARKET EVALUATION FRAMEWORK, 2019–2022

14.6 KEY COMPANY EVALUATION QUADRANT

14.6.1 STARS

14.6.2 EMERGING LEADERS

14.6.3 PERVASIVE PLAYERS

14.6.4 PARTICIPANTS

FIGURE 53 MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

14.7 KEY PLAYER COMPETITIVE BENCHMARKING

14.7.1 COMPANY PRODUCT FOOTPRINT

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

TABLE 266 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

14.8 STARTUP/SME EVALUATION QUADRANT

14.8.1 PROGRESSIVE COMPANIES

14.8.2 RESPONSIVE COMPANIES

14.8.3 DYNAMIC COMPANIES

14.8.4 STARTING BLOCKS

FIGURE 56 NATURAL LANGUAGE PROCESSING MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

14.9 STARTUP/SME COMPETITIVE BENCHMARKING

14.9.1 COMPANY PRODUCT FOOTPRINT

FIGURE 57 PRODUCT PORTFOLIO ANALYSIS OF STARTUPS/SMES

FIGURE 58 BUSINESS STRATEGY EXCELLENCE OF STARTUPS/SMES

TABLE 267 MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES

TABLE 268 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

14.10 COMPETITIVE SCENARIO AND TRENDS

14.10.1 NEW PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 269 NEW PRODUCT LAUNCHES AND ENHANCEMENTS, AUGUST 2018–JUNE 2022

14.10.2 DEALS

TABLE 270 DEALS, FEBRUARY 2019–FEBRUARY 2022

15 COMPANY PROFILES (Page No. - 260)

15.1 INTRODUCTION

15.2 KEY PLAYERS

(Business overview, Solutions offered, Recent developments, COVID-19-related developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

15.2.1 IBM

TABLE 271 IBM: BUSINESS OVERVIEW

FIGURE 59 IBM: COMPANY SNAPSHOT

TABLE 272 IBM: SOLUTIONS OFFERED

TABLE 273 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 274 IBM: DEALS

15.2.2 MICROSOFT

TABLE 275 MICROSOFT: BUSINESS OVERVIEW

FIGURE 60 MICROSOFT: COMPANY SNAPSHOT

TABLE 276 MICROSOFT: SOLUTIONS OFFERED

TABLE 277 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 278 MICROSOFT: DEALS

15.2.3 GOOGLE

TABLE 279 GOOGLE: BUSINESS OVERVIEW

FIGURE 61 GOOGLE: COMPANY SNAPSHOT

TABLE 280 GOOGLE: SOLUTIONS OFFERED

TABLE 281 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 282 GOOGLE: DEALS

15.2.4 AWS

TABLE 283 AWS: BUSINESS OVERVIEW

FIGURE 62 AWS: COMPANY SNAPSHOT

TABLE 284 AWS: SOLUTIONS OFFERED

TABLE 285 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 286 AWS: DEALS

15.2.5 META

TABLE 287 META: BUSINESS OVERVIEW

FIGURE 63 META: COMPANY SNAPSHOT

TABLE 288 META: SOLUTIONS OFFERED

TABLE 289 META: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 290 META: DEALS

15.2.6 3M

TABLE 291 3M: BUSINESS OVERVIEW

FIGURE 64 3M: COMPANY SNAPSHOT

TABLE 292 3M: SOLUTIONS OFFERED

TABLE 293 3M: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 294 3M: DEALS

15.2.7 BAIDU

TABLE 295 BAIDU: BUSINESS OVERVIEW

FIGURE 65 BAIDU: COMPANY SNAPSHOT

TABLE 296 BAIDU: SOLUTIONS OFFERED

TABLE 297 BAIDU: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 298 BAIDU: DEALS

15.2.8 APPLE

TABLE 299 APPLE: BUSINESS OVERVIEW

FIGURE 66 APPLE: COMPANY SNAPSHOT

TABLE 300 APPLE: SOLUTIONS OFFERED

TABLE 301 APPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 302 APPLE: DEALS

15.2.9 SAS INSTITUTE

TABLE 303 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 67 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 304 SAS INSTITUTE: SOLUTIONS OFFERED

TABLE 305 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 306 SAS INSTITUTE: DEALS

15.2.10 IQVIA

TABLE 307 IQVIA: BUSINESS OVERVIEW

FIGURE 68 IQVIA: COMPANY SNAPSHOT

TABLE 308 IQVIA: SOLUTIONS OFFERED

TABLE 309 IQVIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 310 IQVIA: DEALS

15.2.11 ORACLE

15.2.12 INBENTA

15.2.13 HEALTH FIDELITY

15.2.14 LIVEPERSON

15.2.15 SOUNDHOUND

15.2.16 MINDMELD

15.2.17 VERITONE

15.2.18 DOLBEY

15.2.19 AUTOMATED INSIGHTS

15.2.20 BITEXT

15.2.21 CONVERSICA

15.3 STARTUPS/SMES

15.3.1 ADDEPTO

15.3.2 RAGAVERA

15.3.3 OBSERVE.AI

15.3.4 EIGEN TECHNOLOGIES

15.3.5 GNANI.AI

15.3.6 CRAYON DATA

15.3.7 NARRATIVA

15.3.8 DEEPSET

15.3.9 ELLIPSIS HEALTH

15.3.10 DHEEYANTRA

*Details on Business overview, Solutions offered, Recent developments, COVID-19-related developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 312)

16.1 INTRODUCTION

16.2 CONVERSATIONAL AI MARKET - GLOBAL FORECAST TO 2026

16.2.1 MARKET DEFINITION

16.2.2 MARKET OVERVIEW

16.2.2.1 Conversational AI market, by component

TABLE 311 CONVERSATIONAL AI MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 312 CONVERSATIONAL AI MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

16.2.2.2 Conversational AI market, by type

TABLE 313 CONVERSATIONAL AI MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 314 CONVERSATIONAL AI MARKET, BY TYPE, 2021–2026 (USD MILLION)

16.2.2.3 Conversational AI market, by deployment mode

TABLE 315 CONVERSATIONAL AI MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 316 CONVERSATIONAL AI MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

16.2.2.4 Conversational AI market, by organization size

TABLE 317 CONVERSATIONAL AI MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 318 CONVERSATIONAL AI MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

16.2.2.5 Conversational AI market, by mode of integration

TABLE 319 CONVERSATIONAL AI MARKET, BY MODE OF INTEGRATION, 2016–2020 (USD MILLION)

TABLE 320 CONVERSATIONAL AI MARKET, BY MODE OF INTEGRATION, 2021–2026 (USD MILLION)

16.2.2.6 Conversational AI market, by business function

TABLE 321 CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 322 CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

16.2.2.7 Conversational AI market, by vertical

TABLE 323 CONVERSATIONAL AI MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 324 CONVERSATIONAL AI MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

16.2.2.8 Conversational AI market, by region

TABLE 325 CONVERSATIONAL AI MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 326 CONVERSATIONAL AI MARKET, BY REGION, 2021–2026 (USD MILLION)

16.3 CHATBOT MARKET - GLOBAL FORECAST TO 2026

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

16.3.2.1 Chatbot market, by component

TABLE 327 CHATBOT MARKET, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 328 CHATBOT MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

16.3.2.2 Chatbot market, by type

TABLE 329 CHATBOT MARKET, BY TYPE, 2015–2019 (USD MILLION)

TABLE 330 CHATBOT MARKET, BY TYPE, 2020–2026 (USD MILLION)

16.3.2.3 Chatbot market, by deployment mode

TABLE 331 CHATBOT MARKET, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 332 CHATBOT MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

16.3.2.4 Chatbot market, by channel integration

TABLE 333 CHATBOT MARKET, BY CHANNEL INTEGRATION, 2015–2019 (USD MILLION)

TABLE 334 CHATBOT MARKET, BY CHANNEL INTEGRATION, 2020–2026 (USD MILLION)

16.3.2.5 Chatbot market, by business function

TABLE 335 CHATBOT MARKET, BY BUSINESS FUNCTION, 2015–2019 (USD MILLION)

TABLE 336 CHATBOT MARKET, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

16.3.2.6 Chatbot market, by application

TABLE 337 CHATBOT MARKET, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 338 CHATBOT MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

16.3.2.7 Chatbot market, by vertical

TABLE 339 CHATBOT MARKET, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 340 CHATBOT MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

16.3.2.8 Chatbot market, by region

TABLE 341 CHATBOT MARKET, BY REGION, 2015–2019 (USD MILLION)

TABLE 342 CHATBOT MARKET, BY REGION, 2020–2026 (USD MILLION)

17 APPENDIX (Page No. - 326)

17.1 INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

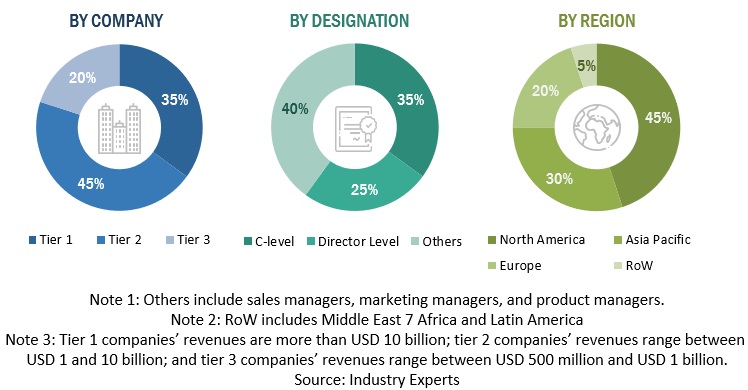

This research study involved the extensive use of secondary sources, directories, and databases such as Dun & Bradstreet (D&B) Hoovers, and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, and commercial study of the Natural Language Processing (NLP) market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information. The following illustrative figure shows the market research methodology applied in making this report on the natural language processing market.

Secondary Research

The market for companies offering NLP solutions and services for different verticals was estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the NLP market. It also involved rating products of companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study on the natural language processing market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottommost level, regional markets, and key developments from both, market and technology-oriented perspectives that were further validated by primary sources.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from different key companies and organizations operating in the NLP market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, the key natural language processing vendors, such as IBM (US), Microsoft (US), Google (US), AWS (US), Meta (US), 3M (US), Baidu (China), Apple (US), SAS Institute (US), IQVIA (UK), Oracle (US), Inbenta (US), Health Fidelity (US), LivePerson (US), SoundHound (US), MindMeld (US), Veritone (US), Dolbey (US), Automated Insights (US), Bitext (US), Conversica (US), Addepto (US), RaGaVeRa (India), Observe.ai (US), Eigen (US), Gnani.ai (India), Crayon Data (Singapore), Narrativa (US), deepset (US), Ellipsis Health (US), and DheeYantra (US) contribute almost 60-65% to the global NLP market. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. These companies’ revenue pertaining to the Business Units (BUs) that offer NLP was identified through similar sources. Then through primaries, the data of revenue generated was collected through specific NLP. The collective revenue of key companies that offer NLP comprises 60%–65% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (55%–60%) and unorganized players (40%–45%) collectively was assumed to be the market size of the global NLP market for Financial Year (FY) 2022.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on NLP based on some of the key use cases. These factors for the NLP industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the natural language processing market by component (solutions & services), type, deployment mode, organization size, application, technology, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the NLP market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American natural language processing market

- Further breakup of the European NLP market

- Further breakup of the Asia Pacific NLP market

- Further breakup of the Latin American NLP market

- Further breakup of the Middle East and Africa NLP market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Natural Language Processing (NLP) Market