Network as a Service Market by Type (LAN and WLAN, WAN, Communication and Collaboration, and Network Security), Organization Size (Large Enterprises and SMEs), Application, End User (BFSI, Manufacturing, Healthcare) and Region - Global Forecast to 2027

[296 Pages Report] The network as a service market was valued at USD 13.2 billion in 2022. It is projected to reach USD 46.6 billion over the next five years, registering a CAGR of 19.0%. The major growing factor of network as a service is an increase in investment of advanced technologies. Companies have adopted the NaaS model as it provides various benefits, including significant cost savings, improved security, and increased business agility. NaaS solutions enable enterprises to focus and extend the range of their business offerings without sacrificing quality or content.

To know about the assumptions considered for the study, Request for Free Sample Report

Network as a Service Market Growth Dynamics

Driver: High reliability and security for mission critical business applications

NaaS is a simple and effective network service model for businesses to operate their network infrastructure without any hassles. It helps businesses to effectively manage network infrastructure with strong and reliable security. NaaS vendors offer a broad range of network security services, including secure web gateway, secure Domain Name System (DNS)/ Dynamic Host Configuration Protocol (DHCP)/ IP Address Management (IPAM) (DDI), DDoS protection, and zero-trust network access. The pandemic has compelled businesses to move their workloads over the cloud and adopt remote work facilities for the workforce. As a result, the demand for network security has increased exponentially to safeguard networks against cyber threats. NaaS protects network infrastructure holistically with traffic routed through a high encryption tunnel with the help of chunks of TLS protocols such as IPSec, SSL, and Wireguard.

Restraint: Lack of standardization in the NaaS market

The major issue faced in this market is the difficulty in ensuring proper regulatory compliances while offering NaaS services to clients. Appropriate security and regulatory policies are to be practiced by the market vendors, which are vital for enterprises to achieve their business goals. With specific requirements such as increased security, business reorganizations, mergers, and consolidations, cloud providers have to meet stringent scalability specifications for storage, computing, and network resource sharing to encourage the growth of NaaS solutions. The vendors, at some point, may find it difficult to maintain and secure their technologies and adhere to certain standards and laws. The non-compliance with regulations and standards by the vendors can directly affect the services they offer to clients, leading to major financial and business risks to the clients and their business processes. NaaS service vendors offer full transparency to their customers. They emphasize and offer programs and services by adhering to set standards and following the best service-delivery practices. As technologies evolve, it becomes difficult for vendors to keep up with the constantly changing technology and government regulations. This is a major challenge for vendors and clients in this market.

Opportunity: Growing mobile workforce

The pandemic has forced various organizations to adopt remote work facilities all over the globe. Within numbered days or a week, businesses have moved their workforce into remote facilities and implemented the work from home policy. The number of remote workforces is increasing daily amid the growing impact of the COVID-19 on businesses. Several organizations have declared permanent work-from-home policies for employees. As a result, businesses are adopting as a service business model for network, compute, and storage. During the pandemic, cloud adoption has skyrocketed across every line of business. Most businesses have adopted as-a-service and subscription-based business models for network services. Hence, the industry has witnessed strong demand for the NaaS market. NaaS offers a wide range of benefits, including reduced costs, proactive maintenance, enhanced security, increased levels of uptime, improved quality of service, maximized performance and increased productivity, optimized systems, and access to expertise and experience. The remote workforce strategy has shown an upward trajectory in terms of growth and is only growing at an exponential rate.

Challenge: Data security and privacy concerns

One of the major challenges of the NaaS market is security concerns for cloud-based network connectivity that is holding back the adoption of NaaS solutions among various industry verticals. Security is one of the main criteria considered by enterprises while choosing cloud-based and on-premises solutions. NaaS solutions are facing synchronization issues due to network complexities and complex applications. Hence, the outsourcing of network connectivity can generate issues in organizational security. Organizations usually assume that NaaS-based connectivity can expose their sensitive data and would cause them to lose control over their network infrastructure. Therefore, companies are uncertain about the adoption of cloud-based networking solutions.

North America to account for largest market size during the forecast period

The geographic analysis of the network as a service is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The US is the major contributor to the North American region in terms of data generated from multiple sources and the adoption of emerging technologies, such as AI, big data, and business intelligence. The increasing demand for high-performance networks and the rising adoption of reliable connectivity solutions are encouraging organizations in the country to switch to service providers. Canada is expected to offer major growth opportunities for NaaS providers, as businesses from Canada are rapidly adopting emerging technologies and innovations. The growing availability of wireless technologies is changing the traditional business operations in Canada.

To know about the assumptions considered for the study, download the pdf brochure

As per type, network security segment is expected to grow at highest CAGR during the forecast period

The network as a service enterprise size segment is sub segmented into WAN, LAN and WLAN, Network Security and Communication and Collaboration. As per type, network security segment expected to grow at highest CAGR during the forecast period. The increase in digitalization initiatives and the rise in penetration of IoT across developing countries have led SMEs and large enterprises to adopt cloud computing. These factors have exposed their critical business process data to the risk of cyber-attacks. These sophisticated attacks have the potential to disrupt the evolution of digitalization and would restrict the benefits offered by it. BYOD and IoT trends are increasing cybersecurity needs. The service providers have adopted organic and inorganic growth strategies and acquired innovative security vendors to deliver end-to-end NaaS to enterprise customers and protect applications and data from advanced cyber threats.

Key Market Players

The network as a service solutions vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the major network as a service vendors are AT&T (US), Verizon (US), Telefonica (Spain), NTT Communications (Japan), Orange Business Services (France), Vodafone (UK), BT Group (UK), Tata Communications (India), Lumen (US), Comcast Business (US), and Axians (France).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 13.2 Billion |

|

Revenue forecast by 2027 |

USD 46.6 Billion |

|

Growth Rate (CAGR) |

CAGR of 19.0% from 2022 to 2027 |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

By Type, Application, Oganization Size, End User and Regions |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

AT&T (US), Verizon (US), Telefonica (Spain), NTT Communications (Japan), Orange Business Services (France), Vodafone (UK), BT Group (UK), Tata Communications (India), Lumen (US), Comcast Business (US), Axians (France), Servsys (US), TELUS (Canada), KDDI (Japan), Cloudflare (US), PCCW Global (China), China Telecom (China), Singtel (Singapore), China Mobile (China), GTT Communications (US), Aryaka Networks (US), Telia (Sweden), Telstra (Australia), Deutsche Telekom (Germany), Colt Technology Services (UK), Wipro (India), HGC (China), TenFour (US), PacketFabric (US), OnX Canada (Canada), Megaport (Australia), Epsilon (Singapore), IPC Tech (US), and Microland (India). |

This research report categorizes the Network as a service based on Type, Application, Oganization Size, End User and Regions.

By Type:

- Local Area Network and Wireless Local Area Network

- Wire Area Network

- Communication and Collaboration

- Network Security

By Application:

- UCaaS/Video Conferencing

- Virtual Private Network

- Cloud and SaaS Connectivity

- Bandwidth on Demand

- Multi-Branch Connectivity

- WAN Optimization

- Secure Web Gateway

- Network Access Control

- Other Applications

Network as a service market by Organization Type:

- Large Enterprises

- Small and Medium-Sized Enterprises

By End User:

- Banking, Financial, Services, and Insurance

- Manufacturing

- Retail and eCommerce

- Software and Technology

- Media and Entertainment

- Healthcare

- Education

- Government

- Other End Users

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Vodafone launched DWDM, , the new compact and flexible DWDM technology will enable Vi to optimize fiber assets while providing 100Gcapacity and future connection expansion capabilities to 200G and beyond.

- In April 2022, Tata Communications launched IZO Internet WAN, The Tata Communications IZO Internet WAN is ideal for organizations wishing to integrate cloud services into their existing IT and networking infrastructure, as well as companies planning to broaden their worldwide reach to new markets at a low cost.

- In January 2022, Comcast Business announced a deal with Nokia to expand its enterprise networking offering to include 5G private wireless networks, which will be delivered utilizing Nokia's DAC (Digital Automation Cloud) industrial-grade private wireless solution and modernization enablement platform.

- In December 2021, Telefonica collaborated with Tech Mahindra. Tech Mahindra and Telefonica used open software-defined networking (SDN) to electronically change their microwave network.

- In July 2021, Lumen Technologies extended its fiber network infrastructure in Europe, boosting its service capabilities in France, Switzerland, and Spain, as the 4th Industrial Revolution continues to increase corporate demand for high-speed internet and cloud footprint.

- In November 2020, NTT expanded its managed services portfolio by adding cybersecurity advisory and security consulting services. These services provide strategic assessments and solutions to analyze and secure complex corporate networks.

Frequently Asked Questions (FAQ):

What is the projected market value of the marketing automation market?

The marketing automation market size is expected to grow from USD 5.2 billion in 2022 to USD 9.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period.

Which region has the highest market share in the marketing automation market?

North American region has a higher market share in the marketing automation market.

Which component is expected to witness high adoption in the coming years?

Services is expected to witness the highest rate adoption in the coming five years.

Which are the major vendors in the marketing automation market?

Adobe, IBM, Oracle, Salesforce, and Microsoft are major vendors in marketing automation market.

What are some of the drivers in the marketing automation market?

Rising adoption of SMAC technologies

Need for personalized marketing to maximize returns by reaching target audience

Increasing focus of enterprises to optimize marketing spending

Growing number of marketing channels to reach end customers .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 1 NETWORK AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

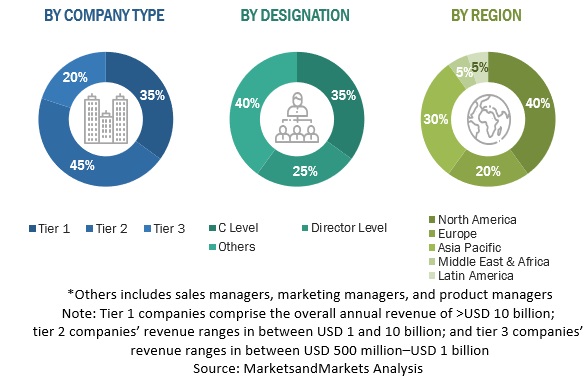

FIGURE 2 MARKET: BREAKDOWN OF PRIMARIES

2.1.2.2 Insights from industry experts

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1): SUPPLY-SIDE ANALYSIS OF REVENUE FROM LAN AND WLAN, WAN, COMMUNICATION AND COLLABORATION, AND NETWORK SECURITY

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE OF NETWORK AS A SERVICE VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF COMPANY REVENUE ESTIMATION IN NETWORK AS A SERVICE MODEL

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 2 NETWORK AS A SERVICE MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 3 MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 8 MARKET: HOLISTIC VIEW

FIGURE 9 MARKET: GROWTH TREND

FIGURE 10 ASIA PACIFIC EXPECTED TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 59)

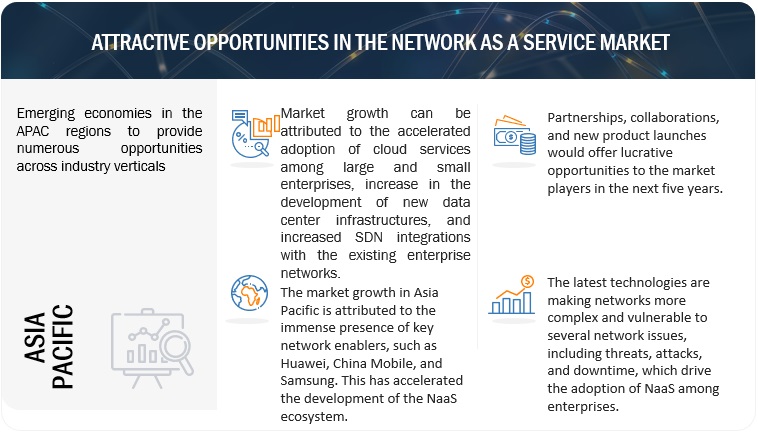

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 INCREASING ADOPTION OF CLOUD SERVICES DRIVING MARKET GROWTH DURING FORECAST PERIOD

4.2 NORTH AMERICA: MARKET, BY TYPE AND ORGANIZATION SIZE

FIGURE 12 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN NORTH AMERICAN MARKET IN 2022

4.3 EUROPE: MARKET, BY TYPE AND ORGANIZATION SIZE

FIGURE 13 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN EUROPEAN MARKET IN 2022

4.4 ASIA PACIFIC: MARKET, BY TYPE AND ORGANIZATION SIZE

FIGURE 14 WAN AND LARGE ENTERPRISES SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN ASIA PACIFIC MARKET IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NETWORK AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Accelerated adoption of cloud services among large and small enterprises

5.2.1.2 High reliability and security for mission-critical business applications

5.2.1.3 Increase in development of new data center infrastructures

5.2.1.4 Rise in SDN integration with existing network infrastructures

5.2.1.5 Reduction in time and money spent on automation

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardization in NaaS market

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for SDN- and NFV-based cloud-native solutions to replace traditional networking model

5.2.3.2 Growing mobile workforce

5.2.3.3 Adoption of a hybrid working model

FIGURE 16 ADOPTION OF HYBRID WORKING MODEL

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.2.4.2 Loss of WAN connection impeding business network activities

5.3 CASE STUDY ANALYSIS

5.3.1 ARYAKA NETWORKS

5.3.2 TELEFONICA

5.3.3 CBTS

5.3.4 NETFOUNDRY

5.3.5 GTT COMMUNICATIONS

5.3.6 PACKETFABRIC

5.3.7 HITACHI LTD

5.3.8 GLOBAL RETAILER

5.4 VALUE CHAIN ANALYSIS

FIGURE 17 NETWORK AS A SERVICE MARKET: VALUE CHAIN ANALYSIS

5.5 SUPPLY CHAIN ECOSYSTEM

5.6 INDUSTRY REGULATIONS

5.6.1 GENERAL DATA PROTECTION REGULATION

5.6.2 CALIFORNIA CONSUMER PRIVACY ACT

5.6.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.6.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.6.5 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.6.6 HEALTH LEVEL SEVEN

5.6.7 GRAMM-LEACH-BLILEY ACT

5.6.8 SARBANES-OXLEY ACT

5.6.9 SERVICE ORGANIZATION CONTROL 2

5.6.10 COMMUNICATIONS DECENCY ACT

5.6.11 DIGITAL MILLENNIUM COPYRIGHT ACT

5.6.12 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.6.13 LANHAM ACT

5.7 TECHNOLOGY ANALYSIS

5.7.1 VIRTUAL ETHERNET PORT AGGREGATOR

5.7.2 VIRTUAL EXTENSIBLE LOCAL AREA NETWORK

5.7.3 TRANSPARENT INTERCONNECTION OF LOTS OF LINKS

5.7.4 SHORTEST PATH BRIDGING

5.7.5 FIBER CHANNEL OVER ETHERNET

5.7.6 NETWORK VIRTUALIZATION USING GENERIC ROUTING ENCAPSULATION

5.7.7 DATA CENTER BRIDGING

5.7.8 PRIORITY FLOW CONTROL

5.7.9 BANDWIDTH MANAGEMENT

5.7.10 DATA CENTER BRIDGING EXCHANGE

6 NETWORK AS A SERVICE MARKET, BY TYPE (Page No. - 79)

6.1 INTRODUCTION

FIGURE 18 NETWORK SECURITY SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 5 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.1.1 TYPE: MARKET DRIVERS

6.1.2 TYPE: COVID-19 IMPACT

6.2 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK

6.2.1 DIGITALIZATION OF BUSINESSES REVOLUTIONIZING LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK SERVICES

TABLE 6 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 7 LOCAL AREA NETWORK AND WIRELESS LOCAL AREA NETWORK: NETWORK AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 WIDE AREA NETWORK

6.3.1 EMERGENCE OF SD-WAN INCREASING ADOPTION OF NETWORK AS A SERVICE MODEL IN WIDE AREA NETWORK

TABLE 8 WIDE AREA NETWORK: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 9 WIDE AREA NETWORK: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 COMMUNICATION AND COLLABORATION

6.4.1 REMOTE WORKING TRENDS DRIVING DEMAND FOR VIDEO COLLABORATION SERVICES

TABLE 10 COMMUNICATION AND COLLABORATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 11 COMMUNICATION AND COLLABORATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 NETWORK SECURITY

6.5.1 BORDERLESS NETWORK INFRASTRUCTURE BOOSTING DEMAND FOR NETWORK SECURITY SERVICES

TABLE 12 NETWORK SECURITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 NETWORK SECURITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 NETWORK AS A SERVICE MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 19 VIRTUAL PRIVATE NETWORK SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 15 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 UCAAS/VIDEO CONFERENCING

7.2.1 RISING NEED FOR REDUCING COMMUNICATION GAPS AND ENHANCING COMMUNICATION

TABLE 16 UCAAS/VIDEO CONFERENCING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 UCAAS/VIDEO CONFERENCING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 VIRTUAL PRIVATE NETWORK

7.3.1 WORK FROM HOME AND HYBRID WORKFORCE MODEL DRIVING DEMAND

TABLE 18 VIRTUAL PRIVATE NETWORK: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 VIRTUAL PRIVATE NETWORK: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 CLOUD AND SAAS CONNECTIVITY

7.4.1 DEMAND FOR HIGHER DEGREE OF RESILIENCE, FASTER PERFORMANCE, AND ENHANCED SECURITY

TABLE 20 CLOUD AND SAAS CONNECTIVITY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 CLOUD AND SAAS CONNECTIVITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 BANDWIDTH ON DEMAND

7.5.1 FLEXIBLE BANDWIDTH, CONNECTIVITY, AND LOCATION BENEFITS

TABLE 22 BANDWIDTH ON DEMAND: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 BANDWIDTH ON DEMAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 MULTI-BRANCH CONNECTIVITY

7.6.1 INCREASING NEED TO CONNECT MULTIPLE BRANCHES WITH SEVERAL MOBILE DEVICES AND ENDPOINTS

TABLE 24 MULTI-BRANCH CONNECTIVITY: NETWORK AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 MULTI-BRANCH CONNECTIVITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 WAN OPTIMIZATION

7.7.1 NEED FOR APPLICATION ACCELERATION AND ENHANCED USER EXPERIENCE

TABLE 26 WAN OPTIMIZATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 27 WAN OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 SECURE WEB GATEWAY

7.8.1 RISING NEED TO PREVENT UNSECURED WEB TRAFFIC FROM ENTERING OR LEAVING NETWORKS

TABLE 28 SECURE WEB GATEWAY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 SECURE WEB GATEWAY: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.9 NETWORK ACCESS CONTROL

7.9.1 INCREASED NETWORK VISIBILITY AND REDUCED RISKS

TABLE 30 NETWORK ACCESS CONTROL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 NETWORK ACCESS CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.10 OTHER APPLICATIONS

TABLE 32 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 102)

8.1 INTRODUCTION

FIGURE 20 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 34 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 35 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

8.2 LARGE ENTERPRISES

8.2.1 INCREASING DIGITALIZATION BOOSTING GROWTH OF NETWORK AS A SERVICE SOLUTIONS

TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 NEED FOR COST-EFFECTIVENESS MAXIMIZING LARGE-SCALE ADOPTION OF NETWORK AS A SERVICE MODEL

TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NETWORK AS A SERVICE MARKET, BY END-USER (Page No. - 108)

9.1 INTRODUCTION

FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 40 MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 41 MARKET, BY END-USER, 2022–2027 (USD MILLION)

9.1.1 END-USER: MARKET DRIVERS

9.1.2 END-USER: COVID-19 IMPACT

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 NEED FOR REAL-TIME CUSTOMER SERVICE AND GROWTH OF FINTECH

TABLE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MANUFACTURING

9.3.1 NEED FOR ACCELERATING DIGITALIZATION AND AUTOMATION

TABLE 44 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 RETAIL AND ECOMMERCE

9.4.1 INCREASING ADOPTION OF LATEST TECHNOLOGIES

TABLE 46 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 SOFTWARE AND TECHNOLOGY

9.5.1 FOCUS NEEDED ON GAINING INSIGHTS FROM VOLUMINOUS CONTENT

TABLE 48 SOFTWARE AND TECHNOLOGY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 SOFTWARE AND TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 MEDIA AND ENTERTAINMENT

9.6.1 DEMAND FOR MANAGING DATA

TABLE 50 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 HEALTHCARE

9.7.1 DIGITAL REVOLUTION IN HEALTHCARE

TABLE 52 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 EDUCATION

9.8.1 INCREASED FOCUS ON COST SAVING

TABLE 54 EDUCATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 GOVERNMENT

9.9.1 RE-ENGINEERED TRADITIONAL MODELS ENCOURAGING GROWTH

TABLE 56 GOVERNMENT: ICE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHER END-USERS

TABLE 58 OTHER END-USERS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 OTHER END-USERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NETWORK AS A SERVICE MARKET, BY REGION (Page No. - 124)

10.1 INTRODUCTION

10.1.1 COVID-19 IMPACT

FIGURE 22 ASIA PACIFIC EXPECTED TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 23 NORTH AMERICA EXPECTED TO LEAD DURING FORECAST PERIOD

TABLE 60 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 UNITED STATES

10.2.2.1 Demand for high-performance networks and high adoption of reliable connectivity solutions

TABLE 72 UNITED STATES: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 73 UNITED STATES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 75 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 76 UNITED STATES: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 77 UNITED STATES: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 78 UNITED STATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 79 UNITED STATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Rising adoption of innovative delivery methods

TABLE 80 CANADA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 81 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 82 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 83 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 84 CANADA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: NETWORK AS A SERVICE MARKET DRIVERS

TABLE 88 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UNITED KINGDOM

10.3.2.1 Need for better overall network management solutions

TABLE 98 UNITED KINGDOM: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 102 UNITED KINGDOM: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 103 UNITED KINGDOM: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 104 UNITED KINGDOM: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 105 UNITED KINGDOM: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 New government regulations and digitalization

TABLE 106 GERMANY: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 114 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Broad internet user base and widespread adoption of Wi-Fi technology

TABLE 124 CHINA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 125 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 127 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 CHINA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 129 CHINA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 130 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Expansion in 5G and focus on cloud supporting adoption of NaaS model

TABLE 132 JAPAN: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 133 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 JAPAN: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 137 JAPAN: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 138 JAPAN: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 Strategic collaborations and developed infrastructure driving market growth

TABLE 140 SOUTH KOREA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 141 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 SOUTH KOREA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 143 SOUTH KOREA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 144 SOUTH KOREA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 145 SOUTH KOREA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 146 SOUTH KOREA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 147 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.5 INDIA

10.4.5.1 Rising adoption of NaaS among retail and eCommerce and telecom industries

TABLE 148 INDIA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 149 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 151 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 152 INDIA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 153 INDIA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 154 INDIA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 155 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: NETWORK AS A SERVICE MARKET DRIVERS

TABLE 156 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Supportive government initiatives boosting higher adoption of NaaS

TABLE 166 MIDDLE EAST: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 167 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 169 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 171 MIDDLE EAST: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Business transformations and supportive policies gaining market traction

TABLE 174 AFRICA: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 175 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 177 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 178 AFRICA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 179 AFRICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 180 AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 181 AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: NETWORK AS A SERVICE MARKET DRIVERS

TABLE 182 LATIN AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.2 MEXICO

10.6.2.1 Wireless internet connectivity initiatives fueling market growth

TABLE 192 MEXICO: NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 193 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 195 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 196 MEXICO: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 197 MEXICO: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 198 MEXICO: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 199 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Increasing adoption of wireless internet connectivity among enterprises

TABLE 200 BRAZIL: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 202 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 203 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 204 BRAZIL: MARKET, BY END-USER, 2016–2021 (USD MILLION)

TABLE 205 BRAZIL: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 206 BRAZIL: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 207 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 200)

11.1 INTRODUCTION

11.2 COMPANY EVALUATION QUADRANT

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

FIGURE 26 NETWORK AS A SERVICE MARKET, COMPANY EVALUATION QUADRANT, 2021

11.2.5 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

TABLE 208 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN MARKET

12 COMPANY PROFILES (Page No. - 204)

12.1 INTRODUCTION

12.2 KEY PLAYERS

Business overview, Solutions offered, Recent Developments, MNM view)*

12.2.1 AT&T

TABLE 209 AT&T: BUSINESS OVERVIEW

FIGURE 27 AT&T: COMPANY SNAPSHOT

TABLE 210 AT&T: SOLUTIONS OFFERED

TABLE 211 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 212 AT&T: DEALS

12.2.2 VERIZON

TABLE 213 VERIZON: BUSINESS OVERVIEW

FIGURE 28 VERIZON: COMPANY SNAPSHOT

TABLE 214 VERIZON: SOLUTIONS OFFERED

TABLE 215 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 216 VERIZON: DEALS

TABLE 217 VERIZON: OTHERS

12.2.3 TELEFONICA

TABLE 218 TELEFONICA: BUSINESS OVERVIEW

FIGURE 29 TELEFONICA: COMPANY SNAPSHOT

TABLE 219 TELEFONICA: SOLUTIONS OFFERED

TABLE 220 TELEFONICA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 221 TELEFONICA: DEALS

TABLE 222 TELEFONICA: OTHERS

12.2.4 NTT COMMUNICATIONS

TABLE 223 NTT COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 30 NTT COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 224 NTT COMMUNICATIONS: SOLUTIONS OFFERED

TABLE 225 NTT COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 226 NTT COMMUNICATIONS: DEALS

12.2.5 ORANGE BUSINESS SERVICES

TABLE 227 ORANGE BUSINESS SERVICES: BUSINESS OVERVIEW

FIGURE 31 ORANGE BUSINESS SERVICES: COMPANY SNAPSHOT

TABLE 228 ORANGE BUSINESS SERVICES: SOLUTIONS OFFERED

TABLE 229 ORANGE BUSINESS SERVICES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 ORANGE BUSINESS SERVICES: DEALS

12.2.6 VODAFONE

TABLE 231 VODAFONE: BUSINESS OVERVIEW

FIGURE 32 VODAFONE: COMPANY SNAPSHOT

TABLE 232 VODAFONE: SOLUTIONS OFFERED

TABLE 233 VODAFONE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 234 VODAFONE: DEALS

TABLE 235 VODAFONE: OTHERS

12.2.7 BT GROUP

TABLE 236 BT GROUP: BUSINESS OVERVIEW

FIGURE 33 BT GROUP: COMPANY SNAPSHOT

TABLE 237 BT GROUP: SOLUTIONS OFFERED

TABLE 238 BT GROUP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 239 BT GROUP: DEALS

12.2.8 TATA COMMUNICATIONS

TABLE 240 TATA COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 34 TATA COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 241 TATA COMMUNICATIONS: SOLUTIONS OFFERED

TABLE 242 TATA COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 243 TATA COMMUNICATIONS: DEALS

12.2.9 LUMEN

TABLE 244 LUMEN: BUSINESS OVERVIEW

FIGURE 35 LUMEN: COMPANY SNAPSHOT

TABLE 245 LUMEN: SOLUTIONS OFFERED

TABLE 246 LUMEN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 247 LUMEN: DEALS

TABLE 248 LUMEN: OTHERS

12.2.10 COMCAST BUSINESS

TABLE 249 COMCAST BUSINESS: BUSINESS OVERVIEW

TABLE 250 COMCAST BUSINESS: SOLUTIONS OFFERED

TABLE 251 COMCAST BUSINESS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 COMCAST BUSINESS: DEALS

12.2.11 AXIANS

TABLE 253 AXIANS: BUSINESS OVERVIEW

TABLE 254 AXIANS: SOLUTIONS OFFERED

TABLE 255 AXIANS: DEALS

12.3 OTHER PLAYERS

12.3.1 SERVSYS

12.3.2 TELUS

12.3.3 KDDI

12.3.4 CLOUDFLARE

12.3.5 PCCW GLOBAL

12.3.6 CHINA TELECOM

12.3.7 SINGTEL

12.3.8 CHINA MOBILE

12.3.9 GTT COMMUNICATIONS

12.3.10 ARYAKA NETWORKS

12.3.11 TELIA

12.3.12 TELSTRA

12.3.13 DEUTSCHE TELEKOM

12.3.14 COLT TECHNOLOGY SERVICES

12.3.15 WIPRO

12.3.16 HGC

12.3.17 TENFOUR

12.3.18 PACKETFABRIC

12.3.19 ONX CANADA

12.3.20 MEGAPORT

12.3.21 EPSILON

12.3.22 IPC TECH

12.3.23 MICROLAND

*Details on Business overview, Solutions offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 277)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.1.2 NETWORK MANAGEMENT SYSTEM

13.1.2.1 Market definition

13.1.2.2 Network management system market, by component

TABLE 256 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2017–2024 (USD MILLION)

13.1.2.3 Network management system market, by deployment mode

TABLE 257 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

13.1.2.4 Network management system market, by organization size

TABLE 258 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.1.2.5 Network management system market, by vertical

TABLE 259 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017–2024 (USD MILLION)

13.1.3 WAN OPTIMIZATION MARKET

13.1.3.1 Market definition

13.1.3.2 WAN optimization market, by component

TABLE 260 WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

13.1.3.3 WAN optimization market, by end-user

13.1.3.3.1 Small and medium-sized enterprises

TABLE 261 SMALL AND MEDIUM-SIZED ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.3.2 Large enterprises

TABLE 262 LARGE ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4 WAN optimization market, by vertical

13.1.3.4.1 Banking, financial services, and insurance

TABLE 263 BANKING, FINANCIAL SERVICES, AND INSURANCE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.2 Healthcare

TABLE 264 HEALTHCARE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.3 Information technology and telecom

TABLE 265 INFORMATION TECHNOLOGY AND TELECOM: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.4 Manufacturing

TABLE 266 MANUFACTURING: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.5 Retail

TABLE 267 RETAIL: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.6 Media and entertainment

TABLE 268 MEDIA AND ENTERTAINMENT: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.7 Energy

TABLE 269 ENERGY: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.4.8 Education

TABLE 270 EDUCATION: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

13.1.3.5 WAN optimization market, by region

13.1.3.5.1 Europe

TABLE 271 EUROPE: WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 272 EUROPE: WAN OPTIMIZATION MARKET, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 273 EUROPE: WAN OPTIMIZATION MARKET, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 274 EUROPE: WAN OPTIMIZATION MARKET, BY END-USER, 2018–2025 (USD MILLION)

TABLE 275 EUROPE: WAN OPTIMIZATION MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 276 EUROPE: WAN OPTIMIZATION MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 277 EUROPE: WAN OPTIMIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 290)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The research study for the network as a service involved the use of extensive secondary sources, directories, and several journals, including the Global Journal of Management and Business Research and Asia Pacific Journal of Information Systems (APJIS), and publications, such as the Journal of Enterprise Information Management, to identify and collect information useful for this comprehensive market research study. Primary sources were mainly industry experts from the core and related industries, preferred NMS providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases and investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net were also referred. In addition, various telecom and NaaS associations/forums, Citizens Broadband Radio Service (CBRS) Alliance, MulteFire Alliance, and 3GPP. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from NMS solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using network as a service solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of network as a service solutions and services, which would impact the overall network as a service.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The network as a service is in an initial stage, with a very limited number of available deployments, and a limited number of vendors. Multiple approaches were adopted to estimate and forecast the market size of the NaaS market. The first approach involves the estimation of market size by summing up the revenue generated by companies through the sale of NaaS types, such as LAN and WLAN, WAN, communication and collaboration, and network security. Available secondary data as well as primary information was analyzed to identify use cases, research projects, initiatives, and consortiums specific to the network as a service. An exhaustive list of all vendors offering solutions and services in the network as a service was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, business functions, channel integration, and verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

The list of vendors considered for estimating the market size is not limited to the vendors profiled in the report. However, MarketsandMarkets prepared a laundry list of vendors offering network as a service solutions and services and mapped their products related to the network as a service to identify major vendors operating in the market

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, manufacturing, retail and ecommerce, software and technology, media & entertainment, healthcare, education, government, and other end users. Others include transportation and logistics, energy and utilities, and hospitality.

Report Objectives

- To define, describe, and forecast the Network as a Service (NaaS) market by type, organization size, application, end user, and region

- To forecast the size of the market’s segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about major factors (drivers, opportunities, threats, and challenges) influencing the growth of the NaaS market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global NaaS market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global NaaS market

- To profile key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American network as a service market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network as a Service Market

Interested in Network-as-a-Service market

Which industries/end customer segments are keen to adopt Network as a Service Market?