Network Emulator Market by Application Type (SD-WAN, Cloud, and IoT), Vertical (Telecommunication, Government and Defense, BFSI), and Region (North America, Europe, APAC, MEA, and Latin America) - Global Forecast to 2024

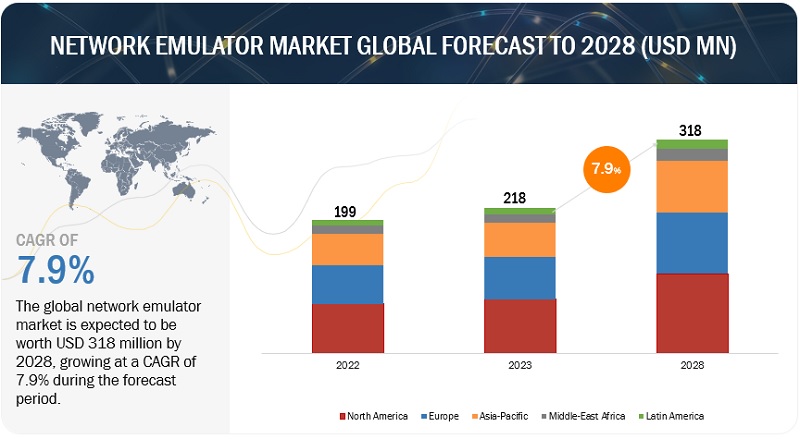

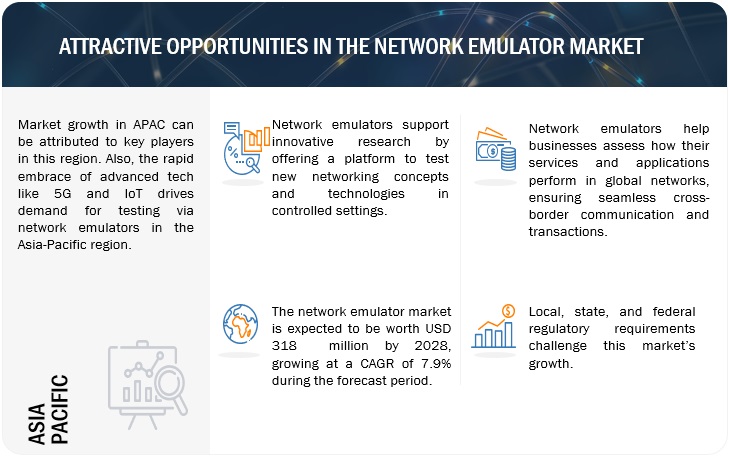

[90 Pages Report] The global Network Emulator Market size is projected to reach $217 million by 2024, at a CAGR of 8.1%. Network emulators provide such an environment in the virtual format for network performance and security testing, which can ensure the safety of networks and devices in any complicated condition. The network emulators enable organizations to troubleshoot, design networks, test application performance, and optimize network performance. These factors drive the network emulator market.

Software-define Wide Area Network to account for the largest market size during the forecast period

SD-WAN networks typically connect corporate headquarters and data centers with local offices and Software as a Service (SaaS)-based applications through multiple Wide Area Network (WAN) links. While SD-WANs are capable of increasing the capacity and performance of the networks they manage, mission-critical applications depend on them to function properly. Thorough testing proves vital in selecting and configuring the right system for specific network conditions, application mix, and budget. Network emulators simplify the testing and evaluation of SD-WAN systems by replicating real-world networks in the lab with state-of-the-art WAN emulators. They help configure SD-WAN optimization efforts for specific network conditions and applications as well as emulate WAN connections to validate performance before risking business in real-world scenarios.

Telecommunication vertical to account for the largest market size during the forecast period

The need to emulate complex network deployments and create complex network conditions is expected to drive market growth telecom network operators. These operators transform their network environments toward next-generation networking solutions to introduce advanced value-added services. The increase in the number of connected devices has generated an unprecedented demand for bandwidth for these devices. The network operators are required to transform their network for continual optimization, to facilitate capacity reallocation and upgradation, in order to meet the increasing bandwidth demand for advanced services and cost optimization for delivering services. Network emulators help telecommunication network operators to emulate the complex network deployments and create complex network conditions in the lab for testing and troubleshooting networks.

North America to hold the largest market size during the forecast period

North America comprises developed countries, such as the US and Canada. These countries have invested significantly in Research and Development (R&D) activities, thereby contributing to the development of innovative technologies. The network emulator market in North America is highly competitive, as countries such as the US and Canada are focused on R&D and innovation. These countries are early adopters of technologies in various verticals. The US and Canada are also the leading countries in retail, financial services, banking, and other industries, such as transportation and manufacturing. The US is expected to have the highest market share among all the countries in the market during the forecast period. It is a technologically advanced country with strong regulations for various verticals.

Key Market Players

Major vendors in the network emulator market include Spirent Communications (US), Keysight Technologies (US), Apposite Technologies (US), Polaris Networks (US), PacketStorm Communications (US), iTrinegy (New England), Aukua (US), Calnex (UK), SolarWinds (US), InterWorking Labs (US), GigaNet Systems (US), SCALABLE Network Technologies (US), Valid8 (US), Tetcos (India), and W2BI (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Market Value in 2024 |

USD 217 million |

|

Largest Market |

North America |

|

Segments covered |

Type (SD-WAN, Cloud, IoT, and Others [satellite network, voice and VoIP, and storage]), Vertical (Telecommunication, Government and Defense, BFSI, and Others [Gaming and Broadcasting]), and Region (North America, Europe, APAC, MEA, and Latin America) |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Spirent Communications (US), Keysight Technologies (US), Apposite Technologies (US), Polaris Networks (US), PacketStorm Communications (US), iTrinegy (New England), Aukua (US), Calnex (UK), SolarWinds (US), InterWorking Labs (US), GigaNet Systems (US), SCALABLE Network Technologies (US), Valid8 (US), Tetcos (India), and W2BI (US). |

This research report categorizes the network emulator market based on the application type, vertical, and region.

By Application Type:

- Software-defined Wide Area Network (SD-WAN)

- Cloud

- Internet of Things (IoT)

- Others (Satellite Network, Voice and Voice over Internet Protocol [VoIP], and Storage)

By Vertical:

- Telecommunication

- Government and Defense

- Banking, Financial Services, and Insurance (BFSI)

- Others (Gaming and Broadcasting)

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In May 2019, Calnex Solutions acquired Luceo Technologies. With the acquisition, Calnex Solutions included Luceo Technologies’ product, High Speed Optical Module Testers. The product complements Calnex Solutions’ existing portfolio of synchronization testers and network emulators.

Frequently Asked Questions (FAQ):

What is network emulator?

Network emulators are product that replicate real-time network performance, enable manipulation of bandwidth constraints, and apply impairments, such as packet loss, delay, and jitter, to accurately gauge application’s responsiveness and throughput, and the quality of end-user experience, so as to provide quality assurance, proof of concept, and troubleshooting.

How big is the Network Emulator Market?

The network emulator market is expected to grow from USD 146 million in 2019 to USD 217 million by 2024.

What is the global Network Emulator Market growth?

The global network emulator market is projected to register a moderate 8.1% CAGR in the forecast period.

Which application of the global network emulator market expected to witness the highest growth?

Software-Defined Wide Area Network segment to account for the largest market size during the forecast period.

Who are the major vendors in the Network Emulator Market?

Spirent Communications, Keysight Technologie, Apposite Technologie, Polaris Networks, PacketStorm Communications, iTrinegy, Aukua , Calnex, SolarWinds, InterWorking Labs , GigaNet Systems, SCALABLE Network Technologies, Valid8, Tetcos, and W2BI. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Competitive Leadership Mapping Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 24)

4.1 Attractive Opportunities in the Network Emulator Market

4.2 Global Network Emulator Market, Top 2 Application Types and Verticals

4.3 Network Emulator Market, By Region

4.4 Network Emulator Market: Global Revenue Shares

5 Market Overview and Industry Trends (Page No. - 26)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise of Attacks and Security Breaches on Networks

5.2.1.2 Need for Reduced Downtime in Networking

5.2.2 Restraints

5.2.2.1 Longer Timelines and Extended R&D Requirements for New Networking Technologies

5.2.2.2 Price Sensitivity of Network Testing and Emulators

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Software-Defined Networking and Virtualization

5.2.3.2 Multi-Protocol Support and Advanced Functions Provided By Same Hardware Emulator

5.2.3.3 Investments in R&D and Positive Outcomes From the Testing Phase of 5g Networks

5.2.4 Challenges

5.2.4.1 Lack of Skilled Workforce to Comprehend and Report Issues in Networking

5.2.4.2 Fast-Changing Network Requirements a Concern for Emulators

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.3.4 Use Case: Scenario 4

5.3.5 Use Case: Scenario 5

5.3.6 Use Case: Scenario 6

5.4 Solution Architecture

5.4.1 Introduction

5.4.2 Architecture

6 Network Emulator Market, By Application Type (Page No. - 34)

6.1 Introduction

6.2 SD-WAN

6.2.1 Increased Deployment of Applications on WAN Networks to Fuel Market Growth

6.3 Cloud

6.3.1 Simulated Conditions in Cloud to Help Test and Validate Application Performance to Drive the Market Growth

6.4 Internet of Things

6.4.1 Increase in Number of Connected Devices to Accelerate use of Network Emulators

6.5 Others

7 Network Emulator Market, By Vertical (Page No. - 40)

7.1 Introduction

7.2 Telecommunication

7.2.1 Network Emulators Help Telecom Network Operators to Emulate the Complex Network Deployments and Create Complex Network Conditions

7.3 Banking, Financial Services, and Insurance

7.3.1 Simulation of a Variety of Networks to Conduct Realistic Pre-Deployment Testing to Drive Growth of Network Emulator Market in BFSI Vertical

7.4 Government and Defense

7.4.1 Increased Expenditure on Defense Projects to Accelerate Market Growth in Government and Defense Vertical

7.5 Others

8 Network Emulator Market, By Region (Page No. - 46)

8.1 Introduction

8.2 North America

8.2.1 United States

8.2.1.1 Enterprises and Service Providers in the United States to Implement Network Emulator Solutions on a Large Scale

8.2.2 Canada

8.2.2.1 Need for Network Emulators to Ensure Proper Functioning of Apps or Devices in Cloud, Internet, and Other Network Environments to Drive Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Increased Spending on Network Infrastructure to Fuel the Growth of the Network Emulator Market in Germany

8.3.2 France

8.3.2.1 Increasing It Budget in France to Drive the Network Emulator Market Growth in France

8.3.3 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.1.1 Increasing Investments in Network Infrastructure to Fuel the Growth of the Network Emulator Market in China

8.4.2 Japan

8.4.2.1 Japan to Experience Noticeable Increase in Adoption of Network Emulator Solutions

8.4.3 Rest of Asia Pacific

8.5 Middle East and Africa

8.6 Latin America

9 Competitive Landscape (Page No. - 57)

9.1 Overview

9.2 Competitive Leadership Mapping

9.2.1 Visionary Leaders

9.2.2 Dynamic Differentiators

9.2.3 Innovators

9.2.4 Emerging Companies

9.3 Ranking of Key Players

9.4 Competitive Scenario

9.4.1 New Product Launches /Product Enhancements

9.4.2 Partnerships, Collaborations, and Agreements

9.4.3 Mergers and Acquisitions

10 Company Profiles (Page No. - 63)

10.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2 Spirent Communications

10.3 Keysight Technologies

10.4 Apposite Technologies

10.5 iTrinegy

10.6 Polaris Networks

10.7 PacketStorm

10.8 Aukua

10.9 Calnex

10.10 SolarWinds

10.11 InterWorking Labs

10.12 Giganet Systems

10.13 SCALABLE Network Technologies

10.14 Valid8

10.15 Tetcos

10.16 W2BI

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 85)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (28 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Network Emulator Market Size and Growth Rate, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Market Size, By Application Type, 2017–2024 (USD Million)

Table 5 SD-WAN: Market Size, By Region, 2017–2024 (USD Million)

Table 6 Cloud: Network Emulator Market Size, By Region, 2017–2024 (USD Million)

Table 7 Internet of Things: Market Size, By Region, 2017–2023 (USD Million)

Table 8 Other Applications: Market Size, By Region, 2017–2024 (USD Million)

Table 9 Market Size, By Vertical, 2017–2023 (USD Million)

Table 10 Telecommunication: Network Emulator Market Size, By Region, 2017–2024 (USD Million)

Table 11 Banking, Financial Services, and Insurance: Market Size, By Region, 2017–2024 (USD Million)

Table 12 Government and Defense: Market Size, By Region, 2017–2024 (USD Million)

Table 13 Other Verticals: Market Size, By Region, 2017–2024 (USD Million)

Table 14 Network Emulator Market Size, By Region, 2017–2024 (USD Million)

Table 15 North America: Market Size, By Application Type, 2017–2024 (USD Million)

Table 16 North America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 17 Europe: Market Size, By Application Type, 2017–2024 (USD Million)

Table 18 Europe: Network Emulator Market Size, By Vertical, 2017–2024 (USD Million)

Table 19 Asia Pacific: Market Size, By Application Type, 2017–2024 (USD Million)

Table 20 Asia Pacific: Market Size, By Vertical, 2017–2024 (USD Million)

Table 21 Middle East and Africa: Network Emulator Market Size, By Application Type, 2017–2024 (USD Million)

Table 22 Middle East and Africa: Market Size, By Vertical, 2017–2024 (USD Million)

Table 23 Latin America: Market Size, By Application Type, 2017–2024 (USD Million)

Table 24 Latin America: Network Emulator Market Size, By Vertical, 2017–2024 (USD Million)

Table 25 Evaluation Criteria

Table 26 New Product Launches /Product Enhancements, 2016–2018

Table 27 Partnerships, Collaborations, and Agreements, 2017–2018

Table 28 Mergers and Acquisitions, 2017–2019

List of Figures (23 Figures)

Figure 1 Network Emulator Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Competitive Leadership Mapping: Criteria Weightage

Figure 4 Network Emulator Market, Top 3 Segments, 2019

Figure 5 SD-WAN to Have the Highest Market Share in 2019

Figure 6 Increasing Deployment of IoT and Cloud Technologies to Provide Opportunities in the Network Emulator Market

Figure 7 SD-WAN and Telecommunication to Hold the Highest Market Shares in 2019

Figure 8 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 9 North America to Have the Highest Market Share in 2019

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Network Emulator Market

Figure 11 IoT Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Banking, Financial Services, and Insurance to Grow at the Highest CAGR During the Forecast Period

Figure 13 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 14 North America: Market Snapshot

Figure 15 Asia Pacific: Market Snapshot

Figure 16 Network Emulator Market (Global), Competitive Leadership Mapping, 2018

Figure 17 Ranking of Key Players in the Network Emulator Market, 2018

Figure 18 Key Developments By the Leading Players in the Market During 2017–2019

Figure 19 Spirent Communications: Company Snapshot

Figure 20 Spirent Communications: SWOT Analysis

Figure 21 Keysight Technologies: Company Snapshot

Figure 22 Keysight Technologies: SWOT Analysis

Figure 23 SolarWinds: Company Snapshot

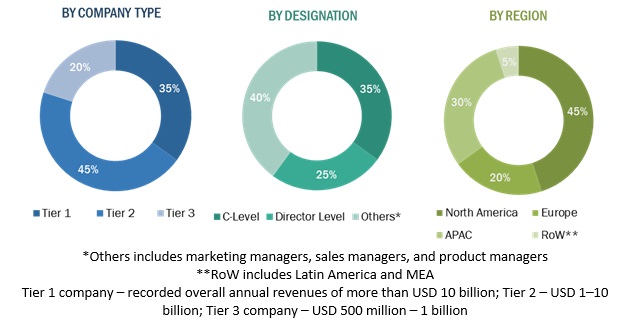

The study involved 4 major steps to estimate the current market size for the network emulator market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies; white papers, technology journals and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

The network emulator market comprises several stakeholders, such as solution and service providers, support and maintenance service providers, manufacturing enterprises, technology consultants, system design and development vendors, and logistics and supply chain management providers. The extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Network Emulator Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the network emulator market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The network emulator market expenditures across regions, along with the geographic split in various segments have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the network emulator market.

Report Objectives:

- To define, describe, and forecast the network emulator market by application type, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies1

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the network emulator market

1Core competencies of the companies have been captured in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

Company Information

- Detailed analysis and profiling of additional market players

Key Questions Addressed by the Report:

- Where would all these developments take the network emulators industry in the mid to long term?

- What are the upcoming industry solutions for the network emulator market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth for vendors in the market?

- Which service would gain the highest market share in the market?

Growth opportunities and latent adjacency in Network Emulator Market