NDT and Inspection Market by Technique (Visual Testing, Magnetic Particle, Liquid Penetrant, Eddy-Current, Ultrasonic, Radiographic, Terahertz Imaging, Acoustic Emission), Method, Service, Application, Vertical and Region-Global Forecast, 2028

Updated on : May 8, 2023

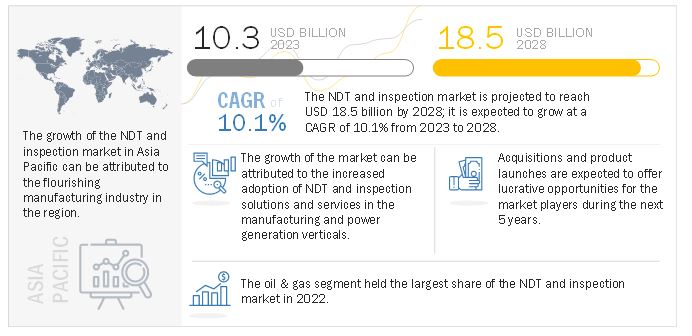

[337 Pages Report] The global NDT and Inspection market size is estimated to be USD 10.3 billion in 2023 and is projected to reach USD 18.5 billion by 2028, at a CAGR of 10.1% during the forecast period. Some of the major factors contributing to the high demand for the NDT and Inspection industry includes stringent government regulations regarding public safety and product quality and continuous advancements in electronics, automation, and robotics applications.

NDT and Inspection Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing demand for artificial intelligence in NDT and Inspection

Factors such as rising demand from the aerospace sector for maintaining a higher standard of material, structure, and strength, along with widening application lists, including finding cracks, flaws, and leaks, will boost the non-destructive testing (NDT) market growth. Additionally, rising demand from various sectors, including oil & gas, automotive, and power, will increase the footprint of the market. Also, increasing awareness regarding improving operational efficiency & reliability will drive the growth of the market.

Restraint: Substantial investments for NDT and Inspection equipment

The high amounts of investments in NDT equipment and technologies such as infrared thermography, computed tomography, radiography technologies, etc., may tend to be a restraining factor in the growth of this market. The high costs of equipment is not affordable in a few of the developing and under-developed countries. This may lead to lesser adoption of NDT equipment by these countries, and hence, this will lead to a dip in equipment adoption.

Opportunity: Increasing demand for NDT in the power generation industry

The global power generation industry is expected to witness the increased adoption of NDT and inspection services. NDT techniques are used in the power industry to inspect pressure systems and steam and gas turbines. The NDT techniques in nuclear power plants are used to inspect rods, small valves, waste containers, and waste management infrastructure. So, this factor creates an opportunity for the growth of the NDT and Inspection market. Several industries in emerging economies, such as China, India, and Mexico, are witnessing large-scale infrastructure development projects, with power generation facilities holding a prominent position.

Challenge: High replacement cost of automated NDT equipment

One of the major drawbacks of NDT and inspection services is the high replacement costs of automated NDT and inspection equipment. Small- and medium-sized enterprises use simple NDT equipment that may not be as reliable as automated NDT and inspection equipment. This prompts some end users, who perceive it to be a burden on their recurring investments, to opt for third-party inspection services. Various companies are focusing on the development of automated NDT and inspection equipment that can offer a high return on investments in the future.

Public Infrastructure segment to hold significant market share throughout the forecast period

High requirements of public safety, especially in public infrastructure, result in a significant market share in the overall NDT and Inspection market in 2022 as well as throughout the forecast period, i.e., between 2023-2028. NDT and inspection techniques are used in thousands of inspections and tests to evaluate the condition, quality, and reliability of construction equipment and new products. Government infrastructures include military bases, defense camps, airports, railways, bridges and tunnels, border-crossing security monitoring centers, nuclear plants, etc. NDT and inspection equipment and techniques are used in all infrastructures during their development. The techniques used in public infrastructures are visual testing, Eddy-current testing, phased array ultrasonic testing, and magnetic and electromagnetic testing.

Ultrasonic testing segment likely to hold largest market share during the forecast period

In 2022, the UT technique segment accounted for the largest share of the overall NDT and inspection market. UT has evolved considerably over the last few decades and is the most important NDT and inspection method for identifying and quantifying surface and subsurface defects. It can be conducted using a wide range of methods, a few of which are manual and cost-effective. In contrast, others require advanced automated equipment to determine critical application faults. UT technique can also be deployed to inspect objects that are not easily accessible through direct contact; for instance, it is used for inspecting piping systems buried under the surface of the earth.

Training Service segment to witness highest CAGR among all NDT and Inspection services market between 2023 and 2028

The market for NDT training services is gaining traction with the growing demand for NDT and inspection equipment. Skilled technicians are required to operate the equipment. Over the past few years, there has been a shortfall of skilled NDT technicians in the market, especially in countries such as the US and Canada, where there has been a shift toward phased array ultrasonic testing (PAUT) from radiography testing for weld inspections. NDT training is offered for magnetic particle inspection, visual inspection, penetrant inspection, radiographic inspection, ultrasonic inspection, and Eddy-current inspection services in a wide range of industries, such as power, aerospace, nuclear, defense, transport, and oil & gas.

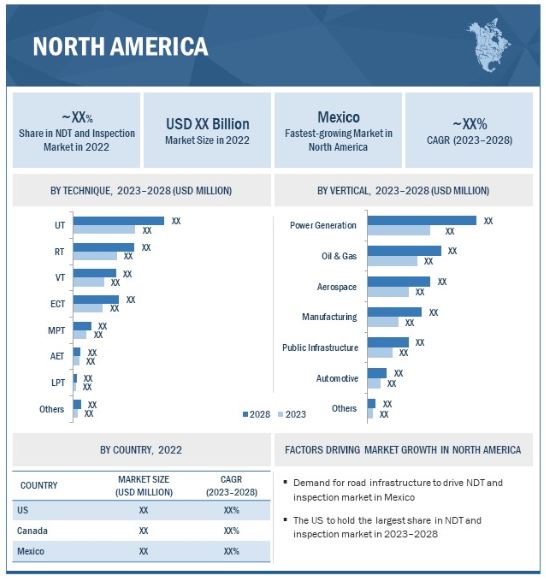

Mexico likely to witness highest growth rate for NDT and Inspection Market in North America during the forecast period

NDT and inspection market in Mexico to grow at higher CAGR due to increasing focus on urban mobility, expanding natural gas pipeline network, growing economy, and rapid population growth. The entire road infrastructure is monitored by the Government of Mexico and deployed based on US standards. Mexico uses nuclear power, and according to the Federal Electricity Commission (CFE) presentation, Mexico is planning to build almost 10 new reactors by 2028. Mexico is expected to seek private investments of about USD 10 billion in the next five years to expand its natural gas pipeline network; also, the Mexican government has started major infrastructure development projects, with average spending of USD 300–350 million on each project.

NDT and Inspection Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

General Electric (US), MISTRAS Group (US), Olympus Corporation (Japan), Ashtead Technology (Scotland), Nikon Metrology NV (US) are among the major players in the NDT and Inspection companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion) and Volume (Thousand Units) |

|

Segments Covered |

By Technique, Method, Service, Application, Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

General Electric (US), MISTRAS Group (US), Olympus Corporation (Japan), Ashtead Technology (Scotland), Nikon Metrology NV (UK) |

NDT and Inspection Market Highlights

This research report categorizes the NDT and Inspection market by technique, method, services, application, vertical, and region

|

Aspect |

Details |

|

Based on the Technique: |

|

|

Based on Method: |

|

|

Based on Service: |

|

|

Based on Application: |

|

|

Based on Vertical: |

|

|

Based on the Region: |

|

Recent Developments

- In October 2022, Laser Radar stations from Nikon Industrial Metrology offer a powerful new alternative against traditional CMMs for manufacturers seeking to measure the geometry of medium-to-large parts – from a car door, casting, or fabrication to a whole car chassis or airframe structure.

- In October 2022, Eddyfi launched Ectane 3, a powerful non-destructive testing (NDT) instrument for surface and tubing inspections. The next-generation Ectane 3 supports remote-field array (RFA) technology for advanced carbon steel heat exchanger inspections.

- In April 2022, Ashtead Technology developed a new optical chain measurement system (CMS) to provide highly accurate and repeatable mooring chain measurements to track chain corrosion, wear, and elongation between surveys, combined with inclination measurement to verify chain tension. Using high-resolution video combined with machine vision algorithms, Ashtead Technology’s new optical CMS reduces chain measurement time by more than 50% and provides real-time results.

- In March 2022, Olympus Corporation launched 72DL PLUS ultrasonic thickness gauge. It delivers precision thickness measurements at high speed in a portable, easy-to-use device. With fast scanning, advanced algorithms, and Olympus’ lowest-ever minimum thickness capability, the gauge can measure the thickness of very thin layers for challenging applications across industries.

- In February 2022, Olympus Corporation launched the OmniScan X3 64 flaw detector, which delivers improved power and performance. This 64-channel instrument has the pulse capacity to drive phased array (PA) probes with a larger number of elements, increasing the data acquisition speed for total focusing method (TFM) imaging. Users can exploit its increased capabilities to expand and diversify their application portfolio.

- In November 2021, Eddyfi launched Sonyks, a piece of equipment for guided wave testing to identify and detect defects in pipework applications and examination of high attenuation of pipelines, which are buried or flanged.

- In July 2021, General Electric’s inspection company – Waygate Technologies – launched a new service – BRIC, which uses robotics to provide the safe and efficient inspection and cleaning of industrial boilers. This will reduce physical risks to inspectors as well as provide more precise data and reduce inspection costs.

- In March 2021, Eddyfi launched Capture 3.2, a data acquisition and analysis software which enables the technicians or inspectors to use multiple phased array (PAUT) probes at the same time on each side of the weld for better defect detection and characterization.

- In January 2021, Eddyfi launched Spyne, an efficient tool for hard spot detection on pipelines. It is pre-configured to deliver unprecedented scanning speed and coverage. An entire pipe surface can be examined in a substantially shorter period.

- In December 2020, General Electric’s inspection company – Waygate Technologies, launched an extended version of its flagship ecosystem for inspection data management, InspectionWorks. The upgrade includes an easy-to-use and customer-centric user interface and user experience design, as well as new features, including fleet management, remote monitoring diagnostics, inspection data storage, and advanced analytics.

- In September 2020, General Electric’s inspection company – Waygate Technologies launched two new portable X-ray detectors from its digital X-ray family DXR to ensure the safety, quality, and productivity of its customers’ complex products and processes. The direct radiography detectors DXR140P-HC and DXR75P-HR combine the latest technological advances with extensive customer feedback and guarantee high-quality, efficient imaging as well as thorough protection for use in harsh environments.

- In June 2020, Nikon Metrology launched an advanced MCAx S articulated arm that augments the ModelMaker H120 with improved precision and connectivity. It is a go-to portable handheld laser scanning solution that provides supreme detail and productivity.

- In March 2020, Sonatest launched the NEW X6B Phased Array Probe Series. This new B model comes with an irrigation port and has a lower frequency spectrum offering. The C-scan covers a wide area quickly, even on large components, without compromising the mapping resolution.

- In October 2019, Olympus Corporation launched OmniScan instruments that are recognized globally as the benchmark for portable phased array ultrasonic testing (PAUT). The new OmniScan X3 flaw detector elevates the standard with innovations that improve the entire inspection workflow.

Frequently Asked Questions (FAQs):

Who are the key players in NDT and Inspection market? What are the major growth strategies adopted by major players to strengthen their position in the market?

Major companies operating in the NDT and Inspection market are General Electric (US), MISTRAS Group (US), Olympus Corporation (Japan), Ashtead Technology (Scotland), Nikon Metrology NV (UK). Product launches and developments, acquisitions, collaborations, and agreements were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in NDT and Inspection market?

High demand for NDT and Inspection in industrial automation, electronics, oil & gas, power generation industries, as well as public infrastructure.

What new technologies in the NDT and Inspection market offer higher growth potential?

The growing use of drone inspection, IoT-powered real-time NDT for predictive maintenance, use of AI to detect defects, use of a combination of techniques, development of new materials to refurbish the market, and increased customer expectations from NDT inspection equipment are a few of the technologies in this market.

Which region to offer lucrative growth for NDT and Inspection market by 2028?

Asia Pacific is likely to lead the NDT and Inspection market during the forecast period. The region is also expected to witness the highest CAGR during the forecast period. The European region is expected to witness the second-highest growth rate between 2023 to 2028.

What are the key factors driving the growth of the NDT and Inspection market?

Stringent government regulations regarding public safety and product quality and continuous advancements in electronics, automation, and robotics applications are key factors driving the growth of the NDT and inspection market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

In order to estimate the size of the NDT and Inspection market, four major activities were performed. Secondary research has been conducted extensively to collect information regarding the market, the peer market, and the parent market. This was followed by a primary research study involving industry experts across the value chain to validate the findings, assumptions, and sizing. The total market size has been estimated using both top-down and bottom-up approaches. Then, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred for this research study to identify and collect information. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

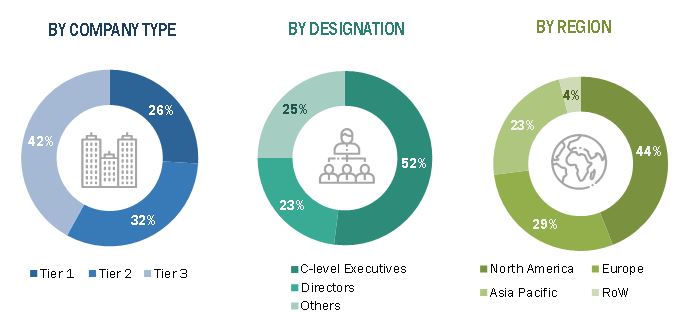

Primary Research

After understanding and analyzing the NDT and Inspection market through secondary research, extensive primary research was conducted. A number of primary interviews have been conducted with key opinion leaders from supply-side vendors and demand-side vendors in four major regions - North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Qualitative and quantitative information on the market has been obtained by interviewing a variety of sources on both the supply and demand sides. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

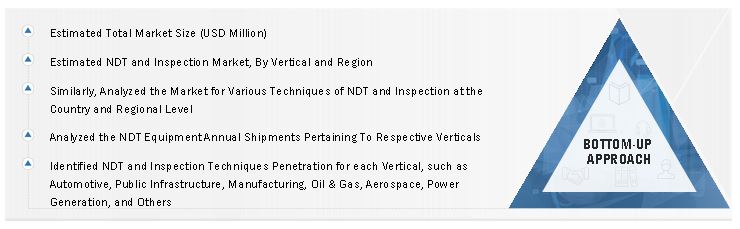

Market Size Estimation

The total size of the NDT and Inspection market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Identifying various industries that are using or are expected to deploy NDT and inspection techniques, along with related services

- Analyzing trends and penetration rates of different NDT and inspection techniques in different verticals

- Estimating the size of different vertical segments of the NDT and inspection market to help in understanding the demand for NDT techniques and services

- Conducting multiple discussions with the key opinion leaders to understand the types of NDT and inspection techniques deployed for examinations, which helps in analyzing the break-up of the scope of work carried out by the key companies manufacturing NDT and inspection equipment and offering related services

- Estimating the size by analyzing the functioning of NDT and inspection equipment manufacturers based on their locations and then combining the market estimates based on region

- This process entails the study of various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global NDT and Inspection Market Size: Bottom-Up Approach

Data Triangulation

With the overall market size derived from the estimation process described previously, the global market was divided into several segments and subsegments. In order to gather the exact statistics for segments and subsegments, the data triangulation and breakdown procedures have been applied, wherever possible. By analyzing various factors and trends from both the demand and supply sides, the data has been triangulated. Furthermore, the NDT and Inspection market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the size of the NDT and Inspection market based on techniques, methods, services, verticals, and regions in terms of value

- To forecast the size of the NDT and Inspection market based on the technique in terms of volume

- To describe and forecast the market for four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of NDT and Inspection market ecosystem, along with the average selling prices of product types

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To strategically analyze the ecosystem, Porter’s five forces, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the NDT and Inspection market

- To analyze strategic approaches adopted by the leading players in the NDT and Inspection market, including product launches/developments/collaborations/partnerships/expansions, and mergers & acquisitions

- To strategically profile key players and provide details of the current competitive landscape

- To analyze strategic approaches adopted by players in the NDT and Inspection market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NDT and Inspection Market

I am really interested on NDT, so can you provide me the general information about it and also a market research on NDT in Spain if that is possible.

I am interested in the following sections of the report - Gamma Radiography Equipment and Isotopes for Industrial Radiography Inspection. Digital Imaging in Industrial Radiography for CR and DR.

After reviewing several different market research reports, MarketsandMarkets have concluded that the NDT market is much lower than other research institutions by up to 50%. I was wondering if you could highlight why this may be?

Could you give me a sample of pages, inspection (page 82 onwards)? It would be very helpful in making a decision on whether to buy.

I am looking for information to support an NDT Inspection Services client in making strategic growth decisions.

We need the details of 2019 to 2024 market of Turkey about Advanced NDT methods and conventional NDT methods.

This is not a typical area for us, just trying to get a high level understanding of what industrial radiography (only) looks like at the global level.

Can I get more information related to NDT Market, identify top player US and international players, pricing analysis, market share?

I want to start my business in NDT market. Do you have any discounts for start-ups?

I am looking to tap into the NDT rental equipment market in Malaysia but not limited to the Asia region. Any help in the current market information would be great.

I was wondering if this report could be reorganized or customized to fit the NDT trends in Saudi Arabia. We are interested to learn about the demand in terms of industry, techniques, growth, competition, etc.

I am interested in the following - 1. market share of UAE alone, 2.market share of NDT companies within UAE. 3. Market share for NDT equipment 4. Market share of NDT services.

Could you please provide data related to the prices of the following equipment; AC Yoke, UT wall thickness, UT Shear wave, Flux inspection equipment & Eddy Current.

Request a Complimentary Copy of the NDT Report Insights, Key Findings, Drivers, Trends, Program Sources, and Methodology.

We are a start up in Kenya for NDT solutions and want to do aerospace and industrial testing. Our scope is east and central Africa, please send us some date.

We are a start up in Kenya for NDT solutions and want to do aerospace and industrial testing. Our scope is east and central Africa, please send us some date.

Do you provide any discount for visual inspection Technology only? Details available for visual inspection e.g. video scopes.

We are a sales agent in Japan. Now we are asked by one of our customers in Japan for quote for the NDT market report (Single User License). If we help the customer to purchase the report, could you give us quote for it, please ? The customer has difficulty to pay directly to foreign companies, therefore, they ask us to obtain the item on behalf of them. As for payment, we will pay by our corporate credit card or remit by wire transfer into your bank account in advance. When we place an order, we will send you a PO by fax if required.

We are interested in your report on Non-Destructive Testing and Inspection Market by Technique (Visual Testing, Magnetic Particle, Liquid Penetrant, Eddy Current, Ultrasonic, Radiographic, Acoustic Emission, Terahertz Imaging), Service, Vertical, and Geography - Global Forecast to 2022

Please share the PDF file of NDT market for us to evaluate the suitable technology.

I am interested in the following - Non-Destructive Testing Equipment & Services Market by Contact Methods (Ultrasonic, Eddy Current, Electromagnetic, Liquid Penetrant), Non-Contact (Radiography, Thermography, Visual Testing), Services (Inspection, Rental, Training, Consultation)

I am interested in the following - Pulse Reflectometry Technology, Acoustic Pulse Recognition (APR), global market analysis, current trends and future growth potential. NDT tech applications in new sectors, cross-industry applications, and potential revenues.

Our focus is on most granular data available. Ideally view on supplier landscape (competitive research) in Power gen. Focus on wind, nuclear, gas… Can you provide a free sample of the report?

We are looking for testing service market size of "corrosion" vs. "welding/construction" as % of NDT market in North America. Do you have this type of breakdown?

Kindly assist with a copy of Non-Destructive Testing and Inspection Market by Technique (Visual Testing, Magnetic Particle, Liquid Penetrant, Eddy Current, Ultrasonic, Radiographic, Acoustic Emission), Method, Service, Vertical, and Geography - Global Forecast to 2023

I'd like to have some information which is NDT inspection market size. Especially, I want to know RT(Radiographic testing) application market information.

We would like to know NDT market situation in Kazakhstan. Specifically we would like to know NDT market information of NDT flat panel detector in Kazakhstan.

What all have you covered under NDT by technique section? Can you provide more details?

I'm interested in the following sections: Visual Testing, Magnetic Particle, Liquid Penetrant, Eddy Current, Ultrasonic, Radiographic, Acoustic Emission

I am preparing a business plan, and want to know the movement or the world market for my business and NDT market.

I am interested in the applications part of NDT market. Do you provide only that section?

Our focus is on Eddy current NDT primarily. Can we get a pdf brochure of the NDT report?

I'm looking to better understand the size and structure of the NDT market and would appreciate a sample of this report before committing to the full report.

We are looking for some information on Market by Non-Contact (Radiography, Thermography, Visual Testing), Services (Inspection, Rental, Training, Consultation), Application & Geography - Analysis & Global Forecast to 2013 - 2020

I am looking for cheaper solutions for NDT equipment and accessories, list of manufacturers in India and NDT work force solutions.

I am interested in your NDT report. I see that it is a worldwide report but the point it is that I am only interested of Mexico which I am located. Does it include the customers list directory per industry as well? Is it possible to buy only the Mexico section of your report? In case of positive, could you please let me know the cost?

I am working on SAM for NDT & Inspection in Sub-Sahara Africa and looking for material to help my forecast.

I would like to better understand the services analysis to assure this product is appropriate for our use.

I am interested in the phase array method, eddy current testing method and a whole overview of the NDT services.

Can I get more information about Pulsed eddy current, ACFM, In-Line inspection, Robotic online tank inspection, Infrared thermography?

I am looking for information about the NDT application and their automatization. Investment impact and cost-benefit are my focus point.

Looking for the biggest companies by market share for both Germany and Europe would be helpful. Also the market volumes of both Regions in total and for each technological category (Ultrasonic testing, eddy current,..)

Specifically want examples of sales figures of penetrant testing equipment world wide, Europe & UK 2014 on wards

I am a student doing an industry report project on the NDT industry. Access to this report would help me understand and gain more knowledge on this industry.

I am interested in understanding the NDT market size in dollar value for each country in Asia. If this information is sufficient we may consider buying the entire document to assist with expansion planning.

Looking forward for Visual Inspection Standards evolution in Gas Turbine Industry and Additive Mfg. inspection for the same.