Oil & Gas Pumps Market by Type (Submersible, Non-submersible) Pump Type (Centrifugal, Positive Displacement (Screw, Reciprocating, Rotary and Gear, Progressive Cavity), Cryogenic), Application (Upstream, Midstream, Downstream), Region - Global Forecast to 2025

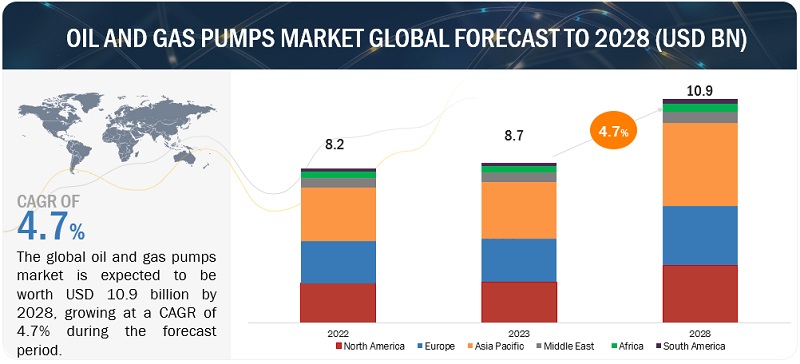

[230 Pages Report] The global oil & gas pumps market is projected to reach a size of USD 9.0 billion by 2025, at a CAGR of 6.4%, from an estimated USD 6.6 billion in 2020. The continuous shale development activities and the development of gas terminals are the key factors driving the growth of the oil & gas pumps market

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Oil & gas pumps Market

The COVID-19 outbreak has entire power industry negatively. According to IEA, the COVID-19 crisis has significantly impacted the oil & gas exploration & production activities. The decline is caused mainly due to delay in project construction activity and supply chain disruptions, as major countries imposed lockdown, social distancing measures for workers, and financial challenges.

China, which is largest consumer of oil, gas, and refined petroleum products, was under lockdown for about 2 months. Due to this, the oil prices started to decline in February 2020. Besides, in March 2020, Saudi Arabia and Russia witnessed an oil price war, when Saudi Arabia responded to Russias denial on cutting production so that prices could remain moderate. This lasted for days, resulting in a declining trend in oil prices in spring. Although it was just for a day, it had severely impacted economies of oil-producing countries. Since July 2020, the oil prices gained momentum, and are still lying in price ranges of USD 3540.

Oil & gas pumps Market Dynamics

Driver: Continuous shale development activities

Shale and oil sands are important energy sources in North America, Latin America, and Asia Pacific. In the past decade, North America witnessed enormous growth in the production of unconventional resources such as shale and tight oil. The growth was possible due to technological innovation in horizontal drilling and hydraulic fracturing. Shale is one of the fastest-growing energy sectors, with a series of discoveries and technological advances.

Although drilling can extract a large amount of oil & natural gas from the reservoir rock, much of it remains trapped within the reservoir itself. Thus, shale reservoirs require more intervention processes to optimize oil production. The horizontal drilling done to extract shale oil & gas is very prone to water shutoffs and requires proper zonal isolation and cementing processes. The CO2 injection pump plays an active role as a part of the EOR process that injects CO2 into the oil layer and recovers crude oil efficiently.

The International Energy Agency (IEA) states that Canada is expected to be fourth in oil production during the forecast period, after Iraq, Brazil, and Iran. Despite decline in oil prices, Canadian oil sand production is estimated to grow from 2.4 million barrels per day in 2015 to 3.8 million barrels per day by 2040. Oil sands are major unconventional resources in Canada, and companies use pressure pumping technique to extract these resources. Shale developments in China, the US, and Argentina boost well production activities in these countries. Thus, the rising production of shale oil & gas is likely to increase the demand for oil & gas pumps.

Restraints: Increasing focus on use of renewable energy

The usage of renewable energy witnessed substantial growth across regions such as Asia Pacific, Europe, and North America in the past decade. This has been further backed by reducing the cost of power generation and growing concerns regarding carbon emissions. According to the Energy Information Administration (EIA), the growth in the use of renewable energy is projected to scale up by 40% from 2012 to 2018. According to the IEA Oil Demand Report for 2018, the European oil demand remained stagnant due to slowing economic activity and rising crude oil prices. This decline is expected to continue as the region is transiting its energy consumption from conventional fossil energy to renewable energy. The reduction in solar and wind farm construction costs due to the emergence of new technologies and the increase in the adoption of electric vehicles are supporting this dramatic shift from conventional energy (oil & gas) to renewable energy.

Opportunities: Development of pipeline infrastructure in Asia Pacific & Middle East

The midstream oil & gas sector requires widely distributed network as distances can range from many acres for an intermediate or end terminal tank farm, to entire continents for a pipeline system. SCADA systems, control systems, and safety system in storage facilities, control centers, and corporate offices as well a fast and reliable communication infrastructure are required to perform integration within and among intranets. This demand holds a high growth potential for midstream communication solutions.

In August 2019, GAIL India announced an investment of USD 4.4 billion in pipeline laying and another USD 1.6 billion in city gas distribution (CGD) networks. In 2019, Eni planned to boost production from the Zubair field, located in southern Iraq, from 195,000 b/d to a plateau of 700,000 b/d in 7 years. The project is being carried out in two phases: Rehabilitation Phase (RP) and Enhanced Re-Development Phase (EP). The first RP phase is expected to take 2 years while the EP phase is expected to take 6 years. The scope includes the design, supply, and commissioning of an 18-inch carbon steel gas pipeline to carry up to 100 million cubic feet a day of gas from a depot at the Zubair field to the FAO depot; construction of five degassing stations; revamp of existing degassing stations; overhaul of existing wells; and construction of a new water injection project. The approximate cost of this project is USD 18 billion. Such developments of midstream infrastructure are likely to offer lucrative opportunities for the players operating in the oil & gas pumps market

Challenges: Managing lead time of the product

Pumps for the oil & gas industry are made to order products, and companies hold a very small level of inventory for a few applications. The pump manufacturer produces pumps on the basis of client requirements and generally takes a long time to deliver. The timeline can vary from a couple of weeks to 1 year, depending upon the criticality and volume. However, operators insist on reducing the delivery time. This scenario creates a major restraint for manufacturers to meet the timeline

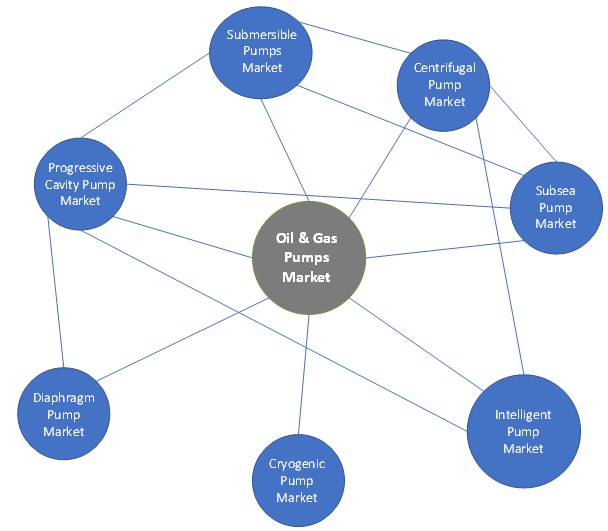

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By type, the submersible pump segment is the largest contributor in the oil & gas pumps market in 2019.

Submersible pumps, as the name implies, can be submersed within a tank, well, or other containers. These pumps are designed to be suitable for immersion. The motors of submersible pumps are encased in oil-filled compartments that do not have contact with the substance they are pumping. They have the advantage of being essentially self-priming because they operate below the surface of the media to be pumped. Submersible pumps find applications in oil production and in supplying water for agriculture and industry. The type most widely used in the Soviet Union is the submersible centrifugal pump with electric drive for oil production and vertical pumping of water. In other countries, submersible pumps of the piston type with hydraulic drive are also used. The increasing offshore oil & gas activities are expected to boost the demand for submersible pumps in the oil & gas industry

By pump type, centrifugal pump segment is expected to be the largest contributor during the forecast period.

A centrifugal pump is the most common type of pump used in the oil & gas industry. It comprises one or more impellers, which move fluids by rotation and draw them into the suction end of the pump and then, through centrifugal force, push the fluid out from the discharge end. Centrifugal pumps are widely used for various applications and are preferred for processes that handle low viscosity liquids and high flow rates. Centrifugal pumps handle the fluids with low viscosity as long as they do not contain air, vapor, or a heavy amount of solid. Centrifugal pumps are used in the upstream segment as part of tri-phase or multi-phase pumping applications. Various types of centrifugal pumps are used in a wide variety of applications, for example, electrical submersible pumps are used as a water and oil separator, in which water can be reinjected into a reservoir without lifting it to the ground surface. Investments in the oil & gas sector from emerging economies and continuing developments in high crude oil-producing regions such as the Middle East, North America, and Russia are projected to drive the growth of the market for centrifugal pumps globally.

By end user, the midstream segment is expected to be the largest contributor during the forecast period.

The oil & gas midstream segment serves as critical infrastructure for the transport and storage of hydrocarbons. The growth in shale oil and gas production in the US market is creating the need for an expanded midstream network of pipelines, rail, tankers, and terminals. The midstream natural gas activities include gathering, transporting, and processing of natural gas from the wellhead, removal of impurities, production of natural gas liquids, storage, pipeline transport, and shipping, liquefaction or regasification of Liquefied Natural Gas (LNG). Companies that operate bulk stations and terminals and manufacture and install storage tanks and pipelines are also included in carrying out the operations of the midstream industry. Pumps are employed in the midstream segment in pipeline & transportation, terminals, CO2 pipeline, and others. North America is estimated to hold the largest share of the midstream market, followed by Asia pacific. The countries in North America have planned an investment of approximately USD 30 billion/year in oil & gas infrastructure. This is expected to drive the growth of the midstream segment during the forecast period

Asia Pacific is expected to account for the largest market size during the forecast period.

The Asia Pacific market is further segmented into China, Japan, India, South Korea, Australia, and Rest of Asia Pacific. The market in China is expected to grow as it is one of the major importers of oil and its domestic demand surpasses its production. Automation ensures optimum utilization of resources and curbs imports. It also helps in the reduction of labor costs and human interference, which is currently a major concern in Asia Pacific owing to stringent labor laws. The demand for oil products in the Asia Pacific region is rapidly increasing as the region experiences strong economic growth. The region has less than 9.0% of the worlds proven reserves, implying a high rate of redevelopment and rehabilitation of oilfields.

Substantial economic growth and the demand for oil & gas have led to an increase in offshore oil & gas E&P in the region. The increasing activities in deeper and more remote waters in the Philippines and Myanmar are expected to meet the growing energy demand. According to the BP Statistical Review of World Energy 2020, Asia Pacific accounted for 44.1% share of global primary energy consumption

Recent Developments

- In September 2020, Alfa Laval won a contract to supply Framo pumping systems for two FPSO (Floating Production, Storage and Offloading) vessels to operate outside the coast of Brazil. The orders have a total value of approximately USD 16.5 million (SEK 155 million), with deliveries scheduled for 2021. The two orders comprise marine pumping systems for firewater and seawater lift service.

- In August 2020, Weir Oil & Gas Dubai won a three-year contract from a national oil company in the UAE for servicing and repairing pumps and motors. The contract secures the provision of Weir Oil & Gas Rotating Equipment services, machine shop services, emergency manufacturing, and site works.

- In April 2020, Atlas Copco launched a new addition to the WEDA submersible dewatering pump range with the WEDA S50. The WEDA S range is designed for thick, soft, wet mud or other similar mixtures. These pumps are ideally suited for construction dewatering, industrial, or refining applications.

- In August 2019, Flowserve won a contract from Shell Australia to provide general maintenance services for Shells Prelude Floating Liquefied Natural Gas (FLNG) facility, which is producing natural gas from an offshore field in Western Australia.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, solution, end user and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Flowserve (US), Sulzer (Switzerland), Weir Group (UK), KSB (Germany), and Xylem(US) (Germany), Alfa Laval (Sweden), Gardner Denver (US), Grundfos (Denmark), HMS Group (Russia), Nikkiso (Japan), Schmitt Kreiselpumpen (Germany), Trillium Flow Technologies (Scotland), Atlas Copco (Sweden), Wilo SE (Germany), Corporacion E.G. (Mexico), Halliburton (US), Baker Hughes Company (US), Groman-Rupp (US), EBARA Corporation (Japan), Tsurumi Manufacturing Co., Ltd. (Japan), and Gemmecotti (Italy) |

This research report categorizes the Oil & gas pumps market-based on type, pump type, application, and region

Based on type, the Oil & gas pumps market has been segmented as follows:

- Submersible Pumps

- Non-submersible Pumps

Based on pump type, the Oil & gas pumps market has been segmented as follows:

- Centrifugal Pump

- Positive Displacement Pump

- Screw Pump

- Reciprocating pump

- Diaphragm pump

- Multi-plunger pump

- Piston pump

- Rotary & Gear pump

- Progressive Cavity pump

- Cryogenic Pump

Based on application, the Oil & gas pumps market has been segmented as follows:

- Upstream

- Midstream

- Downstream

Based on the region, the Oil & gas pumps market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Frequently Asked Questions (FAQ):

What is the current size of the Oil & gas pumps market?

The current market size of global Oil & gas pumps market is USD 8.8 billion in 2019.

What is the major drivers for Oil & gas pumps market?

The continuous shale development activities and the development of gas terminals are the key factors driving the growth of the oil & gas pumps market.

Which is the fastest growing region during the forecasted period in Oil & gas pumps market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing investments for development of pipeline infrastructure

Which is the fastest growing segment, by type during the forecasted period in Oil & gas pumps market?

The submersible pump segment, by type is the fastest growing segment during the forecasted period owing increasing offshore oil & gas activities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 OIL & GAS PUMPS MARKET, BY PUMP TYPE: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 LIMITATION

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, & REGION

TABLE 1 OIL & GAS PUMPS MARKET: PLAYERS/COMPANIES CONNECTED

2.2 SCOPE

2.2.1 IMPACT OF COVID-19

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET ESTIMATION METHODOLGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET ESTIMATION METHODOLGY: TOP-DOWN APPROACH

2.3.3 IDEAL DEMAND SIDE ANALYSIS

FIGURE 6 OIL & GAS PUMPS MARKET: DEMAND SIDE ANALYSIS

2.3.3.1 Assumptions for demand side analysis

2.3.3.2 Demand side Calculation

2.3.4 SUPPLY SIDE ANALYSIS

2.3.4.1 Supply side assumptions

2.3.4.2 Supply side calculation

FIGURE 7 INDUSTRY CONCENTRATION, 2019

2.3.5 FORECAST

2.4 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: OIL & GAS PUMPS MARKET, 20162025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 OIL & GAS PUMPS MARKET SNAPSHOT

FIGURE 9 NON-SUBMERSIBLE PUMPS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 CENTRIFUGAL PUMPS SEGMENT TO LEAD OIL & GAS PUMPS MARKET DURING FORECAST PERIOD

FIGURE 11 MIDSTREAM SEGMENT TO LEAD OIL & GAS PUMPS MARKET DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA DOMINATED OIL & GAS PUMPS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN OIL & GAS PUMPS MARKET

FIGURE 13 CONTINOUS DEVELOPMENTS IN SHALE RESERVES AND GAS TERMINALS TO DRIVE GROWTH OF OIL & GAS PUMPS MARKET

4.2 OIL & GAS PUMPS MARKET, BY TYPE

FIGURE 14 NON-SUBMERSIBLE PUMPS SEGMENT DOMINATED OIL & GAS PUMPS MARKET IN 2019

4.3 OIL & GAS PUMPS MARKET, BY PUMP TYPE

FIGURE 15 CENTRIFUGAL PUMPS SEGMENT DOMINATED OIL & GAS PUMPS MARKET IN 2019

4.4 OIL & GAS PUMPS MARKET, BY APPLICATION

FIGURE 16 MIDSTREAM SEGMENT DOMINATED OIL & GAS PUMPS MARKET IN 2019

FIGURE 17 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 NORTH AMERICA OIL & GAS PUMPS MARKET, BY APPLICATION & COUNTRY

FIGURE 18 MIDSTREAM SEGMENT AND US DOMINATE OIL & GAS PUMPS MARKET IN NORTH AMERICA

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.1.1 YC SHIFT

FIGURE 19 YC SHIFT

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19: GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 22 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 24 OIL & GAS PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Continuous shale development activities

FIGURE 25 UNCONVENTIONAL RESOURCE POTENTIAL ACROSS MAJOR COUNTRIES

5.5.1.2 Development of gas terminals

FIGURE 26 RAMP UP OF LNG SUPPLY, BY COUNTRY, 2018

5.5.2 RESTRAINTS

5.5.2.1 Increasing focus on use of renewable energy

FIGURE 27 INCREASE IN CAPACITY, 20092019

5.5.2.2 Low oil & gas prices

FIGURE 28 CRUDE OIL PRICE TREND (20132018)

5.5.3 OPPORTUNITIES

5.5.3.1 New discoveries in Africa

5.5.3.2 Development of pipeline infrastructure in Asia Pacific & Middle East

5.5.4 CHALLENGES

5.5.4.1 High competition

5.5.4.2 Managing lead time of product

5.5.4.3 Impact of COVID-19 on oil & gas industry

5.6 SUPPLY CHAIN OVERVIEW

FIGURE 29 OIL & GAS PUMPS MARKET SUPPLY CHAIN

5.6.1 KEY INFLUENCERS

5.6.1.1 Raw material/component providers

5.6.1.2 Pumps manufacturers

5.6.1.3 End users

5.7 TRADE ANALYSIS

5.7.1 EXPORT DATA ANALYSIS

TABLE 3 EXPORT DATA: CENTRIFUGAL PUMPS & POSITIVE DISPLACEMENT PUMPS, BY VALUE, 2019

5.7.2 IMPORT DATA ANALYSIS

TABLE 4 IMPORT DATA: CENTRIFUGAL PUMPS & POSITIVE DISPLACEMENT PUMPS, BY VALUE, 2019

5.8 CASE STUDY ANALYSIS

5.8.1 FLOWSERVE PROVIDES CUSTOM-ENGINEERED PUMPS FOR EXXONMOBILS KIZOMBA A AND B FLOATING PLATFORMS

5.9 MARKET MAP

FIGURE 30 OIL & GAS PUMPS MARKET: MARKET MAP

5.10 COVID-19 IMPACT

5.10.1 UPSTREAM OUTLOOK AND IMPACT OF COVID-19 PANDEMIC

5.10.2 IMPACT OF COVID-19 PANDEMIC ON MIDSTREAM OIL & GAS INDUSTRY

5.10.3 IMPACT OF COVID-19 PANDEMIC ON DOWNSTREAM OIL & GAS INDUSTRY

6 IMPACT OF COVID-19 ON OIL & GAS PUMPS MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 72)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON GDP

TABLE 5 GDP ANALYSIS (IN PERCENTAGE)

6.3 SCENARIO ANALYSIS OF OIL & GAS INDUSTRY

FIGURE 31 CRUDE OIL PRICE VS. CRUDE OIL PRODUCTION (20182025)

6.4 OPTIMISTIC SCENARIO

TABLE 6 OPTIMISTIC SCENARIO: OIL & GAS PUMPS MARKET, BY REGION, 20182025 (USD MILLION)

6.5 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: OIL & GAS PUMPS MARKET, BY REGION, 20182025 (USD MILLION)

6.6 PESSIMISTIC SCENARIO

TABLE 8 PESSIMISTIC SCENARIO: OIL & GAS PUMPS MARKET, BY REGION, 20182025 (USD MILLION)

7 OIL & GAS PUMPS MARKET, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 32 NON-SUBMERSIBLE PUMPS SEGMENT DOMINATED OIL & GAS PUMPS MARKET IN 2019

TABLE 9 OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 10 OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

7.2 SUBMERSIBLE PUMPS

7.2.1 INCREASING OFFSHORE OIL & GAS ACTIVITIES TO INCREASE DEMAND FOR SUBMERSIBLE PUMPS

TABLE 11 SUBMERSIBLE PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 12 SUBMERSIBLE PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

7.3 NON-SUBMERSIBLE PUMPS

7.3.1 INCREASING INVESTMENTS IN DEVELOPMENT OF MIDSTREAM INFRASTRUCTURE TO DRIVE GROWTH OF NON-SUBMERSIBLE PUMPS MARKET

TABLE 13 NON-SUBMERSIBLE PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 14 NON-SUBMERSIBLE PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

8 OIL & GAS PUMPS MARKET, BY PUMP TYPE (Page No. - 80)

8.1 INTRODUCTION

FIGURE 33 CENTRIFUGAL PUMPS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

TABLE 15 OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 16 OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

8.2 CENTRIFUGAL PUMPS

8.2.1 DEVELOPMENTS IN HIGH CRUDE OIL PRODUCING REGIONS TO FUEL DEMAND FOR CENTRIFUGAL PUMPS

TABLE 17 CENTRIFUGAL PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 18 CENTRIFUGAL PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

8.3 POSITIVE DISPLACEMENT PUMPS

8.3.1 INCREASING UPSTREAM ACTIVITIES TO BOOST GROWTH OF MARKET FOR POSITIVE DISPLACEMENT PUMPS

TABLE 19 POSITIVE DISPLACEMENT PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 20 POSITIVE DISPLACEMENT PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

TABLE 21 POSITIVE DISPLACEMENT PUMPS: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 22 POSITIVE DISPLACEMENT PUMPS: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

8.3.2 SCREW PUMPS

8.3.3 ROTARY & GEAR PUMPS

8.3.4 PROGRESSIVE CAVITY PUMP

8.3.5 RECIPROCATING PUMPS

8.3.5.1 Diaphragm pump

8.3.5.2 Multi-Plunger pump

8.3.5.3 Piston pump

TABLE 23 RECIPROCATING PUMPS: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 24 RECIPROCATING PUMPS: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

8.4 CRYOGENIC PUMP

8.4.1 DEVELOPMENT OF NATURAL GAS RESERVES AND TRANSPORTATION INFRASTRUCTURE TO SUREG DEMAND FOR CRYOGENIC PUMPS

TABLE 25 CRYOGENIC PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 26 CRYOGENIC PUMPS: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

9 OIL & GAS PUMPS MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 34 MIDSTREAM SEGMENT DOMINATED OIL & GAS PUMPS MARKET IN 2019

TABLE 27 GLOBAL OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 28 GLOBAL OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

9.2 UPSTREAM

9.2.1 INCREASING EXPLORATION & PRODUCTION ACTIVITIES TO DRIVE GROWTH OF UPSTREAM OIL & GAS PUMPS MARKET

9.2.2 SEAWATER LIFT PUMP

9.2.3 WATER & CO2 INJECTION

9.2.4 SAFETY & FIREFIGHTING

9.2.5 GATHERING & SEPARATIONS

TABLE 29 UPSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 30 UPSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

TABLE 31 UPSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 32 UPSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

9.3 MIDSTREAM

9.3.1 INCREASING INVESTMENTS IN PIPELINE & TRANSPORTATION INFRASTRUCTURE TO DRIVE MARKET FOR MIDSTREAM OIL & GAS PUMPS

9.3.2 PIPELINE & TRANSPORTATION

9.3.3 TERMINAL

9.3.4 CO2 PIPELINE

9.3.5 OTHERS

TABLE 33 MIDSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 34 MIDSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

TABLE 35 MIDSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 36 MIDSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

9.4 DOWNSTREAM

9.4.1 INCREASING REFINING CAPACITY TO DRIVE GROWTH OF DOWNSTREAM OIL & GAS PUMPS MARKET

9.4.2 PRIMARY PROCESSING

9.4.3 SECONDARY PROCESSING

9.4.4 STORAGE & TRANSFER

TABLE 37 DOWNSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20162025 (USD MILLION)

TABLE 38 DOWNSTREAM: OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

TABLE 39 DOWNSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 40 DOWNSTREAM: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10 OIL & GAS PUMPS MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 35 CHINA AND INDIA TO REGISTER HIGHEST CAGRS DURING FORECAST PERIOD

TABLE 41 OIL & GAS PUMPS MARKET, BY REGION, 20162019 (USD MILLION)

TABLE 42 OIL & GAS PUMPS MARKET, BY REGION, 20202025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 SNAPSHOT OF NORTH AMERICAN MARKET

10.2.1 BY TYPE

TABLE 43 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 44 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

10.2.2 BY PUMP TYPE

TABLE 45 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 46 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

10.2.3 BY APPLICATION

TABLE 47 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 48 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.2.4 BY COUNTRY

TABLE 49 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 50 NORTH AMERICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20202025 (USD MILLION)

10.2.4.1 US

10.2.4.1.1 Increasing shale gas production to boost US market growth

TABLE 51 US: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 52 US: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 53 US: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 54 US: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.2.4.2 Canada

10.2.4.2.1 Proposed pipeline projects to drive market growth in Canada

TABLE 55 CANADA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 56 CANADA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 57 CANADA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 58 CANADA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.2.4.3 Mexico

10.2.4.3.1 Increasing offshore oil & gas activities to drive growth of Mexico market

TABLE 59 MEXICO: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 60 MEXICO: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 61 MEXICO: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 62 MEXICO: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 37 REGIONAL SNAPSHOT: ASIA PACIFIC

10.3.1 BY TYPE

TABLE 63 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 64 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

10.3.2 BY PUMP TYPE

TABLE 65 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 66 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

10.3.3 BY APPLICATION

TABLE 67 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 68 ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3.4 BY COUNTRY

TABLE 69 ASIA PACIFIC: PUMP MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 70 ASIA PACIFIC: PUMP MARKET, BY COUNTRY, 20202025 (USD MILLION)

10.3.4.1 China

10.3.4.1.1 Need to meet energy demand to drive growth of oil & gas pumps market in China

TABLE 71 CHINA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 72 CHINA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 73 CHINA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 74 CHINA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3.4.2 Japan

10.3.4.2.1 Development of LNG infrastructure to fuel market in Japan

TABLE 75 JAPAN: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 76 JAPAN: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 77 JAPAN: OIL & GAS PUMPS MARKET SIZE, BY APPLICATION, 20162019 (USD MILLION)

TABLE 78 JAPAN: OIL & GAS PUMPS MARKET SIZE, BY APPLICATION, 20202025 (USD MILLION)

10.3.4.3 India

10.3.4.3.1 Initiatives by government to develop pipeline network to drive growth of oil & gas pumps market in India

TABLE 79 INDIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 80 INDIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 81 INDIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 82 INDIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3.4.4 South Korea

10.3.4.4.1 Increasing efforts to increase energy production to boost demand for oil & gas pumps

TABLE 83 SOUTH KOREA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 84 SOUTH KOREA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 85 SOUTH KOREA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 86 SOUTH KOREA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3.4.5 Australia

10.3.4.5.1 Development of natural gas reserves to drive market growth

TABLE 87 AUSTRALIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 88 AUSTRALIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 89 AUSTRALIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 90 AUSTRALIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.3.5 REST OF ASIA PACIFIC

TABLE 91 REST OF ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 92 REST OF ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 93 REST OF ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4 EUROPE

10.4.1 BY TYPE

TABLE 95 EUROPE: OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 96 EUROPE: OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

10.4.2 BY PUMP TYPE

TABLE 97 EUROPE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 98 EUROPE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

10.4.3 BY APPLICATION

TABLE 99 EUROPE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 100 EUROPE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4 BY COUNTRY

TABLE 101 EUROPE: OIL & GAS PUMPS MARKET SIZE, BY COUNTRY, 20162019 (USD MILLION)

TABLE 102 EUROPE: OIL & GAS PUMPS MARKET SIZE, BY COUNTRY, 20202025 (USD MILLION)

10.4.4.1 Russia

10.4.4.1.1 Rising gas production activities to drive market growth

TABLE 103 RUSSIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 104 RUSSIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 105 RUSSIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 106 RUSSIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.2 Germany

10.4.4.2.1 Development of midstream and downstream infrastructure to boost demand for oil & gas pumps

TABLE 107 GERMANY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 108 GERMANY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 109 GERMANY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 110 GERMANY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.3 UK

10.4.4.3.1 Increasing offshore oil & gas production activities to drive market growth in UK

TABLE 111 UK: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 112 UK: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 113 UK: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 114 UK: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.4 Norway

10.4.4.4.1 Growing activities in Norwegian continental shelf to fuel demand for oil & gas pumps

TABLE 115 NORWAY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 116 NORWAY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 117 NORWAY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 118 NORWAY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.5 France

10.4.4.5.1 Development of pipeline & transportation network to drive market growth

TABLE 119 FRANCE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 120 FRANCE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 121 FRANCE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 122 FRANCE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.6 Italy

10.4.4.6.1 Development of midstream infrastructure to drive market growth

TABLE 123 ITALY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 124 ITALY: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 125 ITALY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 126 ITALY: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.4.4.7 Rest of Europe

TABLE 127 REST OF EUROPE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 128 REST OF EUROPE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 129 REST OF EUROPE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 130 REST OF EUROPE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY TYPE

TABLE 131 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

10.5.2 BY PUMP TYPE

TABLE 133 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

10.5.3 BY APPLICATION

TABLE 135 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4 BY COUNTRY

TABLE 137 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20202025 (USD MILLION)

10.5.4.1 Saudi Arabia

10.5.4.1.1 Development of unconventional reserves in offshore region to boost market growth in Saudi Arabia

TABLE 139 SAUDI ARABIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 140 SAUDI ARABIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 141 SAUDI ARABIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 142 SAUDI ARABIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.2 UAE

10.5.4.2.1 Development of upstream and midstream infrastructure to fuel the demand for oil & gas pumps

TABLE 143 UAE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 144 UAE: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 145 UAE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 146 UAE: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.3 Kuwait

10.5.4.3.1 Initiatives by government to boost production to drive market growth

TABLE 147 KUWAIT: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 148 KUWAIT:OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 149 KUWAIT: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 150 KUWAIT: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.4 Qatar

10.5.4.4.1 Increasing efforts to boost refining capacity to drive market growth

TABLE 151 QATAR: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 152 QATAR: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 153 QATAR: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 154 QATAR: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.5 Angola

10.5.4.5.1 Increasing offshore exploration & production activities to propel demand for oil & gas pumps

TABLE 155 ANGOLA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 156 ANGOLA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 157 ANGOLA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 158 ANGOLA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.6 Nigeria

10.5.4.6.1 Development of deepwater and ultra-deepwater reserves to fuel demand for oil & gas pumps

TABLE 159 NIGERIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 160 NIGERIA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 161 NIGERIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 162 NIGERIA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.5.4.7 Rest of the Middle East & Africa

TABLE 163 REST OF MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST & AFRICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY TYPE

TABLE 167 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY TYPE, 20162019 (USD MILLION)

TABLE 168 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY TYPE, 20202025 (USD MILLION)

10.6.2 BY PUMP TYPE

TABLE 169 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 170 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

10.6.3 BY APPLICATION

TABLE 171 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 172 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.6.4 BY COUNTRY

TABLE 173 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20162019 (USD MILLION)

TABLE 174 SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY COUNTRY, 20202025 (USD MILLION)

10.6.4.1 Brazil

10.6.4.1.1 Increasing investments in exploration and production activities to drive market growth

TABLE 175 BRAZIL: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 176 BRAZIL: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 177 BRAZIL: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 178 BRAZIL: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.6.4.2 Argentina

10.6.4.2.1 Development of pipeline network to fuel demand for oil & gas pumps

TABLE 179 ARGENTINA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 180 ARGENTINA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 181 ARGENTINA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 182 ARGENTINA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.6.4.3 Venezuela

10.6.4.3.1 Offshore production activities to drive growth of market during forecast period

TABLE 183 VENEZUELA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 184 VENEZUELA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 185 VENEZUELA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 186 VENEZUELA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

10.6.4.4 Rest of South America

TABLE 187 REST OF SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20162019 (USD MILLION)

TABLE 188 REST OF SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY PUMP TYPE, 20202025 (USD MILLION)

TABLE 189 REST OF SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20162019 (USD MILLION)

TABLE 190 REST OF SOUTH AMERICA: OIL & GAS PUMPS MARKET, BY APPLICATION, 20202025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 OVERVIEW

FIGURE 38 KEY DEVELOPMENTS IN OIL & GAS PUMPS MARKET, JANUARY 2017SEPTEMBER 2020

11.2 INDUSTRY CONCENTRATION, 2019

FIGURE 39 INDUSTRY CONCENTRATION, 2019

11.3 COMPETITIVE SCENARIO

TABLE 191 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 20172020

11.3.1 CONTRACTS & AGREEMENTS

11.3.2 NEW PRODUCT LAUNCHES

11.3.3 INVESTMENTS & EXPANSION

11.3.4 MERGERS & ACQUISITIONS

11.4 WINNERS VS. TAIL ENDERS

11.4.1 WINNERS

11.4.2 TAIL ENDERS

11.5 COMPETITIVE LEADERSHIP MAPPING, 2019

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 EMERGING COMPANY

FIGURE 40 OIL & GAS PUMPS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12 COMPANY PROFILES (Page No. - 165)

(Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view)*

12.1 ALFA LAVAL

FIGURE 41 ALFA LAVAL: COMPANY SNAPSHOT

FIGURE 42 ALFA LAVAL: SWOT ANALYSIS

12.2 FLOWSERVE

FIGURE 43 FLOWSERVE: COMPANY SNAPSHOT

FIGURE 44 FLOWSERVE: SWOT ANALYSIS

12.3 KSB

FIGURE 45 KSB: COMPANY SNAPSHOT

FIGURE 46 KSB: SWOT ANALYSIS

12.4 SULZER

FIGURE 47 SULZER: COMPANY SNAPSHOT

FIGURE 48 SULZER: SWOT ANALYSIS

12.5 WEIR GROUP

FIGURE 49 WEIR GROUP: COMPANY SNAPSHOT

12.6 GRUNDFOS

FIGURE 50 GRUNDFOS: COMPANY SNAPSHOT

12.7 HMS

FIGURE 51 HMS: COMPANY SNAPSHOT

12.8 GARDNER DENVER

FIGURE 52 GARDNER DENVER: COMPANY SNAPSHOT

12.9 XYLEM

FIGURE 53 XYLEM: COMPANY SNAPSHOT

12.10 NIKKISO

FIGURE 54 NIKKISO: COMPANY SNAPSHOT

12.11 SCHMITT KREISELPUMPEN

12.12 TRILLIUM FLOW TECHNOLOGIES

12.13 ATLAS COPCO

FIGURE 55 ATLAS COPCO: COMPANY SNAPSHOT

12.14 WILO SE

FIGURE 56 WILO SE: COMPANY SNAPSHOT

12.15 CORPORACION E.G.

12.16 HALLIBURTON

12.17 BAKER HUGHES

12.18 GROMAN-RUPP

12.19 EBARA CORPORATION

12.20 TSURUMI MANUFACTURING CO. LTD.

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 221)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

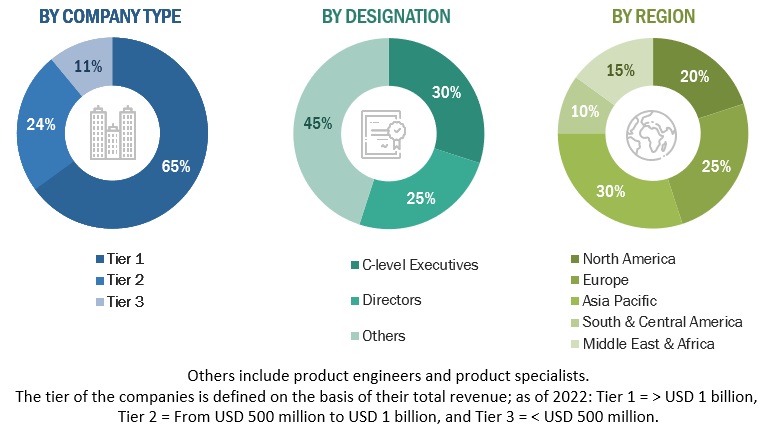

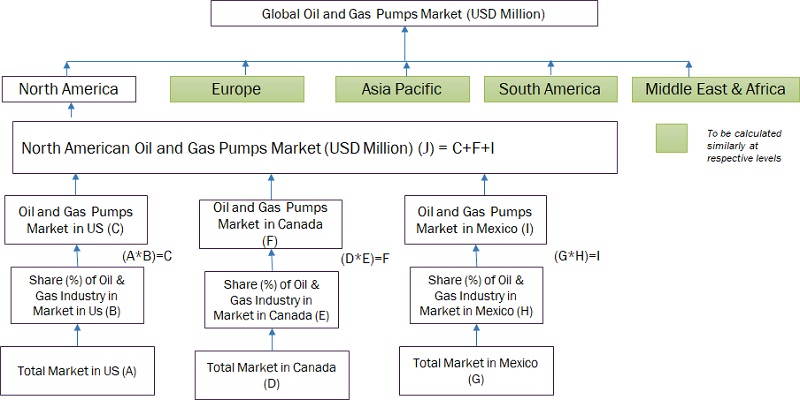

This study involved four major activities in estimating the current size of the oil & gas pumps market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global oil & gas pumps market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The oil & gas pumps market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-user, such as oilfield opertors, pipeline operators, refinery operators and others. The supply-side is characterized by oil & gas pumps OEMS, raw material providers, tool providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global oil & gas pumps market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Oil & gas pumps Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the oil & gas pumps market by type, pump type, application, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the oil & gas pumps market with respect to individual growth trends, future expansions, and contribution of each segment to the overall market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the oil & gas pumps market with respect to five regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To profile and rank key players and comprehensively analyze their market share

- To track and analyze developments such as contracts & agreements, investments & expansions, new product developments, mergers & acquisitions, partnerships, collaborations, alliances, and joint ventures in the oil & gas pumps market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Oil & Gas Pumps Market