Optical Transceiver Market Size, Share and Industry Growth Analysis Report by Form Factor (SFF and SFP; SFP+ and SFP28; XFP; CXP), Data Rate, Wavelength, Fiber Type, Connector, Distance, Protocol, Application (Data Center, Enterprise), and Global Growth Driver and Industry Forecast to 2026

Updated on : April 19, 2023

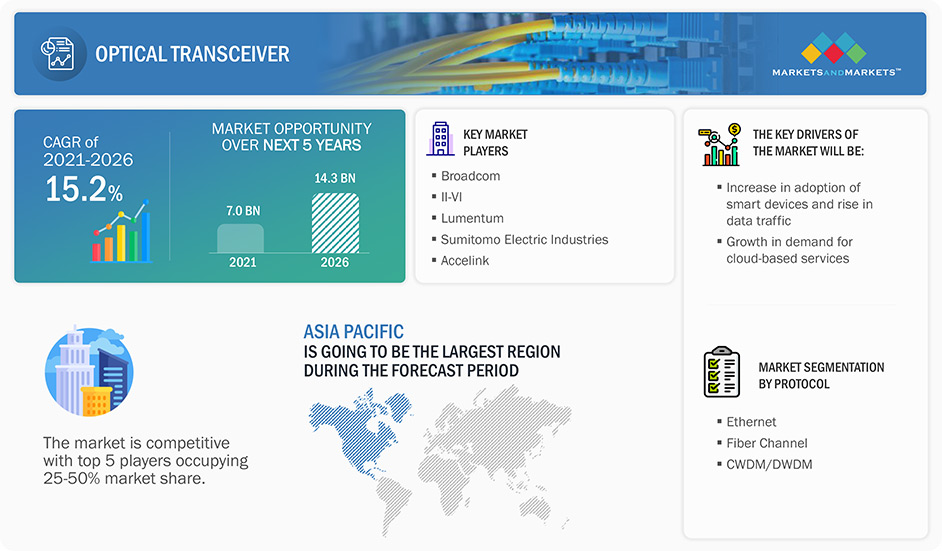

According to the latest report by MarketsandMarkets™, Global optical transceiver market size is expected to achieve a market valuation of USD 14.3 billion by 2026, with a projected compound annual growth rate (CAGR) of 15.2% during the forecast period, The market is experiencing growth as a result of a number of important factors, such as the increasing use of smart devices and data traffic, the rising need for cloud-based services, the growing demand for small, energy-efficient transceivers, and the increasing significance of mega data centres.

Optical Transceiver Market Forecast to 2026

To know about the assumptions considered for the study, Request for Free Sample Report

Optical Transceiver Market Dynamics

Driver : Rise in demand for compact and energy-efficient transceivers

The increasing demand for low-cost transceivers, due to energy-efficient characteristics, boosted their sales across telecom and data center applications. Currently, the smaller, cheaper, and energy-efficient optical transceivers have great demand in the optical transceiver industry . Since the launch of the CFP module, various improvements in the technological segment have resulted in the development of compact form factors. Data centers and enterprises require longer reach and high rates of data transmission, which led to an increase in port density and efficient power consumption. This is enough to increase the industry growth for low-cost optical transceivers. The surge in demand for low-cost transceivers boosted the market for this segment with offerings from recognized players, such as Broadcom (US) that offers cost-effective SFF optical transceiver modules for data center applications, Lumentum (US) offers SFP+ optical transceiver modules for metro networks, Accelink (China) offers multi-channel 100/400G optical transceivers for datacom application.

The manufacturers of optical transceivers are concentrating more on R&D for serving different applications in the metro network, data center interconnect, long haul applications, and others, which require optical transceivers to be compatible with the complex network. Optical transceiver OEMs such as Fujitsu Optical Components (Japan) and Broadcom (US) are companies offering transceivers that are compact and consume little power. This trend is expected to increase the market growth of small and compact optical modules due to their high range of data connectivity at a faster speed. Hence, it can be said that, due to the reduced package size, accelerated deployment in the datacom and telecom applications and dependency on the already decided standards (IEEE), the strategy of cost leadership and continuous development of smaller and more energy-efficient modules provide large growth potential for the optical transceiver market.

Restraint: Increase in network complexity

Data center networks comprise several layers, including the core, spine (distribution layer), and leaf (access layer). Transceivers are distributed across these layers. Because the switches in these layers are frequently swamped with data traffic, the receiver units of transceivers may experience delayed data packet delivery. All these factors generate a need for more compact form factors to enable compatibility and increase space inside the network. The current network infrastructure is fragmented, focused more on domain-specific growth than the consumer-centric joint approach. The companies need to adopt an innovative and network-oriented approach to minimize the network complexity, which acts as a restraint for the growth of the optical transceiver market.

Opportunity : Expansion of telecom infrastructure in developing economies

The expansion of telecommunication infrastructure will have a substantial effect on developing countries in a positive way. With the advent of IoT, AI, and Big Data, there is an increasing demand for smart devices and other connected applications. The interconnected technologies across telecommunication sectors play an important role in capturing, translating, and transferring data into meaningful information, which is crucial for the reinforcement of urban infrastructure. The backbone for this kind of infrastructural development is a high-speed fiber optics network, which can transfer enormous amounts of data, at high speed, from one end to another.

The advent of optical transceiver-induced fiber optical networks has made it possible for high-bandwidth and low latency communication across cities, successfully replacing the traditional copper cable network. Developing nations, including China and South Korea, have already updated their network infrastructure by implementing advanced communication networks across their territories. Middle Eastern and African countries are also investing in telecom infrastructures to cope up with the developments regarding the 5G network. 5G is now widely available on some mobile networks in the US, the UK, Japan, Qatar, China, and Kuwait. The implementation of the 5G network requires high-bandwidth oriented fiber optical cables integrated with optical transceivers for secured and reliable data transfers. Therefore, the expansion of telecom infrastructure across developing nations will drive the optical transceivers market trends in the foreseeable future.

Challenge: Everchanging customer demands for portable devices and better speeds

The increase in the communication capabilities of electronic devices, followed by their growing speed of data transfer, has been enabled by optical transceivers. However, as industries are shifting their focus on developing more compact and portable devices, the major issue for optical transceiver manufacturers lies in meeting the changing demands. Manufacturing compact components will help to reduce the complexity of the network as well as the performance penalty. The companies such as Sumitomo Electric Industries (Japan) and II-VI (US) accepted that COVID-19 impacted the sales leading to more demand fluctuations than usual.

As the market is driven by new product and technology development, the optical transceiver manufacturers are investing a certain percentage of their revenue in the R&D of the respective technology. All these factors act as barriers to justify the return on investments due to the uncertain life cycle of developed technology or product, making standardization difficult from the perspective of the application. Transceivers have applicability in various networks, and as the network complexity acts as a restraint for the optical transceiver industry , continuous optimization of the component size is a major challenge for the market.

Ethernet protocol was the largest market for optical transceiver in 2021.

Ethernet is the most common protocol adopted in an optical network as ethernet transceiver modules can support a wider range of transmission speeds, including 10 Mbps/100 Mbps/1000 Mbps and 10 Gbps/25 Gbps/50 Gbps/40 Gbps/100 Gbps/400 Gbps and is hence mostly adopted to implement local area network (LAN). The ethernet protocol held the largest share of the optical transceiver market in 2020. Ethernet transceivers are mainly combined/integrated with ethernet switches while deploying the ethernet network at any facility. The frequently used form factors of ethernet-based optical transceivers include SFP, SFP+, SFP28, 40G QSFP+, QSFP28, QSFP28, and QSFP-DD, and the corresponding data rates of these optical transceivers range from 1 Gbps to 400 Gbps. This wide range of data rates is the key reason for the adoption of ethernet-based optical transceiver modules in network infrastructure varying from small-sized offices to hyper-scale data centers, based on the requirement of the bandwidth.

Optical transceivers supporting data rate 10 Gbps to 40 Gbps hold the largest market for optical transceiver in 2021.

The segment of 10 Gbps to 40 Gbps provides data transmission up to 80 km using single-mode as well as multimode fibers. The 10 Gbps to 40 Gbps range includes data rates such as 10 Gbps, 10.5 Gbps, 11.3 Gbps, 14.025 Gbps, 25 Gbps, 28 Gbps, and 40 Gbps. The data transmission is carried along with a wavelength band of 850 nm, 1310 nm, and BiDi across telecom, data aggregation, backplane, and enterprise-related applications. These transceivers can perform highly reliable operations in data center networks and are optimized for extreme networks such as VDX, SLX, and MLXe switching and routing platforms. Transceivers with data speeds in the range of 10 Gbps to 40 Gbps have form factors such as SFP+, SFP28, QSFP+, QSFP28, and XFP. The growing data center consolidation, higher-performance servers, and increasing application density on virtualized servers drive the network capacity demands to unparalleled levels. Over the last several years, data center networks have transitioned from 1 Gbps to 10 Gbps to accommodate this rapid growth.

The transceiver operating across 850 nm bandwidth hold the largest market for optical transceiver in 2021.

Transceivers operating across the 850 nm bandwidth held the largest share in 2021. Factors such as lower attenuation generated by this band and data accuracy contribute to the growth of this market. Most of the attenuation in fiber is caused by light being scattered by minute variations (less than 1/10th of the wavelength) in the density or composition of the glass. This is called “Rayleigh Scattering.” In fiber, Rayleigh scattering is inversely proportional to the fourth power of the wavelength. This accounts for approximately 90% of the enormous difference in attenuation of light at 850 nm wavelength from that at 1550 nm. The optical transceivers operating in this band need low-cost optical sources and detectors. The 850 nm band of wavelength is suitable for shorter distances for data transmission and ensures proper data accuracy. This wavelength is also considered a semi-covert wavelength as its output produces a red glow. The transceivers of this wavelength include form factors such as SFP, SFP+, SFP28, QSFP28, QSFP+, QSFP56, CFP2, CXP, and QSFP-DD. Multimode fiber is designed to operate at 850 nm.

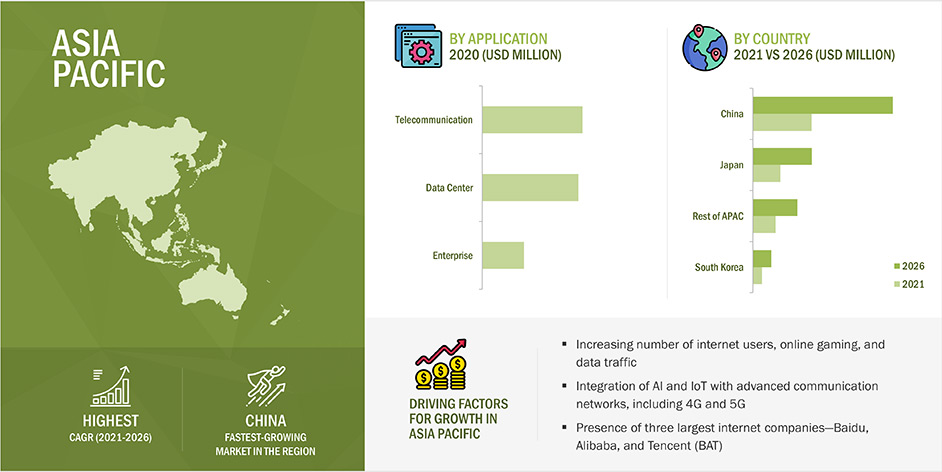

Asia Pacific to register the highest CAGR during the forecast period

APAC is projected to grow at the highest CAGR throughout the forecast period. Asia Pacific is one of the emerging markets for optical transceivers. The major drivers for the growth of the optical transceiver market share in the APAC region include the increasing adoption of phones, an increase in the number of internet users, increasing connectivity, growing network establishment, and rise in high bandwidth-intensive applications. The APAC region has become a global focal point for huge investments and business expansions. Asian markets encourage the development of 5G mobile technologies, with commercial deployments already implemented in South Korea and ready to be deployed in Japan and China in 2020. Moreover, APAC is a leading producer and supplier of electronics products, including smartphones, smart devices (such as wearable devices, home assistants, IoT-based home security systems, and gaming consoles), and laptops & desktops. This factor further drives the market for optical transceivers, as these transceivers are used either as an extension or in combination with these electronic products for internet connectivity.

Optical Transceiver Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Optical Transceiver Market Companies - Key Market Players

Major players in the optical transceiver companies are II-VI (US), Broadcom (US), Lumentum (US), Sumitomo Electric Industries (Japan), Accelink (China), Smartoptics (Norway), Infinera (US), Fujitsu Optical Components (Japan), Hisense Broadband (China), Huawei (China), InnoLight (China), Ciena (US), Applied Optoelectronics (US), Amphenol (US), Intel (US), NEC (Japan), Cisco (US), NeoPhotonics (US), Perle Systems (Canada), FOCI (Taiwan), Source Photonics (US), Solid Optics (US), and Eoptolink (China).

The top companies have adopted merger & acquisition, partnership, collaboration, and product launch strategies to grow in the global optical transceiver market.

Optical Transceiver Market Report Scope :

|

Report Metric |

Details |

| Estimated Value | USD 7.0 Billion |

| Expected Value | USD 14.3 Billion |

| Growth Rate | 15.2% CAGR |

|

Market size available for years |

2017—2026 |

|

Base year |

2020 |

|

Forecast period |

2021—2026 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Top Optical Transceiver Market Companies covered |

II-VI (US), Broadcom (US), Lumentum (US), Sumitomo Electric industries (Japan), Accelink (China), Smartoptics (Norway), Infinera (US), Fujitsu optical Components (Japan), Hisense Broadband (China), Huawei (China), Innolight (China), Ciena (US), Mellanox (US) (acquired by Nvidia in April 2020), Applied Optoelectronics (US), Amphenol (US), Intel (US), NEC (Japan), Cisco (US), NeoPhotonics (US), Perle Systems (Canada), FOCI (Taiwan), Source Photonics (US), Solid Optics (US), Eoptolink (China), and Reflex Photonic (Canada); (acquired by Smiths Interconnect (US) in November 2019) |

| Key Market Driver | Rise in demand for compact and energy-efficient transceivers |

| Key Market Opportunity | Expansion of telecom infrastructure in developing economies |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Data rate 10 Gbps to 40 Gbps |

| Highest CAGR Segment | Ultrasonic fingerprint sensors |

Optical Transceiver Market Highlights

This report categorizes the optical transceiver market based on form factor, data rate, wavelength, fiber type, connector, distance, protocol, application, and geography.

|

Aspects |

Details |

|

Optical Transceiver Market, by Form factor: |

|

|

Optical Transceiver Market, by Data rate: |

|

|

Optical Transceiver Market, by Wavelength: |

|

|

Optical Transceiver Market, by Fiber type: |

|

|

Optical Transceiver Market, by Connector: |

|

|

Optical Transceiver Market, by Distance: |

|

|

Optical Transceiver Market, by Protocol: |

|

|

Optical Transceiver Market, by Application: |

|

|

Optical Transceiver Market, by Region: |

|

Recent Developments in Optical Transceiver Industry

- In December 2020, The company announced the addition of a 100G PAM4 (53 Gbaud) directly-modulated laser (DML) for hyper-scale data center applications to its broad datacom laser chip portfolio. This product was designed to complement Lumentum’s existing 100G PAM4 externally modulated laser (EML) products and provides transceiver designers with a lower-cost option.

- In December 2020, InnoLight demonstrated the industry’s first 800G pluggable OSFP 2xFR4, OSFP DR8 plus and QSFP-DD800 DR8 plus light modules via video at the ECOC2020 online show.

- In October 2020, Fujitsu Optical Components expanded the portfolio of next-generation 400G pluggable coherent transceivers. The company announced the release of a 400G ZR+ transceiver that enabled coherent WDM transmission greater than 120 km (74.5 miles) in the same form factors (QSFP56-DD and OSFP) as its 400G ZR transceiver. Both these transceivers used advanced coherent technology to enable higher bandwidth capacity and lower cost per bit compared to 100G WDM technology.

- In August 2020, Chengdu Shuhan Technology (China) and InnoLight joined hands together and announced four major application solutions at exhibit CIOE 2020. This included a comprehensive product line for interconnection within and between data centers; optimized solutions for 5G prequels, mid-pass and backhaul; coherent optical communication module; and improved market layout to provide access network high-speed optical device optical modules a full range of solutions

- In July 2020, Chengdu Shuhan Technology (China) and InnoLight joined hands together and announced four major application solutions at exhibit CIOE 2020. This included a comprehensive product line for interconnection within and between data centers; optimized solutions for 5G prequels, mid-pass and backhaul; coherent optical communication module; and improved market layout to provide access network high-speed optical device optical modules a full range of solutions

Frequently Asked Questions (FAQ):

What is the current size of the optical transceiver market?

The optical transceiver market is projected to grow from USD 7.0 billion in 2021 to USD 14.3 billion by 2026; it is expected to grow at a CAGR of 15.2% from 2021 to 2026.

Who are the key players in the optical transceiver market?

Companies such as II-VI (US), Broadcom (US), Lumentum (US), Sumitomo Electric Industries (Japan), Accelink (China), Smartoptics (Norway), Infinera (US), Fujitsu Optical Components (Japan), Hisense Broadband (China), Huawei (China), InnoLight (China), Ciena (US), Applied Optoelectronics (US), Amphenol (US), Intel (US), NEC (Japan), Cisco (US), NeoPhotonics (US), Perle Systems (Canada), FOCI (Taiwan), Source Photonics (US), Solid Optics (US), and Eoptolink (China). These companies cater to the requirements of their customers by providing advanced optical transceiver products and software/applications with a presence in multiple countries.

What are the opportunities for the existing players and for those who are planning to enter various stages of the optical transceiver value chain?

There are various opportunities for the existing players to enter the value chain of optical transceiver industry. Some of these include emerging focus on 5G network, introduction of 800G optical transceivers for extended wavelengths over longer distances without regeneration, and expansion of telecom infrastructure in developing economies

What are the challenges for the existing players and for those who are planning to enter various stages of the optical transceiver value chain?

There are various challenges for the existing players to enter the value chain of optical transceiver industry. Some of these include ever changing customer demands for portable devices and better speeds and device compatibility and sustainability issues.

Which is the potential market for optical transceiver in terms of region?

APAC is projected to grow at the highest CAGR throughout the forecast period. Increasing investment in 4G and 5G networks by telecommunication companies, such as China Broadcast Network (China), Rakuten (Japan), and Dito Telecom (Philippines), is expected to be the key driver for the market in APAC.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 OPTICAL TRANSCEIVER MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY, PRICING, AND VOLUME

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 OPTICAL TRANSCEIVER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR OPTICAL TRANSCEIVERS IN THE US

FIGURE 4 OPTICAL TRANSCEIVER MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE GENERATED FROM PRODUCTS IN THE MARKET

FIGURE 6 OPTICAL TRANSCEIVER INDUSTRY SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN THE OPTICAL TRANSCEIVER MARKET

FIGURE 7 OPTICAL TRANSCEIVER MARKET: TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

TABLE 1 MARKET GROWTH ASSUMPTIONS

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

TABLE 2 RECOVERY SCENARIOS FOR THE GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 10 GROWTH PROJECTIONS OF THE OPTICAL TRANSCEIVER MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 11 OPTICAL TRANSCEIVERS WITH FORM FACTORS OF QSFP, QSFP+, QSFP-DD, AND QSFP28 EXPECTED TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

FIGURE 12 MULTIMODE OPTICAL TRANSCEIVERS TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 13 OPTICAL TRANSCEIVERS WITH LC CONNECTORS EXPECTED TO HOLD A LARGER SHARE DURING THE FORECAST PERIOD

FIGURE 14 OPTICAL TRANSCEIVER INDUSTRY FOR DATA CENTER APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 15 NORTH AMERICA HELD THE LARGEST SHARE OF THE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE OPTICAL TRANSCEIVER MARKET

FIGURE 16 INCREASING ADOPTION OF SMART DEVICES AND RISING DATA TRAFFIC ARE EXPECTED TO FUEL MARKET GROWTH

4.2 MARKET, BY FORM FACTOR

FIGURE 17 QSFP FORM FACTOR TO HOLD THE LARGEST SHARE IN 2021

4.3 MARKET, BY APPLICATION

FIGURE 18 DATA CENTER PROJECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN 2021

4.4 NORTH AMERICAN MARKET, BY APPLICATION AND COUNTRY

FIGURE 19 DATA CENTER APPLICATION TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2021

4.5 OPTICAL TRANSCEIVER MARKET, BY COUNTRY

FIGURE 20 US HELD THE LARGEST SHARE OF THE GLOBAL MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 75)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 INCREASING ADOPTION OF SMART DEVICES AND RISING DATA TRAFFIC TO DRIVE THE MARKET

5.2.1 DRIVERS

FIGURE 22 IMPACT OF DRIVERS ON THE OPTICAL TRANSCEIVER MARKET

5.2.1.1 Increase in adoption of smart devices and rise in data traffic

TABLE 3 BREAKDOWN FOR THE SHARE OF DATA TRAFFIC BY SMART DEVICES (2020–2021)

FIGURE 23 GLOBAL INTERNET USERS AND INTERNET PENETRATION RATE DURING 2012–2021

5.2.1.2 Growth in demand for cloud-based services

5.2.1.3 Rise in demand for compact and energy-efficient transceivers

5.2.1.4 Growth in the importance of mega data centers

FIGURE 24 100G AND 400G OPTICAL TRANSCEIVER PATENTS BETWEEN 2010 AND 2020

5.2.2 RESTRAINTS

FIGURE 25 IMPACT OF RESTRAINTS ON THE OPTICAL TRANSCEIVER INDUSTRY

5.2.2.1 Increase in network complexity

5.2.3 OPPORTUNITIES

FIGURE 26 IMPACT OF OPPORTUNITIES ON THE MARKET

5.2.3.1 Emerging focus on 5G network

5.2.3.2 Introduction of 800G optical transceivers for extended wavelengths over longer distances without regeneration

FIGURE 27 800G OPTICAL TRANSCEIVER PATENTS BETWEEN 2010 AND 2020

5.2.3.3 Expansion of telecom infrastructure in developing economies

5.2.4 CHALLENGES

FIGURE 28 IMPACT OF CHALLENGES ON THE OPTICAL TRANSCEIVER MARKET

5.2.4.1 Everchanging customer demands for portable devices and better speeds

5.2.4.2 Device compatibility and sustainability issues

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 29 SUPPLY CHAIN ANALYSIS OF THE OPTICAL TRANSCEIVER ECOSYSTEM: R&D AND MANUFACTURING PHASE CONTRIBUTE THE MOST VALUE

5.3.1 PLANNING AND REVISING FUND

5.3.2 RESEARCH & DEVELOPMENT

5.3.3 MANUFACTURING

5.3.4 ASSEMBLY, DISTRIBUTION, AND AFTER-SALES SERVICES

5.4 ECOSYSTEM

FIGURE 30 OPTICAL TRANSCEIVER ECOSYSTEM

TABLE 4 LIST OF COMPANIES AND THEIR ROLE IN THE OPTICAL TRANSCEIVER ECOSYSTEM

5.5 TRENDS IMPACTING CUSTOMERS BUSINESS

FIGURE 31 REVENUE SHIFT IN THE OPTICAL TRANSCEIVER MARKET

5.6 CASE STUDIES

5.6.1 TELIA CARRIER IS PLANNING TO USE ACACIA COMMUNICATIONS’ COHERENT PLUGGABLE TRANSCEIVER FOR ROUTER INTERCONNECTION

5.6.2 CHAMPION ONE (US) UPGRADES A US-BASED UNIVERSITY'S NETWORK WITH AN LR4-TO-LR4 INTERFACE SOLUTION FOR 10G, 40G, AND 100G OPTICAL TRANSCEIVERS

5.6.3 TXO'S (UK) QSFP28 TRANSCEIVERS ARE BEING USED BY A MULTINATIONAL TELECOMMUNICATIONS COMPANY TO ADVANCE THEIR GLOBAL 100G NETWORK

5.6.4 FS (US) PROVIDED A LONG-DISTANCE 10G DWDM SOLUTION WITH LINK PROTECTION FOR BUSINESS EXPANSION

5.6.5 SMITHS INTERCONNECT OFFERED OPTICAL INTERCONNECT FOR HIGH-SPEED, HIGH-BANDWIDTH 10GIGE AND 40GIGE CAMERAS WITH OPTICAL ENGINE EMQSFP+

5.6.6 SMITHS INTERCONNECT (UK) UPGRADED OPTICAL TRANSCEIVERS FOR 100/140 µM AIRCRAFT OPTICAL CABLING

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 OPTICAL TRANSCEIVER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 DEGREE OF COMPETITION

5.8 TECHNOLOGY TRENDS

5.8.1 KEY TECHNOLOGY

5.8.1.1 Use of Silicon Photonics (SiPh) Technology for manufacturing optical transceivers

5.8.1.2 XR optics-based networking solutions

5.8.1.3 Development of PAM4 for 100G and 400G applications

5.8.1.4 Rise of ultra-high-speed 800G optical transceivers

5.8.1.5 The wave of high performance coherent pluggable modules with greater reach

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 The emergence of 5G networks and integration with AI and IoT

5.8.3 ADJACENT TECHNOLOGY

5.8.3.1 Laser technology for modulation of high data rate

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

5.9.1.1 Import scenario for the optical transceiver market

TABLE 6 TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) IMPORTS, BY KEY COUNTRY, 2012–2020 (USD BILLION)

FIGURE 33 IMPORT DATA FOR TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) IN THE MARKET FOR THE TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.9.2 EXPORT SCENARIO

5.9.2.1 Export scenario for optical transceiver market

TABLE 7 TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) EXPORTS, BY KEY COUNTRY, 2012–2020 (USD BILLION)

FIGURE 34 EXPORT DATA FOR TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) IN THE MARKET FOR TOP FIVE COUNTRIES, 2016–2020 (USD BILLION)

5.10 PATENT ANALYSIS

TABLE 8 PATENTS FILED FOR VARIOUS TYPES OF OPTICAL TRANSCEIVER, 2018–2020

FIGURE 35 OPTICAL TRANSCEIVER PATENTS PUBLISHED BETWEEN 2010 & 2020

FIGURE 36 TOP 10 COMPANIES WITH LARGEST NO. OF PATENT APPLICATIONS, 2010–2020

5.11 TARIFFS AND REGULATIONS

5.11.1 TARIFFS

TABLE 9 US: MFN TARIFFS FOR TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) EXPORTED, BY KEY COUNTRY, 2021

TABLE 10 CHINA: MFN TARIFFS FOR TRANSMISSION OR RECEPTION APPARATUS (INCLUDING OPTICAL TRANSCEIVERS) EXPORTED, BY KEY COUNTRY, 2021

5.11.1.1 Positive impact of tariffs on transmission or reception apparatus (including optical transceivers)

5.11.1.2 Negative impact of tariffs on transmission or reception apparatus (including optical transceivers)

5.11.2 REGULATIONS

FIGURE 37 VARIOUS STANDARDS FOR OPTICAL TRANSCEIVERS

5.11.2.1 ISO 9001:2015

5.11.2.2 IEEE

5.11.2.3 IEC laser safety regulation

5.11.2.4 RoHS

5.11.2.5 REACH

5.11.2.6 CB

5.11.2.7 CE

5.11.2.8 FCC

5.11.2.9 FDA

TABLE 11 FDA AND IEC LASER CLASS AND LASER PRODUCT HAZARD

5.11.2.10 RCM

5.12 AVERAGE SELLING PRICE TRENDS

TABLE 12 AVERAGE SELLING PRICES OF OPTICAL TRANSCEIVERS BASED ON DATA RATES SUPPORTED

6 OPTICAL TRANSCEIVER MARKET, BY FORM FACTOR (Page No. - 119)

6.1 INTRODUCTION

TABLE 13 OPTICAL TRANSCEIVER MARKET, BY FORM FACTOR, 2017–2020 (USD MILLION)

FIGURE 38 OPTICAL TRANSCEIVERS WITH QSFP, QSFP+, QSFP-DD, AND QSFP28 EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET, BY FORM FACTOR, 2021–2026 (USD MILLION)

6.2 SFF AND SFP

6.2.1 SFF AND SFP ENABLE A LOWER DATA RATE TRANSMISSION

TABLE 15 MARKET FOR SFF AND SFP, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 39 1310 NM BAND WAVELENGTH FOR SFF AND SFP OPTICAL TRANSCEIVERS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 16 MARKET FOR SFF AND SFP, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR SFF AND SFP, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 18 OPTICAL TRANSCEIVER INDUSTRY FOR SFF AND SFP, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR SFF AND SFP, BY CONNECTOR, 2017–2020 (USD MILLION)

FIGURE 40 LC CONNECTORS FOR SFF AND SFP TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

TABLE 20 MARKET FOR SFF AND SFP, BY CONNECTOR, 2021–2026 (USD MILLION)

6.3 SFP+ AND SFP28

6.3.1 SFP+ AND SFP28 ENABLE BOTH SINGLE-MODE AND MULTIMODE FIBER OPTIC COMMUNICATION

TABLE 21 MARKET FOR SFP+ AND SFP28, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 41 850 NM BAND WAVELENGTH FOR SFP+ AND SFP28 EXPECTED TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

TABLE 22 MARKET FOR SFP+ AND SFP28, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 23 MARKET FOR SFP+ AND SFP28, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 24 OPTICAL TRANSCEIVER INDUSTRY FOR SFP+ AND SFP28, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 25 MARKET FOR SFP+ AND SFP28, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 42 SINGLE MODE FIBER TYPE FOR SFP+ AND SFP28 SEGMENT TO HOLD A LARGER SHARE DURING THE FORECAST PERIOD

TABLE 26 MARKET FOR SFP+ AND SFP28, BY FIBER TYPE, 2021–2026 (USD MILLION)

6.4 QSFP, QSFP+, QSFP-DD, AND QSFP28

6.4.1 FASTEST-GROWING SEGMENT OWING TO THE ADOPTION OF HIGH DATA RATE TRANSMISSION

TABLE 27 OPTICAL TRANSCEIVER MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 43 850 NM BAND WAVELENGTH FOR QSFP, QSFP+, QSFP-DD, AND QSFP28 EXPECTED TO HOLD A LARGER SHARE DURING THE FORECAST PERIOD

TABLE 28 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 29 OPTICAL TRANSCEIVER INDUSTRY FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 44 MULTIMODE FIBER TYPE FOR THE QSFP, QSFP+, QSFP-DD, AND QSFP28 SEGMENT TO HOLD A LARGER SHARE DURING THE FORECAST PERIOD

TABLE 32 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 33 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28, BY CONNECTOR, 2021–2026 (USD MILLION)

6.5 CFP, CFP2, AND CFP4

6.5.1 MARKET FOR CFP, CFP2, AND CFP4 TYPE TRANSCEIVERS EXPECTED TO GROW AT THE HIGHEST CAGR IN APAC

TABLE 35 MARKET FOR CFP, CFP2, AND CFP4, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 45 1310 NM BAND WAVELENGTH FOR THE CFP, CFP2, AND CFP4 OPTICAL TRANSCEIVER MARKET EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 36 MARKET FOR CFP, CFP2, AND CFP4, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR CFP, CFP2, AND CFP4, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 46 SINGLE-MODE FIBER TYPE FOR THE CFP, CFP2, AND CFP4 SEGMENT TO HOLD A LARGER SHARE DURING THE FORECAST PERIOD

TABLE 38 MARKET FOR CFP, CFP2, AND CFP4, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 39 OPTICAL TRANSCEIVER INDUSTRY FOR CFP, CFP2, AND CFP4, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR CFP, CFP2, AND CFP4, BY CONNECTOR, 2021–2026 (USD MILLION)

6.6 XFP

6.6.1 IT SUPPORTS ETHERNET, FIBER CHANNEL, AND SONET STANDARDS

TABLE 41 MARKET FOR XFP, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 47 1550 NM BAND WAVELENGTH FOR THE XFP OPTICAL TRANSCEIVER MARKET EXPECTED TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

TABLE 42 MARKET FOR XFP, BY WAVELENGTH, 2021–2026 (USD MILLION)

6.7 CXP

6.7.1 CXP TRANSCEIVERS ARE USED FOR HIGH-DENSITY APPLICATIONS

6.8 COVID-19 IMPACT ON VARIOUS FORM FACTORS OF OPTICAL TRANSCEIVERS

6.8.1 MOST IMPACTED FORM FACTOR

FIGURE 48 IMPACT OF COVID-19 ON THE CXP MARKET

6.8.2 LEAST IMPACTED FORM FACTOR

FIGURE 49 IMPACT OF COVID-19 ON THE QSFP, QSFP+, QSFP-DD, AND QSFP28 MARKET

7 OPTICAL TRANSCEIVER MARKET, BY DATA RATE (Page No. - 143)

7.1 INTRODUCTION

TABLE 43 OPTICAL TRANSCEIVER MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

FIGURE 50 OPTICAL TRANSCEIVERS SUPPORTING 41 GBPS TO 100 GBPS DATA RATE EXPECTED TO GROW THE FASTEST FROM 2021 TO 2026

TABLE 44 MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 45 MARKET, BY DATA RATE, 2017–2020 (THOUSAND UNITS)

TABLE 46 MARKET, BY DATA RATE, 2021–2026 (THOUSAND UNITS)

7.2 LESS THAN 10 GBPS

7.2.1 LESS THAN 10 GBPS DATA RATE MODULES OPERATE THROUGH SINGLE-MODE AS WELL AS MULTIMODE FIBERS

TABLE 47 LIST OF PRODUCTS FOR LESS THAN 10 GBPS DATA RATE

TABLE 48 MARKET FOR LESS THAN 10 GBPS DATA RATE, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 49 OPTICAL TRANSCEIVER INDUSTRY FOR LESS THAN 10 GBPS DATA RATE, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR LESS THAN 10 GBPS DATA RATE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR LESS THAN 10 GBPS DATA RATE, BY REGION, 2021–2026 (USD MILLION)

7.3 10 GBPS TO 40 GBPS

7.3.1 10 GBPS TO 40 GBPS OF DATA RATE MODULES ARE MOSTLY USED FOR SWITCHING AND ROUTING APPLICATIONS

TABLE 52 LIST OF PRODUCTS FOR 10 GBPS TO 40 GBPS DATA RATE

TABLE 53 MARKET FOR 10 GBPS TO 40 GBPS DATA RATE, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 54 OPTICAL TRANSCEIVER INDUSTRY FOR 10 GBPS TO 40 GBPS DATA RATE, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR 10 GBPS TO 40 GBPS DATA RATE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR 10 GBPS TO 40 GBPS DATA RATE, BY REGION, 2021–2026 (USD MILLION)

7.4 41 GBPS TO 100 GBPS

7.4.1 MARKET FOR OPTICAL TRANSCEIVERS SUPPORTING DATA RATES BETWEEN 41 GBPS AND 100 GBPS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 57 LIST OF PRODUCTS FOR 41 GBPS TO 100 GBPS DATA RATE

TABLE 58 MARKET FOR 41 GBPS TO 100 GBPS DATA RATE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR 41 GBPS TO 100 GBPS DATA RATE, BY REGION, 2021–2026 (USD MILLION)

7.5 MORE THAN 100 GBPS

7.5.1 MORE THAN 100 GBPS DATA RATE MODULES ARE PROMINENTLY USED FOR SHORT-REACH COMMUNICATIONS

TABLE 60 LIST OF PRODUCTS FOR MORE THAN 100 GBPS DATA RATE

TABLE 61 MARKET FOR ABOVE 100 GBPS, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 62 OPTICAL TRANSCEIVER INDUSTRY FOR ABOVE 100 GBPS, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR MORE THAN 100 GBPS DATA RATE, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR MORE THAN 100 GBPS DATA RATE, BY REGION, 2021–2026 (USD MILLION)

7.6 IMPACT OF COVID-19 ON THE OPTICAL TRANSCEIVER MARKET FOR DATA RATE

7.6.1 MOST IMPACTED DATA RATE

FIGURE 51 IMPACT OF COVID-19 ON THE MARKET FOR LESS THAN 10 GBPS DATA RATE

7.6.2 LEAST IMPACTED DATA RATE

FIGURE 52 IMPACT OF COVID-19 ON THE MARKET FOR 41 GBPS TO 100 GBPS DATA RATE

8 OPTICAL TRANSCEIVER MARKET, BY FIBER TYPE (Page No. - 157)

8.1 INTRODUCTION

TABLE 65 OPTICAL TRANSCEIVER MARKET, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 53 MULTIMODE OPTICAL TRANSCEIVERS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 66 MARKET, BY FIBER TYPE, 2021–2026 (USD MILLION)

8.2 SINGLE MODE FIBER (SMF)

8.2.1 SINGLE MODE FIBERS ARE SUITABLE FOR LONG-DISTANCE TRANSMISSION DUE TO LOWER ATTENUATION

TABLE 67 LIST OF PLAYERS OFFERING SINGLE-MODE TRANSCEIVERS

TABLE 68 MARKET FOR SINGLE MODE FIBER, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR SINGLE MODE FIBER, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR SINGLE MODE FIBER, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR SINGLE MODE FIBER, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 72 MARKET FOR SINGLE MODE FIBER, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR SINGLE MODE FIBER, BY REGION, 2021–2026 (USD MILLION)

8.3 MULTIMODE FIBER (MMF)

8.3.1 MULTIMODE FIBERS CONSUME LESS POWER THAN SINGLE MODE FIBERS AND ARE BEST SUITED FOR DATA CENTER APPLICATIONS

TABLE 74 LIST OF PLAYERS OFFERING MULTIMODE TRANSCEIVERS

TABLE 75 MARKET FOR MULTIMODE FIBER, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR MULTIMODE FIBER, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR MULTIMODE FIBER, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR MULTIMODE FIBER, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR MULTIMODE FIBER, BY REGION, 2017–2020 (USD MILLION)

FIGURE 54 MULTIMODE MARKET TO GROW AT THE HIGHEST CAGR IN APAC DURING THE FORECAST PERIOD

TABLE 80 MARKET FOR MULTIMODE FIBER, BY REGION, 2021–2026 (USD MILLION)

9 OPTICAL TRANSCEIVER MARKET, BY DISTANCE (Page No. - 169)

9.1 INTRODUCTION

TABLE 81 OPTICAL TRANSCEIVER MARKET, BY DISTANCE, 2017–2020 (USD MILLION)

FIGURE 55 OPTICAL TRANSCEIVERS FOR LESS THAN 1 KM TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 82 MARKET, BY DISTANCE, 2021–2026 (USD MILLION)

9.2 LESS THAN 1 KM

9.2.1 MULTIMODE FIBER TRANSCEIVERS ARE PREFERRED FOR LESS THAN 1 KM DISTANCE CONNECTIVITY FOR HIGH DATA RATE TRANSMISSION

TABLE 83 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH LESS THAN 1 KM REACH COMPATIBILITY

TABLE 84 MARKET FOR LESS THAN 1 KM, BY REGION, 2017–2020 (USD MILLION)

FIGURE 56 NORTH AMERICA TO DOMINATE THE MARKET FOR LESS THAN 1 KM RANGE MODULES DURING THE FORECAST PERIOD

TABLE 85 MARKET FOR LESS THAN 1 KM, BY REGION, 2021–2026 (USD MILLION)

9.3 1 TO 10 KM

9.3.1 TRANSCEIVER MODULES OPERATING WITHIN 1 TO 10 KM DISTANCE ARE USED FOR INTRA DATA CENTER CONNECTION APPLICATIONS

TABLE 86 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH 1 TO 10 KM REACH

TABLE 87 MARKET FOR 1 TO 10 KM, BY REGION, 2017–2020 (USD MILLION)

FIGURE 57 APAC MARKET FOR 1 TO 10 KM RANGE MODULES EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 88 OPTICAL TRANSCEIVER MARKET FOR 1 TO 10 KM, BY REGION, 2021–2026 (USD MILLION)

9.4 11 TO 100 KM

9.4.1 OPTICAL TRANSCEIVERS OPERATING WITHIN A DISTANCE OF 11 TO 100 KM ARE OPERATED ON SINGLE-MODE FIBERS

TABLE 89 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH 11 TO 100 KM REACH

TABLE 90 MARKET FOR 11 TO 100 KM, BY REGION, 2017–2020 (USD MILLION)

FIGURE 58 APAC REGION FOR 11 TO 100 KM RANGE MODULES EXPECTED TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 91 MARKET FOR 11 TO 100 KM, BY REGION, 2021–2026 (USD MILLION)

9.5 MORE THAN 100 KM

9.5.1 OPTICAL TRANSCEIVERS FOR MORE THAN 100 KM ARE MAINLY USED FOR LONG-DISTANCE TELECOMMUNICATION NETWORKS

TABLE 92 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH MORE THAN 100 KM REACH

TABLE 93 MARKET FOR MORE THAN 100 KM, BY REGION, 2017–2020 (USD MILLION)

FIGURE 59 APAC REGION FOR MORE THAN 100 KM RANGE MODULES EXPECTED TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 94 OPTICAL TRANSCEIVER MARKET FOR MORE THAN 100 KM, BY REGION, 2021–2026 (USD MILLION)

10 OPTICAL TRANSCEIVER MARKET, BY WAVELENGTH (Page No. - 179)

10.1 INTRODUCTION

TABLE 95 MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

FIGURE 60 OPTICAL TRANSCEIVERS OPERATING IN THE 1310 NM BAND TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 96 MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

10.2 850 NM BAND

10.2.1 MULTIMODE OPTICAL TRANSCEIVERS OPERATING IN THE 850 NM BAND ARE USED FOR SHORT-DISTANCE COMMUNICATION

TABLE 97 LIST OF PRODUCTS OPERATING AT 850 NM BAND

TABLE 98 MARKET FOR 850 NM BAND, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 99 OPTICAL TRANSCEIVER INDUSTRY FOR 850 NM BAND, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 100 MARKET FOR 850 NM BAND, BY REGION, 2017–2020 (USD MILLION)

TABLE 101 MARKET FOR 850 NM BAND, BY REGION, 2021–2026 (USD MILLION)

10.3 1310 NM BAND

10.3.1 1310 NM BAND IS SUITED FOR DATA TRANSFER THROUGH SINGLE-MODE AND MULTIMODE FIBERS

TABLE 102 LIST OF PRODUCTS OPERATING AT 1310 NM BAND

TABLE 103 MARKET FOR 1310 NM BAND, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR 1310 NM BAND, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 105 MARKET FOR 1310 NM BAND, BY REGION, 2017–2020 (USD MILLION)

FIGURE 61 NORTH AMERICA TO LEAD THE MARKET FOR THE 1310 NM BAND

TABLE 106 OPTICAL TRANSCEIVER MARKET FOR 1310 NM BAND, BY REGION, 2021–2026 (USD MILLION)

10.4 1550 NM BAND

10.4.1 1150 NM BAND IS APT FOR LONG-DISTANCE COMMUNICATION

TABLE 107 LIST OF PRODUCTS OPERATING AT 1550 NM BAND

TABLE 108 MARKET FOR 1550 NM BAND, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 109 MARKET FOR 1550 NM BAND, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 110 MARKET FOR 1550 NM BAND, BY REGION, 2017–2020 (USD MILLION)

TABLE 111 OPTICAL TRANSCEIVER MARKET FOR 1550 NM BAND, BY REGION, 2021–2026 (USD MILLION)

10.5 OTHERS

TABLE 112 MARKET FOR OTHER WAVELENGTHS, BY FORM FACTOR, 2017–2020 (USD MILLION)

TABLE 113 MARKET FOR OTHER WAVELENGTHS, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 114 MARKET FOR OTHER WAVELENGTHS, BY REGION, 2017–2020 (USD MILLION)

TABLE 115 MARKET FOR OTHER WAVELENGTHS, BY REGION, 2021–2026 (USD MILLION)

11 OPTICAL TRANSCEIVER MARKET, BY CONNECTOR (Page No. - 193)

11.1 INTRODUCTION

TABLE 116 OPTICAL TRANSCEIVER MARKET, BY CONNECTOR, 2017–2020 (USD MILLION)

FIGURE 62 MPO CONNECTOR-BASED OPTICAL TRANSCEIVERS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 117 MARKET, BY CONNECTOR, 2021–2026 (USD MILLION)

11.2 LC CONNECTORS

11.2.1 LC CONNECTORS ARE WELL-SUITED FOR COHERENT POINT-TO-POINT AND METRO APPLICATIONS

TABLE 118 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH LC CONNECTOR COMPATIBILITY

TABLE 119 MARKET FOR LC CONNECTORS, BY FORM FACTOR, 2017–2020 (USD MILLION)

FIGURE 63 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28 MODULES BASED ON LC CONNECTORS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 120 OPTICAL TRANSCEIVER INDUSTRY FOR LC CONNECTORS, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 121 MARKET FOR LC CONNECTORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 122 MARKET FOR LC CONNECTORS, BY REGION, 2021–2026 (USD MILLION)

11.3 SC CONNECTORS

11.3.1 SC CONNECTOR-BASED OPTICAL TRANSCEIVERS ARE EXPECTED TO GROW AT THE HIGHEST CAGR IN APAC

TABLE 123 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH SC CONNECTOR COMPATIBILITY

TABLE 124 MARKET FOR SC CONNECTORS, BY FORM FACTOR, 2017–2020 (USD MILLION)

FIGURE 64 MARKET FOR CFP, CFP2, AND CFP4 MODULES BASED ON SC CONNECTORS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 125 OPTICAL TRANSCEIVER MARKET SIZE FOR SC CONNECTORS, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 126 MARKET FOR SC CONNECTORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 MARKET FOR SC CONNECTORS, BY REGION, 2021–2026 (USD MILLION)

11.4 MPO CONNECTOR

11.4.1 USE OF MPO CONNECTORS FOR HIGH-SPEED OPTICAL TRANSCEIVERS TO DRIVE THE MARKET GROWTH

TABLE 128 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH MPO CONNECTOR COMPATIBILITY

TABLE 129 MARKET FOR MPO CONNECTORS, BY FORM FACTOR, 2017–2020 (USD MILLION)

FIGURE 65 MARKET FOR QSFP, QSFP+, QSFP-DD, AND QSFP28 MODULES BASED ON MPO CONNECTOR TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

TABLE 130MARKET FOR MPO CONNECTORS, BY FORM FACTOR, 2021–2026 (USD MILLION)

TABLE 131 MARKET FOR MPO CONNECTORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 132 MARKET FOR MPO CONNECTORS, BY REGION, 2021–2026 (USD MILLION)

11.5 RJ-45

11.5.1 RJ-45 TRANSCEIVERS OFFER THE LOWEST DATA RATE CAPABILITY

TABLE 133 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS WITH RJ-45 CONNECTOR COMPATIBILITY

TABLE 134 MARKET FOR RJ-45 CONNECTORS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 66 APAC REGION FOR MODULES BASED ON RJ-45 CONNECTORS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 135 MARKET FOR RJ-45 CONNECTORS, BY REGION, 2021–2026 (USD MILLION)

12 OPTICAL TRANSCEIVER MARKET, BY APPLICATION (Page No. - 208)

12.1 INTRODUCTION

TABLE 136 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 67 MARKET FOR DATA CENTER APPLICATIONS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 137 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12.2 TELECOMMUNICATION

12.2.1 ULTRA-LONG-HAUL NETWORK

12.2.1.1 DWDM technology is used for ultra-long-haul network communication

12.2.2 LONG-HAUL NETWORK

12.2.2.1 Single mode fibers are mostly used for long distances (metro and long-haul networks)

12.2.3 METRO NETWORK

12.2.3.1 Expansion of 4G and rising adoption of 5G would present opportunities for market growth

TABLE 138 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS FOR TELECOMMUNICATION APPLICATIONS

TABLE 139 OPTICAL TRANSCEIVER MARKET FOR TELECOMMUNICATION, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 68 SINGLE MODE FIBER OPTICAL TRANSCEIVERS TO LEAD THE MARKET FOR TELECOMMUNICATION APPLICATIONS DURING THE FORECAST PERIOD

TABLE 140 OPTICAL TRANSCEIVER INDUSTRY FOR TELECOMMUNICATION, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 141 MARKET FOR TELECOMMUNICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 142 MARKET FOR TELECOMMUNICATION, BY REGION, 2021–2026 (USD MILLION)

12.3 DATA CENTER

12.3.1 DATA CENTER INTERCONNECT

12.3.1.1 Increasing data traffic and demand for higher data rates create opportunities for 400G transceivers in the market

12.3.2 INTRA-DATA CENTER CONNECTION

12.3.2.1 Growing demand for cloud-based services, and emerging technologies such as AI, deep learning, and virtual reality are driving the growth of energy-efficient and high-speed transceivers

TABLE 143 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS FOR DATA CENTER APPLICATIONS

TABLE 144 MARKET FOR DATA CENTER, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 69 MULTIMODE FIBER OPTICAL TRANSCEIVERS TO HOLD A LARGER MARKET SHARE FOR DATA CENTER APPLICATIONS DURING THE FORECAST PERIOD

TABLE 145 MARKET FOR DATA CENTER, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 146 MARKET FOR DATA CENTER, BY REGION, 2017–2020 (USD MILLION)

TABLE 147 MARKET FOR DATA CENTER, BY REGION, 2021–2026 (USD MILLION)

12.4 ENTERPRISE

12.4.1 INCREASING NEED FOR HIGH DATA RATES FOR VARIOUS ENTERPRISE APPLICATIONS DRIVES THE MARKET GROWTH

TABLE 148 PLAYERS MANUFACTURING OPTICAL TRANSCEIVERS FOR ENTERPRISE APPLICATIONS

TABLE 149 MARKET FOR ENTERPRISE, BY FIBER TYPE, 2017–2020 (USD MILLION)

FIGURE 70 MULTIMODE FIBER OPTICAL TRANSCEIVERS TO HOLD A LARGER MARKET SHARE FOR ENTERPRISE APPLICATIONS DURING THE FORECAST PERIOD

TABLE 150 OPTICAL TRANSCEIVER MARKET SIZE , FOR ENTERPRISE, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 151 MARKET FOR ENTERPRISE, BY REGION, 2017–2020 (USD MILLION)

TABLE 152 MARKET FOR ENTERPRISE, BY REGION, 2021–2026 (USD MILLION)

12.5 COVID-19 IMPACT ON VARIOUS APPLICATIONS OF OPTICAL TRANSCEIVERS

12.5.1 MOST IMPACTED APPLICATION

FIGURE 71 IMPACT OF COVID-19 ON THE MARKET FOR ENTERPRISE APPLICATIONS

12.5.2 LEAST IMPACTED APPLICATION

FIGURE 72 IMPACT OF COVID-19 ON THE OPTICAL TRANSCEIVER MARKET FOR DATA CENTER APPLICATIONS

13 OPTICAL TRANSCEIVER MARKET, BY PROTOCOL (Page No. - 223)

13.1 INTRODUCTION

TABLE 153 OPTICAL TRANSCEIVER MARKET SIZE , BY PROTOCOL, 2017–2020 (USD MILLION)

FIGURE 73 MARKET FOR FTTX TO WITNESS THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 154 MARKET, BY PROTOCOL, 2021–2026 (USD MILLION)

13.2 ETHERNET

13.2.1 WIDE RANGE OF DATA RATE SUPPORT ENABLES THE ADOPTION OF ETHERNET OPTICAL TRANSCEIVERS FOR OFFICES AS WELL AS DATA CENTERS

TABLE 155 KEY COMPANIES OFFERING ETHERNET OPTICAL TRANSCEIVERS

13.3 FIBER CHANNEL

13.3.1 FIBER CHANNEL OPTICAL TRANSCEIVERS ARE MAINLY ADOPTED IN DATA CENTERS

TABLE 156 KEY COMPANIES OFFERING FIBER CHANNEL OPTICAL TRANSCEIVERS

13.4 CWDM/DWDM

13.4.1 WAVELENGTH DIVISION MULTIPLEXING (WDM) PROTOCOLS HELP IN INCREASING THE DATA CARRYING CAPACITY WITHOUT INCREASING THE DATA RATES

TABLE 157 KEY COMPANIES OFFERING CWDM/DWDM OPTICAL TRANSCEIVERS

13.5 FTTX (PON/BIDI)

13.5.1 FTTH IS ONE OF THE KEY APPLICATIONS FUELING THE GROWTH OF THE MARKET

TABLE 158 KEY COMPANIES OFFERING FTTX (PON/BIDI) OPTICAL TRANSCEIVERS

13.6 OTHER PROTOCOLS

TABLE 159 KEY COMPANIES OFFERING OPTICAL TRANSCEIVERS COMPATIBLE WITH OTHER PROTOCOLS

14 OPTICAL TRANSCEIVERS MARKET, BY GEOGRAPHY (Page No. - 229)

14.1 INTRODUCTION

FIGURE 74 OPTICAL TRANSCEIVER MARKET IN CHINA TO GROW AT THE HIGHEST CAGR

TABLE 160 MARKET, BY REGION, 2017–2020 (USD MILLION)

FIGURE 75 MARKET IN APAC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 161 MARKET, BY REGION, 2021–2026 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 76 SNAPSHOT: NORTH AMERICAN OPTICAL TRANSCEIVER MARKET

TABLE 162 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 167 NORTH AMERICA: MARKET, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 168 NORTH AMERICA: MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 169 NORTH AMERICA: MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 170 NORTH AMERICA: MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 171 NORTH AMERICA: MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 172 NORTH AMERICA: MARKET, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: MARKET, BY CONNECTOR, 2021–2026 (USD MILLION)

TABLE 174 NORTH AMERICA: MARKET, BY DISTANCE, 2017–2020 (USD MILLION)

TABLE 175 NORTH AMERICA: MARKET, BY DISTANCE, 2021–2026 (USD MILLION)

TABLE 176 NORTH AMERICA: MARKET, BY PROTOCOL, 2017–2020 (USD MILLION)

TABLE 177 NORTH AMERICA: MARKET, BY PROTOCOL, 2021–2026 (USD MILLION)

14.2.1 US

14.2.1.1 Data centers and cloud-based services are fueling the market growth in the United States

14.2.2 CANADA

14.2.2.1 Canada is an emerging hotspot for data center application and 5G networking

14.2.3 MEXICO

14.2.3.1 The increase in internet data traffic and data centers with leading streaming services and online gaming will propel the Mexican market

14.3 EUROPE

FIGURE 77 SNAPSHOT: EUROPEAN OPTICAL TRANSCEIVER MARKET

TABLE 178 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 179 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 180 EUROPE: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 181 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 182 EUROPE: MARKET, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 183 EUROPE: MARKET, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 184 EUROPE: MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 185 EUROPE: MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 186 EUROPE: MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 187 EUROPE: MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 188 EUROPE: MARKET, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 189 EUROPE: MARKET, BY CONNECTOR, 2021–2026 (USD MILLION)

TABLE 190 EUROPE: MARKET, BY DISTANCE, 2017–2020 (USD MILLION)

TABLE 191 EUROPE: MARKET, BY DISTANCE, 2021–2026 (USD MILLION)

TABLE 192 EUROPE: MARKET, BY PROTOCOL, 2017–2020 (USD MILLION)

TABLE 193 EUROPE: MARKET, BY PROTOCOL, 2021–2026 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Germany is expected to be driven by its leading 5G readiness, strong infrastructures, and cloud-based services integrated with big data, AI, and IoT

14.3.2 UK

14.3.2.1 The UK has a growing market for smart devices and 5G technology, as well as an increasing number of data center applications

14.3.3 FRANCE

14.3.3.1 The presence of several big telecom operators, as well as opportunities for digital skills, and AI integration with 5G networks across France, presents market opportunities

14.3.4 REST OF EUROPE (ROE)

14.4 APAC

FIGURE 78 SNAPSHOT: APAC OPTICAL TRANSCEIVER MARKET

TABLE 194 APAC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 195 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 196 APAC: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 197 APAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 198 APAC: MARKET, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 199 APAC: MARKET, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 200 APAC: MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 201 APAC: MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 202 APAC: MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 203 APAC: MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 204 APAC: MARKET, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 205 APAC: MARKET, BY CONNECTOR, 2021–2026 (USD MILLION)

TABLE 206 APAC: MARKET, BY DISTANCE, 2017–2020 (USD MILLION)

TABLE 207 APAC: MARKET, BY DISTANCE, 2021–2026 (USD MILLION)

TABLE 208 APAC: MARKET, BY PROTOCOL, 2017–2020 (USD MILLION)

TABLE 209 APAC: MARKET, BY PROTOCOL, 2021–2026 (USD MILLION)

14.4.1 CHINA

14.4.1.1 The rapidly increasing number of data centers, as well as the advancement of 5G networks with higher bandwidths, are driving market opportunities in China

14.4.2 JAPAN

14.4.2.1 Increasing cloud-based services, smart electronic devices, and technological advancements in 5G and beyond 5G are expanding opportunities in Japan's optical transceiver market

14.4.3 SOUTH KOREA

14.4.3.1 South Korean market expected to be driven by 5G development and a strong foundation in electronics, semiconductors, and consumer electronic devices

14.4.4 REST OF APAC (ROAPAC)

14.5 REST OF THE WORLD (ROW)

FIGURE 79 SNAPSHOT: ROW OPTICAL TRANSCEIVER MARKET

TABLE 210 ROW: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 211 ROW: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 212 ROW: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 213 ROW: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 ROW: MARKET, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 215 ROW: MARKET, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 216 ROW: MARKET, BY DATA RATE, 2017–2020 (USD MILLION)

TABLE 217 ROW: MARKET, BY DATA RATE, 2021–2026 (USD MILLION)

TABLE 218 ROW: MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 219 ROW: MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

TABLE 220 ROW: MARKET, BY CONNECTOR, 2017–2020 (USD MILLION)

TABLE 221 ROW: MARKET, BY CONNECTOR, 2021–2026 (USD MILLION)

TABLE 222 ROW: MARKET, BY DISTANCE, 2017–2020 (USD MILLION)

TABLE 223 ROW: MARKET, BY DISTANCE, 2021–2026 (USD MILLION)

TABLE 224 ROW: MARKET, BY PROTOCOL, 2017–2020 (USD MILLION)

TABLE 225 ROW: MARKET, BY PROTOCOL, 2021–2026 (USD MILLION)

14.5.1 SOUTH AMERICA

14.5.1.1 The market for South America is expected to be driven by 5G development and data centers as a result of the rising data traffic due to OTT platforms

14.5.2 MIDDLE EAST & AFRICA (MEA)

14.5.2.1 5G development and cloud services integration with IoT and digital skills are expected to drive the MEA market

14.6 COVID-19 IMPACT ON THE OPTICAL TRANSCEIVER MARKET IN VARIOUS REGIONS

14.6.1 MOST IMPACTED REGION

FIGURE 80 EUROPE: IMPACT OF COVID-19 ON THE MARKET

14.6.2 LEAST IMPACTED REGION

FIGURE 81 NORTH AMERICA: IMPACT OF COVID-19 ON THE MARKET

15 COMPETITIVE LANDSCAPE (Page No. - 273)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 226 OVERVIEW OF STRATEGIES DEPLOYED BY OPTICAL TRANSCEIVER COMPANIES

15.2.1 PRODUCT PORTFOLIO

15.2.2 REGIONAL FOCUS

15.2.3 MANUFACTURING FOOTPRINT

15.2.4 ORGANIC/INORGANIC PLAY

15.3 MARKET SHARE ANALYSIS, 2020

TABLE 227 DEGREE OF COMPETITION IN THE MARKET, 2020

15.4 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 82 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN THE OPTICAL TRANSCEIVER MARKET

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE

15.5.4 PARTICIPANTS

FIGURE 83 OPTICAL TRANSCEIVER MARKET: COMPANY EVALUATION QUADRANT, 2020

15.6 STARTUP/SME EVALUATION MATRIX

TABLE 228 STARTUPS/SMES IN THE MARKET

15.6.1 PROGRESSIVE COMPANIES

15.6.2 RESPONSIVE COMPANIES

15.6.3 DYNAMIC COMPANIES

15.6.4 STARTING BLOCKS

FIGURE 84 MARKET, STARTUP/SME EVALUATION MATRIX, 2020

15.7 COMPANY FOOTPRINT (40 COMPANIES)

TABLE 229 COMPANY FOOTPRINT (40 COMPANIES)

TABLE 230 COMPANY APPLICATION FOOTPRINT

TABLE 231 COMPANY DATA RATE FOOTPRINT (40 COMPANIES)

TABLE 232 COMPANY REGION FOOTPRINT (40 COMPANIES)

15.8 COMPETITIVE SITUATIONS AND TRENDS

15.8.1 PRODUCT LAUNCHES

TABLE 233 PRODUCT LAUNCHES, MARCH 2020–DECEMBER 2020

15.8.2 DEALS

TABLE 234 DEALS, FEBRUARY 2020–DECEMBER 2020

15.8.3 OTHERS

TABLE 235 EXPANSION, JANUARY 2018–DECEMBER 2020

16 COMPANY PROFILES (Page No. - 292)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

16.1 KEY PLAYERS

16.1.1 II-VI

TABLE 236 II-VI: BUSINESS OVERVIEW

FIGURE 85 II-VI: COMPANY SNAPSHOT

16.1.2 BROADCOM

TABLE 237 BROADCOM: BUSINESS OVERVIEW

FIGURE 86 BROADCOM: COMPANY SNAPSHOT

16.1.3 LUMENTUM

TABLE 238 LUMENTUM: BUSINESS OVERVIEW

FIGURE 87 LUMENTUM: COMPANY SNAPSHOT

16.1.4 SUMITOMO ELECTRIC INDUSTRIES

TABLE 239 SUMITOMO ELECTRIC INDUSTRIES: BUSINESS OVERVIEW

FIGURE 88 SUMITOMO ELECTRIC INDUSTRIES: COMPANY SNAPSHOT

16.1.5 ACCELINK

TABLE 240 ACCELINK: BUSINESS OVERVIEW

FIGURE 89 ACCELINK: COMPANY SNAPSHOT

16.1.6 APPLIED OPTOELECTRONICS

TABLE 241 APPLIED OPTOELECTRONICS: BUSINESS OVERVIEW

FIGURE 90 APPLIED OPTOELECTRONICS: COMPANY SNAPSHOT

16.1.7 FUJITSU OPTICAL COMPONENTS

TABLE 242 FUJITSU OPTICAL COMPONENTS: BUSINESS OVERVIEW

FIGURE 91 FUJITSU OPTICAL COMPONENTS: COMPANY SNAPSHOT

16.1.8 INNOLIGHT

TABLE 243 INNOLIGHT: BUSINESS OVERVIEW

16.1.9 MELLANOX

TABLE 244 MELLANOX: BUSINESS OVERVIEW

FIGURE 92 MELLANOX: COMPANY SNAPSHOT

16.1.10 NEOPHOTONICS

TABLE 245 NEOPHOTONICS: BUSINESS OVERVIEW

FIGURE 93 NEOPHOTONICS: COMPANY SNAPSHOT

16.2 OTHER KEY PLAYERS

16.2.1 CIENA

16.2.2 CISCO

16.2.3 HISENSE BROADBAND

16.2.4 INTEL

16.2.5 NEC

16.2.6 PERLE SYSTEMS

16.2.7 REFLEX PHOTONICS

16.2.8 SMARTOPTICS

16.2.9 SOLID OPTICS

16.2.10 SOURCE PHOTONICS

16.2.11 HUAWEI

16.2.12 EOPTOLINK

16.2.13 INFINERA

16.2.14 FOCI

16.2.15 AMPHENOL

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 357)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS (OPTICAL TRANSCEIVER MARKET)

17.5 AUTHOR DETAILS

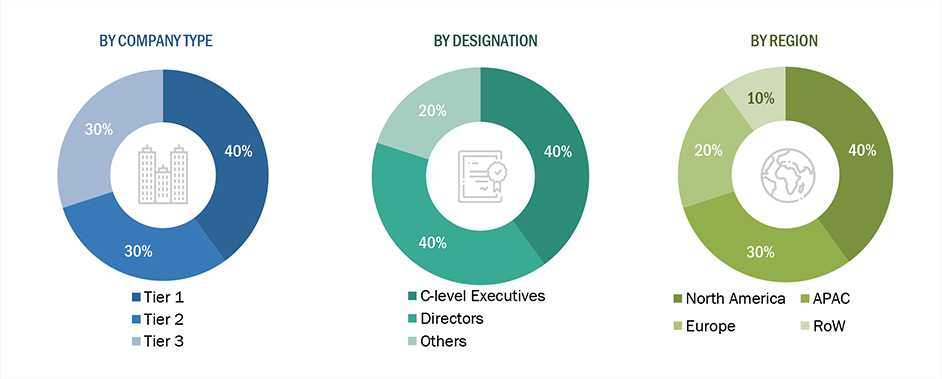

This research study incorporates the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and Dun & Bradstreet to identify and collect information useful for the technical, market-oriented, and commercial study of the optical transceiver market.

In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of the major companies in the market, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as to assess the future market prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports, press releases, investor presentations, white papers, journals and certified publications, and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, value chain, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research has been carried out to gather information and verify and validate the critical numbers arrived at.

Primary research has also been conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the optical transceiver market. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information and insights throughout the report.

Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the optical transceiver market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (end-users) and supply (equipment manufacturers and distributors) sides across 4 major regions—North America, Europe, APAC, and RoW. Approximately 25% and 75% of primary interviews were conducted with parties from the demand side and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

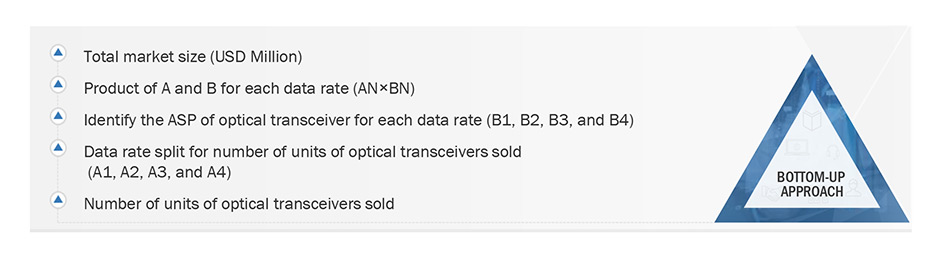

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the optical transceiver market and other dependent submarkets. Key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) about the optical transceiver market.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Optical Transceiver Market: Bottom-Up Approach

Optical Transceiver Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the optical transceiver market, in terms of value, based on form factor, data rate, wavelength, fiber type, connector, distance, protocol, and application

- To describe and forecast the optical transceiver market, in terms of volume, based on data rates

- To describe and forecast the optical transceiver market size, in terms of value, with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the optical transceiver market

- To provide a detailed overview of the supply chain of the optical transceiver ecosystem

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze the competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the optical transceiver market

Outlook and Growth of Optical Transceiver and Optical Modules Market

The outlook for the optical transceiver and optical modules market is positive, with strong expected growth in the coming years. This market includes a wide range of products that are used in a variety of applications, including telecommunications, data centers, and industrial settings.

One key factor driving growth in this market is the increasing demand for high-speed data transmission. With the rise of technologies such as 5G and the Internet of Things (IoT), there is a growing need for faster and more reliable data transmission, which optical transceivers and modules are well-suited to provide.

In addition, there is also a trend towards the adoption of fiber-optic communication technology in various industries. This is due to the advantages offered by fiber-optic communication, including high bandwidth, low latency, and long-distance transmission capabilities.

Another factor driving growth in this market is the development of new technologies and standards. For example, the emergence of 400G Ethernet is driving demand for higher-speed optical transceivers and modules, which can provide the necessary bandwidth and performance.

How Optical Modules is going to impact the Optical Transceiver market?

Optical modules and optical transceivers are closely related and often work together in optical communication systems. Optical modules, such as SFP, SFP+, QSFP, QSFP28, and CFP, provide the optical interface and connectivity for the optical transceiver. Optical transceivers, such as GBIC, XFP, and XENPAK, contain both the transmitter and receiver components and convert electrical signals to optical signals.

The impact of optical modules on the optical transceiver market is significant, as the demand for higher-speed, more reliable, and more cost-effective optical communication systems continues to grow. The use of optical modules has allowed for more flexible and scalable designs, enabling users to easily upgrade or change their network configurations.

Optical modules have also led to the development of pluggable and hot-swappable transceiver designs, which have simplified network maintenance and management, reduced system downtime, and minimized costs. This has resulted in an increased adoption of optical transceivers in a wider range of applications and industries.

Moreover, the adoption of standardized optical module form factors and interfaces, such as Small Form-factor Pluggable (SFP), has promoted interoperability between different vendors' products, providing greater flexibility and reducing the cost of optical communication systems.

Some futuristic growth use-cases of Optical Modules market?

There are several futuristic growth use-cases for the optical modules market that are expected to drive demand and growth in the coming years. Some of these include:

5G Networks: The deployment of 5G networks is expected to be a major growth driver for the optical modules market. 5G networks require high-speed, low-latency connectivity, and optical modules are well-suited to provide the necessary bandwidth and performance.

Internet of Things (IoT): As the number of IoT devices continues to grow, there is a growing need for reliable, high-speed connectivity. Optical modules can provide the necessary bandwidth and performance to support the increasing demand for IoT devices.

Artificial Intelligence (AI) and Machine Learning (ML): AI and ML applications require high-speed data processing and transmission, and optical modules are well-suited to provide the necessary bandwidth and performance.

Cloud Computing: Cloud computing is increasingly becoming the norm for data storage and processing, and optical modules are essential for providing the necessary connectivity between servers and data centers.

Autonomous Vehicles: Autonomous vehicles require high-speed and reliable connectivity for communication between vehicles and with infrastructure. Optical modules can provide the necessary bandwidth and performance for this communication.

Medical and Scientific Applications: Optical modules are increasingly being used in medical and scientific applications, such as remote surgery, diagnostic imaging, and research, due to their high-bandwidth, low-latency, and high-reliability.

Industries That Will Be Impacted in the Future by Optical Modules

Optical modules are already being used in various industries, and their impact is expected to grow significantly in the future. Some of the industries that will be impacted in the future by optical modules include:

Telecommunications: The telecommunications industry is one of the primary users of optical modules. With the rise of 5G networks and the increasing demand for high-speed data transmission, the use of optical modules is expected to increase even further.

Data Centers: Data centers are another industry that heavily relies on optical modules for high-speed, low-latency connectivity between servers and storage devices. With the growing demand for cloud computing and big data analytics, the use of optical modules is expected to increase in this industry.

Healthcare: The healthcare industry is increasingly adopting optical modules for various applications, such as telemedicine, remote surgery, and diagnostic imaging. The high-speed, reliable connectivity provided by optical modules is critical in these applications.

Industrial Automation: The use of optical modules is expected to increase in industrial automation applications, such as factory automation, robotics, and process control. Optical modules can provide high-speed and reliable connectivity in harsh environments, enabling automation systems to operate more efficiently and safely.

Aerospace and Defense: The aerospace and defense industries require high-speed and reliable connectivity for communication and data transmission. Optical modules are well-suited for this application due to their high-bandwidth and low-latency.

Energy and Utilities: The energy and utilities industries are also expected to adopt optical modules for communication and data transmission applications. Optical modules can provide high-speed and reliable connectivity for monitoring and control systems in power plants and substations.

Growth Opportunities and Key Challenges for Optical Modules in the Future

Growth Opportunities:

5G Networks: The deployment of 5G networks is a significant growth opportunity for optical modules. The high-speed, low-latency connectivity required by 5G networks can be provided by optical modules, which are well-suited for this application.

Internet of Things (IoT): As the number of IoT devices continues to grow, there is an increasing need for reliable, high-speed connectivity. Optical modules can provide the necessary bandwidth and performance to support the growing demand for IoT devices.

Cloud Computing: The growing demand for cloud computing and big data analytics is a significant growth opportunity for optical modules. Optical modules are essential for providing the necessary connectivity between servers and data centers.

Artificial Intelligence (AI) and Machine Learning (ML): AI and ML applications require high-speed data processing and transmission, and optical modules are well-suited to provide the necessary bandwidth and performance.

Autonomous Vehicles: Autonomous vehicles require high-speed and reliable connectivity for communication between vehicles and with infrastructure. Optical modules can provide the necessary bandwidth and performance for this communication.

Key Challenges:

Cost: The cost of optical modules remains a challenge for widespread adoption in some industries. While the cost of optical modules has decreased in recent years, it still remains higher than traditional copper-based solutions.

Interoperability: Interoperability between different vendors' products remains a challenge in the optical modules market. While there are standardized form factors and interfaces, there are still compatibility issues between some vendors' products.

Complexity: The use of optical modules can add complexity to network design and management, which can be a challenge for some users.

Security: As the use of optical modules increases, security concerns may arise. Optical signals can be intercepted or disrupted, which can lead to data breaches or network downtime.

Maintenance: Maintenance and replacement of optical modules can be more challenging than traditional copper-based solutions, particularly in harsh environments.

Top Companies in Optical Modules market:

The optical modules market is highly competitive, with several companies vying for a share of the market. Some of the top companies in the optical modules market include Finisar Corporation, Lumentum Holdings Inc., Broadcom Inc., NeoPhotonics Corporation, and Sumitomo Electric Industries, Ltd. These companies offer a range of optical modules for various applications, such as telecommunications, data centers, and healthcare, and are investing heavily in research and development to improve their product offerings. Additionally, some of these companies are partnering with other companies to provide comprehensive solutions to their customers.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Transceiver Market

I'm interesting about the tunable DWDM Optical Transceiver Markets and expectations while 5G wireless network environment. Has this been considered? How would 5G impact the use of optical transiver market?

The key players in the optical transceiver market are 1. Finisar Corp. (U.S.), 2. Accelink Technologies Co., Ltd. (China), 3. Lumentum Holdings Inc. (U.S.), 4. Oclaro, Inc. (U.S.), 5. Sumitomo Electric Industries, Ltd. (Japan), 6. Foxconn Electronics Inc. (Taiwan), 7. NeoPhotonics Corp. (U.S.), 8. Fujitsu Optical Components Ltd. (Japan), 9. Reflex Photonics Inc. (Canada), and Source 10. Photonics Inc. (U.S.), among others. Which other players have you considered? How smartphones would impact the overall offerings of this market?

We would like to know the market research of the optical transceiver. Have you considered the market by data ranges and data rates?

Looking for market research on optical transceiver market broken down by speed and industry vertical. Which are the major industries apart from telecom sector? How 5G impact the further adoption of optical transivers?

We are going to develop connector in optical fiber industry. Can you provide us with the market scope of the same? Has connectors been included in the scope of the study?

I am interested in a Optical Receiver / GBIC break down ... Esp. problems with GBIC counter fits (or use of non-compliant GBIC modules in service contracts) and the resulting financial damage. Is this a major restraining factor for the Optical Transceiver Market?