Overall Equipment Effectiveness Software Market by Offering (Software, Services), Deployment Mode (On-premises, Cloud), Type (SCADA, Cloud ERP, Predictive Maintenance, Data Historian), Industry (Automotive, Healthcare, Power) - Global Forecast to 2028

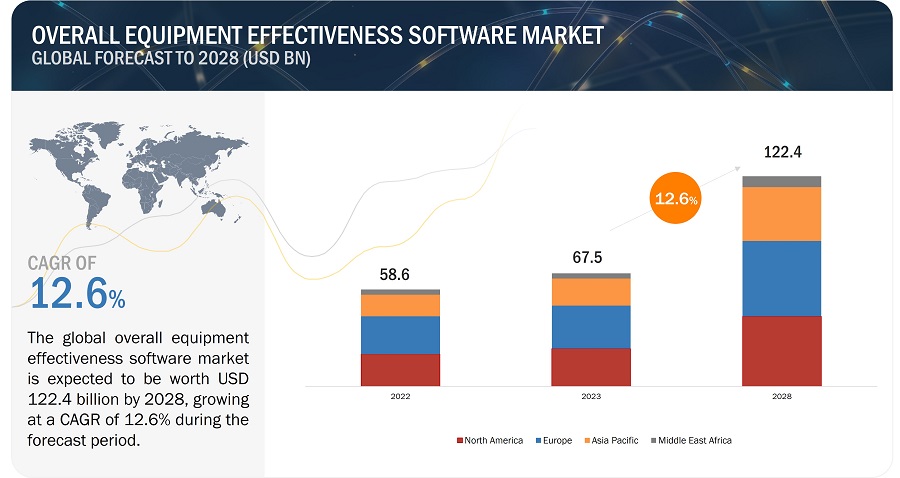

[261 Pages Report] The global overall equipment effectiveness software market size is expected to grow from USD 67.5 billion in 2023 to USD 122.4 billion by 2028, at a CAGR of 12.6%. The increase in the use of ERP software for performing various functions within industries, the need for a connected supply chain and mass production to cater to the rising global population, and the rising adoption of IoT and AI across manufacturing industries globally are the major driving factors for the growth of the overall equipment effectiveness software market. Moreover, the rise in the integration of manufacturing execution systems with enterprise resource planning and product lifecycle management, as well as rapid developments in wireless sensor networks, are some factors that are also expected to drive the growth of the market in the near future.

Overall Equipment Effectiveness Software Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Overall Equipment Effectiveness Software Market Dynamics

DRIVER: Rising usage of ERP software for performing a variety of functions across industries

Organizations have adopted cloud ERP models to identify which model best aligns with their strategy, workloads, and security requirements, thus adopting the best cloud ERP solution. Some of the benefits of cloud ERP systems for organizations are such as avoiding the need to pay for all computer platforms, including hardware platforms and data server platforms, cutting IT services and support since the data center offers IT support, and replacing paying ahead for application software licensing.

RESTRAINT: High initial capital investments and growing maintenance and upgradation costs

The investment cost of OEE software includes consultation, acquisition, adjustment, implementation, and running costs, which subsequently increase a company’s expenditures.

- Consultation cost: It includes the cost of consultations and discussions before implementing manufacturing execution systems. This stage also comprises the investigation and decision-making processes, specifying the updated requirements of an enterprise based on trial runs. Moreover, before using a manufacturing execution system, every company needs to investigate the benefits of the system individually. Therefore, organizations need to identify their requirements, which helps in making the right decision. This can be best ensured by consultation.

- Acquisition cost: This includes all the costs that arise at the beginning of a project and are associated with the actual purchase of the system. It comprises hardware, system software, application software, and installation costs.

OPPORTUNITY: Rising integration of MES with PLM and ERP solutions

Manufacturing execution systems perform various functions, such as managing products and resources, scheduling, dispatching, collecting data, analyzing performance, and auditing data. For the smooth functioning of these processes and effective results, manufacturing execution systems are integrated with various solutions, such as ERP, supply chain management (SCM), warehouse management system (WMS), decision support system (DSS), business intelligence, e-commerce. For example, the integration of manufacturing execution systems with WMS enables the maintenance of orders that come into the warehouse. To feed the data in the system accurately and promptly, an order management system within the MES solution is used.

CHALLENGE: Growing concerns regarding integration issues of certain OEE software with legacy systems

System complexities and implementation costs are still the major challenges organizations face while integrating these solutions with their existing systems. Due to the lack of resources, only some organizations still rely on existing systems that use old technologies, where manual processes lead to a high error rate and long turnaround time. Moreover, because legacy systems underuse are mostly on-premises, integrating these systems with new cloud-based systems might challenge adopting digital process automation solutions and services.

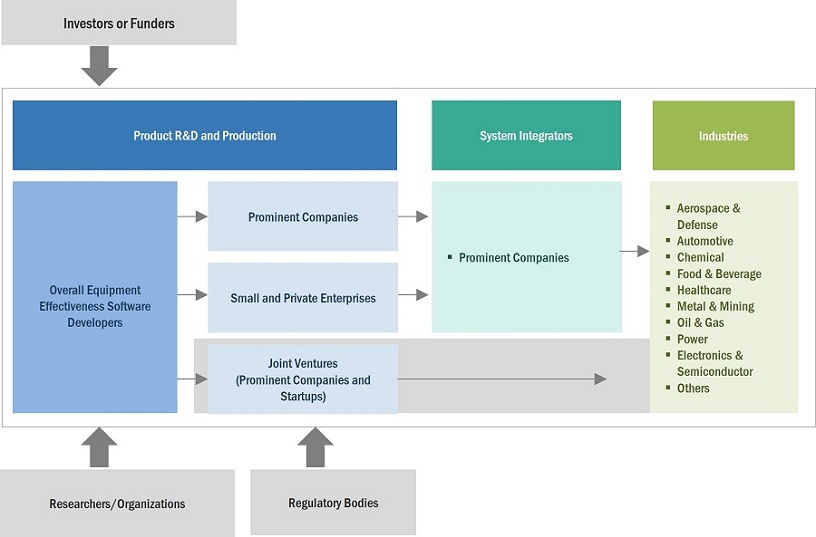

Overall Equipment Effectiveness Software Ecosystem

Prominent companies in this market include well-established, financially stable developers and providers of overall equipment effectiveness software. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), and Rockwell Automation (US).

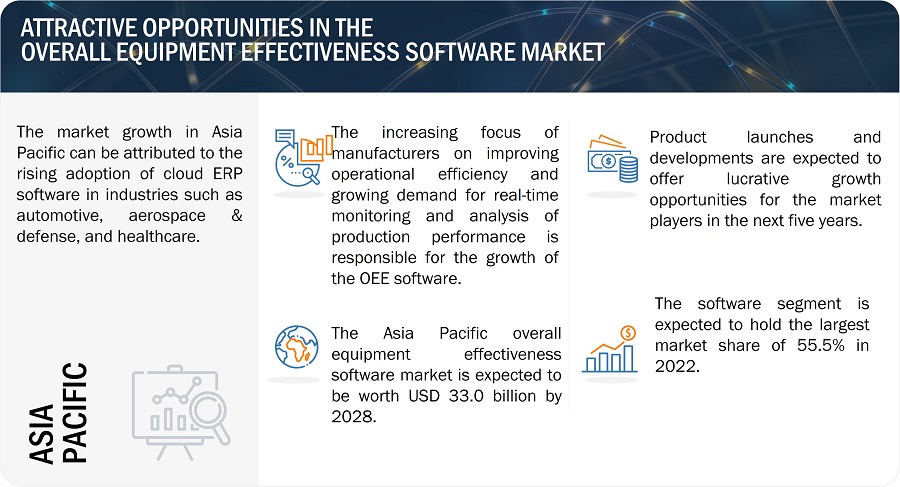

Software segment to hold the largest share of the market in 2022

The software segment holds the largest market share in 2022 due to factors such as increasing adoption of automation, advanced analytics capabilities, integration with other software systems, scalability and flexibility, and the growing focus on productivity and efficiency improvement. These software solutions play a crucial role in monitoring and optimizing equipment performance in automated processes, providing real-time data, performance metrics, and analytics dashboards. The ability to analyze and optimize equipment performance, along with their compatibility with other enterprise systems, makes OEE software highly sought after by industries looking to improve operational efficiency and remain competitive in the market.

On-premises segment to dominate the overall equipment effectiveness software market in 2022

In 2022, the on-premises segment held the largest equipment effectiveness software market share. On-premises deployment eliminates the reliance on external networks or internet connectivity. Manufacturers can access and utilize the OEE software locally within their facilities without concerns about network stability or latency issues. This ensures uninterrupted access to critical information and real-time monitoring, enabling prompt decision-making and response to equipment performance issues. The widespread adoption of on-premises deployment in OEE software is because it provides organizations with control, customization, security, compliance, and compatibility with existing infrastructure, addressing their specific needs and preferences.

Predictive maintenance is estimated to hold the highest CAGR during the forecast period

The core function of predictive maintenance is to precisely predict asset failure, thereby enabling enterprises to take the asset out of production just before it fails and ensure production is not hampered due to the asset’s failure. Predictive maintenance is estimated to hold the highest CAGR during the forecast period as organizations increasingly recognize the value of proactive equipment maintenance to enhance overall equipment effectiveness. Predictive maintenance OEE software utilizes advanced analytics, machine learning, and sensor data to predict and prevent equipment failures, reducing unplanned downtime and optimizing production efficiency.

Healthcare to be the largest growing industry during the forecast period

The healthcare industry is expected to hold significant growth in the overall equipment effectiveness software market during the forecast period owing to the increasing focus on operational efficiency and cost optimization to meet the growing demand for healthcare services while maintaining high-quality patient care. OEE software helps track and analyze the utilization of medical equipment such as diagnostic machines, surgical tools, imaging devices, and patient monitoring systems. By collecting real-time data on equipment usage and downtime, healthcare providers can identify inefficiencies, optimize scheduling, and ensure that equipment is available when needed, thereby maximizing its utilization.

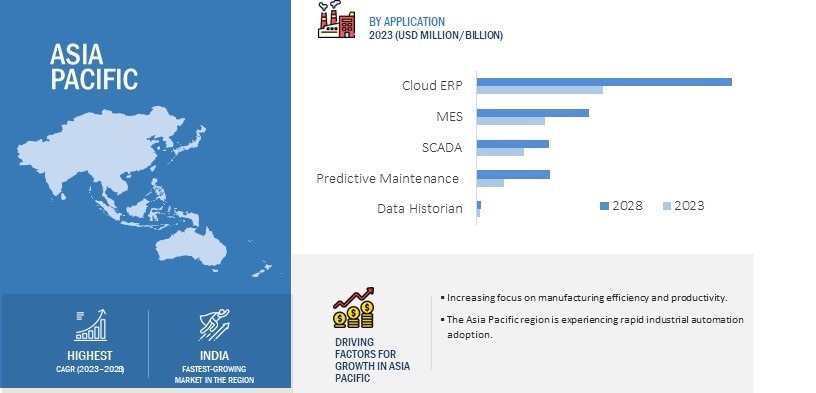

Asia Pacific region is likely to hold the largest growth rate by 2028

The Asia Pacific region is experiencing rapid industrial automation adoption. Companies are implementing advanced technologies such as robotics, IoT (Internet of Things), and AI (Artificial Intelligence) to streamline their manufacturing operations. These technologies enable businesses to automate production, improve efficiency, and optimize equipment utilization. OEE software plays a crucial role in this automation journey by providing real-time monitoring, performance analysis, and predictive maintenance capabilities to maximize equipment efficiency. The major factor driving the growth of the overall equipment effectiveness software market in APAC is the increasing focus of manufacturers toward industrial automation and smart manufacturing.

Overall Equipment Effectiveness Software Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The overall equipment effectiveness software companies is dominated by a few globally established players such as Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), and Rockwell Automation (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Overall Equipment Effectiveness Software Methods, Offering, Deployment Mode, Type, and Industry |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies Covered |

Major Players: Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), Rockwell Automation (US), General Electric (US), Honeywell International, Inc. (US), among others - total 25 players have been covered. |

Overall Equipment Effectiveness Software Market Highlights

This research report segments the overall equipment effectiveness software market based on overall equipment effectiveness software methods, offering, deployment mode, type, industry, and region.

|

Segment |

Subsegment |

|

By Overall Equipment Effectiveness Software Methods: |

|

|

By Offering: |

|

|

By Deployment Mode: |

|

|

By Type: |

|

|

By Industry |

|

|

By Region: |

|

Recent Developments

- In June 2022, Siemens acquired Senseye, a leading global provider of AI-powered solutions for industrial machine performance and reliability. This acquisition will enable Siemens to expand its predictive maintenance and asset intelligence portfolio.

- In May 2022, Schneider announced version 22.0 of EcoStruxure Automation Expert to provide end-to-end digital continuity through close integration with AVEVA applications. EcoStruxure can connect to AVEVA Engineering to import plant design data for automated bulk systems.

- In April 2022, ABB signed a partnership agreement with Samsung Electronics to innovate holistic energy management solutions to drive the growth of smart building technology. The development is aimed at enabling ABB to expand customer access to home automation technologies and device management solutions.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the overall equipment effectiveness software market during 2023-2028?

The global overall equipment effectiveness software market is expected to record a CAGR of 12.6% from 2023–2028.

What are the driving factors for the overall equipment effectiveness software market?

The rising usage of ERP software for performing a variety of functions across industries, the increase in the number of initiatives to drive the adoption of industrial automation solutions, the rising necessity for improving efficiency and ensuring optimum utilization of resources, growing demand for cloud-based applications, need for connected supply chain and mass production to cater to the rising global population, and rising adoption of IoT and AI across manufacturing industries globally.

Which are the significant players operating in the overall equipment effectiveness software market?

Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Emerson Electric, Co. (US), and Rockwell Automation (US) are some of the major companies operating in the overall equipment effectiveness software market.

Which region will lead the overall equipment effectiveness software market in the future?

Asia Pacific is expected to lead the overall equipment effectiveness software market during the forecast period.

What is the total market size of the overall equipment effectiveness software market in 2022?

The total market size of the overall equipment effectiveness software market in 2022 is USD 58.6 billion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

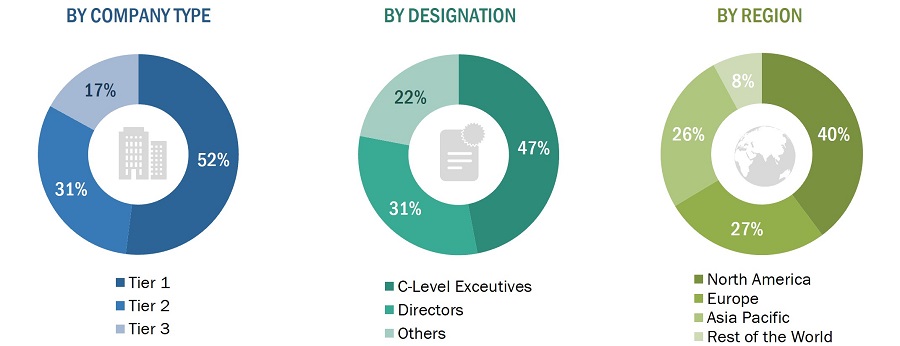

The study involved four major activities in estimating the current size of the overall equipment effectiveness software market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information important for the overall equipment effectiveness software market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers and certified publications; articles from recognized authors; directories; and databases.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the overall equipment effectiveness software market.

To know about the assumptions considered for the study, download the pdf brochure

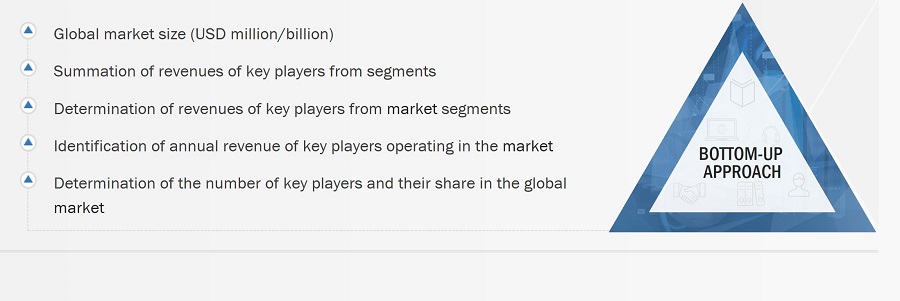

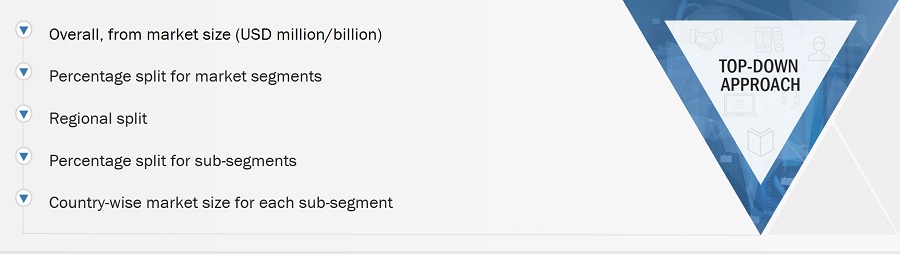

Market Size Estimation

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the overall equipment effectiveness software market.

Overall Equipment Effectiveness Software Market: Bottom-Up Approach

- Key players operating in the overall equipment effectiveness software market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Overall Equipment Effectiveness Software Market: Top-Down Approach

- Focusing on the top-line expenditures and investments made throughout the overall equipment effectiveness software ecosystem for installing new overall equipment effectiveness software and retrofitting the existing ones.

- Information related to revenues generated by the key developers and providers of overall equipment effectiveness software has been studied and analyzed.

- Multiple on-field discussions have been carried out with the key opinion leaders of the leading companies involved in developing overall equipment effectiveness software.

- The geographical split has been estimated using secondary sources based on various factors, such as the number of players in a specific country or region and the type of overall equipment effectiveness software offered by these players.

Data Triangulation

After arriving at the overall equipment effectiveness software market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the overall equipment effectiveness software market.

Market Definition

Overall equipment effectiveness (OEE) software is a tool used to measure and improve the efficiency and productivity of manufacturing processes. It is a metric that quantifies the performance of equipment or a production line by considering three key factors: availability, performance, and quality. OEE software collects data from various sources, such as machines, sensors, and operators, and provides real-time monitoring and analysis of production performance. It calculates the OEE score by multiplying the abovementioned factors (availability, performance, and quality) to measure the equipment's effectiveness comprehensively.

Key Stakeholders

- OEE software providers

- Associations and regulatory authorities developing standards related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

- Automation consultants

- Automation system integrators

- Software developers

- Distributors and providers of SCADA, MES, ERP, predictive maintenance, and data historian

- Providers of professional services/solutions

- Process and discrete industries

- Research organizations and consulting companies

- Technology investors

- Technology standards organizations, forums, alliances, and associations

Report Objectives:

- To describe, segment, and forecast the overall equipment effectiveness software market based on offering, deployment mode, type, and industry.

- To describe and forecast the market for various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World, in terms of value.

- To provide qualitative information about the overall equipment effectiveness software methods.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the said market.

- To provide a comprehensive overview of the overall equipment effectiveness software value chain

- To analyze opportunities for stakeholders by identifying high-growth segments of the overall equipment effectiveness software market

- To strategically analyze the ecosystem, Porter’s five forces, tariffs and regulations, patent landscape, trade landscape, and case studies/use cases pertaining to the market under study

- To provide a detailed analysis of the impact of the recession on the overall equipment effectiveness software market, its segments, and market players

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, along with detailing the competitive landscape for market leaders.

- To analyze competitive developments, such as product launches and development, acquisition, agreement, and partnership in the overall equipment effectiveness software market.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Overall Equipment Effectiveness Software Market