Packaging Adhesives Market by Resin Type (Polyurethane, Acrylics, PVA), Technology (Solvent-based, Water-Based, Hot-Melt), Application (Case & Carton, Corrugated Packaging, Labeling, Flexible Packaging, Folding Cartons), and Region - Global Forecast to 2028

Packaging Adhesives Market

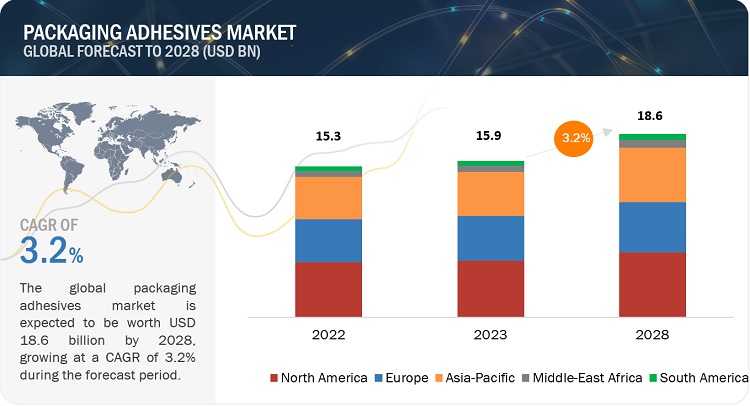

The global packaging adhesives market was valued at USD 15.3 billion in 2022 and is projected to reach USD 18.6 billion by 2028, growing at a cagr 3.2% from 2023 to 2028. The PVA, by resin segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for packaging adhesives.

Attractive Opportunities in the packaging adhesives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Packaging Adhesives Market Dynamics

Drivers: Growth in packaging industry

Due to factors such as rising population, urbanisation, and shifting customer preferences, the packaging sector is steadily expanding. The need for packaging adhesives to assemble and seal the packaging materials grows as more products are packaged.

The packaging industry is experiencing steady growth due to factors such as increasing population, urbanization, and changing consumer preferences. As more products are packaged, there is a higher demand for packaging adhesives to assemble and seal the packaging materials.

Restraints: Stringent Government regulations in North America and Europe

Government regulations often impose restrictions on the use of certain chemicals in packaging adhesives, especially those that are considered hazardous or have potential health and environmental risks. For example, regulations like the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) in Europe and the Toxic Substances Control Act (TSCA) in the United States require manufacturers to assess and manage the risks associated with chemicals used in their products. Compliance with these regulations can lead to the reformulation of adhesives to replace restricted substances, which may require additional research and development efforts.

Opportunities: Emerging markets like Asia Pacific and Middle East & Africa

The packaging adhesives market is experiencing growth and expansion in several emerging markets around the world. These markets offer significant opportunities for packaging adhesive manufacturers due to factors such as economic development, urbanization, rising consumer spending power, and increased industrial activities. The strong manufacturing base, expanding consumer markets, and increasing demand for packaged goods in Asia Pacific region drive the growth of the packaging adhesives market. The rising popularity of e-commerce and the growing middle class further contribute to the demand for innovative and sustainable packaging solutions, creating opportunities for adhesive manufacturers.

Challenges: Environmental Sustainability

Increasing environmental concerns and consumer demand for sustainable packaging solutions pose challenges for packaging adhesive manufacturers. Developing eco-friendly adhesive formulations that minimize environmental impact while maintaining performance properties can be challenging. Adhesive manufacturers need to invest in research and development to create sustainable alternatives and address the industry's sustainability expectations.

Water-based, by technology accounted for the highest segment of packaging adhesives market

Due to its multiple benefits over other adhesive formulations, water-based packaging adhesives have become more and more common. The water-based technology category is the largest market for packaging adhesives because of the industry's growing demand for food packaging, consumer goods packaging, and industrial goods packaging. Due to increased environmental concerns and higher VOC regulations, manufacturers of packaging adhesives are producing more water-based technologies. This has raised the need for water-based packaging adhesives.

To know about the assumptions considered for the study, download the pdf brochure

Middle East & Africa is the fastest-growing packaging adhesives market.

The increasing the per capita income has increased the spending capacity of the consumer, in the Middle Eastern and African countries. The increase in industrialisation and urbanisation are major factors driving the packaging industry, which in turn is expected to support the laminating adhesive market in the region. The demand for flexible packaging in the Middle east and African countries is growing with rapid growth of the food and beverage industry.

Packaging Adhesives Market Players

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France) are the key players in the global packaging adhesives market.

Henkel AG is engaged in adhesive technologies and consumer brands. The company operates through various segments, including adhesive technologies (adhesives, sealants, and surface treatments for consumer and industrial purposes), laundry & home care (household cleaning products such as laundry detergent and dishwashing liquid), beauty care (beauty & oral care products such as shampoos, toothpaste, hair colorants, and shower products), and corporate.

Packaging Adhesives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 15.3 billion |

|

Revenue Forecast in 2028 |

USD 18.6 billion |

|

CAGR |

3.2% |

|

Years Considered for the study |

2020-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Technology |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, South America |

|

Companies profiled |

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France). A total of 26 players have been covered. |

This research report categorizes the Packaging adhesives market based on Technology, Application, and Region.

By Technology:

- Water-Based

- Solvent-Based

- Hot Melt

- Others

By Resins:

- PVA

- Acrylics

- Polyurethane

- Others

By Application:

- Case & Carton

- Corrugated Packaging

- Labeling

- Flexible Packaging

- Folding Cartons

- Specialty Packaging

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2022, Henkel AG went into a strategic partnership cyclos-HTP Institute (CHI), a specialized company in classification, assessment, and certification of recyclability of packaging and goods. This will include access to in-house testing and certification, joint material science R&D.

- In Septembber 2022, Henkel acquires advanced materials start-up NBD Nanotechnologies Inc., US-based advanced materials company. This acquisition Henkel aims to strengthen the position of its Adhesive Technologies business unit in the area of functional coatings.

Frequently Asked Questions (FAQ):

What are the growth driving factors of packaging adhesives market?

Growing packaging industry is a driving factor for packaging adhesives market.

What are the major applications for packaging adhesives?

The major applications of packaging adhesives are case & carton, corrugated packaging, labeling, flexible packaging, folding cartons, and specialty packaging.

Who are the major manufacturers?

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France), are some of the leading players operating in the global packaging adhesives market.

What are the reasons behind packaging adhesives gaining market share?

Packaging Adhesives are gaining market share due to growing packaging adhesives industry.

Which is the largest region in the packaging adhesive market?

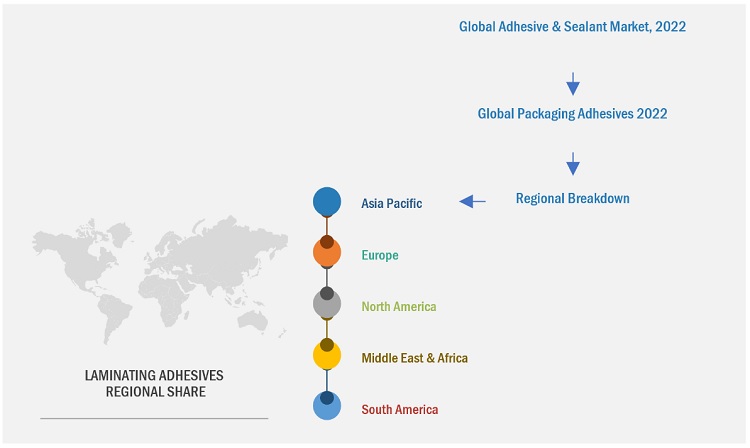

Asia Pacific is the largest region in packaging adhesive market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

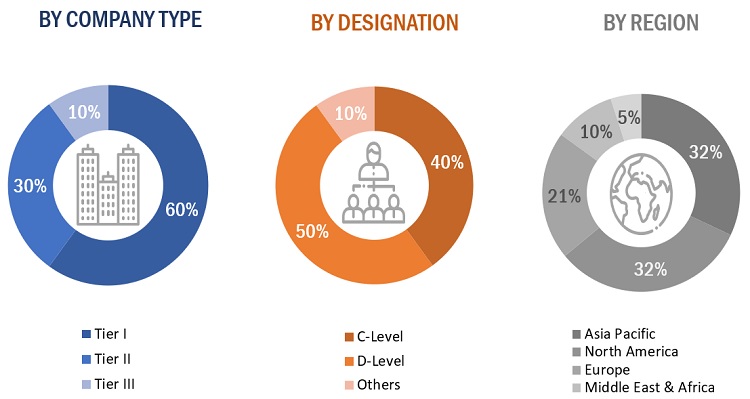

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global packaging adhesives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the packaging adhesives market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the packaging adhesives market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both the top-down and bottom-up approaches have been extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

The key players in the market have been identified in the respective regions through primary and secondary research. All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources. All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and added with detailed inputs and analysis from the MNM data repository and presented in this report.

Global Packaging Adhesives Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. The market has been validated using both, the top-down and bottom-up approaches.

Market Definition.

Packaging adhesives are a component of a variety of end use applications such as case & carton, corrugated packaging, labeling, flexible packaging, folding cartons, specialty packaging, and others, facilitate packaging purpose.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the packaging adhesives market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by resin, technology, and application

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as merger & acquisition, new product launch, partnership, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the subsegments of the global packaging adhesives market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Packaging adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Packaging Adhesives Market