Paper Straw Market by Type (Flexible, Non-flexible), Material Type (Virgin paper, Recycled paper), Product Type (Printed, Non-printed), Straw Length, Straw Diameter, End-use Application (Foodservice, , Household), and Region - Global Forecast to 2028

Paper Straw Market

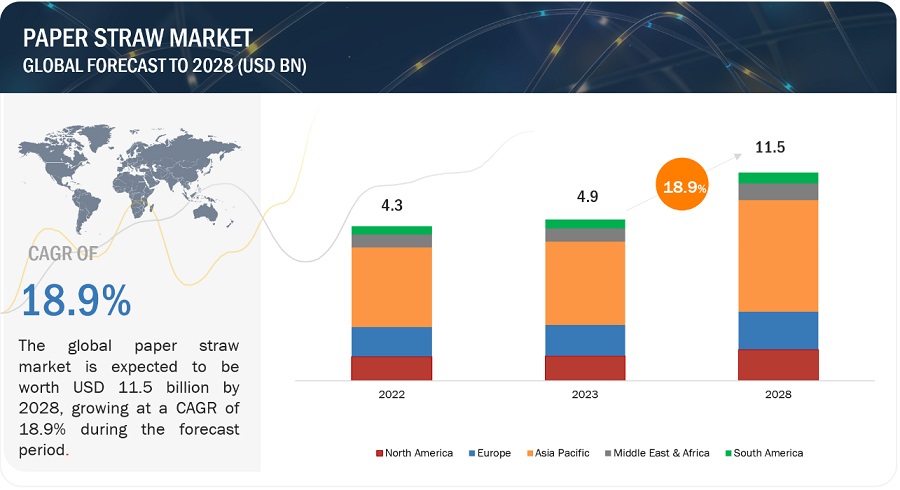

The paper straw market is projected to grow from USD 4.9 billion in 2023 to USD 11.5 billion by 2028, at a cagr 18.9% during the forecast period. The global market is experiencing a significant surge in demand across various industries, including foodservice, institutional, and household sectors. One of the primary drivers behind this growth is the increasing popularity of paper straws for different applications. Consumers are increasingly gravitating towards paper straws due to their eco-friendly nature, as they are made from renewable resources and biodegrade easily, thus reducing environmental impact. Moreover, governments and organizations are implementing reforms and launching campaigns to ban the use of plastic straws, further propelling the demand for paper alternatives. Additionally, there is a growing intolerance towards the use of plastic straws, as people become more conscious of the detrimental effects of plastic pollution on the environment. These factors combined are expected to foster the expansion of the paper straw market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Paper Straw Market

Paper Straw Market Dynamics

Driver: Government regulations and bans on plastic straws to fuel the demand for paper straws

Government regulations and bans on plastic straws have played a crucial role in fueling the demand for paper straws. Several countries and regions have taken proactive measures to restrict or phase out single-use plastics, including plastic straws, due to their harmful environmental impact. For instance, the European Union passed a directive in 2019 banning various single-use plastic products, including plastic straws, and encouraging the use of more sustainable alternatives. This has stimulated the adoption of paper straws as a viable solution in the European market. In the United States, various cities, states, and even major companies have implemented plastic straw bans or restrictions. For example, Seattle, Washington, implemented a city-wide ban on plastic straws and utensils in 2018, driving businesses to switch to alternatives such as paper straws.

Additionally, major players in the food and beverage industry, including Starbucks and McDonald's, have committed to phasing out plastic straws globally, which has further fueled the demand for paper straws as a sustainable alternative. These government regulations and bans have had a tangible impact on the paper straw market, creating a conducive environment for the growth of sustainable alternatives. Moreover, this growth is partly attributed to the increasing implementation of regulations and bans on plastic straws, which have accelerated the adoption of paper straws as a preferred choice for consumers and businesses striving for environmental responsibility.

Restraints: Cost considerations and price competitiveness compared to plastic straws

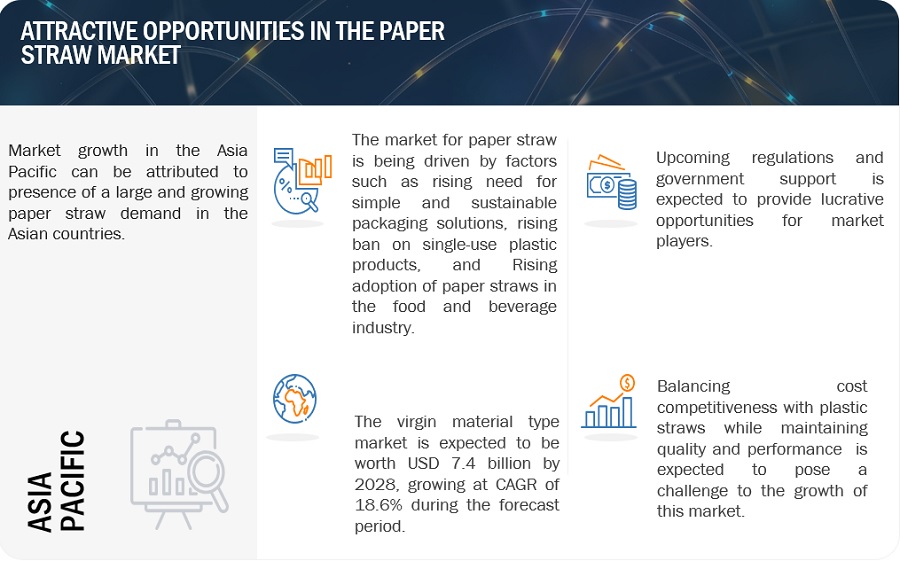

Cost considerations and price competitiveness compared to plastic straws can act as a restraint to the widespread adoption of paper straws in the market. The production cost of paper straws is generally higher than that of plastic straws, making it challenging for businesses to make the switch, particularly smaller establishments, or those with tight profit margins. This cost disparity can hinder the market growth of paper straws, as businesses may be reluctant to absorb the additional expenses or pass them on to customers.

For instance, a study conducted by the Foodservice Packaging Institute (FPI) found that the price of paper straws can be up to 10 times higher than plastic straws, depending on factors such as quantity and quality. This significant price difference can pose a financial burden for businesses, especially those that rely on high straw consumption or operate in price-sensitive markets. As a result, some businesses may choose to stick with plastic straws due to their lower cost, despite the environmental concerns associated with them

Additionally, price competitiveness is a crucial factor in consumer behavior. Consumers have become accustomed to receiving complimentary or low-cost plastic straws when purchasing beverages. The higher price point of paper straws may deter businesses from fully transitioning to them, fearing that customers may perceive the increased cost as a negative aspect or opt for establishments that continue to offer plastic straws.

Opportunity : Growing consumer demand for sustainable products

The growing consumer demand for sustainable products presents a significant opportunity for the paper straw market. As more consumers become environmentally conscious and prioritize eco-friendly alternatives, the market potential for paper straws to fulfill this demand is substantial. Shifting consumer preferences play a vital role in creating opportunities for paper straws. With increasing awareness of environmental issues, consumers actively seek alternatives to plastic straws, favoring sustainable options like paper straws. Surveys have indicated that a significant percentage of consumers globally prefer environmentally friendly products, indicating a growing demand for sustainable choices.

Corporate sustainability initiatives further contribute to the market's potential. Many businesses are adopting sustainability goals and eliminating single-use plastics, including plastic straws, from their operations. This creates an opportunity for paper straws to meet the growing demand generated by these businesses. Restaurants, cafes, and foodservice providers are embracing paper straws to demonstrate their commitment to sustainability and attract environmentally conscious customers.

Challenges : Balancing cost competitiveness with plastic straws while maintaining quality and performance poses a challenge for the paper straw market

Balancing cost competitiveness with plastic straws while maintaining quality and performance is a significant challenge for the paper straw market. While paper straws are considered a more sustainable alternative, their production costs can be higher than plastic straws. This cost differential can pose challenges for businesses and consumers, impacting the adoption and market growth of paper straws. Maintaining a competitive price point without compromising on quality and performance becomes crucial in addressing this challenge.

Maintaining quality and performance is another challenge for the paper straw market. Paper straws need to demonstrate comparable durability, functionality, and aesthetic appeal as plastic straws to gain wider acceptance. Consumer dissatisfaction due to issues like straws becoming soggy, disintegrating, or imparting a paper taste to beverages can hamper market adoption. Paper straw manufacturers must invest in research and development to improve their product quality, including developing advanced coatings or structural enhancements to enhance durability and functionality.

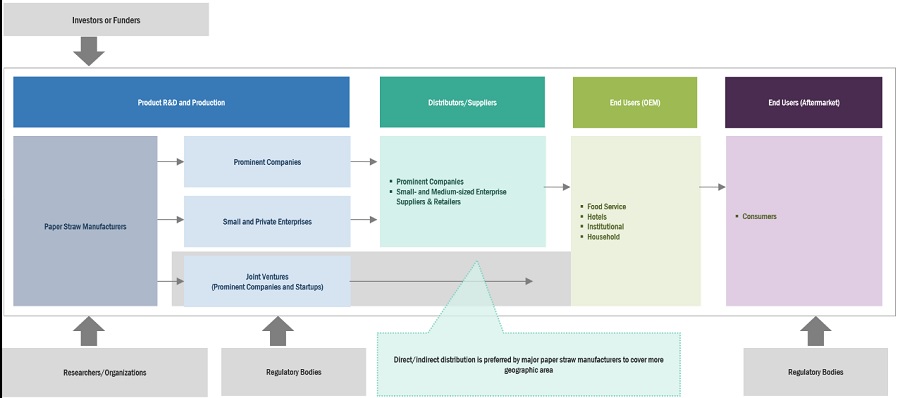

Market Ecosystem

The non-flexible segment is projected to lead the paper straw market during the forecast period, in terms of value and volume.

The non-flexible segment is expected to lead the paper straw market during the forecast period due to several key factors. Firstly, there is a growing global awareness about the environmental impact of single-use plastic straws. Governments and environmental organizations worldwide are implementing regulations and campaigns to reduce plastic waste, leading to a significant shift towards eco-friendly alternatives like paper straws. The non-flexible paper straws, with their sturdy construction and ability to retain their shape, are seen as a reliable and practical replacement for plastic straws in various applications. Additionally, the non-flexible paper straws offer advantages in terms of durability and suitability for different beverage types. These straws are designed to withstand prolonged use without getting soggy or losing their structural integrity. They can handle both hot and cold beverages, making them a versatile choice for a wide range of establishments, including restaurants, cafes, bars, and even fast food chains. With the rising demand for sustainable packaging solutions across industries, the non-flexible paper straw market is expected to experience substantial growth as businesses seek alternatives that align with their sustainability goals.

The virgin paper segment is projected to lead the paper straw market during the forecast period, in terms of value and volume.

During the forecast period from 2023 to 2028, the flexible segment of the paper straw market is anticipated to emerge as the leading force, both in terms of value and volume. This segment primarily encompasses paper straws that are manufactured using virgin paper, which offers a range of advantageous characteristics. These straws exhibit exceptional strength, reliability, and higher absorbency rates, making them highly efficient and effective for various applications. One significant advantage of virgin paper-based straws is their superior quality, which ensures that they do not easily break or become damaged during use. This durability eliminates the need for consumers to employ multiple straws for a single-use scenario, consequently reducing wastage.

The non-printed segment is projected to lead the paper straw market during the forecast period, in terms of value and volume.

Based on product type, the Non-printed segment is projected to grow at a higher rate during the forecast period, in terms of both value and volume. This growth can be attributed to several factors, including the unique characteristics of non-printed paper straws and the increasing demand driven by changing consumer preferences. Non-printed paper straws are specifically designed to prevent the ingestion of inks or dyes, ensuring a safer and more environmentally friendly option for consumers. These straws are typically manufactured using sustainably sourced paper or food-grade paper materials, further enhancing their appeal among environmentally conscious individuals. The rising demand for non-printed paper straws is expected to persist and even increase over the next six years. This trend reflects the growing importance of sustainability and eco-consciousness in consumer decision-making processes. As more individuals prioritize environmentally friendly options, the market for non-printed paper straws is likely to expand further, providing opportunities for manufacturers and suppliers in this segment.

The foodservice segment in the paper straw market is projected to grow at the highest CAGR during the forecast period, in terms of value.

Based on end-use application, the foodservice segment in the paper straw market is projected to grow at the highest CAGR, in terms of value, during the forecast period. The paper straw market is set to experience remarkable growth, particularly in the foodservice sector, with a focus on end-use applications. This growth can be attributed to the increasing adoption of eco-friendly alternatives for single-use disposable items. As the awareness regarding sustainability continues to rise, there is a growing trend to avoid or ban the use of plastic straws and other single-use plastic products. Consequently, the demand for paper straws is expected to witness a substantial surge in the near future.

The foodservice industry plays a crucial role in driving the growth of the paper straw market. With a heightened emphasis on sustainability, businesses in the foodservice sector are actively seeking eco-friendly alternatives to replace plastic straws. Governments and organizations worldwide are implementing bans on single-use plastic products, further fueling the demand for paper straws. As a result, the foodservice segment within the paper straw market is projected to grow at an impressive compound annual growth rate (CAGR) in terms of value during the forecast period. This growth is a direct response to the increasing awareness of the detrimental effects of plastic waste and the need for more sustainable alternatives in the foodservice industry.

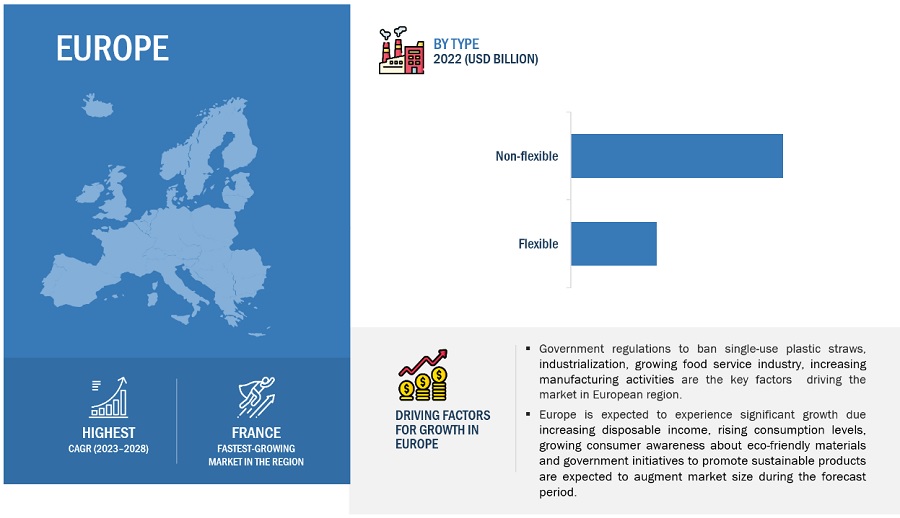

The European paper straw market is projected to grow at the highest CAGR during the forecast period, in terms of value.

The European paper straw market is expected to experience significant growth between 2023 and 2028, both in terms of value and volume. This growth can be primarily attributed to the rising demand for paper straws in key European countries like Germany and the United Kingdom, where they are increasingly being adopted in the foodservice industry. These countries are witnessing a shift towards sustainable and eco-friendly alternatives to plastic straws, driven by consumer awareness and changing preferences.

Furthermore, the growth of the paper straw market in Europe is also propelled by the strong influence of environmental concerns and governmental regulations. European countries have been actively implementing reforms and restrictions to combat plastic pollution and reduce single-use plastics. The introduction of bans on plastic straws and other single-use plastics has created a favorable environment for the adoption of paper straws. As a result, the European market is expected to witness a surge in demand for paper straws, as businesses and consumers alike embrace sustainable alternatives to plastic and support the ongoing environmental initiatives in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Hoffmaster Group Inc. (US), Transcend Packaging Ltd. (UK), Huhtamaki Oyj (Finland), Footprint (US), Fuling Global Inc. (China), Bygreen (Australia), Biopak (Australia), Soton Daily Necessities Co., Ltd. (China), and Canada Brown Eco Products Ltd (Canada) and Nippon Paper Industries Co Ltd (Japan) are the key players operating in the paper straw market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million), Volume (Billion Units) |

|

Segments |

Type, Material Type, Product Type, Straw Length, Straw Diameter, End-use Application, and Region |

|

Regions |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies |

The major players are Hoffmaster Group Inc. (US), Transcend Packaging Ltd. (UK), Huhtamaki Oyj (Finland), Footprint (US), Fuling Global Inc. (China), Bygreen (Australia), Biopak (Australia), Soton Daily Necessities Co., Ltd. (China), and Canada Brown Eco Products Ltd (Canada) , Nippon Paper Industries Co Ltd (Japan). |

This research report categorizes the global paper straw market based on Product Type, Application, Type, Packaging Type, and Region

On the basis of Type, the paper straw market has been categorized as follows:

- Flexible

- Non-flexible

On the basis of material type, the paper straw market has been categorized as follows:

- Virgin paper

- Recycled paper

On the basis of product type, the paper straw market has been categorized as follows:

- Printed

- Non-printed

On the basis of staw length, the paper straw market has been categorized as follows:

- <5.75 inches

- 5.75-7.75 inches

- 7.75-8.5 inches

- 8.5-10.5 inches

- >10.5 inches

On the basis of staw diameter , the paper straw market has been categorized as follows:

- <0.15 inches

- 0.15 – 0.196 inches

- 0.196 – 0.25 inches

- 0.25 – 0.4 inches

- >0.4 inches

On the basis of end-use application, the paper straw market has been categorized as follows:

- Foodservice

- Institutional

- Household

On the basis of region, the paper straw market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Hoffmaster Inc. has recently introduced Earthwise® Compostable Plant Based Straws as part of their commitment to sustainability and in response to the increasing bans on single-use plastics. These straws are made from plant-based starches and have a similar look and performance to traditional plastic straws. They are designed to fully compost in a matter of months and are certified as industrial compostable by BPI (Biodegradable Products Institute).

- In February 2023, Hoffmaster Group, Inc., has completed the acquisition of Paterson Pacific Parchment Company. Paterson Paper is a well known producer of foodservice paper and parchment products. As part of this acquisition, Hoffmaster will take over the operations of Paterson and integrate it into its existing production facilities. This development further strengthens Hoffmaster's position in the industry and expands its product portfolio to better serve its customers. Further, this strategic initiative will widen their customer base for their products and strengthen their marketing and manufacturing capabilities for paper straws.

- In April 2023, Transcend Packaging has entered into a strategic partnership and investment agreement with ITOCHU Corporation, one of Japan's largest companies renowned for its pulp and paper offerings. This partnership aims to bring a diverse range of sustainable packaging products made from paper and fibers to various markets across the UK, Europe, and beyond. By joining forces with ITOCHU, Transcend Packaging is strategically positioning itself to expand its reach and deliver environmentally friendly packaging solutions on a global scale.

- In January 2022, Fuling Global Inc. plans to establish Semarang factory in Indonesia. This strategic move allows Fuling Global Inc. to tap into the Indonesian market with its population of 262 million and also provides a platform for further expansion in the Southeast Asian region.

- In May 2019, Hoffmaster Group, Inc. (US) acquired The Paper Straw Co (UK), a UK-based manufacturer of paper straws. Through this strategic acquisition, the company is projected to expand its operations in the European markets for paper straw products and increase its product portfolio for paper straws.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the Paper straw Market?

The major driver influencing the growth of the paper straw market is government regulations and bans on plastic straws.

How is the Paper straw Market Segmented?

The paper straw market is segmented into type, product type, material type, straw length, straw diameter and end-use.

What is the major challenge in the Paper straw Market?

Balancing cost competitiveness with plastic straws while maintaining quality and performance poses a challenge for the paper straw market.

How is the Paper straw Market segmented by application?

By application, the paper straw market is segmented into food services, hotels, institutional, household and others.

What are the major opportunities in the Paper straw Market?

upcoming regulations and government support are set to provide greater opportunities for the paper straw market.

How is the Paper straw Market segmented by product type?

By resin type, the paper straw market is segmented into printed and non-printed.

Which region has the largest market for Paper straw?

Asia Pacific region has the largest market for paper straw owing to increasing disposable income, rising consumption levels, and growing concern towards single use plastics.

How is the market segmented by type?

The paper straw market is segmented into flexible and non-flexible.

How is the market segmented based on region?

On the basis of region, the market is segmented into North America, Asia Pacific, Europe, South America, and Middle East and Africa.

Who are the major manufacturers of paper straws?

The major manufacturers of paper straws are Hoffmaster Group Inc. (US), Transcend Packaging Ltd. (UK), Huhtamaki Oyj (Finland), Footprint (US), Fuling Global Inc. (China), Bygreen (Australia), Biopak (Australia), Soton Daily Necessities Co., Ltd. (China), and Canada Brown Eco Products Ltd (Canada) and Nippon Paper Industries Co Ltd (Japan) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

12 PAPER STRAW MARKET, BY END-USE – FORECAST TILL 2028

Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the paper straw market. In-depth interviews were conducted with various primary respondents which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

The market size of paper straw has been estimated based on secondary data available through paid and unpaid sources, and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The paper straw market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-product manufacturers. Various primary sources from the supply and demand sides of the paper straw market have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations, and institutions involved in the market, and key opinion leaders.

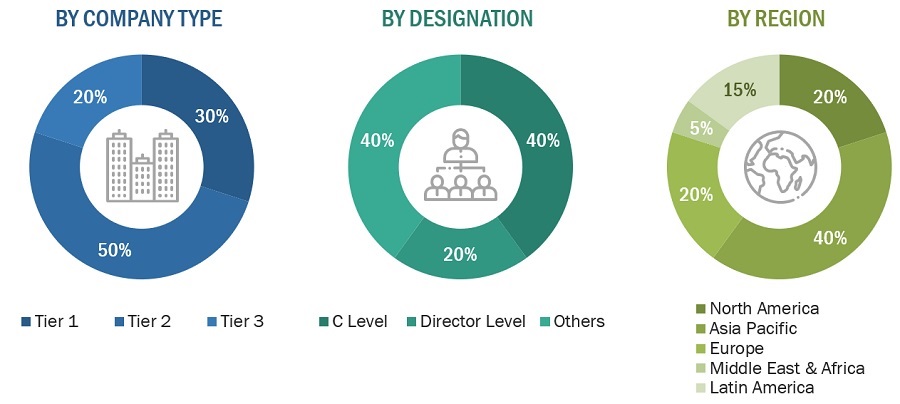

Following is the breakdown of primary respondents

Notes: *Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: < USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

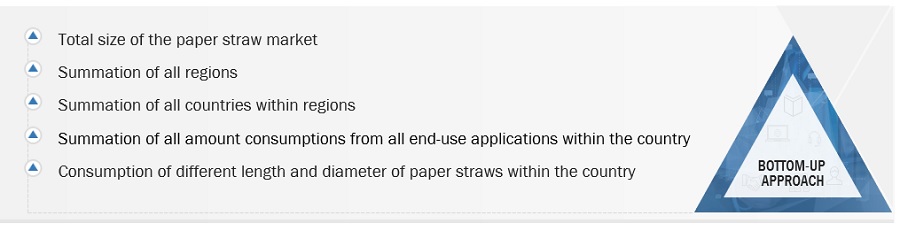

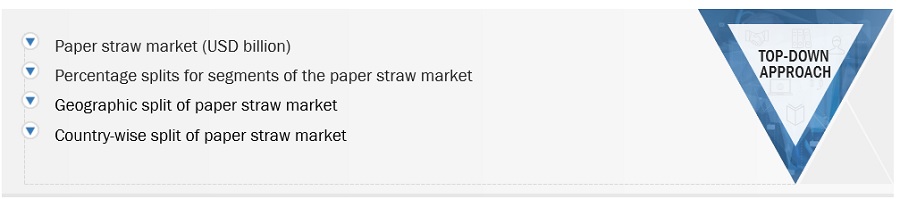

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of annual reports, reviews, paper straw associations, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Global Paper Straw Market: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Paper Straw Market: Bottom Up Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market estimation process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Paper straws are eco-friendly and sustainable alternatives to traditional plastic straws. They are cylindrical tubes made from paper materials, such as recycled paper fibers or biodegradable materials like bamboo or wheat straw. These straws are designed to provide a convenient and functional means of consuming beverages while minimizing the negative environmental impact associated with single-use plastic straws.

The market for paper straws caters to various industries, including food service, hospitality, and retail. It primarily targets businesses that serve beverages such as restaurants, cafes, bars, fast-food chains, hotels, and event organizers. The demand for paper straws has gained momentum due to increasing public awareness and concern about the detrimental effects of plastic pollution on the environment, particularly on marine ecosystems.

Key stakeholders

- Raw material suppliers and producers of paper straws

- Paper straw material importers and exporters

- Regulatory bodies

- Environmental protection bodies

- Local governments

- End users

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the size of the paper straw market in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on type, product type,straw length, straw diameter, material type and end-use

- To analyze and forecast the market size with respect to five main regions, namely, Asia Pacific, North America, Europe, South America, and Rest of the World, along with their respective key countries

- To analyze competitive developments such as mergers & acquisitions, joint ventures, and investments & expansions in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Paper straw Market

- Further breakdown of Rest of Europe Paper straw Market

- Further breakdown of Rest of South America Paper straw Market

- Further breakdown of Rest of Middle East & Africa Paper straw Market

Company Information:

- Detailed analysis and profiling of additional

Growth opportunities and latent adjacency in Paper Straw Market