Parking Management Market by Offering (Solutions (Parking Guidance, Parking Reservation Management, Parking Permit Management) and Services), Deployment Type, Parking Site (Off-street and On-street), and Region - Global Forecast to 2025

[237 Pages Report] The global parking management market size is expected to grow from USD 3.8 billion in 2020 to USD 5.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 7.4% during the forecast period. Parking management solutions help in increasing the overall revenue by optimizing vacant parking spaces. Simultaneously, they play a crucial role in reducing the overall Operational Expenditure (OPEX) and Capital Expenditure (CAPEX). All authorities worldwide are working toward improving traffic congestion by providing sufficient parking spaces to their citizens. Thus, in the coming years, the demand for parking management solutions is expected to increase.

To know about the assumptions considered for the study, Request for Free Sample Report

Analysis of COVID-19 Impact on Parking Management Market

The outbreak of the pandemic has slowed down the growth of the parking management solutions due to strict mobility restrictions imposed by local and national governments. However, the growing use of advanced technologies to increase contactless parking facilities is expected to create opportunities for parking management solution providers during the pandemic.

Market Dynamics

Driver: Growing demand for optimum utilization of parking spaces

Several parking spaces remain unutilized as developers end up building additional spaces in adherence to regulations regarding the size and number of parking spaces. Consistent parking management solutions, such as improved signage and real-time parking indicators, reduce the wastage of parking spaces by informing customers when and where a parking space is available. Parking management also results in the more efficient use of parking resources through better revenue management, by countering over-pricing and underpricing parking spaces. An effective and integrated parking management solution can reduce parking requirements by 20–40%, which helps in maintaining city infrastructure, reducing land consumption, increasing revenue generation for the government, and improving user convenience.

Restraint: System integration complexities

Parking management comprises various hardware sensors, real-time messaging systems, traffic control devices, wireless and wired telecommunications systems, computer servers, and application interfaces. The variety and variability in the parking management hardware infrastructure and software systems are enormous. Also, the collection and analysis of parking data from different systems are necessary to implement the concept of dynamic priced parking. These parking data stores are disparate and often present on incompatible hardware and software systems, making it quite difficult to integrate the data into a coherent whole. The integration of all the hardware and software involved in parking management together into one single platform is difficult and acts as a restraint to the growth of the parking management market.

Opportunity: Rising smart city initiative across the globe

The surge in emerging technologies has propelled major urban areas to transform them into smart cities. Smart cities integrate their housing, mobility, and economic functions by utilizing innovative information and communications technologies. The smart city initiatives adopted by governments across the world are expected to provide business opportunities for the providers of smart parking management solutions, which can be integrated with smart city solutions. Smart cities need flexible, scalable, easy-to-manage, and space-efficient parking systems, which can be addressed by intelligent parking management systems.

Challenge: High implementation costs

The parking management architecture is very complex and involves several input/output devices and processors. It results in low motivation for parking space operators to adopt new parking management systems. Although parking management solutions enhance the parking operator’s profitability in the long run, they are costly to implement. Huge initial investments are required for setting up a parking management system that constitutes multiple hardware components, such as system planning and design, system development, management and coordination, test evaluation, electronic signs, static signs, communication lines, parking facility equipment, and testing/training, and a software component. Additionally, the recurring cost of operations and maintenance comes up at regular intervals. Smaller organizations operating in the parking management market space have to pay huge charges for implementing parking management solutions, which may become a burden for them. Furthermore, the complexity of the system calls for highly skilled labor for the installation and maintenance part, which further increases the overall operating costs. The high installation cost, therefore, is a major challenge for the global parking management market.

Among the deployment type, the cloud segment to grow at the highest CAGR during the forecast period

Under the deployment type segment, the cloud is expected to grow at a higher growth rate during the forecast period. The market for cloud-based solutions is gaining popularity due to multiple advantages offered by the cloud. The cloud deployment type not only enables organizations to manage their costs but also helps them ensure improved business agility. Cloud-based deployments involve on-demand requirements that are provided as SaaS solutions offered by parking management providers. These solutions can be accessed through the internet using web-based tools. They can be accessed anytime from any place on-demand via the pay-per-usage platform.

Among the solutions, Parking Access And Revenue Control (PARC) segment is expected to dominate the market during the forecast period

Under the solutions segment, the parking access and revenue control solution is expected to hold a larger market size during the forecast period. PARC manages the in-and-out of vehicles in parking facilities. In addition to this, it manages payments of transient and non-transient vehicles in parking facilities. It is a combination of hardware, such as alarms, barrier gates, ticket validator machines, encoding stations, exist verifiers, and lane controllers; and software that are used for efficient parking operations. Parking access control systems have a large number of advantages, such as reduced manpower requirements, internal levels of restriction of access, and access and restriction to multiple entries and exits. These systems have been further segmented into biometrics, LPR-based Automatic Vehicle Identification (AVI), and ID management. Parking revenue management is also used in the parking management market to counter the challenges of over or under capacity, variable demand, and advanced reservation. PARC helps parking operators collect parking fees from commuters that utilize their parking facilities.

To know about the assumptions considered for the study, download the pdf brochure

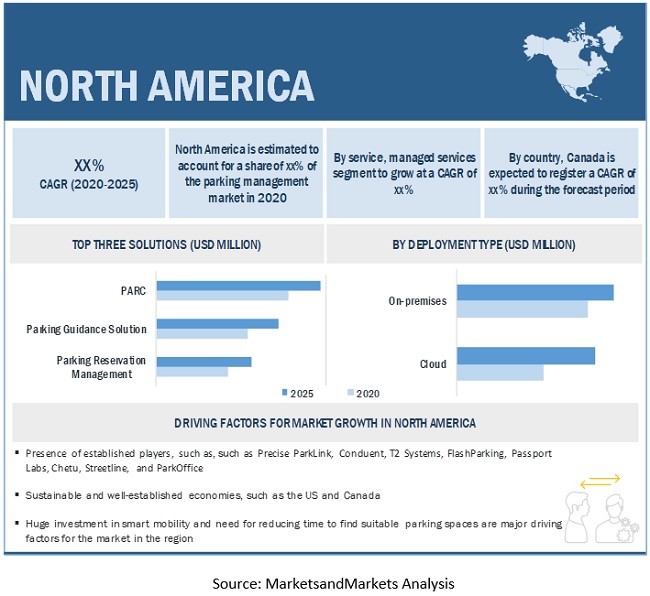

North America to account for the largest market size during the forecast period

North America constitutes of developed economies, such as the US and Canada. North America is one of the largest contributors to the parking management market. The market growth in this region is driven by large IT companies and rapid technological advancements, such as digitalization in the US and Canada. Well-established economies of these countries enable the region to invest heavily in leading Parking Management solutions and services. There are several parking management projects currently underway in the region.

Market Players

The report includes the study of key players offering parking management solutions and services. It profiles major vendors in the global Parking Management market. The major vendors include GROUP Indigo (France), Amano (Japan), Siemens (Germany), Bosch Group (Germany), Conduent (US), APCOA PARKING (US), Precise ParkLink (Canada), SWARCO (Austria), SKIDATA (Austria), T2 Systems (US), FlashParking (US), Passport Labs (US), Flowbird Group (France), ParkMobile (US), SpotHero (US), Get My Parking (India), INRIX (US), IPS Group (US), Smart Parking (Australia), Chetu (US), TIBA Parking Systems (US), Q-Free (Norway), Streetline (US), ParkOffice (US), Urbiotica (Spain), and CivicSmart (US). These players have adopted various strategies to grow in the global parking management market.

The study includes an in-depth competitive analysis of these key players in the parking management market with their company profiles, recent developments, and key market strategies.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

2016 – 2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Offering (Solutions and Services), Deployment type(Cloud and On-Premises), Parking Site(Off-street, On-street), and Region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

GROUP Indigo (France), Amano (Japan), Siemens (Germany), Bosch Group (Germany), Conduent (US), APCOA PARKING (US), Precise ParkLink (Canada), SWARCO (Austria), SKIDATA (Austria), T2 Systems (US), FlashParking (US), Passport Labs (US), Flowbird Group (France), ParkMobile (US), SpotHero (US), Get My Parking (India), INRIX (US), IPS Group (US), Smart Parking (Australia), Chetu (US), TIBA Parking Systems (US), Q-Free (Norway), Streetline (US), ParkOffice (US), Urbiotica (Spain), and CivicSmart (US) |

This research report categorizes the parking management market to forecast revenue and analyze trends in each of the following submarkets:

Based on offering

-

Solutions

- Parking Guidance Solution

- Parking Reservation Management

- Parking Permit Management

- Parking Enforcement Management

- Parking Access and Revenue Control (PARC)

- Parking Security and Surveillance

- Parking Analytics

-

Services

-

Professional Service

- Consulting and Training

- System Integration and Deployment

- Support and Maintenance

- Managed Service

-

Professional Service

Based on the parking site:

- Off-street Parking

- On-street Parking

Based on the deployment type

- Cloud

- On-premises

Based on region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

MEA

- UAE

- South Africa

- Israel

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2020, Flowbird Group launched Park and Sanitize, a contactless hydro-alcoholic gel dispenser attached to the Flowbird parking and transport ticketing terminals, to help safeguard potentially millions of motorists and transport passengers for combating the risks associated with the spread of the COVID-19.

- In July 2020, GROUP Indigo extended its European presence by opening a subsidiary in Poland.

- In May 2020, APCOA PARKING entered into a strategic technology and commercial partnership with HERE Technologies, one of the leading location data and technology platform providers, to develop and commercialize digital parking services and HD indoor maps of parking facilities in Europe.

- In April 2020, SWARCO has made available a parking application named PARCO, for German citizens. PARCO has parking information of more than 1,200 cities in Germany, Austria, and Switzerland and is planning to expand its operations.

- In January 2020, APCOA PARKING Sweden AB acquired the Swedish parking operator XPERT Parkering. This operator managed around 40,000 parking spaces with a geographical focus on the Skåne region in southern Sweden.

Frequently Asked Questions (FAQ):

What is the projected market value of the global parking management market?

The global parking management market size to grow from USD 3.8 billion in 2020 to USD 5.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 7.4% during the forecast period.

Which region has the largest market share in the parking management market?

North America is estimated to hold the largest market share in parking management in 2020. The region comprises the US and Canada, which are the leading regions in terms of the development of smart cities, smart transportation, and smart parking projects. These countries have sustainable and well-established economies that empower them to invest in R&D activities, thereby contributing to the development of new technologies in the parking management market strongly.

Which solution is expected to hold a larger market size during the forecast period?

Among solutions, parking access and revenue control solution segment is expected to hold a larger market size during the forecast period. The key trend contributing to this market growth is the increased need to control access and hassle-free collection of parking revenues from end-users.

Which service is expected to hold a larger market size during the forecast period?

Among services, the professional services segment is expected to hold a larger market size during the forecast period compared to managed services; as prpfessional services majorly focus on improving business processes and optimizing parking operations. The implementation of parking management solutions is not possible without proper planning and design; parking management vendors offer professional and managed services to plan, design, implement, and deploy the parking management solutions in various parking sites.

Who are the major vendors in the parking management market?

Major vendors in the parking management market are GROUP Indigo (France), Amano (Japan), Siemens (Germany), Bosch Group (Germany), Conduent (US), APCOA PARKING (US), Precise ParkLink (Canada), SWARCO (Austria), SKIDATA (Austria), T2 Systems (US), FlashParking (US), Passport Labs (US), Flowbird Group (France), ParkMobile (US), SpotHero (US), Get My Parking (India), INRIX (US), IPS Group (US), Smart Parking (Australia), Chetu (US), TIBA Parking Systems (US), Q-Free (Norway), Streetline (US), ParkOffice (US), Urbiotica (Spain), and CivicSmart (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 6 PARKING MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF THE PARKING MANAGEMENT MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES IN THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 PARKING MANAGEMENT MARKET, 2018–2025 (USD MILLION)

FIGURE 12 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 13 MARKET: REGIONAL SNAPSHOT

FIGURE 14 ASIA PACIFIC TO BE A HIGHLY POTENTIAL MARKET TO INVEST IN DURING 2020–2025

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PARKING MANAGEMENT MARKET

FIGURE 15 GROWTH IN SMART CITY INITIATIVES WORLDWIDE TO DRIVE THE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 NORTH AMERICA MARKET, BY OFFERING AND COUNTRY

FIGURE 16 SOLUTIONS SEGMENT AND THE UNITED STATES TO ACCOUNT FOR HIGHER SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 ASIA PACIFIC MARKET, BY OFFERING AND TOP THREE COUNTRIES

FIGURE 17 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR HIGH SHARES IN THE ASIA PACIFIC MARKET IN 2020

4.4 MARKET: MAJOR COUNTRIES

FIGURE 18 UNITED ARAB EMIRATES TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PARKING MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for seamless traffic flow and reduction in fuel consumption

TABLE 4 INRIX PARKING RANKING – HOURS SPENT SEARCHING FOR PARKING, 2017

FIGURE 20 RANKING OF 15 THE MOST CONGESTED CITIES GLOBALLY (OVERALL DAILY CONGESTION LEVEL – EXTRA TRAVEL TIME – POPULATION OVER 800,000) IN 2019

5.2.1.2 Growing motor vehicle sales across the globe

FIGURE 21 EUROPE: NUMBER OF MOTOR VEHICLES IN USE DURING 2014-2018

FIGURE 22 REGION-WISE GLOBAL MOTOR VEHICLE SALES DURING 2010-2019

5.2.1.3 Proliferation of mobile and smartphones

5.2.1.4 Exponentially rising urban population to actuate smart parking management

5.2.1.5 Growing demand for optimum utilization of parking spaces

5.2.1.6 Adoption of cloud, IoT, and data analytics technologies

5.2.2 RESTRAINTS

5.2.2.1 System integration complexities

5.2.3 OPPORTUNITIES

5.2.3.1 Rising smart city initiative across the globe

TABLE 5 SMART CITY INITIATIVES AND INVESTMENTS

5.2.3.2 Emergence of autonomous cars

5.2.3.3 Demand for innovative parking management solutions

5.2.4 CHALLENGES

5.2.4.1 High implementation costs

5.2.4.2 Data security and privacy issues related to IoT devices

5.2.4.3 Disruption in logistics and supply chain of IoT devices

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN ANALYSIS

FIGURE 23 PARKING MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

5.3.2 ECOSYSTEM

FIGURE 24 MARKET: ECOSYSTEM

5.3.3 MARKET: TECHNOLOGICAL LANDSCAPE

5.3.3.1 Artificial Intelligence

5.3.3.2 Big data and analytics

5.3.3.3 Internet of Things

5.3.3.4 Edge computing

5.3.3.5 5G Network

5.4 PATENT ANALYSIS

TABLE 6 EUROPE PATENT PUBLICATION, BY COUNTRY, 2015-2020

TABLE 7 EUROPE PATENT PUBLICATION, BY YEAR, 2015-2020

5.5 AVERAGE SELLING PRICE TREND

TABLE 8 PRICING ANALYSIS

5.5.1 USE CASES

5.6 COVID-19 MARKET OUTLOOK FOR PARKING MANAGEMENT SOLUTIONS NETWORKS

TABLE 9 PARKING MANAGEMENT MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 10 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.6.1 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 PARKING MANAGEMENT MARKET, BY OFFERING (Page No. - 71)

6.1 INTRODUCTION

FIGURE 25 SERVICES SEGMENT TO GROW AT A HIGHER CAGR IN THE MARKET FROM 2020 TO 2025

TABLE 12 MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 13 MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

FIGURE 26 PARKING GUIDANCE SOLUTION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 OFFERING: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 15 OFFERING: MARKET, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 18 SOLUTIONS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 19 SOLUTIONS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.3 PARKING GUIDANCE SOLUTION

TABLE 20 PARKING GUIDANCE SOLUTION: PARKING MANAGEMENT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 PARKING GUIDANCE SOLUTION: MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 22 PARKING GUIDANCE SOLUTION: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 23 7PARKING GUIDANCE SOLUTION: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.4 PARKING RESERVATION MANAGEMENT

TABLE 24 PARKING RESERVATION MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 PARKING RESERVATION MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 26 PARKING RESERVATION MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 27 PARKING RESERVATION MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.5 PARKING PERMIT MANAGEMENT

TABLE 28 PARKING PERMIT MANAGEMENT: PARKING MANAGEMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 PARKING PERMIT MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 30 PARKING PERMIT MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 31 PARKING PERMIT MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.6 PARKING ENFORCEMENT MANAGEMENT

TABLE 32 PARKING ENFORCEMENT MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 PARKING ENFORCEMENT MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 34 PARKING ENFORCEMENT MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 35 PARKING ENFORCEMENT MANAGEMENT: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.7 PARKING ACCESS AND REVENUE CONTROL

TABLE 36 PARKING ACCESS AND REVENUE CONTROL: PARKING MANAGEMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 PARKING ACCESS AND REVENUE CONTROL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 38 PARKING ACCESS AND REVENUE CONTROL: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 39 PARKING ACCESS AND REVENUE CONTROL: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.8 PARKING SECURITY AND SURVEILLANCE

TABLE 40 PARKING SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 PARKING SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 42 PARKING SECURITY AND SURVEILLANCE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 PARKING SECURITY AND SURVEILLANCE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.9 PARKING ANALYTICS

TABLE 44 PARKING ANALYTICS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 PARKING ANALYTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 46 PARKING ANALYTICS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 PARKING ANALYTICS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: PARKING MANAGEMENT MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 48 OFFERING: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 49 OFFERING: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 50 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 52 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

FIGURE 28 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 54 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 56 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 58 PROFESSIONAL SERVICES: NORTH AMERICA PARKING MANAGEMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 59 PROFESSIONAL SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.3.1 Consulting and training

TABLE 60 CONSULTING AND TRAINING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 CONSULTING AND TRAINING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 62 CONSULTING AND TRAINING NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 CONSULTING AND TRAINING NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.3.2 System integration and deployment

TABLE 64 SYSTEM INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 SYSTEM INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 66 SYSTEM INTEGRATION AND DEPLOYMENT NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 SYSTEM INTEGRATION AND DEPLOYMENT NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.3.3 Support and maintenance

TABLE 68 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 70 SUPPORT AND MAINTENANCE NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 71 SUPPORT AND MAINTENANCE NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.4 MANAGED SERVICES

TABLE 72 MANAGED SERVICES: PARKING MANAGEMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 74 MANAGED SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 75 MANAGED SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7 PARKING MANAGEMENT MARKET, BY PARKING SITE (Page No. - 99)

7.1 INTRODUCTION

FIGURE 29 OFF-STREET PARKING SEGMENT TO GROW AT A HIGHER CAGR IN THE MARKET DURING 2020–2025

TABLE 76 MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 77 MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

7.2 OFF-STREET PARKING

7.2.1 OFF-STREET PARKING: MARKET DRIVERS

7.2.2 OFF-STREET PARKING: COVID-19 IMPACT

TABLE 78 OFF-STREET PARKING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 OFF-STREET PARKING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 80 OFF-STREET PARKING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 81 OFF-STREET PARKING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3 ON-STREET PARKING

7.3.1 ON-STREET PARKING: PARKING MANAGEMENT MARKET DRIVERS

7.3.2 ON-STREET PARKING: COVID-19 IMPACT

TABLE 82 ON-STREET PARKING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 ON-STREET PARKING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 84 ON-STREET PARKING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 85 ON-STREET PARKING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8 PARKING MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 106)

8.1 INTRODUCTION

FIGURE 30 CLOUD DEPLOYMENT TYPE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 86 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 87 MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

8.2 ON-PREMISES

8.2.1 ON-PREMISES: MARKET DRIVERS

8.2.2 ON-PREMISES: COVID-19 IMPACT

TABLE 88 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 89 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 90 ON-PREMISES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 ON-PREMISES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3 CLOUD

8.3.1 CLOUD: PARKING MANAGEMENT MARKET DRIVERS

8.3.2 CLOUD: COVID-19 IMPACT

TABLE 92 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 93 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 94 CLOUD: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 CLOUD: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9 PARKING MANAGEMENT MARKET, BY REGION (Page No. - 112)

9.1 INTRODUCTION

FIGURE 31 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 32 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING 2020-2025

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 96 NORTH AMERICA: PARKING MANAGEMENT MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.4 UNITED STATES

TABLE 110 UNITED STATES: PARKING MANAGEMENT MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 113 UNITED STATES: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 114 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 115 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 116 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 117 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 118 UNITED STATES: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 119 UNITED STATES: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 120 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 121 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.2.5 CANADA

TABLE 122 CANADA: PARKING MANAGEMENT MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 124 CANADA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 126 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 131 CANADA: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 132 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 133 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: PARKING MANAGEMENT MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: MARKET REGULATORY IMPLICATIONS

TABLE 134 EUROPE: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.5 GERMANY

9.3.6 FRANCE

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: PARKING MANAGEMENT MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.4 CHINA

9.4.5 JAPAN

9.4.6 SOUTH KOREA

9.4.7 REST OF ASIA PACIFIC

9.5 LATIN AMERICA

9.5.1 LATIN AMERICA: PARKING MANAGEMENT MARKET DRIVERS

9.5.2 LATIN AMERICA: COVID-19 IMPACT

9.5.3 LATIN AMERICA: MARKET REGULATORY IMPLICATIONS

TABLE 162 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.5.4 BRAZIL

9.5.5 MEXICO

9.5.6 REST OF LATIN AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 MIDDLE EAST AND AFRICA: PARKING MANAGEMENT MARKET DRIVERS

9.6.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.6.3 MIDDLE EAST AND AFRICA: MARKET REGULATORY IMPLICATIONS

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2019 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PARKING SITE, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PARKING SITE, 2019–2025 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.6.4 UNITED ARAB EMIRATES

9.6.5 SOUTH AFRICA

9.6.6 ISRAEL

9.6.7 REST OF MIDDLE EAST AND AFRICA

10 COMPETITIVE LANDSCAPE (Page No. - 159)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK, 2019–2020

10.3 KEY MARKET DEVELOPMENTS

10.3.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 190 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019 –2020

10.3.2 BUSINESS EXPANSIONS

TABLE 191 BUSINESS EXPANSIONS, 2019-2020

10.3.3 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 192 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019 –2020

10.3.4 MERGERS AND ACQUISITIONS

TABLE 193 MERGERS AND ACQUISITIONS, 2019 –2020

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 36 REVENUE ANALYSIS OF PLAYERS IN THE PARKING MANAGEMENT MARKET

10.5 HISTORICAL REVENUE ANALYSIS

FIGURE 37 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS IN THE MARKET

10.6 COMPANY EVALUATION MATRIX OVERVIEW

10.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 38 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

10.6.1.1 Star

10.6.1.2 Emerging leaders

10.6.1.3 Pervasive

10.6.1.4 Participant

10.6.2 COMPANY EVALUATION MATRIX, 2020

FIGURE 39 PARKING MANAGEMENT MARKET: COMPANY EVALUATION MATRIX, 2020

10.7 MARKET RANKING OF TOP 5 KEY PLAYERS

FIGURE 40 RANKING OF KEY PLAYERS, 2020

10.8 STARTUP/SME EVALUATION MATRIX OVERVIEW

10.8.1 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 41 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

10.8.1.1 Progressive companies

10.8.1.2 Responsive companies

10.8.1.3 Dynamic companies

10.8.1.4 Starting blocks

10.8.2 STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 42 PARKING MANAGEMENT MARKET: STARTUP/SME EVALUATION MATRIX, 2020

11 COMPANY PROFILES (Page No. - 172)

11.1 INTRODUCTION

(Business Overview, Platform, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.2 GROUP INDIGO

FIGURE 43 GROUP INDIGO: COMPANY SNAPSHOT

11.3 AMANO

FIGURE 44 AMANO: COMPANY SNAPSHOT

11.4 SIEMENS

FIGURE 45 SIEMENS: COMPANY SNAPSHOT

11.5 BOSCH GROUP

FIGURE 46 BOSCH GROUP: COMPANY SNAPSHOT

11.6 CONDUENT

FIGURE 47 CONDUENT: COMPANY SNAPSHOT

11.7 APCOA PARKING

11.8 SWARCO

11.9 SKIDATA

11.10 FLOWBIRD GROUP

11.11 CHETU

11.12 PRECISE PARKLINK

11.13 T2 SYSTEMS

11.14 FLASHPARKING

11.15 PASSPORT LABS

11.16 PARKMOBILE

11.17 SPOTHERO

11.18 GET MY PARKING

11.19 INRIX

11.20 IPS GROUP

11.21 SMARTPARKING

11.22 TIBA PARKING SYSTEMS

11.23 Q-FREE

11.24 STREETLINE

11.25 PARKOFFICE

11.26 URBIOTICA

11.27 CIVICSMART

*Details on Business Overview, Platform, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 216)

12.1 ADJACENT/RELATED MARKET

12.1.1 LIMITATIONS

12.1.2 SMART BUILDING MARKET – GLOBAL FORECAST TO 2024

12.1.2.1 Market definition

12.1.2.2 Market overview

12.1.2.3 Smart building market, by component

TABLE 194 SMART BUILDING MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

12.1.2.4 Smart building market, by solution

TABLE 195 SMART BUILDING MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

12.1.2.5 Smart building market, by service

TABLE 196 SMART BUILDING MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

12.1.2.6 Smart building market, by building type

TABLE 197 SMART BUILDING MARKET SIZE, BY BUILDING TYPE, 2017–2024 (USD MILLION)

12.1.2.7 Smart building market, by region

TABLE 198 SMART BUILDING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.1.3 VISITOR MANAGEMENT SYSTEM MARKET – GLOBAL FORECAST TO 2025

12.1.3.1 Market definition

12.1.3.2 Market overview

12.1.3.3 Visitor management system market, by component

TABLE 199 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

12.1.3.4 Visitor management system market, by service

TABLE 200 SERVICES: VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

12.1.3.5 Visitor management system market, by application

TABLE 201 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.1.3.6 Visitor management system market, by deployment mode

TABLE 202 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

12.1.3.7 Visitor management system market, by organization size

TABLE 203 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.1.3.8 Visitor management system market, by industry vertical

TABLE 204 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

12.1.3.9 Visitor management system market, by region

TABLE 205 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.1.4 TRAFFIC MANAGEMENT MARKET – GLOBAL FORECAST TO 2024

12.1.4.1 Market definition

12.1.4.2 Market overview

12.1.4.3 Traffic management market, by component

TABLE 206 TRAFFIC MANAGEMENT MARKET SIZE, BY COMPONENT, 2017-2024 (USD MILLION)

12.1.4.4 Traffic management market, by solution

TABLE 207 TRAFFIC MANAGEMENT MARKET SIZE, BY SOLUTION, 2017-2024 (USD MILLION)

12.1.4.5 Traffic management market, by hardware

TABLE 208 TRAFFIC MANAGEMENT MARKET SIZE, BY HARDWARE, 2017-2024 (USD MILLION)

12.1.4.6 Traffic management market, by service

TABLE 209 TRAFFIC MANAGEMENT MARKET SIZE, BY SERVICE, 2017-2024 (USD MILLION)

12.1.4.7 Traffic management market, by region

TABLE 210 TRAFFIC MANAGEMENT MARKET SIZE, BY REGION, 2017-2024 (USD MILLION)

12.1.5 FLEET MANAGEMENT MARKET – GLOBAL FORECAST TO 2025

12.1.5.1 Market definition

12.1.5.2 Market overview

12.1.5.3 Fleet management market, by component

TABLE 211 FLEET MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 212 FLEET MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

12.1.5.4 Fleet management market, by deployment type

TABLE 213 FLEET MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019(USD MILLION)

TABLE 214 FLEET MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

12.1.5.5 Fleet management market, by fleet type

TABLE 215 FLEET MANAGEMENT MARKET SIZE, BY FLEET TYPE, 2015–2019 (USD MILLION)

TABLE 216 FLEET MANAGEMENT MARKET SIZE, BY FLEET TYPE, 2019–2025 (USD MILLION)

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

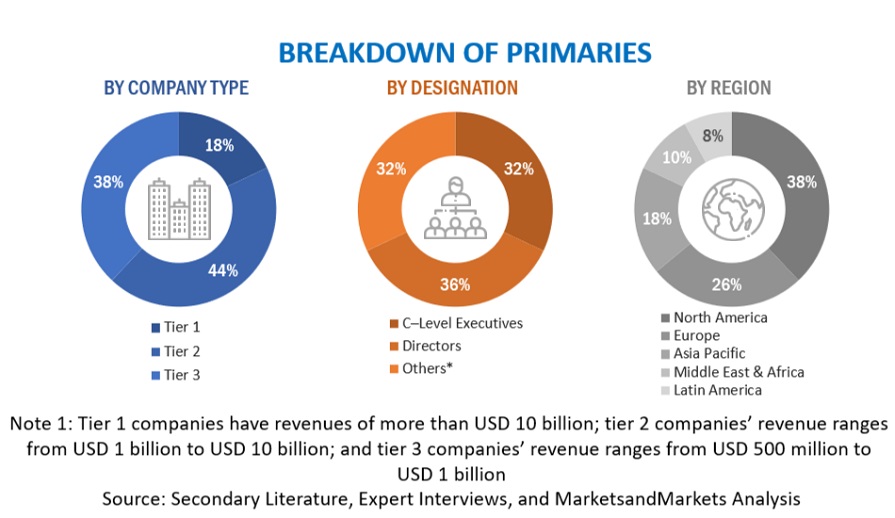

The study involved four major activities in estimating the current size of the parking management market. Exhaustive secondary research was done to collect information on the logistics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the parking management market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The parking management market comprises several stakeholders, such as parking management vendors, parking management service providers, venture capitalists, government organizations, regulatory authorities, policymakers, and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the market consists of all the firms operating in several industry verticals. The supply side includes parking management providers, offering parking management services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global parking management market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the parking management market, by offering, deployment, type, parking site, and region

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the impact of COVID-19 on the market

- To analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall parking management market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information :

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic analysis:

- Further breakdown of the UK parking management market

- Further breakdown of China market

- Further breakdown of UAE market

- Further breakdown of Brazil market

Growth opportunities and latent adjacency in Parking Management Market