Patient Engagement Solutions Market by Component (Software, Services), Delivery (On-Premise, Cloud), Therapy Area (CVD, Diabetes, Obesity, Fitness), Functionality (E-prescribing, Virtual care), End User (Provider, Payer, Patients) - Global Forecast to 2027

Updated on : May 22, 2023

The global patient engagement solutions market in terms of revenue was estimated to be worth $17.3 billion in 2022 and is poised to reach $27.9 billion by 2027, growing at a CAGR of 10% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The factors driving the growth of this market are implementation of changing government regulations and healthcare initiatives to promote patient-centric care, high demand for patient engagement solutions in the post pandemic era, and the growing utilization of m-health apps.However, interoperability for patient engagement solutions and a shortage of skilled IT professionals in the healthcare industry are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Patient Engagement Solutions Market Dynamics

Driver: Implementation of government regulations and initiatives to promote patient-centric care

In March 2020, the US President signed a USD 2 million coronavirus emergency stimulus package called the CARES (Coronavirus Aid, Relief, and Economic Security) Act. The law expands cover treatment and services for those affected by COVID-19. The CARES Act also increases flexibility for Medicare to cover telehealth services; authorizes Medicare certification for home health services by physician assistants, nurse practitioners, and certified nurse specialists; and increases Medicare payments for COVID-19-related hospital stays and durable medical equipment. Such initiatives/regulations are expected to increase further the demand and adoption of patient engagement solutions in major markets worldwide.

Restraint: Large investment requirements for healthcare infrastructure

Payers have made substantial investments in infrastructure and proprietary systems in the past. Moving or integrating these systems with patient engagement solutions will pose various challenges to these organizations in terms of cost. It will also require changes to their current systems that are optimized to handle only their current requirements. Also, the move to cloud-based patient engagement solutions would involve changing the current IT architecture, especially in hospitals that already serve as hubs connecting multiple physicians, labs, and pharmacists. Hence, finding the resources to achieve large-scale interoperability and interconnectivity could hamper the transition to cloud-based patient engagement solutions for such healthcare institutions.

Challenge: High deployments costs of healthcare IT systems

Healthcare IT systems have high-priced software solutions.The maintenance and software update costs of these systems may be more than the software price. Support and maintenance services along with software upgrades , represent a recurring expenditure, which amounts to almost 30% of the total cost of ownership. The lack of internal skilled IT professionals in the healthcare industry necessitates training for end users to increase the efficiency and results of various healthcare IT solutions, thereby adding to the cost of ownership of the systems. Evaluating information systems in healthcare can also be challenging as the organizational impact & benefits of IT systems in healthcare are often intangible.

Opportunity: Growth opportunities in emerging markets

Several factors, such as adopting government initiatives that support the adoption of HCIT solutions, rising government expenditure on healthcare facilities, and the presence of skilled IT experts in emerging Asian countries, such as China and India, are expected to support the growth of the global market in the APAC region. Technological advancements play a key role in reforming the country’s healthcare management sector. China is currently facing challenges such as underfunded rural health centers, overburdened city hospitals, and a nationwide shortage of doctors.

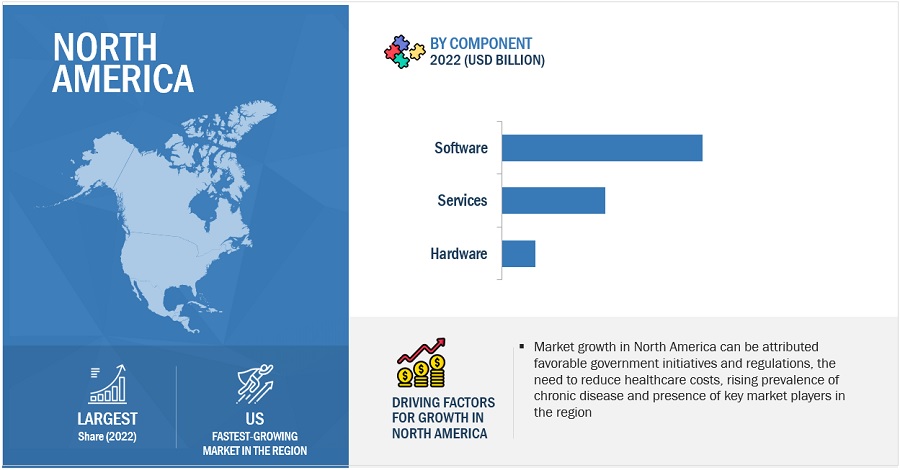

North America accounted for the largest share of the global patient engagement solutions market.

North America accounted for the largest share of this market. Government regulations supporting the healthcare system, the need to reduce healthcare costs for better accessibility, the rising prevalence of chronic diseases, and the majority of key market players operating in the region are the key factors driving the growth of the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players operating in patient engagement solutions market are IBM (US), McKesson Corporation (US), Allscripts (US), Cerner Corporation (US), Epic Systems Corporation (US), Orion Health (New Zealand), GetWellNetwork (US), athenahealth (US), Oneview Healthcare (Ireland), MEDITECH (US), IQVIA (US), Get Real Health (US), Cognizant (US), Symphony Care (US), Harris Healthcare (US), Kareo (US), CureMD Healthcare (US), eClinicalWorks (US), and Lincor Solutions (US), AdvancedMD (US), WellStack(US), IQVIA (US), Vivify Health (US), Medhost (US), Validic (US) MEDISYSINC (US), and Patient point LLC (US)

Patient Engagement Solutions Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$17.3 billion |

|

Estimated Value by 2027 |

$27.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 10.0% |

|

Market Driver |

Implementation of government regulations and initiatives to promote patient-centric care< |

|

Market Opportunity |

Growth opportunities in emerging economies |

The study categorizes the global patient engagement solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Hardware

- Software

- Standalone Software

- Integrated Software

- Services

By Delivery Mode

- PREMISE Mode

- CLOUD-BASED Mode

By Application

- Health management

- Home health management

- Social

- Financial health management

By Therapeutic Area

- Chronic diseases

- Cardiovascular diseases (CVD)

- Diabetes

- Obesity

- Other chronic diseases

- Women’s health

- Fitness

- Other Therapeutic Areas

By Functionality

- Introduction

- E-Prescribing

- Virtual Consultation

- Patient/Client Scheduling

- Document Management

By End User

- Providers

- Payers

- Patients

- Other End users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

ROW

- Latin America

- Middle East & Africa

Recent Developments:

- In 2021, McKesson (US) announced a strategic agreement with Merck (US) that enables the two healthcare leaders to harness the power of real-world evidence (RWE) toward the common goal of improving patient outcomes and the quality of cancer care.

- In 2021, Humana (US) collaborated with IBM (US) to deploy IBM Watson Assistant for Health Benefits; it is an AI-enabled virtual agent built in the IBM Watson Health Cloud. This agent helps provide a better member experience while providing greater clarity and transparency on benefits and other related matters for Humana Employer Group members.

- In 2021, Allied Digestive Health (ADH) selected athenahealth’s (US) cloud-based healthcare payments and patient engagement solutions to drive patient relations and revenue cycle excellence, thus supporting the organization’s growth in the coming years.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global patient engagement solutions market?

The global patient engagement solutions market boasts a total revenue value of $27.9 billion by 2027.

What is the estimated growth rate (CAGR) of the global patient engagement solutions market?

The global patient engagement solutions market has an estimated compound annual growth rate (CAGR) of 10% and a revenue size in the region of $17.3 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 PATIENT ENGAGEMENT SOLUTIONS MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.5.1 SCOPE-RELATED LIMITATIONS

1.5.2 METHODOLOGY-RELATED LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.2 PRIMARY SOURCES

2.2.1 KEY INDUSTRY INSIGHTS

2.2.2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 2 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4 MARKET ESTIMATION

2.4.1 RESEARCH METHODOLOGY: MARKET ESTIMATION

2.4.2 APPROACH: END USER-BASED MARKET ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: MARKET ESTIMATION

2.4.3 TOP-DOWN APPROACH: CONTRIBUTION-BASED MARKET SIZE ESTIMATION

2.4.4 GLOBAL MARKET: TOP-DOWN APPROACH

2.4.5 GROWTH FORECAST

FIGURE 4 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE LABORATORY INFORMATICS MARKET (2022–2027)

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.5 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.6 ASSUMPTIONS FOR THE STUDY

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: GLOBAL MARKET

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 8 GLOBAL MARKET, BY DELIVERY MODE, 2022 VS. 2027

FIGURE 9 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 10 GLOBAL MARKET, BY THERAPEUTIC AREA, 2022 VS. 2027

FIGURE 11 GLOBAL MARKET, BY FUNCTIONALITY, 2022 VS. 2027

FIGURE 12 GLOBAL MARKET, BY END USER, 2022 VS. 2027

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 14 RISING GOVERNMENT INITIATIVES FOR PATIENT-CENTRIC CARE DRIVE THE MARKET GROWTH

4.2 GLOBAL MARKET, BY END USER

FIGURE 15 PROVIDERS ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2021

4.3 NORTH AMERICA: MARKET, BY DELIVERY MODE & COUNTRY (2021)

FIGURE 16 ON-PREMISE SOLUTIONS ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2021

4.4 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 17 ASIA PACIFIC MARKET TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Implementation of government regulations and initiatives to promote patient-centric care

5.2.1.2 Increasing adoption of patient engagement solutions

5.2.1.3 Rising number of collaborations and partnerships between stakeholders

TABLE 2 INDICATIVE LIST OF COLLABORATIONS BETWEEN ORGANIZATIONS FROM 2020 TO 2022

5.2.1.4 Increasing utilization of mobile health apps

5.2.2 RESTRAINTS

5.2.2.1 Large investment requirements for healthcare infrastructure

5.2.2.2 Protection of patient information

5.2.2.3 Inadequate interoperability across healthcare providers

5.2.2.4 Shortage of skilled IT professionals in the healthcare industry

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging markets

5.2.3.2 Wearable health technology

5.2.3.3 Cloud-computing solutions

5.2.4 CHALLENGES

5.2.4.1 High deployments costs of healthcare IT systems

5.2.4.2 Low levels of healthcare literacy

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4 CASE STUDIES

5.4.1 FOCUS ON REDUCING READMISSION RATES AND IMPROVING CARE

5.4.1.1 Case 1: Need to reduce patient hospital stays

5.4.2 IMPROVE OUTPATIENT COMMUNICATION

5.4.2.1 Case 2: Rising need to curb miscommunication with discharged patients

5.4.3 PATIENT ENGAGEMENT STRATEGY

5.4.3.1 Case 3: Post-discharge care

5.5 ECOSYSTEM ANALYSIS

FIGURE 19 GLOBAL MARKET: ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

TABLE 3 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

5.7 REGULATORY ANALYSIS

5.7.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

5.7.2 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

5.7.3 CONSUMER PRIVACY PROTECTION ACT OF 2017

5.7.4 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

5.7.5 CYBERSECURITY LAW OF THE PEOPLE’S REPUBLIC OF CHINA

5.7.6 AFFORDABLE CARE ACT, 2010

5.8 PRICING ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PATIENT ENGAGEMENT SOLUTION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10 INDUSTRY TRENDS

5.10.1 RISING NEED FOR INTEROPERABILITY & INTEGRATION OF HCIT SOLUTIONS

5.10.2 GRADUAL SHIFT OF ACCOUNTABILITY FROM PAYERS TO PROVIDERS

5.10.3 GROWING DEMAND FOR VALUE-BASED HEALTHCARE

6 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY COMPONENT (Page No. - 70)

6.1 INTRODUCTION

TABLE 5 GLOBAL MARKET, BY COMPONENT, 2020–2027

6.2 HARDWARE

6.2.1 HARDWARE SOLUTIONS ARE AN INTERACTIVE EXPERIENCE FOR PATIENTS & FAMILIES

TABLE 6 HARDWARE MARKET, BY REGION, 2020–2027

6.3 SOFTWARE

TABLE 7 SOFTWARE MARKET, BY REGION, 2020–2027

TABLE 8 SOFTWARE MARKET, BY TYPE, 2020–2027

6.3.1 STANDALONE SOFTWARE

6.3.1.1 Standalone software refers to the traditional software installed in client systems

TABLE 9 STANDALONE SOFTWARE MARKET, BY REGION, 2020–2027

6.3.2 INTEGRATED SOFTWARE

6.3.2.1 Reduction in time spent on data management is driving the growth of this segment

TABLE 10 INTEGRATED SOFTWARE MARKET, BY REGION, 2020–2027

6.4 SERVICES

6.4.1 THE SERVICES SEGMENT IS EXPECTED TO WITNESS THE HIGHEST GROWTH IN THE FORECAST PERIOD

TABLE 11 SERVICES MARKET, BY REGION, 2020–2027

7 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY DELIVERY MODE (Page No. - 76)

7.1 INTRODUCTION

TABLE 12 GLOBAL MARKET, BY DELIVERY MODE, 2020–2027

7.2 ON-PREMISE MODE

7.2.1 PATIENT DATA SAFETY AND COST BENEFITS OF ON-PREMISE DELIVERY MODES TO DRIVE THE MARKET GROWTH

TABLE 13 ON-PREMISE MODE MARKET, BY REGION, 2020–2027

7.3 CLOUD-BASED MODE

7.3.1 REGULATORY REQUIREMENTS HAVE DRIVEN HEALTHCARE PROVIDERS TO ADOPT CLOUD-BASED SOLUTIONS

TABLE 14 CLOUD-BASED MODE MARKET, BY REGION, 2020–2027

8 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

TABLE 15 GLOBAL MARKET, BY APPLICATION, 2020–2027

8.2 HEALTH MANAGEMENT

8.2.1 HEALTH MANAGEMENT PLAYS A CRUCIAL TOOL IN GUIDING PATIENTS IN SELF-CARE

TABLE 16 GLOBAL MARKET FOR HEALTH MANAGEMENT, BY REGION, 2020–2027

8.3 HOME HEALTH MANAGEMENT

8.3.1 GROWING PREFERENCE FOR HOME HEALTHCARE TO SUPPORT THE MARKET GROWTH

TABLE 17 GLOBAL MARKET FOR HOME HEALTH MANAGEMENT, BY REGION, 2020–2027

8.4 SOCIAL & BEHAVIORAL MANAGEMENT

8.4.1 GROWING POPULARITY OF SOCIAL MEDIA TO DRIVE THE MARKET GROWTH

TABLE 18 GLOBAL MARKET FOR SOCIAL & BEHAVIORAL MANAGEMENT, BY REGION, 2020–2027

8.5 FINANCIAL HEALTH MANAGEMENT

8.5.1 FINANCIAL ENGAGEMENT SOLUTIONS HELP PROVIDERS MANAGE PATIENT PAYMENTS

TABLE 19 GLOBAL MARKET FOR FINANCIAL HEALTH MANAGEMENT, BY REGION, 2020–2027

9 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY THERAPEUTIC AREA (Page No. - 85)

9.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY THERAPEUTIC AREA, 2020–2027

9.2 CHRONIC DISEASES

TABLE 21 GLOBAL MARKET FOR CHRONIC DISEASES, BY REGION, 2020–2027

TABLE 22 GLOBAL MARKET FOR CHRONIC DISEASES, BY TYPE, 2020–2027

9.2.1 CARDIOVASCULAR DISEASES (CVD)

9.2.1.1 CVD is the leading cause of death worldwide

TABLE 23 GLOBAL MARKET FOR CVD, BY REGION, 2020–2027

9.2.2 DIABETES

9.2.2.1 The high incidence of diabetes worldwide drives the growth of this segment

TABLE 24 GLOBAL MARKET FOR DIABETES, BY REGION, 2020–2027

9.2.3 OBESITY

9.2.3.1 Rising prevalence of obesity to drive the growth of this segment

TABLE 25 GLOBAL MARKET FOR OBESITY, BY REGION, 2020–2027

9.2.4 OTHER CHRONIC DISEASES

TABLE 26 GLOBAL MARKET FOR OTHER CHRONIC DISEASES, BY REGION, 2020–2027

9.3 WOMEN’S HEALTH

9.3.1 INCREASING SELF AWARENESS FOR THE MANAGEMENT OF DISEASES TO DRIVE THE MARKET GROWTH

TABLE 27 GLOBAL MARKET FOR WOMEN’S HEALTH, BY REGION, 2020–2027

9.4 FITNESS

9.4.1 GROWING PREFERENCE FOR A HEALTHY LIFESTYLE TO SUPPORT THE MARKET GROWTH FOR FITNESS-RELATED APPS

TABLE 28 GLOBAL MARKET FOR FITNESS, BY REGION, 2020–2027

9.5 OTHER THERAPEUTIC AREAS

TABLE 29 GLOBAL MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2020–2027

10 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY FUNCTIONALITY (Page No. - 93)

10.1 INTRODUCTION

TABLE 30 GLOBAL MARKET, BY FUNCTIONALITY, 2020–2027

10.1.1 E-PRESCRIBING

10.1.1.1 E-prescribing is a cost-effective method of providing valuable information to clinicians to enhance decision-making

TABLE 31 GLOBAL MARKET FOR E-PRESCRIBING, BY REGION, 2020–2027

10.1.2 VIRTUAL CONSULTATION

10.1.2.1 Telehealth provides flexibility in treatment options due to remote monitoring

TABLE 32 GLOBAL MARKET FOR VIRTUAL CONSULTATION, BY REGION, 2020–2027

10.1.3 PATIENT/CLIENT SCHEDULING

10.1.3.1 Patient/client scheduling enables physicians to streamline workflows and efficiently manage patient schedules

TABLE 33 GLOBAL MARKET FOR PATIENT/CLIENT SCHEDULING, BY REGION, 2020–2027

10.1.4 DOCUMENT MANAGEMENT

10.1.4.1 The effective management of patient documents is crucial for healthcare providers

TABLE 34 GLOBAL MARKET FOR DOCUMENT MANAGEMENT, BY REGION, 2020–2027

11 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY END USER (Page No. - 98)

11.1 INTRODUCTION

TABLE 35 GLOBAL MARKET, BY END USER, 2020–2027

11.2 PROVIDERS

11.2.1 PROVIDERS ARE THE LARGEST END USERS OF PATIENT ENGAGEMENT SOLUTIONS

TABLE 36 GLOBAL MARKET FOR PROVIDERS, BY REGION, 2020–2027

11.3 PAYERS

11.3.1 PATIENT ENGAGEMENT SOLUTIONS HELP HEALTHCARE PAYERS MINIMIZE ERRORS

TABLE 37 GLOBAL MARKET FOR PAYERS, BY REGION, 2020–2027

11.4 PATIENTS

11.4.1 PATIENT ENGAGEMENT SOLUTIONS MOTIVATE INDIVIDUALS TO MONITOR & IMPROVE HEALTH OUTCOMES

TABLE 38 GLOBAL MARKET FOR PATIENTS, BY REGION, 2020–2027

11.5 OTHER END USERS

TABLE 39 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2020–2027

12 PATIENT ENGAGEMENT SOLUTIONS MARKET, BY REGION (Page No. - 103)

12.1 INTRODUCTION

TABLE 40 GLOBAL MARKET, BY REGION, 2020–2027

12.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027

TABLE 42 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2027

TABLE 43 NORTH AMERICA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 44 NORTH AMERICA: MARKET, BY END USER, 2020–2027

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027

TABLE 46 NORTH AMERICA: MARKET, BY THERAPEUTIC AREA, 2020–2027

TABLE 47 NORTH AMERICA: MARKET, BY FUNCTIONALITY, 2020–2027

12.2.1 US

12.2.1.1 The US is the largest market in North America for patient engagement solutions in 2022

TABLE 48 US: MARKET, BY COMPONENT, 2020–2027

TABLE 49 US: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 50 US: MARKET, BY END USER, 2020–2027

TABLE 51 US: MARKET, BY APPLICATION, 2020–2027

TABLE 52 US: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.2.2 CANADA

12.2.2.1 Growing need for cost containment to propel the market growth in Canada

TABLE 53 CANADA: MARKET, BY COMPONENT, 2020–2027

TABLE 54 CANADA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 55 CANADA: MARKET, BY END USER, 2020–2027

TABLE 56 CANADA: MARKET, BY APPLICATION, 2020–2027

TABLE 57 CANADA: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3 EUROPE

TABLE 58 EUROPE: MARKET, BY COUNTRY, 2020–2027

TABLE 59 EUROPE: MARKET, BY COMPONENT, 2020–2027

TABLE 60 EUROPE: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 61 EUROPE: MARKET, BY END USER, 2020–2027

TABLE 62 EUROPE: MARKET, BY APPLICATION, 2020–2027

TABLE 63 EUROPE: MARKET, BY THERAPEUTIC AREA, 2020–2027

TABLE 64 EUROPE: MARKET, BY FUNCTIONALITY, 2020–2027

12.3.1 GERMANY

12.3.1.1 Germany is the largest market for patient engagement solutions in Europe in 2022

TABLE 65 GERMANY: MARKET, BY COMPONENT, 2020–2027

TABLE 66 GERMANY: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 67 GERMANY: MARKET, BY END USER, 2020–2027

TABLE 68 GERMANY: MARKET, BY APPLICATION, 2020–2027

TABLE 69 GERMANY: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3.2 FRANCE

12.3.2.1 Digital health insurance startups in France to drive the market growth for patient engagement solutions

TABLE 70 FRANCE: MARKET, BY COMPONENT, 2020–2027

TABLE 71 FRANCE: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 72 FRANCE: MARKET, BY END USER, 2020–2027

TABLE 73 FRANCE: MARKET, BY APPLICATION, 2020–2027

TABLE 74 FRANCE: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3.3 UK

12.3.3.1 Favorable government initiatives to promote healthcare to support market growth in the UK

TABLE 75 UK: MARKET, BY COMPONENT, 2020–2027

TABLE 76 UK: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 77 UK: MARKET, BY END USER, 2020–2027

TABLE 78 UK: MARKET, BY APPLICATION, 2020–2027

TABLE 79 UK: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3.4 SPAIN

12.3.4.1 Data security concerns restrict the market growth in Spain

TABLE 80 SPAIN: MARKET, BY COMPONENT, 2020–2027

TABLE 81 SPAIN: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 82 SPAIN: MARKET, BY END USER, 2020–2027

TABLE 83 SPAIN: MARKET, BY APPLICATION, 2020–2027

TABLE 84 SPAIN: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3.5 ITALY

12.3.5.1 The growing burden of chronic diseases in Italy drives the demand for patient engagement solutions

TABLE 85 ITALY: MARKET, BY COMPONENT, 2020–2027

TABLE 86 ITALY: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 87 ITALY: MARKET, BY END USER, 2020–2027

TABLE 88 ITALY: MARKET, BY APPLICATION, 2020–2027

TABLE 89 ITALY: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.3.6 REST OF EUROPE (ROE)

TABLE 90 ROE: MARKET, BY COMPONENT, 2020–2027

TABLE 91 ROE: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 92 ROE: MARKET, BY END USER, 2020–2027

TABLE 93 ROE: MARKET, BY APPLICATION, 2020–2027

TABLE 94 ROE: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.4 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027

TABLE 96 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2027

TABLE 97 ASIA PACIFIC: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 98 ASIA PACIFIC: MARKET, BY END USER, 2020–2027

TABLE 99 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027

TABLE 100 ASIA PACIFIC: MARKET, BY THERAPEUTIC AREA, 2020–2027

TABLE 101 ASIA PACIFIC: MARKET, BY FUNCTIONALITY, 2020–2027

12.4.1 JAPAN

12.4.1.1 The rising geriatric population in Japan supports the market growth for patient engagement solutions

TABLE 102 JAPAN: MARKET, BY COMPONENT, 2020–2027

TABLE 103 JAPAN: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 104 JAPAN: MARKET, BY END USER, 2020–2027

TABLE 105 JAPAN: MARKET, BY APPLICATION, 2020–2027

TABLE 106 JAPAN: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.4.2 CHINA

12.4.2.1 Implementation of EMR solutions in healthcare by the Chinese government is expected to drive the demand for patient engagement solutions

TABLE 107 CHINA: MARKET, BY COMPONENT, 2020–2027

TABLE 108 CHINA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 109 CHINA: MARKET, BY END USER, 2020–2027

TABLE 110 CHINA: MARKET, BY APPLICATION, 2020–2027 USD MILLION)

TABLE 111 CHINA: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.4.3 INDIA

12.4.3.1 High burden of chronic diseases to support the market growth for patient engagement solutions

TABLE 112 INDIA: MARKET, BY COMPONENT, 2020–2027

TABLE 113 INDIA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 114 INDIA: MARKET, BY END USER, 2020–2027

TABLE 115 INDIA: MARKET, BY APPLICATION, 2020–2027

TABLE 116 INDIA: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 117 ROAPAC: MARKET, BY COMPONENT, 2020–2027

TABLE 118 ROAPAC: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 119 ROAPAC: MARKET, BY END USER, 2020–2027

TABLE 120 ROAPAC: MARKET, BY APPLICATION, 2020–2027

TABLE 121 ROAPAC: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.5 REST OF THE WORLD

TABLE 122 REST OF THE WORLD: MARKET, BY REGION, 2020–2027

TABLE 123 ROW: MARKET, BY COMPONENT, 2020–2027

TABLE 124 ROW: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 125 ROW: MARKET, BY END USER, 2020–2027

TABLE 126 ROW: MARKET, BY APPLICATION, 2020–2027

TABLE 127 ROW: MARKET, BY THERAPEUTIC AREA, 2020–2027

TABLE 128 ROW: MARKET, BY FUNCTIONALITY, 2020–2027

12.5.1 LATIN AMERICA

12.5.1.1 Developments in healthcare infrastructure to support the market growth

TABLE 129 LATIN AMERICA: MARKET, BY COMPONENT, 2020–2027

TABLE 130 LATIN AMERICA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 131 LATIN AMERICA: MARKET, BY END USER, 2020–2027

TABLE 132 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027

TABLE 133 LATIN AMERICA: MARKET, BY THERAPEUTIC AREA, 2020–2027

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 Rising government support to drive the market growth for patient engagement solutions in the MEA

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2020–2027

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY DELIVERY MODE, 2020–2027

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027

TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY THERAPEUTIC AREA, 2020–2027

13 COMPETITIVE LANDSCAPE (Page No. - 150)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE MARKET

13.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 22 REVENUE ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

13.4 MARKET RANKING

FIGURE 23 GLOBAL MARKET RANKING, BY KEY PLAYER, 2021

13.5 COMPETITIVE BENCHMARKING

TABLE 139 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 140 GLOBAL MARKET: DETAILED LIST OF KEY STARTUP/SMES

13.6 COMPETITIVE LEADERSHIP MAPPING

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 24 GLOBAL MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

13.7 COMPETITIVE LEADERSHIP MAPPING – START-UP/SME

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 25 COMPETITIVE LEADERSHIP MAPPING, START-UP/SME MATRIX MARKET

13.8 COMPETITIVE SITUATIONS AND TRENDS

13.8.1 PRODUCT LAUNCHES

13.8.2 DEALS

14 COMPANY PROFILES (Page No. - 166)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 IBM

TABLE 141 IBM: BUSINESS OVERVIEW

FIGURE 26 IBM: COMPANY SNAPSHOT (2021)

14.1.2 MCKESSON CORPORATION

TABLE 142 MCKESSON CORPORATION: BUSINESS OVERVIEW

FIGURE 27 MCKESSON CORPORATION: COMPANY SNAPSHOT (2021)

14.1.3 ALLSCRIPTS HEALTHCARE SOLUTIONS INC

TABLE 143 ALLSCRIPTS HEALTHCARE SOLUTIONS INC: BUSINESS OVERVIEW

FIGURE 28 ALLSCRIPTS HEALTHCARE, LLC: COMPANY SNAPSHOT (2021)

14.1.4 ATHENAHEALTH

TABLE 144 ATHENAHEALTH: BUSINESS OVERVIEW

14.1.5 ORION HEALTH

TABLE 145 ORION HEALTH: BUSINESS OVERVIEW

14.1.6 CERNER CORPORATION

TABLE 146 CERNER: BUSINESS OVERVIEW

FIGURE 29 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

TABLE 147 GETWELL NETWORK INC: BUSINESS OVERVIEW

14.1.8 LINCOR SOLUTIONS

TABLE 148 LINCOR SOLUTIONS: BUSINESS OVERVIEW

14.1.9 COGNIZANT

TABLE 149 COGNIZANT: BUSINESS OVERVIEW

FIGURE 30 COGNIZANT: COMPANY SNAPSHOT (2020)

14.1.10 HARRIS HEALTHCARE

TABLE 150 HARRIS HEALTHCARE: BUSINESS OVERVIEW

14.2 OTHER KEY PLAYERS

14.2.1 GET REAL HEALTH

14.2.2 ONEVIEW HEALTHCARE

14.2.3 ADVANCEDMD

14.2.4 EPIC SYSTEMS CORPORATION

14.2.5 MEDITECH

14.2.6 KAREO

14.2.7 ECLINICAL WORKS

14.2.8 WELLSTACK

14.2.9 IQVIA

14.2.10 VIVIFY HEALTH

14.2.11 MEDHOST

14.2.12 VALIDIC

14.2.13 CUREMD HEALTHCARE

14.2.14 MEDISYSINC.COM

14.2.15 PATIENTPOINT, LLC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 204)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

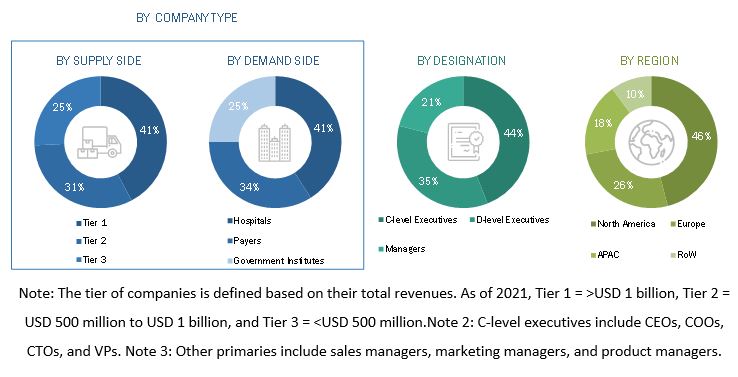

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Patient Engagement Solutions market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and AAHM. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Patient Engagement Solutions Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of patient engagement solutions products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the patient engagement solutions market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market

Report Objectives

- To define, describe, and forecast the global patient engagement solutions market based on component, delivery mode, application, therapeutic area, functionality, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure and profile the key players of the market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Latin America and the Middle East & Africa)

- To track and analyze competitive developments such as product launches, acquisitions, partnerships, agreements, and collaborations in the patient engagement solutions market during the forecast period

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Engagement Solutions Market

What will be the value for the global Patient Engagement Solutions Market in 2030?

Which of the geographical segment holds the major share of the Patient Engagement Solutions Market?