Personal Protective Equipment Market by Type (Hands & Arm Protection, Protective Clothing, Foot & Leg Protection, Respiratory Protection, Head Protection), End-Use Industry (Manufacturing, Construction, Oil & Gas, Healthcare) - Global Forecast to 2027

Personal Protective Equipment Market

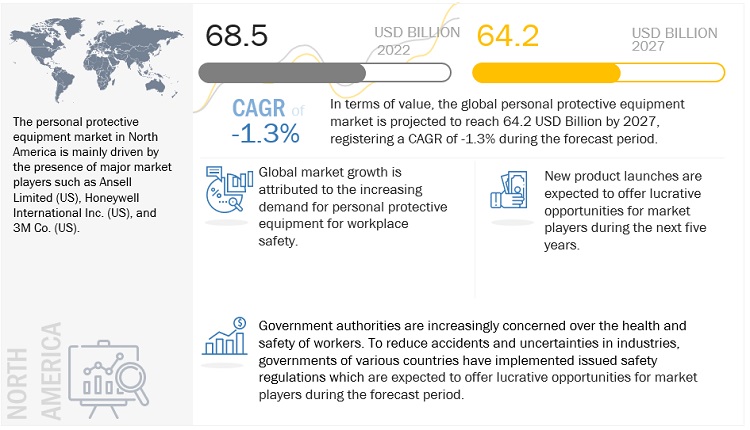

The global personal protective equipment market was USD 68.5 billion in 2022 and is projected to reach USD 64.2 billion by 2027, at a cagr -1.3% from 2022 to 2027. Increasing demand for personal protective equipment in manufacturing and construction industry is the major factors driving the market growth. Personal protective equipment protects workers from workplace hazards and injuries. Instances of non-compliance in the use of personal protective equipment are increasing. According to the respiratory protection standard, 29 CFR 1910.134, of the U.S. Occupational Safety and Health Administration (OSHA), it is mandatory for employers to have a complete respiratory program. Workers who wear respiratory protection must participate in written respiratory programs, and follow OSHA’s guidelines which include medical evaluation, respirator fit testing, and training. The rising concerns of both, the employer and employee regarding safety at the workplace is driving the market for personal protective equipment such as protective gloves, full-body suits, safety boots, elbow protectors’ safety spectacles, and welding shields, globally.

Attractive Opportunities in the Personal Protective Equipment Market

To know about the assumptions considered for the study, Request for Free Sample Report

Personal Protective Equipment Market Dynamics

Driver: Stringent regulations in developed economies

During the COVID-19 crisis, the U.S. Food and Drug Administration issued the Emergency Use Authorization (EUA) under section 564 of the Federal Food, Drug, and Cosmetic Act in response to the shortage of face shields, protective gloves, and other PPE for healthcare professionals as personal protective equipment as directed by the Centers for Disease Control and Prevention (CDC) to cover the front and side of a face during the COVID-19 pandemic. These PPE kits help in limiting the transmission of SARS-CoV-2 from patients to healthcare professionals and vice versa. The face shield provides greater protection as compared to the mask by reducing the risk of self-contamination and enables facial non-verbal communication.

Restraint: Reduced demand due to decreasing Covid-19 cases

The sudden surge in demand for face masks is attributed to the COVID-19 pandemic. According to the WHO, the pandemic is expected to end after approximately 70% of the world's population has been vaccinated. The course of the pandemic is expected to depend significantly upon the spread of new variants of the virus and the time period for which the immune system is able to protect after vaccination or recovery from infection. With the end of the COVID-19 pandemic, the global mandates for the usage of face masks, face shields, PPE kits, and other equipment are also expected to see withdrawal. Therefore, the demand for personal protective equipment could decline significantly, resulting in restricted future growth for the personal protective equipment market.

Opportunity: Growing healthcare industry in emerging economies

Emerging economies such as India, Brazil, China, and South Africa provide significant opportunities for players in the personal protective equipment market. According to the United Nations World Population Prospects, by 2025, approximately half a billion people in the Asia Pacific region are expected to be aged 65 years or older. The need for improved healthcare services in these economies is mainly driven by the rapidly increasing aging population, high patient numbers, growing per capita income, and rising awareness. A growing middle-class population, coupled with new diseases such as COVID-19, are boosting the demand for healthcare and health insurance coverage. The private sector has benefited significantly from the growth in demand for healthcare. This is an encouraging sign as far as the market for personal protective equipment and the use of face masks, face shields, protective clothing, protective gloves, and others in the hospital industry is concerned.

Challenge: Increased comfort along with functionality

One of the major challenges for personal protective equipment manufacturers is to provide comfortable and multi-functional personal protective equipment. Due to the changing nature of applications, customers demand equipment with more functionalities. Customers are focusing on acquiring multi-functional fire-resistant protective clothing serving more than one function. The current issue in the market is to make appropriate use of materials and fabrics for manufacturing protective apparel and gloves more comfortable for the persons wearing them without compromising upon the functionalities.

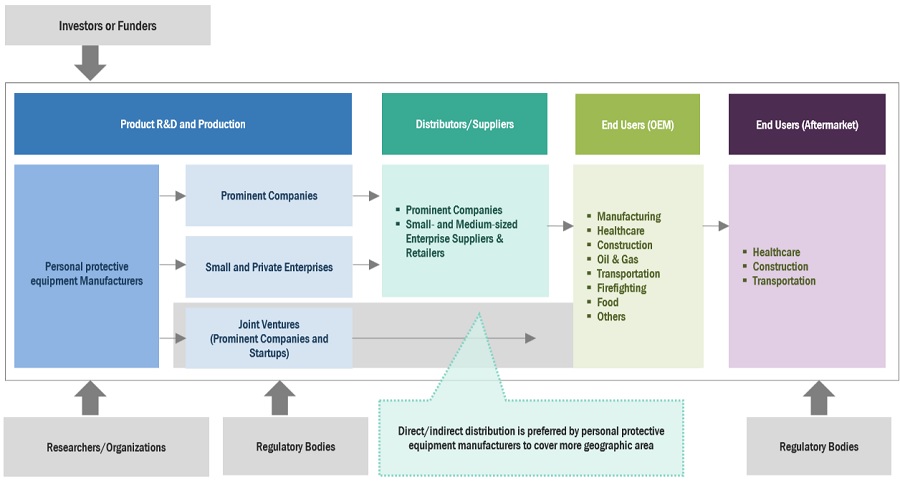

Personal Protective Equipment Ecosystem

“Head protection is projected to be the fastest-growing type during the forecast period”

Head protection is an integral component to ensure workplace safety. Head protection is required by different individuals such as carpenters, electricians, plumbers, welders, and linemen, among others. Wearing a safety helmet or hard hat is the easiest way to protect an employee from head injuries. Protective helmets or hard hats are used to resist penetration by objects and absorb the shocks of blows. Hard hats or industrial safety helmets are used to protect against swinging objects and materials falling from heights. They also offer protection while working near exposed electrical conductors by reducing electrical shocks. All these factors are expected to drive the market demand.

“Healthcare was the largest personal protective equipment application in 2021 in terms of value”

The increased emphasis on the safety of personnel is driving the market. The healthcare segment dominated the overall market in 2020 and 2021. During the COVID-19 pandemic, most industries experienced a slowdown due to stringent measures taken by governments such as lockdowns, labor shortages, supply chain failures, and financial crises. The rising prevalence of COVID-19 was a key contributor to the increase in the use of personal protective equipment globally. Factors such as the increasing demand for hospital beds and ICUs in countries with increasing incidences of COVID-19 and an increasing number of temporary hospitals are driving the demand for personal protective equipment in hospitals while treating patients.

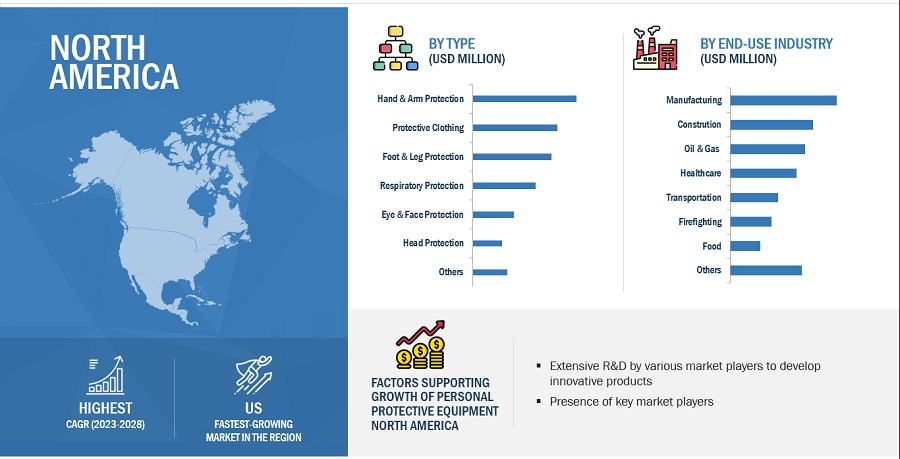

“North America accounted for the largest share of the global personal protective equipment market in 2021”

North America is the largest personal protective equipment market. This can primarily be attributed to the COVID-19 outbreak and the rise in consumer awareness across the globe. Government initiatives for the safety of personnel in various industries are driving market demand.

The personal protective equipment market in North America is majorly driven by the presence of major market players such as Ansell Limited (US), Honeywell International Inc. (US), and 3M Company (US). The personal protective equipment market in North America is highly fragmented as many small & medium-sized companies are operating in this market. The growing automotive industry and increasing demand from the residential construction sector are driving the market in North America

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Personal Protective Equipment Market Players

Honeywell International Inc. (US), DuPont De Nemours, Inc. (US), 3M Company (US), Lakeland Industries, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Sioen Industries NV (Belgium), Radians Inc. (US), Kimberly-Clark Corporation (US), Ansell Ltd. (Australia), and MSA Safety Inc. (US), among others are the major players in this market.

Personal Protective Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 68.5 Billion |

|

Revenue Forecast in 2027 |

USD 64.2 Billion |

|

CAGR |

-1.3% |

|

Years considered for the study |

2017 – 2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments covered |

Type, End-use industry and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa and South America |

|

Companies profiled |

Honeywell International Inc. (US), DuPont De Nemours, Inc. (US), 3M Company (US), Lakeland Industries, Inc. (US), Alpha Pro Tech, Ltd. (Canada), Sioen Industries NV (Belgium), Radians Inc. (US), Kimberly-Clark Corporation (US), Ansell Ltd. (Australia), and MSA Safety Inc. (US), among others |

This report categorizes the global personal protective equipment market based on type, end-use industry and region.

On the basis of type:

- Hand & Arm Protection

- Disposable gloves

- Reusable gloves

- Others (wrist cuffs & armlets, elbow protectors, mitts, barrier creams)

- Protective Clothing

- Disposable protective clothing

- Reusable protective clothing

- Foot & Leg Protection

- Respiratory Protection

- Disposable face masks

- Reusable face masks

- Others (Breathing apparatus, air purifying respirators, supplied air respirators)

- Eye & Face Protection

- Head Protection

- Others

On the basis of end-use industry:

- Manufacturing

- Construction

- Oil & Gas

- Healthcare

- Transportation

- Firefighting

- Food

- Others

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments:

- In May, 2022, Honeywell International Inc. launched two new NIOSH-certified respiratory offerings DC365 & RU8500X series masks to help meet the needs of healthcare workers. The new products expand Honeywell’s personal protective equipment (PPE) portfolio.

- In February 2022, Honeywell International Inc. announced a commercial partnership with AstraZeneca to develop next-generation respiratory inhalers that use near-zero global warming potential (GWP) propellants to treat asthma and chronic obstructive pulmonary disease (COPD).

- In September 2020, Honeywell International Inc. announced that NFL's Carolina Panthers and Honeywell International Inc. are collaborating to create a safer stadium experience by offering individual personal protective equipment (PPE) packs for Panthers fans and staff, as well as deploying air quality monitoring solutions, via a custom real-time Healthy Buildings dashboard.

- In August 2020, DuPont de Nemours, Inc. announced collaboration with Home Depot (US) to donate rolls of Tyvek 1222A to Kaiser Permanente to manufacture PPE products for the COVID-19 crisis.

- In April 2020, DuPont de Nemours, Inc. expanded its business by launching a new program, TyvekTogether, to increase the overall availability of Tyvek personal protective garments in the company's continued efforts to help combat the spread of COVID-19 and protect healthcare workers. The company is expected to supply Tyvek material to other PPE manufacturers in the COVID-19 scenario.

- In May 2022, 3M Company announced an expansion to grow its plant in Valley, Nebraska. The Company is investing approximately USD 58 million to fund the 80,000 square foot expansion that is expected to create approximately 50 new jobs at the facility. This facility is expected to produce respiratory and hearing protection products.

Frequently Asked Questions (FAQ):

What are the high growth type of personal protective equipment?

Head Protection is the largest type in terms of value, in the global personal protective equipment market in 2021.

Which is the largest application of personal protective equipment?

Healthcare holds the largest market share in personal protective equipment market, in terms of value, in 2021,

What are the major factors impacting market growth during the forecast period?

The market growth is impacted majorly due to increased automation in end-use industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.3.2 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.4 STUDY SCOPE

1.4.1 PERSONAL PROTECTIVE EQUIPMENT MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 PERSONAL PROTECTIVE EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews–demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

2.3 DATA TRIANGULATION

FIGURE 5 PERSONAL PROTECTIVE EQUIPMENT MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 8 HAND & ARM SEGMENT LED PERSONAL PROTECTIVE EQUIPMENT MARKET IN 2021

FIGURE 9 HEALTHCARE TO BE LARGEST END-USE INDUSTRY

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 BRIEF OVERVIEW OF PERSONAL PROTECTIVE EQUIPMENT MARKET

FIGURE 11 HAND & ARM PROTECTION TYPE TO DRIVE MARKET

4.2 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY REGION

FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET

4.3 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY AND COUNTRY (2021)

FIGURE 13 HEALTHCARE SEGMENT AND US ACCOUNTED FOR LARGEST SHARES

4.4 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, END-USE INDUSTRY VS. REGION

FIGURE 14 HEALTHCARE END-USE INDUSTRY LED MARKET IN 2021

4.5 PERSONAL PROTECTIVE EQUIPMENT MARKET: BY MAJOR COUNTRIES

FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PERSONAL PROTECTIVE EQUIPMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Outbreak of COVID-19 pandemic

TABLE 1 FACE MASK MANDATES, BY COUNTRY

5.2.1.2 Surge in social media marketing

FIGURE 17 FACE MASK KEYWORD COUNT ON GOOGLE, 2018–2021

5.2.1.3 Rising awareness about importance of workplace safety

TABLE 2 DIRECT AND HIDDEN COSTS OF WORKPLACE ACCIDENTS

5.2.1.4 Stringent regulations in developed economies

5.2.1.5 Massive industrial growth in Asia Pacific and Middle East & Africa

5.2.2 RESTRAINTS

5.2.2.1 Reduced demand due to decreasing COVID-19 cases

5.2.2.2 Increased automation in end-use industries

5.2.2.3 High price of specialized clothing

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare industry in emerging economies

FIGURE 18 GROWTH OF HEALTHCARE INDUSTRY IN INDIA (2016-2022)

5.2.3.2 Demand for multipurpose equipment

5.2.4 CHALLENGES

5.2.4.1 Increased comfort along with functionality

5.2.4.2 Adverse effect on environment

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 PERSONAL PROTECTIVE EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 4 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2019–2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 69)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 20 PERSONAL PROTECTIVE EQUIPMENT: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURERS

6.1.3 DISTRIBUTION

6.1.4 END-USE INDUSTRIES

6.2 PERSONAL PROTECTIVE EQUIPMENT MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 21 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 5 PERSONAL PROTECTIVE EQUIPMENT MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.3.1 REVENUE SHIFTS & REVENUE POCKETS FOR PERSONAL PROTECTIVE EQUIPMENT MARKET

FIGURE 22 REVENUE SHIFT FOR PERSONAL PROTECTIVE EQUIPMENT MARKET

6.4 CONNECTED MARKETS: ECOSYSTEM

TABLE 6 PERSONAL PROTECTIVE EQUIPMENT MARKET: ECOSYSTEM

FIGURE 23 PERSONAL PROTECTIVE EQUIPMENT: ECOSYSTEM

6.5 CASE STUDY ANALYSIS

6.5.1 CASE STUDY ON THERMA

6.5.2 CASE STUDY ON USE OF FACE MASKS (RESPIRATORS) IN FOUNDRIES FOR RESPIRATORY PROTECTION

6.5.3 ROLE OF FACE MASKS IN MITIGATING SPREAD OF COVID-19

6.6 TRADE DATA STATISTICS

6.6.1 IMPORT SCENARIO OF PERSONAL PROTECTIVE EQUIPMENT

FIGURE 24 IMPORT OF PERSONAL PROTECTIVE EQUIPMENT, BY KEY COUNTRIES

TABLE 7 IMPORT OF PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2017–2021 (USD MILLION)

6.6.2 EXPORT SCENARIO OF PERSONAL PROTECTIVE EQUIPMENT

FIGURE 25 EXPORT OF PERSONAL PROTECTIVE EQUIPMENT, BY KEY COUNTRIES

TABLE 8 EXPORT OF PERSONAL PROTECTIVE EQUIPMENT, BY REGION, 2017–2021 (USD MILLION)

6.7 KEY STAKEHOLDERS AND BUYING CRITERIA

6.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

6.7.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

6.8 REGULATORY LANDSCAPE

6.8.1 REGULATIONS RELATED TO PERSONAL PROTECTIVE EQUIPMENT

6.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 11 PERSONAL PROTECTIVE EQUIPMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.10 PATENT ANALYSIS

6.10.1 APPROACH

6.10.2 PATENT STATUS

TABLE 12 TOTAL NUMBER OF PATENTS DURING LAST 11 YEARS (2011–2021)

FIGURE 28 PATENTS REGISTERED IN PERSONAL PROTECTIVE EQUIPMENT MARKET, 2011–2021

FIGURE 29 PATENT PUBLICATION TRENDS, 2011–2021

FIGURE 30 LEGAL STATUS OF PATENTS FILED IN PERSONAL PROTECTIVE EQUIPMENT MARKET

6.10.3 JURISDICTION ANALYSIS

FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA

6.10.4 TOP APPLICANTS

FIGURE 32 SEMICONDUCTOR ENERGY LABORATORY CO. LTD REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 13 PATENTS BY SEMICONDUCTOR ENERGY LABORATORY CO. LTD.

TABLE 14 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

TABLE 15 TOP 10 PATENT OWNERS IN US, 2011–2021

7 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 33 HAND & ARM PROTECTION SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

TABLE 16 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 17 SAFETY STANDARDS FOR INDUSTRIES

TABLE 18 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

7.2 HAND & ARM PROTECTION EQUIPMENT

7.2.1 REGULATIONS TO PREVENT SPREAD OF COVID-19

FIGURE 34 NORTH AMERICA TO DOMINATE HAND & ARM PROTECTION EQUIPMENT MARKET

TABLE 19 HAND & ARM PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 HAND & ARM PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.2.2 DISPOSABLE GLOVES

7.2.3 REUSABLE GLOVES

7.2.4 OTHERS

7.2.4.1 Wrist cuffs & armlets

7.2.4.2 Elbow protectors

7.2.4.3 Mitts

7.2.4.4 Barrier creams

7.3 PROTECTIVE CLOTHING

7.3.1 DISPOSABLE PROTECTIVE CLOTHING TO PREVENT SPREAD OF COVID-19

FIGURE 35 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR

TABLE 21 PROTECTIVE CLOTHING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 PROTECTIVE CLOTHING MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.3.2 DISPOSABLE PROTECTIVE CLOTHING

7.3.3 REUSABLE PROTECTIVE CLOTHING

7.4 FOOT & LEG PROTECTION EQUIPMENT

7.4.1 PROTECTION IN VARIOUS INDUSTRIES

FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING FOOT & LEG PROTECTION EQUIPMENT MARKET

TABLE 23 FOOT & LEG PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 FOOT & LEG PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5 RESPIRATORY PROTECTION EQUIPMENT

7.5.1 INCREASED USE OF RESPIRATORS IN HOSPITALS

FIGURE 37 EUROPE TO BE SECOND-LARGEST RESPIRATORY PROTECTION EQUIPMENT MARKET

TABLE 25 RESPIRATORY PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 RESPIRATORY PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5.2 DISPOSABLE FACE MASKS

7.5.3 REUSABLE FACE MASKS

7.5.4 OTHERS

7.6 EYE & FACE PROTECTION EQUIPMENT

7.6.1 DEMAND FROM CHEMICAL, MANUFACTURING, AND CONSTRUCTION INDUSTRIES

FIGURE 38 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING EYE & FACE PROTECTION EQUIPMENT MARKET

TABLE 27 EYE & FACE PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 EYE & FACE PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.6.2 SAFETY SPECTACLES

7.6.3 WELDING SHIELDS

7.6.4 OTHERS

7.6.4.1 Safety goggles

7.6.4.2 Face shields

7.7 HEAD PROTECTION EQUIPMENT

7.7.1 REGULATIONS IN WORKPLACE SAFETY FUELING DEMAND

FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING HEAD PROTECTION EQUIPMENT MARKET

TABLE 29 HEAD PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 HEAD PROTECTION EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.8 OTHER PERSONAL PROTECTIVE EQUIPMENT

FIGURE 40 NORTH AMERICA TO DOMINATE OTHER PERSONAL PROTECTIVE EQUIPMENT MARKET DURING FORECAST PERIOD

TABLE 31 OTHER PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 OTHER PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.8.1 FALL PROTECTION

7.8.1.1 Full body harnesses

7.8.1.2 Others

7.8.2 HEARING PROTECTION

7.8.2.1 Earplugs

7.8.2.2 Others

8 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY (Page No. - 108)

8.1 INTRODUCTION

FIGURE 41 FOOD END-USE INDUSTRY TO BE FASTEST-GROWING BETWEEN 2022 AND 2027

TABLE 33 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 34 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

8.2 MANUFACTURING

8.2.1 INCREASING INDUSTRIAL ACTIVITIES TO DRIVE MARKET

FIGURE 42 NORTH AMERICA TO DOMINATE MANUFACTURING END-USE INDUSTRY

TABLE 35 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN MANUFACTURING END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN MANUFACTURING END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.3 CONSTRUCTION

8.3.1 INCREASING INVESTMENTS TO DRIVE MARKET

FIGURE 43 NORTH AMERICA TO LEAD CONSTRUCTION END-USE INDUSTRY

TABLE 37 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.4 OIL & GAS

8.4.1 LIFE-THREATENING HAZARDS TO TRIGGER DEMAND

FIGURE 44 MIDDLE EAST & AFRICA TO GROW AT SECOND-HIGHEST CAGR IN OIL & GAS END-USE INDUSTRY

TABLE 39 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.5 HEALTHCARE

8.5.1 HARMFUL DISEASES AND INCREASING HEALTHCARE INFRASTRUCTURE TO BOOST MARKET

FIGURE 45 EUROPE TO ACCOUNT FOR SECOND-LARGEST HEALTHCARE END-USE INDUSTRY

TABLE 41 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.6 TRANSPORTATION

8.6.1 GROWING AUTOMOTIVE INDUSTRY FUELING GROWTH

FIGURE 46 ASIA PACIFIC TO BE FASTEST-GROWING TRANSPORTATION END-USE INDUSTRY

TABLE 43 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN TRANSPORTATION END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.7 FIREFIGHTING

8.7.1 PROTECTION FROM VARIOUS HAZARDS TO DRIVE MARKET

FIGURE 47 SOUTH AMERICA TO GROW AT SECOND-HIGHEST CAGR IN FIREFIGHTING END-USE INDUSTRY

TABLE 45 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN FIREFIGHTING END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN FIREFIGHTING END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.8 FOOD

8.8.1 RISING POPULATION AND DEMAND FOR HEALTHY FOOD TO SUPPORT MARKET GROWTH

FIGURE 48 SOUTH AMERICA TO GROW AT SECOND-HIGHEST CAGR IN FOOD END-USE INDUSTRY

TABLE 47 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN FOOD END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN FOOD END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

8.9 OTHERS

FIGURE 49 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN OTHER END-USE INDUSTRIES

TABLE 49 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

9 PERSONAL PROTECTIVE EQUIPMENT MARKET, BY REGION (Page No. - 124)

9.1 INTRODUCTION

FIGURE 50 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

TABLE 51 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 51 ASIA PACIFIC MARKET SNAPSHOT

9.2.1 ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

TABLE 53 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 54 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.2.2 ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

TABLE 55 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 56 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3 ASIA PACIFIC PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY

TABLE 57 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 58 ASIA PACIFIC: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

9.2.3.1 China

9.2.3.1.1 Availability of raw material and low-cost labor

TABLE 59 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 61 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 62 CHINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.2 Japan

9.2.3.2.1 Growth in food, healthcare, construction, and automotive industries

TABLE 63 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 64 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 65 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 66 JAPAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.3 India

9.2.3.3.1 Entry of global auto manufacturers and increasing infrastructure activities

TABLE 67 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 68 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 69 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 70 INDIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.4 South Korea

9.2.3.4.1 Rapid industrialization and technological advancements

TABLE 71 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 73 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 74 SOUTH KOREA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.5 Indonesia

9.2.3.5.1 Growth in oil & gas and industrial sectors

TABLE 75 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 77 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 78 INDONESIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.6 Australia

9.2.3.6.1 Growth of healthcare and mining industries

TABLE 79 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 81 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 82 AUSTRALIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.7 Thailand

9.2.3.7.1 Social and economic development

TABLE 83 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 85 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 86 THAILAND: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.2.3.8 Malaysia

9.2.3.8.1 Large industrial sector to propel demand

TABLE 87 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 89 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 90 MALAYSIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 52 NORTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET SNAPSHOT

9.3.1 NORTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

TABLE 91 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.3.2 NORTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

TABLE 93 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3.3 NORTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY

TABLE 95 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

9.3.3.1 US

9.3.3.1.1 Presence of key players to drive market

TABLE 97 US: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 US: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 99 US: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 100 US: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3.3.2 Canada

9.3.3.2.1 Increase in number of surgeries to drive demand

TABLE 101 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 103 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 104 CANADA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.3.3.3 Mexico

9.3.3.3.1 Low labor cost and free trade agreements to drive market

TABLE 105 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 107 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 108 MEXICO: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4 EUROPE

FIGURE 53 EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET SNAPSHOT

9.4.1 EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

TABLE 109 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 110 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.4.2 EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

TABLE 111 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 112 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3 EUROPE PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY

TABLE 113 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 EUROPE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

9.4.3.1 Germany

9.4.3.1.1 Government emphasis on safety of industrial workers

TABLE 115 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 117 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 118 GERMANY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3.2 UK

9.4.3.2.1 Economic growth and increase in consumer spending

TABLE 119 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 120 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 121 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 122 UK: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3.3 France

9.4.3.3.1 Developments in end-use industries

TABLE 123 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 124 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 125 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 126 FRANCE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3.4 Italy

9.4.3.4.1 Economic recovery to support market growth

TABLE 127 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 129 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 130 ITALY: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.4.3.5 Spain

9.4.3.5.1 Increasing construction activities and foreign investments

TABLE 131 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 132 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 133 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 134 SPAIN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

TABLE 135 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

TABLE 137 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3 MIDDLE EAST & AFRICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY

TABLE 139 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

9.5.3.1 Saudi Arabia

9.5.3.1.1 Growth of oil & gas and healthcare industries

TABLE 141 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 142 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 143 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 144 SAUDI ARABIA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3.2 UAE

9.5.3.2.1 Increased investments in construction industry

TABLE 145 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 146 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 147 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 148 UAE: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3.3 Iran

9.5.3.3.1 Rising government expenditure on infrastructure development

TABLE 149 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 150 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 151 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 152 IRAN: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3.4 Egypt

9.5.3.4.1 Economic growth and infrastructure development

TABLE 153 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 154 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 155 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 156 EGYPT: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.5.3.5 South Africa

9.5.3.5.1 Increasing workplace injuries

TABLE 157 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 158 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 159 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 160 SOUTH AFRICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 SOUTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY TYPE

TABLE 161 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 162 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.6.2 SOUTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY END-USE INDUSTRY

TABLE 163 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 164 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6.3 SOUTH AMERICA PERSONAL PROTECTIVE EQUIPMENT MARKET, BY COUNTRY

TABLE 165 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 166 SOUTH AMERICA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

9.6.3.1 Brazil

9.6.3.1.1 Economic growth to drive demand

TABLE 167 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 168 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 169 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 170 BRAZIL: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

9.6.3.2 Argentina

9.6.3.2.1 Regulatory mandates for use of personal protective equipment

TABLE 171 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 173 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 174 ARGENTINA: PERSONAL PROTECTIVE EQUIPMENT MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 197)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 54 RANKING OF TOP FIVE PLAYERS IN PERSONAL PROTECTIVE EQUIPMENT MARKET, 2021

10.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 175 PERSONAL PROTECTIVE EQUIPMENT MARKET: DEGREE OF COMPETITION

FIGURE 55 HONEYWELL INTERNATIONAL INC. LED PERSONAL PROTECTIVE EQUIPMENT MARKET IN 2021

10.3.2.1 Honeywell International Inc.

10.3.2.2 The 3M Company

10.3.2.3 DuPont De Nemours

10.3.2.4 Ansell Ltd.

10.3.2.5 Kimberly-Clark Corporation

10.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 56 REVENUE ANALYSIS OF KEY COMPANIES FOR LAST FIVE YEARS

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 57 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY FOOTPRINT

TABLE 176 PERSONAL PROTECTIVE EQUIPMENT MARKET: TYPE FOOTPRINT

TABLE 177 PERSONAL PROTECTIVE EQUIPMENT MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 178 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPANY REGION FOOTPRINT

10.5 COMPANY EVALUATION QUADRANT (TIER 1)

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PARTICIPANTS

FIGURE 58 COMPANY EVALUATION QUADRANT FOR PERSONAL PROTECTIVE EQUIPMENT MARKET (TIER 1)

10.6 COMPETITIVE BENCHMARKING

TABLE 179 PERSONAL PROTECTIVE EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 180 PERSONAL PROTECTIVE EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

FIGURE 59 STARTUP/SME EVALUATION QUADRANT FOR PERSONAL PROTECTIVE EQUIPMENT MARKET

10.8 COMPETITIVE SCENARIOS

10.8.1 DEALS

TABLE 181 PERSONAL PROTECTIVE EQUIPMENT MARKET: DEALS (2018–2022)

10.8.2 PRODUCT LAUNCHES

TABLE 182 PERSONAL PROTECTIVE EQUIPMENT MARKET: NEW PRODUCT LAUNCHES (2018–2022)

10.8.3 OTHER DEVELOPMENTS

TABLE 183 PERSONAL PROTECTIVE EQUIPMENT MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018–2022)

11 COMPANY PROFILES (Page No. - 219)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 HONEYWELL INTERNATIONAL INC.

FIGURE 60 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 184 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

11.1.2 DUPONT DE NEMOURS, INC.

FIGURE 61 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

TABLE 185 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

11.1.3 THE 3M COMPANY

FIGURE 62 THE 3M COMPANY: COMPANY SNAPSHOT

TABLE 186 THE 3M COMPANY: COMPANY OVERVIEW

11.1.4 LAKELAND INDUSTRIES, INC.

FIGURE 63 LAKELAND INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 187 LAKELAND INDUSTRIES, INC.: COMPANY OVERVIEW

11.1.5 ALPHA PRO TECH, LTD.

FIGURE 64 ALPHA PRO TECH, LTD.: COMPANY SNAPSHOT

TABLE 188 ALPHA PRO TECH, LTD.: COMPANY OVERVIEW

11.1.6 SIOEN INDUSTRIES NV

TABLE 189 SIOEN INDUSTRIES NV: COMPANY OVERVIEW

11.1.7 RADIANS, INC.

TABLE 190 RADIANS, INC.: COMPANY OVERVIEW

11.1.8 KIMBERLY-CLARK CORPORATION

FIGURE 65 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT

TABLE 191 KIMBERLY-CLARK CORPORATION: COMPANY OVERVIEW

11.1.9 ANSELL LIMITED

FIGURE 66 ANSELL LIMITED: COMPANY SNAPSHOT

TABLE 192 ANSELL LIMITED: COMPANY OVERVIEW

11.1.10 MSA SAFETY INC.

FIGURE 67 MSA SAFETY INC.: COMPANY SNAPSHOT

TABLE 193 MSA SAFETY INC.: COMPANY OVERVIEW

11.2 OTHER KEY MARKET PLAYERS

11.2.1 PROTECTIVE INDUSTRIAL PRODUCTS, INC.

TABLE 194 PROTECTIVE INDUSTRIAL PRODUCTS, INC.: COMPANY OVERVIEW

11.2.2 DELTA PLUS GROUP

TABLE 195 DELTA PLUS GROUP: COMPANY OVERVIEW

11.2.3 MOLDEX/METRIC AG & CO. KG.

TABLE 196 MOLDEX/METRIC AG & CO. KG.: COMPANY OVERVIEW

11.2.4 KLEIN TOOLS, INC.

TABLE 197 KLEIN TOOLS, INC.: COMPANY OVERVIEW

11.2.5 MCR SAFETY

TABLE 198 MCR SAFETY: COMPANY OVERVIEW

11.2.6 NATIONAL SAFETY APPAREL, INC.

TABLE 199 NATIONAL SAFETY APPAREL, INC.: COMPANY OVERVIEW

11.2.7 CORDOVA SAFETY PRODUCTS

TABLE 200 CORDOVA SAFETY PRODUCTS: COMPANY OVERVIEW

11.2.8 W. W. GRAINGER, INC.

TABLE 201 W. W. GRAINGER, INC.: COMPANY OVERVIEW

11.2.9 SAF-T-GARD INTERNATIONAL, INC.

TABLE 202 SAF-T-GARD INTERNATIONAL, INC.: COMPANY OVERVIEW

11.2.10 LINDSTROM GROUP

TABLE 203 LINDSTROM GROUP: COMPANY OVERVIEW

11.2.11 DYNAMIC SAFETY SOLUTIONS LTD

TABLE 204 DYNAMIC SAFETY SOLUTIONS LTD: COMPANY OVERVIEW

11.2.12 AVON PROTECTION PLC

TABLE 205 AVON PROTECTION PLC: COMPANY OVERVIEW

11.2.13 POLISON CORPORATION

TABLE 206 POLISON CORPORATION: COMPANY OVERVIEW

11.2.14 PAN TAIWAN ENTERPRISE CO., LTD.

TABLE 207 PAN TAIWAN ENTERPRISE CO., LTD.: COMPANY OVERVIEW

11.2.15 COFRA S.R.L.

TABLE 208 COFRA S.R.L.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 272)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 PROTECTIVE CLOTHING MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 PROTECTIVE CLOTHING MARKET, BY REGION

TABLE 209 PROTECTIVE CLOTHING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 210 PROTECTIVE CLOTHING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.3.3.1 North America

12.3.3.1.1 North America: Protective clothing market, by country

TABLE 211 NORTH AMERICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 212 NORTH AMERICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.2 Europe

12.3.3.2.1 Europe: Protective clothing market, by country

TABLE 213 EUROPE: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 214 EUROPE: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.3 Asia Pacific

12.3.3.3.1 Asia Pacific: Protective clothing market, by country

TABLE 215 ASIA PACIFIC: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 216 ASIA PACIFIC: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.4 Middle East & Africa

12.3.3.4.1 Middle East & Africa: Protective clothing market, by country

TABLE 217 MIDDLE EAST & AFRICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.5 South America

12.3.3.5.1 South America: Protective clothing market, by country

TABLE 219 SOUTH AMERICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 220 SOUTH AMERICA: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 279)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

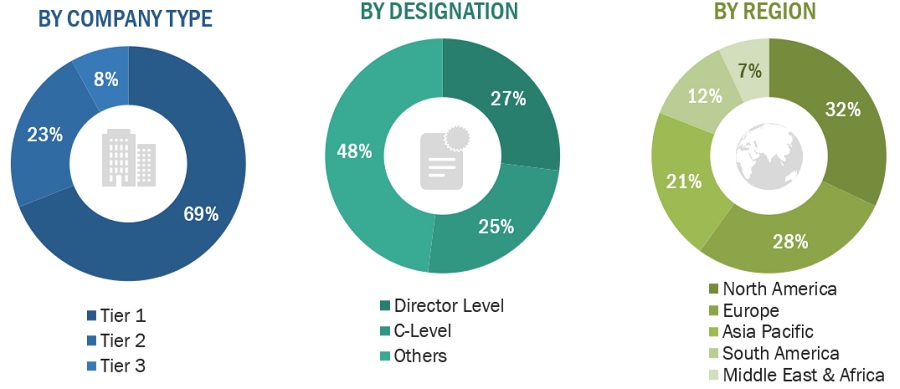

The study involved four major activities in estimating the market size for the personal protective equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The personal protective equipment market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of fertilizers, food, industrial, water treatment and other industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Notes: Other designations include sales managers, marketing managers, and product managers.

Tier 1: > USD 5 billion; Tier 2: USD 1 billion–USD 5 billion; and Tier 3: < USD 1 billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the personal protective equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food, pharmaceuticals, cosmetics, among other industries.

Report Objectives

- To analyze and forecast the size of the personal protective equipment market in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the personal protective equipment market based on type, and end-use industry.

- To forecast the size of the market segments for regions such as North America, Europe, Asia Pacific, Middle East & Africa and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Personal Protective Equipment Market