Polyhydroxyalkanoate (PHA) Market by Type (Short chain length, Medium Chain Lenth), Production Methods (Sugar Fermentation, Vegetable Oil Fermentation), Application (Packaging & Food Services, Biomedical) and Region - Global Forecast to 2028

Get the updated report with forecasts to 2028 : Inquire Now

The PHA market is projected to reach USD 167 million by 2027, at a cagr 15.3% from USD 81 million in 2022. The increasing focus on the reduction of non-degradable plastics is attributed to the implementation of stringent government norms and regulations regarding the use of petroleum-based plastics. The global demand for PHA from various applications including packaging & food services, biomedical, and agriculture is expected to increase significantly during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Green procurement policies

According to a recent report by the UN Environmental Programme, 66% countries worldwide have adopted some form of legislation to regulate the utilization of plastic bags, while only 8 (4%) of 192 countries assessed have banned the use of microbeads through national laws or regulations. UNEP launched a campaign in 2017 which was called Clean Seas, and, until the present, the campaign has garnered a commitment from over 50 countries representing over 60% of the world’s coastlines, including a commitment from India to eliminate single-use plastics by 2022. The European Union has also recently updated the list of Food Contact Materials Regulation (EU) No. 10/2011 on January 11, 2019, Commission Regulation (EU) 2019/37, which is expected to boost the use of PHA in the packaging & food services application.

Restraints: High price compared to conventional polymers

One of the key restraints to the growth of the market is the relatively higher cost of PHA than that of conventional polymers. Generally, the cost of production of biodegradable plastics such as PHA is 20% to 80% higher than conventional plastics. This is primarily due to the high cost of polymerization of biodegradable plastics, as most of the processes are still in the developmental stages. Hence, they have not achieved economies of scale.

Opportunities: Increasing scope in end-use segments

Similar to conventional plastics, there are a high number of applications of PHA-based plastics. The biodegradable plastics market is expected to witness significant growth in consumer goods packaging applications owing to the increasing focus on sustainability and favorable government regulations for green procurement policies. The packaging applications segment is expected to witness significant growth in compostable waste bags, biodegradable mulch films, catering products, film packaging, and rigid packaging.

Challenges: Manufacturing technology in initial phase

The current technology is as yet in the developmental stage, and various raw materials are being tested for the optimal production of PHA. Similarly, tests are being carried out to increase the performance of strains which attenuate the demand for PHAs. The recovery of PHA from biomass leads to high costs in purification and processing. Once the technology is finalized with the careful selection of raw materials, biological/natural strains, and purification technology, PHA production is expected to witness a significant surge. This is only possible if there is widespread production globally. Currently, production is sparsely distributed with the US and China, accounting for almost 90% share of the total PHA production globally.

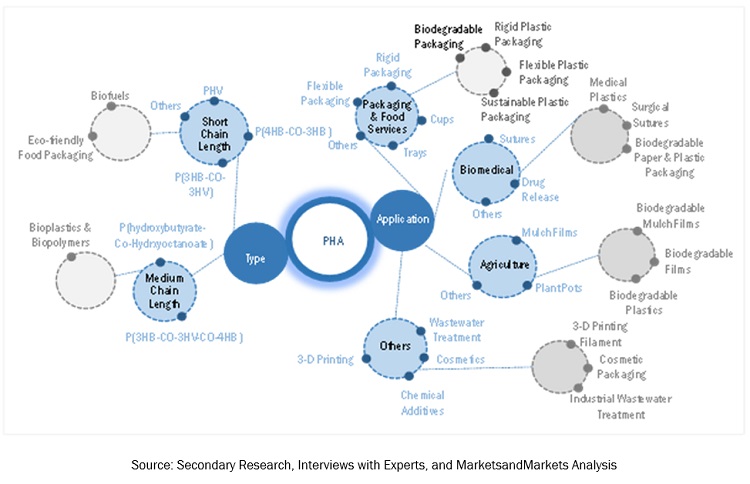

PHA Market Ecosystem

“Short chain length was the largest type of PHA market in 2021, in terms of volume”

Short chain length accounted for the largest market share, in terms of volume and value, in 2021. The low cost of short chain length as compared to medium chain length is the major attribute for its higher market share in global PHA market. It is the most produced PHA type by major global manufacturers.

“Packaging & food services was the largest application for PHA market in 2021, in terms of value”

Packaging is the most promising application wherein PHA can replace conventional plastics. As per a recent United Nations Environment Programme report on plastic waste, packaging accounts for a 42% share of the total plastic waste generated globally. Most of this waste is from single-use plastic. Many European countries are banning the use of single-use plastics; Spain and Italy have already banned their use in departmental stores and malls, which is creating an effective opportunity for PHA to gain momentum in the packaging & food services application

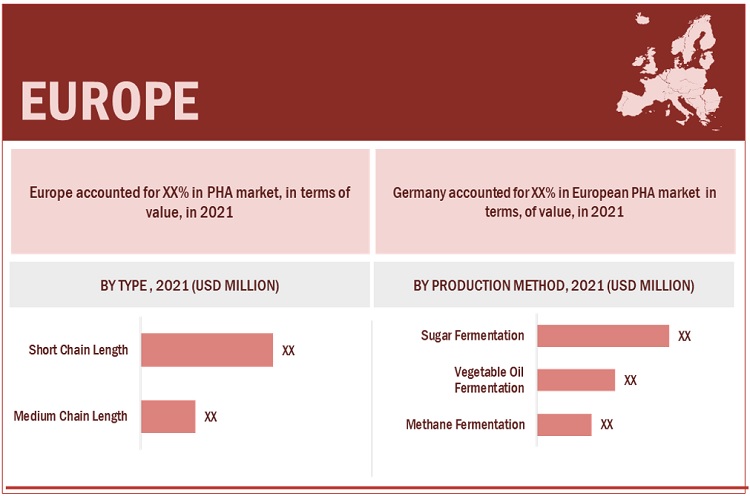

“Europe was the largest market for PHA in 2021, in terms of volume.”

Europe leads the global PHA market, in terms of value. The growth rates in terms of both, value and volume are also very high for Europe because some of the most stringent legislations have been passed in different countries including Italy and Spain, against the use of plastics. According to an industry expert, socio-economic lobbying in favor of the use of bioplastics or biodegradable plastics is very high in European countries.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Danimer Scientific(US), Shenzhen Ecomann Biotechnology Co., Ltd. (China), Kaneka Corporation (Japan), RWDC Industries (Singapore), TianAn Biologic Materials Co. Ltd. (China), Newlight Technologies LLC (US), and Biomer (Germany). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of PHA have opted for new product launches to sustain their market position. They are introducing several products and investing substantially to increase their production capacity of PHA.

PHA Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 81 Million |

|

Revenue Forecast in 2027 |

USD 167 Million |

|

CAGR |

15.3% |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (ton); Value (USD Million) |

|

Segments |

Type, Production Method, Application and Region |

|

Regions |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies |

The key players in this market are as Danimer Scientific (US), Shenzhen Ecomann Biotechnology Co., Ltd (China), Kaneka Corporation (Japan), RWDC Industries (Singapore), Newlight Technologies LLC (US), TianAn Biologic Materials Co. Ltd (China), and Biomer (Germany) |

This report categorizes the global PHA market based on type, production method, application and region.

On the basis of type, the PHA market has been segmented as follows:

- Short Chain Length

- Medium Chain Length

On the basis of production method, the PHA market has been segmented as follows:

- Sugar Fermentation

- Vegetable Oil Fermentation

- Methane Fermentation

On the basis of application, the PHA market has been segmented as follows:

- Packaging & Food Services

- Biomedical

- Agriculture

- Others

On the basis of region, the PHA market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In June 2022, Newlight Technologies launched plastic-free AirCarbon-based coated paper products created from regenerative materials. This product is made by the nature-based carbon capture process which results in a paper product that is moisture-resistant, grease-resistant, and plastic-free.

- In May 2022, Kaneka Corporation has developed expandable plastic technology that turns biodegradable polymer into molded foam products which has been adopted by the fisheries business for fish boxes to store fresh fish.

- On March 2022, Tokyu Hotels decided to use the toothbrush made from KANEKA Biodegradable Polymer Green Planet in its hotels, rolling out deployment starting from April 2022 which is expected to become the first hotel chain to purchase toothbrushes made from Green Planet.

- In January 2022, Bluepha’s first commercial biodegradable material, PHA plant covers 86,000 sqm and is located in the Coastal Industrial Park of Jiangsu Binhai Economic Development Zone, with an annual PHA capacity of 25,000 tons. The entire plant is divided into two phases, whereby the first phase holds 5,000 tons per annum PHA capacity, to be completed by the end of 2022.

Frequently Asked Questions (FAQ):

What is the expected growth rate of PHA market?

The forecast period for PHA market in this study is 2022-2027. The PHA market is expected to grow at CAGR of 15.3%, in terms of value, during the forecast period.

Who are the major key players in PHA market?

Danimer Scientific (US), Shenzhen Ecomann Biotechnology Co. Ltd. (China), Kaneka Corporation (Japan), RWDC Industries (Singapore), and TianAn Biologic Materials Co. Ltd. (China) are the leading manufacturers of PHA.

Who are the major regulations the PHA market in various countries?

Under the Canadian Environmental Protection Act, the government has banned items where there is evidence that they are found in the environment, are often not recycled, and have readily available alternatives. The government has banned six items based on these criteria: plastic grocery bags, cutlery, stir sticks, straws, six-pack rings for beer, and food ware made from hard-to-recycle plastics.

What is the average selling price trend for PHA market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific.

What are the technological advancements in PHA market?

The selection of feedstock or raw materials is highly crucial for PHA production as it affects the overall cost of production. A Chinese startup, Bluepha, developed a procedure that utilizes seawater for open and continuous fermentation, using halophile bacterium Halomonas Bluephagenesis TD, which is found in Chaka Salt Lake in China. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 PHA MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 PHA: MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 PHA: MARKET DEFINITION AND INCLUSIONS, BY PRODUCTION METHOD

1.2.4 PHA: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 PHA MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews: Demand- and Supply-sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY-SIDE): COMBINED SHARE OF MAJOR PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION - BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM PHA SALE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND-SIDE): PRODUCTS SOLD AND AVERAGE SELLING PRICE

2.3 DATA TRIANGULATION

FIGURE 5 PHA MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/FORECAST

2.4.1 SUPPLY-SIDE

FIGURE 6 CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4.2 DEMAND-SIDE

FIGURE 7 PROJECTIONS FROM DEMAND-SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 PHA MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 8 SHORT CHAIN LENGTH SEGMENT TO DOMINATE IN 2022

FIGURE 9 PACKAGING & FOOD SERVICES LARGEST APPLICATION

FIGURE 10 EUROPE ACCOUNTED FOR LARGEST SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN PHA MARKET

FIGURE 11 PACKAGING & FOOD SERVICES AND BIOMEDICAL OFFER SIGNIFICANT OPPORTUNITIES

4.2 EUROPE PHA MARKET, BY APPLICATION AND COUNTRY

FIGURE 12 GERMANY LED EUROPE PHA MARKET IN “2O21”

4.3 PHA MARKET, BY PRODUCTION METHOD

FIGURE 13 SUGAR FERMENTATION SEGMENT TO DOMINATE BETWEEN 2022 AND 2027

4.4 PHA MARKET, BY REGION

FIGURE 14 EUROPE PROJECTED TO BE FASTEST-GROWING MARKET

4.5 PHA MARKET, REGION VS. APPLICATION

FIGURE 15 PACKAGING AND FOOD SERVICES TO LEAD GROWTH

4.6 PHA MARKET ATTRACTIVENESS

FIGURE 16 ITALY FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.1.1 EVOLUTION OF PHA

FIGURE 17 PHA DISCOVERY IN 1925 IN FRANCE

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PHA MARKET

5.2.1 DRIVERS

5.2.1.1 Green procurement policies

TABLE 2 NORTH AMERICA AND EUROPEAN UNION REGULATIONS

5.2.1.2 High availability of renewable and cost-effective raw materials

5.2.1.3 Biodegradability driving consumption

FIGURE 19 SHORTCOMINGS OF NON-BIODEGRADABLE WASTE DISPOSAL METHODS

5.2.1.4 Increasing concerns about human health and safety

TABLE 3 CONVENTIONAL PLASTICS: HEALTH CONCERNS

5.2.2 RESTRAINTS

5.2.2.1 High price compared with conventional polymers

5.2.2.2 Performance issues

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing scope in end-use segments

5.2.3.2 Emergence of new raw materials

5.2.3.3 Cost reductions through economies of scale

5.2.3.4 Cyanobacteria enabling cost reduction

5.2.3.5 Growth opportunities in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Manufacturing technology in initial phase

5.2.4.2 Underutilization of manufacturing plants

TABLE 4 PHA PRODUCTION CAPACITY, BY COMPANY, 2021 (TONS/YEAR)

5.2.4.3 Expensive and complex production process

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: PHA MARKET

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 5 PHA MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS FOR TOP THREE APPLICATIONS

TABLE 6 STAKEHOLDER INFLUENCE IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.4.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 8 FORECAST GDP TRENDS FOR MAJOR ECONOMIES, 2019–2027 (USD BILLION)

6 INDUSTRY TRENDS (Page No. - 65)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 23 PHA MARKET: SUPPLY CHAIN ANALYSIS

6.1.1 RAW MATERIAL

6.1.2 FERMENTATION

6.1.3 EXTRACTION

6.1.4 END-USE INDUSTRIES

6.2 PHA MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 24 REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 9 PHA MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICES OF APPLICATIONS OF KEY PLAYERS

FIGURE 25 AVERAGE SELLING PRICES OF TOP THREE APPLICATIONS OF KEY PLAYERS

TABLE 10 AVERAGE SELLING PRICES OF TOP THREE APPLICATIONS OF KEY, USD/KG

6.3.2 PHA AVERAGE SELLING PRICE, BY REGION

FIGURE 26 PHA AVERAGE SELLING PRICE, BY REGION, USD/KG

TABLE 11 PHA AVERAGE SELLING PRICE, BY REGION (USD/KG)

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

6.4.1 REVENUE SHIFTS AND POCKETS FOR PHA MARKET

FIGURE 27 REVENUE SHIFTS FOR PHA MARKET

6.5 CONNECTED MARKETS: ECOSYSTEM

TABLE 12 PHA MARKET: ECOSYSTEM

FIGURE 28 PHA MARKET: ECOSYSTEM

6.6 TECHNOLOGY ANALYSIS

FIGURE 29 DIFFERENT SUBSTRATES UTILIZED FOR PHA PRODUCTION

6.6.1 COMMERCIALIZED TECHNOLOGIES

TABLE 13 COMMERCIALIZED AND TO BE COMMERCIALIZED TECHNOLOGIES, TYPE AND PRODUCTION METHOD

6.6.2 PHA PRODUCTION IN BIOREFINERIES

6.6.3 YET TO BE COMMERCIALIZED

6.6.4 OTHER POSSIBILITIES

6.7 CASE STUDY ANALYSIS

6.7.1 CASE STUDY: PHA USED TO PRODUCE BIODEGRADABLE STRAWS

6.7.2 CASE STUDY: UTILIZATION OF PHA FOR SUSTAINABLE PACKAGING

6.7.3 CASE STUDY: USE OF PHA FOR MANUFACTURE OF BIODEGRADABLE SPIRIT BOTTLES

6.8 TRADE DATA STATISTICS

6.8.1 IMPORT SCENARIO OF PHA

FIGURE 30 IMPORT OF PHA, BY KEY COUNTRIES (2015–2021)

TABLE 14 IMPORT OF PHA, BY REGION, 2015–2021 (USD THOUSAND)

6.8.2 EXPORT SCENARIO OF PHA

FIGURE 31 EXPORT OF PHA, BY KEY COUNTRIES (2015–2020)

TABLE 15 EXPORT OF PHA, BY REGION, 2015–2021 (USD THOUSAND)

6.9 REGULATORY LANDSCAPE

TABLE 16 REGULATIONS FOR PHA

6.9.1 REACH

6.9.2 EPA

6.10 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 17 PHA MARKETS: LIST OF CONFERENCES & EVENTS

6.11 PATENT ANALYSIS

6.11.1 APPROACH

6.11.2 DOCUMENT TYPE

FIGURE 32 PATENT PUBLICATION TRENDS FOR PHA MARKET, 2011–2021

FIGURE 33 LEGAL STATUS OF PATENTS

6.11.3 JURISDICTION ANALYSIS

FIGURE 34 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.11.4 TOP APPLICANTS

FIGURE 35 KANEKA CORPORATION REGISTERED HIGHEST PATENTS BETWEEN 2011 AND 2021

TABLE 18 RECENT PATENTS BY KANEKA CORPORATION

TABLE 19 RECENT PATENTS BY YIELD10 BIOSCIENCE

TABLE 20 RECENT PATENTS BY VEOLIA WATER TECHNOLOGIES

TABLE 21 TOP 10 PATENT OWNERS IN US, 2011–2021

7 SOURCES AND PROCESSES OF PHA PRODUCTION (Page No. - 87)

7.1 GENERAL PRODUCTION PROCESS

FIGURE 36 PROCESS FLOW OF PHA PRODUCTION

7.2 SUGAR SUBSTRATE OR CARBOHYDRATES FROM PLANTS

FIGURE 37 SUGAR SUBSTRATES FOR PHA PRODUCTION

7.3 TRIACYLGLYCEROLS

7.4 HYDROCARBONS

FIGURE 38 HYDROCARBON SUBSTRATES

7.5 STRAIN SELECTION

TABLE 22 LIST OF BACTERIUM STRAINS AND OUTPUT

7.6 BIOPROCESS AND DOWNSTREAM PROCESS

7.6.1 FERMENTATION PROCESS

7.6.1.1 Discontinuous process

7.6.1.1.1 Batch process

7.6.1.1.2 Fed-batch process

7.6.1.1.3 Fed-batch process with cell recycling

7.6.1.1.4 Repeated fed-batch

7.6.1.2 Continuous process

7.6.1.2.1 Continuous fed-batch process

7.6.1.2.2 One-stage chemostat

7.6.1.2.3 Two-stage chemostat

7.6.1.2.4 Multi-stage chemostat

7.6.2 EXTRACTION PROCESS

FIGURE 39 EXTRACTION PROCESS FLOW

8 PRODUCTION CAPACITY ANALYSIS (Page No. - 93)

TABLE 23 CURRENT PRODUCTION CAPACITIES (TON)

TABLE 24 UPCOMING PLAYERS

TABLE 25 DISCONTINUED OR STALLED PRODUCTION

9 POLYHYDROXYALKANOATE (PHA) MARKET, BY TYPE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 40 SHORT CHAIN LENGTH SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2022

TABLE 26 PHA MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 27 PHA MARKET SIZE, BY TYPE, 2021–2027 (TON)

TABLE 28 PHA MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 29 PHA MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

9.2 SHORT CHAIN LENGTH

9.2.1 POLYHYDROXYVALERATE (PHV)

9.2.1.1 PHV polymers can form single crystals with lamellar

9.2.2 P (4HB-CO-3HB)

9.2.2.1 4HB and 3HB ratio decide copolymer properties

9.2.3 P (3HB-CO-3HV)

9.2.3.1 High HV fraction makes polymers more elastic

9.2.4 OTHERS

9.2.4.1 Utilization as copolymers

TABLE 30 SHORT CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 31 SHORT CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 32 SHORT CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 SHORT CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3 MEDIUM CHAIN LENGTH

9.3.1 P (HYDROXYBUTYRATE-CO-HYDROXYOCTANOATE)

9.3.1.1 Nodax most common PHA

9.3.2 P (3HB-CO-3HV-CO-4HB)

9.3.2.1 Suitable for medical applications due to high mechanical strength

9.3.3 OTHERS

9.3.3.1 Potential use in medical and biotechnology fields

TABLE 34 MEDIUM CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 35 MEDIUM CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 36 MEDIUM CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MEDIUM CHAIN LENGTH PHA MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10 POLYHYDROXYALKANOATE (PHA) MARKET, BY PRODUCTION METHOD (Page No. - 104)

10.1 INTRODUCTION

FIGURE 41 SUGAR FERMENTATION PRODUCTION METHOD TO LEAD MARKET

TABLE 38 PHA MARKET SIZE, BY PRODUCTION METHOD, 2017–2020 (TON)

TABLE 39 PHA MARKET SIZE, BY PRODUCTION METHOD, 2021–2027 (TON)

TABLE 40 PHA MARKET SIZE, BY PRODUCTION METHOD, 2017–2020 (USD MILLION)

TABLE 41 PHA MARKET SIZE, BY PRODUCTION METHOD, 2021–2027 (USD MILLION)

11 POLYHYDROXYALKANOATE (PHA) MARKET, BY APPLICATION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 42 PACKAGING & FOOD SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET

TABLE 42 PHA MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 43 PHA MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 44 PHA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 45 PHA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

11.2 PACKAGING & FOOD SERVICES

11.2.1 PACKAGING

11.2.1.1 Rigid packaging

11.2.1.1.1 High impact on rigid packaging segment

11.2.1.2 Flexible packaging

11.2.1.2.1 Replacement for petroleum-based plastics in flexible packaging

11.2.1.3 Others

11.2.1.3.1 Loose-fill

11.2.1.3.2 Compost bags

11.2.2 FOOD SERVICES

11.2.2.1 High number of applications

11.2.2.2 Cups

11.2.2.2.1 Biodegradable disposable PHA cups reduce plastic waste

11.2.2.3 Trays

11.2.2.3.1 Sustainable trays from PHA-based plastics

11.2.2.4 Other food services

11.2.2.4.1 Containers

11.2.2.4.2 Jars

TABLE 46 PHA MARKET SIZE IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 47 PHA MARKET SIZE IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 48 PHA MARKET SIZE IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 PHA MARKET SIZE IN PACKAGING & FOOD SERVICES APPLICATION, BY REGION, 2021–2027 (USD MILLION)

11.3 BIOMEDICAL

11.3.1 SUTURES

11.3.1.1 High tensile strength enables manufacture of biodegradable sutures

11.3.2 DRUG RELEASE

11.3.2.1 Biocompatibility suitable for drug carrier applications

11.3.3 OTHER BIOMEDICAL APPLICATIONS

TABLE 50 PHA MARKET SIZE IN BIOMEDICAL APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 51 PHA MARKET SIZE IN BIOMEDICAL APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 52 PHA MARKET SIZE IN BIOMEDICAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 PHA MARKET SIZE IN BIOMEDICAL APPLICATION, BY REGION, 2021–2027 (USD MILLION)

11.4 AGRICULTURE

11.4.1 MULCH FILMS

11.4.1.1 Mulch films enable farmers to directly plow fields

11.4.2 PLANT POTS

11.4.2.1 Plant pots help initial stages of plant growth

11.4.3 OTHER AGRICULTURAL APPLICATIONS

11.4.3.1 Bins

11.4.3.2 Chutes

11.4.3.3 Hoppers

TABLE 54 PHA MARKET SIZE IN AGRICULTURE APPLICATION, BY REGION, 2017–2020 (TON)

TABLE 55 PHA MARKET SIZE IN AGRICULTURE APPLICATION, BY REGION, 2021–2027 (TON)

TABLE 56 PHA MARKET SIZE IN AGRICULTURE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 PHA MARKET SIZE IN AGRICULTURE APPLICATION, BY REGION, 2021–2027 (USD MILLION)

11.5 OTHERS

11.5.1 WASTEWATER TREATMENT

11.5.2 COSMETICS

11.5.3 CHEMICAL ADDITIVES

11.5.4 3D PRINTING

TABLE 58 PHA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (TON)

TABLE 59 PHA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (TON)

TABLE 60 PHA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 PHA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

12 POLYHYDROXYALKANOATE (PHA) MARKET, BY REGION (Page No. - 123)

12.1 INTRODUCTION

TABLE 62 PHA MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 63 PHA MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 64 PHA MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 PHA MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: PHA MARKET SNAPSHOT

TABLE 66 MAJOR PHA MANUFACTURERS IN NORTH AMERICA

TABLE 67 UPCOMING PHA MANUFACTURERS IN NORTH AMERICA

12.2.1 NORTH AMERICA PHA MARKET, BY APPLICATION

TABLE 68 NORTH AMERICA: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 69 NORTH AMERICA: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 70 NORTH AMERICA: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

12.2.2 NORTH AMERICA PHA MARKET, BY TYPE

TABLE 72 NORTH AMERICA: PHA MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 73 NORTH AMERICA: PHA MARKET SIZE, BY TYPE, 2021–2027 (TON)

TABLE 74 NORTH AMERICA: PHA MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: PHA MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.2.3 NORTH AMERICA PHA MARKET, BY COUNTRY

TABLE 76 NORTH AMERICA: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 77 NORTH AMERICA: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 78 NORTH AMERICA: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.2.3.1 US

12.2.3.1.1 Stringent production, use, and disposal regulations

TABLE 80 US: PHA MARKET SIZE, 2017–2020

TABLE 81 US: PHA MARKET SIZE, 2021–2027

12.2.3.2 Canada

12.2.3.2.1 Proposed ban on single-use plastics to influence market growth

TABLE 82 CANADA: PHA MARKET SIZE, 2017–2020

TABLE 83 CANADA: PHA MARKET SIZE, 2021–2027

12.2.3.3 Mexico

12.2.3.3.1 Government initiatives and international investments creating opportunities

TABLE 84 MEXICO: PHA MARKET SIZE, 2017–2020

TABLE 85 MEXICO: PHA MARKET SIZE, 2021–2027

12.3 EUROPE

FIGURE 44 EUROPE: PHA MARKET SNAPSHOT

TABLE 86 MAJOR PHA MANUFACTURERS IN EUROPE

TABLE 87 UPCOMING PHA MANUFACTURERS IN EUROPE

12.3.1 EUROPE PHA MARKET, BY APPLICATION

TABLE 88 EUROPE: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 89 EUROPE: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 90 EUROPE: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 91 EUROPE: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

12.3.2 EUROPE PHA MARKET, BY TYPE

TABLE 92 EUROPE: PHA MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 93 EUROPE: PHA MARKET SIZE, BY TYPE, 2021–2027 (TON)

TABLE 94 EUROPE: PHA MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 EUROPE: PHA MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.3.3 EUROPE PHA MARKET, BY COUNTRY

TABLE 96 EUROPE: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 97 EUROPE: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 98 EUROPE: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 EUROPE: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.3.3.1 Germany

12.3.3.1.1 Advanced infrastructure for solid waste management to propel market

TABLE 100 GERMANY: PHA MARKET SIZE, 2017–2020

TABLE 101 GERMANY: PHA MARKET SIZE, 2021–2027

12.3.3.2 UK

12.3.3.2.1 Government’s aim to achieve zero-waste economy to influence growth

TABLE 102 UK: PHA MARKET SIZE, 2017–2020

TABLE 103 UK: PHA MARKET SIZE, 2021–2027

12.3.3.3 France

12.3.3.3.1 Government’s initiatives for bio-based economy to drive market

TABLE 104 FRANCE: PHA MARKET SIZE, 2017–2020

TABLE 105 FRANCE: PHA MARKET SIZE, 2021–2027

12.3.3.4 Italy

12.3.3.4.1 Demand for eco-friendly packaging solutions to drive market

TABLE 106 ITALY: PHA MARKET SIZE, 2017–2020

TABLE 107 ITALY: PHA MARKET SIZE, 2021–2027

12.3.3.5 Rest of Europe

TABLE 108 REST OF EUROPE: PHA MARKET SIZE, 2017–2020

TABLE 109 REST OF EUROPE: PHA MARKET SIZE, 2021–2027

12.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: PHA MARKET SNAPSHOT

TABLE 110 MAJOR PHA MANUFACTURERS IN ASIA PACIFIC

TABLE 111 UPCOMING PHA MANUFACTURERS IN ASIA PACIFIC

12.4.1 ASIA PACIFIC PHA MARKET, BY APPLICATION

TABLE 112 ASIA PACIFIC: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 113 ASIA PACIFIC: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 114 ASIA PACIFIC: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

12.4.2 ASIA PACIFIC PHA MARKET, BY TYPE

TABLE 116 ASIA PACIFIC: PHA MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 117 ASIA PACIFIC: PHA MARKET SIZE, BY TYPE, 2021–2027 (TON)

TABLE 118 ASIA PACIFIC: PHA MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: PHA MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.4.3 ASIA PACIFIC PHA MARKET, BY COUNTRY

TABLE 120 ASIA PACIFIC: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

TABLE 121 ASIA PACIFIC: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

TABLE 122 ASIA PACIFIC: PHA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 ASIA PACIFIC: PHA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.4.3.1 China

12.4.3.1.1 Global and local PHA manufacturers to drive market

TABLE 124 CHINA: PHA MARKET SIZE, 2017–2020

TABLE 125 CHINA: PHA MARKET SIZE, 2021–2027

12.4.3.2 Japan

12.4.3.2.1 Biomass-based plastics and biodegradable plastics to fuel market

TABLE 126 JAPAN: PHA MARKET SIZE, 2017–2020

TABLE 127 JAPAN: PHA MARKET SIZE, 2021–2027

12.4.3.3 India

12.4.3.3.1 Ban on non-biodegradable plastics to boost market

TABLE 128 INDIA: PHA MARKET SIZE, 2017–2020

TABLE 129 INDIA: PHA MARKET SIZE, 2021–2027

12.4.3.4 Malaysia

12.4.3.4.1 Fully automated plant producing biodegradable plastic from palm oil, propelling market

TABLE 130 MALAYSIA: PHA MARKET SIZE, 2017–2020

TABLE 131 MALAYSIA: PHA MARKET SIZE, 2021–2027

12.4.3.5 South Korea

12.4.3.5.1 Existing R&D establishments to encourage PHA manufacturers

TABLE 132 SOUTH KOREA: PHA MARKET SIZE, 2017–2020

TABLE 133 SOUTH KOREA: PHA MARKET SIZE, 2021–2027

12.4.3.6 Rest of Asia Pacific

TABLE 134 REST OF ASIA PACIFIC: PHA MARKET SIZE, 2017–2020

TABLE 135 REST OF ASIA PACIFIC: PHA MARKET SIZE, 2021–2027

12.5 REST OF THE WORLD (ROW)

12.5.1 REST OF THE WORLD PHA MARKET, BY APPLICATION

TABLE 136 REST OF THE WORLD: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

TABLE 137 REST OF THE WORLD: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

TABLE 138 REST OF THE WORLD: PHA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 139 REST OF THE WORLD: PHA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

12.5.2 REST OF THE WORLD PHA MARKET, BY TYPE

TABLE 140 REST OF THE WORLD: PHA MARKET SIZE, BY TYPE, 2017–2020 (TON)

TABLE 141 REST OF THE WORLD: PHA MARKET SIZE, BY TYPE, 2021–2027 (TON)

TABLE 142 REST OF THE WORLD: PHA MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 REST OF THE WORLD: PHA MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

12.5.3 REST OF THE WORLD PHA MARKET, BY REGION

TABLE 144 REST OF THE WORLD: PHA MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 145 REST OF THE WORLD: PHA MARKET SIZE, BY REGION, 2021–2027 (TON)

TABLE 146 REST OF THE WORLD: PHA MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 147 REST OF THE WORLD: PHA MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

12.5.3.1 South America

12.5.3.1.1 Awareness toward green economy to propel market

TABLE 148 SOUTH AMERICA: PHA MARKET SIZE, 2017–2020

TABLE 149 SOUTH AMERICA: PHA MARKET SIZE, 2021–2027

12.5.3.2 Middle East & Africa

12.5.3.2.1 Growing biomedical industry to drive market

TABLE 150 MIDDLE EAST & AFRICA: PHA MARKET SIZE, 2017–2020

TABLE 151 MIDDLE EAST & AFRICA: PHA MARKET SIZE, 2021–2027

13 COMPETITIVE LANDSCAPE (Page No. - 157)

13.1 INTRODUCTION

13.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 152 OVERVIEW OF STRATEGIES ADOPTED BY KEY PHA MANUFACTURERS

13.3 MARKET SHARE ANALYSIS

13.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 46 RANKING OF TOP FIVE PLAYERS IN PHA MARKET, 2021

13.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 153 PHA MARKET: DEGREE OF COMPETITION

FIGURE 47 DANIMER SCIENTIFIC LED PHA MARKET IN 2021

13.3.2.1 Danimer Scientific

13.3.2.2 Shenzhen Ecomann Biotechnology Co., Ltd

13.3.2.3 Kaneka Corporation

13.3.2.4 RWDC Industries

13.3.2.5 TianAn Biologic Materials Co. Ltd.

13.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES FOR LAST FIVE YEARS

13.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 49 PHA MARKET: COMPANY FOOTPRINT

TABLE 154 PHA MARKET: TYPE FOOTPRINT

TABLE 155 PHA MARKET: APPLICATION FOOTPRINT

TABLE 156 PHA MARKET: COMPANY REGION FOOTPRINT

13.5 COMPANY EVALUATION QUADRANT (TIER 1)

13.5.1 STARS

13.5.2 EMERGING LEADERS

FIGURE 50 COMPANY EVALUATION QUADRANT FOR PHA MARKET (TIER 1)

13.6 COMPETITIVE BENCHMARKING

TABLE 157 PHA MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 158 PHA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 RESPONSIVE COMPANIES

13.7.2 STARTING BLOCKS

FIGURE 51 STARTUP/SME EVALUATION QUADRANT FOR PHA MARKET

13.8 COMPETITIVE SITUATIONS AND TRENDS

13.8.1 NEW PRODUCT LAUNCHES

TABLE 159 PHA MARKET: NEW PRODUCT LAUNCHES (2019–2022)

13.8.2 DEALS

TABLE 160 PHA MARKET: DEALS (2019–2022)

13.8.3 OTHER DEVELOPMENTS

TABLE 161 PHA MARKET: OTHER DEVELOPMENTS (2019–2022)

14 COMPANY PROFILES (Page No. - 173)

14.1 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

14.1.1 KANEKA CORPORATION

TABLE 162 KANEKA CORPORATION: COMPANY OVERVIEW

FIGURE 52 KANEKA CORPORATION: COMPANY SNAPSHOT

14.1.2 DANIMER SCIENTIFIC

TABLE 163 DANIMER SCIENTIFIC: COMPANY OVERVIEW

FIGURE 53 DANIMER SCIENTIFIC: COMPANY SNAPSHOT

14.1.3 SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD

TABLE 164 SHENZHEN ECOMANN BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

14.1.4 RWDC INDUSTRIES

TABLE 165 RWDC INDUSTRIES: COMPANY OVERVIEW

14.1.5 NEWLIGHT TECHNOLOGIES, INC

TABLE 166 NEWLIGHT TECHNOLOGIES, INC: COMPANY OVERVIEW

14.1.6 TIANAN BIOLOGIC MATERIALS CO., LTD

TABLE 167 TIANAN BIOLOGIC MATERIALS CO., LTD: COMPANY OVERVIEW

14.1.7 BIOMER

TABLE 168 BIOMER: COMPANY OVERVIEW

14.1.8 PHABUILDER

TABLE 169 PHABUILDER: COMPANY OVERVIEW

14.1.9 TERRAVERDAE BIOWORKS INC.

TABLE 170 TERRAVERDAE BIOWORKS INC.: COMPANY OVERVIEW

14.1.10 BLUEPHA

TABLE 171 BLUEPHA: COMPANY OVERVIEW

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.2 STARTUP/SME PLAYERS

14.2.1 NAFIGATE CORPORATION

TABLE 172 NAFIGATE CORPORATION: COMPANY OVERVIEW

14.2.2 GENECIS BIOINDUSTRIES INC

TABLE 173 GENECIS BIOINDUSTRIES INC.: COMPANY OVERVIEW

14.2.3 TEPHA, INC.

TABLE 174 TEPHA, INC.: COMPANY OVERVIEW

14.2.4 CJ CHEILJEDANG I BIO

TABLE 175 CJ CHEILJEDANG I BIO: COMPANY OVERVIEW

14.2.5 FULL CYCLE BIOPLASTICS LLC

TABLE 176 FULL CYCLE BIOPLASTICS LLC: COMPANY OVERVIEW

14.2.6 MANGO MATERIALS

TABLE 177 MANGO MATERIALS.: COMPANY OVERVIEW

14.2.7 COFCO

TABLE 178 COFCO: COMPANY OVERVIEW

14.2.8 MEDPHA

TABLE 179 MEDPHA: COMPANY OVERVIEW

15 ADJACENT AND RELATED MARKETS (Page No. - 201)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 BIOPLASTICS & BIOPOLYMERS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.4 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

TABLE 180 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 181 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.4.1 ASIA PACIFIC

15.4.1.1 By country

TABLE 182 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 183 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.4.1.2 By end-use industry

TABLE 184 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 185 ASIA PACIFIC: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

15.4.2 EUROPE

15.4.2.1 By country

TABLE 186 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 187 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.4.2.2 By end-use industry

TABLE 188 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 189 EUROPE: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

15.4.3 NORTH AMERICA

15.4.3.1 By country

TABLE 190 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 191 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.4.3.2 By end-use industry

TABLE 192 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 193 NORTH AMERICA: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

15.4.4 REST OF THE WORLD

15.4.4.1 By country

TABLE 194 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 195 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

15.4.4.2 By end-use industry

TABLE 196 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 197 REST OF THE WORLD: BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

16 APPENDIX (Page No. - 210)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

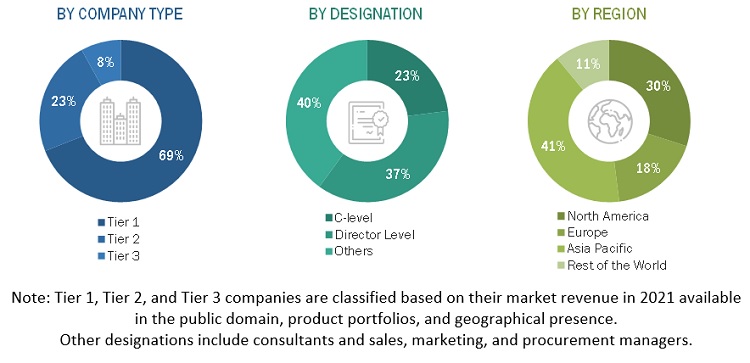

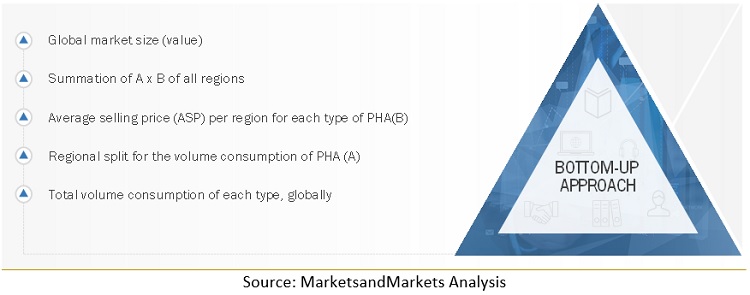

The study involved four major activities to estimate the market size for PHA market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The PHA market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the PHA market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the PHA industry.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the PHA market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

PHA Market: Bottom-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the polyhydroxyalkanoate (PHA) market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, production method, and application

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Rest of the World (RoW), along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyhydroxyalkanoate (PHA) Market

Requires the data on PHA market for establishment of PHA plant

main producers produced quantify applications areas sectors raw material consumers partners economics aspects environmentals aspects social aspects

Interested in understanding PHA market report

Information on PHA market in North America

Production capactities of the specific report

Information on the PHA market

Required data on methane fermentation and product specifications.