Pharmaceutical Excipients Market by Product (Organic Chemicals (Carbohydrates), Inorganic Chemicals (Calcium Phosphate)), Functionality (Fillers, Binders, Lubricants, Preservatives), Formulation (Tablets, Capsules, Parenteral) & Region - Global Forecast to 2027

Updated on : May 17, 2023

The global pharmaceutical excipients market in terms of revenue was estimated to be worth $8.6 billion in 2022 and is poised to reach $11.5 billion by 2027, growing at a CAGR of 5.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Factors such as the growth of the pharmaceuticals market backed by functional excipients, the surge in the generics market, the increasing uptake of biopharmaceuticals, and the rising adoption of orphan drugs are driving the market growth for pharmaceutical excipients. Furthermore, multifunctional excipients, the shifting focus of pharmaceutical manufacturing to emerging countries, and growth in the biosimilars market provide significant growth opportunities for the market players in the near future. However, increasing regulatory stringency regarding the approval of drugs and excipients and a time- and cost-intensive drug development process are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Pharmaceutical Excipients Market Dynamics

Driver: Surge in the Generics Market

Generic drugs are cost-effective and have similar therapeutic effectiveness and safety profiles as their branded counterparts. This market segment has received a boost due to the lower cost of generics. According to the Association for Accessible Medicines, the US healthcare system saved USD 265 billion in 2017 alone and over USD 1.67 trillion in the last decade using generic drugs. In the same year, Medicare and Medicaid saved USD 82.7 billion and USD 40.6 billion, respectively. Considering these advantages, governments in various countries promote generic drugs. Generics are gaining traction globally. According to the Association for Accessible Medicines Report, in 2020, generics accounted for 90 percent of prescriptions dispensed in the US. This is due to many drugs going off-patent and healthcare reforms favouring generics. According to the National Pharmaceutical Services report, 47 drugs will face patent expiration between 2019 and 2022. Some major players, such as Merck, Novartis, Bristol-Myers Squibb, and Eli Lilly, are expected to lose patents on important medications.

According to industry experts, generic erosion is expected to result in significant revenue and volume losses for the branded drug industry. This will enable the entry of cheaper generic counterparts into the market, which will boost the volume of drugs sold. The growing affordability and increasing healthcare expenditure in emerging economies will also drive the sales volume of generics in the forecast period. This is considered a positive indicator of the growth of the pharmaceutical excipients market.

Restraint: Cost and time-intensive drug development process

According to the California Biomedical Research Association (CBRA), it takes 12 years for a drug to travel from the research lab to the patient, including 1 to 6 years for toxicology studies alone. Also, only 5 of every 5,000 drugs that begin preclinical testing ever make it to human testing. Of these, only one is approved for human usage. According to the Tufts Center for the Study of Drug Development (CSDD), the cost of developing a drug that gains market approval is about $2.6 billion. The centre also reports an additional USD 312 million in post-approval development expenditures to test new indications, formulations, and dosage strengths. This leads to a total cost of USD 1.7 billion for developing a single prescription drug over 10–12 years. Moreover, late-stage failures in the drug development process increase R&D costs and impact the profit margins of pharmaceutical companies. The intensifying regulations on the quality and safety of the excipients and drugs result in the need to upgrade current manufacturing and quality assurance practices, which adds to the overall manufacturing cost.

Although excipient and drug production has seen significant advances in recent years, the requirement for high capital investments is expected to hamper market growth during the forecast period.

Opportunity: Increase in multifunctional excipients

The development of excipients capable of multiple functions is considered a novel solution to counter the high time and cost requirements for bringing a drug to market, a process that may take, on average, 10–12 years. Multifunctional excipients enhance the drug manufacturing process and improve flowability, compressibility, bioavailability, and particle size distribution. They offer several advantages, such as improved efficiency, low cost, reduced production time, the development of new chemical entities, and the formulation of ODT. The introduction of multifunctional excipients will help solve formulation development issues and ease optimization studies. Most market players are now focusing on introducing new grades of existing excipients to improve their performance for specific applications, such as excipients for orally disintegrating tablets, controlled-release formulations, immediate-release applications, and topical formulations. thus producing lucrative growth opportunities.

Challenge: Safety and quality concerns

Despite the growing use of excipients in pharmaceuticals, the industry faces the challenge of meeting the quality expectations of regulators, end users, drug makers, and patients. Variations in excipient production affect the drug's performance and its critical quality attributes. The supplier-to-supplier or batch-to-batch variation of excipients affects the excipient-drug interaction and, in turn, the drug. A large part of the pharmaceutical excipient manufacturing process is outsourced to smaller manufacturers in low-cost countries. This leads to low control over the excipient manufacturing process and quality, thereby increasing the need for process transparency in the entire supply chain. However, achieving immediate streamlining and maximum transparency in supply chain activities poses a challenge for drug manufacturers and excipient manufacturers.

The organic chemicals segment is expected to have the dominant share of the pharmaceutical excipients market.

Based on product, the market is segmented into three major categories: organic chemicals, inorganic chemicals, and other chemicals. The organic chemicals segment accounted for the largest market share. This segment is also projected to register the highest CAGR during the forecast period. This can be attributed to the non-toxic nature of organic chemicals and the efficacy of these chemicals as excipients for oral drug formulations. The market for organic chemicals is further divided into five major segments: oleochemicals, carbohydrates, petrochemicals, proteins, and other organic chemicals. The oleochemicals segment commanded the largest share of the organic chemicals market.

To know about the assumptions considered for the study, download the pdf brochure

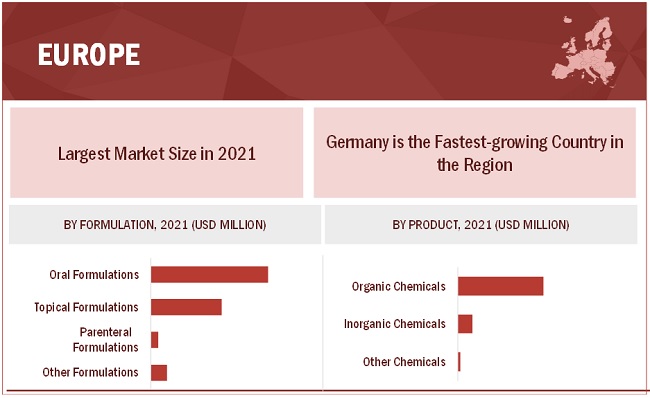

Europe was the most important region of the pharmaceutical excipients market.

The market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, Europe accounted for the largest share of the market. The large share of this region can be attributed to the presence of many pharmaceutical giants with large production capacities leading to high consumption of excipients. The growing emphasis on superior pharmaceutical products, generics, and biosimilars has also led to the increasing demand for novel excipients, which, in turn, is expected to drive market growth.

Key players in the pharmaceutical excipients market include Ashland Global Holdings, Inc (US), BASF SE (Germany), International Flavors & Fragrances, Inc. (US), Evonik Industries AG (Germany), Roquette Frères (France).

Pharmaceutical Excipients Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$8.6 billion |

|

Projected Revenue by 2027 |

$11.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Surge in generics market |

|

Market Opportunity |

Increase in multifunctional excipients |

This report categorizes the pharmaceutical excipients market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Organic Chemicals

-

Oleochemicals

- Fatty Alcohols

- Metal Stearates

- Glycerin

- Other Oleochemicals

-

Carbohydrates

-

Sugars

- Actual Sugars

- Sugar Alcohols

- Artificial Sweetners

-

Cellulose

- Microcrystalline cellulose

- Cellulose ethers

- Carboxymethyl cellulose (CMC) and croscarmellose sodium

- Cellulose esters

-

Starches

- Modified Starch

- Dried Starch

- Converted Starch

-

Sugars

-

Petrochemicals

- Glycols

- Povidones

- Mineral Hydrocarbons

- Acrylic Polymers

- Other Petrochemical Excipients

- Proteins

- Other Organic Chemicals

- Inorganic Chemicals

- Calcium Phosphate

- Metal Oxides

- Halites

- Calcium Carbonate

- Calcium Sulphate

- Other Inorganic Chemicals

- Other Chemicals

By Functionality

- Fillers & Diluents

- Suspending & Viscosity Agents

- Coating Agents

- Binders

- Flavoring Agents & Sweeteners

- Disintegrants

- Colorants

- Lubricants & Glidants

- Preservatives

- Emulsifying Agents

- Other Functionalities

By End User

- Oral Formulations

- Tablets

-

Capsules

- Hard-gelatin Capsules

- Soft-gelatin Capsules

- Liquid Formulations

- Topical Formulations

- Parenteral Formulations

- Other Formulations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- Italy

- Spain

- UK

- RoE

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In May 2019, Ashland launched the Aquaflow NMS 460E rheology modifier, a nonionic synthetic associative thickener.

- In May 2019, Colorcon launched STARTAB, a new starch tableting excipient designed specifically for the direct compression process.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global pharmaceutical excipients market?

The global pharmaceutical excipients market boasts a total revenue value of $11.5 billion by 2027.

What is the estimated growth rate (CAGR) of the global pharmaceutical excipients market?

The global pharmaceutical excipients market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $8.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 57)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PHARMACEUTICAL EXCIPIENTS MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 61)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARIES BY RESPONDENT, DESIGNATION, AND REGION: PHARMACEUTICAL EXCIPIENTS MARKET

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 GLOBAL MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2021

FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2021

2.2.1 INSIGHTS FROM PRIMARY EXPERTS

FIGURE 6 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

2.3 MARKET GROWTH RATE PROJECTIONS

FIGURE 7 GLOBAL MARKET (SUPPLY SIDE): CAGR PROJECTIONS

FIGURE 8 GLOBAL MARKET (DEMAND-SIDE): GROWTH ANALYSIS OF DEMAND-SIDE FACTORS

2.3.1 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.4.1 COVID-19 ASSUMPTIONS

2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 70)

FIGURE 10 PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY FUNCTIONALITY, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY FORMULATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 73)

4.1 PHARMACEUTICAL EXCIPIENTS: MARKET OVERVIEW

FIGURE 14 GROWING PHARMACEUTICALS INDUSTRY, COUPLED WITH ADVANCEMENTS IN FUNCTIONAL EXCIPIENTS, ARE KEY FACTORS DRIVING MARKET GROWTH

4.2 ASIA PACIFIC: PHARMACEUTICAL EXCIPIENTS MARKET SHARE, BY FORMULATION AND COUNTRY (2020)

FIGURE 15 ORAL FORMULATIONS ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

4.3 PHARMACEUTICALS EXCIPIENTS MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 16 ORGANIC CHEMICALS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2027

4.4 GLOBAL MARKET SHARE, BY FORMULATION, 2022

FIGURE 17 ORAL FORMULATIONS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2022

4.5 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 ASIA PACIFIC COUNTRIES TO SHOW THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 76)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 PHARMACEUTICAL EXCIPIENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 1 GLOBAL MARKET: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Growth of the pharmaceuticals market backed by functional excipients

FIGURE 20 GLOBAL PHARMACEUTICAL DRUG SALES (2008–2022)

5.2.1.2 Surge in the generics market

TABLE 2 DRUG PATENT EXPIRY, BY YEAR

5.2.1.3 Increasing uptake of biopharmaceuticals

5.2.1.4 Rising adoption of orphan drugs

FIGURE 21 INCREASING PENETRATION OF ORPHAN DRUGS (2010–2024)

FIGURE 22 RISING NUMBER OF ORPHAN INDICATIONS APPROVED IN THE US

5.2.2 RESTRAINTS

5.2.2.1 Cost and time-intensive drug development process

5.2.2.2 Increasing regulatory stringency

5.2.3 OPPORTUNITIES

5.2.3.1 Multifunctional excipients

TABLE 3 MULTIFUNCTIONAL EXCIPIENTS

5.2.3.2 Shifting focus of pharmaceutical manufacturing to emerging countries

5.2.3.3 Growth in the biosimilars market

5.2.4 CHALLENGES

5.2.4.1 Safety and quality concerns

5.2.4.2 Changing trade policies

5.2.5 INDUSTRY TRENDS

5.2.5.1 Rising demand for co-processed excipients

TABLE 4 MARKETED CO-PROCESSED EXCIPIENTS

5.2.5.2 Improving excipient capabilities using nanotechnology

5.2.5.3 Increasing use of direct compression in oral dosage formulations

5.2.5.4 Pharmaceutical excipients influencing the cost of production

5.3 RANGES/SCENARIO

FIGURE 23 SPECTRUM OF SCENARIOS BASED ON THE IMPACT OF UNCERTAINTIES ON THE GROWTH OF THE GLOBAL MARKET

5.4 IMPACT OF COVID-19 ON THE GLOBAL MARKET

FIGURE 24 INCREASE IN REVENUE, BY QUARTER

FIGURE 25 COVID-19 IMPACT ON SECTIONS OF THE PHARMACEUTICAL INDUSTRY

FIGURE 26 GLOBAL MARKET SCENARIO WITH AND WITHOUT COVID-19 IMPACT, 2019-2021

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 27 REVENUE SHIFT AND NEW POCKETS FOR PHARMACEUTICAL EXCIPIENTS PROVIDERS

5.6 TRADE DATA

5.6.1 SUCROSE

5.6.2 PREPARED BINDERS FOR MOLDS/CORES, CHEMICAL PRODUCTS, AND PREPARATION FOR CHEMICAL INDUSTRIES

5.6.3 MANNITOL (ACYCLIC ALCOHOLS & THEIR DERIVATIVES)

5.6.4 CELLULOSE

5.7 INDICATIVE PRICING MODEL ANALYSIS

5.7.1 US

5.7.2 CHINA

5.7.3 INDIA

5.8 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS OF THE PHARMACEUTICAL EXCIPIENTS MARKET

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 29 MARKET: SUPPLY CHAIN ANALYSIS

5.10 ECOSYSTEM ANALYSIS

FIGURE 30 ECOSYSTEM ANALYSIS: GLOBAL MARKET

TABLE 5 SUPPLY CHAIN ECOSYSTEM

5.11 PATENT ANALYSIS

FIGURE 31 PATENT APPLICATIONS FOR THE GLOBAL MARKET, JANUARY 2012–MAY 2022

TABLE 6 INDICATIVE LIST OF PATENTS IN THE GLOBAL MARKET

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 7 CONFERENCES, 2022–2023

5.13 REGULATORY ANALYSIS

5.13.1 NORTH AMERICA

5.13.1.1 US

5.13.1.2 Canada

5.13.2 EUROPE

5.13.3 ASIA PACIFIC

5.13.3.1 Japan

5.13.3.2 China

5.13.3.3 India

5.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 THREAT OF SUBSTITUTES

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 BARGAINING POWER OF SUPPLIERS

5.14.5 DEGREE OF COMPETITION

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN COMPANIES AND THEIR INFLUENCE ON THE BUYING PROCESS

FIGURE 32 INFLUENCE OF COMPANY STAKEHOLDERS IN THE BUYING PROCESS OF PHARMACEUTICAL EXCIPIENTS PRODUCTS

5.15.2 KEY BUYING CRITERIA FOR PHARMACEUTICAL EXCIPIENT PRODUCTS AMONG END USERS

FIGURE 33 KEY BUYING CRITERIA FOR END USERS

6 PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT (Page No. - 110)

6.1 INTRODUCTION

TABLE 9 GLOBAL MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 ORGANIC CHEMICALS

TABLE 10 GLOBAL MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 11 GLOBAL MARKET FOR ORGANIC CHEMICALS, BY REGION, 2020–2027 (USD MILLION)

TABLE 12 NORTH AMERICA: MARKET FOR ORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 EUROPE: MARKET FOR ORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 ASIA PACIFIC: MARKET FOR ORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1 OLEOCHEMICALS

TABLE 15 OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 OLEOCHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 NORTH AMERICA: OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 EUROPE: OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 ASIA PACIFIC: OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.1 Fatty alcohols

6.2.1.1.1 Fatty alcohols are widely used as nonionic surfactants due to their amphipathic nature—a major driver for market growth

TABLE 20 FATTY ALCOHOLS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 NORTH AMERICA: FATTY ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 EUROPE: FATTY ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 ASIA PACIFIC: FATTY ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.2 Mineral stearates

6.2.1.2.1 Wide use of magnesium stearates as excipients in nutraceutical and pharmaceutical formulations to drive market growth

TABLE 24 METAL STEARATES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: METAL STEARATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 EUROPE: METAL STEARATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: METAL STEARATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.3 Glycerin

6.2.1.3.1 Extensive applications of glycerin to drive market growth

TABLE 28 GLYCERIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: GLYCERIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 EUROPE: GLYCERIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 ASIA PACIFIC: GLYCERIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1.4 Other oleochemicals

TABLE 32 OTHER OLEOCHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: OTHER OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 EUROPE: OTHER OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 ASIA PACIFIC: OTHER OLEOCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 CARBOHYDRATES

TABLE 36 CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 37 CARBOHYDRATES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 EUROPE: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 ASIA PACIFIC: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.1 Sugars

TABLE 41 SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 SUGARS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.1.1 Actual sugars

6.2.2.1.1.1 Growing use of actual sugars in pediatric formulations drives the market growth

TABLE 46 ACTUAL SUGARS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: ACTUAL SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: ACTUAL SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: ACTUAL SUGARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.1.2 Sugar alcohols

6.2.2.1.2.1 Mannitol to show the highest growth in the market for sugar alcohols

TABLE 50 SUGAR ALCOHOLS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: SUGAR ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: SUGAR ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: SUGAR ALCOHOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.1.3 Artificial sweeteners

6.2.2.1.3.1 Aspartame is the most used artificial sweetener

TABLE 54 ARTIFICIAL SWEETENERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: ARTIFICIAL SWEETENERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: ARTIFICIAL SWEETENERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: ARTIFICIAL SWEETENERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2 Cellulose

TABLE 58 CELLULOSE MARKET BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 CELLULOSE MARKET BY REGION, 2020–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: CELLULOSE MARKET BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: CELLULOSE MARKET BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: CELLULOSE MARKET BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2.1 Microcrystalline cellulose

6.2.2.2.1.1 Microcrystalline cellulose is the most widely used excipient in the direct compression method for tablets

TABLE 63 MICROCRYSTALLINE CELLULOSE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MICROCRYSTALLINE CELLULOSE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: MICROCRYSTALLINE CELLULOSE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: MICROCRYSTALLINE CELLULOSE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2.2 Cellulose ethers

6.2.2.2.2.1 Cellulose ethers are effective even at a lower concentration

TABLE 67 CELLULOSE ETHERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: CELLULOSE ETHERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: CELLULOSE ETHERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: CELLULOSE ETHERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2.3 CMC & croscarmellose sodium

6.2.2.2.3.1 Multiple advantages of CMC and croscarmellose sodium make them the most widely used suspending agents in injectable preparations

TABLE 71 CMC & CROSCARMELLOSE SODIUM MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: CMC & CROSCARMELLOSE SODIUM MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: CMC & CROSCARMELLOSE SODIUM MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: CMC & CROSCARMELLOSE SODIUM MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.2.4 Cellulose esters

6.2.2.2.4.1 Cellulose esters enable the delivery of drugs in cellular membranes and the intracellular matrix

TABLE 75 CELLULOSE ESTERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: CELLULOSE ESTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: CELLULOSE ESTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: CELLULOSE ESTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.3 Starch

TABLE 79 STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 STARCH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.3.1 Modified starch

6.2.2.3.1.1 Modified starch is widely used in sustained-release tablets due to its cold-water swelling and gel barrier formation capabilities

TABLE 84 MODIFIED STARCH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MODIFIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: MODIFIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: MODIFIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.3.2 Dried starch

6.2.2.3.2.1 Dried starch is a strong binding and coating agent

TABLE 88 DRIED STARCH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: DRIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 90 EUROPE: DRIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: DRIED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2.3.3 Converted starch

6.2.2.3.3.1 Converted starch is used as a molecular encapsulation agent and offers enhanced solubility and stability for drugs

TABLE 92 CONVERTED STARCH MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: CONVERTED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: CONVERTED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: CONVERTED STARCH MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3 PETROCHEMICALS

TABLE 96 PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 PETROCHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: PETROCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 99 EUROPE: PETROCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: PETROCHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.1 Glycols

6.2.3.1.1 The availability of highly purified polyethylene glycol to enhance stability has driven the demand

TABLE 101 GLYCOLS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: GLYCOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 103 EUROPE: GLYCOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: GLYCOLS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.2 Povidones

6.2.3.2.1 Rising demand for fast-dissolving tablets is expected to propel the growth of this segment

TABLE 105 POVIDONES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: POVIDONES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: POVIDONES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: POVIDONES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.3 Mineral hydrocarbons

6.2.3.3.1 Growing preference for topical formulations in pain management has supported the demand for mineral hydrocarbons

TABLE 109 MINERAL HYDROCARBONS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MINERAL HYDROCARBONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 111 EUROPE: MINERAL HYDROCARBONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MINERAL HYDROCARBONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.4 Acrylic polymers

6.2.3.4.1 Wide use of acrylic polymers in controlled-release drug formulations to drive market growth

TABLE 113 ACRYLIC POLYMERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: ACRYLIC POLYMERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 115 EUROPE: ACRYLIC POLYMERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: ACRYLIC POLYMERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3.5 Other petrochemical excipients

TABLE 117 OTHER PETROCHEMICAL EXCIPIENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: OTHER PETROCHEMICAL EXCIPIENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 119 EUROPE: OTHER PETROCHEMICAL EXCIPIENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: OTHER PETROCHEMICAL EXCIPIENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.4 PROTEINS

6.2.4.1 Growing applications of proteins as carriers for microparticles and nanoparticles to drive market growth

TABLE 121 PROTEINS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: PROTEINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 123 EUROPE: PROTEINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: PROTEINS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.5 OTHER ORGANIC CHEMICALS

TABLE 125 OTHER ORGANIC CHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: OTHER ORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 127 EUROPE: OTHER ORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: OTHER ORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 INORGANIC CHEMICALS

TABLE 129 PHARMACEUTICAL EXCIPIENTS MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 GLOBAL MARKET FOR INORGANIC CHEMICALS, BY REGION, 2020–2027 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET FOR INORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 132 EUROPE: MARKET FOR INORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET FOR INORGANIC CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1 CALCIUM PHOSPHATE

6.3.1.1 Chemical purity and low incompatibility with drugs aid their high usage in the pharmaceutical industry

TABLE 134 CALCIUM PHOSPHATE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 135 NORTH AMERICA: CALCIUM PHOSPHATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 136 EUROPE: CALCIUM PHOSPHATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: CALCIUM PHOSPHATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 METAL OXIDES

6.3.2.1 Availability of silicon oxides in the hydrophobic, hydrophilic, and granulated forms to aid market growth

TABLE 138 METAL OXIDES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 139 NORTH AMERICA: METAL OXIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 140 EUROPE: METAL OXIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: METAL OXIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.3 HALITES

6.3.3.1 Increased utilization of halites in vaccines and controlled-release formulations is driving their demand in the market

TABLE 142 HALITES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 143 NORTH AMERICA: HALITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 144 EUROPE: HALITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: HALITES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.4 CALCIUM CARBONATE

6.3.4.1 Properties such as short disintegration time and excellent mechanical strength for oral dosage formulations to drive the market

TABLE 146 CALCIUM CARBONATE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 147 NORTH AMERICA: CALCIUM CARBONATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 148 EUROPE: CALCIUM CARBONATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: CALCIUM CARBONATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.5 CALCIUM SULFATE

6.3.5.1 Calcium sulfate is a cost-effective, quality-enhancing diluent for solid dosage forms

TABLE 150 CALCIUM SULFATE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 151 NORTH AMERICA: CALCIUM SULFATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 152 EUROPE: CALCIUM SULFATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: CALCIUM SULFATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.6 OTHER INORGANIC CHEMICALS

TABLE 154 OTHER INORGANIC CHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 155 NORTH AMERICA: OTHER INORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 156 EUROPE: OTHER INORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: OTHER INORGANIC CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 OTHER CHEMICALS

TABLE 158 GLOBAL MARKET FOR OTHER CHEMICALS, BY REGION, 2020–2027 (USD MILLION)

TABLE 159 NORTH AMERICA: MARKET FOR OTHER CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 160 EUROPE: MARKET FOR OTHER CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET FOR OTHER CHEMICALS, BY COUNTRY, 2020–2027 (USD MILLION)

7 PHARMACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY (Page No. - 174)

7.1 INTRODUCTION

TABLE 162 GLOBAL MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

7.2 FILLERS & DILUENTS

7.2.1 DILUENTS OFFER PROPERTIES SUCH AS IMPROVED COHESION, DIRECT COMPRESSION, AND FLOW TO THE FINAL DOSE INTABLETS

TABLE 163 GLOBAL MARKET FOR FILLERS & DILUENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 164 NORTH AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR FILLERS & DILUENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 165 EUROPE: MARKET FOR FILLERS & DILUENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET FOR FILLERS & DILUENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SUSPENDING & VISCOSITY AGENTS

7.3.1 SUSPENSIONS OFFER ADVANTAGES SUCH AS DRUG STABILITY AND TASTE MASKING

TABLE 167 GLOBAL MARKET FOR SUSPENDING & VISCOSITY AGENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 168 NORTH AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR SUSPENDING & VISCOSITY AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 169 EUROPE: MARKET FOR SUSPENDING & VISCOSITY AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET FOR SUSPENDING & VISCOSITY AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 COATING AGENTS

7.4.1 INCREASING USE OF SUSTAINED-RELEASE FORMULATIONS IN THE PHARMA INDUSTRY TO DRIVE MARKET GROWTH

TABLE 171 PHARMACEUTICAL EXCIPIENTS MARKET FOR COATING AGENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 172 NORTH AMERICA: MARKET FOR COATING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 173 EUROPE: MARKET FOR COATING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET FOR COATING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 BINDERS

7.5.1 BINDERS PROVIDE FLUIDITY AND COMPRESSIBILITY ESSENTIAL FOR TABLET MANUFACTURING

TABLE 175 PHARMACEUTICAL EXCIPIENTS MARKET FOR BINDERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 176 NORTH AMERICA: MARKET FOR BINDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 177 EUROPE: MARKET FOR BINDERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET FOR BINDERS, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 FLAVORING AGENTS & SWEETENERS

7.6.1 FLAVORING AGENTS ARE USED TO IMPROVE THE PALATABILITY OF DRUGS

TABLE 179 GLOBAL MARKET FOR FLAVORING AGENTS & SWEETENERS, BY REGION, 2020–2027 (USD MILLION)

TABLE 180 NORTH AMERICA: MARKET FOR FLAVORING AGENTS & SWEETENERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 181 EUROPE: MARKET FOR FLAVORING AGENTS & SWEETENERS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET FOR FLAVORING AGENTS & SWEETENERS, BY COUNTRY, 2020–2027 (USD MILLION)

7.7 DISINTEGRANTS

7.7.1 DISINTEGRANTS CAUSE A RAPID BREAK-UP OF SOLID DOSAGE FORMS

TABLE 183 PHARMACEUTICAL EXCIPIENTS MARKET FOR DISINTEGRANTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 184 NORTH AMERICA: MARKET FOR DISINTEGRANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 185 EUROPE: MARKET FOR DISINTEGRANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET FOR DISINTEGRANTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.8 COLORANTS

7.8.1 COLORING AGENTS ARE USED IN HARD AND SOFT GELATIN CAPSULES, TABLETS, ORAL LIQUIDS, AND TOPICAL CREAMS

TABLE 187 GLOBAL MARKET FOR COLORANTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 188 NORTH AMERICA: MARKET FOR COLORANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 189 EUROPE: MARKET FOR COLORANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET FOR COLORANTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.9 LUBRICANTS & GLIDANTS

7.9.1 GLIDANTS IMPROVE THE FLOW PROPERTIES OF A FORMULATION BY REDUCING INTER-PARTICLE FRICTION AND COHESION

TABLE 191 PHARMACEUTICAL EXCIPIENTS MARKET FOR LUBRICANTS & GLIDANTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 192 NORTH AMERICA: MARKET FOR LUBRICANTS & GLIDANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 193 EUROPE: MARKET FOR LUBRICANTS & GLIDANTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET FOR LUBRICANTS & GLIDANTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.10 PRESERVATIVES

7.10.1 BENZYL ALCOHOL IS A WIDELY USED PRESERVATIVE IN THE PHARMACEUTICAL AND NUTRACEUTICAL INDUSTRY

TABLE 195 GLOBAL MARKET FOR PRESERVATIVES, BY REGION, 2020–2027 (USD MILLION)

TABLE 196 NORTH AMERICA: MARKET FOR PRESERVATIVES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 197 EUROPE: MARKET FOR PRESERVATIVES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET FOR PRESERVATIVES, BY COUNTRY, 2020–2027 (USD MILLION)

7.11 EMULSIFYING AGENTS

7.11.1 USE OF SOLUBILITY ENHANCEMENT EXCIPIENTS IN LIQUID DRUG FORMULATIONS HELPS INCREASE API BIOAVAILABILITY

TABLE 199 PHARMACEUTICAL EXCIPIENTS MARKET FOR EMULSIFYING AGENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 200 NORTH AMERICA: MARKET FOR EMULSIFYING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 201 EUROPE: MARKET FOR EMULSIFYING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET FOR EMULSIFYING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.12 OTHER FUNCTIONALITIES

TABLE 203 GLOBAL MARKET FOR OTHER FUNCTIONALITIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 204 NORTH AMERICA: MARKET FOR OTHER FUNCTIONALITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 205 EUROPE: MARKET FOR OTHER FUNCTIONALITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 206 ASIA PACIFIC: MARKET FOR OTHER FUNCTIONALITIES, BY COUNTRY, 2020–2027 (USD MILLION)

8 PHARMACEUTICAL EXCIPIENTS MARKET, BY FORMULATION (Page No. - 195)

8.1 INTRODUCTION

TABLE 207 GLOBAL MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

8.2 ORAL FORMULATIONS

TABLE 208 GLOBAL MARKET FOR ORAL FORMULATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 209 NORTH AMERICA: MARKET FOR ORAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 210 EUROPE: MARKET FOR ORAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 211 ASIA PACIFIC: MARKET FOR ORAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 212 MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

8.2.1 TABLETS

8.2.1.1 Tablets are the most widely used dosage forms

TABLE 213 TYPICAL COMPOSITION OF TABLETS

TABLE 214 PHARMACEUTICAL EXCIPIENTS MARKET FOR TABLETS, BY REGION, 2020–2027 (USD MILLION)

TABLE 215 NORTH AMERICA: MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 216 EUROPE: MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 217 ASIA PACIFIC: MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2 CAPSULES

TABLE 218 GLOBAL MARKET FOR CAPSULES, BY REGION, 2020–2027 (USD MILLION)

TABLE 219 NORTH AMERICA: MARKET FOR CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 220 EUROPE: MARKET FOR CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 221 ASIA PACIFIC: MARKET FOR CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 222 PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

8.2.2.1 Hard-gelatin capsules

8.2.2.1.1 Ease of manufacturing and versatility are driving the growth of the hard-gelatin capsules market

TABLE 223 HARD-GELATIN CAPSULES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 224 NORTH AMERICA: HARD-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 225 EUROPE: HARD-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 226 ASIA PACIFIC: HARD-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2.2 Soft-gelatin capsules

8.2.2.2.1 Stability concerns with highly water-soluble compounds and compounds susceptible to hydrolysis have restricted market growth

TABLE 227 SOFT-GELATIN CAPSULES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 228 NORTH AMERICA: SOFT-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 229 EUROPE: SOFT-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 230 ASIA PACIFIC: SOFT-GELATIN CAPSULES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.3 LIQUID FORMULATIONS

8.2.3.1 Liquid formulations require no dissolution time and boast faster absorption from the stomach than tablets

TABLE 231 PHARMACEUTICAL EXCIPIENTS MARKET FOR LIQUID FORMULATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 232 NORTH AMERICA: MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 233 EUROPE: MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 234 ASIA PACIFIC: MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 TOPICAL FORMULATIONS

8.3.1 ADVANTAGES OF TOPICAL DRUG DELIVERY ARE DRIVING THE DEMAND FOR EXCIPIENTS IN THIS SEGMENT

TABLE 235 PHARMACEUTICAL EXCIPIENTS MARKET FOR TOPICAL FORMULATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 236 NORTH AMERICA: MARKET FOR TOPICAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 237 EUROPE: MARKET FOR TOPICAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 238 ASIA PACIFIC: MARKET FOR TOPICAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 PARENTERAL FORMULATIONS

8.4.1 EMERGENCE OF NEW BIOLOGICAL MOLECULES INCREASES THE DEMAND FOR EXCIPIENTS

TABLE 239 TYPICAL COMPOSITION OF PARENTERAL FORMULATIONS

TABLE 240 EXCIPIENTS USED IN PARENTERAL FORMULATIONS

TABLE 241 GLOBAL MARKET FOR PARENTERAL FORMULATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 242 NORTH AMERICA: MARKET FOR PARENTERAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 243 EUROPE: MARKET FOR PARENTERAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 244 ASIA PACIFIC: MARKET FOR PARENTERAL FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 OTHER FORMULATIONS

TABLE 245 PHARMACEUTICAL EXCIPIENTS MARKET FOR OTHER FORMULATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 246 NORTH AMERICA: MARKET FOR OTHER FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 247 EUROPE: MARKET FOR OTHER FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 248 ASIA PACIFIC: MARKET FOR OTHER FORMULATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 PHARMACEUTICAL EXCIPIENTS MARKET, BY REGION (Page No. - 215)

9.1 INTRODUCTION

TABLE 249 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 EUROPE

FIGURE 34 EUROPE: PHARMACEUTICAL EXCIPIENTS MARKET SNAPSHOT

TABLE 250 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 251 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 252 EUROPE: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 253 EUROPE: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 254 EUROPE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 255 EUROPE: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 256 EUROPE: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 257 EUROPE: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 258 EUROPE: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 EUROPE: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 260 EUROPE: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 261 EUROPE: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 EUROPE: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 263 EUROPE: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 264 EUROPE: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 265 EUROPE: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 266 EUROPE: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 267 EUROPE: MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.1 GERMANY

9.2.1.1 Germany accounted for the largest share of the European pharmaceutical excipients market in 2021

TABLE 268 GERMANY: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 269 GERMANY: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 270 GERMANY: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 271 GERMANY: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 272 GERMANY: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 273 GERMANY: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 274 GERMANY: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 275 GERMANY: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 276 GERMANY: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 277 GERMANY: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 278 GERMANY: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 279 GERMANY: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 280 GERMANY: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 281 GERMANY: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 282 GERMANY: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 283 GERMANY: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 284 GERMANY: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.2 FRANCE

9.2.2.1 Large geriatric population in the country to support market growth

TABLE 285 FRANCE: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 286 FRANCE: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 287 FRANCE: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 288 FRANCE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 289 FRANCE: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 290 FRANCE: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 291 FRANCE: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 292 FRANCE: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 293 FRANCE: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 294 FRANCE: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 295 FRANCE: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 296 FRANCE: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 297 FRANCE: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 298 FRANCE: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 299 FRANCE: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 300 FRANCE: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 301 FRANCE: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.3 UK

9.2.3.1 Growing adoption of generics and the development of novel multi-functional, co-processed excipients to drive market growth

TABLE 302 UK: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 303 UK: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 304 UK: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 305 UK: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 306 UK: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 307 UK: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 308 UK: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 309 UK: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 310 UK: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 311 UK: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 312 UK: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 313 UK: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 314 UK: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 315 UK: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 316 UK: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 317 UK: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 318 UK: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.4 ITALY

9.2.4.1 Budgetary constraints and restricted healthcare spending impede the growth of the Italian market

TABLE 319 ITALY: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 320 ITALY: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 321 ITALY: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 322 ITALY: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 323 ITALY: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 324 ITALY: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 325 ITALY: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 326 ITALY: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 327 ITALY: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 328 ITALY: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 329 ITALY: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 330 ITALY: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 331 ITALY: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 332 ITALY: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 333 ITALY: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 334 ITALY: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 335 ITALY: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.5 SPAIN

9.2.5.1 High consumption of biologics to support market growth

TABLE 336 SPAIN: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 337 SPAIN: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 338 SPAIN: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 339 SPAIN: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 340 SPAIN: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 341 SPAIN: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 342 SPAIN: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 343 SPAIN: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 344 SPAIN: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 345 SPAIN: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 346 SPAIN: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 347 SPAIN: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 348 SPAIN: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 349 SPAIN: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 350 SPAIN: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 351 SPAIN: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 352 SPAIN: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.2.6 REST OF EUROPE

TABLE 353 ROE: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 354 ROE: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 355 ROE: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 356 ROE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 357 ROE: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 358 ROE: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 359 ROE: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 360 ROE: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 361 ROE: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 362 ROE: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 363 ROE: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 364 ROE: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 365 ROE: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 366 ROE: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 367 ROE: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 368 ROE: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 369 ROE: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET SNAPSHOT

TABLE 370 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 371 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 372 NORTH AMERICA: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 373 NORTH AMERICA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 374 NORTH AMERICA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 375 NORTH AMERICA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 376 NORTH AMERICA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 377 NORTH AMERICA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 378 NORTH AMERICA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 379 NORTH AMERICA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 380 NORTH AMERICA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 381 NORTH AMERICA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 382 NORTH AMERICA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 383 NORTH AMERICA: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 384 NORTH AMERICA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 385 NORTH AMERICA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 386 NORTH AMERICA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 387 NORTH AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.3.1 US

9.3.1.1 The US dominates the North American market

TABLE 388 US: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 389 US: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 390 US: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 391 US: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 392 US: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 393 US: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 394 US: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 395 US: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 396 US: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 397 US: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 398 US: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 399 US: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 400 US: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 401 US: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 402 US: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 403 US: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 404 US: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Strong growth of the emerging markets and slowdown in new product approvals hamper the market growth in Canada

TABLE 405 CANADA: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 406 CANADA: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 407 CANADA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 408 CANADA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 409 CANADA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 410 CANADA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 411 CANADA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 412 CANADA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 413 CANADA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 414 CANADA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 415 CANADA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 416 CANADA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 417 CANADA: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 418 CANADA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 419 CANADA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 420 CANADA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 421 CANADA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 422 ASIA PACIFIC: PHARMACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 423 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 424 ASIA PACIFIC: PHARMACEUTICAL EXCIPIENTS MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 425 ASIA PACIFIC: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 426 ASIA PACIFIC: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 427 ASIA PACIFIC: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 428 ASIA PACIFIC: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 429 ASIA PACIFIC: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 430 ASIA PACIFIC: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 431 ASIA PACIFIC: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 432 ASIA PACIFIC: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 433 ASIA PACIFIC: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 434 ASIA PACIFIC: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 435 ASIA PACIFIC: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 436 ASIA PACIFIC: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 437 ASIA PACIFIC: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 438 ASIA PACIFIC: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 439 ASIA PACIFIC: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 The rapid growth of Japan’s geriatric population will greatly drive the demand for pharmaceuticals

TABLE 440 JAPAN: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 441 JAPAN: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 442 JAPAN: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 443 JAPAN: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 444 JAPAN: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 445 JAPAN: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 446 JAPAN: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 447 JAPAN: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 448 JAPAN: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 449 JAPAN: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 450 JAPAN: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 451 JAPAN: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 452 JAPAN: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 453 JAPAN: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 454 JAPAN: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 455 JAPAN: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 456 JAPAN: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Emphasis on generics and off-patent drugs to drive the market in China

TABLE 457 CHINA: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 458 CHINA: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 459 CHINA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 460 CHINA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 461 CHINA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 462 CHINA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 463 CHINA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 464 CHINA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 465 CHINA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 466 CHINA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 467 CHINA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 468 CHINA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 469 CHINA: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 470 CHINA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 471 CHINA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 472 CHINA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 473 CHINA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 India is a leading producer of generics

TABLE 474 INDIA: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 475 INDIA: PHARMACEUTICAL EXCIPIENTS MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 476 INDIA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 477 INDIA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 478 INDIA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 479 INDIA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 480 INDIA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 481 INDIA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 482 INDIA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 483 INDIA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 484 INDIA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 485 INDIA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 486 INDIA: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 487 INDIA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 488 INDIA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 489 INDIA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 490 INDIA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 491 ROAPAC: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 492 ROAPAC: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 493 ROAPAC: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 494 ROAPAC: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 495 ROAPAC: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 496 ROAPAC: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 497 ROAPAC: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 498 ROAPAC: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 499 ROAPAC: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 500 ROAPAC: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 501 ROAPAC: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 502 ROAPAC: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 503 ROAPAC: MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 504 ROAPAC: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 505 ROAPAC: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 506 ROAPAC: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 507 ROAPAC: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 GROWING GERIATRIC POPULATION AND DISEASE PREVALENCE ARE DRIVING MARKET GROWTH

TABLE 508 LATIN AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 509 LATIN AMERICA: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 510 LATIN AMERICA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 511 LATIN AMERICA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 512 LATIN AMERICA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 513 LATIN AMERICA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 514 LATIN AMERICA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 515 LATIN AMERICA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 516 LATIN AMERICA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 517 LATIN AMERICA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 518 LATIN AMERICA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 519 LATIN AMERICA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 520 LATIN AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 521 LATIN AMERICA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 522 LATIN AMERICA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 523 LATIN AMERICA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 524 LATIN AMERICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 UNSATURATED MARKETS IN THE REGION HAVE DRAWN THE ATTENTION OF GLOBAL PLAYERS

TABLE 525 MIDDLE EAST & AFRICA: PHARMACEUTICAL EXCIPIENTS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 526 MIDDLE EAST & AFRICA: MARKET FOR ORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 527 MIDDLE EAST & AFRICA: OLEOCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 528 MIDDLE EAST & AFRICA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 529 MIDDLE EAST & AFRICA: SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 530 MIDDLE EAST & AFRICA: ACTUAL SUGARS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 531 MIDDLE EAST & AFRICA: SUGAR ALCOHOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 532 MIDDLE EAST & AFRICA: CELLULOSE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 533 MIDDLE EAST & AFRICA: STARCH MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 534 MIDDLE EAST & AFRICA: PETROCHEMICALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 535 MIDDLE EAST & AFRICA: GLYCOLS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 536 MIDDLE EAST & AFRICA: MINERAL HYDROCARBONS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 537 MIDDLE EAST & AFRICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR INORGANIC CHEMICALS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 538 MIDDLE EAST & AFRICA: MARKET, BY FUNCTIONALITY, 2020–2027 (USD MILLION)

TABLE 539 MIDDLE EAST & AFRICA: MARKET, BY FORMULATION, 2020–2027 (USD MILLION)

TABLE 540 MIDDLE EAST & AFRICA: MARKET FOR ORAL FORMULATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 541 MIDDLE EAST & AFRICA: PHARMACEUTICAL EXCIPIENTS MARKET FOR CAPSULES, BY TYPE, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 324)

10.1 INTRODUCTION

10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 36 PHARMACEUTICAL EXCIPIENTS MARKET: STRATEGIES ADOPTED

10.3 MARKET SHARE ANALYSIS

FIGURE 37 GLOBAL MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2021)

TABLE 542 GLOBAL MARKET: DEGREE OF COMPETITION

10.4 REVENUE ANALYSIS

FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES (2019-2021)

10.5 COMPANY EVALUATION QUADRANT

FIGURE 39 PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY EVALUATION MATRIX, 2021

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

10.6 COMPANY EVALUATION QUADRANT: START-UPS/SMES

FIGURE 40 PHARMACEUTICAL EXCIPIENTS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

10.7 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

TABLE 543 PHARMACEUTICAL EXCIPIENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 544 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

10.8 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

10.8.1 COMPANY FOOTPRINT ANALYSIS (25 COMPANIES)

TABLE 545 COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE PHARMACEUTICAL EXCIPIENTS MARKET

10.8.2 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 546 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

10.8.3 COMPANY FUNCTIONALITY FOOTPRINT (25 COMPANIES)

TABLE 547 FUNCTIONALITY FOOTPRINT ANALYSIS OF KEY PLAYERS IN PHARMACEUTICAL EXCIPIENTS MARKET

10.8.4 COMPANY REGIONAL FOOTPRINT (25 COMPANIES)

TABLE 548 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

10.9 COMPETITIVE SCENARIO AND TRENDS

10.9.1 PRODUCT LAUNCHES

TABLE 549 PHARMACEUTICAL EXCIPIENTS MARKET: PRODUCT LAUNCHES, JANUARY 2019-MAY 2022

10.9.2 DEALS

TABLE 550 GLOBAL MARKET: DEALS, JANUARY 2019-MAY 2022

11 COMPANY PROFILES (Page No. - 340)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 INTERNATIONAL FLAVORS & FRAGRANCES INC.

TABLE 551 INTERNATIONAL FLAVORS & FRAGRANCES, INC.: BUSINESS OVERVIEW

FIGURE 41 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

11.1.2 ASHLAND GLOBAL HOLDINGS INC

TABLE 552 ASHLAND: BUSINESS OVERVIEW

FIGURE 42 ASHLAND: COMPANY SNAPSHOT

11.1.3 EVONIK INDUSTRIES AG

TABLE 553 EVONIK INDUSTRIES: BUSINESS OVERVIEW

FIGURE 43 EVONIK INDUSTRIES: COMPANY SNAPSHOT

11.1.4 BASF SE

TABLE 554 BASF SE.: BUSINESS OVERVIEW

FIGURE 44 BASF SE.: COMPANY SNAPSHOT

11.1.5 KERRY GROUP PLC

TABLE 555 KERRY GROUP: BUSINESS OVERVIEW

FIGURE 45 KERRY GROUP: COMPANY SNAPSHOT

11.1.6 ROQUETTE FRÈRES

TABLE 556 ROQUETTE FRÈRES: BUSINESS OVERVIEW

11.1.7 MERCK KGAA

TABLE 557 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 46 MERCK KGAA: COMPANY SNAPSHOT

11.1.8 ASSOCIATED BRITISH FOODS PLC

TABLE 558 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 47 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

11.1.9 ARCHER DANIELS MIDLAND (ADM) COMPANY

TABLE 559 ARCHER DANIELS MIDLAND (ADM) COMPANY: BUSINESS OVERVIEW

FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

11.1.10 WACKER CHEMIE AG

TABLE 560 WACKER CHEMIE AG: BUSINESS OVERVIEW

FIGURE 49 WACKER CHEMIE AG: COMPANY SNAPSHOT

11.1.11 AIR LIQUIDE SA

TABLE 561 AIR LIQUIDE: BUSINESS OVERVIEW

FIGURE 50 AIR LIQUIDE SA: COMPANY SNAPSHOT

11.1.12 DOW CHEMICALS

TABLE 562 DOW CHEMICALS: BUSINESS OVERVIEW

FIGURE 51 DOW CHEMICALS: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 LUBRIZOL CORPORATION

11.2.2 COLORCON, INC

11.2.3 DMV-FONTERRA EXCIPIENTS GMBH & CO. KG

11.2.4 INNOPHOS HOLDINGS, INC

11.2.5 JRS PHARMA GMBH & CO. KG

11.2.6 FINAR LIMITED

11.2.7 MEGGLE GMBH & CO. KG

11.2.8 FUJI CHEMICAL INDUSTRIES CO., LTD.

11.2.9 CAPTISOL

11.2.10 IDEAL CURES PVT. LTD.

11.2.11 COREL PHARMA CHEM

11.2.12 BIOGRUND GMBH

11.2.13 NITIKA PHARMACEUTICAL SPECIALTIES PVT. LTD.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 385)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

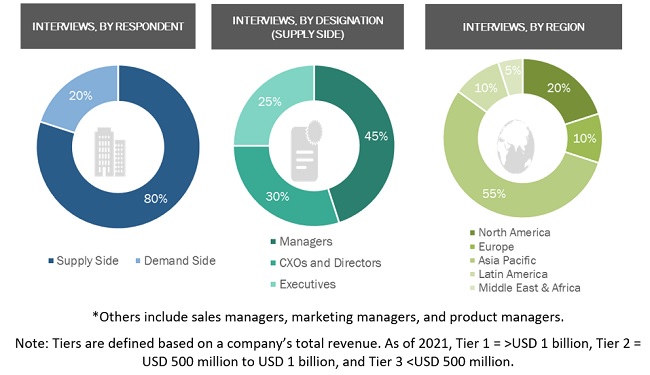

This study involved four major activities in estimating the current size of the pharmaceutical excipients market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the pharmaceutical excipients market. The secondary sources used for this study include European Federation of Pharmaceutical Industries and Associations (EFPIA), Pharmaceutical Research and Manufacturers of America (PhRMA), Parenteral Drug Association (PDA), International Pharmaceutical Excipients Council (IPEC), International Journal of Production Research (IJPR), Generics and Biosimilars Initiative (GaBI), PharmaTimes, World Journal of Pharmaceutical Sciences, International Federation of Pharmaceutical Manufacturers & Association (IFPMA), Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical excipients market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the pharmaceutical excipients business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global pharmaceutical excipients market based on the product, functionslity, formulation and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)