Pharmaceutical Packaging Market by Raw Material (Plastics, Paper & paperboard, Glass, Metal), Type (Plastic Bottles, Blisters, Caps & Closures, Labels & Accessories, Pre-filled syringes), Drug Delivery, and Region - Global Forecast to 2027

Pharmaceutical Packaging Market

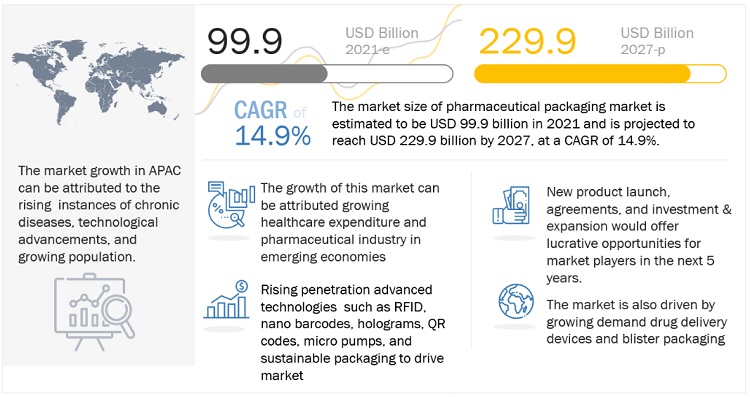

The global Pharmaceutical packaging market was valued at USD 99.9 billion in 2021 and is projected to reach USD 229.9 billion by 2027, growing at a cagr 14.9% from 2022 to 2027. The growing demand for pharmaceutical packaging is due to rising healthcare expenses, and growing consumer awareness regarding healthier lifestyle. Moreover, advanced drug delivery, growing emerging economy markets such as India, Thailand, China, and others, and innovative packaging solutions with higher patient convenience and compliance drive the market for pharmaceutical packaging.

Global Pharmaceutical Packaging Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

Covid-19 pandemic had adverse effects on the healthcare industry. Shortage of infrastructure, manpower, disruptions in supply chain, lack of preparedness, shortage of essential drugs, and many other factors were responsible for the decline in healthcare industry functioning. The practices were not robust enough of handle such disruptions in supply chain, infrastructure, manpower and others. China, which was a major import destination of medical equipment’s, healthcare supply chain requirements, and drug formulations was reeling under the pandemic. This resulted in loss of stability in both the healthcare and pharmaceutical sectors. Global medical supply chain is still in a state of imbalance but is stabilizing as per the new normal. Pharmaceutical companies are also analyzing and updating their operation capabilities as per the current situation.

Durnig pandemic, packaging activies were considered essential. The pharmaceutical packaging companies have increased their production to keep up with the rising demand for blister packs, vials, prefilled syringes, containers, bottles and cartridges. This was mainly due to rise in the demand for Covid-related drugs and vaccines. In addition, pharmaceutical packaging for biologics, smart packaging, sterile packaging, patient focus packaging, cleanroom expansion, and others would propel the market in the long term.

Pharmaceutical Packaging Market Dynamics

Driver: Technological advancements to contribute to growth of pharmaceutical packaging

Nano drug delivery systems are technologies that use nanoparticles for the targeted delivery and controlled release of therapeutic agents. These are new but rapidly developing technology for curing cancer, diabetes, cardiovascular, inflammatory, and microbial diseases. Nanotechnology offers many advantages in treating chronic diseases such as cardiovascular diseases (CVDs) by site-specific and target oriented delivery of drugs. CRP (Child-Resistant Packaging) is a special type of packaging used to reduce the risk of children handling and ingesting dangerous items. This packaging prevents children from opening a pharmaceutical product. CRP is required, by regulation, for prescription drugs, nicotine-based products, and over-the-counter medications. In developed countries, it is mandatory to use CRP for drugs such as aspirin, paracetamol, elemental iron, contraceptives, and others.

Restrain:Lack of access to proper healthcare

In developing economies, poverty is a significant obstacle to access healthcare facilities. The major challenges that limit the access of healthcare services are financial limitation, a lack of information, awareness of basic healthcare practices, and outdated equipment. These challenges limit the pharmaceutical packaging market in emerging nations like India, South Africa, Brazil and others. In India, a majority of the population is still suffering due to poor quality of healthcare and lack of access.

Opportunity: Growing demand for primary pharmaceutical packaging

Primary pharmaceutical packaging are products that come in direct contact with the medicine or drug. They generally include plastic bottles, glass bottles, pre-filled syringes, pre-filled inhalers, medication tubes, blister packaging, and others. The major contributors to the growth of this segment are pre-fillable syringes and pre-fillable inhalers. Plastic bottles, blister packs, and ampoules & vials are also some of the primary pharmaceutical packaging that are growing rapidly. Advancements in biotechnology, leading to the introduction of new injectable parenteral therapies, and increased demand for high visibility unit dosage packaging for diseases such as diabetes will drive the primary packaging segment.

Challenge: Safeguarding against counterfeit products

Counterfeit drugs are made with incorrect ingredients in inappropriate quantities, which when consumed would result in harmful effects such as allergic reactions or sometimes death. Nearly half of the counterfeit drugs are reported in developing economies such as China, the Philippines, and Vietnam. Delay in approval of new drugs and their packaging due to the long product development cycles and costs are resulting in the increased availability of counterfeit drugs and fake packaging. These counterfeit products have negative effects on the human body, in terms of allergic reactions, nausea, vomiting, and others. Safeguarding against these counterfeit products is a major challenge for the sector.

Plastics accounted for the largest share amongst other raw material in the pharmaceutical packaging market

Plastic offers design flexibility and cost-effective packaging solution, making it very suitable choice for pharmaceutical packaging. They are adopted for their enticing properties such as shatter resistance, rigidity, strength, light weighting, and moldability. Pharmaceutical packaging widely uses plastics as raw materials for. The excellent shatter resistance provided by plastics enables ease of handling and transportation. Plastic’s easy molding strength and efficiency as barrier against vapour and gas are further benefits.

Plastic bottles accounted for the largest market share amongst other types in the pharmaceutical packaging market

Pharmaceutical most common type of packaging item is Plastic bottles. They are suitable for storage of drugs in liquid and solid forms. Plastic bottles can be coupled with the appropriate type of cap & closure to suit specific applications such as nasal spray and ophthalmic drops. Plastic bottles are used in various types of packaging such as rigid form for solid dosages, sterile packaging for blood and related components, squeezable bottles, jars, and others. Growing patient compliance and convenience with oral drug delivery, increasing cases of communicable diseases, and rise in aging population in developed economies are responsible for the high share of the bottles segment.

Nasal is projected to be the second highest CAGR in pharmaceutical packaging drug delivery mode during forecast period.

Nasal drugs used are generally in liquid formulation, but powder form can also offer higher stability and support new device developments in the future. Nasal drug delivery containers are also known as nasal sprays. These drug products have therapeutically active ingredients dissolved or suspended in solutions or mixtures of excipients in non-pressurized dispensers to deliver a spray containing a metered dose of the active ingredient. The dose can be metered by the spray pump or be pre-metered during manufacture.

Asia Pacific is projected to grow the fastest in the pharmaceutical packaging market during the forecast period.

Asia Pacific is predicted to be the fastest-growing region amongst others in the pharmaceutical packaging market in 2020. Increasing government initiatives in emerging pharmaceutical market, increase in contract manufacturing activities, rise in aging population, and increased spending on healthcare are driving the market in Asia Pacific. China, Australia, Japan, South Korea, and India are the major markets in this region. India and China are investing heavily in their respective healthcare sectors, which is going to benefit the rapidly growing pharmaceuticals industry. In addition, growing technological advancements in healthcare sector in countries such as Singapore, China, Malaysia, Thailand, and others, increasing urbanization, and changing lifestyle are also some of the driving factors for the market growth in pharmaceutical packaging industry.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Pharmaceutical Packaging Market Players

The key players in the pharmaceutical packaging market include Schott AG (Germany), Amcor PLC (Switzerland), AptarGroup,Inc (US), West Pharmaceutical Services, Inc. (US), Berry Global (US), Gerresheimer AG (Germany), Catalent,Inc (US), and WestRock (US). The pharmaceutical packaging market report analyzes the key growth strategies, such as new product launches, investments & expansions, joint ventures, agreements, partnerships, and mergers & acquisitions adopted by the leading market players between 2019 and 2022.

Pharmaceutical Packaging Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 99.9 Billion |

|

Revenue Forecast in 2027 |

USD 229.9 Billion |

|

CAGR |

14.9% |

|

Years considered for the study |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Raw Material, Types, Drug Delivery Modes, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Schott AG (Germany), Amcor PLC (Switzerland), AptarGroup,Inc (US), West Pharmaceutical Services, Inc. (US), Berry Global (US), Gerresheimer AG (Germany), Catalent,Inc (US), and WestRock (US) |

This research report categorizes the pharmaceutical packaging market based on raw material, types, drug delivery modes, and region.

By Material:

- Plastics

- Paper & paperboard

- Glass

- Metal

- Others

By Drug Delivery

- Oral Drugs

- Injectables

- Topical

- Ocular/ Ophthalmic

- Nasal

- Pulmonary

- Transdermal

- IV Drugs

- Others

By Type

- Plastic bottles

- Blister

- Labels & accessories

- Caps & closures

- Pre-filled syringes

- Medical specialty bags

- Temp controlled packaging

- Pouches & strip packs

- Pre-filled inhalers

- Vials

- Ampoules

- Medication tubes

- Jars & Canisters

- Cartridges

- Others

By Region

- North America

- Aisa Pacific

- Europe

- Middle East & Africa

- South America

The pharmaceutical packaging market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In January 2022, Berry Global Group and Raw Elements USA Collaborated to launch sustainable tube made from sugarcane. The tubes are made from sugarcane waste that is converted into HDPE and LDPE to create a material with the same chemical makeup of fossil fuel-based polyethylene.

- In July 2022, Gerresheimer AG and Stevanato Group announce collaboration, to develop a new ready-to-use solution platform based on EZ-fill® pre-sterilized platform.

- In June 2021, Amcor PLC introduced ACT2100 heat seal coating for medical grade DuPont Tyvek2 and paper packaging applications. This next generation coating technology delivers enhanced performance features for healthcare applications.

- In August 2021, Schott AG and Serum Institute of India Announce Joint Venture for Pharmaceutical Packaging. Serum Institute of India (SII) acquires 50% stake of Schott Kaisha to become Schott’s joint venture partner and secure pharma packaging supply.

Frequently Asked Questions (FAQ):

What is the current size of the global pharmaceutical packaging market?

Global pharmaceutical packaging market size is estimated to reach USD 229.9 billion by 2027 from USD 99.9 billion in 2021, at a CAGR of 14.9% during the forecast period.

Are there any regulations for pharmaceutical packaging?

Several countries in Europe and North America have introduced regulations for this market. For e.g., in the European Union, European Medicines Agency and European Commission oversee the proper packaging for active substances or medicinal products. The US Food & Drug Administration (US FDA) is the authority which regulates and provides guidelines on packaging, labelling, storage, and transport of medical products in the US.

Who are the winners in the global pharmaceutical packaging market?

Companies such as Schott AG, Amcor PLC, AptarGroup,Inc, West Pharmaceutical Services, Berry Global, Gerresheimer AG, Catalent,Inc, Nolato, SGD Pharma, Origin Pharma, and WestRock under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on pharmaceutical packaging manufacturers?

Packaging activities were considered essential during the pandemic. Pharmaceutical packaging companies benefitted from this and experienced stable revenue growth in 2020. Pharmaceutical packaging companies had increased their productivity to support the increased demand for blister packs, vials, pre-filled syringes, containers, bottles, cartridges, and pouches. This was mainly due to increased demand for Covid related medications, and vaccines.

What are some of the drivers in the market?

The increasing requirement of pharmaceutical packaging in emerging economies and demand for advance drug delivery devices systems drive the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

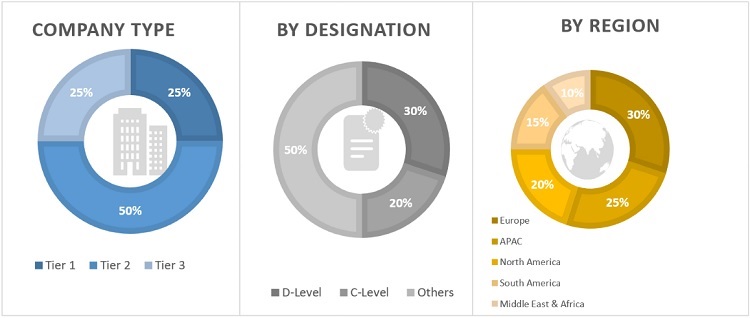

The study involved four major activities in estimating the current market size for pharmaceutical packaging. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Bloomberg, World Bank, Statista, Packaging Industry Associations, Trademap, Zauba, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the Food & Drug Administration (FDA), World Health organization (WHO), The European Federation of Pharmaceutical Industries and Associations (EFPIA), Pharmaceuticals Export Promotion Council of India, regulatory bodies, and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the pharmaceutical packaging market scenario through secondary research The pharmaceutical packaging market comprises several stakeholders such as raw material suppliers, distributors of pharmaceutical packaging, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of pharmaceutical drug manufacturers, medical drug filling contractors, hospitals, labs, research institutes, and other healthcare institutions. Several primary interviews have been conducted with market experts from both the demand- (pharmaceutical packaging manufacturers) and supply-side (end-product manufacturers, buyers, and distributors) players across six major regions, namely, North America, Western Europe, Eastern & Central Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical packaging market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, raw material, types, and drug delivery modes in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of pharmaceutical packaging and their applications.

Report Objective:

- To analyze and forecast size of the pharmaceutical packaging market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market by type, by raw material, drug delivery, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, future prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments such as mergers & acquisitions, new product developments, investments & expansions, and agreements & partnerships in the market

- Strategically profile key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the pharmaceutical packaging market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the pharmaceutical packaging market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pharmaceutical Packaging Market