Agricultural Pheromones Market by Crop Type (Fruits & Nuts, Field Crops, & Vegetable Crops), Function (Mating Disruption, Mass Trapping, Detection & Monitoring), Mode of Application (Dispensers, Traps, & Sprays), Type, and Region - Global Forecast to 2028

Speak to Analyst to get the Global Forecasts Data up to 2028

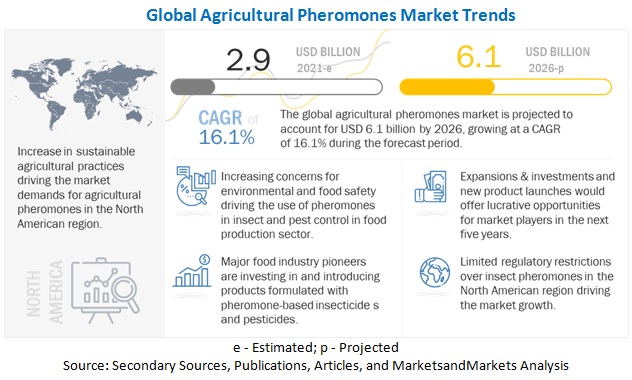

[324 Pages Report] The global agricultural pheromones market will be valued at USD 2,879.8 million in 2021. It is projected to reach USD 6,087.8 million by 2026, recording a CAGR of 16.1% during the forecast period.

Agricultural pheromones are chemical signals that trap pests such as insects in crop fields. Key players in the market are investing in developing advanced and innovative agricultural pheromones, such as trap designs, microencapsulation, and pheromones, with different techniques to provide solutions in terms of the mass trapping of insects without the application of insecticides. The manufacturers capitalized on advanced studies of different pheromones secreted by major insect pests can be regarded as effective methods to limit the application of insecticides. The rising trends in the agricultural pheromones market, such as the synthesis of pheromone molecules bio-organically through bacteria and yeasts, are projected to widen the market opportunities for crop protection manufacturers. These production techniques can reduce the adoption of complex chemical synthesis processes and lower the manufacturing costs of the technical ingredients.

The growing popularity of microencapsulated spray pheromones due to their easy applicability, reachability (the required crop height for effective mating disruption), and efficient release rate of technical ingredients are projected to drive market growth for the next five years.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing demand for crop protection solutions

The global agriculture sector actively uses insecticides and pesticides to eliminate pests and attain high crop yields. Per the FAO, the global consumption of pesticides accounted for over 4.1 million tons in 2018. However, the rising consumer inclination toward the harmful effects of insecticides and chemical pesticides on human health has compelled farmers to improve their agricultural practices. It, in turn, led to the worldwide utilization of biopesticides and the implementation of a sustainable crop management system.

Semiochemicals such as pheromones and allelochemicals are biological pesticides that are organic and environmentally safe. Companies nowadays are increasing their research & development investments to diversify the application area for these pesticides and, thus, propelling the growth of the overall market over the next few years. For instance, Provivi invested over USD 85 million in October 2019 to support the development of its pheromone product portfolio.

Many horticulture and agriculture farmers are employing sex pheromones and attractants to decrease the number of crop-damaging insects and pests effectively. Rising R&D initiatives to improve the overall efficiency of the product are projected to drive the agricultural pheromones market in the coming years. For instance, the England-based Earlham Institute recognizes and validates biosynthetic enzymes to obtain pheromones from the Coccoidea insect superfamily.

Restraints: High maintenance and production cost associated with the development of agricultural pheromones

The continuous and extensive use of modern crop protection products to eliminate or reduce pest infestation has increased the resistance to conventional crop protection products among pests. This resistance can be classified into metabolic, target-site, penetration, and behavioral.

Increased pest resistance has led to the development of modern pest control approaches, such as (IPM), which has led to significant demand for agricultural insect pheromones in the global market. With the introduction of advanced solutions, production and maintenance costs of manufacturers are also rising, creating limitations for market growth.

Opportunities: Supportive regulations for semiochemicals

Regulatory agencies such as the United States Environmental Protection Agency (EPA), Canada’s Pest Management Regulatory Agency (PMRA), and the European Union’s regulatory authorities have not observed adverse effects on human health or the environment associated with semiochemicals, such as pheromones that are registered for use in the mating disruption of arthropods and other applications. Most registered products belong to Straight Chain Lepidopteran Pheromones (SCLPs).

In the US, pheromones used for biological control have more regulatory relief for testing and registration. In addition, non-SCLP pheromones or products that are out of established exemptions and regulated by the US EPA as regular biochemicals or biopesticides avail reduced timelines and fees compared to conventional insecticides. In most countries, pheromones and traps are free of regulation for monitoring purposes.

Challenges: Lack of awareness and low utilization of biologicals in developing economies

As the market is highly fragmented at the regional level, awareness regarding various brands is low. Despite considerable efforts by agronomists, agricultural universities, companies, and governments across the globe in recent years, the majority of farmers are unaware of pheromone products and their benefits in increasing cost-yield sustainability.

On the other hand, in countries such as India and China, which are the most populous economies and where agriculture is the major source of income for more than half of the population, food demand remains higher, and farmers are not willing to take risks by production capacity. According to the Institute of Management Development and Research (IMDR) of India, small retailers and shopkeepers are unwilling to stock and sell biologicals in the country as they feel their quality is unreliable.

Another reason for the low adoption rate of pheromones is the established chemical pesticides market, which caters to the needs of farmers with the help of a wide range of products. The chemical pesticides industry consists of many multinational companies with a greater market presence and strong & organized distribution networks, reaching the remote parts of almost all continents. However, established players could utilize this network to supply the biological products offered by other manufacturers.

High efficiency in controlling invasive pests, such as codling moths, in driving the market for Mating disruption

Mating disruption involves using sex pheromones to prevent male insects from locating females for mating. It is accomplished by two principles: false trails and confusion. In the false trail following, the pheromone is released from dispensers that act as false sources of mating signals. The false pheromone sources are distributed evenly in the field and emit nearly the same amount of pheromones as a calling female.

However, in the other mating disruption technique, pheromones are released at such a high rate that the male is confused or is unable to detect the plume of the calling female. When the sensory organs of males are constantly exposed to high and uniform levels of pheromones in orchards, their ability to detect the pheromone is limited or inhibited. In habituation, males become less responsive after exposure to a high concentration of pheromones for longer. As this directly affects the nervous system, the chances of recovery diminish within the male species. Mating disruption helps control key pests, such as codling moths, and limits the usage and exposure to toxic pesticides.

Convenient and ready-to-use Pheromone traps to drive the growth of the market

Pheromone traps are usually used to capture certain species of insects in stored products. A pheromone attractant is used inside the trap to lure the insects. Traps are used for monitoring and mass trapping as well. However, in the case of mass trapping, the number of traps per unit area is increasing effectively to trap more insects. Some of the most commonly used traps include delta, sticky, winged, and funnel traps.

To know about the assumptions considered for the study, download the pdf brochure

The North American region dominated the agricultural pheromones market and is projected to grow at the highest CAGR of 16.9% from 2021 to 2026.

The market for pheromones is growing in North America owing to the widening scope of applications across different industries.

The US has the largest market for pheromones because the country is one of the largest producers and consumers of fresh and processed fruits. Sales of organic products in the US were USD 2.5 billion in 2018, i.e., up 6.3% from 2017. According to the 2019 Organic Industry Survey by the OTA, Organic food sales increased by 5.9% to USD 47.9 billion, outpacing total food sales growth at 2.3%. These factors have aided the country in accounting for the largest share of the market.

In Canada, sex pheromones are most widely used for monitoring and lure-and-kill purposes and to disrupt the mating of insects. The crops widely grown in Canada are apples, corn, cherries, tomatoes, soybean, and grapes. Insect pheromones are utilized to target pests, such as codling moths on apples and grape berry moths on grapes, by applying monitoring and mating disruption. The use of insect pheromones for monitoring purposes is carried out largely in greenhouse farming, where mainly vegetable crops are cultivated.

Key Market Players

The key players in this market include Shin-Etsu Chemical Co., Ltd (Japan), Koppert Biological Systems (Netherlands), Isagro Group (Italy), Biobest Group NV (Belgium), Suterra LLC (US), Russell IPM (UK), ISCA Technologies (US), Trécé Incorporated (US), Bedoukian Research, Inc. (US), Pherobank B.V. (Netherlands), BASF (Germany), Certis Europe BV (Netherlands), Bioline AgroSciences Ltd. (US), Bio Controle (Brazil), and ATGC Biotech Pvt Ltd. (India).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) & Volume (Tons) |

|

Segments covered |

Types, functions, modes of application, crop types, and regions |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

|

This research report categorizes the agricultural pheromones market, based on types, functions, modes of application, crop types, and regions.

Agricultural pheromones: By type

- Sex pheromones

- Aggregation pheromones

- Other types (alarm pheromones, host-marking pheromones, and trail pheromones)

By function

- Mating disruption

- Detection & monitoring

- Mass trapping

By mode of application

- Dispensers

- Traps

- Sprays

By crop type

- Fruits & nuts

- Field crops

- Vegetable crops

- Other crop types (plantation crops, alfalfa, and ornamental crops)

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In October 2020, Trécé Incorporated launched CIDETRAK IMM MEC, a novel MEC sprayable formulation that provides mating disruption control of Indian Meal Moth (IMM), Plodia interpunctella; tobacco moth Ephestia ellutella; almond moth, Cadra cautella; raisin moth, Cadra figulilella and Mediterranean flour moth, Ephestia kuehniella.

- In June 2019, Koppert Biological Systems acquired Natural Enemies (US), a leader in the cannabis industry for chemical-free pest management. This acquisition would help growers access Koppert Biological Systems’ high-quality products and efficiently use the company’s knowledge in horticulture.

- In July 2019, Pherobank B.V. introduced a pheromone lure for Contarinia nasturtii, a small fly, the larvae of which infest the brassica plants that cause distortion of leaf stems and foliage.

- In February 2019, Biobest Group NV launched Bug-Scan sticky traps, which were incorporated with quick and easy hanging systems, to make the system more time-efficient. This integrated hanging system would reduce the labor effort for hanging these sticky traps.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the agricultural pheromones market?

North America accounts for the largest agricultural pheromones market due to the multiple application of pheromones across different industries, including agriculture, pharmaceutical, forestry, and others.

What is the current size of the global agricultural pheromones market?

The global agricultural pheromones market will be valued at USD 2.9 billion in 2021. It is projected to reach USD 6.1 billion by 2026, recording a CAGR of 16.1% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Players such as Shin-Etsu Chemical Co., Ltd., Koppert Biological Systems, Isagro Group, Biobest Group NV, and Suterra LLC lead the market because of their innovative products and different distribution channels to meet the demands of consumers. These factors are projected to contribute to the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2016–2020

1.6 VOLUME UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

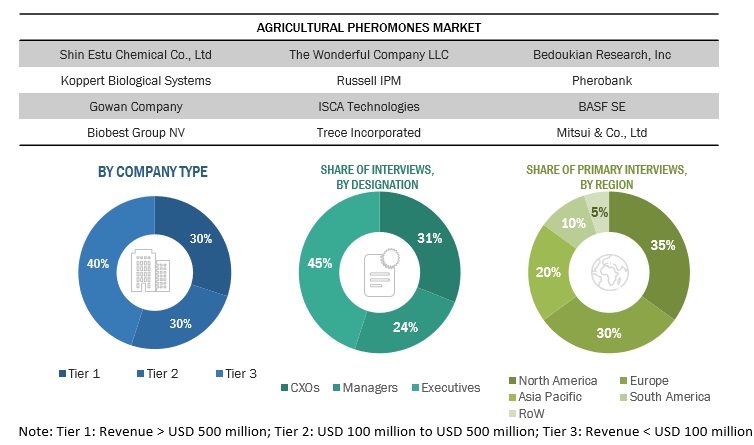

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION – SUPPLY SIDE (1/2)

FIGURE 6 AGRICULTURAL PHEROMONE MARKET SIZE ESTIMATION – SUPPLY SIDE (2/2)

FIGURE 7 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 8 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 11 COVID-19: GLOBAL PROPAGATION

FIGURE 12 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 13 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 14 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 15 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 66)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 16 IMPACT OF COVID-19 ON THE AGRICULTURAL PHEROMONES MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 17 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 AGRICULTURAL PHEROMONES MARKET SHARE (VALUE), BY TYPE, 2021 VS. 2026

FIGURE 19 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021 VS. 2026 (USD MILLION)

FIGURE 20 AGRICULTURAL PHEROMONES MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 73)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 21 INCREASING ADOPTION OF INTEGRATED PEST MANAGEMENT PRACTICES AND SUSTAINABLE AGRICULTURE TO PROPEL THE MARKET

4.2 NORTH AMERICA: MARKET FOR AGRICULTURAL PHEROMONES, BY TYPE & COUNTRY

FIGURE 22 SEX PHEROMONES SEGMENT AND THE US REGION TO ACCOUNT FOR THE LARGE SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.3 MARKET FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION

FIGURE 23 DISPENSERS TO BE THE MOST PREFERRED MODE OF APPLICATION FOR AGRICULTURAL PHEROMONES IN 2020

4.4 MARKET FOR AGRICULTURAL PHEROMONES, BY CROP TYPE & REGION

FIGURE 24 NORTH AMERICA TO DOMINATE THE MARKET ACROSS ALL CROP TYPES DURING THE FORECAST PERIOD

4.5 MARKET FOR AGRICULTURAL PHEROMONES, BY KEY COUNTRY

FIGURE 25 NETHERLANDS & FRANCE TO BE THE FASTEST-GROWING MARKETS DURING THE FORECAST PERIOD

4.6 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET

FIGURE 26 CHART OF PRE & POST-COVID SCENARIOS IN THE AGRICULTURAL PHEROMONES MARKET

5 MARKET OVERVIEW (Page No. - 78)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 STEADY INCREASE OF ORGANIC FARMLAND

FIGURE 27 ORGANIC FARM AREA GROWTH TREND, 2015–2019

5.2.2 RISING GLOBAL POPULATION AND DIVERSE FOOD CONSUMPTION

FIGURE 28 POPULATION GROWTH TREND, 1950–2050

5.3 MARKET DYNAMICS

FIGURE 29 AGRICULTURAL PHEROMONES: MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Pest proliferation as a result of rapid climate change

5.3.1.2 Increasing demand for sustainable crop protection solutions

FIGURE 30 GLOBAL SEMIOCHEMICALS MARKET SIZE, 2016–2026 (USD MILLION)

5.3.2 RESTRAINTS

5.3.2.1 High maintenance and production cost of agricultural pheromones

5.3.3 OPPORTUNITIES

5.3.3.1 Rising global consumption of high-value crops

5.3.3.2 Supportive regulations for semiochemicals

5.3.4 CHALLENGES

5.3.4.1 Need for development of multi-target insect pheromone dispensers

5.3.4.2 Lack of awareness and low utilization of biologicals in developing economies

5.4 IMPACT OF COVID-19 ON THE MARKET DYNAMICS

5.4.1 TRANSPORTATION DISRUPTION AMID COVID-19 PANDEMIC SUBSTANTIALLY IMPACTED THE MARKET

5.4.2 COVID-19 PROPELLED THE DEMAND FOR HIGH-VALUE CROP YIELD

6 IMPACT ON THE ECOSYSTEM AND EXTENDED ECOSYSTEM (Page No. - 86)

6.1 AGRICULTURAL PHEROMONES MARKET: ECOSYSTEM ANALYSIS, BY STAKEHOLDER

6.1.1 RAW MATERIAL SUPPLIERS

6.1.2 MANUFACTURERS

6.1.3 TRADERS & DISTRIBUTORS

6.1.4 END USERS

7 INDUSTRY TRENDS (Page No. - 88)

7.1 INTRODUCTION

7.2 SUPPLY CHAIN ANALYSIS

FIGURE 31 SUPPLY CHAIN ANALYSIS

7.3 ECOSYSTEM

FIGURE 32 AGRICULTURAL PHEROMONES: MARKET MAP

TABLE 3 AGRICULTURAL PHEROMONES MARKET: ECOSYSTEM

7.4 VALUE CHAIN ANALYSIS

FIGURE 33 VALUE CHAIN ANALYSIS

7.5 TECHNOLOGY ANALYSIS

7.5.1 AGRICULTURAL PHEROMONES AND THE INTERNET OF THINGS (IOT)

7.5.2 AGRICULTURAL PHEROMONES AND CRISPR

7.6 PRICING ANALYSIS: AGRICULTURAL PHEROMONES MARKET, BY TYPE AND REGION

FIGURE 34 PRICING TREND OF THE AGRICULTURAL PHEROMONES, BY REGION, 2016-2020 (USD/KG)

FIGURE 35 PRICING TREND OF THE AGRICULTURAL PHEROMONES, BY TYPE, 2016-2020 (USD/KG)

7.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 36 YC - YCC: REVENUE SHIFT FOR THE AGRICULTURAL PHEROMONES MARKET

7.8 PORTER’S FIVE FORCES ANALYSIS

7.8.1 MARKET FOR AGRICULTURAL PHEROMONES: PORTER’S FIVE FORCES ANALYSIS

7.8.2 THREAT OF NEW ENTRANTS

7.8.3 THREAT OF SUBSTITUTES

7.8.4 BARGAINING POWER OF SUPPLIERS

7.8.5 BARGAINING POWER OF BUYERS

7.8.6 INTENSITY OF COMPETITIVE RIVALRY

7.9 PATENT ANALYSIS

FIGURE 37 NUMBER OF PATENTS GRANTED FOR AGRICULTURAL PHEROMONES IN THE MARKET, 2015–2019

FIGURE 38 REGIONAL ANALYSIS OF PATENTS APPROVED IN THE AGRICULTURAL PHEROMONES MARKET, 2015–2019

FIGURE 39 LIST OF TOP PATENTS IN THE MARKET, 2019 - 2021

TABLE 4 LIST OF MAJOR PATENTS FOR THE AGRICULTURAL PHEROMONES MARKET, 2017–2019

7.10 TRADE ANALYSIS

7.10.1 IMPORT SCENARIO OF INSECTICIDES

FIGURE 40 INSECTICIDES IMPORT, BY KEY COUNTRY, 2016–2020 (KILOTONS)

7.10.2 EXPORT SCENARIO OF INSECTICIDES

FIGURE 41 INSECTICIDES EXPORT, BY KEY COUNTRY, 2016–2020 (KILOTONS)

7.11 CASE STUDY ANALYSIS

7.11.1 USE CASE 1: ANTICIMEX’S IOT SOLUTION HELPED CREATE DIGITAL CONNECTED TRAPS

7.11.2 USE CASE 2: RENTOKIL USED IOT SOLUTIONS TO INCREASE ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

7.12 REGULATORY FRAMEWORK

7.12.1 US

7.12.2 CANADA

7.12.3 INDIA

7.12.4 AUSTRALIA

7.12.5 SOUTH AFRICA

8 AGRICULTURAL PHEROMONES MARKET, BY TYPE (Page No. - 109)

8.1 INTRODUCTION

FIGURE 42 MARKET FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 5 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 6 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

8.2 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY TYPE

8.2.1 OPTIMISTIC SCENARIO

TABLE 7 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

8.2.2 REALISTIC SCENARIO

TABLE 8 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONE MARKET, BY TYPE, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

8.2.3 PESSIMISTIC SCENARIO

TABLE 9 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONE MARKET, BY TYPE, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

8.3 SEX PHEROMONES

8.3.1 SEX PHEROMONES MOST COMMONLY USED IN THE PROCESS OF MATING DISRUPTION

TABLE 10 SEX PHEROMONES: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 SEX PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

TABLE 12 SEX PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2016-2020 (TONS)

TABLE 13 SEX PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021-2026 (TONS)

8.4 AGGREGATION PHEROMONES

8.4.1 AGGREGATION PHEROMONES FIND USE IN MASS TRAPPING PRACTICES

TABLE 14 AGGREGATION PHEROMONES: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 AGGREGATION PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

TABLE 16 AGGREGATION PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2016-2020 (TONS)

TABLE 17 AGGREGATION PHEROMONES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021-2026 (TONS)

8.5 OTHER TYPES

8.5.1 HOST-MARKING PHEROMONES UTILIZED IN TACKLING INSECTS THAT HAVE PREVIOUSLY LAID EGGS ON FRUITS

TABLE 18 OTHER TYPES: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 OTHER TYPES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

TABLE 20 OTHER TYPES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2016-2020 (TONS)

TABLE 21 OTHER TYPES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021-2026 (TONS)

9 AGRICULTURAL PHEROMONES MARKET, BY FUNCTION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 43 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021 VS. 2026 (USD MILLION)

TABLE 22 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 23 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

9.2 MATING DISRUPTION

9.2.1 HIGH EFFICIENCY TO CONTROL INVASIVE PESTS, SUCH AS CODLING MOTHS, TO DRIVE THE MARKET FOR MATING DISRUPTION

TABLE 24 MATING DISRUPTION: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 MATING DISRUPTION: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

9.3 DETECTION & MONITORING

9.3.1 RISE IN DETECTION & MONITORING ACTIVITIES IN NORTH AMERICA

TABLE 26 DETECTION & MONITORING: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 DETECTION & MONITORING: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

9.4 MASS TRAPPING

9.4.1 HIGH SUPPRESSION OF INSECT POPULATION THROUGH MASS TRAPPING

TABLE 28 MASS TRAPPING: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 MASS TRAPPING: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

10 AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION (Page No. - 126)

10.1 INTRODUCTION

FIGURE 44 AGRICULTURAL PHEROMONES MARKET SHARE (VALUE), BY MODE OF APPLICATION, 2021 VS. 2026

TABLE 30 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 31 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

10.2 DISPENSERS

10.2.1 COMPANIES RESEARCHING ON THE LAUNCH OF ENVIRONMENT-FRIENDLY AND SUSTAINABLE OPTIONS IN DISPENSERS

TABLE 32 DISPENSERS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 DISPENSERS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

10.3 TRAPS

10.3.1 CONVENIENT AND READY-TO-USE PHEROMONE TRAPS TO DRIVE THE GROWTH OF THE MARKET

TABLE 34 TRAPS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 TRAPS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

10.4 SPRAYS

10.4.1 MICROENCAPSULATED PHEROMONES INCREASINGLY FINDING APPLICATION IN MATING DISRUPTION SOLUTIONS

TABLE 36 SPRAYS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 SPRAYS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

11 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE (Page No. - 134)

11.1 INTRODUCTION

FIGURE 45 GLOBAL ORGANIC AGRICULTURE IN 2017 (MILLION HECTARES)

FIGURE 46 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 38 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 39 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

11.2 FRUITS & NUTS

11.2.1 EXTENSIVE RESEARCH TO CONDUCT ON THE USE OF PHEROMONE NANOGELS IN PEST MANAGEMENT FOR FRUITS

TABLE 40 PESTS THAT INFEST FRUIT CROPS

TABLE 41 FRUITS & NUTS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 FRUITS & NUTS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

11.3 FIELD CROPS

11.3.1 STARTUPS IN THE PHEROMONES MARKET TO OFFER MATING DISRUPTION SOLUTIONS FOR FIELD CROPS

TABLE 43 FIELD CROPS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 FIELD CROPS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

11.4 VEGETABLE CROPS

11.4.1 PHEROMONES FOUND TO ACT IN SYNERGY WHEN COMBINED WITH HOST VEGETABLE PLANT VOLATILES

TABLE 45 VEGETABLE CROPS: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 VEGETABLE CROPS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

FIGURE 47 US VEGETABLE INDUSTRY AT A GLANCE, 2016–2018

11.5 OTHER CROP TYPES

11.5.1 PHEROMONE TRAPS USED FOR DETECTING INSECTS IN PLANTATION AND ALFALFA CROPS

TABLE 47 OTHER CROP TYPES: AGRICULTURAL PHEROMONES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 OTHER CROP TYPES: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

12 AGRICULTURAL PHEROMONES MARKET, BY REGION (Page No. - 143)

12.1 INTRODUCTION

FIGURE 48 US TO HOLD THE LARGEST SHARE IN THE AGRICULTURAL PHEROMONES MARKET IN 2020

TABLE 49 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2016–2020 (TONS)

TABLE 52 MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY REGION, 2021–2026 (TONS)

12.2 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 53 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2021 (USD MILLION) (OPTIMISTIC SCENARIO)

12.2.2 REALISTIC SCENARIO

TABLE 54 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2021 (USD MILLION) (REALISTIC SCENARIO)

12.2.3 PESSIMISTIC SCENARIO

TABLE 55 COVID-19 IMPACT ON THE AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2021 (USD MILLION) (PESSIMISTIC SCENARIO)

12.3 NORTH AMERICA

FIGURE 49 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET SNAPSHOT, 2020

TABLE 56 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (TONS)

TABLE 65 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (TONS)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.3.1 US

12.3.1.1 Presence of major pheromone companies in the US aiding the growth of the market

TABLE 68 US: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 69 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 70 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 71 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 73 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 74 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 75 US: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Semiochemicals-based tactics used for forest pest management

TABLE 76 CANADA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Mating disruption, the most common method used in Mexico for combating insects

TABLE 84 MEXICO: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 85 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 86 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 87 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 88 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 89 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 90 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 91 MEXICO: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4 EUROPE

TABLE 92 EUROPE: AGRICULTURAL PHEROMONES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (TONS)

TABLE 99 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (TONS)

TABLE 100 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.1 SPAIN

12.4.1.1 Dispensers and sprayers to be the modes of application adopted in Spain

TABLE 104 SPAIN: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 105 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 106 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 107 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 108 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 109 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 110 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 111 SPAIN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.2 ITALY

12.4.2.1 Financial support from the government for organic farmers to drive the growth of the market

TABLE 112 ITALY: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 113 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 114 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 115 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 116 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 117 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 118 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 119 ITALY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.3 GERMANY

12.4.3.1 Germany, one of the largest markets in the EU for fresh fruits, a key factor for the agricultural pheromones market growth in the country

TABLE 120 GERMANY: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 125 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 127 GERMANY: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.4 FRANCE

12.4.4.1 The presence of major players offering integrated pest management solutions to drive the growth of the market

TABLE 128 FRANCE: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 129 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 130 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 131 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 134 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 135 FRANCE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.5 NETHERLANDS

12.4.5.1 Dispensers and sprayers the most economical modes of application adopted in the Netherlands

TABLE 136 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 137 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 138 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 139 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 141 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 142 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 143 NETHERLANDS: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.4.6 REST OF EUROPE

12.4.6.1 Mating disruption to be most commonly adopted in Russia and the UK to prevent insect pests

TABLE 144 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 150 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5 ASIA PACIFIC

TABLE 152 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (TONS)

TABLE 159 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (TONS)

TABLE 160 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Combined focus of food production and sustainable farming practices to drive the growth in the Chinese market

TABLE 164 CHINA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.2 JAPAN

12.5.2.1 Economically viable option pheromones to combat the Japanese beetle to cause large-scale destruction of crops

TABLE 172 JAPAN: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 173 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 174 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 175 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 176 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 177 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 178 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 179 JAPAN: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.3 INDIA

12.5.3.1 Pheromone traps to mostly be preferred in India among large landholders of high-value crops

TABLE 180 INDIA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 181 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 182 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 183 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 184 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 185 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 186 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 187 INDIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.4 BANGLADESH

12.5.4.1 Government support policies to drive the growth of the market in Bangladesh

TABLE 188 BANGLADESH: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 189 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 190 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 191 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 192 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 193 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 194 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 195 BANGLADESH: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.5 AUSTRALIA

12.5.5.1 Biosecurity measures taken by the government to aid the growth of the agricultural pheromones market

TABLE 196 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 197 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 198 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 199 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 200 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 201 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 202 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 203 AUSTRALIA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.5.6 REST OF ASIA PACIFIC

12.5.6.1 Pheromone traps being utilized in South Korea to combat pests in fruit crops

TABLE 204 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 211 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 212 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 213 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 214 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 215 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 216 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (TONS)

TABLE 217 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (TONS)

TABLE 218 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 219 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 220 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 221 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 222 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 223 SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.6.1 ARGENTINA

12.6.1.1 Argentina to witness a high demand for pheromone traps to combat corn earworms

TABLE 224 ARGENTINA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 225 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 226 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 227 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 228 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 229 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 230 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 231 ARGENTINA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Demand for pheromone application in field crops, such as cotton and corn, to grow in Brazil

TABLE 232 BRAZIL: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 233 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 234 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 235 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 236 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 237 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 238 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 239 BRAZIL: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.6.3 CHILE

12.6.3.1 Chile invested in R&D activities for the development of pheromone-equipped biopolymers to combat grapevine moth

TABLE 240 CHILE: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 241 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 242 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 243 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 244 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 245 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 246 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 247 CHILE: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.6.4 REST OF SOUTH AMERICA

12.6.4.1 Codling moth attacks to lead to an increase in the demand for pheromones in Ecuador

TABLE 248 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 249 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 250 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 251 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 252 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 253 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 254 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 255 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.7 REST OF THE WORLD (ROW)

TABLE 256 ROW: AGRICULTURAL PHEROMONES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 257 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 258 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 259 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 260 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (TONS)

TABLE 261 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (TONS)

TABLE 262 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 263 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 264 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 265 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

TABLE 266 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 267 ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

12.7.1 SOUTH AFRICA

12.7.1.1 Mating disruption and mass trapping techniques used for combating insect pests

TABLE 268 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 269 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 270 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 271 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 272 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 273 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 274 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 275 SOUTH AFRICA: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

12.7.2 OTHERS IN ROW

12.7.2.1 Efficient combinations of lure & kill and mass trapping techniques used in Egypt to combat insect pests

TABLE 276 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 277 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY CROP TYPE, 2021–2026 (USD MILLION)

TABLE 278 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2016–2020 (USD MILLION)

TABLE 279 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 280 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2016–2020 (USD MILLION)

TABLE 281 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY FUNCTION, 2021–2026 (USD MILLION)

TABLE 282 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2016–2020 (USD MILLION)

TABLE 283 OTHERS IN ROW: MARKET SIZE FOR AGRICULTURAL PHEROMONES, BY MODE OF APPLICATION, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 241)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS

TABLE 284 AGRICULTURAL PHEROMONES MARKET: DEGREE OF COMPETITION (COMPETITIVE)

13.3 KEY PLAYER STRATEGIES

13.4 REVENUE ANALYSIS OF KEY PLAYERS, 2016-2020

FIGURE 50 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

13.5 COVID-19-SPECIFIC COMPANY RESPONSE

13.5.1 SHIN-ETSU CHEMICAL CO., LTD

13.5.2 BEDOUKIAN RESEARCH, INC.

13.5.3 BASF SE

13.5.4 CERTIS EUROPE BV

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 51 AGRICULTURAL PHEROMONES MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.6.5 PRODUCT FOOTPRINT

TABLE 285 COMPANY FUNCTION FOOTPRINT

TABLE 286 COMPANY CROP TYPE FOOTPRINT

TABLE 287 COMPANY REGION FOOTPRINT

TABLE 288 COMPANY PRODUCT FOOTPRINT

13.7 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 52 AGRICULTURAL PHEROMONES MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

13.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.8.1 PRODUCT LAUNCHES

TABLE 289 PRODUCT LAUNCHES, OCTOBER 2018 – OCTOBER 2020

13.8.2 DEALS

TABLE 290 DEALS, JANUARY 2018 – JUNE 2021

13.8.3 OTHERS

TABLE 291 EXPANSIONS, DECEMBER 2018

14 COMPANY PROFILES (Page No. - 259)

14.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.1.1 SHIN-ETSU CHEMICAL CO., LTD

TABLE 292 SHIN-ETSU CHEMICAL CO., LTD: BUSINESS OVERVIEW

FIGURE 53 SHIN-ETSU CHEMICAL CO., LTD: COMPANY SNAPSHOT

TABLE 293 SHIN-ETSU CHEMICAL CO., LTD: PRODUCTS OFFERED

14.1.2 KOPPERT BIOLOGICAL SYSTEMS

TABLE 294 KOPPERT BIOLOGICAL SYSTEMS: BUSINESS OVERVIEW

TABLE 295 KOPPERT BIOLOGICAL SYSTEMS: PRODUCTS OFFERED

TABLE 296 AGRICULTURAL PHEROMONES MARKET: DEALS, OCTOBER 2018-JUNE 2019

TABLE 297 AGRICULTURAL PHEROMONES MARKET: OTHERS, DECEMBER 2018

14.1.3 ISAGRO GROUP

TABLE 298 ISAGRO GROUP: BUSINESS OVERVIEW

FIGURE 54 ISAGRO GROUP: COMPANY SNAPSHOT

TABLE 299 ISAGRO GROUP: PRODUCTS OFFERED

TABLE 300 AGRICULTURAL PHEROMONES MARKET: DEALS, SEPTEMBER 2019

14.1.4 BIOBEST GROUP NV

TABLE 301 BIOBEST GROUP NV: BUSINESS OVERVIEW

TABLE 302 BIOBEST GROUP NV: PRODUCTS OFFERED

TABLE 303 AGRICULTURAL PHEROMONES MARKET: PRODUCT LAUNCHES, FEBRUARY 2019

TABLE 304 AGRICULTURAL PHEROMONES MARKET: DEALS, JANUARY 2018-JUNE 2021

14.1.5 SUTERRA LLC

TABLE 305 SUTERRA LLC: BUSINESS OVERVIEW

TABLE 306 SUTERRA LLC: PRODUCTS OFFERED

14.1.6 RUSSELL IPM

TABLE 307 RUSSELL IPM: BUSINESS OVERVIEW

TABLE 308 RUSSELL IPM: PRODUCTS OFFERED

14.1.7 ISCA TECHNOLOGIES

TABLE 309 ISCA TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 310 ISCA TECHNOLOGIES: PRODUCTS OFFERED

TABLE 311 AGRICULTURAL PHEROMONES MARKET: DEALS, JUNE 2018- NOVEMBER 2020

14.1.8 TRÉCÉ INCORPORATED

TABLE 312 TRÉCÉ INCORPORATED: BUSINESS OVERVIEW

TABLE 313 TRÉCÉ INCORPORATED: PRODUCTS OFFERED

TABLE 314 AGRICULTURAL PHEROMONES MARKET: PRODUCT LAUNCHES, FEBRUARY 2019- OCTOBER 2020

TABLE 315 AGRICULTURAL PHEROMONES MARKET: DEALS, MARCH 2018- OCTOBER 2018

14.1.9 BEDOUKIAN RESEARCH, INC.

TABLE 316 BEDOUKIAN RESEARCH, INC.: BUSINESS OVERVIEW

TABLE 317 BEDOUKIAN RESEARCH, INC.: PRODUCTS OFFERED

14.1.10 PHEROBANK BV.

TABLE 318 PHEROBANK B.V.: BUSINESS OVERVIEW

TABLE 319 PHEROBANK BV: PRODUCTS OFFERED

TABLE 320 AGRICULTURAL PHEROMONES MARKET: PRODUCT LAUNCHES, OCTOBER 2018- JULY 2019

14.2 OTHER PLAYERS

14.2.1 BASF SE

TABLE 321 BASF SE: BUSINESS OVERVIEW

FIGURE 55 BASF SE: COMPANY SNAPSHOT

TABLE 322 BASF SE: PRODUCTS OFFERED

14.2.2 CERTIS EUROPE BV

TABLE 323 CERTIS EUROPE BV: BUSINESS OVERVIEW

TABLE 324 CERTIS EUROPE BV: PRODUCTS OFFERED

TABLE 325 AGRICULTURAL PHEROMONES MARKET: DEALS, OCTOBER 2018- MARCH 2018

14.2.3 BIOLINE AGROSCIENCES LTD.

TABLE 326 BIOLINE AGROSCIENCES LTD.: BUSINESS OVERVIEW

TABLE 327 BIOLINE AGROSCIENCES LTD.: PRODUCTS OFFERED

14.2.4 BIO CONTROLE

TABLE 328 BIO CONTROLE: BUSINESS OVERVIEW

TABLE 329 BIO CONTROLE: PRODUCTS OFFERED

14.2.5 ATGC BIOTECH PVT LTD.

TABLE 330 ATGC BIOTECH PVT. LTD.: BUSINESS OVERVIEW

TABLE 331 ATGC BIOTECH PVT. LTD.: PRODUCTS OFFERED

14.2.6 SUMI AGRO FRANCE

14.2.7 SEDQ HEALTHY CROPS SL.

14.2.8 LABORATORIOS AGROCHEM, S.L.

14.2.9 NOVAGRICA

14.2.10 INTERNATIONAL PHEROMONE SYSTEMS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS (Page No. - 311)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 BIOPESTICIDES MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.3 BIOPESTICIDES MARKET, BY TYPE

TABLE 332 BIOPESTICIDES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

15.3.4 BIOPESTICIDES MARKET, BY REGION

TABLE 333 GLOBAL BIOPESTICIDES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.4 AGRICULTURAL BIOLOGICALS MARKET

15.4.1 LIMITATIONS

15.4.2 MARKET DEFINITION

15.4.3 MARKET OVERVIEW

15.4.4 AGRICULTURAL BIOLOGICALS MARKET, BY PRODUCT TYPE

TABLE 334 AGRICULTURAL BIOLOGICALS MARKET SIZE, BY PRODUCT TYPE, 2017–2025 (USD MILLION)

15.4.5 AGRICULTURAL BIOLOGICALS MARKET, BY REGION

15.4.5.1 Introduction

TABLE 335 AGRICULTURAL BIOLOGICALS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

16 APPENDIX (Page No. - 317)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the market size for the agricultural pheromones market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. These sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the agricultural pheromones market has the presence of field crops, fruit & nuts, and vegetable crop growers and farmers. The supply side has the presence of agricultural pheromones manufacturers and key technology providers producing pheromones. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative & quantitative information. Primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the suppliers of sex pheromones and aggregation pheromones. Primary sources from the supply side include research institutions involved in R&D to introduce technology, key opinion leaders, distributors, and agricultural pheromone manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Agricultural Pheromones Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major agricultural pheromones manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Other factors considered include penetration rate of agricultural pheromones in field crops, fruit & nuts, and vegetable crops, consumer awareness, and function trends, pricing trends, the adoption rate & price factors, patents registered, and organic & inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the most precise estimations for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the agricultural pheromones market, based on types, functions, modes of application, and crop types

- To describe and forecast the agricultural pheromones market, in terms of value, by region—Asia Pacific, Europe, North America, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of agricultural pheromones

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the agricultural pheromones ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions and divestments; expansions and investments; product launches and approvals; agreements; and collaborations and partnerships in the market

Target Audience:

- Insect pheromone manufacturers

- Insect pheromone product traders, distributors, suppliers, and service providers

- Crop protection product manufacturers

- Raw material suppliers and technology providers to manufacturers

- Government and research organizations

- Agricultural institutes and universities

- Associations and industry bodies

- Consumers, including farmers

- Government, legislative, and regulatory bodies

The Integrated Pest Management (IPM) Pheromones market and Agricultural Pheromones market are closely related, as both involve the use of pheromones for pest management in agriculture. Pheromones are chemical signals that are produced by insects and other pests to communicate with each other. By mimicking or disrupting these signals, pheromones can be used to manage pest populations in an eco-friendly and sustainable way.

The Agricultural Pheromones market includes products such as pheromone traps and dispensers, which are used to attract and trap pests such as moths, fruit flies, and beetles. These products are typically used as part of an integrated pest management (IPM) strategy, which aims to minimize the use of chemical pesticides and maximize the use of non-toxic pest control methods.

The use of pheromones in agriculture has several benefits, including:

- Targeted pest control: Pheromone-based pest control methods are highly specific, targeting only the pests that are causing damage to crops, without harming beneficial insects or other non-target organisms.

- Reduced chemical use: By reducing the need for chemical pesticides, pheromone-based pest control methods can help to reduce the environmental impact of agriculture and improve the health and safety of farm workers.

- Increased sustainability: Pheromone-based pest control methods are a key component of sustainable agriculture, as they promote a more natural and balanced approach to pest management.

As the demand for sustainable agriculture practices continues to grow, the Agricultural Pheromones market and the IPM Pheromones market are expected to experience significant growth in the coming years. The use of pheromones for pest control is becoming increasingly popular as farmers and consumers alike seek eco-friendly and sustainable solutions to pest management in agriculture.

The Integrated Pest Management (IPM) Pheromones market is expected to have a significant impact on the agriculture industry in the future.

As the demand for sustainable and eco-friendly agriculture practices continues to grow, the use of IPM methods, including pheromones, is likely to become more widespread.

One industry that is likely to be heavily impacted by the IPM Pheromones market is the fruit and vegetable production industry. These crops are particularly vulnerable to pest damage and are often heavily treated with chemical pesticides, which can be harmful to the environment and human health. By using pheromone-based pest control methods, farmers can reduce their reliance on chemical pesticides and produce healthier, safer, and more sustainable crops.

Additionally, the use of pheromones in pest control is also gaining popularity in other industries such as forestry, horticulture, and stored product protection. As the demand for eco-friendly and sustainable pest control methods continues to grow across these industries, the IPM Pheromones market is expected to experience significant growth in the future.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for agricultural pheromones into the UK, and Greece

- Further breakdown of the Rest of Asia Pacific market for agricultural pheromones into South Korea, Thailand, and Indonesia

- Further breakdown of the Rest of South America market for agricultural pheromones into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for agricultural pheromones into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Pheromones Market