Plant Growth Regulators Market by Type (Auxins, Cytokinins, Gibberellins, Ethylene), Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turf & Ornamentals), Formulation, Function and Region - Global Forecast to 2028

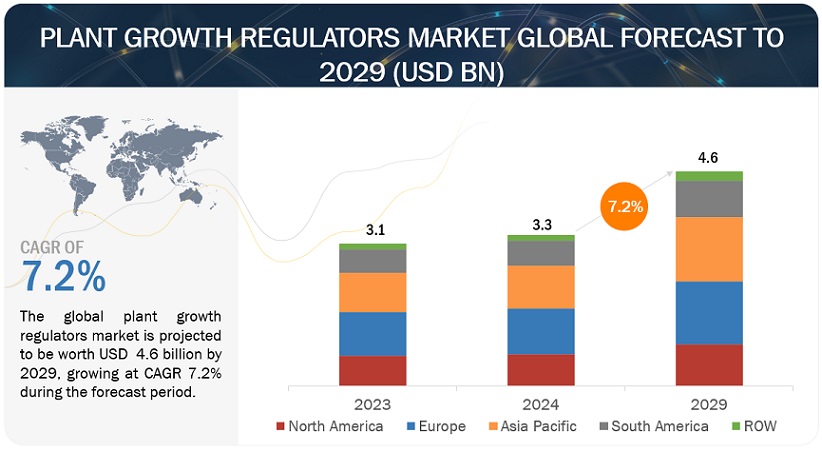

The global plant growth regulators market in terms of revenue was valued at USD 2.9 billion in 2022. It is projected to reach USD 4.5 billion by 2028, recording a CAGR of 7.4% during the forecast period.

Under the changing climatic conditions, numerous biotic and abiotic stresses hamper seed germination, seedling growth, and plant development, which is resulting in severe decline in crop yield globally. The biosynthesis of PGRs, including gibberellins, auxin, cytokinin, abscisic acid, and ethylene, constitutes a potent strategy for plants to respond to stress conditions. They are required in lesser quantities than conventional fertilizers. Other advantages are that some plant growth regulators have fewer impurities and do not harm seedlings. Hence, the concept of plant growth regulators is viewed as a business opportunity in a slow-growing market. As a result, many multinational players have entered into the production of various types of plant growth regulators.

The development of advanced technologies to tap niche markets and the growth in demand for plant growth regulators in emerging economies are opportunities for this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Plant Growth Regulators Market Dynamics

Drivers: Rise in resistance development in various pest and insect species to drive consumption of natural plant growth regulators in agriculture

Presently over-reliance on pesticides leads to the evolution of pesticide resistance in insects, weeds, and diseases. When farmers repeatedly apply the same pesticides, they eliminate most of the population susceptible to the chemical. However, when the same pesticides are applied yearly on a massive scale, these resistant individuals quickly multiply until the whole population is resistant to the pesticide. Weeds that have evolved resistance to multiple herbicides, become superweeds, pose a serious threat to farmers on repeated application to the cropland. Herbicide resistance is increasingly common, and some areas may have multiple herbicide-resistant weed species in their fields, making weed control even more difficult. In just the US, scientists have already discovered 25 species of weeds that have grown resistant to herbicides. According to the Chemistry World blog of April 2021, a recent report shows that resistant black-grass (Alopecurus monureides), a single weed in the UK, reduces this cereal crop’s yield by up to 800,000 tons, representing a cost of USD 449.2 Million (£380 million) per year in lost income to farmers.

However, rather than addressing the root causes of resistance, agrichemical companies release new formulations of multiple herbicides. Sometimes, these new formulations contain older, more hazardous chemicals, such as dicamba, atrazine, and 2,4-D. These reformulations can lead to massive increases in the number of chemicals sprayed on crops. Some pesticides can drift off target and damage other crops depending on how they are applied. For example, dicamba, previously approved only for ground spreading, was EPA-approved in 2017 for aerial spraying with soybean seeds genetically engineered to be resistant to the chemical. While farmers were optimistic that dicamba would be a useful tool against glyphosate-resistant superweeds, the situation quickly soured; dicamba is extremely volatile even when applied according to label instructions. It can turn back into gas and drift several miles, killing or damaging any plant material wherever it lands. In this case, dicamba drift damaged 3.6 million acres of non-resistant soybeans in neighboring fields and vegetables, fruits, and trees in 25 states.

Thus, rising resistance to pesticides and concurrent issues from new formulations for tackling pests are hazardous to other non-targeted crops, propelling the farmers to look for other alternatives. Biologically synthesized plant growth regulators can be an excellent alternative in enhancing crop production by protecting the crops from pests without causing any harm to the non-targeted crops. According to a research article shared by the Department of Zoology and Entomology, Egypt,2018, PGRs can be used as an alternative to conventional insecticides for controlling economically dangerous insect pests. These PGRs are marketed specifically for the purpose of stimulation or retardation of plant growth and development. They are found to be used successfully for the reduction of insect pest infestation on crop plants.

Restraints of the Plant Growth Regulators Market: Long approval period for new products

The approval process for plant growth regulators is very lengthy due to multi-location field trials and residual effects for synthetic plant growth regulators. Due to the stringent regulatory approval process, the average time taken to bring a new crop protection product to market can exceed ten years and cost more than USD 100 million. Patent protection and exclusivity are critical in helping companies recover the costs of research & development, incentivizing them to make future investments that will lead to continued industry-wide growth. Increased costs due to product development and a greater regulatory period led to increased retail prices, reducing the net profit value for growers. The decreased profit margins cannot help improve plant growth regulators' share in the global agrochemicals market.

Even for generic products, it can take up to five years to get the product registered. To bring a new PGR to market, manufacturers must undergo a lengthy and expensive approval process with both state and federal regulators. There is currently no clear regulatory framework for these products in many jurisdictions. The regulatory bodies do not have adequate resources and infrastructure to execute the timely registration of products. At times, the rules are not clearly defined, creating interpretation challenges for the regulatory bodies, and leading to confusion, thereby adding to the complexities for crop protection chemical companies. This makes it difficult for companies to commercialize new products and brings down investment in research and development.

Opportunities in the Plant Growth Regulators Market: Increasing importance of sustainable food production globally

Food companies are taking notice of this environment, and efforts such as “Field to Market or Farm to Table” define sustainable farming. The concept of bio-farming is actively gaining pace as it is based on the use of organic and biofertilizers (natural and manufactured) instead of chemical fertilizers and the use of safe green pesticides and pesticides. By adopting sustainable practices, farmers reduce their reliance on non-renewable energy, minimize chemical use, and save scarce resources. Keeping the land healthy and replenished can go a long way when considering the rising population and demand for food. Food companies are strengthening their sustainable efforts, collaborating with suppliers, and fine-tuning their business models.

According to research conducted by the International Food Information Council Foundation (IFIC) 2018, 59% of consumers surveyed in 2018 said it was important that the foods they purchased and consumed be produced sustainably, up from 50% in 2017. The incorporation of biologically synthesized plant growth regulators in agricultural systems as a sustainable approach for disease management and nutrient supplements could reduce the negative effects associated with the excess application of chemical inputs. The rising awareness among consumers regarding food consumption produced through sustainable practices is expected to boost growers' use of plant growth regulators.

Challenges: Identification of PGR-modulated genic/multigenic expressions

Plant growth regulators are known to trigger particular genes in plants that remain suppressed. Essentially, hormones are used to alter genotypes so as to consequently alter the phenotype, as required. When plants are applied with a set of plant hormones, a diverse set of genes is regulated to affect the final morphological expressions. The existing share for plant growth regulators in the overall agrochemicals industry is minimal, as the demand is concentrated for high-value crops, such as plantation crops, cotton, and fruits & vegetables.

As the above segments are nearing saturation, the application and benefits of plant growth regulators have to be extended toward broad-acre crops, such as cereals, grains, oilseeds, and pulses. The high cost-to-value ratio for plant growth regulators reduces their potential as agricultural inputs for cereal cultivation. Therefore, research activities must be carried out to identify genetic strains that can be stimulated by plant growth regulators to exhibit the desired characteristics.

Trial tests are required to identify the appropriate concentration and stage of application to enhance the product’s effectiveness to the crop. These plant benefits must be achieved along with cost-effectiveness to strengthen its growth among other crop types, such as cereals and oilseeds. These high-volume and low-value crops require inputs that can improve crop productivity at a limited cost in a sustainable way.

Increase in soil erosion due to global warming to drive growth of plant growth promoters

Plant growth promoters are substances that improve the growth and development of plants. These substances are obtained either synthetically or biologically, of which biological plant growth promoters are more effective and safer. Plant growth promoters are used to improve the quality and productivity of crops. There are various types of plant growth promoters; some of the most popular ones include auxins, gibberellins, and cytokinins. They help in growth and development during flowering, fruiting, root initiation, and an overall increase in yield. In flowering, it helps in inducing flowering & reduces flower drop. During fruiting, it helps improve fruit size, quality, and color.

The current climate has caused changes in temperature and precipitation rates, resulting in extreme drought conditions. These changes in environmental conditions contributed to an increase in global warming, increasing the demand for irrigation. Population growth, on the other hand, has resulted in significant devastation of valuable crops due to increased soil erosion and urbanization. As a result, there is an urgent need to use soils with reduced capability for agricultural development and production. For example, sandy soils have weaker plant development and less capacity to transfer water from deeper layers because sandy soil is loose and light in structure. These soils drain fast. However, the fertility and yield capacities of these soils can be increased using Plant Growth Promoters (PGP), such as Plant Growth Promoting Rhizobacteria (PGPR). To meet global food demand, there is an increasing desire to enhance drought resistance in pulses, particularly chickpeas. As a result, policies may be devised to protect agricultural plants from drought stress and to develop drought tolerance in crop plants.

Nanosensors in Plant Growth Regulators Market is one of the Major Trends

Researchers from supreme organizations including the Singapore-MIT Alliance for Research and Technology (SMARTDisruptive)'s, Sustainable Technologies for Agricultural Precision (DiSTAP) interdisciplinary research group and their local collaborators from Temasek Life Sciences Laboratory (TLL) and Nanyang Technological University (NTU) have developed the nanosensor to enable rapid testing of synthetic auxin plant hormones. Nanosensors are less time-consuming than existing techniques for testing plants' responses to compounds, such as herbicide, and can potentially transform agricultural production.

The researchers created sensors for two plant hormones, 1-naphthalene acetic acid (NAA) and 2,4-dichlorophenoxyacetic acid (2,4-D), which are widely used in agriculture to regulate plant growth and as herbicides, respectively. Companies such as Syngenta (Switzerland) have launched nano emulsions smart delivery systems in its growth regulators Primo Maxx category.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific dominated the plant growth regulators market in 2022; it is projected to grow at a CAGR of 8.2% during the forecast period.

Being the world's largest and most densely populated region, the Asia Pacific is one of the key markets for plant growth regulators. This region accounted for nearly 30% of the land available on Earth and 60% of the human population in 2021 (Source: FAOSTAT). However, it continues to remain untapped by key market players. The use of plant growth regulators has significantly increased to meet the food requirements of the densely populated countries in the Asia Pacific region.

In the Asia Pacific, the total area of agriculture is shrinking due to the high rate of industrialization and urbanization. As a result, farmers opt for plant growth promoters, which help increase the yield or productivity of crops. However, the lack of awareness and adoption of advanced technologies, adverse socio-economic conditions, and fragmented landholdings are the main hurdles to the development of the crop protection chemicals industry as well as the plant growth regulators market in the Asia Pacific region.

Over the last two decades, plant growth regulator industries in most countries of the Asia Pacific region have shifted their emphasis from developing plant growth regulators to technology upgradation, management, and sustainability. The total area of agriculture is shrinking due to industrialization and rapid urbanization. As a result, farmers have to opt for practices that help increase the yield or productivity of crops.

More global players in the market are trying to enter the Asia Pacific region through mergers & acquisitions or partnerships. For instance, in 2020, Sumitomo Chemical Company acquired four South American subsidiaries in Brazil, Argentina, Chile, and Colombia, owned by group companies of Nufarm Limited, a leading Australian Chemical Company. This acquisition by Sumitomo was made to expand the global footprint and achieve exponential crop protection business growth. In 2019, Sumitomo Chemical merged two subsidiary companies, Sumitomo Chemical India Ltd and Excel Crop Care Limited, to make it India’s second-largest company in India’s agrichemical market. This merger also helped the company to have a rich portfolio and strengthen its position in the market.

Key Market Players

The key players in plant growth regulators market include Sumitomo Chemicals Co., Ltd. (Japan), Xinyi Industrial Co., Ltd. (China), Sichuan Guoguang Agrochemical Co., Ltd. (China) Tata Chemicals Ltd. (India), and UPL (India).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 2.9 billion |

|

Market size value in 2028 |

USD 4.5 billion |

|

Market growth rate |

CAGR of 7.4% |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By Type, Form, Mode of Application, Crop Type |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

This research report categorizes the Plant Growth Regulators Market, based on type, application, concentration and region

Target Audience:

- Plant growth regulators raw material suppliers

- Plant growth regulators manufacturers

- Intermediate suppliers, such as traders and distributors of Plant growth regulators

- Manufacturers of biostimulant, crop nutrition, biofertilizers, bipesticides etc.

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- World Health Organization (WHO)

- European Food Safety Authority (EFSA)

- U.S. Food and Drug Administration

- Environmental Protection Agency

- Food and Agricultural Organisation

- Research Institute of Organic Agriculture (FiBL)

Report Scope:

Plant Growth Tegulators Market:

By Type

- Cytokinins

- Auxins

- Gibberellins

- Ethylene

- Other types

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turfs & Ornamentals

By Formulation

- Water-Dispersible & Water-soluble Granules

- Wettable Powders

- Solutions

By Function

- Plant Growth Promoters

- Plant Growth Inhibitors

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)**

*Other Types include abscisic acid, phaseic acid, florigen, anthesin, vernalin, and coumarin

**Rest of the World (RoW) includes the Middle East and Africa.

Recent Developments

- In May 2022, BASF SE acquired an Italian Company, Horta, specializing in digital farming solutions. This would help BASF SE expand its agriculture solutions portfolio as the agriculture sector increasingly relies on digital farming solutions.

- In September 2022, Corteva signed a definitive agreement to acquire Symborg, an expert in microbiological technologies based in Murcia, Spain. This agreement accelerated the development of the biological solutions portfolio, such as plant growth regulators, which would help the company launch new innovative products.

- In May 2022, Nufarm acquired the plant growth regulator, Pentia from BASF SE in 2021 and also completed the new Pentia product facility, where Nufarm would be the exclusive manufacturer and supplier of Pentia. This would help the company produce Pentia in mass and thereby fulfill customer demand for this plant growth regulator.

- In June 2020, ChemChina and Sinochem announced the consolidation of their agribusinesses Syngenta Group and ADAMA, which will be called Syngenta Group Co. This deal was done to become the world’s leading agriculture inputs company, spanning crop protection, seeds, fertilizers and digital technologies.

Frequently Asked Questions (FAQ):

What is the projected market value of the global plant growth regulators market?

The global plant growth regulators market was valued at USD 2.9 billion in 2022. It is projected to reach USD 4.5 billion by 2028.

What is the estimated growth rate (CAGR) of the plant growth regulators market for the next five years?

The global plant growth regulators market is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2028.

What are the major revenue pockets in the plant growth regulators market currently?

The plant growth regulators market was dominated by the Asia Pacific region in 2022, and it is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period. This region is the world's largest and most densely populated, making it a key market for plant growth regulators. The Asia Pacific region accounted for approximately 30% of the Earth's land and 60% of the human population in 2021, according to data from the Food and Agriculture Organization of the United Nations (FAO). Despite its significant potential, the Asia Pacific region remains largely untapped by major market players. Due to the high population density in the region, the use of plant growth regulators has increased significantly to meet the demand for food.

What are the factors driving the plant growth regulators market?

Strong demand for high-value crops is contributing to the consumption of natural plant growth regulators in agriculture.

Which segment accounted for the largest plant growth regulators market share?

Plant growth promoters segment accounted for the largest market share in the function segment in 2022 with a value of USD 2,317.7 million.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

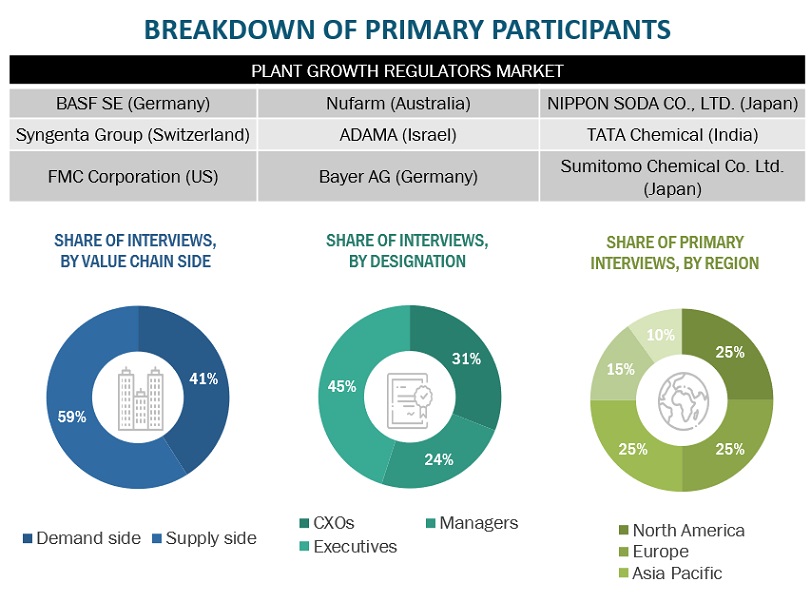

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant growth regulators market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the plant growth regulators market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the plant growth regulators market. These approaches were extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

Bottom-up approach:

- The approach was employed to determine the overall size of the plant growth regulators market in particular regions. Its share at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

- Based on the demand from each type, offerings of key players, and the region-wise market share of major players, the global market for the types was estimated.

- All macroeconomic and microeconomic factors affecting the growth of the plant growth regulators market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall plant growth regulators market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches

Report Objectives

Market Intelligence

- To determine and project the size of the plant growth regulators market with respect to the function, type, formulation, crop type, and region, over five years, ranging from 2023 to 2028.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- To analyze the demand-side factors based on the following:

- Impact of macro-and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

Competitive Intelligence

- To identify and profile the key market players in the plant growth regulators market.

- To determine the market share of key players operating in the plant growth regulators market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

- To provide insights into the trade scenario

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Plant growth regulators into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

- Further breakdown of the Rest of South America market for plant growth regulators into Chile, Colombia, Paraguay, and Peru

- Further breakdown of other countries in the RoW market for plant growth regulators into the Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant Growth Regulators Market

We need information on unique PGR product not being used in India and manufactured internationally. Is this information covered in the report?