Power Electronics Market by Device Type (Power Discrete, Power Module, Power IC), Material (Si, SiC, GaN), Vertical (ICT, Consumer Electronics, Industrial, Automotive, Aerospace), and Geography - Global Forecast to 2026

Updated on : March 14, 2023

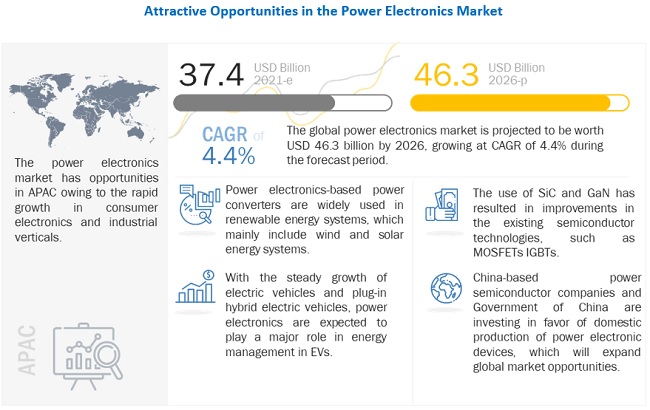

Power Electronics Market was valued at USD 41.2 billion in 2023 and is projected to reach USD 46.3 billion by 2026 ,at a CAGR of 4.4% during 2023 to 2026. Automotive & transportation segment is expected to witness highest CAGR of 7.0%

Power electronics modules are used in smart home appliances, and they are expected to grow with the increased purchase of advanced consumer electronics. Power electronics are used extensively in air conditioners, smart TVs, HVAC control systems, robotic vacuums, smart energy meters, and other smart appliances to increase power efficiency and enable better power management of these devices. The Power Electronics Industry has been segmented based on device type, material, voltage, vertical, and geography. These market segments are further analyzed on the basis of market trends across the four regions considered in this study.

To know about the assumptions considered for the study, Request for Free Sample Report

Power Electronics Market Dynamics

Driver: High adoption of renewable power sources

At present, several countries are shifting from electricity generation using fossil fuels like coal and gas to renewable energy sources. This has led to the continuous growth of new installations for renewable energy sources and a simultaneous decline for non-renewable ones. Power electronics play a key role in shifting electrical energy patterns to renewable energy with higher energy efficiency. Power electronics convert and control AC and DC electrical power. Power electronics-based power converters are also widely used in renewable energy systems, primarily wind and solar energy systems, as these are the most promising renewable energy sources for electricity generation. These renewable systems include solar panels, wind turbines, fuel cells, batteries, capacitors, and other power devices. These systems can be integrated with different types of power electronics to handle varying power requirements. For instance, for maximum efficiency, solar panels can convert solar energy into electrical energy when sunlight directly hits the photovoltaic (PV) panels. The solar cells generate DC power which is then converted to AC power for general applications using a power electronics converter. Alternatively, power from wind turbines can be used when wind speed and direction are ideal. Moreover, the energy generated from these devices can be stored in batteries, further utilizing power electronics.

Restraint: Complex design and integration process

The players operating in the power electronics industry are focusing on integrating multiple functionalities in a single chip, which results in a complex design. Furthermore, the designing and integrating complex devices require special skillsets, robust methodology, and a particular toolset, which increase the overall cost of the devices. Consequently, the high cost of the devices is expected to hamper the switching process toward advanced technological devices. Subsequently, evolving technologies generate demand for more functionalities to be integrated into system-on-chips (SoCs), making devices smaller and more efficient. There is also a high requirement for reducing power consumption in SOCs across CPUs, GPUs, wearables, and mobile devices. However, integrating multiple ICs into a single device is a complex task because of different functionalities and operating modes and voltages, which is expected to restrain the growth of the Power Electronics Market during the forecast period.

Opportunity: Wide bandgap semiconductors promoting new applications of power electronics

The emergence of wide bandgap semiconductor materials, such as GaN and SiC, has changed the landscape of the Power Electronics Market. Wide bandgap semiconductor materials allow designing smaller, faster, and more reliable power electronic components with higher efficiency than their silicon-based components. The reduction in energy dissipated as heat as a result of higher efficiency not only cuts power losses but also enables the use of smaller systems, reducing costs with higher switching speeds compared to silicon solutions. These capabilities make it possible to reduce weight, volume, and life cycle costs in a wide range of power applications. Moreover, the use of SiC and GaN has resulted in improvements in the existing semiconductor technologies, such as MOSFETs and isolated gate bipolar transistors (IGBTs). The higher electron mobility of SiC and GaN enables devices built with those WBG materials to operate at higher switching speeds. Companies including Infineon Technologies, NXP Semiconductors, and STMicroelectronics use wide bandgap semiconductor materials to accommodate the increased power and frequencies involved in new power designs for electric vehicles, optoelectronics, and other applications that present severe operating conditions. These are a few applications where wide bandgap power electronics are expected to be deployed.

Challenge:Ever-changing demand for miniature, highly efficient, and cost-effective devices

Increasing demand for compact and portable devices creates significant opportunities; however, a major issue faced by manufacturers is to meet the ever-changing needs of consumers for more compact devices. To cater to the demand for compact, portable, and multifunctional devices, components and systems need to be miniaturized to lower production costs. For this purpose, manufacturers are actively investing in research and development (R&D) to develop products and enhance their product offerings to stay competitive in the market. Thus, continuous demand for more compact devices can be a barrier, as it does not justify the return on investments due to the uncertainty associated with the life cycle of developed technologies or products.

Market Interconnections

Intelligent power module market to register the highest CAGR during the forecast period

Intelligent power module (IPM) helps in improving the efficiency of an inverter. IPMs are advanced hybrid power devices that integrate high-speed, low-loss devices with optimized gate drive and protection circuitry. IPMs are highly effective in monitoring high-power devices. Intelligent modules are compact and assembled to reduce size, cost of devices, and time to market of electronic devices. IPMs can protect themselves in harsh conditions, which reduces the chances of device failure during operations. They are used in industrial motors, home appliances, refrigerators, motor control drives, fan motors, washing machines, dishwashers, consumer electronics, automotive high voltage auxiliary motors, and other devices.

GaN-based power electronics to grow at highest CAGR during the forecast period

The demand for GaN-based semiconductor devices is from industrial, transportation, energy and power, and ICT verticals. Lately, power electronics device manufacturers have started using GaN materials for developing power discrete devices, such as MOSFETs, diodes, rectifiers, and other FETs, with several varieties in them. Semiconductor products, devices, and system manufacturers started developing GaN-based semiconductor and electronic devices in the recent past. GaN is considered an alternative to SiC and sapphire-based materials used in power electronics.

Low voltage power electronics to register the highest share for Power Electronics Market in 2021

Low power consumption, energy harvesting, and wireless connectivity enable low voltage power electronics, which are being deployed in application fields, such as consumer electronics and automotive. Wireless connectivity requires miniaturized devices that can work in harsh environments and be placed in hard-to-reach locations. Wireless devices are usually battery-powered and hence have to deal with smaller energy storage devices. Furthermore, advancements in energy harvesting techniques in electronics have given rise to low voltage power electronics. In automotive, low-voltage power electronics are traditionally used to provide standardized power, thermal, and control interfaces with the help of converters. These electronics help in simplifying the converter design and assembly, allowing a reduction in production costs.

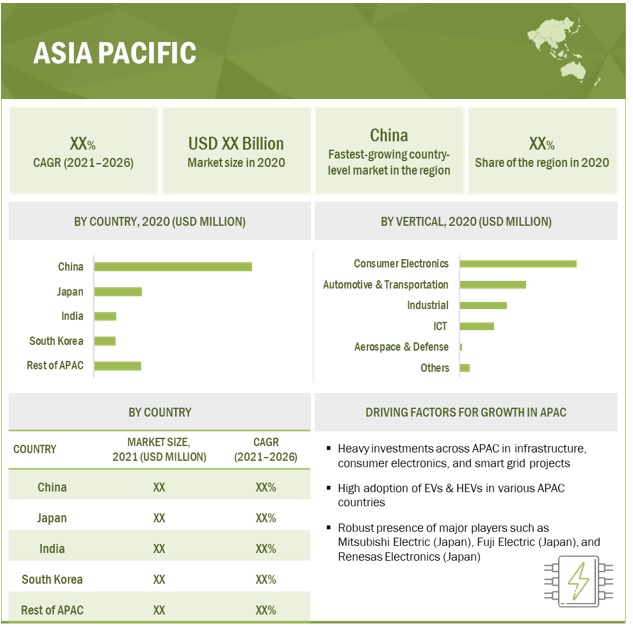

Market in China estimated to hold major share during the forecast period

China is one of the largest consumers of power electronics. It is also the largest manufacturer of various consumer electronics, such as smartphones, tablets, laptops, wearable devices, and other connecting devices. The country is also adopting electric vehicles at a rapid pace and is expected to remain the world’s largest EV market throughout the forecast period. As a result, many foreign vehicle manufacturers have set up manufacturing and assembly plants in China, which, in turn, is expected to create power electronics demand from regional suppliers. China also has an increasing need for power electronics in data centers and UPS applications for supporting its large communication infrastructure. The country, already with a large number of operational solar energy farms, is inclined towards the adoption of renewable energy sources. This is expected to create market growth opportunities for various types of power electronics.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the Power Electronics Companies include Infineon Technologies (Germany), ON Semiconductor (US), STMicroelectronics (Switzerland), Mitsubishi Electric (Japan), Vishay Intertechnology (US), Fuji Electric (Japan), NXP Semiconductors (Netherlands), Renesas Electronics (Japan), Texas Instruments (US), Toshiba (Japan), ABB (Switzerland), GaN Systems (Canada), Littelfuse (US), Maxim Integrated (US), Microchip (US), ROHM (Japan), SEMIKRON (Germany), Transphorm (US), UnitedSiC (US), and Wolfspeed, A Cree Company (US), Euclid Techlabs (US), GeneSiC (US), EPC (US), Analog Devices (US), and Hitachi (Japan).

Power Electronics Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 37.4 Billion |

| Revenue Forecast in 2026 | USD 46.3 Billion |

| Growth Rate | 4.4% |

|

Base Year Considered |

2020 |

|

Forecast period |

2021—2026 |

|

Historical Data Available for Years |

2017—2026 |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | High adoption of renewable power sources |

| Key Market Opportunity | Wide bandgap semiconductors promoting new applications of power electronics |

| Largest Growing Region | Asia Pacific |

| Highest CAGR Segment | GaN-based power electronics |

This report categorizes the Power Electronics Market based on device type, material, voltage, vertical, and geography.

Based on Offering, the Power Electronics Market been Segmented as follows:

- Power Discrete

- Power Module

- Power IC

Based on Material, the Power Electronics Market been Segmented as follows:

- Silicon

- Silicon Carbide

- Gallium Nitride

Based on Voltage, the Power Electronics Market been Segmented as follows:

- Low Voltage

- Medium Voltage

- High Voltage

Based on Vertical, the Power Electronics Market been Segmented as follows:

- Consumer Electronics

- Industrial

- Automotive & Transportation

- ICT

- Aerospace & Defense

- Others

- COVID-19 impact on various verticals

Based on Region, the Power Electronics Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

- Impact of COVID-19 on Power Electronics Market in different regions

Recent Developments

- In August 2021, STMicroelectronics (Switzerland) introduced its new 45W and 150W MasterGaN devices for high-efficiency power conversion.

- In July 2021, Mitsubishi Electric (Japan) announced the launch of seven new X-Series products—two HVIGBTs and five HVDIODEs—boosting the X-Series lineup to 24 power semiconductor modules suitable for increasingly large-capacity, small-sized inverters used in traction motors, DC-power transmitters, large industrial machinery, and other high-voltage, large-current equipment.

- In June 2021, ON Semiconductor (US) announced its new, full silicon carbide MOSFET module solutions for charging electric vehicles with its 1200V full silicon carbide (SiC) MOSFET 2-PACK modules. This is expected to provide a comprehensive portfolio of wide bandgap devices for high-performance charging solutions.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of power electronics based on device type?

Power integrated circuits (ICs) hold the largest share of the power electronics market. Power IC is used for the functioning of power management in various applications. Power IC is used in various devices such as smartphones, tablets, smartwatches, TVs, and SSD for power management applications. Power ICs combine multiple functions into a single device to reduce the component numbers and board space needed to easily and cost-effectively manage power in devices for IoT, consumer, medical, industrial, automotive, and many other applications.

Which power electronics material is expected to have high market growth by 2026?

Semiconductor products, devices, and system manufacturers started developing GaN-based semiconductor and electronic devices in the recent past. GaN is considered an alternative to SiC and sapphire-based materials used in power electronics. Lately, power electronics device manufacturers have started using GaN materials for developing power discrete devices, such as MOSFETs, diodes, rectifiers, and other FETs.

How will manufacturing developments in power electronics change the market landscape in the future?

The current power semiconductor (MOSFETs, IGBTs and power IC) manufacturing relies on 150 mm and 200 mm wafer technology. However, due to their larger diameter compared to standard 200mm wafers, two-and-a-half times as many chips can be made from each 300mm wafer. Semiconductors manufactured on 300 mm substrates are expected to enable better chip performance at lower costs, and 300mm wafers are now being mass-produced. Infineon Technologies is one of the primary power electronic manufacturers adopting a 300mm wafer manufacturing process with its own fabrication facilities.

Which industry is expected to adopt power electronics at a fast rate?

Power electronics plays a vital role in the automotive segment as it helps optimize the use of electrical energy. Increasing concerns over environmental pollution and sustainable growth are boosting the growth of the market for hybrid electric vehicles and high-end automobiles. Power electronics components, including MOSFETs and IGBTs, are used in vehicles to increase efficiency.

What are the key factors influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Power electronics play a key role in shifting electrical energy patterns to renewable energy with higher energy efficiency. In the Americas and Europe, governments are highly focused on upgrading existing power infrastructure, wherein renewables are expected to account for most capacity additions. The need to enhance the power infrastructure and concerns regarding using renewable power supplies are increasing globally. Governments across the globe are increasingly investing in renewable energy sources, such as solar and wind and working on formulating better feed-in-tariff policies to provide photovoltaic projects equipped with grid connections. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SEGMENTATION OF POWER ELECTRONICS MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 POWER ELECTRONICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primary interviews

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market size using bottom-up analysis(demand-side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: (DEMAND SIDE)—DEMAND FOR POWER ELECTRONICS

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for obtaining market size using top-down analysis (supply-side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: (SUPPLY-SIDE)—IDENTIFICATION OF SEGMENT SIZE IN POWER ELECTRONICS MARKET

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 1 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 8 GROWTH PROJECTIONS OF MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 9 IMPACT OF COVID-19 ON MARKET

FIGURE 10 POWER IC SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2026

FIGURE 11 SILICON-BASED POWER ELECTRONICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

FIGURE 12 CONSUMER ELECTRONICS VERTICAL TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

FIGURE 13 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER ELECTRONICS MARKET

FIGURE 14 GLOBAL FOCUS ON RENEWABLE ENERGY GENERATION AND ELECTRIC VEHICLE UTILIZATION TO DRIVE GROWTH OF MARKET

4.2 POWER ELECTRONICS MARKET, BY DEVICE TYPE

FIGURE 15 POWER IC TO HOLD LARGEST MARKET SIZE IN 2026

4.3 POWER ELECTRONICS MODULE MARKET, BY TYPE

FIGURE 16 STANDARD AND POWER INTEGRATED MODULES TO ACCOUNT FOR LARGER MARKET SHARE THAN INTELLIGENT POWER MODULES THROUGHOUT FORECAST PERIOD

4.4 POWER ELECTRONICS MARKET, BY VERTICAL

FIGURE 17 CONSUMER ELECTRONICS TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2021 TO 2026

4.5 POWER ELECTRONICS MARKET IN APAC, BY DEVICE TYPE AND VERTICAL

FIGURE 18 POWER IC AND CONSUMER ELECTRONICS SEGMENTS HELD LARGEST MARKET SHARE IN APAC, BY DEVICE TYPE AND VERTICAL, RESPECTIVELY, IN 2021

4.6 POWER ELECTRONICS MARKET, BY COUNTRY

FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 IMPACT OF DRIVERS AND OPPORTUNITIES ON MARKET

FIGURE 21 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

5.2.1 DRIVERS

5.2.1.1 High adoption of renewable power sources

5.2.1.2 Rapid development of electric vehicles

FIGURE 22 ELECTRIC VEHICLE MARKET, 2021–2030

5.2.1.3 Increased use of power electronics in consumer devices

5.2.2 RESTRAINTS

5.2.2.1 Complex design and integration process

5.2.3 OPPORTUNITIES

5.2.3.1 Wide bandgap semiconductors promoting new applications of power electronics

5.2.3.2 Huge investments in power electronics by China-based companies

5.2.4 CHALLENGES

5.2.4.1 Ever-changing demand for miniature, highly efficient, and cost-effective devices

5.2.4.2 COVID-19 impact on power electronics market

5.3 TARIFFS AND REGULATIONS

5.3.1 TARIFFS PERTAINING TO POWER ELECTRONICS

5.4 REGULATIONS

5.4.1 AEC-Q101

5.4.2 ROHS

5.4.3 IEEE 1662-2016

5.5 CASE STUDIES

5.5.1 INFINEON TECHNOLOGIES SHOWCASED POWER ELECTRONICS BASED ON GAN, SIC, AND SI MATERIALS

5.5.2 INFINEON TECHNOLOGIES SHOWCASED POWER ELECTRONICS BASED ON WIDE BANDGAP SEMICONDUCTOR MATERIALS

5.5.3 ON SEMICONDUCTOR SHOWCASED POWER ELECTRONICS MOSFETS FOR AUTOMOTIVE APPLICATIONS

5.5.4 ON SEMICONDUCTOR SHOWCASED NEW POWER ELECTRONICS FOR AUTOMOTIVE AND INDUSTRIAL APPLICATIONS

5.5.5 VISHAY INTERTECHNOLOGY RECEIVED AWARD FOR MOSFET DESIGN

5.5.6 FUJI ELECTRIC EXPANDING CAPABILITIES OF SIC-BASED DIODES AND TRANSISTORS

5.5.7 FUJI ELECTRIC DEVELOPS WORLD’S HIGHEST LEVEL OF LOW SPECIFIC RESISTANCE MOSFET

5.5.8 FUJI ELECTRIC DEVELOPS IGBT MODULES FOR AUTOMOTIVE APPLICATIONS

5.5.9 ROHM AND GEELY PARTNER TO DEVELOP SIC-BASED POWER ELECTRONICS FOR AUTOMOTIVE APPLICATION

5.5.10 BEIJING SIFANG AUTOMATION USING INTEGRATED SIGNAL-CHAIN ICS FROM MAXIM INTEGRATED

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF POWER ELECTRONICS ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

6.3 ECOSYSTEM/MARKET MAP

FIGURE 24 POWER ELECTRONICS MARKET ECOSYSTEM

6.3.1 SUPPLIERS

6.3.2 MANUFACTURERS

6.3.3 DISTRIBUTORS

6.3.4 OEMS

6.4 TECHNOLOGY ANALYSIS

6.4.1 KEY TECHNOLOGIES

6.4.1.1 Renewable energy systems

6.4.1.2 Automotive electronics and drives

6.4.1.3 UPS

6.5 TECHNOLOGY TRENDS

6.5.1 300MM WAFER TECHNOLOGY

6.5.2 SIC AND GAN MATERIALS

6.6 PATENT ANALYSIS

FIGURE 25 PATENT APPLICATION TRENDS FOR POWER ELECTRONICS IN LAST FIVE YEARS

6.7 TRADE DATA

6.7.1 TRADE DATA

FIGURE 26 IMPORTS DATA FOR HS CODE 8451, BY COUNTRY, 2016–2020

TABLE 2 IMPORTS DATA FOR HS CODE 8541, BY COUNTRY, 2016–2020 (USD BILLION)

FIGURE 27 EXPORTS DATA FOR HS CODE 8541, BY COUNTRY, 2016–2020

TABLE 3 EXPORTS DATA FOR HS CODE 8541, BY COUNTRY, 2016–2020 (USD BILLION)

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 POWER ELECTRONICS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT FROM SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 POWER ELECTRONICS MARKET: SUPPLY CHAIN

6.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 28 POWER ELECTRONICS MARKET

7 POWER ELECTRONICS MARKET, BY DEVICE TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 29 POWER MODULE SEGMENT TO REGISTER HIGHEST CAGR IN POWER ELECTRONICS MARKET DURING FORECAST PERIOD

TABLE 5 MARKET, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 6 MARKET, BY DEVICE TYPE, 2021–2026 (USD BILLION)

7.2 POWER DISCRETE

TABLE 7 MARKET FOR DISCRETE, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 8 MARKET FOR DISCRETE, BY DEVICE TYPE, 2021–2026 (USD BILLION)

TABLE 9 MARKET, BY DEVICE TYPE, 2017–2020 (BILLION UNITS)

TABLE 10 MARKET, BY DEVICE TYPE, 2021–2026 (BILLION UNITS)

TABLE 11 MARKET FOR DISCRETE, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 12 MARKET FOR DISCRETE, BY VERTICAL, 2021–2026 (USD BILLION)

FIGURE 30 MARKET FOR DISCRETE DEVICES IN APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 13 MARKET FOR DISCRETE, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 MARKET FOR DISCRETE, BY REGION, 2021–2026 (USD MILLION)

TABLE 15 MARKET FOR DISCRETE IN CONSUMER ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR DISCRETE IN CONSUMER ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 MARKET FOR DISCRETE IN INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 MARKET FOR DISCRETE IN INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 19 MARKET FOR DISCRETE IN ICT, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 MARKET FOR DISCRETE IN ICT, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 MARKET FOR DISCRETE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR DISCRETE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 MARKET FOR DISCRETE IN AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR DISCRETE IN AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 MARKET FOR DISCRETE IN OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR DISCRETE IN OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

7.2.1 DIODE

7.2.1.1 Mounting type and diode packaging

7.2.1.1.1 Through-hole

7.2.1.1.1.1 Through-hole involves the use of leads inserted into holes drilled in PCBs

7.2.1.1.2 Surface mount

7.2.1.1.2.1 Surface-mount involves electrical components mounted directly onto the surface of a PCB

7.2.1.1.3 Categories of packaging

7.2.1.1.4 Examples of packaging

TABLE 27 LIST OF PLAYERS OFFERING DIFFERENT TYPES OF DIODES

7.2.1.2 PIN diode

7.2.1.2.1 PIN diodes are mostly used in high-switching applications

7.2.1.3 Zener diode

7.2.1.3.1 Zener diodes are useful for voltage regulators

7.2.1.4 Schottky diode

7.2.1.4.1 Schottky diodes are extensively used as they consume less voltage

7.2.1.5 Switching diode

7.2.1.5.1 Switching diodes offer small-scale switching operations

7.2.1.6 Rectifier diode

7.2.1.6.1 Cost-effective solutions are mainly used for rectification

7.2.2 TRANSISTORS

FIGURE 31 FET TRANSISTORS TO EXHIBIT HIGHEST CAGR IN POWER ELECTRONICS MARKET DURING FORECAST PERIOD

TABLE 28 POWER ELECTRONICS MARKET FOR TRANSISTORS, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 29 POWER ELECTRONICS MARKET FOR TRANSISTOR, BY DEVICE TYPE, 2021–2026 (USD BILLION)

7.2.2.1 Field-effect transistor (FET)

7.2.2.1.1 GaN technology enables manufacturing of more efficient FETs with high input impedance

7.2.2.2 Bipolar junction transistor (BJT)

7.2.2.2.1 Bipolar junction transistors are mostly suitable for high-frequency applications

7.2.2.3 Insulated gate bipolar transistor (IGBT)

7.2.2.3.1 Insulated gate bipolar transistor provides fast switching speed and is combined with zero gate drive current

7.2.2.3.2 NPT IGBT

7.2.2.3.2.1 NOT IGBT is suitable for high voltage devices

7.2.2.3.3 PT IGBT

7.2.2.3.3.1 PT IGBT is used for higher switching speed applications

7.2.3 THYRISTOR

7.2.3.1 Thyristors offers cost-effective solutions across variable speed motor drives

7.3 POWER MODULE

FIGURE 32 INTELLIGENT POWER MODULE MARKET TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 30 POWER ELECTRONICS MARKET FOR MODULE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 31 MARKET FOR MODULE, BY TYPE, 2021–2026 (USD BILLION)

FIGURE 33 APAC TO LEAD POWER MODULE MARKET DURING FORECAST PERIOD

TABLE 32 MARKET FOR MODULE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR MODULE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 MARKET FOR MODULE, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 35 MARKET FOR MODULE, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 36 MARKET FOR MODULE IN CONSUMER ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR MODULE IN CONSUMER ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR MODULE IN INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR MODULE IN INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 MARKET FOR MODULE IN ICT, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR MODULE IN ICT, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 MARKET FOR MODULE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR MODULE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 MARKET FOR MODULEIN AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR MODULE IN AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 MARKET FOR MODULE IN OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR MODULE IN OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

7.3.1 INTELLIGENT POWER MODULE (IPM)

7.3.1.1 Intelligent modules are compact and assembled to reduce size, cost, and time to market electronic devices

7.3.2 STANDARD AND POWER INTEGRATED MODULE

TABLE 48 POWER ELECTRONICS MARKET FOR STANDARD & INTEGRATED MODULE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 49 POWER ELECTRONICS MARKET FOR STANDARD & INTEGRATED MODULE, BY TYPE, 2021–2026 (USD BILLION)

7.3.2.1 MOSFET module

7.3.2.1.1 MOSFET, by type

7.3.2.1.1.1 N-channel

7.2.2.2.1 Bipolar junction transistors are mostly suitable for high-frequency applications

7.3.2.1.1.2 P-channel

7.2.2.2.1 Bipolar junction transistors are mostly suitable for high-frequency applications

7.3.2.1.2 MOSFET, by mode

7.3.2.1.2.1 Depletion mode

7.2.2.2.1 Bipolar junction transistors are mostly suitable for high-frequency applications

7.3.2.1.2.2 Enhancement mode

7.2.2.2.1 Bipolar junction transistors are mostly suitable for high-frequency applications

7.3.2.2 IGBT module

7.3.2.2.1 IGBT module is mostly used in industrial and automobile applications

7.3.3 OTHER MODULES

7.4 POWER IC

TABLE 50 POWER ELECTRONICS MARKET FOR IC, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 51 MARKET FOR IC, BY VERTICAL, 2021–2026 (USD BILLION)

TABLE 52 MARKET FOR IC, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR IC, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR POWER IC, FOR CONSUMER ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR POWER IC, FOR CONSUMER ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 MARKET FOR POWER IC IN INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR POWER IC IN INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR POWER IC IN ICT, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR POWER IC IN ICT, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 MARKET FOR POWER IC IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR POWER IC IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR POWER IC IN AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MARKET FOR POWER IC IN AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 64 MARKET FOR POWER IC IN OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR POWER IC IN OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

7.4.1 POWER MANAGEMENT IC

7.4.1.1 PMICs are used in many consumer applications

7.4.2 APPLICATION-SPECIFIC IC

7.4.2.1 Power ICs can be customized according to requirements of end users

8 POWER ELECTRONICS MARKET, BY MATERIAL (Page No. - 120)

8.1 INTRODUCTION

FIGURE 34 GAN-BASED POWER ELECTRONICS TO REGISTER HIGH CAGR DURING FORECAST PERIOD

TABLE 66 MARKET, BY MATERIAL, 2017–2020 (USD BILLION)

TABLE 67 MARKET, BY MATERIAL, 2021–2026 (USD BILLION)

8.2 SILICON (SI)

8.2.1 SILICON DEVICES ARE SUITABLE FOR LOW- AND MEDIUM-VOLTAGE SEMICONDUCTOR APPLICATIONS

8.3 SILICON CARBIDE (SIC)

8.3.1 SILICON-CARBIDE SEMICONDUCTOR DEVICES ARE DESIGNED FOR HIGH-VOLTAGE AND HIGH-TEMPERATURE APPLICATIONS

TABLE 68 RECENT DEVELOPMENTS FOR SIC DEVICES

8.4 GALLIUM NITRIDE (GAN)

8.4.1 GAN-BASED SEMICONDUCTORS OFFER WIDE BANDGAP, HIGH VOLTAGE, AND HIGH THERMAL CONDUCTIVITY

TABLE 69 RECENT DEVELOPMENTS FOR GAN DEVICES (2018–2020)

8.5 OTHERS

9 POWER ELECTRONICS MARKET, BY VOLTAGE (Page No. - 126)

9.1 INTRODUCTION

FIGURE 35 LOW-VOLTAGE POWER ELECTRONICS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

TABLE 70 MARKET, BY VOLTAGE, 2017–2020 (USD BILLION)

TABLE 71 MARKET, BY VOLTAGE, 2021–2026, (USD BILLION)

9.2 LOW VOLTAGE

9.2.1 GROWING ADOPTION OF LOW-VOLTAGE DEVICES IN AUTOMOTIVE, CONSUMER, AND INDUSTRIAL SECTORS TO BOOST MARKET GROWTH

TABLE 72 MARKET FOR LOW VOLTAGE, BY REGION, 2017–2020 (USD BILLION)

TABLE 73 MARKET FOR LOW VOLTAGE, BY REGION, 2021–2026 (USD BILLION)

9.3 MEDIUM VOLTAGE

9.3.1 R INCREASING USE OF MEDIUM-VOLTAGE POWER ELECTRONICS IN POWER AND ENERGY APPLICATIONS ACCELERATES MARKET GROWTH

TABLE 74 MARKET FOR MEDIUM VOLTAGE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR MEDIUM VOLTAGE, BY REGION, 2021–2026 (USD MILLION)

9.4 HIGH VOLTAGE

9.4.1 SURGING NEED FOR HIGH-VOLTAGE POWER ELECTRONICS IN HVDC APPLICATIONS

TABLE 76 MARKET FOR HIGH VOLTAGE, BY REGION, 2017–2020 (USD BILLION)

TABLE 77 MARKET FOR HIGH VOLTAGE, BY REGION, 2021–2026 (USD BILLION)

10 POWER ELECTRONICS, BY WAFER SIZE (Page No. - 132)

10.1 INTRODUCTION

10.2 200MM AND LESS THAN 200MM WAFER

10.3 300MM WAFER

11 POWER ELECTRONICS, BY CURRENT LEVEL (Page No. - 134)

11.1 INTRODUCTION

11.2 UP TO 25A

11.3 25A TO 40A

11.4 ABOVE 40A

12 APPLICATIONS OF POWER ELECTRONICS (Page No. - 135)

12.1 INTRODUCTION

12.2 POWER MANAGEMENT

12.3 DRIVES

12.4 UPS

12.5 RAIL TRACTION

12.6 TRANSPORTATION

12.7 RENEWABLES

12.8 OTHERS

13 POWER ELECTRONICS MARKET, BY VERTICAL (Page No. - 138)

13.1 INTRODUCTION

FIGURE 36 MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICALS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 78 MARKET, BY VERTICAL, 2017–2020 (USD BILLION)

TABLE 79 MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

13.2 ICT

13.2.1 ELEVATING DEMAND FOR ADVANCED POWER ELECTRONIC DEVICES TO DRIVE GROWTH OF ICT SEGMENT

TABLE 80 POWER ELECTRONICS MARKET FOR ICT, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 81 MARKET FOR ICT, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 82 MARKET FOR ICT, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR ICT, BY REGION, 2021–2026 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA FOR ICT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA FOR ICT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 MARKET IN EUROPE FOR ICT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN EUROPE FOR ICT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 MARKET IN APAC FOR ICT, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN APAC FOR ICT, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 90 MARKET IN ROW FOR ICT, BY REGION, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN ROW FOR ICT, BY REGION, 2021–2026 (USD MILLION)

13.3 CONSUMER ELECTRONICS

13.3.1 INCREASING ADOPTION OF CONSUMER ELECTRONICS TO STIMULATE MARKET GROWTH FOR POWER MANAGEMENT IC

TABLE 92 POWER ELECTRONICS MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 93 MARKET FOR CONSUMER ELECTRONICS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

FIGURE 37 APAC TO DOMINATE MARKET FOR CONSUMER ELECTRONICS THROUGHOUT FORECAST PERIOD

TABLE 94 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 95 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN EUROPE FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 MARKET IN APAC FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN APAC FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 MARKET IN ROW FOR CONSUMER ELECTRONICS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN ROW FOR CONSUMER ELECTRONICS, BY COUNTRY, 2021–2026 (USD MILLION)

13.4 INDUSTRIAL

13.4.1 RISING DEPLOYMENT OF INDUSTRIAL MACHINERY TO DRIVE MARKET GROWTH

TABLE 104 POWER ELECTRONICS MARKET FOR INDUSTRIAL, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 105 MARKET FOR INDUSTRIAL, BY DEVICE TYPE, 2021–2026 (USD MILLION)

FIGURE 38 MARKET IN APAC FOR INDUSTRIAL VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 106 MARKET FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 107 MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 108 MARKET IN NORTH AMERICA FOR INDUSTRIAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN NORTH AMERICA FOR INDUSTRIAL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 110 MARKET IN EUROPE FOR INDUSTRIAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN EUROPE FOR INDUSTRIAL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 112 MARKET IN APAC FOR INDUSTRIAL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN APAC FOR INDUSTRIAL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN ROW FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN ROW FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

13.4.2 ENERGY AND POWER

13.4.2.1 Photovoltaics

13.4.2.1.1 Increasing initiatives of governments to produce clean energy to drive photovoltaics and power electronics market

13.4.2.2 Wind Turbine

13.4.2.2.1 Growing focus on electricity generation using wind turbines to increase demand for power electronic devices

13.5 AUTOMOTIVE & TRANSPORTATION

13.5.1 INCREASING IMPORTANCE OF ADVANCED POWER SEMICONDUCTOR DEVICES IN AUTOMOTIVE APPLICATIONS TO DRIVE SIC AND GAN POWER ELECTRONICS MARKET

FIGURE 39 POWER MODULE MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 116 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 117 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

FIGURE 40 APAC TO LEAD MARKET FOR AUTOMOTIVE & TRANSPORTATION DURING FORECAST PERIOD

TABLE 118 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 119 MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 120 MARKET IN NORTH AMERICA FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN NORTH AMERICA FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 MARKET IN EUROPE FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN EUROPE FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 41 MARKET IN CHINA FOR AUTOMOTIVE & TRANSPORTATION VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 124 MARKET IN APAC FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN APAC FOR AUTOMOTIVE & TRANSPORTATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 126 MARKET IN ROW FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 MARKET IN ROW FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

13.5.1.1 Powertrain

13.5.1.2 Body and convenience

13.5.1.3 Chassis and safety systems

13.5.1.4 Infotainment

13.6 AEROSPACE & DEFENSE

13.6.1 HIGH POWER CAPABILITY OF GAN INCREASES ITS ADOPTION IN AEROSPACE & DEFENSE VERTICAL

TABLE 128 POWER ELECTRONICS MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 129 MARKET FOR AEROSPACE & DEFENSE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 130 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 131 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 132 MARKET IN NORTH AMERICA FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 MARKET IN NORTH AMERICA FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 134 MARKET IN EUROPE FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 MARKET IN EUROPE FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 136 MARKET IN APAC FOR AEROSPACE & DEFENSE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 137 MARKET IN APAC FOR AEROSPACE & DEFENSE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 138 MARKET IN ROW FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 139 MARKET IN ROW FOR AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

13.7 OTHERS

TABLE 140 POWER ELECTRONICS MARKET FOR OTHER VERTICALS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 141 MARKET FOR OTHER VERTICALS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 142 MARKET FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 143 MARKET FOR OTHER VERTICALS, BY REGION, 2021–2026 (USD MILLION)

TABLE 144 MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 MARKET IN EUROPE FOR OTHER VERTICALS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 147 MARKET IN EUROPE FOR OTHER VERTICALS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 148 MARKET IN APAC FOR OTHER VERTICALS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 MARKET IN APAC FOR OTHER VERTICALS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 150 MARKET IN ROW FOR OTHER VERTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 151 MARKET IN ROW FOR OTHER VERTICALS, BY REGION, 2021–2026 (USD MILLION)

13.8 COVID-19 IMPACT ON VARIOUS VERTICALS

14 GEOGRAPHIC ANALYSIS (Page No. - 171)

14.1 INTRODUCTION

FIGURE 42 APAC TO LEAD POWER ELECTRONICS MARKET DURING FORECAST PERIOD

TABLE 152 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 153 MARKET, BY REGION, 2021–2026 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 43 MARKET SNAPSHOT IN NORTH AMERICA

TABLE 154 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 155 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 MARKET IN NORTH AMERICA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 157 MARKET IN NORTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 158 MARKET IN NORTH AMERICA, BY VOLTAGE, 2017–2020 (USD MILLION)

TABLE 159 MARKET IN NORTH AMERICA, BY VOLTAGE, 2021–2026 (USD MILLION)

TABLE 160 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 161 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2021–2026 (USD MILLION)

14.2.1 US

14.2.1.1 US is largest market for power electronics in North America

14.2.2 CANADA

14.2.2.1 Power electronics are primarily used in power transmission and power management applications in Canada

14.2.3 MEXICO

14.2.3.1 market in Mexico is at nascent stage

14.3 EUROPE

FIGURE 44 POWER ELECTRONICS MARKET SNAPSHOT IN EUROPE

TABLE 162 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 164 MARKET IN EUROPE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 165 MARKET IN EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 166 MARKET IN EUROPE, BY VOLTAGE, 2017–2020 (USD MILLION)

TABLE 167 MARKET IN EUROPE, BY VOLTAGE, 2021–2026 (USD MILLION)

TABLE 168 MARKET IN EUROPE, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 169 MARKET IN EUROPE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

14.3.1 UK

14.3.1.1 UK government’s active support to reduce carbon footprint across various verticals to propel market growth

14.3.2 GERMANY

14.3.2.1 Germany accounts for largest share of power electronics market in Europe

14.3.3 FRANCE

14.3.3.1 French government emphasizes on reducing pollution levels by promoting use of electric vehicles

14.3.4 ITALY

14.3.4.1 Italy is among top ten countries in Europe producing electricity from renewable energy sources

14.3.5 REST OF EUROPE

14.4 APAC

FIGURE 45 POWER ELECTRONICS MARKET SNAPSHOT IN APAC

TABLE 170 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 171 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 172 MARKET IN APAC, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 173 MARKET IN APAC, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 174 MARKET IN APAC, BY VOLTAGE, 2017–2020 (USD MILLION)

TABLE 175 MARKET IN APAC, BY VOLTAGE, 2021–2026 (USD MILLION)

TABLE 176 MARKET IN APAC, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 177 MARKET IN APAC, BY DEVICE TYPE, 2021–2026 (USD MILLION)

14.4.1 CHINA

14.4.1.1 China is largest manufacturer of various consumer electronic devices

14.4.2 JAPAN

14.4.2.1 Japanese government is investing significantly in renewable energy and electric vehicles

14.4.3 INDIA

14.4.3.1 Rapid urbanization and infrastructure modernization are key factors driving market growth in India

14.4.4 SOUTH KOREA

14.4.4.1 Well-established consumer electronics industry in South Korea supports power electronics market growth

14.4.5 REST OF APAC

14.5 ROW

FIGURE 46 MARKET IN SOUTH AMERICA TO GROW AT HIGHER RATE THAN IN MIDDLE EAST & AFRICA DURING FORECAST PERIOD

TABLE 178 POWER ELECTRONICS MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 179 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 180 MARKET IN ROW, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 181 MARKET IN ROW, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 182 MARKET IN ROW, BY VOLTAGE, 2017–2020 (USD MILLION)

TABLE 183 MARKET IN ROW, BY VOLTAGE, 2021–2026 (USD MILLION)

TABLE 184 MARKET IN ROW, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 185 MARKET IN ROW, BY DEVICE TYPE, 2021–2026 (USD MILLION)

14.5.1 SOUTH AMERICA

14.5.1.1 Brazil would continue to be largest market for power electronics in South America

14.5.2 MIDDLE EAST & AFRICA

14.5.2.1 Growing construction of energy infrastructure projects are expected to drive growth of Middle Eastern market

14.6 COVID-19 IMPACT ON POWER ELECTRONICS MARKET IN DIFFERENT REGIONS

15 COMPETITIVE LANDSCAPE (Page No. - 193)

15.1 OVERVIEW

15.2 STRATEGIES OF KEY PLAYERS/MARKET EVALUATION FRAMEWORK

TABLE 186 OVERVIEW OF STRATEGIES ADOPTED BY POWER ELECTRONICS MANUFACTURERS FROM 2018 TO 2020

15.2.1 PRODUCT PORTFOLIO

15.2.2 REGIONAL FOCUS

15.2.3 MANUFACTURING FOOTPRINT

15.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

15.3 MARKET SHARE ANALYSIS: POWER ELECTRONICS MARKET, 2020

TABLE 187 DEGREE OF COMPETITION, 2020

15.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN POWER ELECTRONICS MARKET

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STAR

15.5.2 EMERGING LEADER

15.5.3 PERVASIVE

15.5.4 PARTICIPANT

FIGURE 48 POWER ELECTRONICS COMPANY EVALUATION QUADRANT, 2020

15.5.5 COMPANY FOOTPRINT

TABLE 188 OVERALL COMPANY FOOTPRINT

TABLE 189 FOOTPRINTS OF COMPANIES, BY PRODUCT TYPE

TABLE 190 FOOTPRINTS OF COMPANIES, BY VERTICAL

TABLE 191 FOOTPRINTS OF COMPANIES, BY REGION

15.6 COMPETITIVE SITUATIONS AND TRENDS

15.6.1 PRODUCT LAUNCHES

TABLE 192 PRODUCT LAUNCHES, 2018–2020

15.6.2 DEALS

TABLE 193 DEALS, 2018–2020

15.6.3 OTHERS

TABLE 194 EXPANSIONS, 2018–2020

16 COMPANY PROFILES (Page No. - 206)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

16.1 KEY PLAYERS

16.1.1 INFINEON TECHNOLOGIES

TABLE 195 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

16.1.2 ON SEMICONDUCTOR

TABLE 196 ON SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 50 ON SEMICONDUCTOR: COMPANY SNAPSHOT

16.1.3 STMICROELECTRONICS

TABLE 197 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 51 STMICROELECTRONICS: COMPANY SNAPSHOT

16.1.4 MITSUBISHI ELECTRIC

TABLE 198 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 52 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

16.1.5 VISHAY INTERTECHNOLOGY

TABLE 199 VISHAY INTERTECHNOLOGY: BUSINESS OVERVIEW

FIGURE 53 VISHAY INTERTECHNOLOGY: COMPANY SNAPSHOT

16.1.6 FUJI ELECTRIC

TABLE 200 FUJI ELECTRIC: BUSINESS OVERVIEW

FIGURE 54 FUJI ELECTRIC: COMPANY SNAPSHOT

16.1.7 NXP SEMICONDUCTORS

TABLE 201 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 55 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

16.1.8 RENESAS ELECTRONICS

TABLE 202 RENESAS ELECTRONICS: BUSINESS OVERVIEW

FIGURE 56 RENESAS ELECTRONICS: COMPANY SNAPSHOT

16.1.9 TEXAS INSTRUMENTS

TABLE 203 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 57 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

16.1.10 TOSHIBA GROUP

TABLE 204 TOSHIBA GROUP: BUSINESS OVERVIEW

FIGURE 58 TOSHIBA GROUP: COMPANY SNAPSHOT

16.2 OTHER KEY PLAYERS

16.2.1 ABB

16.2.2 GAN SYSTEMS

16.2.3 LITTELFUSE

16.2.4 MAXIM INTEGRATED

16.2.5 MICROCHIP

16.2.6 ROHM

16.2.7 SEMIKRON

16.2.8 TRANSPHORM

16.2.9 UNITEDSIC

16.2.10 WOLFSPEED, A CREE COMPANY

16.2.11 EUCLID TECHLABS

16.2.12 GENESIC

16.2.13 EPC

16.2.14 ANALOG DEVICES

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 269)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

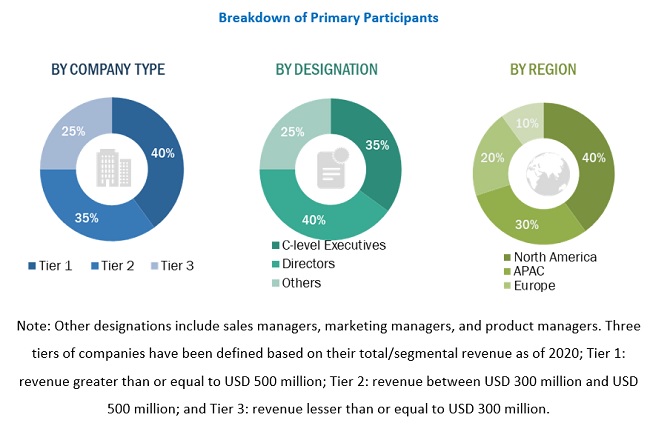

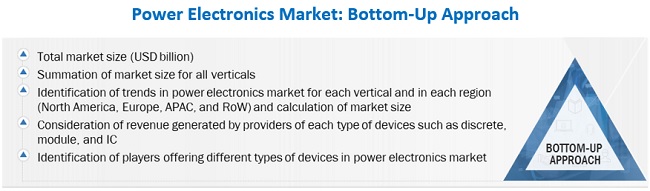

The study involved four major activities in estimating the size for the power electronics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, related journals, and certified publications; articles by recognized authors; gold and silver standard websites; directories; and databases like Factiva.

Secondary research was mainly conducted to obtain key information about the industry supply chain, the market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the power electronics market.

Extensive primary research was conducted after obtaining information about the power electronics market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides. Primary data has been mainly collected through telephonic interviews, which constitute approximately 80% of the overall primary interviews. Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods for estimating and forecasting the size of the power electronics market and its segments and subsegments listed in this report. The key players in the market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews of the industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the power electronics market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the power electronics market, in terms of value, based on device type, material, voltage, and vertical. Volume data has been provided for the device type segment

- To describe and forecast the market size, in terms of value, with respect to four major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market’s growth

- To provide a detailed overview of the supply chain of the power electronics ecosystem

- To provide a qualitative overview of power electronics based on wafer size, current level, and application

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches and developments, expansions, and partnerships in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Electronics Market

HI, I want to know more about power electronics business in Asia & Europe Can I have specific information about that with in this study

Can someone clarify Power Electronics market in this report? Are the numbers for Power Electronics Systems or only Power Semiconductor Devices/modules?

I would like to buy sections of this report - is that possible? I am interested in understanding the market for transportation application in Europe. Also, I would like to know more about the transportation market for specific countries in Europe.

We would like to understand the ecosystem for the power electronics market and the major product offerings of leading players in this market, Can you provide market share analysis and product offerings along with business strategies adopted by each player;

We are looking into how this industry works and would like more information about the developments and future trends in power electronics market. Also, we would like to know more about the segments covered in the report and research methodology used to arrive at the market size.

I would like to know the inclusion and exclusion of the power electronics market report in terms of the industries covered and the type of components that are included in the report. Also, can you provide market sizing for the transportation and renewable industry?