Power SCADA Market by Architecture (Hardware, Software, Services), Component (Remote Terminal Unit, Programmable Logic Controller, Human Machine Interface, Communication System Protection relays), End User and Region - Global Forecast to 2026

[218 Pages Report] The global power SCADA market is expected to grow from an estimated USD 1.7 billion in 2021 to USD 2.5 billion by 2026, at a CAGR of 7.6% during the forecast period. Increasing adoption of Industry 4.0 is a key factor driving the growth of the power SCADA market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on power SCADA market

COVID-19 has slowed the growth of the market, as countries were forced to implement lockdowns during the first half of 2020. Strict guidelines were issued by governments and local authorities, and all non-essential operations were halted. This adversely affected the market owing to the suspension of activities of end-users.

In addition, production and supply chain delays were also witnessed during the second quarter which poised a challenge to the market, since end-user industries were still not operating at their full capacity.

Power SCADA Market Dynamics

Driver: Increasing adoption of industry 4.0 principles

The concept of 4th generation industrial revolution (Industry 4.0) started in Germany and evolved in Europe and the Americas. The wide adoption of Industry 4.0 principles by various sectors is likely to be a key factor encouraging the growth of the market. Most of the processes and systems in the power industry are being automated, which allows power plants to operate 24/7 with zero human errors, high efficiency, and full accuracy. It has well-shaped the future of the power sector by reducing errors associated with the involvement of humans in processes, as automated systems work with greater efficiency. Power SCADA systems are key enablers of automation of industrial processes. Various machines can be controlled and operated using automation solutions such as Power SCADA solutions.

In a power plant, the operational components include mechanical and electronic components, sensors, and actuators; these components communicate with each other through a network and share information related to problems and faults, changes in generation schedule, and other parameters. With the proliferation of such interconnected devices in various end-use industries, power SCADA systems have become an indispensable part of various end-use industries. This predictive maintenance strategy boosts efficiency optimizes throughput times and improves the use of resources and improves the efficiency of transmission and distribution. Thus, the aforementioned factors are likely to boost the demand for power SCADA systems.

Restraints: High costs associated with initial setup and maintenance and upgrade of power SCADA solutions

The setting up of power plants, new T&D lines, and substations requires huge capital investment associated with the installation of equipment and software, as well as training. Some of these solutions are installed in remote locations for controlling and maintaining the systems, as well as for gathering real-time data. Gathering data with the help of a power SCADA system helps in reducing errors while improving efficiency and productivity. Investment of such a huge amount is difficult for a new company. The management has to conduct a deep analysis of the return on investment (ROI) before implementing state-of-the-art control and automation systems. It is not feasible for many companies to replace their existing systems because of the high cost of new and advanced systems and lack of interoperability in legacy systems. Legacy systems rely on their own proprietary protocols to communicate, which makes it difficult to connect them to systems based on new technology. Moreover, the additional costs incurred by power SCADA manufacturers or suppliers to upgrade the existing systems is high. Furthermore, automation software systems used in power plants require maintenance and upgrades occasionally. It is not feasible for small power plants and captive power plants to bear such expenses. Thus, cost acts as a key factor restraining the growth of the market. Once the power SCADA system is installed in an operating plant, it becomes difficult to add any alternative system, hardware, or software that is not compatible with the Power SCADA system, as it has to seamlessly integrate with the existing system for optimum results.

The initial capital investment is followed by maintenance cost. Maintenance and upgrading the plant with modern technologies require a high capital re-investment, which is difficult for companies who have fewer financial resources. Thus, both initial capital investment and cost of maintenance and upgrades are restraining factors for the market.

Opportunities: Convergence of power SCADA systems and wireless sensor networks (WSNs)

A wireless network integrated with distributed autonomous devices consisting of sensors to monitor physical or environmental conditions is known as a wireless sensor network (WSN). WSNs are used in various industries, such as oil & gas, transportation, and water & wastewater treatment. Oil & gas plants are generally located in remote areas with rough environmental conditions. In an oil & gas plant, tanks, compressors, generators, and separators are monitored, managed, and controlled by a power SCADA system with the help of sensors deployed in a WSN. The use of a WSN reduces the costs associated with the implementation of a sensor network and communication system. Moreover, wired technologies are comparatively costlier than their wireless counterparts due to the increased hardware requirements such as cables, networking devices, routers, and network adapters. Several parameters, such as pressure, temperature, flow and level of systems, in plant operations are measured and detected using a WSN.

Some major applications of WSN in power grids are preventing theft of cables, conductors, and lattices, monitoring conductor temperature and low hanging temperature, monitoring partial discharge and leakage current, fault detection. The use of a WSN enables real-time data monitoring and process control. Thus, growing R&D in the field of WSN and its active adoption in SCADA systems and solutions would increase the application scope of power SCADA systems. Also, frequent software updates in wireless sensor networks make them apt for the current automated systems in various industries adopting power SCADA systems.

Challenges: Vulnerability to Cyberattacks

Cyberattacks are among the primary issues to be addressed while developing a sensor-based network to monitor and control critical infrastructures. As power SCADA systems comprise a network of sensors, mainframe computers, communication systems, and storage systems, they are vulnerable to cyberattacks. SCADA systems manage the operational aspects of critical infrastructure by using logical processes and physical operations. Failure of these systems can affect an organization, a community, and subsequently an economy. Disasters such as leakage and spills from oil or sewage pipelines and electricity grid failures can have a long-term negative effect on plant operations.

As SCADA systems are equipped with different types of communication systems, there are nodes and points from where cyberattacks can negatively affect the system, causing them to malfunction and leading to disastrous events. A cyberattack can have adverse effects such as oil spills, possible radiation leaks, delays in the commuter rail network, and long downtime for a manufacturer during peak hours. The use of common technology standards and network protocols such as IPv5 and IPv6 is increasing the connectivity among corporate IT networks. This helps decision makers access data from anywhere, thereby helping them make effective and timely decisions. However, the network becomes more vulnerable to external attacks as it is shared on a common platform. While constructing a power SCADA system, the availability of real-time data is more important than the confidentiality of data. Hence, cyberattacks pose a big threat to the power SCADA system market.

Moreover, due to the COVID-19 pandemic, there has been a rise in communication and the shift of businesses to the online operations model, which, in turn, has increased the risk of cyberattacks for all devices connected over the Internet. This has created risks related to cyberattacks owing to the vulnerability over the network.

Market Trend

By architecture, the hardware segment is the largest contributor in the power SCADA market in 2020.

The hardware segment accounted for the largest share of the market, by architecture, in 2020. The hardware segment is estimated to hold the largest share of the global power SCADA market in 2021, as it is largely utilized in SCADA automation and substations. This growth is attributed to the higher demand for power SCADA in the APAC region. The Mexican government supports usage of renewable energy and industrial grid modernization by companies. Most of the work that has been going on in grid modernization in Mexico across substation and distribution automation includes integrated communication technologies such as SCADA systems. The hardware segment is expected to grow at the highest CAGR from 2021 to 2026 due to the increasing requirement for latest software and ability to handle massive data and avoid cyberattacks.

By end-user industry, the oil and gas industry is the largest contributor in the power SCADA market in 2020.

The oil and gas industry accounted for the largest share of the power SCADA market, by end-user industry, in 2020. Oil & gas is one of the largest industries in terms of revenue generation for the market. The oil & gas industry is classified into 3 major sectors—upstream, midstream, and downstream. Processes carried out in this industry are highly complex, lengthy, and critical. Power SCADA systems are widely applied across all sectors of the oil & gas industry. Using power SCADA systems in these industries ensure safety, reliability, and profitability in oil & gas operations. The industry involves extreme operating conditions, financial constraints, profitability concerns, safety issues, and potential environmental hazards. Oil and gas plants are prone to incidents that could affect people, assets, and the environment inside and outside a plant. Power SCADA systems along with management of power; can considerably reduce the risk of accidents in these plants.

By component, the Remote Terminal Unit (RTU) segment is the largest contributor in the power SCADA market in 2020.

The Remote Terminal Unit (RTU) segment accounted for the largest share of the power SCADA market, by component, in 2020. A remote terminal unit (RTU) in a power SCADA system is an electronic device that is installed at a remote location to collect data through actuators and sensors and transmit the information back to the master terminal station, usually depending on the request sent from the master station. RTUs are geographically distributed over different sites, collecting and processing the real-time information to the master station using LAN/WAN (radio signals, telephone line, cable connection, satellite, and microwaves media, etc.). The accuracy of the control system highly depends upon the number of RTUs installed in any power SCADA system to capture real-time information.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific includes countries such as the China, South Korea, India, Japan, Australia, and Rest of APAC. The China and Japan, which are among the largest consumers in this region as well as globally, constitute the largest share of the power SCADA market. Fast-growing economies, increasing demand of huge population, necessity for high-quality products and increased production rates are expected to drive the power SCADA market in this region.

The market in China is expected to grow mainly because the number of manufacturing units in China is increasing, which is expected to create a massive demand for power SCADA. The demand for process automation and instrumentation is very high in APAC owing to the increasing investments in power transmission and distribution in industrial sector. All of these factors are expected to drive the growth of the power SCADA market in Asia Pacific.

The leading players in the power SCADA market include Siemens (Germany), ABB (Switzerland), Emerson (US), Schneider Electric (France), and Rockwell Automation (US).

Recent Developments

- In February 2021, Honeywell signed a contract with SEPCO Electric Power Construction Corporation to provide its services related to safety and security systems, connected control, and telecommunications to a shipyard that is being developed in Saudi Arabia.

- In August 2020, Schneider acquired Larsen and Toubro’s electrical and automation business partnering with Temasek. Schneider Electric owns a 65% stake of the acquired L&T’s business division and the rest by Temasek. This acquisition will strengthen low-voltage offerings and the Industrial Automation business and will help Schneider Electric to grow in the Middle East, Africa, and East Asia as L&T offers strong R&D and engineering capabilities.

- In May 2019, Mitsubishi Electric acquired ICONICS Inc, a US-based software company focusing on SCADA and others such as IoT, analytics, mobility, HMI, and cloud applications.

- In July 2018, ABB acquired GE Industrial Solutions’ electrification solution business to expand its digital and automation business. This will give the company a competitive advantage, particularly in North America.

- In January 2017, Efacec has set up its second switchgear factory in Nashik, Maharashtra (India). This was a move to establish its footprint in India and the Asian continent.

Frequently Asked Questions (FAQ):

What is the current size of the power SCADA market?

The current market size of global power SCADA market is estimated to be USD 1.78 billion in 2021.

What is the major drivers for power SCADA market?

Increasing demand of industry 4.0, Most of the processes and systems in the power industry are being automated, which allows industries to operate 24/7 with zero human errors, high efficiency, and full accuracy. It has well-shaped the future of the industries by reducing errors associated with the involvement of humans in processes, as automated systems work with greater efficiency. Power SCADA systems are key enablers of automation of industrial processes. Various machines can be controlled and operated using automation solutions such as Power SCADA solutions, industry 4.0 smoothens this process. Thus, industry 4.0 is the key factor driving the growth of the power SCADA market.

Which is the fastest-growing region during the forecasted period in power SCADA market?

Asia Pacific is the fastest growing region during the forecasted period. The region is the most populated region in the world and is expected to become the largest power SCADA deploying region globally. It comprises many developing countries and requires more increased efficiency of industries for its development. Thus, rise in demand for process automation and instrumentation is likely to drive the growth of market.

Which is the fastest growing segment, by end-user industry during the forecasted period in power SCADA market?

The oil and gas industry, by end-user industry is the fastest growing segment during the forecasted period. The market for oil and gas industry, is projected to grow because the Power SCADA systems help collect data from remote oil and gas sites and, thus, reduce personnel visits to the site. This helps optimize the system as both human labor and error are reduced. Since the global infrastructure relies mostly on the oil and gas sector, the sector strives for continuous innovation and automation of its processes. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 POWER SCADA MARKET, BY ARCHITECTURE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY END-USER INDUSTRY: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

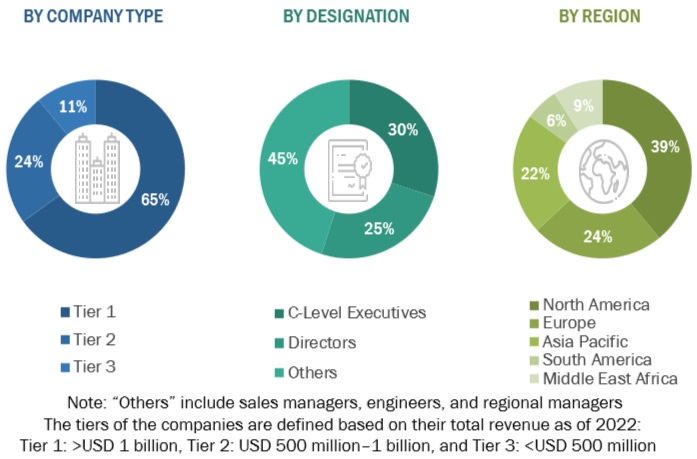

2.2.2.2 Breakdown of primaries

2.3 SCOPE

2.4 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: INDUSTRY-REGION/COUNTRY-WISE ANALYSIS

2.5 DEMAND-SIDE ANALYSIS

2.5.1 METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR MARKET

FIGURE 4 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR MARKET

2.5.1.1 Calculation for Demand side

2.5.1.2 Assumptions for demand side

2.5.2 SUPPLY-SIDE ANALYSIS

FIGURE 5 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF POWER SCADA SYSTEMS

FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

2.5.2.1 Calculations for Supply side

2.5.2.2 Assumptions

2.5.3 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 1 POWER SCADA MARKET SNAPSHOT

FIGURE 7 MARKET IN ASIA PACIFIC LED GLOBAL MARKET IN 2020

FIGURE 8 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 9 REMOTE TERMINAL UNIT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 OIL AND GAS SECTOR TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER SCADA MARKET

FIGURE 11 INCREASING INVESTMENTS IN AUTOMATION OF SUBSTATIONS DRIVING MARKET DURING FORECAST PERIOD

4.2 MARKET, BY REGION

FIGURE 12 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.3 MARKET IN ASIA PACIFIC, BY END USER & COUNTRY

FIGURE 13 OIL AND GAS INDUSTRY AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2020

4.4 MARKET, BY COMPONENT

FIGURE 14 REMOTE TERMINAL UNIT MARKET TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.5 MARKET, BY ARCHITECTURE

FIGURE 15 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 16 POWER SCADA MARKET, BY END-USER INDUSTRY, 2019–2020 (USD MILLION)

FIGURE 17 COVID-19 GLOBAL PROPAGATION

FIGURE 18 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 19 RECOVERY ROAD FOR 2020 AND 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing adoption of industry 4.0 principles is driving the market

FIGURE 22 GLOBAL ELECTRICITY INVESTMENT (2014–2019)

5.5.1.2 Growing focus on carbon footprint management

5.5.1.3 Rising use of SCADA in oil & gas sector

5.5.2 RESTRAINTS

5.5.2.1 High costs associated with initial setup and maintenance and upgrade of power SCADA solutions

5.5.2.2 Risks of cyberattacks affects growth of power SCADA systems

5.5.3 OPPORTUNITIES

5.5.3.1 Convergence of power SCADA systems and wireless sensor networks (WSNs)

FIGURE 23 GLOBAL POWER CONSUMED BY ALL ICT DEVICES

5.5.3.2 Anticipated shift from on-premises to cloud-based power SCADA systems

5.5.3.3 Rise in use of big data analytics and 5G technology in industrial environment

5.5.4 CHALLENGES

5.5.4.1 Vulnerability to cyberattacks negatively affecting power SCADA systems

FIGURE 24 ENTRY POINTS FOR CYBERATTACKS

5.5.4.2 Inadequate data storage and management concerns

5.5.4.3 Impact of COVID-19 on market

5.6 TRENDS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR POWER SCADA MANUFACTURERS

FIGURE 25 REVENUE SHIFT FOR POWER SCADAS

5.7 PRICING ANALYSIS

TABLE 2 PRICING ANALYSIS OF POWER SCADA SOLUTIONS

TABLE 3 PRICING ANALYSIS OF REMOTE TERMINAL UNITS (RTUS)

TABLE 4 PRICING ANALYSIS OF PROGRAMMABLE LOGIC CONTROLLERS (PLCS)

5.8 MARKET MAP

FIGURE 26 MARKET MAP FOR POWER SCADA

TABLE 5 POWER SCADA: ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS

FIGURE 27 POWER SCADA VALUE CHAIN ANALYSIS

5.9.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.9.2 COMPONENT MANUFACTURERS

5.9.3 POWER SCADA MANUFACTURERS/ASSEMBLERS

5.9.4 DISTRIBUTORS (BUYERS)/END USERS AND POST-SALES SERVICE PROVIDERS

5.10 TECHNOLOGY ANALYSIS

5.10.1 POWER SCADA BASED ON DIFFERENT TECHNOLOGIES

5.11 POWER SCADA: CODES AND REGULATIONS

TABLE 6 POWER SCADA: CODES AND REGULATIONS

5.12 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 7 POWER SCADA: INNOVATIONS AND PATENT REGISTRATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 PORTER’S FIVE FORCES ANALYSIS FOR POWER SCADA MARKET

TABLE 8 POWER SCADAS: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 CASE STUDY ANALYSIS

5.14.1 SIEMENS PROVIDED TIA SOLUTIONS DESIGNED BY TESCO TO MUNICIPAL WATER MANAGEMENT SYSTEM AFTER CITY OF HOBBS RAISED ISSUES RELATED TO MUNICIPAL WASTEWATER MANAGEMENT SYSTEM

5.14.2 SIEMENS INTEGRATOR HELPED SMALL TOWN MODERNIZE WATER SUPPLY WHILE CUTTING DOWN COSTS

6 POWER SCADA MARKET, BY ARCHITECTURE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 29 HARDWARE DOMINANT ARCHITECTURE TYPE IN MARKET, 2020 (%)

TABLE 9 MARKET SIZE, BY ARCHITECTURE, 2019–2026 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE COMPONENTS HELP PERFORM VARIETY OF FUNCTIONS, INCLUDING FIELD DATA COLLECTION

TABLE 10 HARDWARE IN MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 SOFTWARE

6.3.1 SOFTWARE APPLICATIONS ANALYZE DATA AND HELP IN IDENTIFYING PRECISE LOCATIONS FOR REPAIR

TABLE 11 SOFTWARE IN MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES COVER PROCEDURES—FROM DESIGNING TO INSTALLATION AND FROM TRAINING TO MAINTENANCE OF POWER SCADA SYSTEMS

TABLE 12 SERVICES IN MARKET, BY REGION, 2019–2026 (USD MILLION)

7 POWER SCADA MARKET, BY END-USER INDUSTRY (Page No. - 77)

7.1 INTRODUCTION

FIGURE 30 MARKET SHARE, BY END-USER INDUSTRY, 2020 (%)

TABLE 13 MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

7.2 OIL AND GAS

7.2.1 USE OF POWER SCADA SYSTEMS ESSENTIAL IN OIL AND GAS INDUSTRY TO OPTIMIZE PRODUCTION

TABLE 14 POWER SCADA MARKET SIZE FOR OIL AND GAS, BY REGION, 2019–2026 (USD MILLION)

7.3 WATER AND WASTEWATER

7.3.1 INCREASING NEED FOR LOSS MINIMIZATION DUE TO LEAKAGES SUPPORTING POWER SCADA GROWTH

TABLE 15 MARKET SIZE FOR WATER AND WASTEWATER, BY REGION, 2019–2026 (USD MILLION)

7.4 METAL AND MINING

7.4.1 INCREASING DEMAND FOR ENSURING OPERATIONAL SAFETY AND ACHIEVING CONSISTENT EFFICIENCY DRIVING MARKET

TABLE 16 MARKET SIZE FOR METAL AND MINING, BY REGION, 2019–2026 (USD MILLION)

7.5 CHEMICALS

7.5.1 INCREASING NEED FOR RELIABLE PLANT OPERATIONS DRIVING MARKET

TABLE 17 MARKET SIZE FOR CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

7.6 TRANSPORTATION

7.6.1 DEMAND FOR TRANSPARENCY OF LOCATION AND OPERATION DURING MOVEMENT OF GOODS TO PROPEL MARKET GROWTH

TABLE 18 POWER SCADA MARKET SIZE FOR TRANSPORTATION, BY REGION, 2019–2026 (USD MILLION)

7.7 OTHERS

TABLE 19 MARKET SIZE FOR OTHER END-USER INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

8 POWER SCADA MARKET, BY COMPONENT (Page No. - 86)

8.1 INTRODUCTION

FIGURE 31 MARKET SHARE, BY COMPONENT TYPE, 2020 (%)

TABLE 20 POWER SCADA MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

8.2 MASTER TERMINAL UNIT (MTU)

8.2.1 MASTER TERMINAL UNIT (MTU) MONIT0RS AND CONTROLS COMPLTE POWER SCADA SYSTEM

TABLE 21 MTU MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 REMOTE TERMINAL UNIT (RTU)

8.3.1 COLLECTION OF DATA FROM REMOTE LOCATIONS ESSENTIALLY DONE BY RTU

TABLE 22 RTU MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 HUMAN–MACHINE INTERFACE (HMI)

8.4.1 INTERFACE BETWEEN HARDWARE AND SOFTWARE ALLOWS EFFECTIVE WORKING OF SYSTEM

TABLE 23 HMI MARKET, BY REGION, 2019–2026 (USD MILLION)

8.5 PROGRAMMABLE LOGIC CONTROLLER (PLC)

8.5.1 LOGIC BASED DECISIONS ARE TAKEN BY PLC

TABLE 24 PLC MARKET, BY REGION, 2019–2026 (USD MILLION)

8.6 COMMUNICATION SYSTEM

8.6.1 COMMUNICATION NETWORK PROVIDES LINK FOR COMMUNICATION BETWEEN NODES IN SCADA NETWORK SYSTEM

TABLE 25 COMMUNICATION SYSTEM MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7 PROTECTION RELAYS (IEDS)

8.7.1 MICRIPROCESSOR-BASED CONTROLLERS ALSO ACTING AS TRIPPING CIRCUIT BREAKER HELPS TAKE PREVENTIVE ACTION AVOIDING ANY DAMAGE

TABLE 26 PROTECTION RELAYS (IEDS) MARKET, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHERS

TABLE 27 OTHER COMPONENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

9 GEOGRAPHICAL ANALYSIS (Page No. - 96)

9.1 INTRODUCTION

FIGURE 32 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 33 POWER SCADA MARKET SHARE, BY REGION, 2020 (%)

TABLE 28 GLOBAL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: SNAPSHOT, 2020

9.2.1 BY ARCHITECTURE

TABLE 29 MARKET IN ASIA PACIFIC, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.2 BY COMPONENT

TABLE 30 MARKET IN ASIA PACIFIC, BY COMPONENT, 2019–2026 (USD MILLION)

9.2.3 BY END-USER INDUSTRY

TABLE 31 MARKET IN ASIA PACIFIC, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 32 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4.1 China

9.2.4.1.1 Market in China to experience negative growth owing to COVID-19

9.2.4.1.2 By Architecture

TABLE 33 MARKET IN CHINA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.1.3 By End-User Industry

TABLE 34 MARKET IN CHINA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4.2 Japan

9.2.4.2.1 Power SCADA systems useful in flood warning and prevention

9.2.4.2.2 By Architecture

TABLE 35 MARKET IN JAPAN, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.2.3 By End-User Industry

TABLE 36 MARKET IN JAPAN, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4.3 India

9.2.4.3.1 Market in India to revolutionize water and wastewater industry

9.2.4.3.2 By Architecture

TABLE 37 MARKET IN INDIA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.3.3 By End-User Industry

TABLE 38 MARKET IN INDIA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4.4 South Korea

9.2.4.4.1 Manufacturing applications fostering market growth

9.2.4.4.2 By Architecture

TABLE 39 MARKET IN SOUTH KOREA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.4.3 By End-User Industry

TABLE 40 MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4.5 Australia

9.2.4.5.1 Integration of digital technologies into production processes leading to market growth

9.2.4.5.2 By Architecture

TABLE 41 MARKET IN AUSTRALIA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.5.3 By End-User Industry

TABLE 42 MARKET IN AUSTRALIA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.2.4.6 Rest of Asia Pacific

9.2.4.6.1 By Architecture

TABLE 43 MARKET IN REST OF ASIA PACIFIC, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.2.4.6.2 By End-User Industry

TABLE 44 MARKET IN REST OF ASIA PACIFIC, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT, 2020

9.3.1 BY ARCHITECTURE

TABLE 45 POWER SCADA MARKET IN NORTH AMERICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.3.2 BY COMPONENT

TABLE 46 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

9.3.3 BY END-USER INDUSTRY

TABLE 47 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 48 MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4.1 US

9.3.4.1.1 COVID-19 impacted market growth

9.3.4.1.2 By Architecture

TABLE 49 MARKET IN US, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.3.4.1.3 By End-User Industry

TABLE 50 MARKET IN US, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.3.4.2 Canada

9.3.4.2.1 Oil and gas industry contributes to market growth

9.3.4.2.2 By Architecture

TABLE 51 MARKET IN CANADA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.3.4.2.3 By End-User Industry

TABLE 52 MARKET IN CANADA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.3.4.3 Mexico

9.3.4.3.1 Mexican government adopting power SCADA systems to streamline power grids

9.3.4.3.2 By Architecture

TABLE 53 MARKET IN MEXICO, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.3.4.3.3 By End-User Industry

TABLE 54 MARKET IN MEXICO, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4 EUROPE

9.4.1 BY ARCHITECTURE

TABLE 55 POWER SCADA MARKET IN EUROPE, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.2 BY COMPONENT

TABLE 56 MARKET IN EUROPE, BY COMPONENT, 2019–2026 (USD MILLION)

9.4.3 BY END-USER INDUSTRY

TABLE 57 MARKET IN EUROPE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 58 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4.1 Germany

9.4.4.1.1 Efforts to digitize transportation industry to drive market

9.4.4.1.2 By Architecture

TABLE 59 MARKET IN GERMANY, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.4.1.3 By End-User Industry

TABLE 60 MARKET IN GERMANY, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4.2 France

9.4.4.2.1 Power SCADA systems used to enhance efficiency of transportation systems

9.4.4.2.2 By Architecture

TABLE 61 MARKET IN FRANCE, BY ARCHITECTURE,2019–2026 (USD MILLION)

9.4.4.2.3 By End-User Industry

TABLE 62 MARKET IN FRANCE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4.3 UK

9.4.4.3.1 UK government to invest more in oil and gas industry

9.4.4.3.2 By Architecture

TABLE 63 MARKET IN UK, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.4.3.3 By End-User Industry

TABLE 64 MARKET IN UK, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4.4 Russia

9.4.4.4.1 Russia to strengthen its oil field communications with help of power SCADA systems

9.4.4.4.2 By Architecture

TABLE 65 MARKET IN RUSSIA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.4.4.3 By End-User Industry

TABLE 66 MARKET IN RUSSIA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4.5 Italy

9.4.4.5.1 Italy to upgrade obsolete pharmaceutical plants by integrating them with power SCADA systems

9.4.4.5.2 By Architecture

TABLE 67 MARKET IN ITALY, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.4.5.3 By End-User Industry

TABLE 68 MARKET IN ITALY, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.4.4.6 Rest of Europe

9.4.4.6.1 By Architecture

TABLE 69 MARKET IN REST OF EUROPE, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.4.4.6.2 By End-User Industry

TABLE 70 MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 BY ARCHITECTURE

TABLE 71 POWER SCADA MARKET IN MIDDLE EAST AND AFRICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.5.2 BY COMPONENT

TABLE 72 MARKET IN MIDDLE EAST AND AFRICA, BY COMPONENT, 2019–2026 (USD MILLION)

9.5.3 BY END-USER INDUSTRY

TABLE 73 MARKET IN MIDDLE EAST AND AFRICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 74 MARKET IN MIDDLE EAST AND AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4.1 Saudi Arabia

9.5.4.1.1 Oil and gas—prominent industry in Saudi Arabia that contributes to market growth

9.5.4.1.2 By Architecture

TABLE 75 MARKET IN SAUDI ARABIA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.5.4.1.3 By End-User Industry

TABLE 76 MARKET IN SAUDI ARABIA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.5.4.2 UAE

9.5.4.2.1 UAE’s oil and gas sector has significant infrastructure

9.5.4.2.2 By Architecture

TABLE 77 MARKET IN UAE, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.5.4.2.3 By End-User Industry

TABLE 78 MARKET IN UAE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.5.4.3 South Africa

9.5.4.3.1 Lack of skilled labor led to implementation of power SCADA solutions in mining industry

9.5.4.3.2 By Architecture

TABLE 79 MARKET IN SOUTH AFRICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.5.4.3.3 By End-User Industry

TABLE 80 MARKET IN SOUTH AFRICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.5.4.4 Rest of Middle East and Africa

9.5.4.4.1 By Architecture

TABLE 81 MARKET IN REST OF MIDDLE EAST AND AFRICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.5.4.4.2 By End-User Industry

TABLE 82 MARKET IN REST OF MIDDLE EAST AND AFRICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY ARCHITECTURE

TABLE 83 POWER SCADA MARKET IN SOUTH AMERICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.6.2 BY COMPONENT

TABLE 84 MARKET IN SOUTH AMERICA, BY COMPONENT, 2019–2026 (USD MILLION)

9.6.3 BY END-USER INDUSTRY

TABLE 85 MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 86 MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4.1 Brazil

9.6.4.1.1 Oil and gas sector in Brazil facing downfall due to COVID-19

9.6.4.1.2 By Architecture

TABLE 87 MARKET IN BRAZIL, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.6.4.1.3 By End-User Industry

TABLE 88 MARKET IN BRAZIL, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.6.4.2 Argentina

9.6.4.2.1 Increasing investments in power SCADA systems in oil and gas industry

9.6.4.2.2 By Architecture

TABLE 89 MARKET IN ARGENTINA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.6.4.2.3 By End-User Industry

TABLE 90 MARKET IN ARGENTINA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

9.6.4.3 Rest of South America

9.6.4.3.1 By Architecture

TABLE 91 MARKET IN REST OF SOUTH AMERICA, BY ARCHITECTURE, 2019–2026 (USD MILLION)

9.6.4.3.2 By End-User Industry

TABLE 92 MARKET IN REST OF SOUTH AMERICA, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 141)

10.1 KEY PLAYER STRATEGIES

TABLE 93 OVERVIEW OF TOP PLAYERS, JANUARY 2017– MARCH 2021

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 94 MARKET: DEGREE OF COMPETITION

FIGURE 36 POWER SCADA MARKET SHARE ANALYSIS, 2020

10.3 MARKET EVALUATION FRAMEWORK

TABLE 95 MARKET EVALUATION FRAMEWORK

10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 37 TOP FIVE PLAYERS IN MARKET FROM 2015 TO 2019

10.5 COMPANY EVALUATION MATRIX

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2019

TABLE 96 COMPANY PRODUCT FOOTPRINT

TABLE 97 COMPANY ARCHITECTURE FOORPRINT

TABLE 98 COMPANY END-USER INDUSTRY FOOTPRINT

TABLE 99 COMPANY REGIONAL FOOTPRINT

10.6 COMPETITIVE SCENARIO

TABLE 100 POWER SCADA MARKET: PRODUCT LAUNCHES, JANUARY 2017–JANUARY 2021

TABLE 101 MARKET: DEALS, JANUARY 2017–MARCH 2021

TABLE 102 MARKET: OTHER DEVELOPMENTS, JANUARY 2017–MARCH 2021

11 COMPANY PROFILES (Page No. - 155)

11.1 MAJOR PLAYERS

(Business overview, Products/Solutions Offered, Recent Developments, MNM view)*

11.1.1 ABB

TABLE 103 ABB: COMPANY OVERVIEW

FIGURE 39 ABB: COMPANY SNAPSHOT

TABLE 104 ABB: PRODUCTS/SOLUTIONS OFFERED

TABLE 105 ABB: PRODUCT LAUNCHES, FEBRUARY 2021

TABLE 106 ABB: DEALS, FEBRUARY 2017–NOVEMBER 2020

11.1.2 SIEMENS

TABLE 107 SIEMENS: COMPANY OVERVIEW

FIGURE 40 SIEMENS: COMPANY SNAPSHOT

TABLE 108 SIEMENS: PRODUCTS/SOLUTIONS OFFERED

TABLE 109 SIEMENS: DEALS, MAY 2019–DECEMBER 2020

11.1.3 EMERSON

TABLE 110 EMERSON: COMPANY OVERVIEW

FIGURE 41 EMERSON: COMPANY SNAPSHOT

TABLE 111 EMERSON PRODUCT/SOLUTIONS OFFERED

TABLE 112 EMERSON: DEALS, MAY 2019

TABLE 113 EMERSON: OTHER DEVELOPMENTS, NOVEMBER 2017

11.1.4 SCHNEIDER ELECTRIC

TABLE 114 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 42 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 115 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 116 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES, JANUARY 2017

TABLE 117 SCHNEIDER ELECTRIC: DEALS, FEBRUARY 2017-JANUARY 2021

11.1.5 ROCKWELL AUTOMATION

TABLE 118 ROCKWELL AUTOMATION: COMPANY OVERVIEW

FIGURE 43 ROCKWELL: COMPANY SNAPSHOT

TABLE 119 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 120 ROCKWELL AUTOMATION: DEALS, NOVEMBER 2019–OCTOBER 2020

11.1.6 MITSUBISHI ELECTRIC

TABLE 121 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

FIGURE 44 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 122 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS OFFERED

TABLE 123 MITSUBISHI ELECTRIC: DEALS, MAY 2019

TABLE 124 MITSUBISHI ELETRIC: OTHER DEVELOPMENTS, MAY 2017–MARCH2021

11.1.7 HONEYWELL

TABLE 125 HONEYWELL: COMPANY OVERVIEW

FIGURE 45 HONEYWELL: COMPANY SNAPSHOT

TABLE 126 HONEYWELL: PRODUCTS/SOLUTIONS OFFERED

TABLE 127 HONEYWELL: PRODUCT LAUNCHES, JUNE 2017

TABLE 128 HONEYWELL: DEALS, JANUARY 2017–FEBRUARY 2021

11.1.8 YOKOGAWA ELECTRIC CORPORATION

TABLE 129 YOKOGAWA: COMPANY OVERVIEW

FIGURE 46 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 130 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS OFFERED

TABLE 131 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES, JANUARY 2017– MARCH 2021

TABLE 132 YOKOGAWA ELECTRIC CORPORATION: DEALS, JUNE 2017–JANUARY 2018

11.1.9 OPEN SYSTEM INTERNATIONAL

TABLE 133 OPEN SYSTEM INTERNATIONAL: COMPANY OVERVIEW

TABLE 134 OPEN SYSTEMS INTERNATIONAL: PRODUCTS/SOLUTIONS OFFERED

TABLE 135 OPEN SYSTEMS INTERNATIONAL: DEALS, MARCH 2017–SEPTEMBER 2020

11.1.10 INDRA SISTEMAS

TABLE 136 INDRA SISTEMAS: COMPANY OVERVIEW

TABLE 137 INDRA SISTEMAS: PRODUCTS/SOLUTIONS OFFERED

TABLE 138 INDRA SISTEMAS: PRODUCT LAUNCHES, FEBRUARY 2021

TABLE 139 INDRA SISTEMAS-DEALS, AUGUST 2019-FEBRUARY 2021

11.1.11 MOTOROLA SOLUTIONS

TABLE 140 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

FIGURE 47 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

TABLE 141 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTION OFFERED

TABLE 142 MOTOROLA SOLUTIONS: DEALS, OCTOBER 2018–MARCH 2020

11.1.12 BENTEK SYSTEMS

TABLE 143 BENTEK SYSTEMS: COMPANY OVERVIEW

TABLE 144 BENTEK SYSTEMS: PRODUCTS/SOLUTION OFFERED

11.1.13 EFACEC POWER SOLUTIONS

TABLE 145 EFACEC POWER SOLUTIONS: COMPANY OVERVIEW

TABLE 146 EFACEC POWER SOLUTIONS: PRODUCTS/SOLUTION OFFERED

TABLE 147 EFACEC POWER SOLUTIONS: DEALS, AUGUST 2019–JANUARY 2021

TABLE 148 EFACEC POWER SOLUTIONS: OTHER DEVELOPMENTS, JANUARY 2017

11.1.14 EATON

TABLE 149 EATON: COMPANY OVERVIEW

FIGURE 48 EATON: COMPANY SNAPSHOT

TABLE 150 EATON: PRODUCTS/SOLUTION OFFERED

11.1.15 GENERAL ELECTRIC

TABLE 151 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 49 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 152 GENERAL ELECTRIC: PRODUCTS/SOLUTION OFFERED

TABLE 153 GENERAL ELECTRIC: DEALS, JUNE 2019–JANUARY 2020

TABLE 154 GENRAL ELECTRIC: OTHER DEVELOPMENTS, DECEMBER 2018

11.1.16 PSI AG

TABLE 155 PSI AG: COMPANY OVERVIEW

FIGURE 50 PSI AG: COMPANY SNAPSHOT

TABLE 156 PSI AG: PRODUCTS/SOLUTION OFFERED

TABLE 157 PSI AG: DEALS, APRIL 2020

*Details on Business overview, Products/Solutions Offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 TOSHIBA

11.2.2 HITACHI

11.2.3 OUTLAW AUTOMATION

11.2.4 OMRON TECHNOLOGIES

11.2.5 ADVANTECH CO

11.2.6 INDUCTIVE AUTOMATION

11.2.7 SURVALENT TECHNOLOGY CORPORATION

11.2.8 NUGEN AUTOMATION

11.2.9 OVAK TECHNOLOGIES

12 APPENDIX (Page No. - 209)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved major activities in estimating the current size of the power SCADA market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power SCADA market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power SCADA market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its industrial end-user industries. Moreover, the demand is also driven by the rising demand of data monitoring and controlling of remote location. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the power SCADA market ecosystem.

Report Objectives

- To define, describe, and forecast the market by component, architecture, end-user industry, and region, in terms of value

- To estimate and forecast the global power SCADA market for various segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth.

- To provide a detailed overview of the power SCADA value chain, along with industry trends, technology trends, use cases, security standards, and Porter’s five forces.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies2

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power SCADA Market