Preparative and Process Chromatography Market by Type (Preparative (Chemicals and Reagents, Resin (Affinity, Ion Exchange), Column, Systems (Liquid Chromatography), Services), Process), End User (Research Laboratories) - Global Forecasts to 2026

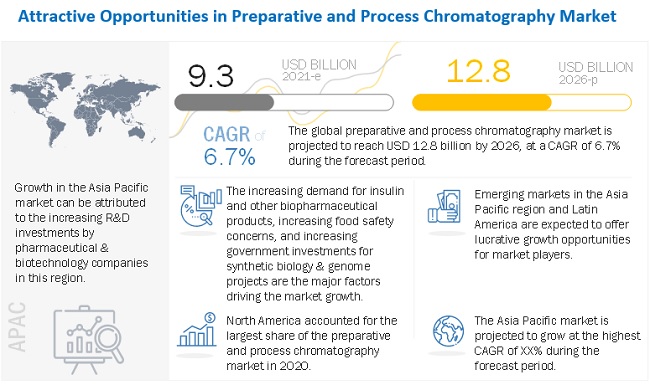

[330 Pages Report]The preparative and process chromatography market is projected to reach USD 12.8 billion by 2026 from USD 9.3 billion in 2021, at a CAGR of 6.7% from 2021 to 2026. Factors such as, increasing demand for insulin and other biopharmaceutical products, high demand for omega-3 fatty acids, increasing awareness about the advancements in preparative and process chromatography, increasing food safety concerns, and growing government investments for synthetic biology and genome projects to drive the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact on the Preparative and Process Chromatography Market

The COVID-19 pandemic has significantly affected the preparative and process chromatography market. With the increasing threat associated with COVID, researchers are highly dependent on analytical laboratory techniques such as chromatography to gain effective and efficient methods for characterizing the virus and analyze potential vaccines and anti-COVID-19 compounds.

Analytical instruments play a vital role in the laboratory work around the SARS-CoV-2 virus, including the three main areas of COVID-19 related research -- vaccine development, therapeutics development, and diagnostic testing. As of 8th March 2021, over 250 COVID-19 vaccine candidates are under development, and over 800 potential COVID-19 therapeutic compounds are under investigation. Chromatography is one of the essential technologies in this field, mainly in purifying biomolecules, including RNA. Analytical instruments play a central role in the laboratory work centering around the SARS-CoV-2 virus, including the three main areas of COVID-19-related research -- vaccine development, therapeutics development, and diagnostic testing.

As the battle against the deadly SARS-CoV-2 virus continues, researchers rely on analytical laboratory techniques like chromatography to provide effective and efficient methods for characterizing the virus and analyzing potential vaccines and anti-COVID-19 compounds.

Market Dynamics

DRIVERS: Increasing awareness about advancements in preparative and process chromatography

Market participants such as manufacturers of chromatography instruments, consumables, accessories, and service providers are increasing awareness about the advancements in preparative and process chromatography. In 2020, PREP 2020 — 33rd International Symposium on Preparative and Process Chromatography held in the United States on 31 May 2020. The PREP 2020 is the longest-running & recognized international scientific conference and exposition driving the field of Preparative and Process Chromatography, organized by expert scientists and engineers for the separation science practitioner. The symposium addressed the latest scientific and technological advances, critical and emerging applications and processes, and challenges and solutions in all aspects of Preparative and Process Chromatography, Ion Exchange, Adsorption/Desorption Processes, and Related Separation Techniques. The focus of this conference is the development, design, optimization, and operation of chromatographic processes and technology for a broad range of applications. (Source: PREP 2020 — 33rd International Symposium on Preparative and Process Chromatography, Royal Society of Chemistry 2021).

The 17th International Symposium on Preparative and Industrial Chromatography and Allied Techniques, SPICA 2018, was held on October 7 to 10, 2018, in Darmstadt, Germany. The symposium was dedicated to learning about the latest progress and state-of-the-art technology in Preparative and Industrial Chromatography. The conference is an exceptional multi-disciplinary forum for expert scientists working in fundamental research and practical applications of Preparative Separation Sciences in chemistry, pharmaceuticals, polymers, natural products, and biotechnology. (Source: 17th International Symposium on Preparative and Industrial Chromatography and Allied Techniques 2018)

These conferences and symposia help increase awareness about the upcoming and available technologically advanced products in preparative and process chromatography, which is expected to drive market growth.

RESTRAINTS: High cost of instruments

Preparative and process chromatography systems are priced at a premium because of the features and technologies involved. Small- & medium-sized companies in the oil & gas, food & beverage, biotech & pharmaceutical industries, and research and academic institutions require many such systems in their processes. Hence, the capital cost spent on these systems increases significantly. Moreover, academic research laboratories find it difficult to afford such systems, as they have controlled budgets. The maintenance costs and other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This restricts the adoption of chromatographic accessories & consumables among price-sensitive end users, such as research laboratories, academic institutes, and small companies.

Due to the high costs involved and the budget constraints of many academic institutions, preparative and process chromatography products are witnessing limited adoption. Moreover, pharmaceutical companies currently using preparative and process chromatography are reluctant to invest in new instruments. Due to this, limited buyers are looking for industrial separation. In this scenario, the high cost of instruments is expected to restrict the growth of the preparative and process chromatography market.

OPPORTUNITY: Increasing demand for monoclonal antibodies

Preparative and process chromatography plays a vital role in purifying monoclonal antibodies (mAbs). mAbs showcase enormous potential as biopharmaceuticals to treat a wide range of diseases. With such promising opportunities, major biopharmaceutical players such as Pfizer Inc. (US), Novartis International AG (Switzerland), Boehringer Ingelheim International GmbH (Germany), Amgen Inc. (US), and Samsung Bioepis (South Korea) have increased their focus on mAbs. The increasing number of mAbs approved by regulatory bodies is also a key factor supporting the growth of the mAbs market. As of December 2019, 79 therapeutic mAbs have been approved by the US FDA, but there is still significant growth potential. (Source: Development of therapeutic antibodies for treating diseases, Journal of Biomedical Science 2020). The increasing number of mAbs available in the market is expected to increase the demand for the preparative and process chromatography technique, thereby supporting the growth of the market.

CHALLENGES: Shortage of skilled professionals

The proper usage of chromatographic analytical technologies requires expertise with relevant experience and knowledge of the technique, mechanism, principle, resins, type of separation, and column packing. Lack of sound knowledge is likely to incur several direct and indirect expenses, besides increasing researchers' workload and time pressure. This also leads to inefficient practical experience and an insufficient understanding of data output. Currently, there is a significant dearth of skilled personnel for method development, validation, operation, and troubleshooting activities, which is expected to restrain the growth of the chromatography market in the coming years. Technological advancements in chromatography instruments have considerably increased their complexity, necessitating the presence of a trained workforce to make effective use of these systems. The efficient utilization of equipment requires expertise with relevant experience and knowledge of chromatography. As a result, the dearth of skilled professionals is likely to restrain the adoption of these instruments and consumables among end users, thus affecting market growth to a certain extent.

“Process Chromatography is expected to hold the largest share of the preparative and process chromatography market, by type in 2021.”

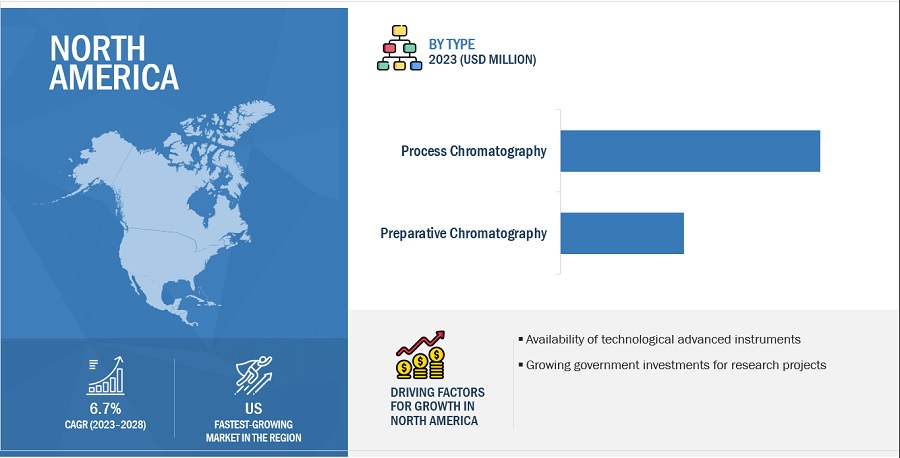

Based on type, the process and preparative chromatography market has been segmented into process chromatography and preparative chromatography. In 2020, the process chromatography segment accounted for the largest share of the market. This is mainly due to the increasing production of pharmaceutical products and rising investments in the pharma biotech industry. Moreover, with the outbreak of COVID-19, there has been a rise in demand for vaccines and drugs for treatment, hence driving the demand for process chromatography products.

“Biotechnology & pharmaceutical industries are expected to hold the largest share of the preparative and process chromatography market, by end user in 2021.”

Based on end user, the preparative and process chromatography market has been segmented into biotechnology & pharmaceutical industries; food and nutraceutical industries; and research laboratories. The biotechnology & pharmaceutical industries segment accounted for the largest market share in 2020. This can primarily be attributed to the increasing research activities by pharmaceutical & biotechnological companies and the rising demand for monoclonal antibodies and insulin by these industries.

To know about the assumptions considered for the study, download the pdf brochure

“North America commanded the largest share of the preparative and process chromatography market in 2021.”

Based on region, the preparative and process chromatography market is segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW). In 2020, North America commanded the largest share of the preparative and process chromatography market. The large share of North America can be attributed to the availability of government funding for life science R&D, high adoption of technologically advanced solutions, advances in the pharmaceutical and biotechnology industries, a large number of ongoing clinical research studies, and the presence of major players in the region.

Key Market Players

The major players operating in this market are Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Waters Corporation (France), Novasep Holding S.A.S. (France), Daicel Corporation (Japan), PerkinElmer, Inc. (US), Hitachi High-Tech Corporation (Japan), GL Sciences, Inc. (Japan), Sartorius AG (Germany), Repligen Corporation (US), Trajan Scientific and Medical (Australia), Hamilton Company (US), Valco Instruments Co. Inc. (US), KNAUER Wissenschaftliche Geräte GmbH (Germany), Gilson, Inc. (US), Restek Corporation (US), SCION Instruments (The Netherlands), Orochem Technologies Inc. (US), Sepragen Corporation (US), SRI Instruments (US), and JASCO (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, end user, and region |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and the RoE), APAC (Japan, China, India, and the RoAPAC), and Rest of the World (Middle East & Africa and Latin America) |

|

Companies Covered |

Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), Bio-Rad Laboratories, Inc. (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Waters Corporation (France), Novasep Holding S.A.S. (France), Daicel Corporation (Japan), PerkinElmer, Inc. (US), Hitachi High-Tech Corporation (Japan), GL Sciences, Inc. (Japan), Sartorius AG (Germany), Repligen Corporation (US), Trajan Scientific and Medical (Australia), Hamilton Company (US), Valco Instruments Co. Inc. (US), KNAUER Wissenschaftliche Geräte GmbH (Germany), Gilson, Inc. (US), Restek Corporation (US), SCION Instruments (The Netherlands), Orochem Technologies Inc. (US), Sepragen Corporation (US), and JASCO (US) |

This research report categorizes the preparative and process chromatography market into the following segments and subsegments:

Preparative and Process Chromatography Market by Type

Process Chromatography

-

Process Chromatography, By Product & Service

- Chemical and Reagents

-

Resins

- Affinity Resins

- Protein A Resins

- Hydrophobic Interaction Resins

- Ion Exchange Resins

- Mixed-Mode/Multimode Resins

-

Columns

- Prepacked Columns

- Empty Columns

- Systems

- Services

Preparative Chromatography

Preparative Chromatography, By Product & Service

- Chemical and Reagents

-

Resins

- Affinity Resins

- Protein A Resins

- Hydrophobic Interaction Resins

- Ion Exchange Resins

- Mixed-Mode/Multimode Resins

-

Columns

- Prepacked Columns

- Empty Columns

-

Systems

- Liquid Chromatography Systems

- Other Chromatography Systems

- Services

Preparative and process chromatography Market by End User

- Hospitals

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutions

Preparative and process chromatography Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East & Africa

- Latin America

Key developments:

- In 2021, Waters launched the Waters Arc Premier System, optimized for chromatographic separations on 2.5 – 3.5 micron columns

- In 2021, Daicel Chiral Technologies launched the CHIRALPAK IK

- In 2021, Novasep and Sartorius Stedim Biotech signed an agreement to sell the former company’s chromatography equipment division to Sartorius. This strategy will enable Novasep to accelerate the growth of its chromatography division by joining an established leader in the field.

- In 2020, Danaher acquired the Biopharma business from General Electric Company's Life Sciences division, which is now called Cytiva. Cytiva is a standalone operating company within Danaher’s life sciences segment.

- In 2020, Repligen and ARTeSYN entered into a definitive agreement to acquire the later company. The addition of ARTeSYN has strengthened Repligen’s systems offering in the market.

- In 2019, Trajan invested nearly USD 1.7 million (i.e., A$2.4M) into its Melbourne facility, with support from the Victorian Government over the next three years to meet growing global demand for its scientific products and technologies.

- In 2019, Sartorius acquired parts of Danaher’s Life Science Portfolio. The acquisition has helped strengthen the Bioprocess Solutions Division of Sartorius by adding Danaher’s chromatography hardware and resins and the microcarrier businesses.

- In 2018, Bio-Rad launched chromatography media and resin: CHT Ceramic Hydroxyapatite XT Media and Nuvia HP-Q Resin.

Frequently Asked Questions (FAQ):

Which region is anticipated to witness considerable growth in the preparative and process chromatography market?

The market for preparative and process chromatography in Asia Pacific region is anticipated to grow at a significant rate owing to the opportunities being offered by emerging nations such as India and China. Besides, increasing R&D investments by pharmaceutical & biotechnology companies in this region are the major factors supporting the growth of the preparative and process chromatography market.

Which type of chromatography is expected to hold the largest share in the preparative and process chromatography market?

Among the types of chromatography, the demand for process chromatography is expected to be considerably high, owing to factors such as increasing production of pharmaceutical products and rising investments in the pharma biotech industry. Moreover, with the outbreak of COVID-19, there has been a rise in demand for vaccines and drugs for treatment, hence driving the demand for process chromatography products.

Which are the driving factors of the preparative and process chromatography market?

Factors such as the increasing demand for insulin and other biopharmaceutical products, high demand for omega-3 fatty acids, increasing awareness about the advancements in preparative and process chromatography, increasing food safety concerns, and growing government investments for synthetic biology and genome projects to support growth of the market.

What are the challenges witnessed in the preparative and process chromatography market?

Shortage of skilled professionals handling preparative and process chromatography coupled with the technical limitations associated with the technique are the challenges witnessed in the market

Which is the most common end user of preparative and process chromatography?

The end users of preparative and process chromatography include, biotechnology & pharmaceutical industries, food and neutraceuticals industries and research laboratories. Among these, the demand for preparative and process chromatography is considered to be high in the biotechnology & pharmaceutical industries, owing to rising R&D expenditure, development of drugs and vaccines, and increasing research activities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SEGMENTATION

1.3.1 MARKETS COVERED

FIGURE 1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET – REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC INC.

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF PROCESS AND PREPARATIVE CHROMATOGRAPHY PRODUCTS

FIGURE 7 CAGR PROJECTIONS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT

2.9 COVID-19 HEALTH ASSESSMENT

2.10 COVID-19 ECONOMIC ASSESSMENT

2.11 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.12 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

3 EXECUTIVE SUMMARY (Page No. - 67)

FIGURE 12 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 13 PROCESS AND PREPARATIVE CHROMATOGRAPHY MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GEOGRAPHIC SNAPSHOT OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET OVERVIEW

FIGURE 15 RISING ADVANCEMENTS IN CHROMATOGRAPHY TECHNIQUES AND THE INCREASING DEMAND FOR INSULIN & OTHER BIOPHARMACEUTICAL PRODUCTS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE (2020)

FIGURE 16 THE PROCESS CHROMATOGRAPHY SEGMENT DOMINATED THE ASIA PACIFIC PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET IN 2020

4.3 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 INDIA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.4 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION (2019–2026)

FIGURE 18 NORTH AMERICA WILL CONTINUE TO DOMINATE THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET DURING THE FORECAST PERIOD

4.5 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 19 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 75)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3 DRIVERS

5.3.1 INCREASING DEMAND FOR INSULIN AND OTHER BIOPHARMACEUTICAL PRODUCTS

5.3.2 HIGH DEMAND FOR OMEGA-3 FATTY ACIDS

5.3.3 INCREASING AWARENESS ABOUT ADVANCEMENTS IN PREPARATIVE AND PROCESS CHROMATOGRAPHY

5.3.4 INCREASING FOOD SAFETY CONCERNS

TABLE 4 PERFORMANCE OF COUNTRIES BASED ON FOOD SECURITY SCORE, 2021

5.3.5 INCREASING GOVERNMENT INVESTMENTS FOR SYNTHETIC BIOLOGY AND GENOME PROJECTS

5.4 RESTRAINTS

5.4.1 HIGH COST OF INSTRUMENTS

5.4.2 AVAILABILITY OF ALTERNATIVE TECHNIQUES

5.4.3 AVAILABILITY OF REFURBISHED PRODUCTS

5.5 OPPORTUNITIES

5.5.1 INCREASING DEMAND FOR MONOCLONAL ANTIBODIES

5.5.2 EMERGING MARKETS TO OFFER HIGH-GROWTH OPPORTUNITIES

5.5.3 INCOMING ADVANCED TECHNOLOGIES FOR THE PURIFICATION OF BIOPHARMACEUTICAL & BIOMOLECULE SEPARATIONS AND CHROMATOGRAPHY INSTRUMENTS

5.6 CHALLENGES

5.6.1 SHORTAGE OF SKILLED PROFESSIONALS

5.6.2 TECHNICAL LIMITATIONS ASSOCIATED WITH CHROMATOGRAPHY

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 21 DIRECT DISTRIBUTION: THE PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.8 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.9 ECOSYSTEM ANALYSIS OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

FIGURE 23 ECOSYSTEM ANALYSIS OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

5.9.1 COMPANY ROLE IN ECOSYSTEM

FIGURE 24 KEY PLAYERS IN THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET ECOSYSTEM

5.10 PRICING ANALYSIS

TABLE 5 AVERAGE SELLING PRICES OF PREPARATIVE AND PROCESS CHROMATOGRAPHY PRODUCTS

5.11 GLOBAL REGULATORY GUIDELINES (AS OF 2019/2020)

5.12 TRADE ANALYSIS

5.12.1 IMPORT DATA FOR HS CODE 902720, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.12.2 EXPORT DATA FOR HS CODE 902720, BY COUNTRY, 2017–2019 (USD THOUSAND)

5.13 PATENT ANALYSIS

5.13.1 PATENT ANALYSIS: HYDROPHOBIC INTERACTION RESINS

5.14 TECHNOLOGY ANALYSIS

5.15 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 HIGH CONSOLIDATION IN THE MARKET TO RESTRICT THE ENTRY OF NEW PLAYERS

5.15.1 DEGREE OF COMPETITION

5.15.2 BARGAINING POWER OF SUPPLIERS

5.15.3 BARGAINING POWER OF BUYERS

5.15.4 THREAT OF SUBSTITUTES

5.15.5 THREAT OF NEW ENTRANTS

5.16 COVID-19 IMPACT ANALYSIS FOR THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

5.17 RANGES/ SCENARIOS

5.17.1 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FORECAST

FIGURE 25 REALISTIC SCENARIO OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

FIGURE 26 PESSIMISTIC SCENARIO OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

FIGURE 27 OPTIMISTIC SCENARIO OF THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

5.18.1 REVENUE SHIFT & REVENUE POCKETS FOR PREPARATIVE AND PROCESS CHROMATOGRAPHY MANUFACTURERS

5.18.2 REVENUE SHIFT FOR THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

6 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE (Page No. - 99)

6.1 INTRODUCTION

TABLE 7 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 8 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 PROCESS CHROMATOGRAPHY

6.2.1 PROCESS CHROMATOGRAPHY HELD THE LARGEST SHARE IN 2020

TABLE 9 PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 PROCESS CHROMATOGRAPHY, BY PRODUCT & SERVICE

TABLE 11 PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 12 PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

6.2.2.1 Chemicals and Reagents

TABLE 13 PROCESS CHROMATOGRAPHY FOR CHEMICALS AND REAGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 PROCESS CHROMATOGRAPHY FOR CHEMICALS AND REAGENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2 Resins

TABLE 15 PROCESS CHROMATOGRAPHY FOR RESINS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 16 PROCESS CHROMATOGRAPHY FOR RESINS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2.2.2.1 Affinity resins

TABLE 17 PROCESS CHROMATOGRAPHY FOR AFFINITY RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 PROCESS CHROMATOGRAPHY FOR AFFINITY RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2.2 Protein A resins

TABLE 19 PROCESS CHROMATOGRAPHY FOR PROTEIN A RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 PROCESS CHROMATOGRAPHY FOR PROTEIN A RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2.3 Hydrophobic interaction (HIC) resins

TABLE 21 PROCESS CHROMATOGRAPHY FOR HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 PROCESS CHROMATOGRAPHY FOR HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2.4 Ion exchange resins

TABLE 23 PROCESS CHROMATOGRAPHY FOR ION EXCHANGE RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 PROCESS CHROMATOGRAPHY FOR ION EXCHANGE RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2.5 Mixed-mode/Multimode Resins

TABLE 25 PROCESS CHROMATOGRAPHY FOR MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 PROCESS CHROMATOGRAPHY FOR MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.3 Columns

TABLE 27 PROCESS CHROMATOGRAPHY FOR COLUMNS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 28 PROCESS CHROMATOGRAPHY FOR COLUMNS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2.2.3.1 Prepacked columns

TABLE 29 PROCESS CHROMATOGRAPHY FOR PREPACKED COLUMNS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 PROCESS CHROMATOGRAPHY FOR PREPACKED COLUMNS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.3.2 Empty Columns

TABLE 31 EMPTY CHROMATOGRAPHY COLUMNS OFFERED BY PLAYERS IN THE MARKET

TABLE 32 PROCESS CHROMATOGRAPHY FOR EMPTY COLUMNS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 PROCESS CHROMATOGRAPHY FOR EMPTY COLUMNS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.4 Systems

TABLE 34 PROCESS CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 PROCESS CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.5 Services

TABLE 36 PROCESS CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 PROCESS CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 PREPARATIVE CHROMATOGRAPHY

6.3.1 PREPARATIVE CHROMATOGRAPHY IS BEING INCREASINGLY USED IN THE PHARMACEUTICAL INDUSTRY

TABLE 38 PREPARATIVE CHROMATOGRAPHY MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 PREPARATIVE CHROMATOGRAPHY MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 PREPARATIVE CHROMATOGRAPHY, BY PRODUCT & SERVICE

TABLE 40 PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 41 PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

6.3.2.1 Chemicals and Reagents

TABLE 42 PREPARATIVE CHROMATOGRAPHY FOR CHEMICAL AND REAGENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 PREPARATIVE CHROMATOGRAPHY FOR CHEMICAL AND REAGENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Resins

TABLE 44 PREPARATIVE CHROMATOGRAPHY FOR RESINS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 45 PREPARATIVE CHROMATOGRAPHY FOR RESINS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 46 PREPARATIVE CHROMATOGRAPHY FOR RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 PREPARATIVE CHROMATOGRAPHY FOR RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2.1 Affinity resins

TABLE 48 PREPARATIVE CHROMATOGRAPHY FOR AFFINITY RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 PREPARATIVE CHROMATOGRAPHY FOR AFFINITY RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2.2 Protein A resins

TABLE 50 PREPARATIVE CHROMATOGRAPHY FOR PROTEIN A RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 PREPARATIVE CHROMATOGRAPHY FOR PROTEIN A RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2.3 Hydrophobic interaction resins

TABLE 52 PREPARATIVE CHROMATOGRAPHY FOR HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 PREPARATIVE CHROMATOGRAPHY FOR HYDROPHOBIC INTERACTION RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2.4 Ion exchange resins

TABLE 54 PREPARATIVE CHROMATOGRAPHY FOR ION EXCHANGE RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 PREPARATIVE CHROMATOGRAPHY FOR ION EXCHANGE RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2.5 Mixed-mode/Multimode Resins

TABLE 56 PREPARATIVE CHROMATOGRAPHY FOR MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 PREPARATIVE CHROMATOGRAPHY FOR MIXED-MODE/MULTIMODE RESINS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3 Columns

TABLE 58 PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 59 PREPARATIVE CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.2.3.1 Prepacked Columns

TABLE 60 PREPARATIVE CHROMATOGRAPHY FOR PREPACKED COLUMNS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 PREPARATIVE CHROMATOGRAPHY FOR PREPACKED COLUMNS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3.2 Empty Columns

TABLE 62 PREPARATIVE CHROMATOGRAPHY FOR EMPTY COLUMNS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 PREPARATIVE CHROMATOGRAPHY FOR EMPTY COLUMNS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.4 Systems

TABLE 64 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 67 PREPARATIVE CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.3.2.4.1 Liquid chromatography systems

TABLE 68 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.4.2 Other chromatography systems

TABLE 70 OTHER CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 OTHER CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2.5 Services

TABLE 72 PREPARATIVE CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 PREPARATIVE CHROMATOGRAPHY SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

7 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER (Page No. - 134)

7.1 INTRODUCTION

TABLE 74 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 75 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

7.2 BIOTECHNOLOGY & PHARMACEUTICAL INDUSTRIES

7.2.1 GROWTH IN THE PHARMACEUTICAL INDUSTRY TO ACCELERATE THE GROWTH OF THIS MARKET

TABLE 76 R&D EXPENDITURE OF MAJOR PHARMACEUTICAL COMPANIES, 2019 VS. 2020

TABLE 77 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR BIOTECHNOLOGY & PHARMACEUTICAL INDUSTRIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 78 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR BIOTECHNOLOGY & PHARMACEUTICAL INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

7.3 FOOD AND NUTRACEUTICAL INDUSTRIES

7.3.1 CHROMATOGRAPHY PLAYS AN IMPORTANT ROLE IN FOOD ANALYSIS & SEPARATION

TABLE 79 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR FOOD AND NUTRACEUTICAL INDUSTRIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 80 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR FOOD AND NUTRACEUTICAL INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

7.4 RESEARCH LABORATORIES

7.4.1 RISING USE OF CHROMATOGRAPHY ACROSS A BROAD RANGE OF APPLICATIONS TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 81 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR RESEARCH LABORATORIES, BY REGION, 2016–2020 (USD MILLION)

TABLE 82 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021–2026 (USD MILLION)

8 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION (Page No. - 141)

8.1 INTRODUCTION

TABLE 83 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 84 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY REGION, 2021–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Increasing government investments and funding in biomedical research to support the market growth

TABLE 99 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 100 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 US: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 102 US: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 103 US: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 104 US: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 105 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 106 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 107 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 108 US: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 109 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 110 US: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rising use of chromatography techniques in food safety testing to drive the market growth in Canada

TABLE 111 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 112 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 114 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 115 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 116 CANADA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 117 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 118 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 119 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 120 CANADA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 121 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 122 CANADA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3 EUROPE

TABLE 123 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 124 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 126 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 128 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 129 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 130 EUROPE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 132 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 133 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 134 EUROPE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 136 EUROPE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Growing biotechnology sector and a large number of ongoing drug research projects to drive the market growth in Germany

TABLE 137 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 138 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 139 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 140 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 141 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 142 GERMANY: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 143 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 144 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 145 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 146 GERMANY: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 147 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 148 GERMANY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Increasing investments in infrastructure development to drive the market growth

TABLE 149 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 150 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 151 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 152 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 153 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 154 FRANCE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 155 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 156 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 157 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 158 FRANCE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 159 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 160 FRANCE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 Rising number of academia-industry partnerships and research activities to drive the growth of the UK market

TABLE 161 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 162 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 163 UK: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 164 UK: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 165 UK: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 166 UK: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 167 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 168 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 169 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 170 UK: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 171 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 172 UK: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 The growing number of biotechnology firms in Italy to support the market growth

TABLE 173 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 174 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 175 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 176 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 177 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 178 ITALY: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 179 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 180 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 181 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 182 ITALY: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 183 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 184 ITALY: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Availability of research funds and grants in Spain to boost the market growth in Spain

TABLE 185 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 186 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 188 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 189 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 190 SPAIN: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 191 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 192 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 193 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 194 SPAIN: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 195 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 196 SPAIN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 197 ROE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 198 ROE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 199 ROE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 200 ROE: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 201 ROE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 202 ROE: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 203 ROE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 204 ROE: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 205 ROE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 206 ROE: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 207 ROE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 208 ROE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SNAPSHOT

TABLE 209 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 210 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 211 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 212 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 213 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 214 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 215 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 216 ASIA PACIFIC: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 217 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 218 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 219 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 220 ASIA PACIFIC: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 221 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 222 ASIA PACIFIC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Increasing investments in R&D for mAbs to drive the market growth in China

TABLE 223 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 224 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 225 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 226 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 227 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 228 CHINA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 229 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 230 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 231 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 232 CHINA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 233 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 234 CHINA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.4.2 INDIA

8.4.2.1 Introduction of food safety standards in India to drive the market growth for chromatography techniques

TABLE 235 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 236 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 237 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 238 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 239 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 240 INDIA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 241 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 242 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 243 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 244 INDIA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 245 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 246 INDIA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.4.3 JAPAN

8.4.3.1 Japan is the largest market for preparative and process chromatography in the APAC region

TABLE 247 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 248 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 249 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 250 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 251 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 252 JAPAN: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 253 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 254 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 255 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 256 JAPAN: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 257 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 258 JAPAN: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 259 ROAPAC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 260 ROAPAC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 261 ROAPAC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 262 ROAPAC: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 263 ROAPAC: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 264 ROAPAC: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 265 ROAPAC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 266 ROAPAC: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 267 ROAPAC: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 268 ROAPAC: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 269 ROAPAC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 270 ROAPAC: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.5 REST OF THE WORLD (ROW)

TABLE 271 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY SUB-REGION, 2016–2020 (USD MILLION)

TABLE 272 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY SUB-REGION, 2021–2026 (USD MILLION)

TABLE 273 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 274 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 275 ROW: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 276 ROW: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 277 ROW: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 278 ROW: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 279 ROW: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 280 ROW: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 281 ROW: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 282 ROW: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 283 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 284 ROW: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.5.1 MIDDLE EAST & AFRICA (MEA)

8.5.1.1 Ongoing economic growth in the MEA and the high prevalence of chronic conditions to aid the market growth in this region

TABLE 285 MEA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 286 MEA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 287 MEA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 288 MEA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 289 MEA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 290 MEA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 291 MEA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 292 MEA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 293 MEA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 294 MEA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 295 MEA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 296 MEA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

8.5.2 LATIN AMERICA

8.5.2.1 Growing biopharma industry in Latin America to drive the market growth

TABLE 297 LA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 298 LA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 299 LA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 300 LA: PROCESS CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 301 LA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 302 LA: PROCESS CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 303 LA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2016–2020 (USD MILLION)

TABLE 304 LA: PREPARATIVE CHROMATOGRAPHY MARKET, BY PRODUCT & SERVICE, 2021–2026 (USD MILLION)

TABLE 305 LA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2016–2020 (USD MILLION)

TABLE 306 LA: PREPARATIVE CHROMATOGRAPHY MARKET, BY COLUMN, 2021–2026 (USD MILLION)

TABLE 307 LA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2016–2020 (USD MILLION)

TABLE 308 LA: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET, BY END USER, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 232)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PREPARATIVE AND PROCESS PRODUCT MANUFACTURERS

9.3 REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS IN THE PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

9.4 MARKET SHARE ANALYSIS

FIGURE 31 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET SHARE ANALYSIS, 2020

TABLE 309 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: DEGREE OF COMPETITION

9.5 COMPANY EVALUATION QUADRANT (MAJOR PLAYERS)

9.5.1 STARS

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE PLAYERS

9.5.4 PARTICIPANTS

FIGURE 32 VENDOR DIVE: PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET

9.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS AND SMES)

9.6.1 PROGRESSIVE COMPANIES

9.6.2 STARTING BLOCKS

9.6.3 RESPONSIVE COMPANIES

9.6.4 DYNAMIC COMPANIES

FIGURE 33 PREPARATIVE AND PROCESS CHROMATOGRAPHY MARKET: VENDOR DIVE MATRIX FOR SMES AND START-UPS, 2020

9.7 COMPANY FOOTPRINT

TABLE 310 COMPANY FOOTPRINT

TABLE 311 COMPANY PRODUCT & SERVICES FOOTPRINT

TABLE 312 COMPANY GEOGRAPHICAL FOOTPRINT

9.8 COMPETITIVE SCENARIO AND TRENDS

9.8.1 PRODUCT LAUNCHES

TABLE 313 PRODUCT LAUNCHES, JANUARY 2018-DECEMBER 2021

9.8.2 DEALS

TABLE 314 DEALS, JANUARY 2018-DECEMBER 2021

9.8.3 EXPANSIONS

TABLE 315 EXPANSIONS, JANUARY 2018-DECEMBER 2021

9.8.4 OTHER DEVELOPMENTS

9.8.5 OTHER DEVELOPMENTS, JANUARY 2018-DECEMBER 2021

10 COMPANY PROFILES (Page No. - 248)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 316 THERMO FISHER SCIENTIFIC INC: BUSINESS OVERVIEW

FIGURE 34 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2020)

10.1.2 DANAHER

TABLE 317 DANAHER: BUSINESS OVERVIEW

FIGURE 35 DANAHER: COMPANY SNAPSHOT (2020)

10.1.3 MERCK KGAA

TABLE 318 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 36 MERCK KGAA: COMPANY SNAPSHOT (2020)

10.1.4 BIO-RAD LABORATORIES, INC.

TABLE 319 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 37 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2020)

10.1.5 SARTORIUS AG

TABLE 320 SARTORIUS AG: BUSINESS OVERVIEW

FIGURE 38 SARTORIUS AG: COMPANY SNAPSHOT (2020)

10.1.6 AGILENT TECHNOLOGIES

TABLE 321 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 39 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2021)

10.1.7 SHIMADZU CORPORATION

TABLE 322 SHIMADZU CORPORATION: BUSINESS OVERVIEW

FIGURE 40 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2020)

10.1.8 WATERS CORPORATION

TABLE 323 WATERS CORPORATION: BUSINESS OVERVIEW

FIGURE 41 WATERS CORPORATION: COMPANY SNAPSHOT (2020)

10.1.9 NOVASEP HOLDING S.A.S

TABLE 324 NOVASEP HOLDING S.A.S.: BUSINESS OVERVIEW

FIGURE 42 NOVASEP HOLDING S.A.S: COMPANY SNAPSHOT (2020)

10.1.10 DAICEL CORPORATION

TABLE 325 DAICEL CORPORATION: BUSINESS OVERVIEW

FIGURE 43 DAICEL CORPORATION: COMPANY SNAPSHOT (2020)

10.1.11 PERKINELMER, INC.

TABLE 326 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 44 PERKINELMER, INC.: COMPANY SNAPSHOT (2020)

10.1.12 HITACHI HIGH-TECH CORPORATION

TABLE 327 HITACHI HIGH-LTD: BUSINESS OVERVIEW

FIGURE 45 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT (2020)

10.1.13 GL SCIENCES INC.

TABLE 328 GL SCIENCES, INC.: BUSINESS OVERVIEW

FIGURE 46 GL SCIENCES, INC.: COMPANY SNAPSHOT (2020)

10.1.14 REPLIGEN CORPORATION

TABLE 329 REPLIGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 47 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2020)

10.1.15 TRAJAN SCIENTIFIC AND MEDICAL

TABLE 330 TRAJAN SCIENTIFIC AND MEDICAL: BUSINESS OVERVIEW

FIGURE 48 TRAJAN SCIENTIFIC AND MEDICAL: COMPANY SNAPSHOT (2020)

10.2 OTHER PLAYERS

10.2.1 HAMILTON COMPANY

TABLE 331 HAMILTON COMPANY: BUSINESS OVERVIEW

10.2.2 VALCO INSTRUMENTS CO. INC.

TABLE 332 VALCO INSTRUMENTS CO. INC.: BUSINESS OVERVIEW

10.2.3 KNAUER WISSENSCHAFTLICHE GERÄTE GMBH

TABLE 333 KNAUER WISSENSCHAFTLICHE GERÄTE GMBH: BUSINESS OVERVIEW

10.2.4 JASCO

TABLE 334 JASCO: BUSINESS OVERVIEW

10.2.5 GILSON, INC.

TABLE 335 GILSON, INC.: BUSINESS OVERVIEW

10.2.6 RESTEK CORPORATION

TABLE 336 RESTEK CORPORATION: BUSINESS OVERVIEW

10.2.7 SCION INSTRUMENTS

TABLE 337 SCION INSTRUMENTS: BUSINESS OVERVIEW

10.2.8 OROCHEM TECHNOLOGIES INC.

TABLE 338 OROCHEM TECHNOLOGIES INC.: BUSINESS OVERVIEW

10.2.9 SRI INSTRUMENTS

TABLE 339 SRI INSTRUMENTS: BUSINESS OVERVIEW

10.2.10 SEPRAGEN CORPORATION

TABLE 340 SEPRAGEN CORPORATION BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 319)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the preparative and process chromatography market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

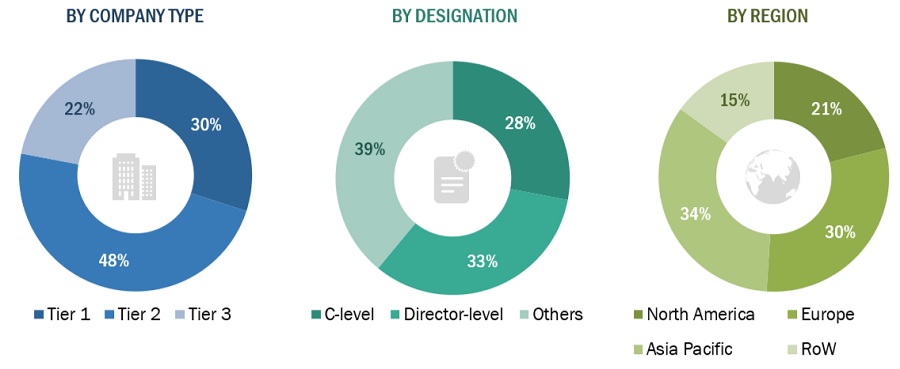

Several stakeholders such as preparative and process chromatography products manufacturers, vendors, distributors, and technologists from hospitals and clinics were consulted for this report. The demand side of this market is characterized by the increasing demand for insulin and other biopharmaceutical products, high demand for omega-3 fatty acids, increasing awareness about the advancements in preparative and process chromatography, increasing food safety concerns, and growing government investments for synthetic biology and genome projects. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the preparative and process chromatography market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the preparative and process chromatography industry.

Report Objectives

- To define, describe, and forecast the preparative and process chromatography market based on type, end user, and region.

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges, and COVID-19 impact analysis)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall preparative and process chromatography market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches, deals and expansions in the preparative and process chromatography market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Geographic Analysis: Further breakdown of the preparative and process chromatography market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, Middle East & Africa, and Latin America.

-

Company Information: Detailed analysis and profiling of additional market players (up to three) inclusive of:

- Business Overview

- Financial Information

- Product Portfolio

- Developments (last three years)

Impact of Purification Chromatography Market on Preparative and Process Chromatography Market

Purification chromatography is a technique used to separate and purify biomolecules, such as proteins and nucleic acids, from complex biological mixtures. It has become an essential tool in the fields of biotechnology, pharmaceuticals, and life sciences.

The impact of the purification chromatography market on preparative and process chromatography markets is significant. Preparative chromatography involves the separation and purification of larger quantities of biomolecules for use in downstream applications, such as drug development and industrial processes. Process chromatography is used for large-scale purification of biomolecules in industrial settings, such as in the production of biologics.

As the demand for biologics and other biomolecules continues to grow, so does the demand for purification chromatography products and services. This growth is driving the development of new technologies and products for purification chromatography, which in turn is leading to increased efficiency, productivity, and cost-effectiveness in preparative and process chromatography markets.

The expansion of the purification chromatography market has also led to increased competition among manufacturers, which is driving innovation and pushing prices down. This is making preparative and process chromatography more accessible to a wider range of users, including smaller companies and academic researchers.

Top Players in the Purification Chromatography Market

Top players in the Purification Chromatography Market, based on market share and revenue, are:

- GE Healthcare : Biopharma (a subsidiary of Danaher Corporation)

- Merck KGaA

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Sartorius AG

These companies offer a wide range of products and services for purification chromatography, including columns, resins, media, instruments, and software. They are also involved in research and development to develop new and innovative solutions for biomolecule purification.

Growth Drivers for Purification Chromatography Market from Macro to Micro

- Increasing Demand for Biologics: The demand for biologics, including antibodies, vaccines, and other recombinant proteins, is growing rapidly. These products require high-purity biomolecules, which can be obtained through purification chromatography.

- Advancements in Chromatography Techniques: There have been significant advancements in chromatography techniques, including the development of new resins and media, high-throughput screening methods, and automation, which are driving the growth of the purification chromatography market.

- Growing Pharmaceutical Industry: The pharmaceutical industry is one of the major end-users of purification chromatography products. As the industry continues to grow, the demand for purification chromatography products is also increasing.

- Increasing Research Activities: Research activities in the life sciences and biotechnology sectors are growing, which is driving the demand for purification chromatography products for the separation and purification of biomolecules.

- Increasing Government Funding for Life Sciences Research: Governments around the world are increasing their funding for life sciences research, which is driving the growth of the purification chromatography market.

- Growing Biotech Industry: The biotech industry is one of the major end-users of purification chromatography products. As the industry continues to grow, the demand for purification chromatography products is also increasing.

- Increasing Use of Monoclonal Antibodies: Monoclonal antibodies are increasingly being used in the treatment of various diseases, which is driving the demand for purification chromatography products.

- Expansion in Emerging Markets: Emerging markets, such as China and India, are experiencing rapid growth in the biotech and pharmaceutical industries, which is driving the demand for purification chromatography products in these regions.

- Focus on Product Development: Companies are focusing on developing new and innovative products to meet the increasing demand for purification chromatography products, which is driving the growth of the market.

- Increasing Adoption of Single-Use Technologies: Single-use technologies are increasingly being adopted in the biopharmaceutical industry, which is driving the growth of the purification chromatography market for single-use products.

Market Outlook for the Top Companies in Purification Chromatography Market

- GE Healthcare : Biopharma (a subsidiary of Danaher Corporation): GE Healthcare is one of the leading players in the purification chromatography market, with a wide range of products and services for biomolecule purification. The company's focus on research and development and its strong presence in emerging markets are expected to drive its growth in the coming years.

- Merck KGaA: Merck KGaA is a leading provider of purification chromatography products and services, including resins, media, and instruments. The company's strong focus on innovation and its investments in emerging markets are expected to drive its growth in the coming years.

- Thermo Fisher Scientific: Thermo Fisher Scientific is a leading provider of analytical instruments, including chromatography instruments and systems, for the biotech and pharmaceutical industries. The company's strong focus on research and development and its partnerships with leading companies are expected to drive its growth in the coming years.

- Bio-Rad Laboratories: Bio-Rad Laboratories is a leading provider of chromatography resins and systems for protein purification. The company's focus on innovation and its strong presence in emerging markets are expected to drive its growth in the coming years.

- Agilent Technologies: Agilent Technologies is a leading provider of chromatography instruments and systems for the biotech and pharmaceutical industries. The company's focus on research and development and its partnerships with leading companies are expected to drive its growth in the coming years.

- Waters Corporation: Waters Corporation is a leading provider of chromatography instruments and systems for the biotech and pharmaceutical industries. The company's focus on research and development and its strong presence in emerging markets are expected to drive its growth in the coming years.

- Shimadzu Corporation: Shimadzu Corporation is a leading provider of chromatography instruments and systems for the biotech and pharmaceutical industries. The company's focus on innovation and its investments in emerging markets are expected to drive its growth in the coming years.

- Sartorius AG: Sartorius AG is a leading provider of chromatography systems and consumables for protein purification. The company's focus on innovation and its strong presence in emerging markets are expected to drive its growth in the coming years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Preparative and Process Chromatography Market