Push to Talk Market by Component (Hardware, Solutions, and Services), Network type (LMR and Cellular), Organization Size (SMEs and Large Enterprises), Vertical (Public Safety, Government and Defense, Commercial) and Region - Global Forecast to 2026

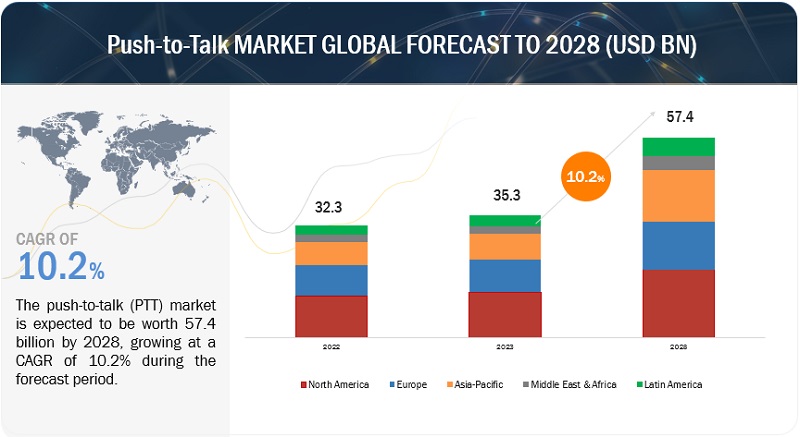

[253 Pages Report] The push-to-talk market is expected to increase from USD 29.2 billion in 2021 to USD 45.2 billion by 2026 by projected CAGR of 9.1% over the forecast period. The rising adoption of cloud-based PoC solutions is helping to solve the gaps in communications by providing real-time & secured communication, increasing penetration of wireless PTT devices and multimedia sharing features driving the Push-to-Talk (PTT) market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing need for driver safety

The U.S. Department of Transportation has laid rules and regulations to end distracted driving and keep drivers safe from road accidents. According to new rules laid down by the Federal Motor Carrier Safety Administration (FMCSA) and the Pipeline and Hazardous Materials Safety Administration (PHMSA), interstate truck and bus drivers and drivers transporting enormous quantities of hazardous materials are prohibited from texting or using hand-held mobile phones while operating their vehicles. Any violation would result in a penalty or possible driver disqualification. In this case, the PTT is a crucial enabler of safe communication for the driver(s). Commercial drivers can use PTT mobile communication equipment while driving as the user need not reach for, dial, or hold the actual mobile phone in their hand. The driver can touch the button needed to operate the PTT feature from the normal seated driving position.

Restraint: Irregularity and delay in the standardization of spectrum allocation

The irregularity in spectrum allocation and the delay in agreement on spectrum use are the factors hampering the clarity of the exact security requirement, thereby increasing the network's vulnerability. Standardizing spectrum allocation across regions and countries is important for developing 5G infrastructure. It impacts the economies of scale and clarifies equipment vendors for developing suitable products.

Opportunity: Standardization of infrastructure platforms

Standardization institutions and alliances, such as the 3GPP and Next Generation Mobile Networks (NGMN), unveil market players' wide range of opportunities. Their vision is to simultaneously incorporate a simplified architectural structure for future technologies (such as 3G, 4G, and 5G LTE) and have an architectural convergence. There is excellent scope for constant evolution in technologies and technological advances, which need to be brought down to a common platform, thereby eradicating the need for the re-deployment of infrastructure and other network-related equipment and reducing long-term costs. This gives a lucrative opportunity for the PTT market to grow in the coming years with the adoption of standardized platforms worldwide. The standardization process will resolve existing interoperability issues and, more specifically, enable end users to adopt device and network-agnostic PTT solutions per their requirements.

Challenge: High existing investments by the public sector to deploy LMR systems

High upfront costs related to the core and radio networks pose a challenge for overlaying critical communication on the existing public network. A new LMR and antenna package cost is relatively high and can be as high as USD 5,000. The development of LMR over these other technologies requires extensive testing, which increases the overall development cost of the product. The high existing investments, especially by the public safety vertical, hinder the complete replacement of LMR systems with PoC. Hence, public safety organizations use PoC alongside LMR systems to expand the LMR coverage area without requiring additional infrastructure or devices investments.

The Top solution segment is expected to account for a higher CAGR during the forecast period

An adequately designed Over the Top (OTT) system can communicate over traditional wireless carrier networks, Wi-Fi networks, standard wired networks (for P.C. clients), and private LTE networks, including FirstNet and Deployable systems. OTT PTT solutions are entirely independent of the carrier's wireless networks and can be used on various wireless networks where the carrier acts as the data provider.

North America to account for the largest market share during the forecast period

North America is estimated to hold the highest market share of the PTT market. It leads the global market using Push-to-Talk based hardware, solutions, and services. The U.S. and Canada, being well-established economies, empower them to invest highly in R&D activities, thereby contributing to developing new technologies. The rising adoption of push-to-talk solutions among various end-use industries such as public safety organizations, government and defense, healthcare, and others makes the U.S. the largest market share holder in North America. Thus, the key players in the market are focused on product expansion to meet the rising demand for efficient and cost-effective push-to-talk solutions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Push-to-Talk market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Push-to-Talk market include AT&T (U.S.), Verizon Wireless (U.S.), Motorola Solutions, Inc. (U.S.),(T-Mobile (U.S.), Qualcomm Incorporated (U.S.), Bell Canada (Canada), Iridium Satellite LLC (U.S.), Tait Communications (New Zealand), Zebra Technologies Corporation (U.S.), Telstra Corporation Limited (Australia), Hytera Communications Corporation Limited (China), Simoco Wireless Solutions Limited (England), GroupTalk (Sweden), Orion Labs, Inc. (U.S.), Zello Inc (U.S.), Yiip, Inc. VoiceLayer (U.S.), VoxerNet LLC (U.S.), International Push to Talk Ltd (iPTT) (England), Enterprise Secure Chat (ESChat) (U.S.), AINA Wireless (U.S.), S.L. (Azetti Networks) (Spain), ServiceMax, Inc. (U.S.), PeakPTT (U.S.), RugGear (China), and TeamConnect (U.S.). The study includes an in-depth competitive analysis of these key players in the Push-to-Talk market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market value in 2021 |

USD 29.2 Billion |

|

Market value in 2026 |

USD 45.2 Billion |

|

Market growth rate |

9.1% CAGR |

|

Largest Market |

North America |

|

Push to Talk Market Drivers |

|

|

Push to Talk Market Opportunities |

|

|

Market size available for years |

2017-2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

Segments covered |

By component, vertical, organization size, network type, and region |

|

Regions covered |

North America, Europe, APAC, Latin America, MEA, |

|

Companies covered |

AT&T Inc. (US), Verizon Wireless (US), Motorola Solutions, Inc. (US), T-Mobile (US), Qualcomm Incorporated (US), Bell Canada (Canada), Iridium Satellite LLC (US), Tait Communications (New Zealand), Zebra Technologies Corporation (US), Telstra Corporation Limited (Australia), Hytera Communications Corporation Limited (China), Simoco Wireless Solutions Limited (England), GroupTalk (Sweden), Orion Labs, Inc. (US), Zello Inc (US), Yiip, Inc. VoiceLayer (US), VoxerNet LLC (US), International Push to Talk Ltd (iPTT) (England), Enterprise Secure Chat (ESChat) (US), AINA Wireless (US), S.L. (Azetti Networks) (Spain), ServiceMax, Inc. (US), PeakPTT (US), RugGear (China), and TeamConnect (US). |

This research report categorizes the Push to Talk market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Hardware

-

Solutions

- Carrier integrated PTT solutions

- Over the top PTT solution

- Mission-critical PTT solution

-

Services

- Consulting

- Implementation

- Support and maintenance

By vertical:

- Public safety

- Government and defense

-

Commercial

- Transportation and logistics

- Travel and Hospitality

- Energy and utilities

- Construction

- Manufacturing

- Others (retail, mining, education, and healthcare)

By Organization Size:

- Large enterprises

- SMEs

By Network Type:

- LMR

- Cellular

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Singapore

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- Kingdom of Saudi Arabia

- Israel

- Rest of MEA

Recent Developments:

- In July 2021, Motorola and AT&T collaborated on a second MCPTT offering for FirstNet.

- In February 2021, Bharti Airtel partnered with Qualcomm Technologies to roll out 5G services in India. The new partnership will see Airtel use Qualcomm's Radio Access Network (RAN) platform. Airtel will utilize the Qualcomm 5G RAN Platforms to roll out virtualized and Open RAN-based 5G networks.

- In December 2020, FirstNet-AT&T landed a communications contract with the Federal Bureau of Investigations that expands the bureau's use of FirstNet to cover day-to-day communications and emergency operations.

- In April 2020, T-Mobile U.S. and Sprint Corporation completed their merger, with T-Mobile now being the sole owner of Sprint, making Sprint an effective subsidiary of T-Mobile until the Sprint brand was officially phased out on August 2, 2020.

Frequently Asked Questions (FAQ):

What is Push-to-Talk?

The Institute of Electrical and Electronics Engineers (IEEE) defines PTT as a half-duplex communication system that performs one-to-one or one-to-many group calls. PTT allows group members to speak by pressing a button on the User Equipment (U.E.) and other members to listen; upon releasing the controller, the call is disconnected.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany in the European region.

Which are the key drivers supporting the growth of the Push-to-Talk market?

Factors such as increasing growing demand for PoC, proliferation of rugged and ultra-rugged smartphones, growing need for driver safety, and transition of LMR systems from analog to digital are expected to drive the adoption of Push-to-Talk hardware, solutions, and services.

Who are the key vendors in the Push-to-Talk market?

The key vendors operating in the Push-to-Talk market include. AT&T Inc. (AT&T), Verizon Wireless, Motorola Solutions, Inc. (Motorola Solutions),(T-Mobile), Bell Canada, Qualcomm Incorporated (Qualcomm), Iridium Satellite LLC (Iridium), Tait International Limited (Tait Communications), Zebra Technologies Corporation (Zebra), Telstra Corporation Limited (Telstra), Hytera Communications Corporation Limited (Hytera), Simoco Wireless Solutions Limited (Simoco Wireless Solutions), GroupTalk, Orion Labs, Inc. (Orion), Zello Inc (Zello), Yiip, Inc. (VoiceLayer), VoxerNet LLC (Voxer), International Push to Talk Ltd (iPTT), Enterprise Secure Chat (ESChat), AINA Wireless (AINA Wireless), S.L. (Azetti Networks), ServiceMax, Inc. (ServiceMax Zinc), PeakPTT, RugGear, and TeamConnect. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGION

1.6.3 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 6 PUSH TO TALK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL THE OFFERINGS IN MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): PTT MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 10 PUSH TO TALK MARKET TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 11 SUBSEGMENTS WITH THE LARGEST MARKET SIZE IN THE GLOBAL PUSH-TO-TALK MARKET IN 2021

FIGURE 12 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL PUSH TOTALK MARKET

FIGURE 13 PROLIFERATION OF PUSH-TO-TALK OVER CELLULAR NETWORKS TO DRIVE THE GLOBAL MARKET

4.2 MARKET, BY COMPONENT, 2021

FIGURE 14 HARDWARE SEGMENT TO HOLD A HIGHER MARKET SHARE IN THE MARKET IN 2021

4.3 MARKET, BY SERVICE, 2021

FIGURE 15 SUPPORT AND MAINTENANCE SEGMENT TO LEAD THE PUSH-TO-TALK SERVICES MARKET IN 2021

4.4 MARKET, BY ORGANIZATION SIZE, 2021–2026

FIGURE 16 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

4.5 MARKET, BY NETWORK TYPE, 2021

FIGURE 17 LAND MOBILE RADIO SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2021

4.6 MARKET, BY VERTICAL, 2021 VS. 2026

FIGURE 18 PUBLIC SAFETY SEGMENT TO LEAD THE MARKET IN 2021

4.7 MARKET, BY COMMERCIAL VERTICAL, 2019–2026

FIGURE 19 TRANSPORTATION AND LOGISTICS SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.8 MARKET: MARKET INVESTMENT SCENARIO (2021–2026)

FIGURE 20 ASIA PACIFIC CONSIDERED AS THE BEST MARKET TO INVEST DURING 2021–2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 67)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PUSH TO TALK MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for PoC

5.2.1.2 Proliferation of rugged and ultra-rugged smartphones

5.2.1.3 Growing need for driver safety

5.2.1.4 Transition of LMR systems from analog to digital

5.2.2 RESTRAINT

5.2.2.1 Delay in the standardization of spectrum allocation

5.2.3 OPPORTUNITIES

5.2.3.1 High-speed 5G network for enhancing PTT-related operations

5.2.3.2 Standardization of infrastructure platforms

5.2.4 CHALLENGES

5.2.4.1 LMR and PTT interoperability issues

5.2.4.2 High existing investments by the public sector to deploy LMR systems

5.3 INDUSTRY TRENDS

5.3.1 USE CASES

5.3.1.1 USE CASE 1: Connexus Energy selected Motorola's WAVE for workforce communications

5.3.1.2 USE CASE 2: Connexus Energy extends workforce communications with WAVE

5.3.1.3 USE CASE 3: Orion Labs increased Summit Hospitality Group's operational efficiency across properties with its PTT Voice Services

5.3.1.4 USE CASE 4: Iridium helped protect communities and wildlife in Kenya with its PTT solution and services

5.3.1.5 USE CASE 5: Zello helped YRC Worldwide to improve communications for dispatchers

5.3.2 ECOSYSTEM: PUSH-TO-TALK OVER CELLULAR FOR 1-MANY VOICE TRANSMISSION SESSION

FIGURE 22 ONE-TO-MANY PUSH-TO-TALK OVER CELLULAR GROUP SESSION (VOICE TRANSMISSION)

TABLE 4 PUSH TO TALK MARKET: ECOSYSTEM

5.3.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 PTT MARKET: SUPPLY CHAIN ANALYSIS

5.3.4 PATENT ANALYSIS

5.3.4.1 Methodology

5.3.4.2 Document Types of Patents

TABLE 5 PATENTS FILED, 2019–2021

5.3.4.3 Innovation And Patent Applications

FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2021

5.3.4.3.1 Top applicants

FIGURE 25 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

TABLE 6 US: TOP TEN PATENT OWNERS IN THE MARKET, 2019–2021

5.3.5 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 26 PUSH TO TALK MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.6 AVERAGE SELLING PRICE TRENDS

TABLE 7 PRICING ANALYSIS

5.3.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES MODEL

5.3.7.1 Threat of new entrants

5.3.7.2 Threat of substitutes

5.3.7.3 Bargaining power of buyers

5.3.7.4 Bargaining power of suppliers

5.3.7.5 Competitive rivalry

5.3.8 TECHNOLOGY TRENDS

5.3.8.1 Introduction

5.3.8.2 Artificial Intelligence and Machine Learning

5.3.8.3 Cloud Computing

5.3.8.4 5G Network

5.3.9 REGULATORY IMPACT

5.4 COVID-19 MARKET OUTLOOK FOR PUSH TO TALK MARKET NETWORK

TABLE 9 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN COVID-19 ERA

TABLE 10 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.4.1 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 PUSH TO TALK MARKET, BY COMPONENT (Page No. - 84)

6.1 INTRODUCTION

6.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 27 SOLUTIONS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 HARDWARE

6.2.1 GROWING NUMBER OF END-USE DEVICES TO DRIVE THE ADOPTION OF PTT HARDWARE

6.2.2 HARDWARE: DRIVER

TABLE 14 HARDWARE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 HARDWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SOLUTION

6.3.1 PUSH-TO-TALK SOLUTIONS ENABLE SECURED AND RELIABLE COMMUNICATION FOR MISSION AND NON-MISSION CRITICAL PURPOSES

6.3.2 SOLUTION: DRIVERS

FIGURE 28 MISSION-CRITICAL PTT SOLUTION SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 PUSH TO TALK MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 18 SOLUTION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 SOLUTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 CARRIER INTEGRATED PTT SOLUTION

TABLE 20 CARRIER-INTEGRATED PTT SOLUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 CARRIER-INTEGRATED PTT SOLUTION, BY REGION, 2021–2026 (USD MILLION)

6.3.4 OVER THE TOP PTT SOLUTION

TABLE 22 OVER THE TOP PTT SOLUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 OVER THE TOP PTT SOLUTION, BY REGION, 2021–2026 (USD MILLION)

6.3.5 MISSION-CRITICAL PTT SOLUTION

TABLE 24 MISSION-CRITICAL PTT SOLUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MISSION-CRITICAL PTT SOLUTION, BY REGION, 2021–2026 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: DRIVERS

FIGURE 29 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 26 PUSH TO TALK MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.2 CONSULTING

6.4.2.1 Need for technical expertise in setting up a robust PTT system to drive the demand for consulting services

TABLE 30 CONSULTING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 CONSULTING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.3 IMPLEMENTATION

6.4.3.1 Implementation services to have significant revenue growth opportunities in the Asia Pacific

TABLE 32 IMPLEMENTATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 IMPLEMENTATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.4 SUPPORT AND MAINTENANCE

6.4.4.1 Need for 24/7 real-time support to fuel the demand for support and maintenance services

TABLE 34 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 PUSH TO TALK MARKET, BY NETWORK TYPE (Page No. - 97)

7.1 INTRODUCTION

FIGURE 30 CELLULAR SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

7.1.1 NETWORK TYPE: COVID-19 IMPACT

TABLE 36 MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 37 MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

7.2 LAND MOBILE RADIO

7.2.1 GROWING ADOPTION IN PUBLIC SAFETY VERTICAL TO DRIVE THE MARKET FOR LAND MOBILE RADIO SYSTEMS

7.2.2 LAND MOBILE RADIO: MARKET DRIVERS

TABLE 38 LAND MOBILE RADIO: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 LAND MOBILE RADIO: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 LAND MOBILE RADIO MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 41 LAND MOBILE RADIO MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

7.3 CELLULAR

7.3.1 LONG-TERM EVOLUTION TO DRIVE THE CELLULAR PUSH TO TALK MARKET

7.3.2 CELLULAR: MARKET DRIVERS

TABLE 42 CELLULAR: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 CELLULAR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 CELLULAR MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 45 CELLULAR MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

8 PUSH TO TALK MARKET, BY ORGANIZATION SIZE (Page No. - 103)

8.1 INTRODUCTION

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 46 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 POC SOLUTION PROVIDES A WIDE RANGE OF COMMUNICATION FOR LARGE ENTERPRISES

8.2.2 LARGE ENTERPRISES: DRIVERS

TABLE 48 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 COST-EFFECTIVENESS OF CLOUD-BASED SOLUTIONS TO DRIVE THE DEMAND AMONG SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: DRIVERS

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 PUSH TO TALK MARKET, BY VERTICAL (Page No. - 108)

9.1 INTRODUCTION

FIGURE 32 COMMERCIAL SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

9.1.1 VERTICAL: COVID-19 IMPACT

TABLE 52 MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 53 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 PUBLIC SAFETY

9.2.1 NEED FOR A RELIABLE NETWORK FOR MISSION-CRITICAL COMMUNICATION IN PUBLIC SAFETY

9.2.2 PUBLIC SAFETY: MARKET DRIVERS

TABLE 54 PUBLIC SAFETY: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 PUBLIC SAFETY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 GOVERNMENT AND DEFENSE

9.3.1 USE OF PUSH-TO-TALK SOLUTIONS TO AUGMENT THE EXISTING USE OF LAND MOBILE RADIOS IN GOVERNMENT AND DEFENSE VERTICAL

9.3.2 GOVERNMENT AND DEFENSE: PUSH TO TALK MARKET DRIVERS

TABLE 56 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 COMMERCIAL

9.4.1 COMMERCIAL: MARKET DRIVERS

TABLE 58 COMMERCIAL: LK MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 COMMERCIAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

FIGURE 33 TRAVEL AND HOSPITALITY SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 60 COMMERCIAL: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 61 COMMERCIAL: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.4.2 TRANSPORTATION AND LOGISTICS

9.4.2.1 Push-to-talk solutions are vital tools for fleet dispatchers

TABLE 62 TRANSPORTATION AND LOGISTICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 TRANSPORTATION AND LOGISTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4.3 TRAVEL AND HOSPITALITY

9.4.3.1 Increasing demand for PoC to improve overall guest and traveler experience

TABLE 64 TRAVEL AND HOSPITALITY MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 TRAVEL AND HOSPITALITY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4.4 ENERGY AND UTILITIES

9.4.4.1 Push-to-talk devices enable real-time communication and ensure the safety of large workforces in the energy and utilities vertical

TABLE 66 ENERGY AND UTILITIES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 ENERGY AND UTILITIES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4.5 CONSTRUCTION

9.4.5.1 Push-to-talk solutions offer an effective communication tool for construction sites

TABLE 68 CONSTRUCTION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 CONSTRUCTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4.6 MANUFACTURING

9.4.6.1 Push-to-talk solutions help manufacturers improve worker safety and productivity

TABLE 70 MANUFACTURING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MANUFACTURING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHER VERTICALS

TABLE 72 OTHER VERTICALS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 OTHER VERTICALS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 PUSH TO TALK MARKET, BY REGION (Page No. - 121)

10.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 74 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY NORMS

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: PUSH TO TALK MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 Highly developed telecom infrastructure and presence of several PTT vendors to drive the market growth in the US

TABLE 98 UNITED STATES: PUSH TO TALK MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 109 UNITED STATES: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 110 UNITED STATES: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 111 UNITED STATES: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 112 UNITED STATES: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 113 UNITED STATES: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 114 UNITED STATES: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 115 UNITED STATES: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 116 UNITED STATES: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 117 UNITED STATES: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Adoption of critical communication solutions to drive PTT market growth in Canada

TABLE 118 CANADA: PUSH TO TALK MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 119 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 CANADA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 121 CANADA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 122 CANADA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 124 CANADA: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 126 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 129 CANADA: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 130 CANADA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 131 CANADA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 132 CANADA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 133 CANADA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 134 CANADA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 135 CANADA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 136 CANADA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 137 CANADA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: PUSH TO TALK MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY NORMS

TABLE 138 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 149 EUROPE: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 150 EUROPE: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 151 EUROPE: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 152 EUROPE: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 153 EUROPE: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 154 EUROPE: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 155 EUROPE: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 156 EUROPE: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 157 EUROPE: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 159 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 Increasing demand for digital transformation to boost the growth of the PTT market in the UK

10.3.5 GERMANY

10.3.5.1 Lack of 5G readiness to hinder the deployment of advanced PTT solutions

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: PUSH TO TALK MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY NORMS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 171 ASIA PACIFIC: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 172 ASIA PACIFIC: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 173 ASIA PACIFIC: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 174 ASIA PACIFIC: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 175 ASIA PACIFIC: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 176 ASIA PACIFIC: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 177 ASIA PACIFIC: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.4 CHINA

10.4.4.1 CCSA adoption of 3GPP standards to drive the adoption of PoC solutions in China

10.4.5 JAPAN

10.4.5.1 Government initiatives to improve public safety and worker productivity to drive the market growth in Japan

10.4.6 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.5.1 LATIN AMERICA: PUSH TO TALK MARKET DRIVERS

10.5.2 LATIN AMERICA: COVID-19 IMPACT

10.5.3 LATIN AMERICA: REGULATORY NORMS

TABLE 182 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 193 LATIN AMERICA: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 194 LATIN AMERICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 195 LATIN AMERICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 196 LATIN AMERICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 197 LATIN AMERICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 198 LATIN AMERICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 199 LATIN AMERICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.4 BRAZIL

10.5.4.1 Established 4G LTE networks to boost the adoption of PoC solutions in Brazil

10.5.5 MEXICO

10.5.5.1 Telecom reforms to boost the adoption of PTT technology in Mexico

10.5.6 REST OF LATIN AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 MIDDLE EAST AND AFRICA: PUSH TO TALK MARKET DRIVERS

10.6.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.6.3 MIDDLE EAST AND AFRICA: REGULATORY NORMS

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA: PUSH TO TALK MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 217 MIDDLE EAST AND AFRICA: PUBLIC SAFETY MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA: GOVERNMENT AND DEFENSE MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2017–2020 (USD MILLION)

TABLE 221 MIDDLE EAST AND AFRICA: COMMERCIAL MARKET SIZE, BY NETWORK TYPE, 2021–2026 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2017–2020 (USD MILLION)

TABLE 223 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMMERCIAL VERTICAL, 2021–2026 (USD MILLION)

TABLE 224 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 225 MIDDLE EAST AND AFRICA: PUSH TO TALK MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.4 UNITED ARAB EMIRATES

10.6.4.1 Adoption of LTE to drive PTT market growth in the UAE

10.6.5 KINGDOM OF SAUDI ARABIA

10.6.5.1 Focus on safe communications to drive adoption of MCPTT solutions in the KSA

10.6.6 REST OF THE MIDDLE EAST AND AFRICA

11 COMPETITIVE LANDSCAPE (Page No. - 174)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 226 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE PTT MARKET

11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 227 PTT MARKET: DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS

FIGURE 37 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2020 (USD MILLION)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 38 KEY PTT MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

TABLE 228 PRODUCT FOOTPRINT WEIGHTAGE

11.6 COMPETITIVE BENCHMARKING

TABLE 229 COMPANY FOOTPRINT

TABLE 230 COMPANY VERTICAL FOOTPRINT

TABLE 231 COMPANY OFFERING FOOTPRINT

TABLE 232 COMPANY REGION FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 39 STARTUP/SME PTT MARKET EVALUATION MATRIX, 2021

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 233 PRODUCT LAUNCHES, SEPTEMBER 2019–APRIL 2021

11.8.2 DEALS

TABLE 234 DEALS, APRIL 2020–JULY 2021

11.8.3 OTHERS

TABLE 235 OTHERS, SEPTEMBER 2021

12 COMPANY PROFILES (Page No. - 186)

12.1 KEY PLAYERS

(Business Overview, Hardware/Solutions/Services Offered, Recent developments, Response to COVID-19, MnM View, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 AT&T

TABLE 236 AT&T: BUSINESS OVERVIEW

FIGURE 40 AT&T: COMPANY SNAPSHOT

TABLE 237 AT&T: HARDWARE/SOLUTIONS/ SERVICES OFFERED

TABLE 238 AT&T: PRODUCT LAUNCHES

TABLE 239 AT&T: DEALS

12.1.2 VERIZON WIRELESS

TABLE 240 VERIZON WIRELESS: BUSINESS OVERVIEW

FIGURE 41 VERIZON WIRELESS: COMPANY SNAPSHOT

TABLE 241 VERIZON WIRELESS: SERVICE OFFERED

TABLE 242 VERIZON WIRELESS: PRODUCT LAUNCHES

12.1.3 MOTOROLA SOLUTIONS

TABLE 243 MOTOROLA SOLUTIONS: BUSINESS OVERVIEW

FIGURE 42 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

TABLE 244 MOTOROLA SOLUTIONS: HARDWARE/SOLUTIONS/SERVICES OFFERED

TABLE 245 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES

TABLE 246 MOTOROLA SOLUTIONS: DEALS

12.1.4 T-MOBILE

TABLE 247 T-MOBILE: BUSINESS OVERVIEW

FIGURE 43 T-MOBILE: COMPANY SNAPSHOT

TABLE 248 T-MOBILE: HARDWARE OFFERED

TABLE 249 T-MOBILE: PUSH TO TALK: PRODUCT LAUNCHES

TABLE 250 T-MOBILE: PUSH TO TALK: DEALS

12.1.5 QUALCOMM

TABLE 251 QUALCOMM: BUSINESS OVERVIEW

FIGURE 44 QUALCOMM: COMPANY SNAPSHOT

TABLE 252 QUALCOMM: SOLUTIONS/SERVICES OFFERED

TABLE 253 QUALCOMM: PUSH TO TALK: DEALS

TABLE 254 BELL CANADA: BUSINESS OVERVIEW

FIGURE 45 BELL CANADA: COMPANY SNAPSHOT

TABLE 255 BELL CANADA: HARDWARE/SOLUTIONS/SERVICES OFFERED

12.1.7 IRIDIUM

TABLE 256 IRIDIUM: BUSINESS OVERVIEW

FIGURE 46 IRIDIUM: COMPANY SNAPSHOT

TABLE 257 IRIDIUM: HARDWARE/SOLUTIONS/SERVICES OFFERED

TABLE 258 IRIDIUM: PUSH TO TALK: DEALS

12.1.8 TAIT COMMUNICATIONS

TABLE 259 TAIT COMMUNICATIONS: BUSINESS OVERVIEW

TABLE 260 TAIT COMMUNICATIONS: SOLUTIONS/SERVICES OFFERED

12.1.9 ZEBRA

TABLE 261 ZEBRA: BUSINESS OVERVIEW

FIGURE 47 ZEBRA: COMPANY SNAPSHOT

TABLE 262 ZEBRA: SOLUTIONS/SERVICES OFFERED

TABLE 263 ZEBRA: PUSH TO TALK: DEALS

12.1.10 TELSTRA

TABLE 264 TELSTRA: BUSINESS OVERVIEW

FIGURE 48 TELSTRA: COMPANY SNAPSHOT

TABLE 265 TELSTRA: SOLUTIONS/SERVICES OFFERED

TABLE 266 TELSTRA: PUSH TO TALK: DEALS

12.1.11 HYTERA

TABLE 267 HYTERA: BUSINESS OVERVIEW

TABLE 268 HYTERA: HARDWARE/SOLUTIONS/SERVICES OFFERED

TABLE 269 HYTERA: PUSH TO TALK: PRODUCT LAUNCHES

TABLE 270 HYTERA: DEALS

12.2 STARTUP/SMES PLAYERS

12.2.1 GROUPTALK

12.2.2 ORION

12.2.3 ZELLO

12.2.4 VOXER

12.2.5 IPTT

12.2.6 ESCHAT

12.2.7 AINA WIRELESS

12.2.8 AZETTI NETWORKS

12.2.9 TEAMCONNECT

12.2.10 SERVICEMAX ZINC

12.2.11 VOICELAYER

12.2.12 SIMOCO WIRELESS SOLUTIONS

12.2.13 PEAKPTT

12.2.14 RUGGEAR

*Details on Business Overview, Hardware/Solutions/Services Offered, Recent developments, Response to COVID-19, MnM View, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 231)

13.1 ADJACENT & RELATED MARKETS

13.1.1 INTRODUCTION

TABLE 271 ADJACENT MARKETS AND FORECASTS

13.1.2 ENTERPRISE MOBILITY MANAGEMENT MARKET– GLOBAL FORECAST TO 2026

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.3 Enterprise mobility management market, by component

TABLE 272 EMM MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

13.1.2.4 Enterprise mobility management market, by organization size

TABLE 273 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

13.1.2.5 Enterprise mobility management market, by deployment mode

TABLE 274 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

13.1.2.6 Enterprise mobility management market, by vertical

TABLE 275 ENTERPRISE MOBILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

13.1.3 MOBILE DEVICE MANAGEMENT MARKET – GLOBAL FORECAST TO 2026

13.1.3.1 Market definition

13.1.3.2 Market overview

13.1.3.3 Mobile device management market, by component

TABLE 276 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 277 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 278 COMPONENTS: MOBILE DEVICE MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 279 COMPONENTS: MOBILE DEVICE MANAGEMENT MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 280 COMPONENTS: MOBILE DEVICE MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 281 COMPONENTS: MOBILE DEVICE MANAGEMENT MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

13.1.3.4 Mobile device management market, by operating system

TABLE 282 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY OPERATING SYSTEM, 2015–2020 (USD MILLION)

TABLE 283 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY OPERATING SYSTEM, 2021–2026 (USD MILLION)

13.1.3.5 Mobile device management market, by deployment mode

TABLE 284 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 285 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

13.1.3.6 Mobile device management market, by organization size

TABLE 286 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 287 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

13.1.3.7 Mobile device management market, by vertical

TABLE 288 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 289 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

13.1.3.8 Mobile device management market, by region

TABLE 290 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 291 MOBILE DEVICE MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.1.4 PRIVATE LTE MARKET – GLOBAL FORECAST TO 2025

13.1.4.1 Market definition

13.1.4.2 Market overview

13.1.4.3 Private LTE market, by component

TABLE 292 PRIVATE LTE MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 293 PRIVATE LTE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 294 INFRASTRUCTURE: PRIVATE LTE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 295 INFRASTRUCTURE: PRIVATE LTE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 296 SERVICES: PRIVATE LTE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 297 SERVICES: PRIVATE LTE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

13.1.4.4 Private LTE market, by frequency band

TABLE 298 PRIVATE LTE MARKET SIZE, BY FREQUENCY BAND, 2016–2019 (USD MILLION)

TABLE 299 PRIVATE LTE MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

13.1.4.5 Private LTE market, by technology

TABLE 300 PRIVATE LTE MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 301 PRIVATE LTE MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

13.1.4.6 Private LTE market, by deployment model

TABLE 302 PRIVATE LTE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2019 (USD MILLION)

TABLE 303 PRIVATE LTE MARKET SIZE, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

13.1.4.7 Private LTE market, by end user

TABLE 304 PRIVATE LTE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 305 PRIVATE LTE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

13.1.4.8 Private LTE market, by region

TABLE 306 PRIVATE LTE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 307 PRIVATE LTE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

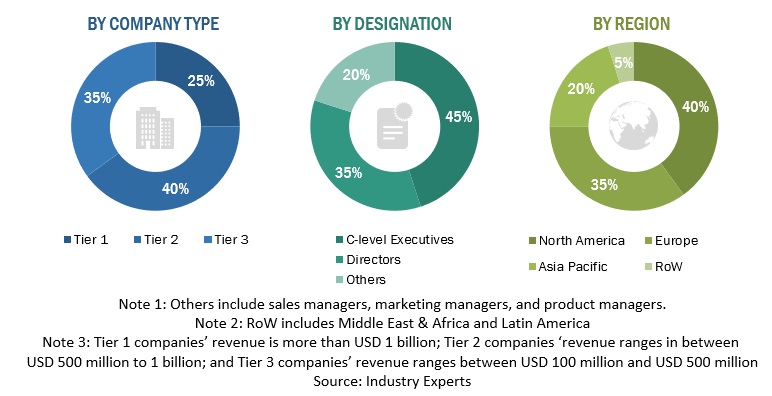

The study involved four major activities in estimating the current size of the Push to Talk market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Push to Talk market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Push to Talk market. The primary sources from the demand side included Push-to-Talk end users, network administrators/consultants/specialists, Chief Information Officers (CIOs) and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Push to Talk market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the Push to Talk market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (hardware, solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering Push-to-Talk hardware solutions and services were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer Push-to-Talk was identified through similar sources. Then through primaries, the data on revenue generated through specific Push-to-Talk components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the Push to Talk market by Component (Hardware, solution, and services), vertical, organization size, network type, and region during the forecast period.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the impact of COVID-19 on the market.

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall Push to Talk market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the North American Push to Talk market

Futuristic Growth Use-Cases of Push to Talk (PTT) Market

- Healthcare: In the healthcare industry, PTT technology can be used to connect doctors and nurses in real-time, enabling them to share patient information and coordinate care more efficiently. With the development of wearable devices and smart sensors, PTT technology can also be used to monitor patient vital signs remotely and provide immediate medical attention when necessary.

- Smart Cities: In smart city environments, PTT technology can be used to enable real-time communication between public safety officials and city residents, helping to improve emergency response times and enhance community safety. PTT solutions can also be used to connect city officials with public transit operators, enabling real-time communication for traffic management and other city services.

- Industrial IoT: In industrial IoT (IIoT) applications, PTT technology can be used to enable real-time communication between workers in manufacturing and other industrial environments. PTT solutions can be integrated with sensors and other IIoT devices, providing workers with real-time information about equipment status, safety alerts, and other critical data.

- Logistics and Transportation: In the logistics and transportation industry, PTT technology can be used to enable real-time communication between drivers, dispatchers, and other stakeholders. With the development of autonomous vehicles and drone delivery systems, PTT solutions can also be used to enable real-time communication between these systems and human operators.

- Education: In the education industry, PTT technology can be used to connect teachers and students in real-time, enabling real-time collaboration and communication. PTT solutions can be integrated with educational software applications, providing students with real-time access to course materials and enabling teachers to provide immediate feedback.

New Business Opportunities in Push to Talk Market (PTT) Market

- Public safety: PTT technology is widely used by first responders, such as police, fire and emergency medical services. There is a growing demand for PTT services that can be used on mobile devices, as it allows emergency responders to communicate in real-time during critical situations.

- Transportation: PTT technology is also widely used in the transportation industry, including trucking and logistics, taxi and limousine services, and public transit systems. PTT services can help drivers and dispatchers communicate more effectively, leading to improved efficiency and safety.

- Hospitality: The hospitality industry is increasingly using PTT technology to improve communication between staff members. This can lead to improved customer service and operational efficiency.

- Construction and manufacturing: PTT services are also used in the construction and manufacturing industries, where workers need to communicate with each other in noisy or hazardous environments. PTT technology can help to improve safety and productivity in these industries.

- Retail: PTT services are also used in the retail industry, where employees need to communicate with each other to manage inventory, handle customer inquiries, and coordinate tasks.

- Sports and events: PTT services can also be used at sporting events and other large-scale events, where staff members need to communicate in real-time to ensure the safety and security of attendees.

Future Push to Talk Market (PTT) Market Trends

- Integration with other communication technologies: PTT technology is likely to be integrated with other communication technologies like video conferencing and messaging to create a more seamless and efficient communication platform. This can help to improve collaboration and productivity across various industries.

- Expansion into new markets: The PTT market is expected to expand into new markets like education, hospitality, and retail, where real-time communication is becoming increasingly important. This can create new opportunities for PTT service providers to expand their customer base and grow their business.

- Development of advanced PTT solutions: PTT technology is likely to become more sophisticated, with the development of advanced solutions that incorporate features like voice recognition and natural language processing. This can help to improve the accuracy and efficiency of PTT communication, making it an even more valuable tool for various industries.

- Increased use of mobile devices: As more people use mobile devices for work, PTT services are expected to become more mobile-friendly. This can help to increase adoption of PTT technology by a wider range of users, and make it more accessible for remote workers and those in the field.

- Emphasis on security: With the increasing use of PTT technology across various industries, security is becoming a more critical concern. PTT service providers are likely to place an increasing emphasis on security, with the development of advanced encryption and authentication technologies to ensure the privacy and security of PTT communication.

Growth Drivers for Push to Talk (PTT) Market Business from Macro to Micro

Push to Talk (PTT) Market - Macro-level drivers:

- Increasing adoption of mobile broadband networks: The widespread availability of mobile broadband networks is a key driver for the PTT market. With the proliferation of 4G and 5G networks, PTT services can now be used on mobile devices, making it easier and more convenient for users to communicate in real-time.

- Growing demand for real-time communication: There is a growing demand for real-time communication across various industries, including public safety, transportation, and healthcare. PTT technology provides a reliable and secure communication platform that can be used in real-time, making it an ideal solution for these industries.

- Emergence of new technologies: The emergence of new technologies like the Internet of Things (IoT), artificial intelligence (AI), and cloud computing is also driving the growth of the PTT market. These technologies are helping to create new use cases for PTT technology and are making it more accessible to a wider range of users.

Push to Talk (PTT) Market - Micro-level drivers:

- Increasing adoption of PTT services by enterprises: Many enterprises are adopting PTT services to improve communication and collaboration between their employees. PTT services can help to increase productivity and efficiency, and are often more cost-effective than traditional communication methods.

- Rising demand for integrated PTT solutions: There is a growing demand for integrated PTT solutions that can be seamlessly integrated with other enterprise software applications. This can help to streamline workflows and make communication more efficient.

- Increasing use of PTT services in the public safety sector: The public safety sector is a key market for PTT services, and there is a growing demand for more sophisticated PTT solutions that can be used in a range of different environments and situations.

- Growing adoption of PTT technology in emerging markets: PTT technology is also being adopted in emerging markets, where there is a growing demand for reliable and affordable communication solutions.

Top 10 companies in Push to Talk Market (PTT) Market

- Verizon Communications Inc.

- AT&T Inc.

- Motorola Solutions Inc.

- Zebra Technologies Corp.

- Hytera Communications Corp.

- Sonim Technologies Inc.

- Kyocera International Inc.

- Sprint Corporation

- Tait Communications

- Azetti Networks AG

Note that this list is not exhaustive and there are many other companies that offer PTT solutions in the market. The ranking and market share of these companies may vary based on various factors such as geography, target industries, and service offerings.

Speak to our Analyst today to know more about "Push to Talk Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Push to Talk Market