Radome Market by Platform(Ground, Airborne, Naval), Application(Radar, Sonar, Communication Antenna), Frequency(HF/UHF/VHF-Band, L- Band, S-Band, C- Band, X- Band, KU- Band, KA- Band, Multi-Band), Offering, and Region (2021-2026)

[240 Pages Report] The radome market is estimated at USD 1.7 billion in 2021 and projected to reach USD 3.3 billion by 2026, at a CAGR of 15.0% from 2021 to 2026. The radome market is growing at a significant rate across the world, and a similar trend is expected to be observed during the forecast period. The Advancements in composite materials technology for Radome structure, focus on the development of compact radome for UAV platforms, demand for technologically advanced radome systems for next-generation aircraft and significance of radomes in warfare are fueling the growth of the Radome Industry.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Radome Market

- Components and required raw materials used to manufacture radomes were not available for ready production.

- The supply chain is experiencing transportation-related delays due to travel restrictions and shortage of workforce.

- Production/assembly lines were are also either running at lower capacities or are completely shut down.

Long-term market drivers for radomes remain strong, and, before the pandemic, the market had started to show signs of recovery from the major market price reset. The COVID-19 pandemic has swept the world, with many industries trying to stay afloat. Governments and businesses involved with radome are reacting differently to the new situation. Some product launches are moving forward, while some are not; some tests continue, and some are delayed; some companies still operate, and others have shuttered.

The spread of the COVID-19 pandemic has resulted in supply chain and logistical disruptions across North America. According to a survey published by the National Association of Manufacturers (NAM) in March 2020, ~80% of manufacturers expect that the pandemic will have a financial impact on their businesses. Some key companies in the region have closed their facilities and are mulling employee layoffs. The manufacturing sector, which employs ~13 million workers in the US, is also expected to be impacted by the pandemic, primarily for two reasons: firstly, a number of manufacturing jobs are onsite that eliminates the scope of working remotely. Secondly, slowed economic activities have the reduced demand for industrial products in the US and globally.

Radome Market Dynamics

Driver: Advancements in composite materials technology for radome structure

Governments of major countries are increasingly adopting composite material-based radome structures due to their UV stabilized hydrophobic coatings which offers them their hydrophobic characteristics, flexible geometry which can be tuned to meet specific RF configurations and high reliability. These design characteristics are missing when compared with traditional radome materials. The use of composites overcomes challenges with signal attenuation and improves global broadband speeds as well.

In November 2020, Meggitt PLC, a leading international company specializing in high-performance components and subsystems for the aerospace and defense, secured a USD 5.6 million contract with BAE Systems plc for the supply of innovative nose radome technology to enable the effective operation of a pioneering Multi-Function Array radar system on the Typhoon.

Restraints: Stringent regulatory norms to ensure safe aircraft operations

Aviation is one of the highly regulated industries across the globe. This is mainly due to the inherent risks associated with failure of flight operations. Thus, companies manufacturing aircraft and aircraft components such as aircraft radomes, have to adhere to a multitude of bilateral, national, and international regulations and standards. Different countries across the globe have different regulatory bodies governing safety levels of aircraft operations. In addition, the International Civil Aviation Organization (ICAO) has laid down safety regulations that are to be adhered to by manufacturers of aircraft, aircraft components, and airlines, globally. All aircraft components and systems manufactured have to meet the standards set by various regulatory bodies to ensure safe aircraft operations and reduce risks associated with defective aircraft components.

Aircraft components and systems also have to undergo strict quality checks and rigorous testing to meet the safety standards and reduce the risks associated with the use of defective components. All aircraft components need to undergo a one-time inspection prior to their incorporation in an airplane. For instance, the US Federal Aviation Administration has formulated an Airworthiness Directive (AD) that directs replacement of aircraft components that do not meet safety requirements and design tolerance levels. Hence, it is a challenge for aircraft radome manufacturers to adhere to the stringent regulatory norms to deliver quality products.

Opportunities: Emergence of aircraft manufacturers in Asia Pacific and Latin America.

The emergence of aircraft manufacturers in Asia Pacific and Latin America is a major opportunity for the growth of the radome market in the coming years. Commercial Aircraft Corporation of China (COMAC), Embraer, and Mitsubishi are some of the new aircraft manufacturing companies in the Asia Pacific and Latin American regions. Mitsubishi Aircraft Corporation is engaged in the production of regional aircraft, while COMAC manufactures commercial, business, and regional aircraft. The rise in demand for commercial aircraft, business jets, and regional transport aircraft, owing to the increased air passenger traffic, is expected to provide these manufacturers with growth opportunities for the production of new aircraft. This, in turn, is expected to provide several growth opportunities for the aircraft radome market during the forecast period.

Challenges: Complexities in maintenance and repair of radomes.

Radomes are constructed using materials that minimally attenuate the electromagnetic signal transmitted or received by antennas. The slightest change in their physical characteristics can affect the performance of radar and antenna systems and hamper the communication process. This makes timely maintenance of radomes important. The repairs of radomes should be performed in a way that their original properties, such as transmissivity and reflectivity, are restored. The maintenance of radomes requires technical expertise and the use of proper tools and simulation processes, which, in turn, acts as a challenge for radome developers.

Based on material, glass fiber is projected to lead radome market by material from 2021 to 2026.

Development and procurement of modern aircraft systems, such as targeting and surveillance systems and communication systems, for various applications is driving the demand for radome market globally. The surface of the fiberglass radome is reinforced with additives to enhance the adhesion between them so that the surface paint will not fall off, wrinkle and maintain its color even in severe weather. This also offers excellent electrical insulation and permeability.

Based on application, the radar segment will register the highest growth from 2021 to 2026.

A radome is often used to prevent ice and freezing rain from accumulating on antennas. In the case of a spinning radar parabolic antenna, the radome also protects the antenna from debris and rotational irregularities due to wind. In November 2020, Meggitt PLC secured a pioneering radome contract with BAE Systems to enable advanced radar technology for the Royal Air Force Typhoon fighter jet.

Based on Platform, naval segment is projected to grow at the highest CAGR during the forecast period.

Upgrades in communication, navigation, and surveillance systems have helped modernize the maritime industry at a significant pace. An increase in automation, modernization of ships, upcoming autonomous technology, and the increase in unmanned marine vehicles are expected to drive the radome market of the naval platform. The naval platform comprises commercial vessels, military vessels, and unmanned marine vehicles. In January 2021, Saab and the Swedish Defence Materiel Administration (FMV) signed two agreements with the Swedish navy concerning the next generation of surface ships and corvettes.

Based on region, North America is projected to lead the radome market from 2021 to 2026.

Significant investments in R&D activities for the development of advanced radome solutions by key players and increased demand for advanced radome systems are some of the factors expected to fuel the growth of the radome market in this region. The US is expected to drive the growth of the North American radome market during the forecast period, owing to easy access to various innovative technologies and significant investments being made by manufacturers in the country for the development of improved military ISR and communication & monitoring systems. Several developments have taken place in the field of radome systems in the region. For instance, in January 2020, Telephonics Corporation (US) successfully developed and tested its MOSAIC Active Electronically Scanned Array (AESA) surveillance radar system which requires technologically advanced solid laminate radomes with the US Navy’s MH-60S helicopter. The MOSAIC AESA surveillance radar is capable of performing continuous scheduled Inverse Synthetic Aperture Radar (ISAR) imaging tasks while simultaneously conducting surveillance, detection, and tracking operations.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major manufacturers in this market are based in North America and Europe. The Radome Companies are dominated by a few globally established players such as General Dynamics (US), L3Harris Technologies (US), Cobham plc (UK), Jenoptik (Germany), Saint-Gobain (France) are among the key manufacturers that secured radome contracts in the last few years. Major focus was given to the development of new products due to the changing requirements of communication and radar capabilities across the world. These players have adopted various growth strategies to strengthen their position in the market. These include product launches, contracts, partnerships, mergers and acquisitions, and new product development activities further to expand their presence in the radome market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Offering, By Platform, By Application, By Frequency band |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), General Dynamics (US), Saint-Gobain (France), BAE Systems (UK), L3Harris Technologies (US), Raytheon Technologies (US), and others. Total 25 Market Players |

The study categorizes the Radome market based on solution, platform, application, end user, and region.

By Offering

- Product

- Service

By Platform

- Airborne

- Ground

- Naval

By Application

- Radar

- Sonar

-

Communication Antenna

By Frequency

- HF/UHF/VHF-Band

- L-Band

- S-Band

- C-Band

- X-Band

- KU-Band

- KA-Band

- Multi-Band

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In November 2020, Meggitt PLC secured a pioneering radome contract with BAE Systems to enable advanced radar technology for the Royal Air Force Typhoon fighter jet.

- In March 2021, Raytheon Intelligence & Space will operate and maintain US Government's Relocatable Over-the-Horizon Radar (ROTHR) and radome system under a five-year contract to counter narco-terrorism operations.

- In April 2020, Raytheon Technologies was awarded a maximum USD 13.7 million one-time purchase contract for radar radomes.

- In February 2021, Lockheed Martin Corporation was selected to develop rugged radomes and windows to withstand the rigors of hypersonic flight. Hypersonics require RF radomes or infrared windows to protect sensitive electronics from environmental extremes while letting through IR and RF signals.

- In May 2021, General Dynamics Mission Systems announced that it had delivered the 500th wideband nose radome to Lockheed Martin Corporation for installation aboard the US Air Force, the US Navy, the US Marine Corps, and international military F-35 aircraft. These radomes physically protect the aircraft’s Active Electronically Scanned Array (AESA) radar while minimizing radio frequency (RF) interference and reducing the susceptibility from detection by enemy radar.

Frequently Asked Questions (FAQ):

Which are the major companies in the radome market? What are their major strategies to strengthen their market presence?

Some of the key players in the radome market are General Dynamics (US), L3Harris Technologies (US), Cobham plc (UK), Jenoptik (Germany), Saint-Gobain (France), among others that secured radome contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their radome market presence.

What are the drivers and opportunities for the radome market?

The market for radome market has grown substantially across the globe, and especially in Asia Pacific, where increase in fighter aircraft investments such as China, India, and South Korea, will offer several opportunities for radome industry companies. The rising R&D activities to develop radomes are also expected to boost the growth of the market around the world.

The Advancements in composite materials technology for Radome structure, focus on development of compact radome for UAV platforms, demand for technologically advanced radome systems for next-generation aircraft and significance of radomes in warfare are fueling the growth of the radome market.Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand for radome systems in the region. China, with its strong defense expenditure and its air force programmes, is recognized as one of the key users and adopters of radome systems. China has long relied on its technological superiority and high standards of training and professionalization to offset its numerical inferiority.

Which platform of radome systems is expected to significantly lead in the coming years?

Naval segment will grow the highest as they offer radome solutions by integrating radar and communication equipment into a single simplified unit that provides unmeasured tactical performance and safety. In terms of CAGR, the Naval segment will register the highest growth rate in the coming years as well i.e., in between 2021 to 2026. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SEGMENTATION

1.2.2 REGIONAL SCOPE

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY & PRICING

1.4 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

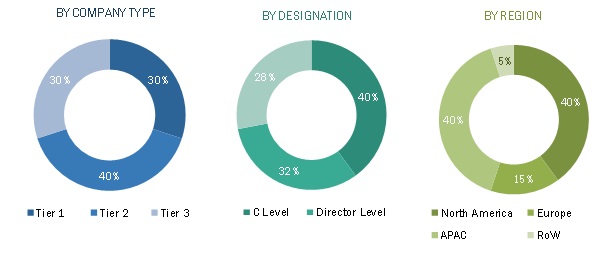

FIGURE 3 BREAK DOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.3 Primary details

2.1.2.4 Key industry insights

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Effect of COVID-19 on aircraft deliveries

2.2.2.2 Growth of military expenditure on the development of modern warfare

FIGURE 4 MILITARY EXPENDITURE, 2019-2020

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

FIGURE 5 NUMBER OF TERRORIST ATTACKS IN 2019, BY COUNTRY

2.2.3 SUPPLY-SIDE INDICATORS

2.3 RESEARCH APPROACH & METHODOLOGY

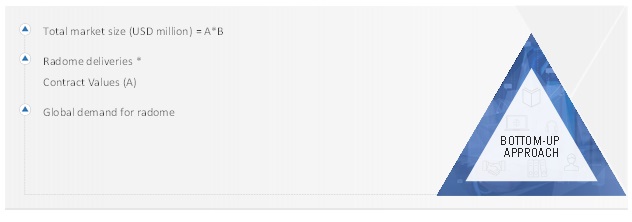

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market Size estimation

2.3.1.2 Radome market research methodology

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.3 COVID-19 impact on radome market

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET TRIANGULATION

2.4.1 TRIANGULATION THROUGH SECONDARY

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 9 GLASS FIBER PROJECTED TO LEAD RADOME MARKET BY MATERIAL FROM 2021 TO 2026

FIGURE 10 SANDWICH SEGMENT TO DOMINATE RADOME MARKET DURING FORECAST PERIOD

FIGURE 11 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN RADOME MARKET

FIGURE 12 DEMAND FOR RADOMES FOR VARIOUS SURVEILLANCE AND COMMUNICATION SYSTEMS IS KEY THE MARKET

4.2 RADOME MARKET, BY PLATFORM

FIGURE 13 GROUND SEGMENT TO LEAD DURING FORECAST PERIOD

4.3 RADOME MARKET, BY APPLICATION

FIGURE 14 RADAR SEGMENT EXPECTED TO LEAD DURING FORECAST PERIOD

4.4 RADOME MARKET, BY FREQUENCY

FIGURE 15 X-BAND SEGMENT TO LEAD DURING FORECAST PERIOD

4.5 RADOME MARKET, MAJOR COUNTRIES

FIGURE 16 RADOME MARKET IN GERMANY PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Advancements in composite materials technology for radome structure

5.2.1.2 Focus on development of compact radome for UAV platforms

5.2.1.3 Demand for technologically advanced carbon fiber radome systems for next-generation aircraft

5.2.1.4 Significance of radomes in warfare

5.2.2 RESTRAINTS

5.2.2.1 Long duration of product certification

5.2.2.2 Manufacturing challenges faced by product manufacturers

5.2.2.3 Stringent regulatory norms to ensure safe aircraft operations

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of aircraft manufacturing in Asia Pacific

5.2.3.2 New composites developed to improve radome properties

5.2.4 CHALLENGES

5.2.4.1 Complexities in maintenance and repair of radomes

5.2.4.2 Reduced global demand for MRO due to COVID-19

5.3 IMPACT OF COVID-19 ON RADOME MARKET

FIGURE 17 IMPACT OF COVID-19 ON RADOME MARKET

5.4 RANGES AND SCENARIOS

FIGURE 18 IMPACT OF COVID-19 ON RADOME MARKET: 3 GLOBAL SCENARIOS

5.5 VALUE CHAIN ANALYSIS OF RADOME MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR RADOME MANUFACTURERS

5.7 RADOME MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 APPLICATION

FIGURE 20 MARKET ECOSYSTEM MAP: RADOME MARKET

FIGURE 21 RADOME MARKET: MARKET ECOSYSTEM

TABLE 1 RADOME MARKET ECOSYSTEM

5.7.4 DEMAND-SIDE IMPACTS

5.7.4.1 Key developments from January 2020 to July 2021

TABLE 2 KEY DEVELOPMENTS IN RADOME MARKET, JANUARY 2020 TO MAY 2021

5.7.5 SUPPLY-SIDE IMPACT

5.7.5.1 Key developments from January 2020 to September 2021

TABLE 3 KEY DEVELOPMENTS IN RADOME MARKET, JANUARY 2020 TO SEPTEMBER 2021

5.8 AVERAGE SELLING PRICE OF RADOMES

TABLE 4 AVERAGE SELLING PRICE TRENDS OF RADOMES, 2020 (USD MILLION)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 RADOME: PORTER’S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 TRADE DATA STATISTICS

5.10.1 EXPORT DATA STATISTICS

TABLE 6 EXPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 852610) RADOME APPARATUS, RADIO COMMUNICATION AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS

5.10.2 IMPORT DATA STATISTICS

TABLE 7 IMPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 8526) RADOME APPARATUS, RADIO COMMUNICATION AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS

5.11 REGULATORY LANDSCAPE

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

6 INDUSTRY TRENDS (Page No. - 75)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 USE OF WIDE V-BAND FOR SATELLITE-AIRCRAFT COMMUNICATION

6.2.2 PLASMA RADOME TECHNOLOGY FOR SPACE-BASED ANTENNAS

6.2.3 STEALTH RADOMES

6.2.4 DYNEEMA CRYSTAL TECHNOLOGY FOR RADOMES

6.2.5 RESIN TRANSFER MOLDING TECHNOLOGY

6.2.6 MULTI-BAND RADOMES

6.3 USE CASE ANALYSIS

6.3.1 USE CASE: COMPOSITE RADOME

6.3.2 USE CASE: STEALTH RADOME

6.4 IMPACT OF MEGATRENDS

6.4.1 3D PRINTING

6.4.2 SHIFT IN GLOBAL ECONOMIC POWER

6.5 TECHNOLOGY ANALYSIS

TABLE 8 RADOME MARKET – TECHNOLOGY ANALYSIS

6.6 INNOVATION & PATENT REGISTRATIONS

TABLE 9 IMPORTANT INNOVATION & PATENT REGISTRATIONS, 2001-2020

7 RADOME MARKET, BY OFFERING (Page No. - 81)

7.1 INTRODUCTION

7.2 PRODUCT

7.2.1 RADOME BODY

7.2.1.1 Material

FIGURE 22 GLASS FIBER PROJECTED TO LEAD RADOME MARKET BY MATERIAL FROM 2021 TO 2026

TABLE 10 RADOME MARKET, BY MATERIAL, 2018–2020 (USD MILLION)

TABLE 11 RADOME MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

7.2.1.1.1 Glass fiber

7.2.1.1.1.1 Growing demand for high temperature resistance in radomes to drive the segment

7.2.1.1.2 Quartz

7.2.1.1.2.1 Need for exceptional strength-to-weight ratios and low electromagnetic interference (EMI) characteristics to drive the segment

7.2.1.2 Structure

FIGURE 23 SANDWICH SEGMENT TO DOMINATE RADOME MARKET DURING FORECAST PERIOD

TABLE 12 RADOME MARKET, BY STRUCTURE, 2018–2020 (USD MILLION)

TABLE 13 RADOME MARKET, BY STRUCTURE, 2021–2026 (USD MILLION)

7.2.1.2.1 Sandwich

7.2.1.2.1.1 Need for rigid, self-supporting structures for radomes to drive the segment

7.2.1.2.2 Solid laminate

7.2.1.2.2.1 Use of cost-effective options for commercial applications to drive the segment

7.2.1.2.3 Dielectric space frame

7.2.1.2.3.1 Need for extremely high wind structural performance to drive the segment

7.2.1.2.4 Metal space frame

7.2.1.2.4.1 Use of self-supporting structures in SATCOM, intelligence gathering, surveillance, and weather forecasting to drive the segment

7.2.2 ACCESSORIES

7.3 SERVICE

8 RADOME MARKET, BY APPLICATION (Page No. - 87)

8.1 INTRODUCTION

FIGURE 24 RADAR SEGMENT PROJECTED TO DOMINATE ATR MARKET FROM 2021 TO 2026

TABLE 14 RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 15 RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 RADAR

8.2.1 RADAR SEGMENT DRIVEN BY NEED FOR ELECTRONIC WARFARE, ISR, AND INFORMATION DISSEMINATION

8.3 SONAR

8.3.1 NEED FOR IMPROVING SEAWATER SURVEILLANCE IN WATER TERRITORIES TO DRIVE THE MARKET FOR SONAR

8.4 COMMUNICATION ANTENNA

8.4.1 DEMAND FOR CUSTOMIZED COMMUNICATION SOLUTIONS INCREASING IN AVIATION

9 RADOME MARKET, BY PLATFORM (Page No. - 90)

9.1 INTRODUCTION

FIGURE 25 NAVAL SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 17 RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2 AIRBORNE

TABLE 18 AIRBORNE: RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 19 AIRBORNE: RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 20 AIRBORNE: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 AIRBORNE: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2.1 MILITARY AIRCRAFT

TABLE 22 MILITARY AIRCRAFT: RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 23 MILITARY AIRCRAFT: RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2.1.1 Fighter Aircraft

9.2.1.1.1 Fighter aircraft are equipped with powerful surveillance systems to provide air-to-air and air-to-ground surveillance, which require radome protection

9.2.1.2 Transport Aircraft

9.2.1.2.1 Transport aircraft are being fitted with modern radome systems to enhance the situational awareness of the operator.

9.2.1.3 Trainer aircraft

9.2.1.3.1 Trainer aircraft are fitted with radome systems for hands-on experience of onboard communication and radar equipment

9.2.1.4 Reconnaissance aircraft

9.2.1.4.1 Increasing need to detect cross-border infiltrations will fuel the radome market

9.2.1.5 Special mission aircraft

9.2.1.5.1 Special mission aircraft are primarily used to collect imagery intelligence, signals intelligence.

9.2.2 COMMERCIAL AIRCRAFT

TABLE 24 COMMERCIAL AIRCRAFT: RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 25 COMMERCIAL AIRCRAFT: RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2.2.1 Narrow-body aircraft (NBA)

9.2.2.1.1 Narrow-body aircraft use low-reflection radomes for optimum performance of various radar systems, such as weather radar.

9.2.2.2 New mid-size aircraft

9.2.2.2.1 Increase in domestic air traffic in various countries will fuel the growth of mid-size aircraft radome market

9.2.2.3 Wide-body aircraft (WBA)

9.2.2.3.1 Growth of global travel industry will fuel market growth

9.2.3 BUSINESS JETS

9.2.3.1 Increase in number of high net-worth individuals worldwide will fuel the growth of business jet radome market

9.2.4 HELICOPTERS

TABLE 26 HELICOPTERS: RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 27 HELICOPTERS: RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2.4.1 Commercial helicopters

9.2.4.1.1 Rising use of helicopters in transportation, touring, and VIP movement will fuel the demand for helicopter radomes

9.2.4.2 Military helicopters

9.2.4.2.1 Military helicopters use radar and surveillance equipment to locate and track friendly as well as enemy forces

9.2.5 UAV

TABLE 28 UAV: RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 29 UAV: RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.2.5.1 Commercial UAV

9.2.5.1.1 Integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) in UAVs will fuel the UAV radome market

9.2.5.2 Military UAV

9.2.5.2.1 Rising border disputes across the globe will fuel the market for military UAV radome

9.2.6 URBAN AIR MOBILITY (UAM)

9.2.6.1 Growing demand for alternative modes of transportation in urban cities will fuel the growth of UAM radome market

9.2.7 AEROSTATS

9.2.7.1 Need for surveillance to monitor border disputes and drug trafficking will fuel the radome market

9.3 GROUND

TABLE 30 GROUND: RADOME MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 31 GROUND: RADOME MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 32 GROUND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 GROUND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3.1 TELECOM TOWERS

9.3.1.1 Radomes provide protection to antennas and transponders on telecom towers from damage and extreme weather

9.3.2 AIR TRAFFIC CONTROL

9.3.2.1 Rising investments in commercial airports will fuel the ATC radome market

9.3.3 COMMAND CENTERS

9.3.3.1 Radome systems ensure that actionable intelligence and mission orders are communicated through high quality

9.3.4 GROUND VEHICLES

TABLE 34 GROUND VEHICLES: RADOME MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 35 GROUND VEHICLES: RADOME MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.3.4.1 Command & control vehicles

9.3.4.1.1 Command and control vehicles use radar systems to detect intrusions and issue warnings of any incoming air or land attack

9.3.4.2 Self-propelled artillery vehicles

9.3.4.2.1 Advanced self-propelled artillery vehicles with radar and communication equipment will drive the radome market growth

9.3.4.3 Unmanned ground vehicles (UGV)

9.3.4.3.1 Unmanned ground vehicles (UGVS) require sensors for navigation as well as to track and identify targets and engage them

9.3.4.4 Commercial Vehicles

9.3.4.4.1 Increasing market penetration of radar-based driver assistance systems will fuel the radome market

9.4 NAVAL

TABLE 36 NAVAL: RADOME MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 37 NAVAL: RADOME MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 38 NAVAL: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 NAVAL: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4.1 COMMERCIAL VESSELS

9.4.1.1 Passenger vessels

9.4.1.1.1 Long-range passenger vessels use advanced navigational radar systems that require radome protection

9.4.1.2 Tankers

9.4.1.2.1 Increase in global commodity trade will drive market growth

9.4.1.3 Bulk carriers

9.4.1.3.1 Bulk carrier vessels use advanced navigational radar systems that require radome protection

9.4.1.4 Containers

9.4.1.4.1 Container ships use advanced radar and communication antenna equipment which are protected by radomes

9.4.1.5 Dry cargo vessels

9.4.1.5.1 Increase in global commodity trade will drive market growth

9.4.1.6 General cargo vessels

9.4.1.6.1 General cargo vessels use advanced navigational radar systems that require radome protection

9.4.2 MILITARY VESSELS

9.4.2.1 Submarines

9.4.2.1.1 Increase in deliveries of submarines will directly impact the radome market

9.4.2.2 Frigates

9.4.2.2.1 Frigates are fitted with sophisticated command and control systems, sensor suites that require radome protection

9.4.2.3 Destroyers

9.4.2.3.1 Increase in global naval tensions will fuel the radome market

9.4.2.4 Corvettes

9.4.2.5 Increase in global tension between countries will drive the growth of the market

9.4.2.6 Aircraft carriers

9.4.2.6.1 Increased requirement for security on coastal borders will drive the market growth

9.4.3 UNMANNED UNDERWATER VEHICLES (UUV)

9.4.3.1 Advancements in autonomous technology and its integration with unmanned systems will fuel the market growth

10 RADOME MARKET, BY FREQUENCY (Page No. - 110)

10.1 INTRODUCTION

10.2 CLASSIFICATION OF BANDS BY FREQUENCY

FIGURE 26 MULTI-BAND SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 41 RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

10.2.1 HF/UHF/VHF-BAND

10.2.1.1 HF/UHF/VHF band offers benefits during long-range surveillance and tracking

TABLE 42 HF/UHF/VHF-BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 HF/UHF/VHF-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.2 L-BAND

10.2.2.1 L-Band band radar systems are used extensively for fleet management and asset tracking

TABLE 44 L- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 L-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.3 S-BAND

10.2.3.1 S-band radar radomes are lightweight and suitable for corvettes, offshore patrol vessels, and frigates.

TABLE 46 S- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 S-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.4 C-BAND

10.2.4.1 C-band radar systems and radome systems are used for long-range military battlefield and ground surveillance

TABLE 48 C- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 49 C-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.5 X-BAND

10.2.5.1 Radomes for x-band radar systems are specially designed to minimize the attenuation

TABLE 50 X- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 51 X-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.6 KU-BAND

10.2.6.1 Ku-bands provide wide beam coverage and higher throughput in comparison with lower bands

TABLE 52 KU- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 KU-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.7 KA-BAND

10.2.7.1 Ka-band transmits data at a higher rate as compared to Ku-Band

TABLE 54 KA- BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 55 KA-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2.8 MULTI-BAND

10.2.8.1 Multi-band radar systems are used for coherent detection and tracking of moving target objects

TABLE 56 MULTI-BAND: RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 57 MULTI-BAND: RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 122)

11.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC RADOME MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 58 RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 59 RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 COVID-19 IMPACT ON NORTH AMERICA

11.2.2 PESTE ANALYSIS: NORTH AMERICA

FIGURE 28 NORTH AMERICA: RADOME MARKET SNAPSHOT

TABLE 60 NORTH AMERICA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 61 NORTH AMERICA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 65 NORTH AMERICA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA RADOME MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 67 NORTH AMERICA RADOME MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.3 US

11.2.3.1 Fighter aircraft fleet modernization program to drive the market

FIGURE 29 US: MILITARY SPENDING, 2014–2021 (USD BILLION)

TABLE 68 US RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 69 US RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 70 US RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 71 US RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Increasing R&D investments to drive the market

FIGURE 30 CANADA: MILITARY SPENDING, 2014–2019 (USD BILLION)

TABLE 72 CANADA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 73 CANADA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 74 CANADA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 75 CANADA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 COVID-19 IMPACT ON EUROPE

11.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE: RADOME MARKET SNAPSHOT

TABLE 76 EUROPE RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 77 EUROPE RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 78 EUROPE RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 79 EUROPE: RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 80 EUROPE RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 81 EUROPE RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 82 EUROPE RADOME MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 83 EUROPE RADOME MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.3 RUSSIA

11.3.3.1 Growing investments in surveillance systems to drive the market

TABLE 84 RUSSIA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 85 RUSSIA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 86 RUSSIA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 87 RUSSIA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Need to detect and stop illegal immigrants through UAV-based surveillance to drive the market

TABLE 88 GERMANY RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 89 GERMANY RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 90 GERMANY RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 91 GERMANY RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.5 UK

11.3.5.1 Emphasis on replacing existing airborne radar systems with advanced early warning and control (AEW&C) systems

to drive the market

TABLE 92 UK RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 93 UK RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 94 UK RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 95 UK RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Demand for surveillance drones for ISR missions to drive the market

TABLE 96 ITALY RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 97 ITALY RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 98 ITALY RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 99 ITALY RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.7 FRANCE

11.3.7.1 Demand for airborne surveillance systems for command & control operations to drive the market

TABLE 100 FRANCE RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 101 FRANCE RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 102 FRANCE RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 103 FRANCE RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 104 REST OF EUROPE RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 105 REST OF EUROPE RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 106 REST OF EUROPE RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 107 REST OF EUROPE RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 COVID-19 IMPACT ON ASIA PACIFIC

11.4.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 32 ASIA PACIFIC: RADOME MARKET SNAPSHOT

TABLE 108 ASIA PACIFIC RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 111 ASIA PACIFIC: RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC RADOME MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC RADOME MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.3 CHINA

11.4.3.1 Development of advanced early-warning aircraft radar to drive the market

TABLE 116 CHINA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 117 CHINA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 118 CHINA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 119 CHINA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Uplifting of self-imposed defense equipment export ban to drive the market

TABLE 120 JAPAN RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 121 JAPAN RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 122 JAPAN RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 123 JAPAN RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.5 INDIA

11.4.5.1 Procurement of advanced airborne warning and control systems to drive the market

TABLE 124 INDIA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 125 INDIA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 126 INDIA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 127 INDIA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Need for advanced radar to detect stealth aircraft to drive the market

TABLE 128 SOUTH KOREA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 129 SOUTH KOREA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 130 SOUTH KOREA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 131 SOUTH KOREA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 132 REST OF ASIA PACIFIC RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 MIDDLE EAST COVID-19 IMPACT

11.5.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 33 MIDDLE EAST: RADOME MARKET SNAPSHOT

TABLE 136 MIDDLE EAST RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 137 MIDDLE EAST RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 138 MIDDLE EAST RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 139 MIDDLE EAST: RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 140 MIDDLE EAST RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 141 MIDDLE EAST RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 142 MIDDLE EAST RADOME MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 143 MIDDLE EAST RADOME MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.3 SAUDI ARABIA

11.5.3.1 Demand for fighter aircraft with airborne warning and control systems to drive the market

TABLE 144 SAUDI ARABIA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 145 SAUDI ARABIA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 146 SAUDI ARABIA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 147 SAUDI ARABIA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 ISRAEL

11.5.4.1 Presence of major manufacturers of airborne radar to drive the market

TABLE 148 ISRAEL RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 149 ISRAEL RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 150 ISRAEL RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 151 ISRAEL RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.5 UAE

11.5.5.1 Focus on strengthening defense capability to drive the market

TABLE 152 UAE RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 153 UAE RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 154 UAE RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 155 UAE RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST

TABLE 156 REST OF MIDDLE EAST RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 157 REST OF MIDDLE EAST RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 160 REST OF THE WORLD RADOME MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 161 REST OF THE WORLD RADOME MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 162 REST OF THE WORLD RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 163 REST OF THE WORLD RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 164 REST OF THE WORLD RADOME MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 165 REST OF THE WORLD RADOME MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 166 REST OF THE WORLD RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 167 REST OF THE WORLD RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.1 COVID-19 IMPACT ON REST OF THE WORLD

11.6.2 PESTLE ANALYSIS: REST OF THE WORLD

11.6.3 LATIN AMERICA

11.6.3.1 Demand for advanced surveillance, navigation, and communication capabilities to drive the market

TABLE 168 LATIN AMERICA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 169 LATIN AMERICA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 170 LATIN AMERICA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 171 LATIN AMERICA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.4 AFRICA

11.6.4.1 Growth in demand for general aviation in next 20 years to drive the market

TABLE 172 AFRICA RADOME MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 173 AFRICA RADOME MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 174 AFRICA RADOME MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 175 AFRICA RADOME MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 172)

12.1 INTRODUCTION

12.2 COMPETITIVE OVERVIEW

TABLE 176 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE RADOME MARKET BETWEEN 2018 AND 2020

FIGURE 34 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

12.3 MARKET SHARE OF KEY PLAYERS, 2020

FIGURE 35 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE RADOME MARKET, 2020

TABLE 177 RADOME MARKET: DEGREE OF COMPETITION

12.4 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 36 RANKING OF TOP PLAYERS IN THE RADOME MARKET, 2020

FIGURE 37 REVENUE ANALYSIS OF RADOME MARKET PLAYERS, 2017-2020

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING, 2020

12.6 STARTUPS/SMES EVALUATION QUADRANT

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING, (STARTUPS/SME) 2020

12.7 COMPETITIVE BENCHMARKING

TABLE 178 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 179 COMPANY APPLICATION FOOTPRINT

TABLE 180 COMPANY PRODUCT FOOTPRINT

TABLE 181 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE SCENARIO

12.8.1 DEALS, 2018–2021

TABLE 182 DEALS, 2018–2021

13 COMPANY PROFILES (Page No. - 188)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 L3HARRIS TECHNOLOGIES

TABLE 183 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 40 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 184 L3HARRIS TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 185 L3HARRIS TECHNOLOGIES: DEALS

13.2.2 BAE SYSTEMS PLC

TABLE 186 BAE SYSTEMS PLC: BUSINESS OVERVIEW

FIGURE 41 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 187 BAE SYSTEMS: DEALS

13.2.3 COBHAM PLC

TABLE 188 COBHAM PLC: BUSINESS OVERVIEW

FIGURE 42 COBHAM PLC: COMPANY SNAPSHOT

TABLE 189 COBHAM PLC: DEALS

13.2.4 RAYTHEON TECHNOLOGIES

TABLE 190 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 43 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 191 RAYTHEON TECHNOLOGIES: DEALS

13.2.5 LOCKHEED MARTIN CORPORATION

TABLE 192 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 44 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 193 LOCKHEED MARTIN CORPORATION: DEALS

13.2.6 GENERAL DYNAMICS

13.2.6.1 Business overview

TABLE 194 GENERAL DYNAMICS: BUSINESS OVERVIEW

FIGURE 45 GENERAL DYNAMICS: COMPANY SNAPSHOT

TABLE 195 GENERAL DYNAMICS: DEALS

13.2.7 JENOPTIK

TABLE 196 JENOPTIK: BUSINESS OVERVIEW

FIGURE 46 JENOPTIK: COMPANY SNAPSHOT

TABLE 197 JENOPTIK: DEALS

13.2.8 SAINT-GOBAIN

TABLE 198 SAINT-GOBAIN: BUSINESS OVERVIEW

FIGURE 47 SAINT-GOBAIN: COMPANY SNAPSHOT

TABLE 199 SAINT-GOBAIN: DEALS

13.2.9 NORDAM

TABLE 200 NORDAM: BUSINESS OVERVIEW

TABLE 201 NORDAM: DEALS

13.2.10 CPI

TABLE 202 CPI: BUSINESS OVERVIEW

TABLE 203 CPI: DEALS

13.2.11 FLIR SYSTEMS (RAYMARINE)

TABLE 204 FLIR SYSTEMS: BUSINESS OVERVIEW

FIGURE 48 FLIR SYSTEMS: COMPANY SNAPSHOT

13.2.12 NORTHROP GRUMMAN CORPORATION

TABLE 205 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 49 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 206 NORTHROP GRUMMAN: DEALS

13.2.13 COMTECH TELECOMMUNICATIONS

TABLE 207 COMTECH TELECOMMUNICATIONS: BUSINESS OVERVIEW

TABLE 208 COMTECH TELECOMMUNICATIONS: DEALS

13.2.14 ANTENNAS FOR COMMUNICATIONS

TABLE 209 ANTENNAS FOR COMMUNICATIONS: BUSINESS OVERVIEW

TABLE 210 ANTENNAS FOR COMMUNICATIONS: DEALS

13.2.15 THE BOEING COMPANY

TABLE 211 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 50 THE BOEING COMPANY: COMPANY SNAPSHOT

13.2.16 THALES GROUP

TABLE 212 THALES GROUP: BUSINESS OVERVIEW

FIGURE 51 THALES GROUP: COMPANY SNAPSHOT

13.2.17 VERDANT TELEMETRY & ANTENNA SYSTEMS

TABLE 213 VERDANT TELEMETRY & ANTENNA SYSTEMS: BUSINESS OVERVIEW

13.2.18 KELVIN HUGHES

TABLE 214 KELVIN HUGHES: BUSINESS OVERVIEW

13.2.19 STARWIN INDUSTRIES

TABLE 215 STARWIN INDUSTRIES: BUSINESS OVERVIEW

13.2.20 TORAY ADVANCED COMPOSITES

TABLE 216 TORAY ADVANCED COMPOSITES: BUSINESS OVERVIEW

13.2.21 ROYAL ENGINEERED COMPOSITES

TABLE 217 ROYAL ENGINEERED COMPOSITES: BUSINESS OVERVIEW

13.2.22 KITSAP COMPOSITES

TABLE 218 KITSAP COMPOSITES: BUSINESS OVERVIEW

13.2.23 HARBIN TOPFRP COMPOSITE CO., LTD (HTC)

TABLE 219 HARBIN TOPFRP COMPOSITE CO. LTD (HTC): BUSINESS OVERVIEW

13.3 OTHER PLAYERS

13.3.1 DELTA G DESIGN

13.3.2 KAMAN COMPOSITES

*Details on Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 234)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved various activities in estimating the market size for Radome market. Exhaustive secondary research was undertaken to collect information on the Radome market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Radome market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study, such as annual reports, Secondary sources include Publications of Statista, Clarksons Research, the International Maritime Organization (IMO). The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA). The corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases and the US Department of Defense: Publications, press releases & investor presentations of companies, certified publications, and articles by recognized authors were also referred to for information on the Radome market.

Primary Research

The Radome market comprises several stakeholders such as army, navy, air forces, regulatory bodies, research institutes and organizations, wholesalers, retailers, and distributors of Radome components in its supply chain. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the Radome market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the Radome market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Radome market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Radome market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Radome market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Radome market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the Radome market based on offering, application, platform, frequency band, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the Radome market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the Radome market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Radome market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Radome market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Radome Market