Real World Evidence Solutions Market by Component (Services, Disparate Data Sets, (Claims, Clinical, Pharmacy, Patient), Application (Oncology, Cardiovascular, Neurology, Immunology), End User (Pharma, Medtech, Payers, Providers) & Region - Global Forecast to 2027

Updated on : July 12, 2023

The global real world evidence solutions market in terms of revenue was estimated to be worth $1.5 billion in 2022 and is poised to reach $2.9 billion by 2027, growing at a CAGR of 15.2% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new edition of the report includes profiles for Thermo Fisher Scientific Inc. (US), Elevance Health Inc. (US), Cegedim Health Data (France), LabCorp Holdings (US), HealthVerity Inc. (US), and Datavant (US). The industry insights chapters include value chain analysis, Porter’s five forces analysis, technology analysis, patent analysis, key conferences and events in 2022–2023, pricing analysis, and key stakeholders and buying criteria. The growth of this market is primarily driven by the increasing growth in clinical trials and the shift from volume-based to value-based care. Using RWE and RWD can inform better protocol design, thereby reducing the number of costly protocol amendments, and can enable the creation of synthetic control arms to accelerate trial execution and decrease overall costs. Similarly, RWE can accelerate label expansion and decrease the overall cost of the evidence needed for filing. Because of these benefits, the use of real-world evidence solutions is increasing in drug and medical device R&D activities.

To know about the assumptions considered for the study, Request for Free Sample Report

Real World Evidence Solutions Market Dynamics

Driver: R&D spending has been increased for the development of new pharmaceutical products and medical devices.

Most pharmaceutical, biopharmaceutical, and medical device companies continue to invest heavily in the development of novel drugs and devices. R&D is particularly important in the pharmaceutical industry. To meet the demands for both drug discovery and development, pharmaceutical and biopharmaceutical companies are opting for fully integrated or functional outsourcing services, from the early development stage to the late-stage development phase. Among all industry sectors, the pharmaceutical industry spends the largest percentage of its revenue on research and development. This growth in R&D expenditure, fueled by the need for numerous preclinical and clinical services during the drug development process, is expected to drive the growth of the market.

Restraint: Reluctance of medical practitioners and researchers to rely on real-world studies

Despite the rapid adoption of RWE across applications, some stakeholders remain reluctant to rely on real-world studies. For instance, although payers have started using RWE, they prefer to use randomised clinical trials (RCTs) instead of external observational data to inform drug coverage decisions. The major reason for this preference is the presence of multiple standards and methods for analysing real-world clinical experience evidence. Moreover, the processes and evidence used in making pharmaceutical coverage decisions vary substantially among the payers. These variations can affect reimbursement, patient access, and potentially healthcare outcomes across health plans during the pharmaceutical technology assessment (PTA) process. Thus, stakeholders are reluctant to utilise evidence lacking a standard data generation procedure.

Opportunity: Increased emphasis on end-to-end real world evidence services

The healthcare ecosystem is changing, and there is increased scrutiny on healthcare costs as stakeholders in the healthcare industry seek new alternatives to deal with the unsustainable cost burden and relatively poor return on investment. In order to prove value, companies need strong evidence of lifecycle management capabilities. As a result, an opportunity for an end-to-end approach to leverage the data, evidence, and knowledge assets of a life sciences organisation has been created, which is helping to break down the conventional silos and is enabling insight-driven decision-making from the phase of product R&D to its commercialization. This includes implementing an effective governance strategy, taking help from technologies such as cloud and self-service analytics, and acquiring the ability to integrate data sets and understand the appropriate resources for the necessary analytics (and tactical issues around data access and quality).

Challenge: Lack of universally accepted methodologies, standards, and data processing infrastructure

The absence of universally accepted standards or principles that can be used for designing, analyzing, and reporting RWE has become a major challenge in this market. This lack of consensus has led to a situation where RWE lacks the quality to be part of the body of evidence used to determine the comparative effectiveness of different treatment options. This has reduced the potential value of the information produced, thus reducing the incentive to generate it. In addition, this further reduces the inclination of major stakeholders to adopt real world evidence solutions.

The services segment was the largest segment in the real world evidence solutions industry

The rise in the need to convert data into actionable evidence increased the need to reduce drug development delays, and the availability of a large volume of healthcare data is one of the major factors driving the growth of this segment of real world evidence solutions market. Vendors often customise the required services as per the client's requirements, which proves time- and cost-effective for clients in comparison to procuring the data sets and analysing them to generate meaningful information. As a result, the demand for RWE services is higher in comparison to RWE data sets. RWE experts communicate and collaborate with the subject matter experts of the pharmaceutical and medical device companies to offer services to develop intelligent RWE strategies (consulting services) and use the analytical capabilities to provide meaningful statistical insights.

The drug development and approvals segment dominates the real world evidence solutions industry

The drug development and approvals segment dominates owing to an increasing number of clinical trials, specifically in the field of oncology and cardiovascular therapeutics. Furthermore, post-pandemic, therapeutic developments for COVID-19 infection saw a significant boost. The drug development and approvals segment is further sub-segmented into oncology, cardiovascular disease, neurology, immunology, and other therapeutic areas. The oncology segment dominates owing to the rising prevalence of cancer and the increasing number of clinical trials and studies focused on cancer treatment and prevention.

Pharmaceutical and medical device companies are expected to remain the fastest-growing end users in the real world evidence solutions industry.

The fast growth of pharmaceutical and medical device companies can be attributed to the increasing importance of RWE studies in drug approvals, the prevention of costly drug recalls, and the assessment of drug performance in real-world settings. Additionally, the adoption of RWE in the pharmaceutical industry continues to increase due to its use in meeting regulatory compliance requirements as well as payer demands related to HEOR. Pharmaceutical companies require data describing both the approved and medically accepted alternative uses of previously approved drugs. RWE data is needed for new drugs to successfully pass through clinical phases. Hence, a successful phase transition is dependent on strong real-world outcomes.

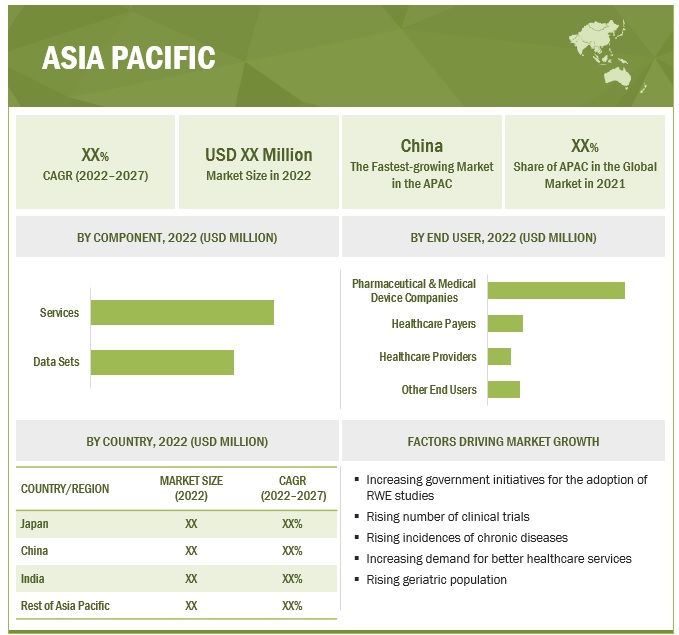

Asia Pacific is expected to witness the highest growth rate in the real world evidence solutions industry.

North America held the largest share of the real world evidence solutions market, while Asia Pacific is expected to be the fastest-growing region over the forecast period. Factors such as the rising number of clinical trials, increasing government initiatives for the adoption of RWE studies, increasing incidences of chronic diseases, increasing demand for better healthcare services, and the rising geriatric population are supporting the growth of the RWE solutions market in the Asia Pacific region. Additionally, countries such as Japan and China in the region have a well-established clinical trial infrastructure, a strong medical workforce, robust healthcare capabilities, and stringent quality standards, which are supporting market growth in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

The real world evidence solutions market is dominated by a few globally established players such as IQVIA Holdings Inc. (US), IBM Corporation (US), OPTUM Inc. (US), Icon Plc (Ireland), Syneos Health Inc. (US), and Parexel International Corporation (US).

Scope of the Real World Evidence Solutions Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.5 billion |

|

Projected Revenue by 2027 |

$2.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 15.2% |

|

Market Driver |

R&D spending has been increased for the development of new pharmaceutical products and medical devices |

|

Market Opportunity |

Increased emphasis on end-to-end real world evidence services |

The study categorizes the global real world evidence solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Services

-

Data Sets

-

Disparate Data Sets

- Clinical Settings Data

- Claims Data

- Pharmacy Data

- Patient-Powered Data

- Registry-Based Data Sets

- Integrated Data Sets

-

Disparate Data Sets

By Application

-

Drug Development And Approvals

- Oncology

- Neurology

- Immunology

- Cardiovascular Disease

- Other Therapeutic Areas

- Medical Device Development And Approvals

- Post-Market Surveillance

- Market Access Reimbursement/Coverage Decision Making

- Clinical And Regulatory Decision-Making

By End User

- Pharmaceutical & Medical Device Companies

- Healthcare Providers

- Healthcare Payers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Real World Evidence Solutions Industry

- In August 2022, Trinity Life Sciences (US), announced a partnership with Bain & Company (US). The partnership is intended to pair the extensive experience of Bain & Company (US) in the Life Sciences value chain with the evidence-based solutions of Trinity Life Sciences (US).

- In July 2022, TriNetX LLC announced the collaboration with Pediatric Medical Centers (US), to help Pediatric Medical Centers including Children’s National Hospital (US), WVU Medicine Children’s (US), and John Hopkins All Children Hospitals (US), to improvise the investor-initiated research utilizing the pediatric real-world data.

- In December 2021, TriNetX LLC announced the launch of Diversity Lens, an analytic feature that enables healthcare and life sciences organizations to make use of real-world data to comprehend and address racial and ethnic differences in clinical trial patient participation.

- In April 2021, IQVIA Holdings Inc. announced the launch of Connected Intelligence Platform. This platform is an innovative approach that enables customers in the life sciences industry to discover powerful new insights, drive smarter decision-making, and get treatments to patients faster.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the real world evidence solutions market?

The real world evidence solutions market boasts a total revenue value of $2.9 billion by 2027.

What is the estimated growth rate (CAGR) of the real world evidence solutions market?

The global real world evidence solutions market has an estimated compound annual growth rate (CAGR) of 15.2% and a revenue size in the region of $1.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION: REAL WORLD EVIDENCE SOLUTIONS MARKET

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION: SEGMENTAL EXTRAPOLATION

FIGURE 7 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 8 CAGR PROJECTIONS: OVERALL RWE SOLUTIONS MARKET

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 10 REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 DATA SETS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 DISPARATE DATA SETS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 REAL WORLD EVIDENCE SOLUTIONS MARKET OVERVIEW

FIGURE 17 SUPPORT FROM REGULATORY BODIES FOR THE USE OF RWE SOLUTIONS IS A MAJOR FACTOR DRIVING THE MARKET GROWTH

4.2 ASIA PACIFIC: RWE SOLUTIONS MARKET, BY END USER AND COUNTRY (2021)

FIGURE 18 JAPAN ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

4.3 RWE SOLUTIONS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: MARKET (2022−2027)

FIGURE 20 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 RWE SOLUTIONS MARKET: DEVELOPED VS. EMERGING MARKETS

FIGURE 21 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 RWE SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rise in the geriatric population and the subsequent increase in the prevalence of chronic diseases

5.2.1.2 Shift from volume- to value-based care

5.2.1.3 Potential of RWE in reducing drug development costs and expediting the drug development process

5.2.1.4 Increased R&D spending for the development of new pharmaceutical products and medical devices

FIGURE 23 NUMBER OF CLINICAL TRIALS STARTED DURING 2015–2020

5.2.1.5 Support from regulatory bodies for the use of RWE solutions

5.2.2 RESTRAINTS

5.2.2.1 Reluctance of medical practitioners and researchers to rely on real-world studies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging markets

5.2.3.2 Rise in focus on end-to-end RWE services

5.2.4 CHALLENGES

5.2.4.1 Lack of universally accepted methodology standards and data processing infrastructure

5.2.4.2 Shortage of skilled professionals

6 INDUSTRY INSIGHTS (Page No. - 59)

6.1 INDUSTRY TRENDS

6.1.1 EMERGING ROLE OF WEARABLE DEVICES

FIGURE 24 UTILIZATION OF WEARABLES IN CLINICAL TRIALS, BY THERAPEUTIC AREA, 2019

6.1.2 SOCIAL MEDIA-SOURCED RWE

6.1.3 RISE IN THE USE OF RWD AND RWE ACROSS THE PHARMACEUTICAL INDUSTRY

FIGURE 25 RECOMMENDED INVESTMENT MODEL FOR RWD AND RWE

6.1.4 INTERNAL VS. OUTSOURCED RWE ANALYTICS APPROACH

FIGURE 26 INTERNAL VS. OUTSOURCED RWE ANALYTICS APPROACH

6.1.5 INCORPORATION OF ARTIFICIAL INTELLIGENCE IN RWD MANAGEMENT

6.2 REAL-WORLD DATA SOURCES

TABLE 4 INDICATIVE LIST OF NATIONAL DATABASES IN DEVELOPED COUNTRIES

6.3 ECOSYSTEM ANALYSIS

FIGURE 27 ECOSYSTEM COVERAGE: PARENT MARKET (HEALTHCARE IT SOLUTIONS)

FIGURE 28 ECOSYSTEM COVERAGE: RWE SOLUTIONS MARKET

6.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 BARGAINING POWER OF SUPPLIERS

6.4.3 BARGAINING POWER OF BUYERS

6.4.4 THREAT OF SUBSTITUTES

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 PRICING ANALYSIS

6.5.1 AVERAGE SELLING PRICE

6.5.2 HCIT EXPENDITURE/PRICING ANALYSIS

6.5.2.1 North America

TABLE 6 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

6.5.2.2 Europe

6.5.2.3 Asia Pacific

TABLE 7 JAPAN: HEALTHCARE IT INITIATIVES AND FUNDING

6.6 TECHNOLOGY ANALYSIS

6.7 REGULATORY BODIES, GOVERNMENTS, AND OTHER ORGANIZATIONS

6.7.1 NORTH AMERICA

6.7.1.1 Case examples

6.7.2 EUROPE

6.7.3 ASIA PACIFIC

6.7.3.1 China

6.7.3.2 Japan

6.8 PATENT ANALYSIS

6.8.1 PATENT PUBLICATION TRENDS FOR RWE SOLUTIONS

FIGURE 29 GLOBAL PATENT PUBLICATION TRENDS IN THE RWE SOLUTIONS MARKET, 2016–2021

6.8.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 30 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR MEDICAL SIMULATION PATENTS (JANUARY 2011 TO JUNE 2021)

6.8.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN THE MARKET

FIGURE 31 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR RWE SOLUTIONS, 2016–2021

TABLE 8 LIST OF PATENTS IN THE RWE SOLUTIONS MARKET, 2019–2022

6.9 KEY CONFERENCES AND EVENTS (2022-2023)

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

6.10.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 11 KEY BUYING CRITERIA FOR TOP 3 END USERS

7 REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT (Page No. - 81)

7.1 INTRODUCTION

TABLE 12 MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

7.2 SERVICES

7.2.1 RISING NEED TO CONVERT DATA INTO ACTIONABLE EVIDENCE TO DRIVE DEMAND

TABLE 13 RWE SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 14 RWE SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DATA SETS

TABLE 15 DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 DISPARATE DATA SETS

TABLE 17 DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 18 DISPARATE DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1.1 Clinical settings data set

7.3.1.1.1 Increasing utilization of EHR data for trial recruitment to fuel growth

FIGURE 34 ADOPTION OF EHR BY HOSPITAL SERVICE TYPE, 2019-2021

TABLE 19 CLINICAL SETTINGS DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 20 CLINICAL SETTINGS DISPARATE DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1.2 Claims data set

7.3.1.2.1 Growing need to understand the economic benefits of drug reimbursement by payers to drive growth

TABLE 21 CLAIMS DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 22 CLAIMS DISPARATE DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1.3 Pharmacy data set

7.3.1.3.1 Increasing adoption of e-prescribing systems to drive growth

FIGURE 35 TOTAL E-PRESCRIPTIONS AND CONTROLLED SUBSTANCE PRESCRIPTIONS IN THE US (2018-2021)

TABLE 23 PHARMACY DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 24 PHARMACY DISPARATE DATA SET MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1.4 Patient-powered data set

7.3.1.4.1 Increasing need to access opinions on diseases and treatments across social media to drive growth

TABLE 25 PATIENT-POWERED DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 26 RWE PATIENT-POWERED DISPARATE DATA MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1.5 Registry-based data sets

7.3.1.5.1 Increasing number of disease registries is driving the demand for registry-based data sets in evidence generation

TABLE 27 USE OF REGISTRIES FOR EVIDENCE GENERATION

TABLE 28 REGISTRY-BASED DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 29 REGISTRY-BASED DISPARATE DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 INTEGRATED DATA SETS

7.3.2.1 Increasing demand for integrated data from multiple sources to drive growth

TABLE 30 INTEGRATED DATA SETS OFFERED BY KEY MARKET PLAYERS

TABLE 31 INTEGRATED DATA SETS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 REAL WORLD EVIDENCE SOLUTIONS MARKET, BY APPLICATION (Page No. - 98)

8.1 INTRODUCTION

FIGURE 36 NUMBER OF CLINICAL TRIALS (COMPLETED), BY CONDITION/DISEASE, SEPTEMBER 2022

TABLE 32 RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 DRUG DEVELOPMENT AND APPROVALS

TABLE 33 MARKET IN DRUG DEVELOPMENT AND APPROVALS, BY TYPE 2020–2027 (USD MILLION)

8.2.1 ONCOLOGY

8.2.1.1 Growing number of clinical trials focused on cancer treatment to drive growth

TABLE 34 LIST OF PIPELINE DRUGS FOR ONCOLOGY (2018)

TABLE 35 DRUG DEVELOPMENT AND APPROVALS MARKET IN ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2 CARDIOVASCULAR DISEASE

8.2.2.1 High prevalence of CVD to drive growth

TABLE 36 LIST OF PIPELINE DRUGS FOR CARDIOVASCULAR DISEASE (BY FEBRUARY 2022)

TABLE 37 DRUG DEVELOPMENT AND APPROVALS MARKET IN CARDIOVASCULAR DISEASE, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.3 NEUROLOGY

8.2.3.1 Growing prevalence of neurological disorders to drive growth

TABLE 38 DRUG DEVELOPMENT AND APPROVALS MARKET IN NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.4 IMMUNOLOGY

8.2.4.1 Increasing focus on developing innovative products to drive growth

TABLE 39 DRUG DEVELOPMENT AND APPROVALS MARKET IN IMMUNOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.5 OTHER THERAPEUTIC AREAS

TABLE 40 DRUG DEVELOPMENT AND APPROVALS MARKET IN OTHER THERAPEUTIC AREAS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 MEDICAL DEVICE DEVELOPMENT AND APPROVALS

8.3.1 INCREASING RESEARCH IN MEDICAL DEVICE DEVELOPMENT TO DRIVE DEMAND

TABLE 41 MARKET IN MEDICAL DEVICE DEVELOPMENT AND APPROVALS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 POST-MARKET SURVEILLANCE

8.4.1 EMR AND PRODUCT/PATIENT REGISTRIES HAVE BECOME KEY DATA SOURCES FOR GENERATING EVIDENCE IN POST-MARKET SURVEILLANCE

TABLE 42 MARKET IN POST-MARKET SURVEILLANCE, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 MARKET ACCESS AND REIMBURSEMENT/COVERAGE DECISION MAKING

8.5.1 GROWING USE OF RWE SOLUTIONS TO DEVELOP ECONOMIC AND BUDGET IMPACT MODELS

TABLE 43 RWE SOLUTIONS MARKET IN MARKET ACCESS AND REIMBURSEMENT/COVERAGE DECISION MAKING, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 CLINICAL AND REGULATORY DECISION MAKING

8.6.1 LIMITED VALIDITY OF RANDOMIZED CONTROLLED TRIALS DRIVING THE USE OF RWE SOLUTIONS IN THE SEGMENT

TABLE 44 MARKET IN CLINICAL AND REGULATORY DECISION MAKING, BY COUNTRY, 2020–2027 (USD MILLION)

9 REAL WORLD EVIDENCE SOLUTIONS MARKET, BY END USER (Page No. - 113)

9.1 INTRODUCTION

TABLE 45 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 PHARMACEUTICAL & MEDICAL DEVICE COMPANIES

9.2.1 INCREASED R&D EXPENDITURE IN INNOVATIVE MEDICINES TO DRIVE MARKET GROWTH

FIGURE 37 FDA PHASE TRANSITION SUCCESS RATES, 2011–2020

FIGURE 38 ANNUAL DRUG APPROVALS BY CDER (FDA), 2011–2021

FIGURE 39 R&D SPENDING OF PHARMA MEMBER COMPANIES, 2011–2020

TABLE 46 RWE SOLUTIONS MARKET FOR PHARMACEUTICAL & MEDICAL DEVICE COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 HEALTHCARE PAYERS

9.3.1 INCREASED FOCUS ON OUTCOME-BASED PAYMENT MODELS TO DRIVE DEMAND

TABLE 47 RWE SOLUTIONS MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 HEALTHCARE PROVIDERS

9.4.1 RISE IN THE NEED TO IMPROVE THE PROFITABILITY OF HEALTHCARE PROVIDERS TO BOOST USE

TABLE 48 RWE SOLUTIONS MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.5 OTHER END USERS

TABLE 49 RWE SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

10 RWE SOLUTIONS MARKET, BY REGION (Page No. - 122)

10.1 INTRODUCTION

TABLE 50 RWE SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: RWE SOLUTIONS MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 The US accounted for the largest share of the North American market

TABLE 58 US: MACROECONOMIC INDICATORS

TABLE 59 US: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 60 US: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 US: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 US: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 63 US: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 US: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing number of clinical trials in Canada to drive market growth

TABLE 65 CANADA: MACROECONOMIC INDICATORS

TABLE 66 CANADA: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 67 CANADA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 CANADA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 CANADA: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 CANADA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 CANADA: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 72 EUROPE: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 EUROPE: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 EUROPE: RWE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High pharmaceutical R&D spending in Germany to boost the market growth

TABLE 79 GERMANY: MACROECONOMIC INDICATORS

TABLE 80 GERMANY: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 81 GERMANY: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 GERMANY: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 GERMANY: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 GERMANY: RWE MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 The growing adoption of HTA in the UK supports market growth

TABLE 86 UK: MACROECONOMIC INDICATORS

TABLE 87 UK: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 88 UK: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 UK: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 UK: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 UK: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 UK: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High number of oncology clinical trials in France to drive market growth

TABLE 93 FRANCE: MACROECONOMIC INDICATORS

TABLE 94 FRANCE: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 FRANCE: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 FRANCE: RWE MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 The demand for RWE in Italy is high due to the widespread use of pay-for-outcomes

TABLE 100 ITALY: MACROECONOMIC INDICATORS

TABLE 101 ITALY: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 102 ITALY: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 ITALY: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 ITALY: RWE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 105 ITALY: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 ITALY: RWE MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising R&D expenditure to propel market growth in Spain

TABLE 107 SPAIN: MACROECONOMIC INDICATORS

TABLE 108 SPAIN: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 109 SPAIN: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 SPAIN: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 SPAIN: RWE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 SPAIN: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 SPAIN: RWE MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 114 REST OF EUROPE: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 115 REST OF EUROPE: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 REST OF EUROPE: RWE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: REAL WORLD EVIDENCE SOLUTIONS MARKET SNAPSHOT

TABLE 120 ASIA PACIFIC: RWE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Stringent regulatory scenario in Japan to restrain market growth

TABLE 127 JAPAN: MACROECONOMIC INDICATORS

TABLE 128 JAPAN: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 129 JAPAN: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 JAPAN: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 132 JAPAN: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Low cost of clinical trials and large pharmaceutical R&D base in China to drive market growth

TABLE 134 CHINA: MACROECONOMIC INDICATORS

TABLE 135 CHINA: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 136 CHINA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 CHINA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 CHINA: RWE MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 CHINA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 CHINA: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing adoption of outcomes-based research among pharmaceutical and medical device manufacturers in India to drive market growth

TABLE 141 INDIA: MACROECONOMIC INDICATORS

TABLE 142 INDIA: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 143 INDIA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 INDIA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 INDIA: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 146 INDIA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 148 REST OF ASIA PACIFIC: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INCREASED HEALTHCARE EXPENDITURE TO SUPPORT MARKET GROWTH

TABLE 154 LATIN AMERICA: REAL WORLD EVIDENCE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 155 LATIN AMERICA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 LATIN AMERICA: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 158 LATIN AMERICA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 GROWING AVAILABILITY OF HEALTHCARE FUNDING IN THE MIDDLE EAST OFFERS OPPORTUNITIES FOR MARKET GROWTH

TABLE 160 MIDDLES EAST & AFRICA: RWE SOLUTIONS MARKET, BY COMPONENT, 2020–2027 (USD MILLION)

TABLE 161 MIDDLES EAST & AFRICA: RWE SOLUTIONS DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 MIDDLES EAST & AFRICA: DISPARATE DATA SETS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 MIDDLES EAST & AFRICA: RWE SOLUTIONS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 164 MIDDLES EAST & AFRICA: RWE SOLUTIONS IN DRUG DEVELOPMENT AND APPROVALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 MIDDLES EAST & AFRICA: RWE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 181)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS /RIGHT TO WIN

TABLE 166 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE REAL WORLD EVIDENCE SOLUTIONS MARKET

11.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 42 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET

11.4 MARKET RANKING ANALYSIS

FIGURE 43 MARKET RANKING, BY KEY PLAYER, 2021

11.5 COMPETITIVE BENCHMARKING

TABLE 167 MARKET: DETAILED LIST OF SMALL & MEDIUM PLAYERS

11.6 COMPANY FOOTPRINT

11.6.1 END-USER FOOTPRINT OF COMPANIES

11.6.2 PRODUCT FOOTPRINT OF COMPANIES

11.6.3 REGIONAL FOOTPRINT OF COMPANIES

11.7 COMPANY EVALUATION QUADRANT

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

FIGURE 44 REAL WORLD EVIDENCE SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT (2021)

11.8 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

11.8.1 PROGRESSIVE COMPANIES

11.8.2 STARTING BLOCKS

11.8.3 RESPONSIVE COMPANIES

11.8.4 DYNAMIC COMPANIES

FIGURE 45 START-UP/SME EVALUATION QUADRANT (2021)

11.9 COMPETITIVE SCENARIO

11.9.1 FDA APPROVALS/SERVICE ENHANCEMENTS

TABLE 168 FDA APPROVALS/ENHANCEMENTS, 2019–2022

11.9.2 DEALS

TABLE 169 DEALS, 2019–2022

11.9.3 OTHER DEVELOPMENTS

TABLE 170 OTHER DEVELOPMENTS, 2019–2022

12 COMPANY PROFILES (Page No. - 198)

12.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 IQVIA HOLDINGS INC.

TABLE 171 IQVIA HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 46 IQVIA HOLDINGS INC: COMPANY SNAPSHOT (2021)

12.1.2 IBM CORPORATION (IBM)

TABLE 172 IBM CORPORATION: BUSINESS OVERVIEW

FIGURE 47 IBM CORPORATION: COMPANY SNAPSHOT (2021)

12.1.3 OPTUM INC. (A SUBSIDIARY OF THE UNITED HEALTH GROUP, INC.)

TABLE 173 OPTUM INC.: BUSINESS OVERVIEW

FIGURE 48 OPTUM INC.: COMPANY SNAPSHOT (2021)

12.1.4 ICON PLC.

TABLE 174 ICON PLC.: BUSINESS OVERVIEW

FIGURE 49 ICON PLC.: COMPANY SNAPSHOT (2021)

12.1.5 SYNEOS HEALTH, INC.

TABLE 175 SYNEOS HEALTH INC.: BUSINESS OVERVIEW

FIGURE 50 SYNEOS HEALTH INC.: COMPANY SNAPSHOT (2021)

12.1.6 PAREXEL INTERNATIONAL CORPORATION

TABLE 176 PAREXEL INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

12.1.7 THERMO FISHER SCIENTIFIC INC.

TABLE 177 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 51 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

12.1.8 LABCORP HOLDINGS

TABLE 178 LABCORP HOLDINGS: BUSINESS OVERVIEW

FIGURE 52 LABCORP HOLDINGS: COMPANY SNAPSHOT (2021)

12.1.9 ORACLE CORPORATION

TABLE 179 ORACLE CORPORATION: BUSINESS OVERVIEW

FIGURE 53 ORACLE CORPORATION: COMPANY SNAPSHOT (2021)

12.1.10 ELEVANCE HEALTH

TABLE 180 ELEVANCE HEALTH: BUSINESS OVERVIEW

FIGURE 54 ELEVANCE HEALTH: COMPANY SNAPSHOT (2021)

12.1.11 SAS INSTITUTE

TABLE 181 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 55 SAS INSTITUTE: COMPANY SNAPSHOT (2021)

12.1.12 AETION INC.

TABLE 182 AETION INC.: BUSINESS OVERVIEW

12.1.13 TRINETX LLC

TABLE 183 TRINETX LLC: BUSINESS OVERVIEW

12.1.14 TRINITY LIFE SCIENCES

TABLE 184 TRINITY LIFE SCIENCES: BUSINESS OVERVIEW

12.1.15 PERKINELMER INC.

TABLE 185 PERKINELMER INC.: BUSINESS OVERVIEW

FIGURE 56 PERKINELMER INC.: COMPANY SNAPSHOT (2021)

12.1.16 COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

TABLE 186 COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION: BUSINESS OVERVIEW

FIGURE 57 COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.17 CLINIGEN

TABLE 187 CLINIGEN: BUSINESS OVERVIEW

FIGURE 58 CLINIGEN: COMPANY SNAPSHOT (2021)

12.1.18 CEGEDIM HEALTH DATA

TABLE 188 CEGEDIM HEALTH DATA: BUSINESS OVERVIEW

FIGURE 59 CEGEDIM HEALTH DATA: COMPANY SNAPSHOT (2021)

12.1.19 VERANTOS INC.

TABLE 189 VERANTOS INC.: BUSINESS OVERVIEW

12.1.20 MEDPACE HOLDINGS INC.

TABLE 190 MEDPACE HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 60 MEDPCE HOLDINGS INC.: COMPANY SNAPSHOT (2021)

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 HEALTHVERITY INC.

12.2.2 DATAVANT

12.2.3 SYAPSE INC.

12.2.4 TEMPUS LABS INC.

12.2.5 FLATIRON HEALTH

13 APPENDIX (Page No. - 257)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The report presents a detailed assessment of the real world evidence solutions market, along with qualitative inputs and insights from MarketsandMarkets. This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify the segmentation types, industry trends, key players, competitive landscape of different solutions provided by market players, key player strategies, and key market dynamics, such as drivers, restraints, opportunities, and challenges.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; companies’ house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the real world evidence solutions market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

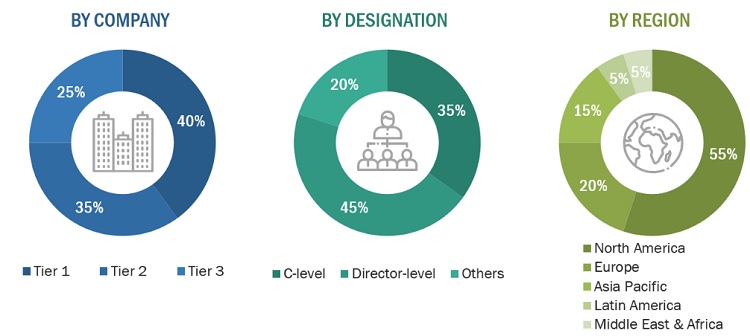

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, managing directors, marketing heads and sales directors, marketing managers, product managers and related key executives from various key companies and organizations operating in the real world evidence solutions market. The primary sources from the demand side included Directors, and strategy managers of pharmaceutical and medical device companies, insurance providers, healthcare providers, and department heads.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the real world evidence solutions market was arrived at after data triangulation from three different approaches- revenue share analysis, segmental extrapolation, and primary interviews. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Objectives of the Study

- To define, describe, and forecast the real world evidence solutions market on the basis of components, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall real world evidence solutions market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To profile the key players and comprehensively analyze their core competencies2 in terms of key developments, solution portfolios, and recent financials

- To track and analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the real world evidence solutions market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoAPAC market into Australia, South Korea, New Zealand, Hong Kong, Singapore, and other countries

- Further breakdown of the RoE market into Switzerland, Russia, the Netherlands, Nordic countries, and other countries

- Further breakdown of the Latin America market into Brazil, Mexico, and the Rest of Latin America

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Real World Evidence Solutions Market

Which are the different countries covered across the regions of the Global RWE Solutions Market?

Which geographical segment holds the major share of the global RWE Solutions Market?

What are the benefits of the emerging trends in the global RWE Solutions Market?