Recloser Market by Phase Type (Three Phase, Single Phase, and Triple-single Phase), Control Type (Electronic and Hydraulic), Voltage Rating (Up to 15 kV, 16-27 kV, and 28-38 kV), Insulation Medium (Oil, Air, and Epoxy) and Region - Global Forecast to 2027

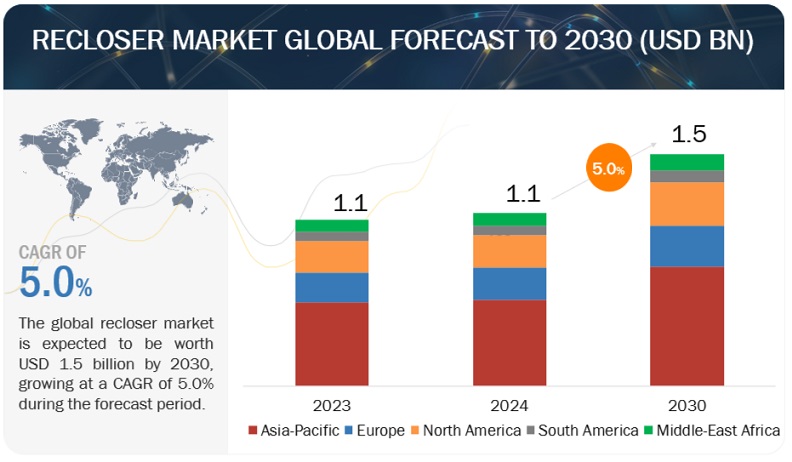

[227 Pages Report] The recloser market is expected to grow from an estimated USD 1.0 billion in 2022 to USD 1.3 billion by 2027, at a CAGR of 5.4% during the forecast period. The rising share of renewable energy is likely to create the demand for electricity distribution infrastructure upgrades, which would further fuel the demand for advanced protection devices such as reclosers.

To know about the assumptions considered for the study, Request for Free Sample Report

Recloser Market Dynamics

Driver: Growing renewable power generation and increasing investments in renewable energy

Start-ups in the US and Europe have raised record funds for promising energy storage, hydrogen, and renewable energy technologies. Renewable technologies have accounted for 70% of all power sector investments supported by public finance institutions since 2010. More than 60% of investment in renewables is from the private sector, although the role of governments in providing strong policy support has been key. Hence, the growth of renewable energy sources is a significant opportunity for the existing recloser market players. This scenario will benefit the global recloser industry as the need for green and clean energy rises.

Restraints: Availability of cheap alternatives to reclosers

Multiple manufacturers in the safety system industry have started producing cheap alternatives to reclosers. Developing countries such as India and China are among the fastest-growing markets for automatic reclosers. However, these are cost-cautious markets, and the price is an important parameter during purchases. The availability of cheaper substitutes such as PVB for reclosers is a threat to the growth of the recloser market in these high-growth regions.

Opportunities: Increasing investments in smart grids

Investment is increasing in all parts of the energy sector, but the main boost in recent years has come from the power sector—mainly in renewables and grids—and increased spending on end-use efficiency. A smart grid monitors and manages electricity transmission from the generation source to the end users. It minimizes cost and is an important enabler of energy security while maximizing system reliability, stability, and resilience. Also, several government bodies have added a reliability component to performance-based revenue regulations. These regulations have a financial incentive structure that may be one-sided, where distributors may face a penalty for not meeting the standards, or two-sided, where distributors can also receive a bonus for their extra work and contribution.

Challenges: Lack of investments by governments in grid stability

Financing renewable energy continues to face multiple conundrums, largely entrenched with the nature of the current financial market in general, such as short tenure of loans, high capital costs, and lack of adequate financing from the government. Governments of various countries are spending on increasing the existing grids and installing newer ones for better T&D of power. However, they are not investing enough toward ensuring grid stability. The installation of reclosers involves high capital expenditure, and these components are essential for line upgrades and modernization.

To know about the assumptions considered for the study, download the pdf brochure

Electronic segment, by control type, to emerge as the largest segment of the recloser market from 2022 to 2027

Based on the control type, the electronic segment holds the largest market share during the forecast period. The applications for electronic control reclosers include end-use industries such as energy (utilities, oil & gas, renewables), substations, and overhead distribution lines. The increasing global demand for grid modernization, such as distribution automation, is one of the key reasons for the growth of the electronic control recloser market.

Up to 15 kV segment, by voltage rating, to grow at the highest CAGR from 2022 to 2027

By voltage rating, the up to 15 kV segment forms the largest voltage rating segment and grows at the highest CAGR from 2022 to 2027. The segment is also expected to grow at the highest CAGR due to the increase in residential power distribution capacity to cater to the increasing demand for electricity in residential areas. Also, rising urbanization, increasing investment in smart grid projects, and growing commercial, residential, and industrial sectors are likely to drive the market for reclosers of voltage rating up to 15 kV.

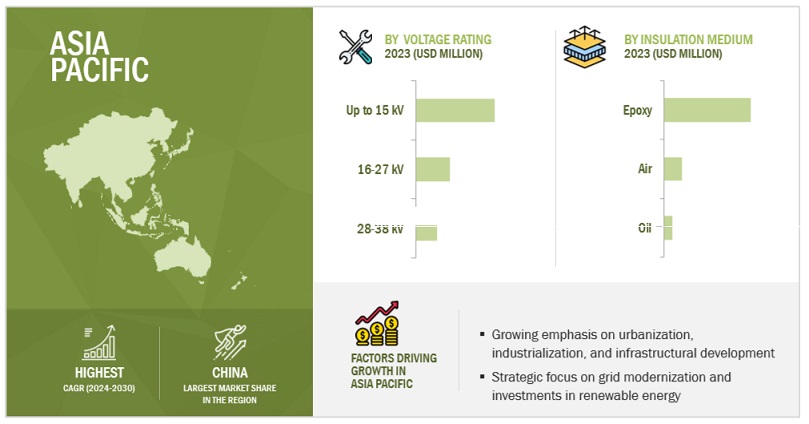

Asia Pacific to account for the largest market size during the forecast period

Asia Pacific is expected to dominate the recloser market during the forecast period. The region's recloser industry is expanding as a result of rising investments in smart grid projects, automatic distribution systems, and infrastructure development. Growing population, industrial growth, and rapid urbanization have also led to increased demand for power, resulting in the development of power generation, transmission, and distribution infrastructure in this region.

Key Players

ABB (Switzerland), Hubbell (US), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), NOJA Power (Australia), Brush Group (England), G&W Electric (US), Entec Electric & Electronic (South Korea), Tavrida Electric (Estonia), and Elektrolites (India).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion), Volume (Thousand Units) |

|

Segments covered |

By Phase Type, By Control Type, By Voltage rating, By Insulation medium |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Hubbell (US), Eaton Corporation (Ireland), Tavrida Electric (Estonia), G&W Electric (US), S&C Electric (US), Hughes Power System (Sweden), Entec Electric & Electronic (South Korea), Brush Group (England), Elektrolites (India), NOJA Power (Australia), ILJIN Electric (South Korea), Ghorit Electricals (China), Ningbo Tianan Group (China), Arteche Group (Spain), Nikum Energy Control (India), Shinsung Industrial Electric (South Korea), Huayi Electric (China), Ensto Group (Finland) |

This research report categorizes the recloser market based on by Phase Type, Control Type, Voltage Rating, Insulation Medium, and Region.

Based on Phase Type, the recloser market has been segmented as follows:

- Three

- Single

- Triple-single

Based on Control Type, the recloser market has been segmented as follows:

- Electronic

- Hydraulic

Based on Voltage Rating, the recloser market has been segmented as follows:

- Up to 15 kV

- 16-27 kV

- 28-38 kV

Based on Insulation Medium, the recloser market has been segmented as follows:

- Oil

- Air

- Epoxy

Based on region, the recloser market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In February 2022, Eaton and LG electronics partnered to deliver flexible load management for renewable distributed energy applications. Under this partnership, Eaton will integrate its intelligent power management technology, including its smart breakers and EV chargers, with the LG ThinQ Energy mobile app and LG energy management solutions.

- In January 2021, ABB completed the delivery of medium- and low-voltage digital solutions for the Shanghai Bailonggang Wastewater Treatment Plant expansion project in China. ABB also created a custom power management scheme as part of the project to ensure continuous operations and avoid downtime throughout the facility refurbishment.

- In November 2020, Eaton invested USD 100 million in building electrical manufacturing and distribution facilities in North America to increase the sales of its intelligent solutions, such as circuit breakers, load centers, switchboards, and residential solutions, which are highly in demand.

Frequently Asked Questions (FAQ):

What is the current size of the global recloser market?

The global recloser market is estimated to be USD 1.0 billion in 2022.

What are the major drivers for the recloser market?

The recloser market is expected to witness significant growth during the forecast period due to rising growth in renewable power generation and increase in investments in renewable energy, expanding transmission and distribution networks globally, and the increasing implementation of distribution automation solutions for power quality and reliability. Also, recloser designs tested to IEC standards can be applied for even higher reliability and safety without increasing equipment footprint. Therefore, recloser offers the powerful advantage of being used for overhead distribution lines, distribution substation applications, and smart grid applications.

Which is the largest-growing region during the forecast period in the recloser market?

Asia Pacific is expected to account for the largest market size during the forecast period. The region covers China, India, South Korea, Australia, and the Rest of Asia Pacific. The requirement to modernize grids and make them ready to integrate the electricity generated from renewable sources, driving the demand for auto reclosers. Hence, these countries offer lucrative opportunities for the growth of the recloser market.

Which is the fastest-growing segment in the recloser market during the forecast period?

The electronic segment, by control type, is the fastest-growing segment in the recloser market. The electronic controls are more reliable because they count with security sensors and position switches, if any element on the recloser is out of service, the control will alarm in the operator panel and by SCADA if available. Electronic control reclosers are used in applications such as utility, overhead distribution lines, substations, and industries such as oil & gas and mining. They are primarily used in three-phase reclosers because they are light in weight, compact, and programmed for future automation requirements. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 RECLOSER MARKET, BY PHASE TYPE

1.3.2 RECLOSER MARKET, BY CONTROL TYPE

1.3.3 RECLOSER MARKET, BY VOLTAGE RATING

1.3.4 RECLOSER MARKET, BY INSULATION MEDIUM

1.3.5 RECLOSER MARKET, BY REGION

1.4 MARKET SCOPE

1.4.1 RECLOSER MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 RECLOSER MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR RECLOSERS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF RECLOSERS

FIGURE 9 RECLOSER MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 1 RECLOSER MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC DOMINATED RECLOSER MARKET IN 2021

FIGURE 11 BY PHASE TYPE, THREE-PHASE SEGMENT ESTIMATED TO LEAD RECLOSER MARKET FROM 2022 TO 2027

FIGURE 12 BY CONTROL TYPE, ELECTRONIC SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 BY INSULATION MEDIUM, EPOXY SEGMENT ESTIMATED TO LEAD RECLOSER MARKET IN 2027

FIGURE 14 BY VOLTAGE RATING, UP TO 15 KV SEGMENT ESTIMATED TO LEAD RECLOSER MARKET BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN RECLOSER MARKET

FIGURE 15 EXPANSION OF TRANSMISSION & DISTRIBUTION NETWORKS TO DRIVE RECLOSER MARKET BETWEEN 2022 AND 2027

4.2 RECLOSER MARKET, BY REGION

FIGURE 16 MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: RECLOSER MARKET, BY CONTROL TYPE AND COUNTRY, 2021

FIGURE 17 ELECTRONIC SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF RECLOSER MARKET IN 2021

4.4 RECLOSER MARKET, BY PHASE TYPE

FIGURE 18 THREE-PHASE SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE IN RECLOSER MARKET, 2027

4.5 RECLOSER MARKET, BY CONTROL TYPE

FIGURE 19 ELECTRONIC SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE THAN HYDRAULIC SEGMENT IN 2027

4.6 RECLOSER MARKET, BY VOLTAGE RATING

FIGURE 20 UP TO 15 KV SEGMENT TO DOMINATE RECLOSER MARKET, BY VOLTAGE RATING, IN 2027

4.7 RECLOSER MARKET, BY INSULATION MEDIUM

FIGURE 21 EPOXY SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: RECLOSER MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing implementation of distribution automation solutions for power quality and reliability

5.2.1.2 Expanding T&D networks

TABLE 2 EXPANDING T&D NETWORKS

5.2.1.3 Growing renewable power generation and increasing investments in renewable energy

FIGURE 23 INSTALLED RENEWABLE ENERGY CAPACITY (2016–2021)

5.2.1.4 Upgrades in existing substations and feeder line protection

5.2.2 RESTRAINTS

5.2.2.1 Increasing competition from unorganized sector

5.2.2.2 Availability of cheap alternatives to reclosers

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing investments in smart grids

FIGURE 24 INVESTMENT SPENDING IN ELECTRICITY NETWORKS, BY REGION, (2016–2021)

5.2.3.2 Implementation of performance-based incentive schemes and guaranteed service programs

5.2.4 CHALLENGES

5.2.4.1 High cost of reclosers

5.2.4.2 Lack of investments by governments in grid stability

FIGURE 25 REVENUE SHIFT FOR RECLOSER PROVIDERS

5.3 MARKET MAP

FIGURE 26 MARKET MAP: RECLOSER MARKET

TABLE 3 RECLOSER MARKET: ROLE IN ECOSYSTEM

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 RECLOSER MARKET: VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.4.2 COMPONENT MANUFACTURERS

5.4.3 RECLOSER MANUFACTURERS/ASSEMBLERS

5.4.4 DISTRIBUTORS

5.4.5 END USERS

5.4.6 POST-SALES SERVICE PROVIDERS

5.5 TECHNOLOGY ANALYSIS

5.5.1 ARTIFICIAL INTELLIGENCE (AI)-BASED DETECTION OF AUTOMATIC CIRCUIT RECLOSERS

5.5.2 INTERNET OF THINGS (IOT)-CONNECTED AUTOMATIC CIRCUIT RECLOSERS

5.6 PRICING ANALYSIS

5.6.1 AVERAGE SELLING PRICE OF RECLOSERS, BY VOLTAGE RATING

TABLE 4 AVERAGE SELLING PRICE OF RECLOSERS, 2021

TABLE 5 AVERAGE SELLING PRICE OF RECLOSERS OFFERED BY KEY PLAYERS, BY VOLTAGE RATING (2021)

FIGURE 28 AVERAGE SELLING PRICE OF RECLOSERS OFFERED BY KEY PLAYERS, BY VOLTAGE RATING

5.7 KEY CONFERENCES AND EVENTS, 2022–2024

TABLE 6 RECLOSER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.8 TARIFFS, CODES, AND REGULATIONS

5.8.1 TARIFFS RELATED TO RECLOSER MARKET

TABLE 7 IMPORT TARIFFS FOR HS 853690 LOW VOLTAGE PROTECTION EQUIPMENT, 2019

TABLE 8 IMPORT TARIFFS FOR HS 8535 HIGH VOLTAGE PROTECTION EQUIPMENT, 2019

5.9 TRADE ANALYSIS

5.9.1 TRADE ANALYSIS OF ELECTRICAL APPARATUS USED FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE EXCEEDING 1,000 VOLTS

5.9.2 IMPORT SCENARIO

TABLE 9 IMPORT SCENARIO FOR HS CODE: 8535, BY COUNTRY, 2019–2021 (USD)

5.9.3 EXPORT SCENARIO

TABLE 10 EXPORT SCENARIO FOR HS CODE: 8535, BY COUNTRY, 2019–2021 (USD)

5.9.4 TRADE ANALYSIS RELATED TO ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE NOT EXCEEDING 1,000 VOLTS

5.9.5 IMPORT SCENARIO

TABLE 11 IMPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.9.6 EXPORT SCENARIO

TABLE 12 EXPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.9.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.8 CODES AND REGULATIONS RELATED TO RECLOSER MARKET

TABLE 17 RECLOSER MARKET: CODES AND REGULATIONS

5.10 PATENT ANALYSIS

TABLE 18 RECLOSER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, MAY 2018–APRIL 2022

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS FOR RECLOSER MARKET

TABLE 19 RECLOSER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF SUBSTITUTES

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF NEW ENTRANTS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 20 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.13 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.14 CASE STUDY ANALYSIS

5.14.1 UK WESTERN POWER DISTRIBUTION USES LATERAL RECLOSER TO COMPLY WITH PERFORMANCE-BASED REGULATIONS

5.14.1.1 Problem Statement: June 2022

5.14.1.2 Solution

5.14.2 COPEL USES S&C’S TRIPSAVER II RECLOSERS IN ELECTRICAL NETWORKS

5.14.2.1 Problem Statement: April 2022

5.14.2.2 Solution

6 RECLOSER MARKET, BY PHASE TYPE (Page No. - 81)

6.1 INTRODUCTION

FIGURE 32 RECLOSER MARKET, BY PHASE TYPE, 2021

TABLE 22 RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

6.2 THREE PHASE

6.2.1 INCREASING DEMAND FOR THREE-PHASE POWER IN INDUSTRIES TO AID SEGMENT GROWTH

TABLE 23 THREE PHASE: RECLOSER MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 SINGLE PHASE

6.3.1 WIDE USE OF SINGLE-PHASE RECLOSERS FOR DOMESTIC APPLICATIONS LIKELY TO PROPEL SEGMENT

TABLE 24 SINGLE PHASE: RECLOSER MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 TRIPLE-SINGLE PHASE

6.4.1 BETTER NETWORK RELIABILITY AND OVERCURRENT PROTECTION EXPECTED TO DRIVE DEMAND

TABLE 25 TRIPLE-SINGLE PHASE: RECLOSER MARKET, BY REGION, 2020–2027 (USD MILLION)

7 RECLOSER MARKET, BY CONTROL TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 33 RECLOSER MARKET, BY CONTROL TYPE, 2021

TABLE 26 RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

7.2 ELECTRONIC

7.2.1 ADVANCED FEATURES OF ELECTRONIC CONTROL RECLOSERS LIKELY TO FUEL DEMAND

TABLE 27 ELECTRONIC: RECLOSER MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 HYDRAULIC

7.3.1 WIDESPREAD USE OF HYDRAULIC CONTROL RECLOSERS IN RURAL DISTRIBUTION NETWORKS LIKELY TO DRIVE SEGMENT

TABLE 28 HYDRAULIC: RECLOSER MARKET, BY REGION, 2020–2027 (USD MILLION)

8 RECLOSER MARKET, BY VOLTAGE RATING (Page No. - 91)

8.1 INTRODUCTION

FIGURE 34 RECLOSER MARKET, BY VOLTAGE RATING, 2021

TABLE 29 RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 30 RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

8.2 UP TO 15 KV

8.2.1 WIDE USAGE OF UP TO 15 KV RECLOSERS FOR RESIDENTIAL APPLICATIONS EXPECTED TO DRIVE DEMAND

TABLE 31 UP TO 15 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 UP TO 15 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (THOUSAND UNITS)

8.3 16–27 KV

8.3.1 USE OF 16–27 KV RECLOSERS FOR INDUSTRIAL AND COMMERCIAL APPLICATIONS LIKELY TO BOOST MARKET

TABLE 33 16–27 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 16–27 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (THOUSAND UNITS)

8.4 28–38 KV

8.4.1 INCREASING DISTRIBUTION SUBSTATION UPGRADE TO PROPEL MARKET FOR 28–38 KV RECLOSERS

TABLE 35 28–38 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 28–38 KV: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (THOUSAND UNITS)

9 RECLOSER MARKET, BY INSULATION MEDIUM (Page No. - 97)

9.1 INTRODUCTION

FIGURE 35 RECLOSER MARKET, BY INSULATION MEDIUM, 2021

TABLE 37 RECLOSER MARKET SIZE, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

9.2 OIL

9.2.1 OIL INSULATION RECLOSERS USED FOR POWER DISTRIBUTION AND AUTOMATION PRODUCTS

TABLE 38 OIL: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.3 AIR

9.3.1 AIR INSULATION MEDIUM RECLOSERS APPLIED FOR POWER TRANSMISSION AND DISTRIBUTION

TABLE 39 AIR: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.4 EPOXY

9.4.1 EPOXY INSULATION MEDIUM RECLOSERS ALLOW DISTRIBUTION SUBSTATION UPGRADES AND INCREASE RELIABILITY

TABLE 40 EPOXY: RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10 RECLOSER MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC RECLOSER MARKET EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 RECLOSER MARKET SHARE (VALUE), BY REGION, 2021

TABLE 41 RECLOSER MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: RECLOSER MARKET SNAPSHOT

10.2.1 BY PHASE TYPE

TABLE 42 ASIA PACIFIC: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

10.2.2 BY CONTROL TYPE

TABLE 43 ASIA PACIFIC: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.2.3 BY INSULATION MEDIUM

TABLE 44 ASIA PACIFIC: RECLOSER MARKET SIZE, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

10.2.4 BY VOLTAGE RATING

TABLE 45 ASIA PACIFIC: RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 46 ASIA PACIFIC: RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

10.2.5 BY COUNTRY

TABLE 47 ASIA PACIFIC: RECLOSER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.5.1 China

10.2.5.1.1 Growing electricity sector to drive recloser market

TABLE 48 CHINA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 49 CHINA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.2.5.2 Australia

10.2.5.2.1 Rising investments in renewables and distribution infrastructure expected to drive market

TABLE 50 AUSTRALIA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 51 AUSTRALIA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.2.5.3 India

10.2.5.3.1 Increasing power consumption expected to propel market growth

TABLE 52 INDIA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 53 INDIA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.2.5.4 South Korea

10.2.5.4.1 Rising focus on renewable energy generation likely to propel demand for reclosers

TABLE 54 SOUTH KOREA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 55 SOUTH KOREA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.2.5.5 Rest of Asia Pacific

TABLE 56 REST OF ASIA PACIFIC: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 57 REST OF ASIA PACIFIC: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 39 NORTH AMERICA: RECLOSER MARKET SNAPSHOT

10.3.1 BY PHASE TYPE

TABLE 58 NORTH AMERICA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

10.3.2 BY CONTROL TYPE

TABLE 59 NORTH AMERICA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.3.3 BY INSULATION MEDIUM

TABLE 60 NORTH AMERICA: RECLOSER MARKET SIZE, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

10.3.4 BY VOLTAGE RATING

TABLE 61 NORTH AMERICA: RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: RECLOSER MARKET SIZE, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

10.3.5 BY COUNTRY

TABLE 63 NORTH AMERICA: RECLOSER MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.5.1 US

10.3.5.1.1 Rising focus of US government on replacing aging T&D infrastructure

TABLE 64 US: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 65 US: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.3.5.2 Canada

10.3.5.2.1 Increasing investments in grid integration projects

TABLE 66 CANADA: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 67 CANADA: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.3.5.3 Mexico

10.3.5.3.1 Rising focus on renewable energy generation and T&D infrastructure upgrade

TABLE 68 MEXICO: RECLOSER MARKET SIZE, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 69 MEXICO: RECLOSER MARKET SIZE, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4 EUROPE

10.4.1 BY PHASE TYPE

TABLE 70 EUROPE: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

10.4.2 BY CONTROL TYPE

TABLE 71 EUROPE: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.3 BY INSULATION MEDIUM

TABLE 72 EUROPE: RECLOSER MARKET, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

10.4.4 BY VOLTAGE RATING

TABLE 73 EUROPE: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

10.4.5 BY COUNTRY

TABLE 75 EUROPE: RECLOSER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.5.1 Germany

10.4.5.1.1 Increasing focus on energy efficiency and grid expansion to drive market growth

TABLE 76 GERMANY: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 77 GERMANY: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.5.2 UK

10.4.5.2.1 Growing integration of renewables in electricity mix to drive market

TABLE 78 UK: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 79 UK: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.5.3 Italy

10.4.5.3.1 Transition toward renewable energy sector expected to boost recloser market

TABLE 80 ITALY: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 81 ITALY: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.5.4 France

10.4.5.4.1 Investments in smart grids and energy efficiency likely to boost market

TABLE 82 FRANCE: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 83 FRANCE: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.5.5 Spain

10.4.5.5.1 Development of electricity transmission networks to fuel demand for reclosers

TABLE 84 SPAIN: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 85 SPAIN: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.4.5.6 Rest of Europe

TABLE 86 REST OF EUROPE: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 87 REST OF EUROPE: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY PHASE TYPE

TABLE 88 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

10.5.2 BY CONTROL TYPE

TABLE 89 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5.3 BY INSULATION MEDIUM

TABLE 90 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

10.5.4 BY VOLTAGE RATING

TABLE 91 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

10.5.5 BY COUNTRY

TABLE 93 MIDDLE EAST & AFRICA: RECLOSER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.5.1 Saudi Arabia

10.5.5.1.1 Increasing investments in power generation projects to drive market growth

TABLE 94 SAUDI ARABIA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 95 SAUDI ARABIA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5.5.2 UAE

10.5.5.2.1 Expanding construction sector to increase demand for reclosers

TABLE 96 UAE: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 97 UAE: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5.5.3 South Africa

10.5.5.3.1 Developing industrial and commercial sectors and renewable energy integration to boost market growth

TABLE 98 SOUTH AFRICA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 99 SOUTH AFRICA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5.5.4 Nigeria

10.5.5.4.1 Growing renewable energy demand to drive market

TABLE 100 NIGERIA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 101 NIGERIA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.5.5.5 Rest of Middle East & Africa

10.5.5.5.1 Growing investments in power sector to drive market

TABLE 102 REST OF MIDDLE EAST & AFRICA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 103 REST OF MIDDLE EAST & AFRICA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY PHASE TYPE

TABLE 104 SOUTH AMERICA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

10.6.2 BY CONTROL TYPE

TABLE 105 SOUTH AMERICA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.6.3 BY INSULATION MEDIUM

TABLE 106 SOUTH AMERICA: RECLOSER MARKET, BY INSULATION MEDIUM, 2020–2027 (USD MILLION)

10.6.4 BY VOLTAGE RATING

TABLE 107 SOUTH AMERICA: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (USD MILLION)

TABLE 108 SOUTH AMERICA: RECLOSER MARKET, BY VOLTAGE RATING, 2020–2027 (THOUSAND UNITS)

10.6.5 BY COUNTRY

TABLE 109 SOUTH AMERICA: RECLOSER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.5.1 Brazil

10.6.5.1.1 Increasing demand for power and renewable energy to drive market growth

TABLE 110 BRAZIL: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 111 BRAZIL: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.6.5.2 Argentina

10.6.5.2.1 Rising power demand from industries and government initiatives on utilizing renewable energy to drive market

TABLE 112 ARGENTINA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 113 ARGENTINA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.6.5.3 Chile

10.6.5.3.1 Government investments in clean energy expected to drive demand for reclosers

TABLE 114 CHILE: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 115 CHILE: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

10.6.5.4 Rest of South America

TABLE 116 REST OF SOUTH AMERICA: RECLOSER MARKET, BY PHASE TYPE, 2020–2027 (USD MILLION)

TABLE 117 REST OF SOUTH AMERICA: RECLOSER MARKET, BY CONTROL TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 144)

11.1 OVERVIEW

11.2 KEY PLAYERS’ STRATEGIES

TABLE 118 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, APRIL 2019–APRIL 2022

11.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 119 RECLOSER MARKET: DEGREE OF COMPETITION

FIGURE 40 RECLOSER MARKET SHARE ANALYSIS, 2021

11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 41 TOP PLAYERS IN RECLOSER MARKET, 2017–2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING: RECLOSER MARKET, 2021

11.6 START-UP/SME EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 43 RECLOSER MARKET: START-UP/SME EVALUATION QUADRANT, 2021

11.6.5 COMPETITIVE BENCHMARKING

TABLE 120 RECLOSER MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 121 RECLOSER MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

11.7 RECLOSER MARKET: COMPANY FOOTPRINT

TABLE 122 COMPANY FOOTPRINT: BY PHASE TYPE

TABLE 123 COMPANY FOOTPRINT: BY CONTROL TYPE

TABLE 124 COMPANY FOOTPRINT: BY INSULATION MEDIUM

TABLE 125 COMPANY FOOTPRINT: BY VOLTAGE RATING

TABLE 126 BY REGION: COMPANY FOOTPRINT

TABLE 127 OVERALL COMPANY FOOTPRINT

11.8 COMPETITIVE SCENARIO

TABLE 128 RECLOSER MARKET: PRODUCT LAUNCHES, FEBRUARY 2022

TABLE 129 RECLOSER MARKET: DEALS, FEBRUARY 2019– AUGUST 2022

TABLE 130 RECLOSER MARKET: DEALS, JANUARY 2018–APRIL 2021

12 COMPANY PROFILES (Page No. - 166)

(Business overview, Products/Services/Solutions offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 ABB

TABLE 131 ABB: BUSINESS OVERVIEW

FIGURE 44 ABB: COMPANY SNAPSHOT

TABLE 132 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 133 ABB: DEALS

TABLE 134 ABB: OTHERS

12.1.2 EATON CORPORATION

TABLE 135 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 45 EATON CORPORATION: COMPANY SNAPSHOT

TABLE 136 EATON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 137 EATON CORPORATION: DEALS

12.1.3 SCHNEIDER ELECTRIC

TABLE 138 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 139 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 140 SCHNEIDER ELECTRIC: OTHERS

12.1.4 SIEMENS

TABLE 141 SIEMENS: BUSINESS OVERVIEW

FIGURE 47 SIEMENS: COMPANY SNAPSHOT

TABLE 142 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 143 SIEMENS: DEALS

12.1.5 NOJA POWER

TABLE 144 NOJA POWER: BUSINESS OVERVIEW

TABLE 145 NOJA POWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 146 NOJA POWER: DEALS

12.1.6 HUBBELL

TABLE 147 HUBBELL: BUSINESS OVERVIEW

FIGURE 48 HUBBELL: COMPANY SNAPSHOT (2021)

TABLE 148 HUBBELL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.7 S&C ELECTRIC COMPANY

TABLE 149 S&C ELECTRIC COMPANY: BUSINESS OVERVIEW

TABLE 150 S&C ELECTRIC COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 151 S&C ELECTRIC COMPANY: DEALS

12.1.8 TAVRIDA ELECTRIC

TABLE 152 TAVRIDA ELECTRIC: BUSINESS OVERVIEW

TABLE 153 TAVRIDA ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 154 TAVRIDA ELECTRIC: DEALS

12.1.9 ENTEC ELECTRIC & ELECTRONIC

TABLE 155 ENTEC ELECTRIC & ELECTRONIC: BUSINESS OVERVIEW

TABLE 156 ENTEC ELECTRIC & ELECTRONIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.10 G&W ELECTRIC

TABLE 157 G&W ELECTRIC: BUSINESS OVERVIEW

TABLE 158 G&W ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 159 G&W ELECTRIC: DEALS

12.1.11 BRUSH GROUP

TABLE 160 BRUSH GROUP: BUSINESS OVERVIEW

TABLE 161 BRUSH GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.12 ELEKTROLITES

TABLE 162 ELEKTROLITES POWER: BUSINESS OVERVIEW

TABLE 163 ELEKTROLITES: PRODUCTS OFFERED

12.1.13 GHORIT ELECTRICALS

TABLE 164 GHORIT ELECTRICALS: BUSINESS OVERVIEW

TABLE 165 GHORIT ELECTRICALS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.14 ILJIN ELECTRIC

TABLE 166 ILJIN ELECTRIC: BUSINESS OVERVIEW

FIGURE 49 ILJIN ELECTRIC: COMPANY SNAPSHOT

TABLE 167 ILJIN ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.15 HUGHES POWER SYSTEM

TABLE 168 HUGHES POWER SYSTEM: BUSINESS OVERVIEW

TABLE 169 HUGHES POWER SYSTEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

12.1.16 NINGBO TIANAN GROUP

TABLE 170 NINGBO TIANAN GROUP: BUSINESS OVERVIEW

TABLE 171 NINGBO TIANAN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

*Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ARTECHE GROUP

12.2.2 NIKUM ENERGY CONTROL

12.2.3 SHINSUNG INDUSTRIAL ELECTRIC

12.2.4 HUAYI ELECTRIC

12.2.5 ENSTO GROUP

12.3 LIST OF MORE PLAYERS AS MARKET IS FRAGMENTED

13 APPENDIX (Page No. - 219)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved major activities in estimating the current size of the recloser market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved using extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global recloser market. The other secondary sources comprised press releases and investor presentations of companies, whitepapers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

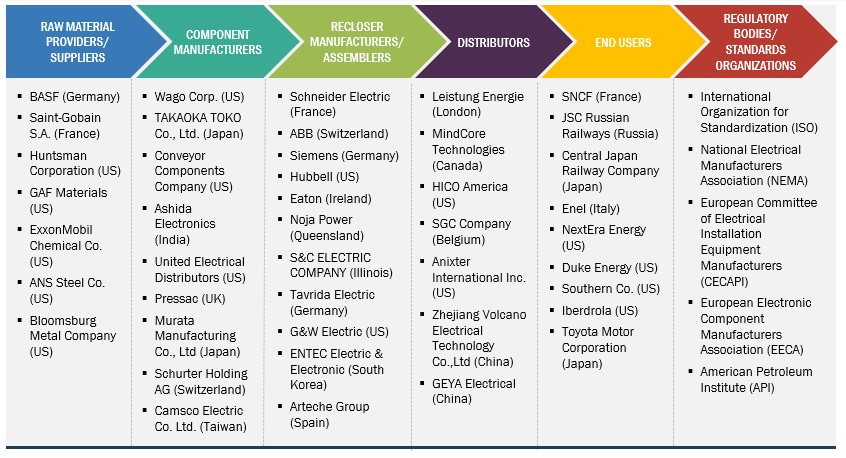

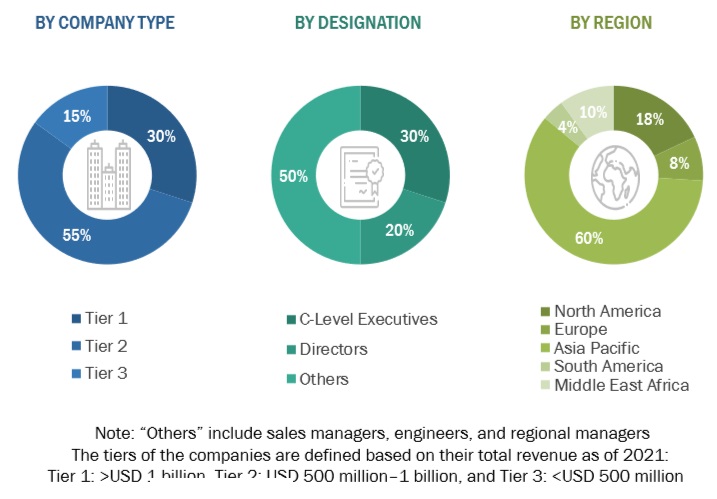

Primary Research

The recloser market comprises stakeholders, such as raw material suppliers, component manufacturers, product manufacturers/assemblers, distributors, end-users, and regulatory bodies/standard organizations in the supply chain. Industrial end-users characterize the demand side of this market. Moreover, the demand is also fueled by the growing transmission and distribution utility demand. The supply side is characterized by rising demand for contracts from the industrial sector and mergers and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

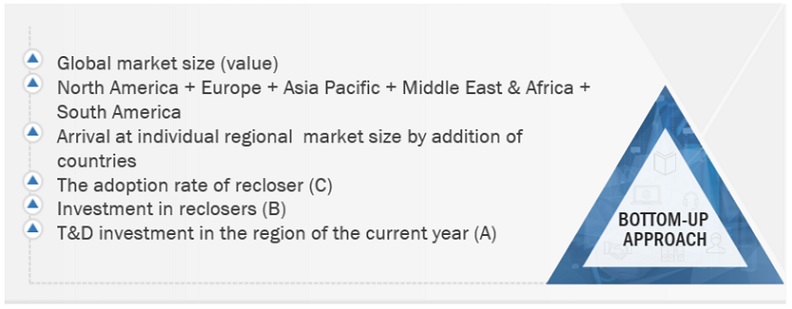

The bottom-up approach has been used to estimate and validate the recloser market size.

- In this approach, the recloser production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of reclosers.

- Several primary interviews have been conducted with key opinion leaders related to recloser system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

Global Reclosers Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying numerous factors and trends from both the demand and supply sides in the recloser market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the recloser market by Phase Type, Control Type, Voltage Rating, Insulation Medium, and Region.

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East and Africa, along with their key countries

- To provide comprehensive information about drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the recloser market

- This report covers the recloser market size in terms of value and volume

Power Distribution Equipment & Its impact on Recloser Market

Reclosers are an essential part of Power Distribution Equipment (PDE), hence PDE and the Recloser Market are closely related. When faults or short circuits are detected, reclosers are safety devices that are put on power distribution lines. They isolate the damaged region by opening and closing the circuit after detecting faults or short circuits. They are made to automatically restore electricity to the unaffected areas after a problem is fixed to prevent prolonged power outages. Transformers, switchgear, distribution panels, and other parts are included in the broad category of electrical equipment known as PDE. Reclosers are frequently incorporated into this equipment to increase reliability and offer protection. Reclosers can be utilised in both rural and urban environments and are often installed on overhead distribution lines, subterranean distribution lines, or in substations.

The Recloser Market is a segment of the Power Distribution Equipment market that is devoted exclusively to the manufacture, marketing, and supply of reclosers. Manufacturers, distributors, and service providers who supply a range of recloser products and services, such as installation, maintenance, and repair, are present in the market.

The increase of the PDE market is closely related to the growth of the recloser market. The need for reclosers is anticipated to rise along with the demand for dependable and effective power distribution systems. This increase is being fueled by the rising use of renewable energy sources, urbanisation, and population growth, all of which call for increasingly sophisticated and intricate power distribution networks.

By extending the reach of Power Distribution Equipment companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increasing demand for PDE: The growth in the construction and infrastructure sectors, as well as the increase in demand for reliable and efficient power supply, will drive the growth of the PDE market.

- Technology advancements: As PDE systems become more sophisticated, the demand for advanced and intelligent reclosers will also increase.

- Renewable energy integration: The integration of renewable energy sources into power distribution systems will also drive the demand for reclosers.

- Replacement market: The replacement market for reclosers will also continue to drive demand for new products.

The top players in the Power Distribution Equipment Market are Siemens AG, ABB Ltd., General Electric Company, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd.

Some of the key industries that are going to get impacted because in the future because of Power Distribution Equipment are,

- Renewable Energy: Power distribution equipment will need to be modified to satisfy the special needs of these sources as more and more renewable energy sources, such as wind and solar power, are integrated into the electrical grid.

- Electric Vehicles: Transformers and switchgear used in power distribution will need to be modified to accommodate the increased demand for electricity needed to power EVs.

- Data Centres: As more businesses move their operations online, the demand for data centres will increase rapidly.

- Smart Cities: As cities become more connected and intelligent, the demand for power distribution equipment that can support advanced technologies like smart lighting, traffic management systems, and other IoT devices will increase.

- Healthcare: Healthcare facilities rely on electricity to power life-saving equipment and medical devices.

Speak to our Analyst today to know more about, Power Distribution Equipment Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for a report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Recloser Market

Could you please let us know the Recloser Market, By Voltage: Up to 15 kV; 16–27 kV; 28–38 kV. How much percentage each?