Recombinant Proteins Market by Product (Growth Factors, Chemokines, Structural Proteins, Membrane Proteins), Application (Drug Discovery & Development, Biopharma Production, Research, Diagnostics), End User (Biotech, CROs) & Region - Global Forecast to 2027

Updated on : June 18, 2023

The global recombinant proteins market in terms of revenue was estimated to be worth $1.4 billion in 2022 and is poised to reach $2.4 billion by 2027, growing at a CAGR of 11.4% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new edition of the report provides updated financial information through 2023 (depending on availability) for each listed company in a graphical representation. This will facilitate an easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region or country, and business segment focus in terms of the highest revenue-generating segment. Growth in this market is primarily driven by factors such as the rise in collaboration between academics and the pharmaceutical industry, the high prevalence of major infectious diseases and genetic disorders, as well as government investment in life-science research activities. Emerging markets in Asian countries, as well as the rising focus on personalized medicines and protein therapeutics, are other factors expected to offer robust growth opportunities for players in the global market. In contrast, labor-intensive and low-yield production may restrict market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Recombinant Proteins Market Dynamics

Driver: Patent expiry of biologics

The growth of the global market corresponds with the growth in the life science and biopharmaceutical industries, as these industries are significant end users for recombinant protein products. The growth in the end user base has compelled several companies to launch new products and invest in the global market. The pharmaceutical industry is currently witnessing the expiration of blockbuster mAbs. For instance, patents for Inlyta, Tykerb, Lucentis, and Atrovent HFA are set to expire in 2020, while those for Remicade and Zevalin expired in 2018 and 2019, respectively. To address this issue, several global pharmaceutical manufacturers are employing various strategies to enhance research activities. These measures are likely to increase the number of drug discovery programs to develop therapeutic antibodies, especially mAbs, which are further creating opportunities for the global market.

Restraint: Declining cost of recombinant proteins

The concept of Price erosion can be defined as the following as a large number of players that enter a niche market and offer similar products without any differentiation, thus crowding the market with less innovative and competitively priced products. During price erosion, the price of such products in the particular market is observed to decline continuously, which then declines the market growth. New technological advacments in the field of recombinant protein manufacturing process have changed the older trend, resulting in higher yield and lower cost of finished products, which permits the production of such proteins on an industrial scale and opens the door for small players who competitively price products without innovation and thus restrain the market growth.

Opportunity: Rising focus on personalized medicine and protein therapeutics

Developing personalized medicine includes the integration of several biotechnologies, such as cell and gene therapies, recombinant proteins, and vaccines, as they play a vital part in the personalization of treatment. Personalized medicine, which has become a core area of research in the healthcare industry, has entered mainstream clinical practices and is changing the way many diseases are identified, classified, and treated. The demand for recombinant protein therapeutics, including hormones, vaccines, monoclonal antibodies, blood factors, and therapeutic enzymes, has also increased over the last few years. Recombinant protein therapeutics have found high recognition for their potential in treating various kinds of diseases, and their demand has increased significantly in recent years owing to the increasing prevalence of chronic diseases. Recombinant proteins are known as highly potent medicines that are safe from off-target side effects, and it takes a shorter time to develop than small molecules.

Challenge: Protein aggregation into inclusion bodies hampering the production of soluble recombinant proteins with proper biological function

Escherichia coli is one of the organisms of choice to produce recombinant proteins. Its use as a cell factory is well-established, and it has become the most popular expression platform. The high-level expression of recombinant protein in Escherichia coli often results in an aggregation of the expressed protein molecules into inclusion bodies. Retrieving active recombinant protein from inclusion bodies is often a long and time-consuming process. The formation of inclusion bodies in bacterial hosts possess a major challenge for the large-scale recovery of bioactive proteins. The process of obtaining bioactive protein from inclusion bodies is labor-intensive, and the yields of recombinant protein are often low. Such challenges in the manufacturing of recombinant proteins affect the market negatively.

Growth factors and chemokines segment dominated the recombinant proteins industry

Based on product, the recombinant proteins market is classified into growth factors and chemokines, structural proteins, kinase proteins, regulatory proteins, membrane proteins, recombinant metabolic enzymes, adhesion molecules and receptors, immune response proteins, and other recombinant proteins. Growth factors and chemokines commanded the largest share of the global market in 2020. The large share of the growth factors and chemokines segment can be attributed to its major role in for research in field such as cancer, Covid-19, cell culture, neurobiology, transplantation, stem cell research, HIV/AIDS, and wound healing. They also help in orchestrating both innate and adaptive immune responses. Cytokines are gradually being used as adjuvants in the development of vaccines, such as interleukin-2.

The biologics segment to witness the highest CAGR in the recombinant proteins industry during the forecast period.

Based on type, the recombinant proteins market is segmented into biologics, vaccines, and cell & gene therapy. Biologics accounted for the largest share of the drug discovery & development application for the recombinant proteins market and is also expected to witness the highest CAGR during the forecast period. This is attributed to the growing use of biologics to treat various diseases such as cancer, anemia, chronic kidney disease, autoimmune diseases, diabetes, growth deficiency, and other serious disorders, as well as a strong development pipeline for recombinant protein-based biologics.

To know about the assumptions considered for the study, download the pdf brochure

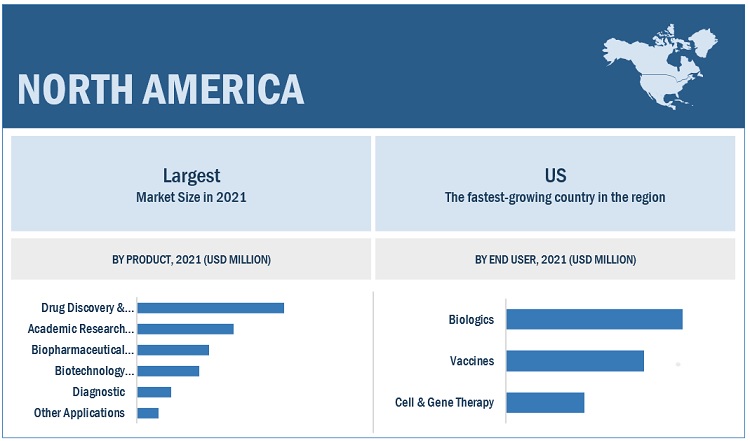

North America was the largest regional market for recombinant proteins industry

The recombinant proteins market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America was the largest regional segment of the overall market, followed by Europe. The large share of North America in the global market is attributed to the availability of funding for R&D, government initiatives for R&D in the pharmaceutical industry, the high incidence of chronic & genetic diseases, the growing adoption of life science techniques in research & academia, the large presence of major pharmaceutical and biotechnology companies, and the use of analytical instruments in drug discovery and development.

The prominent players operating in the recombinant proteins market include Thermo Fisher Scientific, Inc. (US), R&D Systems (US), Abcam plc (UK), Merck KGaA (Germany), and Proteintech Group, Inc. (US)

Scope of the Recombinant Proteins Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.4 billion |

|

Projected Revenue by 2027 |

$2.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 11.4% |

|

Market Driver |

Patent expiry of biologics |

|

Market Opportunity |

Rising focus on personalized medicine and protein therapeutics |

This report categorizes the global recombinant proteins market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Growth Factors and Chemokines

- Immune Response Proteins

- Structural Proteins

- Membrane Proteins

- Kinase Proteins

- Regulatory Proteins

- Recombinant Metabolic Enzymes

- Adhesion Molecules and Receptors

- Other Recombinant Proteins (include viral antigens and other proteins that participate in the vital cellular role of cell migration, survival, and regulation of immune responses to apoptosis, Alzheimer’s disease, tumor cell phenotypes, neuroinflammation, and autoimmune diseases)

By Application

-

Drug Discovery & Development

- Biologics

- Vaccines

- Cell & Gene Therapy

- Biopharmaceutical Production

- Biotechnology Research

- Academic Research Studies

- Diagnostics

- Other Applications (Forensic and Cosmetology Applications)

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations

- Other End Users [Diagnostic Centers, Laboratories (Hospital-attached Laboratories (Hals) and Independent Diagnostic Laboratories), Forensic Laboratories, and Cosmetic Industry]

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Recombinant Proteins Industry

- Celltrion and Teva Pharmaceutical Industries Merger: In 2022, Celltrion and Teva Pharmaceutical Industries merged to become the largest biopharmaceutical company in the world. The merger will allow Teva to expand its biosimilar portfolio and will strengthen Celltrion’s position in the market. The combined company is expected to have greater access to the global market and will be able to offer more cost-effective products.

- Merck and Pfizer Merger: In 2022, Merck and Pfizer announced that they would merge to create a new healthcare giant. The two companies will be combining their respective portfolios of branded and generic drugs, vaccines, and biologics. The combined company is expected to have a larger presence in the recombinant protein market and will be able to offer more cost-effective products.

- Novo Nordisk and Sanofi Merger: In 2022, Novo Nordisk and Sanofi announced that they would merge to create a new biopharmaceutical giant. The two companies will be combining their respective portfolios of branded and generic drugs, vaccines, and biologics. The combined company is expected to have a larger presence in the recombinant protein market and will be able to offer more cost-effective products.

- Amgen and GlaxoSmithKline Merger: In 2022, Amgen and GlaxoSmithKline announced that they would merge to create a new biopharmaceutical giant. The two companies will be combining their respective portfolios of branded and generic drugs, vaccines, and biologics. The combined company is expected to have a larger presence in the recombinant protein market and will be able to offer more cost-effective products.

- Bayer and Johnson & Johnson Merger: In 2022, Bayer and Johnson & Johnson announced that they would merge to create a new biopharmaceutical giant. The two companies will be combining their respective portfolios of branded and generic drugs, vaccines, and biologics. The combined company is expected to have a larger presence in the recombinant protein market and will be able to offer more cost-effective products.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global recombinant proteins market?

The global recombinant proteins market boasts a total revenue value of $2.4 billion by 2027.

What is the estimated growth rate (CAGR) of the global recombinant proteins market?

The global recombinant proteins market has an estimated compound annual growth rate (CAGR) of 11.4% and a revenue size in the region of $1.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the current size of the recombinant proteins market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the recombinant proteins market. The secondary sources used for this study include The Antibody Society, Pharmaceutical Research and Manufacturers of America (PhRMA), National Institutes of Health (NIH), American Medical Association, Associations of Medical Laboratories, National Cancer Institute (NCI), Association of Medical Laboratory Immunologists (AMLI), American Society of Clinical Oncology (ASCO), American Association for Cancer Research (AACR), Biomolecular Interaction Network Database, European Medicines Agency (EMA), British Society for Immunology (BSI), press releases, company websites, annual reports, SEC Filings, interviews with experts, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

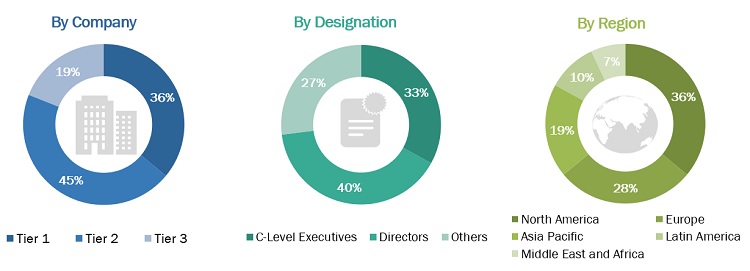

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the recombinant proteins market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the recombinant proteins business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global recombinant proteins market based on the product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall recombinant proteins market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the recombinant proteins market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Recombinant Proteins Market

What are the growth estimates for Recombinant protein market till 2026?

What are the key factors hampering growth of the Recombinant protein market?

Interested in data of Recombinant Protein Market, Industry Share, Size, Growth and forecasts of 2027 - 2030

How big is the recombinant proteins market?