DRaaS Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection, and Professional Services), Deployment Mode (Public Cloud and Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2027

Updated on : March 03, 2023

DRaaS Market Size

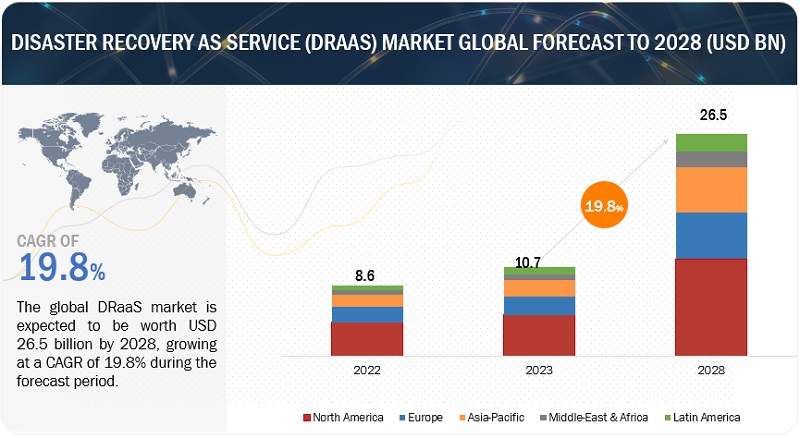

The disaster recovery as a service market size was estimated to be worth USD 8.8 billion in 2022. It is projected to reach USD 23.5 billion over the next five years, it is anticipated to grow at a CAGR of 21.6%. The increased need for business continuity is one of the primary factors driving market growth. Moreover, the need to lower the total cost of ownership and minimize RTO and RPO is driving adoption of DRaaS solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of COVID-19 on the disaster recovery as a service market has affected large and small enterprises alike across various industry verticals.

Owing to the pay-as-you-use model, the revenue for cloud services is declining. The positive impacts of the COVID-19 pandemic are the sustained growth in the demand for cloud infrastructure services and increased expenditure on specialized SaaS, such as CRM, enterprise collaboration/UCaaS tools, and other productivity and business continuity tools.

Many European start-ups are helping those in need during the coronavirus pandemic with the help of the cloud. For instance, Sidekick Health, an Icelandic digital therapeutics start-up, has built a COVID-19 tracker app for the national health system, and Velmio, an Estonian digital health start-up, has built a COVID-19 tracker app and plans to share data with researchers.

While technology spending in Asia Pacific has increased, the setback due to the recent COVID-19 pandemic is imminent. The cloud technology adoption is expected to increase in verticals such as IT & ITeS, BFSI, and Government & Public Sector where the work-from-home initiative is helping to sustain enterprise business functions.

In the Middle East & Africa, countries are fighting the unpleasant effects of low oil prices and the economic and health fallout of COVID-19. While this crisis has generated a lot of challenges, it has also created opportunities, particularly in the technology sector. Several governments and enterprise initiatives would influence the adoption of cloud services in the region.

DRaaS Market Dynamics

Driver: Increased need for business continuity across SMEs

SMEs need cost-efficient, flexible, scalable, and automated DR services, which can be fulfilled by customized DRaaS solutions. Compared to disaster recovery as a service, the traditional disaster recovery solutions require ample time, technical personnel, and huge capital. This model enables enterprises to pay only for the amount of usage. DRaaS is easy to set up and allows employees to access data from remote locations once recovery solutions are implemented. It is gaining popularity across SMEs because it fulfills requirements at less cost.

Restraint: Reluctance of enterprises toward the adoption of cloud-based DR over traditional methods

Many organizations still prefer traditional methodologies over the latest technologies. There are several factors for the reluctance of enterprises to adopt cloud and cloud-based disaster recovery. The key reasons include concerns over data security, unawareness, budget constraints, and stubbornness to changing the well-established existing disaster recovery methods. Furthermore, the lack of awareness about cloud environments among organizations are the major factors responsible for the less adoption of DRaaS solutions.

Opportunity: Rise in adoption of cloud due to COVID-19 pandemic

COVID-19 has globally changed the dynamics of business operations. The pandemic has made businesses revisit their IT infrastructure and network capabilities. Businesses are going digital and adopting cloud computing to salvage the situation and maintain business continuity. Keeping the data of the company protected is necessary for the ongoing virtual work environment. Thus, the COVID-19 outbreak has offered several opportunities to DRaaS vendors to expand their business across enterprises as the adoption of cloud has increased during lockdown caused due to COVID-19.

Challenge: Difficulty in achieving security and compliance in cloud environments

Enterprises that have to work with multiple providers and different service-level agreements have a hard time maintaining and demonstrating compliances through cloud environments. Data security is a rising concern for enterprises who store their data over the cloud, as any disruption to data would have a significant effect on their businesses. Due to this, many enterprises are hesitant to adopt cloud based recovery solutions unless the vendors can assure multilayer cybersecurity with complete testing and auditing services. DRaaS solution vendors are faced with the challenge of upholding strong security standards, along with reduced downtime and recovery costs.

DRaaS Market Supply Chain

To know about the assumptions considered for the study, download the pdf brochure

By Service Type, the backup & restore segment to have the highest growth during the forecast period

The backup & restore segment is expected to have the highest growth rate during the forecast period. Backup enables the retrieval of duplicate sets in case of data loss during downtime or failures, such as power outages, human errors, and natural catastrophes. Restore helps to recover specific data that becomes inaccessible because of logical or physical damages to targeted storage devices. The need for backup is increasing among enterprises to ensure business continuity in the event of disasters due to the rising amount of data.

By Organization Size, the large enterprises segment to have a higher market size during the forecast period

By Organization Size, the large enterprises segment is estimated to account for a larger market share. Large enterprises heavily invest in advanced technologies to increase their overall productivity and efficiency. The pressure to increase revenue and remain competitive encourages large enterprises to incorporate innovative DRaaS solutions into their businesses. Furthermore, due to the affordability and high demand for advanced technologies in large organizations, they hold a higher market share than SMEs.

By Region, Asia Pacific to record the highest growth during the forecast period

Asia Pacific is the fastest-growing region in terms of cloud workloads and gaining traction mainly due to the high growth of technology adoption in countries such as China and India. The increasing availability of skilled labor and SMEs’ keen focus on entering and growing in this region are a few factors driving the adoption of DRaaS in Asia Pacific. Businesses across the region are cautious about their investment plans and focus on affordable options. Thus, public cloud services have gained huge traction in Asia Pacific as they offer including scalability, reliability, accessibility, and affordability. Major players such as Microsoft, AWS, Google, and IBM are rapidly expanding their cloud offerings in this region due to the availability of huge customer potential and the growing economic outlook.

Asia Pacific: DRaaS Market Snapshot

Key Market Players

The report includes the study of key players offering DRaaS solutions and services. The major vendors in the DRaaS include Microsoft (US), IBM (US), VMware (US), AWS (US), Sungard AS (US), iland (US), Recovery Point (US), InterVision (US), TierPoint (US), and Infrascale (US).

The study includes an in-depth competitive analysis of these key players in the DRaaS market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Service Type, Deployment Mode, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors include Microsoft (US), IBM (US), VMware (US), AWS (US), and Sungard AS (US) (Total 32 companies) |

This research report categorizes the DRaaS market to forecast revenues and analyze trends in each of the following subsegments:

By Service Type:

- Real-time Replication

- Backup & Restore

- Data Protection

-

Professional Services

- Integration

- Training & Consulting

- Support & Maintenance

By Deployment Mode:

- Public

- Private

By Organization Size:

- Large Enterprises

- Small & Medium Sized Enterprises

By Vertical:

- Banking, Financial Services & Insurance

- Telecommunications

- IT & ITeS

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Broadcom, a leading provider of semiconductor and infrastructure software solutions, entered into an agreement to acquire VMware. The combined solutions would enable customers, including leaders in all industry verticals, greater choice, and flexibility to build, run, manage, connect, and protect applications at scale across diversified, distributed environments.

- In January 2022, iland was acquired by 11:11 Systems, a managed infrastructure solutions provider. 11:11 would leverage iland’s Secure Cloud Console natively, combining deep-layered security, predictive analytics, and compliance to deliver visibility and ease of management across all its cloud services.

- In June 2020, Microsoft partnered with Wipro and Citrix. The partnership was intended to enable customers to continue their businesses in the work-from-home scenario. The companies aimed to offer a combined solution that enables the fast and easy deployment of secure and reliable digital workspaces.

- In January 2020, Recovery Point launched a new low-cost object storage solution, z/Archive, using Transparent Cloud Tiering from IBM. It allows clients to create point-in-time snapshots of data on their systems and then copy and store that data in the RPS cloud.

- In December 2019, IBM collaborated with Hitit to expand its footprint in travel and hospitality industry verticals with its on-premises data center for resiliency and DR solutions. Under this partnership, IBM designed a hybrid cloud strategy planned to guarantee the continuous availability of critical applications and uninterrupted services for Hitit’s clients, including 27 major airlines in 19 countries, travel agencies, and ground handling companies.

Frequently Asked Questions (FAQ):

What is the projected market value of the global DRaaS market?

The Global DRaaS market size to grow from USD 8.8 billion in 2022 to USD 23.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 21.6% during the forecast period.

Which Region has the largest market share in the DRaaS market?

North America is estimated to hold the largest share in the DRaaS Market in 2022. North America’s stable economy and technological advancements have a positive impact on the market, which is expected to drive its growth. North America also has the presence of most of the top market vendors, such as Microsoft, IBM, VMware, AWS, and Sungard AS.

Which Service Type is expected to have a higher growth during the forecast period?

By Service Type, the backup & restore segment is expected to have a higher growth during the forecast period due to the increasing need among enterprises to ensure business continuity.

Which Vertical is expected to hold the largest market size during the forecast period?

By Vertical, the BFSI segment is expected to hold the largest market size during the forecast period due to the significant rise in data volumes and digital transactions.

Who are the major vendors in the DRaaS market?

Major vendors in the DRaaS market include Microsoft (US), IBM (US), VMware (US), AWS (US), Sungard AS (US), iland (US), Recovery Point (US), InterVision (US), TierPoint (US), and Infrascale (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 DISASTER RECOVERY AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

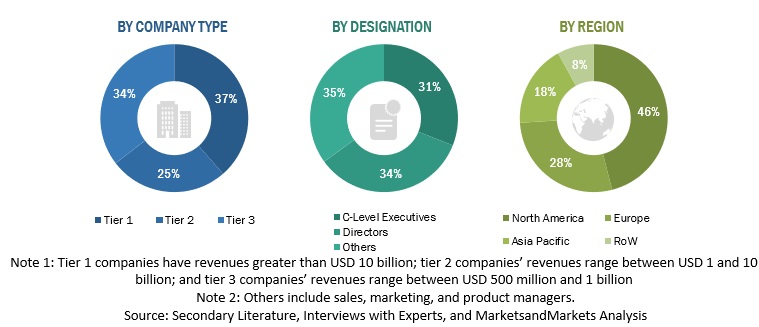

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 DISASTER RECOVERY AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): CAGR PROJECTIONS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY VENDORS FROM EACH APPLICATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT SERVICE TYPES

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 DISASTER RECOVERY AS A SERVICE MARKET, 2019–2027 (USD MILLION)

FIGURE 10 FASTEST-GROWING SEGMENTS IN THE MARKET, 2022–2027

FIGURE 11 MARKET, BY SERVICE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY DEPLOYMENT MODE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 TOP VERTICALS IN THE MARKET

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 OVERVIEW OF THE DISASTER RECOVERY AS A SERVICE MARKET

FIGURE 16 INCREASE IN DISASTERS AND GROWING AVAILABILITY OF LOW-COST DISASTER RECOVERY AS A SERVICE OFFERINGS TO DRIVE MARKET GROWTH

4.2 MARKET, BY SERVICE TYPE

FIGURE 17 BACKUP & RESTORE SERVICES TO ACCOUNT FOR THE LARGEST SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY DEPLOYMENT MODE

FIGURE 18 PUBLIC CLOUD DEPLOYMENT TO BE THE LARGER MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY ORGANIZATION SIZE

FIGURE 19 LARGE ENTERPRISES TO ACCOUNT FOR LARGER DEMAND DURING THE FORECAST PERIOD

4.5 MARKET, BY VERTICAL

FIGURE 20 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO BE THE LARGEST VERTICAL DURING THE FORECAST PERIOD

4.6 MARKET: REGIONAL SCENARIO

FIGURE 21 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DISASTER RECOVERY AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Need to lower TCO, save time, and allow IT teams to shift focus to higher-value tasks

FIGURE 23 WITH SIGNIFICANTLY FASTER RECOVERY TIMES OF DRAAS, DISASTER RECOVERY BECOMES MUCH MORE COST-EFFECTIVE

5.2.1.2 Increased need for data security and scalability

5.2.1.3 Rise in DRaaS utilization to mitigate the risk of cyberattacks on data centers

5.2.1.4 Increased need for business continuity across SMEs

5.2.2 RESTRAINTS

5.2.2.1 Concerns over dependency on service providers

5.2.2.2 Reluctance of enterprises toward the adoption of cloud-based DR over traditional methods

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in the adoption of cloud due to the COVID-19 pandemic

FIGURE 24 COVID-19 DROVE CLOUD ADOPTION, 2021

FIGURE 25 GROWING INCLINATION OF ORGANIZATIONS TOWARD MSP FOR DATA SECURITY AND BACKUP, 2021

5.2.3.2 Emergence of AI and ML in DRaaS solutions to strengthen the DR strategies of enterprises

5.2.4 CHALLENGES

5.2.4.1 Difficulty in achieving security and compliance in cloud environments

5.2.4.2 Potential performance issues with applications running in the cloud and bandwidth challenges

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: ALLEGANY INSURANCE GROUP SIMPLIFIES ITS DISASTER RECOVERY STRATEGY WITH ILAND

5.3.2 CASE STUDY 2: MANUFACTURING COMPANY TRANSITIONS TO DRAAS FOR GREATER RESILIENCE WITH INTERVISION

5.3.3 CASE STUDY 3: COMPUTER-DRIVEN SOLUTIONS DEPLOYED INFRASCALE BACKUP AND DISASTER RECOVERY (IBDR) TO PROTECT SME CLIENTS’ DATA AND PREPARE FOR DISASTERS

5.3.4 CASE STUDY 4: RMS USES TIERPOINT’S HYBRID CLOUD & DRAAS TO IMPROVE PERFORMANCE AND RELIABILITY

5.4 COVID-19-DRIVEN MARKET DYNAMICS

5.4.1 DRIVERS AND OPPORTUNITIES

5.4.2 RESTRAINTS AND CHALLENGES

5.5 PRICING ANALYSIS

TABLE 3 DISASTER RECOVERY AS A SERVICE MARKET: PRICING LEVELS

5.6 ECOSYSTEM

FIGURE 26 MARKET: ECOSYSTEM

5.7 PATENT ANALYSIS

TABLE 4 MARKET: PATENTS

TABLE 5 TOP 10 PATENT OWNERS (US)

FIGURE 27 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENTS

6 DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 28 BACKUP & RESTORE SERVICES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.1 SERVICE TYPE: MARKET DRIVERS

6.1.2 SERVICE TYPE: COVID-19 IMPACT

TABLE 6 MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 7 MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

6.2 REAL-TIME REPLICATION

TABLE 8 REAL-TIME REPLICATION SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 9 REAL-TIME REPLICATION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 BACKUP & RESTORE

TABLE 10 BACKUP & RESTORE SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 BACKUP & RESTORE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 DATA PROTECTION

TABLE 12 DATA PROTECTION SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 DATA PROTECTION SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 PROFESSIONAL SERVICES

TABLE 14 PROFESSIONAL SERVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 PROFESSIONAL SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5.1 INTEGRATION

6.5.2 TRAINING & CONSULTING

6.5.3 SUPPORT & MAINTENANCE

7 DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 29 PRIVATE CLOUD DEPLOYMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

TABLE 16 MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 PUBLIC CLOUD

TABLE 18 PUBLIC CLOUD DEPLOYMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 PUBLIC CLOUD DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PRIVATE CLOUD

TABLE 20 PRIVATE CLOUD DEPLOYMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 PRIVATE CLOUD DEPLOYMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8 DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 30 DRAAS IN SMES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 22 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 24 LARGE ENTERPRISES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL- & MEDIUM-SIZED ENTERPRISES

TABLE 26 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL (Page No. - 87)

9.1 INTRODUCTION

FIGURE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

TABLE 28 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 TELECOMMUNICATIONS

TABLE 32 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 IT & ITES

TABLE 34 IT & ITES VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 IT & ITES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 GOVERNMENT & PUBLIC SECTOR

TABLE 36 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 RETAIL & CONSUMER GOODS

TABLE 38 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 MANUFACTURING

TABLE 40 MANUFACTURING VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 ENERGY & UTILITIES

TABLE 42 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 MEDIA & ENTERTAINMENT

TABLE 44 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 HEALTHCARE & LIFE SCIENCES

TABLE 46 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER VERTICALS

TABLE 48 OTHER VERTICALS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DISASTER RECOVERY AS A SERVICE MARKET, BY REGION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 33 NORTH AMERICA TO BE THE LARGEST MARKET IN 2022

TABLE 50 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

TABLE 62 US: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 63 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 64 US: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 65 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

TABLE 66 CANADA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 67 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 69 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 70 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

TABLE 80 UK: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 81 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 82 UK: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 83 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

TABLE 84 GERMANY: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

TABLE 88 FRANCE: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 92 REST OF EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

TABLE 106 CHINA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 107 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 108 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 109 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.4 JAPAN

TABLE 110 JAPAN: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 111 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 112 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA

TABLE 114 AUSTRALIA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 115 AUSTRALIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 116 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 117 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: MARKET

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 122 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 132 KINGDOM OF SAUDI ARABIA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 133 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 134 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 135 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 136 UNITED ARAB EMIRATES: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 137 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 138 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 139 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 SOUTH AFRICA

TABLE 140 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 141 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 142 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 143 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.6 REST OF THE MIDDLE EAST & AFRICA

TABLE 144 REST OF THE MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 145 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 146 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 147 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 148 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

TABLE 158 BRAZIL: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 159 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 160 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 161 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.4 MEXICO

TABLE 162 MEXICO: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 163 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 164 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 165 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 166 REST OF LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 167 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 168 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 169 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 149)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 REVENUE ANALYSIS

FIGURE 37 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD BILLION)

11.4 MARKET SHARE ANALYSIS

FIGURE 38 DISASTER RECOVERY AS A SERVICE MARKET SHARE ANALYSIS, 2021

TABLE 170 MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

TABLE 171 COMPANY EVALUATION QUADRANT CRITERIA

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 39 MARKET, KEY COMPANY EVALUATION MATRIX, 2022

11.5.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 172 COMPANY PRODUCT FOOTPRINT

TABLE 173 COMPANY SERVICE FOOTPRINT

TABLE 174 COMPANY VERTICAL FOOTPRINT

TABLE 175 COMPANY REGION FOOTPRINT

11.6 RANKING OF KEY PLAYERS

FIGURE 40 RANKING OF KEY PLAYERS IN DISASTER RECOVERY AS A SERVICE MARKET, 2021

11.7 STARTUP/SME EVALUATION MATRIX

FIGURE 41 STARTUP/SME EVALUATION MATRIX CRITERIA

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 42 DISASTER RECOVERY AS A SERVICE MARKET (GLOBAL) STARTUP/SME COMPANY EVALUATION MATRIX, 2022

11.8 KEY MARKET DEVELOPMENTS

11.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

TABLE 176 PRODUCT LAUNCHES & ENHANCEMENTS, 2019–2022

11.8.2 DEALS

TABLE 177 DEALS, 2019–2022

11.8.3 OTHERS

TABLE 178 OTHERS, 2019–2021

12 COMPANY PROFILES (Page No. - 168)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, Response to COVID-19, MnM View)*

12.2.1 MICROSOFT

TABLE 179 MICROSOFT: BUSINESS OVERVIEW

FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

TABLE 180 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 MICROSOFT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 182 MICROSOFT: DEALS

12.2.2 IBM

TABLE 183 IBM: BUSINESS OVERVIEW

FIGURE 44 IBM: COMPANY SNAPSHOT

TABLE 184 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 IBM: DEALS

12.2.3 VMWARE

TABLE 186 VMWARE: BUSINESS OVERVIEW

FIGURE 45 VMWARE: COMPANY SNAPSHOT

TABLE 187 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 VMWARE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 189 VMWARE: DEALS

12.2.4 AWS

TABLE 190 AWS: BUSINESS OVERVIEW

FIGURE 46 AWS: COMPANY SNAPSHOT

TABLE 191 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 AWS: NEW SOLUTION/SERVICE LAUNCHES

TABLE 193 AWS: DEALS

12.2.5 SUNGARD AS

TABLE 194 SUNGARD AS: BUSINESS OVERVIEW

TABLE 195 SUNGARD AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 196 SUNGARD AS: NEW SOLUTION/SERVICE LAUNCHES

TABLE 197 SUNGARD AS: DEALS

12.2.6 ILAND

TABLE 198 ILAND: BUSINESS OVERVIEW

TABLE 199 ILAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 ILAND: NEW SOLUTION/SERVICE LAUNCHES

TABLE 201 ILAND: DEALS

TABLE 202 ILAND: OTHERS

12.2.7 RECOVERY POINT

TABLE 203 RECOVERY POINT: BUSINESS OVERVIEW

TABLE 204 RECOVERY POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 205 RECOVERY POINT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 206 RECOVERY POINT: DEALS

12.2.8 INTERVISION

TABLE 207 INTERVISION: BUSINESS OVERVIEW

TABLE 208 INTERVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 INTERVISION: DEALS

TABLE 210 INTERVISION: OTHERS

12.2.9 TIERPOINT

TABLE 211 TIERPOINT: BUSINESS OVERVIEW

TABLE 212 TIERPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 213 TIERPOINT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 214 TIERPOINT: DEALS

TABLE 215 TIERPOINT: OTHERS

12.2.10 INFRASCALE

TABLE 216 INFRASCALE: BUSINESS OVERVIEW

TABLE 217 INFRASCALE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 218 INFRASCALE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 219 INFRASCALE: DEALS

12.3 OTHER PLAYERS

12.3.1 ACRONIS

12.3.2 AXCIENT

12.3.3 BIOS MIDDLE EAST

12.3.4 C&W BUSINESS

12.3.5 CARBONITE

12.3.6 DAISY

12.3.7 DATABARRACKS

12.3.8 DATTO

12.3.9 DXC

12.3.10 EVOLVE IP

12.3.11 EXPEDIENT

12.3.12 FLEXENTIAL

12.3.13 NTT DATA

12.3.14 QUORUM

12.3.15 UNITRENDS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, Response to COVID-19, MnM View might not be captured in case of unlisted companies.

12.4 SME/STARTUPS

12.4.1 ARCSERVE

12.4.2 RACKWARE

12.4.3 DRUVA

12.4.4 APTUM

12.4.5 DARZ

12.4.6 ZETTAGRID

12.4.7 PHOENIXNAP

13 ADJACENT MARKETS (Page No. - 217)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 220 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 DISASTER RECOVERY AS A SERVICE MARKET ECOSYSTEM AND ADJACENT MARKETS

13.4 CLOUD STORAGE MARKET

13.4.1 CLOUD STORAGE MARKET, BY COMPONENT

TABLE 221 CLOUD STORAGE MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 222 CLOUD STORAGE MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

13.4.2 CLOUD STORAGE MARKET, BY APPLICATION

TABLE 223 CLOUD STORAGE MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 224 CLOUD STORAGE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.3 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE

TABLE 225 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 226 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

13.4.4 CLOUD STORAGE MARKET, BY DEPLOYMENT TYPE

TABLE 227 CLOUD STORAGE MARKET, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 228 CLOUD STORAGE MARKET, BY DEPLOYMENT TYPE, 2020–2025 (USD MILLION)

13.4.5 CLOUD STORAGE MARKET, BY VERTICAL

TABLE 229 CLOUD STORAGE MARKET, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 230 CLOUD STORAGE MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

13.4.6 CLOUD STORAGE MARKET, BY REGION

TABLE 231 CLOUD STORAGE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 232 CLOUD STORAGE MARKET, BY REGION, 2020–2025 (USD MILLION)

13.5 CLOUD COMPUTING MARKET

13.5.1 CLOUD COMPUTING MARKET, BY SERVICE MODEL

TABLE 233 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2015–2020 (USD BILLION)

TABLE 234 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2021–2026 (USD BILLION)

13.5.2 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE

TABLE 235 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 236 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2021–2026 (USD BILLION)

13.5.3 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE

TABLE 237 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 238 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2021–2026 (USD BILLION)

13.5.4 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE

TABLE 239 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2015–2020 (USD BILLION)

TABLE 240 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2021–2026 (USD BILLION)

13.5.5 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL

TABLE 241 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2015–2020 (USD BILLION)

TABLE 242 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2021–2026 (USD BILLION)

13.5.6 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE

TABLE 243 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 244 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

13.5.7 CLOUD COMPUTING MARKET, BY VERTICAL

TABLE 245 CLOUD COMPUTING MARKET, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 246 CLOUD COMPUTING MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

13.5.8 CLOUD COMPUTING MARKET, BY REGION

TABLE 247 CLOUD COMPUTING MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 248 CLOUD COMPUTING MARKET, BY REGION, 2021–2026 (USD BILLION)

14 APPENDIX (Page No. - 232)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involves four major activities in estimating the current size of the disaster recovery as a service market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub segments of the DRaaS market.

Secondary Research

The market size of companies offering DRaaS was based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases. This secondary data was collected to arrive at the overall market size and was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; and related key executives from DRaaS vendors, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, service type, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using DRaaS, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall DRaaS market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the DRaaS market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the top-down approach, an exhaustive list of all vendors in the DRaaS market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The market size was estimated from revenues generated by vendors from different service types. Revenue generated from each service type from different vendors was identified with the help of secondary and primary sources and combined to arrive at market size. Further, the procedure included an analysis of the DRaaS market’s regional penetration. With the data triangulation procedure and validation of data through primaries, the exact values of the overall DRaaS market size and its segments’ market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption trend of disaster recovery as a service offerings among different verticals in key countries with respect to the regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of DRaaS offerings, along with different use cases, with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in the different application areas for the calculation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global Disaster Recovery as a Service (DRaaS) market based on service types, deployment modes, organization size, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the DRaaS market

- To analyze the impact of COVID-19 on service types, deployment modes, organization size, verticals, and regions across the globe

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DRaaS Market

Analyse the Mergers and acquisitions opportunities for the Apple Seagate EVault Downtime Ecosystem and their Strategy Technology partners and suppliers value chain.

Understand the market dynamics impacting the Tier-1, Tier-2, Tier-3 companies in this market

Need insights on cloud disaster recovery and business continuity as a service for SMBs in APAC

Detailed understanding of the role of ISPs in DRaaS and redundancy of the internet connections and potential growth opportunities

Interested in country-level analysis and forecast for Central and Eastern Europe - Slovak Republic, Czech Republic, Poland, Hungaria, Ukraina and baltic countries: Croatia, Romania,Bulgaria, Monte Negro, Serbia

Interested in customer reasoning that leads to purchasing DRaaS offerings

Understand the DRaaS market dynamics

Understanding the Data backup and recovery for the New Zealand market by various segments including market size and industry verticals.

Need in-depth information on the market segmentation at country-level