Remote Patient Monitoring Market by Product (Software, Services, Devices, Cardiology, Neurological, BP Monitors, Neonatal, Weight, Temperature, Neuro), End User (Providers, Hospitals, Clinics, Homecare, Patients, Payers) & Region - Global Forecast to 2027

Updated on : May 04, 2023

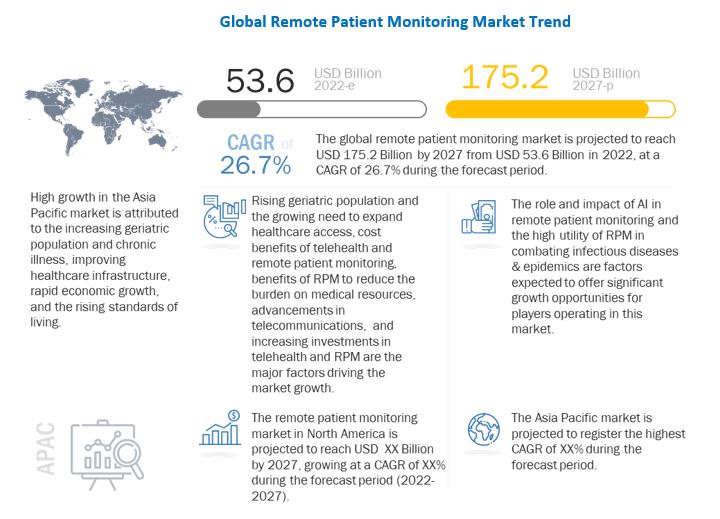

The global remote patient monitoring market in terms of revenue was estimated to be worth $53.6 billion in 2022 and is poised to reach $175.2 billion by 2027, growing at a CAGR of 26.7% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The updated version of the report covers the historical market for remote patient monitoring for the years 2020 and 2021, the estimated market for 2022, and forecasts until 2027, along with a CAGR from 2022 to 2027. The new research study provides the company evaluation quadrant for 25 companies operating in the remote patient monitoring market. The predominant factors influencing the growth of the market include the benefits of remote patient monitoring to reduce the burden on medical resources, the monitoring benefits of telehealth and remote patient monitoring services, advancements in telecommunications, an increasing geriatric population, and the growing need to expand healthcare access. However, the regulatory differences and challenges among various regions, combined with the informal usage of social media practises and related healthcare fraud, are some factors that are anticipated to negatively affect market growth during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Remote Patient Monitoring Market Dynamics

Driver: rising geriatric population and growing need to expand healthcare access

The rising geriatric population and the growing need to expand healthcare access are major drivers of the remote patient monitoring market. An increasing number of elderly patients who require medical care are driving the demand for remote patient monitoring systems. Remote patient monitoring systems make it easier for elderly patients to stay connected with their physicians and access medical care without having to make frequent trips to the hospital. Additionally, the need to reduce healthcare costs and the need to provide better care to patients in remote and rural areas are also driving the demand for remote patient monitoring systems.

Opportunity: high utility of remote patient monitoring in combating infectious diseases and epidemics

Remote patient monitoring (RPM) is a rapidly growing technology that has the potential to revolutionize healthcare delivery. Remote patient monitoring allows healthcare providers to monitor a patient’s health from a distance, typically using wireless technology. By collecting data such as vital signs, physical activity, and sleep patterns, remote patient monitoring can provide medical professionals with a real-time view of a patient’s health and alert them to any changes or potential problems. The utility of remote patient monitoring is particularly high in the context of infectious diseases and epidemics. By allowing healthcare providers to monitor patients from a distance, remote patient monitoring can help them identify symptoms of a disease before they become severe, allowing for early diagnosis and treatment. Additionally, remote patient monitoring can help healthcare providers monitor the health of individuals in quarantine or isolation, reducing the risk of the disease spreading to other individuals or communities. In this way, remote patient monitoring can help reduce the spread of infectious diseases and limit their impact.

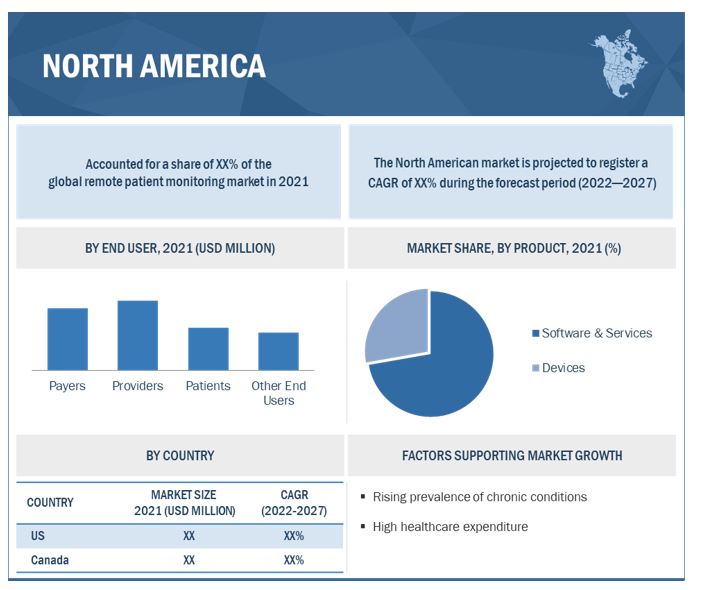

North America accounted for the largest share of the global remote patient monitoring market.

North America accounted for the largest share of this market, followed by Europe. The large share of North America in the remote patient monitoring market can be attributed to the rising incidence and prevalence of chronic conditions, the increasing global population, and the rising need to reduce healthcare expenditure.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the remote patient monitoring market are Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Cerner Corporation (US), Siemens Healthineers AG (Germany), OMRON Healthcare (Japan), Boston Scientific Corporation (US), Abbott Laboratories (US), Resideo Life Care Solutions (US), Vivify Health, Inc. (US), ALTEN Calsoft Labs (France), Preventice Solutions (US), Bio-Beat Technologies (Israel), VitalConnect (US), Welch Allyn (US), Teladoc Health Inc. (US), Dexcom Inc. (US), iRhythm Technologies, Inc. (US), and VivaLNK Inc. (US).

Remote Patient Monitoring Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$53.6 billion |

|

Projected Revenue by 2027 |

$175.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 26.7% |

|

Market Driver |

Rising geriatric population and the growing need to expand healthcare access |

|

Market Opportunity |

High utility of Remote Patient Monitoring in combating infectious diseases & epidemics |

The study categorizes the remote patient monitoring market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Services & Software

-

Devices

- Cardiac Monitoring Devices

- Neurological Monitoring Devices

- Respiratory Monitoring Devices

- Multiparameter Monitoring Devices

- Blood Glucose Monitoring Devices

- Fetal & Neonatal Monitoring Devices

- Weight Monitoring Devices

- Other Monitoring Devices

By End User

-

Providers

- Hospitals and Clinics

- Home Care Settings and Long Term Care Centers

- Ambulatory Care Centers

- Other End Users

- Passive Exoskeletons

- Payers

- Patients

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (LATAM)

- Middle East & Africa

Recent Developments:

- In 2020, Philips, Launched the Avalon CL Fetal and Maternal Pod and Patch for remote monitoring in the US, Europe, Australia, New Zealand, and Singapore to support fetal and maternal monitoring

- In 2020, Koninklijke Philips formed collaboration with American Telemedicine Association (ATA) (US). This collaboration helped increase the adoption of telehealth across acute, post-acute, and home care settings.

- In 2020, BioTelemetry acquired the On.Demand remote patient monitoring (RPM) and coaching platform, operated by Envolve People Care, Inc., which is a Centene Corporation subsidiary. This acquisition expands chronic RPM and coaching solutions to BioTelemetry’s current suite of acute care connected health products and services, focusing specifically on diabetes, hypertension, and chronic heart failure.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global remote patient monitoring market?

The global remote patient monitoring market boasts a total revenue value of $175.2 billion by 2027.

What is the estimated growth rate (CAGR) of the global remote patient monitoring market?

The global remote patient monitoring market has an estimated compound annual growth rate (CAGR) of 26.7% and a revenue size in the region of $53.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

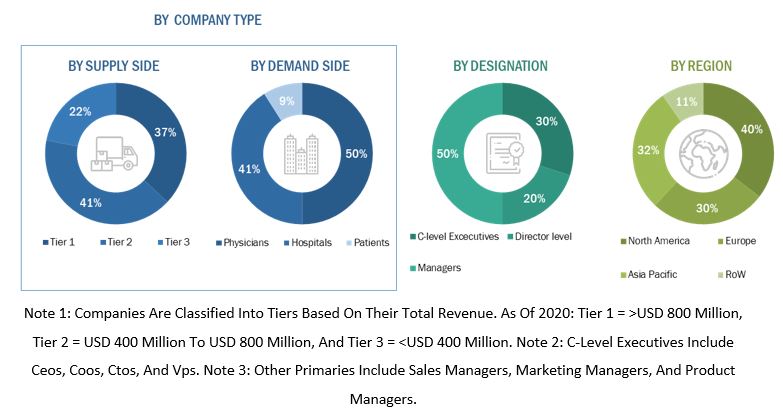

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global remote patient monitoring market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the blood collection devices market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and OECD. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global remote patient monitoring market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of remote patient monitoring products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the remote patient monitoring market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market

Report Objectives

- To define, describe, segment, and forecast the remote patient monitoring market based on product, end user and region

- To provide detailed information about the factors influencing market growth, such as drivers, opportunities, restraints and challenges

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall in remote patient monitoring market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific (APAC), Middle East and Africa

- To profile the key players in the global remote patient monitoring market and comprehensively analyze their core competencies3 and market shares

- To track and analyze competitive developments, such as product launches, expansions, acquisition and partnerships in the remote patient monitoring market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Top 10 companies in remote health monitoring market

- Philips Healthcare

- Medtronic

- Abbott Laboratories

- Honeywell Life Care Solutions

- GE Healthcare

- Cisco Systems

- McKesson Corporation

- IBM Corporation

- Qualcomm Life

- Boston Scientific

These companies offer a range of products and services related to remote health monitoring, including wearable devices, telehealth platforms, remote patient monitoring systems, and more. While these companies are among the leaders in the industry, there are many other companies and startups that are also making significant contributions to the remote health monitoring market.

Top 10 remote health monitoring market companies by region

Here are the Top 10 remote health monitoring market companies by region, in no particular order

North America

- Philips Healthcare

- Medtronic

- Honeywell Life Care Solutions

- Qualcomm Life

- Boston Scientific

Europe

- Abbott Laboratories

- GE Healthcare

- Siemens Healthineers

- Roche Diagnostics

- Draeger Medical

Asia-Pacific

- Omron Healthcare

- Biotronik SE & Co. KG

- Fujitsu Limited

- Panasonic Corporation

- Koninklijke Philips N.V.

Future remote health monitoring market trends

The future of remote health monitoring is expected to be shaped by several trends, including

Growth in wearable and connected devices: The use of wearable devices and connected health monitoring devices is expected to grow, driven by advancements in technology and increasing consumer demand. This will enable individuals to monitor their health and well-being remotely and in real-time.

Increased adoption of telemedicine: Telemedicine, which allows healthcare providers to remotely diagnose and treat patients, is expected to become more widespread as healthcare systems seek to improve access to care and reduce costs. Remote health monitoring technologies will play a key role in enabling telemedicine by providing real-time data and remote patient monitoring capabilities.

Advancements in data analytics and artificial intelligence: As the volume of remote health monitoring data grows, data analytics and artificial intelligence (AI) technologies will become increasingly important in analyzing and interpreting this data. This will enable healthcare providers to identify trends and patterns that can be used to improve patient outcomes.

Focus on chronic disease management: Remote health monitoring is particularly well-suited for the management of chronic diseases such as diabetes, cardiovascular disease, and respiratory disease. As the incidence of chronic diseases continues to rise, the demand for remote health monitoring technologies is expected to grow.

Increased focus on patient-centered care: Remote health monitoring technologies enable patients to take a more active role in managing their health, providing them with greater control and autonomy. This trend towards patient-centered care is expected to continue, with remote health monitoring technologies playing an important role in empowering patients to manage their own health.

Hypothetical challenges of remote health monitoring business in future

While remote health monitoring has the potential to revolutionize healthcare, there are also some hypothetical challenges that businesses in this space may need to address in the future. Some of these challenges include

Data security and privacy concerns: As the volume of remote health monitoring data grows, there is a risk that this data could be hacked or stolen, leading to privacy breaches and other security issues. Companies will need to ensure that they have robust data security and privacy policies in place to protect patient data.

Limited access to technology: While remote health monitoring has the potential to improve access to care, there is a risk that certain populations may not have access to the technology required to use these services. Companies may need to find ways to make remote health monitoring technologies more accessible, particularly in rural or underserved areas.

Regulatory barriers: Remote health monitoring technologies are subject to a range of regulatory requirements, and these requirements may vary by jurisdiction. Companies will need to navigate these regulatory barriers in order to bring their products and services to market.

Integration with existing healthcare systems: Remote health monitoring technologies will need to integrate with existing healthcare systems in order to be effective. This may require significant investment in infrastructure and software development.

Cost and reimbursement challenges: Remote health monitoring technologies may be more expensive than traditional healthcare delivery models, particularly in the short term. Companies will need to find ways to demonstrate the cost-effectiveness of their products and services in order to secure reimbursement from payers.

These are just a few hypothetical challenges that remote health monitoring businesses may need to address in the future. While these challenges may be significant, they are not insurmountable, and companies that can successfully navigate these challenges stand to benefit from the significant opportunities presented by remote health monitoring.

Examples of the hypothetical challenges in remote health monitoring market

Rural populations: People living in rural areas may not have access to high-speed internet or other technologies required for remote health monitoring, limiting their ability to use these services.

Elderly populations: Older adults may be less familiar with technology or have limited access to devices such as smartphones or tablets, making it difficult for them to use remote health monitoring services.

Low-income populations: People with limited financial resources may not be able to afford the cost of devices or internet access required for remote health monitoring.

People with disabilities: Individuals with certain disabilities may require specialized equipment or technology to use remote health monitoring services, which may not be readily available or affordable.

Developing countries: In some developing countries, access to basic healthcare services is limited, and the infrastructure required for remote health monitoring may not be in place.

Industries which are likely to be impacted by remote health monitoring market

Healthcare: This is the most obvious industry that will be impacted by remote health monitoring. Remote health monitoring has the potential to improve patient outcomes, reduce healthcare costs, and increase access to care, which will be particularly important as populations age and healthcare resources become more strained.

Insurance: Insurance companies are likely to be impacted by remote health monitoring as they look for ways to incentivize healthy behaviors and reduce costs associated with chronic diseases. Remote health monitoring can provide insurers with valuable data that can be used to develop more accurate risk assessments and pricing models.

Technology: The remote health monitoring market is heavily dependent on technology, and as such, it is likely to have a significant impact on the technology industry. Companies that develop wearables, telehealth platforms, and remote patient monitoring systems are likely to see increased demand for their products and services as the remote health monitoring market grows.

Pharmaceuticals: Remote health monitoring has the potential to improve clinical trials by providing real-time data on patient outcomes and drug efficacy. As a result, pharmaceutical companies are likely to be impacted by remote health monitoring as they explore new ways to conduct clinical trials and develop more effective treatments.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Patient Monitoring Market

Can you explain your reasoning around the projection of the $72.8 Billion Mkt for RPM in North America? Thanks

Which are growth driving factors for the global growth of Remote Patient Monitoring Market?

What will be the size of the Remote Patient Monitoring Market for the European region?