Power Rental Market by Fuel Type (Diesel, Natural Gas), Equipment (Generators, Transformers, Load Banks), Power Rating (Up to 50 kW, 51–500 kW, 501-2500 kW, Above 2500 kW), Application, End User and Region - Global Forecast to 2027

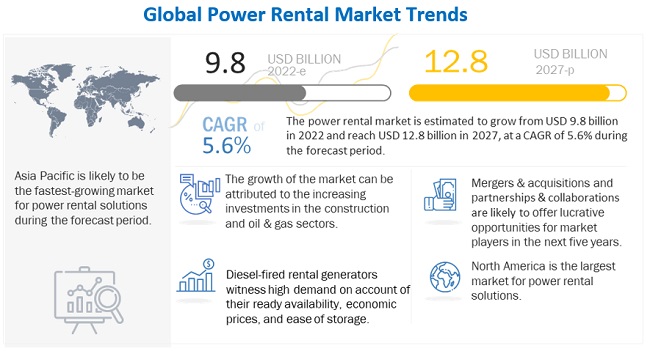

[272 Pages Report] The global power rental market in terms of revenue was estimated to be worth $9.8 billion in 2022 and is poised to reach $12.8 billion by 2027, growing at a CAGR of 5.6% from 2022 to 2027. The rapid expansion of the industrial sector along with the Surging demand for uninterrupted & reliable power supply is expected to drive the demand for the global power rental market.

To know about the assumptions considered for the study, Request for Free Sample Report

Power rental Market Dynamics

Driver: Surging demand for uninterrupted & reliable power supply

According to the International Energy Outlook 2021 by Energy Information Administration (EIA), the global electricity demand is expected to increase by 1.4% per year on average until 2040. A major part of the growth is expected to occur in non-OECD countries, such as China and India. However, the short-term electricity demand in 2020 decreased by 5% as a consequence of COVID-19 and the resultant economic downturn. From 2010 to 2018, the global electricity production capacity grew at a faster rate, and the growth of the T&D network development has not kept pace with it, thereby resulting in reliability issues such as power outages and surges. Developing regions face more blackouts and power outages, whereas developed regions face more brownouts and voltage fluctuations.

Hurricanes, wildfires, ice storms, flooding, heat waves, and other extreme weather events are growing in number or intensity with climate change. Weather-related incidents are creating power outages in China, India, Japan, the US, and Australia. According to the EIA, electricity customers in the US experienced over 8 hours of electric power interruptions in 2020. In February 2021, an extreme winter storm event caused a massive electricity generation failure in Texas, which resulted in a loss of power for more than 4.5 million customers. Such power outages are increasing the demand for power backup solutions and uninterrupted and reliable power supply for catering to emergency needs.

Data centers are the major end users of electrical power and distribution systems. According to IEA, the global data center electricity demand in 2020 was 200–250 TWh or about 1% of the global electricity demand. This excludes energy used for cryptocurrency mining, which was ~100 TWh in 2020. Data centers require a highly reliable power supply to ensure proper functioning. The loss of power for even a short period can cause disruptions in the functioning of businesses and result in financial loss. Therefore, the rising need for highly reliable mediums of power supply is boosting the demand for backup generator sets. The manufacturing sector is one of the major end users of generator sets. Its unprecedented growth in developing nations is one of the major drivers for the power rental market.

Restraint: stringent government regulations associated with generators

Diesel generators are used for a wide range of applications, particularly in above 50 kW power ratings. When diesel is burnt, it emits oxides of nitrogen, carbon monoxide, and particulate matter. These emissions are directly released into the atmosphere and deteriorate the environment as well as inhabitants. Several regulations have been implemented across the world to reduce air and noise pollution by generator sets. With growing environmental concerns, each country has come up with its own set of regulations and policies to reduce air pollution. For instance, the UAE pledged to limit emissions and increase the share of clean energy in the energy mix to 24% by 2021, up from 0.2% in 2014. In 2005, Canada pledged a 30% reduction in greenhouse gas emissions by 2030. Environmental regulations, policies, and subsidy schemes vary country-wise based on the intensity of emissions caused by harmful gases such as SOx, NOx, and CO2.

Stringent governmental norms have been imposed for diesel fuel globally to reduce emissions and meet environmental regulations. In 2014, the US EPA mandated that the diesel standard for non-road diesel engines must be ultra-low sulfur diesel (ULSD). The main challenge for generator manufacturers is to reduce emission levels while maintaining performance levels. In 2016, Caterpillar launched C175-16 IMO Tier-II and IMO Tier-III emissions certified gensets with diesel engines for the offshore industry to meet the emission norms. During 2017–21, several manufacturers launched new products that comply with these stringent standards. However, there are new rules for genset manufacturers with regard to obtaining approvals as well as for noise pollution. The main aim of the new standards is to control air and noise pollution originating from DG sets. Also, to attenuate or minimize the noise produced by the components of diesel generators, manufacturers should provide an acoustic enclosure. This acts as a major challenge for the emerging and local companies operating in this market.

Opportunity: Integration of power rental equipment with renewable energy

Countries across the world are trying to limit their carbon footprint, and many companies have come up with integrated renewable, as well as hybrid, power rental solutions, helping them achieve their emission targets. For instance, Aggreko has launched a product called Y-Cube that can store up to 1 MW of equivalent electrical power. Likewise, Atlas Copco offers hybrid energy generation systems that can generate electricity through solar and diesel power and can store the produced energy for the optimum utilization of resources. Similarly, Europe-based Bredenoord provides the Mobile Solar Power Plant, Big Battery Box, and Mini-Sun Box power rental solutions that use solar energy and store it in batteries for later usage.

Challenge: Increased operational expenditure of diesel generator due to high fuel price

Diesel generator sets have been one of the most popular backup power solutions for many end users such as manufacturing and oil & gas owing to their quick start-up time, low initial investments, less space requirement, and ease of installation and operation. However, diesel generator sets entail high operating costs, which is mainly on account of the high cost of fuel. Fuel costs account for over 80% of the total life cycle cost of a diesel generator set. This has made diesel a less cost-efficient solution for backup, especially in view of the drop in solar power prices.

The low initial cost was one of the key factors driving the adoption of diesel generator sets. However, the difference in the costs of diesel generator sets and solar and wind power systems has reduced significantly over the past few years. In addition, the increasing focus of statutory authorities on pollution control is expected to drive up the capital costs of diesel generator sets. The price of crude oil and diesel has also increased consistently over the past three years. Crude oil prices increased in 2021 as increasing COVID- 19 vaccination rates, loosening pandemic-related restrictions, and a growing economy resulted in global petroleum demand rising faster than petroleum supply. Thus, with the rising diesel fuel prices and falling solar and wind power prices, diesel generator sets have become a less cost-competitive option for providing power backup.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

By fuel type, the natural gas segment has the fastest growth in the power rental market during the forecast period.

The natural gas segment is estimated to be the fastest-growing segment of the power rental market, by fuel type, from 2022 to 2027. Natural gas can be used to power emergency and portable generators and is considered one of the most affordable and effective fuels among the non-renewable resources for power generation. Also, gas generators are cheaper and more environment-friendly compared with diesel generators, as gas reduces harmful air pollutants and carbon emissions compared with diesel. Natural gas generators operate on LPG, compressed gas, propane, and others; and can be found in different sizes, ranging from portable to industrial. These generators are less costly and more environment friendly compared to diesel generators only below 150 KVA. However, as power rating increases, the cost of gas generators surpass the cost of similarly powered diesel generators. Additionally, for power ratings above 150 kVA, the cost of gas generators increases by 60–100% in comparison to diesel generators. Another key factor while operating a natural gas generator is its requirement of a well-developed gas distribution network, for a regular supply of natural gas to feed the generators. According to US EIA, in 2020, the gas transportation network in the US delivered about 27.7 trillion cubic feet (Tcf) of gas to about 77.3 million customers. Since these generators are more efficient and cleaner than diesel generators, helping reduce greenhouse gas emissions; this segment is expected to grow at the highest CAGR in the market during the forecast period.

By the application, the peak shaving segment is expected to grow at the fastest rate during the forecast period.

The peak shaving segment is estimated to be the fastest-growing segment of the power rental market, by application, from 2022 to 2027. Since the demand for power is increasing throughout the world, the generation has to grow as well in order to compensate for it. This demand especially rises during the daytime in summer and during night time in the winter season. The instantaneous growth in the level of demanded power is termed as peak demand and it is a common problem wherein utilities fall short of this requirement, specifically in the developing regions. Peak demand charges are applied during peak operational hours. Peak shaving generators help organizations with huge electricity consumption to reduce their utility costs during peak hours. These charges also vary according to the region as well as season, whereas the rates are normal for the off-peak period. In such times, in a few countries, the cost of operating this generator is less compared to the peak utility cost. Hence, to cut down on electricity bills, consumers use generators for their power requirements during peak hours. Moreover, in a few countries, the cost of operating power rental equipment is less compared to the peak utility cost or investing in the development of a new power plant. By using power rental solutions, utilities can ensure grid stability by feeding instantaneous additional power to the grid as and when required. Additionally, this solution of additional power supply is economical for the utilities.

By rental type, the project rental segment is expected to grow at the fastest rate during the forecast period.

The project rental segment of the power rental market, by rental type, is estimated to grow at a faster rate from 2022 to 2027. The equipment and solutions offered by major rental companies on a rental basis, including power, heating, and cooling, across key sectors in emerging/developing markets for various end-use customers with longer-rental duration are considered under this segment. In the case of project rental, generators are rented for a long period of time, generally for the entire duration of the particular project. For instance, oil & gas and mining projects. On the other hand, in retail rental, generators are rented for a short duration, mainly for commercial purposes. Various applications such as base load/continuous power and stand-by power supply are majorly required in the developing regions, which can be attributed to the growth of this project rental type over time. For instance, in Arad, Romania, a local utility was provided with 2 1 MW batteries for over a period of 36 months along with various other equipment such as diesel generators, gas generators, cables, and more. This impacted the surroundings of the utility in a positive manner by limiting the carbon emissions and providing heated water and electricity at economical prices.

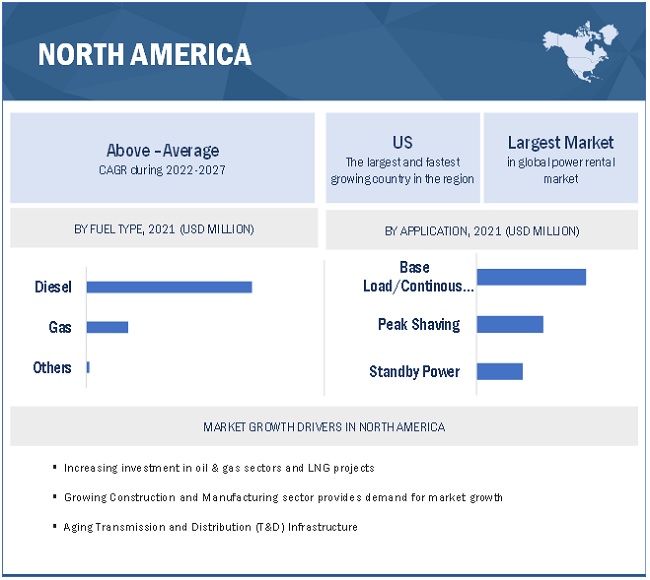

North America: Key market for power rental market during the forecast period.

In this report, the power rental has been analyzed with respect to five regions, namely, Asia Pacific, Europe, North America, South America, and Middle East & Africa. North America is expected to continue to dominate the power rental market during the forecast period, owing to factors such as increasing investments in the oil & gas, construction, and mining industries. Countries such as the US and Canada are the fastest-growing markets in the North American region. North America has a population of almost 530 million and an economy representing more than 25% of the world’s GDP. According to International Monetary Fund (IMF), the North American economy is expected to grow by approximately 5% in 2022. It is one of the major industrialized regions of the world. Additionally, the increased investments in the mining and related exploration activities in the region are also driving the requirement for power rental equipment during the forecast duration.

Key Market Players

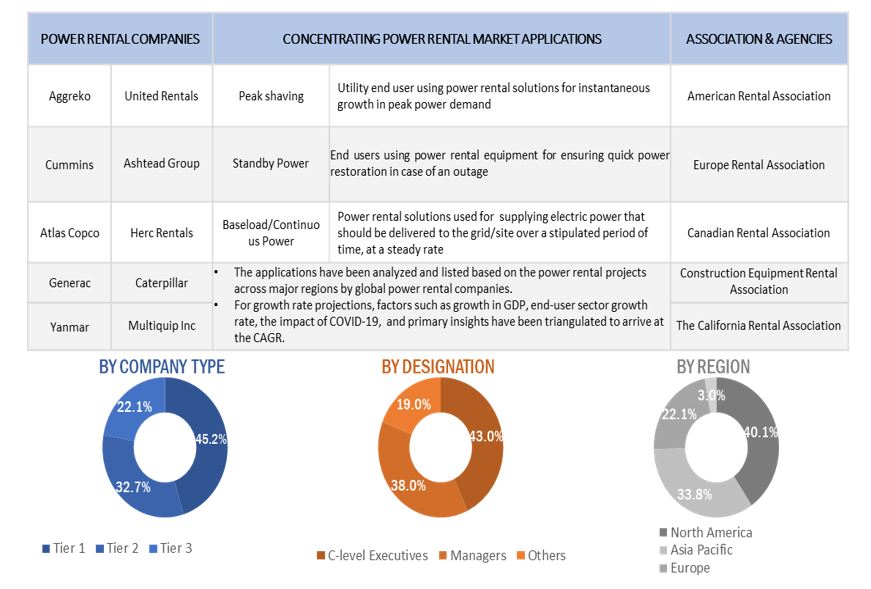

The global power rental market is dominated by a few global players, including Aggreko (UK), United Rentals (US), Caterpillar (US), Herc Rental (US), Ashtead Group (UK), and Atlas Copco (Sweden). Other major players in the market include Cummins (US), Bredenoord (UK), Kohler (US), Multiquip (US), SoEnergy (US), Allmand Brothers (US), Generac Power (US), Wacker Neuson (Germany), and more. New product launches, contracts, and agreements are among the key growth strategies adopted by some of the leading companies to increase their market shares and expand their geographic presence.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Coverage |

Details |

|

Market size: |

USD 9.8 billion in 2022 to USD 12.8 billion by 2027 |

|

Growth Rate: |

5.6% |

|

Largest Market: |

North America |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Fuel type, power rating, end-user, rental type, equipment, application, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Integration of power rental equipment with renewable energy |

|

Key Market Drivers: |

Surging demand for uninterrupted & reliable power supply |

This research report categorizes the power rental market Fuel type, power rating, end-user, rental type, equipment, application, and region

On the basis of by Fuel type, the market has been segmented as follows:

- Diesel

- Natural gas

- Others

On the basis of by application, the market has been segmented as follows:

- Standby power

- Peak shaving

- Base load/ continuous power

On the basis of by equipment, the market has been segmented as follows:

- Generators

- Transformers

- Load Banks

- Others

On the basis of by end-users, the market has been segmented as follows:

- Utilities

- Oil & gas

- Construction

- Manufacturing

- Metal & Mining

- IT and Data centers

- Corporate & Retail

- Events

- Others

On the basis of by rental type, the market has been segmented as follows:

- Retail Rental

- Project Rental

On the basis of by equipment, the market has been segmented as follows:

- Up to 50 kW

- 51 kW – 500 kW

- 501 kW – 2500 kW

- Above 2500 kW

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2021, Caterpillar Inc. announced a three-year project through collaboration with Microsoft and Ballard Power Systems to demonstrate a power system incorporating large-format hydrogen fuel cells to produce reliable and sustainable backup power for Microsoft data centers.

- In June 2021, the first hydrogen power generation units piloted at the Aggreko Plc depot in Moerdijk, Netherlands for use in temporary power applications.

- In April 2021: Atlas Copco introduced ZBC, the latest model in its lithium-ion energy storage system range called ZenergiZe. It can be used as a standalone source, combined with generators to make a hybrid power solution or renewable sources of energy as well as to create Microgrids.

- In August 2020: Aggreko signed a contract to deliver three temporary power generators for the pro women’s golf in Scotland.

- In May 2019: Bredenoord expanded its rental fleet with extra Big Battery Boxes, adding up to 4.5 MWh battery capacity.

- In February 2019: Pramac (a subsidiary of Generac) acquired majority stakes in an Indian generator manufacturer called Captiva Energy Solutions. Captiva Energy manufactured, sold, and rented generators for various applications.

Frequently Asked Questions (FAQ):

What is the current size of the power rental market?

The size of the global power rental market is USD 9.8 billion in 2022.

What are the major drivers for the power rental market?

Key factors driving the demand for power rental solutions include demand for continuous power supply in oil & gas and mining industries, growing need for electrification, as well as the continuous power supply of rural areas. The rapid expansion of the industrial sector along with the Surging demand for uninterrupted & reliable power supply is expected to drive the demand for the global power rental market.

Which region dominates during the forecasted period in the power rental market?

The North American region is projected to be the largest market, during 2022 to 2027, followed by Asia Pacific and Middle East & Africa. North America is expected to continue to dominate the power rental market during the forecast period, owing to factors such as increasing investments in the oil & gas, construction, and mining industries.

Which end-user industries prefer renting power rental equipment rather than buying them?

The end-use industries such as the Oil & Gas, construction, mining, utilities events, and medical (hospitals) industries rely heavily on the power rental equipment for baseload/continuous power and standby power applications.

Which is the fastest-growing fuel type segment during the forecasted period in the power rental market?

The diesel segment is estimated to be the fastest-growing segment of the power rental market, by fuel type, from 2022 to 2027. Key advantages of using diesel generators include economical operation and easy availability and storage. Additionally, diesel generator sets are ideal for long-term (prime) operations with a load of range 70–80% as they are designed typically to offer the best operational efficiency. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 POWER RENTAL MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY FUEL TYPE: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY POWER RATING: INCLUSIONS & EXCLUSIONS

1.2.4 MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.2.5 MARKET, BY EQUIPMENT: INCLUSIONS & EXCLUSIONS

1.2.6 MARKET, BY RENTAL TYPE: INCLUSIONS & EXCLUSIONS

1.3 MARKETS COVERED

FIGURE 1 MARKETS COVERED: POWER RENTAL MARKET

FIGURE 2 GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 POWER RENTAL MARKET: RESEARCH DESIGN

FIGURE 4 MARKET: DATA TRIANGULATION

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 KEY DATA FROM PRIMARY SOURCES

2.3.2 BREAK-UP OF PRIMARIES

2.4 SCOPE

FIGURE 5 MAIN METRICS CONSIDERED WHILE ASSESSING DEMAND FOR POWER RENTAL SOLUTIONS

2.5 MARKET SIZE ESTIMATION

2.5.1 DEMAND-SIDE ANALYSIS

FIGURE 6 YEAR-ON-YEAR CAPACITY ADDITION OF POWER RENTAL TECHNOLOGY ACROSS COUNTRIES IS KEY DETERMINING FACTOR FOR MARKET SIZE ESTIMATION

2.5.1.1 Key assumptions

2.5.1.2 Calculation

2.5.2 FORECAST

2.5.3 SUPPLY-SIDE ANALYSIS

FIGURE 7 YEAR-ON-YEAR REVENUE OF COMPANIES PROVIDING POWER RENTAL EQUIPMENT ACROSS REGIONS IS KEY DETERMINING FACTOR

2.5.3.1 Supply-side calculation

FIGURE 8 SUPPLY-SIDE CALCULATION ILLUSTRATION

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 GLOBAL POWER RENTAL MARKET SNAPSHOT

FIGURE 9 NORTH AMERICA HELD LARGEST SHARE OF MARKET IN 2021

FIGURE 10 UTILITIES SEGMENT IS EXPECTED TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 11 501–2,500 KW SEGMENT IS EXPECTED TO HOLD LARGEST SIZE OF MARKET FROM 2022 TO 2027

FIGURE 12 GENERATORS SEGMENT IS EXPECTED TO CAPTURE LARGEST SIZE OF MARKET FROM 2022 TO 2027

FIGURE 13 DIESEL SEGMENT TO CAPTURE LARGEST SIZE OF MARKET IN 2022

FIGURE 14 BASE LOAD/CONTINUOUS POWER SEGMENT IS EXPECTED TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 15 RETAIL RENTAL SEGMENT IS EXPECTED TO CONTINUE TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER RENTAL MARKET, 2022–2027

FIGURE 16 FREQUENT POWER OUTAGES AND SURGING DEMAND FOR UNINTERRUPTED & RELIABLE POWER SUPPLY TO DRIVE GROWTH OF MARKET

4.2 POWER RENTAL MARKET, BY REGION

FIGURE 17 ASIA PACIFIC IS EXPECTED TO GROW AT FASTEST RATE IN GLOBAL MARKET DURING FORECAST PERIOD

4.3 MARKET, BY END USER

FIGURE 18 UTILITIES SEGMENT HELD LARGEST MARKET SHARE IN 2021

4.4 MARKET, BY APPLICATION

FIGURE 19 BASELOAD/ CONTINUOUS POWER SEGMENT DOMINATED MARKET IN 2021

4.5 MARKET, BY POWER RATING

FIGURE 20 501–2,000 KW SEGMENT HELD LARGEST SHARE OF MARKET IN 2021

4.6 MARKET, BY FUEL TYPE

FIGURE 21 DIESEL SEGMENT IS EXPECTED TO DOMINATE POWER RENTAL MARKET DURING FORECAST PERIOD 2021

4.7 MARKET, BY EQUIPMENT

FIGURE 22 GENERATORS SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4.8 MARKET, BY RENTAL TYPE

FIGURE 23 RETAIL RENTAL SEGMENT ACCOUNTED FOR LARGER SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MARKET DYNAMICS FOR POWER RENTAL MARKET

5.2.1 DRIVERS

5.2.1.1 Rapid industrialization in developing economies of Asia Pacific

FIGURE 25 GREENFIELD PROJECT INVESTMENTS FOR MANUFACTURING AND CHEMICALS & CHEMICAL PRODUCTS IN ASIA, 2016–2020

5.2.1.2 Surging demand for uninterrupted and reliable power supply

FIGURE 26 AVERAGE DURATION OF TOTAL ANNUAL POWER INTERRUPTIONS IN US, 2013–2020

5.2.1.3 Growing need for electrification and continuous power supply in developing regions

TABLE 2 GLOBAL ELECTRICITY ACCESS RATE, 2019

5.2.2 RESTRAINTS

5.2.2.1 Growing adoption of renewable energy sources and energy storage technologies

FIGURE 27 INSTALLED RENEWABLE ELECTRICITY GENERATING CAPACITY, 2020–2050

FIGURE 28 INSTALLATION OF BATTERY STORAGE CAPACITY, 2020–2050

5.2.2.2 Stringent government regulations associated with generators

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of power rental equipment with renewable energy sources

FIGURE 29 GLOBAL INVESTMENT IN POWER SECTOR, BY TECHNOLOGY, 2016–2021

5.2.3.2 Technological advancements in power rental equipment for operations enhancement

5.2.4 CHALLENGES

5.2.4.1 Increased operating expenditure of diesel generators owing to high fuel prices

FIGURE 30 CRUDE OIL SPOT PRICES, JANUARY 2018–JANUARY 2022

5.2.4.2 Raw material and component shortage and sudden fluctuation in demand for power rental equipment

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 POWER RENTAL MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USERS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USERS (%)

5.4.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 4 END USER

TABLE 5 KEY BUYING CRITERIA, BY POWER RATING

5.5 COVID-19 IMPACT ANALYSIS

5.5.1 COVID-19 HEALTH ASSESSMENT

FIGURE 34 COVID-19 GLOBAL PROPAGATION

FIGURE 35 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.5.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 36 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.6 AVERAGE SELLING PRICE TREND

FIGURE 37 GLOBAL AVERAGE 24 HOURS RENTAL PRICE OF GENERATORS, 2021

5.7 VALUE CHAIN ANALYSIS

FIGURE 38 VALUE CHAIN ANALYSIS: POWER RENTAL MARKET

5.7.1 COMPONENT MANUFACTURES

5.7.2 EQUIPMENT MANUFACTURERS/ASSEMBLERS

5.7.3 END USERS

5.7.4 MAINTENANCE AND REPAIRS

5.8 TECHNOLOGY ANALYSIS

5.8.1 DIRECT POWER INSTALLATION TECHNOLOGY

5.8.2 POWER MANAGEMENT SYSTEMS

5.8.3 ASSET PERFORMANCE MANAGEMENT SYSTEMS

5.9 KEY CONFERENCES & EVENTS TO BE HELD DURING 2022–2023

TABLE 6 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 MARKET MAP

FIGURE 39 MARKET MAP: POWER RENTAL MARKET

5.11 CASE STUDY ANALYSIS

5.11.1 APRIL 2020: MEMS PROVIDED POWER SUPPLY TO NHS NIGHTINGALE HOSPITAL IN LONDON IN SHORT SPAN DURING COVID-19

5.11.2 DECEMBER 2019: AGGREKO PROVIDED POWER RENTAL SOLUTIONS FOR 4 MW OFF-GRID GAS PLANT FOR MINE REOPENING

5.11.3 JANUARY 2021: PR POWER PROVIDED POWER RENTAL EQUIPMENT IN SHORT SPAN IN WESTERN AUSTRALIA

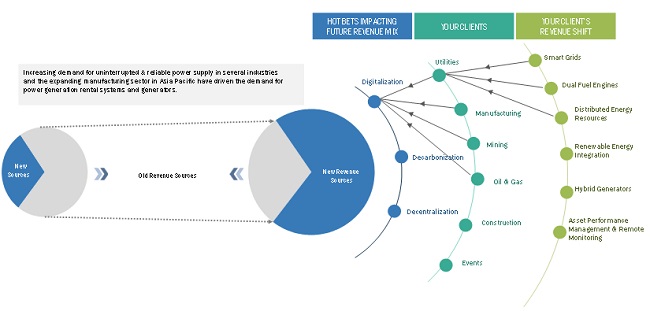

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.12.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 40 REVENUE SHIFT FOR POWER RENTAL

5.13 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 7 POWER EQUIPMENT: INNOVATIONS AND PATENT REGISTRATIONS, 2017–2021

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 CODES AND REGULATIONS RELATED TO POWER RENTAL EQUIPMENT

TABLE 13 NORTH AMERICA: CODES AND REGULATIONS

TABLE 14 ASIA PACIFIC: CODES AND REGULATIONS

TABLE 15 REST OF THE WORLD: CODES AND REGULATIONS

TABLE 16 GLOBAL: CODES AND REGULATIONS

5.14 TRADE DATA STATISTICS

TABLE 17 GLOBAL IMPORT DATA OF GENERATORS, 2018–2020 (USD MILLION)

TABLE 18 GLOBAL EXPORT DATA OF GENERATORS, 2018–2020 (USD MILLION)

5.15 TARIFFS, CODES, AND REGULATIONS

TABLE 19 RESIDENTIAL ELECTRICITY PRICES IN SELECTED ECONOMIES, 2018

5.15.1 TARIFFS RELATED TO GENERATORS

TABLE 20 IMPORT TARIFFS FOR HS 850161 AC GENERATORS OF OUTPUT < 75 KVA

TABLE 21 IMPORT TARIFFS FOR HS 850162 AC GENERATORS OF OUTPUT 75–375 KVA

TABLE 22 IMPORT TARIFFS FOR HS 850163 AC GENERATORS OF OUTPUT 375–750 KVA

TABLE 23 IMPORT TARIFFS FOR HS 850164 AC GENERATORS OF OUTPUT > 750 KVA

6 POWER RENTAL MARKET, BY FUEL TYPE (Page No. - 106)

6.1 INTRODUCTION

FIGURE 41 POWER RENTAL MARKET SHARE, BY FUEL TYPE, 2021

TABLE 24 MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

6.2 DIESEL

6.2.1 EASY AVAILABILITY AND STORAGE OF DIESEL ARE DRIVING DIESEL SEGMENT

TABLE 25 DIESEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 NATURAL GAS

6.3.1 EXPANDING GAS DISTRIBUTION NETWORK TO DRIVE GROWTH OF NATURAL GAS SEGMENT DURING FORECAST PERIOD

TABLE 26 NATURAL GAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 OTHERS

TABLE 27 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 POWER RENTAL MARKET, BY POWER RATING (Page No. - 111)

7.1 INTRODUCTION

FIGURE 42 POWER RENTAL MARKET SHARE, BY POWER RATING, 2021

TABLE 28 MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

7.2 UP TO 50 KW

7.2.1 UP TO 50 KW POWER RENTAL EQUIPMENT ARE COMPACT AND PORTABLE

TABLE 29 UP TO 50 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 51 KW–500 KW

7.3.1 GENERATORS IN 51 KW–500 KW POWER RATING CATEGORY ARE MOSTLY USED IN CONSTRUCTION AND OIL & GAS INDUSTRIES

TABLE 30 51 KW–500 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 501 KW–2,500 KW

7.4.1 501–2,500 KW GENERATORS ARE MAINLY USED TO PROVIDE STANDBY POWER

TABLE 31 501 KW–2,500 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 ABOVE 2,500 KW

7.5.1 ABOVE 2,500 KW GENERATORS ARE USED FOR UNINTERRUPTED POWER SUPPLY IN MINING AND OFFSHORE OIL & GAS OPERATIONS

TABLE 32 ABOVE 2,500 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 POWER RENTAL MARKET, BY APPLICATION (Page No. - 116)

8.1 INTRODUCTION

FIGURE 43 POWER RENTAL MARKET SHARE, BY APPLICATION, 2021

TABLE 33 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PEAK SHAVING

8.2.1 NEED TO REDUCE UTILITY COSTS DRIVES DEMAND FOR PEAK SHAVING

TABLE 34 PEAK SHAVING: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 STANDBY POWER

8.3.1 REQUIREMENT OF POWER DURING GRID OUTAGE IS DRIVING DEMAND FOR STANDBY POWER

TABLE 35 STANDBY POWER: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 BASE LOAD/CONTINUOUS POWER

8.4.1 INCREASING DEMAND FROM UTILITIES AND MINING END USERS IS DRIVING BASE LOAD/CONTINUOUS POWER SEGMENT

TABLE 36 BASE LOAD/CONTINUOUS POWER: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 POWER RENTAL MARKET, BY EQUIPMENT (Page No. - 121)

9.1 INTRODUCTION

FIGURE 44 POWER RENTAL MARKET SHARE, BY EQUIPMENT, 2021

TABLE 37 MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

9.2 GENERATORS

9.2.1 GENERATORS ARE USED FOR STANDBY POWER APPLICATIONS IN TELECOM, DATA CENTER, AND OTHER INDUSTRIES

TABLE 38 GENERATORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 TRANSFORMERS

9.3.1 INCREASING DEMAND FOR UTILITY-SCALE TEMPORARY POWER PLANTS IS DRIVING TRANSFORMERS MARKET

TABLE 39 TRANSFORMERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 LOAD BANKS

9.4.1 INCREASING NUMBER OF POWER PLANT INSTALLATIONS WORLDWIDE IS FUELING DEMAND FOR LOAD BANKS

TABLE 40 LOAD BANKS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5 OTHERS

TABLE 41 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 POWER RENTAL MARKET, BY END USER (Page No. - 127)

10.1 INTRODUCTION

FIGURE 45 POWER RENTAL MARKET, BY END USER, 2021

TABLE 42 MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 UTILITIES

10.2.1 INCREASING REQUIREMENT FOR CONTINUOUS POWER IS DRIVING DEMAND FOR POWER RENTAL SOLUTIONS FROM UTILITIES

TABLE 43 UTILITIES: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 OIL & GAS

10.3.1 GROWING OIL AND GAS EXPLORATIONS IS DRIVING MARKET FOR POWER RENTAL SOLUTIONS

TABLE 44 OIL & GAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.4 MINING & METALS

10.4.1 GROWING EXPLORATION OF METALS & MINERALS THROUGH MINING IS DRIVING MARKET FOR POWER RENTAL SOLUTIONS

TABLE 45 MINING & METALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.5 MANUFACTURING

10.5.1 INCREASING INVESTMENT IN MANUFACTURING SECTOR IN ASIA PACIFIC IS DRIVING MARKET

TABLE 46 MANUFACTURING: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.6 CONSTRUCTION

10.6.1 INFRASTRUCTURE DEVELOPMENT ACTIVITIES IN SOUTHEAST ASIAN COUNTRIES EXPECTED TO PROPEL MARKET GROWTH

TABLE 47 CONSTRUCTION: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.7 IT & DATA CENTERS

10.7.1 INCREASING NUMBER OF DATA CENTRES IS DRIVING MARKET FOR POWER RENTAL SOLUTIONS

TABLE 48 IT & DATA CENTERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.8 CORPORATE & RETAIL

10.8.1 MASSIVE INVESTMENTS IN CORPORATE SECTOR BY BOTH PUBLIC AND PRIVATE ENTERPRISES IS EXPECTED TO PROPEL MARKET GROWTH

TABLE 49 CORPORATE & RETAIL: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.9 EVENTS

10.9.1 GROWING NUMBER OF PUBLIC EVENTS IS BOOSTING DEMAND FOR POWER RENTAL SOLUTIONS

TABLE 50 EVENTS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.10 OTHERS

TABLE 51 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 POWER RENTAL MARKET, BY RENTAL TYPE (Page No. - 137)

11.1 INTRODUCTION

FIGURE 46 POWER RENTAL MARKET SHARE, BY RENTAL TYPE, 2021

TABLE 52 MARKET, BY RENTAL TYPE, 2020–2027(USD MILLION)

11.2 RETAIL RENTAL

11.2.1 REQUIREMENT FOR CONTINUOUS POWER SUPPLY DURING PEAK HOURS AND POWER OUTAGES IS DRIVING MARKET

TABLE 53 RETAIL RENTAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 PROJECT RENTAL

11.3.1 DEMAND FOR RENTAL POWER FROM UTILITIES AND OTHER LONG-DURATION USERS IS PROPELLING MARKET GROWTH

TABLE 54 PROJECT RENTAL: MARKET, BY REGION, 2020–2027(USD MILLION)

12 REGIONAL ANALYSIS (Page No. - 141)

12.1 INTRODUCTION

FIGURE 47 REGIONAL SNAPSHOT: ASIA PACIFIC TO BE FASTEST-GROWING MARKET, BY VALUE, DURING FORECAST PERIOD

FIGURE 48 POWER RENTAL MARKET SHARE (VALUE), BY REGION, 2021

TABLE 55 MARKET, BY REGION, 2020–2027 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 49 SNAPSHOT: MARKET IN ASIA PACIFIC

12.2.1 BY FUEL TYPE

TABLE 56 ASIA PACIFIC: POWER RENTAL MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

12.2.2 BY POWER RATING

TABLE 57 ASIA PACIFIC: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

12.2.3 BY APPLICATION

TABLE 58 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.2.4 BY END USER

TABLE 59 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.5 BY RENTAL TYPE

TABLE 60 ASIA PACIFIC: MARKET, BY RENTAL TYPE, 2020–2027 (USD MILLION)

12.2.6 BY EQUIPMENT

TABLE 61 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

12.2.7 BY COUNTRY

TABLE 62 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.2.7.1 China

12.2.7.1.1 Rise in energy demand due to rapid urbanization and industrialization to create market growth opportunities

TABLE 63 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.2 India

12.2.7.2.1 Increased need for reliable electricity and rapid economic growth to drive market

TABLE 64 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.3 Australia

12.2.7.3.1 Increased construction and mining activities to accelerate market growth

TABLE 65 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.4 Japan

12.2.7.4.1 High demand from utilities due to renovation of grid infrastructure to drive market

TABLE 66 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.5 South Korea

12.2.7.5.1 Rising investments in manufacturing and marine industries in South Korea to drive market growth

TABLE 67 SOUTH KOREA: POWER RENTAL MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.6 Bangladesh

12.2.7.6.1 Expanding manufacturing sector and weak T&D infrastructure drive market growth

TABLE 68 BANGLADESH: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.7.7 Rest of Asia Pacific

TABLE 69 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 50 SNAPSHOT: MARKET IN NORTH AMERICA

12.3.1 BY FUEL TYPE

TABLE 70 NORTH AMERICA: POWER RENTAL MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

12.3.2 BY POWER RATING

TABLE 71 NORTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

12.3.3 BY APPLICATION

TABLE 72 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.3.4 BY END USER

TABLE 73 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.5 BY RENTAL TYPE

TABLE 74 NORTH AMERICA: MARKET, BY RENTAL TYPE, 2020–2027 (USD MILLION)

12.3.6 BY EQUIPMENT

TABLE 75 NORTH AMERICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

12.3.7 BY COUNTRY

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.3.7.1 US

12.3.7.1.1 Increasing investment in construction, oil & gas exploration, and mining activities driving power rental market

TABLE 77 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.7.2 Canada

12.3.7.2.1 Rising initiation of new mining and construction projects to boost market growth

TABLE 78 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.7.3 Mexico

12.3.7.3.1 Increasing investments in oil & gas industry and data centers is propelling market growth

TABLE 79 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4 MIDDLE EAST & AFRICA

12.4.1 BY FUEL TYPE

TABLE 80 MIDDLE EAST & AFRICA: POWER RENTAL MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

12.4.2 BY POWER RATING

TABLE 81 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

12.4.3 BY APPLICATION

TABLE 82 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.4.4 BY END USER

TABLE 83 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.5 BY RENTAL TYPE

TABLE 84 MIDDLE EAST & AFRICA: MARKET, BY RENTAL TYPE, 2020–2027 (USD MILLION)

12.4.6 BY EQUIPMENT

TABLE 85 MIDDLE EAST & AFRICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

12.4.7 BY COUNTRY

TABLE 86 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.4.7.1 Saudi Arabia

12.4.7.1.1 Rising investment in oil & gas sector and data centers is favoring market growth

TABLE 87 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.2 UAE

12.4.7.2.1 Demand from construction, oilfields, and manufacturing sectors leading to growth of power rental market

TABLE 88 UAE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.3 Qatar

12.4.7.3.1 Events and construction industries are expected to drive power rental market

TABLE 89 QATAR: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.4 Nigeria

12.4.7.4.1 High dependence on rental generators to provide continued power supply substantiates market growth

TABLE 90 NIGERIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.5 South Africa

12.4.7.5.1 Increasing investment in mining sector to fuel demand for power rental solutions

TABLE 91 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.7.6 Rest of Middle East & Africa

TABLE 92 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5 EUROPE

12.5.1 BY FUEL TYPE

TABLE 93 EUROPE: POWER RENTAL MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

12.5.2 BY POWER RATING

TABLE 94 EUROPE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

12.5.3 BY APPLICATION

TABLE 95 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.5.4 BY END USER

TABLE 96 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.5 BY RENTAL TYPE

TABLE 97 EUROPE: MARKET, BY RENTAL TYPE, 2020–2027 (USD MILLION)

12.5.6 BY EQUIPMENT

TABLE 98 EUROPE: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

12.5.7 BY COUNTRY

TABLE 99 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.5.7.1 UK

12.5.7.1.1 Rapid industrialization is expected to drive power rental market in UK

TABLE 100 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.2 Russia

12.5.7.2.1 Surging investments in oil & gas and mining sectors to accelerate power rental market growth in Russia

TABLE 101 RUSSIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.3 Germany

12.5.7.3.1 Need for reliable backup power in manufacturing, data center, and construction sectors to boost market growth

TABLE 102 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.4 Italy

12.5.7.4.1 Increasing focus on developments and events is expected to drive power rental market

TABLE 103 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.5 France

12.5.7.5.1 Demand for power rental solutions in mining sector and major events is fueling market growth

TABLE 104 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5.7.6 Rest of Europe

TABLE 105 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6 SOUTH AMERICA

12.6.1 BY FUEL TYPE

TABLE 106 SOUTH AMERICA: POWER RENTAL MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

12.6.2 BY POWER RATING

TABLE 107 SOUTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

12.6.3 BY APPLICATION

TABLE 108 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

12.6.4 BY END USER

TABLE 109 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.5 BY RENTAL TYPE

TABLE 110 SOUTH AMERICA: MARKET, BY RENTAL TYPE, 2020–2027 (USD MILLION)

12.6.6 BY EQUIPMENT

TABLE 111 SOUTH AMERICA: MARKET, BY EQUIPMENT, 2020–2027 (USD MILLION)

12.6.7 BY COUNTRY

TABLE 112 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

12.6.7.1 Brazil

12.6.7.1.1 Increasing investments in mining sector and expansion of data centers propel demand for power rental solutions

TABLE 113 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.7.2 Argentina

12.6.7.2.1 Investments in oil & gas, mining, and manufacturing industries to fuel demand for power rental equipment

TABLE 114 ARGENTINA: MARKET BY END USER, 2020–2027 (USD MILLION)

12.6.7.3 Chile

12.6.7.3.1 Developments in infrastructure and mining sectors to augment market growth

TABLE 115 CHILE: MARKET, BY END USER, 2020–2027 (USD MILLION)

12.6.7.4 Rest of South America

TABLE 116 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 187)

13.1 KEY PLAYERS STRATEGIES

TABLE 117 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

13.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 118 POWER RENTAL MARKET: DEGREE OF COMPETITION

FIGURE 51 MARKET SHARE ANALYSIS, 2020

13.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 52 TOP PLAYERS IN MARKET FROM 2016 TO 2020

13.4 COMPETITIVE LEADERSHIP MAPPING

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 53 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

13.5 START-UP/SME EVALUATION QUADRANT, 2021

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 54 POWER RENTAL MARKET: START-UP/SME EVALUATION QUADRANT, 2020

TABLE 119 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 120 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

13.6 POWER RENTAL MARKET: COMPANY FOOTPRINT

TABLE 121 POWER RATING: COMPANY POWER RATING FOOTPRINT

TABLE 122 FUEL TYPE: COMPANY FUEL TYPE FOOTPRINT

TABLE 123 END USER: COMPANY END USER FOOTPRINT

TABLE 124 REGION: COMPANY REGION FOOTPRINT

TABLE 125 COMPANY FOOTPRINT

13.7 COMPETITIVE SCENARIO

TABLE 126 POWER RENTAL MARKET: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2022

TABLE 127 MARKET: DEALS, JANUARY 2018–JANUARY 2022

TABLE 128 MARKET: OTHERS, JANUARY 2018–JANUARY 2022

14 COMPANY PROFILES (Page No. - 206)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 AGGREKO PLC

TABLE 129 AGGREKO PLC: BUSINESS OVERVIEW

FIGURE 55 AGGREKO PLC: COMPANY SNAPSHOT, 2020

TABLE 130 AGGREKO PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 131 AGGREKO PLC: PRODUCT LAUNCHES

TABLE 132 AGGREKO PLC: DEALS

TABLE 133 AGGREKO PLC: OTHERS

14.1.2 ASHTEAD GROUP PLC

TABLE 134 ASHTEAD GROUP PLC: BUSINESS OVERVIEW

FIGURE 56 ASHTEAD GROUP PLC: COMPANY SNAPSHOT, 2021

TABLE 135 ASHTEAD GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 136 ASHTEAD GROUP PLC: OTHERS

14.1.3 UNITED RENTALS INC

TABLE 137 UNITED RENTALS INC: BUSINESS OVERVIEW

FIGURE 57 UNITED RENTALS INC: COMPANY SNAPSHOT, 2021

TABLE 138 UNITED RENTALS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 UNITED RENTALS INC: DEALS

TABLE 140 UNITED RENTALS INC: OTHERS

14.1.4 ATLAS COPCO

TABLE 141 ATLAS COPCO: BUSINESS OVERVIEW

FIGURE 58 ATLAS COPCO: COMPANY SNAPSHOT, 2020

TABLE 142 ATLAS COPCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 143 ATLAS COPCO: PRODUCT LAUNCHES

TABLE 144 ATLAS COPCO: DEALS

TABLE 145 ATLAS COPCO: OTHERS

14.1.5 CATERPILLAR INC.

TABLE 146 CATERPILLAR INC: BUSINESS OVERVIEW

FIGURE 59 CATERPILLAR INC: COMPANY SNAPSHOT, 2020

TABLE 147 CATERPILLAR INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 148 CATERPILLAR INC: DEALS

TABLE 149 CATERPILLAR INC: OTHERS

14.1.6 CUMMINS INC.

TABLE 150 CUMMINS INC.: BUSINESS OVERVIEW

FIGURE 60 CUMMINS INC.: COMPANY SNAPSHOT, 2021

TABLE 151 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 152 CUMMINS INC.: PRODUCT LAUNCHES

TABLE 153 HERC RENTALS: BUSINESS OVERVIEW

FIGURE 61 HERC RENTALS: COMPANY SNAPSHOT, 2020

TABLE 154 HERC RENTALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.8 GENERAC HOLDINGS INC.

TABLE 155 GENERAC HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 62 GENERAC HOLDINGS INC.: COMPANY SNAPSHOT, 2020

TABLE 156 GENERAC HOLDINGS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 GENERAC HOLDINGS INC: PRODUCT LAUNCHES

TABLE 158 GENERAC HOLDINGS INC: DEALS

TABLE 159 GENERAC HOLDINGS INC.: OTHERS

14.1.9 WACKER NEUSON

TABLE 160 WACKER NEUSON: BUSINESS OVERVIEW

FIGURE 63 WACKER NEUSON: COMPANY SNAPSHOT, 2020

TABLE 161 WACKER NEUSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 162 WACKER NEUSON: PRODUCT LAUNCHES

TABLE 163 WACKER NEUSON: OTHERS

14.1.10 KOHLER CO

TABLE 164 KOHLER CO: BUSINESS OVERVIEW

TABLE 165 KOHLER CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.11 SOENERGY INTERNATIONAL

TABLE 166 SOENERGY INTERNATIONAL: BUSINESS OVERVIEW

TABLE 167 SOENERGY INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 SOENERGY INTERNATIONAL: OTHERS

14.1.12 BREDENOORD

TABLE 169 BREDENOORD: BUSINESS OVERVIEW

TABLE 170 BREDENOORD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 BREDENOORD: PRODUCT LAUNCHES

TABLE 172 BREDENOORD: DEALS

TABLE 173 BREDENOORD: OTHERS

14.1.13 ALLMAND BROTHERS INC.

TABLE 174 ALLMAND BROTHERS INC.: BUSINESS OVERVIEW

TABLE 175 ALLMAND BROTHERS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.14 MULTIQUIP INC

TABLE 176 MULTIQUIP INC: BUSINESS OVERVIEW

TABLE 177 MULTIQUIP INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.15 OTHER KEY PLAYERS

14.1.15.1 J&J equipment rentals & sales

14.1.15.2 Ahern rentals

14.1.15.3 One source rentals

14.1.15.4 D.I.Y. rentals

14.1.15.5 APR energy

14.1.15.6 AL Faris Group

14.1.15.7 Shenton group

14.1.15.8 ProPower Rental

14.1.15.9 Yanmar

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 264)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the power rental market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, Factiva, and environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the power rental market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The Power rental market comprises several stakeholders such as Generator rental companies, Distributors, Power rental providers, Government and research organizations, Construction equipment rental association, American rental association Generator manufacturers, Mining companies, Power generation companies, Raw material suppliers and Oil & gas operators. The demand side of the market is characterized by increased investment in the construction, mining & metals and oil & gas sector. The supply side is characterized by investments & expansion and, partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global power rental market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the size of the global power rental market after COVID-19’s impact and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define and describe the power rental market based on fuel type, power rating, end-user, rental type, equipment, application, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the market with respect to individual growth trends, future expansions, and their contributions to the market

- To analyze growth opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the market with respect to six main regions—the North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies1

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Rental Market