RFID Market Size, Share & Industry Growth Analysis Report by Offering (Tags, Readers, Software & Services), Tag Type (Passive, Active), Wafer Size, Frequency, Form Factor (Card, Implant, Key Fob, Label, Paper Ticket, Band), Material, Application & Region - Global Growth Driver and Industry Forecast to 2030

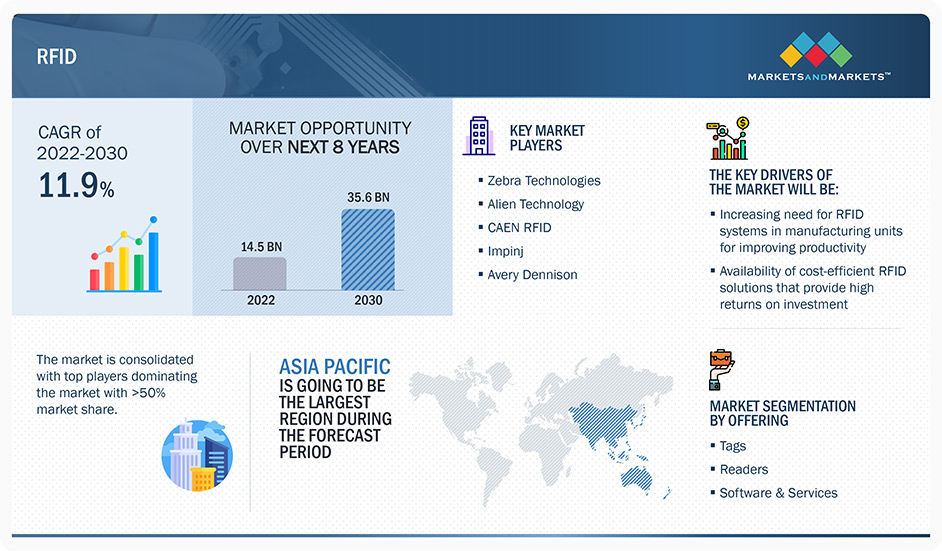

The global RFID Market size is expected to reach USD 35.6 billion by 2030 from USD 18.45 billion by 2023, it is expected to grow at a compound annual growth rate (CAGR) of 11.9% during the forecast period. One of the major driving factors of the RFID market is the increasing demand for inventory management and supply chain optimization in various industries such as retail, healthcare, and automotive. RFID technology offers real-time and accurate tracking of goods and assets, enabling businesses to improve their operational efficiency and reduce costs. Additionally, the growing need for enhanced security and authentication measures is also fueling the growth of the RFID market.

RFID technology uses radio waves to identify/detect people or objects. RFID tags are small electronic devices that send/receive data to/from RFID readers. RFID tags can be incorporated into products, animals, or humans for identification and data collection. According to the Food and Drug Administration (FDA), “Radio frequency identification (RFID) refers to a wireless system composed of two components: tags and readers. The reader is a device that has one or more antennas that emit radio waves and receive signals back from the RFID tag. Tags that use radio waves to communicate their identity and other information to nearby readers, can be passive or active. Passive RFID tags are powered by the reader and do not have a battery. Active RFID tags are powered by batteries.” RFID technology is a modern solution for industrial and consumer applications due to the increasing adoption of information technologies. An RFID solution involves a label or tag and a reader to communicate with the tags.

The availability of handheld readers or sled readers has enhanced the capabilities of RFID solutions, as they help track the asset more conveniently at a low cost. The RFID tag technology has evolved from reading from a close distance to more than 100 meters, i.e., active frequency tags. Active frequency tags are not only used to track standalone assets but also to track moving assets and personnel in real time. These tags are now being widely used in industries such as transportation, logistics and supply chain, retail, defense, etc., to track assets in real time. With technological advancements and innovations, the passive ultra-high frequency has been further segmented into a new band (860 to 960 MHz), called RAIN RFID. The adoption of RAIN RFID has increased multifold to reach many suppliers in the ecosystem. It is currently the most adopted RFID frequency globally.

Increasing need of RFID in manufacturing units for productivity, availability of cost effective RFID solutions and high returns of investments, rising need for improving inventory management, increasing government initiatives and regulations for safety and security are some of the major drivers of RFID industry.

RFID Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on RFID Market Trends

The outbreak of the COVID-19 virus led to the shutdown of factories globally, along with the implementation of other lockdown measures, which included stringent social distancing norms as well. This was complemented by the disruption in supply chain operations and logistics-related services. The detection of a second strain of the COVID-19 virus in Europe further affected the rfid market report in the region.

The fall in demand for expensive retail products worldwide due to lockdown measures, along with supply chain disruptions, is expected to have slowed down the growth of the RFID market. The falling global demand for automobiles is also expected to have a mid-term impact on the automotive RFID market. Although governments in developing regions have mandated the RFID tagging on vehicles for tolling, the slowdown in travel has currently restricted the deployment of RFID tags. Manufacturing facilities across several sectors, such as automotive and consumer electronics, re-opened post-third quarter of 2020 as lockdown measures were lifted in various countries. Still, factories in the European region are yet to function at pre-COVID-19 levels due to social distancing norms. However, this has offered an opportunity to the RFID players for promoting the use of RFID solutions for industrial automation. The manufacturing companies are seeking RFID technology to increase their productivity with fewer employees and complying with social distancing norms. This is expected to boost the RFID market during the forecast period higher than that of the pre-COVID-19 scenario. The recovery path to this has begun in the fourth quarter of 2020. With the logistics and supply chain industry gaining momentum after the relaxation of lockdown measures, the adoption of RFID solutions has increased to fasten the deliveries pending due to lockdown.

Many companies might deploy RFID solutions to continuously monitor the assets to reduce delivery time and increase productivity. Thus, the adoption of RFID technology is expected to be more than in the pre-COVID-19 scenario. The healthcare sector has been under tremendous pressure due to the continuous increase in COVID-19 cases globally. This has given way to the adoption of advanced medical technologies, including smart medical robots, advanced imaging systems, remote sensing equipment, and smart ventilation systems. Such developments could also aid in improving the current growth of the RFID market.

Market Dynamics:

Driver: Increasing need for RFID systems in manufacturing units for improving productivity

Manufacturing facilities need to monitor equipment condition and performance, defects in processes, and system failures, and ensure predictive maintenance of equipment and systems through the integration of specialized tools and adoption of quality management practices. The use of RFID technology for plant asset management helps manufacturers achieve this goal. A combination of RFID tags and sensors is an ideal solution for various locations in a manufacturing facility, such as conveyors, cameras, boilers, tanks, pipes, etc., to manage and maintain the quality and output of a manufacturing process. RFID tags are attached to movable assets in industries such as tools, manufacturing equipment, and process components (e.g., doors, engine, wheels, mirrors, and other parts of an automobile) that are part of a final product to track them in the process.

The use of RFID solutions not only helps track the parts but also helps understand the lifecycle of manufacturing equipment. This helps manufacturers schedule the maintenance of the equipment whenever required and not as per predefined schedules. An RFID solution can be easily configured with a plant asset management (PAM) software solution for monitoring and diagnosing devices and equipment. The information about asset conditions provided by the solution can be used to optimize plant operation, increase production capacity, and implement operational strategies. This helps achieve cost savings through enhanced maintenance efficiency.

In the current scenario of the COVID-19 pandemic, many companies have faced a slowdown in operations due to the lockdown and restrictions on working norms laid down by governments. Companies need to ensure adherence to social distancing mandates within the plant. With just 50% of employees working on the floor, it is difficult for many players to achieve production targets. Using RFID technology with industrial automation solutions, companies can revive faster than what was predicted. The benefits of RFID help manufacturers not only track the parts and equipment remotely but also help to identify if more than the stipulated number of people have gathered at a point.

Restraint: High initial cost associated with installation of RFID systems

The installation cost of an RFID system can range from USD 2 million to 5 million for a standard active real-time monitoring system. This cost can differ according to end-use industry and installation area. High installation cost is one of the major restraining factors for the implementation of RFID technology. Adoption of RFID systems in any industry requires high investments, including the purchase cost of RFID tags, readers, and software, and the costs associated with replacement services and electricity. Add-on features such as continuous accuracy checking of systems, IoT integration, and training costs make RFID solutions more costly. This results in a low adoption rate of RFID systems.

The installation cost of Wi-Fi-based passive RFID is less than active RFID systems. However, the maintenance of Wi-Fi-based solutions is costlier compared with systems based on technologies such as active RFID or BLE. Many RFID companies are facing various issues in terms of deployment and technology, as many projects are failing because they require a lot of engineering efforts and for a large area, multiple asset tracking. The high price of an active RFID system is because of the high price of tags, batteries, software, infrastructure, and wiring. The infrastructure is expensive, and wiring, power, and installation of these components in the wall and roof increase the total cost.

Opportunity: Increasing demand for hybrid RFID solutions

The RFID market is witnessing a rise in demand for hybrid solutions. Hybrid solutions have been designed to overcome some of the challenges associated with a single technology-based RFID system. A hybrid solution not only helps the end users deploy RFID technology at blind spots but also helps reduce infrastructure cost by utilizing existing technologies such as Wi-Fi or GPS. For instance, localized RFID can be used in areas where GPS has visibility problems, without incurring the infrastructure cost of full-scale RFID. The result is a robust, easy-to-install, and flexible solution that offers unsurpassed reliability immediately after the deployment.

Generally, in hybrid solutions, technologies are combined with the goal of achieving cost efficiency without compromising accuracy. For example, Wi-Fi and ZigBee, which rely only on radio frequency, can penetrate through walls and floors, while infrared can pass through sliding glass doors and windows, enhancing their ability to determine the location accurately. Infrared has a limited range, while ultrasound has a range of about 60 ft., which is ideal for covering hallways and large open areas. Ultrasound can stay within the boundaries of a room; however, it lacks the distance precision for sub-room or bed-level positioning. Also, the communication time between the tag and locator in an ultrasound/radio system is extremely fast, resulting in its ability to support a very high number of tags in a room. Another advantage of a hybrid system is its ability to use only the RF for location triangulation and to quickly capture fast-moving assets, which are useful for theft prevention. A hybrid system can deliver the highest accuracy and precision with a consistent 100% certainty to drive meaningful workflow.

Challenge: Lack of backup for large volumes of data

The lack of backend data support is one of the major challenges for the market. The data generated by tracking, identifying, and monitoring is huge. For instance, in a data center, the tracking of assets such as servers, tapes, media, routers, and other devices aggregates to terabytes of data in a single day. To channelize this data over the storage such that data traffic is avoided is a major challenge that needs to be carefully handled. If this data is not handled carefully, an additional issue for load on servers or low storage capacity might arise.

In livestock monitoring, the data related to animal diseases, farm management, and traceability of animals generates a large amount of data, which can be used for further analysis. However, the low CAPEX of end users results in a lack of data analytics tools, due to which data analysis becomes impossible. This acts as a challenge to the growth of the RFID market.

In offering segment, the tags sub-segment is expected to hold the largest rfid market share during the forecast period

The tags segment accounted for the highest market share of the total RFID market, by value, in 2021. Tags are the key components in an RFID solution and are used in multiple applications in large quantities, owing to which the segment captured the largest market share in 2021. The number of tags installed is much higher than the number of readers and software used in a complete RFID system of an organization. Additionally, with the rising number of assets, the number of tags installed increases; however, old readers can scan new tags. This is the main reason due to which the rfid market size for tags is larger. A tag is used to identify a particular asset or person. Each tag has its own identity or ID number. These tags are used to track individuals, equipment, or any other asset of an enterprise. An RFID tag comprises different elements, such as electronic circuitry, battery, and antenna.

The electronic circuitry includes semiconductor chips and other electronic components, such as resistors and capacitors. The other two elements—integrated antenna and battery—vary according to the requirement and the technology used for communication between the tag and the reader. Various types of tags are ring tags, labels, cards, tickets, wristbands, key fobs, tie wraps, embedded tags, and mountable tags. These tags can be used for standalone monitoring and real-time

In tag type segment, passive tags is expected to grow at higher CAGR and hold the largest market share during the forecast period

Passive tags is expected to hold higher rfid market share and grow at a higher CAGR during the forecast period. The large share of this segment can primarily be attributed to the low cost of passive tags in comparison with active tags. The most commonly used RFID tags are labels and cards. RFID labels and cards are used for identification, access control, asset labeling, and payment applications. Passive RFID tags do not require an external power source, e.g., battery, and are instead powered by electromagnetic waves transmitted by RFID readers. The readers transmit a low-power radio signal through the antenna, which is received by the tag to activate it. The tag then verifies and exchanges the data with the reader. Passive tags can transmit information over a shorter distance (10 feet or less) than active tags. Passive tags do not require an external power source. These are inexpensive and smaller, and easier to manufacture than active tags. Passive RFID tags can be used in various applications and are commonly used to track goods in pharmaceuticals, retail, supply chain, enterprise, and other industries. Based on the range of frequency, passive tags are further segmented into low-frequency (LF), high-frequency (HF), and ultra-high-frequency (UHF) tags.

RFID Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The RFID market in APAC is expected to grow at highest CAGR during the forecast period (2022-2027)

The Asia Pacific region stores huge opportunities for the RFID market; the market in this region is expected to grow at the highest CAGR during the forecast period. With the growing trade network among Asia Pacific countries, companies are leveraging the benefits of RFID solutions for gaining visibility into the supply chain. RFID is an ideal medium for tracking assets or people in organizations in real time. Adoption of RFID solutions across various industries, such as manufacturing, sports & entertainment, logistics and supply chain, and retail, is expected to increase in Asia Pacific during the forecast period.

The region is witnessing advancements in healthcare, retail, and manufacturing sectors, along with the adoption of new technologies. Countries such as Japan, South Korea, China, India, Australia & New Zealand (ANZ), and ASEAN are also showing interest in RFID technology, as it is affordable and can derive benefits in the long term. RFID technology is largely adopted by the healthcare industry players in Japan.

In 2021, China was the largest RFID tag market in Asia Pacific. The growing manufacturing sector in the country is generating huge demand for RFID solutions to improve operational efficiency and lower operational costs by tracking equipment, goods, materials, safety, assembly lines, and distribution in manufacturing facilities in China. This factor is anticipated to drive the market growth in the country.

Top RFID Companies- Key Market Players

The prominent players operating in the RFID companies are Zebra Technologies (US), Alien Technology (US), CAEN RFID (Italy), Impinj (US), Avery Dennison (US), Honeywell (US), NXP Semiconductors (Netherlands), GAO RFID (Canada), HID Global (US), Invengo (China), Infotek Software & Systems (P) Ltd (i-TEK) (India), Bartronics India Ltd. (India), Bartech Data Systems Pvt. Ltd., Bar Code India Ltd. (BCI) (India), ORBCOMM Inc. (US), GlobeRanger (US), Mojix (US), Securitag Assembly Group (SAG) (Taiwan), Linxens (France), Checkpoint Systems (US), Identiv (US), Confidex (Finland), Datalogic (Italy), Nedap (Netherlands), ThingMagic (Jadak Company) (US), and Omni-ID (US).

Report Scope

The report covers the demand- and supply-side segmentation of the RFID market. The supply-side market segmentation includes the offering, wafer size, tag type, form factor, frequency, and material, whereas the demand-side market segmentation includes application, and region.

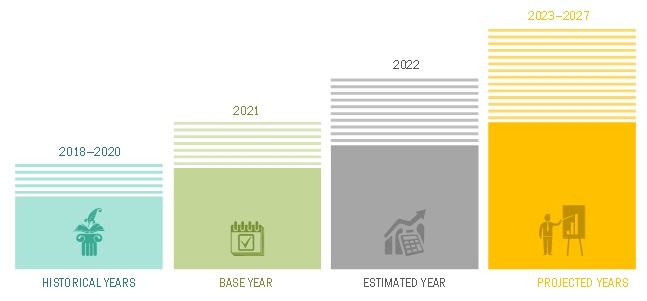

The following are the years considered:

RFID Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 14.5 Billion |

| Expected Value | USD 35.6 Billion |

| Growth Rate | CAGR of 11.9% |

| Forecast Period |

2022–2030 |

|

Base Year Considered |

2021 |

|

Market Size Available for Years |

2018–2030 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Market Leaders |

CAEN RFID (Italy), NXP Semiconductors (Netherlands), GAO RFID (Canada), Invengo (China), Infotek Software & Systems (P) Ltd (i-TEK) (India), Bartronics India Ltd. (India), Bartech Data Systems Pvt. Ltd., Bar Code India Ltd. (BCI) (India), Securitag Assembly Group (SAG) (Taiwan), Linxens (France), Confidex (Finland), Datalogic (Italy), Nedap (Netherlands) |

|

Top Companies in North America |

Zebra Technologies (US), Alien Technology (US), Impinj (US), Avery Dennison (US), Honeywell (US), HID Global (US), ORBCOMM Inc. (US), GlobeRanger (US), Mojix (US), Linxens (France), Checkpoint Systems (US), Identiv (US), ThingMagic (Jadak Company) (US), and Omni-ID (US) |

|

Largest Growing Region |

Asia Specific |

|

Largest Market Share Segment |

Passive Tags Type Segment |

|

Key Market Driver |

Increasing need for RFID systems in manufacturing units for improving productivity |

|

Key Market Opportunity |

Increasing demand for hybrid RFID solutions |

RFID Market Highlights

In this report, the RFID market trends has been segmented into the following categories:

|

Aspects |

Details |

|

By Offering: |

|

|

By Wafer Size: |

|

|

By Tag Type: |

|

|

By Frequency: |

|

|

By Form Factor: |

|

|

By Material: |

|

|

By Application: |

|

|

By Region |

|

Recent Developments

- In March 2022, Avery Dennison Corporation announced the acquisition of the linerless label technology developed by Catchpoint Ltd, a company based in Yorkshire, England. The purchase covers Catchpoint's patents, brand, trade secrets, and know-how. Under the agreement, Avery Dennison will honor Catchpoint’s existing commercial agreements.

- In February 2022, Avery Dennison Corporation announced the acquisition of TexTrace AG, (“TexTrace”), a technology developer that specializes in custom-made woven and knitted RFID products, which can be sewn onto or inserted into garments. TexTrace was formerly a subsidiary of Jakob Müller Holding. The innovative technology developed by TexTrace provides the opportunity to fully integrate RFID into garments. Brand labels with built-in RFID are an all-in-one solution for product branding, brand and theft protection, product availability, consumer interaction and enhanced convenience, such as self-checkout.

- In June 2021, Impinj, Inc. introduced three next-generation RAIN RFID reader chips that enable IoT device makers to meet the increasing demand for item connectivity in retail, supply chain and logistics, consumer electronics, and many other markets. The new Impinj E710, E510, and E310 RAIN RFID reader chips are high-performance, low-power systems-on-chips (SoCs) that extend the item connectivity opportunity to hundreds of billions of things worldwide. With industry-leading system integration and easy-to-use development tools, they enable the development of quick-to-market IoT devices that reliably identify, locate, and authenticate connected things.

- In September 2020, Avery Dennison introduced the AD-332u8 RAIN RFID inlay that excels in high density, close proximity conditions and can be used for inventory accuracy (item-level tagging) and supply chain management. AD-332u8 inlays are equipped with UCODE 8 chips from NXP, featuring 128 bits of EPC memory and a 96-bit Tag IDentifier (TID) with a 48-bit unique serial number factory-encoded into the TID. The new RAIN RFID inlay measures 70 x 14.5mm—the market’s smallest product that meets ARC category H specifications.

- In June 2020, NXP Semiconductors launched the MIFARE DESFire EV3 IC that ushers next-generation performance, advanced security, and seamless integration of mobile services for a new era of security and connectivity in smart city services. The IC is backward-compatible and offers enhanced performance with a greater operating distance and improved transaction speed.

Frequently Asked Questions (FAQ):

Which are the major companies in the RFID market? What are their major strategies to strengthen their market presence?

The major companies in RFID market are – Zebra Technologies (US), Alien Technology (US), CAEN RFID (Italy), Impinj (US), Avery Dennison (US), Honeywell (US), NXP Semiconductors (Netherlands), GAO RFID (Canada), HID Global (US), Invengo (China), Infotek Software & Systems (P) Ltd (i-TEK) (India), Bartronics India Ltd. (India), Bartech Data Systems Pvt. Ltd., Bar Code India Ltd. (BCI) (India), ORBCOMM Inc. (US), GlobeRanger (US), Mojix (US), Securitag Assembly Group (SAG) (Taiwan), Linxens (France), Checkpoint Systems (US), Identiv (US), Confidex (Finland), Datalogic (Italy), Nedap (Netherlands), ThingMagic (Jadak Company) (US), and Omni-ID (US). The major strategies adopted by these players are product launches, collaborations, agreements and acquisitions.

Which is the potential market for RFID in terms of region?

North America is the largest market for RFID. North America, being one of the fastest-growing markets for technology solutions, provides attractive opportunities for players offering RFID; as a result, many companies are expanding their footprint in this region. US, Canada and Mexico are among the key hubs in North America that occupy the maximum share of the market of the region.

Which application segment is expected to drive the growth of the RFID market in the next 5 years?

Logistics & supply chain application segment among all others is expected to grow at the highest CAGR in coming years.

How big is the RFID Market?

11.9% Annual growth rate is expected and estimated to reach USD 35.6 billion by 2030.

Which is the fastest growing region of the RFID Market?

The Asia Pacific RFID market is projected to have the highest market share during the forecast period

What are the Challenges in RFID Market?

The lack of backend data support is one of the major challenges for the market.

What are the Restraint in RFID Market?

High initial cost associated with installation of RFID systems.

What Company Leading the North America RFID Market?

Zebra Technologies (US), Alien Technology (US), Impinj (US), Avery Dennison (US), Honeywell (US), HID Global (US), ORBCOMM Inc. (US), GlobeRanger (US), Mojix (US), Checkpoint Systems (US), Identiv (US), ThingMagic (Jadak Company) (US), and Omni-ID (US) are leading players.

What is RFID?

RFID refers to Radio-frequency identification uses electromagnetic fields to automatically identify and track tags attached to objects. An RFID system consists of a tiny radio transponder, a radio receiver and transmitter.

What are Opportunities in RFID Market?

The RFID market is witnessing a rise in demand for hybrid solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS, BY OFFERING

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RFID MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 RFID MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of key interview participants

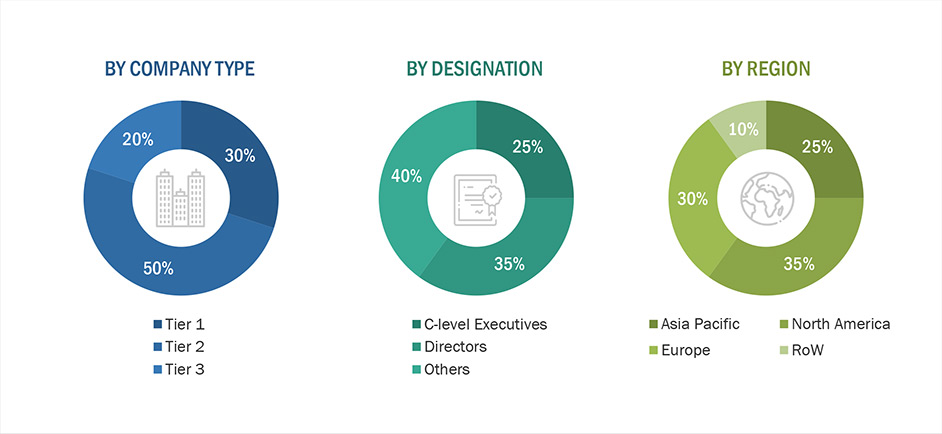

2.1.2.3 Breakdown of primaries

2.1.2.4 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 RFID MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN RFID MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN RFID MARKET

FIGURE 5 RFID MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE): BOTTOM-UP ESTIMATION OF RFID MARKET, BY GEOGRAPHY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing rfid market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 RFID MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 9 SCENARIO-BASED ANALYSIS OF IMPACT OF COVID-19 ON RFID MARKET

TABLE 2 IMPACT OF COVID-19 ON RFID MARKET, 2018–2030 (USD BILLION)

3.1 SCENARIO ANALYSIS

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 TAGS SEGMENT IS EXPECTED TO HOLD LARGEST RFID MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 PASSIVE TAGS SEGMENT IS EXPECTED TO GROW AT HIGHER CAGR DURING 2022–2030

FIGURE 12 LABEL FORM FACTOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING 2022–2030

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 RFID MARKET OVERVIEW

FIGURE 14 ASIA PACIFIC TO EMERGE AS LUCRATIVE GROWTH AVENUE FOR RFID MARKET

4.2 RFID TAG MARKET, BY FREQUENCY

FIGURE 15 ULTRA-HIGH FREQUENCY SEGMENT TO LEAD RFID MARKET FROM 2022 TO 2030

4.3 RFID TAG MARKET, BY MATERIAL

FIGURE 16 PAPER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING 2022–2030

4.4 ASIA PACIFIC: RFID TAG MARKET, BY APPLICATION & COUNTRY

FIGURE 17 LOGISTICS & SUPPLY CHAIN SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2030

4.5 GEOGRAPHICAL SNAPSHOT OF RFID MARKET

FIGURE 18 RFID MARKET TO RECORD HIGHEST CAGR IN JAPAN DURING 2022–2030

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 HISTORY AND EVOLUTION

5.3 MARKET DYNAMICS

FIGURE 19 RFID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Increasing need for RFID systems in manufacturing units for improving productivity

5.3.1.2 Availability of cost-efficient RFID solutions that provide high returns on investment

5.3.1.3 Rising need for improving inventory management

TABLE 3 TYPICAL LOSSES IN DATA CENTERS DURING MANUAL ASSET MANAGEMENT FOR APPROXIMATELY 40 THOUSAND SQ. FT. AREA

5.3.1.4 Increasing government initiatives and regulations for safety and security

5.3.1.5 Growing use of RFID solutions in healthcare organizations to check spread of COVID-19

FIGURE 20 RFID MARKET DRIVERS: IMPACT ANALYSIS

5.3.2 RESTRAINTS

5.3.2.1 High initial cost associated with installation of RFID systems

5.3.2.2 Concerns regarding data security and privacy

FIGURE 21 RFID MARKET RESTRAINTS: IMPACT RFID MARKET ANALYSIS

5.3.3 OPPORTUNITIES

5.3.3.1 Surging demand for hybrid RFID solutions

5.3.3.2 Rising adoption of RFID tags for IoT and smart manufacturing

5.3.3.3 Developing regions creating opportunities for RFID market

FIGURE 22 RFID MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.3.4 CHALLENGES

5.3.4.1 Lack of backup for large volumes of data

5.3.4.2 Supply chain disruptions due to COVID-19

FIGURE 23 RFID MARKET CHALLENGES: IMPACT ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: RFID MARKET

5.5 REVENUE SHIFT AND NEW REVENUE POCKETS FOR RFID MARKET PLAYERS

FIGURE 25 REVENUE SHIFT IN RFID MARKET

5.6 MARKET MAP/MARKET ECOSYSTEM

TABLE 4 RFID MARKET: ECOSYSTEM

FIGURE 26 KEY PLAYERS IN RFID MARKET

5.7 PRICE TREND ANALYSIS

5.7.1 COST ANALYSIS

5.7.1.1 Major factors affecting manufacturing cost

FIGURE 27 ESTIMATED ASP TRENDS OF RFID TAGS AND READERS, 2018–2030

5.7.1.2 Manufacturing cost structure analysis

5.7.2 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

FIGURE 28 AVERAGE SELLING PRICES OF KEY PLAYERS FOR THREE APPLICATIONS

TABLE 5 AVERAGE SELLING PRICES OF KEY PLAYERS FOR THREE APPLICATIONS (USD)

5.8 TECHNOLOGY ANALYSIS

5.8.1 RFID TECHNOLOGY COMPARISON

TABLE 6 COMPARISON OF RFID TAGS BASED ON ACTIVE AND PASSIVE FREQUENCIES

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 RFID MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS WITH THEIR IMPACT

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR THREE APPLICATIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR THREE APPLICATIONS (%)

5.10.2 BUYING CRITERIA

TABLE 9 KEY BUYING CRITERIA FOR THREE APPLICATIONS

5.11 CASE STUDY ANALYSIS

5.11.1 RFID IN HEALTHCARE

TABLE 10 DOSEID CONSORTIUM ADVANCED USE OF RAIN RFID IN HEALTHCARE

5.11.2 RFID IN RETAIL

TABLE 11 VERA BRADLEY LEVERAGES RETAIL WORKFORCE, TASK, AND INVENTORY SOLUTIONS FOR SUCCESS

5.11.3 RFID IN TRANSPORTATION

TABLE 12 FORZA CASH LOGISTICS USES ZEBRA HANDHELD MOBILE COMPUTERS TO PROVIDE REAL-TIME UPDATES AND REDUCE ERRORS WHILE TRANSPORTING VALUABLES

5.11.4 RFID IN LOGISTICS

TABLE 13 INVENGO EMPOWERED APPAREL BRAND TO ACHIEVE SMART LOGISTICS AND WAREHOUSING WITH RFID

5.11.5 RFID IN AGRICULTURE

TABLE 14 COOPERATIE HOOGSTRATEN TRACKS STRAWBERRIES FROM FARM TO TABLE WITH RAIN RFID

5.11.6 RFID IN FOOD

TABLE 15 CAESARS ENTERTAINMENT GAINS REAL-TIME VISIBILITY INTO FOOD SAFETY WITH RFID SOLUTION FROM ZEBRA TECHNOLOGIES

5.11.7 RFID IN FOOD & WAREHOUSING

TABLE 16 LUIK NATIE KEEPS FROZEN FOODS ICE-COLD WITH RAIN RFID

5.11.8 RFID IN LAUNDRY

TABLE 17 ELIS IMPROVED WORKFLOWS BY AUTOMATING LAUNDRY TRACKING & SORTING

5.11.9 RFID IN PUBLIC LIBRARY

TABLE 18 SMART RFID EXPERIENCE OF CHONGQING CITY PUBLIC LIBRARY

5.11.10 RFID IN AUTOMOTIVE

TABLE 19 SHOCKWATCH RFID HELPED AUTOMOTIVE MANUFACTURER TRACK INDIVIDUAL PRODUCT DAMAGE

5.11.11 RFID IN AIRPORT

TABLE 20 BRUSSELS AIRPORT ALLOWS FLYERS TO TRACK THEIR LUGGAGE WITH IMPINJ RFID

5.11.12 RFID IN PUBLIC AREAS

TABLE 21 LEADING AUSTRALIAN SKI RESORT IMPROVES GUEST EXPERIENCE USING RFID FROM ZEBRA TECHNOLOGIES

5.12 TRADE ANALYSIS

FIGURE 31 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8523, 2017–2021

TABLE 22 EXPORT SCENARIO FOR HS CODE: 8523-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

FIGURE 32 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8523, 2017–2021

TABLE 23 IMPORT SCENARIO FOR HS CODE: 8523-COMPLIANT PRODUCTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.13 PATENT ANALYSIS

5.13.1 DOCUMENT TYPE

TABLE 24 PATENTS FILED

FIGURE 33 PATENTS FILED FROM 2012 TO 2021

5.13.2 PUBLICATION TREND

FIGURE 34 NO. OF PATENTS FILED EACH YEAR FROM 2012 TO 2021

5.13.3 JURISDICTION ANALYSIS

FIGURE 35 JURISDICTION ANALYSIS

5.13.4 TOP PATENT OWNERS

FIGURE 36 TOP 10 COMPANIES IN TERMS OF PUBLISHED PATENT APPLICATIONS FROM 2012 TO 2021

TABLE 25 TOP 20 PUBLISHED PATENT OWNERS IN LAST 10 YEARS

5.14 EVENTS AND CONFERENCES

5.15 REGULATORY LANDSCAPE

TABLE 26 RFID MARKET: REGULATORY LANDSCAPE

5.15.1 REGION-WISE REGULATORY ANALYSIS

5.15.2 US

5.15.3 CANADA

5.15.4 EUROPE

5.15.5 INDONESIA

5.15.6 INDIA

6 RFID MARKET, BY OFFERING (Page No. - 101)

6.1 INTRODUCTION

FIGURE 37 RFID MARKET, BY OFFERING

FIGURE 38 TAGS SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST RFID MARKET SHARE DURING FORECAST PERIOD

TABLE 27 RFID MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 28 RFID INDUSTRY, BY OFFERING, 2022–2030 (USD MILLION)

6.2 TAGS

6.2.1 TAGS ARE USED TO IDENTIFY ASSETS OR PERSON

6.3 READERS

6.3.1 FIXED READERS

6.3.1.1 Fixed readers are rugged and cost-efficient

6.3.2 HANDHELD READERS

6.3.2.1 Handheld readers are mainly adopted due to their mobility

6.4 SOFTWARE & SERVICES

6.4.1 INCREASING ADOPTION OF DATA ANALYSIS AND CLOUD-BASED DATA STORAGE EXPECTED TO DRIVE DEMAND FOR SOFTWARE & SERVICES

7 RFID MARKET, BY TAG (Page No. - 108)

7.1 WAFER SIZE

FIGURE 39 8 INCH SEGMENT PROJECTED TO HOLD LARGEST SHARE OF RFID MARKET DURING FORECAST PERIOD

TABLE 29 RFID TAGS MARKET, BY WAFER SIZE, 2018–2021 (USD MILLION)

TABLE 30 RFID TAGS MARKET, BY WAFER SIZE, 2022–2030 (USD MILLION)

7.2 TAG TYPE

FIGURE 40 PASSIVE RFID TAGS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 31 RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 32 RFID TAGS MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

7.2.1 PASSIVE TAGS

7.2.1.1 Passive tags can transmit information over shorter distances (10 feet or less) than active tags

TABLE 33 RFID PASSIVE TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 RFID PASSIVE TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.2.2 ACTIVE TAGS

7.2.2.1 Active tags have longer read range and facilitate real-time monitoring of assets

TABLE 35 RFID ACTIVE TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 RFID ACTIVE TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.3 FREQUENCY

FIGURE 41 ULTRA-HIGH FREQUENCY SEGMENT TO DOMINATE RFID TAGS MARKET DURING FORECAST PERIOD

TABLE 37 RFID TAGS MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 38 RFID TAGS MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

7.3.1 LOW FREQUENCY

7.3.1.1 Low-frequency passive RFID tags are used in animal tagging, access control, and ticketing applications

TABLE 39 LOW FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 LOW FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.3.2 HIGH FREQUENCY

7.3.2.1 High-frequency passive tags are mainly used in retail, security, logistics, and supply chain applications

TABLE 41 HIGH FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 42 HIGH FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.3.3 ULTRA-HIGH FREQUENCY (UHF)

7.3.3.1 Ultra-high frequency tags are available in both active and passive variants

TABLE 43 ULTRA-HIGH FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 ULTRA-HIGH FREQUENCY: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4 FORM FACTOR

FIGURE 42 LABEL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 RFID TAGS MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 46 RFID TAGS MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

7.4.1 CARD

7.4.1.1 RFID cards are majorly used in access control applications in enterprises

TABLE 47 CARD: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 CARD: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.2 IMPLANT

7.4.2.1 RFID implant tags are majorly used to tag animals and patients

TABLE 49 IMPLANT: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 IMPLANT: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.3 KEY FOB

7.4.3.1 Key fobs are used to trace misplaced assets in enterprises or to monitor personnel in real time

TABLE 51 KEY FOB: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 KEY FOB: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.4 LABEL

7.4.4.1 Label tags are used to store information about products and identify them at any stage of supply chain

TABLE 53 LABEL: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 LABEL: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.5 PAPER TICKET

7.4.5.1 Paper-based RFID tags are majorly used in travel tickets, event tickets, and amusement park tickets

TABLE 55 PAPER TICKET: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 PAPER TICKET: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.6 BAND

7.4.6.1 RFID bands are majorly used in sports activities, baggage tagging at airports, and healthcare activities

TABLE 57 BAND: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 BAND: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.4.7 OTHER FORM FACTORS

TABLE 59 OTHER FORM FACTORS: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 OTHER FORM FACTORS: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.5 MATERIAL

FIGURE 43 PAPER SEGMENT TO REGISTER HIGHEST CAGR IN RFID TAGS MARKET DURING FORECAST PERIOD

TABLE 61 RFID TAGS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 62 RFID TAGS MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

7.5.1 PLASTIC

7.5.1.1 Plastic-based RFID tags are used for applications such as access control, identification, and animal tracking

TABLE 63 PLASTIC: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 64 PLASTIC: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.5.2 PAPER

7.5.2.1 Paper-based RFID tags are majorly available in label, ticket, and band form factors

TABLE 65 PAPER: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 PAPER: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.5.3 GLASS

7.5.3.1 Glass-based RFID tags are primarily used for implant applications

TABLE 67 GLASS: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 68 GLASS: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

7.5.4 OTHER MATERIALS

TABLE 69 OTHER MATERIALS: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 OTHER MATERIALS: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

8 RFID MARKET, BY APPLICATION (Page No. - 141)

8.1 INTRODUCTION

FIGURE 44 LOGISTICS & SUPPLY CHAIN SEGMENT PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 71 RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

8.1.1 AGRICULTURE

8.1.1.1 Use of RFID tags for cold chain monitoring is expected to drive agriculture segment

TABLE 73 AGRICULTURE: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 74 AGRICULTURE: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 75 AGRICULTURE: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 76 AGRICULTURE: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 77 AGRICULTURE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 78 AGRICULTURE: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 79 AGRICULTURE: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 80 AGRICULTURE: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 81 AGRICULTURE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 AGRICULTURE: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.2 COMMERCIAL

8.1.2.1 RFID tags are used for industrial materials management and IT assets tracking in commercial sector

TABLE 83 COMMERCIAL: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 84 COMMERCIAL: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 85 COMMERCIAL: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 86 COMMERCIAL: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 87 COMMERCIAL: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 88 COMMERCIAL: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 89 COMMERCIAL: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 90 COMMERCIAL: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 91 COMMERCIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 COMMERCIAL: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.3 TRANSPORTATION

8.1.3.1 Road tolling, parking management, and key fob access are major transportation applications of RFID solutions

TABLE 93 TRANSPORTATION: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 94 TRANSPORTATION: RFID TAGS MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 95 TRANSPORTATION: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 96 TRANSPORTATION: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 97 TRANSPORTATION: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 98 TRANSPORTATION: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 99 TRANSPORTATION: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 100 TRANSPORTATION: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 101 TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 TRANSPORTATION: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.4 HEALTHCARE

8.1.4.1 Patient monitoring is anticipated to be highly promising healthcare application of RFID during forecast period

TABLE 103 HEALTHCARE: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 104 HEALTHCARE: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 105 HEALTHCARE: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 106 HEALTHCARE: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 107 HEALTHCARE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 108 HEALTHCARE: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 109 HEALTHCARE: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 110 HEALTHCARE: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 111 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 HEALTHCARE: MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.5 APPAREL

8.1.5.1 Product tracking, quality control, checking inventories are major apparel applications of RFID

TABLE 113 APPAREL: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 114 APPAREL: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 115 APPAREL: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 116 APPAREL: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 117 APPAREL: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 118 APPAREL: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 119 APPAREL: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 120 APPAREL: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 121 APPAREL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 APPAREL: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.6 FOOD

8.1.6.1 Increasing focus on food safety to drive adoption of RFID in food applications

TABLE 123 FOOD: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 124 FOOD: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 125 FOOD: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 126 FOOD: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 127 FOOD: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 128 FOOD: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 129 FOOD: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 130 FOOD: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 131 FOOD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 132 FOOD: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.7 AUTOMOTIVE

8.1.7.1 RFID tracking for monitoring individual vehicle parts boosting market growth

TABLE 133 AUTOMOTIVE: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 134 AUTOMOTIVE: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 135 AUTOMOTIVE: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 136 AUTOMOTIVE: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 137 AUTOMOTIVE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 138 AUTOMOTIVE: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 139 AUTOMOTIVE: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 140 AUTOMOTIVE: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 141 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 AUTOMOTIVE: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.8 LOGISTICS AND SUPPLY CHAIN

8.1.8.1 Need to gain real-time visibility into logistics and supply chain operations to propel adoption of RFID tags

TABLE 143 LOGISTICS & SUPPLY CHAIN: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 144 LOGISTICS & SUPPLY CHAIN: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 145 LOGISTICS & SUPPLY CHAIN: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 146 LOGISTICS & SUPPLY CHAIN: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 147 LOGISTICS & SUPPLY CHAIN: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 148 LOGISTICS & SUPPLY CHAIN: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 149 LOGISTICS & SUPPLY CHAIN: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 150 LOGISTICS & SUPPLY CHAIN: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 151 LOGISTICS & SUPPLY CHAIN: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 152 LOGISTICS & SUPPLY CHAIN: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.9 AEROSPACE

8.1.9.1 Use of RFID for baggage tagging application to fuel market growth

TABLE 153 AEROSPACE: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 154 AEROSPACE: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 155 AEROSPACE: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 156 AEROSPACE: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 157 AEROSPACE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 158 AEROSPACE: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 159 AEROSPACE: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 160 AEROSPACE: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 161 AEROSPACE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 162 AEROSPACE: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.10 DEFENSE

8.1.10.1 RFID tags are majorly used in border security and weapon movement tracking

TABLE 163 DEFENSE: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 164 DEFENSE: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 165 DEFENSE: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 166 DEFENSE: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 167 DEFENSE: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 168 DEFENSE: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 169 DEFENSE: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 170 DEFENSE: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 171 DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 172 DEFENSE: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.11 RETAIL

8.1.11.1 Focus of retail industry to reduce counterfeiting to augment adoption of RFID tags

TABLE 173 RETAIL: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 174 RETAIL: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 175 RETAIL: RFID TAGS MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 176 RETAIL: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 177 RETAIL: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 178 RETAIL: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 179 RETAIL: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 180 RETAIL: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 181 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 182 RETAIL: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.12 SECURITY AND ACCESS CONTROL

8.1.12.1 Large-scale adoption of RFID card tags for physical access control and payment applications to improve market outlook

TABLE 183 SECURITY & ACCESS CONTROL: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 184 SECURITY & ACCESS CONTROL: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 185 SECURITY & ACCESS CONTROL: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 186 SECURITY & ACCESS CONTROL: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 187 SECURITY & ACCESS CONTROL: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 188 SECURITY & ACCESS CONTROL: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 189 SECURITY & ACCESS CONTROL: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 190 SECURITY & ACCESS CONTROL: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 191 SECURITY & ACCESS CONTROL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 192 SECURITY & ACCESS CONTROL: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.13 SPORTS

8.1.13.1 Growing adoption of RFID tags in sports activities contributes to market growth

TABLE 193 SPORTS: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 194 SPORTS: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 195 SPORTS: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 196 SPORTS: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 197 SPORTS: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 198 SPORTS: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 199 SPORTS: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 200 SPORTS: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 201 SPORTS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 202 SPORTS: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.14 ANIMAL TRACKING

8.1.14.1 Extensive use of ear and implant tags in animal tracking to support market expansion

TABLE 203 ANIMAL TRACKING: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 204 ANIMAL TRACKING: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 205 ANIMAL TRACKING: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 206 ANIMAL TRACKING: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 207 ANIMAL TRACKING: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 208 ANIMAL TRACKING: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 209 ANIMAL TRACKING: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 210 ANIMAL TRACKING: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 211 ANIMAL TRACKING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 212 ANIMAL TRACKING: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

8.1.15 TICKETING

8.1.15.1 Need to maintain public flow in trains, buses, and events to foster adoption of RFID for ticketing applications

TABLE 213 TICKETING: RFID TAGS MARKET, BY TAG TYPE, 2018–2021 (USD MILLION)

TABLE 214 TICKETING: MARKET, BY TAG TYPE, 2022–2030 (USD MILLION)

TABLE 215 TICKETING: MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 216 TICKETING: MARKET, BY FREQUENCY, 2022–2030 (USD MILLION)

TABLE 217 TICKETING: MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 218 TICKETING: MARKET, BY FORM FACTOR, 2022–2030 (USD MILLION)

TABLE 219 TICKETING: MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 220 TICKETING: MARKET, BY MATERIAL, 2022–2030 (USD MILLION)

TABLE 221 TICKETING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 222 TICKETING: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

9 REGIONAL ANALYSIS (Page No. - 193)

9.1 INTRODUCTION

FIGURE 45 RFID MARKET: REGIONAL SNAPSHOT

FIGURE 46 RFID INDUSTRY IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2030

TABLE 223 RFID TAGS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 224 RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 47 NORTH AMERICA: RFID MARKET SNAPSHOT

TABLE 225 NORTH AMERICA: RFID INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 227 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 228 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.2.1 US

9.2.1.1 Presence of numerous RFID vendors supports market growth in US

9.2.2 CANADA

9.2.2.1 Healthcare sector to generate growth opportunities for RFID solution providers in Canada

9.2.3 MEXICO

9.2.3.1 Focus on reducing industrial accidents to fuel adoption of RFID solutions

9.2.4 IMPACT OF COVID-19 ON NORTH AMERICA

9.3 EUROPE

FIGURE 48 EUROPE: RFID MARKET SNAPSHOT

TABLE 229 EUROPE: RFID TAGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 230 EUROPE: RFID TAGS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 231 EUROPE: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 232 EUROPE: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Manufacturing industry in Germany to underpin RFID market growth

9.3.2 UK

9.3.2.1 Supportive government regulations in UK to boost RFID tag market growth

9.3.3 FRANCE

9.3.3.1 High adoption of RFID by aerospace manufacturing industry to support market growth

9.3.4 ITALY

9.3.4.1 Need for effective asset management to drive RFID adoption

9.3.5 RUSSIA

9.3.5.1 Demand from railway and energy industries expected to drive Russian RFID market

9.3.6 POLAND

9.3.6.1 Logistics applications to propel demand for RFID solutions

9.3.7 REST OF EUROPE

9.3.8 IMPACT OF COVID-19 ON EUROPE

9.4 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC: RFID MARKET SNAPSHOT

TABLE 233 ASIA PACIFIC: RFID TAGS MARKET, BY GEOGRAPHY, 2018–2021 (USD MILLION)

TABLE 234 ASIA PACIFIC: RFID TAGS MARKET, BY GEOGRAPHY, 2022–2030 (USD MILLION)

TABLE 235 ASIA PACIFIC: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 236 ASIA PACIFIC: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Demand from healthcare and retail sectors to substantiate RFID market growth

9.4.2 CHINA

9.4.2.1 Rapid automation of manufacturing processes to boost uptake of RFID solutions

9.4.3 SOUTH KOREA

9.4.3.1 Large-scale adoption of RFID solutions by food and electronics manufacturing industries to favor market growth

9.4.4 INDIA

9.4.4.1 Defense and healthcare industries in India to drive growth of RFID market

9.4.5 AUSTRALIA & NEW ZEALAND

9.4.5.1 Food and healthcare industries are upcoming growth avenues for RFID market in Australia & New Zealand

9.4.6 ASEAN

9.4.6.1 Increasing demand for RFID in healthcare and supply chain applications supporting ASEAN RFID market growth

9.4.7 REST OF ASIA PACIFIC

9.4.8 IMPACT OF COVID-19 ON ASIA PACIFIC

9.5 REST OF THE WORLD

FIGURE 50 ROW: RFID MARKET SNAPSHOT

TABLE 237 ROW: RFID TAGS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 238 ROW: RFID TAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 239 ROW: RFID TAGS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 240 ROW: RFID TAGS MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Brazil

9.5.1.1.1 Focus on achieving safety in industrial operations to augment demand for RFID solutions

9.5.1.2 Rest of South America

TABLE 241 SOUTH AMERICA: RFID TAGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 242 SOUTH AMERICA: RFID TAGS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 South Africa

9.5.2.1.1 Retail industry generating huge demand for RFID in South Africa

9.5.2.2 Turkey

9.5.2.2.1 Upgrade of tolling systems with RFID to improve market outlook in Turkey

9.5.2.3 Saudi Arabia & UAE

9.5.2.3.1 Healthcare sector to propel demand for RFID in Saudi Arabia & UAE

9.5.2.4 Rest of Middle East & Africa

TABLE 243 MIDDLE EAST & AFRICA: RFID TAGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 244 MIDDLE EAST & AFRICA: RFID TAGS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

9.5.3 IMPACT OF COVID-19 ON ROW

10 COMPETITIVE LANDSCAPE (Page No. - 227)

10.1 OVERVIEW

TABLE 245 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN RFID MARKET FROM 2019 TO 2022

10.2 MARKET SHARE AND RANKING ANALYSIS, 2021

TABLE 246 DEGREE OF COMPETITION

FIGURE 51 RANKING ANALYSIS OF TOP 5 PLAYERS IN RFID MARKET

10.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT, 2021

FIGURE 53 GLOBALRFID MARKET: COMPANY EVALUATION QUADRANT, 2021

10.4.1 STAR

10.4.2 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

10.5 COMPETITIVE BENCHMARKING

TABLE 247 COMPANY FOOTPRINT (16 COMPANIES)

TABLE 248 COMPANY APPLICATION FOOTPRINT (16 COMPANIES)

TABLE 249 COMPANY REGION FOOTPRINT (16 COMPANIES)

10.6 STARTUP/SME EVALUATION QUADRANT, 2021

FIGURE 54 RFID (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

TABLE 250 RFID MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 251 RFID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES

TABLE 252 PRODUCTS LAUNCHES, JANUARY 2019 TO JUNE 2021

10.7.2 DEALS

TABLE 253 DEALS, JANUARY 2019 TO MARCH 2022

11 COMPANY PROFILES (Page No. - 244)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

11.2.1 ZEBRA TECHNOLOGIES

TABLE 254 ZEBRA TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 55 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 255 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 256 ZEBRA TECHNOLOGIES: DEALS

11.2.2 IMPINJ

TABLE 257 IMPINJ: BUSINESS OVERVIEW

FIGURE 56 IMPINJ: COMPANY SNAPSHOT

TABLE 258 IMPINJ: PRODUCT LAUNCHES

TABLE 259 IMPINJ: DEALS

11.2.3 HONEYWELL

TABLE 260 HONEYWELL: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL: COMPANY SNAPSHOT

11.2.4 AVERY DENNISON

TABLE 261 AVERY DENNISON: BUSINESS OVERVIEW

FIGURE 58 AVERY DENNISON: COMPANY SNAPSHOT

TABLE 262 AVERY DENNISON: PRODUCT LAUNCHES

TABLE 263 AVERY DENNISON: DEALS

11.2.5 NXP SEMICONDUCTORS

TABLE 264 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 59 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 265 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

TABLE 266 NXP SEMICONDUCTORS: DEALS

11.2.6 ALIEN TECHNOLOGY

TABLE 267 ALIEN TECHNOLOGY: BUSINESS OVERVIEW

TABLE 268 ALIEN TECHNOLOGY: PRODUCT LAUNCHES

11.2.7 CAEN RFID

TABLE 269 CAEN RFID: BUSINESS OVERVIEW

TABLE 270 CAEN RFID: PRODUCT LAUNCHES

TABLE 271 CAEN RFID: DEALS

11.2.8 GAO RFID

TABLE 272 GAO RFID: BUSINESS OVERVIEW

TABLE 273 GAO RFID: PRODUCT LAUNCHES

11.2.9 HID GLOBAL

TABLE 274 HID GLOBAL: BUSINESS OVERVIEW

TABLE 275 HID GLOBAL: PRODUCT LAUNCHES

TABLE 276 HID GLOBAL: DEALS

11.2.10 INVENGO

TABLE 277 INVENGO: BUSINESS OVERVIEW

FIGURE 60 INVENGO: COMPANY SNAPSHOT

TABLE 278 INVENGO: PRODUCT LAUNCHES

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.3 OTHER KEY PLAYERS

11.3.1 MOJIX

11.3.2 SECURITAG ASSEMBLY GROUP (SAG)

11.3.3 LINXENS

11.3.4 CHECKPOINT SYSTEMS

11.3.5 IDENTIV

11.3.6 CONFIDEX

11.3.7 DATALOGIC

11.3.8 NEDAP

11.3.9 THINGMAGIC (JADAK COMPANY)

11.3.10 OMNI-ID

11.3.11 INFOTEK SOFTWARE & SYSTEMS LTD. (I-TEK)

11.3.12 BARTRONICS INDIA LTD.

11.3.13 BARTECH DATA SYSTEMS PVT. LTD.

11.3.14 GLOBERANGER- A FUJITSU COMPANY

11.3.15 ORBCOMM INC.

12 APPENDIX (Page No. - 296)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study helps in understanding the methodology implemented for developing this report on the RFID market. Two basic sources of information—secondary sources and primary sources—have been used to identify and collect information for an extensive, technical, and commercial study of the RFID market. Secondary sources include company websites, magazines, associations, and databases (OneSource, Factiva, and Bloomberg). Primary sources such as key opinion leaders from various sectors, which include experts from different government organizations or associations, preferred suppliers, RFID developers, distributors, technology developers, subject matter experts (SMEs), C-level executives of key companies, and industry consultants have been interviewed to understand, obtain, and verify critical information, as well as to assess future RFID Market trends and its growth prospects. Key players in the RFID market have been identified through secondary research, and their market ranking analysis has been determined through primary and secondary research. This research includes the study of the annual reports of the market players to identify the top players in the RFID market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information relevant to this study on the RFID market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the RFID market was obtained from the secondary data made available through paid and unpaid sources. It was determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research was used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the rfid industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It was conducted to identify and analyze the rfid market trends in the market and key developments that were undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources were interviewed to obtain the qualitative and quantitative information related to the market across four main regions—Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations operating in the RFID market or related markets.

After the completion of market engineering, primary research was conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research was also conducted to identify various market segments; rfid industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most of the primary interviews were conducted with the supply side of the market. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used extensively in the market engineering process. Several data triangulation methods were also used to perform the market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses were performed on the market engineering process to gain key insights throughout the report.

Secondary research was used to identify the key players of the RFID market. The revenues of those key players were determined through both primary and secondary research. The revenues were identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the RFID market. All the market shares were estimated using secondary and primary research. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was then split into several segments and sub-segments. The data triangulation procedure was employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Study Objectives

- To estimate, segment, and forecast the overall size of the radio frequency identification (RFID) market, by product, tag, application, and region in terms of value.

- To estimate and forecast the overall size of RFID tags market, in terms of volume

- To forecast the market size, in terms of value, for RFID tag types with regard to three main regions—North America, Europe, Asia Pacific, and RoW (Rest of the World).

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the value chain of the RFID market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies2, and to provide detailed information about the competitive landscape of the market

- To analyze competitive developments, such as product launches & developments, collaborations, contracts, partnerships, acquisitions, and expansions, in the RFID market

- To analyze the impact of the COVID-19 pandemic on the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

- Market size based on different subsegments of the RFID market

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RFID Market

I need the report, for analyzing RFID manufacturing companies

I’m doing market research as an investor. COuld you please provide me a sample of the report. Thank you for your help.

Sample for RFID overview, including LF, HF, UHF markets and products by type.

I would like to have a big picture (map) of RFID tag consumers (sectors, companies, buyers, applications, etc.) and providers (tag manufacturers, chip manufacturers, solution providers, distributors, etc.) worldwide. thanks

Keener to know about the Indian market, Applications, verticals.. etc

Can we get a sample of the report on LF/HF.UHF segment? If specific info on India is available, same would be useful. Please treat this on priority.

Training about RFID markets, and internal knowledge.