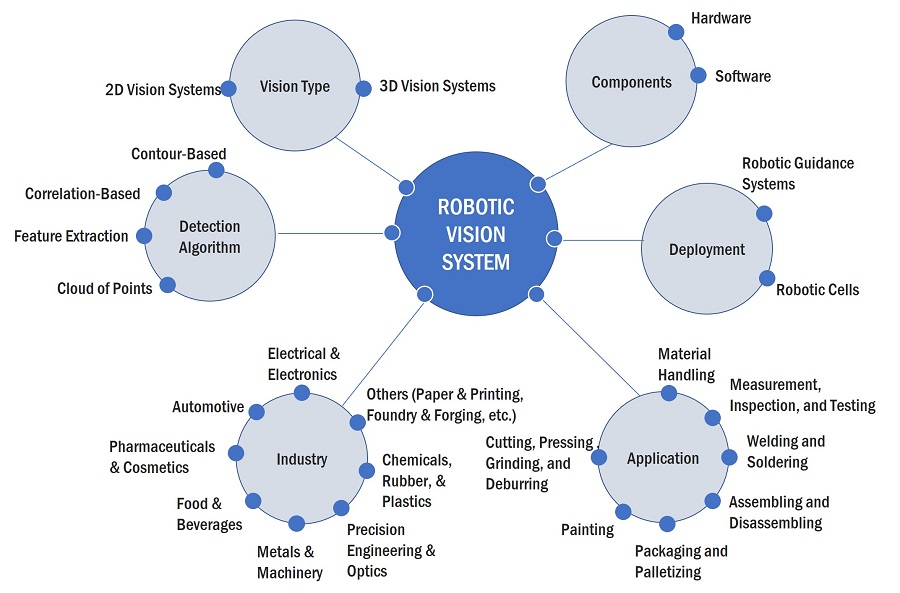

Robotic Vision Market by Type (2D Vision, 3D Vision Systems), Hardware (Cameras, Lighting, Optics, Processors & Controllers, Frame Grabbers), Software(Traditional software, Deep Learning Software), Application, Industry, Region - Global Forecast to 2028

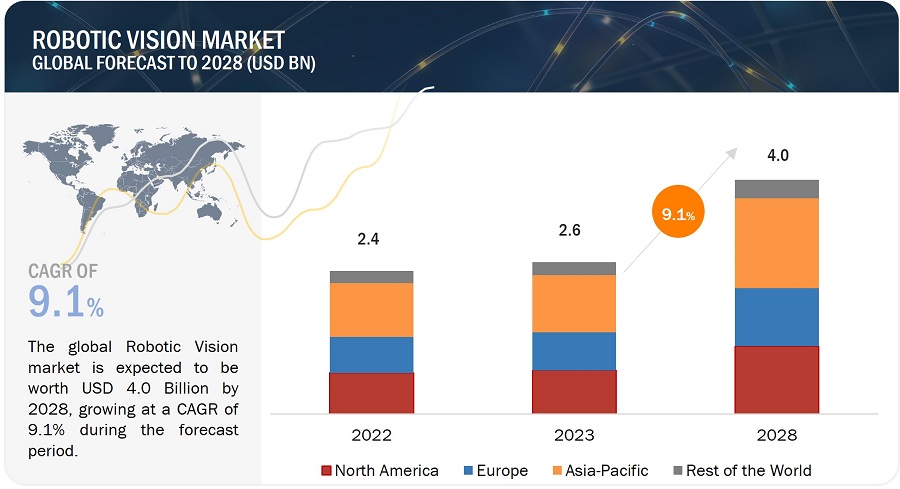

[250 Pages Report] The global Robotic Vision market is expected to grow from USD 2.6 billion in 2023 to USD 4.0 billion by 2028, registering a CAGR of 9.1%. The major factors driving the robotic vision market are the growing need for automation and quality inspection in the industries and the capability of 3D vision systems allowing robotic systems to perform more than one task without reprogramming.

Robotic Vision Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in use of smart cameras in robotic vision

Smart cameras are compact, highly integrated, and easily programmed. It offers an attractive alternative to more complex PC-based vision systems. Smart cameras have traditionally provided more robust processing; however, embedded systems are blurring the line with the emergence of highly functional embedded cameras with MIPI interfaces, image pre-processing, and even IP cores for decoding video streams in an onboard FPGA. Smart cameras still pack more processing power, as a rule. They are further distinguished by incorporating system storage, digital I/O, and standard industrial communication interfaces within an often-ruggedized stand-alone housing.

As self-contained vision solutions, smart cameras offer speedier integration and more straightforward programming than PC-based systems. They also tend to offer a lower price point and a cost-effective solution. Smart camera systems are also best suited for harsh industrial environments. Any industry with messy factory floors, irregularly sanitized workspaces, or typified by a dirty, dusty environment is a natural fit for a smart camera. Besides, pharmaceutical and food & beverage production are early adopters of smart camera technologies.

Besides the integrated processors for faster data processing, smart cameras have easy-to-use software. Smart cameras reduce the efforts required for integration and configuration, as external components, such as processors and lighting, are integrated within the camera. It also reduces overall costs. Hence, smart cameras drive the widespread adoption of robotic vision systems due to their tightly integrated hardware and software design.

Restraint: Limited awareness of Robotic Vision Systems

Due to the lack of awareness about robotic vision systems, customers do not adopt them widely in developing countries. For instance, in India, industrial robots are primarily deployed in more significant industries, such as automotive and metals. Hence, 3D vision systems are mainly used in industrial manufacturing processes, whereas there is a lower penetration of 2D vision systems, as robot automation is not common in smaller industries. The benefits of a robotic vision system should be known to end users to encourage its use. Robotic vision systems are also becoming more affordable over time, and the growing number of smart cameras and robust software packages is making vision systems more accessible to a wide range of users. There is also a shortage of a skilled workforce to program vision systems effectively. The younger generation often views manufacturing as a dirty and dangerous job. This issue is further amplified in the case of developing countries. In North America and Europe, robotic vision companies are sending engineers to universities to showcase the benefits of modern vision system solutions in manufacturing. Although such activities have improved the collaboration between industries and educational institutions, a talent shortage for robotic vision professionals is still prevalent.

Opportunity: Increasing customization of Robotic Vision systems

With the rising demand for robotic vision, the need for customization is also growing globally. The robotic vision systems are customized and delivered to the end users. Automotive assembly, food packaging, medical device manufacturing, and pharmaceutical manufacturing are the early adopters of leading-edge robotic vision technology. These industries highly demand customized robotic vision systems to meet the rising demand of customers for quality products. Over the past decade, manufacturers have increasingly turned to flexible, customizable automation platforms to meet the needs of high/low volume orders and ensure their long-term survival in a competitive manufacturing environment. This trend has seen collaborative robots—low-cost, industrial robot platforms designed to work safely alongside humans on various tasks, including quality inspection-grow from niche product status in the past few years. For instance, Sick Ag (Germany) provides customizable 2D and 3D vision sensors that can be tailored to the business. These are ready-to-use solutions that can be easily configured without a vision or programming expert or modified to solve applications.

Similarly, Cotmac Electronics is Cognex's Authorized Solution Partner (ASP). Cotmac offers customized vision-based inspection, guidance, and identification systems that give machines the power to see. Vision systems detect process errors early, ensure the shipment is free from all defects, and reduce the quantity of scrapped components. These systems are rugged, easy to use, reliable, and more efficient. Through robotics and intelligent material handling systems, Cotmac helps to optimize production to match process speed and positioning accurately. Thus, the rising adoption of customized robotic vision systems will likely drive the market’s growth.

Challenge: Programming the complex inspection task

Robotic vision systems primarily utilize step-by-step filtering and rule-based algorithms to detect deviations and defects in the target part. With consistent and well-manufactured features, such algorithms perform reliably with reasonable accuracy. However, as the number of defects and exceptions increases, it becomes challenging to program the robotic vision to account for new anomalies. These challenges sometimes do not identify the object per the algorithm, impacting the whole process. For instance, in the food & beverages industries, if the robotic vision system does not recognize the rotten potatoes while making potato chips, it will impact the whole production process, including waste of product prepared, time consumption, etc. Vision systems allow for some minor tolerance in the variability of a part due to factors such as scale, rotation, and pose distortion. Complex surface textures and image distortion due to improper lighting further add to this challenge. Although functional anomalies can be accurately detected through robust programming, visual and cosmetic anomalies are often difficult to distinguish through a vision system. Hence, robotic vision systems can be challenging to program and maintain over time for complex inspections involving deviation and unpredictable defects. However, the current development of AI-based software solutions for vision processing systems is expected to solve a few of these challenges.

Robotic Vision Market Ecosystem

Component suppliers and system integrators have witnessed a decline in production activities. Consequently, OEMs have needed more essential components. The figure below shows the Robotic Vision ecosystem.

3D Vision Systems segment to grow at highest CAGR in the forecast period 2023-2028

A convergence of factors is propelling the expansion of 3D vision systems. Technological breakthroughs in hardware, sensors, and imaging technologies have enhanced accuracy and affordability. The versatility of these systems is reflected in their diverse applications across industries, including robotics, manufacturing, healthcare, and entertainment. The demand for automation, improved safety, and security further drive the adoption of 3D vision systems. Advancements in machine learning techniques have also played a pivotal role in augmenting the understanding and interpretation of complex visual data. With continued innovation, the future holds immense potential for further growth in this field.

Software segment to grow at highest CAGR in the forecast period 2023-2028.

The software segment will likely grow at the highest CAGR during the forecast period. Integrating AI in robotic vision software is expected to fuel the growth of the robotic vision market for software during the forecast period, as deep learning enables robots to recognize objects. Deep learning-based vision software helps minimize human intervention and provides a real-time solution by distinguishing the acceptable product variations and defects in manufacturing industries.

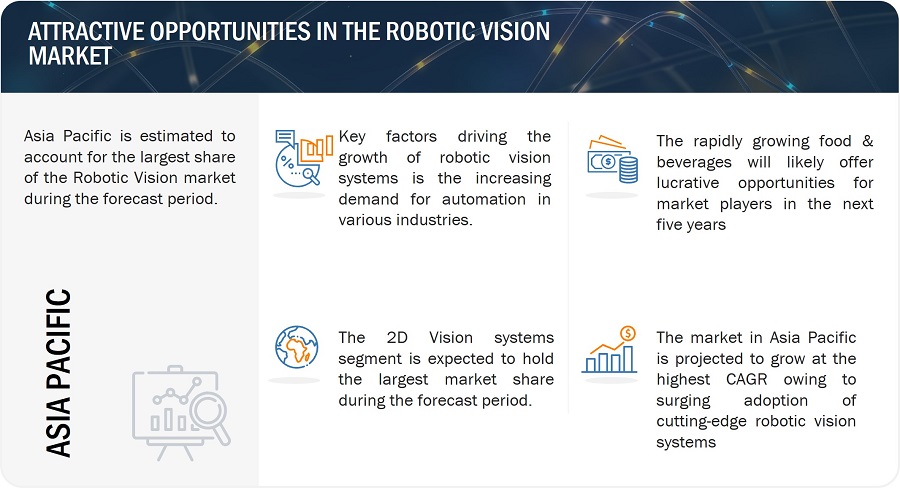

Food & Beverages Industry is expected to register highest CAGR during the forecast period.

Robotic vision has revolutionized the food and beverages industry, experiencing remarkable growth. Robots can visually perceive and comprehend their environment by leveraging advanced cameras and image-processing algorithms. This technology finds application in quality inspection, packaging, sorting, pick-and-place operations, food safety, traceability, and even autonomous vehicles within the industry. With increased efficiency, enhanced product quality, and improved safety standards, robotic vision is reshaping the future of food and beverages, paving the way for unprecedented advancements and possibilities.

Robotic Vision Market by Region

To know about the assumptions considered for the study, download the pdf brochure

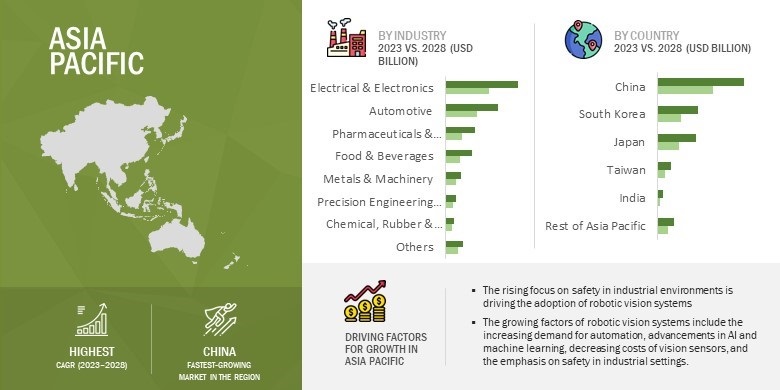

Asia Pacific to grow at highest CAGR during the forecast period

Asia Pacific is the largest market for robotic vision and is home to some of the fastest-growing economies in the world. Asia Pacific is expected to provide significant growth opportunities for the robotic vision market since the region is considered the manufacturing hub for most industries. China has been a potential market for all emerging technologies, including industrial robots and vision systems. The large scale of manufacturing industries in other countries in the Asia Pacific, such as Japan and South Korea, have also contributed to the market growth in the region.

Key Market Players

The Robotic Vision market players have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are Cognex Corporation (US), Basler AG (Germany), OMRON Corporation (Japan), National Instruments Corporation (US), Keyence Corporation (Japan), Teledyne DALSA (Canada), Sick AG (Germany), Torvidel AS (Norway), Hexagon AB (Sweden), Advantech (Taiwan), Yaskawa America, Inc. (Japan), ISRA VISION (Germany), FANUC CORPORATION (Japan), ABB (Switzerland), Qualcomm Incorporated (US).

The study includes an in-depth competitive analysis of these key players in the Robotic Vision market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Type, By Component, By Industry, and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies Covered |

Cognex Corporation (US), Basler AG (Germany), OMRON Corporation (Japan), National Instruments Corporation (US), Keyence Corporation (Japan), Teledyne DALSA (Canada), Sick AG (Germany), Torvidel AS (Norway), Hexagon AB (Sweden), Advantech (Taiwan), Yaskawa America, Inc. (Japan), ISRA VISION (Germany), FANUC CORPORATION (Japan), ABB (Switzerland), Qualcomm Incorporated (US) and total of 25 players covered |

This report has segmented the Robotic Vision market based on offerings, By product type and component, Installation type application, and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Component |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In May 2023, Cognex Corporation unveiled the Advantage 182 vision system. This cutting-edge system is precisely engineered to streamline intricate tasks such as location identification, classification, and inspection. This solution integrates machine vision capabilities, barcode reading functionality, and advanced edge learning technology. With these advanced features, the Advantage 182 enables automation across various applications, from essential presence/absence detection and track-and-trace functions to particular alignment tasks and comprehensive color inspections.

- In April 2023, Cognex Corporation, a renowned industrial robotic leader, introduced the In-Sight 3800 Vision System. This advanced system is engineered to cater to high-speed production lines. The In-Sight 3800 boasts a comprehensive array of vision tools, exceptional imaging capabilities, and adaptable software, resulting in a seamlessly integrated solution for various inspection applications.

- In March 2023, Teledyne introduced the Sapera Vision Software Edition 2023-03. Teledyne DALSA's Sapera Vision Software offers reliable features for image acquisition, control, image processing, and artificial intelligence capabilities, enabling the creation, advancement, and implementation of top-notch machine vision applications. The latest updates encompass improvements to the AI training graphical tool Astrocyte 1.40 and enhancements to the image processing and AI libraries tool Sapera Processing 9.40.

Frequently Asked Questions (FAQ):

What will be the Robotic Vision market size in 2023?

The Robotic Vision market will be valued at USD 2.6 billion in 2023.

What CAGR will be recorded for the Robotic Vision market from 2023 to 2028?

The global Robotic Vision market is expected to record a CAGR of 9.1% from 2023–2028.

Who are the top players in the Robotic Vision market?

The significant vendors operating in the Robotic Vision market include Cognex Corporation (US), Basler AG (Germany), OMRON Corporation (Japan), National Instruments Corporation (US), Keyence Corporation (Japan).

Which significant countries are considered in the Asia Pacific region?

The report includes an analysis of China, Japan, South Korea, Taiwan, India, and the Rest of Asia Pacific.

Which types have been considered in the Robotic Vision market?

2D Vision Systems & 3D Vision Systems are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

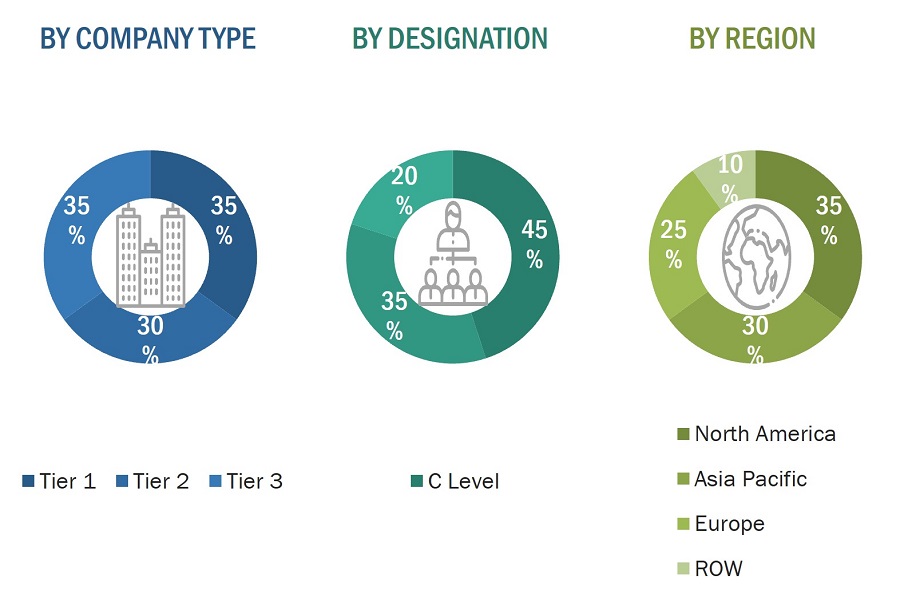

The study involves four significant activities for estimating the size of the Robotic Vision market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Robotic Vision market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Robotic Vision market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been implemented to estimate and validate the size of the Robotic Vision market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Robotic Vision Market: Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For calculating the Robotic Vision market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which was later confirmed with the primary respondents across different regions.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

- Each company’s market share has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primaries, the size of the overall Robotic Vision and each market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data was then triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Robotic vision is the integration of machine vision systems with industrial robots. It is the method of characterizing, processing, and decoding data from the images, leading to vision-based dynamic inspection, robot arm guidance, and enhanced identification of defective products. The robot has been programmed through an algorithm and fitted with a camera to capture images of each object with which it can communicate. Robots coupled with 2D or 3D vision systems can be made to perform various tasks—from basic inspection to more complex pick and place operations. The Key players in the Robotic Vision Market are Cognex Corporation (US), Basler AG (Germany), OMRON Corporation (Japan), National Instruments Corporation (US), Keyence Corporation (Japan), Teledyne DALSA (Canada), Sick AG (Germany), Torvidel AS (Norway), Hexagon AB (Sweden), Advantech (Taiwan), Yaskawa America, Inc. (Japan), ISRA VISION (Germany), FANUC CORPORATION (Japan), ABB (Switzerland), Qualcomm Incorporated (US), LMI TECHNOLOGIES INC. (Canada), Industrial Vision Systems (UK), VITRONIC (Germany), Matrox Electronic Systems Ltd (Canada), ADLINK Technology Inc. (Taiwan), Zivid (Norway), STEMMER IMAGING Ltd. (Germany), MVTec Software GmbH (Germany), Wenglor Sensoric GmbH (Germany), Aquifi (US).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to Robotic Vision

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives:

- To describe and forecast the Robotic Vision market in terms of value based on Type, Component, and Industry

- To describe and forecast the Robotic Vision market size in terms of value for four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the Robotic Vision market

- To provide a detailed overview of the supply chain of the ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the Robotic Vision market

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robotic Vision Market