Satellite Communication (SATCOM) Equipment Market by Solution (Products and Services), Platform (Portable, Land Mobile, Land Fixed, Maritime), Technology (SOTM/COTM, SOTP), Vertical, Connectivity, Frequency and Region - Forecast to 2028

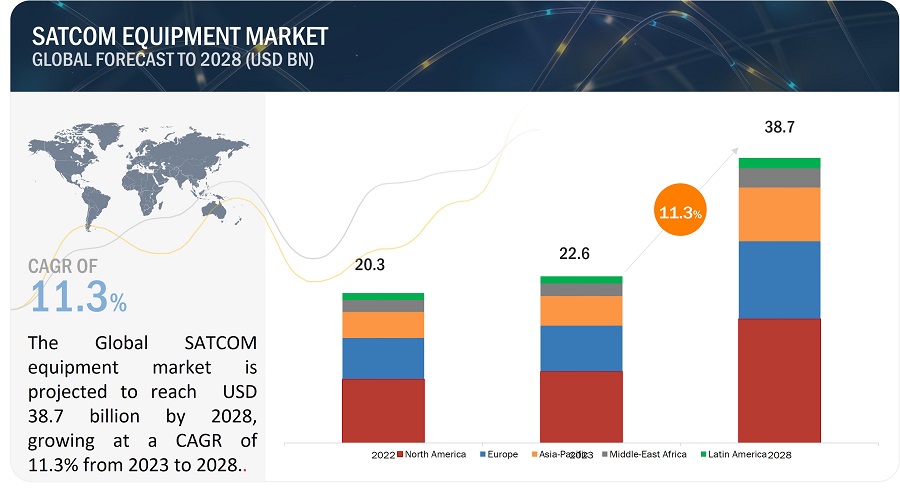

[300 Pages Report] The SATCOM Equipment Market is projected to grow from USD 22.6 billion in 2023 to USD 38.7 billion by 2028, growing at a CAGR of 11.3% from 2023 to 2028. The Satellite Communication (SATCOM) Equipment Industry has grown significantly over the last few years. The market’s growth can be attributed to the increasing launch of low earth orbit (LEO) satellites and constellations of satellites for communications applications. The demand for satcom equipment is also driven by various factors, including the increasing need for high-speed, reliable communication networks in remote areas, the growth of the commercial space industry, and the expanding use of satellite technology in military and government applications.

The market is also influenced by technological advancements, such as the development of smaller, more efficient satellites and the increasing use of software-defined networking (SDN) and virtualization technologies. Other factors driving the market growth include the growing demand for Ku- and Ka-band satellites and the growing fleet of autonomous and connected vehicles used for various applications in the military and commercial sectors, which require customized SATCOM-on-the-move antennas.

Satellite Communication (SATCOM) Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

SATCOM Equipment Market Dynamics

Driver: Increasing launches of LEO satellites and constellations

Low earth orbit (LEO) satellites populate the 500–2,000 km band. These satellites offer rapid communication, lower latency, and often provide higher bandwidths per user than geostationary satellites, which accounts for the rising interest in this segment. CubeSats and other small satellites are also gaining attention; many companies in this market have proposed or are implementing plans to build satellite constellations. The demand for low-cost small satellites with increased capacity for enterprise data (retail, banking), the energy sector (oil, gas, mining), and governments in industrialized countries is growing.

Satellite constellations operated by SpaceX (US), Orbcomm (US), SES 5 (Luxembourg), and Planet La (US) currently exist in orbit. OneWeb (UK), Boeing (US), Teles (Canada), and Amazon (US) are actively developing their own constellations of small satellites. The demand for affordable and high-speed broadband is increasing in industrialized countries. If fully implemented, the supply of satellite-based broadband could exceed expectations due to successful sales of fully planned GEO HTS (High Throughput Satellites) and LEO (Low Earth Orbit) constellations. As a result, the price per megabit of bandwidth for broadband access from GEO, MEO (Medium Earth Orbit), and LEO satellites is expected to decrease to 3 terabits by 2025. The proposed LEO constellations, when combined, have the potential to deliver more than ten times the current capacity

The increase in small satellite launches can be attributed to performance improvement and miniaturization of small satellites that enable them to perform missions that only larger satellites could previously undertake. The development of microelectronics and microsystems has allowed small satellites to meet various applications, especially LEO missions for scientific research, observation, remote sensing, and telecommunications. The need for communication equipment on every satellite will drive the SATCOM equipment market for small satellites during the forecast period.

Restraints: Government regulations and policies restrict satellite communication system deployment in certain regions.

Government regulations and policies significantly impact the deployment of satellite communication systems, particularly in certain regions. Some governments may have restrictions that limit the use of specific frequency bands or require a license to use satellite communication systems. For example, in some countries, the government controls certain frequency bands to prevent interference with military or other government communication systems. Additionally, some governments may restrict satellite communication systems for national security or other reasons.

These restrictions limit the market potential for satcom equipment manufacturers in these regions. However, it is worth noting that these regulations and policies are often subject to change over time and can be influenced by various factors, such as technological advancements and changes in geopolitical situations.

Opportunities: Increasing need for high-speed, reliable communication networks in remote areas

The increasing demand for high-speed internet connectivity and reliable communication in remote locations is a significant opportunity for the satcom equipment market. Satcom technology enables communication in remote areas where traditional communication infrastructure is not available or feasible. This technology is critical for industries such as oil and gas, mining, and forestry operating in remote areas. Satcom equipment provides high-speed internet connectivity, voice communication, and data transfer services to users in remote locations. This enables remote workers to stay connected to their offices and families, access critical information, and conduct business activities. Satcom equipment also allows emergency and first responders to communicate and coordinate during natural disasters and other emergencies.

Satcom equipment can be used for various applications, including telemedicine, education, remote equipment, and systems monitoring. For example, doctors can use satcom equipment to diagnose and treat patients in remote locations remotely. In contrast, schools and universities can use this technology to educate and train students in remote areas. Modern consumer-grade satellite internet services are being provided to individual users through geostationary satellites, which can offer relatively high data speeds—newer satellites using the Ku-band can achieve downstream data speeds of up to 506 Mbit/s. This indicates their potential to provide internet services, especially in emerging and remote areas of the world. For example, according to the International Finance Corporation (IFC), the African Development Bank has led a group of development institutions to provide a total of USD 260 million to help O3b Networks Ltd. implement a satellite system.

This aims to provide affordable broadband access to landlocked and remote countries near the equator. In its initial phase, O3b will deploy eight satellites that circle the equator and offer broadband services to developing countries 45° north and south of the equator. The satellites will serve countries in Africa, Asia, the Middle East, Europe, and South America. Overall, the increasing demand for high-speed internet connectivity and reliable communication in remote locations is expected to drive the growth of the satcom equipment market in the coming years.

Challenges: Electromagnetic compatibility-related challenges associated with satellites.

EMC design is integral to every electrical component and system, specifically modern communication spacecraft. Satellites face significant EMC-related challenges due to the everyday use of high-power communication payloads and external sources within the UHF to Ka frequency bands. Some of the difficulties related to EMC for satellites are antenna systems compatibility, electrostatic discharge, and plasma charging, conducted and radiated emission, electromagnetic interferences between electronic units, compatibility of a system to operate in a specific environment that is subject to electromagnetic interference caused by radio frequency or electrical noise from many sources.

Based on the platform, the airborne SATCOM segment is estimated to lead the SATCOM equipment market from 2023 to 2028.

Based on the platform, the airborne SATCOM segment is estimated to lead the SATCOM equipment market from 2023 to 2028. This is because North American and European countries have been focusing on modernizing and overhauling their aircraft communication systems using customized SATCOM on-the-move solutions. These modernization programs are expected to increase the demand for advanced airborne SATCOM in new aircraft. Airborne SATCOM equipment can also be installed in the existing fleet as a part of retrofitting or upgrading activities.

Based on the solution, the product segment of the SATCOM Equipment market by solution type is projected to witness the largest share in 2023.

Based on the solution, the product market is expected to lead the SATCOM equipment market from 2023 to 2028. This is due to the increasing demand for phased-array antenna systems in naval and airborne platforms during the forecast period. The transceiver segment of SATCOM equipment has the highest share due to the development of advanced transceivers for seamless communication and the need for uninterrupted satellite communication.

Based on technology, the SOTM segment is estimated to account for the larger share of the SATCOM Equipment market from 2023 to 2028.

Based on technology, the satellite communication equipment market has been segmented into SATCOM-on-the-move (SOTM/COTM) and SATCOM-on-the-pause (SOTP). Technological advancements incorporating lightweight, precise, and efficient systems into communication systems would drive the growth of the SATCOM-on-the-move (SOTM/COTM) segment. SATCOM on-the-move terminals provide reliable, high data rate satellite communications while on the move, enabling secure, beyond-line-of-sight communications for vehicles in motion for land, marine, and air applications.

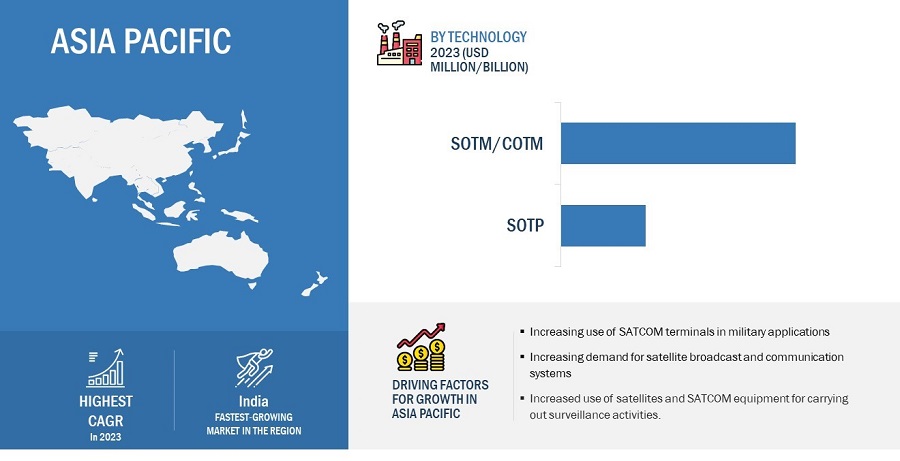

The Asia Pacific market is projected to grow at the highest CAGR from 2023 to 2028 in the SATCOM equipment market.

Based on region, the Asia Pacific market is projected to grow at the highest CAGR from 2023 to 2028 in the SATCOM equipment market. One key factor driving the Asia Pacific market is the rising demand for launch & early orbit support, TT&C services, and data handling & processing services. The increase in demand for telecommunication and mobile broadband services is projected to drive the growth of the Asia Pacific SATCOM equipment market during the forecast period. Technological advancements in the field of SATCOM have led to the development of advanced SATCOM equipment with improved designs and functionalities and enhanced integration capabilities. The region is considered a lucrative market for the domestic and regional manufacturers of SATCOM equipment. Governments in the Asia Pacific are investing heavily in satellite communication infrastructure to bridge the digital divide and connect remote areas with reliable communication services. These investments aim to improve communication networks, enable better disaster management and response, and support various sectors such as healthcare, education, and e-commerce. Additionally, the expansion of cellular networks and the increasing penetration of IoT devices in industries such as transportation, agriculture, and manufacturing drive the demand for SATCOM equipment. These industries require seamless connectivity and efficient data transfer, which SATCOM solutions can provide. Moreover, the Asia Pacific region is witnessing rapid technological advancements and innovation in satellite technologies. The development of high-throughput satellites (HTS) and the deployment of satellite constellations are enhancing the capabilities and capacity of SATCOM systems, thereby driving market growth.

Satellite Communication (SATCOM) Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The SATCOM equipment Companies is dominated by a few globally established players such as EchoStar Corporation (US), L3Harris Technologies (US), Thales Group (France), Raytheon Technologies Corporation (US), General Dynamics Corporation (US), among others, are the key manufacturers that secured SATCOM equipment contracts in the last few years. The primary focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security, and defense & space users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By solutions, by vertical, by technology, by connectivity, by frequency, by platform, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Thales Group (France), L3Harris Technologies (US), Honeywell International Inc. (US), EchoStar Corporation (US), General Dynamics Corporation (US), Raytheon Technologies Corporation (US), Cobham Satcom (Denmark), Viasat, Inc. (US) are some of the major players of SATCOM equipment market. (25 Companies) |

Satellite Communication (SATCOM) Equipment Market Highlights

The study categorizes the SATCOM equipment market based on solutions, vertical, technology, connectivity, frequency, platform, and region.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Platform |

|

|

By Frequency |

|

|

By Vertical |

|

|

By Connectivity |

|

|

By Region |

|

Recent Developments

- In May 2023, Gilat Satellite Networks Ltd. received a multi-million dollar order for VSATs to expand the deployment of a sophisticated disaster response network in Asia. The VSATs will support the national initiative to enhance disaster prevention and management. The network will enable secure, bandwidth-efficient voice services, video feeds, multicasts, emergency alerts, mobility services, and data services to boost effective disaster response capabilities for governmental bodies, individuals, and first responders.

- In May 2023, Viasat Inc. and Inmarsat, have received approval from the UK's Competition & Markets Authority (CMA) for their proposed acquisition deal. The CMA has concluded its Phase II review, finding that the acquisition does not pose competition concerns and allowing the deal to proceed without remedies. This is a crucial step towards completing the deal, which has already received clearance from the UK government under the National Security and Investment Act, the Australian government's Foreign Investment Review Board, and the Committee on Foreign Investment in the United States. Viasat will acquire Inmarsat and strengthen competition in the dynamic market, ultimately providing better services to customers. The acquisition will also create new high-skill technology jobs, deepen Viasat's capabilities in the UK, and help achieve the UK's National Space Strategy goals. Viasat's CEO, Mark Dankberg, appreciated the CMA's extensive review and efforts to clear the transaction.

- In April 2023, ASELSAN announced the completion of the delivery of a Satellite Communication System produced for AKINCI Armed UAV. The system was completed within six months after the Presidency of Defence Industries (SSB) and ASELSAN signed Air Satellite Communication Terminals and Portable Satellite Communication Systems contract. With this system, AKINCI can communicate beyond the Line of Sight (LOS) and has participated in cross-border operations for the first time.

- In March 2023, Cobham Satcom and SES, the leading provider of global satellite connectivity solutions, announced a contract for several Communications on the Pause (COTP) terminals enabled by O3b mPOWER. The agreement includes Cobham Satcom's TACTICAL TRACKER terminal series, which ranges from 1.35 to 2.64 meters and can operate in LEO/MEO/GEO environments. The contract also includes the EXPLORER 8120 vehicle mount tracking antenna, which has been widely successful. The TACTICAL TRACKER terminal series is designed to serve the Government and Defense sector. In contrast, government agencies, carriers, and enterprise customers will use the EXPLORER terminals for service augmentation and restoration.

- In February 2023, Cobham Satcom was chosen by Inmarsat Government to provide the latest generation of SAILOR XTR user terminals to support fast, secure, and reliable worldwide end-to-end commercial satcom for the US Navy Military Sealift Command's (MSC) Next Generation Wideband service. Inmarsat Government has been tasked with upgrading the primary MSC afloat network from Ku-band VSAT to the Global Xpress (GX) Ka-band, following a USD 578 million Follow-On contract with the Defense Information Systems Agency (DISA) awarded in August 2022. Cobham Satcom was selected as the user terminal partner for this project.

- In January 2023, Intellian, has expanded its XEO Series with the launch of the X100D and X150D. The XEO Series, first introduced in March 2022, consists of electronically switching dual-band multi-orbit Ku/Ka VSAT antennas. The X100D will be available later this month, while the X150D will be launched in Q3 2023. The XEO Series provides high bandwidth, maximum agility, and availability, making them ideal for government, energy, cruise, shipping, superyachts, and expedition vessels.

Frequently Asked Questions (FAQ):

Which are the major companies in the SATCOM Equipment market? What are their major strategies to strengthen their market presence?

Some of the key players in the SATCOM equipment market are EchoStar Corporation (US), L3Harris Technologies (US), Thales Group (France), Raytheon Technologies Corporation (US), General Dynamics Corporation (US), among others, are the key manufacturers that secured SATCOM equipment contracts in the last few years. Contracts were the key strategies these companies adopted to strengthen their SATCOM equipment market presence.

What are the drivers and opportunities for the SATCOM Equipment market?

Technological advancements, such as the development of smaller, more efficient satellites and the increasing use of software-defined networking (SDN) and virtualization technologies, influence the market. Other factors driving the market growth include the growing demand for Ku- and Ka-band satellites and the growing fleet of autonomous and connected vehicles used for various applications in the military and commercial sectors, which require customized SATCOM-on-the-move antennas. Satcom systems are used in multiple applications, including telecommunications, broadcasting, navigation, weather monitoring, and military and defense. The Satcom equipment market has been proliferating in recent years due to technological advancements, increasing demand for high-speed internet connectivity, and the need for reliable communication in remote locations.

Which region is expected to grow most in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for SATCOM equipment in the region. One key factor driving the Asia Pacific market is the rising demand for launch & early orbit support, TT&C services, and data handling & processing services.

Which type of SATCOM equipment will significantly lead in the coming years?

Land fixed SATCOM segment of the SATCOM equipment market is projected to witness the highest CAGR due to the increasing use of C2 (command and control) centers and the increasing need for the fastest, most secure, and most comprehensive coverage international and intercontinental data network for enterprise systems in between 2023 to 2028.

Which are the key technology trends prevailing in the SATCOM Equipment market?

The SATCOM equipment market is witnessing key technology trends such as the emergence of High-throughput Satellites (HTS) for higher data rates, Software-Defined Networking (SDN) for centralized control, Cognitive Radio Technology for improved spectrum utilization, Virtualization and Network Function Virtualization (NFV) for flexibility, integration with the Internet of Things (IoT) for seamless connectivity, enhanced cybersecurity measures, advanced antenna technologies, and integration with terrestrial networks like 5G and 6G. These trends drive performance, efficiency, and connectivity advancements, enabling the industry to meet evolving communication needs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

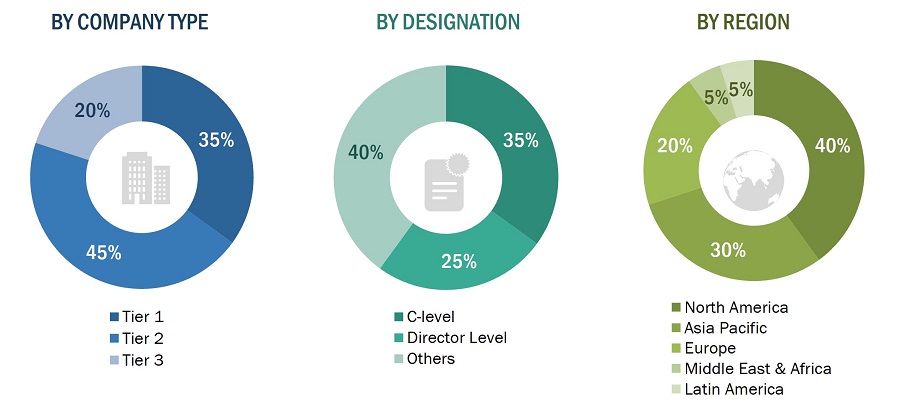

The study involved four major activities in estimating the current size of the SATCOM equipment Market. Exhaustive secondary research was done to collect information on the SATCOM equipment market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the SATCOM Equipment Market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources for this research study include financial statements of companies offering SATCOM equipment and information from various trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall size of the SATCOM equipment market, which primary respondents validated.

Primary Research

Extensive primary research was conducted after acquiring information regarding the SATCOM equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and modernizations in the land fixed, land mobile, airborne, naval, and portable platforms. Such procurements provide information on each platform's demand aspects of SATCOM equipment, product, and services. For each platform, all possible application areas where SATCOM equipment is integrated or installed were mapped.

The global market is a summation of SATCOM equipment usage in commercial, government & defense verticals.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all solutions, verticals, technology, connectivity, frequency, and platforms were based on the recent and upcoming launches of SATCOM equipment products and services in every country from 2020 to 2028.

SATCOM Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures described below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from both the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

SATCOM equipment consists of systems installed on various commercial and military platforms used for communication using satellites application. These equipments are designed to facilitate the transmission and reception of signals between satellite networks and ground-based stations or user terminals. Satcom equipment plays a crucial role in establishing reliable and efficient communication links, enabling various applications such as broadband internet access, voice communication, data transfer, video broadcasting, remote sensing, and IoT connectivity. The SATCOM equipment market covers applications across the government & defense and commercial sectors. Government & defense applications include military, homeland security, and emergency management. Commercial applications cover satellite communication used for voice, data, or video communications. SATCOM systems installed on various platforms, such as vehicles, ships, unmanned aerial vehicles, unmanned marine vehicles, unmanned ground vehicles, and aircraft, have been considered for the study. Space-based satellite communication equipment has not been considered for the study.

Market Stakeholders

- Manufacturers of Military Antennas

- System Integrators

- Original Equipment Manufacturers (OEMs)

- Military Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the SATCOM equipment market based on solutions, verticals, technology, connectivity, frequency, platform, and region.

- To indicate the size of the various segments of the SATCOM equipment market based on five regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To determine industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the SATCOM equipment Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the SATCOM equipment Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Satellite Communication (SATCOM) Equipment Market