Security Screening Market by Technology (X-Ray, Metal Detection, Biometric, Spectrometry, Spectroscopy), End Use, Application (People Screening, Baggage & Cargo Screening, Vehicle Inspection), Region (2021-2026)

Updated on : May 08, 2023

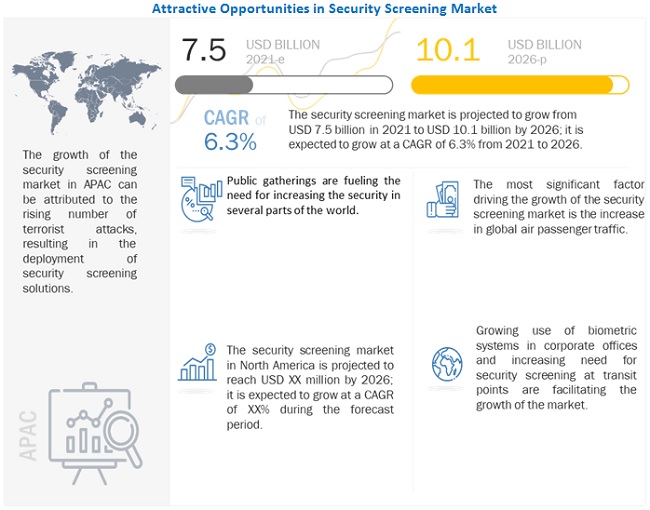

The global security screening market in terms of revenue was estimated to be worth USD 7.5 billion in 2021 and is poised to reach USD 10.1 billion by 2026, growing at a CAGR of 6.3 %.from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

The market's expansion is mainly attributed to the rising instances of criminal activities, the need for increased surveillance in public areas, and a growing demand for security screening in the private sector.

To know about the assumptions considered for the study, Request for Free Sample Report

Rising Security Concerns Drive Growth in Security Screening Market

The security screening industry offers manufacturers and suppliers enticing prospects to provide cutting-edge security solutions in response to the escalating security concerns. Market expansion is anticipated to be fueled by the growing use of security screening systems in public and commercial locations such airports, offices of government, and entertainment venues. There are additional chances to strengthen security precautions and increase the precision of threat identification with the integration of biometric systems, artificial intelligence, and machine learning technologies into security screening systems. In addition, rising public safety and infrastructure spending by the government is anticipated to open up new markets for security screening equipment. To address the rising demand for security screening systems, manufacturers and suppliers are actively funding research and development to create sophisticated security screening technologies.

The security screening market includes major Tier I and II players likeSmiths Detection (UK), OSI Systems (US), Leidos (US), Thales (France), NEC (Japan), and others.

Security Screening Market Dynamics

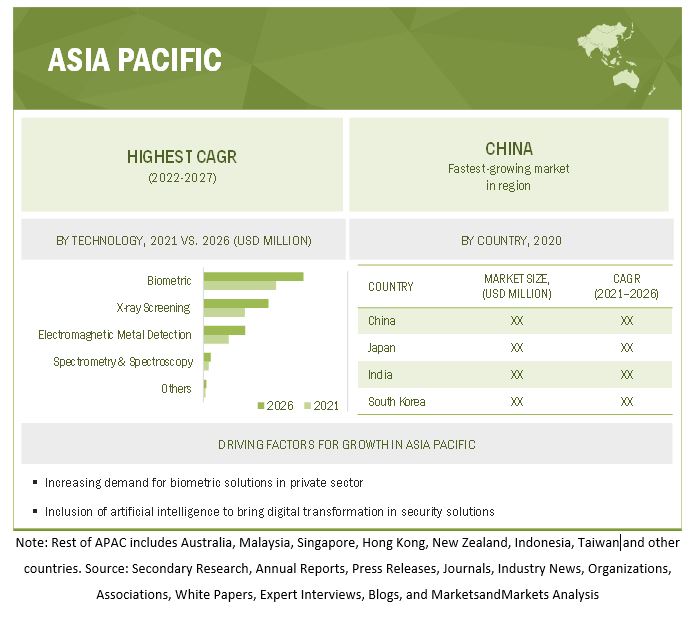

Driver : Surge in demand for biometric solutions in private sector

Many organizations implement biometrics technology for physical and logical access control to mitigate the risks associated with data theft. IT companies, in particular, are playing a crucial role in the growth of the biometrics market. In IT companies, biometric technologies are mainly used to provide access control, register attendance of employees, and stop the theft or leakage of crucial information. In the case of biometrics, the person does not have to remember the passwords or carry anything to prove his/her identity. Only biological or behavioral traits can work for the identification purpose. This makes the implementation of biometrics technologies much easier as compared with other security and identification solutions. Due to these reasons, most private sector companies prefer biometrics security systems

Restraint: High installation and maintenance cost

Security screening systems are widely used to ensure safety at transit facilities, public places, hospitals, government organizations, banks, commercial buildings, educational institutions, critical infrastructure, etc. However, these systems incur a high cost of ownership. Many of the aforementioned places require costly explosive detectors, trace detectors, scanners, radiation detectors, etc., for which the operational cost is equally high. For instance, full-body X-ray scanners require a huge initial investment. The maintenance cost of many explosive detectors is high. All these factors may result in a reluctance toward deploying security measures at facilities

Opportunity : Inclusion of artificial intelligence to bring digital transformation in security applications

Advanced technologies such as AI and IoT will not only reduce the screening time but also ensure accurate detection of contraband items in baggage and cargo. Governments from various countries have been investing in new AI-based security systems. The UK government has invested USD 2.37 million (GBP 1.8 million) for the development of AI-based systems at its airports. At the Los Angeles International Airport and John F. Kennedy and Phoenix airports, the US Transportation Security Administration has introduced new CT scanners in which AI technology is used to help target threats with greater accuracy. In the aviation industry, AI technology is expected to be used in self-check-in robots for facial recognition checks.

Challenge: Data security concerns and lack of technical know-how

Biometrics technology has rapidly expanded in recent years owing to the increasing deployment of biometric systems in public and private sectors to identify and authenticate inhabitants and clients. However, the biometrics data acquired for authentication must be protected against data breaches, as data breaches can be disastrous.Biometrics technology faces the highest resistance in North America. Similar resistance has also been observed in Europe and other regions. For instance, in July 2019, the Oakland City Council in the US voted unanimously to ban the use of facial recognition solutions by city departments and police. Prior to this, cities such as San Francisco (California) and Somerville (Massachusetts) banned facial recognition technology-based solutions.

Market for electromagnetic metal detection technologyto grow at the highest CAGR during the forecast period

Electromagnetic metal detectors detect the presence of metals on individuals and in their belongings. Due to the increase in criminal activities, metal detectors with high operational and functional performance are required for inspecting people. These detectors alert the security personnel if an individual possesses dangerous objects such as knives or weapons. Metal detectors are also used at public places such as shopping malls where public safety is necessary. The increasing deployment of metal detectors in public and private sectors is expected to drive the growth of the electromagnetic metal detectors segment during the forecast period.

Security screening market for people screening application to hold the highest market sharefrom 2021 to 2026

People screening has been one of the key uses of security screening systems at different places such as airports, shopping malls, hotels and resorts, and corporate offices.The use of X-ray systems, metal detectors, body scanners, biometric systems, and spectrometry & spectroscopy solutions is common for people screening.Deployment of facial recognition and iris recognition solutions at places such as transit points, border checkpoints, government offices, and critical infrastructure is another reason for the high market share of biometric systems for people screening.

Security screening market for transportation sectorto hold the highest market share during the forecast period

The rising passenger traffic has made it essential to regularly and rigorously inspect people, cargo, baggage, and vehicles. Individual and baggage screening is very important at airports and other transit locations, while cargo screening plays an important role in preventing illegal activities at seaports. Many countries are focusing on installing security measures at airports, bus depots, and train stations due to the increasing incidents of terrorist attacks and crimes. Massive growth in the global shipping industry and widespread adoption of containers enabling globalization have brought security threats to the ports and harbors worldwide. Such security threats across transortatinon sector is expected to fuel the demand for security screening products and solutions.

Security screening market in APAC to hold the highest market share from 2021 to 2026

The security screening market in APAC is estimated to grow at the highest CAGR due to combat the increasing instances of terrorism, smuggling, and other unlawful activities. APAC also hosts a lot of public events,due to which the need for security screening products is expected to increase in the region.In recent years, several APAC countries, such as India, Sri Lanka, and Australia, have experienced terrorist attacks. These attacks have compelled the governments in these countries to upgrade their security measures by investing significantly in developing and installing security systems.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Security Screening Market

The Security Screening Companies is dominated by players such as Smiths Detection (UK), OSI Systems (US), Leidos (US), Thales (France), and NEC (Japan).

Security Screening Market Report Scope :

|

Report Metric |

Scope |

| Estimated Market Size | USD 7.5 Billion |

| Projected Market Size | USD 10.1 Billion |

| Growth Rate | 6.3% CAGR |

|

Historical Data Available for Years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Surge in demand for biometric solutions in private sector |

| Key Market Opportunity | Inclusion of artificial intelligence to bring digital transformation in security applications |

| Largest Growing Region | North America |

| Largest Market Share Segment | Biometric technology |

| Highest CAGR Segment | Electromagnetic metal detection technology |

| Largest Application Market Share | Security screening systems |

The study categorizes the security screening market based on technology, end use at the regional and global level.

Security Screening Market , By Technology

- X-Ray Screening

- Biometric

- Electromagnetic Metal Detection

- Spectrometry and Spectroscopy

- Others

By Application

- People Screening

- Baggage and Cargo Screening

- Vehicle Inspection

By End Use

- Transportation

- Retail Stores and Malls

- Hospitality

- Government

- Industrial

- Commercial

- Educational Institutes

- Events and Sports

By Region

- North America

- Europe

- Asia Pacific

- Rest of World

Recent Developments in Security Screening Industry :

- In March 2021, NEC announced a new boarding procedure for international departure flights using facial recognition technology, known as Face Express. This facial recognition system belongs to NEC's portfolio of advanced biometric authentication technologies, ("Bio-IDiom"), and features the world's most accurate precision.

- In March 2021, Smiths Detection announced it will supply a full suite of passenger baggage screening equipment for Kuwait’s new International Airport Terminal 2, which is currently under construction. The contract includes the supply and installation of 70 x Hi-SCAN 6040 CTiX computed tomography (CT) X-rays, which allow passengers to leave electronic devices and liquids in their baggage.

- In March 2021, OSI Systems announced that its Security division received an order for approximately USD 15 million for upgrading a key international airport. Under the terms of the contract, the company is expected to provide its RTT 110 hold baggage screening systems along with a range of checkpoint security systems, including the Rapiscan 920CT and Orionbaggage scanners, Itemiser 5x trace detection units, and Metor walk-through metal detectors.

- In February 2021, FLIR Systems launched the upgraded FLIR identiFINDER R440, the next generation of its field-trusted premium handheld radiation detection system.

- In January 2021, Leidos announced that it has completed the acquisition of 1901 Group for approximately USD 215 million in cash. 1901 Group is a leading provider of managed IT services and cloud solutions in the private and public market.

Frequently Asked Questions (FAQ):

What is the market size for the security screening market?

The security screening market was valued at USD 7.5 billion in 2021 and is projected to reach USD 10.1 billion by 2026, at a CAGR of 6.3 %.

What are the major driving factors and opportunities in the security screening market?

The growth of the security screening market is primarily driven by the increasing criminal activities, growing need for large-scale surveillance at public places, and increasing demand in the private sector. Technological advancements in security systems, and inclusion of AI in security systems are some of the major opportunities for the security screening market

Who are theleading players in the global security screening market?

Companies such as Smiths Detection (UK), OSI Systems (US), Leidos (US), Thales (France), and NEC (Japan)are the leading players in the market. Moreover, these companies rely on strategiesthat include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

The adoption of artificial intelligence (AI) is increasing; almost every industry has witnessed the advantages of AI in some form. AI is also being integrated into security screening solutions to carry out the screening process more efficiently with higher accuracy. AI was already transforming many aspects of human life and culture before the COVID-19 pandemic; now, companies are escalating their reliance on AI to build new processes, launch new services. One such solution is offered by Evolv Technology (US), a futuristic security screening solutions provider. Evolv is transforming the physical security industry with the first AI-enabled touchless screening system, Evolv Express.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SECURITY SCREENING MARKET SEGMENTATION

FIGURE 2 SECURITY SCREENING MARKET: GEOGRAPHIC SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 INCLUSIONS AND EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 SECURITY SCREENING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 4 SECURITY SCREENING MARKET: RESEARCH APPROACH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.1.3.3 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size by bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 SECURITY SCREENING MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

2.2.3 TOP-DOWN APPROACH

2.2.3.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.4 SECURITY SCREENING MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 ANALYSIS OF RISK FACTORS

2.5 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

3.1 POST-COVID-19: REALISTIC SCENARIO

3.2 POST-COVID-19: OPTIMISTIC SCENARIO

3.3 POST-COVID-19: PESSIMISTIC SCENARIO

FIGURE 10 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR SECURITY SCREENING MARKET, 2017–2026 (USD MILLION)

FIGURE 11 BIOMETRIC TECHNOLOGY TO HOLD LARGEST SHARE IN MARKET IN 2021

FIGURE 12 TRANSPORTATION END USER TO WITNESS HIGHEST GROWTH IN MARKET DURING 2021–2026

FIGURE 13 PEOPLE SCREENING APPLICATION EXPECTED TO HOLD LARGEST SHARE IN MARKET IN 2021

FIGURE 14 SECURITY SCREENING MARKET TO WITNESS HIGHEST GROWTH IN APAC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN SECURITY SCREENING MARKET

FIGURE 15 RISING INCIDENCES OF TERRORIST ATTACKS AND INCREASING ILLEGAL IMMIGRATION ARE DRIVING SECURITY SCREENING MARKET

4.2 SECURITY SCREENING MARKET IN NORTH AMERICA, BY TECHNOLOGY AND COUNTRY

FIGURE 16 BIOMETRICS SYSTEMS AND US HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2020

4.3 MARKET, BY TECHNOLOGY

FIGURE 17 ELECTROMAGNETIC METAL DETECTION TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY END USE

FIGURE 18 TRANSPORTATION END USE HOLDS LARGEST SHARE OF MARKET

4.5 SECURITY SCREENING MARKET, BY APPLICATION

FIGURE 19 PEOPLE SCREENING APPLICATION IS EXPECTED TO DOMINATE MARKET

4.6 MARKET, BY GEOGRAPHY

FIGURE 20 APAC COUNTRIES WOULD PROVIDE SIGNIFICANT OPPORTUNITIES WITH HIGH GROWTH RATE

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 GROWTH IN AVIATION SECURITY WILL SPUR DEMAND FOR SECURITY SCREENING SOLUTIONS

5.2.1 DRIVERS

5.2.1.1 Global increase in terrorist attacks and illegal immigration

FIGURE 22 TOP COUNTRIES WITH HIGHEST DEATHS FROM TERRORISM, BY PERCENTAGE OF TOTAL DEATHS, 2019

5.2.1.2 Public gatherings fuel demand for security enhancement solutions

5.2.1.3 Improvements in security screening at airports

FIGURE 23 PASSENGER AIR TRAFFIC, 2015–2020

5.2.1.4 Surge in demand for biometrics solutions in private sector

FIGURE 24 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High installation and maintenance costs

5.2.2.2 Privacy concerns

FIGURE 25 VIEW OF RESPONDENTS TOWARD THEIR COUNTRY’S DATA PRIVACY LAW, 2020

FIGURE 26 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements in security screening systems

5.2.3.2 Inclusion of artificial intelligence to bring digital transformation in security applications

FIGURE 27 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Health hazards of full-body scanning

5.2.4.2 Data security concerns and lack of technical know-how

FIGURE 28 IMPACT ANALYSIS: CHALLENGES

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED TO BIOMETRIC SYSTEMS DURING DEVELOPMENT AND INTEGRATION PHASES

FIGURE 30 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED TO X-RAY SCREENING SYSTEMS DURING MANUFACTURING AND ASSEMBLY PHASES

6.3 PORTER’S FIVE FORCES’ ANALYSIS

TABLE 3 SECURITY SCREENING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS: SECURITY SCREENING MARKET

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 AVERAGE SELLING PRICE TRENDS

FIGURE 32 ASP TRENDS FOR X-RAY BODY SCANNERS (2020–2026)

FIGURE 33 ASP TREND FOR HANDHELD METAL DETECTORS (2020–2026)

6.5 MARKET ECOSYSTEM

FIGURE 34 SECURITY SCREENING MARKET ECOSYSTEM

TABLE 4 SECURITY SCREENING MARKET: ECOSYSTEM

6.6 TECHNOLOGY ANALYSIS

6.6.1 SECURITY-AS-A-SERVICE MODEL INTEGRATED WITH ARTIFICIAL INTELLIGENCE

6.6.2 USE OF BIOMETRICS AND TOUCHLESS TECHNOLOGIES TO AVOID CROSS-CONTAMINATION DUE TO COVID-19

6.7 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SECURITY SCREENING MARKET

FIGURE 35 REVENUE SHIFT IN SECURITY SCREENING MARKET

6.8 PATENTS ANALYSIS

TABLE 5 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS, 2014–2020

FIGURE 36 NUMBER OF PATENTS GRANTED FROM 2011 TO 2020 FOR SECURITY SCREENING SOLUTIONS

6.9 TRADE DATA

TABLE 6 IMPORTS DATA FOR KEY COUNTRIES FOR HS CODE 85437012, 2016–2020 (USD THOUSAND)

TABLE 7 EXPORTS DATA FOR KEY COUNTRIES FOR HS CODE 85437012, 2016–2020 (USD THOUSAND)

TABLE 8 IMPORTS DATA FOR KEY COUNTRIES FOR HS CODE 902229, 2016–2020 (USD THOUSAND)

TABLE 9 EXPORTS DATA FOR KEY COUNTRIES FOR HS CODE 902229, 2016–2020 (USD THOUSAND)

6.1 TARIFF AND REGULATORY LANDSCAPE

6.11 CASE STUDIES

6.11.1 PARTNERSHIP OF FRENCH CUSTOMS WITH SMITHS DETECTION

6.11.2 ARKANSAS DEPARTMENT OF CORRECTION USED X-RAY SCANNERS BY ADANI TO ENHANCE OPERATIONAL EFFICIENCY

6.11.3 OREGON COUNTY JAIL USED SMITHS DETECTION’S BODY SCANNERS TO CONTROL CONTRABAND SMUGGLING

7 SECURITY SCREENING MARKET, BY TECHNOLOGY (Page No. - 78)

7.1 INTRODUCTION

TABLE 10 SECURITY SCREENING MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 37 BIOMETRIC SYSTEMS ARE ANTICIPATED TO DOMINATE SECURITY SCREENING MARKET UNTIL 2026

TABLE 11 SECURITY SCREENING MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 X-RAY SCREENING

TABLE 12 MARKET FOR X-RAY SCREENING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 MARKET FOR X-RAY SCREENING, BY TYPE, 2021–2026 (USD MILLION)

TABLE 14 MARKET, X-RAY SCREENING, BY TYPE 2017-2020 (UNITS)

TABLE 15 MARKET, X-RAY SCREENING, BY TYPE 2021-2026 (UNITS)

TABLE 16 MARKET FOR X-RAY SCREENING, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 17 MARKET FOR X-RAY SCREENING, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 18 MARKET FOR X-RAY SCREENING, BY END USE, 2017–2020 (USD MILLION)

FIGURE 38 MARKET FOR X-RAY SCREENING TO WITNESS HIGHEST GROWTH RATE IN RETAIL STORES AND MALLS DURING 2021–2026

TABLE 19 MARKET FOR X-RAY SCREENING, BY END USE, 2021–2026 (USD MILLION)

TABLE 20 MARKET FOR X-RAY SCREENING, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 MARKET FOR X-RAY SCREENING, BY REGION, 2021–2026 (USD MILLION)

7.2.1 BODY SCANNERS

7.2.1.1 Rising terrorist activities have resulted in increased demand for body scanners

7.2.2 BAGGAGE SCANNERS

7.2.2.1 Growing cases of highjacks and smuggling have resulted in deployment of high-tech baggage screening systems

7.2.3 HANDHELD SCANNERS

7.2.3.1 Handheld scanners provide fast and real-time security screening

7.2.4 CABINET X-RAY SYSTEMS

7.2.4.1 Cabinet X-ray systems allow inspection of interior of various objects

7.3 ELECTROMAGNETIC METAL DETECTION

TABLE 22 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 23 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 24 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 39 PEOPLE SCREENING TO HOLD LARGER SHARE OF SECURITY SCREENING MARKET FOR ELECTROMAGNETIC METAL DETECTION UNTIL 2026

TABLE 25 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 26 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY END USE, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY END USE, 2021–2026 (USD MILLION)

TABLE 28 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR ELECTROMAGNETIC METAL DETECTION, BY REGION, 2021–2026 (USD MILLION)

7.3.1 HANDHELD METAL DETECTORS

7.3.1.1 Handheld metal detectors are commonly used in social gatherings, airports, and prisons

7.3.2 WALKTHROUGH METAL DETECTORS

7.3.2.1 Walkthrough metal detectors are gaining momentum owing to their extensive utility

7.4 BIOMETRIC

TABLE 30 MARKET FOR BIOMETRIC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR BIOMETRIC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 32 MARKET FOR BIOMETRIC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR BIOMETRIC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 34 MARKET FOR BIOMETRIC, BY END USE, 2017–2020 (USD MILLION)

TABLE 35 MARKET FOR BIOMETRIC, BY END USE, 2021–2026 (USD MILLION)

TABLE 36 SMARKET FOR BIOMETRIC, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR BIOMETRIC, BY REGION, 2021–2026 (USD MILLION)

7.4.1 FACIAL RECOGNITION SYSTEMS

7.4.1.1 Increasing need for surveillance and video analytics boosts demand for facial recognition systems

7.4.2 IRIS RECOGNITION SYSTEMS

7.4.2.1 Iris recognition systems are adopted mainly in government applications for identification and authentication

7.4.3 FINGERPRINT RECOGNITION SYSTEM

7.4.3.1 COVID-19 pandemic is expected to shift focus of end users from fingerprint recognition systems to other biometric-based solutions

7.5 SPECTROMETRY AND SPECTROSCOPY

7.5.1 SPECTROMETRY AND SPECTROSCOPY TECHNOLOGIES ARE MAINLY USED IN TRANSPORTATION APPLICATIONS

TABLE 38 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 40 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY END USE, 2017–2020 (USD MILLION)

FIGURE 40 MARKET FOR SPECTROMETRY & SPECTROSCOPY TO WITNESS HIGHEST GROWTH IN GOVERNMENT SECTOR DURING FORECAST PERIOD

TABLE 41 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY END USE, 2021–2026 (USD MILLION)

TABLE 42 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR SPECTROMETRY & SPECTROSCOPY, BY REGION, 2021–2026 (USD MILLION)

7.6 OTHERS

7.6.1 MM WAVE SCANNERS ARE HIGH-PRECISION SCANNERS USED FOR FULL-BODY SCANNING

TABLE 44 MARKET FOR OTHER TECHNOLOGIES, BY APPLICATION, 2017–2020 (USD THOUSAND)

TABLE 45 MARKET FOR OTHER TECHNOLOGIES, BY APPLICATION, 2021–2026 (USD THOUSAND)

TABLE 46 MARKET FOR OTHER TECHNOLOGIES, BY END USE, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR OTHER TECHNOLOGIES, BY END USE, 2021–2026 (USD MILLION)

TABLE 48 MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2017–2020 (USD MILLION)

FIGURE 41 MARKET FOR OTHER TECHNOLOGIES TO WITNESS HIGHEST GROWTH IN APAC DURING FORECAST PERIOD

TABLE 49 SECURITY SCREENING MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2026 (USD MILLION)

8 SECURITY SCREENING MARKET, BY END USE (Page No. - 102)

8.1 INTRODUCTION

TABLE 50 MARKET, BY END USE, 2017–2020 (USD MILLION)

FIGURE 42 TRANSPORTATION IS ANTICIPATED TO BE FASTEST-GROWING END USE SEGMENT IN SECURITY SCREENING MARKET

TABLE 51 MARKET, BY END USE, 2021–2026 (USD MILLION)

8.2 TRANSPORTATION

8.2.1 RISING PASSENGER TRAFFIC HAS MADE IT ESSENTIAL TO REGULARLY AND RIGOROUSLY INSPECT PEOPLE, CARGO, BAGGAGE, AND VEHICLES

TABLE 52 MARKET FOR TRANSPORTATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR TRANSPORTATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 54 MARKET FOR TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

8.3 GOVERNMENT

8.3.1 DEMAND FOR BIOMETRIC TECHNOLOGIES IN GOVERNMENT SECTOR HAS INCREASED IN RECENT YEARS

TABLE 56 MARKET FOR GOVERNMENT, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 43 ELECTROMAGNETIC METAL DETECTION TO GROW AT HIGHEST CAGR IN SECURITY SCREENING MARKET FOR GOVERNMENT END USE

TABLE 57 MARKET FOR GOVERNMENT, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR GOVERNMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR GOVERNMENT, BY REGION, 2021–2026 (USD MILLION)

8.4 RETAIL STORES AND MALLS

8.4.1 MARKET FOR RETAIL STORES AND MALLS TO GROW AT HIGHEST RATE OWING TO RISING SECURITY CONCERNS

TABLE 60 MARKET FOR RETAIL STORES AND MALLS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR RETAIL STORES AND MALLS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR RETAIL STORES AND MALLS, BY REGION, 2017–2020 (USD MILLION)

FIGURE 44 APAC SECURITY SCREENING MARKET FOR RETAIL STORES AND MALLS TO GROW AT HIGHEST CAGR

TABLE 63 MARKET FOR RETAIL STORES AND MALLS, BY REGION, 2021–2026 (USD MILLION)

8.5 HOSPITALITY

8.5.1 HOTELS, CLUBS, AND CASINOS ARE VULNERABLE TO CRIMINAL ATTACKS

TABLE 64 MARKET FOR HOSPITALITY, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR HOSPITALITY, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 66 MARKET FOR HOSPITALITY, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 MARKET FOR HOSPITALITY, BY REGION, 2021–2026 (USD MILLION)

8.6 COMMERCIAL

8.6.1 INCREASING CRIMINAL ACTIVITIES IN BFSI SECTOR REQUIRE ADVANCED SECURITY MEASURES

TABLE 68 MARKET FOR COMMERCIAL, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR COMMERCIAL, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 70 MARKET FOR COMMERCIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR COMMERCIAL, BY REGION, 2021–2026 (USD MILLION)

8.7 INDUSTRIAL

8.7.1 INCREASING IMPORTANCE OF SECURITY SCREENING SYSTEMS IN INDUSTRIES SUCH AS OIL & GAS, AND MINING BOOSTS MARKET GROWTH

TABLE 72 MARKET FOR INDUSTRIAL, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 45 X-RAY SCREENING SYSTEMS IS FASTEST-GROWING SEGMENT IN SECURITY SCREENING MARKET FOR INDUSTRIAL

TABLE 73 MARKET FOR INDUSTRIAL, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 74 MARKET FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

8.8 EDUCATIONAL INSTITUTES

8.8.1 MULTIMODAL TECHNOLOGY IS DRIVING MARKET IN EDUCATIONAL INSTITUTES TO PROVIDE BETTER ACCURACY

TABLE 76 MARKET FOR EDUCATIONAL INSTITUTES, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 77 MARKET FOR EDUCATIONAL INSTITUTES, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 78 MARKET FOR EDUCATIONAL INSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 MARKET FOR EDUCATIONAL INSTITUTES, BY REGION, 2021–2026 (USD MILLION)

8.9 EVENTS AND SPORTS

8.9.1 METAL DETECTION SYSTEMS AND X-RAY IMAGING SYSTEMS ARE USED AT ENTRANCES OF VENUES OF PUBLIC EVENTS

TABLE 80 SECURITY SCREENING MARKET FOR EVENTS AND SPORTS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 46 X-RAY SCREENING SYSTEMS IS FASTEST-GROWING PRODUCT SEGMENT IN SECURITY SCREENING MARKET FOR EVENTS AND SPORTS

TABLE 81 MARKET FOR EVENTS AND SPORTS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 82 MARKET FOR EVENTS AND SPORTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR EVENTS AND SPORTS, BY REGION, 2021–2026 (USD MILLION)

9 SECURITY SCREENING MARKET, BY APPLICATION (Page No. - 121)

9.1 INTRODUCTION

TABLE 84 SECURITY SCREENING MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 47 BAGGAGE & CARGO SCREENING APPLICATION IS ANTICIPATED TO REGISTER HIGHEST CAGR IN MARKET

TABLE 85 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 PEOPLE SCREENING

9.2.1 RISING AIR PASSENGER TRAFFIC COULD FURTHER BOOST USE OF PEOPLE SCREENING SYSTEMS AT AIRPORTS

TABLE 86 MARKET FOR PEOPLE SCREENING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 87 SMARKET FOR PEOPLE SCREENING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.3 BAGGAGE & CARGO SCREENING

9.3.1 INCREASING MAILS AND PARCELS DUE TO EXTENSIVE GROWTH OF E-COMMERCE BOOSTS DEMAND FOR SECURITY SCREENING SOLUTIONS

TABLE 88 MARKET FOR BAGGAGE & CARGO SCREENING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 89 SMARKET FOR BAGGAGE & CARGO SCREENING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.4 VEHICLE INSPECTION

9.4.1 DRIVE-THROUGH HIGH-ENERGY X-RAY SYSTEMS PROVIDE DETECT CONTRABAND ITEMS IN VEHICLES

TABLE 90 MARKET FOR VEHICLE INSPECTION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 48 X-RAY SCREENING SYSTEMS TO GROW AT HIGHER CAGR IN MARKET FOR VEHICLE INSPECTION

TABLE 91 MARKET FOR VEHICLE INSPECTION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 128)

10.1 INTRODUCTION

FIGURE 49 GEOGRAPHIC SNAPSHOT: APAC COUNTRIES ARE EMERGING AS NEW HOTSPOTS

TABLE 92 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 50 SNAPSHOT OFMARKET IN NORTH AMERICA

TABLE 94 MARKET IN NORTH AMERICA, BY END USE, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA, BY END USE, 2021–2026 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 IMPACT OF COVID-19 ON SECURITY SCREENING MARKET IN NORTH AMERICA

10.2.2 US

10.2.2.1 High adoption of security screening solutions in US has led to its large market share

10.2.3 CANADA

10.2.3.1 Stringent government regulations could lead to high growth of security screening market in Canada

10.2.4 MEXICO

10.2.4.1 Increasing illicit activities in Mexico could lead to significant deployment of security screening systems

10.3 EUROPE

FIGURE 51 SNAPSHOT OF SECURITY SCREENING MARKET IN EUROPE

TABLE 100 MARKET IN EUROPE, BY END USE, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN EUROPE, BY END USE, 2021–2026 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN EUROPE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON SECURITY SCREENING MARKET IN EUROPE

10.3.2 UK

10.3.2.1 Surge in terrorist and criminal attacks has led to increased adoption of security screening systems

10.3.3 GERMANY

10.3.3.1 Presence of multiple international airports in Germany has led to increased demand for security screening systems

10.3.4 ITALY

10.3.4.1 Rising tourism has resulted in demand for sophisticated security screening systems

10.3.5 FRANCE

10.3.5.1 Terrorist attacks and unlawful activities have propelled market growth in France

10.3.6 REST OF EUROPE (ROE)

10.4 APAC

FIGURE 52 SNAPSHOT OF SECURITY SCREENING MARKET IN ASIA PACIFIC

TABLE 106 MARKET IN APAC, BY END USE, 2017–2020 (USD MILLION)

TABLE 107 MARKET IN APAC, BY END USE, 2021–2026 (USD MILLION)

TABLE 108 MARKET IN APAC, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN APAC, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 110 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON SECURITY SCREENING MARKET IN APAC

10.4.2 CHINA

10.4.2.1 Stringent government rules pertaining to security screening have provided momentum to security screening market in China

FALSE

10.4.3 JAPAN

10.4.3.1 Significant investments in public transport have provided growth opportunities to market players

10.4.4 INDIA

10.4.4.1 Infrastructure development has led to growth of security screening market in India

10.4.5 SOUTH KOREA

10.4.5.1 Technological advancements and large seaports in South Korea have facilitated growth of security screening market

10.4.6 REST OF APAC

10.5 ROW

TABLE 112 MARKET IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN ROW, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN ROW, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 116 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Rapid globalization and increase in global trade have boosted demand for security screening systems in South America

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Abundance of natural resources has increased demand for security screening solutions

11 COMPETITIVE LANDSCAPE (Page No. - 150)

11.1 OVERVIEW

TABLE 118 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGY DURING 2019 TO 2021

11.2 MARKET SHARE ANALYSIS, 2020

TABLE 119 MARKET: DEGREE OF COMPETITION

FIGURE 53 MARKET SHARE OF KEY COMPANIES IN MARKET, 2020

11.3 REVENUE ANALYSIS

FIGURE 54 5-YEAR REVENUE ANALYSIS FOR KEY COMPANIES

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 55 SECURITY SCREENING MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

11.5 SME EVALUATION QUADRANT

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 56 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2020

TABLE 120 PRODUCT FOOTPRINT OF COMPANIES

TABLE 121 END USE FOOTPRINT OF COMPANIES

TABLE 122 APPLICATION FOOTPRINT OF COMPANIES

TABLE 123 REGIONAL FOOTPRINT OF COMPANIES

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES

TABLE 124 MARKET: PRODUCT LAUNCHES, JANUARY 2019–MARCH 2021

11.6.2 DEALS

TABLE 125 SMARKET: DEALS, JANUARY 2019–MARCH 2021

12 COMPANY PROFILES (Page No. - 172)

12.1 INTRODUCTION

(Products offered, Recent Developments, MNM view)*

12.2 KEY PLAYERS

12.2.1 SMITHS DETECTION

TABLE 126 SMITHS DETECTION: BUSINESS OVERVIEW

FIGURE 57 SMITHS DETECTION: COMPANY SNAPSHOT

12.2.2 OSI SYSTEMS

TABLE 127 OSI SYSTEMS: BUSINESS OVERVIEW

FIGURE 58 OSI SYSTEMS: COMPANY SNAPSHOT

12.2.3 LEIDOS

TABLE 128 LEIDOS: BUSINESS OVERVIEW

FIGURE 59 LEIDOS: COMPANY SNAPSHOT

12.2.4 THALES

TABLE 129 THALES: BUSINESS OVERVIEW

FIGURE 60 THALES: COMPANY SNAPSHOT

12.2.5 NEC

TABLE 130 NEC: BUSINESS OVERVIEW

FIGURE 61 NEC: COMPANY SNAPSHOT

12.2.6 FLIR SYSTEMS

TABLE 131 FLIR SYSTEMS: BUSINESS OVERVIEW

FIGURE 62 FLIR SYSTEMS: COMPANY SNAPSHOT

12.2.7 TELEDYNE ICM

TABLE 132 TELEDYNE ICM: BUSINESS OVERVIEW

FIGURE 63 TELEDYNE ICM: COMPANY SNAPSHOT

12.2.8 BRUKER

TABLE 133 BRUKER: BUSINESS OVERVIEW

FIGURE 64 BRUKER: COMPANY SNAPSHOT

12.2.9 ANALOGIC CORPORATION

TABLE 134 ANALOGIC CORPORATION: BUSINESS OVERVIEW

12.2.10 ADANI SYSTEMS

TABLE 135 ADANI SYSTEMS: BUSINESS OVERVIEW

12.3 OTHER PLAYERS

12.3.1 NUCTECH

12.3.2 3DX-RAY

12.3.3 METRASENS

12.3.4 MAGAL SECURITY SYSTEMS

12.3.5 WESTMINSTER GROUP

12.3.6 GARETT ELECTRONICS

12.3.7 AUTOCLEAR

12.3.8 VIDISCO

12.3.9 NEUROTECHNOLOGY

12.3.10 DERMALOG IDENTIFICATION SYSTEMS

12.3.11 DAON

12.3.12 COGNITEC SYSTEMS

12.3.13 AWARE

12.3.14 STANLEY BLACK & DECKER

12.3.15 PRECISE BIOMETRICS

*Details on Business overview, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 220)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

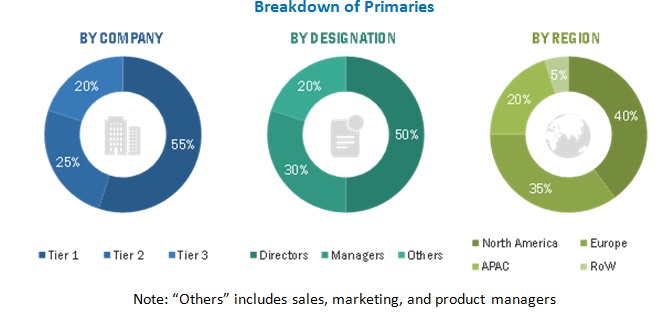

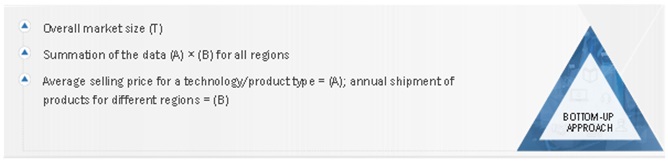

The research study involved 4 major activities in estimating the size of the security screening market. Exhaustive secondary research has been done to collect significant information on the security screening market, peer market, and parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. Post which the market breakdown and data triangulation have been used to estimate the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred for this research study includes Transport Security Administration (TSA), European Civil Aviation Conference (ECAS), International Air Transport Association, Canadian Air Transport Security Authority (CATSA), and International Civil Aviation Organization.

In the security screening market report, the top-down, as well as the bottom-up approaches, have been used for the estimation and validation of the size of the security screening market, along with several other dependent submarkets. The major players in the security screening market were identified using extensive secondary research and their presence using primary and secondary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the security screening market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific (APAC), and the Rest of the World (South America, Middle East, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the security screening market, as well as that of various other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying the number of players in the security screening market offering products such as X-ray scanners, electromagnetic metal detectors, biometric systems, spectrometry and spectroscopy, and others

- Identifying the annual shipment of X-ray systems, biometric systems, electromagnetic metal detectors, spectrometry and spectroscopy solutions, and other security screening products

- Identifying the average price of the abovementioned products for different companies

- Identifying various current end uses of security screening solutions

- Analyzing each end use segment and application, along with the related major companies in the market

- Understanding the demand generated by different end use for various applications

- Tracking the ongoing and upcoming installation of security screening systems across end use segments, and forecasting the market based on these developments and other parameters

- Conducting multiple discussions with primary respondents to understand the types of OEM providers, resellers, manufacturers, and assembling units developed for end use segments; the discussions help analyze the breakdown of the scope of work carried out by each major company in the market

- Arriving at the market estimates through country-wise analysis of security screening companies; thereafter, combining country-wise data to arrive at the market estimates, by region

- Verifying and cross-checking the estimates at every level via discussions with key opinion leaders, including CXOs, directors, and operation managers, and, finally, with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for this process

Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall security screening market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the security screening market has been validated using both top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the security screening market, in terms of value and volume, by technology, end use and region

- To forecast the market, for various segments with respect to 4 main regions— North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value and volume

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall security screening market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the security screening market growth

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the security screening market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the security screening market landscape

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile key players, startups and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the security screening market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security Screening Market