Seed Coating Market by Form, Additives (Polymers, Pellets, Colorants, Minerals/pumice), Process (Film coating, Encrusting, Pelleting), Crop (Cereals & grains, Oilseeds & pulses, Vegetables, Flowers & ornamentals) and Region - Global Forecast to 2027

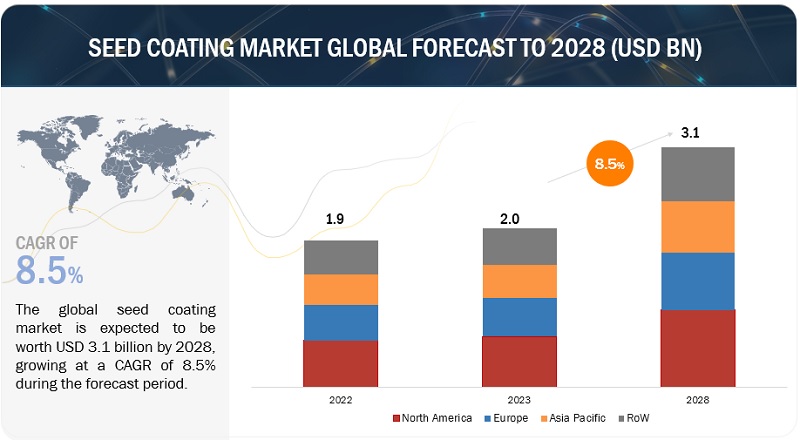

The seed coating market is estimated to be valued at USD 2.4 billion in 2022. It is projected to reach USD 3.6 billion by 2027, recording a CAGR of 8.4% during the forecast period. Growth in the seed coating industry is driven by factors such as increasing demand for food, farmer efforts to improve yields, and the advantages of seed protection, handling and flowability offered by coatings.

To know about the assumptions considered for the study, Request for Free Sample Report

Seed Coating Market Dynamics

Benefits associated with the seed coating technologies to drive the market demand

Seed coating protects the seeds from various factors that damage the seed, such as extreme weather conditions and harmful insects. Protection from diseases and pest protection are the key factors driving the growth of seed coatings. Seed coating also improves germination by maintaining the seed to allow them to mature when the conditions are favorable. It also enhances plantability with increased yield and reduced labor costs.

Low yield of crops in under-irrigated areas to impact seed coating market

Unfavorable irrigation infrastructure is a primary concern for the seed coating industry, as it hampers the crop yield and quality. Crops are grown in developing countries, such as rice, corn, wheat, soybean, and groundnut, require ample water. These crops are grown in countries such as India. South Africa and Turkey have underdeveloped irrigation infrastructure. Even though the seeds are coated, the unavailability of adequate water supply hampers the crop yield, and thus the seed coatings growth is restricted.

Development of biodegradable seed coatings to reduce environmental pollution

Biodegradable seed coatings are projected to account for a significant market share in the coming years. This is due to the increasing awareness about healthy food consumption by consumers and the adverse effects of non-biodegradable seed coatings on the environment. Moreover, industrial seed applications require seed coatings to be biodegradable with the rising environmental concerns. There have been increased ecological concerns by the European Chemical Agency (ECHA) regarding the restriction on the use of oxo-plastics and intentionally added microplastic particles in consumer or commercial products of all kinds, further offering lucrative opportunities for market players.

Unorganized new entrants with a low profit-to-cost ratio

New technologies, such as breeding methods, focus on creating opportunities for new entrants in the market. Some of these are disrupting the market for the leading players. New entrants in the market do not have brand recognition. Still, the seed prices of these small players are meager compared to those of the established players, affecting the market share of the major players.

The film coating process is most widely used and held the largest market share in 2021, primarily owing to its easier handling and safety considerations

Film coating is a widespread technique used in seed coating due to its ease of handling. It is applied as a thin water-permeable polymer-based coating onto the seed, seed coating, or pellet. Polymers are available in various colors, coverage qualities, opacities, and finishes such as matt, shine, and sparkle. It minimizes dust and increases the market appeal, adding value to the seed. Crops are prey to diseases and insect pests at all life stages, such as blight and sucking insects, which are combated through seed coating techniques. The encrusted seed is coated with a lighter covering to improve the handling. This gives the seed a better size, shape, and weight, enabling greater planting accuracy and maximizing the germinating rate.

Key Features of Seed Coating Market

-

Improved seed protection: Seed coating helps to protect seeds from physical damage, insects, and diseases during storage and transportation.

-

Enhanced seed performance: Seed coatings can improve seed germination rates, seedling vigor, and overall plant growth and development.

-

Control release fertilizers: Seed coatings can be used to incorporate fertilizer, herbicides, and insecticides into the seed coat, which results in a controlled and slow release of these substances.

-

Enhanced seed aesthetics: Seed coatings can improve the appearance of seeds, making them more attractive to farmers and consumers.

-

Increased seed durability: Seed coatings can help to extend seed shelf life by protecting seeds from environmental factors such as moisture, temperature, and light.

- Customizable solutions: Seed coating technologies allow for customization and tailored solutions for specific crop species and environmental conditions.

North America: Seed Coating Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the seed coating market and is projected to grow with a CAGR of 8.7% during the forecast period (2022 - 2027)

The key players in the North American seed coating market include Sensient Technologies (U.S.), Precision Laboratories (U.S.), Brett Young Seeds Ltd (U.S.), and Chromatech Incorporated (U.S.). The demand for high-yielding and disease-resistant crops from domestic markets and export destinations are some of the critical drivers of the global market in the region. In North America, agriculture is heavily mechanized with an integrated system supporting agribusinesses. Especially in the U.S. and Canada, most farmers and ranchers have adopted technology, although few groups continue to use animal power for cultivation purposes.

Key Market Players

The key players involved in the global market include BASF SE (Germany), Solvay S.A. (Belgium), Clariant AG (Switzerland), Croda International plc (U.K.), DSM (Netherlands), Sensient Technologies (U.S.), and Germain Seed Technology Inc. (U.K.)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 2.4 billion |

|

Market size value in 2027 |

USD 3.6 billion |

|

Market growth rate |

CAGR of 8.4% |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Form, Process, Additive, Active Ingredient, Crop Type, and Region. |

|

Regions covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies studied |

|

This research report categorizes the seed coating market. Based on form, process, additive, active ingredient, crop type, and region.

Target Audience

- Seed Coating manufacturers

- Seed Coating Raw Material Suppliers and Manufacturers

- Seed Coating Material Importers and Exporters

- Seed Coating Material Traders and Distributors

- Government and Research Organizations

- Specialty Chemical Manufacturers

- Associations and Industrial Bodies

- Agricultural Institutes and Universities

- Seed coating distributors

- Academicians and research organizations

- End users

Report Scope

By Form

- Liquid

- Solid

By Additive

- Polymers

- Colorants

- Pellets

- Binders

- Minerals/pumice

- Active ingredients

- Other additives

By Process

- Film coating

- Encrusting

- Pelleting

By Active Ingredient

- Protectants

- Phytoactive promoters

- Other active ingredients

By Crop Type

- Cereals and grains

- Vegetables

- Oilseeds & pulses

- Flowers & ornamentals

- Other crop types

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In July 2022, Solvay S.A. acquired Bayer's global seeds coating business to provide reinvestment opportunities in the crop science division.

- In February 2022, Croda International plc partnered with Cambridge University (Xampla) to work on biodegradable, micro plastic-free seed coatings.

- In September 2021, Croda International plc announced opening the crop product validation center in Holambra. It prepares the plant growth mediums based on the region's climatic conditions. The state-of-the-art center is dedicated to serving the agrochemical industry.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the seed coating market?

North America accounted for the largest share of about 31.8% of the overall seed coating market in2021 and is projected to reach USD 1,144.9 million by 2027.

What is the current size of the global seed coating market?

The global seed coating market is projected to reach USD 3.6 Billion by 2027 growing at a CAGR of 8.4% from 2022 to 2027.

Which are the primary seed coating types considered in the study, and which segments are projected to have favorable growth rates in the future?

All the major specialty yeast types include polymers, colorants, minerals/ pumice, pellets, active ingredients, binder, and others.

Which are the key players in the market, and how intense is the competition?

The key players involved in the seed coating market include BASF SE (Germany), Solvay S.A. (Belgium), Clariant AG (Switzerland), Croda International plc (U.K.), DSM (Netherlands), Sensient Technologies (U.S.), ] Precision Laboratories (U.S.), and Germain Seed Technology Inc. (U.K.).

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company's business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIOD CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primary interviews

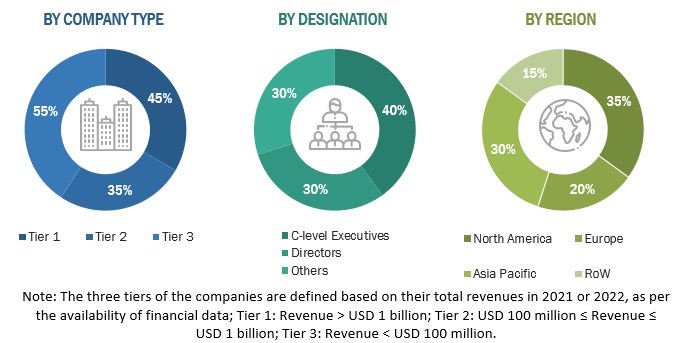

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.4 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 3 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY ADDITIVE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THIS MARKET

FIGURE 12 INCREASING NEED FOR QUALITY SEEDS TO SUPPORT GROWTH OF THE GLOBAL MARKET

4.2 SEED COATING MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 13 CHINA TO BE FASTEST-GROWING MARKET FOR SEED COATING DURING FORECAST PERIOD

4.3 ASIA PACIFIC: SEED COATING MARKET, BY CROP TYPE & COUNTRY

FIGURE 14 CEREALS & GRAINS SUBSEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC MARKET IN 2022

4.4 MARKET FOR SEED COATING, BY FORM

FIGURE 15 LIQUID SUBSEGMENT TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.5 MARKET FOR SEED COATING, BY ADDITIVE

FIGURE 16 POLYMERS SUBSEGMENT TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.6 MARKET FOR SEED COATING, BY PROCESS

FIGURE 17 FILM COATING SUBSEGMENT TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.7 MARKET FOR SEED COATING, BY CROP TYPE

FIGURE 18 CEREALS & GRAINS SUBSEGMENT TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

4.8 MARKET FOR SEED COATING, BY REGION

FIGURE 19 NORTH AMERICA TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

FIGURE 20 EUROPE: TOP SIX SEED-PRODUCING COUNTRIES, 2018–2021 (‘000 HECTARES)

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SEED COATING MARKET

5.2.1 DRIVERS

5.2.1.1 Enhancements and benefits derived from seed technologies to encourage adoption of seed coating

TABLE 4 IMPACT OF KEY DRIVERS ON THE GLOBAL MARKET

5.2.1.2 Seed coating would support agricultural productivity on marginal lands

FIGURE 22 ANNUAL AVAILABILITY OF ARABLE LAND, 1950–2020 (HECTARES/PERSON)

5.2.1.3 Increase in seed replacement rate to drive adoption of commercialized seeds

5.2.2 RESTRAINTS

5.2.2.1 Uncertainty in climate conditions to impact the global market

TABLE 5 WEATHER CONDITIONS VS. DISEASES AFFECTING GROUNDNUTS IN SPECIFIC COUNTRIES

5.2.2.2 Low yield of crops in under-irrigated areas to impact seed coating market

5.2.3 OPPORTUNITIES

5.2.3.1 Development of biodegradable seed coatings to reduce environmental pollution

5.2.4 CHALLENGES

5.2.4.1 Unorganized new entrants with low profit-to-cost ratio

6 INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 23 R&D AND MANUFACTURING PROCESSES TO CONTRIBUTE MAJOR VALUE TO OVERALL SEED COATING MARKET

6.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON SEED COATING MARKET

FIGURE 24 MARKET FOR SEED COATING: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 PATENT ANALYSIS

TABLE 7 MAJOR PATENTS RELATED TO SEED COATING, 2019–2021

7 SEED COATING MARKET, BY FORM (Page No. - 65)

7.1 INTRODUCTION

FIGURE 25 SEED COATING MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 8 MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 9 MARKET, BY FORM, 2022–2027 (USD MILLION)

7.2 POWDER

7.2.1 SOLID PARTICULATE BINDERS APPLIED AS FINE POWDERS BECOME HYDROLYZED AS WATER DURING COATING PROCESS

7.3 LIQUID

7.3.1 DOSAGE OF LIQUID SEED COATING FORMULATIONS TYPICALLY TO RANGE FROM <0.05 TO 1.0% BY WEIGHT

8 SEED COATING MARKET, BY CROP TYPE (Page No. - 68)

8.1 INTRODUCTION

FIGURE 26 SEED COATING MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 10 MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 11 MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

8.2 CEREALS & GRAINS

8.2.1 HIGH CONSUMPTION OF CEREALS IN FOOD AND FEED TO ENCOURAGE GROWERS TO ADOPT SEED COATING TECHNIQUE

TABLE 12 CEREALS & GRAINS: MARKET FOR SEED COATING, BY REGION, 2019–2021 (USD MILLION)

TABLE 13 CEREALS & GRAINS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 OILSEEDS & PULSES

8.3.1 HIGH PROTEIN CONTENT TO BE MAJOR DRIVER OF DEMAND FOR OILSEEDS & PULSES

TABLE 14 OILSEEDS & PULSES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 15 OILSEEDS & PULSES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 VEGETABLES

8.4.1 PROTECTED CULTIVATION OF HIGH-VALUE CROPS TO DRIVE USE OF INNOVATIVE TECHNIQUES

TABLE 16 VEGETABLES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 17 VEGETABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 FLOWERS & ORNAMENTALS

8.5.1 HIGH EXPORT POTENTIAL TO URGE GROWERS TO MAINTAIN STANDARD QUALITY

TABLE 18 FLOWERS & ORNAMENTALS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 19 FLOWERS & ORNAMENTALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER CROP TYPES

TABLE 20 OTHER CROP TYPES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 OTHER CROP TYPES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SEED COATING MARKET, BY PROCESS (Page No. - 76)

9.1 INTRODUCTION

FIGURE 27 SEED COATING MARKET, BY PROCESS, 2022 VS. 2027 (USD MILLION)

TABLE 22 MARKET, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 23 MARKET, BY PROCESS, 2022–2027 (USD MILLION)

9.2 FILM COATING

9.2.1 FILM COATING IS AVAILABLE IN SEVERAL DIFFERENT COLORS TO AID IN SEED IDENTITY AND SAFETY AWARENESS

9.3 ENCRUSTING

9.3.1 ENCRUSTING ENABLES SINGULATION MAXIMIZING PLANT EFFICIENCY

9.4 PELLETING

9.4.1 PELLETING RESULTS IN UNIFORMITY OF PLANT GROWTH

10 SEED COATING MARKET, BY ADDITIVE (Page No. - 80)

10.1 INTRODUCTION

FIGURE 28 SEED COATING MARKET, BY ADDITIVE, 2022 VS. 2027 (USD MILLION)

TABLE 24 MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 25 MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

10.2 POLYMERS

10.2.1 POLYMERS ARE WIDELY USED IN SEED COATING AS THEY OFFER MULTIPLE BENEFITS

TABLE 26 MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 27 MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

TABLE 28 POLYMERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 POLYMERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.2 POLYMER GELS

TABLE 30 POLYMER GELS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 POLYMER GELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.3 SUPERABSORBENT POLYMER GELS

TABLE 32 SUPERABSORBENT POLYMER GELS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 SUPERABSORBENT POLYMER GELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 COLORANTS

10.3.1 COLORANTS TO ENHANCE APPEARANCE OF SEEDS

TABLE 34 COLORANTS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 COLORANTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 PELLETS

10.4.1 PELLETING TO INCREASE WEIGHT OF SEED, IMPROVING PLANTABILITY

TABLE 36 PELLETS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 PELLETS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 BINDERS

10.5.1 SURVIVAL OF PLANT GROWTH PROMOTING RHIZOBACTERIA TO GROW DEMAND FOR BINDERS

10.5.2 POLYVINYL ALCOHOL

10.5.3 BENTONITE

10.5.4 OTHER BINDERS

TABLE 38 BINDERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 BINDERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MINERALS/PUMICE

10.6.1 POROSITY OF PUMICE TO HELP IN GERMINATION OF SEEDS

TABLE 40 MINERALS/PUMICE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 41 MINERALS/PUMICE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 ACTIVE INGREDIENTS

10.7.1 INVOLVEMENT OF ACTIVE INGREDIENTS TO ENHANCE SEEDLING HEALTH, COMBAT PEST INFESTATION, AND IMPROVE PLANT ESTABLISHMENT

TABLE 42 ACTIVE INGREDIENTS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 ACTIVE INGREDIENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHER ADDITIVES

TABLE 44 OTHER ADDITIVES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 OTHER ADDITIVES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 SEED COATING MARKET, BY ACTIVE INGREDIENT (Page No. - 92)

11.1 INTRODUCTION

TABLE 46 SEED COATING MARKET, BY ACTIVE INGREDIENT, 2019–2021 (USD MILLION)

TABLE 47 MARKET, BY ACTIVE INGREDIENT, 2022–2027 (USD MILLION)

11.2 PROTECTANTS

11.2.1 DEMAND FOR DISEASE-RESISTANT CROPS TO PAVE WAY FOR PROTECTANTS

11.3 PHYTOACTIVE PROMOTERS

11.3.1 INNOVATION IN USE OF PHYTOACTIVE PROMOTERS VIA SEED COATS TO MAKE FARMING POSSIBLE IN DEGRADED AREAS

11.4 OTHER ACTIVE INGREDIENTS

12 SEED COATING MARKET, BY REGION (Page No. - 96)

12.1 INTRODUCTION

FIGURE 29 US, CANADA, AND CHINA TO ACCOUNT FOR LARGER SHARES IN THE GLOBAL MARKET DURING FORECAST PERIOD

TABLE 48 SEED COATING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 50 NORTH AMERICA: MARKET FOR SEED COATING, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Seeds can be coated for precision placement of insecticide near young growing roots of just-emerged plants

TABLE 58 US: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 59 US: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 60 US: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 61 US: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 62 US: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 63 US: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Delayed harvest can be enabled using seed coating technique due to cold temperature

TABLE 64 CANADA: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 65 CANADA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 66 CANADA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 67 CANADA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 68 CANADA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 69 CANADA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Mexico has greater relevance in organic sector due to increased demand for organic products in developed markets

TABLE 70 MEXICO: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 71 MEXICO: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 72 MEXICO: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 73 MEXICO: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 74 MEXICO: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 75 MEXICO: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

TABLE 76 EUROPE: MARKET FOR SEED COATING, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.1 SPAIN

12.3.1.1 Increase in cultivation of GM crops to drive growth of the global market

TABLE 84 SPAIN: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 85 SPAIN: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 86 SPAIN: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 87 SPAIN: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 89 SPAIN: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.2 ITALY

12.3.2.1 Vegetables, corns, and wheat are key crops identified in seed coating market

TABLE 90 ITALY: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 91 ITALY: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 92 ITALY: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 93 ITALY: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 94 ITALY: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 95 ITALY: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Regulations in Europe to lead to increased usage of new seed enhancement techniques in Germany

TABLE 96 GERMANY: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 100 GERMANY: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Increase in bio-farming to lead to surge in demand for biodegradable seed enhancement methods

TABLE 102 FRANCE: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 104 FRANCE: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 107 FRANCE: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.5 NETHERLANDS

12.3.5.1 By adopting new technologies, Netherlands to witness enhanced production efficiency for crop yields

TABLE 108 NETHERLANDS: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 109 NETHERLANDS: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 110 NETHERLANDS: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 111 NETHERLANDS: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 112 NETHERLANDS: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 113 NETHERLANDS: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 114 REST OF EUROPE: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

TABLE 120 ASIA PACIFIC: MARKET FOR SEED COATING, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Unstable economic conditions and declining ecological conditions to drive the global market

TABLE 128 CHINA: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 129 CHINA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 130 CHINA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 132 CHINA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 133 CHINA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.2 AUSTRALIA

12.4.2.1 Policy reforms emphasize increased production and high-quality seeds and seedlings

TABLE 134 AUSTRALIA: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 135 AUSTRALIA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 136 AUSTRALIA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 137 AUSTRALIA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 138 AUSTRALIA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 139 AUSTRALIA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Developing countries to provide growth opportunities due to high economic growth and favorable seed policies

TABLE 140 INDIA: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 141 INDIA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 142 INDIA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 143 INDIA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 144 INDIA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 145 INDIA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increase in agricultural outputs through limited resources to encourage market growth

TABLE 146 JAPAN: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 148 JAPAN: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 149 JAPAN: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 150 JAPAN: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 151 JAPAN: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.5 THAILAND

12.4.5.1 Increasing demand for cereal crops and export of vegetable seeds to drive market for seed coating

TABLE 152 THAILAND: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 153 THAILAND: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 154 THAILAND: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 155 THAILAND: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 156 THAILAND: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 157 THAILAND: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 158 REST OF ASIA PACIFIC: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 164 ROW: SEED COATING MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 165 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 166 ROW: MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 167 ROW: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 168 ROW: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 169 ROW: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 170 ROW: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 171 ROW: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Emphasis on R&D, supportive policies, and integrated approach toward cultivation to enhance quality of agricultural yield

TABLE 172 BRAZIL: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 173 BRAZIL: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 175 BRAZIL: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 176 BRAZIL: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 177 BRAZIL: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Increasing demand for high-quality seeds due to different soil-climate combination to drive market

TABLE 178 ARGENTINA: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 179 ARGENTINA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 180 ARGENTINA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 181 ARGENTINA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 182 ARGENTINA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 183 ARGENTINA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.5.3 SOUTH AFRICA

12.5.3.1 Adoption of innovative and precise techniques to obtain effective crop yield

TABLE 184 SOUTH AFRICA: MARKET FOR SEED COATING, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 185 SOUTH AFRICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 186 SOUTH AFRICA: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 187 SOUTH AFRICA: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 188 SOUTH AFRICA: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 189 SOUTH AFRICA: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

12.5.4 OTHERS IN ROW

TABLE 190 OTHERS IN ROW: SEED COATING MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 191 OTHERS IN ROW: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 192 OTHERS IN ROW: MARKET, BY ADDITIVE, 2019–2021 (USD MILLION)

TABLE 193 OTHERS IN ROW: MARKET, BY ADDITIVE, 2022–2027 (USD MILLION)

TABLE 194 OTHERS IN ROW: MARKET, BY POLYMER TYPE, 2019–2021 (USD MILLION)

TABLE 195 OTHERS IN ROW: MARKET, BY POLYMER TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 155)

13.1 OVERVIEW

13.2 RANKING OF KEY PLAYERS, 2021

FIGURE 31 BASF SE TO DOMINATE THE GLOBAL MARKET IN 2021

13.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.3.1 STARS

13.3.2 EMERGING LEADERS

13.3.3 PERVASIVE PLAYERS

13.3.4 PARTICIPANTS

FIGURE 32 COMPANY EVALUATION QUADRANT

13.4 COMPETITIVE BENCHMARKING

TABLE 196 SEED COATING MARKET: DETAILED LIST OF KEY PLAYERS

13.5 COMPETITIVE SCENARIO

13.5.1 EXPANSIONS & INVESTMENTS

TABLE 197 EXPANSIONS & INVESTMENTS, 2019–2021

13.5.2 ACQUISITIONS

TABLE 198 ACQUISITIONS, 2022

13.5.3 AGREEMENTS & JOINT VENTURES

TABLE 199 AGREEMENTS & JOINT VENTURES, 2022

14 COMPANY PROFILES (Page No. - 160)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 BASF SE

TABLE 200 BASF SE: BUSINESS OVERVIEW

FIGURE 33 BASF SE: COMPANY SNAPSHOT

TABLE 201 BASF SE: PRODUCTS OFFERED

TABLE 202 BASF SE: OTHERS

14.1.2 SOLVAY S.A.

TABLE 203 SOLVAY S.A.: BUSINESS OVERVIEW

FIGURE 34 SOLVAY S.A.: COMPANY SNAPSHOT

TABLE 204 SOLVAY S.A.: PRODUCTS OFFERED

TABLE 205 SOLVAY S.A.: DEALS

14.1.3 CRODA INTERNATIONAL PLC

TABLE 206 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

FIGURE 35 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 207 CRODA INTERNATIONAL PLC: PRODUCTS OFFERED

TABLE 208 CRODA INTERNATIONAL PLC: OTHERS

14.1.4 CLARIANT AG

TABLE 209 CLARIANT AG: BUSINESS OVERVIEW

FIGURE 36 CLARIANT AG: COMPANY SNAPSHOT

TABLE 210 CLARIANT AG: PRODUCTS OFFERED

14.1.5 DSM

TABLE 211 DSM: BUSINESS OVERVIEW

FIGURE 37 DSM: COMPANY SNAPSHOT

TABLE 212 DSM: PRODUCTS OFFERED

14.1.6 SENSIENT TECHNOLOGIES

TABLE 213 SENSIENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 38 SENSIENT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 214 SENSIENT TECHNOLOGIES: PRODUCTS OFFERED

14.1.7 BRETTYOUNG SEEDS LIMITED

TABLE 215 BRETTYOUNG SEEDS LIMITED: BUSINESS OVERVIEW

TABLE 216 BRETTYOUNG SEEDS LIMITED: PRODUCTS OFFERED

14.1.8 MILLIKEN CHEMICAL

TABLE 217 MILLIKEN CHEMICAL: BUSINESS OVERVIEW

TABLE 218 MILLIKEN CHEMICAL: PRODUCTS OFFERED

14.1.9 PRECISION LABORATORIES, LLC

TABLE 219 PRECISION LABORATORIES, LLC: BUSINESS OVERVIEW

TABLE 220 PRECISION LABORATORIES, LLC: PRODUCTS OFFERED

14.1.10 GERMAINS SEED TECHNOLOGY INC

TABLE 221 GERMAINS SEED TECHNOLOGY INC: BUSINESS OVERVIEW

TABLE 222 GERMAINS SEED TECHNOLOGY INC: PRODUCTS OFFERED

14.1.11 CR MINERALS COMPANY, LLC

TABLE 223 CR MINERALS COMPANY, LLC: BUSINESS OVERVIEW

TABLE 224 CR MINERALS COMPANY, LLC: PRODUCTS OFFERED

14.1.12 GLOBACHEM

TABLE 225 GLOBACHEM: BUSINESS OVERVIEW

TABLE 226 GLOBACHEM: PRODUCTS OFFERED

14.1.13 UNIVERSAL COATING SYSTEMS

TABLE 227 UNIVERSAL COATING SYSTEMS: BUSINESS OVERVIEW

TABLE 228 UNIVERSAL COATING SYSTEMS: PRODUCTS OFFERED

14.1.14 CENTOR OCEANIA

TABLE 229 CENTOR OCEANIA: BUSINESS OVERVIEW

TABLE 230 CENTOR OCEANIA: PRODUCTS OFFERED

14.1.15 CHROMATECH INCORPORATED

TABLE 231 CHROMATECH INCORPORATED: BUSINESS OVERVIEW

TABLE 232 CHROMATECH INCORPORATED: PRODUCTS OFFERED

14.1.16 MICHELMAN, INC.

TABLE 233 MICHELMAN, INC.: BUSINESS OVERVIEW

TABLE 234 MICHELMAN, INC.: PRODUCTS OFFERED

14.1.17 SMITH SEED SERVICES

TABLE 235 SMITH SEED SERVICES: BUSINESS OVERVIEW

TABLE 236 SMITH SEED SERVICES: PRODUCTS OFFERED

14.1.18 PREBBLE SEEDS LTD

TABLE 237 PREBBLE SEEDS LTD: BUSINESS OVERVIEW

TABLE 238 PREBBLE SEEDS LTD: PRODUCTS OFFERED

14.1.19 ORGANIC DYES AND PIGMENTS

TABLE 239 ORGANIC DYES AND PIGMENTS: BUSINESS OVERVIEW

TABLE 240 ORGANIC DYES AND PIGMENTS: PRODUCTS OFFERED

14.1.20 CISTRONICS TECHNOVATIONS PVT LTD

TABLE 241 CISTRONICS TECHNOVATIONS PVT LTD: BUSINESS OVERVIEW

TABLE 242 CISTRONICS TECHNOVATIONS PVT LTD: PRODUCTS OFFERED

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 194)

15.1 INTRODUCTION

TABLE 243 ADJACENT MARKETS TO SEED COATING MARKET

15.2 LIMITATIONS

15.3 SEED TREATMENT MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 244 SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 245 SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 246 SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2019–2021 (KT)

TABLE 247 SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2022–2027 (KT)

15.4 SEEDS MARKET

15.4.1 MARKET DEFINITION

TABLE 248 SEEDS MARKET SIZE, BY CROP TYPE, 2016–2020 (USD MILLION)

TABLE 249 SEEDS MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 198)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the seed coating market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both demand- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the seed coating market.

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Market Scope of Seed Dressing Market

The seed dressing market refers to the use of various chemicals, fungicides, and insecticides to treat and protect seeds from various diseases and pests. The market scope of the seed dressing market is vast and includes various crops such as cereals, oilseeds, fruits, and vegetables.

The increasing demand for high-quality seeds, along with the rising need for food security, is expected to drive the growth of the seed dressing market in the coming years. Additionally, the growing trend of using bio-based and organic seed treatment products is also expected to boost market growth.

The market scope of the seed dressing market is also influenced by factors such as government regulations, increasing awareness about sustainable farming practices, and advancements in technology for seed treatment.

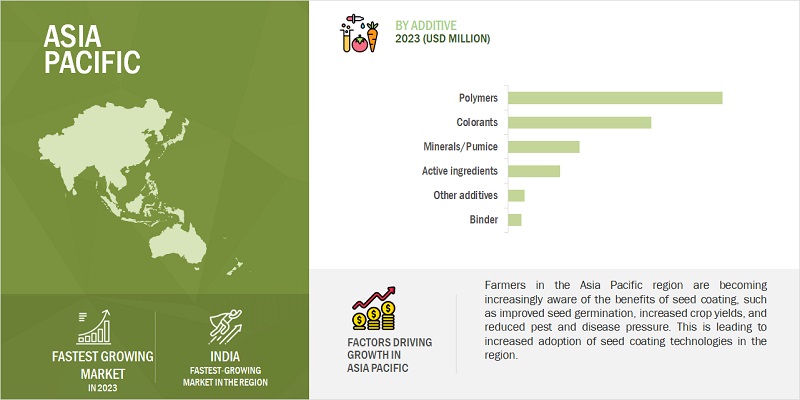

Geographically, North America and Europe are the largest markets for seed dressing, followed by Asia Pacific and South America. The Asia Pacific region is expected to witness significant growth in the coming years, driven by the increasing adoption of modern agricultural practices and the growing population.

Major Factors Influencing the Growth of Seed Protectant Market

The seed protectant market is influenced by several major factors that impact its growth and development. Some of the key factors that are driving the growth of the seed protectant market include:

- Growing demand for high-quality seeds: There is a significant demand for high-quality seeds that are protected from pests, diseases, and other environmental stressors. This demand is driving the growth of the seed protectant market as farmers are increasingly looking for ways to protect their crops and ensure high yields.

- Increasing focus on sustainable agriculture: There is a growing focus on sustainable agriculture practices that aim to minimize the use of synthetic chemicals and promote natural solutions for crop protection. This trend is leading to increased adoption of seed protectants that are eco-friendly and safe for use in agriculture.

- Technological advancements in seed protection: The seed protectant market is witnessing several technological advancements, including the development of new seed treatments that offer improved protection against pests and diseases. These advancements are expected to drive the growth of the market as farmers increasingly adopt new and innovative seed protection solutions.

- Government regulations: Government regulations are an important factor influencing the growth of the seed protectant market. Several countries have regulations in place that require farmers to use certified seed that is protected against pests and diseases. These regulations are driving the demand for seed protectants and contributing to the growth of the market.

- Increasing awareness about crop protection: There is a growing awareness among farmers about the importance of crop protection and the need to use seed protectants to safeguard their crops. This awareness is driving the growth of the seed protectant market as farmers increasingly prioritize crop protection in their farming practices.

Overall, the seed protectant market is expected to continue growing in the coming years, driven by factors such as growing demand for high-quality seeds, increasing focus on sustainable agriculture, technological advancements, government regulations, and increasing awareness about crop protection.

How Seed Treatment is Going to Impact Seed Coating Market

Seed treatment is expected to have a significant impact on the seed coating market in the coming years. Seed treatment involves the application of various chemicals, fungicides, and insecticides to seeds to protect them from pests and diseases and to enhance their germination and growth. Seed coating, on the other hand, involves the application of a thin layer of materials to seeds to improve their appearance, handling, and performance.

The increasing adoption of seed treatment solutions is expected to drive the growth of the seed coating market as seed treatment and seed coating are often used together to enhance the performance and protection of seeds. Seed coating can act as a carrier for seed treatment products, making it easier to apply them uniformly to seeds.

Seed treatment can also help to improve the effectiveness of seed coating by protecting the seeds from pests and diseases, which can damage the seed coating and reduce its efficacy. This, in turn, can lead to increased demand for high-quality seed coating products that offer enhanced protection and performance.

Furthermore, the growing trend towards sustainable agriculture practices is expected to drive the growth of the seed coating market as farmers increasingly look for eco-friendly and safe solutions for crop protection. Seed coating products that use natural and bio-based materials are expected to gain popularity as they align with this trend.

Overall, the increasing adoption of seed treatment solutions and the growing demand for sustainable agriculture practices are expected to have a positive impact on the seed coating market in the coming years. The combination of seed treatment and seed coating is expected to lead to the development of new and innovative products that offer enhanced protection and performance for crops.

Report Objectives

- To define, segment, and project the global market size for seed coating based on form, process, additive, active ingredient, crop type, and region ranging from 2022 to 2027

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and the influence of all critical stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- Analyzing the micromarkets concerning individual growth trends, prospects, and their contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Sweden, the UK, and Greece

- Further analysis of the Rest of Asia Pacific into Indonesia, Vietnam, and South Korea.

- The rest of the World (RoW) includes Africa (excluding South Africa), and the Middle East

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Seed Coating Market