Self-Adhesive Labels Market by Composition (Facestock, Adhesive, Release Liner), Type (Release Liner, Linerless), Nature (Permanent, Repositionable, Removable), Printing Technology, Application, and Region - Global Forecast to 2026

The global self adhesive labels market is projected to reach USD 62.3 billion by 2026, at a cagr 5.4%. The self-adhesive labels market is expected to witness significant growth in the coming years due to its increased demand across the food & beverages, pharmaceuticals and e-commerce industries. With the increasing demand for convenience and quality food products, people are opting for packaged food products, where the product information and other details such as nutritional values of the product and manufactured & expiry dates need to be printed; this is an opportunity for self-adhesive label manufacturers.

Global Self-Adhesive Labels Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Self-adhesive labels Market Dynamics

Driver: Increasing urban population

The increasing urban population is a factor for the growth in demand for products that use self-adhesive labels such as medicines, beverages, FMCGs (Fast-Moving Consumer Goods), and consumer durables. In APAC, the population shift from rural to urban areas has elevated the growth rate even further. According to the United Nations Population Division, the total population in APAC is projected to reach 5.1 billion by 2050, where the urban population will account for at least 68% of the total. Combined with the overall growth of the world’s population could add another 2.5 billion people to urban areas by 2050, with close to 90% of this increase taking place in Asia and Africa. The improved living standards will increase the demand for branded products, which will lead to a rise in demand for self-adhesive labels.

In addition to this, the converting industry is expansive and caters to several markets and industries, providing them requisite solutions according to the specifications given by them. The highest per capita consumption of label stock comes from developed regions, where the highest growth rate is observed among developing regions such as APAC, Africa, and the Middle East. The label converting industry has a huge scope for growth in these developing economies.

Restraint: Advantages of wet-glue labels over self-adhesive labels and printing on package

Wet-glue labels are labels on which the adhesive is not pre-applied; the adhesive is applied after the printing process and right before the application of the label on the product. They are cost-effective as compared to self-adhesive labels because manufacturers need not spend on the purchase of raw materials such as adhesives and release liners. The production process of wet-glue labels is simple, as it does not need to be coated with an adhesive; this reduces the time taken for production. Wet-glue labels are preferred by buyers, as they can be stored for a long period, which results in less wastage.

Self-adhesive labels are more suitable for shorter runs and fewer labels. But for longer runs and larger quatatites of labels, wet glue labels are still considered the best option.

Developments in printing technologies, including inks and techniques, have enabled manufacturers to print on the package. Companies such as DuPont (US) and The Dow Chemical Company (US) have developed inks that are compatible with different materials, including fabrics. Packages such as stand-up pouches, cartoons, and boxes usually do not make use of labels. They have the content/information directly printed on the package. This is a major restraint to the growth of the self-adhesive labels market.

Opportunity: Forward integrations in value chain and new product development

Companies engaged in the manufacturing of self-adhesive labels can aim at providing a complete solution to clients. Manufacturers usually deal with products with plain labels, which is later supplied to clients in the form of rolls or sheets. The client then undertakes the task of printing on the label. Technological advancements have led to the development of machinery that can be incorporated in the printing process within the production process of the self-adhesive labels; this will enable manufacturers to provide a complete solution to clients and gain a higher margin.

Nice Label (Slovenia), for instance, one of the leading developers of label design software and label management systems, developed a single software platform for all printing devices and for all packaging and shipping, from primary to tertiary labeling. Through this, it aimed at eliminating the risk of labeling errors, enhancing supply chain efficiencies, and significantly reducing operational costs.

Extensive R&D has resulted in the advent of new technologies in the self-adhesive labels industry. Apart from the developments and advancements in the equipment and machinery used in self-adhesive label manufacturing, this market has also experienced developments in new printing technologies such as digital printing and laser printing. The use of biodegradable packaging material is also one of the major trends in the market. Linerless labels reduce the amount of waste accumulated at landfills, which is why it has been preferred by government agencies over the last few years. Avery Dennison (US), a pioneer in the industry, has developed advanced labels that are eco-friendly and solvent-free, and are being widely used in beer labels, battery labels, consumer goods, medical goods, and transportation. In such instances, pressure labels are more durable, grease & water resistant, and provide better insulation, which will find innovative applications across industries.

Challenge: Varying environmental mandates across regions and cost-to-benefit concern for smaller manufacturers

Consumers are showing more interest in biodegradable and eco-friendly materials. Manufacturing units and printing units try to ensure that the packaging of the product does not increase the cost of the product to such a large extent that they lose out on market share and hence try to use materials that are inexpensive and may not be sustainable or eco-friendly. Retailers are also skeptical about the raw materials being used in the preparation of labels and make sure that they are eco-friendly. Governments in Europe, North America, and North Asia have developed regulations strictly pertaining to the packaging and labeling industry, with regard to recycling rates, container deposits, and packaging levies. However, environmental mandates in the packaging & labeling industry differ across countries; this makes it challenging for companies to adjust to the labeling materials used according to the regulations applicable in that region.

The manufacturing of self-adhesive labels is a capital-intensive process; the initial capital involved in setting up a label manufacturing plant is high. Rapid technological innovations have led to the development of highly advanced equipment, which is expensive to buy. In general, players with high investment capabilities are entering the market, as returns are high only in the long term. The demands of clients with respect to shape, sizes, materials, and adhesives differ. This means that the production lines need to be fully equipped to produce labels according to different specifications. That is why small manufacturers find it difficult to enter the business. They fail to enjoy the cost-benefit ratio in the long run, as they do not have the capacity to make an initial investment.

Permanent labels segment to dominated self-adhesive labels market in 2020

Permanent, by nature, accounted for the largest share in the self-adhesive labels market. Permanent labels are the most common and cost-effective labels and can only be removed with the help of solvents as their composition is made to be non-removable. The application of permanent adhesives on self-adhesive labels usually depends on the substrate and surface material as well as the environmental conditions such as UV (ultraviolate) exposure, moisture, temperature range, and contact with chemicals. Removing a permanent label destroys it. Hence, these labels are suitable for non-polar surfaces, films, and corrugated board; these are not recommended for labeling highly curved surfaces.

Significant increase in the demand for self-adhesive labels in food & beverage industry

Food & beverages, by application, accounted for the largest share in self-adhesive labels in 2019, in terms of value and volume. A large number of self-adhesive labels are used in the food industry for fresh food, meat, fish, seafood, fresh produce, poultry, and ready meals. Increase in demand for convenience and quality food products has led the market for self-adhesive labels.

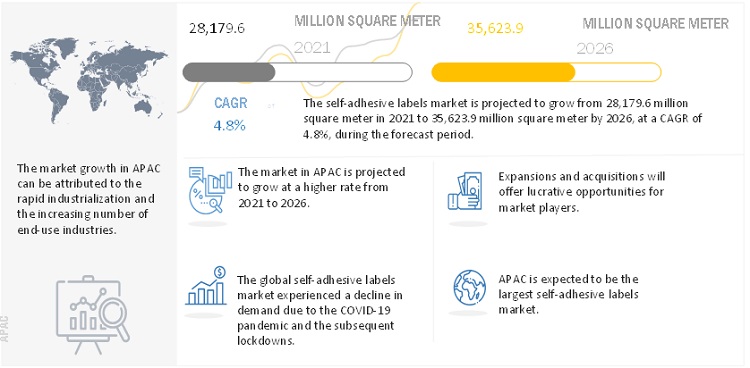

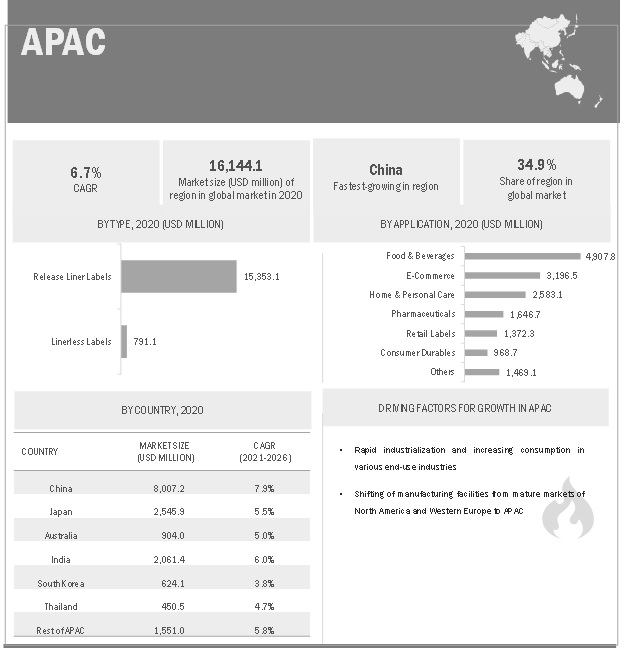

APAC region to lead the global self-adhesive labels market by 2026.

The APAC region is projected to lead the self-adhesive labels market, in terms of both value and volume from 2021 to 2026. The usage of self-adhesive labels in the region has increased due to cost effectiveness, easy availability of raw materials, and demand for product labeling from highly populated countries such as India and China. The increasing scope of applications of self-adhesive labels in the food & beverage, healthcare, and personal care industries in the region is expected to drive the self-adhesive labels market in APAC. The growing population in these countries presents a huge customer base for FMCG products and food & beverages. Industrialization, growing middle-class population, rising disposable income, changing lifestyles, and rising consumption of packed products are expected to drive the demand for self-adhesive labels during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key manufacturers in the self-adhesive labels market are CCL Industries Inc. (Canada), Avery Dennison Corporation (US), Multi-Color Corporation (US), Coveris Holdings S.A. (Austria), Huhtamaki OYJ (US), and Fuji Seal International (Japan), amongst others.

Self Adhesive Labels Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 47.9 billion |

|

Revenue Forecast in 2026 |

USD 62.3 billion |

|

CAGR |

5.4% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Meter) |

|

Segments covered |

Type, Nature, Printing Technology, Application And Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

CCL Industries Inc. (Canada), Avery Dennison Corporation (US), Multi-Color Corporation (US), Coveris Holdings S.A. (Austria), Huhtamaki OYJ (US), and Fuji Seal International (Japan), among others. |

This research report categorizes the self-adhesive labels market based on type, nature, printing technology, application and region.

Based on Type:

- Release Liner

- Linerless

Based on Nature:

- Permanent

- Removable

- Repositionable

Based on Printing Technology:

- Flexography

- Digital Printing

- Lithography

- Screen Printing

- Gravure

- Letterpress

- Offset

Based on Application:

- Food & Beverages

- Consumer Durables

- Pharmaceuticals

- Home & Personal Care

- Retail Labels

- E-Commerce

- Others

Based on region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments:

- In October 2021, Multi-Color Corporation acquired the Hexagon Label Group in Australia and New Zealand. This acquisition aims at an enhanced footprint and offerings to ANZ customers with comprehensive label solutions in Adelaide, Brisbane, Griffith, Melbourne, Perth, Sydney, Auckland, and Christchurch.

- In April 2021, Lintec acquired all shares of Duramark, a manufacturer and distributor of various adhesive products. The acquisition provides immediate access to production equipment that Mactac requires to increase the production capacity of adhesive papers and films for labels, its main products.

- In July 2020, CCL Industries Inc. acquired InTouch Labels and Packaging Co., Inc. (InTouch), near Boston, Massachusetts. InTouch is a specialized short-run digital label converter and was added to Avery’s direct-to-consumer operations.

- In March 2020, Avery Dennison announced an investment worth 35 million in the coating technology to expand its Fasson Roll North America pressure-sensitive base materials operations in Greenfield, Indiana. This initiative is expected to significantly expand the production capacity of Fasson-brand paper and film label materials in the US.

- In March 2020, Coveris acquired Plasztik-Tranzit Kft (Hungary), a producer of flexible packaging solutions for the food industry. The acquired company is renamed as Coveris Pirto and is a part of Coveria Holdings. This strategic development is expected to create a center for high-tech packaging manufacturing in East Europe and to boost the production capability of the company in the medical, food and films end-markets.

Frequently Asked Questions (FAQ):

Which Market hold maximum market share of the Self-Adhesive Labels Market?

APAC hold the maximum market share of the Self-Adhesive Labels Market

What is the Leading Types of Self-Adhesive Labels Market?

The leading Types of Self-Adhesive Labels Market are Release Liner, Lineless

What is the current size of the global self-adhesive labels market?

The global self-adhesive labels market size is projected to grow from USD 47.9 billion in 2021 to USD 62.3 billion by 2026, at a CAGR of 5.4% from 2021 to 2026.

Who are the key players in the global self-adhesive labels market?

Key manufacturers in the self-adhesive labels market are CCL Industries Inc. (Canada), Avery Dennison Corporation (US), Multi-Color Corporation (US), Coveris Holdings S.A. (Austria), Huhtamaki OYJ (US), and Fuji Seal International (Japan), amongst others.

What are the factors driving the growth of the self-adhesive labels market?

The growth of the self-adhesive labels market is attributed to the increase in demand for self-adhesive labels in applications, particularly for food & beverage industry .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 SELF-ADHESIVE LABELS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.3.2 REGIONAL SCOPE

FIGURE 2 SELF-ADHESIVE LABELS MARKET, BY REGION

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 SELF-ADHESIVE LABELS MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 4 DATA TRIANGULATION

2.3 KEY MARKET INSIGHTS

FIGURE 5 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 MARKET SIZE ESTIMATION

FIGURE 6 APPROACH 1: BOTTOM-UP APPROACH (BASED ON LINERLESS LABELS MARKET)

2.4.1 APPROACH – 2

FIGURE 7 SELF-ADHESIVE LABELS MARKET: BOTTOM-UP APPROACH (BASED ON RELEASE LINER LABELS MARKET)

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

FIGURE 8 LIMITATIONS

2.5.2 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 9 RELEASE LINER TO BE LARGER MARKET DURING FORECAST PERIOD

FIGURE 10 FLEXOGRAPHY TO BE FASTEST-GROWING TECHNOLOGY SEGMENT

FIGURE 11 APAC TO BE FASTEST-GROWING SELF-ADHESIVE LABELS MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 APAC TO SHOW HIGHER GROWTH RATE DUE TO RAPID INDUSTRIALIZATION AND INCREASING END-USE INDUSTRIES

FIGURE 12 INCREASING DEMAND FROM FOOD & BEVERAGE INDUSTRY TO DRIVE DEMAND FOR SELF-ADHESIVE LABELS

4.2 SELF-ADHESIVE LABELS MARKET, BY NATURE

FIGURE 13 PERMANENT TO BE FASTEST-GROWING SEGMENT

4.3 SELF-ADHESIVE LABELS MARKET, BY APPLICATION

FIGURE 14 FOOD & BEVERAGES SEGMENT TO LEAD SELF-ADHESIVE LABELS MARKET

4.4 SELF-ADHESIVE LABELS MARKET, BY REGION AND APPLICATION

FIGURE 15 FOOD & BEVERAGES AND APAC LED SELF-ADHESIVE LABELS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE SELF-ADHESIVE LABELS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing urban population

TABLE 3 APAC URBANIZATION PROSPECTS

5.2.1.2 Strong demand from end-use industries

5.2.1.3 Growth of parent industry

5.2.2 RESTRAINTS

5.2.2.1 Advantages of wet-glue labels over self-adhesive labels

5.2.2.2 Printing on package

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.3.2 Forward integrations in value chain

5.2.3.3 New product development

5.2.4 CHALLENGES

5.2.4.1 Varying environmental mandates across regions

TABLE 4 ACTS AND REGULATIONS REGARDING LABELLING

5.2.4.2 Cost-to-benefit ratio concern for small manufacturers

5.2.4.3 High R&D investments

5.2.4.4 Management of packaging supply chain

6 INDUSTRY TRENDS (Page No. - 51)

6.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 Self-Adhesive Labels Market : PORTER'S FIVE FORCES ANALYSIS

6.1.1 THREAT OF SUBSTITUTES

6.1.2 BARGAINING POWER OF SUPPLIERS

6.1.3 BARGAINING POWER OF BUYERS

6.1.4 THREAT OF NEW ENTRANTS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

7 IMPACT OF COVID-19 (Page No. - 54)

TABLE 5 INTERIM ECONOMIC OUTLOOK FORECAST, 2019–2021 (PERCENTAGE)

7.1 IMPACT OF COVID-19 ON SELF-ADHESIVE LABELS MARKET

7.2 RANGE SCENARIO ANALYSIS

FIGURE 18 RANGE SCENARIO FOR SELF-ADHESIVE LABELS

7.2.1 OPTIMISTIC SCENARIO

7.2.2 PESSIMISTIC SCENARIO

7.2.3 REALISTIC SCENARIO

8 SELF-ADHESIVE LABELS MARKET, BY COMPOSITION (Page No. - 57)

8.1 INTRODUCTION

8.2 FACESTOCK

8.3 ADHESIVE

8.3.1 HOT-MELT

8.3.2 ACRYLIC

8.4 RELEASE LINER OR BACKING

9 PIPELINE MONITORING SYSTEM MARKET, BY TECHNOLOGY (Page No. - 59)

9.1 INTRODUCTION

FIGURE 19 PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

TABLE 6 Self-Adhesive Labels Market SIZE, BY NATURE, 2019–2026 (USD MILLION)

TABLE 7 MARKET SIZE, BY NATURE, 2019–2026 (MILLION SQUARE METER)

9.2 PERMANENT

9.2.1 COST-EFFECTIVE LABELS WITH SEVERAL APPLICATIONS

9.3 REMOVABLE

9.3.1 INCREASING APPLICATION IN RETAIL SECTOR DRIVING SEGMENT

9.4 REPOSITIONABLE

9.4.1 CAN BE REMOVED AND REAPPLIED SEVERAL TIMES

10 SELF-ADHESIVE LABELS MARKET, BY TYPE (Page No. - 62)

10.1 INTRODUCTION

FIGURE 20 SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 8 SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

10.2 RELEASE LINER

10.2.1 RELEASE LINER SEGMENT TO DOMINATE THE SELF-ADHESIVE LABELS MARKET

10.3 LINERLESS

10.3.1 LOW COST AND MORE DURABILITY OF LINERLESS LABELS IS DRIVING THE MARKET

11 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY (Page No. - 65)

11.1 INTRODUCTION

FIGURE 21 SELF-ADHESIVE LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

TABLE 10 SELF-ADHESIVE LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 11 SELF-ADHESIVE LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METER)

11.2 FLEXOGRAPHY

11.2.1 COST-EFFECTIVENESS AND EFFICIENT PRINTING DRIVING SEGMENT GROWTH

11.3 SCREEN PRINTING

11.3.1 INCREASING DEMAND FOR DIFFERENT APPLICATION DRIVING SEGMENT

11.4 DIGITAL PRINTING

11.4.1 HIGH QUALITY AND LESS PRODUCT WASTAGE INCREASING DEMAND

11.5 GRAVURE

11.5.1 RISING DEMAND FOR VARIOUS APPLICATIONS DRIVING MARKET GROWTH

11.6 OFFSET

11.6.1 HIGH AND CONSISTENT IMAGE QUALITY INCREASING DEMAND

11.7 LITHOGRAPHY

11.7.1 SEVERAL ADVANTAGES OVER OTHER TECHNOLOGIES

11.8 LETTERPRESS

11.8.1 TIME-CONSUMING PROCESS LOWERING DEMAND

12 SELF-ADHESIVE LABELS MARKET, BY APPLICATION (Page No. - 70)

12.1 INTRODUCTION

FIGURE 22 SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 12 SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 13 SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

12.2 FOOD & BEVERAGES

12.2.1 FOOD & BEVERAGES SEGMENT TO DOMINATE SELF-ADHESIVE LABELS MARKET

12.3 CONSUMER DURABLES

12.3.1 INCREASING APPLICATIONS OF SELF-ADHESIVE LABELS PROPELLING MARKET GROWTH

12.4 HOME & PERSONAL CARE

12.4.1 IMPROVED STANDARDS OF LIVING, COUPLED WITH RISING DISPOSABLE INCOME LEADING TO GROWTH OF SEGMENT

12.5 PHARMACEUTICALS

12.5.1 GOVERNMENT REGULATIONS, SAFETY STANDARDS, CERTIFICATIONS, AND DRUG-RELATED LAWS DRIVING SEGMENT GROWTH

12.6 RETAIL LABELS

12.6.1 RISING CONSUMER DEMAND LEADING TO MARKET GROWTH

12.7 E-COMMERCE

12.7.1 GROWING INVESTMENTS IN LOGISTICS AND WAREHOUSES SUPPORTING MARKET

12.8 OTHERS

13 SELF-ADHESIVE LABELS MARKET, BY REGION (Page No. - 75)

13.1 INTRODUCTION

TABLE 14 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 23 APAC TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 15 SELF-ADHESIVE LABELS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 SELF-ADHESIVE LABELS MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

13.2 APAC

13.2.1 IMPACT OF COVID-19 IN APAC

FIGURE 24 APAC: Self-Adhesive Labels Market SNAPSHOT

TABLE 17 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 18 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 19 APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 20 APAC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 21 APAC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 22 APAC: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.2 CHINA

13.2.2.1 Increasing industrial activities and high growth of food sector to boost Self-Adhesive Labels Market TABLE 23 CHINA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 24 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 25 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 26 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.3 INDIA

13.2.3.1 Growing demand for FMCG and convenience products driving market

TABLE 27 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 28 INDIA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 29 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 30 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.4 JAPAN

13.2.4.1 Increasing demand from pharmaceutical industry propelling market growth

TABLE 31 JAPAN: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 32 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 33 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.5 SOUTH KOREA

13.2.5.1 The increasing government investments for research on the use of Self-Adhesive Labels Market across industries are boosting the market

TABLE 35 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 37 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.6 AUSTRALIA

13.2.6.1 Food & beverage industry are driving the market

TABLE 39 AUSTRALIA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 41 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.7 THAILAND

13.2.7.1 Growing manufacturing and processing industries to propel the Self-Adhesive Labels Market TABLE 43 THAILAND: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 THAILAND: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 45 THAILAND: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 46 THAILAND:MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.2.8 REST OF APAC

TABLE 47 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 49 REST OF APAC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 REST OF APAC: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3 EUROPE

13.3.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 25 EUROPE: SELF-ADHESIVE LABELS MARKET SNAPSHOT

TABLE 51 EUROPE:MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 53 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 55 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.2 GERMANY

13.3.2.1 Food & beverage segment to increase demand

TABLE 57 GERMANY: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 59 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 60 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.3 UK

13.3.3.1 Increased demand for convenience food to boost market

TABLE 61 UK: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 UK: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 63 UK: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 64 UK: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.4 ITALY

13.3.4.1 Growing demand for processed and packaged food to drive demand for self-adhesive labels

TABLE 65 ITALY: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 67 ITALY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 ITALY: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.5 FRANCE

13.3.5.1 Increasing use of self-adhesive labels in home & personal care products propelling market

TABLE 69 FRANCE: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 71 FRANCE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 FRANCE: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.6 SPAIN

13.3.6.1 Growing food & beverages industry propelling market

TABLE 73 SPAIN: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 75 SPAIN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 SPAIN: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.7 RUSSIA

13.3.7.1 Increasing demand from end-use industries supporting market growth

TABLE 77 RUSSIA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 RUSSIA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 79 RUSSIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 RUSSIA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.3.8 REST OF EUROPE

TABLE 81 REST OF EUROPE: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 83 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.4 NORTH AMERICA

13.4.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 26 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.4.2 US

13.4.2.1 Largest consumer of self-adhesive labels in North

TABLE 91 US: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 US: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 93 US: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 US: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.4.3 CANADA

13.4.3.1 Increasing disposable income and growth in food industry significantly contributing to market growth

TABLE 95 CANADA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 97 CANADA: SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 CANADA: SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.4.4 MEXICO

13.4.4.1 Increasing demand for convenience and ready-to-go products to drive market

TABLE 99 MEXICO: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 101 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 102 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5 MIDDLE EAST & AFRICA

13.5.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

TABLE 103 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 105 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 107 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5.2 TURKEY

13.5.2.1 Rapid industrialization and urbanization to drive market

TABLE 109 TURKEY: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 TURKEY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 111 TURKEY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 TURKEY: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5.3 SAUDI ARABIA

13.5.3.1 Increasing manufacturing activities to boost market growth

TABLE 113 SAUDI ARABIA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 115 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 116 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5.4 SOUTH AFRICA

13.5.4.1 High demand from takeaway and fast-food outlets

TABLE 117 SOUTH AFRICA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 119 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 120 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5.5 UAE

13.5.5.1 Growing healthcare and food sectors to fuel market

TABLE 121 UAE: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 UAE: TABLE 123 UAE: SELF-ADHESIVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 124 UAE: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 125 REST OF MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 127 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 128 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.6 SOUTH AMERICA

13.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

TABLE 129 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 130 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METER)

TABLE 131 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 133 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 SOUTH AMERICA:MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.6.2 BRAZIL

13.6.2.1 Government’s efforts for fiscal sustainability to aid market growth

TABLE 135 BRAZIL: SELF-ADHESIVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 137 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 138 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.6.3 ARGENTINA

13.6.3.1 Food to be largest segment of self-adhesive labels market

TABLE 139 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 141 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

13.6.4 REST OF SOUTH AMERICA

TABLE 143 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 145 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 146 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION SQUARE METER)

14 COMPETITIVE LANDSCAPE (Page No. - 136)

14.1 OVERVIEW

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 27 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY, 2016–202O

14.3 MARKET RANKING

FIGURE 28 MARKET RANKING OF KEY PLAYERS, 2020

14.3.1 CCL INDUSTRIES INC.

14.3.2 AVERY DENNISON CORPORATION

14.3.3 MULTI-COLOR CORPORATION

14.3.4 HUHTAMAKI OYJ

14.3.5 COVERIS HOLDINGS SA

14.4 COMPANY EVALUATION QUADRANT

FIGURE 29 SELF-ADHESIVE LABELS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

14.4.1 STAR

14.4.2 PERVASIVE

14.4.3 EMERGING LEADER

14.4.4 PARTICIPANT

14.5 COMPETITIVE SCENARIO AND TRENDS

14.5.1 DEALS

TABLE 147 SELF-ADHESIVE LABELS MARKET: DEALS, JANUARY 2016- OCTOBER 2021

14.5.2 OTHERS

TABLE 148 SELF-ADHESIVE LABELS MARKET: OTHERS, -NOVEMBER 2020

15 COMPANY PROFILES (Page No. - 150)

15.1 KEY COMPANIES

(Business Overview, Products and solutions, Recent Developments, Deals, MnM View, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats)*

15.1.1 CCL INDUSTRIES INC.

TABLE 149 CCL INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 30 CCL INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 150 CCL INDUSTRIES INC.: PRODUCTS OFFERED

15.1.2 AVERY DENNISON CORPORATION

TABLE 151 AVERY DENNISON CORPORATION: BUSINESS OVERVIEW

FIGURE 31 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 152 AVERY DENNISON CORPORATION: PRODUCTS OFFERED

15.1.3 MULTI-COLOR CORPORATION

TABLE 153 MULTI-COLOR CORPORATION: BUSINESS OVERVIEW

FIGURE 32 MULTI-COLOR CORPORATION: COMPANY SNAPSHOT

TABLE 154 MULTI-COLOR CORPORATION: PRODUCTS OFFERED

15.1.4 HUHTAMAKI OYJ

TABLE 155 HUHTAMAKI OYJ: BUSINESS OVERVIEW

FIGURE 33 HUHTAMAKI OYJ: COMPANY SNAPSHOT

TABLE 156 HUHTAMAKI OYJ: PRODUCTS OFFERED

15.1.5 COVERIS HOLDINGS SA

TABLE 157 COVERIS HOLDINGS SA: BUSINESS OVERVIEW

TABLE 158 COVERIS HOLDINGS SA: PRODUCTS OFFERED

15.1.6 SATO HOLDINGS CORPORATION

TABLE 159 SATO HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 34 SATO HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 160 SATO HOLDINGS CORPORATION: PRODUCTS OFFERED

15.1.7 LINTEC CORPORATION

TABLE 161 LINTEC CORPORATION: BUSINESS OVERVIEW

FIGURE 35 LINTEC CORPORATION: COMPANY SNAPSHOT

TABLE 162 LINTEC CORPORATION: PRODUCTS OFFERED

15.1.8 TORRASPAPEL ADESTOR

TABLE 163 TORRASPAPEL ADESTOR: BUSINESS OVERVIEW

TABLE 164 TORRASPAPEL ADESTOR: PRODUCTS OFFERED

15.1.9 FUJI SEAL INTERNATIONAL

TABLE 165 FUJI SEAL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 36 FUJI SEAL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 166 FUJI SEAL INTERNATIONAL: PRODUCTS OFFERED

15.1.10 ALL4LABELS GROUP

TABLE 167 ALL4LABELS GROUP: BUSINESS OVERVIEW

TABLE 168 ALL4LABELS GROUP: PRODUCTS OFFERED

15.2 OTHER PLAYERS

15.2.1 SKANEM

TABLE 169 SKANEM: COMPANY OVERVIEW

15.2.2 BSP LABELS LTD.

TABLE 170 BSP LABELS LTD.: COMPANY OVERVIEW

15.2.3 INLAND LABEL AND MARKETING SERVICES

TABLE 171 INLAND LABEL AND MARKETING SERVICES: COMPANY OVERVIEW

15.2.4 CS LABELS

TABLE 172 CS LABELS: COMPANY OVERVIEW

15.2.5 SECURA LABELS

TABLE 173 SECURA LABELS: COMPANY OVERVIEW

15.2.6 TERRAGENE

TABLE 174 TERRAGENE: COMPANY OVERVIEW

15.2.7 LABEL CRAFT

TABLE 175 LABEL CRAFT: COMPANY OVERVIEW

15.2.8 REFLEX LABELS LTD.

TABLE 176 REFLEX LABELS LTD.: COMPANY OVERVIEW

15.2.9 ETIQUETTE LABELS

TABLE 177 ETIQUETTE LABELS: COMPANY OVERVIEW

15.2.10 ROYSTON LABELS

TABLE 178 ROYSTON LABELS: COMPANY OVERVIEW

15.2.11 AZTEC LABEL

TABLE 179 AZTEC LABEL: COMPANY OVERVIEW

15.2.12 SVS SPOL. S R.O.

TABLE 180 SVS SPOL. S R.O.: COMPANY OVERVIEW

15.2.13 MAXIM LABEL AND PACKAGING

TABLE 181 MAXIM LABEL AND PACKAGING: COMPANY OVERVIEW

15.2.14 DURALABEL GRAPHICS PVT. LTD.

TABLE 182 DURALABEL GRAPHICS PVT. LTD.: COMPANY OVERVIEW

15.2.15 PROPRINT GROUP

TABLE 183 PROPRINT GROUP: COMPANY OVERVIEW

*Details on Business Overview, Products and solutions, Recent Developments, Deals, MnM View, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 192)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

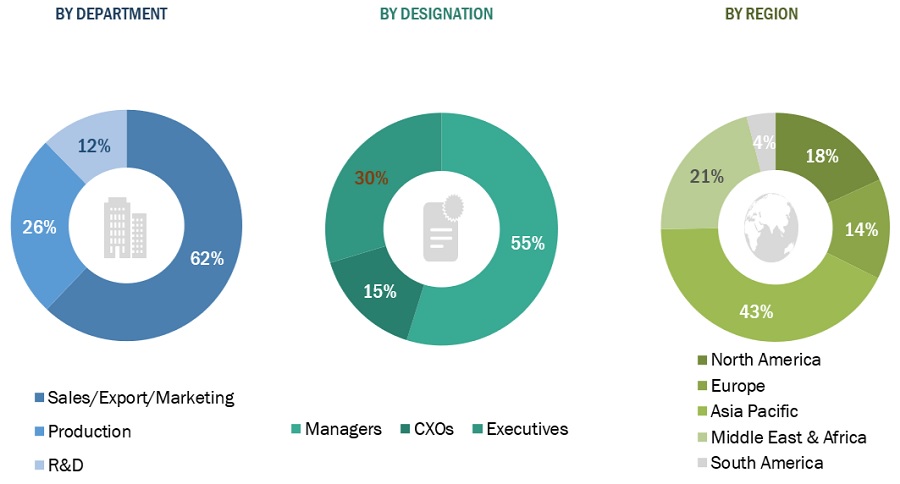

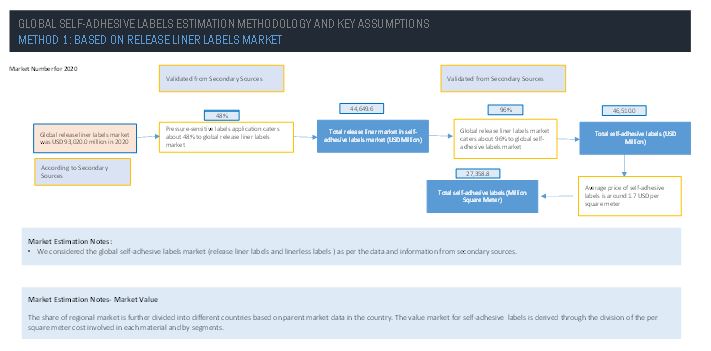

The study involved four major activities for estimating the current global size of the self-adhesive labels market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of self-adhesive labels through primary research. The bottom-up approach was employed to estimate the overall size of the self-adhesive labels market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the self-adhesive labels market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the self-adhesive labels market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the self-adhesive labels industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The above approach was used to estimate and validate the global size of the self-adhesive labels market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the self-adhesive labels market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the self-adhesive labels market in terms of value and volume based on type, nature, printing technology, application and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the self-adhesive labels report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis

- Further analysis of the self-adhesive labels market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Self-Adhesive Labels Market