IoT Sensors Market by Sensor Type, Network Technology, Vertical, Application, and Geography - Global Forecast - 2026

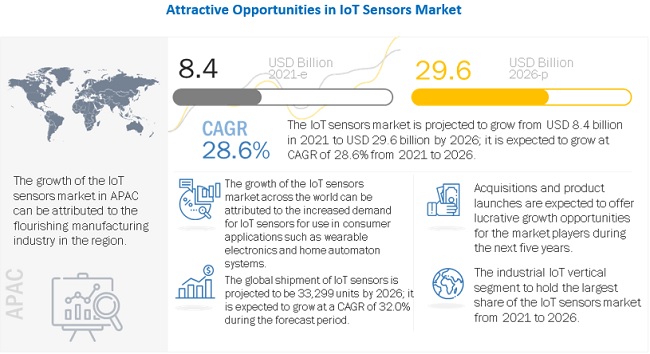

[300 Pages Report] The IoT Sensors Market is projected to reach USD 29.6 billion by 2026 from USD 11.1 Billion in 2022 at a CAGR of 28.6% during the forecast period.It was observed that the growth rate was 33.78% from 2021 to 2022. Pressure sensor is expected to grow at a highest CAGR of 33.73%.

Increasing use of sensors in IoT applications due to cost and size reduction, and technological advancement, and Introduction of 3GPP Release 13 and Release 14 specifications are the key factors driving the growth of the IoT sensors market. The Growth of Internet penetration rate and High demand for connected and wearables devices are factors propelling the growth of IoT sensors industry.

To know about the assumptions considered for the study, Request for Free Sample Report

IoT Sensors Market Dynamics

DRIVERS: Increasing use of sensors in IoT applications due to cost and size reduction, and technological advancements

Owing to the rapid reduction in the sensor size and high adoption of microelectromechanical systems (MEMS) technology, sensors are finding applications in automotive, healthcare, and consumer products. This has played a major role in the growth of the overall sensors market. During the last 5 years, smaller sensors have rapidly been deployed in devices such as smartphones, drones, wearables, and robots.

RESTRAINTS: Data security concerns

Although IoT has a huge potential, there are concerns regarding data privacy and security associated with IoT devices. The IoT is entirely data-driven. IoT-enabled devices and sensors generate a huge volume of data per second. Companies and organizations use various sensors to monitor this data and make decisions based on the data. As they depend more on machine-generated data for real-time business processes, it is necessary to ensure the authenticity of the data and security, resilience, and reliability of the devices that collect data. As IoT connects numerous devices, it provides more decentralized entry points for malware. If IoT devices are poorly secured, then cyber attackers may use them as entry points to cause harm to other devices in the network.

OPPORTUNITIES: Supportive government initiatives and funding for IoT projects

Governments worldwide are supporting and funding IoT-related innovations, as the government sector is likely to be one of the largest potential customers of IoT. Governments are looking for improvements and innovations in key areas such as smart traffic management systems, energy conservation through smart meters, and security system improvements through smart cameras. Moreover, governments are funding new IoT research projects for the development of smart cities. This support is expected to play a crucial role in the growth of the IoT in the next few years.

CHALLENGES: Social distancing and supply chain disruption due to COVID-19 restricted growth of market in the first half of 2020

Social distancing is a precautionary and mandatory measure being followed to contain the COVID-19 outbreak. During the early days of the outbreak, manufacturing plants were also following this precaution to restrict the number of workers on the shop floor. This resulted in reducing the manufacturing operations and capacity. Some companies had completely stopped the manufacturing operations, which disrupted the supply chain.

Social distancing was also being observed in other parts of the manufacturing ecosystem, including transportation. Supplying essential manufacturing components and raw materials to regions that were under complete lockdown became difficult. This further brought the commercial activities to a standstill, thereby negatively affecting the market's growth, especially in the manufacturing sector.

Pressure sensor is likely to be the largest contributor in the IoT sensors market during the forecast period

The market for pressure sensors is largely driven by increased concerns regarding safety, comfort levels, and reduction in automobile emissions. The regulatory mandates requiring the compulsory installation of onboard diagnostics to reduce greenhouse gas emissions will further lead to growth in demand for pressure sensors. Additionally, the application of pressure sensors in autonomous cars would present several growth opportunities to players operating in the pressure sensor market.

Wireless network technology to account for the largest market

The growing demand for wireless data from mobile devices, connected cars, and smart grids, among others, is creating the need for a more robust internet connection. Further, the proliferation of mobile devices and the rapidly increasing adoption of the bring-your-own-device (BYOD) concept as well as IoT within enterprises is expected to drive the growth of the market for wireless network technology. The upcoming 5G mobile technology is expected to provide much faster internet connectivity and coverage, which would also boost the market for wireless network technology.

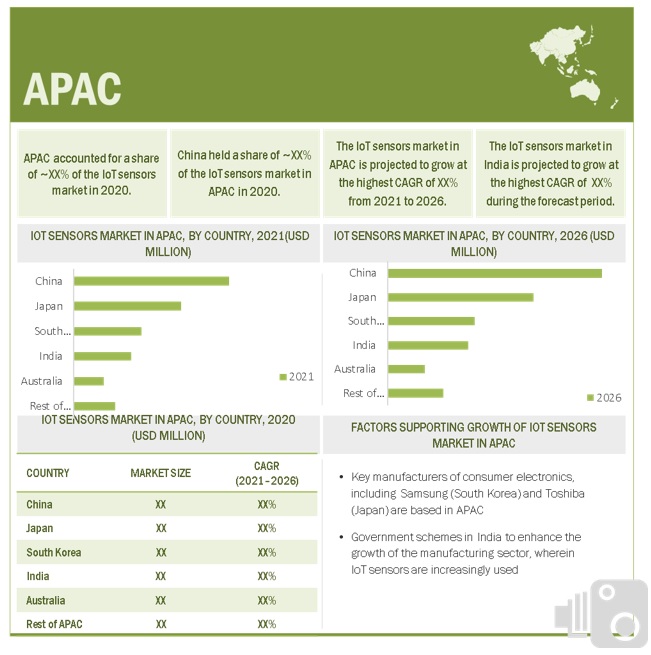

The IoT sensors market in APAC to grow at the highest CAGR during the forecast period

The market in APAC is expected to register the highest CAGR amongst all regions during the forecast period. The market in this region has been studied for India, China, Japan, South Korea, Australia, and the Rest of APAC. APAC is a key market for consumer devices and appliances, automobiles, and healthcare products. This region has become a global focal point for large investments and business expansions.

To know about the assumptions considered for the study, download the pdf brochure

Top Key Players in IoT Sensors Companies :

-

Texas Instrument (US),

-

TE Connectivity(Switzerland),

-

Broadcom(US),

-

NXP Semiconductors(Netherlands),

-

STMicroelectronics (Switzerland),

-

Bosch Sensortec (Germany), and...

TDK (Invensense)(Japna), Infineon Technologies(Germany), Analog Devices(US), and Omron(Japan). These players have adopted various growth strategies, such as product launches, expansions, acquisition, collaborations, agreements, and partnerships to achieve growth in IoT sensors market from 2017 to 2020, which helped them to strengthen their product portfolio and broaden their customer base.

IoT Sensors Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 8.4 Billion |

| Projected Market Size | USD 29.6 Billion |

| Growth Rate | CAGR of 28.6% |

|

Market size available for years |

2017–2026 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million/ Billion) |

|

Segments Covered |

Sensor Type, Network Technology, Vertical, and Geography |

|

Base Year considered |

2021 |

This report categorizes the IoT sensors market based on the sensor type, Network Technology, Vertical, and region.

IoT Sensors Market By Sensor Type

- Temperature Sensor

- Pressure Sensor

- Humidity Sensor

- Flow Sensor

- Accelerometer

- Magnetometer

- Gyroscope

- Inertial Sensor

- Image Sensor

- Touch Sensor

- Proximity Sensor

- Acoustic Sensor

- Motion Sensor

- Occupancy Sensor

- CO2 Sensor

- Others (Light sensor, and Radar sensor)

By Network Technology

-

Wired

- KNX

- LonWorks

- Ethernet

- MODBUS

- DALI

-

Wireless

-

Wi-Fi

- Bluetooth Smart

- Wi-Fi Bluetooth Smart

- Bluetooth Smart / Ant+

- Bluetooth 5

-

Wi-Fi

- ZIGBEE

- Z-WAVE

- NFC

- RFID

- ENOCEAN

- THREAD

- GLoWPAN

- WIRELESS-HART

- Frocess field bus

- DECT-ULE

- Others (ANT+, ISA100, GPS, Sub-Gig, and Cellular)

IoT Sensors Market By Vertical

-

Consumer

- Home automation

- Smart Cities

- Wearable Electronics

-

Commercial

- Retail

- Aerospace and Defense

- Logistics and supply chain

- Entertainment

- Financial Institutes

- Corporate Offices

-

Industrial

- Energy

- Industrial Automation

- Transportation

- Healthcare

- Smart Agriculture

-

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments in IoT Sensors Industry

- In July 2020, Texas Instruments launched the industry’s first zero-drift Hall-effect current sensors. The TMCS1100 and TMCS1101 enable the lowest drift and highest accuracy over time and temperature while providing reliable 3-kVrms isolation, which is especially important for AC or DC high-voltage systems, such as industrial motor drives, solar inverters, energy storage equipment, and power supplies.

- In June 2020, TE Connectivity launched LVDT position sensors. These sensors offer standard and custom solutions based on hydraulic application requirements of ICT off-highway equipment and industrial machine tools.

- In December 2019, NXP Semiconductors announced the acquisition of the wireless connectivity assets from Marvell (NASDAQ: MRVL).

- In May 2018, STMicroelectronics launched high-accuracy MEMS sensors with 10-year life for advanced industrial sensing. IIS3DHHC is the first sensor in this category with a 3-axis accelerometer optimized for high measurement resolution and stability.

Frequently Asked Questions (FAQ):

How big is IoT Sensors Market?

The market for IoT Sensors is expected to grow from USD 8.4 billion in 2021 to USD 29.6 billion by 2026. Growth of Internet penetration rate are propelling the demand for IoT Sensors across different verticals during forecast period.

Are IoT Sensors in Demand?

Factors such as increasing use of sensors in IoT applications due to cost and size reduction, and technological advancement, and high adoption of IoT Sensors in industrial, and consumer vertical will further drive the demand for the sensors.

What are the various verticals of IoT sensors market?

Verticals include consumer, commercial, and industrial. The consumer vertical to showcase the highest CAGR growth during the forecast period.

What are the various sensor types available in IoT sensors?

The various sensor types are Temperature Sensor, Pressure Sensor, Humidity Sensor, Flow Sensor, Accelerometer, Magnetometer, Gyroscope, Inertial Sensor, Image Sensor, Touch Sensor, Proximity Sensor, Acoustic Sensor, Motion Sensor, Occupancy Sensor, CO2 Sensor, and Others

Who is the Leader in IoT sensors market?

Texas Instruments (US) is one of the key player in the of IoT sensors market. The company is the leading provider of IoT sensors globally, relying on its R&D capabilities and balanced product portfolio.

What is the COVID-19 impact on the IoT sensors market?

The outbreak and the spread of the COVID-19 have severely impacted the growth of the IoT sensors market across the world. The global sales of IoT sensors for key industrial and commercial verticals declined by 10–15% in the fiscal year 2020 owing to the progression of the virus in different parts of the world. The decline in the number of new industrial projects, temporary shutdowns of production facilities, and reduction in crude oil prices are some factors that hampered the growth of the IoT sensors market. The short-term supply chain disruptions also affected the market growth in the key regions. The COVID-19 has severely impacted the global industrial sector owing to the shutting down of a number of production facilities across the world. The global demand for IoT sensors used in commercial applications declined further in the fiscal year 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 IOT SENSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for obtaining market size using bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (DEMAND SIDE) – DEMAND FOR DIFFERENT TYPES OF IOT SENSORS

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for obtaining market size using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUES GENERATED FROM SALES OF IOT SENSOR-RELATED PRODUCTS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 PRE- AND POST-COVID-19 IMPACT ANALYSIS FOR IOT SENSORS MARKET

TABLE 1 PRE- AND POST-COVID-19 IMPACT ANALYSIS FOR MARKET, 2017–2026 (USD MILLION)

FIGURE 9 MARKET SIZE, 2021–2026 (USD MILLION AND MILLION UNITS)

FIGURE 10 INDUSTRIAL IOT SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2026

FIGURE 11 PRESSURE SENSOR SEGMENT TO ACCOUNT FOR LARGEST SIZE MARKET FROM 2021 TO 2026

FIGURE 12 WIRELESS NETWORK TECHNOLOGY SEGMENT TO LEAD MARKET FROM 2021 TO 2026

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN IOT SENSORS MARKET

FIGURE 14 MARKET TO GROW AT SIGNIFICANT RATE FROM 2021 TO 2026

4.2 MARKET, BY SENSOR TYPE

FIGURE 15 PRESSURE SENSOR SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2026

4.3 MARKET, BY NETWORK TECHNOLOGY

FIGURE 16 WIRELESS SEGMENT TO LEAD MARKET FROM 2021 TO 2026

4.4 MARKET, BY VERTICAL

FIGURE 17 INDUSTRIAL IOT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2026

4.5 MARKET IN NORTH AMERICA, BY COUNTRY AND SENSOR TYPE

FIGURE 18 PRESSURE SENSOR SEGMENT AND US HELD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2020

4.6 MARKET, BY REGION

FIGURE 19 NORTH AMERICA HELD LARGEST SHARE OF IOT SENSORS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT SENSORS MARKET

5.2.1 DRIVERS

FIGURE 21 DRIVERS FOR MARKET AND THEIR IMPACT

5.2.1.1 Increased use of sensors in IoT applications due to cost and size reduction, and technological advancements

5.2.1.2 Introduction of 3GPP Release 13 and Release 14 specifications

5.2.1.3 Growth in Internet penetration rate

FIGURE 22 INTERNET USERS TILL SEPTEMBER 2020, BY REGION

FIGURE 23 INTERNET PENETRATION RATE TILL SEPTEMBER 2020, BY REGION

5.2.1.4 High demand for connected and wearables devices

5.2.1.5 Introduction of IPv6 creating large address space

FIGURE 24 WORLDWIDE ADOPTION OF IPV6 (2020)

5.2.1.6 Importance of real-time computing for IoT applications

5.2.2 RESTRAINTS

FIGURE 25 RESTRAINTS FOR MARKET AND THEIR IMPACT

5.2.2.1 Data security concerns

5.2.3 OPPORTUNITIES

FIGURE 26 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.3.1 Supportive government initiatives and funds for IoT projects

TABLE 2 GOVERNMENT FUNDING PLANS FOR INTERNET OF THINGS

5.2.3.2 Benefits of implementation of predictive maintenance programs for IoT applications

5.2.3.3 Emergence of requirements of cross-domain collaborations

5.2.3.4 High adoption of IoT by small- and medium-sized businesses

5.2.4 CHALLENGES

FIGURE 27 CHALLENGES FOR MARKET AND THEIR IMPACT

5.2.4.1 Social distancing and supply chain disruptions due to COVID-19 restricted growth of market in first half of 2020

5.2.4.2 Lack of common protocols and communication standards

5.2.4.3 Shortage of technical know-how for using IoT devices

5.2.4.4 High power consumption by connected devices

5.2.4.5 High latency and limited bandwidth issues

5.3 TARIFFS AND REGULATIONS

TABLE 3 MFN TARIFFS FOR GAS OR SMOKE ANALYSIS APPARATUS EXPORTED BY US

TABLE 4 MFN TARIFFS FOR GAS OR SMOKE ANALYSIS APPARATUS IMPORTS BY CHINA

5.3.1 NEGATIVE IMPACT OF TARIFFS ON IOT SENSOR MARKET

5.3.2 POSITIVE IMPACT OF TARIFFS ON IOT SENSOR MARKET

5.3.3 REGULATIONS RELATED TO SENSORS

5.4 AVERAGE SELLING PRICE ANALYSIS

FIGURE 28 AVERAGE SELLING PRICE OF IOT SENSORS, 2017–2019

FIGURE 29 AVERAGE SELLING PRICE OF IOT SENSORS, BY SENSOR TYPE, 2018 AND 2019 (USD MILLION)

5.5 CASE STUDIES

5.5.1 MONITORING HVAC SYSTEMS

5.5.2 CONTROLLING WATER QUALITY IN FISH FARMS

5.5.3 MONITORING WATER QUALITY PARAMETERS IN IRRIGATION DAM

5.5.4 USING HUMAN CONDITION SAFETY SENSORS TO MINIMIZE JOB SITE RISKS

5.5.5 MANAGING COWS AND HERDS

5.5.6 CARRYING OUT SMART CONSTRUCTION USING IOT SENSORS

5.5.7 MONITORING TEMPERATURE AND HUMIDITY IN DATA CENTERS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IOT SENSORS MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS (Page No. - 85)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: MARKET

6.2.1 CORE INDUSTRY SEGMENTS

6.2.1.1 Chip designers

6.2.1.2 Component manufacturers

6.2.1.3 Technology providers

6.2.1.4 Integrators

6.2.1.5 End-use applications

6.3 KEY INDUSTRY TRENDS IN IOT SENSORS MARKET

FIGURE 31 INNOVATIVE PRODUCT OFFERINGS BY KEY PLAYERS

6.4 PATENT ANALYSIS

TABLE 6 IMPORTANT INNOVATIONS AND PATENTS REGISTRATION

6.5 ECOSYSTEM/MARKET MAP

FIGURE 32 IOT SENSORS ECOSYSTEM

TABLE 7 SUPPLY CHAIN

6.6 TECHNOLOGY ANALYSIS

6.6.1 KEY TECHNOLOGIES

6.6.1.1 5G

6.6.1.2 Low-power wide area networks (LPWAN)

6.6.2 COMPLEMENTARY TECHNOLOGIES

6.6.2.1 Quantum dot CMOS technology

6.6.2.2 Multi pixel technology (MPT)

6.6.3 ADJACENT TECHNOLOGIES

6.6.3.1 Thermal imaging technology

6.6.3.2 Electronic nose (E-nose)

6.7 TRADE ANALYSIS

6.7.1 IMPORT SCENARIO OF IMAGE SENSORS

FIGURE 33 IMPORT DATA FOR IMAGE SENSORS FOR TOP FIVE COUNTRIES IN IOT SENSORS MARKET, 2015–2019 (THOUSAND UNITS)

6.7.2 EXPORT SCENARIO OF IMAGE SENSORS

FIGURE 34 EXPORT DATA FOR IMAGE SENSORS FOR TOP FIVE COUNTRIES IN MARKET, 2015–2019 (THOUSAND UNITS)

7 IOT SENSORS MARKET, BY SENSOR TYPE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY SENSOR TYPE

FIGURE 36 PRESSURE SENSOR SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2026

TABLE 8 MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 9 MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 10 MARKET, BY SENSOR TYPE, 2017–2020 (MILLION UNITS)

TABLE 11 MARKET, BY SENSOR TYPE, 2021–2026 (MILLION UNITS)

7.2 TEMPERATURE SENSOR

7.2.1 HIGH ADOPTION OF TEMPERATURE SENSORS IN AVIATION AND MANUFACTURING INDUSTRIES TO DRIVE MARKET GROWTH

FIGURE 37 INDUSTRIAL IOT SEGMENT TO HOLD LARGEST SIZE OF TEMPERATURE IOT SENSORS MARKET FROM 2021 TO 2026

TABLE 12 TEMPERATURE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 13 TEMPERATURE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 14 TEMPERATURE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 TEMPERATURE MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 PRESSURE SENSOR

7.3.1 INCREASED USE OF PRESSURE SENSORS IN VARIOUS APPLICATIONS

TABLE 16 PRESSURE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 17 PRESSURE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 18 PRESSURE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 PRESSURE MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 HUMIDITY SENSOR

7.4.1 EASY CONNECTIVITY TO DEVICES ENABLED WITH WI-FI TO DRIVE DEMAND FOR HUMIDITY SENSORS

TABLE 20 HUMIDITY MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 21 HUMIDITY MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 38 HUMIDITY MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 22 HUMIDITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 HUMIDITY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 FLOW SENSOR

7.5.1 HIGH ADOPTION OF FLOW SENSOR IN INDUSTRIAL MANUFACTURING AND HEALTHCARE SECTORS TO FUEL THEIR DEMAND

TABLE 24 FLOW MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 25 FLOW MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 26 FLOW IOT SENSORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 FLOW MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 ACCELEROMETER

7.6.1 RISEN DEPLOYMENT OF ACCELEROMETERS IN WEARABLE ELECTRONICS TO BOOST MARKET GROWTH

TABLE 28 ACCELEROMETER MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 29 ACCELEROMETER MARKET , BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 30 ACCELEROMETER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 ACCELEROMETER MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 MAGNETOMETER

7.7.1 SURGED ADOPTION OF CONSUMER ELECTRONICS TO DRIVE MARKET FOR MAGNETOMETERS

TABLE 32 MAGNETOMETER MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 33 MAGNETOMETER MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 39 APAC TO HOLD LARGEST SIZE OF MAGNETOMETER MARKET BY 2026

TABLE 34 MAGNETOMETER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MAGNETOMETER IOT SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.8 GYROSCOPE

7.8.1 LOWER POWER CONSUMPTION OF GYROSCOPES THAN OTHER SENSORS TO INCREASE THEIR GLOBAL DEMAND

TABLE 36 GYROSCOPE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 37 GYROSCOPE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 38 GYROSCOPE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 GYROSCOPE MARKET, BY REGION, 2021–2026 (USD MILLION)

7.9 INERTIAL SENSOR

7.9.1 HIGH ADOPTION IN AUTOMOTIVE AND MEDICAL INDUSTRIES TO FUEL DEMAND FOR INERTIAL SENSORS

TABLE 40 INERTIAL MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 41 INERTIAL MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 42 INERTIAL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 INERTIAL MARKET, BY REGION, 2021–2026 (USD MILLION)

7.10 IMAGE SENSOR

7.10.1 INCREASED ADOPTION OF IMAGE SENSORS IN CONSUMER AND INDUSTRIAL VERTICALS

TABLE 44 IMAGE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 45 IMAGE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 46 IMAGE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 IMAGE IOT SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.11 TOUCH SENSOR

7.11.1 INCREASED DEPLOYMENT OF TOUCH SENSORS IN AUTOMATION AND CONSUMER ELECTRONICS APPLICATIONS TO ACCELERATE THEIR DEMAND

FIGURE 40 INDUSTRIAL IOT SEGMENT TO HOLD LARGEST SIZE OF TOUCH MARKET IN 2021 AND 2026

TABLE 48 TOUCH MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 49 TOUCH MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 50 TOUCH MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 TOUCH IOT SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.12 PROXIMITY SENSOR

7.12.1 RISEN DEPLOYMENT OF PROXIMITY SENSORS IN AUTOMOTIVE INDUSTRY AND HOME APPLICATIONS TO BOOST THEIR DEMAND

TABLE 52 PROXIMITY MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 53 PROXIMITY MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 54 PROXIMITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 PROXIMITY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.13 ACOUSTIC SENSOR

7.13.1 SURGED USE OF ACOUSTIC SENSORS TO AID UNDERWATER AND UNDERGROUND COMMUNICATION

TABLE 56 ACOUSTIC MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 57 ACOUSTIC MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 58 ACOUSTIC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 ACOUSTIC MARKET, BY REGION, 2021–2026 (USD MILLION)

7.14 MOTION SENSOR

7.14.1 HIGH ADOPTION OF MOTION SENSORS IN INDUSTRIAL APPLICATIONS TO FUEL THEIR GLOBAL DEMAND

FIGURE 41 MOTION IOT SENSORS MARKET FOR INDUSTRIAL IOT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 60 MOTION MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 61 MOTION MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 62 MOTION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MOTION MARKET, BY REGION, 2021–2026 (USD MILLION)

7.15 OCCUPANCY SENSOR

7.15.1 INCREASED ADOPTION OF OCCUPANCY SENSORS IN RESIDENTIAL AND COMMERCIAL BUILDINGS TO FUEL THEIR DEMAND

TABLE 64 OCCUPANCY MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 65 OCCUPANCY MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 66 OCCUPANCY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 OCCUPANCY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.15.2 IMAGE PROCESSING OCCUPANCY SENSOR

7.15.3 INTELLIGENT OCCUPANCY SENSOR

7.16 CO2 SENSOR

7.16.1 RISEN USAGE OF CO2 SENSORS FOR INDOOR CLIMATE SENSING TO BOOST THEIR DEMAND

TABLE 68 CO2 IOT SENSORS MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 69 CO2 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 42 APAC TO HOLD LARGEST SIZE OF CO2 MARKET DURING FROM 2021 TO 2026

TABLE 70 CO2 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 CO2 MARKET, BY REGION, 2021–2026 (USD MILLION)

7.17 OTHERS

7.17.1 LIGHT SENSOR

7.17.2 RADAR SENSOR

TABLE 72 OTHER MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 73 OTHER MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 74 OTHER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 OTHER IOT SENSORS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.18 IMPACT OF COVID-19 ON MARKET, BY SENSOR TYPE

8 IOT SENSORS MARKET, BY NETWORK TECHNOLOGY (Page No. - 132)

8.1 INTRODUCTION

FIGURE 43 SNAPSHOT OF KEY NETWORK TECHNOLOGIES MARKET

FIGURE 44 WIRELESS NETWORK TECHNOLOGY SEGMENT TO LEAD MARKET FROM 2021 TO 2026

TABLE 76 MARKET, BY NETWORK TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 77 MARKET, BY NETWORK TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 WIRED

FIGURE 45 ETHERNET SEGMENT TO HOLD LARGEST SIZE OF IOT SENSORS MARKET FOR WIRED TECHNOLOGY FROM 2021 TO 2026

TABLE 78 MARKET FOR WIRED TECHNOLOGY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 79 MARKET FOR WIRED TECHNOLOGY, BY TYPE, 2021–2026 (USD MILLION)

8.2.1 KNX

8.2.1.1 High adoption of KNX in various applications to drive its demand

8.2.2 LONWORKS

8.2.2.1 Ability of LonWorks to exchange information to fuel market growth

8.2.3 ETHERNET

8.2.3.1 Adoption of Ethernet in WAN to contribute to market growth

8.2.4 MODBUS

8.2.4.1 High adoption of Modbus in manufacturing industries to drive market growth

8.2.5 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

8.2.5.1 Continuous advancements in lighting technologies to propel market growth for DALI

8.3 WIRELESS

TABLE 80 IOT SENSORS MARKET FOR WIRELESS TECHNOLOGY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 IOT SENSORS MARKET FOR WIRELESS TECHNOLOGY, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 WI-FI

8.3.1.1 Adoption of Wi-Fi in private, as well as public places to boost market growth

8.3.2 BLUETOOTH

8.3.2.1 Bluetooth Smart

8.3.2.1.1 High adoption of Bluetooth Smart in wearable electronics to fuel its demand

8.3.2.2 Wi-Fi/Bluetooth Smart

8.3.2.2.1 Wi-Fi/Bluetooth Smart offers enormous benefits to industries, thus boosting its demand

8.3.2.3 Bluetooth Smart/Ant+

8.3.2.3.1 Ability to support various connection types to accelerate demand for Bluetooth Smart/ANT+

8.3.2.4 Bluetooth 5

8.3.2.4.1 Features such as long range and fast speed to fuel demand for Bluetooth 5

8.3.3 ZIGBEE

8.3.3.1 Adoption in monitoring applications to drive market growth for ZigBee

8.3.4 Z-WAVE

8.3.4.1 High adoption of home automation to boost market for Z-Wave

8.3.5 NFC

8.3.5.1 Surged incorporation of NFC in automotive industry and smartphones to fuel market growth

8.3.6 RFID

8.3.6.1 Implementation of RFID in manufacturing industries to boost market growth

8.3.7 ENOCEAN

8.3.7.1 Low energy requirement of EnOcean to fuel its demand

8.3.8 THREAD

8.3.8.1 High adoption of Thread owing to advanced support to IoT devices to drive market growth

8.3.9 6LOWPAN

8.3.9.1 Scalability features of 6LoWPAN to contribute to market growth

8.3.10 WIRELESS-HART (WHART)

8.3.10.1 High adoption of WHART in industrial environments to enhance market growth

8.3.11 PROCESS FIELD BUS

8.3.11.1 Risen demand for automation technology to fuel adoption of PROFIBUS

8.3.12 DECT-ULE

8.3.12.1 Features including long range and low latency to contribute to adoption of DECT-ULE

8.3.13 OTHERS

8.3.13.1 ANT+

8.3.13.2 ISA100

8.3.13.3 GPS

8.3.13.4 Sub-Gig

8.3.13.5 Cellular

9 IOT SENSORS MARKET, BY VERTICAL (Page No. - 146)

9.1 INTRODUCTION

FIGURE 46 CONSUMER MARKET TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 82 MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 83 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 CONSUMER IOT

9.2.1 SMART APPLIANCES TO DRIVE GLOBAL DEMAND FOR IOT SENSORS SIGNIFICANTLY

TABLE 84 CONSUMER MARKET, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 85 CONSUMER MARKET, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 86 CONSUMER MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 87 CONSUMER IOT SENSORS MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

9.2.2 HOME AUTOMATION

9.2.2.1 Consumer devices

9.2.2.1.1 Smart TV

9.2.2.1.1.1 Improved quality and increased features offered by smart TV equipped with IoT sensors

9.2.2.1.2 Smart locks

9.2.2.1.2.1 Reinvention of conventional residential devices and appliances to fuel growth of market for smart locks

9.2.2.1.3 Smoke detectors

9.2.2.1.3.1 Increased adoption of security and safety features in houses to contribute to demand for smoke detectors

9.2.2.1.4 Home theater projectors

9.2.2.1.4.1 Home theater projectors offer connectivity through portable devices

9.2.2.1.5 Next-generation gaming consoles

9.2.2.1.5.1 Online multiplayer gaming and dynamic in-game advertising to fuel demand for next-generation gaming consoles

9.2.2.1.6 Set-top boxes

9.2.2.1.6.1 Surged adoption of set-top boxes in smart homes to facilitate their connection with mobility solutions

9.2.2.2 Consumer appliances

9.2.2.2.1 Smart washing machines

9.2.2.2.1.1 Energy efficiency offered by smart washing machines to fuel their global demand

9.2.2.2.2 Smart dryers

9.2.2.2.2.1 Smart dryers equipped with Wi-Fi can monitor and control their dryers through smartphones

9.2.2.2.3 Smart refrigerators

9.2.2.2.3.1 Smart refrigerators can keep track of their cooling efficiency

9.2.2.2.4 Smart ovens

9.2.2.2.4.1 Smart ovens allow users to set timers, check cooking status, and preheat food remotely using their smartphones

9.2.2.2.5 Smart cooktops

9.2.2.2.5.1 Smart cooktops allow users to control all their functions wirelessly

9.2.2.2.6 Smart cookers

9.2.2.2.6.1 Smart cookers can be accessed and controlled through smartphone or tablet apps

9.2.2.2.7 Smart deep freezers

9.2.2.2.7.1 Smart deep freezers can automatically keep stock of their inventory level in real-time

9.2.2.2.8 Smart dishwashers

9.2.2.2.8.1 Smart dishwashers provide information about status and duration of wash cycles

9.2.2.2.9 Smart coffee makers

9.2.2.2.9.1 Smart coffee makers allow users to make coffee using an app

9.2.2.2.10 Smart kettles

9.2.2.2.10.1 Smart kettles can be remotely-operated using smartphone or tablet apps

9.2.3 SMART CITIES

9.2.3.1 Traffic management

9.2.3.1.1 Adoption of smart technology solutions to streamline traffic flow

9.2.3.2 Water management

9.2.3.2.1 Smart water management helps utilities and water regulatory bodies reduce their maintenance and repair expenditure

9.2.3.3 Smart waste management

9.2.3.3.1 Smart waste management systems carry out efficient food waste management

9.2.3.4 Smart parking

9.2.3.4.1 Smart parking systems monitor parking spaces or assist drivers in finding free parking lots

9.2.3.5 Smart lighting

9.2.3.5.1 Smart light switches allow users to turn room lights on or off from any location in world

9.2.4 WEARABLE ELECTRONICS

FIGURE 47 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST SIZE OF CONSUMER IOT SENSORS MARKET FOR WEARABLE ELECTRONICS FROM 2021 TO 2026

TABLE 88 CONSUMER MARKET FOR WEARABLE ELECTRONICS, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 89 CONSUMER MARKET FOR WEARABLE ELECTRONICS, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

TABLE 90 CONSUMER MARKET FOR WEARABLE ELECTRONICS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 91 CONSUMER MARKET FOR WEARABLE ELECTRONICS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

9.2.4.1 Consumer application types

9.2.4.1.1 Wearable electronics enable mobile computing and wireless networking

9.2.4.2 Healthcare application types

9.2.4.2.1 Shift in global focus from on-premises healthcare services to remote monitoring of patients or their self-monitoring

9.2.4.3 Industrial application types

9.2.4.3.1 Wearable devices used in logistics and supply chain sector help track goods during their transit

9.3 COMMERCIAL IOT

TABLE 92 COMMERCIAL MARKET, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 COMMERCIAL MARKET, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 COMMERCIAL MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 95 COMMERCIAL IOT SENSORS MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

9.3.1 RETAIL

FIGURE 48 SAFETY AND SECURITY SEGMENT TO HOLD LARGEST SIZE OF COMMERCIAL IOT SENSORS MARKET FOR RETAIL FROM 2021 TO 2026

TABLE 96 COMMERCIAL MARKET FOR RETAIL, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 97 COMMERCIAL MARKET FOR RETAIL, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

9.3.1.1 Advertising and marketing

9.3.1.1.1 Increased use of IoT solutions by retailers to advertise and market their products

9.3.1.2 Digital signage

9.3.1.2.1 Deployment of digital signage in retail stores for creating brand awareness

9.3.1.3 Energy optimization

9.3.1.3.1 Surged demand for energy optimization to use available energy resources effectively to avoid their wastage

9.3.1.4 Intelligent payment solutions

9.3.1.4.1 Installation of intelligent payment counters in retail stores results in enhanced customer experience

9.3.1.5 Real-time/streaming analytics

9.3.1.5.1 Use of analytics for effective decision-making owing to proliferation of big data

9.3.1.6 Resource management

9.3.1.6.1 IoT platforms provide retail solutions to customers and also help organizations track employees

9.3.1.7 Safety and security

9.3.1.7.1 Potentially critical and sensitive IoT data requires proper security solutions at every node

9.3.1.8 Smart shelves and smart doors

9.3.1.8.1 Smart shelves help retailers analyze gathered information and convert it into desired customer preferences

9.3.1.9 Smart vending machines

9.3.1.9.1 Smart vending machines help in carrying out contactless payments

9.3.2 AEROSPACE AND DEFENSE

9.3.2.1 Drones/unmanned aerial vehicles (UAV)

9.3.2.1.1 Risen use of drones/UAV for reconnaissance missions

9.3.2.2 Predictive maintenance

9.3.2.2.1 Surged adoption of predictive maintenance to analyze data and understand issues related to equipment

9.3.3 LOGISTICS AND SUPPLY CHAIN

9.3.3.1 Increased deployment of IoT sensors in logistics and supply chain applications for data management and capability visualization

9.3.4 ENTERTAINMENT

9.3.4.1 Installation of IoT sensors in shopping malls and theme parks for making them interactive for customers

9.3.5 FINANCIAL INSTITUTES

9.3.5.1 Deployment of new and highly convenient solutions for customers by financial and banking sector

9.3.6 CORPORATE OFFICES

9.3.6.1 High adoption of occupancy sensors in corporate houses

9.4 INDUSTRIAL IOT

FIGURE 49 TRANSPORTATION SEGMENT TO HOLD LARGEST SIZE OF INDUSTRIAL IOT SENSORS MARKET IN 2026

TABLE 98 INDUSTRIAL MARKET, BY END-USE APPLICATION, 2017–2020 (USD MILLION)

TABLE 99 INDUSTRIAL MARKET, BY END-USE APPLICATION, 2021–2026 (USD MILLION)

TABLE 100 INDUSTRIAL MARKET, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 101 INDUSTRIAL IOT SENSORS MARKET, BY SENSOR TYPE, 2021–2026 (USD MILLION)

9.4.1 ENERGY

9.4.1.1 IoT sensors enable energy sector to adopt solutions for production enhancement, error reduction, and downtime minimization

9.4.2 INDUSTRIAL AUTOMATION

9.4.2.1 Requirement of increased productivity of different industries to drive growth of IoT sensors market

9.4.3 TRANSPORTATION

FIGURE 50 ROADWAYS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF INDUSTRIAL MARKET FOR TRANSPORTATION FROM 2021 TO 2026

TABLE 102 INDUSTRIAL MARKET FOR TRANSPORTATION, BY TRANSPORTATION MODE, 2017–2020 (USD MILLION)

TABLE 103 INDUSTRIAL MARKET FOR TRANSPORTATION, BY TRANSPORTATION MODE, 2021–2026 (USD MILLION)

9.4.3.1 Transportation modes

9.4.3.1.1 Roadways

9.4.3.1.1.1 Increased use of IoT sensors in navigation, vehicle maintenance, and security and safety systems

9.4.3.1.2 Railways

9.4.3.1.2.1 Deployment of new technologies help acquire and analyze information across rail networks to become highly efficient and effective

9.4.3.1.3 Airways

9.4.3.1.3.1 Risen use of IoT sensors in airways to carry out automated real-time processes

9.4.3.1.4 Maritime

9.4.3.1.4.1 Large-scale deployment of IoT sensors in marine vessels for smooth maritime operations

TABLE 104 INDUSTRIAL IOT SENSORS MARKET FOR TRANSPORTATION, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 105 INDUSTRIAL MARKET FOR TRANSPORTATION, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

9.4.3.2 Transportation application types

9.4.3.2.1 Predictive analysis

9.4.3.2.1.1 Surged use of predictive analytics in maintenance and repair databases

9.4.3.2.2 Telematics

9.4.3.2.2.1 In-vehicle (In-V)

9.4.3.2.2.1.1 Increased demand for in-vehicle telematics to provide accurate individual travel and route information

9.4.3.2.2.2 Vehicle-to-vehicle (V2V)

9.4.3.2.2.2.1 Surged usage of vehicle-to-vehicle connectivity for short-range vehicular networks

9.4.3.2.2.3 Vehicle-to-infrastructure (V2I)

9.4.3.2.2.3.1 Risen demand for vehicle-to-infrastructure connectivity for wireless exchange of critical operational data between vehicles and highway infrastructures

9.4.3.2.2.4 Infotainment

9.4.3.2.2.4.1 Risen use of cloud-based media by consumers

9.4.3.2.2.5 Advanced driver-assistance systems (ADAS)

9.4.3.2.2.5.1 Surged deployment of ADAS in vehicles for enhanced safety

9.4.4 HEALTHCARE

FIGURE 51 INPATIENT MONITORING SEGMENT OF INDUSTRIAL IOT SENSORS MARKET FOR HEALTHCARE TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 106 INDUSTRIAL MARKET FOR HEALTHCARE, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 107 INDUSTRIAL MARKET FOR HEALTHCARE, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

9.4.4.1 Telemedicine

9.4.4.1.1 Telemedicine can electronically deliver diagnostic and health services to patients

9.4.4.2 Clinical operations and workflow management

9.4.4.2.1 IoT sensors help local and remote healthcare teams in managing medical equipment and inventories

9.4.4.3 Connected imaging

9.4.4.3.1 Connected imaging to carry out clinical trials of new tests in timely manner

9.4.4.4 Inpatient monitoring

9.4.4.4.1 Increased use of IoT sensors to collect comprehensive physiological information of patients

9.4.4.5 Medication management

9.4.4.5.1 IoT sensors enable easy tracking of prescription compliance by medication dispensing devices

9.4.4.6 Others

9.4.5 SMART AGRICULTURE

FIGURE 52 PRECISION FARMING SEGMENT TO HOLD LARGEST SIZE OF INDUSTRIAL IOT SENSORS MARKET FOR SMART AGRICULTURE IN 2026

TABLE 108 INDUSTRIAL MARKET FOR SMART AGRICULTURE, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 109 INDUSTRIAL MARKET FOR SMART AGRICULTURE, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

9.4.5.1 Precision farming

9.4.5.1.1 Optimization of operational practices being used in farms and enhancement of field efficiency using IoT sensors

9.4.5.2 Livestock monitoring

9.4.5.2.1 Deployment of IoT sensors to gather real-time information for improved livestock management

9.4.5.3 Smart fish farming

9.4.5.3.1 New technologies help in monitoring feeding patterns of fish and detecting diseases

9.4.5.4 Smart greenhouse

9.4.5.4.1 Deployment of IoT sensor-based control systems to regulate internal conditions of smart greenhouses

9.4.5.5 Others

10 GEOGRAPHIC ANALYSIS (Page No. - 191)

10.1 INTRODUCTION

FIGURE 53 GEOGRAPHIC SNAPSHOT OF IOT SENSORS MARKET

TABLE 110 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 111 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 54 SNAPSHOT OF IOT SENSORS MARKET IN NORTH AMERICA

TABLE 112 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN NORTH AMERICA, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US to be largest market for IoT sensors in North America from 2021 to 2026

10.2.2 CANADA

10.2.2.1 IoT sensors market to witness significant growth in Canada owing to establishment of data centers in country

10.2.3 MEXICO

10.2.3.1 Increased adoption of IoT sensors in various sectors to drive growth of market in Mexico

10.3 EUROPE

FIGURE 55 SNAPSHOT OF IOT SENSORS MARKET IN EUROPE

TABLE 116 MARKET IN EUROPE, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN EUROPE, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 118 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 119 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Automotive and manufacturing industries increase adoption of IoT sensors in Germany

10.3.2 UK

10.3.2.1 Risen adoption of IoT sensors in manufacturing and healthcare industries to drive market growth in UK

10.3.3 FRANCE

10.3.3.1 Aerospace industry to drive growth of IoT sensors market in France

10.3.4 ITALY

10.3.4.1 Increased adoption of IoT sensors in automotive industry of Italy

10.3.5 SPAIN

10.3.5.1 Surged demand for IoT sensors from automotive and energy industries to drive market growth in Spain

10.3.6 REST OF EUROPE

10.4 APAC

FIGURE 56 SNAPSHOT OF IOT SENSORS MARKET IN APAC

TABLE 120 MARKET IN APAC, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN APAC, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 122 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 High adoption of IoT sensors in industrial automation to drive growth of market in China

10.4.2 JAPAN

10.4.2.1 Surged deployment of IoT sensors in manufacturing industry to fuel market growth in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Supportive government initiatives to drive growth of IoT sensors market in South Korea

10.4.4 INDIA

10.4.4.1 Rapid industrialization in India to drive growth market in country

10.4.5 AUSTRALIA

10.4.5.1 Increased demand for IoT sensors from healthcare industry to fuel growth of market in Australia

10.4.6 REST OF APAC

10.5 ROW

FIGURE 57 SOUTH AMERICA TO LEAD IOT SENSORS MARKET IN ROW FROM 2021 TO 2026

TABLE 124 MARKET IN ROW, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN ROW, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 126 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 Oil & gas industries fuel growth of IoT sensors market in Middle East and Africa

10.5.2 SOUTH AMERICA

10.5.2.1 Industrial automation and automotive industries fuel growth of IoT sensors market in South America

11 COMPETITIVE LANDSCAPE (Page No. - 215)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 128 OVERVIEW OF STRATEGIES DEPLOYED BY MANUFACTURERS OF IOT SENSORS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC PLAY

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 129 DEGREE OF COMPETITION

11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

FIGURE 58 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS MARKET

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 59 MARKET: COMPANY EVALUATION QUADRANT, 2020

11.6 STARTUP/SME EVALUATION MATRIX

TABLE 130 LIST OF STARTUP COMPANIES IN IOT SENSORS MARKET

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 60 MARKET: STARTUP/SME EVALUATION MATRIX, 2020

11.7 COMPANY PRODUCT FOOTPRINT

TABLE 131 COMPANY PRODUCT FOOTPRINT

FIGURE 61 FOOTPRINT OF DIFFERENT SENSOR TYPES OFFERED BY DIFFERENT COMPANIES

TABLE 132 FOOTPRINT OF DIFFERENT COMPANIES IN DIFFERENT VERTICALS

TABLE 133 REGIONAL FOOTPRINT OF DIFFERENT COMPANIES

11.8 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 62 STRATEGIES ADOPTED BY KEY PLAYERS FROM JANUARY 2017 TO NOVEMBER 2020

11.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 134 PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2017– NOVEMBER 2020

11.8.2 DEALS

TABLE 135 DEALS, JANUARY 2017–NOVEMBER 2020

11.8.3 OTHERS

TABLE 136 OTHERS, JANUARY 2017–NOVEMBER 2020

12 COMPANY PROFILES (Page No. - 237)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 KEY PLAYERS

12.1.1 TEXAS INSTRUMENTS

TABLE 137 TEXAS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 63 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

12.1.2 TE CONNECTIVITY

TABLE 138 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 64 TE CONNECTIVITY: COMPANY SNAPSHOT

12.1.3 BROADCOM (AVAGO)

TABLE 139 BROADCOM: BUSINESS OVERVIEW

FIGURE 65 BROADCOM: COMPANY SNAPSHOT

12.1.4 NXP SEMICONDUCTORS

TABLE 140 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 66 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

12.1.5 STMICROELECTRONICS

TABLE 141 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 67 STMICROELECTRONICS: COMPANY SNAPSHOT

12.1.6 BOSCH SENSORTEC

12.1.6.1 Business overview

TABLE 142 BOSCH SENSORTEC: BUSINESS OVERVIEW

12.1.6.2 Products offered

12.1.6.3 Recent developments

12.1.7 TDK (INVENSENSE)

TABLE 143 TDK: BUSINESS OVERVIEW

FIGURE 68 TDK: COMPANY SNAPSHOT

12.1.8 INFINEON TECHNOLOGIES

TABLE 144 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 69 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

12.1.9 ANALOG DEVICES

TABLE 145 ANALOG DEVICES: BUSINESS OVERVIEW

FIGURE 70 ANALOG DEVICES: COMPANY SNAPSHOT

12.1.10 OMRON

TABLE 146 OMRON: BUSINESS OVERVIEW

FIGURE 71 OMRON: COMPANY SNAPSHOT

12.1.11 AMS AG

TABLE 147 AMS AG: BUSINESS OVERVIEW

FIGURE 72 AMS AG: COMPANY SNAPSHOT

12.2 OTHER KEY PLAYERS

12.2.1 SENSIRION

12.2.2 HONEYWELL

12.2.3 SIEMENS

12.2.4 KNOWLES ELECTRONICS

12.2.5 ABB

12.2.6 SENSATA TECHNOLOGIES

12.2.7 EMERSON ELECTRIC

12.2.8 TELEDYNE TECHNOLOGIES INCORPORATED

12.2.9 SMARTTHINGS

12.2.10 MONNIT

12.2.11 MURATA MANUFACTURING

12.2.12 FIGARO ENGINEERING INC.

12.2.13 SAFRAN COLIBRYS SA

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 291)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

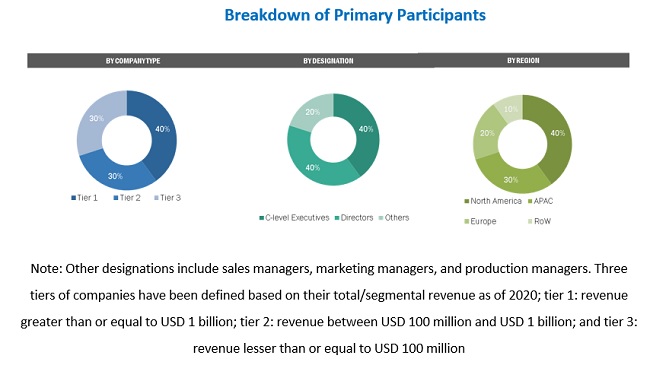

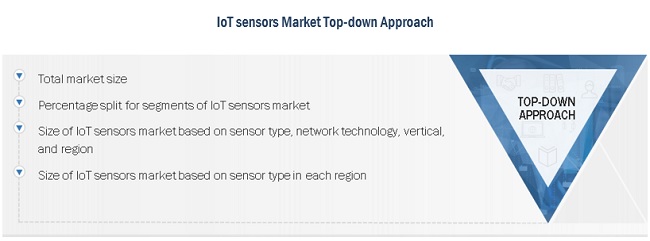

The study involved 4 major activities in estimating the current size of the IoT sensors market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research has been carried out to gather information, as well as to verify and validate the critical numbers arrived at. Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, subject matter experts (SMEs), consultants and related key executives from major companies and organizations operating in the display market. Several primary interviews have been conducted with experts from both demand and supply sides across 4 major regions: North America, Europe, APAC, and RoW (Middle East, South America, and Africa). Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected through questionnaires, e-mails, and telephonic interviews. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list key information/insights. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand-and supply-side. Along with this, the market has been validated using both top-down and bottom-up approaches.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To describe and forecast the size of the Internet of Things (IoT) sensors market in terms of value, based sensor type, network technology, vertical, and region

- To forecast the market size, in terms of value, for various segments in four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To forecast the size of the IoT sensors market in terms of volume

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the IoT sensors market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

-

To analyze the opportunities in the market for various stakeholders by identifying the

high-growth segments of the IoT sensors market - To profile the key players and comprehensively analyze their market ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments, such as product launches and developments, partnerships, collaborations, and acquisitions undertaken in the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Sensors Market

We are interested in the thermopile part of the market. Do you have any information of companies like Heimann ad Excelitas in the report?

We provide need to IoT solutions including sensor manufacturer and are interested in the predicted market demand

I am new researcher in field of IoT. I am looking for suitable sensor and free sample for investigating.

I am looking for the market that meet needs to be our market driven. Then, I want to know which kind of IoT sensor has potential market size and to match the technology what we have.

I am interested in getting some clarity around the non-SCADA, non-IoT IoT, sensor marketplace. Retrofit, crossover, and emerging light industrial. is this addressed in your report?

I would like to have an overview of this report for a task I'm conducting on Power Solutions for IoT devices, current and future trends, especially in the field of energy management.

Looking for a market share of IoT sensors especially for use in remote areas such as Mining, Energy, Agriculture etc..

We are currently building an application that entails some IoT elements and we want to better understand the IoT Sensor Market and the Global Forecast to understand what the future holds for the Africa market

As an enterprise architect, intelligent edge solutions also come under my solution port. Therefore, such market intelligence is essential for me

Hi, My company is a "start-up" in segment of IoT Sensor with focus in Temperature and Humidity Sensors and Energy Sensors. I want access to the article to better understand it market and how it will expand in next years.

Hello! I am doing some research on the sensor market. I would appreciate your time to clarify any details you shared on the report. Just a heads up that I am out of the country for travel so please contact me via email.

We are seeking to expand our portfolio of IoT solutions and would like to get a brief overview as to who are the key players in this market.

Hello! I am looking to do research on the IoT sensors market for supply chain management. This report looks very useful.

When you say 'market will USD 38 BN', please explain its scope are also. Is it include entire IoT sensor ecosystem or just devices, applications, and services? You get the drift.

We do have unbalanced sensors manufacturing in Russia. It is interesting to see where the rest of the world is going for this market.

Research in the field of ultra-low power chips for IoT sensor nodes (www.green-ic.org), with an interest to start-up a company in this space.