Simulators Market Size, Share & Industry Growth Analysis Report by Application (Commercial Training, Military Training), Solution (products, Services), Platform (Airborne, Land, Maritime), Technique (Live, Virtual & Constructive, Synthetic Environment, Gaming), Type, Region - Global Forecast to 2027

Updated on : May 10, 2023

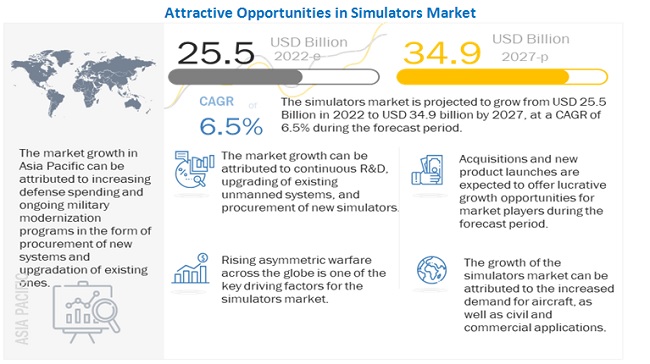

[280 Pages Report] A Simulator is a system that combines software and hardware to simulate training. The market for simulators includes the airborne, land, and maritime platforms used to train commercial and military crew members. Training through simulators is provided via three techniques: live, virtual & constructive simulation, synthetic environment simulation, and gaming simulation. The Simulators Industry size is projected to grow from USD 25.5 billion in 2022 to USD 34.9 billion by 2027, at a CAGR of 6.5% from 2022 to 2027. The need to train pilots to cater to the increase in air travel is fueling the demand for flight simulators. Training pilots via simulators enables them to handle various flight operations while eliminating the risks that could otherwise be involved. The increasing acceptance of virtual pilot training to ensure aviation safety is another significant factor expected to contribute to the growth of the simulators market.

To know about the assumptions considered for the study, Request for Free Sample Report

Simulators Market Dynamics:

Driver: Growing demand for pilots in aviation industry

According to the Boeing Pilot Outlook 2021, around 612,000 new commercial pilots will be required to manage and fly the global commercial fleet over the next two decades, mostly in the Asia Pacific and the Middle East regions. The growing middle-class population and the increase in trade, tourism, and disposable income in economies such as India, China, and the UAE have increased the need for aircraft and, thereby, pilots.

Mature markets such as North America and Europe are seeing a gradual revival in demand for pilots due to recruitment initiatives by legacy carriers. Pilots not only require extensive training to handle aircraft operations under unusual situations but also need to obtain adequate knowledge about new features in aircraft. Using flight simulators to train pilots avoids damage to expensive aircraft while ensuring the public's safety.

The aviation industry faces a shortage of skilled pilots and thus requires recruitment. These recruited pilots need training, which, in turn, leads to increased demand for simulators. Various airlines and pilot training institutes are being established to offer training courses for pilots, which is another factor expected to drive the demand for simulators..

Restraint: Longer product lifecycle

According to CAE, Inc., the leading manufacturer and supplier of simulators globally, the average lifecycle of a full flight simulator is almost 25 years. However, this lifecycle can easily be extended by software and hardware upgrades. As civil and military aircraft are updated, simulator software is upgraded and modified to provide a more realistic training experience. Periodic modifications to simulator systems to elongate their lifecycle and provide training on the latest aircraft models is the major factor restraining the market's growth.

Opportunity: Development of simulators for unmanned aerial systems

The increasing demand for unmanned systems for defense and commercial applications is expected to drive the demand for simulators. Companies such as AEgis Technologies Group (US) and Havelsan Inc. (US) are introducing highly sophisticated unmanned simulators independent of hardware configurations to simulate any unmanned aerial system (UAS) with the help of any sensor operator and payload suite. These simulators can create a virtual battlefield in real-time, enabling ab-initio training, basic payload and flight operations, mission rehearsal, and mission planning. These simulators, however, need to be cost-effective, capable of precise simulation of flight dynamics, have an error-tolerant control system design, and multi-vehicle simulation with interoperability.

Challenge: Minimization of weight and size to maintain advanced features

Simulator products and solutions find applications in various systems for different combat operations. Soldiers also use these military simulator products during critical missions to gain an advantage over their enemies. However, heavy batteries increase the weight of products, hampering the soldier's performance.

Reducing the size of military simulators is also difficult, owing to the requirement for several components to perform vital functions. The complexity of reducing the size and weight is expected to make the manufacturing process more expensive. Industry players must install sophisticated machinery and invest in R&D activities to increase device efficiency. Trying to minimize devices' associated weight and size while maintaining their advanced features may create a barrier to the market's growth.

Simulators Market Ecosystem

Prominent companies and start-ups that provide simulators and their services, distributors/ suppliers/ retailers, and end customers are the key stakeholders in the simulators market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries serve as the major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

The air traffic control simulators segments projected to register highest growth rate during forecast period

Based on type, the air traffic control simulators segment is projected to register the highest growth rate during the forecast period. Air traffic control towers house major equipment, resulting in the highest growth rate for the air traffic control simulators segment. Regions such as North America and Europe are also focusing on the modernization of equipment to improve the efficiency of their air traffic, thereby contributing to the growth of the aforementioned segment.

The maritime segment projected to lead simulators market during forecast period

Based on platform, the maritime segment is projected to lead the simulators market during the forecast period. This segment has been further segmented into military, commercial, and unmanned maritime vehicles. There is a huge demand for new ships, owing to the rise in seaborne trade across the globe. The deployment of new ships will lead to a requirement for new ship crew members, in turn, fueling the demand for simulators to train them.

Asia Pacific is expected to account for the largest share in 2021

Asia Pacific accounted for the largest market share in 2021, and North America is projected to witness the highest CAGR during the forecast period. Improving lifestyles, an expanding number of metro cities and a continually growing population have all contributed to the increased manufacturing and sales of passenger automobiles in the Asia Pacific region. A few Asia Pacific countries, such as Japan and South Korea, have safety rules in place, and the demand for passenger vehicles in these countries is expected to expand over the next five years. With rising population and car demand, China, South Korea, India, and Japan are expected to implement stringent vehicle and road safety laws. Factors such as limited infrastructure and a growing number of road accidents are projected to increase the demand for skilled drivers, subsequently increasing the need for training simulators.

Simulators Industry Companies: Top Key Market Players

The Simulators Companies are dominated by globally established players such as CAE Inc. (Canada), L3Harris Technologies, Inc. (US), Thales SA (France), Saab AB (Sweden), Indra (Spain), Flight Safety International(US), The Boeing Company (US), Airbus S.A.S. (Netherlands), Tru Simulaion + Training Inc. (US), and Raytheon Company (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By Type, Platform, Technique, Application, Solution and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, and Rest of the World |

|

Companies covered |

CAE Inc. (Canada), L3Harris Technologies, Inc. (US), Thales SA (France), Saab AB (Sweden), Indra (Spain), Flight Safety International(US), The Boeing Company (US), and among others |

This research report categorizes the Simulators Market based on Type, Platform, Technique, Application, Solution and Region

Simulators Market, By Platform

- Airborne

- Land

- Maritime

Simulators Market, By Type

- Full Mission Bridge Simulators

- Full Flight Simulators

- Driving Simulators

- Fixed Base Simulators

- Flight Training Devices

- Vessel Traffic Control Simulators

- Land Forces Training Simulators

- Full Mission Flight Simulators

- Air Traffic Control Simulators

Simulators Market, By Solution

- Products

- Services

Simulators Market, By Technique

- Live, Virtual, & Constructive (LVC) Simulation

- Synthetic Environment Simulation

- Gaming Simulation

Simulators Market, By Application

- Military Training

- Commercial Training

Simulators Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In May 2022, Thales acquired RUAG Simulation & Training, which employs 500 people and has annual revenues of USD 93.81 million.

- In February 2022, Kongsberg Digital (KDI), a division of Kongsberg Gruppen, was awarded a major contract to provide a wide variety of marine simulator systems to the South Metropolitan TAFE (Technical and Further Education) college in Fremantle, Western Australia.

- In March 2019, CAE entered into a five-year agreement with AirAsia (Malaysia) to provide CAE Rise, a full flight simulator for initial training of AirAsia’s pilots. This helped the company in expanding its customer base in Malaysia.

- In March 2019, Thales received a contract from Caverton Helicopters (Africa) to provide Thales’ Reality-H Full Flight Simulator to train the pilots of Caverton Helicopters for the AW139 aircraft platform. This helped the company in expanding its customer base in Africa.

Frequently Asked Questions (FAQ):

What is the current size of the Simulators market?

The Simulators market size is projected to grow from USD 25.5 billion in 2022 to USD 34.9 billion by 2027, at a CAGR of 6.5% from 2022 to 2027.

Who are the winners in the Simulatorsmarket?

CAE Inc. (Canada), L3Harris Technologies, Inc. (US), Thales SA (France), Saab AB (Sweden), Indra (Spain), Flight Safety International(US), and The Boeing Company (US)are some of the winners in the market.

What are some of the technological advancements in the market?

Haptic technology, reconfigurable flight simulation and training, inculcation of AI across simulation and training systems, 3D printing, Internet of Things, and Big data analytics are some of the technological advancements in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 VALUE CHAIN ANALYSIS

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMERS BUSINESS

5.5 PRICING ANALYSIS

5.6 USECASE ANALYSIS

5.7 TRADE ANALYSIS

5.8 SIMULATORS MARKET ECOSYSTEM

5.9 TARIFF AND REGULATORY LANDSCAPE

5.10 RANGES & SCENARIOS

5.11 PORTER’S FIVE FORCES ANALYSIS

5.12 TECHNOLOGICAL ANALYSIS

5.13 KEY CONFERENCES & EVENTS IN 2022-2023 ANALYSIS

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.3 PATENT ANALYSIS

7 SIMULATORS MARKET, BY SOLUTION

7.1 INTRODUCTION

7.2 PRODUCTS

7.2.1 HARDWARE

7.2.2 SOFTWARE

7.3 SERVICES

7.3.1 HARDWARE UPGRADES

7.3.2 SOFTWARE UPGRADES

7.3.3 MAINTENANCE & SUPPORT

8 SIMULATORS MARKET, BY PLATFORM

8.1 INTRODUCTION

8.2 AIRBORNE

8.2.1 COMMERCIAL

8.2.1.1 Narrow body aircraft (NBA)

8.2.1.2 Wide body aircraft (WBA)

8.2.1.3 Extra wide body (EWB)

8.2.1.4 Regional transport aircraft (RTA)

8.2.2 MILITARY

8.2.2.1 Helicopters

8.2.2.2 Combat aircraft

8.2.2.3 Training aircraft

8.2.2.4 Transport aircraft

8.2.3 UAVS

8.3 LAND

8.3.1 COMMERCIAL

8.3.1.1 Trucks

8.3.1.2 Buses

8.3.1.3 Trains & trams

8.3.1.4 Cars

8.3.1.5 Airports

8.3.2 MILITARY

8.3.2.1 Reconnaissance vehicles

8.3.2.2 Infantry carrier vehicles

8.3.2.3 Tanks

8.3.2.4 Infantry weapons

8.3.3 UGVS

8.4 MARITIME

8.4.1 COMMERCIAL

8.4.1.1 Bulk carriers

8.4.1.2 Container ships

8.4.1.3 Fishing vessels

8.4.1.4 Rescue boats

8.4.1.5 Passenger cruises

8.4.1.6 Ports

8.4.2 MILITARY

8.4.2.1 Frigates

8.4.2.2 Submarines

8.4.2.3 Corvettes

8.4.2.4 Destroyers

8.4.2.5 Amphibious assault ships

8.4.3 UMVS

9 SIMULATORS MARKET, BY TYPE

9.1 INTRODUCTION

9.2 FLIGHT TRAINING DEVICES

9.3 FULL FLIGHT SIMULATORS

9.4 FULL MISSION FLIGHT SIMULATORS

9.5 FIXED BASE SIMULATORS

9.6 AIR TRAFFIC CONTROL SIMULATORS

9.7 DRIVING SIMULATORS

9.8 LAND FORCE TRAINING SIMULATORS

9.9 FULL MISSION BRIDGE SIMULATORS

9.10 VESSEL TRAFFIC CONTROL SIMULATORS

10 SIMULATORS MARKET, BY APPLICATION

10.1 INTRODUCTION

10.2 COMMERCIAL TRAINING

10.3 MILITARY TRAINING

11 SIMULATORS MARKET, BY TECHNIQUE

11.1 INTRODUCTION

11.2 LIVE, VIRTUAL & CONSTRUCTIVE (LVC) SIMULATION

11.3 SYNTHETIC ENVIRONMENT SIMULATION

11.4 GAMING SIMULATION

12 REGIONAL ANALYSIS

12.1 INTRODUCTION

12.2 REGIONAL CONTRACT MAPPING FOR THE SIMULATORS MARKET

12.3 NORTH AMERICA

12.3.1 US

12.3.2 CANADA

12.4 EUROPE

12.4.1 UK

12.4.2 FRANCE

12.4.3 GERMANY

12.4.4 ITALY

12.4.5 RUSSIA

12.4.6 SWEDEN

12.4.7 REST OF EUROPE

12.5 ASIA PACIFIC

12.5.1 CHINA

12.5.2 JAPAN

12.5.3 INDIA

12.5.4 SOUTH KOREA

12.5.5 AUSTRALIA

12.5.6 REST OF APAC

12.6 MIDDLE EAST & AFRICA

12.6.1 SAUDI ARABIA

12.6.2 ISRAEL

12.6.3 TURKEY

12.6.4 UAE

12.6.5 SOUTH AFRICA

12.6.6 REST OF MIDDLE EAST & AFRICA

12.7 LATIN AMERICA

12.7.1 BRAZIL

12.7.2 MEXICO

13 COMPETITIVE LANDSCAPE

13.1 INTRODUCTION

13.2 COMPETITIVE ANALYSIS

13.3 MARKET RANKING ANALYSIS

13.4 BRAND ANALYSIS

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

13.5.5 COMPETITIVE BENCHMARKING

13.6 START-UP/SME EVELUATION QUADRANT

13.6.1 PROGRESIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 STARTING BLOCKS

13.6.4 DYNAMIC COMPANIES

13.7 COMPETITIVE SCENARIO

13.7.1 CONTRACTS

13.7.2 NEW PRODUCT LAUNCHES

13.7.3 AGREEMENTS, ACQUISITIONS, COLLABORATIONS, PARTNERSHIPS, AND JOINT VENTURES

13.7.4 OTHERS

14 COMPANY PROFILES

14.1 KEY PROFILES

14.1.1 CAE INC.

14.1.2 SAAB AB

14.1.3 RAYTHEON TECHNOLOGIES

14.1.4 ST ENGINEERING

14.1.5 TRU SIMULATION +TRAINING INC.

14.1.6 THALES SA

14.1.7 RHEINMETALL AG

14.1.8 FLIGHTSAFETY INTERNATIONAL

14.1.9 L3HARRIS TECHNOLOGIES.

14.1.10 INDRA SISTEMAS SA

14.1.11 FRASCA INTERNATIONAL, INC.

14.1.12 THE BOEING COMPANY.

14.1.13 ECA GROUP

14.1.14 KONGSBERG MARITIME

14.1.15 AIRBUS S.A.S

14.1.16 ELITE SIMULATION SOLUTIONS

14.1.17 SIMCOM AVIATION TRAINING

14.2 KEY PROFILES

14.2.1 VIRTRA.

14.2.2 ARI SIMULATION

14.2.3 VSTEP BV

14.2.4 AVION GROUP

14.2.5 PRECISION FLIGHT CONTROLS, INC.

14.2.6 BOHEMIA INTERACTIVE SIMULATIONS

14.2.7 AVT SIMULATION

14.2.8 OKTAL SYDAC

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

15.4 AVAILABLE CUSTOMIZATION

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

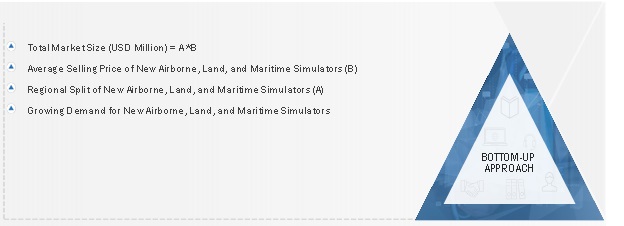

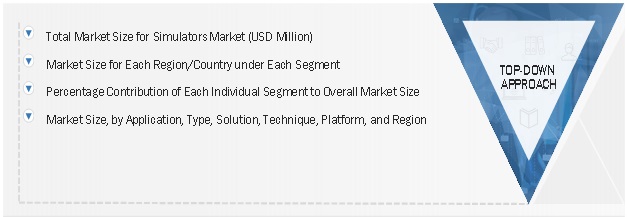

The study involved four major activities in estimating the current market size for the simulators market. Exhaustive secondary research was carried out to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

Primary Research

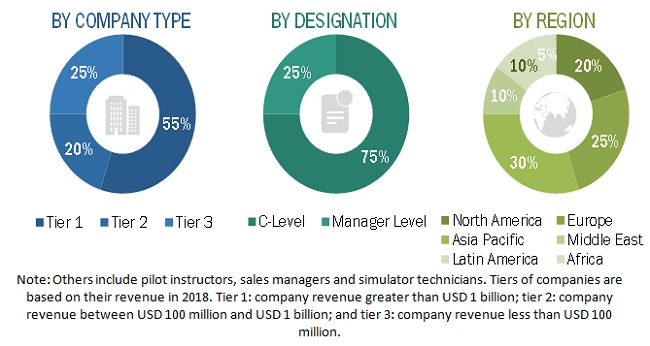

The simulators market comprises several stakeholders, such as software and hardware providers, airborne, land and maritime simulator manufacturers and suppliers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end users, such as hardware manufacturers as well as facility providers and OEMs. The supply side is characterized by technological advancements in simulators. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the simulators market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-down approach

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the simulators market in the aviation industry.

Growth Drivers in the: Constructive Simulation in Simulators Market

Constructive simulation is a type of simulation used in military and defense applications to model and simulate scenarios and operations in a virtual environment. It involves creating virtual models of different components of the system and simulating their behavior and interactions to explore different scenarios, test strategies, and evaluate the effectiveness of systems and processes. Constructive simulation is one of the key technologies driving growth in the simulator market as the demand for advanced and realistic simulations increases. Manufacturers are expected to develop and produce new and innovative simulation technologies to meet this demand.

The simulator market includes a wide range of simulation technologies used in various applications, such as aviation, military, and healthcare. The demand for simulators has been increasing due to the benefits they offer in terms of training, safety, and cost savings. Constructive simulation is expected to drive growth in the simulator market as a whole as it plays a crucial role in creating advanced and realistic simulations. This will lead to the development of new and innovative simulation technologies to meet the demand, and as a result, drive growth in the simulators market.

Benefits of Constructive Simulation and its Impact on the Simulation Market

The benefits of constructive simulation are expected to drive growth in the simulation market. Constructive simulation can reduce costs by allowing users to test scenarios and strategies in a virtual environment, thus reducing the need for expensive equipment and resources. Constructive simulation can also be used for training purposes, allowing users to improve their skills in a safe and controlled environment. Additionally, constructive simulation can help identify potential safety issues and risks, which can be addressed before they become a problem. Furthermore, constructive simulation can improve decision-making by providing a better understanding of different scenarios and their potential outcomes. Lastly, constructive simulation can drive innovation by allowing users to test new technologies and strategies in a virtual environment.

The above benefits of constructive simulation are expected to increase demand for simulation technologies, leading to the development of new and innovative simulation solutions and driving growth in the simulation market. As a result, the simulation market is expected to continue to grow in the coming years.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the simulators market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Simulators Market

Working on a report for Cornell analyzing the market for satellite simulators. (market size/share, potential ROI, etc...)