Single Use Assemblies Market Size, Growth by Product (Bag, Filtration, Bottle Assemblies, Mixing Assemblies), Solution (Customized, Standard), Application (Filtration, Cell Culture, Storage, Fill-finish), End User (Pharma, Biopharma, CMOs) & Region - Global Forecasts to 2027

Updated on : February 09, 2023

The global Single Use Assemblies Market in terms of revenue was estimated to be worth $2.7 billion in 2022 and is poised to reach $6.5 billion by 2027, growing at a CAGR of 18.8% from 2022 to 2027. The growth of the single use assemblies market is largely driven by the advantages of single-use assemblies over traditional stainless steel equipment, such as quick implementation from small to large-scale production and a cost-effective solution. Additionally, growing adoption of single-use assemblies in research activities, coupled with increased investments in biopharmaceutical R&D activities, is spurring market growth across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Single Use Assemblies Market Dynamics

Drivers: Increasing Biopharmaceutical R&D is projecting the market growth

Key players operating in the global single use assemblies market are increasingly focused on developing and commercializing technologically advanced single-use assemblies products that offer streamlined workflows, ease of operability, and rapid implementation. As single-use assemblies contribute largely to small and large scale biopharmaceutical manufacturing, increasing investments in biopharmaceutical R&D for product development are attributed to the high market growth of single-use assemblies. Single-use assembly market growth is being driven by benefits such as reduced product cross-contamination and the elimination of additional sterilisation processes. For example, in 2021, the 15 largest pharmaceutical companies will invest a record USD 133 billion in R&D.

Restraints: Issues related to extractables and leachables

Most end users, such as large research facilities and pharmaceutical companies, require many single-use assemblies to simultaneously carry out multiple research studies and production processes. These studies and processes take place at high temperatures and in harsh environments. Single-use assemblies made of polymers and plastics contain various preservatives that are likely to degrade in the form of extractables and leachables in small amounts. This poses the risk of cross-contamination of the material. Thus, extractables and leachables are major concerns limiting the market growth of single-use assemblies.

Opportunities: Emerging Countries

Due to their advantages, the adoption of single-use assemblies has increased significantly during the last decade. In addition to the supportive regulatory environment and cost advantages in emerging countries like China, India, and South Korea, many pharmaceutical and biopharmaceutical companies are expected to expand their single-use manufacturing plants to make this country a hub for bioprocess outsourcing. This is also supported by the increasing number of investments from key players in the market into developing countries. For instance, Cytiva, in collaboration with Wego Pharmaceutical, expanded its manufacturing capacity in China to strengthen its supply chain in the APAC region.

Biopharmaceuticals & Pharmaceutical companies held a dominant share in end user segment in Single use assemblies market

Based on end user, the single-use assemblies market is segmented into biopharmaceuticals and pharmaceutical companies, contract research organizations and contract manufacturing organizations, and academic and research institutes. The biopharmaceuticals and pharmaceutical companies segment accounted for the largest market share in 2021. Higher adoption of standard solutions is mainly due to the flexibility of their use with pre-qualified components of different assemblies, increased cost-efficiency, and rapid implementation of a production plan from small scale to large scale. These are the factors attributed to the increasing demand for single-use assembly products in this end user segment. Additionally, growing investments by pharmaceutical companies in research activities further support market growth.

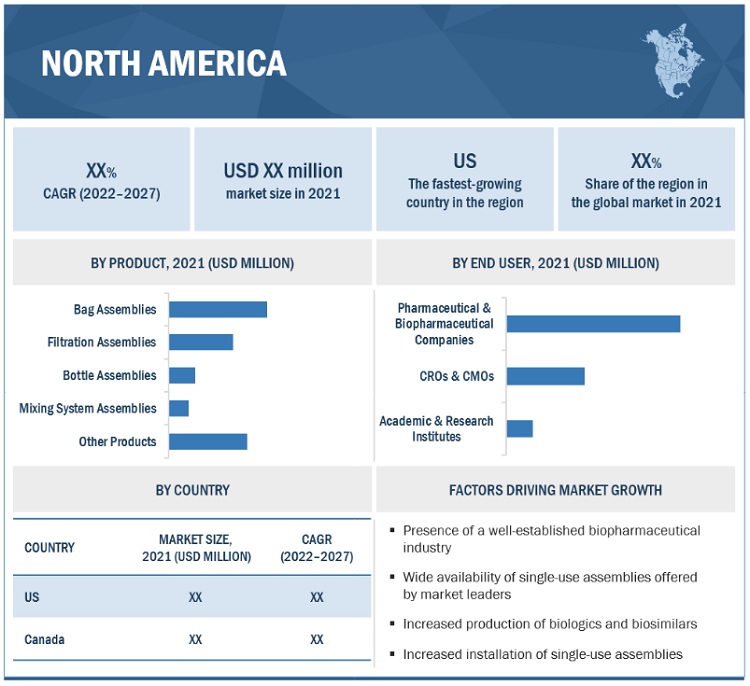

North America accounted for largest share in single use assemblies market in 2021

Geographically, the single use assemblies market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America held the dominant share, followed by Europe. North America held a dominant share owing to various factors such as increased biologic and biosimilar production in the region, followed by the huge number of key market players with well-established infrastructure for large-scale manufacturing. However, the APAC market is expected to grow at a higher CAGR during the forecast period. Factors such as the presence of a favourable business environment and increased capital investments in biopharmaceutical R&D and life sciences research are accountable for the growth of the single-use assemblies market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the global single use assemblies market Thermo Fisher Scientific, Inc. (US), Sartorius Stedim Biotech (France), Danaher Corporation (US), Merck KGaA (Germany), Avantor Inc. (US) and among others.

Single Use Assemblies Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$2.7 billion |

|

Estimated Value by 2027 |

$6.5 billion |

|

Growth Rate |

poised to grow at a CAGR of 18.8% |

|

Largest Share Segments |

Pharmaceutical and Bio-pharmaceutical Companies, Bag Assemblies & Filtration Applications |

|

Market Report Segmentation |

Product, Application, Solution, End User & Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the global single use assemblies market into the following segments:

By Products

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Mixing System Assemblies

- Other Products

By Solutions

- Standard Solutions

- Customized Solutions

By Applications

- Filtration

- Cell culture & Mixing

- Storage

- Sampling

- Fill-Finish

- Other Application

By End Users

- Biopharmaceutical & Pharmaceutical Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic & Research Institutes

By Regions

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- South Korea

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In April 2022, Merck KGaA (Germany), planed to invest around USD 110 million for expanding the existing Wuxi production site (China) to substantially expand biopharma single-use assemblies and custom design capabilities. With this expansion, Merck will broaden its geographic footprint and strengthen its supply chain in China and the Asia-Pacific region.

- September 2021, Cytiva planned to triple single-use component production in China through Wego Pharmaceutical Co.’s Weihai, China. 11 manufacturing lines are planned to be launched by end of Q3 2022.

Frequently Asked Questions (FAQ):

What is the size of Single use Assemblies Market ?

The Single use Assemblies Market size is projected to reach USD 6.5 Billion by 2027, growing at a CAGR of 18.8%.

Why is Single use Assemblies Market Growing?

The growth of the single-use assemblies market is largely driven by the increased pharmaceutical research & development and rising adoption of single use assemblies over traditional methods. Furthermore, single-use assemblies has been prominently adopted biologics manufacturing industry for multiple stages, i.e., in the upstream process, media & buffer preparation, downstream process, and process-intermediate storage.

Who all are the prominent players of Single use Assemblies Market ?

The prominent players in the single-use assemblies market are Thermo Fisher Scientific, Inc. (US), Sartorius Stedim Biotech (France), Danaher Corporation (US), Merck KGaA (Germany), and Avantor, Inc. (US). These companies have adopted organic and inorganic growth strategies, such as product launches and acquisitions, to maintain their leading positions in the single-use assemblies market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 SINGLE USE ASSEMBLIES MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

FIGURE 4 AVERAGE MARKET SIZE ESTIMATION (2021)

2.3 DATA TRIANGULATION APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 GROWTH RATE ASSUMPTIONS

2.5 RISK ASSESSMENT

2.6 GROWTH FORECAST

2.6.1 SUPPLY-SIDE ANALYSIS

2.6.2 DEMAND-SIDE ANALYSIS

2.6.2.1 Insights from primary experts

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 SINGLE USE ASSEMBLIES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 7 SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 SINGLE-USE ASSEMBLIES MARKET SHARE, BY END USER, 2021

FIGURE 9 GEOGRAPHICAL SNAPSHOT OF SINGLE-USE ASSEMBLIES MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 SINGLE-USE ASSEMBLIES MARKET OVERVIEW

FIGURE 10 VARIOUS ADVANTAGES OF SINGLE-USE ASSEMBLIES OVER TRADITIONAL METHODS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET SHARE, BY PRODUCT (2021)

FIGURE 11 BAG ASSEMBLIES ACCOUNTED FOR LARGEST SHARE IN 2021

4.3 SINGLE-USE ASSEMBLIES MARKET SHARE, BY SOLUTION, 2022 VS. 2027

FIGURE 12 STANDARD SOLUTIONS TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 SINGLE-USE ASSEMBLIES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 13 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 SINGLE USE ASSEMBLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapid implementation and low risk of cross-contamination

5.2.1.2 Increasing biopharmaceutical R&D

5.2.1.3 Growing biologics market

5.2.1.4 Cost savings

5.2.2 RESTRAINTS

5.2.2.1 Issues related to extractables & leachables

5.2.2.2 Breakage of bags and loss of production materials

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries

5.2.4 CHALLENGES

5.2.4.1 Waste disposal

5.2.4.2 Demand and supply gap

5.3 TECHNOLOGICAL ADVANCEMENTS

TABLE 1 IMPORTANT TECHNOLOGICAL ADVANCEMENTS IN SINGLE-USE ASSEMBLIES MARKET DURING 2019–2022

TABLE 2 COMPARISON OF DISPOSAL OPTIONS FOR SINGLE-USE ASSEMBLY PRODUCTS

5.4 PATENT ANALYSIS

FIGURE 15 PATENT ANALYSIS OF SINGLE-USE ASSEMBLIES MARKET

5.4.1 LIST OF MAJOR PATENTS

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 16 DIRECT DISTRIBUTION STRATEGY PREFERRED BY PROMINENT COMPANIES

5.5.1 KEY INFLUENCERS

5.6 VALUE CHAIN ANALYSIS

FIGURE 17 SINGLE-USE ASSEMBLIES MARKET: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM ANALYSIS

FIGURE 18 ECOSYSTEM ANALYSIS OF SINGLE-USE ASSEMBLIES MARKET

5.7.1 ROLE IN ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 SINGLE-USE ASSEMBLIES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 THREAT FROM SUBSTITUTES

5.8.5 THREAT FROM NEW ENTRANTS

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 19 REVENUE SHIFTS & NEW REVENUE POCKETS FOR SINGLE-USE ASSEMBLIES MARKET

5.10 PRICING ANALYSIS

TABLE 4 COST OF DIFFERENT TYPES OF ASSEMBLIES, BY REGION

TABLE 5 COST OF VARIOUS ASSEMBLIES BY MERCK KGAA

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 6 SINGLE-USE ASSEMBLIES MARKET: DETAILED LIST OF EVENTS AND CONFERENCES

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 20 KEY STAKEHOLDERS IN PHARMACEUTICAL COMPANIES AND THEIR INFLUENCE IN BUYING PROCESS

FIGURE 21 KEY BUYING CRITERIA FOR SINGLE-USE ASSEMBLIES AMONG END USERS

6 SINGLE USE ASSEMBLIES MARKET, BY PRODUCT (Page No. - 66)

6.1 INTRODUCTION

TABLE 7 SINGLE-USE ASSEMBLIES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 BAG ASSEMBLIES

6.2.1 EXPANDED APPLICATIONS OF SINGLE-USE BAGS AND CONTAINERS ACROSS BIOMANUFACTURING PROCESSES TO DRIVE MARKET

TABLE 8 SINGLE-USE BAG ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 9 NORTH AMERICA: SINGLE-USE BAG ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 EUROPE: SINGLE-USE BAG ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 ASIA PACIFIC: SINGLE-USE BAG ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 FILTRATION ASSEMBLIES

6.3.1 ADVANTAGES OF FILTRATION ASSEMBLIES TO SUPPORT SEGMENTAL GROWTH

TABLE 12 SINGLE-USE FILTRATION ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 NORTH AMERICA: SINGLE-USE FILTRATION ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 EUROPE: SINGLE-USE FILTRATION ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 ASIA PACIFIC: SINGLE-USE FILTRATION ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 BOTTLE ASSEMBLIES

6.4.1 ADVANTAGES SUCH AS REDUCED DOWNTIME AND TURNAROUND TIME TO BOOST DEMAND

TABLE 16 SINGLE-USE BOTTLE ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 NORTH AMERICA: SINGLE-USE BOTTLE ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 EUROPE: SINGLE-USE BOTTLE ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 ASIA PACIFIC: SINGLE-USE BOTTLE ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 MIXING SYSTEM ASSEMBLIES

6.5.1 FLEXIBILITY IN MULTIPRODUCT MANUFACTURING TO DRIVE ADOPTION OF MIXING SYSTEM ASSEMBLIES

TABLE 20 SINGLE-USE MIXING SYSTEM ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 21 NORTH AMERICA: SINGLE-USE MIXING SYSTEM ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 EUROPE: SINGLE-USE MIXING SYSTEM ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 ASIA PACIFIC: SINGLE-USE MIXING SYSTEM ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6 OTHER PRODUCTS

TABLE 24 OTHER SINGLE-USE ASSEMBLY PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: OTHER SINGLE-USE ASSEMBLY PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 EUROPE: OTHER SINGLE-USE ASSEMBLY PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: OTHER SINGLE-USE ASSEMBLY PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 SINGLE USE ASSEMBLIES MARKET, BY SOLUTION (Page No. - 80)

7.1 INTRODUCTION

TABLE 28 SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

7.2 STANDARD SOLUTIONS

7.2.1 ADVANTAGES SUCH AS REDUCED CAPITAL COSTS AND IMPROVED FLEXIBILITY TO DRIVE DEMAND

TABLE 29 SINGLE-USE ASSEMBLIES MARKET FOR STANDARD SOLUTIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR STANDARD SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR STANDARD SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR STANDARD SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 CUSTOMIZED SOLUTIONS

7.3.1 LIMITED ADOPTION OF CUSTOMIZED SOLUTIONS DUE TO ADDED PROCESS COMPLEXITY TO RESTRICT MARKET GROWTH

TABLE 33 SINGLE-USE ASSEMBLIES MARKET FOR CUSTOMIZED SOLUTIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR CUSTOMIZED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR CUSTOMIZED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR CUSTOMIZED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 SINGLE USE ASSEMBLIES MARKET, BY APPLICATION (Page No. - 87)

8.1 INTRODUCTION

TABLE 37 SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 FILTRATION

8.2.1 ADVANTAGES OF SINGLE-USE FILTRATION ASSEMBLIES TO DRIVE MARKET

TABLE 38 SINGLE-USE ASSEMBLIES MARKET FOR FILTRATION APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR FILTRATION APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 CELL CULTURE & MIXING

8.3.1 LOWER RISK OF CONTAMINATION TO INCREASE USE OF SINGLE-USE ASSEMBLIES FOR CELL CULTURE & MIXING

TABLE 42 SINGLE-USE ASSEMBLIES MARKET FOR CELL CULTURE & MIXING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR CELL CULTURE & MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR CELL CULTURE & MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR CELL CULTURE & MIXING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 STORAGE

8.4.1 LAUNCH OF NOVEL PRODUCTS TO BOOST MARKET GROWTH

TABLE 46 SINGLE-USE ASSEMBLIES MARKET FOR STORAGE APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR STORAGE APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 SAMPLING

8.5.1 STRICT GUIDELINES FOR DRUG SAFETY TO SUPPORT MARKET FOR SAMPLING APPLICATIONS

TABLE 50 SINGLE-USE ASSEMBLIES MARKET FOR SAMPLING APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR SAMPLING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 FILL-FINISH

8.6.1 REDUCED RISK OF CONTAMINATION TO PROPEL DEMAND FOR SINGLE-USE ASSEMBLIES FOR FILL-FINISH APPLICATIONS

TABLE 54 SINGLE-USE ASSEMBLIES MARKET FOR FILL-FINISH APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR FILL-FINISH APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR FILL-FINISH APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR FILL-FINISH APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 58 SINGLE-USE ASSEMBLIES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 SINGLE USE ASSEMBLIES MARKET, BY END USER (Page No. - 103)

9.1 INTRODUCTION

TABLE 62 SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

9.2.1 GROWING BIOLOGICS PRODUCTION TO DRIVE DEMAND FOR SINGLE-USE ASSEMBLIES

TABLE 63 LIST OF FDA-APPROVED BIOLOGICS, 2021

TABLE 64 SINGLE-USE ASSEMBLIES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 CONTRACT RESEARCH ORGANIZATIONS & CONTRACT MANUFACTURING ORGANIZATIONS

9.3.1 INCREASING OUTSOURCING OF R&D SERVICES TO SUPPORT MARKET

TABLE 68 SINGLE-USE ASSEMBLIES MARKET FOR CROS & CMOS, BY REGION, 2020–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR CROS & CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR CROS & CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR CROS & CMOS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 ACADEMIC & RESEARCH INSTITUTES

9.4.1 GROWING PHARMA-ACADEMIA COLLABORATIONS TO DRIVE ADOPTION OF SINGLE-USE ASSEMBLIES

TABLE 72 SINGLE-USE ASSEMBLIES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 EUROPE: SINGLE-USE ASSEMBLIES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

10 SINGLE USE ASSEMBLIES MARKET, BY REGION (Page No. - 113)

10.1 INTRODUCTION

TABLE 76 SINGLE-USE ASSEMBLIES MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growing biologics and biosimilars markets in US to drive market

TABLE 82 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 83 US: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 84 US: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 US: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing demand for biopharmaceuticals to support growth in Canada

TABLE 86 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 87 CANADA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 88 CANADA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 CANADA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 92 EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising focus and investments in pharmaceutical R&D to promote market growth

TABLE 95 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 96 GERMANY: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 97 GERMANY: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 GERMANY: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Investments in novel drug development to propel demand for single-use assemblies in UK

TABLE 99 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 100 UK: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 101 UK: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 UK: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increase in biopharmaceutical manufacturing to drive demand for single-use assemblies in France

TABLE 103 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 FRANCE: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 105 FRANCE: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 FRANCE: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 107 REST OF EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 108 REST OF EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 109 REST OF EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 REST OF EUROPE: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 111 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to continue to dominate Asia Pacific market during forecast period

TABLE 116 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 117 CHINA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 118 CHINA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 CHINA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 SOUTH KOREA

10.4.2.1 Government investments to contribute to market growth in South Korea

TABLE 120 KOREAN BIOPHARMACEUTICAL MARKET (USD HUNDRED THOUSAND)

TABLE 121 SOUTH KOREA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 122 SOUTH KOREA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 123 SOUTH KOREA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 124 SOUTH KOREA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Expansion of biopharmaceutical manufacturing plants in Japan to create opportunities

TABLE 125 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 126 JAPAN: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 127 JAPAN: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 JAPAN: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 INDIA

10.4.4.1 COVID-19 vaccine production to create significant demand for single-use assemblies

TABLE 129 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 130 INDIA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 131 INDIA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 132 INDIA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 133 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING BIOTECHNOLOGY & PHARMACEUTICAL INDUSTRIES IN LATIN AMERICA TO INCREASE DEMAND FOR SINGLE-USE ASSEMBLIES

TABLE 137 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 138 LATIN AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 140 LATIN AMERICA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 GROWING PHARMACEUTICAL SALES IN UAE TO DRIVE DEMAND FOR SINGLE-USE ASSEMBLIES

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: SINGLE-USE ASSEMBLIES MARKET, BY SOLUTION, 2020–2027 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: SINGLE-USE ASSEMBLIES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: SINGLE-USE ASSEMBLIES MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 154)

11.1 INTRODUCTION

11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

TABLE 145 MARKET: STRATEGIES ADOPTED

11.3 REVENUE ANALYSIS

FIGURE 24 REVENUE ANALYSIS FOR KEY COMPANIES (2019–2021)

11.4 MARKET SHARE ANALYSIS

FIGURE 25 SINGLE-USE ASSEMBLIES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

TABLE 146 SINGLE USE ASSEMBLIES MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 26 SINGLE-USE ASSEMBLIES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 COMPETITIVE LEADERSHIP MAPPING: EMERGING COMPANIES/SMES/START-UPS (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 27 SINGLE USE ASSEMBLIES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS, 2021

11.7 COMPETITIVE BENCHMARKING

TABLE 147 COMPANY FOOTPRINT

TABLE 148 COMPANY PRODUCT FOOTPRINT

TABLE 149 COMPANY REGIONAL FOOTPRINT

11.8 COMPETITIVE SCENARIO AND TRENDS

TABLE 150 SINGLE-USE ASSEMBLIES MARKET: PRODUCT LAUNCHES, JANUARY 2019–AUGUST 2022

TABLE 151 MARKET: DEALS, JANUARY 2019–JULY 2022

TABLE 152 SINGLE-USE ASSEMBLIES MARKET: OTHER DEVELOPMENTS, JANUARY 2019–JULY 2022

12 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 153 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 28 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2021)

12.1.2 SARTORIUS STEDIM BIOTECH

TABLE 154 SARTORIUS STEDIM BIOTECH: BUSINESS OVERVIEW

FIGURE 29 SARTORIUS STEDIM BIOTECH: COMPANY SNAPSHOT (2021)

12.1.3 DANAHER CORPORATION

TABLE 155 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 30 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.4 MERCK KGAA

TABLE 156 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 31 MERCK KGAA: COMPANY SNAPSHOT (2021)

12.1.5 AVANTOR, INC.

TABLE 157 AVANTOR, INC.: BUSINESS OVERVIEW

FIGURE 32 AVANTOR, INC.: COMPANY SNAPSHOT (2021)

12.1.6 PARKER-HANNIFIN CORPORATION

TABLE 158 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 33 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT (2021)

12.1.7 SAINT-GOBAIN

TABLE 159 SAINT-GOBAIN: BUSINESS OVERVIEW

FIGURE 34 SAINT-GOBAIN: COMPANY SNAPSHOT (2021)

12.1.8 REPLIGEN CORPORATION

TABLE 160 REPLIGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 35 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2021)

12.1.9 CORNING INCORPORATED

TABLE 161 CORNING INCORPORATED: BUSINESS OVERVIEW

FIGURE 36 CORNING INCORPORATED: COMPANY SNAPSHOT (2021)

12.1.10 ENTEGRIS INC.

TABLE 162 ENTEGRIS INC.: BUSINESS OVERVIEW

FIGURE 37 ENTEGRIS INC.: COMPANY SNAPSHOT (2021)

12.2 OTHER PLAYERS

12.2.1 MEISSNER FILTRATION PRODUCTS

TABLE 163 MEISSNER FILTRATION PRODUCTS: BUSINESS OVERVIEW

12.2.2 NEWAGE INDUSTRIES

TABLE 164 NEWAGE INDUSTRIES: BUSINESS OVERVIEW

12.2.3 ANTYLIA SCIENTIFIC

TABLE 165 ANTYLIA SCIENTIFIC: BUSINESS OVERVIEW

12.2.4 LONZA

TABLE 166 LONZA: BUSINESS OVERVIEW

FIGURE 38 LONZA: COMPANY SNAPSHOT (2021)

12.2.5 ROMYNOX B.V.

TABLE 167 ROMYNOX B.V.: BUSINESS OVERVIEW

12.2.6 FLEXBIOSYS, INC.

TABLE 168 FLEXBIOSYS, INC.: BUSINESS OVERVIEW

12.2.7 KEOFITT A/S

TABLE 169 KEOFITT A/S: BUSINESS OVERVIEW

12.2.8 INTELLITECH, INC.

TABLE 170 INTELLITECH, INC.: BUSINESS OVERVIEW

12.2.9 DOVER CORPORATION

TABLE 171 DOVER CORPORATION: BUSINESS OVERVIEW

FIGURE 39 DOVER CORPORATION: COMPANY SNAPSHOT (2021)

12.2.10 FOXX LIFE SCIENCES

TABLE 172 FOXX LIFE SCIENCES: BUSINESS OVERVIEW

12.2.11 TSE INDUSTRIES, INC.

TABLE 173 TSE INDUSTRIES, INC.: BUSINESS OVERVIEW

12.2.12 FUJIMORI KOGYO CO., LTD.

TABLE 174 FUJIMORI KOGYO CO., LTD.: BUSINESS OVERVIEW

FIGURE 40 FUJIMORI KOGYO CO. LTD.: COMPANY SNAPSHOT (2021)

12.2.13 MICHELIN GROUP

TABLE 175 MICHELIN GROUP: BUSINESS OVERVIEW

12.2.14 CELLEXUS INTERNATIONAL LTD.

TABLE 176 CELLEXUS INTERNATIONAL LTD.: BUSINESS OVERVIEW

12.2.15 FLUID FLOW PRODUCTS, INC.

TABLE 177 FLUID FLOW PRODUCTS, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 229)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

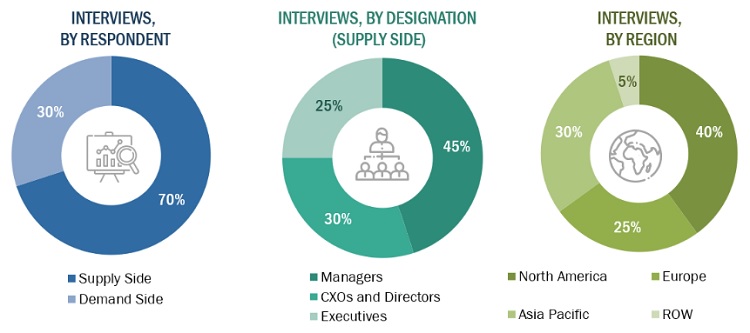

This study involved four major activities in estimating the current size of the single-use assemblies market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the single-use assemblies market. The secondary sources used for this study include World Health Organization (WHO), National Institutes of Health (NIH), National Institute for Bioprocessing Research and Training (NIBRT), Society for Biological Engineering (SBE), Canadian Cancer Statistics (CCS), Germany Trade and Invest (GTAI), Bio-Process Systems Alliance (BPSA), European Patent Office (EPO), Pharmaceuticals Export Promotion Council of India (Pharmexcil), India Brand Equity Foundation (IBEF), Biotechnology Innovation Organization (BIO), National Center for Biotechnology Information (NCBI), World Bank, United States Food and Drug Administration (US FDA), US Census Bureau, Eurostat, Statistics Canada, Factiva, BioProcess International Magazine, BioPharm International, EvaluatePharma, Pharma Vision 2021, PharmaVOICE, Journal of Bioprocessing and Biotechniques, BioPlan Associates, The Scientist Magazine, ScienceDirect, corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Single Use Assemblies Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the single-use assemblies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the single-use assemblies business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global single-use assemblies market based on the solution, product, application, end user and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall single-use assemblies market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, and R&D activities in the single-use assemblies market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Single Use Assemblies Market

What are the new growth opportunities in industry segments related to Single-use Assemblies Market?

What are the growth opportunities and industry-specific challenges in Single-use Assemblies Market?

What are the key industry insights, current and future perspectives?

Can you elaborate more on the growth opportunities across different geographies for Single Use Assemblies Market?

How are leading companies advancing global growth of the Single Use Assemblies Market?