Small Drone Market Size, Share & Industry Growth Analysis Report by Platform (Civil & Commercial and Defense & Government), Type (Fixed Wing, Rotary Wing, and Hybrid), Application, Mode of Operation, Power Source (Fully Powered, Battery Powered) Global Growth Driver and Industry Forecast to 2027

Updated on : July 11, 2023

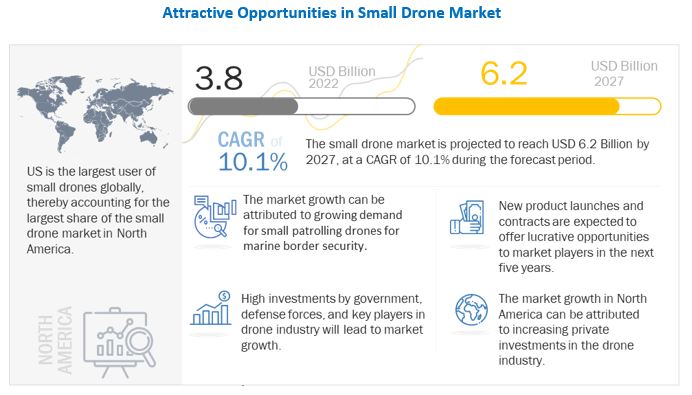

The Small Drone Market was valued at $ 3,800 Million in 2022 and is estimated to grow from $ 4,500 Million in 2023 to $ 6,200 Million by 2027 at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast year. Small Unmanned Aerial Vehicles (SUAVs) or small drones are remotely piloted aerial vehicles that have significant roles in the defense as well as commercial sectors. They are used in commercial applications such as monitoring, surveying & mapping, aerial remote sensing, precision agriculture, and product delivery, as well as military applications such as military attacks and border surveillance.

SUAVs are adopted by the oil & gas, railway, power plant, and construction industries. The use of small drones for new applications, such as cargo delivery in the commercial & defense sectors, is expected to drive the growth of the market across the globe. Small drones are replacing manned aircraft in the defense sector, as they can be operated remotely by human operators or autonomously by onboard computers. The Small Drone Industry has been witnessing significant growth over the past decade due to the increased use of small drones in military applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Small Drone Market Segment Overview

Based on Mode of Operation, the Optionally Piloted Drone Segment Registered Largest Market Share in 2022

Based on mode of operation, the small drone market has been classified into fully autonomous, remotely piloted, and optionally piloted.

The fully autonomous segment is projected to grow at a significant rate during the forecast period. The growth of this segment can be attributed to the cost-effective usage of autonomous small drones in several applications, ranging from defense operations to surveys.

Optionally piloted small drones deliver high maneuverability and are equipped with advanced technologies. They have comparatively low maintenance costs. These small drones are anticipated to be substituted by fully autonomous small drones in the coming years as fully autonomous drones have high payload capacity, enhanced propulsion power, and long endurance, as well as can operate without any human involvement.

Based on Power Source, Battery Operated Segment is Estimated to Account for the Largest Small Drone Market Share in 2022

Based on power source, the small drone market is segmented into fuel-powered and battery-operated/electric. Both type of power source serves a unique purpose and ensures the proper functioning of small drones in different applications.

The battery-operated segment is estimated to account for the largest share in 2022. Battery or electrically powered small drones use batteries to store energy and power electric motors. These drones are easy to operate and emit lesser noise than turbo engine drones.

However, lithium-ion batteries used in small drones need to be recharged once the charge is depleted; the process of recharging consumes a substantial amount of time. In contrast, fuel-powered drones can be refueled at a quick pace. Hydrogen-powered military drones offer the benefit of electric propulsion, thereby enabling drones to fly for long durations.

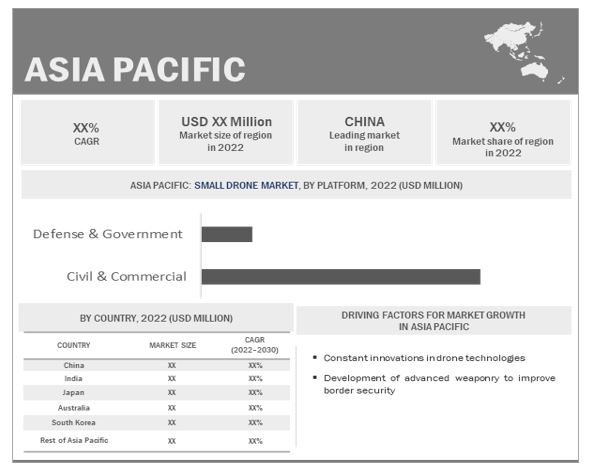

The Asia Pacific Region is Projected to Grow at Highest CAGR During the Forecast Period

Asia Pacific small drone market is expected to witness substantial growth and register the highest CAGR during the forecast period. The market growth in this region can be attributed to the rise in defense spending.

Moreover, Asia Pacific has rapidly growing economies, such as China, India, and Japan, with increasing purchasing power parity. Most countries in the region are expected to overtake several leading economies of the world by 2030, following the rapid expansion of the nominal GDP of Asia Pacific. Several governments are focusing on enhancing economic development and creating favourable environments for encouraging investments in new technologies. Though military budgets in Asia Pacific are not as high as those in Europe and US, the trend to modernize infrastructure and transportation, among other platforms, is on the rise. In addition to this, China is one of the prime manufacturers and buyers of drones globally for commercial, consumer, and military applications. The country has developed drones with capabilities to operate in low and high temperatures with high-performance efficiencies.

The demand for small drones in China is increasing for military and commercial applications. Manufacturers in the country have been focusing on the development of high-performance drones that can work in different temperatures. In addition, China has secured the second position in the list of top 10 countries with the highest defense budget. In 2021, China invested $ 293 billion in the defense sector.

To know about the assumptions considered for the study, download the pdf brochure

Top 5 Key Companies in Small Drone Industry

The Small Drone Companies is dominated by globally established players such as

- DJI (China)

- Parrot Drone SAS (France)

- Israel Aerospace Industry Ltd. (Israel)

- AeroVironment, Inc. (US)

- Lockheed Martin Corporation (US)

These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the small drone market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Small Drone Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

$ 3.8 Billion |

|

Projected Market Size |

$ 6.2 Billion |

|

Growth Rate |

10.1% |

|

Forecast Period |

2022-2027 |

|

Market Size Available for Years |

2019-2027 |

|

Base Year Considered |

2021 |

|

Forecast Units |

Value ($) |

|

Segments Covered |

By Platform, By Type, By Application, By mode of operation, By power source, and By Region |

|

Geographies Covered |

|

|

Companies Covered |

|

|

Companies Covered (Drone Start-Ups and Small Drone Ecosystem) |

|

Small Drone Market Dynamics:

Driver: Supportive Government Regulations and Initiatives

In 2020, the Federal Aviation Administration (FAA) enacted a new regulation called ‘Small Unmanned Aircraft Systems (UAS) Regulations (Part 107)’ to boost the use of small drones.

The regulation is specifically made for drones used for commercial and government applications and weighing less than 55 pounds. The new regulation can smoothen drone registration and use and improve drone safety. Moreover, in December 2020, the US Department of Transportation issued drone rules to boost drone innovation and safety. According to the FAA, there are 1.7 million drone registrations and 203,000 FAA-certificated remote pilots in the US. In addition, India has taken some good initiatives to boost the drone industry in the country.

In 2020, the Indian government started several initiatives, such as SVAMITVA, Drone Rules 2021, SOP for Agri Drones, Hara Bhara Project, and PLI Scheme for Drones and Drone Components, to drive the adoption of small drones. SVAMITVA scheme was launched in April 2020 to carry out drone mapping operations for 600,000 villages. Whereas the PLI Scheme for Drones and Drone Components was launched in September 2021, which is worth $ 15.04 million.

Under this three-year scheme, the government of India aims to fulfill the vision of ‘Atmanirbhar Bharat’. Also, in September 2021, the Indian government organized Bharat Drone Mahotsav-2022 with 150 companies to boost the development and innovation of drones. Besides, in previous years, the FAA has granted 500 exemptions to over 20 industries, such as real estate, aerial photography, agriculture, aerial surveying, and aerial inspection, among others, for the use of drones, especially small drones. These exemptions have increased the adoption of small drones in various commercial applications.

Exemptions were made for 681 drone platforms having a total cost of $ 6.6 million. Of these, the US-made platforms had the highest value of $ 1.9 million, while the China-made platforms had a value of $ 0.8 million.

Restraint: Lack of Air Traffic Management and Safety and Security Issues

According to the Air Traffic Control Association (ATCA) (US), the limited use of small drones in civil airspace is creating a hindrance to market growth in the US.

Presently, commercial small drones are prohibited from flying in civil airspace except for certain companies who have received exemptions to conduct tests or demonstration flights. Another major hurdle restraining the market growth is lack of confidence in secure and effective amalgamation of small drones with existing air traffic systems. Small drones work under a closed loop with continuously evolving air traffic systems.

However, in the coming years, different types of small drones developed to carry out different types of operations are expected to evolve with their increased inventory levels, along with their enhanced characteristics and performance levels that are likely to impact air traffic operations across the globe. Presently, small drones are mostly used by militaries and security agencies. As such, their numbers are limited, and most countries allocate a certain amount of airspace for these small drones.

The appropriate analysis of the impact of allowing small drones in civilian airspace is expected to improve air traffic management in the future, thereby allowing allocation of selected restricted airspace for small drones used in civil & commercial applications.

Opportunity: High Investment by Governments Defense Forces, and Key Companies

Investments in the drone industry have been increasing drastically; during the COVID-19 pandemic (2020 and 2021), drone technology received increased attention due to its increased applications.

Drone services received significant investments, with passenger drones receiving the highest investments in 2021. Drone delivery-related start-ups such as Flirtey Inc. (US) and Matternet, Inc. (US) received investments from venture capital.

Flirtey Inc. received a total of $ 16.2 million with the last round in October 2020, whereas Matternet, Inc. received $ 31.1 million with the last round in January 2020. Such investments will help drone logistics and transportation companies to increase the operative efficiency of first - and last-mile logistics networks.

Challenge: Lack of Sustainable Power Sources to Improve Endurance of Small Drones

Energy consumption is one of the most important challenges facing small drones. Usually, small drones are battery-powered. Small drone batteries are used for small drone hovering, wireless communications, data processing, and image analysis.

One of the most significant challenges faced by manufacturers of small drones is their inability to test energy limits, both in terms of endurance as well as the ability to deliver the required amount of energy to different payloads, such as radar and laser among others. In recent years, extensive research has been undertaken on the development of multi-day plus endurance drones. However, such efforts have failed due to the lack of sustainable power sources.

Some major companies, such as Airbus, have been trying to implement solar energy along with electricity to power drones for ISR missions for a long period of time, but it is still in the testing and feasibility stage. This acts as a challenge to the growth of the small drone market.

Small Drone Market Categorization

This research report categorizes the small drone market based on platform, type, application, mode of operation, power source, and region

Small Drone Market By Platform

-

Civil & Commercial

- Micro (250 g - 2 kg)

- Small (2 kg - 25 kg)

-

Defense & Government

- Nano (<25 g)

- Micro (25 g - 5 kg)

- Mini (5 kg - 150 kg)

Small Drone Industry By Type

-

Fixed Wing

- CTOL

- VTOL

-

Rotary Wing

- Single

- Multi

- Bicopters

- Tricopters

- Quadcopters

- Hexacopters

- Octocopters

- Hybrid

Small Drone Industry By Application

-

Military

- UCAV

- ISR

- Delivery

-

Commercial

- Patient Transport

- Inspection & Monitoring

- Remote Sensing

- Surveying & Mapping

- Product Delivery

- Aerial Imaging

- Industrial Warehousing

- Others

-

Government & Law

- Border Management

- Traffic Monitoring

- Firefighting & Disaster Management

- Search & Rescue

- Police Operations & Investigation

- Maritime Security

- Consumer

Small Drone Industry By Mode of Operation

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

Small Drone Industry By Power Source

- Fuel Powered

-

Battery Powered

- Fuel Cell

- Lithium-ion

- NIckel

Small Drone Industry By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments in Small Drone Market

- In July 2022, Textron Inc introduced its newly developed Aerosonde® Mk. 4.8 Hybrid Quad (HQ) SUAS. It is mainly designed to meet the needs of army ISR missions. Hybrid quadrotor technology is used to accomplish VTOL.

- In June 2022, DJI launched DJI RS 3 and DJI RS 3 Pro, which incorporate a range of new features to get filmmakers up and running as quickly as possible. A redesigned axes-locking system means that the process is now automated. By simply turning on the gimbal, the automated axis locks release and unfold the gimbal, allowing the operator to get started in seconds.

- In May 2022, DJI introduced its newly developed ultra-lightweight camera drone DJI Mini 3 Pro, which weighs less than 249g

- In February, Elbit Systems launched its updated hybrid version of Skylark 3. The new Skylark 3 Hybrid comprises an electric motor and the NW-44 multi-fuel ICE.

- In October 2021, Teledyne FLIR Defense, part of Teledyne FLIR LLC, announced the launch of the ION M640x tactical Unmanned Aerial System (UAS). The designed, developed, and manufactured UAS builds on the capabilities of the ION M440 (a Blue sUAS) and will provide military and other government customers with best-in-class capabilities for their unique missions.

Frequently Asked Questions (FAQs):

What is the Current Size of the Small Drone Market?

The small drone market is projected to grow from $ 3.8 billion in 2022 to $ 6.2 Billion by 2027, at a CAGR of 10.1% from 2022 to 2027.

Who Are the Winners in the Small Drone Market?

DJI (China), Parrot Drone SAS (France), Israel Aerospace Industry Ltd. (Israel), AeroVironment, Inc. (US), and Lockheed Martin Corporation (US)

What Are Some of the Technological Advancements in the Market?

Several technological advancements have been taking place such as microturbine engine-powered drones, high-alti tude pseudo-satellite (HAPS), aerial target drones, inspection drones for confined spaces.

Signals intelligence (SIGINT) is “a category of intelligence comprising either individually or in combination all communications intelligence, electronic intelligence, and foreign instrumentation signals intelligence, however transmitted

What Are the Factors Driving the Growth of the Market?

Surge in adoption for civil and commercial applications, Rising procurement for military applications like ISR, Supportive government regulations and initiatives, and Growing demand for small patrolling drones for marine border security

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 SMALL DRONE INDUSTRY: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 SMALL DRONE INDUSTRY SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 CURRENCY CONSIDERED

1.8 USD EXCHANGE RATES

1.9 SUMMARY OF CHANGES

FIGURE 2 SMALL DRONE INDUSTRY TO GROW AT LOWER RATE COMPARED TO PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.3 SUPPLY-SIDE INDICATORS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Regional split of small drone market

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISKS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 8 CIVIL & COMMERCIAL SEGMENT TO LEAD MARKET

FIGURE 9 COMMERCIAL SEGMENT TO DOMINATE MARKET

FIGURE 10 ROTARY-WING SEGMENT TO REGISTER HIGHEST CAGR

FIGURE 11 OPTIONALLY PILOTED SEGMENT TO HOLD LARGEST SHARE

FIGURE 12 BATTERY-OPERATED SEGMENT TO HOLD DOMINANT SHARE

FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMALL DRONE MARKET

FIGURE 14 INCREASING GOVERNMENT FUNDING TO DRIVE MARKET

4.2 SMALL DRONE MARKET, BY CIVIL & COMMERCIAL

FIGURE 15 MINI DRONE SEGMENT TO LEAD DURING FORECAST PERIOD

4.3 SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT

FIGURE 16 MICRO SEGMENT TO DOMINATE DURING FORECAST PERIOD

4.4 SMALL DRONE MARKET, BY COMMERCIAL

FIGURE 17 INSPECTION & MONITORING SEGMENT HOLD LARGEST SHARE DURING FORECAST PERIOD

4.5 SMALL DRONE MARKET, BY MILITARY

FIGURE 18 ISR SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4.6 SMALL DRONE MARKET, BY GOVERNMENT & LAW

FIGURE 19 BORDER MANAGEMENT SEGMENT TO LEAD DURING FORECAST PERIOD

4.7 SMALL DRONE MARKET, BY FIXED WING

FIGURE 20 CTOL SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

4.8 SMALL DRONE MARKET, BY ROTARY WING

FIGURE 21 MULTIROTOR SEGMENT TO DOMINATE DURING FORECAST PERIOD

4.9 SMALL DRONE ROTARY WING MARKET, BY MULTIROTOR

FIGURE 22 QUADCOPTER SEGMENT TO LEAD DURING FORECAST PERIOD

4.10 SMALL DRONE MARKET, BY BATTERY-OPERATED

FIGURE 23 LITHIUM-ION SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 SMALL DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surge in adoption for civil and commercial applications

5.2.1.2 Rising procurement for military applications like ISR

TABLE 2 COUNTRIES USING LOITERING MUNITION

5.2.1.3 Supportive government regulations and initiatives

TABLE 3 COMMERCIAL INDUSTRIES EXEMPTED BY FAA

5.2.1.4 Growing demand for small patrolling drones for marine border security

5.2.2 RESTRAINTS

5.2.2.1 Lack of air traffic management and safety and security issues

5.2.2.2 Limited certified drone operators

5.2.2.3 Stringent regulations on use in civilian areas

TABLE 4 RESTRICTIONS IMPOSED ON SMALL DRONES IN VARIOUS COUNTRIES

5.2.3 OPPORTUNITIES

5.2.3.1 High investments by governments, defense forces, and key players

FIGURE 25 INVESTMENTS IN DRONE INDUSTRY, 2011–2021 (USD MILLION)

5.2.3.2 Increased deployment for aerial remote sensing

5.2.3.3 Growing use in providing wireless coverage

5.2.3.4 Growing adoption for real-time traffic monitoring

5.2.4 CHALLENGES

5.2.4.1 Lack of sustainable power sources to improve endurance of drones

TABLE 5 ENDURANCE-BASED MAPPING OF POWER SOURCES

5.2.4.2 Severe weather conditions

5.2.4.3 Possible threats to safety and violation of privacy

5.3 SMALL DRONE MARKET ECOSYSTEM

5.3.1 PLATFORM MANUFACTURERS

5.3.2 SUBSYSTEM MANUFACTURERS

5.3.3 SERVICE PROVIDERS

5.3.4 SOFTWARE PROVIDERS

5.3.5 MISCELLANEOUS

FIGURE 26 SMALL DRONE MARKET ECOSYSTEM MAP

TABLE 6 SMALL DRONE MARKET ECOSYSTEM

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMALL DRONE MARKET

FIGURE 27 REVENUE SHIFT IN SMALL DRONE MARKET

5.5 TECHNOLOGY ANALYSIS

5.5.1 AI IN SMALL DRONES

TABLE 7 COMPANIES WORKING ON DEVELOPMENT OF DRONE SOFTWARE WITH AI

TABLE 8 COMPANIES WORKING ON DEVELOPMENT OF DRONE EQUIPMENT WITH AI

5.5.2 LIDAR DRONES

TABLE 9 USE OF DRONES IN AGRICULTURE

5.6 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 SMALL DRONE MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 29 SMALL DRONE MARKET: PORTER’S FIVE FORCE ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS (%)

5.8.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

TABLE 12 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

5.9 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 13 SMALL DRONE MARKET: CONFERENCES & EVENTS

5.10 TRADE DATA ANALYSIS

TABLE 14 IMPORT AND EXPORT STATISTICS FOR SMALL DRONES

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 DRONE REGULATION AND APPROVALS FOR COMMERCIAL SECTOR: BY COUNTRY

5.11.2 NORTH AMERICA

5.11.2.1 US

TABLE 21 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

5.11.2.2 Canada

TABLE 22 CANADA: RULES AND GUIDELINES FOR OPERATION OF DRONES

5.11.3 EUROPE

5.11.3.1 UK

TABLE 23 UK: RULES AND GUIDELINES BY CAA FOR OPERATION OF DRONES

5.11.3.2 Germany

TABLE 24 GERMANY: RULES AND GUIDELINES FOR OPERATION OF DRONES

5.11.3.3 France

TABLE 25 FRANCE: RULES AND GUIDELINES FOR OPERATION OF DRONES

TABLE 26 DRONE REGULATIONS, BY COUNTRY

5.12 OPERATIONAL DATA

FIGURE 32 ENTERPRISE DRONE UNITS SHIPPED, 2014–2021 (THOUSAND)

FIGURE 33 ARMED DRONES ACQUIRED, USED, AND DEVELOPED BY VARIOUS COUNTRIES FROM 2000 TO 2020

5.13 PRICING ANALYSIS

5.13.1 ASP OF SMALL DRONES AND THEIR COMPONENTS

TABLE 27 ASP OF SMALL DRONES AND THEIR COMPONENTS, 2020–2021

6 INDUSTRY TRENDS (Page No. - 106)

6.1 INTRODUCTION

6.2 EMERGING TECHNOLOGY TRENDS

6.2.1 MICROTURBINE ENGINE-POWERED DRONES

6.2.2 HIGH-ALTITUDE PSEUDO-SATELLITE (HAPS)

6.2.3 AERIAL TARGET DRONES

6.2.4 DRONE MANUFACTURING USING ADVANCED MATERIALS

FIGURE 34 MULTIFUNCTIONAL MATERIALS USED IN MANUFACTURING OF SMALL DRONES

6.2.5 INSPECTION DRONES FOR CONFINED SPACES

6.2.6 SMALL DRONE SWARM TECHNOLOGY

6.2.7 SYNTHETIC APERTURE RADAR (SAR)

6.2.8 MULTI-SENSOR DATA FUSION FOR SMALL DRONE NAVIGATION

6.2.9 SPY DRONES

6.3 USE CASE ANALYSIS

6.3.1 AEROVIRONMENT’S MARITIME INITIATIVE

TABLE 28 AEROVIRONMENT UAS FOR MARITIME COUNTER-TRAFFICKING OPERATIONS

6.3.2 CARGO DRONE FIELD TESTS IN AMAZON FOREST IN PERU

TABLE 29 FIELD TESTS USING CARGO DRONES TO DELIVER VACCINES AND BLOOD SAMPLES

6.3.3 MAPPING CANYONS OF ANCIENT NATIONAL MONUMENT IN COLORADO, US

TABLE 30 MAPPING CANYONS OF ANCIENT NATIONAL MONUMENT

6.4 SMALL DRONE SOFTWARE

TABLE 31 SMALL DRONE-BASED SOFTWARE AND THEIR RECENT UPGRADE, 2016–JULY 2022

6.5 SMALL DRONE MARKET: PATENT ANALYSIS

TABLE 32 KEY PATENTS, 2019–JULY 2022

7 SMALL DRONE MARKET, BY PLATFORM (Page No. - 118)

7.1 INTRODUCTION

FIGURE 35 CIVIL & COMMERCIAL SEGMENT TO GROW AT HIGHER CAGR FROM 2022 TO 2027

TABLE 33 SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 34 SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 CIVIL & COMMERCIAL

7.2.1 SMALL DRONES FOR INSPECTION & MONITORING AND AERIAL MAPPING

TABLE 35 CIVIL & COMMERCIAL: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 36 CIVIL & COMMERCIAL SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2.2 MICRO (250G–2KG)

7.2.3 SMALL (2KG–25KG)

7.3 DEFENSE & GOVERNMENT

7.3.1 SMALL DRONES FOR ISR

TABLE 37 DEFENSE & GOVERNMENT SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 38 DEFENSE & GOVERNMENT SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3.2 NANO (25G)

7.3.3 MICRO (25G–5KG)

7.3.4 MINI (5KG–150KG)

8 SMALL DRONE MARKET, BY APPLICATION (Page No. - 123)

8.1 INTRODUCTION

TABLE 39 SMALL DRONE MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 40 SMALL DRONE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 MILITARY

8.2.1 GROWING DEMAND FOR ADVANCED SURVEILLANCE

TABLE 41 MILITARY SMALL DRONE MARKET, BY APPLICATION TYPE, 2019–2021 (USD MILLION)

TABLE 42 MILITARY SMALL DRONE MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

8.2.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

8.2.3 UCAV

8.2.4 DELIVERY

8.3 COMMERCIAL

8.3.1 SMALL DRONES REQUIRED IN MANY INDUSTRIES

TABLE 43 COMMERCIAL SMALL DRONE MARKET, BY APPLICATION TYPE, 2019–2021 (USD MILLION)

TABLE 44 COMMERCIAL SMALL DRONE MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

8.3.2 INSPECTION & MONITORING

8.3.3 REMOTE SENSING

8.3.4 SURVEYING & MAPPING

8.3.5 PRODUCT DELIVERY

8.3.6 AERIAL IMAGING

8.3.7 INDUSTRIAL WAREHOUSING

8.3.8 OTHERS

8.4 GOVERNMENT & LAW ENFORCEMENT

8.4.1 ADOPTION OF SMALL DRONES FOR HOMELAND SECURITY

TABLE 45 GOVERNMENT & LAW ENFORCEMENT SMALL DRONE MARKET, BY APPLICATION TYPE, 2019–2021 (USD MILLION)

TABLE 46 GOVERNMENT & LAW ENFORCEMENT SMALL DRONE MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

8.4.2 BORDER MANAGEMENT

8.4.3 TRAFFIC MONITORING

8.4.4 FIREFIGHTING & DISASTER MANAGEMENT

8.4.5 SEARCH & RESCUE

8.4.6 POLICE OPERATIONS & INVESTIGATIONS

8.4.7 MARITIME SECURITY

8.5 CONSUMER

8.5.1 GROWING USE OF SMALL DRONES FOR RECREATIONAL ACTIVITIES

8.5.2 PROSUMERS

8.5.3 HOBBYISTS

9 SMALL DRONE MARKET, BY TYPE (Page No. - 133)

9.1 INTRODUCTION

FIGURE 37 FIXED-WING SEGMENT TO LEAD MARKET FROM 2022 TO 2027

TABLE 47 SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 48 SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 FIXED-WING

9.2.1 HIGH DEMAND DUE TO LONG-RANGE CAPABILITIES

TABLE 49 FIXED-WING SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 50 FIXED-WING SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2.2 CTOL

9.2.3 VTOL

9.3 ROTARY-WING

9.3.1 SURGED DEMAND IN COMMERCIAL AND MILITARY ISR APPLICATIONS

TABLE 51 ROTARY-WING SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 52 ROTARY-WING SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3.2 SINGLE ROTOR

9.3.3 MULTIROTOR

TABLE 53 MULTIROTOR SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 54 MULTIROTOR SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3.3.1 Bicopters

9.3.3.2 Tricopters

9.3.3.3 Quadcopters

9.3.3.4 Hexacopters

9.3.3.5 Octocopters

9.4 HYBRID

9.4.1 INCREASED ENDURANCE WITH HYBRID DESIGN

10 SMALL DRONE MARKET, BY MODE OF OPERATION (Page No. - 140)

10.1 INTRODUCTION

FIGURE 38 OPTIONALLY PILOTED SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2022 TO 2027

TABLE 55 SMALL DRONE MARKET, BY MODE OF OPERATION, 2019–2021 (USD MILLION)

TABLE 56 SMALL DRONE MARKET, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

10.2 REMOTELY PILOTED

10.2.1 INCREASED ADOPTION AS MAN-PORTABLE EQUIPMENT IN ARMIES

10.3 OPTIONALLY PILOTED

10.3.1 EXTENSIVE USE IN MILITARY AND COMMERCIAL APPLICATIONS

10.4 AUTONOMOUS

10.4.1 EFFICIENT IN SURVEYING INACCESSIBLE AREAS

11 SMALL DRONE MARKET, BY POWER SOURCE (Page No. - 144)

11.1 INTRODUCTION

FIGURE 39 BATTERY OPERATED SEGMENT TO REGISTER HIGHEST GROWTH FROM 2022 TO 2027

TABLE 57 SMALL DRONE MARKET, BY POWER SOURCE, 2019–2021 (USD MILLION)

TABLE 58 SMALL DRONE MARKET, BY POWER SOURCE, 2022–2027 (USD MILLION)

11.2 FUEL POWERED

11.2.1 LONGER FLIGHT TIME FOR DELIVERY APPLICATIONS

11.2.2 PISTON ENGINES

11.2.3 TURBO ENGINES

11.2.4 PULSEJETS

11.3 BATTERY OPERATED

11.3.1 HIGHER ENDURANCE AND REDUCED WEIGHT

TABLE 59 BATTERY OPERATED SMALL DRONE MARKET, BY BATTERY TYPE, 2019–2021 (USD MILLION)

TABLE 60 BATTERY OPERATED SMALL DRONE MARKET, BY BATTERY TYPE, 2022–2027 (USD MILLION)

11.3.2 LITHIUM-ION

11.3.3 FUEL CELL

11.3.4 NICKEL

12 REGIONAL ANALYSIS (Page No. - 148)

12.1 INTRODUCTION

FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE MARKET IN 2022

TABLE 61 SMALL DRONE MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 SMALL DRONE MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 INTRODUCTION

12.2.2 PESTLE ANALYSIS

FIGURE 41 NORTH AMERICA: SMALL DRONE MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: SMALL DRONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.3 US

12.2.3.1 Supportive government regulations

TABLE 73 US: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 74 US: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 US: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 76 US: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 77 US: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 78 US: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM 2022–2027 (USD MILLION)

TABLE 79 US: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 80 US: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Increased use of small drones in military

TABLE 81 CANADA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 82 CANADA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 CANADA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 84 CANADA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 85 CANADA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 86 CANADA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM 2022–2027 (USD MILLION)

TABLE 87 CANADA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 88 CANADA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 INTRODUCTION

12.3.2 PESTLE ANALYSIS

FIGURE 42 EUROPE: SMALL DRONE MARKET SNAPSHOT

TABLE 89 EUROPE: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 90 EUROPE: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 92 EUROPE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 94 EUROPE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 96 EUROPE: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 98 EUROPE: SMALL DRONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Continuous technological advancement in small drones

TABLE 99 UK: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 100 UK: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 101 UK: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 102 UK: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 103 UK: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 104 UK: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 105 UK: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 106 UK: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Government funding and UAV contracts

TABLE 107 GERMANY: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 108 GERMANY: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 109 GERMANY: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 110 GERMANY: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 111 GERMANY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 112 GERMANY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 113 GERMANY: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 GERMANY: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Growing investments by key players

TABLE 115 FRANCE: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 116 FRANCE: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 117 FRANCE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 118 FRANCE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 119 FRANCE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 120 FRANCE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 121 FRANCE: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 122 FRANCE: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Delivery of medicines using small drones

TABLE 123 ITALY: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 124 ITALY: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 125 ITALY: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 126 ITALY: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 127 ITALY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 128 ITALY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 129 ITALY: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 130 ITALY: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.7 RUSSIA

12.3.7.1 Focus on enhancing military capabilities

TABLE 131 RUSSIA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 132 RUSSIA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 133 RUSSIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 134 RUSSIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 135 RUSSIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 136 RUSSIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 137 RUSSIA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 138 RUSSIA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.8 SWEDEN

12.3.8.1 Large scope of small drones in healthcare

TABLE 139 SWEDEN: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 140 SWEDEN: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 141 SWEDEN: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 142 SWEDEN: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 143 SWEDEN: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 144 SWEDEN: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 145 SWEDEN: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 146 SWEDEN: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.9 REST OF EUROPE

TABLE 147 REST OF EUROPE: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 148 REST OF EUROPE: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 149 REST OF EUROPE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 150 REST OF EUROPE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 151 REST OF EUROPE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 152 REST OF EUROPE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 153 REST OF EUROPE: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 154 REST OF EUROPE: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 INTRODUCTION

12.4.2 PESTLE ANALYSIS

FIGURE 43 ASIA PACIFIC: SMALL DRONE MARKET SNAPSHOT

TABLE 155 ASIA PACIFIC: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: SMALL DRONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Constant innovations in drone technologies

TABLE 165 CHINA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 166 CHINA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 167 CHINA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 168 CHINA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 169 CHINA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 170 CHINA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 171 CHINA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 172 CHINA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Development of advanced weaponry to improve border security

TABLE 173 INDIA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 174 INDIA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 175 INDIA: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 176 INDIA: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 177 INDIA: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 178 INDIA: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 179 INDIA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 180 INDIA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.5 JAPAN

12.4.5.1 Growing modernization in drone designs

TABLE 181 JAPAN: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 182 JAPAN: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 183 JAPAN: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 184 JAPAN: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 185 JAPAN: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 186 JAPAN: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 187 JAPAN: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 188 JAPAN: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.6 AUSTRALIA

12.4.6.1 Surge in adoption of small drones for commercial applications

TABLE 189 AUSTRALIA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 190 AUSTRALIA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 191 AUSTRALIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 192 AUSTRALIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 193 AUSTRALIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 194 AUSTRALIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 195 AUSTRALIA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 196 AUSTRALIA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.7 SOUTH KOREA

12.4.7.1 Increase in defense budget and innovations

TABLE 197 SOUTH KOREA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 198 SOUTH KOREA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 199 SOUTH KOREA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 200 SOUTH KOREA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 201 SOUTH KOREA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 202 SOUTH KOREA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 203 SOUTH KOREA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 204 SOUTH KOREA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.8 REST OF ASIA PACIFIC

TABLE 205 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 211 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 INTRODUCTION

12.5.2 PESTLE ANALYSIS

FIGURE 44 MIDDLE EAST: SMALL DRONE MARKET SNAPSHOT

TABLE 213 MIDDLE EAST: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 214 MIDDLE EAST: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 215 MIDDLE EAST: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 216 MIDDLE EAST: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 217 MIDDLE EAST: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 218 MIDDLE EAST: SMALL DRONE MARKET FOR DEFENSE & GOVERNMENT PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 219 MIDDLE EAST: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 220 MIDDLE EAST: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 221 MIDDLE EAST SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 222 MIDDLE EAST SMALL DRONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.3 ISRAEL

12.5.3.1 Extensive small drone use in ISR applications

TABLE 223 ISRAEL: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 224 ISRAEL: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 225 ISRAEL: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 226 ISRAEL: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 227 ISRAEL: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 228 ISRAEL: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 229 ISRAEL: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 230 ISRAEL: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.4 UAE

12.5.4.1 Supportive government regulations

TABLE 231 UAE: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 232 UAE: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 233 UAE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 234 UAE: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 235 UAE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 236 UAE: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 237 UAE: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 238 UAE: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.5 TURKEY

12.5.5.1 High focus on border security

TABLE 239 TURKEY: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 240 TURKEY: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 241 TURKEY: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2019–2021 (USD MILLION)

TABLE 242 TURKEY: SMALL DRONE MARKET FOR CIVIL & COMMERCIAL PLATFORM, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

TABLE 243 TURKEY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 244 TURKEY: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 245 TURKEY: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 246 TURKEY: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.6 SAUDI ARABIA

12.5.6.1 Plans for procurement of small drones

TABLE 247 SAUDI ARABIA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 248 SAUDI ARABIA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 249 SAUDI ARABIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 250 SAUDI ARABIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 251 SAUDI ARABIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 252 SAUDI ARABIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 253 SAUDI ARABIA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 254 SAUDI ARABIA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.7 REST OF MIDDLE EAST

TABLE 255 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 257 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 258 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 259 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 260 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 261 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 262 REST OF MIDDLE EAST: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 INTRODUCTION

12.6.2 PESTLE ANALYSIS

FIGURE 45 LATIN AMERICA: SMALL DRONE MARKET SNAPSHOT

TABLE 263 LATIN AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 264 LATIN AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 265 LATIN AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 266 LATIN AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 267 LATIN AMERICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 268 LATIN AMERICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 269 LATIN AMERICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 270 LATIN AMERICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 271 LATIN AMERICA: SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 272 LATIN AMERICA: SMALL DRONE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Use of small drones in security and surveillance

TABLE 273 BRAZIL: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 274 BRAZIL: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 275 BRAZIL: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 276 BRAZIL: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 277 BRAZIL: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 278 BRAZIL: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 279 BRAZIL: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 280 BRAZIL: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6.4 MEXICO

12.6.4.1 Growing focus on homeland security

TABLE 281 MEXICO: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 282 MEXICO: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 283 MEXICO: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 284 MEXICO: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 285 MEXICO: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 286 MEXICO: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 287 MEXICO: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 288 MEXICO: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6.5 ARGENTINA

12.6.5.1 UAV regulations may be relaxed in future

TABLE 289 ARGENTINA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 290 ARGENTINA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 291 ARGENTINA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 292 ARGENTINA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 293 ARGENTINA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 294 ARGENTINA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6.6 REST OF LATIN AMERICA

TABLE 295 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 296 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 297 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 298 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 299 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 300 REST OF LATIN AMERICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.7 AFRICA

12.7.1 INTRODUCTION

12.7.2 PESTLE ANALYSIS

FIGURE 46 AFRICA: SMALL DRONE MARKET SNAPSHOT

TABLE 301 AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 302 AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 303 AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 304 AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 305 AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 306 AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 307 AFRICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 308 AFRICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 309 AFRICA: SMALL DRONE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 310 SMALL DRONE MARKET IN AFRICA, BY COUNTRY, 2022–2027 (USD MILLION)

12.7.3 SOUTH AFRICA

12.7.3.1 Increasing number of UAV contracts

TABLE 311 SOUTH AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 312 SOUTH AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 313 SOUTH AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 314 SOUTH AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 315 SOUTH AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 316 SOUTH AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 317 SOUTH AFRICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 318 SOUTH AFRICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.7.4 NIGERIA

12.7.4.1 Growing penetration of small drones in military

TABLE 319 NIGERIA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 320 NIGERIA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 321 NIGERIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 322 NIGERIA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 323 NIGERIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 324 NIGERIA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 325 NIGERIA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 326 NIGERIA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.7.5 REST OF AFRICA

TABLE 327 REST OF AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 328 REST OF AFRICA: SMALL DRONE MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 329 REST OF AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2019–2021 (USD MILLION)

TABLE 330 REST OF AFRICA: SMALL DRONE MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2022–2027 (USD MILLION)

TABLE 331 REST OF AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2019–2021 (USD MILLION)

TABLE 332 REST OF AFRICA: SMALL DRONE MARKET, BY DEFENSE & GOVERNMENT PLATFORM, 2022–2027 (USD MILLION)

TABLE 333 REST OF AFRICA: SMALL DRONE MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 334 REST OF AFRICA: SMALL DRONE MARKET, BY TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 244)

13.1 INTRODUCTION

13.2 COMPANY OVERVIEW

TABLE 335 KEY DEVELOPMENTS OF LEADING PLAYERS IN SMALL DRONE MARKET (2019–2021)

13.3 RANKING ANALYSIS OF KEY PLAYERS IN SMALL DRONE MARKET

13.4 REVENUE ANALYSIS

13.5 MARKET SHARE ANALYSIS

FIGURE 49 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

TABLE 336 SMALL DRONE MARKET: DEGREE OF COMPETITION

13.6 COMPETITIVE EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 50 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

13.7 START-UP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 STARTING BLOCKS

13.7.4 DYNAMIC COMPANIES

FIGURE 51 SMALL DRONE MARKET (START-UP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

13.7.4.1 Competitive benchmarking

TABLE 337 SMALL DRONE MARKET: KEY START-UPS/SMES

TABLE 338 SMALL DRONE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

TABLE 339 SMALL DRONE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (MAJOR PLAYERS)

13.8 COMPETITIVE SCENARIO

13.8.1 MARKET EVALUATION FRAMEWORK

13.8.2 RECENT DEVELOPMENTS

TABLE 340 PRODUCT LAUNCHES (2018–2022)

TABLE 341 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS (2018–2022)

TABLE 342 CERTIFICATION AND TESTING (2018–2022)

14 COMPANY PROFILES (Page No. - 266)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 DJI

TABLE 343 DJI: BUSINESS OVERVIEW

TABLE 344 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 345 DJI: PRODUCT LAUNCHES

TABLE 346 DJI: DEALS

14.2.2 PARROT DRONE SAS

TABLE 347 PARROT DRONE SAS: BUSINESS OVERVIEW

FIGURE 52 PARROT DRONE SAS: COMPANY SNAPSHOT

TABLE 348 PARROT DRONE SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 349 PARROT DRONE SAS: PRODUCT LAUNCHES

TABLE 350 PARROT DRONE SAS: DEALS

TABLE 351 PARROT DRONE SAS: OTHERS

14.2.3 NORTHROP GRUMMAN CORPORATION

TABLE 352 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 53 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 353 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 354 NORTHROP GRUMMAN CORPORATION: DEALS

14.2.4 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 355 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 54 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 356 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 357 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

TABLE 358 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

14.2.5 ISRAEL AEROSPACE INDUSTRIES LTD.

TABLE 359 ISRAEL AEROSPACE INDUSTRIES LTD: BUSINESS OVERVIEW

FIGURE 55 ISRAEL AEROSPACE INDUSTRIES LTD: COMPANY SNAPSHOT

TABLE 360 ISRAEL AEROSPACE INDUSTRIES LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 361 ISRAEL AEROSPACE INDUSTRIES LTD: DEALS

TABLE 362 ISRAEL AEROSPACE INDUSTRIES LTD: OTHERS

14.2.6 TELEDYNE FLIR LLC

TABLE 363 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

FIGURE 56 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

TABLE 364 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 365 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

TABLE 366 TELEDYNE FLIR LLC: DEALS

TABLE 367 TELEDYNE FLIR LLC: OTHERS

14.2.7 AEROVIRONMENT, INC.

TABLE 368 AEROVIRONMENT, INC: BUSINESS OVERVIEW

FIGURE 57 AEROVIRONMENT, INC: COMPANY SNAPSHOT

TABLE 369 AEROVIRONMENT, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 370 AEROVIRONMENT, INC: NEW PRODUCT LAUNCHES

TABLE 371 AEROVIRONMENT, INC: DEALS

14.2.8 THE BOEING COMPANY

TABLE 372 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 58 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 373 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 374 THE BOEING COMPANY: DEALS

14.2.9 TEXTRON INC.

TABLE 375 TEXTRON INC: BUSINESS OVERVIEW

FIGURE 59 TEXTRON INC: COMPANY SNAPSHOT

TABLE 376 TEXTRON INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 377 TEXTRON INC: PRODUCT LAUNCHES

TABLE 378 TEXTRON INC: DEALS

14.2.10 LOCKHEED MARTIN CORPORATION

TABLE 379 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

TABLE 60 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 380 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 381 LOCKHEED MARTIN CORPORATION: DEALS

14.2.11 BAE SYSTEMS PLC

TABLE 382 BAE SYSTEMS PLC: BUSINESS OVERVIEW

TABLE 61 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 383 BAE SYSTEMS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 384 BAE SYSTEMS PLC: PRODUCT LAUNCHES

TABLE 385 BAE SYSTEMS PLC: DEALS

14.2.12 THALES GROUP

TABLE 386 THALES GROUP: BUSINESS OVERVIEW

TABLE 62 THALES GROUP: COMPANY SNAPSHOT

TABLE 387 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 388 THALES GROUP: OTHERS

14.2.13 ELBIT SYSTEMS LTD.

TABLE 389 ELBIT SYSTEMS LTD: BUSINESS OVERVIEW

TABLE 63 ELBIT SYSTEMS LTD: COMPANY SNAPSHOT

TABLE 390 ELBIT SYSTEMS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 391 ELBIT SYSTEMS LTD: PRODUCT LAUNCHES

TABLE 392 ELBIT SYSTEMS LTD: DEALS

14.2.14 SAAB AB

TABLE 393 SAAB AB: BUSINESS OVERVIEW

TABLE 64 SAAB AB: COMPANY SNAPSHOT

TABLE 394 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 395 SAAB AB: PRODUCT LAUNCHES

14.2.15 AERONAUTICS LTD

TABLE 396 AERONAUTICS LTD: BUSINESS OVERVIEW

TABLE 397 AERONAUTICS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 398 AERONAUTICS LTD: DEALS

TABLE 399 AERONAUTICS LTD: OTHERS

14.3 OTHER PLAYERS

14.3.1 DELAIR

TABLE 400 DELAIR: COMPANY OVERVIEW

14.3.2 MICRODRONES

TABLE 401 MICRODRONES: COMPANY OVERVIEW

14.3.3 TURKISH AEROSPACE INDUSTRIES

TABLE 402 TURKISH AEROSPACE INDUSTRIES: COMPANY OVERVIEW

14.3.4 SHIELD AI

TABLE 403 SHIELD AI: COMPANY OVERVIEW

14.3.5 INSTANTEYE ROBOTICS

TABLE 404 INSTANTEYE ROBOTICS: COMPANY OVERVIEW

14.3.6 FLYABILITY

TABLE 405 FLYABILITY: COMPANY OVERVIEW

14.3.7 AUTEL ROBOTICS

TABLE 406 AUTEL ROBOTICS: COMPANY OVERVIEW

14.3.8 SKYDIO, INC.

TABLE 407 SKYDIO, INC: COMPANY OVERVIEW

14.3.9 VOLANSI, INC.

TABLE 408 VOLANSI, INC.: COMPANY OVERVIEW

14.3.10 DYNETICS, INC.

TABLE 409 DYNETICS, INC.: COMPANY OVERVIEW

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 329)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study on the small drone market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the small drone market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the small drone market included financial statements of companies offering delivery drones software, drone transportation and logistics services, and transportation and logistics solution providers, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the small drone market, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, solution, technologies, and regions. Stakeholders from the demand side include logistics companies, end consumers, healthcare industry, and quick-service restaurants who are willing to adopt drone delivery by participating in various trials. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution, adoption by type, platform, mode of operation, and deployment segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

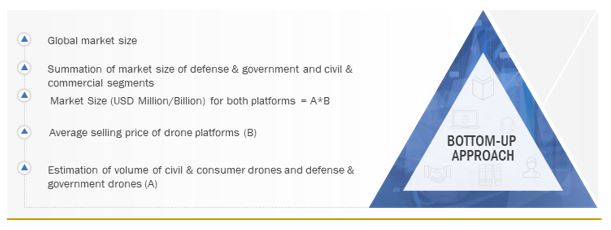

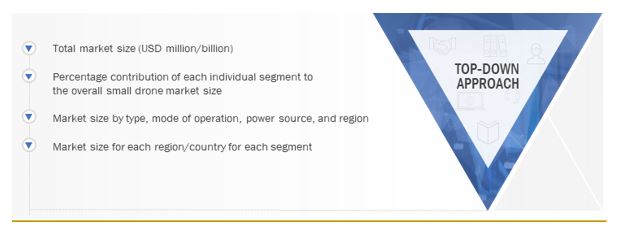

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the small drone market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-Down approach

Data Triangulation

After arriving at the overall size of the small drone market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments, data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the small drone market based on platform, application, type, mode of operation, power source, and region

- To forecast sizes of various segments of the small drone market with respect to 6 major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the small drone market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the small drone market

- To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the small drone market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Small Drone Market