TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 1 SMART CITIES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

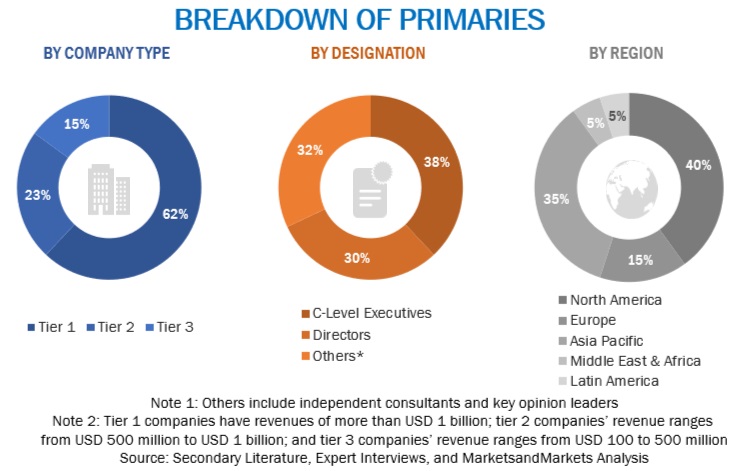

2.1.2 PRIMARY DATA

TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

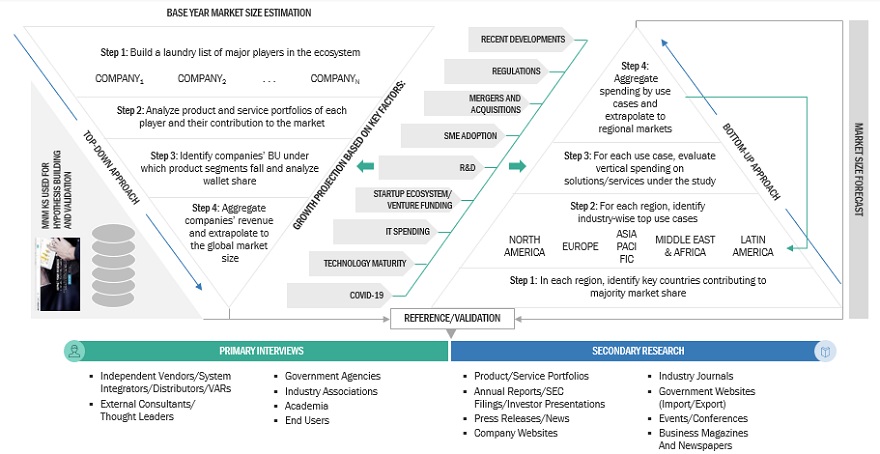

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF FOCUS AREAS OF MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): SMART CITIES MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 6 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 7 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STUDY ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 62)

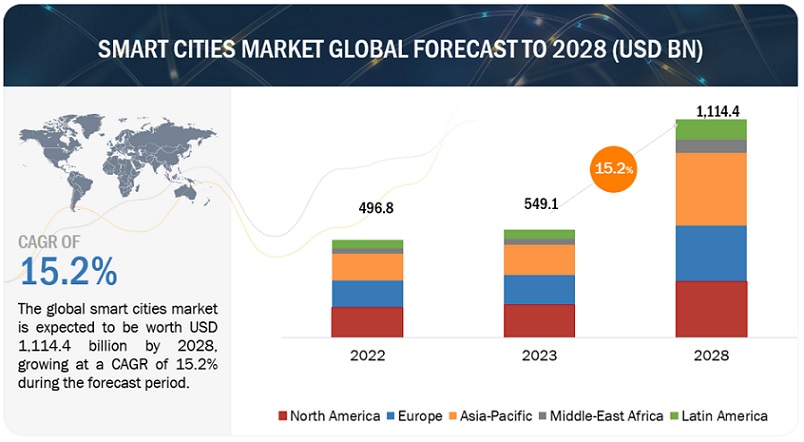

FIGURE 8 SMART CITIES MARKET, 2020-2027

FIGURE 9 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2022

FIGURE 10 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS SMART CITIES MARKET

FIGURE 11 INCREASED USE OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING, GROWING URBANIZATION, AND RESOURCE UTILIZATION TO DRIVE MARKET GROWTH

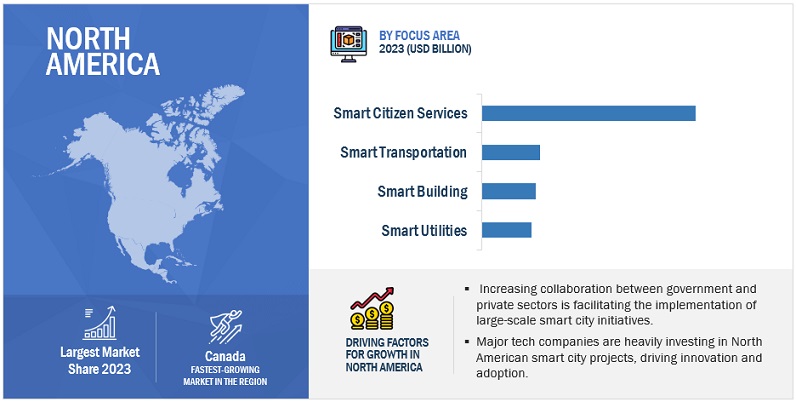

4.2 MARKET IN NORTH AMERICA, BY FOCUS AREA AND COUNTRY

FIGURE 12 SMART CITIZEN SERVICES AND UNITED STATES TO ACCOUNT FOR LARGEST SHARES IN MARKET IN 2022

4.3 ASIA PACIFIC MARKET, 2022

FIGURE 13 SMART CITIZEN SERVICES AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2022

4.4 MARKET, BY COUNTRY

FIGURE 14 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART CITIES MARKET

5.2.1 DRIVERS

5.2.1.1 Artificial intelligence and machine learning to accelerate development of smart cities

5.2.1.2 Growing urbanization to drive adoption of smart city solutions

FIGURE 16 GLOBAL URBAN POPULATION

5.2.1.3 Need for efficient management and utilization of resources

5.2.1.4 Demand for fast and efficient transport

5.2.1.5 Public safety concerns to accelerate smart city adoption

5.2.1.6 Need for healthy environment with efficient energy consumption

FIGURE 17 GLOBAL CO2 EMISSIONS BY SECTOR, 2020

5.2.2 RESTRAINTS

5.2.2.1 Privacy and security concerns

5.2.2.2 High cost of implementation

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in AI, cloud, IoT, and analytics technologies

5.2.3.2 Rise of 5G

FIGURE 18 PERCENTAGE OF GLOBAL CONNECTIONS IN 2018 AND 2023

5.2.3.3 Use of drones to enforce compliance during pandemics

5.2.4 CHALLENGES

5.2.4.1 Absence of appropriate infrastructure in emerging economies

FIGURE 19 STATE OF MOBILE INTERNET CONNECTIVITY, BY REGION, 2020

5.2.4.2 Lack of knowledge among people about smart cities

5.2.4.3 Disruption in logistics and supply chains

5.3 CUMULATIVE GROWTH ANALYSIS

5.4 ECOSYSTEM

TABLE 4 SMART CITIES MARKET: ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES MODEL

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 COMPETITIVE RIVALRY

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS ON BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

5.7.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.8 TECHNOLOGY ANALYSIS

5.8.1 INTRODUCTION

5.8.1.1 AI and ML

5.8.1.2 IoT

5.8.1.3 Big data analytics

5.8.1.4 5G

5.8.2 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 22 REVENUE SHIFT FOR SMART CITIES MARKET

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2019–2022

5.9.3 INNOVATION AND PATENT APPLICATION

FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY BETWEEN 2019 TO 2022

5.9.3.1 Top applicants

FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

5.10 PRICING ANALYSIS

TABLE 9 PRICING ANALYSIS FOR SMART CITIES

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1: ABB HELPED FASTNED EXPAND ITS EV FAST CHARGE NETWORK ACROSS EUROPE

5.11.2 CASE STUDY 2: HONEYWELL ENABLED EFFICIENT FLIGHT ROUTING FOR NEWARK LIBERTY INTERNATIONAL AIRPORT

5.11.3 CASE STUDY 3: BANE NOR SELECTED THALES TO PROVIDE NEXT-GENERATION NATIONWIDE TRAFFIC MANAGEMENT SYSTEM

5.11.4 CASE STUDY 4: CURTIN UNIVERSITY ADOPTED HITACHI INTERNET OF THINGS SOLUTION TO IMPLEMENT SMART CAMPUS

5.11.5 CASE STUDY 5: HUAWEI HELPED QINGHAI-TIBET RAILWAY IMPROVE SURVEILLANCE EFFICIENCY

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

5.12.1 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2022–2023

5.13 REGULATORY COMPLIANCES

6 SMART CITIES MARKET, BY FOCUS AREA (Page No. - 92)

6.1 INTRODUCTION

FIGURE 25 SMART TRANSPORTATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 11 MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

7 SMART CITIES MARKET, BY SMART TRANSPORTATION (Page No. - 94)

7.1 INTRODUCTION

TABLE 12 SMART TRANSPORTATION MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 13 SMART TRANSPORTATION MARKET, BY REGION, 2022–2027 (USD BILLION)

7.1.1 SMART TRANSPORTATION: MARKET DRIVERS

7.2 COMPONENT

7.2.1 INCREASING PRESENCE OF SMART TECHNOLOGIES IN SMART TRANSPORTATION

TABLE 14 SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 15 SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

7.2.2 SOLUTIONS

FIGURE 26 PASSENGER INFORMATION MANAGEMENT SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 16 SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 17 SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

7.2.2.1 Smart ticketing

7.2.2.2 Traffic management

FIGURE 27 PARKING MANAGEMENT SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 TRAFFIC MANAGEMENT: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 19 TRAFFIC MANAGEMENT: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

7.2.2.2.1 Parking management

7.2.2.2.2 Traffic surveillance

7.2.2.3 Passenger information

7.2.2.4 Connected logistics

7.2.2.5 Other smart transportation solutions

7.2.3 SERVICES

FIGURE 28 INFRASTRUCTURE MONITORING AND MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 21 SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

7.2.3.1 Consulting

7.2.3.2 Deployment and integration

7.2.3.3 Infrastructure monitoring and management

7.3 TYPE

7.3.1 RAPID INCREASE IN URBAN DEMOGRAPHICS AND GROWING ENVIRONMENTAL CONCERNS

FIGURE 29 RAILWAYS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 23 SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

7.3.2 ROADWAYS

7.3.3 RAILWAYS

7.3.4 AIRWAYS

8 SMART CITIES MARKET, BY SMART BUILDING (Page No. - 108)

8.1 INTRODUCTION

8.1.1 SMART BUILDING: MARKET DRIVERS

TABLE 24 SMART BUILDINGS MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 25 SMART BUILDINGS MARKET, BY REGION, 2022–2027 (USD BILLION)

8.2 COMPONENT

8.2.1 INCREASING DEMAND FOR ENERGY-SAVING SOLUTIONS AND SERVICES

TABLE 26 SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 27 SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

8.2.2 SOLUTIONS

FIGURE 30 ENERGY MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 29 SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

8.2.2.1 Building infrastructure management

TABLE 30 BUILDING INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 31 BUILDING INFRASTRUCTURE MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

8.2.2.1.1 Parking management system

8.2.2.1.2 Smart water management system

8.2.2.1.3 Elevators and escalators management system

8.2.2.2 Security and Emergency Management

TABLE 32 SECURITY AND EMERGENCY MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 33 SECURITY AND EMERGENCY MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

8.2.2.2.1 Access control system

8.2.2.2.2 Video surveillance system

8.2.2.2.3 Safety system

8.2.2.3 Energy management

TABLE 34 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 35 ENERGY MANAGEMENT: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

8.2.2.3.1 HVAC control systems

8.2.2.3.2 Lighting systems

8.2.2.4 Network management

8.2.2.5 Integrated workplace management system

8.2.3 SERVICES

FIGURE 31 DEPLOYMENT AND INTEGRATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 36 SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 37 SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

8.2.3.1 Consulting

8.2.3.2 Deployment and integration

8.2.3.3 Infrastructure monitoring and management

8.3 TYPE

8.3.1 INCREASED NEED FOR ENERGY-EFFICIENT LIGHTING AND HVAC CONTROL SYSTEMS

FIGURE 32 INDUSTRIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 39 SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

8.3.2 RESIDENTIAL

8.3.3 COMMERCIAL

8.3.4 INDUSTRIAL

9 SMART CITIES MARKET, BY SMART UTILITY (Page No. - 121)

9.1 INTRODUCTION

TABLE 40 SMART UTILITIES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 41 SMART UTILITIES MARKET, BY REGION, 2022–2027 (USD BILLION)

9.1.1 SMART UTILITY: MARKET DRIVERS

9.2 COMPONENT

9.2.1 DIGITAL TRANSFORMATION IN UTILITY SECTOR TO DRIVE MARKET

TABLE 42 SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 43 SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

9.2.2 SOLUTIONS

FIGURE 33 METER DATA ANALYTICS SYSTEM SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 44 SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 45 SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

9.2.2.1 Advanced metering infrastructure

TABLE 46 ADVANCED METERING INFRASTRUCTURE: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 47 ADVANCED METERING INFRASTRUCTURE: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

9.2.2.2 Meter data management

9.2.2.2.1 Meter data analytics

9.2.2.2.2 Smart meters

9.2.2.2.3 Other solutions

9.2.2.3 Distribution management system

9.2.2.4 Substation automation

9.2.2.5 Other smart utilities solutions

9.2.3 SERVICES

FIGURE 34 INFRASTRUCTURE MONITORING AND MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 48 SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 49 SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

9.2.3.1 Consulting

9.2.3.2 Deployment and integration

9.2.3.3 Infrastructure monitoring and management

9.3 TYPE

9.3.1 INCREASING ADOPTION OF CLOUD-BASED SOLUTIONS

FIGURE 35 WATER SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 50 SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 51 SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

9.3.2 ENERGY

9.3.3 GAS

9.3.4 WATER

9.3.5 OTHER TYPES

10 SMART CITIES MARKET, BY SMART CITIZEN SERVICE (Page No. - 134)

10.1 INTRODUCTION

FIGURE 36 SMART HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 52 SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 53 SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 54 SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 55 SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.1.1 SMART CITIZEN SERVICE: MARKET DRIVERS

10.2 SMART HEALTHCARE

10.2.1 GROWING DIGITALIZATION, INCREASING CONNECTIVITY, AND INNOVATION TO DRIVE MARKET

TABLE 56 SMART HEALTHCARE: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 57 SMART HEALTHCARE: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 58 SMART HEALTHCARE: SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 59 SMART HEALTHCARE: SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2.2 MEDICAL DEVICES

10.2.3 SYSTEMS AND SOFTWARE

10.2.4 SERVICES

10.3 SMART EDUCATION

10.3.1 RISE IN ADOPTION OF MOBILE DEVICES AND USE OF INTERNET OF THINGS TO ENHANCE LEARNING EXPERIENCE

TABLE 60 SMART EDUCATION: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 61 SMART EDUCATION: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 62 SMART EDUCATION: SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 63 SMART EDUCATION: SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.3.2 SOLUTIONS

10.3.3 SERVICES

10.4 SMART PUBLIC SAFETY

10.4.1 RISE IN SECURITY BREACHES TO DRIVE DEMAND FOR SMART PUBLIC SAFETY SOLUTIONS

TABLE 64 SMART PUBLIC SAFETY: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 65 SMART PUBLIC SAFETY: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 66 SMART PUBLIC SAFETY: SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 67 SMART PUBLIC SAFETY: SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.4.2 SOLUTIONS

10.4.3 SERVICES

10.5 SMART STREET LIGHTING

10.5.1 SMART PARKING, TRAFFIC VIDEO SURVEILLANCE, AND AIR QUALITY MONITORING TO DRIVE DEMAND FOR SOLUTIONS

TABLE 68 SMART STREET LIGHTING: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 69 SMART STREET LIGHTING: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 70 SMART STREET LIGHTING: SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 71 SMART STREET LIGHTING: SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.6 EGOVERNANCE

10.6.1 ENHANCING TRANSPARENCY AND DECREASING BURDEN OF KEEPING PAPER RECORDS

TABLE 72 SMART EGOVERNANCE: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 73 SMART EGOVERNANCE: SMART CITIZEN SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 74 SMART EGOVERNANCE: SMART CITIZEN SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 75 SMART EGOVERNANCE: SMART CITIZEN SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

10.6.2 SOLUTIONS

10.6.3 SERVICES

11 SMART CITIES MARKET, BY REGION (Page No. - 145)

11.1 INTRODUCTION

FIGURE 37 MARKET: REGIONAL SNAPSHOT

TABLE 76 MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 77 MARKET, BY REGION, 2022–2027 (USD BILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 78 NORTH AMERICA: SMART CITIES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 79 NORTH AMERICA: MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

TABLE 80 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 81 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 82 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 83 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 84 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 85 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 86 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 87 NORTH AMERICA: SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 88 NORTH AMERICA: SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 89 NORTH AMERICA: SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 90 NORTH AMERICA: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 91 NORTH AMERICA: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 92 NORTH AMERICA: SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 93 NORTH AMERICA: SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 94 NORTH AMERICA: SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 95 NORTH AMERICA: SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 96 NORTH AMERICA: SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 97 NORTH AMERICA: SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 98 NORTH AMERICA: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 99 NORTH AMERICA: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 100 NORTH AMERICA: SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 101 NORTH AMERICA: SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 102 NORTH AMERICA: SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 103 NORTH AMERICA: SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 104 NORTH AMERICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 105 NORTH AMERICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 106 NORTH AMERICA: SMART CITIES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 107 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.2.2 US

11.2.2.1 Highest adoption of IoT to lead to market growth

11.2.3 CANADA

11.2.3.1 Increased investments in industrial development to boost market growth

11.3 EUROPE

TABLE 108 EUROPE: SMART CITIES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 109 EUROPE: MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

TABLE 110 EUROPE: SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 111 EUROPE: SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 112 EUROPE: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 113 EUROPE: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 114 EUROPE: SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 115 EUROPE: SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 116 EUROPE: SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 117 EUROPE: SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 118 EUROPE: SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 119 EUROPE: SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 120 EUROPE: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 121 EUROPE: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 122 EUROPE: SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 123 EUROPE: SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 124 EUROPE: SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 125 EUROPE: SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 126 EUROPE: SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 127 EUROPE: SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 128 EUROPE: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 129 EUROPE: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 130 EUROPE: SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 131 EUROPE: SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 132 EUROPE: SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 133 EUROPE: SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 134 EUROPE: SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 135 EUROPE: SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 136 EUROPE: SMART CITIES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 137 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.3.1 UK

11.3.1.1 Higher adoption rate of smart technologies to boost smart cities solutions’ growth

11.3.2 GERMANY

11.3.2.1 Increasing adoption of smart citizen services-related technologies to drive market

11.3.3 FRANCE

11.3.3.1 Strong hold on infrastructure development to drive market

11.3.4 SPAIN

11.3.4.1 Strong economy, high standard of living, and improved quality of life to boost market growth

11.3.5 ITALY

11.3.5.1 High adoption of latest technologies to boost market growth

11.3.6 NORDICS

11.3.6.1 Promoting sustainable development with smart cities solutions to drive market

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 138 ASIA PACIFIC: SMART CITIES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

TABLE 140 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 141 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 142 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 143 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 144 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 145 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 146 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 147 ASIA PACIFIC: SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 148 ASIA PACIFIC: SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 149 ASIA PACIFIC: SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 150 ASIA PACIFIC: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 151 ASIA PACIFIC: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 152 ASIA PACIFIC: SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 153 ASIA PACIFIC: SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 154 ASIA PACIFIC: SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 155 ASIA PACIFIC: SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 156 ASIA PACIFIC: SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 157 ASIA PACIFIC: SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 158 ASIA PACIFIC: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 159 ASIA PACIFIC: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 160 ASIA PACIFIC: SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 161 ASIA PACIFIC: SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 162 ASIA PACIFIC: SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 163 ASIA PACIFIC: SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 164 ASIA PACIFIC: SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 165 ASIA PACIFIC: SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 166 ASIA PACIFIC: SMART CITIES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.4.2 CHINA

11.4.2.1 Global leader in smart city initiatives and largest 5G market

11.4.3 JAPAN

11.4.3.1 Leader in smart city governance

11.4.4 SOUTH KOREA

11.4.4.1 Home to world’s first totally smart city

11.4.5 INDIA

11.4.5.1 Growing urban population to boost market growth

11.4.6 AUSTRALIA & NEW ZEALAND

11.4.6.1 Knowledge-based economy to offer growth opportunity for market

11.4.7 SOUTHEAST ASIA

11.4.7.1 Rapid urbanization to drive market

11.4.8 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 168 MIDDLE EAST & AFRICA: SMART CITIES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

TABLE 170 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 171 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 172 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 173 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 174 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 175 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 176 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 177 MIDDLE EAST & AFRICA: SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 178 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 179 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 180 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 181 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 182 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 183 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 184 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 185 MIDDLE EAST & AFRICA: SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 186 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 187 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 188 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 189 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 190 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 191 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 192 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 193 MIDDLE EAST & AFRICA: SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 194 MIDDLE EAST & AFRICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 195 MIDDLE EAST & AFRICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 196 MIDDLE EAST: SMART CITIES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 197 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 198 AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 199 AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.5.2 UAE

11.5.2.1 Cities to have environment-friendly business practices, paperless government services, and city-wide internet connectivity

11.5.3 KSA

11.5.3.1 Planning of AI-powered city with flying cabs and artificial moon to drive smart cities market

11.5.4 REST OF MIDDLE EAST

11.5.5 SOUTH AFRICA

11.5.5.1 Advancement in transportation and wifi projects to boost market growth

11.5.6 EGYPT

11.5.6.1 Developing people-centered digital policies

11.5.7 NIGERIA

11.5.7.1 Rising urbanization to raise demand for smart cities

11.5.8 REST OF AFRICA

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 200 LATIN AMERICA: SMART CITIES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

TABLE 201 LATIN AMERICA: SMART CITIES MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

TABLE 202 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 203 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 204 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 205 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 206 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 207 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 208 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 209 LATIN AMERICA: SMART TRANSPORTATION MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 210 LATIN AMERICA: SMART BUILDINGS MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 211 LATIN AMERICA: SMART BUILDINGS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 212 LATIN AMERICA: SMART BUILDINGS MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 213 LATIN AMERICA: SMART BUILDINGS MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 214 LATIN AMERICA: SMART BUILDINGS MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 215 LATIN AMERICA: SMART BUILDINGS MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 216 LATIN AMERICA: SMART BUILDINGS MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 217 LATIN AMERICA: SMART BUILDINGS MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 218 LATIN AMERICA: SMART UTILITIES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

TABLE 219 LATIN AMERICA: SMART UTILITIES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

TABLE 220 LATIN AMERICA: SMART UTILITIES MARKET, BY SOLUTION, 2016–2021 (USD BILLION)

TABLE 221 LATIN AMERICA: SMART UTILITIES MARKET, BY SOLUTION, 2022–2027 (USD BILLION)

TABLE 222 LATIN AMERICA: SMART UTILITIES MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 223 LATIN AMERICA: SMART UTILITIES MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 224 LATIN AMERICA: SMART UTILITIES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 225 LATIN AMERICA: SMART UTILITIES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 226 LATIN AMERICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 227 LATIN AMERICA: SMART CITIZEN SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 228 LATIN AMERICA: SMART CITIES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 229 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

11.6.2 BRAZIL

11.6.2.1 High foreign direct investment and presence of large enterprises to boost market growth

11.6.3 MEXICO

11.6.3.1 Surge in number of smart city projects to boost market growth

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 210)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK, 2019–2021

12.3 KEY MARKET DEVELOPMENTS

12.3.1 PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2021

12.3.2 DEALS

TABLE 231 DEALS, 2019–2021

12.3.3 OTHERS

TABLE 232 OTHERS, 2019–2021

12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 233 SMART CITIES MARKET: DEGREE OF COMPETITION

FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 42 HISTORICAL REVENUE ANALYSIS, 2017-2021

12.6 COMPANY EVALUATION MATRIX

12.7 COMPANY EVALUATION QUADRANT METHODOLOGY AND DEFINITIONS

TABLE 234 PRODUCT FOOTPRINT WEIGHTAGE

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

FIGURE 43 MARKET: COMPANY EVALUATION MATRIX (2022)

12.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 235 COMPANY PRODUCT FOOTPRINT

TABLE 236 APPLICATION FOOTPRINT

TABLE 237 INDUSTRY FOOTPRINT

TABLE 238 REGIONAL FOOTPRINT

12.9 COMPANY MARKET RANKING ANALYSIS

FIGURE 44 RANKING OF KEY PLAYERS IN SMART CITIES MARKET (2022)

12.10 STARUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 45 STARTUPS/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.10.1 PROGRESSIVE COMPANIES

12.10.2 RESPONSIVE COMPANIES

12.10.3 DYNAMIC COMPANIES

12.10.4 STARTING BLOCKS

FIGURE 46 MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2022

12.11 COMPETITIVE BENCHMARKING FOR SME/STARTUPS

TABLE 239 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 240 SMART CITIES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

13 COMPANY PROFILES (Page No. - 228)

13.1 MAJOR PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 SIEMENS

TABLE 241 SIEMENS: BUSINESS OVERVIEW

FIGURE 47 SIEMENS: COMPANY SNAPSHOT

TABLE 242 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 243 SIEMENS: PRODUCT LAUNCHES

TABLE 244 SIEMENS: DEALS

13.1.2 CISCO

TABLE 245 CISCO: BUSINESS OVERVIEW

FIGURE 48 CISCO: COMPANY SNAPSHOT

TABLE 246 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 247 CISCO: PRODUCT LAUNCHES

TABLE 248 CISCO: DEALS

13.1.3 HITACHI

TABLE 249 HITACHI: BUSINESS OVERVIEW

FIGURE 49 HITACHI: COMPANY SNAPSHOT

TABLE 250 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 251 HITACHI: PRODUCT LAUNCHES

TABLE 252 HITACHI: DEALS

TABLE 253 HITACHI: OTHERS

13.1.4 IBM

TABLE 254 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 255 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 IBM: PRODUCT LAUNCHES

TABLE 257 IBM: DEALS

13.1.5 MICROSOFT

TABLE 258 MICROSOFT: BUSINESS OVERVIEW

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

TABLE 259 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 260 MICROSOFT: DEALS

TABLE 261 MICROSOFT: OTHERS

13.1.6 SCHNEIDER ELECTRIC

TABLE 262 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 263 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 264 SCHNEIDER ELECTRIC: NEW SOLUTION/SERVICE LAUNCHES

TABLE 265 SCHNEIDER ELECTRIC: DEALS

13.1.7 HUAWEI

TABLE 266 HUAWEI: BUSINESS OVERVIEW

FIGURE 53 HUAWEI: COMPANY SNAPSHOT

TABLE 267 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 HUAWEI: PRODUCT LAUNCHES

TABLE 269 HUAWEI: DEALS

13.1.8 INTEL

TABLE 270 INTEL: BUSINESS OVERVIEW

FIGURE 54 INTEL: COMPANY SNAPSHOT

TABLE 271 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272 INTEL: PRODUCT LAUNCHES

TABLE 273 INTEL: DEALS

13.1.9 NEC

TABLE 274 NEC: BUSINESS OVERVIEW

FIGURE 55 NEC: COMPANY SNAPSHOT

TABLE 275 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 NEC: PRODUCT LAUNCHES

TABLE 277 NEC: DEALS

TABLE 278 NEC: OTHERS

13.1.10 ABB

TABLE 279 ABB: BUSINESS OVERVIEW

FIGURE 56 ABB: COMPANY SNAPSHOT

TABLE 280 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 281 ABB: PRODUCT LAUNCHES

TABLE 282 ABB: DEALS

TABLE 283 ABB: OTHERS

13.1.11 ERICSSON

TABLE 284 ERICSSON: BUSINESS OVERVIEW

FIGURE 57 ERICSSON: COMPANY SNAPSHOT

TABLE 285 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286 ERICSSON: DEALS

13.2 OTHER PLAYERS

13.2.1 ORACLE

13.2.2 FUJITSU

13.2.3 HONEYWELL

13.2.4 ACCENTURE

13.2.5 VODAFONE

13.2.6 AWS

13.2.7 THALES

13.2.8 SIGNIFY

13.2.9 KAPSCH

13.2.10 MOTOROLA

13.2.11 GE

13.2.12 GOOGLE

13.2.13 TCS

13.2.14 AT&T

13.2.15 NOKIA

13.2.16 SAMSUNG

13.2.17 SAP

13.2.18 TOMTOM

13.3 STARTUP/SMES

13.3.1 APPYWAY

13.3.2 KETOS

13.3.3 GAIA

13.3.4 TAKADU

13.3.5 FLAMENCOTECH

13.3.6 XENIUS

13.3.7 BRIGHT CITIES

13.3.8 MYADTECH

13.3.9 ZENCITY

13.3.10 IXDEN

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 297)

14.1 INTRODUCTION

14.1.1 LIMITATIONS

14.2 IOT IN SMART CITIES MARKET – GLOBAL FORECAST TO 2026

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 IoT in market, by offering

TABLE 287 IOT IN MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 288 IOT IN SMART CITES MARKET, BY OFFERING, 2021–2026 (USD BILLION)

14.2.2.2 IoT in market, by solution

TABLE 289 IOT IN MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 290 IOT IN MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

14.2.2.3 IoT in market, by service

TABLE 291 SERVICES: IOT IN MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 292 SERVICES: IOT IN SMART CITIES MARKET, BY TYPE, 2021–2026 (USD BILLION)

TABLE 293 PROFESSIONAL SERVICES: IOT IN MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 294 PROFESSIONAL SERVICES: IOT IN MARKET, BY TYPE, 2021–2026 (USD BILLION)

14.2.2.4 IoT in market, by application

TABLE 295 IOT IN MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 296 IOT IN MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

14.2.2.5 IoT in market, by region

TABLE 297 IOT IN MARKET, BY REGION, 2016–2020 (USD BILLION)

TABLE 298 IOT IN MARKET, BY REGION, 2021–2026 (USD BILLION)

14.3 SMART BUILDINGS MARKET — GLOBAL FORECAST TO 2026

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 Smart buildings market, by component

TABLE 299 SMART BUILDINGS MARKET, BY COMPONENT, 2017–2020 (USD BILLION)

TABLE 300 SMART BUILDINGS MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

14.3.2.2 Smart buildings market, by solution

TABLE 301 SMART BUILDING SOLUTIONS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 302 SMART BUILDING SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.3.2.3 Smart buildings market, by service

TABLE 303 SMART BUILDING SERVICES MARKET, BY TYPE, 2017–2020 (USD BILLION)

TABLE 304 SMART BUILDING SERVICES MARKET, BY TYPE, 2021–2026 (USD BILLION)

14.3.2.4 Smart buildings market, by building type

TABLE 305 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 306 SMART BUILDINGS MARKET, BY BUILDING TYPE, 2021–2026 (USD MILLION)

14.3.2.5 Smart buildings market, by region

TABLE 307 SMART BUILDINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 308 SMART BUILDINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

14.4 SMART CITY PLATFORMS MARKET – GLOBAL FORECAST TO 2026

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

14.4.2.1 Smart city platforms market, by offering

TABLE 309 SMART CITY PLATFORMS MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 310 SMART CITY PLATFORMS MARKET, BY OFFERING, 2021–2026 (USD BILLION)

14.4.2.2 Smart city platforms market, by delivery model

TABLE 311 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016–2020 (USD BILLION)

TABLE 312 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2021–2026 (USD BILLION)

14.4.2.3 Smart city platforms market, by region

TABLE 313 SMART CITY PLATFORMS MARKET, BY REGION, 2016–2020 (USD BILLION)

TABLE 314 SMART CITY PLATFORMS MARKET, BY REGION, 2021–2026 (USD BILLION)

15 APPENDIX (Page No. - 309)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Cities Market