Smart Factory Market by Component (Industrial Sensors, Industrial Robots, Industrial 3D Printers, Machine Vision Systems), Solution (SCADA, MES, Industrial Safety, PAM), Industry (Process Industry, Discrete Industry) and Region - Global Forecast to 2027

[293 Pages Report] The global smart factory market size is estimated to be USD 86.2 billion in 2022 and is projected to reach USD 140.9 billion by 2027, at a CAGR of 10.3%.

Growing emphasis on energy efficiency, resource optimization, and cost reduction in production operations; increasing demand for industrial robots; and rising demand for IoT and artificial intelligence in industrial environments are the major factors driving the growth of the smart factory industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Latest technological Trends in Smart Factory Market

Augmented Reality

Augmented reality enhances the perception and presentation of a real-life situation. It is created using technology to overlay digital information on an image of something that is being viewed through a compatible device, such as a smartphone camera, HMI, or any smart goggle. Usually, these devices are voice-controlled, making the wearer a hands-free user. The alignment of machine learning and physics-based modeling enables engineers to create an entire augmented reality (AR) experience that shows technicians in the factory the process to service the factory floor machine. Companies are increasingly using augmented reality (AR) on the shop floor of the factory to boost production activity and improve production processes.

The incorporation of augmented reality in industrial processes has boosted worker productivity.

Smart Factory Market Dynamics

DRIVERS: Increasing adoption of Industrial robots

Increasing miniaturization of sensors, growing investments in automation (in automotive, electrical & electronics, and metals & machinery industries), and rising demand for industrial robotics systems in developing countries are the factors driving the growth of the industrial robot market. Rising demand for automation across industries has increased the adoption of industrial robots in various industries. The growth of the industrial robots’ market can be attributed to the growth of the electronics industry and towering labor wages in manufacturing. This is expected to increase the demand for industrial robots and support the growth of the smart factory market during the review period.

RESTRAINT: Security risks associated with cyber-physical systems

The manufacturing sector is the most targeted cyberattack sector, around 47% of the cyberattacks target the manufacturing sector to gain competitive advantages and trade secrets. A cyber-physical system (CPS) is an advanced technology that integrates virtual and physical worlds to build a factory with intelligent equipment. CPS technology has transformed manufacturing processes. Cyber-physical manufacturing facilities use cutting-edge technologies such as robotics, big data, automation, artificial intelligence, virtual reality, sensors, augmented reality, and additive manufacturing to offer extraordinary flexibility, precision, and efficiency to manufacturing processes. However, the security risks associated with the adoption of CPS may restrain the market. A CPS enables connectivity among all plant equipment and stores critical information about the plant. This information might be at risk if the system gets hacked.

OPPORTUNITIES: Emergence of 5G technology in smart factory market

With 5G technology, smart factory owners can use cellular technologies more securely and can tune them to specific use cases. By placing sensors on equipment connected to 5G networks, they can take data off the manufacturing networks without connecting to the machines; this can make optimization seamless in real time. Many manufacturers are adopting 5G network for achieving uninterrupted and strong connection. The installation of 5G network in factories eliminates the need for wired connectivity, enabling a high-speed manufacturing environment with high flexibility and less downtime. It becomes crucial for industries to have a network that can support in terms of speed, coverage, and reliability. The emergence of 5G network is going to provide a one-stop solution for factories and create significant opportunities for smart factories.

CHALLENGES:Interoperability between information technology and operational technology

The biggest challenge for the implementation of a smart factory is the lack of interoperability between informational technology (IT) and operational technology (OT); IT and OT use different protocols and architecture, which significantly increases the complexity and costs associated with the adoption of smart factories. Most OT systems today work in silos. However, a smart factory demands a fully functional digital ecosystem for seamless data sharing between machines and other physical systems of different manufacturers. Companies that master in interoperability of the information and operation technology would have an advantage in manufacturing, which would be reflected in the production yield. Furthermore, most companies have invested heavily in expensive industrial equipment having longevity. The equipment was designed to operate in a standalone manner, which is the main pain point for endusers, as such equipment fail to fit in the IIoT ecosystem.

By Segmentaion

Industrial Sensor holds the largest market share for the smart factory market in the year 2021

Smart factories enable connectivity throughout manufacturing operations by deploying sensors. This factor can help establish a better flow of communication and information throughout a manufacturing facility. Modern manufacturing operations include an interconnected network of machines equipped with an extensive array of sensor technologies. Thus, industrial sensors hold the largest market share in the year 2021

PAM segment is projected to witness the highest growth during the forecast period

The PAM segment is expected to grow at the highest CAGR during the forecast period. PAM solutions help manufacturing companies gather timely information and make decisions to optimize competitiveness. This is achieved through the integration of production, organizational design, distribution, strategic, and commercial processes. It focuses on the risk reduction factor, along with helping manufacturers identify problems before a process fails. Hence, reduction in unplanned downtime and operational cost, optimum utilization of assets, and increased returns on investment are the primary factors driving the growth of the PAM market.

Oil & gas industry held the largest share of the Smart Factory market in 2021

Smart factory solutions offer various benefits such as reliability for large-scale production in the oil & gas industries, increased energy efficiency, enhancement in product quality, and acceleration in decision-making processes, leading to more accurate outcomes. Several oil and gas companies are establishing their drilling operations in remote offshore locations. The focus on safety and efficiency is driving the need for smart factory solutions in the industry. IoT device in smart factory solutions of the oil & gas industry can complete those vital operations with less difficulty. Due to the installation of smart factory solutions, employee safety has increased in the oil & gas industry. Key producers in the oil & gas industry are focused on digitalizing their plants to enhance process visibility, ensuring safety, improving production, increasing efficiency, and reducing operational costs.

Automotive industry held the largest share of the Smart Factory market in 2021

The automotive segment is anticipated to hold the largest share of the smart factory market, by discrete industry, during the forecast period. Smart manufacturing plays a key role in the development and production of high-quality automobiles. Innovations in assembly line methods help vehicle manufacturers enhance quality and increase productivity. The latest smart assembly solutions increase the vehicle manufacturers’ capability by automatically identifying the products in the assembly process, followed by assigning the required programs for the tools used in different stages of the assembly process. Mercedes-Benz, Renault, Audi, Volkswagen, and Toyota have all upgraded some facilities to smart factories in the last few years. As industry players recognize the benefits of smart factory solutions, more automotive manufacturers will follow suit for the transformation of manufacturing facilities into smart factories.

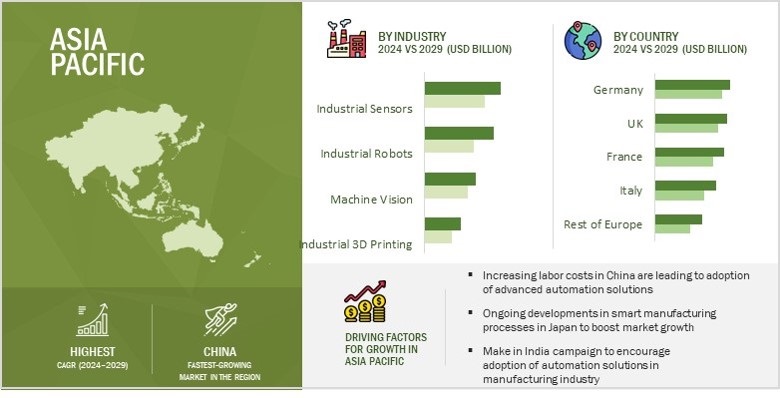

Asia Pacific held the largest share of the smart factory market in 2021

The Asia Pacific smart factory is projected to grow at the highest CAGR. The adoption of smart factory solutions in Asia Pacific is high due to the growing manufacturing sector in the region. The IIoT market in Asia Pacific is expected to exhibit tremendous growth potential in the coming years. Dense population and the growth in per capita income in the region, along with large-scale industrialization and urbanization, are the factors driving the growth of the smart factory market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The smart factory companies such as Rockwell Automation Inc. (US), Siemens AG (Germany), Schneider Electric SE (France), ABB (Switzerland), and Honeywell International Inc. (US).

Scope of the Smart Factory Report:

|

Report Metric |

Details |

| Estimated Value | USD 86.2 billion in 2022 |

| Projected Value | USD 140.9 billion by 2027 |

| Growth Rate | 10.3% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

This research report segments the smart factory market based on product, configuration, industry, and region.

By Component:

- Industrial Sensors

- Industrial Robots

- Industrial 3D Printing

- Machine Vision

By Solution:

- SCADA

- MES

- Industrial Safety

- PAM

By Industry:

- Process Industry

- Discrete Industry

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In March 2022, Emerson Electric Co. launched MT Connect, an industrial control platform driver for enabling easy integration of computer numerical control (CNC) machines with modern data analysis automation environment. This allows the collection of data from machines, robots, tools, and devices, which were previously inaccessible to be cumulatively analyzed in one platform. The new driver offers reduced downtime, improved efficiency, and increased productivity.

- In November 2021, Mitsubishi Electric Corporation, along with the National Institute of Advanced Industrial Science and Technology (AIST), introduced the Maisart AI technology, which offers the capability to predict changes during automated manufacturing processes, which then induces real-time adjustments in the factory automation equipment.

- In March 2021, Stratasys introduced a new 3D printer that gives dental labs 3D printing efficiency paired with PolyJet’s realism and precision. The J5 DentaJet 3D printer is the only multi-material dental 3D printer enabling technicians to load mixed trays of dental parts

Frequently Asked Questions (FAQ’s)

How big smart factory market?

The global smart factory market size is expected to reach USD 140.9 billion by 2027 from USD 86.2 billion in 2022 and is projected to grow at a CAGR of 10.3%.

What are the driving factors for the smart factory market?

Increasing demand for industrial robots and rising demand for IoT and artificial intelligence in industrial environments are driving factors for growth of smart factory market

Which are the significant players operating in the smart factory market?

Rockwell Automation Inc. (US), Siemens AG (Germany), Schneider Electric SE (France), ABB (Switzerland), and Honeywell International Inc. (US) are some of the major companies operating in the Smart Factory market.

Which region will lead the smart factory market in the future?

Asia Pacific is expected to lead the smart factory market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 SMART FACTORY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SMART FACTORY COMPONENTS AND SOLUTIONS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at market size using bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach to arrive at market size using top-down approach

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 7 KEY STAGES IN SMART FACTORY ADOPTION

FIGURE 8 INDUSTRIAL SENSORS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 9 MES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 10 OIL & GAS PROCESS INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 11 AUTOMOTIVE DISCRETE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES FOR SMART FACTORY MARKET PLAYERS

FIGURE 13 INCREASING USE OF AUTOMATION IN MANUFACTURING TO BOOST ADOPTION OF SMART FACTORY SOLUTIONS

4.2 SMART FACTORY MARKET, BY COMPONENT

FIGURE 14 INDUSTRIAL 3D PRINTERS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 SMART FACTORY MARKET, BY SOLUTION

FIGURE 15 SMART FACTORY MARKET FOR PAM TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 SMART FACTORY MARKET, BY PROCESS INDUSTRY

FIGURE 16 OIL & GAS INDUSTRY TO HOLD LARGEST SIZE OF SMART FACTORY MARKET IN 2022

4.5 SMART FACTORY MARKET, BY DISCRETE INDUSTRY

FIGURE 17 AUTOMOTIVE INDUSTRY TO DOMINATE SMART FACTORY MARKET IN 2022

4.6 SMART FACTORY MARKET, BY REGION

FIGURE 18 US TO HOLD LARGEST SHARE OF SMART FACTORY MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SMART FACTORY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing emphasis on energy efficiency, resource optimization, and cost reduction in production operations

5.2.1.2 Increasing demand for industrial robots

FIGURE 20 HISTORICAL AND PROJECTED ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS, 2015–2024

5.2.1.3 Rising demand for technologies such as IoT and artificial intelligence in industrial environments

FIGURE 21 SMART FACTORY MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Need for significant capital investments

5.2.2.2 Security risks associated with cyber-physical systems

FIGURE 22 SMART FACTORY MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of 5G technology

5.2.3.2 Growing number of developments in wireless sensor networks and their adoption in smart factories

FIGURE 23 SMART FACTORY MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Interoperability between information technology (IT) and operational technology (OT)

5.2.4.2 Vulnerability to cyberattacks

FIGURE 24 SMART FACTORY MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 26 SMART FACTORY MARKET: ECOSYSTEM

TABLE 2 COMPANIES AND THEIR ROLE IN SMART FACTORY ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICES OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS OFFERED BY TOP COMPANIES, 2021

TABLE 4 INDICATIVE PRICES OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS

5.5.1 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

FIGURE 27 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

TABLE 5 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE

5.7.2 AUGMENTED REALITY

5.7.3 BLOCKCHAIN

5.7.4 5G

5.7.5 PREDICTIVE MAINTENANCE

5.7.6 SMART ENERGY MANAGEMENT

5.7.7 EDGE COMPUTING

5.7.8 PREDICTIVE SUPPLY CHAIN

5.7.9 CYBERSECURITY

5.7.10 DIGITAL TWIN

5.7.11 IOT

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 DEGREE OF COMPETITION

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING CRITERIA

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USERS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USERS

5.9.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END-USERS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USERS (%)

5.10 CASE STUDY ANALYSIS

5.10.1 LEMATIC EXTENDS VALUE WITH IIOT TECHNOLOGY

5.10.2 BOMBARDIER TRANSPORTATION SELECTED ABB TO SUPPLY AND INSTALL SCADA TO POWER BANGKOK’S FIRST MONORAIL

5.10.3 BEARING PRODUCER IMPLEMENTED SMART FACTORY SOLUTIONS

5.10.4 COOPER TIRE ADOPTED MES SOLUTION BY ROCKWELL AUTOMATION TO PLAN, EXECUTE, AND COLLECT CONTEXTUALIZED DATA

5.10.5 AMRUN BAUXITE MINE IN AUSTRALIA ADOPTED ROCKWELL AUTOMATION’S PROCESS CONTROL SYSTEM (PCS) FOR SEAMLESS INTEGRATION OF CRITICAL MINE PROCESSES

5.11 TRADE ANALYSIS

FIGURE 30 IMPORTS DATA FOR INDUSTRIAL ROBOTS, 2017–2021 (USD MILLION)

FIGURE 31 EXPORTS DATA FOR INDUSTRIAL ROBOTS, 2016–2020 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 32 NO. OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 9 TOP PATENT OWNERS IN LAST 10 YEARS (US)

5.12.1 LIST OF MAJOR PATENTS

5.13 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 10 SMART FACTORY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 REGULATIONS & STANDARDS

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS

TABLE 15 MAJOR COMMUNICATION STANDARDS FOR SCADA SYSTEMS

TABLE 16 INDUSTRIAL SAFETY STANDARDS

6 SMART FACTORY MARKET, BY COMPONENT (Page No. - 94)

6.1 INTRODUCTION

FIGURE 34 SMART FACTORY MARKET, BY COMPONENT

FIGURE 35 INDUSTRIAL SENSORS TO HOLD LARGEST SIZE OF SMART FACTORY MARKET FOR COMPONENTS IN 2027

TABLE 17 SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 18 SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 INDUSTRIAL SENSORS

TABLE 19 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY SENSOR TYPE, 2018–2021 (USD MILLION)

TABLE 20 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY SENSOR TYPE, 2022–2027 (USD MILLION)

TABLE 21 INDUSTRIAL SENSORS: SMART FACTORY MARKET, 2018–2021 (MILLION UNITS)

TABLE 22 INDUSTRIAL SENSORS: SMART FACTORY MARKET, 2022–2027 (MILLION UNITS)

TABLE 23 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 LEVEL SENSORS

6.2.1.1 Used to detect and measure level of liquids, bulk solids, and other fluids

6.2.2 TEMPERATURE SENSORS

6.2.2.1 Used in chemicals, energy & power, and oil & gas industries

6.2.3 FLOW SENSORS

6.2.3.1 Measure rate of fluid flow, either directly or inferentially

6.2.4 POSITION SENSORS

6.2.4.1 Application areas of position sensors increasing with technological advancements

6.2.5 PRESSURE SENSORS

6.2.5.1 Industrial applications include semiconductor processing, robotics, and test & measurement

6.2.6 FORCE SENSORS

6.2.6.1 Measure various types of forces

6.2.7 HUMIDITY & MOISTURE SENSORS

6.2.7.1 Extensively used in chemicals, pharmaceuticals, oil & gas, and food & beverage industries

6.2.8 IMAGE SENSORS

6.2.8.1 Convert optical images into electronic signals

6.2.9 GAS SENSORS

6.2.9.1 Used to measure concentration of different gases in air

6.3 INDUSTRIAL ROBOTS

TABLE 25 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 27 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 28 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 29 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 TRADITIONAL INDUSTRIAL ROBOTS

6.3.1.1 Articulated robots

6.3.1.1.1 Articulated robots held largest size of traditional robots market in 2021

6.3.1.2 Cartesian robots

6.3.1.2.1 Have simple movements and are easy to program

6.3.1.3 Selective compliance assembly robot arm (SCARA)

6.3.1.3.1 Suited for operations wherein horizontal motion required more than vertical motion

6.3.1.4 Cylindrical robots

6.3.1.4.1 Ideal for pick and place operations

6.3.1.5 Other robots

6.3.2 COLLABORATIVE ROBOTS

6.3.2.1 Collaborative robots have highest adoption rate among all industrial robots

6.4 INDUSTRIAL 3D PRINTERS

6.4.1 USED FOR CONSTRUCTION OF THREE-DIMENSIONAL SOLID OBJECTS

TABLE 31 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 32 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 33 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, 2018–2021 (MILLION UNITS)

TABLE 34 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, 2022–2027 (MILLION UNITS)

TABLE 35 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 36 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY PROCESS, 2022–2027 (USD MILLION)

TABLE 37 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 INDUSTRIAL 3D PRINTERS: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 MACHINE VISION SYSTEMS

TABLE 39 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 40 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 41 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 42 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 43 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MACHINE VISION SYSTEMS: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5.1 CAMERAS

6.5.1.1 Capture images and send them for further processing

6.5.2 FRAME GRABBERS, OPTICS, AND LED LIGHTING

6.5.2.1 Influence image quality

6.5.3 PROCESSORS AND SOFTWARE

6.5.3.1 Processors and software are important elements of machine vision systems

7 SMART FACTORY MARKET, BY SOLUTION (Page No. - 113)

7.1 INTRODUCTION

FIGURE 36 SMART FACTORY MARKET, BY SOLUTION

FIGURE 37 MES SEGMENT TO ACCOUNT FOR LARGEST SIZE OF SMART FACTORY MARKET, BY SOLUTION, FROM 2022 TO 2027

TABLE 45 SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 46 SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.2 MANUFACTURING EXECUTION SYSTEM (MES)

7.2.1 CONTROLS, MANAGES, AND MONITORS WORK IN INDUSTRIAL ENVIRONMENTS

TABLE 47 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 48 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 49 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

7.3.1 CONTROLS REMOTE DEVICES AND ACQUIRES DATA FROM THEM

TABLE 51 SUPERVISORY CONTROL & DATA ACQUISITION: SMART FACTORY MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 52 SUPERVISORY CONTROL & DATA ACQUISITION: SMART FACTORY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 53 SUPERVISORY CONTROL & DATA ACQUISITION: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 SUPERVISORY CONTROL & DATA ACQUISITION: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 PLANT ASSET MANAGEMENT (PAM)

7.4.1 HELP PREDICT FAILURES AND AVOID SUBSEQUENT LOSSES

TABLE 55 PLANT ASSET MANAGEMENT: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 PLANT ASSET MANAGEMENT: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 INDUSTRIAL SAFETY

7.5.1 ENSURES SAFETY-CRITICAL CONTROL AND PROTECTIVE SYSTEMS APPROPRIATELY SPECIFIED, DESIGNED, INSTALLED, AND MAINTAINED

TABLE 57 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SMART FACTORY MARKET, BY INDUSTRY (Page No. - 123)

8.1 INTRODUCTION

FIGURE 38 SMART FACTORY MARKET, BY INDUSTRY

TABLE 59 SMART FACTORY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 60 SMART FACTORY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.2 PROCESS INDUSTRY

TABLE 61 SMART FACTORY MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 62 SMART FACTORY MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

FIGURE 39 FOOD & BEVERAGE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

8.2.1 OIL & GAS

8.2.1.1 Employs remote monitoring solutions to monitor drilling operations in remote offshore locations

TABLE 63 OIL & GAS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 64 OIL & GAS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 65 OIL & GAS: MART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 66 OIL & GAS: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.2 CHEMICALS

8.2.2.1 Adopts smart factory solutions to reduce complexities of operations

TABLE 67 CHEMICALS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 68 CHEMICALS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 69 CHEMICALS: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 70 CHEMICALS: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.3 PULP & PAPER

8.2.3.1 Rising digitalization in paper manufacturing to drive adoption of smart manufacturing solutions

TABLE 71 PULP & PAPER: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 72 PULP & PAPER: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 73 PULP & PAPER: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 74 PULP & PAPER: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.4 PHARMACEUTICALS

8.2.4.1 Implements automated processes to ensure production of high-quality products

TABLE 75 PHARMACEUTICALS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 76 PHARMACEUTICALS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 77 PHARMACEUTICALS: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 78 PHARMACEUTICALS: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.5 METALS & MINING

8.2.5.1 Need for predictive maintenance encourages adoption of smart factory solutions

TABLE 79 METALS & MINING: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 80 METALS & MINING: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 METALS & MINING: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 82 METALS & MINING: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.6 FOOD & BEVERAGE

8.2.6.1 Deploys smart factory solutions to maintain quality and safety of products

TABLE 83 FOOD & BEVERAGE: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 84 FOOD & BEVERAGE: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 85 FOOD & BEVERAGE: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 86 FOOD & BEVERAGE: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.7 ENERGY & POWER

8.2.7.1 Need to reduce downtime and enhance production output to boost demand for smart factory solutions

TABLE 87 ENERGY & POWER: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 88 ENERGY & POWER: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 89 ENERGY & POWER: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 90 ENERGY & POWER: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2.8 OTHER PROCESS INDUSTRIES

TABLE 91 OTHER PROCESS INDUSTRIES: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 92 OTHER PROCESS INDUSTRIES: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 OTHER PROCESS INDUSTRIES: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 94 OTHER PROCESS INDUSTRIES: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3 DISCRETE INDUSTRY

TABLE 95 SMART FACTORY MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 96 SMART FACTORY MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

FIGURE 40 AUTOMOTIVE INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2022

8.3.1 AUTOMOTIVE

8.3.1.1 Increasing investments by key automotive manufacturers for deployment of smart factory solutions drive market growth

TABLE 97 AUTOMOTIVE: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 98 AUTOMOTIVE: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 99 AUTOMOTIVE: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 100 AUTOMOTIVE: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3.2 AEROSPACE

8.3.2.1 High equipment cost encourages adoption of smart factory solutions

TABLE 101 AEROSPACE: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 102 SMART FACTORY MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 AEROSPACE: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 104 AEROSPACE: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3.3 SEMICONDUCTOR & ELECTRONICS

8.3.3.1 Need to achieve accuracy in designing complex products to propel adoption of smart factory solutions

TABLE 105 SEMICONDUCTOR & ELECTRONICS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 106 SEMICONDUCTOR & ELECTRONICS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 107 SEMICONDUCTOR & ELECTRONICS: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 108 SEMICONDUCTOR & ELECTRONICS: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3.4 MACHINE MANUFACTURING

8.3.4.1 Increasing need for predictive maintenance in machine manufacturing to drive smart factory market

TABLE 109 MACHINE MANUFACTURING: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 110 MACHINE MANUFACTURING: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 111 MACHINE MANUFACTURING: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 112 MACHINE MANUFACTURING: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3.5 MEDICAL DEVICES

8.3.5.1 Adoption of smart factory solutions enables higher efficiency in medical device manufacturing

TABLE 113 MEDICAL DEVICES: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 114 MEDICAL DEVICES: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 115 MEDICAL DEVICES: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 116 MEDICAL DEVICES: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.3.6 OTHERS

TABLE 117 OTHERS: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 118 OTHERS: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 119 OTHERS: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 120 OTHERS: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

9 SMART FACTORY MARKET, BY REGION (Page No. - 151)

9.1 INTRODUCTION

FIGURE 41 SMART FACTORY MARKET, BY REGION

FIGURE 42 SMART FACTORY MARKET IN INDIA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 121 SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: SMART FACTORY MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: SMART FACTORY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 NORTH AMERICA: SMART FACTORY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 127 NORTH AMERICA: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 128 NORTH AMERICA: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Product launches by key players to strengthen smart factory market growth in US

9.2.2 CANADA

9.2.2.1 Increasing government support for adoption of advanced manufacturing technologies to encourage smart factory market

9.2.3 MEXICO

9.2.3.1 Increasing investments and expansion by global market players to boost growth of smart factory market

9.3 EUROPE

FIGURE 44 EUROPE: SMART FACTORY MARKET SNAPSHOT

TABLE 129 EUROPE: SMART FACTORY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 EUROPE: SMART FACTORY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 132 EUROPE: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 134 EUROPE: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Government support for development of IoT technology to boost growth of smart factory market

9.3.2 GERMANY

9.3.2.1 Comprehensive R&D programs by German government to boost Industry 4.0 to propel market

9.3.3 FRANCE

9.3.3.1 Government initiatives and support to develop industrial sector to fuel growth of smart factory market

9.3.4 ITALY

9.3.4.1 Focus on boosting manufacturing output to fuel demand for smart factory solutions

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: SMART FACTORY MARKET SNAPSHOT

TABLE 135 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.2 JAPAN

9.4.2.1 Ongoing developments in smart manufacturing processes to boost market growth

9.4.3 INDIA

9.4.3.1 Make in India campaign to encourage adoption of automation solutions in manufacturing industry

9.4.4 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD (ROW)

FIGURE 46 REST OF THE WORLD: SMART FACTORY MARKET SNAPSHOT

TABLE 141 REST OF THE WORLD: SMART FACTORY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 REST OF THE WORLD: SMART FACTORY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 143 REST OF THE WORLD: SMART FACTORY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 144 REST OF THE WORLD: SMART FACTORY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 145 REST OF THE WORLD: SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 146 REST OF THE WORLD: SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Increasing recognition of smart factory solutions in Brazil to drive market growth

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 High adoption of advanced manufacturing solutions in oil & gas industry to support market expansion

10 COMPETITIVE LANDSCAPE (Page No. - 173)

10.1 INTRODUCTION

TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SMART FACTORY MARKET

10.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 47 TOP PLAYERS IN SMART FACTORY MARKET, 2017–2021

10.3 MARKET SHARE ANALYSIS

TABLE 148 SMART FACTORY MARKET: MARKET SHARE OF KEY COMPANIES

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 48 SMART FACTORY MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.5 SMALL- AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 49 SMART FACTORY MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

10.6 SMART FACTORY MARKET: COMPANY FOOTPRINT

TABLE 149 PRODUCT FOOTPRINT

TABLE 150 INDUSTRY FOOTPRINT

TABLE 151 REGION FOOTPRINT

TABLE 152 COMPANY FOOTPRINT

10.7 COMPETITIVE BENCHMARKING

TABLE 153 SMART FACTORY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 154 SMART FACTORY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.8 COMPETITIVE SCENARIOS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 155 SMART FACTORY MARKET: PRODUCT LAUNCHES, JANUARY 2021–JUNE 2022

10.8.2 DEALS

TABLE 156 SMART FACTORY MARKET: DEALS, JANUARY 2021–JUNE 2022

10.8.3 OTHERS

TABLE 157 SMART FACTORY MARKET: OTHERS, APRIL 2021–JUNE 2022

11 COMPANY PROFILES (Page No. - 196)

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 ABB

TABLE 158 ABB: BUSINESS OVERVIEW

FIGURE 50 ABB: COMPANY SNAPSHOT

TABLE 159 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 ABB: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 161 ABB: DEALS

11.1.2 EMERSON ELECTRIC CO.

TABLE 162 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 51 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 163 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 165 EMERSON ELECTRIC CO.: DEALS

11.1.3 SIEMENS AG

TABLE 166 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 52 SIEMENS AG: COMPANY SNAPSHOT

TABLE 167 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 SIEMENS AG: DEALS

11.1.4 SCHNEIDER ELECTRIC SE

TABLE 169 SCHNEIDER ELECTRIC SE: BUSINESS OVERVIEW

FIGURE 53 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

TABLE 170 SCHNEIDER ELECTRIC SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 SCHNEIDER ELECTRIC SE: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 172 SCHNEIDER ELECTRIC SE: DEALS

11.1.5 MITSUBISHI ELECTRIC CORPORATION

TABLE 173 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 54 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 174 MITSUBISHI ELECTRIC CORPORATION: PRODUCT OFFERINGS

TABLE 175 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 176 MITSUBISHI ELECTRIC CORPORATION: OTHERS

11.1.6 GENERAL ELECTRIC CO.

TABLE 177 GENERAL ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 55 GENERAL ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 178 GENERAL ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 GENERAL ELECTRIC: PRODUCT LAUNCHES

11.1.7 ROCKWELL AUTOMATION INC.

TABLE 180 ROCKWELL AUTOMATION INC.: BUSINESS OVERVIEW

FIGURE 56 ROCKWELL AUTOMATION INC.: COMPANY SNAPSHOT

TABLE 181 ROCKWELL AUTOMATION INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 ROCKWELL AUTOMATION INC.: DEALS

TABLE 183 ROCKWELL AUTOMATION INC.: OTHERS

11.1.8 HONEYWELL INTERNATIONAL INC.

TABLE 184 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 185 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 186 HONEYWELL INTERNATIONAL INC.: DEALS

11.1.9 YOKOGAWA ELECTRIC CORPORATION

TABLE 187 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 58 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 188 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 189 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 190 YOKOGAWA ELECTRIC CORPORATION: DEALS

11.1.10 OMRON CORPORATION

TABLE 191 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 59 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 192 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 193 OMRON CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 194 OMRON CORPORATION: DEALS

TABLE 195 OMRON CORPORATION: OTHERS

11.1.11 ENDRESS+HAUSER

TABLE 196 ENDRESS+HAUSER: BUSINESS OVERVIEW

FIGURE 60 ENDRESS+HAUSER: COMPANY SNAPSHOT

TABLE 197 ENDRESS+HAUSER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 198 ENDRESS+HAUSER: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 199 ENDRESS+HAUSER: OTHERS

11.1.12 FANUC CORPORATION

TABLE 200 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 61 FANUC CORPORATION: COMPANY SNAPSHOT

TABLE 201 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

11.1.13 WIKA

TABLE 202 WIKA: BUSINESS OVERVIEW

TABLE 203 WIKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 WIKA: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 205 WIKA: OTHERS

11.1.14 DWYER INSTRUMENTS

TABLE 206 DWYER CORPORATION: BUSINESS OVERVIEW

TABLE 207 DWYER INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 208 DWYER INSTRUMENTS: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.15 STRATASYS

TABLE 209 STRATASYS: BUSINESS OVERVIEW

FIGURE 62 STRATASYS: COMPANY SNAPSHOT

TABLE 210 STRATASYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 211 STRATASYS: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 212 STRATASYS: DEALS

11.1.16 3D SYSTEMS CORPORATION

TABLE 213 3D SYSTEMS CORPORATION: BUSINESS OVERVIEW

FIGURE 63 3D SYSTEMS CORPORATION: COMPANY SNAPSHOT

TABLE 214 3D SYSTEMS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 215 3D SYSTEMS CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 216 3D SYSTEMS CORPORATION: DEALS

11.2 OTHER KEY PLAYERS

11.2.1 FUJI ELECTRIC

TABLE 217 FUJI ELECTRIC: COMPANY OVERVIEW

11.2.2 HITACHI

TABLE 218 HITACHI: COMPANY OVERVIEW

11.2.3 KROHNE

TABLE 219 KROHNE: COMPANY OVERVIEW

11.2.4 AZBIL CORPORATION

TABLE 220 AZBIL CORPORATION: COMPANY OVERVIEW

11.2.5 VEGA GRIESHABER

TABLE 221 VEGA GRIESHABER: COMPANY OVERVIEW

11.2.6 DANFOSS

TABLE 222 DANFOSS: COMPANY OVERVIEW

11.2.7 KUKA AG

TABLE 223 KUKA AG: COMPANY OVERVIEW

11.3 OTHER SMALL- AND MEDIUM-SIZED PLAYERS

11.3.1 TRIDITIVE

TABLE 224 TRIDITIVE: COMPANY OVERVIEW

11.3.2 ROBOZE S.P.A.

TABLE 225 ROBOZE S.P.A.: COMPANY OVERVIEW

11.3.3 SOFTGRIPPING

TABLE 226 SOFTGRIPPING: COMPANY OVERVIEW

11.3.4 ZIVID

TABLE 227 ZIVID: COMPANY OVERVIEW

11.3.5 ENERSIS

TABLE 228 ENERSIS: COMPANY OVERVIEW

11.3.6 INXPECT S.P.A.

TABLE 229 INXPECT S.P.A.: COMPANY OVERVIEW

11.3.7 ALGOLUX

TABLE 230 ALGOLUX: COMPANY OVERVIEW

11.3.8 INUITIVE

TABLE 231 INUITIVE: COMPANY OVERVIEW

11.3.9 EAVE

TABLE 232 EAVE: COMPANY OVERVIEW

11.3.10 CANARIA

TABLE 233 CANARIA: COMPANY OVERVIEW

11.3.11 FUELICS

TABLE 234 FUELICS: COMPANY OVERVIEW

11.3.12 ULTIMAKER

TABLE 235 ULTIMAKER: COMPANY OVERVIEW

11.3.13 NANO DIMENSION

TABLE 236 NANO DIMENSION: COMPANY OVERVIEW

11.3.14 DEEP LEARNING ROBOTICS

TABLE 237 DEEP LEARNING ROBOTICS: COMPANY OVERVIEW

11.3.15 PICK-IT 3D

TABLE 238 PICK-IT 3D: COMPANY OVERVIEW

11.3.16 ONROBOT

TABLE 239 ONROBOT: COMPANY OVERVIEW

11.3.17 TRIVISION

TABLE 240 TRIVISION: COMPANY OVERVIEW

11.3.18 CLEVEST

TABLE 241 CLEVEST: COMPANY OVERVIEW

*Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 274)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 DIGITAL TWIN MARKET, BY APPLICATION

12.3.1 INTRODUCTION

TABLE 242 DIGITAL TWIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 243 DIGITAL TWIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4 PRODUCT DESIGN & DEVELOPMENT

12.4.1 DIGITAL TWIN HELPS IN PRODUCT DESIGN & DEVELOPMENT BY MONITORING KEY PERFORMANCE INDICATORS IN REAL TIME

TABLE 244 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 245 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

12.5 PERFORMANCE MONITORING

12.5.1 OPTIMIZES OPERATIONAL DOWNTIME, TRIGGERS PRE-EMPTIVE MAINTENANCE, AND MITIGATES COSTLY FAILURES

TABLE 246 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, 2018–2021 (USD MILLION)

TABLE 247 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

12.6 PREDICTIVE MAINTENANCE

12.6.1 DIGITAL TWIN PREDICTS FAILURES BASED ON REAL-TIME DATA COLLECTION

TABLE 248 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 249 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

12.7 INVENTORY MANAGEMENT

12.7.1 DIGITAL TWINS AID END-USERS IN INVENTORY OPTIMIZATION ACROSS NETWORKS

TABLE 250 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 251 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

12.8 BUSINESS OPTIMIZATION

12.8.1 BUSINESS OPTIMIZATION APPLICATION TO REGISTER HIGHEST GROWTH IN DIGITAL TWIN MARKET DURING FORECAST PERIOD

TABLE 252 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 253 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

12.9 OTHER APPLICATIONS

TABLE 254 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY 2018–2021 (USD MILLION)

TABLE 255 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY 2022–2027 (USD MILLION)

13 APPENDIX (Page No. - 286)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

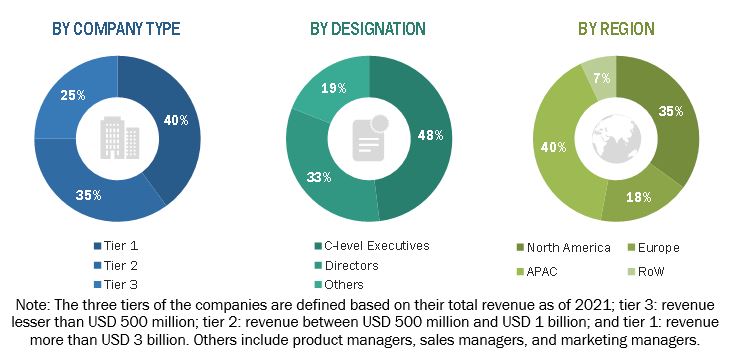

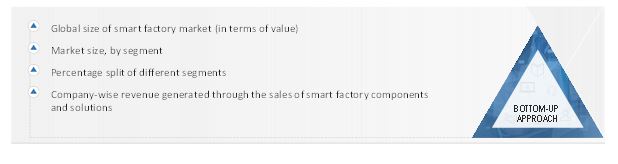

The study involved four major activities in estimating the current size of the smart factory market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the smart factory ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall smart factory market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the smart factory market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the smart factory market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global smart factory market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the smart factory market, in terms of value, based on components, solutions, and industry

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the smart factory ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Factory Market

Could you explain why in Technology(solution) parts no more include PLM, ERP, PLC and DCS as your previous report 2018 ? I want to buy this repot in continuous point, so confusing

Looking to understand the smart factory market at the intersection of technology, software, and services

I would like to know the market trend of Smart factory, especially in Europe and Asia region.

New and competitive smart factory product information. We are an automation products distributor.

The current condition of the manufacturing market in the view of digital transformation

Interested in smart factory report. Please provide pricing

Leveraging the NOW through a Designed National Economics and Infrastructure. Integrated Technology Platforms by region for all citizens as a business service - public and free provided by the EDC. Integrated across Community. Predesigned value chains for the Geography. Automated Value Generation after Value Design (Drag and Drop) of Physical Process components to Design and Create Physical Products within a Region. Export excess of specialization - surplus. Eliminate Tax. Increase Size and Scope of Revenue Generation, allowing for continuously growing Public Services.