Smart Glass Market by Technology (Suspended Particle Display, Electrochromic Glass, Liquid Crystals, Micro blinds, NanoCrystals, Photochromic and Thermochromic), Application, Control Mode and Geographic Analysis - Global Forecast to 2027

Updated on : January 31, 2023

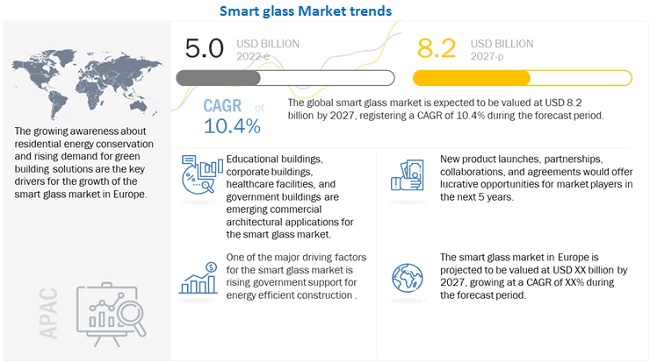

The global smart glass market size is expected to reach USD 8.2 billion by 2027, growing at a CAGR of 10.4% during the forecast period. Smart glass, also known as switchable glass, dimmable glass, or magic glass, can adjust the light transmission properties dynamically or statically, depending on the stimuli.

The stimuli altering the light transmission properties could be light, voltage, or heat. Smart glass does not require electricity to maintain its state of opacity or for a color change. The installation of smart glass helps reduce the energy spent on heating, ventilation, and air conditioning (HVAC) and lighting systems as well as improves the indoor environmental quality of buildings. Decreasing price of electrochromic prices, energy saving capacity of smart glass and use of smart glass in automobile application are significant drivers driving the growth of this smart glass industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global Smart Glass Market

The market includes key companies such as Saint-Gobain (France), AGC Inc. (Japan), NSG Group (Japan), Research frontier (US), Gentex Corporation (US), View Inc (US), Corning (US), Showa Denko Materials (Japan), Pleotint(US) and Smartglass International (Ireland).

These companies have their manufacturing facilities and corporate offices spread across various countries across Asia Pacific, Europe, North America, and RoW. The smart glass products manufactured by these companies are purchased by several stakeholders for various applications. COVID-19 not only impacted the operations of the various smart glass manufacturers companies, but also affected the businesses of their suppliers and distributors.

The fall in export shipments and slow domestic demand for smart glass products in comparison to pre COVID-19 levels is also expected to negatively impact and slightly stagnate the demand for smart glass in short term. The key companies operating in this market, have also witnessed the impact of the pandemic in their order intakes for smart home during the first half of 2020.

Smart Glass Market Segment Overview

Electrochromic technology to hold largest share of smart glass market during forecast period

The electrochromic technology held ~49% of the market in 2021—the largest share. The market share of this technology is attributed to the faster switching time of electrochromic glass from a clear to dark state and increasing investments in this technology.

The increased traction of electrochromic technology is primarily attributed to the benefits it offers in a sustainable building design. A majority of the top smart glass manufacturers are focusing on R&D to bring down the prices of smart glass without compromising on quality and thus achieve economies of scale.

The industry is witnessing a series of funding and investments, which are enabling manufacturers to produce at high volumes and achieve economies of scale. Smart glass using electrochromic and SPD technologies is expected to witness huge demand in the coming years since the degree of customization is high in these two technologies, and the cost of these technologies is expected to drastically decrease.

Architecture is projected to register highest CAGR during the Forecast period by application.

In modern times, the design and steps taken to make a building compliant with the green building norms have been prioritized in the construction industry.

The marketability of a residential or commercial facility considerably depends on comfort, aesthetics or interior design, and eco-friendliness. Smart glass offers the architecture application energy efficiency and improved aesthetics. The applications of smart glass in architecture include doors, partitions, windows, skylights, and elevators. Smart glass products have inherent properties that help in market growth.

The glare control property of smart glass eliminates unwanted glare from sunlight and can provide bright, clear, and customized lighting levels in the building. Smart glass is also used to adjust the heat levels in buildings. The self-cleaning property of smart glass offers users a superior experience at the low cost of maintenance.

Smart glass products also possess a UV-blocking property, which helps maintain a healthy ambiance in buildings. Thus, smart glass not only provides customized lighting and heating experiences but also maintains hygienic and healthy surroundings. The use of smart glass in various applications in architecture increases the aesthetic value of a building and significantly reduces the heating, cooling, and lighting costs. Thus, the overall market is expected to witness an upturn in the coming years.

Europe is projected to register the largest market share of the smart glass market in 2027

Europe is expected to lead the overall market in the coming years. Technological advancements and a recovering economy act as driving factors during the growth period.

Rapidly increasing energy cost is likely to trigger the demand for energy-efficient products. The ability of smart glass to reduce the overall energy consumption of a building while offering attractive features such as on-demand privacy or glare-control is expected to multiply its applications in Europe.

The multipurpose quality of this glass makes it a popular building material for a variety of architectural applications. In extreme weather conditions prevalent in several areas of Europe, smart glass offers a suitable solution for maintaining the internal temperature of buildings or vehicles, thus saving the overall energy costs. Therefore, Europe is expected to be a key potential growth market for smart glass in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

Top Smart Glass Companies - Key Market Players

The smart glass market is dominated by a few globally established players such as

- Saint-Gobain (France),

- AGC Inc. (Japan),

- NSG Group (Japan),

- Research frontier (US),

- Gentex Corporation (US), and

- View Inc (US).

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Smart Glass Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 5.0 billion |

|

Market Size Value in 2027 |

USD 8.2 billion |

|

Growth Rate |

10.4% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographic Regions Covered |

|

|

Companies Covered |

|

| Key Market Driver | Energy-saving capacity of smart glass |

| Key Market Opportunity | Growing need for sustainable buildings |

| Largest Growing Region | Europe |

| Largest Market Share Segment | Electrochromic Technology |

| Largest CAGR Segment | Architecture |

Smart Glass Market Dynamics

Driver: Energy-saving capacity of smart glass

The global energy demand continues to grow despite the historic high prices and mounting concerns over energy security. Improving the energy efficiency of homes, businesses, schools, government buildings, and industries is imperative to balance energy supply and demand.

According to the US Department of Energy (DOE), heating, cooling, and lighting of buildings together account for 25% of the total energy costs of the country. According to the DOE estimation, smart glass can reduce energy consumption by ~40%. Heating, cooling, and lighting equipment consume a lot of energy, adding to the overall expense of any industry.

The type of glass used for windows, doors, and partitions in a room has a major impact on the room’s energy consumption. The heat and light transferred through the glass directly impacts the comfort level of the room’s occupants, apart from affecting energy costs. Switching to smart windows makes a huge difference in overall energy consumption.

Smart windows are installed with smart glass, which regulates the amount of light passing through them, depending on the time of the day. As a result, these windows can switch from translucent to transparent without consuming much energy.

Restraint: Technical glitches in functioning

Despite technological advancements in smart glass, some operational or functionality issues remain unaddressed. Despite having the ability to adjust to different wavelengths and control the amount of light penetrating through it, smart glass cannot provide exact color transparency.

This results in improper color balance and clarity issues. The user expects to get an exact view of the exterior through the windows; however, the contrast ratio of the front view/object often gets disturbed, resulting in improper visibility. Smart glass costs more than ordinary glass, leading the user to expect superior performance. Such shortcomings are restricting the growth of the smart glass market.

Usage of passive smart glasses in extreme temperatures has been an issue due to their functioning related to the surroundings rather than user preference. The recycling of smart glass is also another issue. Although smart glass is helping the environment by conserving energy, recycling smart glass is still a factor to be considered, as no proper procedure is adopted for recycling.

Opportunity: Growing need for sustainable buildings

The world is becoming conscious of climate change, global warming, and its impact on the planet. The pandemic has also shown the need for green buildings and the benefit of having a sustainable living space.

Governments and world organizations are moving toward sustainability, wherein green buildings have a major role in achieving a carbon-neutral society. As part of the EU (European Union) Green Deal, the European Commission has set a target to make Europe a climate-neutral continent by 2050, focusing on sustainable building and energy performance.

The EU also issued directives to member states like the “New Energy Performance in Building” in 2018 to promote sustainable buildings. Furthermore, the US had 3,156 registered green buildings with LEED (Leadership in Environmental and Design) in 2005, compared to ~70,000 in 2019. Thus, the current focus on green buildings and sustainability has the potential to generate growth opportunities in the smart glass market.

Challenge: High initial costs of R&D and manufacturing

Companies operating in the smart glass ecosystem incur high manufacturing and R&D costs. The high manufacturing cost has resulted in a high selling price for smart glass.

Smart glasses are mostly used in premium, high-end applications because of their high costs. In the automobile sector, smart glass is used in windows, sunroofs, rearview mirrors, and side windows in premium cars. Similarly, in the architectural sector, high-end corporate or commercial buildings use this type of glass in their designs.

This niche and elite customer base signifies a higher customer concentration ratio and greater dependency on fewer customers. The limited number of customers puts a limitation on the overall returns. As a result, the ROI is extremely volatile and could restrict the overall growth of the market.

Smart Glass Market Categorization

This report categorizes the smart glass market based on offering, technology, application, lighting type, cultivation, installation type, and region available at the regional and global level

By Technology

- Suspended Particle Display

- Electrochromic

- Liquid Crystal

- Microblind

- Photochromic

- Thermochromic

By Application

- Architecture

- Transportation

- Power Generation Plants (Solar)

- Consumer Electronics & Others

By Control Mode

- Dimmers

- Switches

- Remote Control

- Others

By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments in Smart Glass Industry

- In November 2021, Saint-Gobain acquired IMPAC, a leader in construction chemicals solutions in Mexico. This will enhance the Group’s position in Latin America and accelerate its expansion in the area by expanding its portfolio of light and sustainable building solutions.

- In September 2021, The Research Frontiers SPD-Smart light control film was used in the BMWi Vision Circular Showcar in its headlights. The SPD glass turns transparent from dark once the light is switched on.

- In January 2022, Gentex partnered with eSight to develop digital eyewear to help people with visual impairments.

- In October 2021, Gentex acquired thin-glass laminating technology, included in the acquisition of Air-Craftglass in 2020. The technology is used in aircraft because of its durability, ultra-thinness, and low weight

- In July 2021, Corning partnered with Hyundai Mobis to work on an augmented reality heads-up display. The technology was introduced in the IONIQ5 electric crossover utility vehicle.

- In January 2022, View partnered with a home design company, Nabr, to construct homes with sustainable materials. All Nabr homes will feature View’s smart windows and cloud-connected smart building network.

Frequently Asked Questions (FAQ):

How big smart glass market?

The global smart glass market size is expected to reach USD 8.2 billion by 2027 from USD 5.0 billion in 2022, at a CAGR of 10.4% from 2022 to 2027.

Who are the key players in the global smart glass market?

Saint-Gobain (France), AGC Inc. (Japan), NSG Group (Japan), Research frontier (US), Gentex Corporation (US), and View Inc (US). These companies cater to the requirements of their customers with presence in multiple countries.

What is the COVID-19 impact on smart glass suppliers?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of smart glass and related components manufacturing facilities. Additionally, the first quarter of 2020 also witnessed disruption in global smart glass supply chain operations and logistics-related services due to limited air and road movement. This is expected to have had a global impact on the smart glass market. Additionally, COVID-19 is expected to have led to a delay in the upcoming launches and developments in smart glass products. All these factors resulted in marginal dip of market size of the smart glass products. The supply chain disruptions have led to the procurement of raw materials or commodities from localized sources to ensure their continuous supply.

What are the opportunities for the existing players and for those who are planning to enter various stages of the smart glass value chain?

There are various opportunities for the existing players to enter the value chain of smart glass industry. Some of these include minimalist design architecture has huge potential for smart glass, high potential in solar power generation plants, growing need for sustainable buildings and rising demand for energy-efficient products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

FIGURE 1 SMART GLASS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 SMART GLASS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 SMART GLASS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for capturing market size by top-down analysis (supply side)

FIGURE 4 TOP-DOWN APPROACH: MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 SUPPLY SIDE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - SUPPLY SIDE

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for capturing market share by bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - DEMAND SIDE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 8 SMART GLASS MARKET, 2018–2027 (USD BILLION)

3.1 MARKET SCENARIO

FIGURE 9 GROWTH PROJECTIONS FOR MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

3.1.1 REALISTIC SCENARIO

3.1.2 PESSIMISTIC SCENARIO

3.1.3 OPTIMISTIC SCENARIO

FIGURE 10 TRANSPORTATION APPLICATION TO HOLD LARGEST SHARE OF MARKET IN 2027

FIGURE 11 ELECTROCHROMIC TECHNOLOGY HELD LARGEST SHARE OF MARKET IN 2021

FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 13 ATTRACTIVE OPPORTUNITIES IN MARKET

4.2 MARKET, BY TECHNOLOGY

FIGURE 14 ELECTROCHROMIC TECHNOLOGY TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 15 TRANSPORTATION SEGMENT HELD LARGEST SHARE OF MARKET IN 2021

4.4 COUNTRY-WISE SMART GLASS MARKET GROWTH

FIGURE 16 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing importance of smart glass in healthcare industry

FIGURE 18 SPENDING ON HEALTHCARE CONSTRUCTION IN US

5.2.1.2 Rising use of smart glass in automobile applications

FIGURE 19 GLOBAL CAR SALES

5.2.1.3 Declining prices of electrochromic materials

FIGURE 20 ASP OF ELECTROCHROMIC GLASS

5.2.1.4 Government support for energy-efficient construction

FIGURE 21 GOVERNMENT SPENDING FOR ACHIEVING NET-ZERO LEVELS

5.2.1.5 Energy-saving capacity of smart glass

5.2.2 RESTRAINTS

5.2.2.1 Higher upfront cost of smart glass

5.2.2.2 Technical glitches in functioning

5.2.3 OPPORTUNITIES

5.2.3.1 Minimalist design architecture has huge potential for smart glass

5.2.3.2 High potential in solar power generation plants

5.2.3.3 New avenues for growth

5.2.3.4 Growing need for sustainable buildings

5.2.3.5 Rising demand for energy-efficient products

5.2.4 CHALLENGES

5.2.4.1 High initial costs of R&D and manufacturing

5.2.4.2 Lack of awareness of long-term benefits of smart glass

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES RELATED TO MARKET

5.4 SMART GLASS MARKET: ECOSYSTEM

TABLE 2 SMART GLASS: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 SWITCHABLE PRIVACY GLASS

5.5.2 ELECTROCHROMIC DEVICES

5.5.3 POLYMER DISPERSED LIQUID CRYSTAL

5.5.4 SUSPENDED PARTICLE DEVICE

5.5.5 MICROBLIND

5.5.6 NANOCRYSTALS

5.5.7 PHOTOCHROMIC GLASS

5.5.8 THERMOCHROMIC GLASS

5.5.9 DIGITAL IMAGERY

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN: SMART GLASS MARKET

5.7 PATENT ANALYSIS

TABLE 3 NOTABLE PATENTS PERTAINING TO SMART GLASS

TABLE 4 NUMBER OF PATENTS REGISTERED RELATED TO MARKET IN LAST 10 YEARS

FIGURE 24 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 25 PATENTS GRANTED PER YEAR, 2012–2021

5.8 REGULATORY LANDSCAPE

5.8.1 NORTH AMERICA

5.8.2 EUROPE

5.8.3 GLOBAL

5.9 TRADE DATA

5.9.1 IMPORT DATA

TABLE 5 IMPORT DATA FOR HS CODE 70, BY COUNTRY, 2017–2020 (USD BILLION)

5.9.2 EXPORT DATA

TABLE 6 EXPORT DATA FOR HS CODE 70, BY COUNTRY, 2017–2020 (USD BILLION)

5.10 CASE STUDY ANALYSIS

5.10.1 SMART GLASS IN HOSPITALS

5.10.2 SMART GLASS TO MAKE PASSENGER EXPERIENCE BETTER

5.10.3 REDUCING ENERGY USAGE IN OFFICE

5.10.4 USE OF SMART GLASS IN MUSEUMS

5.10.5 ENERGY SAVINGS USING SMART GLASS

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 7 SMART GLASS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 PORTER’S FIVE FORCE ANALYSIS

TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON MARKET

FIGURE 26 SMART GLASS: PORTER’S FIVE FORCES ANALYSIS

5.12.1 INTENSITY OF COMPETITIVE RIVALRY

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 THREAT OF NEW ENTRANTS

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.13.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.14 AVERAGE SELLING PRICE ANALYSIS

FIGURE 29 GLOBAL ASP OF MARKET, 2021

6 SMART GLASS MARKET, BY TECHNOLOGY (Page No. - 80)

6.1 INTRODUCTION

FIGURE 30 MARKET FOR SUSPENDED PARTICLE DEVICE TECHNOLOGY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 13 MARKET, BY TECHNOLOGY, 2018–2021 (MILLION UNITS)

TABLE 14 MARKET, BY TECHNOLOGY, 2022–2027 (MILLION UNITS)

TABLE 15 DIFFERENTIATING PROPERTIES AND CHARACTERISTICS OF DIFFERENT TECHNOLOGIES

6.2 ACTIVE SMART GLASS TECHNOLOGY

6.2.1 SUSPENDED PARTICLE DISPLAY

6.2.1.1 SPD technology provides control to manage natural light and temperature in buildings

FIGURE 31 ARCHITECTURE TO HOLD LARGEST SIZE OF SPD SMART GLASS MARKET DURING FORECAST PERIOD

TABLE 16 SPD SMART GLASS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 17 SPD SMART GLASS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 18 SPD SMART GLASS, FOR ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 SPD SMART GLASS FOR ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 SPD SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 SPD SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 32 SMART GLASS FOR MARINE TRANSPORTATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 SPD SMART GLASS FOR TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 SPD SMART GLASS FOR TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

TABLE 24 SPD SMART GLASS FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 SPD SMART GLASS FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

TABLE 26 SPD SMART GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 SPD SMART GLASS BY REGION, 2022–2027 (USD MILLION)

TABLE 28 SPD SMART GLASS FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 SPD SMART GLASS FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 SPD SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 SPD SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 SPD SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 SPD SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 SPD SMART GLASS FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 SPD SMART GLASS FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 SPD SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 SPD SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

6.2.2 ELECTROCHROMIC GLASS

6.2.2.1 Electrochromic smart glass market held largest size in 2021

FIGURE 33 ELECTROCHROMIC SMART GLASS FOR TRANSPORTATION TO HOLD LARGEST SHARE IN 2027

TABLE 38 ELECTROCHROMIC SMART GLASS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 39 ELECTROCHROMIC SMART GLASS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 40 ELECTROCHROMIC SMART GLASS FOR ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 ELECTROCHROMIC SMART GLASS FOR ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 ELECTROCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 43 ELECTROCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 44 ELECTROCHROMIC SMART GLASS FOR TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 ELECTROCHROMIC SMART GLASS FOR TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

TABLE 46 ELECTROCHROMIC SMART GLASS FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 47 ELECTROCHROMIC SMART GLASS FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

FIGURE 34 EUROPE TO HOLD LARGEST SIZE OF ELECTROCHROMIC SMART GLASS MARKET IN 2027

TABLE 48 ELECTROCHROMIC SMART GLASS BY REGION, 2018–2021 (USD MILLION)

TABLE 49 ELECTROCHROMIC SMART GLASS BY REGION, 2022–2027 (USD MILLION)

TABLE 50 ELECTROCHROMIC SMART GLASS FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 ELECTROCHROMIC SMART GLASS FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 52 ELECTROCHROMIC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 ELECTROCHROMIC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 ELECTROCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 ELECTROCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 ELECTROCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 ELECTROCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

6.2.3 LIQUID CRYSTALS

6.2.3.1 LC glass is primarily suitable for end-use applications requiring complete privacy

FIGURE 35 LC SMART GLASS MARKET FOR ARCHITECTURE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 58 LC MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 LC MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 LC MARKET FOR ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 LC MARKET FOR ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 LC MARKET FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 63 LC MARKET FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 64 LC MARKET FOR TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 LC MARKET FOR TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

TABLE 66 LC MARKET FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 LC MARKET FOR MARKET FOR AUTOMOTIVE TRANSPORTATION, BY TYPE, 2022–2027(USD MILLION)

FIGURE 36 ASIA PACIFIC TO HOLD LARGEST SIZE OF SMART GLASS MARKET FOR LC IN 2027

TABLE 68 LC SMART GLASS, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 LC SMART GLASS, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 LC SMART GLASS FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 LC MARKET FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 LC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 LC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 LC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 LC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 76 LC SMART GLASS FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 LC SMART GLASS MARKET FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 LC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 LC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

6.2.4 MICROBLIND

6.2.4.1 Microblind offers high switching speed, UV durability, customized appearance, and cost-effectiveness

TABLE 80 MICROBLIND SMART GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 81 MICROBLIND SMART GLASS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 MICROBLIND SMART GLASS, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MICROBLIND SMART GLASS, BY REGION, 2022–2027 (USD MILLION)

6.3 PASSIVE GLASS

6.3.1 PHOTOCHROMIC GLASS

6.3.1.1 Photochromic glass is most suitable for display panels and memory device applications

TABLE 84 PHOTOCHROMIC SMART GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 PHOTOCHROMIC SMART GLASS, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 37 PHOTOCHROMIC SMART GLASS IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 86 PHOTOCHROMIC SMART GLASS, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 PHOTOCHROMIC SMART GLASS, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 PHOTOCHROMIC SMART GLASS FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 PHOTOCHROMIC SMART GLASS FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 PHOTOCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 PHOTOCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 92 PHOTOCHROMIC SMART GLASS MARKET FOR POWER GENERATION PLANTS (SOLAR), BY REGION, 2018–2021 (USD MILLION)

TABLE 93 PHOTOCHROMIC SMART GLASS FOR POWER GENERATION PLANTS (SOLAR), BY REGION, 2022–2027 (USD MILLION)

TABLE 94 PHOTOCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 PHOTOCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

6.3.2 THERMOCHROMIC GLASS

6.3.2.1 Thermochromic glass uses solar energy to change from being transparent to opaque

TABLE 96 THERMOCHROMIC SMART GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 THERMOCHROMIC SMART GLASS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 THERMOCHROMIC SMART GLASS FOR ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 99 THERMOCHROMIC SMART GLASS FOR ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 THERMOCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 THERMOCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY TYPE, 2022–2027 (USD MILLION)

FIGURE 38 NORTH AMERICA TO HOLD LARGEST SIZE OF THERMOCHROMIC SMART GLASS MARKET DURING FORECAST PERIOD

TABLE 102 THERMOCHROMIC SMART GLASS, BY REGION, 2018–2021 (USD MILLION)

TABLE 103 THERMOCHROMIC SMART GLASS, BY REGION, 2022–2027 (USD MILLION)

TABLE 104 THERMOCHROMIC SMART GLASS FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 THERMOCHROMIC SMART GLASS MARKET FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 THERMOCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 107 THERMOCHROMIC SMART GLASS FOR COMMERCIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 108 THERMOCHROMIC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 THERMOCHROMIC SMART GLASS FOR RESIDENTIAL ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

TABLE 110 THERMOCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 111 THERMOCHROMIC SMART GLASS FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 112 THERMOCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 THERMOCHROMIC SMART GLASS FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

7 SMART GLASS MARKET, BY APPLICATION (Page No. - 128)

7.1 INTRODUCTION

TABLE 114 SMART GLASS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 ARCHITECTURE

TABLE 116 MARKET FOR ARCHITECTURE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 117 MARKET FOR ARCHITECTURE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 118 MARKET FOR ARCHITECTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 119 MARKET FOR ARCHITECTURE, BY REGION, 2022–2027 (USD MILLION)

7.2.1 COMMERCIAL

7.2.1.1 Increasing usage of smart glass in commercial architecture for energy efficiency

7.2.1.2 Education

7.2.1.3 Corporate

7.2.1.4 Healthcare and lab facilities

7.2.1.4.1 External windows

7.2.1.4.2 Isolation screens

7.2.1.5 Government and others

7.2.1.5.1 Projection screens

7.2.1.5.2 Advertising displays

7.2.2 RESIDENTIAL

7.3 TRANSPORTATION

TABLE 120 SMART GLASS MARKET FOR TRANSPORTATION, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 121 MARKET FOR TRANSPORTATION, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 122 MARKET FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 123 MARKET FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

7.3.1 AUTOMOTIVE

7.3.1.1 Sunroof

7.3.1.2 Rear-view mirrors

7.3.1.3 Windows

7.3.1.4 Windshields

7.3.1.5 Bus/rail

7.3.2 AEROSPACE

7.3.2.1 Dimmable windows

7.3.2.2 Exit doors

7.3.2.3 Use cases of aviation application

7.3.3 MARINE

7.3.3.1 Windows

7.3.3.2 Skylight

7.4 POWER GENERATION PLANTS (SOLAR)

7.4.1 GROWING USE OF PHOTOCHROMIC SMART GLASS IN SOLAR POWER GENERATION EQUIPMENT TO DRIVE DEMAND

TABLE 124 SMART GLASS MARKET FOR POWER GENERATION (SOLAR), BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 125 MARKET FOR POWER GENERATION (SOLAR), BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 126 MARKET FOR POWER GENERATION (SOLAR), BY REGION, 2018–2021 (USD MILLION)

TABLE 127 MARKET FOR POWER GENERATION (SOLAR), BY REGION, 2022–2027 (USD MILLION)

7.5 CONSUMER ELECTRONICS & OTHERS

7.5.1 GROWING POPULARITY OF SMART GLASS IN ELECTRONICS APPLICATIONS PROPELS MARKET GROWTH

7.5.2 OTHERS

7.5.2.1 Museums and artwork exhibitions

7.5.2.2 Sunglasses

TABLE 128 SMART GLASS MARKET FOR CONSUMER ELECTRONICS & OTHERS, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 129 MARKET FOR CONSUMER ELECTRONICS & OTHERS, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 130 MARKET FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 131 MARKET FOR CONSUMER ELECTRONICS & OTHERS, BY REGION, 2022–2027 (USD MILLION)

8 SMART GLASS MARKET, BY CONTROL SYSTEMS (Page No. - 149)

8.1 INTRODUCTION

8.2 DIMMERS

8.3 SWITCHES

8.4 REMOTE CONTROL DEVICE

8.5 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 151)

9.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 132 SMART GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 133 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 40 SNAPSHOT: SMART GLASS IN NORTH AMERICA

TABLE 134 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 136 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 137 MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 138 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 139 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Government regulations and policies on energy conservation boost demand for energy-efficient products

9.2.2 CANADA

9.2.2.1 Favorable government incentives for energy-efficient products drive market growth

9.2.3 MEXICO

9.2.3.1 Adoption of smart glass in hospitality and construction sectors propels market growth

9.3 EUROPE

FIGURE 41 SNAPSHOT: SMART GLASS MARKET IN EUROPE

TABLE 140 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 141 MARKET EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 142 MARKET IN EUROPE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 143 MARKET IN EUROPE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 144 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 145 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Growing industrialization and government policies regarding energy consumption propel market growth

9.3.2 GERMANY

9.3.2.1 Increasing adoption of smart glass in automotive applications drives market growth

9.3.3 FRANCE

9.3.3.1 Strict energy efficiency regulations by government promote market growth

9.3.4 ITALY

9.3.4.1 Adoptions of smart glass in architecture and automotive sectors boost demand for smart glass

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 42 SNAPSHOT: SMART GLASS MARKET IN ASIA PACIFIC

TABLE 146 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 147 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 148 MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 149 MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 150 MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 151 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Smart glass applications in automobiles and stringent energy policies to drive market

9.4.2 JAPAN

9.4.2.1 Presence of major smart glass manufacturers as well as government regulations aid market growth

9.4.3 SOUTH KOREA

9.4.3.1 Growing demand for smart glass in windows of architecture and automobile applications boosts market growth

9.4.4 INDIA

9.4.4.1 Rising governmental support and awareness regarding smart glass promote market growth

9.4.5 REST OF APAC

9.5 ROW

TABLE 152 SMART GLASS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 153 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 154 MARKET IN ROW, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 155 MARKET IN ROW, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 156 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 157 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Surging demand for smart glass in infrastructure and transport sectors to propel market growth

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Growing adoption of smart glass in commercial architecture to drive market

10 COMPETITIVE LANDSCAPE (Page No. - 172)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 158 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

10.3 MARKET SHARE ANALYSIS: SMART GLASS, 2021

TABLE 159 MARKET: DEGREE OF COMPETITION, 2021

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 43 5-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN SMART GLASS MARKET

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 44 SMART GLASS COMPANY EVALUATION QUADRANT, 2021

10.5.5 COMPANY FOOTPRINT

TABLE 160 OVERALL COMPANY FOOTPRINT

TABLE 161 FOOTPRINT OF DIFFERENT APPLICATIONS OF SMART GLASS

TABLE 162 FOOTPRINT OF DIFFERENT TECHNOLOGIES OF SMART GLASS

TABLE 163 FOOTPRINT OF DIFFERENT COMPANIES IN VARIOUS REGIONS

10.6 COMPETITIVE BENCHMARKING

TABLE 164 SMART GLASS MARKET: DETAILED LIST OF KEY SMES

TABLE 165 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [SMES]

10.7 START-UP/SME EVALUATION MATRIX

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 45 MARKET, STARTUP/SME EVALUATION MATRIX, 2021

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 166 PRODUCT LAUNCHES, 2020–2022

10.8.2 DEALS

TABLE 167 DEALS, 2020–2022

11 COMPANY PROFILES (Page No. - 191)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 INTRODUCTION

11.2 KEY PLAYERS

11.2.1 SAINT GOBAIN

TABLE 168 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 46 SAINT-GOBAIN: COMPANY SNAPSHOT

11.2.2 RESEARCH FRONTIERS

TABLE 169 RESEARCH FRONTIERS: COMPANY SNAPSHOT

FIGURE 47 RESEARCH FRONTIERS: COMPANY SNAPSHOT

11.2.3 AGC

TABLE 170 AGC: COMPANY SNAPSHOT

FIGURE 48 AGC: COMPANY SNAPSHOT

11.2.4 GENTEX

TABLE 171 GENTEX: COMPANY SNAPSHOT

FIGURE 49 GENTEX: COMPANY SNAPSHOT

11.2.5 CORNING

TABLE 172 CORNING: COMPANY SNAPSHOT

FIGURE 50 CORNING: COMPANY SNAPSHOT

11.2.6 NSG GROUP

TABLE 173 NSG GROUP: COMPANY SNAPSHOT

FIGURE 51 NSG GROUP: COMPANY SNAPSHOT

11.2.7 VIEW

TABLE 174 VIEW: COMPANY SNAPSHOT

11.2.8 SHOWA DENKO MATERIALS

TABLE 175 SHOWA DENKO MATERIALS: COMPANY SNAPSHOT

FIGURE 52 SHOWA DENKO: COMPANY SNAPSHOT

11.2.9 GAUZY

TABLE 176 GAUZY: COMPANY SNAPSHOT

11.2.10 PLEOTINT

TABLE 177 PLEOTINT: COMPANY SNAPSHOT

11.2.11 SMARTGLASS INTERNATIONAL

TABLE 178 SMARTGLASS INTERNATIONAL: COMPANY SNAPSHOT

11.3 OTHER PLAYERS

11.3.1 RAVEN WINDOW

TABLE 179 RAVEN WINDOW: COMPANY SNAPSHOT

11.3.2 POLYTRONIX

TABLE 180 POLYTRONIX: COMPANY SNAPSHOT

11.3.3 PGW AUTO GLASS

TABLE 181 PGW AUTO GLASS: COMPANY SNAPSHOT

11.3.4 AGP AMERICA

TABLE 182 AGP AMERICA: COMPANY SNAPSHOT

11.3.5 SPD CONTROL SYSTEMS

TABLE 183 SPD CONTROL SYSTEMS: COMPANY SNAPSHOT

11.3.6 SCIENSTRY

TABLE 184 SCIENSTRY: COMPANY SNAPSHOT

11.3.7 XINYI GLASS

TABLE 185 XINYI GLASS: COMPANY SNAPSHOT

11.3.8 TAIWAN GLASS

TABLE 186 TAIWAN GLASS: COMPANY SNAPSHOT

11.3.9 FUYAO GLASS

TABLE 187 FUYAO GLASS: COMPANY SNAPSHOT

11.3.10 CENTRAL GLASS

TABLE 188 CENTRAL GLASS: COMPANY SNAPSHOT

11.3.11 INNOVATIVE GLASS CORP

TABLE 189 INNOVATIVE GLASS CORP: COMPANY SNAPSHOT

11.3.12 HALIO

TABLE 190 HALIO: COMPANY SNAPSHOT

11.3.13 CHROMOGENICS AB

TABLE 191 CHROMOGENICS LAB: COMPANY SNAPSHOT

11.3.14 MIRU SMART TECHNOLOGIES

TABLE 192 MIRU SMART TECHNOLOGIES: COMPANY SNAPSHOT

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 239)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATION

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

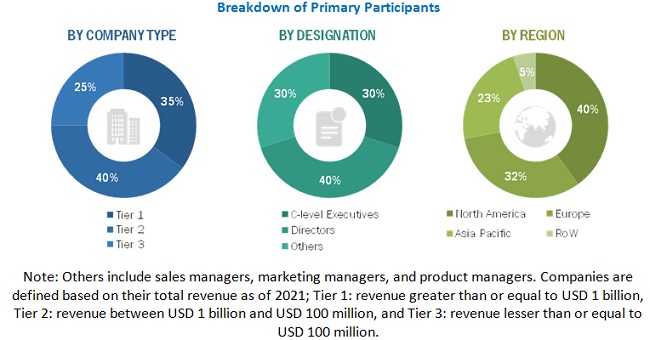

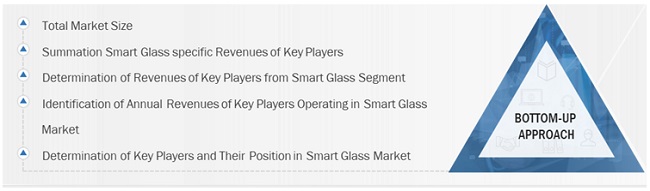

The study involved four major activities for estimating the size of the smart glass market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the smart glass market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the smart glass market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves smart glass magazines, journals, and smart glass associations. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the smart glass market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the smart glass market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, Asiia Pacific, and Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of smart glass market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the smart glass market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to smart glass market including key OEMs, IDMs, and Tier I suppliers

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Smart glass Market Size: Bottom-up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the smart glass market.

Report Objectives

- To describe and forecast the smart glass market size, in terms of value, based on offering, technology, lighting type, cultivation, application, installation type, and region

- To describe and forecast the smart glass market size, in terms of value, for various segments with respect to 4 key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To provide a detailed overview of the smart glass value chain

- To strategically profile the key players and comprehensively analyze their market ranking in terms of revenue and core competencies2

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the smart glass market

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the smart glass market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of smart glass market

- Estimation of the market size of the segments of the smart glass market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Glass Market

Do you have forecasts for the total glass market that would serve as the potential for retrofitting/replacement with Smart Glass?

Reasons why photochromic technology has not been incorporated for manufacturing of smart glass? Details such as it's cost, technological short comings, etc.

I want the list of manufacturers of smart glasses in US with their product prices, because I will sale the best one in KSA as representative of best products.

I came across your report and the segments "Consumer Electronics" and "Power Generation Plant" really caught my eye. What we primarily do is manufacture these glasses for aircraft, vehicles and buildings. If you could explain what goes into consumer electronics and solar power generation, I could have a word with my manager and we could take this ahead. Looking forward to your timely response.

I am interested in Smart Glasses + Touched, separately. Information for the European and Middle East markets , if there are any import figures / country , and market shares among the producing companies , and any general marketing info's !

I am interested in Smart Glasses + Touched, separately. Information for the European and Middle East markets , if there are any import figures / country , and market shares among the producing companies , and any general marketing info's !

I'm looking for data on enterprise use of smart glasses, to create a graphic to accompany a Wall Street Journal article.

I am only interested in the Automotive sector for smart glass report. So if you could customize it so we could reduce the whole report scope I'd appreciate a new quote, considering the actual price is way over my budget.

We have a client who is interested in the smart glass market. He is especially interested in data about installed square meter of facades, installed square meters of glass and installed square meter of smart glass in the following regions: World, Europe, Germany. Further he is interested in the potential of smart glass in the future. We would like to know if the study comprises such data? Furthermore which sources you used to get the data (in general)? Our client likes to purchase a study, but is uncertain about the quality of the data. I would very much appreciate your support. It is possible to get a sample?

I am interested in penetration and growth rates of the major smart glass players (Sage, View, Gauzy, Scienstry, Pleating)

I want to know market trend of using smart glass in 10 years down the road; or any related information about smart glass.

Our company is interested in know more about Smart Glass applications in Aerospace industry, in order to start a pilot trial in our MRO.

I am interested in knowing the Architecture growth in North America, energy savings, renovation vs new construction. Also, which company has best technology?

We are examining the needs of smart glass and the market price. Also, I would like to know why it is expanding in the West and not in Asia.