Smart Lock Market by Lock Type (Deadbolt Locks, Lever Handles), Communication Protocol (Bluetooth, WiFi), Unlocking Mechanism (Keypad, Card Keys, Touch Based), Vertical (Residential, Commercial) and Region - Global Forecast to 2027

Updated on : May 09, 2023

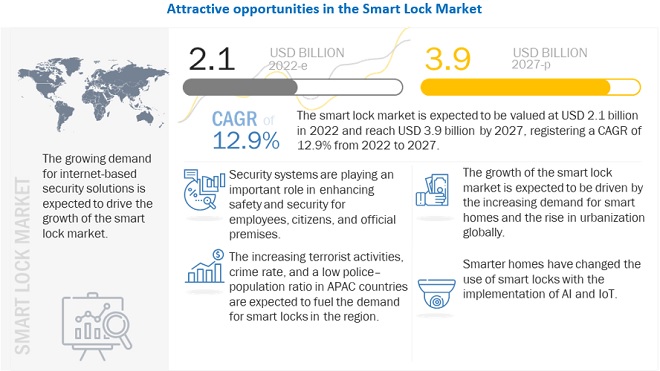

The global Smart Lock Market in terms of revenue was estimated to be worth USD 2,450 Million in 2023 and is poised to reach USD 3,900 Million by 2027, growing at a CAGR of 12.9% from 2023 to 2027.

The new research study consists of an industry trend analysis of the market. This growth is anticipated to be driven by several factors, including heightened safety and security concerns, the growing use of smartphones and other interconnected devices, and the superior capabilities of smart locks industry compared to traditional lock systems.

To know about the assumptions considered for the study, Request for Free Sample Report

The market includes major Tier I and II players like ASSA ABLOY AB (Sweden), dormakaba Group (Switzerland), Spectrum Brands, Inc. (US), SALTO Systems, S.L. (Spain), Allegion plc (Ireland), and others.

Smart Lock Market Segment Overview dynamics

Market for deadbolt locks to hold the highest market share during the forecast period

The market for the deadbolts segment accounted for the largest market share in 2021. The growth of this segment can be attributed to their increasing applications in various verticals and ease of installation.

Deadbolts are among the most common exterior residential locks. Factors such as low installation cost, high durability, and effective protection against intense intrusion or attacks in the residential, commercial, and other verticals are contributing to the growth of this segment.

Smart Lock Market for Bluetooth communication to hold the highest market share from 2022 to 2027

The market for the Bluetooth communication protocol segment accounted for the largest market share in 2021.

Bluetooth is a communication protocol that functions by maintaining the balance between parameters such as wide range, low power consumption, high reliability, bandwidth, and cost. This factor is fueling the demand for smart locks based on this protocol and driving market growth.

Market for keypad unlocking mechanism to hold the highest market during the forecast period

The market for the keypad unlocking mechanism segment is expected to hold the largest market share during the forecast period.

A Wi-Fi-based smart lock equipped with a smart keypad is an excellent addition to a smart home system. The device can open door locks without using a smartphone. It is excellent for use in homes but is expected to be ideal for rentals and businesses.

Smart Lock Market for residential vertical to hold the highest share from 2022 to 2027

The market for the residential vertical accounted for the largest market share in 2021.

The growth of this market can be attributed to the increasing demand for smart homes and rising urbanization across the globe. The growing urban population is increasing the need for better infrastructure equipped with security systems to protect people and property.

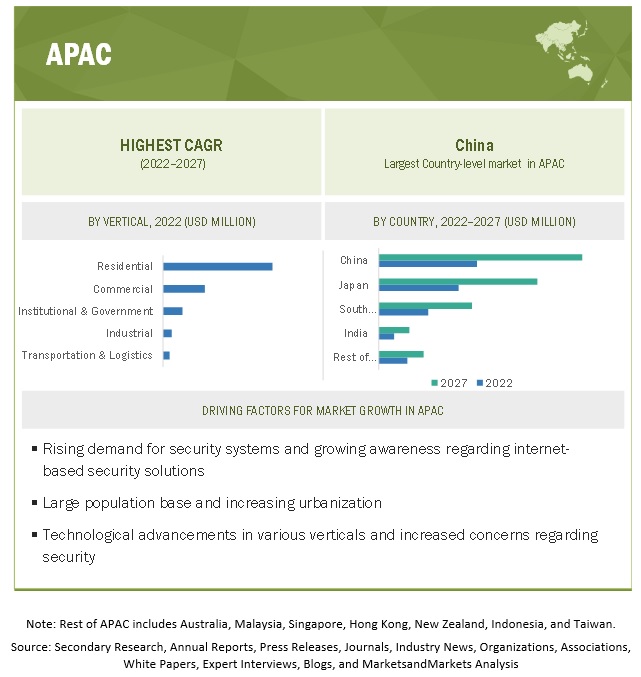

Market in APAC to hold the highest market share from 2022 to 2027

The market in APAC is expected to grow at the highest CAGR during the forecast period.

The vast population base, a large extent of ongoing research and development (R&D) activities, and increasing urbanization are expected to fuel the adoption of smart locks in APAC. Also, the growing terrorist threats and crime rates and a low police-population ratio in APAC countries are expected to create high demand for smart locks.

To know about the assumptions considered for the study, download the pdf brochure

Top Smart Lock Companies - Key Market Players

The Smart Lock Companies is dominated by a few globally established players such as

- ASSA ABLOY AB (Sweden),

- dormakaba Group (Switzerland),

- Spectrum Brands, Inc. (US),

- SALTO Systems, S.L. (Spain), and

- Allegion plc (Ireland).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Smart Lock Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2,450 Million in 2023 |

| Projected Market Size | USD 3,900 Million by 2027 |

| Growth Rate | CAGR of 12.9% |

| Base year considered | 2021 |

|

Historical Data Available for Years |

2018-2027 |

|

Forecast period |

2023-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

Smart Lock Market Dynamics:

Driver: Growing security concerns

The growing concern for security is a major factor driving the rapid adoption of smart locks. Since their inception, smart locks have evolved to provide efficient and user-friendly services.

Their high efficiency and sophistication have led to their deployment in various premises to boost security. There is a growing need for identification and authentication in various premises such as individual houses, condominiums, hotels, retail stores, banks and financial institutions, corporate buildings, and commercial buildings.

Restraint: High cost and perception of unreliability

Price is a major factor restraining the growth of the market since smart locks cost a lot more than traditional locks. Also, the switching cost of smart locks is high, which makes it less attractive for consumers to invest in.

The threat of hackers also hampers the perception of the reliability of smart locks among consumers. If smart locks are not updated regularly, they can become vulnerable to hackers. Being electronic devices, they can also be disrupted by cyber attackers who can create fake access codes with smartphones. As many smart lock models either operate on battery power or electricity, a power failure could also disrupt their functioning and render them vulnerable. Thus, the high cost and perception of unreliability act as restraints for this market.

Opportunity: Increasing adoption of IoT-based security systems

According to FBI reports, home burglary accounted for 17.1% of the estimated number of property crimes in 2020. By subcategorization, 56.7% of burglaries involved forcible entry, and the victims of burglary offenses suffered an estimated USD 3.4 billion in property losses in 2020.

This indicates opportunities for more secured and advanced security systems. The increasing penetration of the Internet and the growing popularity of IoT, coupled with the benefits of connecting smart locks to the Internet, are among the major factors creating a significant opportunity for the growth of the smart lock market.

Challenge: Risk of cyberattacks through smart devices and IoT-enabled devices

The increasing adoption of the Internet of Things has enabled the use of various cyber physical devices such as smartphones, connected cars, and wearable devices. Smart locks can be operated through the remote servers of the manufacturers of smart locks.

All information regarding the properties of a smart lock and its virtual key is stored in the vendor’s cloud server. Smart locks allow for easy sharing of keys to other authorized persons and unauthorized entry and breakage of the lock to be monitored and reported. However, the vendor cloud server can be attacked through code injection, cross-site scripting, password eavesdropping, and other means. Data communication taking place between a smartphone and a smart lock through the Bluetooth Low Energy (BLE) protocol can also be hacked through a man-in-the-middle (MITM) attack.

Smart Lock Market Categorization

The study categorizes the market based on Lock Type, Communication Protocol, Unlocking Mechanism, and Vertical at the regional and global levels.

Based on Lock Type, the Smart Lock Market been Segmented as follows:

- Deadbolt Locks

- Lever Handles

- Server locks & Latches

- Knob Locks

- Others

Based on Communication Protocol, the Smart Lock Market been Segmented as follows:

- Bluetooth

- WiFi

- Z-Wave

- Others

Based on Unlocking Mechanism, the Smart Lock Market been Segmented as follows:

- Keypad

- Card Key

- Touch Based

- Key Fob

- Smartphone Based

Based on Vertical, the Smart Lock Market been Segmented as follows:

- Commercial

- Residential

- Institutional & Government

- Industrial

- Transportation & Logistic

Based on Region, the Smart Lock Market been Segmented as follows:

- North America

- Europe

- APAC

- RoW

Recent Developments in Smart Lock Industry

- In February 2022, dormakaba completed the acquisition of AtiQx Holding B.V., thereby strengthening its core business and services activities in the Netherlands. AtiQx is one of the major providers of electronic access control and workforce management in the relevant market.

- In February 2022, Vivint and New American Funding, one of the nation’s largest independent mortgage companies, announced a strategic partnership that will help homeowners and homebuyers protect their dream homes. Through the partnership, New American Funding customers will be eligible to receive unique and exciting offers from Vivint to protect and automate their homes.

- In November 2021, dormakaba France has completed the acquisition of Fermatic Group, a renowned provider for services for automatic doors and gates in France.

- In November 2021, SALTO introduced XS4 Original+, the next generation of the world’s most flexible and reliable smart locking solution that features a beautiful design with a sleek flat reader in two new colors. The new SALTO XS4 Original+ takes the trusted and proven flagship XS4 Original electronic lock product family and incorporates the latest technology to accommodate the access control needs of today and tomorrow.

- In November 2021, Allegion announced the launch of two new Schlage products, the NDE and LE mobile-enabled wireless locks. The products include an Si option that supports HID smart cards and next-generation Seos credentials. The products allow customers with HID smart cards and mobile credentials to extend access control even further into their buildings. The option allows facility managers freedom to choose the solution that best fits their particular campus.

- In September 2021, Dahua Technology introduced Dahua DeepHub Smart Interactive Whiteboard – an IFPD (Interactive Flat Panel Display) device designed for modern meeting rooms and remote communication demands. It also supports fingerprint lock – a security feature that some IFPDs in the market don’t have. It ensures that only authorized users can log in to the device, which helps secure internal information and conferencing content.

Frequently Asked Questions (FAQ):

What is the market size for the Smart lock market?

The market is estimated to be valued at USD 2.1 billion in 2022 and reach USD 3.9 billion by 2027, registering a CAGR of 12.9% between 2022 and 2027.

What are the major driving factors and opportunities in the smart lock market?

The growth of the smart lock market is projected to be driven by factors such as increasing security and safety concerns, rising adoption of smartphones and other connected devices, and their superior features compared to traditional lock systems. The benefits associated with the use of smart locks over traditional locks include higher connectivity, security, and convenience. The connectivity feature of the smart lock makes it easy to access it remotely. The growing adoption of IoT-based security systems and developing urban infrastructure in emerging nations are expected to create lucrative opportunities for the market players during the review period.

Who are the leading players in the global smart lock market?

Companies such as ASSA ABLOY AB (Sweden), dormakaba Group (Switzerland), Spectrum Brands, Inc. (US), SALTO Systems, S.L. (Spain), and Allegion plc (Ireland) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the COVID-19 impact on the smart lock market?

According to discussions with various primary respondents, the impact of COVID-19 on the smart lock market has been considered to be for a short-to-medium term; hence, it has been assumed that COVID-19 prevailed from the first quarter of 2020 to its fourth quarter.

What are some of the technological advancements in the market?

The ever-growing demand for tablets, smartphones, and connected devices acts as a strong driver for the smart lock market. Smartphones are witnessing rapid adoption in many developed economies. The demand from developing economies, such as China, India, Malaysia, and Indonesia, would continue to fuel the demand for smartphones in the near future. The explosion of Internet usage and the growing adoption of smartphones encourage companies to strategically invest more in smartphone-based applications and mobile websites. Moreover, the increasing penetration of the Internet and the growing popularity of IoT, coupled with the benefits of connecting smart locks to the Internet, are among the major factors creating a significant opportunity for the growth of the smart lock market .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 SMART LOCK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary Expert Interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 2 PROCESS FLOW

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for calculating market share through bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for calculating market share through top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET RANKING ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 6 DEADBOLT LOCKS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 7 WI-FI COMMUNICATION PROTOCOL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 KEYPAD UNLOCKING MECHANISM SEGMENT TO HOLD LARGEST SHARE OF SMART LOCK MARKET IN 2027

FIGURE 9 RESIDENTIAL VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 MARKET IN APAC TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART LOCK MARKET

FIGURE 11 RISING DEMAND FOR INTERNET-BASED SECURITY SOLUTIONS TO DRIVE GROWTH OF MARKET

4.2 MARKET IN NORTH AMERICA, BY COUNTRY AND VERTICAL

FIGURE 12 US AND RESIDENTIAL VERTICAL TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

4.3 MARKET FOR COMMERCIAL VERTICAL, BY LOCK TYPE

FIGURE 13 MARKET FOR DEADBOLT LOCKS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 14 CHINA TO ACCOUNT FOR HIGHEST GROWTH RATE IN GLOBAL MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 SMART LOCK MARKET DYNAMICS

FIGURE 16 DRIVERS AND THEIR IMPACT ON MARKET

FIGURE 17 OPPORTUNITIES AND THEIR IMPACT ON MARKET

FIGURE 18 RESTRAINTS & CHALLENGES AND THEIR IMPACT ON MARKET

5.2.1 DRIVERS

5.2.1.1 Growing security concerns

5.2.1.2 Enhanced features compared with traditional lock systems

5.2.1.3 Rising adoption of smartphones and other connected devices

5.2.2 RESTRAINTS

5.2.2.1 High cost and perception of unreliability

5.2.2.2 Lack of awareness among customers

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of IoT-based security systems

5.2.3.2 Rapid urbanization in emerging nations

5.2.3.3 Global proliferation of smart cities

5.2.4 CHALLENGES

5.2.4.1 Risk of cyberattacks through smart devices and IoT-enabled devices

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY RAW MATERIAL SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS

5.4 SMART LOCK MARKET ECOSYSTEM

FIGURE 20 MARKET ECOSYSTEM

6 SMART LOCK MARKET, BY LOCK TYPE (Page No. - 55)

6.1 INTRODUCTION

FIGURE 21 DEADBOLT LOCKS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 1 MARKET, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 2 MARKET, BY LOCK TYPE, 2022–2027 (USD MILLION)

TABLE 3 MARKET, BY LOCK TYPE, 2018–2021 (MILLION UNITS)

TABLE 4 MARKET, BY LOCK TYPE, 2022–2027 (MILLION UNITS)

6.2 DEADBOLT LOCKS

6.2.1 INCREASING DEPLOYMENT OF DEADBOLT LOCKS IN RESIDENTIAL SECTOR TO DRIVE MARKET GROWTH

FIGURE 22 RESIDENTIAL VERTICAL TO HOLD LARGEST SHARE OF MARKET FOR DEADBOLTS DURING FORECAST PERIOD

TABLE 5 MARKET FOR DEADBOLT LOCKS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 6 MARKET FOR DEADBOLT LOCKS, BY VERTICAL, 2022–2027 (USD MILLION)

6.3 LEVER HANDLES

6.3.1 CONVENIENT STRUCTURE AND THEIR COMPLIANCE WITH US DISABILITIES ACT 1990 TO FUEL DEMAND FOR LEVER HANDLES

TABLE 7 MARKET FOR LEVER HANDLES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 8 MARKET FOR LEVER HANDLES, BY VERTICAL, 2022–2027 (USD MILLION)

6.4 SERVER LOCKS AND LATCHES

6.4.1 RISING CONCERNS REGARDING CYBERATTACKS TO FUEL DEMAND FOR SERVER LOCKS AND LATCHES

TABLE 9 MARKET FOR SERVER LOCKS AND LATCHES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 10 MARKET FOR SERVER LOCKS AND LATCHES, BY VERTICAL, 2022–2027 (USD MILLION)

6.5 KNOB LOCKS

6.5.1 GROWING USE OF KNOB LOCKS WITH DEADBOLTS ON EXTERIOR DOORS IN RESIDENTIAL SECTOR TO DRIVE MARKET GROWTH

TABLE 11 MARKET FOR KNOB LOCKS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 12 MARKET FOR KNOB LOCKS, BY VERTICAL, 2022–2027 (USD MILLION)

6.6 OTHERS

TABLE 13 MARKET FOR OTHERS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR OTHERS, BY VERTICAL, 2022–2027 (USD MILLION)

7 SMART LOCK MARKET, BY COMMUNICATION PROTOCOL (Page No. - 64)

7.1 INTRODUCTION

FIGURE 23 WI-FI COMMUNICATION PROTOCOL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY COMMUNICATION PROTOCOL, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY COMMUNICATION PROTOCOL, 2022–2027 (USD MILLION)

7.2 WI-FI

7.2.1 CONNECTIVITY BENEFITS OFFERED BY WI-FI TO DRIVE MARKET GROWTH

7.3 BLUETOOTH

7.3.1 WIDE RANGE, LOW POWER CONSUMPTION, AND HIGH RELIABILITY AND BANDWIDTH FEATURES TO FUEL MARKET GROWTH

7.4 Z-WAVE

7.4.1 GROWING POPULARITY OF RELIABILITY AND HIGH-SPEED FEATURES OF Z-WAVE TO DRIVE MARKET GROWTH

7.5 OTHERS

7.5.1 ZIGBEE

7.5.2 THREAD

7.5.3 NFC

8 SMART LOCK MARKET, BY UNLOCKING MECHANISM (Page No. - 68)

8.1 INTRODUCTION

FIGURE 24 KEYPAD UNLOCKING MECHANISM SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

TABLE 17 MARKET, BY UNLOCKING MECHANISM, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY UNLOCKING MECHANISM, 2022–2027 (USD MILLION)

8.2 KEYPAD

8.2.1 INTEGRATION OF KEYPADS WITH ACCESS CONTROL SYSTEMS TO DRIVE MARKET GROWTH

8.3 CARD KEY

8.3.1 GROWING USE OF RADIO FREQUENCY IDENTIFICATION (RFID) MAGNETIC DOOR LOCKS IN COMMERCIAL OFFICE BUILDINGS TO DRIVE MARKET GROWTH

8.3.1.1 Low frequency

8.3.1.2 High frequency

8.3.1.3 Ultra-high frequency

8.4 TOUCH BASED

8.4.1 GROWING ADOPTION OF AUTOMATED FINGERPRINT IDENTIFICATION SYSTEMS (AFISS) TO FUEL DEMAND FOR FINGERPRINT RECOGNITION SOLUTIONS USED IN SMART LOCK MECHANISM

8.5 KEY FOBS

8.5.1 RISE IN REPLACEMENT OF OLD METAL KEY SYSTEMS WITH ELECTRONIC FOB SYSTEMS TO DRIVE MARKET GROWTH

8.6 SMARTPHONE BASED

8.6.1 GROWING ADOPTION OF SMART HOMES TO INCREASE DEMAND FOR SMARTPHONE-BASED DOOR LOCKING SYSTEMS

9 SMART LOCK MARKET, BY VERTICAL (Page No. - 74)

9.1 INTRODUCTION

FIGURE 25 RESIDENTIAL VERTICAL TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 19 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 COMMERCIAL

9.2.1 HOSPITALITY

9.2.1.1 Increasing adoption of smart locks in hotels, vacation rental properties, resorts, casinos, and cruise ships to boost market growth

9.2.2 RETAIL STORES AND MALLS

9.2.2.1 Retail stores and malls segment to witness healthy growth in market

9.2.3 HEALTHCARE

9.2.3.1 Growing use of smart locks in healthcare sector to ensure access only to authorized users to boost market growth

9.2.4 BANKS AND FINANCIAL CENTRES

9.2.4.1 Increasing trend of biometric and multifactor authentication in banking and financial institutions to drive market growth

9.2.5 ENTERPRISES AND DATA CENTRES

9.2.5.1 Rising demand for security smart cards and biometric access systems to prevent minor security risks in enterprises to drive market growth

TABLE 21 MARKET, BY COMMERCIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY COMMERCIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 23 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 27 EUROPE: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 28 EUROPE: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 29 APAC: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 APAC: MARKET FOR COMMERCIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 31 ROW: MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 ROW: MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 MARKET FOR COMMERCIAL VERTICAL, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR COMMERCIAL VERTICAL, BY LOCK TYPE, 2022–2027 (USD MILLION)

9.3 RESIDENTIAL

9.3.1 CONDOMINIUM

9.3.1.1 Growing use of smart locks in condominiums or multi-family apartments to prevent invasion, unauthorized access, theft, and burglary to drive market growth

9.3.2 INDIVIDUAL HOUSES

9.3.2.1 Rising adoption of smart locks by individual house owners to ensure security and safety to drive market growth

FIGURE 26 CONDOMINIUM SEGMENT TO HOLD LARGER SHARE OF SMART LOCK MARKET FOR RESIDENTIAL VERTICAL DURING FORECAST PERIOD

TABLE 35 MARKET FOR RESIDENTIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR RESIDENTIAL VERTICAL, 2022–2027 (USD MILLION)

FIGURE 27 APAC TO REGISTER HIGHEST CAGR IN SMART LOCK FOR RESIDENTIAL VERTICAL DURING FORECAST PERIOD

TABLE 37 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 41 EUROPE: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 42 EUROPE: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 43 APAC: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 44 APAC: MARKET FOR RESIDENTIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 45 ROW: MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 ROW: MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR RESIDENTIAL VERTICAL, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR RESIDENTIAL VERTICAL, BY LOCK TYPE, 2022–2027 (USD MILLION)

9.4 INSTITUTIONAL & GOVERNMENT

9.4.1 INCREASING DEMAND FOR SMART LOCKS IN GOVERNMENT VERTICAL TO RESTRICT UNAUTHORIZED ENTRIES TO DRIVE MARKET GROWTH

TABLE 49 SMART LOCK MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 EUROPE: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 APAC: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 56 APAC: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 57 ROW: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 ROW: MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 59 MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR INSTITUTIONAL & GOVERNMENT VERTICAL, BY LOCK TYPE, 2022–2027 (USD MILLION)

9.5 TRANSPORTATION & LOGISTICS

9.5.1 RISING ADOPTION OF BIOMETRICS-BASED ACCESS CONTROL USING SMART LOCKS BY AIRPORT OPERATORS TO DRIVE MARKET GROWTH

TABLE 61 SMART LOCK MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 APAC: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 APAC: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 69 ROW: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 ROW: MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR TRANSPORTATION & LOGISTICS VERTICAL, BY LOCK TYPE, 2022–2027 (USD MILLION)

9.6 INDUSTRIAL

9.6.1 MANUFACTURING

9.6.1.1 Increased need for protecting people and properties across manufacturing sites to create growth opportunities for market players

9.6.2 OIL & GAS

9.6.2.1 Ability of smart locks to provide suitable and enhanced security to fuel their demand in oil & gas vertical

9.6.3 ENERGY & POWER

9.6.3.1 Rising demand for smart locks in energy and power vertical to prevent unauthorized access to drive market growth

TABLE 73 SMART LOCK MARKET FOR INDUSTRIAL VERTICAL, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR INDUSTRIAL VERTICAL, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 APAC: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 82 APAC: MARKET FOR INDUSTRIAL VERTICAL, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 83 ROW: MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 ROW: MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR INDUSTRIAL VERTICAL, BY LOCK TYPE, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR INDUSTRIAL VERTICAL, BY LOCK TYPE, 2022–2027 (USD MILLION)

10 SMART LOCK MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

FIGURE 28 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 87 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA MARKET SNAPSHOT

TABLE 89 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 92 MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 93 MARKET IN US, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 94 MARKET IN US, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 95 MARKET IN CANADA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN CANADA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 97 MARKET IN MEXICO, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 98 MARKET IN MEXICO, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to hold largest share of North American smart lock market

10.2.2 CANADA

10.2.2.1 Growing awareness regarding internet-based safety and security to drive growth of smart lock market in Canada

10.2.3 MEXICO

10.2.3.1 Mexico to be lucrative market for smart locks

10.3 EUROPE

FIGURE 30 EUROPE MARKET SNAPSHOT

TABLE 99 SMART LOCK MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 103 MARKET IN UK, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 104 MARKET IN UK, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 105 MARKET IN GERMANY, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN GERMANY, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 107 MARKET IN FRANCE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN FRANCE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 109 MARKET IN REST OF EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN REST OF EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Decline in cost of mobile broadband connection and increasing adoption of cloud infrastructure to boost demand for smart locks in UK

10.3.2 GERMANY

10.3.2.1 Growing adoption of internet-based security systems in various applications to drive market growth in Germany

10.3.3 FRANCE

10.3.3.1 Growing awareness regarding internet-based home security solutions and rising adoption of wireless portable consumer electronics to drive market growth in France

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 31 APAC MARKET SNAPSHOT

FIGURE 32 CHINA TO HOLD LARGEST SHARE OF APAC SMART LOCK MARKET DURING FORECAST PERIOD

TABLE 111 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 MARKET IN APAC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 114 MARKET IN APAC, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 115 MARKET IN CHINA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 116 MARKET IN CHINA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 117 MARKET IN JAPAN, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 118 MARKET IN JAPAN, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 119 MARKET IN SOUTH KOREA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 120 MARKET IN SOUTH KOREA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 121 MARKET IN INDIA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 122 MARKET IN INDIA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 123 MARKET IN REST OF APAC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 124 MARKET IN REST OF APAC, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing industrialization to fuel demand for smart lock systems in China

10.4.2 JAPAN

10.4.2.1 Rapid industrialization and modernization to create lucrative opportunities for market players in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Rising demand for remotely managed and connected security devices to drive market growth in South Korea

10.4.4 INDIA

10.4.4.1 Rise in terrorist activities, crime rate, and data and security breaches to fuel demand for security and safety systems

10.4.5 REST OF APAC

10.5 ROW

TABLE 125 SMART LOCK MARKET IN ROW, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 MARKET IN ROW, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 127 MARKET IN ROW, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 128 MARKET IN ROW, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 129 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 130 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 131 MARKET IN SOUTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 132 MARKET IN SOUTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Rising urbanization and increased adoption of IoT-based solutions to boost market growth

10.5.2 SOUTH AMERICA

10.5.2.1 Growing industrialization to create lucrative opportunities for players in South American market

11 COMPETITIVE LANDSCAPE (Page No. - 129)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 133 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SMART LOCK PROVIDERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 REVENUE ANALYSIS OF LEADING PLAYERS (2017–2021)

FIGURE 33 5-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN MARKET

11.4 MARKET SHARE ANALYSIS: SMART LOCK MARKET, 2021

TABLE 134 DEGREE OF COMPETITION

11.5 COMPANY EVALUATION MATRIX

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 34 COMPANY EVALUATION MATRIX, 2021

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES

TABLE 135 PRODUCT LAUNCHES, JANUARY 2020–NOVEMBER 2021

11.6.2 DEALS

TABLE 136 DEALS, JANUARY 2020–FEBRUARY 2022

12 COMPANY PROFILES (Page No. - 139)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 ASSA ABLOY

TABLE 137 ASSA ABLOY: BUSINESS OVERVIEW

FIGURE 35 ASSA ABLOY: COMPANY SNAPSHOT

TABLE 138 ASSA ABLOY: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 139 ASSA ABLOY: DEALS

12.2.2 DORMAKABA

TABLE 140 DORMAKBA: BUSINESS OVERVIEW

FIGURE 36 DORMAKABA: COMPANY SNAPSHOT

TABLE 141 DORMAKABA: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 142 DORMAKABA: DEALS

TABLE 143 DORMAKABA: OTHERS

12.2.3 SPECTRUM BRANDS

TABLE 144 SPECTRUM BRANDS: BUSINESS OVERVIEW

FIGURE 37 SPECTRUM BRANDS: COMPANY SNAPSHOT

TABLE 145 SPECTRUM BRANDS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 146 SPECTRUM BRANDS: PRODUCT LAUNCHES

12.2.4 SALTO SYSTEMS

TABLE 147 SALTO SYSTEMS: BUSINESS OVERVIEW

TABLE 148 SALTO SYSTEMS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 149 SALTO SYSTEMS: PRODUCT LAUNCHES

TABLE 150 SALTO SYSTEMS: DEALS

TABLE 151 SALTO SYSTEMS: OTHERS

12.2.5 ALLEGION

TABLE 152 ALLEGION: BUSINESS OVERVIEW

FIGURE 38 ALLEGION: COMPANY SNAPSHOT

TABLE 153 ALLEGION: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 154 ALLEGION: PRODUCT LAUNCHES

TABLE 155 ALLEGION: DEALS

12.2.6 HONEYWELL

TABLE 156 HONEYWELL: BUSINESS OVERVIEW

FIGURE 39 HONEYWELL: COMPANY SNAPSHOT

TABLE 157 HONEYWELL: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.2.7 DAHUA TECHNOLOGY

TABLE 158 DAHUA TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 40 DAHUA TECHNOLOGY: COMPANY SNAPSHOT

TABLE 159 DAHUA TECHNOLOGY: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 160 DAHUA TECHNOLOGY: PRODUCT LAUNCHES

12.2.8 SAMSUNG

TABLE 161 SAMSUNG: BUSINESS OVERVIEW

FIGURE 41 SAMSUNG: COMPANY SNAPSHOT

TABLE 162 SAMSUNG: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 163 SAMSUNG: OTHERS

12.2.9 VIVINT

TABLE 164 VIVINT: BUSINESS OVERVIEW

FIGURE 42 VIVINT: COMPANY SNAPSHOT

TABLE 165 VIVINT: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 166 VIVINT: DEALS

12.2.10 ZKTECO

TABLE 167 ZKTECO: BUSINESS OVERVIEW

TABLE 168 ZKTECO: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 169 ZKTECO: DEALS

12.3 OTHER KEY PLAYERS

12.3.1 IGLOOCOMPANY

12.3.2 REMOTELOCK

12.3.3 ONITY

12.3.4 MASTER LOCK

12.3.5 MIWA LOCK

12.3.6 SENTRILOCK

12.3.7 AVENT SECURITY

12.3.8 HAVENLOCK

12.3.9 SHENZHEN VIANS ELECTRONIC LOCK

12.3.10 ANVIZ GLOBAL

12.3.11 CANDY HOUSE

12.3.12 AMADAS

12.3.13 KEYWE

12.3.14 GATE LABS

12.3.15 DESSMANN SCHLIESSANLAGEN

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 182)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

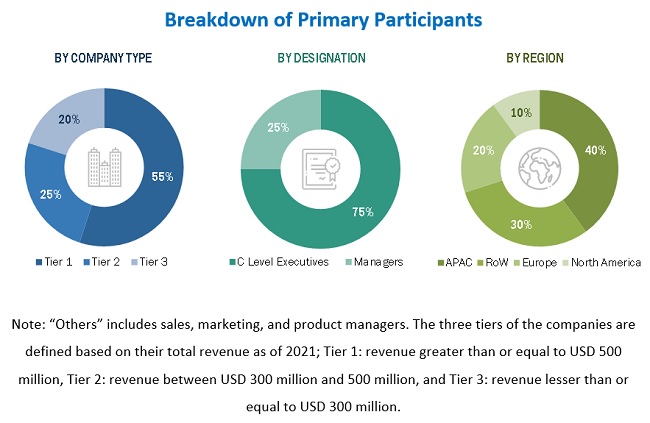

This research study involved extensive use of secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the smart lock market. Primary sources include several industry experts from the core and related industries and suppliers, manufacturers, distributors, technology developers, IP vendors, and standards organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

List of major secondary sources

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the smart lock market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across 4 major regions—North America, Europe, APAC, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the smart lock market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The bottom-up approach was used to arrive at the overall size of the smart lock market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market. The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Identifying various verticals contributing to the growth of the smart lock market

- Analyzing major smart lock providers and studying their portfolios and solution offerings

- Analyzing trends pertaining to smart locks, including lock types, communication protocols, unlocking mechanisms, and verticals

- This estimation would help understand the demand generated by the companies dependent on the smart lock industry

- Tracking the ongoing and upcoming smart lock developments by various companies or end users, and forecasting the market based on these developments and other critical parameters

- Conducting multiple discussions with the key opinion leaders to understand the types of contracts signed and products and systems offered by market players

- This would help analyze the break-up of the scope of work carried out by each major smart lock company

- Conducting multiple discussions with key opinion leaders to understand the current technologies in the smart lock market and analyzing the break-up of the scope of work carried out by each major smart lock company

- Arriving at the market estimates by analyzing revenues of these companies generated from various countries through the subscriptions offered for smart lock products and then combining the same to get the market estimates based on region

- Verifying and crosschecking the estimates at every level by the discussion with key opinion leaders, including directors, operation managers, and then finally with the domain experts in MarketsandMarkets

- Referring to various paid and unpaid sources of information such as annual reports, press releases, white papers, blogs, news, and databases to validate the market estimations

In the top-down approach, the overall size of the smart lock market that was derived through percentage splits obtained from secondary and primary research was used to estimate the size of the individual markets (mentioned in the market segmentation).

For the calculation of the size of specific market segments, the overall size of the smart lock market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each individual market were determined and confirmed in this study.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing initially on top-line investments and expenditures made in the smart lock ecosystem

- Splitting the market considering the types of smart locks used in different verticals and increased use of smart locks them, along with the key developments in the major market area

- Collecting information related to revenue generated by players through the segments offering smart locks

- Conducting multiple on-field discussions with key opinion leaders across each major company involved in the development of smart locks

- Estimating the geographic split with the use of secondary sources based on numerous factors such as the number of players in a specific country or region and smart locks used in various verticals

- Verifying and crosschecking the estimates at every level by discussions with key opinion leaders, including directors, operation managers, and then finally with the domain experts in MarketsandMarkets

Data Triangulation

After arriving at the overall size of the smart lock market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the smart lock market, in terms of value, based on lock type, communication protocol, unlocking mechanism, vertical, and region

- To describe and forecast the market, in terms of volume, based on lock type

- To describe and forecast the market, in terms of value, for 4 major regions, namely, North America, Europe, APAC, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the smart lock ecosystem

- To strategically analyze micromarkets1 with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to boost their positions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Lock Market

We need market sizing for Communication Protocol (Bluetooth, Wi-Fi), Vertical (Residential, Commercial, Institution and Government, Industrial) and Geography.

I am trying to find some information about the smart bicycle lock market in Europe. I need this information for a business plan I have to develop for my Entrepreneurship class.

I am an undergraduate student and required some statistical data about the smart lock industry for a module project. Is it possible for me to gain access to data for market forecasts by lock type and region, etc. The purpose is limited for the module project use only. Proper citations will be used.

I am university student and working on a case project regarding smart locks. Any information on the current smart lock market would be very helpful for me.

Dear analyst, I would like to buy this report but it is too expensive for us. Could you consider a lower price and if you can please let me know how much can I buy it. Note, I cannot call today and please let me know by e-mail.

We would like to know the market potential for Smart padlocks with respect to global and Indian market.

Me and my group currently working on a project related to propose a new Engineering, Technology or Computing (ETC) initiative for a start-up company. We are aim to propose electronic lock for ETC start-up company and we need to do a research on electronic lock market in UK.

We are into the implementation of smart door lock market study analysis which we are looking forward to expand our business in this ecosystem.