Smart Manufacturing Market by Information Technology, Enabling Technology, Industry (Process and Discrete) and Geography (North America, Europe, Asia Pacific, Rest of World) (2021-2027)

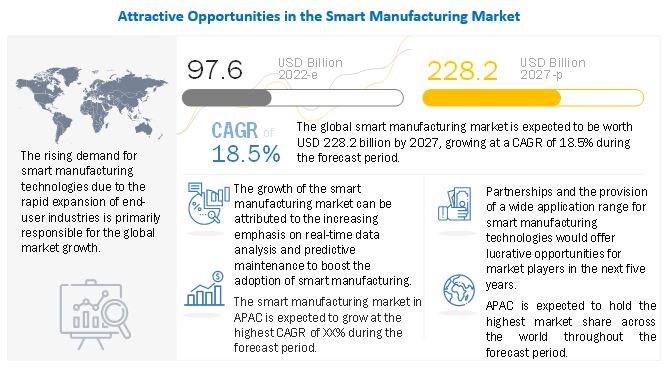

[99 Pages Report] The global smart manufacturing market was valued at USD 97.6 billion in 2022 and is projected to reach USD 228.3 billion by 2027; it is expected to grow at a CAGR of 18.5% from 2022 to 2027.

The major drivers of the smart manufacturing market include the growing adoption of Industry 4.0, rising emphasis on industrial automation in manufacturing processes, increasing government involvement in supporting industrial automation, growing emphasis on regulatory compliances, increasing complexities in the supply chain, and surging demand for software systems that reduce time and cost. The smart manufacturing industry has been segmented by information technology, enabling technology, industry, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Manufacturing Market Dynamics

DRIVERS: Increasing government involvement in supporting smart manufacturing

Governments worldwide are becoming aware of the significant potential of smart manufacturing technologies; therefore, they are supporting and funding R&D for technologies such as IIoT and industrial 3D printing.

The governments of various countries are supporting IIoT innovation as they expect themselves to become potential adopters of the technology. They are financially supporting new IoT research projects and implementations to build and run smart cities in the future.

Governments worldwide are undertaking initiatives and providing funding to educational institutions, research centers, and research and technology organizations to further explore the possibilities of 3D printing technology. Countries, such as the US, the UK, and Canada, have implemented national programs for promoting university-level 3D printing research, driving technology advancements, and establishing numerous startups.

The emergence of new applications for 3D printing has also attracted industrialists and governments across the world toward the technology. Governments of countries in APAC are actively undertaking projects and initiatives to digitalize manufacturing facilities.

RESTRAINT: Highinvestments and costs involved in implementing smart manufacturing solutions

The requirement for high investments for the deployment of smart manufacturing solutions acts as a restraint for the growth of the market globally.

Huge capital is required to set up and install smart manufacturing technologies such as Automated Guided Vehicles (AGVs), Enterprise Manufacturing Intelligence (EMI), HMI, Warehouse Management System (WMS), and PAM. This can discourage manufacturers from adopting smart manufacturing. For example, in an enterprise, EMI is used to enable the real-time planning, control, and execution of operations to increase productivity and operational efficiency; however, this comes with an added cost.

The high installation cost of information and enabling technology systems is due to the requirement for consultation, acquisition, and implementation of these systems and services. The introduction of smart manufacturing results in the adoption of advanced smart manufacturing equipment, such as smart field devices and industrial robots. To communicate with these equipment, technologies need to be more advanced with the latest functional technologies such as voice recognition, gesture recognition, and multitouch screens. This further increases the cost of the system. These technologies are still quite expensive and may lead to an additional financial burden on companies operating in price-sensitive economies.

OPPORTUNITIES: Rapid industrial growth in emerging economies

Companies from developed economies are looking to expand their operations in emerging economies due to cheap labor costs and lower real estate rates.

Additionally, rapid industrialization in emerging economies, such as India, China, Africa, Brazil, Mexico, and Indonesia, has resulted in significant investments in infrastructure development, which in turn is attracting global companies to these economies to set up manufacturing plants. These developments have created a requirement for advanced and sophisticated warehousing facilities to integrate and manage supply chains.

Moreover, 5G industrial IoT in manufacturing operations is gaining traction with the advent of smart devices and advanced data analytics techniques. Manufacturing companies are deploying 5G-enabled industrial subsystems rapidly and integrally focusing on increasing their business process efficiency and production output with the optimum resource utilization. 5G industrial IoT solutions and services offer manufacturing companies the benefit of digital disruption. With the growth of 5G, hundreds of manufacturers have connected thousands of machines across their global factories to IoT platforms, which helps manufacturers increase their capacity utilization and ultimately win more businesses to remain globally competitive in their concerned market.

CHALLENGES: Threats related to cybersecurity

Increasing cybersecurity threats pose a major challenge for the smart manufacturing market due to the ever-increasing instances of viruses and hacking. Vital information may be tampered with by malicious viruses in computer systems, which can cause a major loss.

The entire information flow could be disrupted if communication software systems do not take proper security measures. There is an increasing dependence on web-based communication, and off-the-shelf IT solutions are being used extensively across industries. These industries, therefore, are prone to malware targeted at industrial systems.

Smart Manufacturing Market Segment Overview

Market for digital twins expected to grow at the fastest rate during the forecast period

The smart manufacturing market by enabling technologies for digital twins is expected to grow at thehighest CAGR during the forecast period.

Digital twins are being increasingly used as a means of connecting information about a physical product and its behavior in the real world with a 3D digital representation, which is commonly employed during engineering and other areas of business. For instance, Dassault Systems (France) introduced the virtual twin concept that enables design and engineering teams to visualize and analyze products or systems virtually and provide insights similar to physical behaviors, including stress and vibration, as well as behaviors associated with software and control systems.

Food & beverages process industry is projected to register the highest CAGR from 2022 to 2027

The latest technological methods such as 3D food printing and machine vision are changing the manufacturing processes of the food & beverages industry.

The main aim of the stakeholders involved in the manufacturing and distribution chain of this is to offer high-quality products while keeping the production, maintenance, and distribution costs low. The automation technologies used in the food &beverages industry offer design flexibility, innovative and integrated safety solutions, and advanced software tools for controlling the operations of machines. Food manufacturers are investing significantly in transforming their traditional manufacturing facilities into advanced ones. Thus, the adoption of smart manufacturing technology and advanced manufacturing equipment is considerably increasing in the food & beverages industry.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to lead smart manufacturing market in 2020

Growing adoption of technologies such as IoT, and IIoT; and increasing need to optimize productivity and reduce operational and maintenance costs are major driving factors of the smart manufacturing market in APAC.

Government support in various APAC countries to drive industrialization is one of the important factors that will boost the demand for smart manufacturing in the coming years. Various initiatives have been taken by the governments in the region. For instance, China’s “Made in China 2025,” Japan’s “Industrial Value Chain Initiative (IVI),” South Korea’s “The Manufacturing Innovation Strategy 3.0 (Strategy 3.0),” and India’s “Samarth Udyog Bharat 4.0,” are likely to play major roles in industrial advancement and consequently create growth opportunities for the smart manufacturing market.

Key Market Players in Smart Manufacturing Industry

Major Players offering Smart Manufacturing Companies include ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), and General Electric (US).

Smart Manufacturing Market Report Scope:

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 97.6 billion |

| Revenue Forecast in 2027 | USD 228.3 billion |

| Growth Rate | 18.5% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

Information Technology, Enabling Technology, and Industry |

|

Geographic Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Major Players: ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), General Electric (US), and Others- total 25 players have been covered |

This research report categorizes the smart manufacturing market by information technology, enabling technology, industry, and region.

By Information Technology:

- Human-machine interface

- Plant asset management

- Manufacturing execution system

- Warehouse management system Dual Frequency

By Enabling Technology:

- Industrial 3D Printing

- AI in Manufacturing

- Industrial Cybersecurity

- Industrial Machine Vision

- Industrial Sensors

- Digital Twins

- Robots

- Automated Guided Vehicles

- Machine Condition Monitoring

- Artificial Reality & Virtual Reality

- 5G Industrial IoT

By Industry:

-

Process Industry

- Oil & Gas

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Energy & Power

- Metals & Mining

- Pulp & Paper

- Others

-

Discrete Industry

- Automotive

- Aerospace & Defense

- Semiconductor & Electronics

- Medical Devices

- Machine Manufacturing

- Others

- Mining

- Construction

- Oil & Gas

- Others

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

See Also:

- Germany Smart Manufacturing Market to Grow at a CAGR 17.9% from 2021 to 2027

- Japan Smart Manufacturing Market to Grow at a CAGR 18.7% from 2021 to 2027

Recent Developments in Smart Manufacturing Industry

- In June 2021, Stratasys Ltd. announced two new PolyJet 3D printers, the Stratasys J35 Pro and the Stratasys J55 Prime, along with new software solutions for research and packaging prototyping. Also, it introduced a medical 3D printer that sets a new standard for healthcare providers and medical device companies by combining multiple applications in one system.

- In March 2021, GE Digital introduced enhancements in its CIMPLICITY and Tracker software that provide critical decision support for operators to make them more efficient. CIMPLICITY HMI/SCADA provides client-server visualization to precisely monitor and control operations. Tracker, part of GE Digital’s Proficy Manufacturing Execution Systems (MES) offering, automates routing and sequencing to accelerate time to market, reduce warranty and recall exposure, and support lean operations.

- In February 2021, ABB launched a cobots portfolio in GoFa and SWIFTIcobot families. These cobots will offer higher payloads capacity and speed in movement of robots that will complement YuMi and Single Arm YuMi in ABB's cobot lineup.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the smart manufacturing market during 2022-2027?

The global the smart manufacturing market is expected to record the CAGR of 6.1% from 2022–2027.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

What are the driving factors for the smart manufacturing market?

The major driving factors of the smart manufacturing market include the growing adoption of Industry 4.0, rising emphasis on industrial automation in manufacturing processes, increasing government involvement in supporting industrial automation, growing emphasis on regulatory compliances, increasing complexities in the supply chain, and surging demand for software systems that reduce time and cost.

Which are the significant players operating in the smart manufacturing market?

Major companies offering smart manufacturing technologies include ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), and General Electric (US).

Which region will lead the smart manufacturing market in the future?

APAC is expected to lead the smart manufacturing market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR SMART MANUFACTURING MARKET

4.2 SMART MANUFACTURING MARKET, BY INFORMATION TECHNOLOGY

4.3 SMART MANUFACTURING MARKET, BY ENABLING TECHNOLOGY

4.4 SMART MANUFACTURING MARKET, BY PROCESS INDUSTRY

4.5 SMART MANUFACTURING MARKET, BY DISCRETE INDUSTRY

4.6 SMART MANUFACTURING MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising emphasis on smart manufacturing in manufacturing processes

5.2.1.2 Increasing government involvement in supporting smart manufacturing

5.2.1.3 Growing emphasis on regulatory compliances

5.2.1.4 Surging demand for software systems that reduce time and cost

5.2.2 RESTRAINTS

5.2.2.1 High investments and costs involved in implementing smart manufacturing solutions

5.2.2.2 Lack of standardization among equipment manufacturers and in connectivity protocols

5.2.2.3 Requirement of maintenance attributed to frequent software upgrade

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in adoption of IIoT and Cloud technologies

5.2.3.2 Increased integration of different solutions to provide improved performance

5.2.3.3 Rapid industrial growth in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Threats related to cybersecurity

5.2.4.2 Complexity in implementing smart manufacturing technology systems

5.2.4.3 Lack of skilled workforce

5.3 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 CASE STUDY

5.7.1 USE CASE 1: MICROSOFT CORPORATION

5.7.2 USE CASE 2: PTC INC.

5.7.3 USE CASE 3: RENISHAW

5.8 PRICING ANALYSIS

5.8.1 INDUSTRIAL SAFETY COMPONENTS

5.8.2 INDUSTRIAL ROBOTS

5.8.3 INDUSTRIAL 3D PRINTING

5.8.4 INDUSTRIAL SENSORS

5.8.5 INDUSTRIAL MACHINE VISION SYSTEMS

5.9 TRADE ANALYSIS

5.9.1 INDUSTRIAL ROBOTS

5.9.2 REGULATING OR CONTROLLING INSTRUMENTS AND APPARATUS

5.10 PATENT ANALYSIS

5.10.1 LIST OF MAJOR PATENTS

5.11 TECHNOLOGY TRENDS

5.11.1 INDUSTRY 4.0

5.11.2 ARTIFICIAL INTELLIGENCE (AI)

5.11.3 INTERNET OF THINGS (IOT)

5.11.4 BLOCKCHAIN

5.11.5 AUGMENTED REALITY (AR) & VIRTUAL REALITY (VR)

5.11.6 COLLABORATIVE ROBOTS

5.11.7 PREDICTIVE MAINTENANCE

5.11.8 DIGITAL TWIN

5.12 STANDARDS & REGULATORY LANDSCAPE

5.12.1 IEC TS 62832-1: 2020

5.12.2 OPEN PLATFORM COMMUNICATIONS UNIFIED ARCHITECTURE (OPC UA)

5.12.3 ISO/IEC TR 63306-1:2020

5.12.4 ISO 55001: 2014

5.12.5 INDUSTRIAL SAFETY STANDARDS

5.12.6 REGULATORY LANDSCAPE OF SMART MANUFACTURING

5.12.6.1 Society 5.0 - Japan

5.12.6.2 RIE2020 - Singapore

5.12.6.3 High-Tech Strategy 2020 - Germany

6 SMART MANUFACTURING MARKET, BY INFORMATION TECHNOLOGY (Page No. - 86)

6.1 INTRODUCTION

6.2 HUMAN-MACHINE INTERFACE

6.2.1 BY OFFERING

6.2.1.1 Software

6.2.1.1.1 HMI software enhances efficiency of production processes

6.2.1.2 Hardware

6.2.1.2.1 Evolution of IIoT leading to adoption of HMI

6.2.2 BY CONFIGURATION TYPE

6.2.2.1 Increasing requirement for high efficiency and monitoring in manufacturing plants expected to drive HMI market

6.3 PLANT ASSET MANAGEMENT

6.3.1 SURGE IN ADOPTION OF PAM SYSTEMS TO REDUCE DOWNTIME AND WASTAGE IN MANUFACTURING PLANTS TO FUEL MARKET GROWTH

6.3.2 BY OFFERING

6.3.2.1 PAM solutions help improve operational efficiency of business processes

6.3.3 BY DEPLOYMENT

6.3.3.1 Cloud (online) deployment mode is gaining popularity due to growing demand for advanced technologies

6.3.4 BY ASSET TYPE

6.3.4.1 PAM solutions are in demand for production assets such as monitoring, rotating, and reciprocating equipment

6.4 MANUFACTURING EXECUTION SYSTEM

6.4.1 COST-SAVING AND OPERATION OPTIMIZATION BENEFITS OF MES TO DRIVE ITS DEMAND

6.4.2 BY DEPLOYMENT TYPE

6.4.2.1 Market for hybrid deployment to grow at highest rate during forecast period

6.4.3 BY OFFERING

6.4.3.1 Reduction in manufacturing cycle time and electronic maintenance of data are major drivers for high demand of manufacturing execution systems

6.5 WAREHOUSE MANAGEMENT SYSTEM

6.5.1 BY OFFERING

6.5.1.1 Digitization of supply chain management propels growth of warehouse management system market

6.5.2 IMPLEMENTATION TYPE

6.5.2.1 Increasing adoption of on-cloud WMS solutions

6.5.3 BY TIER TYPE

6.5.3.1 Rising demand for WMS from several industries

7 SMART MANUFACTURING MARKET, BY ENABLING TECHNOLOGY (Page No. - 109)

7.1 INTRODUCTION

7.2 INDUSTRIAL 3D PRINTING

7.2.1 SURGE IN ADOPTION OF INDUSTRIAL 3D PRINTING FOR SIMPLIFYING MANUFACTURING OF PARTS WITH COMPLEX DESIGNS TO FUEL MARKET GROWTH

7.2.2 BY OFFERING

7.2.2.1 Printers

7.2.2.1.1 Increasing demand from several industries to propel growth of industrial 3d printing market

7.2.2.2 Materials

7.2.2.2.1 Rapid increase in demand for wide range of materials owing to emerging technologies

7.2.2.3 Software

7.2.2.3.1 Surging demand for development of user-friendly software

7.2.2.4 Services

7.2.2.4.1 3D printing service sector is gaining significant traction

7.2.3 BY APPLICATION

7.2.3.1 Rising demand for industrial 3d printing in emerging applications

7.2.4 BY PROCESS

7.2.4.1 Government investments and aggressive R&D activities undertaken by industry experts drive industrial 3D printing market

7.2.5 BY TECHNOLOGY

7.2.5.1 Ability to improve manufacturing processes and enhance supply chain management likely to offer opportunity to industrial 3D printing market

7.3 ROBOTS

7.3.1 TRADITIONAL INDUSTRIAL ROBOTS

7.3.1.1 Articulated robots

7.3.1.1.1 Need to increase payload capacity and reliability to fuel demand for articulated robots

7.3.1.2 Cartesian robots

7.3.1.2.1 Simple controls of Cartesian robots have increased their demand globally

7.3.1.3 Selective Compliance Assembly Robot Arms (SCARAs)

7.3.1.3.1 Best price-to-performance ratio offered by SCARAs contribute to their increased adoption in various applications

7.3.1.4 Parallel robots

7.3.1.4.1 Growing use of parallel robots in high-speed applications to fuel market growth

7.3.1.5 Other robots

7.3.2 COLLABORATIVE ROBOTS

7.3.2.1 Safety features, ease of use, and affordability of collaborative industrial robots are fueling their demand globally

7.4 INDUSTRIAL SENSORS

7.4.1 RISE IN USE OF SENSORS TO ENSURE CONNECTIVITY IN MANUFACTURING PLANTS TO BOOST MARKET GROWTH

7.4.1.1 Wired industrial sensors

7.4.1.2 Wireless industrial sensors

7.5 AI IN MANUFACTURING

7.5.1 BY OFFERING

7.5.1.1 Hardware

7.5.1.1.1 Evolving industrial IoT and automation boost hardware market growth

7.5.1.2 Software

7.5.1.2.1 AI solution providers are focusing on developing robust cloud-based solutions for their clients

7.5.2 BY TECHNOLOGY

7.5.2.1 AI technologies enable machines to execute activities that are currently being performed by humans

7.5.3 BY APPLICATION

7.5.3.1 AI-based quality control applications enable plant operators to quickly detect product variations during production

7.6 MACHINE CONDITION MONITORING

7.6.1 BY MONITORING TECHNIQUE

7.6.1.1 Rising adoption of wireless communication technology in machine condition monitoring

7.6.2 BY OFFERING

7.6.2.1 Hardware

7.6.2.1.1 IIoT to unfold new growth avenues

7.6.2.2 Software

7.6.2.2.1 Condition monitoring software help in evaluating equipment reliability parameters

7.6.3 BY DEPLOYMENT TYPE

7.6.3.1 Advantages of cloud deployment over on-premises deployment to drive demand for cloud-based monitoring solutions

7.7 INDUSTRIAL MACHINE VISION

7.7.1 BY COMPONENT

7.7.1.1 Hardware

7.7.1.1.1 Growing demand for vision-guided robotic systems

7.7.1.2 Software

7.7.1.2.1 Deep learning frameworks offer great flexibility to program developers owing to their ability to design and train customized deep neural networks

7.7.2 BY PRODUCT

7.7.2.1 Increasing adoption of 3D machine vision systems

7.7.3 BY APPLICATION

7.7.3.1 Increasing demand for quality inspection and automation to drive adoption of machine vision systems

7.8 INDUSTRIAL CYBERSECURITY

7.8.1 BY TYPE

7.8.1.1 Government funding to improve cybersecurity of industrial environment

7.8.2 BY PRODUCT

7.8.2.1 Growing incidents of data breaches due to increasing number of connected devices in industrial control systems drive market for industrial cybersecurity solutions

7.8.3 BY SOLUTION AND SERVICE

7.8.3.1 Growing number of connected devices and increasing adoption of IoT in industrial control systems propel industrial cybersecurity market growth

7.9 DIGITAL TWINS

7.9.1 INCREASING ADOPTION OF EMERGING TECHNOLOGIES SUCH AS IOT AND CLOUD FOR IMPLEMENTATION OF DIGITAL TWIN ARE DRIVING GROWTH OF DIGITAL TWIN MARKET

7.10 AUTOMATED GUIDED VEHICLES

7.10.1 BY TYPE

7.10.1.1 Growing demand for automation in material handling across industries propels AGV market growth

7.10.2 BY NAVIGATION TECHNOLOGY

7.10.2.1 Increasing demand for automation in material handling across industries propels growth of navigation technology in AGV market

7.10.3 BY APPLICATION

7.10.3.1 High adoption of automated guided vehicles in transportation sector drives AGV market

7.11 AR AND VR IN MANUFACTURING

7.11.1 BY TECHNOLOGY

7.11.1.1 Augmented reality technology

7.11.1.1.1 Increased interest of tech giants in AR Market has resulted in upsurge in investments

7.11.1.2 Virtual reality technology

7.11.1.2.1 Advancements in technologies and growing digitization propel growth of VR technology market

7.11.2 BY OFFERING

7.11.2.1 Hardware

7.11.2.1.1 Sensors are widely used in AR devices

7.11.2.2 Software

7.11.2.2.1 Emergence of mobile devices with AR capabilities drives demand for cloud-based AR solutions

7.11.3 BY DEVICE TYPE

7.11.3.1 AR—head-mounted displays are widely adopted across companies to improve work efficiency

7.12 5G INDUSTRIAL IOT

7.12.1 INCREASING DEMAND FOR HIGH RELIABILITY AND LOW LATENCY NETWORKS DRIVE DEMAND FOR 5G INDUSTRIAL IOT

8 SMART MANUFACTURING MARKET, BY INDUSTRY (Page No. - 159)

8.1 INTRODUCTION

8.2 PROCESS INDUSTRY

8.2.1 OIL & GAS

8.2.1.1 Oil & gas industry to hold significant market share during forecast period

8.2.2 FOOD & BEVERAGES

8.2.2.1 Requirement of increased productivity and reduced downtime fueling demand for smart manufacturing market in food & beverage industry

8.2.3 PHARMACEUTICALS

8.2.3.1 Rising automation improves compliance, minimizes deviation, and ensures operational efficiency in manufacturing process

8.2.4 CHEMICALS

8.2.4.1 Chemical industry to witness high growth rate in coming years

8.2.5 ENERGY & POWER

8.2.5.1 Power & energy is fastest growing process industry for smart manufacturing platform market

8.2.6 METALS & MINING

8.2.6.1 Growing adoption of smart manufacturing to ensure safety of mining operation to fuel market growth

8.2.7 PULP & PAPER

8.2.7.1 Growing adoption of digitalization in paper industry to increase implementation of smart manufacturing process

8.2.8 OTHERS

8.3 DISCRETE INDUSTRY

8.3.1 AUTOMOTIVE

8.3.1.1 Technological innovations in automotive industry drive smart manufacturing market growth

8.3.2 AEROSPACE & DEFENSE

8.3.2.1 High equipment costs encourage adoption of smart manufacturing technologies to avoid equipment failure risks

8.3.3 SEMICONDUCTOR & ELECTRONICS

8.3.3.1 Continuous advancements in semiconductor & electronics industry drive demand for smart manufacturing solutions to increase productivity

8.3.4 MEDICAL DEVICES

8.3.4.1 Increasing demand for smart manufacturing solutions for higher efficiency in manufacturing processes

8.3.5 MACHINE MANUFACTURING

8.3.5.1 Surging demand for predictive maintenance to propel smart manufacturing market growth

8.3.6 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 178)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN NORTH AMERICA

9.2.2 US

9.2.2.1 Increasing adoption of automation solutions by leading industrial players and startups to drive market growth

9.2.3 CANADA

9.2.3.1 Growing investments in process and discrete industries to contribute to growth of smart manufacturing market in Canada

9.2.4 MEXICO

9.2.4.1 Increasing investments by different countries in Mexico to create lucrative growth opportunities for market

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN EUROPE

9.3.2 UK

9.3.2.1 Growing adoption of smart manufacturing in automotive industry to boost growth of smart manufacturing market

9.3.3 GERMANY

9.3.3.1 Germany to witness highest growth rate during forecast period

9.3.4 FRANCE

9.3.4.1 France to hold significant share of smart manufacturing market

9.3.5 REST OF EUROPE

9.4 APAC

9.4.1 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN APAC

9.4.2 CHINA

9.4.2.1 Rising need for adoption of automation technologies and government support to spur growth of industrialization are driving smart manufacturing market

9.4.3 JAPAN

9.4.3.1 Automotive, consumer electronics, and industrial manufacturing are important industries that would create growth opportunities for market

9.4.4 INDIA

9.4.4.1 Government-led initiatives to support growth of manufacturing sector to fuel market

9.4.5 REST OF APAC

9.5 ROW

9.5.1 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN ROW

9.5.2 SOUTH AMERICA

9.5.2.1 Growing adoption of IoT technologies in different industries to drive growth of smart manufacturing market

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Growing implementation of advanced technologies in oil & gas and mining industries to propel market growth

10 COMPETITIVE LANDSCAPE (Page No. - 201)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SMART MANUFACTURING MARKET

10.3 TOP 5 COMPANY REVENUE ANALYSIS

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2020–2021

10.5 COMPETITIVE EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

10.6.5 SMART MANUFACTURING MARKET: COMPANY FOOTPRINT

10.6.6 SMART MANUFACTURING MARKET: STARTUP MATRIX

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

10.7.2 DEALS

10.8 LUCRATIVE GROWTH OPPORTUNITIES FOR SMART MANUFACTURING MARKET

10.8.1 NORTH AMERICA

10.8.2 EUROPE

10.8.3 APAC

10.8.4 REST OF THE WORLD (ROW)

11 COMPANY PROFILES (Page No. - 13)

11.1 KEY PLAYERS

11.1.1 3D SYSTEMS

11.1.1.1 Business overview

11.1.1.2 Products offered

11.1.1.3 Recent developments

11.1.2 ABB

11.1.2.1 Business overview

11.1.2.2 Products offered

11.1.2.3 Recent developments

11.1.2.3.1 Deals

11.1.2.3.2 Product launches and developments

11.1.2.4 MnM View

11.1.2.4.1 Key strengths/Right to win

11.1.2.4.2 Strategic choices made

11.1.2.4.3 Weaknesses and competitive threats

11.1.3 CISCO

11.1.3.1 Business overview

11.1.3.2 Products offered

11.1.3.3 Recent developments

11.1.3.3.1 Deals

11.1.4 EMERSON ELECTRIC CO.

11.1.4.1 Business overview

11.1.4.2 Products offered

11.1.4.3 Recent developments

11.1.4.3.1 Product launches and developments

11.1.4.4 MnM View

11.1.4.4.1 Key strengths/Right to win

11.1.4.4.2 Strategic choices made

11.1.4.4.3 Weaknesses and competitive threats

11.1.5 GENERAL ELECTRIC

11.1.5.1 Business overview

11.1.5.2 Products offered

11.1.5.3 Recent developments

11.1.5.3.1 Product launches and developments

11.1.5.4 MnM view

11.1.5.4.1 Key strengths/Right to win

11.1.5.4.2 Strategic choices made

11.1.5.4.3 Weakness and competitive strength

11.1.6 HONEYWELL INTERNATIONAL INC

11.1.6.1 Business overview

11.1.6.2 Products offered

11.1.6.3 MnM view

11.1.6.3.1 Key strengths/Right to win

11.1.6.3.2 Strategic choices made

11.1.6.3.3 Weaknesses and competitive threats

11.1.7 IBM

11.1.7.1 Business overview

11.1.7.2 Products offered

11.1.8 MITSUBISHI ELECTRIC CORPORATION

11.1.8.1 Business overview

11.1.8.2 Products offered

11.1.9 ROCKWELL AUTOMATION INC

11.1.9.1 Business overview

11.1.9.2 Products offered

11.1.9.3 Recent developments

11.1.9.3.1 Deals

11.1.9.3.2 Product launches and developments

11.1.9.4 MnM view

11.1.9.4.1 Key strengths/Right to win

11.1.9.4.2 Strategic choices made

11.1.9.4.3 Weaknesses and competitive threats

11.1.10 SCHNEIDER ELECTRIC

11.1.10.1 Business overview

11.1.10.2 Products offered

11.1.10.3 MnM View

11.1.10.3.1 Key strengths/Right to win

11.1.10.3.2 Strategic choices made

11.1.10.3.3 Weaknesses and competitive threats

11.1.11 SIEMENS

11.1.11.1 Business overview

11.1.11.2 Products offered

11.1.11.3 Recent developments

11.1.11.3.1 Deals

11.1.11.3.2 Product launches and developments

11.1.11.4 MnM View

11.1.11.4.1 Key strengths/Right to win

11.1.11.4.2 Strategic choices made

11.1.11.4.3 Weaknesses and competitive threats

11.1.12 ORACLE

11.1.12.1 Business overview

11.1.12.2 Products offered

11.1.13 SAP

11.1.13.1 Business overview

11.1.13.2 Products offered

11.1.14 STRATASYS

11.1.14.1 Business overview

11.1.14.2 Products offered

11.1.14.3 Recent developments

11.1.14.3.1 Deals

11.1.14.3.2 Product launches and developments

11.1.15 YOKOGAWA ELECTRIC CORPORATION

11.1.15.1 Business overview

11.1.15.2 Products offered

11.1.15.3 Recent developments

11.1.15.3.1 Deals

11.1.15.3.2 Product launches and developments

11.1.15.4 MnM view

11.1.15.4.1 Key strengths/Right to win

11.1.15.4.2 Strategic choices made

11.1.15.4.3 Weakness and competitive threats

11.2 OTHER KEY PLAYERS

11.2.1 COGNEX CORPORATION

11.2.2 GOOGLE

11.2.3 INTEL

11.2.4 KEYENCE

11.2.5 NVIDIA

11.2.6 PTC

11.2.7 SAMSUNG

11.2.8 SONY

11.2.9 UNIVERSAL ROBOTS

11.2.10 OMRON CORPORATION

12 ADJACENT & RELATED MARKETS (Page No. - 79)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 RFID MARKET

12.4 RFID MARKET, BY PRODUCT

12.5 TAGS

12.5.1 TAGS ACCOUNTED FOR LARGEST SHARE OF RFID MARKET IN 2020

12.6 READERS

12.6.1 FIXED READERS

12.6.1.1 Ruggedness and cost-effectiveness of readers primarily drive fixed readers market

12.6.2 HANDHELD READERS

12.6.2.1 Handheld readers are adopted mainly due to their mobility

12.7 SOFTWARE AND SERVICES

12.7.1 RECURRING REQUIREMENT OF SERVICES AND GROWING ADOPTION OF CLOUD-BASED MODELS FOR DATA ANALYSIS WOULD DRIVE SOFTWARE AND SERVICES MARKET

13 APPENDIX (Page No. - 90)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

13.5 AVAILABLE CUSTOMIZATIONS

13.6 RELATED REPORTS

13.7 AUTHOR DETAILS

LIST OF TABLES (201 Tables)

TABLE 1 COMPANIES AND THEIR ROLES IN SMART MANUFACTURING ECOSYSTEM

TABLE 2 SMART MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 PRICE RANGE OF INDUSTRIAL SAFETY COMPONENTS

TABLE 4 PRICE RANGE OF INDUSTRIAL ROBOTS

TABLE 5 PRICE RANGE OF INDUSTRIAL 3D PRINTERS

TABLE 6 PRICE RANGE OF INDUSTRIAL SENSORS

TABLE 7 PRICE RANGE OF MACHINE VISION SYSTEMS

TABLE 8 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

TABLE 9 MARKET, BY INFORMATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 10 MARKET, BY INFORMATION TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 11 MARKET FOR INFORMATION TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 12 MARKET FOR INFORMATION TECHNOLOGY, BY REGION, 2022–2027 (USD BILLION)

TABLE 13 MARKET FOR INFORMATION TECHNOLOGY, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 14 MARKET FOR INFORMATION TECHNOLOGY, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 15 MARKET FOR INFORMATION TECHNOLOGY, BY DISCRETE INDUSTRY, 2018–2021(USD MILLION)

TABLE 16 SMART MANUFACTURING MARKET FOR INFORMATION TECHNOLOGY, BY DISCRETE INDUSTRY, 2022–2027(USD MILLION)

TABLE 17 INFORMATION TECHNOLOGY MARKET FOR HMI, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 INFORMATION TECHNOLOGY MARKET FOR HMI, BY REGION, 2022–2027 (USD BILLION)

TABLE 19 INFORMATION TECHNOLOGY MARKET FOR HMI, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 20 INFORMATION TECHNOLOGY MARKET FOR HMI, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 21 INFORMATION TECHNOLOGY MARKET FOR HMI, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 22 INFORMATION TECHNOLOGY MARKET FOR HMI, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 23 INFORMATION TECHNOLOGY MARKET FOR PAM, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 INFORMATION TECHNOLOGY MARKET FOR PAM, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 INFORMATION TECHNOLOGY MARKET FOR PAM, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 26 INFORMATION TECHNOLOGY MARKET FOR PAM, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 27 INFORMATION TECHNOLOGY MARKET FOR PAM, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 28 INFORMATION TECHNOLOGY MARKET FOR PAM, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 29 INFORMATION TECHNOLOGY MARKET FOR MES, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 INFORMATION TECHNOLOGY MARKET FOR MES, BY REGION, 2022–2027 (USD MILLION)

TABLE 31 INFORMATION TECHNOLOGY MARKET FOR MES, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 32 INFORMATION TECHNOLOGY MARKET FOR MES, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 33 INFORMATION TECHNOLOGY MARKET FOR MES, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 INFORMATION TECHNOLOGY MARKET FOR MES, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 35 INFORMATION TECHNOLOGY MARKET FOR WMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 INFORMATION TECHNOLOGY MARKET FOR WMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 INFORMATION TECHNOLOGY MARKET FOR WMS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 INFORMATION TECHNOLOGY MARKET FOR WMS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 39 INFORMATION TECHNOLOGY MARKET FOR WMS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 40 INFORMATION TECHNOLOGY MARKET FOR WMS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 41 SMART MANUFACTURING MARKET, BY ENABLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 42 MARKET, BY ENABLING TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 43 MARKET FOR ENABLING TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR ENABLING TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR ENABLING TECHNOLOGY, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR ENABLING TECHNOLOGY, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR ENABLING TECHNOLOGY, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR ENABLING TECHNOLOGY, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 49 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY REGION, 2022–2027 (USD MILLION)

TABLE 51 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 52 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 53 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 54 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL 3D PRINTING, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 55 ENABLING TECHNOLOGY MARKET FOR ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 ENABLING TECHNOLOGY MARKET FOR ROBOTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 ENABLING TECHNOLOGY MARKET FOR ROBOTS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 58 ENABLING TECHNOLOGY MARKET FOR ROBOTS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 59 ENABLING TECHNOLOGY MARKET FOR COLLABORATIVE ROBOTS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 60 ENABLING TECHNOLOGY MARKET FOR COLLABORATIVE ROBOTS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 61 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 64 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 65 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 66 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 67 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 70 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 71 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 72 ENABLING TECHNOLOGY MARKET FOR AI IN MANUFACTURING, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 73 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY REGION, 2022–2027 (USD MILLION)

TABLE 75 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 76 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 77 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 78 ENABLING TECHNOLOGY MARKET FOR MACHINE CONDITION MONITORING, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 79 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 82 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 83 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 84 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL MACHINE VISION, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 85 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL CYBERSECURITY, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL CYBERSECURITY, BY REGION, 2022–2027 (USD MILLION)

TABLE 87 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL CYBERSECURITY, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 ENABLING TECHNOLOGY MARKET FOR INDUSTRIAL CYBERSECURITY, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 89 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWINS, BY REGION, 2018–2021 (USD BILLION)

TABLE 90 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWINS, BY REGION, 2022–2027 (USD BILLION)

TABLE 91 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWINS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWINS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 93 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWIN, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 94 ENABLING TECHNOLOGY MARKET FOR DIGITAL TWINS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 95 ENABLING TECHNOLOGY MARKET FOR AGVS, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 ENABLING TECHNOLOGY MARKET FOR AGVS, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 ENABLING TECHNOLOGY MARKET FOR AGVS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 ENABLING TECHNOLOGY MARKET FOR AGVS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 99 ENABLING TECHNOLOGY MARKET FOR AGVS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 100 ENABLING TECHNOLOGY MARKET FOR AGV, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 101 ENABLING TECHNOLOGY MARKET FOR AR & VR IN MANUFACTURING, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 102 ENABLING TECHNOLOGY MARKET FOR AR & VR IN MANUFACTURING, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 103 ENABLING TECHNOLOGY MARKET FOR AR & VR IN MANUFACTURING, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 ENABLING TECHNOLOGY MARKET FOR AR & VR IN MANUFACTURING, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 105 ENABLING TECHNOLOGY MARKET FOR 5G INDUSTRIAL IOT, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 ENABLING TECHNOLOGY MARKET FOR 5G INDUSTRIAL IOT, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 ENABLING TECHNOLOGY MARKET FOR 5G INDUSTRIAL IOT, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 108 ENABLING TECHNOLOGY MARKET FOR 5G INDUSTRIAL IOT, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 109 SMART MANUFACTURING MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 110 MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 111 MARKET FOR PROCESS INDUSTRY, BY INFORMATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 112 MARKET FOR PROCESS INDUSTRY, BY INFORMATION TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 113 MARKET FOR PROCESS INDUSTRY, BY ENABLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 114 MARKET FOR PROCESS INDUSTRY, BY ENABLING TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 115 MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 116 MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

TABLE 117 MARKET FOR DISCRETE INDUSTRY, BY INFORMATION TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 118 MARKET FOR DISCRETE INDUSTRY, BY INFORMATION TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 119 MARKET FOR DISCRETE INDUSTRY, BY ENABLING TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 120 MARKET FOR DISCRETE INDUSTRY, BY ENABLING TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 121 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 123 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 127 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 SMART MANUFACTURING MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 131 INDUSTRIAL ROBOTS MARKET: MARKET SHARE ANALYSIS

TABLE 132 INDUSTRIAL 3D PRINTING MARKET: MARKET SHARE ANALYSIS

TABLE 133 COMPANY ENABLING TECHNOLOGY FOOTPRINT

TABLE 134 COMPANY INFORMATION TECHNOLOGY FOOTPRINT

TABLE 135 COMPANY INDUSTRY FOOTPRINT

TABLE 136 COMPANY REGION FOOTPRINT

TABLE 137 COMPANY FOOTPRINT

TABLE 138 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 139 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 140 MARKET: PRODUCT LAUNCHES

TABLE 141 SMART MANUFACTURING MARKET: DEALS

TABLE 142 3D SYSTEMS: BUSINESS OVERVIEW

TABLE 143 3D SYSTEMS: PRODUCT OFFERINGS

TABLE 144 ABB: BUSINESS OVERVIEW

TABLE 145 ABB: PRODUCT OFFERINGS

TABLE 146 CISCO: BUSINESS OVERVIEW

TABLE 147 CISCO: PRODUCT OFFERINGS

TABLE 148 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

TABLE 149 EMERSON ELECTRIC CO.: PRODUCT OFFERINGS

TABLE 150 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 151 GENERAL ELECTRIC: BUSINESS OVERVIEW

TABLE 152 GENERAL ELECTRIC: PRODUCT OFFERINGS

TABLE 153 GENERAL ELECTRIC: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 154 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

TABLE 155 HONEYWELL INTERNATIONAL INC.: PRODUCT OFFERINGS

TABLE 156 IBM: BUSINESS OVERVIEW

TABLE 157 IBM: PRODUCT OFFERINGS

TABLE 158 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

TABLE 159 MITSUBISHI ELECTRIC CORPORATION: PRODUCT OFFERINGS

TABLE 160 ROCKWELL AUTOMATION INC: BUSINESS OVERVIEW

TABLE 161 ROCKWELL AUTOMATION INC: PRODUCT OFFERINGS

TABLE 162 ROCKWELL AUTOMATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 163 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

TABLE 164 SCHNEIDER ELECTRIC: PRODUCT OFFERINGS

TABLE 165 SIEMENS: BUSINESS OVERVIEW

TABLE 166 SIEMENS: PRODUCT OFFERINGS

TABLE 167 ORACLE: BUSINESS OVERVIEW

TABLE 168 ORACLE: PRODUCT OFFERINGS

TABLE 169 SAP: BUSINESS OVERVIEW

TABLE 170 SAP: PRODUCT OFFERINGS

TABLE 171 STRATASYS: BUSINESS OVERVIEW

TABLE 172 STRATASYS: PRODUCT OFFERINGS

TABLE 173 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

TABLE 174 YOKOGAWA ELECTRIC CORPORATION: PRODUCT OFFERINGS

TABLE 175 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 176 RFID MARKET, BY PRODUCT, 2017–2020 (USD BILLION)

TABLE 177 RFID MARKET, BY PRODUCT, 2021–2026 (USD BILLION)

TABLE 178 RFID MARKET, BY PRODUCT, 2017–2020 (MILLION UNITS)

TABLE 179 RFID MARKET, BY PRODUCT, 2021–2026 (MILLION UNITS)

TABLE 180 RFID MARKET, BY READER TYPE, 2017–2020 (USD MILLION)

TABLE 181 RFID MARKET, BY READER TYPE, 2021–2026 (USD MILLION)

TABLE 182 RFID MARKET, BY READER TYPE, 2017–2020 (MILLION UNITS)

TABLE 183 RFID MARKET, BY READER TYPE, 2021–2026 (MILLION UNITS)

TABLE 184 FIXED RFID READER MARKET, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 185 FIXED RFID READER MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 186 FIXED RFID READER MARKET, BY FREQUENCY, 2017–2020 (THOUSAND UNITS)

TABLE 187 FIXED RFID READER MARKET, BY FREQUENCY, 2021–2026 (THOUSAND UNITS)

TABLE 188 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 189 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 190 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 191 HANDHELD RFID READER MARKET, BY PRODUCT TYPE, 2021–2026 (THOUSAND UNITS)

TABLE 192 HANDHELD RFID READER MARKET, BY FREQUENCY, 2017–2020 (USD MILLION)

TABLE 193 HANDHELD RFID READER MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

TABLE 194 HANDHELD RFID READER MARKET, BY FREQUENCY, 2017–2020 (THOUSAND UNITS)

TABLE 195 HANDHELD RFID READER MARKET, BY FREQUENCY, 2021–2026 (THOUSAND UNITS)

TABLE 196 HANDHELD RFID READER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 197 HANDHELD RFID READER MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 198 HANDHELD RFID READER MARKET, BY REGION, 2017–2020 (THOUSAND UNITS)

TABLE 199 HANDHELD RFID READER MARKET, BY REGION, 2021–2026 (THOUSAND UNITS)

TABLE 200 RFID SOFTWARE & SERVICES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 201 RFID SOFTWARE & SERVICES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

LIST OF FIGURES (67 Figures)

FIGURE 1 SMART MANUFACTURING MARKET SEGMENTATION

FIGURE 2 SMART MANUFACTURING MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM MACHINE CONDITION MONITORING IN MARKET

FIGURE 4 SMART MANUFACTURING MARKET: BOTTOM-UP APPROACH

FIGURE 5 SMART MANUFACTURING MARKET: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 RISKS & ASSOCIATED RESULTS

FIGURE 8 COVID-19 IMPACT ANALYSIS ON MARKET

FIGURE 9 MARKET FOR WAREHOUSE MANAGEMENT SYSTEMS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 MARKET FOR DIGITAL TWINS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 11 SMART MANUFACTURING MARKET FOR ENERGY & POWER INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN 2027

FIGURE 13 SMART MANUFACTURING MARKET, BY REGION

FIGURE 14 MARKET EXPECTED TO HAVE HUGE GROWTH OPPORTUNITIES IN APAC

FIGURE 15 MARKET FOR MANUFACTURING EXECUTION SYSTEMS EXPECTED TO HOLD LARGEST SHARE THROUGHOUT FORECAST PERIOD

FIGURE 16 MARKET FOR DIGITAL TWINS EXPECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 17 MARKET FOR PHARMACEUTICALS INDUSTRY EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 18 MARKET FOR AEROSPACE & DEFENSE INDUSTRY EXPECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 19 APAC EXPECTED TO HOLD LARGEST SHARE OF MARKET THROUGHOUT FORECAST PERIOD

FIGURE 20 SMART MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 21 DRIVERS FOR MARKET AND THEIR IMPACTS

FIGURE 22 RESTRAINTS FOR MARKET AND THEIR IMPACTS

FIGURE 23 OPPORTUNITIES FOR MARKET AND THEIR IMPACTS

FIGURE 24 CHALLENGES FOR MARKET AND THEIR IMPACTS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: ECOSYSTEM

FIGURE 27 MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 28 IMPORTS DATA FOR INDUSTRIAL ROBOTS, 2016–2020 (USD MILLION)

FIGURE 29 EXPORTS DATA FOR INDUSTRIAL ROBOTS, 2016–2020 (USD MILLION)

FIGURE 30 EXPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 31 IMPORTS, BY KEY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 34 SMART MANUFACTURING MARKET, BY INFORMATION TECHNOLOGY

FIGURE 35 MANUFACTURING EXECUTION SYSTEM TO HOLD LARGEST SIZE OF MARKET FOR INFORMATION TECHNOLOGY IN 2027

FIGURE 36 SMART MANUFACTURING MARKET, BY ENABLING TECHNOLOGY

FIGURE 37 DIGITAL TWINS TO HOLD LARGEST SIZE OF MARKET, BY ENABLING TECHNOLOGY, IN 2027

FIGURE 38 GLOBAL SMART MANUFACTURING MARKET, BY INDUSTRY

FIGURE 39 ENERGY & POWER INDUSTRY TO HOLD LARGEST SIZE OF MARKET IN 2027

FIGURE 40 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SIZE OF MARKET IN 2027

FIGURE 41 GEOGRAPHIC SNAPSHOT: SMART MANUFACTURING MARKET

FIGURE 42 APAC TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 43 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 44 US ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2027

FIGURE 45 EUROPE: SNAPSHOT OF SMART MANUFACTURING MARKET

FIGURE 46 GERMANY ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN EUROPE IN 2027

FIGURE 47 APAC: SNAPSHOT OF SMART MANUFACTURING MARKET

FIGURE 48 CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN APAC IN 2027

FIGURE 49 SOUTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN ROW IN 2027

FIGURE 50 TOP 5 PLAYERS IN SMART MANUFACTURING MARKET, 2016–2020

FIGURE 51 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

FIGURE 52 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

FIGURE 53 3D SYSTEMS: COMPANY SNAPSHOT

FIGURE 54 ABB: COMPANY SNAPSHOT

FIGURE 55 CISCO: COMPANY SNAPSHOT

FIGURE 56 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 57 GENERAL ELECTRIC: COMPANY SNAPSHOT

FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 59 IBM: COMPANY SNAPSHOT

FIGURE 60 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

FIGURE 61 ROCKWELL AUTOMATION INC.: COMPANY SNAPSHOT

FIGURE 62 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 63 SIEMENS: COMPANY SNAPSHOT

FIGURE 64 ORACLE: COMPANY SNAPSHOT

FIGURE 65 SAP: COMPANY SNAPSHOT

FIGURE 66 STRATASYS: COMPANY SNAPSHOT

FIGURE 67 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the smart manufacturing market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the smart manufacturing market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries, as well as smart technologies, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

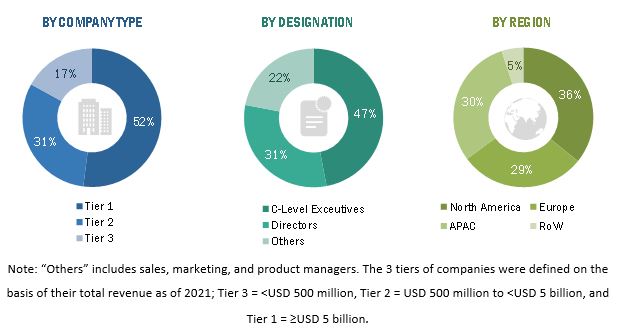

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from smart manufacturing solutions and components manufacturers, such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), and General Electric (US); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the smart manufacturing market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global smart manufacturing market Size: Bottom-Up Approach

Data Triangulation:

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the smart manufacturing market, in terms of information technology, enabling technology, and industry.

- To describe and forecast the market, in terms of value, with regard to four main regions: Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of smart manufacturing solutions and components

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the smart manufacturing market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the smart manufacturing market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders.

- To analyze competitive strategies, such as product launches, expansions, and acquisitions, adopted by key market players in the smart manufacturing market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Manufacturing Market

Smart manufacturing is a powerful disruptive force with the potential to restructure the current competitive landscape and produce a new set of market leaders. It is a combination of various technologies and solutions, which, if implemented in a manufacturing ecosystem, is termed smart manufacturing.This B2B Market study assists in understanding the market potential, Industry Trends, market size of each of the sub segments, and geographies with country level breakdown, Key players operating with their business and product overview and strategic development and a detailed competitor analysis along with a competitive intelligence in this industry.

The report provides the global(regional/country level) market size, trends and future growth potential statistics of Smart Manufacturing Market based on the different enabling technologies, information technologies and industries. These detailed 4 segmentations which covers all the offerings of ADLINK within the smart manufacturing space would give multi-dimensional analysis of the market space along with 25 key player insights, to validate the market understanding, estimates and trends to fulfil research and marketing strategies.