Smart Sensors Market by Type (Temperature & Humidity Sensors, Pressure Sensor, Touch Sensor, Motion & Occupancy Sensors, Water Sensor, Image Sensor), Technology, End-user Industry and Region - 2027

Updated on : April 04, 2023

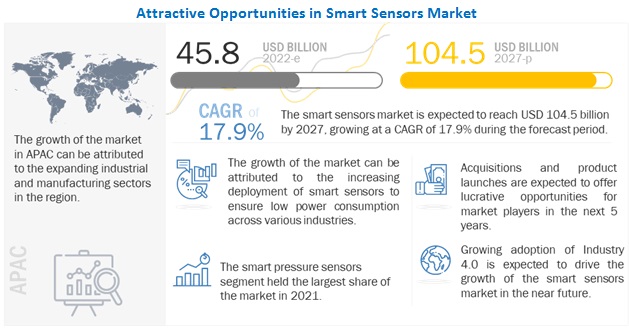

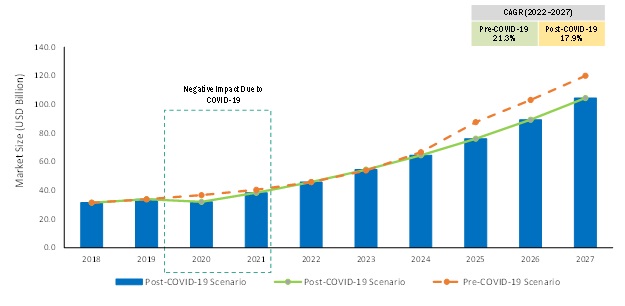

[308 Pages Report] The global smart sensors market is expected to grow from USD 45,800 million in 2022 to USD 104,500 million by 2027; it is expected to grow at a CAGR of 17.9% during 2022–2027.

Key factors fueling this market's growth include surging demand for smart sensors in IoT-based devices and consumer electronics; increasing use of smart sensors industry in revolutionizing industries; high demand for smart sensors by automobile manufacturers to deliver enhanced safety and comfort; and accelerating use of wireless technology to monitor and control security devices equipped with smart sensors. Surge in demand for smart sensor-enabled wearable devices; ongoing support by governments across the world to promote construction of green buildings; and predictive maintenance to offer lucrative opportunities to market players create a strong demand for smart sensors for efficient industrial operations in the midst of COVID-19.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on smart Sensors market

The smart sensors market has witnessed unprecedented growth during the past decade on account of the growing popularity of industry 4.0 and IIoT. However, COVID-19 has dealt a severe blow to the industry, leading to a simultaneous collapse of supply and demand. The market is expected to regain its growth momentum once end-user industries start recovering from the effects of this pandemic.

As a result of the COVID-19 outbreak, businesses worldwide have been impacted with revenue losses and disrupted supply chains as factory shutdowns and quarantine measures have been implemented worldwide in 2020 and the first half of 2021. To provide a perspective on various scenarios, several factors that would influence the economic recovery from the pandemic-induced global recession for the smart sensors market have been assessed.

To know about the assumptions considered for the study, download the pdf brochure

Smart Sensors Market Dynamics

Driver: Surging demand for smart sensors in IoT-based devices and consumer electronics

Internet of Things has taken the evolution of sensors to an entirely different level. The IoT platforms delivers intelligence and data using a variety of sensors, making it possible for devices to function autonomously and for the whole ecosystem to become smarter. By combining a set of sensors and a communication network, devices share information and improve their effectiveness and functionality. IoT devices are used in all types of industry verticals and consumer markets, with the consumer segment accounting for around 60% of all IoT-connected devices in 2020. All these factors will boost the market for smart sensors for IoT-connected devices.

Restraint: High installation and maintenance cost of smart sensors

The deployment of smart sensors has been limited due to the high cost of the sensors because of their costly components and batteries. Due to energy requirements of the sensors and wireless network, limited life span of these batteries that are consumed at a faster rate. Lastly, due to the energy needs of the sensors and wireless link; and poor radio range, the use of technologies designed for short-range applications and limited battery life. The implementation costs include the potential for integrating sensing technologies with a network or signal processing intelligence.

Opportunity: Surge in demand for smart sensor-enabled wearable devices

Wearable devices usually have smart sensors and are connected to the internet to transmit, log, or analyze data. Wearable devices are used for tracking several biometric parameters, such as heartbeat and body temperature. The adoption of various wearable devices is increasing rapidly as users are adopting this technology to improve their fitness and overall health, especially for fitness tracking and medical purposes. They are used in applications such as smart glasses/goggles; ring-/finger-worn scanners; footwear such as athletic, fitness, and sports shoes; wristwear such as advanced electronic watches and wristbands; smart textiles; and headbands and neckwear smart sensors are used. These devices are integrated with smart sensors to send information related to the patient’s health to a caregiver or a healthcare professional so that these patients get quick medical aid at a reduced cost.

Challenge: Stringent performance requirements from advanced sensor application

Ensuring accuracy in the measurement and sensing performance according to the application of smart sensors is a key challenge for the growth of this market as the sensor parameters vary according to the end use or application. Critical application in industrial automation companies (chemicals, oil & gas, textile) have different requirements such as a higher degree of accuracy is required in this industry. On the other hand, building automation applications (access control, HVAC, and RFID) require continuous monitoring and controlling. Therefore, manufacturers need to comply with stringent requirements based on end-use applications. Additionally, volume discounting in the case of low-priced sensors further contributes to this challenge. To sustain the market demand, a high degree of precision, ease of integration, and competency are the prerequisites of smart sensors.

Smart pressure sensors market to dominate in 2021

The market for smart pressure sensors accounted for the largest size in 2021. The market for pressure sensors is largely driven by the increasing concerns regarding safety, comfort levels, and reduction in automobile emissions. The regulatory mandates requiring the installation of onboard diagnostics to reduce greenhouse gas emissions and the use of pressure sensors in autonomous cars would present several growth opportunities to players operating in the pressure sensors market. Also, Pressure sensors are used in consumer electronics such as smart TVs, refrigerators, washing machines, and kitchen appliances and in healthcare devices such as continuous positive airway pressure (CPAP) machines, inhalers and ventilators, invasive and noninvasive blood pressure monitors, and fetal heart rate monitors, which would lead to increased demand for these sensors during the forecast period.

MEMS technology to dominate smart Sensors market, in 2021

The market for MEMS technology-based sensors is estimated to account for a largest share of the overall smart Sensors market, in 2021. MEMS utilize small miniaturized electromechanical and mechanical systems that consist of actuators, sensors, and microelectronics. This technology is likely to continue to dominate the market for smart sensors in the coming years and be the fastest-growing technology during the forecast period, owing to the many advantages offered, such as fast operations, high reliability, improved accuracy, easy maintenance, and replacement, as well as minimal use of energy and materials.

Consumer electronics segment market to dominate in 2021

The consumer electronics segment accounted for the largest size in 2021 and is expected to register the highest growth rate during the forecast period. Smartphones, tablets, PCs, and wearable devices are witnessing an increasing demand globally. The growth of the smart sensors market is driven by the increasing adoption of smart devices such as smart appliances and wearables. Technological developments in smart sensors are leading to advancements in consumer electronics such as smart home appliances and smart TV. In addition to consumer electronics, cities are also becoming smart owing to the deployment of IoT technology. Governments of different countries worldwide are providing funds for the development of smart cities.

APAC to hold the largest share of smart Sensors market in 2027

APAC is expected to be the largest market for smart sensors by 2027. It is the leading market for smart sensors in automotive, infrastructure, consumer electronics, and pharmaceuticals industries, with the major demand in China, India, and Japan. The manufacturing sector in China has shown massive growth, as it is the global manufacturing hub for various industries, such as semiconductor and automotive, which produce home appliances, smartphones, computers, and peripheral devices. This factor has created immense potential for the production and sale of sensing devices. The growth of the smart sensors market in this region is also attributed to the increasing government initiatives for expanding the manufacturing sector in developing countries, rising foreign investments in industrial and manufacturing sectors, and growing population, along with the prominent existence of several manufacturing facilities, low cost of smart sensors, and rapid technological advancements in emerging markets.

Key Market Players

The smart sensors companies such as Analog Devices, Inc. (US), Infineon Technologies (Germany), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Microchip Technology (US), NXP Semiconductors (Netherlands), Robert Bosch GmbH (Germany), Seimens AG (Germany), ABB Ltd. (Switzerland), and Eaton Corporation (Ireland) are a few major companies dominating the smart Sensors market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments covered |

Type, Technology, Component, End-user Industry, and Region |

|

Geographic regions covered |

Americas, APAC, Europe, and RoW |

|

Companies covered |

Analog Devices, Inc. (US), Infineon Technologies (Germany), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Microchip Technology (US), NXP Semiconductors (Netherlands), Robert Bosch GmbH (Germany), Seimens AG (Germany), ABB Ltd. (Switzerland), and Eaton Corporation (Ireland) |

This report categorizes the smart sensors market based on type, technology, component, end-user industry, and region.

By Sensor Type:

- Temperature & Humidity Sensors

- Pressure Sensors

- Flow Sensors

- Touch Sensors

- Image Sensors

- Motion & Occupancy Sensors

- Water Sensors

- Position Sensors

- Light Sensors

- Ultrasonic Sensors

- Others (Electrical Conductivity Sensors, Gesture Sensors, Radar Sensors, Magnetic Field Sensors, and Oxidation-Reduction Potential (ORP) Sensors)

By Technology:

- MEMS

- CMOS

- Others (Optical Spectroscopy, Microsystem Technology (MST), IC-compatible 3D micro-structuring, optical-based sensing, and hybrid sensing)

By Component:

- Analog-to-Digital Converters (ADC)

- Digital-to-Analog Converters (DAC)

- Transceivers

- Amplifiers

- Microcontrollers

- Others (Microprocessors, Transistors, Frequency-to-Digital Converters, and Transducers)

By End-user Industry:

- Aerospace & Defense

- Automotive

- Biomedical & Healthcare

- Industrial Automation

- Building Automation

- Consumer Electronics

- Others (Education, Robotics, Agriculture, and Transportation)

By Geography:

- Americas

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In January 2022, Infineon (Germany) introduced new CO2 sensors, XENSIV PAS CO2 sensor, which provides an innovative solution for the growing demand for accurate indoor air quality.

- In April 2021, Siemens (Germany) is presenting Sitrans SCM IQ, a new Industrial Internet of Things (IIoT) solution for Smart Condition Monitoring, at the Hannover Messe 2021. It enables potential incidents to be detected and prevented at an early stage, thus reducing maintenance costs and downtimes and increasing plant performance by up to ten percent. The wireless, robust Sitrans MS200 multi sensors form the hardware basis for installation on machineries such as pumps, gear units, compressors, and drive trains, where they collect vibration and temperature data.

- In September 2021, Infineon Technologies (Germany) collaborated with Rainforest Connection (RFCx) (US), a non-profit organization that uses acoustic technology, big data, and artificial intelligence/machine learning to save the rainforests and monitor biodiversity. In this collaboration, RFCx will explore the use of Infineon’s gas sensing technologies to elevate and expand upon the capabilities of their current acoustic listening devices used to monitor and protect vulnerable rainforest ecosystems.

Frequently Asked Questions (FAQ):

How big is the opportunity for the smart Sensors market? How rising adoption of smart Sensors can help grasp this opportunity?

The smart Sensors market size is expected to grow from USD 38.3 billion in 2021 to USD 104.5 billion by 2027, at a CAGR of 17.9%. Growing popularity of industrial 4.0 and IoT and increasing demand of sensing devices will help in the adoption of smart sensors.

Which are the recent industry trends that can be implemented to generate additional revenue streams?

Predictive maintenance to offer lucrative opportunities to market players and use of smart sensors in several manufacturing industries are some of the major industry trends in the smart Sensors market.

Who are the major players operating in the smart Sensors detection market? Which companies are the front runners?

Analog Devices, Inc. (US), Infineon Technologies (Germany), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Microchip Technology (US), NXP Semiconductors (Netherlands), Robert Bosch GmbH (Germany), Seimens AG (Germany), ABB Ltd. (Switzerland), and Eaton Corporation (Ireland) are some of the major vendors in the market.

What are the major end-user industries of smart Sensors market?

Aerospace & defense, automotive, biomedical & healthcare, industrial automation, building automation, and consumer electronics, are major end-user industries of smart Sensors market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SMART SENSORS MARKET: SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 SMART SENSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 List of key primary interview participants

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size by bottom-up approach (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size by top-down approach (Supply-side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM SMART SENSORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN SMART SENSORS MARKET

2.3 MARKET PROJECTIONS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTION FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 9 SMART SENSORS MARKET, 2018–2027 (USD BILLION)

3.1 PRE-COVID-19 SCENARIO

3.2 POST-COVID-19 SCENARIO

FIGURE 10 SMART PRESSURE SENSORS SEGMENT, BY TYPE, TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 SMART SENSORS MARKET, BY TECHNOLOGY, 2022 VS. 2027

FIGURE 12 SMART SENSORS MARKET, BY COMPONENT, 2021 VS. 2027

FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

FIGURE 14 SMART SENSORS MARKET TO EXHIBIT HIGHEST GROWTH RATE IN APAC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN SMART SENSORS MARKET

FIGURE 15 GROWING ADOPTION OF INDUSTRY 4.0 TO BOOST GROWTH OF SMART SENSORS MARKET

4.2 SMART SENSORS MARKET, BY TYPE

FIGURE 16 SMART PRESSURE SENSORS SEGMENT TO HOLD LARGEST SIZE OF SMART SENSORS MARKET BY 2027

4.3 SMART SENSORS MARKET, BY TECHNOLOGY

FIGURE 17 MEMS TECHNOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 SMART SENSORS MARKET IN AMERICAS, BY END-USER INDUSTRY AND COUNTRY

FIGURE 18 CONSUMER ELECTRONICS SEGMENT AND US HELD LARGEST SHARE OF AMERICAS SMART SENSORS MARKET IN 2022

4.5 SMART SENSORS MARKET, BY COUNTRY

FIGURE 19 SMART SENSORS MARKET TO EXHIBIT HIGHEST CAGR IN INDIA FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 IMPACT OF DRIVERS AND OPPORTUNITIES ON SMART SENSORS MARKET

FIGURE 21 IMPACT OF CHALLENGES AND RESTRAINTS ON SMART SENSORS MARKET

5.2.1 DRIVERS

5.2.1.1 Surging demand for smart sensors in IOT-based devices and consumer electronics

TABLE 3 COMPANIES OFFERING SMARTPHONES, BY SHIPMENT, VOLUME, MARKET SHARE, AND YEAR-OVER-YEAR-GROWTH (SHIPMENTS IN MILLIONS)

5.2.1.2 Increasing use of smart sensors in revolutionizing industries

5.2.1.3 High demand for smart sensors by automobile manufacturers to deliver enhanced safety and comfort

5.2.1.4 Accelerating the use of wireless technology to monitor and control security devices equipped with smart sensors

5.2.2 RESTRAINTS

5.2.2.1 High installation and maintenance cost of smart sensors

5.2.3 OPPORTUNITIES

5.2.3.1 Surge in demand for smart sensor-enabled wearable devices

TABLE 4 COMPANIES OFFERING WEARABLE DEVICES, BY SHIPMENT, VOLUME, MARKET SHARE, AND YEAR-OVER-YEAR-GROWTH (SHIPMENTS IN MILLIONS)

5.2.3.2 Ongoing support by governments across the world to promote construction of green buildings

5.2.3.3 Predictive maintenance to offer lucrative opportunities to market players

5.2.4 CHALLENGES

5.2.4.1 Stringent performance requirements from advanced sensor application

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MOST VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS

5.4 SMART SENSOR ECOSYSTEM

FIGURE 23 SENSORS ECOSYSTEM

TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

5.5 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 24 REVENUE SHIFT IN SMART SENSORS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF EACH FORCE ON SMART SENSORS MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 CASE STUDY ANALYSIS

5.7.1 AGILE WATER MANAGEMENT USING SMART SENSOR TO SUPPORT FARMERS

5.7.2 ABB LTD. (SWITZERLAND) HELPS AXPO DEVELOP SWITZERLAND’S FIRST DIGITAL HYDROPOWER PLANT USING SMART SENSOR TECHNOLOGY

5.7.3 UMA INTEGRATES PRESSAC’S SMART SENSORS INTO ITS SOFTWARE TO TRANSFORM AN NHS TRUST INTO A SUPER-INTELLIGENT, EFFICIENT, AND ENVIRONMENTALLY FRIENDLY WORKPLACE

5.8 TECHNOLOGY TRENDS

5.8.1 GLUCOSE SENSORS (BIOLOGICAL SENSORS)

5.8.2 COGNITIVE SENSING

5.8.3 SEED TECHNOLOGY

5.8.4 UBIQUITOUS SENSOR NETWORKS

5.8.5 PRINTED GAS SENSORS

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 7 AVERAGE SELLING PRICE OF TEMPERATURE SENSORS

TABLE 8 AVERAGE SELLING PRICE OF ANGULAR SENSORS, 2020

TABLE 9 AVERAGE SELLING PRICE OF GAS SENSORS, 2020

5.10 PATENT ANALYSIS

5.10.1 PATENT REGISTRATIONS, 2018–2021

TABLE 10 SOME PATENT REGISTRATIONS, 2018–2021

5.10.2 SMART SENSOR: PATENT ANALYSIS

5.10.2.1 Methodology

5.10.2.2 Document type

FIGURE 25 PATENTS FILED BETWEEN 2018 AND 2021

FIGURE 26 GRANTED PATENT TRENDS, 2018–2021

5.11 TRADE ANALYSIS

5.11.1 IMPORTS SCENARIO OF HS CODE 902690

TABLE 11 IMPORTS DATA OF HS CODE 902690, BY COUNTRY, 2016–2020 (USD MILLION)

5.11.2 EXPORTS SCENARIO OF HS CODE 902690

TABLE 12 EXPORTS DATA OF HS CODE 902690, BY COUNTRY, 2016–2020 (USD MILLION)

5.12 TARIFF

5.12.1 TARIFFS

5.13 GOVERNMENT REGULATIONS AND STANDARDS

5.13.1 GOVERNMENT REGULATIONS

5.13.2 STANDARDS

5.13.2.1 IEEE 1451 Smart Transducer Interface Standard for Sensors and Actuators

5.13.2.2 IEEE C37.118 Sensor Requirements of Smart Grids

5.13.2.3 ISO 19891-1

5.13.2.4 International Electrotechnical Commission (IEC)

5.13.2.5 Atmosphere Explosible (ATEX)

5.13.2.6 Edison Testing Laboratories (ETL)

6 SMART SENSORS MARKET, BY TYPE (Page No. - 86)

6.1 INTRODUCTION

6.1.1 SMART DEVICES FOR HOME AUTOMATION, SECURITY, HEALTHCARE, AUTOMOTIVE, AND CONSUMER ELECTRONICS INDUSTRIES

FIGURE 27 APPLICATIONS IN VARIOUS INDUSTRIES ARE INCREASINGLY BECOMING SMART

6.1.2 INTERNET OF THINGS (IOT) IS INFLUENTIAL FOR SMART SENSORS MARKET

TABLE 13 SMART SENSORS MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 14 SMART SENSORS MARKET, BY TYPE, 2022–2027 (USD BILLION)

FIGURE 28 SMART PRESSURE SENSORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 15 SMART SENSORS MARKET, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 16 SMART SENSORS MARKET, BY TYPE, 2022–2027 (MILLION UNITS)

6.2 TEMPERATURE AND HUMIDITY SENSORS

6.2.1 INCREASING USE OF TEMPERATURE AND HUMIDITY SENSORS IN BUILDING AUTOMATION, AUTOMOTIVE, AND INDUSTRIAL AUTOMATION INDUSTRIES

6.2.2 TYPES OF TEMPERATURE SENSORS

6.2.2.1 Thermocouples

6.2.2.2 Thermistors

6.2.2.3 Resistance temperature detectors

6.2.2.4 IR sensors

6.2.2.5 Others

6.2.2.5.1 MEMS technology-based temperature sensors

6.2.2.5.2 USB-based temperature sensors

6.2.2.5.3 Wi-Fi-based temperature sensors

6.2.2.5.4 ZigBee-based temperature sensors

6.2.2.5.5 Bluetooth-based temperature sensors

6.2.2.5.6 RFID temperature sensors

6.2.3 TYPES OF HUMIDITY SENSORS

6.2.3.1 Capacitive humidity sensors

6.2.3.2 Resistive humidity sensors

TABLE 17 PROPERTIES OF HUMIDITY SENSORS

TABLE 18 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 19 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 20 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 21 SMART TEMPERATURE & HUMIDITY SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.3 PRESSURE SENSORS

6.3.1 MEMS-BASED PRESSURE SENSORS ARE COMMONLY USED IN CONSUMER ELECTRONICS, AUTOMOTIVE, ENVIRONMENTAL MONITORING, AND MEDICAL DIAGNOSTICS

6.3.2 TYPES OF PRESSURE MEASUREMENT SENSORS

6.3.2.1 Differential and gauge

6.3.2.2 Vacuum and absolute

6.3.3 MAJOR TECHNOLOGIES FOR PRESSURE SENSORS

6.3.3.1 Piezoresistive pressure sensors

6.3.3.2 Capacitive pressure sensors

6.3.3.3 Electromagnetic pressure sensors

6.3.3.4 Resonant solid-state pressure sensors

6.3.3.5 Optical pressure sensors

TABLE 22 SMART PRESSURE SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 23 SMART PRESSURE SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 24 SMART PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 25 SMART PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.4 FLOW SENSOR

6.4.1 AUTOMOTIVE, AEROSPACE, MEDICAL, AND BUILDING AUTOMATION INDUSTRIES ARE MAJOR APPLICATION AREAS OF FLOW SENSORS

TABLE 26 UNIT OF FLOW ACCORDING TO MATERIAL

TABLE 27 SMART FLOW SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 28 SMART FLOW SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 29 SMART FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 30 SMART FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.5 TOUCH SENSOR

6.5.1 HOUSEHOLD APPLIANCES, GAMING CONSOLES, MOBILE PHONES, OFFICE EQUIPMENT, AND PORTABLE MUSIC PLAYERS ARE KEY APPLICATION AREAS OF SMART TOUCH SENSORS

6.5.2 MAJOR TYPES OF TOUCH SENSING TECHNOLOGIES

6.5.2.1 Capacitive sensors

6.5.2.2 Resistive sensors

6.5.2.3 Infrared sensors

TABLE 31 SMART TOUCH SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 32 SMART TOUCH SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 33 SMART TOUCH SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 SMART TOUCH SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.6 IMAGE SENSOR

6.6.1 IMAGE SENSORS PLAY CRUCIAL ROLE IN IOT, SMART HOME, SMART CITY, SMART AUTOMATION, SMART CAR, AND SMART HEALTHCARE APPLICATIONS

6.6.1.1 CMOS-based image sensors

6.6.1.2 Fingerprint recognition

6.6.1.3 Iris scanning

TABLE 35 SMART IMAGE SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 36 SMART IMAGE SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 37 SMART IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 SMART IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.7 MOTION AND OCCUPANCY SENSORS

6.7.1 SMART MOTION SENSORS

6.7.1.1 Growing demand for smart motion sensors from consumer electronics, gaming & entertainment, automotive, and healthcare industries

6.7.2 MAJOR EMBEDDED SENSOR TYPES IN MOTION SENSORS

6.7.2.1 MEMS accelerometers

6.7.2.2 MEMS gyroscopes

6.7.2.3 MEMS magnetometers

6.7.2.4 Sensor combos

6.7.3 SMART OCCUPANCY SENSORS

6.7.3.1 PIR-based occupancy sensors to dominate smart occupancy sensors market

6.7.3.2 Types of occupancy sensors

6.7.3.2.1 PIR-based sensors

6.7.3.2.2 Ultrasonic-based sensors

6.7.3.2.3 Dual technology-based sensors

TABLE 39 SMART MOTION AND OCCUPANCY SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 40 SMART MOTION AND OCCUPANCY SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 41 SMART MOTION AND OCCUPANCY SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 42 SMART MOTION AND OCCUPANCY SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.8 WATER SENSORS

6.8.1 TURBIDITY SENSORS MEASURE CLOUDINESS IN WASTEWATER, RIVER, AND STREAM

TABLE 43 SMART WATER SENSORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 44 SMART WATER SENSORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.8.2 MAJOR TYPES OF WATER SENSORS

6.8.2.1 Turbidity sensors

6.8.2.2 pH sensors

6.8.2.3 Soil moisture sensors

6.8.2.4 Level sensors

6.8.2.5 Dissolved oxygen (DO2) sensors

TABLE 45 SMART WATER SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 46 SMART WATER SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 47 SMART WATER SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 48 SMART WATER SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.9 POSITION SENSOR

6.9.1 SMART POSITION SENSORS ENSURE ACCURATE MOTION CONTROL AND IMPROVE PROCESS EFFICIENCY AS WELL AS SAFETY

6.9.2 MAJOR TYPES OF POSITION SENSORS

6.9.2.1 Linear position sensors

6.9.2.2 Rotary position sensors

6.9.2.3 Proximity sensors

TABLE 49 SMART POSITION SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 50 SMART POSITION SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 51 SMART POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 52 SMART POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.10 LIGHT SENSOR

6.10.1 LIGHT SENSORS ARE USED IN MODERN ELECTRONICS SUCH AS COMPUTERS, WIRELESS PHONES, AND TELEVISIONS

6.10.2 OUTPUT TYPES

6.10.2.1 Analog light sensors

6.10.2.2 Digital light sensors

TABLE 53 SMART LIGHT SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 54 SMART LIGHT SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 55 SMART LIGHT SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 56 SMART LIGHT SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.11 ULTRASONIC SENSOR

6.11.1 ULTRASONIC SENSORS ARE SELF-CONTAINED AND NONCONTACT SENSING SYSTEMS FOR MEASURING AND CONTROLLING POSITION AND DISTANCE

TABLE 57 SMART ULTRASONIC SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 58 SMART ULTRASONIC SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 59 SMART ULTRASONIC SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 60 SMART ULTRASONIC SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

6.12 OTHERS

6.12.1 SMART RADAR SENSORS ARE USED IN SPEECH DETECTION AND ENHANCEMENT APPLICATIONS

6.12.1.1 Electrical conductivity sensors

6.12.1.2 Gesture sensors

6.12.1.3 Radar sensors

6.12.1.4 Oxidation-reduction potential (ORP) sensors

6.12.1.5 Color sensors

TABLE 61 OTHER SMART SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 62 OTHER SMART SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 63 OTHER SMART SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 64 OTHER SMART SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

7 SMART SENSORS MARKET, BY TECHNOLOGY (Page No. - 126)

7.1 INTRODUCTION

FIGURE 29 MEMS TECHNOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 65 SMART SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD BILLION)

TABLE 66 SMART SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

7.2 MAJOR PACKAGING TYPES CONSIDERED IN SMART SENSORS MARKET

7.2.1 SYSTEM-IN-PACKAGE (SIP)

7.2.1.1 Rising demand for miniaturization and higher functionality of devices to drive demand for SIP technology

7.2.2 SYSTEM-ON-CHIP (SOC)

7.2.2.1 Benefits associated with SOC such as compactness, portability, high reliability, fast circuit operation, and small form factor to propel market growth

TABLE 67 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

7.3 MEMS TECHNOLOGY

7.3.1 INCREASING ADOPTION OF MEMS TECHNOLOGY-BASED SMART SENSORS IN VARIOUS PROCESS INDUSTRIES TO BOOST MARKET GROWTH

TABLE 68 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 69 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

7.3.2 ROLE OF VERY-LARGE-SCALE INTEGRATION TECHNOLOGY (VLSI)

7.3.3 RELEVANCE OF NANOELECTROMECHANICAL SYSTEMS (NEMS)

FIGURE 30 MERITS AND DEMERITS OF MEMS TECHNOLOGY

7.4 CMOS TECHNOLOGY

7.4.1 CHARACTERISTICS SUCH AS LOW STATIC POWER CONSUMPTION AND HIGH NOISE IMMUNITY ARE DRIVING DEMAND FOR CMOS TECHNOLOGY

FIGURE 31 MERITS AND DEMERITS OF CMOS TECHNOLOGY

TABLE 70 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

7.5 OTHER TECHNOLOGIES

7.5.1 OPTICAL SPECTROSCOPY

7.5.2 MICROSYSTEMS TECHNOLOGY (MST)

7.5.3 INTEGRATED SMART SENSOR – HYBRID SENSOR

7.5.4 IC-COMPATIBLE 3D MICROSTRUCTURING

7.5.5 APPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC)

7.5.6 OPTICAL SENSING

TABLE 72 SMART SENSORS MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 SMART SENSORS MARKET FOR OTHER TECHNOLOGIES, BY TYPE, 2022–2027 (USD MILLION)

8 SMART SENSORS MARKET, BY COMPONENT (Page No. - 140)

8.1 INTRODUCTION

FIGURE 32 MICROCONTROLLERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 74 SMART SENSORS MARKET, BY COMPONENT, 2018–2021 (USD BILLION)

TABLE 75 SMART SENSORS MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

8.2 ANALOG-TO-DIGITAL CONVERTER

8.2.1 ADCS OFFER SECURITY, DATA COMPRESSION, EASY INTEGRATION, AND LESS NOISE

8.2.1.1 Advantages of analog-to-digital converters

8.3 DIGITAL-TO-ANALOG CONVERTER

8.3.1 DACS WORKS AS AN INTERFACE BETWEEN DIGITAL AND REAL WORLD

8.3.1.1 Advantages of digital-to-analog converters

8.4 TRANSCEIVERS

8.4.1 HIGH-SPEED SERIAL TRANSCEIVERS PROVIDE A BACKBONE TO NETWORKS, SERVERS, COMMUNICATIONS, AND OTHER ELECTRONIC SYSTEMS

8.4.1.1 Advantages of transceivers

8.5 AMPLIFIER

8.5.1 POWER AMPLIFIERS HELP INCREASED SIGNAL POWER

8.5.1.1 Advantages of amplifiers

8.6 MICROCONTROLLERS

8.6.1 MICROCONTROLLERS CAN HELP CARRY OUT LIMITED NUMBER OF COMPUTING FUNCTIONS

8.6.1.1 Advantages of microcontrollers

8.7 OTHERS

9 VARIOUS NETWORK CONNECTIVITY OPTIONS FOR SMART SENSORS (Page No. - 146)

9.1 INTRODUCTION

FIGURE 33 NETWORK CONNECTIVITY OPTIONS FOR SMART SENSORS

9.2 WIRED NETWORK CONNECTIVITY

9.2.1 KNX

9.2.2 LONWORKS

9.2.3 ETHERNET

9.2.4 MODBUS

9.2.5 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

9.3 WIRELESS NETWORK CONNECTIVITY

9.3.1 ENOCEAN

9.3.2 WI-FI

9.3.3 ZIGBEE

9.3.4 Z-WAVE

9.3.5 BLUETOOTH

9.3.5.1 Bluetooth Smart

9.3.5.2 Wi-Fi/Bluetooth Smart

9.3.5.3 Bluetooth Smart/Ant+

9.3.5.4 Bluetooth 5

9.3.6 OTHERS

10 SMART SENSORS MARKET, BY END-USER INDUSTRY (Page No. - 153)

10.1 INTRODUCTION

FIGURE 34 CONSUMER ELECTRONICS INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 76 SMART SENSORS MARKET, BY END-USER INDUSTRY, 2018–2021 (USD BILLION)

TABLE 77 SMART SENSORS MARKET, BY END-USER INDUSTRY, 2022–2027 (USD BILLION)

10.2 INDUSTRIAL AUTOMATION

10.2.1 SURGING ADOPTION OF INDUSTRIAL AUTOMATION AND IIOT IN PROCESS INDUSTRIES TO DRIVE MARKET TO MEET RELIABILITY AND PRECISION REQUIREMENTS

TABLE 78 EXAMPLES OF SMART SENSORS USED IN INDUSTRIAL AUTOMATION

TABLE 79 SMART SENSORS MARKET FOR INDUSTRIAL AUTOMATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 80 SMART SENSORS MARKET FOR INDUSTRIAL AUTOMATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 SMART SENSORS MARKET FOR INDUSTRIAL AUTOMATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 SMART SENSORS MARKET FOR INDUSTRIAL AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

10.3 BUILDING AUTOMATION

10.3.1 SMART SENSORS PLAY AN IMPORTANT ROLE IN HVAC, THERMOSTATS, LIGHTING, AND AIR CONDITIONING SYSTEMS

TABLE 83 EXAMPLES OF SMART SENSORS USED IN BUILDING AUTOMATION

FIGURE 35 SECURITY & SURVEILLANCE SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 84 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 SMART SENSORS MARKET FOR BUILDING AUTOMATION, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1.1 Security & surveillance systems

10.3.1.2 Access control systems

10.3.1.3 Radio frequency identification (RFID) tags

10.3.1.4 Lighting control systems

10.3.1.5 Heating, ventilation, and air-conditioning (HVAC) systems

10.3.1.6 Others

10.4 CONSUMER ELECTRONICS

10.4.1 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS TO BE DRIVEN BY WEARABLE ELECTRONICS

FIGURE 36 COMMUNICATIONS & IT SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 90 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 95 SMART SENSORS MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1.1 Communications and IT solutions

10.4.1.2 Entertainment solutions

10.4.1.3 Home appliances

10.4.1.4 Wearable electronics

10.5 BIOMEDICAL AND HEALTHCARE

10.5.1 DEPLOYMENT OF SMART SENSORS IN LIFE-SUPPORTING INSTRUMENTS TO MONITOR VITAL FLUID LEVELS SUCH AS GLUCOSE, BLOOD PRESSURE, AND GLUCOSE LEVELS

TABLE 96 EXAMPLES OF SMART SENSORS USED IN BIOMEDICAL & HEALTHCARE

TABLE 97 SMART SENSORS MARKET FOR BIOMEDICAL & HEALTHCARE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 98 SMART SENSORS MARKET FOR BIOMEDICAL & HEALTHCARE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 SMART SENSORS MARKET FOR BIOMEDICAL & HEALTHCARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 SMART SENSORS MARKET FOR BIOMEDICAL & HEALTHCARE, BY REGION, 2022–2027 (USD MILLION)

10.6 AUTOMOTIVE

10.6.1 USE OF SMART SENSORS IN SELF-DRIVING CARS TO BOOST MARKET GROWTH FOR AUTOMOTIVE INDUSTRY

TABLE 101 EXAMPLES OF SMART SENSORS USED IN AUTOMOTIVE

TABLE 102 SMART SENSORS MARKET FOR AUTOMOTIVE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 SMART SENSORS MARKET FOR AUTOMOTIVE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 SMART SENSORS MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 SMART SENSORS MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.7 AEROSPACE AND DEFENSE

10.7.1 ADOPTION OF SMART SENSORS FOR DETECTION AND TRACKING OF UNDERWATER VEHICLES AND COMMUNICATION SYSTEMS IN AEROSPACE & DEFENSE INDUSTRY

TABLE 106 EXAMPLES OF SMART SENSORS USED IN AEROSPACE & DEFENSE

TABLE 107 SMART SENSORS MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 108 SMART SENSORS MARKET FOR AEROSPACE & DEFENSE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 109 SMART SENSORS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 110 SMART SENSORS MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHERS

TABLE 111 SMART SENSORS MARKET FOR OTHER INDUSTRIES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 112 SMART SENSORS MARKET FOR OTHER INDUSTRIES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 113 SMART SENSORS MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 SMART SENSORS MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 181)

11.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT: SMART SENSORS MARKET TO WITNESS HIGHEST GROWTH IN APAC FROM 2022 TO 2027

FIGURE 38 APAC TO DOMINATE SMART SENSORS MARKET DURING FORECAST PERIOD

TABLE 115 SMART SENSORS MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 116 SMART SENSORS MARKET, BY REGION, 2022–2027 (USD BILLION)

11.2 AMERICAS

FIGURE 39 AMERICAS: SNAPSHOT OF SMART SENSORS MARKET

TABLE 117 SMART SENSORS MARKET IN AMERICAS, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 118 SMART SENSORS MARKET IN AMERICAS, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 119 SMART SENSORS MARKET IN AMERICAS, BY COUNTRY/REGION, 2018–2021 (USD MILLION)

TABLE 120 SMART SENSORS MARKET IN AMERICAS, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

11.2.1 NORTH AMERICA

11.2.1.1 US

11.2.1.1.1 US to hold largest market share by 2027 in Americas

TABLE 121 SMART SENSORS MARKET IN US, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 122 SMART SENSORS MARKET IN US, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing automation in various sectors such as healthcare and manufacturing drive growth of smart sensors market in Canada

TABLE 123 SMART SENSORS MARKET IN CANADA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 124 SMART SENSORS MARKET IN CANADA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing automation in several industries to boost market growth in Mexico

TABLE 125 SMART SENSORS MARKET IN MEXICO, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 126 SMART SENSORS MARKET IN MEXICO, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.2.4 SOUTH AMERICA

11.2.4.1 Brazil is fastest-growing market for smart sensors in South America

TABLE 127 SMART SENSORS MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 128 SMART SENSORS MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 40 EUROPE: SNAPSHOT OF SMART SENSORS MARKET

TABLE 129 SMART SENSORS MARKET IN EUROPE, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 130 SMART SENSORS MARKET IN EUROPE, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 131 SMART SENSORS MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 SMART SENSORS MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Automotive industry to drive smart sensors market growth in Germany

TABLE 133 SMART SENSORS MARKET IN GERMANY, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 134 SMART SENSORS MARKET IN GERMANY, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Consumer electronics industry to create new market opportunities for smart sensors in UK

TABLE 135 SMART SENSORS MARKET IN UK, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 136 SMART SENSORS MARKET IN UK, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Strong base of automotive and manufacturing industries to drive growth of smart sensors market in France

TABLE 137 SMART SENSORS MARKET IN FRANCE, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 138 SMART SENSORS MARKET IN FRANCE, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Upcoming safety regulations in aerospace and defense to drive growth of smart sensors market

TABLE 139 SMART SENSORS MARKET IN SPAIN, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 140 SMART SENSORS MARKET IN SPAIN, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 141 SMART SENSORS MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 142 SMART SENSORS MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4 APAC

FIGURE 41 APAC: SNAPSHOT OF SMART SENSORS MARKET

TABLE 143 SMART SENSORS MARKET IN APAC, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 144 SMART SENSORS MARKET IN APAC, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 145 SMART SENSORS MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 SMART SENSORS MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China held largest share of smart sensors market in APAC in 2021

TABLE 147 SMART SENSORS MARKET IN CHINA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 148 SMART SENSORS MARKET IN CHINA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Presence of leading sensor manufacturing companies in Japan to support market growth

TABLE 149 SMART SENSORS MARKET IN JAPAN, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 150 SMART SENSORS MARKET IN JAPAN, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Strong government support for adoption of industrial automation to boost demand for smart sensors in India

TABLE 151 SMART SENSORS MARKET IN INDIA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 152 SMART SENSORS MARKET IN INDIA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Increasing demand for advanced sensors from electronics and automotive industries is driving smart sensors market in South Korea

TABLE 153 SMART SENSORS MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 154 SMART SENSORS MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.4.5 REST OF APAC

TABLE 155 SMART SENSORS MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 156 SMART SENSORS MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

11.5 ROW

TABLE 157 SMART SENSORS MARKET IN ROW, BY END-USER INDUSTRY, 2018–2021 (USD MILLION)

TABLE 158 SMART SENSORS MARKET IN ROW, BY END-USER INDUSTRY, 2022–2027 (USD MILLION)

TABLE 159 SMART SENSORS MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 160 SMART SENSORS MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Middle East holds larger share of smart sensors market in RoW

11.5.2 AFRICA

11.5.2.1 Government initiatives to improve healthcare facilities fuel African smart sensors market

12 COMPETITIVE LANDSCAPE (Page No. - 213)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 161 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE SMART SENSORS MARKET

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 162 SMART SENSORS MARKET: DEGREE OF COMPETITION

12.4 REVENUE ANALYSIS OF TOP PLAYERS IN SMART SENSORS MARKET

FIGURE 42 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN SMART SENSORS MARKET

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 PERVASIVE

12.5.3 EMERGING LEADER

12.5.4 PARTICIPANT

FIGURE 43 SMART SENSORS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

12.6 STARTUP/SME EVALUATION QUADRANT

TABLE 163 STARTUP/SME EVALUATION QUADRANT

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 44 SMART SENSORS MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

12.7 COMPANY PRODUCT FOOTPRINT

TABLE 164 COMPANY PRODUCT FOOTPRINT

TABLE 165 SENSOR OFFERING FOOTPRINT OF COMPANIES

TABLE 166 END-USER INDUSTRY FOOTPRINT OF COMPANIES

TABLE 167 REGIONAL FOOTPRINT OF COMPANIES

12.8 COMPETITIVE SITUATION AND TRENDS

12.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 168 SMART SENSORS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018–JANUARY 2022

12.8.2 DEALS

TABLE 169 SMART SENSORS MARKET: DEALS, JANUARY 2019–DECEMBER 2021

12.8.3 OTHERS

TABLE 170 SMART SENSORS MARKET: OTHERS, JANUARY 2019–SEPTEMBER 2021

13 COMPANY PROFILES (Page No. - 241)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, and MnM View)*

13.1.1 ANALOG DEVICES, INC.

TABLE 171 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

FIGURE 45 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

13.1.2 INFINEON TECHNOLOGIES AG

TABLE 172 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 46 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

13.1.3 STMICROELECTRONICS

TABLE 173 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 47 STMICROELECTRONICS: COMPANY SNAPSHOT

13.1.4 TE CONNECTIVITY LTD.

TABLE 174 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

FIGURE 48 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

13.1.5 MICROCHIP TECHNOLOGY

TABLE 175 MICROCHIP TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 49 MICROCHIP TECHNOLOGY: COMPANY SNAPSHOT

13.1.6 NXP SEMICONDUCTORS N.V.

TABLE 176 NXP SEMICONDUCTORS N.V: BUSINESS OVERVIEW

FIGURE 50 NXP SEMICONDUCTORS N.V: COMPANY SNAPSHOT

13.1.7 ABB LTD.

TABLE 177 ABB LTD.: BUSINESS OVERVIEW

FIGURE 51 ABB LTD: COMPANY SNAPSHOT

13.1.8 SIEMENS AG

TABLE 178 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 52 SIEMENS AG: COMPANY SNAPSHOT

13.1.9 ROBERT BOSCH GMBH

TABLE 179 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 53 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

13.1.10 HONEYWELL INTERNATIONAL

TABLE 180 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 54 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

* Business Overview, Products/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 TDK CORPORATION

13.2.2 EATON CORPORATION PLC

13.2.3 EMERSON ELECTRIC COMPANY

13.2.4 GENERAL ELECTRIC COMPANY (GE)

13.2.5 LEGRAND

13.2.6 TEXAS INSTRUMENTS INCORPORATED

13.2.7 BALLUFF GMBH

13.2.8 SENSIRION AG

13.2.9 QUALCOMM TECHNOLOGIES, INC.

13.2.10 MEMSIC INC.

13.2.11 AIRMAR TECHNOLOGY CORPORATION

13.2.12 VISHAY PRECISION GROUP, INC.

13.2.13 GILL SENSORS & CONTROLS LIMITED

13.2.14 MURATA MANUFACTURING CO., LTD.

13.2.15 RENESAS ELECTRONICS CORPORATION (RENESAS)

14 APPENDIX (Page No. - 300)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

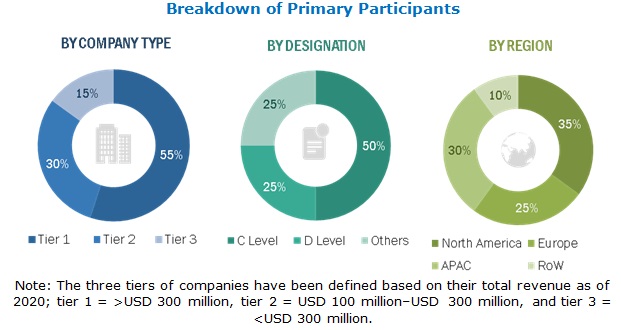

The study involved 4 major activities in estimating the current size of the Smart sensors market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the Smart sensors market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: Americas, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the Smart sensors market and other dependent submarkets.

- The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) into the Smart sensors market.

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To define, describe, and forecast the smart sensors market size, based on type, technology, component, end-user industry, and region, in terms of value

- To define, describe, and forecast the smart sensors market size, in terms of volume, based on the type

- To describe different network connectivity options for smart sensors

- To forecast the market size, in terms of value, about four major regions—Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the smart sensors market

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain of smart sensors

- To analyze the impact of COVID-19 on the smart sensors market, its segments, and the players operating in the market

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape of the market

- To analyze competitive developments such as product launches and developments, collaborations, agreements, contracts, partnerships, acquisitions, and Research and Development (R&D) in the smart sensors market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What are new application areas smart sensors providers exploring?

- Who are the key market players, and how intense is the competition?

- Which applications and geographies would be the biggest markets for smart sensors

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Sensors Market

I am a business student - Indianapolis creating a presentation about smart sensors and I am wanting to know if I could get a sample report to use in my research.

I am doing a research on advancement and use of sensors in the field of agriculture so to accomplish my goal I need the report.

I am potentially interested in purchasing a report encompassing all potential applications for short range radars in 'X' and 'K' Band including motion, occupancy, perimeter protection, automotive, traffic monitoring etc. I am not interested in any other kinds of sensors. What could you offer me?

Positioning my sales team with data so that they can proactively engage with OEM customers that are in need of Smart Sensors.

Before purchasing this report, I need to understand a little more about the methodology used to calculate and forecast the market of each sensor and industry. In particular, I'm looking for information on units of each, in addition to total market size in sales. Is that something that is available? Please let me know if you would like to discuss. I'm on a tight deadline for a project, and need to make a decision before this weekend on whether or not to buy the report.

Looking for Market Share information within the smart sensor market. Particularly optical sensors, CMOS.

How is smart sensor defined? What percent of the total sensor market are smart sensors? what types of non-smart sensors are being excluded?

Annual India market survey report for field instruments, Industrial IOT solutions, Water system management.

I would like to know more about the impact of smart sensors in the next five years in both first and second world countries.

I just want to know about smart sensors for water level, water velocity, water temperature, pressure and hydrodynamic force measurement in physical hydraulic models.