Smart Warehousing Market by Component (Hardware, Solutions, and Services), Technology (IoT & Analytics, RFID, AGV), Application (Inventory Management, Order Management), Organization Size, Deployment Mode, Vertical, and Region - Global Forecast to 2026

Smart Warehousing Market Size

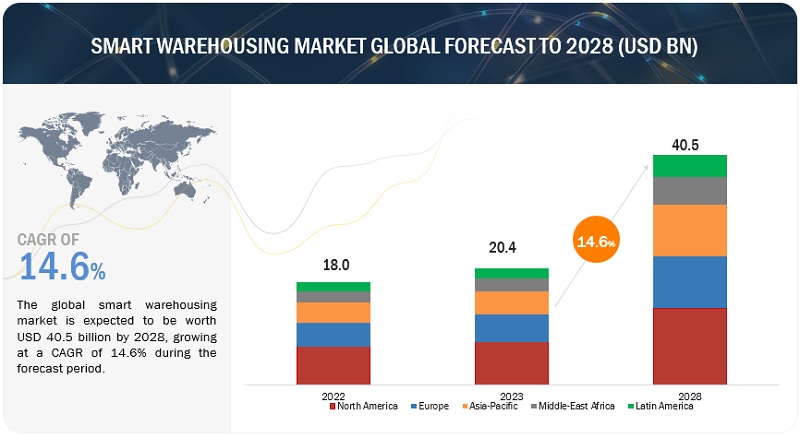

[301 Pages Report] The global smart warehousing market size projected to reach USD 25.4 billion by 2026, at a CAGR of 11.5% during the forecast period.

Smart Warehousing Market Share

Various factors such as the proliferation of smartphones for faster goods management, the rising advancement in the eCommerce industry due to the onset of the COVID-19 pandemic, the emergence of multi-channel distribution networks, and the dynamic nature and globalization of supply chain networks are expected to drive the growth of smart warehousing market.

A smart warehouse is a large building in which raw materials and manufactured goods are stored. It uses machines and computers to complete common warehouse operations that humans previously performed. These operations include identifying and receiving orders, counting products, storing products, remembering where they are later, and sending orders to the correct place. With negligible errors, the most successful smart warehouses automate nearly the entire operation and journey of goods from supplier to customer.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic disrupted global supply chains has outstripped and impacted both supply and demand at a higher pace. But the impact of COVID on the warehouse is going to have long and lasting effects. As the virus spreads throughout the world, there is an outbreak or transportation delay in one part of the world that would have a devastating impact across the globe, causing shutdowns due to warehouse closures or missing or delayed supplies. At the warehouse, some organizations were left with excess inventory they could not ship sitting in inventory and few other firms were at a standstill as they waited to receive inventory at their depleted warehouse. Some industries witnessed unprecedented demand while other industries saw the demand fall, leading to a negative impact on the overall smart warehousing market. Post COVID-19, warehouse and supply chain sectors have adopted and implemented automation technologies, such as Assisted Guided Vehicles (AGV), forklift automation, robotics, and smart sorting to enable businesses to flourish during today’s changing conditions.

Smart Warehousing Market Growth Dynamics

Driver: Proliferation of smartphones for faster and efficient management of goods

The warehouse plays a key role in the overall supply chain industry. The labor-intensive processes in the warehouse for core functions such as order picking, inventory management, and asset tracking can reduce the overall productivity. Hence, streamlining the whole warehouse process with mobile-based technology and applications can increase operational efficiencies and improve the bottom-line. The proliferation of mobile devices, such as smartphones and tablets, means warehouse workers and logistics partners have a wealth of tools and resources at their fingertips. Scanning inventory with barcode scanning apps, viewing the precise location of a shipment on a map, pulling up detailed shipping information and receiving data, and generating reports in lesser time is the functionality that would benefit warehouse managers to handle the overall warehouse process efficiently. Smartphones lower a warehouse's investment in hardware and maintenance by a significant margin. Smartphones enable instant access to data on the warehouse floor. Decision-makers do not have to run around or wait for printed reports anymore. They can pull their phone from their pocket and see their entire supply chain at their fingertips This allows them to make better decisions in real-time and reallocate resources to meet all your daily goals. Ease of access to essential tools and data leading to greater visibility from the office, the receiving department, the floor, and the field would drive the growth of the smart warehousing market across the globe.

Restraint: Lack of uniform governance standards in the fragmented supply chain and logistics industry

One of the major restraints to the widespread adoption of smart warehousing is the lack of governance. High levels of fragmentation within the logistics industry need the development of a logistics IoT standard. Transportation and logistics businesses around the globe are focused on maximizing supply chain efficiency to sustain profitability and viability. There is a requirement of maintaining governance as standard as possible, as having one authority per field would lead to confusion. However, a high level of performance will result in end-to-end improvements in the connected devices and integrated platforms. Certain interoperability standards such as MTConnect, EtherCAT, and Master Control System-Distributed Control System (MCS-DCS) Interface Standardization promote data interchange across heterogeneous domains and industries. A common standardization in the logistics and supply chain system would make it easy and convenient for every service provider to offer most solutions in one package. Compared to North America and Europe, logistics standardization in Asian countries, such as China and Korea, is limited due to stringent government rules and regulations. The lack of uniform governance standards makes it difficult for end users to fully automate the supply chain and logistics operations, thereby restraining the growth of the smart warehousing market.

Opportunity: Focus on warehouse 4.0 for a more efficient and safer warehouse

Warehouse 4.0 combines digital and physical systems, which paves the way for enhanced connected experiences that will impact the overall process of the warehouse from product design and planning to supply chain and production. To reduce the training hours of new employees, warehouses are migrating to a voice-based and screen-directed inventory picking and replenishment process. Organizations are implementing multi-modal picking, which is a combination of picking and screen-directed picking through mobile devices. IoT, big data and data science, AR, wearables, computer vision AI, low-cost sensors, robots, and high-level computing can be combined to build a robust system of warehouse automation. This will lead to the smarter warehouses and distribution centers, an essential component of the integrated supply chain industry. Companies that use warehouse 4.0 solutions reduce their operating costs through more efficient inventory management and delivery processes. A considerable number of warehouse 4.0 research and business initiatives going on that prove that warehousing is continuously changing and bringing many opportunities to the market.

Challenge: Lack of awareness about benefits of smart warehousing among small-scale industries

Small-scale industries traditionally operate their warehouses. As the annual income of small-scale industries is not very high, investments to set up smart warehousing seem to be an unnecessary expense for these business owners. Due to the reluctance to replace traditional systems and limited growth plans, business owners in small-scale industries fail to recognize the benefits of using smart warehousing solutions. Further, significant investments associated with the deployment of smart warehousing solutions and high upfront costs pose a hindrance factor in the growth of the market. the deployment of smart warehousing solutions involves extra costs for license purchase, upgrades, and employee training; this factor also limits the overall adoption by small-scale industries. The deployment of smart warehouse solutions increases the efficiency of warehouse operations, reduces operational expenses, and enhances labor productivity.

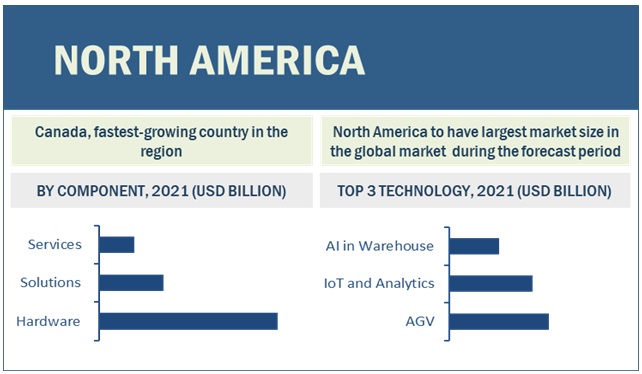

The hardware segment is expected to account for the largest market size during the forecast period

The hardware segment is expected to hold the largest market share in 2021, while the services segment is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing adoption of smartphone devices across various verticals that can easily deploy inventory control systems and automated picking tools to handle the inventory process and reduce overall labor costs. A rise in the demand for IoT, sensors, and AI technologies among users to optimize warehouse operations has influenced vendors to develop smart warehousing hardware.

North America to account for largest market size during the forecast period

North America is estimated to have the largest market size in 2021, followed by Europe; this growth can be attributed to the technological upgrades in these regions. Being an early adopter of technologies, North America is an innovation hub and is expected to present strong opportunities for smart warehousing vendors to expand in this market. However, APAC is projected to grow at the highest Compound Annual Growth Rate (CAGR) due to the rapid rise in technology adoption across verticals to enhance customer experience and productivity. The adoption of smart warehousing hardware, solutions, and services is expected to rise in MEA and Latin America due to the growing demand for automating warehouse processes for improved productivity, efficiency, and accuracy. The smart warehouse solutions that are implemented provide flexibility and enhance the capability of employees.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the smart warehousing market include Oracle ( US), SAP (Germany), Manhattan Associates (US), PSI Logistics (Germany), PTC (US), Tecsys (Canada), Reply (Italy), IBM (US), Infor (US), Korber (Germany), Generic (France), Microlistics (Australia), Blue Yonder (US), Vinculum (India), Epicor (US), Softeon (US), 3PL Central (US), Synergy Logistics (US), BlueJay Solutions (US), Mantis (US), WareIQ (India), Foysonis (US), Logiwa (US), Increff (India), Locus Robotics (US), ShipHero (US), Orderhive US), EasyEcom (India), Unicommerce (India), and IAM Robotics (US). Partnerships, new product developments, mergers and acquisitions, product enhancements, and acquisitions are the key strategies implemented by major vendors in the smart warehousing market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2021 |

US $14.8 billion |

|

Market size value in 2026 |

US $25.4 billion |

|

Growth Rate |

11.5% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2026 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Deployment Mode, Organization Size, Technology, Application, Vertical, And Region |

|

Smart Warehousing Market Drivers |

|

|

Smart Warehousing Market Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Companies covered |

Oracle (US), SAP (Germany), Manhattan Associates (US), PSI Logistics (Germany), PTC (US), Tecsys (Canada), Reply (Italy), IBM (US), Infor (US), Korber (Germany), Generix (France), Microlistics (Australia), Blue Yonder (US), Vinculum (India), Epicor (US), Softeon (US), 3PL Central (US), Synergy Logistics (US), BlueJay Solutions (US), Mantis (US), WareIQ (India), Foysonis (US), Logiwa (US), Increff (India), Locus Robotics (US), ShipHero (US), Orderhive US), EasyEcom (India), Unicommerce (India), and IAM Robotics (US) |

This research report categorizes the smart warehousing market based on components, deployment mode, organization size, technology, application, vertical, and regions.

Smart Warehousing Market By Component:

- Hardware

-

Solutions

- WCS

-

WMS

- Integrated

- Standalone

- Other Solutions (ERP Software, inventory software and SCM software)

-

Services

-

Professional Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

-

Professional Services

- Managed Services

Smart Warehousing Market By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

Smart Warehousing Market By Technology

- IoT and Analytics

- AI in Warehouse

- Automated Guided Vehicles (AGV)

- RFID

- Blockchain in Warehouse

- Other Technologies (AR, security, Wi-Fi, and voice recognition)

By Application

- Transport Management

- Inventory Management

- Order Management

- Yard Management

- Shipping Management

- Labor Management

- Other Applications (dock door management, lot management, and task management)

By Vertical

- Transportation and Logistics

- Retail and eCommerce

- Manufacturing

- Healthcare and Life Sciences

- Energy and Utilities

- Automotive

- Food and Beverages

- Other Verticals (agriculture, mining, and government)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2021, Oracle and Deutsche Bank collaboration is one of the world’s largest financial service organizations to modernize bank database technology and accelerate digital transformation.

- In August 2021, SAP has acquired SwoopTalent, a leading provider of AI-powered platform to improve organizational agility and fuel business growth rate. SAP plans to use SwoopTalent’s technology to strengthen its AI capabilities and provide customers with a holistic and continuously updated view of their clients.

- In May 2020, Manhattan Associates launched the Manhattan Active Warehouse Management solution. It is the world’s first cloud-native enterprise-class WMS that unifies every aspect of distribution and never needs upgradation. Manhattan Active WMS users in a new level of speed, adaptability, and ease of use within distribution management.

- In March 2020, PSI FLS Fuzzy Logik & Neuro Systeme partnered with INDUTRAX GmbH to offer integrated software solutions to analyze business processes using location data and AI methods to identify weaknesses and visualize improvement potential in a comprehensible form.

- In April 2020, PTC has entered a long-term collaboration with the Technion, an Israel Institute of Technology. Under the collaboration, PTC would establish an R&D center and invest USD 5 million into PTC’s Haifa campus.

- In March 2020, TECSYS entered a contract with Delmar International (Canada). Delmar has introduced operational and functional improvements to its 3PL warehousing and distribution business through the deployment of Tecsys software and business intelligence solutions. The company is leveraging Tecsys’ warehouse management platform and extended capabilities across its two largest fulfillment centers.

Frequently Asked Questions (FAQ):

What is Smart Warehousing?

According to SAP, smart warehousing is a system that manages high-volume warehouse operations and integrates complex supply chain logistics with the warehouse and distribution processes, delivering the ultimate visibility and control and optimizing inventory tracking, cross-docking, and distribution operations. A smart warehouse is a large building in which raw materials and manufactured goods are stored. It uses machines and computers to complete common warehouse operations that humans previously performed. These operations include identifying and receiving orders, counting products, storing products, remembering where they are later, and sending orders to the correct place. With negligible errors, the most successful smart warehouses automate nearly the entire operation and journey of goods from supplier to customer.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and other European countries in the European region.

Which are key applications in the smart warehousing market?

Key applications in smart warehousing are transport management, inventory management, order management, yard management, shipping management, labor management, and other applications (dock door management, lot management, and task management).

What are the various vertical in smart warehousing market?

Verticals in smart warehousing market include transportation and logistics, retail and eCommerce, manufacturing, healthcare and life sciences, food and beverages, energy and utilities, automotive, and other verticals (agriculture, government, and mining).

Who are the top vendors in the smart warehousing market?

Some of the major players in the smart warehousing market include Oracle (US), SAP (Germany), Manhattan Associates (US), PSI Logistics (Germany), PTC (US), Tecsys (Canada), Reply (Italy), IBM (US), Infor (US), and Korber (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 6 SMART WAREHOUSING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 SMART WAREHOUSING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE SMART WAREHOUSING MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF SMART WAREHOUSING THROUGH OVERALL SMART WAREHOUSING SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE SMART WAREHOUSING MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 69)

TABLE 4 GLOBAL SMART WAREHOUSING MARKET SIZE AND GROWTH RATE, 2017–2020 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y %)

FIGURE 16 MARKET SNAPSHOT, BY COMPONENT

FIGURE 17 MARKET SNAPSHOT, BY SOLUTION

FIGURE 18 MARKET SNAPSHOT, BY WMS TYPE

FIGURE 19 MARKET SNAPSHOT, BY SERVICE

FIGURE 20 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 21 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 22 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 23 MARKET SNAPSHOT, BY TECHNOLOGY

FIGURE 24 MARKET SNAPSHOT, BY APPLICATION

FIGURE 25 MARKET SNAPSHOT, BY VERTICAL

FIGURE 26 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 76)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE SMART WAREHOUSING MARKET

FIGURE 27 PROLIFERATION OF SMARTPHONES FOR FASTER GOODS MANAGEMENT AND EMERGENCE OF MULTI-CHANNEL DISTRIBUTION NETWORKS TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 28 LABOR MANAGEMENT APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 29 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

4.4 MARKET IN NORTH AMERICA, BY COMPONENT AND APPLICATION

FIGURE 30 HARDWARE COMPONENT AND INVENTORY MANAGEMENT APPLICATION TO ACCOUNT FOR THE LARGEST SHARES IN THE MARKET IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 79)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 31 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART WAREHOUSING MARKET

5.2.1 DRIVERS

5.2.1.1 Proliferation of smartphones for faster and efficient management of goods

5.2.1.2 Rising advancement in the eCommerce industry due to onset of the COVID-19 pandemic

5.2.1.3 Emergence of multi-channel distribution networks

5.2.1.4 Dynamic nature and globalization of supply chain networks

5.2.2 RESTRAINTS

5.2.2.1 Lack of uniform governance standards in the fragmented supply chain and logistics industry

5.2.2.2 Growing concerns for data security and privacy

5.2.2.3 High implementation and maintenance costs for SMEs

5.2.3 OPPORTUNITIES

5.2.3.1 Focus on warehouse 4.0 for a more efficient and safer warehouse

5.2.3.2 Self-driving vehicles and robotics to automate warehouse process

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about benefits of smart warehousing among small-scale industries

5.2.4.2 Slow adoption of smart warehousing solutions due to high capital investment

5.2.4.3 Shortage of supply and demand shocks during COVID-19

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 SMART WAREHOUSING MARKET: COVID-19 IMPACT

FIGURE 32 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.4 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE MARKET

FIGURE 33 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.5 CASE STUDY ANALYSIS

5.5.1 TRANSPORTATION AND LOGISTICS: USE CASES

5.5.1.1 Use case 1: TECSYS

5.5.1.2 Use case 2: INFOR

5.5.1.3 Use case 3: INFOR

5.5.1.4 Use case 4: BLUE YONDAR

5.5.1.5 Use case 5: BLUE YONDAR

5.5.1.6 Use case 6: SOFTEON

5.5.2 RETAIL AND ECOMMERCE: USE CASES

5.5.2.1 Use case 1: Oracle

5.5.2.2 Use case 2: SAP

5.5.2.3 Use case 3: MANHATTAN

5.5.2.4 Use case 4: Manhattan

5.5.2.5 Use case 5: TECSYS

5.5.2.6 Use case 6: MANHATTAN

5.5.3 MANUFACTURING: USE CASES

5.5.3.1 Use case 1: PTC

5.5.4 HEALTHCARE AND LIFE SCIENCES: USE CASES

5.5.4.1 Use case 1: SAP

5.5.5 FOOD AND BEVERAGES: USE CASES

5.5.5.1 Use case 1: SAP

5.5.5.2 Use case 2: Reply

5.5.6 IT AND TELECOM: USE CASES

5.5.6.1 Use case 1: Softeon

5.5.6.2 Use case 2: ShipHero

5.6 REGULATORY COMPLIANCES

5.6.1 GENERAL DATA PROTECTION REGULATION

5.6.2 SARBANES-OXLEY ACT OF 2002

5.6.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

5.7 TECHNOLOGY ANALYSIS: SMART WAREHOUSING MARKET

5.7.1 SMART WAREHOUSING AND IOT TECHNOLOGY

5.7.2 SMART WAREHOUSING AND ARTIFICIAL INTELLIGENCE TECHNOLOGY

5.7.3 SMART WAREHOUSING AND BLOCKCHAIN TECHNOLOGY

5.7.4 SMART WAREHOUSING AND RFID TECHNOLOGY

5.8 SMART WAREHOUSING: ECOSYSTEM

FIGURE 34 ECOSYSTEM OF MARKET

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 35 SUPPLY CHAIN ANALYSIS

TABLE 6 SMART WAREHOUSING MARKET: SUPPLY CHAIN

5.10 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED, 2018-2021

5.10.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 36 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.10.3.1 Top applicants

FIGURE 37 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.11 PRICING MODEL ANALYSIS

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 IMPACT OF EACH FORCE ON THE SMART WAREHOUSING

FIGURE 38 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 SCENARIO

TABLE 9 CRITICAL FACTORS THAT IMPACT THE GROWTH OF THE MARKET

6 SMART WAREHOUSING MARKET, BY COMPONENT (Page No. - 107)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 39 SERVICES SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 11 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 HARDWARE

6.2.1 RISE IN DEMAND FOR AI, IOT, AND BLOCKCHAIN TECHNOLOGIES TO ACCURATELY HANDLE COMPLEX WAREHOUSE PROCESSES TO BOOST THE GROWTH OF HARDWARE

TABLE 12 HARDWARE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 HARDWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SOLUTIONS

6.3.1 SMART WAREHOUSING SOLUTIONS GROW AT A RAPID PACE TO ENHANCE THE NAVIGATION AND TRACKING ABILITY WITHIN THE WAREHOUSE

FIGURE 40 WAREHOUSE MANAGEMENT SYSTEM SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 SMART WAREHOUSING MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 WAREHOUSE CONTROL SYSTEM

TABLE 18 WAREHOUSE CONTROL SYSTEM: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 WAREHOUSE CONTROL SYSTEM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 WAREHOUSE MANAGEMENT SYSTEM

FIGURE 41 STANDALONE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 WAREHOUSE MANAGEMENT SYSTEM: SMART WAREHOUSING MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 21 WAREHOUSE MANAGEMENT SYSTEM: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 22 WAREHOUSE MANAGEMENT SYSTEM: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 WAREHOUSE MANAGEMENT SYSTEM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3.1 Integrated WMS

TABLE 24 INTEGRATED: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 INTEGRATED: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3.2 Standalone WMS

TABLE 26 STANDALONE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 STANDALONE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.4 OTHER SOLUTIONS

TABLE 28 OTHER SOLUTIONS: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 SERVICES

6.4.1 ADOPTION OF SMART WAREHOUSING SOLUTIONS AND TECHNOLOGIES BOOSTS THE GROWTH OF THE SERVICES SEGMENT

FIGURE 42 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 32 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.2 MANAGED SERVICES

TABLE 34 MANAGED SERVICES: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.3 PROFESSIONAL SERVICES

FIGURE 43 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 36 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 37 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.4.3.1 Training and consulting

6.4.3.2 Support and maintenance

6.4.3.3 System integration and implementation

7 SMART WAREHOUSING MARKET, BY ORGANIZATION SIZE (Page No. - 125)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 44 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 ADOPTION OF SMART WAREHOUSING IS ON THE RISE AMONG LARGE ENTERPRISES TO OPTIMIZE COMPLEX INVENTORY PROCESSES

TABLE 40 LARGE ENTERPRISES: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 ADOPTION OF NEW TECHNOLOGIES TO FIX ISSUES FOR ENHANCING BUSINESS PROCESSES TO BOOST THE DEMAND FOR SMART WAREHOUSING AMONG SMES

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE (Page No. - 130)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 45 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 44 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 45 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

8.2.1 REDUCTION OF THE SECURITY RISK OF MANAGING LOGISTICS-BASED DATA ON-PREMISES TO DRIVE THE ADOPTION OF SMART WAREHOUSING

TABLE 46 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

8.3.1 SCALABILITY AND SECURITY FEATURES TO BOOST THE ADOPTION OF CLOUD-BASED SMART WAREHOUSING SOLUTIONS AMONG ENTERPRISES

TABLE 48 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 SMART WAREHOUSING MARKET, BY TECHNOLOGY (Page No. - 135)

9.1 INTRODUCTION

9.1.1 TECHNOLOGIES: COVID-19 IMPACT

FIGURE 46 ARTIFICIAL INTELLIGENCE IN WAREHOUSE TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.2 IOT AND ANALYTICS

TABLE 52 IOT AND ANALYTICS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 IOT AND ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 AI IN WAREHOUSE

TABLE 54 AI IN WAREHOUSE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 AI IN WAREHOUSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 RADIO FREQUENCY IDENTIFICATION

TABLE 56 RFID: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 RFID: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 AUTOMATED GUIDED VEHICLES

TABLE 58 AUTOMATED GUIDED VEHICLES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 AUTOMATED GUIDED VEHICLES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 BLOCKCHAIN IN WAREHOUSE

TABLE 60 BLOCKCHAIN IN WAREHOUSE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 BLOCKCHAIN IN WAREHOUSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 OTHER TECHNOLOGIES

TABLE 62 OTHER TECHNOLOGIES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 OTHER TECHNOLOGIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 SMART WAREHOUSING MARKET, BY APPLICATION (Page No. - 145)

10.1 INTRODUCTION

10.1.1 APPLICATIONS: COVID-19 IMPACT

FIGURE 47 ORDER MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 64 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 TRANSPORT MANAGEMENT

10.2.1 GROWING NEED TO EFFECTIVELY MANAGE ALL TRANSPORTATION ACTIVITIES WITHIN THE WAREHOUSE TO BOOST THE DEMAND FOR SMART WAREHOUSING SOLUTIONS IN THE MARKET

TABLE 66 TRANSPORT MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 TRANSPORT MANAGEMENT: REHOUSING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 INVENTORY MANAGEMENT

10.3.1 SMART WAREHOUSING PROVIDES SOLUTIONS THAT SUPPORT BUSINESSES TO STREAMLINE TEDIOUS TASKS AND TRACK OR CONTROL THE OVERALL THE DELIVERY OF GOODS

TABLE 68 INVENTORY MANAGEMENT: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 INVENTORY MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 ORDER MANAGEMENT

10.4.1 SMART WAREHOUSING PROVIDES ORDER MANAGEMENT APPLICATIONS TO IMPROVE THE OVERALL SYSTEM PERFORMANCE AND STREAMLINE ORDER ORCHESTRATION

TABLE 70 ORDER MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 ORDER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 YARD MANAGEMENT

10.5.1 SMART WAREHOUSING IS USED TO EFFICIENTLY MONITOR THE MOVEMENT OF TRAILERS IN THE YARD OF A WAREHOUSE AND TRACK YARD OPERATIONS IN REAL TIME

TABLE 72 YARD MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 YARD MANAGEMENT: SMART WAREHOUSING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 SHIPPING MANAGEMENT

10.6.1 SMART WAREHOUSING IS USED TO MANAGE AND TRACK THE SHIPPING OF THE GOODS FROM THE WAREHOUSE TO THE INVENTORY IN REAL TIME

TABLE 74 SHIPPING MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 SHIPPING MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 LABOR MANAGEMENT

10.7.1 SMART WAREHOUSING SOLUTIONS ARE USED TO TRACK LABOR PERFORMANCE AND REDUCE THE OVERALL LABOR COSTS

TABLE 76 LABOR MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 LABOR MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHER APPLICATIONS

TABLE 78 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 SMART WAREHOUSING MARKET, BY VERTICAL (Page No. - 155)

11.1 INTRODUCTION

11.1.1 VERTICALS: COVID-19 IMPACT

FIGURE 48 HEALTHCARE AND LIFE SCIENCES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 80 MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 81 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 TRANSPORTATION AND LOGISTICS

11.2.1 SMART WAREHOUSING IS USED TO EFFICIENTLY HANDLE COMPLEX WAREHOUSE PROCESSES FOR BETTER PRODUCTIVITY ACROSS THE TRANSPORTATION AND LOGISTICS INDUSTRY

TABLE 82 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 83 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 RETAIL AND ECOMMERCE

11.3.1 INVENTORY PLANNING AND OPTIMIZATION, REDUCTION IN LOGISTICS AND TRANSPORTATION COSTS, AND ENHANCED OVERALL PROFITABILITY TO ORGANIZATIONS TO DRIVE THE ADOPTION OF SMART WAREHOUSING

TABLE 84 RETAIL AND ECOMMERCE: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4 MANUFACTURING

11.4.1 TECHNOLOGIES, SUCH AS AI AND BLOCKCHAIN, SUPPORT VENDORS TO INCREASE AND OPTIMIZE WAREHOUSE OPERATIONS IN THE MANUFACTURING INDUSTRY

TABLE 86 MANUFACTURING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 87 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

11.5.1 NEED TO IMPROVE SUPPLY CHAIN EFFICIENCY DUE TO AN INCREASE IN DRUG PATENT EXPIRATIONS AND DECREASED PROFIT MARGINS DRIVE THE ADOPTION OF SMART WAREHOUSING IN THE HEALTHCARE AND LIFE SCIENCES VERTICAL

TABLE 88 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.6 FOOD AND BEVERAGES

11.6.1 NEED TO GAIN VISIBILITY INTO THE CURRENT SUPPLY CHAIN NETWORK FOR MANAGING RESOURCES DRIVING THE ADOPTION OF SMART WAREHOUSING SOLUTIONS IN THE FOOD AND BEVERAGES VERTICAL

TABLE 90 FOOD AND BEVERAGES: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 91 FOOD AND BEVERAGES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.7 AUTOMOTIVE

11.7.1 RISING NEED TO ENSURE THE TIMELY AVAILABILITY OF VARIOUS COMPONENTS FOR VEHICLE MANUFACTURING TO BOOST THE DEMAND FOR SMART WAREHOUSING ACROSS THE AUTOMOTIVE INDUSTRY

TABLE 92 AUTOMOTIVE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 AUTOMOTIVE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.8 ENERGY AND UTILITIES

11.8.1 NEED TO DEAL WITH GOVERNMENT POLICIES, TAX INITIATIVES, AND SUBSIDIES FOR ORGANIZATIONS CATERING TO THE ENERGY AND UTILITY VERTICAL DRIVES THE ADOPTION OF SMART WAREHOUSING IN THIS VERTICAL

TABLE 94 ENERGY AND UTILITIES: SMART WAREHOUSING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 95 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.9 OTHER VERTICALS

TABLE 96 OTHER VERTICALS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 SMART WAREHOUSING MARKET, BY REGION (Page No. - 167)

12.1 INTRODUCTION

FIGURE 49 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 50 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 98 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 99 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: COVID-19 IMPACT

12.2.2 NORTH AMERICA: REGULATIONS

12.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

12.2.2.2 Gramm–Leach–Bliley Act

12.2.2.3 Health Insurance Portability and Accountability Act of 1996

12.2.2.4 Occupational Safety and Health Administration (OSHA)

12.2.2.5 Federal Information Security Management Act

12.2.2.6 Federal Information Processing Standards

12.2.2.7 California Consumer Privacy Act

FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

TABLE 100 NORTH AMERICA: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 109 NORTH AMERICA: SMART WAREHOUSING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.3 UNITED STATES

12.2.3.1 Rising need to transform warehouse to automate the delivery process to facilitate the development of the smart warehousing market

TABLE 118 UNITED STATES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 119 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 121 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Advancements in the eCommerce industry to increase the demand for smart warehousing in Canada

TABLE 122 CANADA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 124 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 125 CANADA: SMART WAREHOUSING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: COVID-19 IMPACT

12.3.2 EUROPE: REGULATIONS

12.3.2.1 General Data Protection Regulation

12.3.2.2 Payment Card Industry Data Security Standard

12.3.2.3 European Committee for Standardization

TABLE 126 EUROPE: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 135 EUROPE: SMART WAREHOUSING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.3.1 Increasing need to operate warehousing facilities efficiently to drive the growth of the smart warehousing market in the UK

TABLE 144 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 145 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Need to enhance warehouse process and advance IT infrastructure to drive the growth of the market in Germany

TABLE 146 GERMANY: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 147 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.5 FRANCE

12.3.5.1 Rising growth in the logistics and retail sector to boost the demand for smart warehousing solutions in France

TABLE 148 FRANCE: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 149 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 150 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: COVID-19 IMPACT

12.4.2 ASIA PACIFIC: REGULATIONS

12.4.2.1 Personal Data Protection Act

12.4.2.2 Act on the Protection of Personal Information (APPI)

12.4.2.3 International Organization for Standardization 27001

FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 152 ASIA PACIFIC: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: SMART WAREHOUSING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Rising need to enhance warehouse process across logistics to drive the growth of the smart warehousing market in China

TABLE 170 CHINA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 High internet penetration and developed IT infrastructure to boost the adoption of smart warehousing solutions in Japan

TABLE 172 JAPAN: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 173 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Increasing need for the faster delivery process and better delivery services to drive the growth of smart warehousing solutions in India

TABLE 174 INDIA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 175 INDIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 176 REST OF ASIA PACIFIC: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.2.2 GDPR Applicability in KSA

12.5.2.3 Protection of Personal Information Act

TABLE 178 MIDDLE EAST AND AFRICA: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: SMART WAREHOUSING MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.5.3 MIDDLE EAST

12.5.3.1 Increasing demand to effectively handle complex inventory process to drive the need for smart warehousing solutions in the Middle East sub region

TABLE 196 MIDDLE EAST: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 197 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.5.4 AFRICA

12.5.4.1 Growing eCommerce sectors for effective handling of inventory to drive the demand for smart warehousing solutions in Africa

TABLE 198 AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 199 AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: COVID-19 IMPACT

12.6.2 LATIN AMERICA: REGULATIONS

12.6.2.1 Brazil Data Protection Law

12.6.2.2 Argentina Personal Data Protection Law No. 25.326

TABLE 200 LATIN AMERICA: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 210 LATIN AMERICA: SMART WAREHOUSING MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Need to offer faster delivery process to end users to boost the demand for smart warehousing solutions in Brazil

TABLE 218 BRAZIL: SMART WAREHOUSING MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6.4 MEXICO

12.6.4.1 Implementation of federal laws by the government to secure employee and operational data to drive the demand for smart warehousing in Mexico

TABLE 220 MEXICO: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 221 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12.6.5 REST OF LATIN AMERICA

TABLE 222 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 223 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 224)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

13.3 REVENUE ANALYSIS

FIGURE 53 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

13.4 MARKET SHARE ANALYSIS

FIGURE 54 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 224 SMART WAREHOUSING MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 55 KEY MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2021

13.6 COMPETITIVE BENCHMARKING

13.6.1 COMPANY PRODUCT FOOTPRINT

FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

TABLE 225 COMPANY OFFERING FOOTPRINT

TABLE 226 COMPANY REGION FOOTPRINT

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 58 STARTUP/SME SMART WAREHOUSING MARKET EVALUATION QUADRANT, 2021

13.8 STARTUP/SME COMPETITIVE BENCHMARKING

13.8.1 COMPANY PRODUCT FOOTPRINT

FIGURE 59 PRODUCT PORTFOLIO ANALYSIS OF STARTUP/SME IN THE MARKET

FIGURE 60 BUSINESS STRATEGY EXCELLENCE OF STARTUP/SME IN THE MARKET

TABLE 227 STARTUP/SME COMPANY OFFERING FOOTPRINT

TABLE 228 STARTUP/SME COMPANY REGION FOOTPRINT

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES

TABLE 229 MARKET: PRODUCT LAUNCHES, JANUARY 2018–MAY 2021

13.9.2 DEALS

TABLE 230 SMART WAREHOUSING MARKET: DEALS, JANUARY 2018–JULY 2021

14 COMPANY PROFILES (Page No. - 240)

14.1 INTRODUCTION

(Business and financial overview, Solutions offered, Recent Developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.2 KEY PLAYERS

14.2.1 ORACLE

TABLE 231 ORACLE: BUSINESS AND FINANCIAL OVERVIEW

FIGURE 61 ORACLE: COMPANY SNAPSHOT

TABLE 232 ORACLE: SOLUTIONS OFFERED

TABLE 233 ORACLE: DEALS

14.2.2 SAP

TABLE 234 SAP: BUSINESS OVERVIEW

FIGURE 62 SAP: COMPANY SNAPSHOT

TABLE 235 SAP: SOLUTIONS OFFERED

TABLE 236 SAP: DEALS

14.2.3 MANHATTAN ASSOCIATES

TABLE 237 MANHATTAN ASSOCIATES: BUSINESS OVERVIEW

FIGURE 63 MANHATTAN ASSOCIATES: COMPANY SNAPSHOT

TABLE 238 MANHATTAN ASSOCIATES: SOLUTION OFFERED

TABLE 239 MANHATTAN ASSOCIATES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 240 MANHATTAN ASSOCIATES: DEALS

14.2.4 PSI LOGISTICS

TABLE 241 PSI LOGISTICS: BUSINESS OVERVIEW

FIGURE 64 PSI LOGISTICS: COMPANY SNAPSHOT

TABLE 242 PSI LOGISTICS: SOLUTION OFFERED

TABLE 243 PSI: DEALS AND OTHERS

14.2.5 PTC

TABLE 244 PTC: BUSINESS OVERVIEW

FIGURE 65 PTC: COMPANY SNAPSHOT

TABLE 245 PTC: SOLUTIONS OFFERED

TABLE 246 PTC: DEALS

14.2.6 TECSYS

TABLE 247 TECSYS: BUSINESS OVERVIEW

FIGURE 66 TECSYS: COMPANY SNAPSHOT

TABLE 248 TECSYS TECHNOLOGIES: SOLUTION OFFERED

TABLE 249 TECSYS: DEALS AND OTHERS

14.2.7 REPLY

TABLE 250 REPLY: BUSINESS OVERVIEW

FIGURE 67 REPLY: COMPANY SNAPSHOT

TABLE 251 REPLY: SOLUTION OFFERED

TABLE 252 REPLY: DEALS AND OTHERS

14.2.8 IBM

TABLE 253 IBM GLOBAL: BUSINESS OVERVIEW

FIGURE 68 IBM: COMPANY SNAPSHOT

TABLE 254 IBM: SOLUTIONS OFFERED

TABLE 255 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.9 INFOR

TABLE 256 INFOR SYSTEMS: BUSINESS OVERVIEW

FIGURE 69 INFOR: COMPANY SNAPSHOT

TABLE 257 INFOR: SERVICES AND SOLUTIONS OFFERED

TABLE 258 INFOR: DEALS

14.2.10 KORBER

TABLE 259 KORBER: BUSINESS OVERVIEW

FIGURE 70 KORBER: COMPANY SNAPSHOT

TABLE 260 KORBER: SOLUTIONS OFFERED

TABLE 261 KORBER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 262 KORBER: DEALS

14.3 KEY PLAYERS

14.3.1 GENERIX

14.3.2 MICROLISTICS

14.3.3 BLUE YONDER

14.3.4 VINCULUM

14.3.5 EPICOR

14.3.6 SOFTEON

14.3.7 3PL CENTRAL

14.3.8 SYNERGY LOGISTICS

14.3.9 BLUJAY SOLUTIONS

14.3.10 MANTIS

14.4 SMES/START UPS

14.4.1 WAREIQ

14.4.2 FOYSONIS

14.4.3 LOGIWA

14.4.4 INCREFF

14.4.5 LOCUS ROBOTICS

14.4.6 SHIPHERO

14.4.7 ORDERHIVE

14.4.8 EASYECOM

14.4.9 UNICOMMERCE

14.4.10 IAM ROBOTICS

*Details on Business and financial overview, Solutions offered, Recent Developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 279)

15.1 INTRODUCTION

15.2 SUPPLY CHAIN ANALYTICS MARKET - GLOBAL FORECAST TO 2025

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Supply chain analytics market, by component

TABLE 263 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 264 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.2.2.2 Supply chain analytics market, by service

TABLE 265 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 266 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

15.2.2.3 Supply chain analytics market, by deployment models

TABLE 267 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 268 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

15.2.2.4 Supply chain analytics market, by organization size

TABLE 269 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 270 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.2.2.5 Supply chain analytics market, by industry vertical

TABLE 271 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 272 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

15.2.2.6 Supply chain analytics market, by region

TABLE 273 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 274 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15.3 DIGITAL LOGISTICS MARKET - GLOBAL FORECAST TO 2025

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Digital logistics market, by component

TABLE 275 DIGITAL LOGISTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 276 DIGITAL LOGISTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.3.2.2 Digital logistics market, by solution

TABLE 277 DIGITAL LOGISTICS MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 278 DIGITAL LOGISTICS MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

15.3.2.3 Digital logistics market, by service

TABLE 279 DIGITAL LOGISTICS MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 280 DIGITAL LOGISTICS MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

15.3.2.4 Digital logistics market, by function

TABLE 281 DIGITAL LOGISTICS MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 282 DIGITAL LOGISTICS MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

15.3.2.5 Digital logistics market, by vertical

TABLE 283 DIGITAL LOGISTICS MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 284 DIGITAL LOGISTICS MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

15.3.2.6 Digital logistics market, by region

TABLE 285 DIGITAL LOGISTICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 286 DIGITAL LOGISTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 290)

16.1 INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

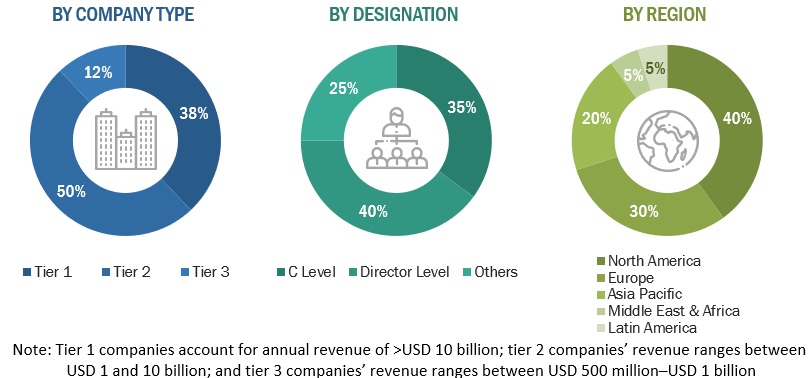

The research study for the smart warehousing market involved extensive secondary sources, directories, and several journals, including the International Journal of Operations & Production Management, and the International Journal of Production Research. Primary sources were industry experts from the core and related industries, preferred smart warehousing providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

Various sources were referred to in the secondary research process to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals—the Journal of warehousing-based Services and related magazines. Smart warehousing spending of various countries was extracted from the respective sources. Secondary research was used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionalities, applications, verticals, and regions, and key developments from both market-and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and smart warehousing expertise; related key executives from smart warehousing solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using smart warehousing solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of smart warehousing solutions and services, which would impact the overall smart warehousing market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the smart warehousing market. The first approach involves estimating the market size by summating companies’ revenue generated through solutions and services. Top-down and bottom-up approaches were used to estimate and validate the size of the smart warehousing market and various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- Key market players were not limited to Oracle (US), SAP (Germany), Manhattan Associates (US), PSI Logistics (Germany), PTC (US), Tecsys (Canada), Reply (Italy), IBM (US), Infor (US), Korber (Germany), Generix (France), Microlistics (Australia), Blue Yonder (US), Vinculum (India), Epicor (US), Softeon (US), 3PL Central (US), Synergy Logistics (US), BlueJay Solutions (US), Mantis (US), WareIQ (India), Foysonis (US), Logiwa (US), Increff (India), Locus Robotics (US), ShipHero (US), Orderhive US), EasyEcom (India), Unicommerce (India), and IAM Robotics (US).

- The market players were identified through extensive secondary research, and their revenue contribution in respective regions was determined through primary and secondary research.

- The entire procedure included studying annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the smart warehousing market by component (hardware, solutions, and services), application, organization size, deployment mode, technology, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the smart warehousing market

- To analyze the impact of the COVID-19 pandemic on the smart warehousing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American smart warehousing market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 10

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Warehousing Market