Smart Water Management Market by Water Meter (AMR, AMI), Solution (Enterprise Asset Management, Network Management, Smart Irrigation), Service (Professional, Managed), End User (Commercial & Industrial, Residential), and Region - Global Forecast to 2026

Updated on : April 17, 2023

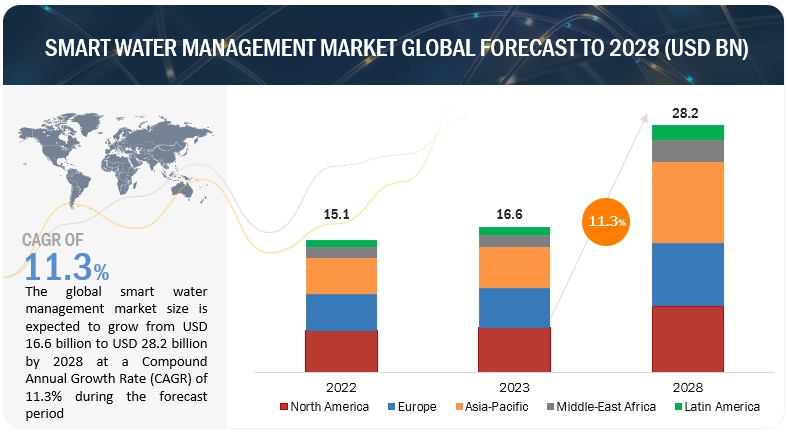

The global smart water management market in terms of revenue was estimated to be worth $13.8 billion in 2021 and is poised to reach $22.4 billion by 2026, growing at a CAGR of 10.1% from 2021 to 2026. An industry trend analysis of the market is part of the latest research report. The latest research study includes market buying trends, pricing analysis, patent analysis, conference and webinar materials, and important stakeholders. The major drivers include rapid urbanization generating enormous pressure on water utilities for quality and continuous water supply and related services; rapid adoption of advanced technologies for innovating smart solutions to cater to the growing water industry challenges; rising concern for sustainable living leading to the development of regulations and laws by governments across the globe to reduce water consumption; and developing water treatment solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

During the COVID-19 pandemic, the IT and telecom sector has played a vital role worldwide to support the digital infrastructure of countries. Every individual and government, irrespective of whether they be federal, state, central, local, and province level, has been in constant touch with one other to provide and get real-time information on COVID-19. Currently, healthcare, telecommunication, utilities, and government sectors are functioning continuously to stabilize the condition and facilitate prerequisite services to every individual. COVID-19 cases are growing every day, as the number of infected cases has been rising. In line with individuals, COVID-19 has had a massive impact on all-sized enterprises. Core industries, such as manufacturing, automotive, textile, transportation and logistics, travel and hospitality, and consumer goods, have been closed due to country-level lockdowns worldwide. This would have a substantial impact on the global economy in terms of a decline in GDP.

Smart Water Management Market Dynamics

Driver: The increasing need for insightful approaches to oversee natural water resources with urban areas becoming increasingly smarter and technologically advanced

Factors such as a surge in population, economic development, and continued urbanization, as well as the growth in per-capita food consumption, have emanated a global challenge of coping with the rising demand for (renewable) water resources. According to the UN World Water Development Report 2021, over 2 billion people live in water-stressed areas. About 3.4 billion people, or 45% of the world’s population, do not have access to safe sanitation facilities. According to their estimates, the world would face a 40% global water deficit by 2030. With such limited water resources and the rising demand, countries are unable to provide water in sufficient quantities and of acceptable quality by using traditional water management systems. The existing water sources are also being over-exploited or mismanaged, causing water utilities to face challenges, such as NRW losses, water contamination, and the inability to provide an uninterrupted water supply. This scenario leads water utilities to readily investigate innovative solutions to utilize the available water resources efficiently, with a sustainable approach.

Restraint: Lack of digitally skilled workforce

According to Workforce Renewal and Skills Strategy published by Energy & Utility Skills in 2017, a shortfall of 221,000 workers is expected in water utilities over the next ten years. The reasons for the shortfall are the aging workforce, a tight labor market, and the lack of technical skills among the workforce. With the inclusion of technologies, such as smart networks and IoT (in the utilities sector) at every level, there has been an immediate requirement to upskill every member in the water utilities workforce, new or existing. However, during this COVID-19 outbreak, it has become important for utilities companies to engage with their most vulnerable customers, anticipate their needs, and provide proactive assistance, including payment options for cash customers and those in financial distress. This pandemic has provided the ultimate test for the utilities sector resilience measures, paving the door for more flexible, responsive ways of working that fully utilize current technologies. One of the major restraints in this era of technology is the dearth of digitally skilled workforce in water utilities. Another factor includes the lack of understanding among millennials related to the growth in the water utilities sector for pursuing a career. These factors further restrain the smart water management market growth.

Opportunity: Increasing role of smart water management in the smart city revolution

Governments worldwide are focusing on including smart technologies for economic development as a key component of their strategy of urban planning. Smart city initiatives, initiated in 2013, consist of various components, such as smart energy, smart buildings, smart mobility, smart technology, smart infrastructure, and smart healthcare. Smart water is one of the major components that define a smart city. SWM comes under the smart infrastructure component, which deploys digital water and wastewater treatment solutions. The smart city initiatives create huge business opportunities for SWM solution providers with the growing population, rapid urbanization, soaring demand for food, and overexploitation of resources. According to the United Nations Department of Economic and Social Affairs, 68% of the world’s population will live in cities by 2050. This has created a vast business landscape for smart water solution providers, where it has become critical that consumption and forecasting of water use should be measured accurately. This creates a demand for smart water systems that are designed to gather actionable data about the flow, pressure, and distribution of a city’s water. For instance, the IWRA collaborates with K-water (the Korea Water Resources Corporation), the Asia Water Council (AWC), and water experts from around the world on its Smart Water Management (SWM) projects from July 2020 to December 2023.

Challenge: Difficulty in technology implementation over the legacy infrastructure

To meet the demand of the highly dynamic and competitive market, the water utilities industry can be seen evolving to cope up with the water sector challenges resulting from climate changes, infrastructure issues, and droughts that are generating water scarcity. Water utilities have, therefore, turned toward digital transformation, which guarantees to optimize water consumption trends and offer sustainable solutions. However, change management is one of the challenges faced by water utilities for adapting to new business and technology requirements over legacy infrastructures. Various technology elements, including hardware, software, and network components, require integration with sensors, smart meters, network switches, and valves over the legacy system infrastructure that can create a challenge for solution providers to compel water utilities to implement SWM solutions.

By Offering, the Solutions segment to have a higher growth during the forecast period

With technology becoming more advanced with time, water utilities are adopting smart solutions to integrate various business processes, accelerating them toward growth. Integrating various advanced technologies with the existing operations helps them increase the operational efficiency of the entire water network even with low infrastructure investment. These technologies and smart infrastructure are used to develop innovative solutions for customers in the smart water management industry. During the forecast period, the adoption of smart solutions fare is expected to surge due to the rising awareness about the quality of water, scarcity of natural freshwater resources, rising consumer demands, and technological advancements.

By End User, the Commercial and Industrial segment to dominate the market during the forecast period

Water supply and distribution come under the municipal authorities directly administered by the government sector in any country. The lack of privatization in the water sector brings about challenges in the efficiency of water supply systems. The number of leakage and water loss incidents is high due to the lack of continuous scrutiny on the water supply networks by the public sector across the globe.

Industries are required to combat many water challenges that include maintaining apt water quality and pressure, disposing industrial wastewater safely in compliance with regulations, and ensuring reduction of process downtime and reduction of production interruptions due to broken assets, such as pumps supplying cooling water or pumping wastewater. The adoption of smart water solutions by commercial and industrial end users is expected to surge for contending these challenges that optimize water consumption, reduce billing inaccuracies, implement cost-effective solutions, and minimize water expenses. In many developing economies, the wastewater disposal systems are inefficient and follow practices, such as force dumping industrial waste in natural water bodies, making wastewater treatment a very big challenge for authorities in these regions.

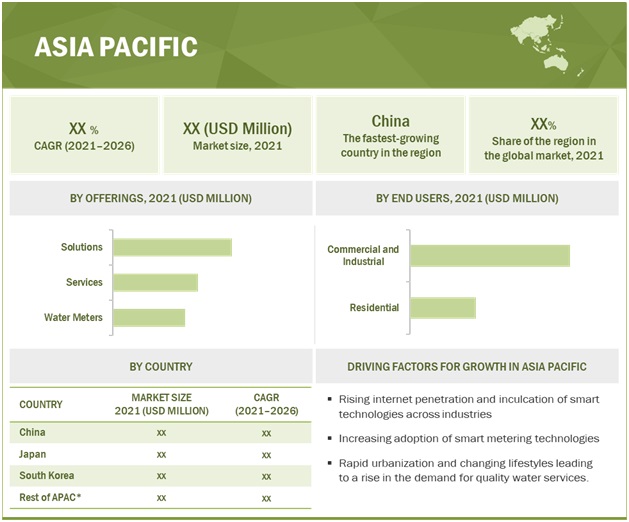

By Region, APAC to grow at the highest CAGR during the forecast period

APAC is estimated to grow at the highest CAGR during the forecast period. The fast growth can be largely attributed to factors, such as a rise in the adoption of smart grid solutions, growth in the levels of urbanization leading to an upsurge in water demands, agricultural production, technological incorporation in the utility sector, and an exponential rise in population. These factors lead to the large-scale deployment of technologies relative to the western regions, supportive government regulations, rising awareness of clean and safe water supply, and growing industrial activities in the region. In APAC, the demand for water efficiency and water resources reusability is high, which is expected to drive the smart water management market growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

Smart Water Management Market - Key Players

The major vendors in the Smart Water Management market include Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ (France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), HydroPoint (US), i2O Water (UK), Xenius (India), Neptune Technology (US), Takadu (Israel), Badger Meter (US), AquamatiX (UK), Fluid (US), Lishtot (Israel), Elentec (UK), Syrinix (UK), CityTaps (France), FREDsense (Canada), Fracta (US), and Xylem (US). These players have adopted various strategies to grow in the global offering market. The study includes an in-depth competitive analysis of these key players in the offering Smart Water Management market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size value in 2021 |

$13.8 billion |

|

Market Size value for 2026 |

$22.4 billion |

|

Growth Rate |

10.1% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Water Meter (AMR, AMI, Solution (Enterprise Asset Management, Network Management, Smart Irrigation), Service (Professional, Managed), End User (Commercial & Industrial, Residential) |

|

Smart Water Management Market Drivers |

|

|

Smart Water Management Market Opportunities |

|

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Siemens (Germany), IBM (US), ABB (Switzerland), Honeywell Elster (US), Schneider Electric (France), Itron (US), SUEZ (France), Oracle (US), Landis+Gyr (Switzerland), Trimble Water (US), HydroPoint (US), i2O Water (UK), Xenius (India), Neptune Technology (US), Takadu (Israel), Badger Meter (US), AquamatiX (UK), Fluid (US), Lishtot (Israel), Elentec (UK), Syrinix (UK), CityTaps (France), FREDsense (Canada), Fracta (US), and Xylem (US) |

This research report categorizes Smart Water Management to forecast revenue and analyze trends in each of the following submarkets:

Smart Water Management Market Based on Offering:

- Water Meters

- Solutions

- Services

Smart Water Management Market Based on Water Meters:

- AMR Meters

- AMI Meters

Based on Solutions

-

Enterprise Asset Management

- Asset Condition Monitoring

- Predictive Maintenance

-

Analytics and data management

- Meter data management

- Supervisory control and data acquisition

- Security

- Smart irrigation management

- Advanced pressure management

- Mobile workforce management

- Network management

- Customer information system and billing

- Leak detection

- Other Solutions

Based on Service:

-

Professional Services

- Consulting services

- System integration and deployment services

- Support and maintenance services

- Managed Services

Based on End User:

- Commercial and industrial

- Residential

Based on Regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In October 2021, ABB partnered with Danish water environment specialist DHI Group. ABB and DHI Group together planned to develop a suite of digital solutions to enable faster and more accurate decision-making for water and wastewater utilities.

- In August 2021, IBM collaborated with Black & Veatch to expand its portfolio on artificial intelligence-driven monitoring solutions.

- In June 2021, ABB launched the latest version of ABB Ability, an analytics software and services solution that combines operational data with engineering and IT data. It delivers actionable intelligence using a scalable advanced analytics platform with pre-built, easy-to-use applications and services.

- In June 2021, Itron signed a contract with United Utilities in England to Optimize Operations. Itron’s cloud-based meter data collection and management solution, Temetra, is expected to improve water delivery and management.

- In March 2021, The SUEZ and Schneider Electric had a joint venture in digital water to develop a market and joint offering of innovative digital solutions to manage the water cycle.

Frequently Asked Questions (FAQ):

What is the projected market value of the global smart water management market?

The global market of smart water management is projected to reach $22.4 billion.

What is the estimated growth rate (CAGR) of the global smart water management market for the next five years?

The global smart water management market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% from 2021 to 2026.

What are the major revenue pockets in the smart water management market currently?

APAC is estimated to grow at the highest CAGR during the forecast period. The fast growth can be largely attributed to factors, such as a rise in the adoption of smart grid solutions, growth in the levels of urbanization leading to an upsurge in water demands, agricultural production, technological incorporation in the utility sector, and an exponential rise in population. These factors lead to the large-scale deployment of technologies relative to the western regions, supportive government regulations, rising awareness of clean and safe water supply, and growing industrial activities in the region. In APAC, the demand for water efficiency and water resources reusability is high, which is expected to drive the smart water management market growth in the region.

Who are the major vendors in smart water management market?

Major vendors in Smart Water Management market include ABB, IBM, Honeywell Elster, Siemens, and Schneider Electric. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 6 SMART WATER MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

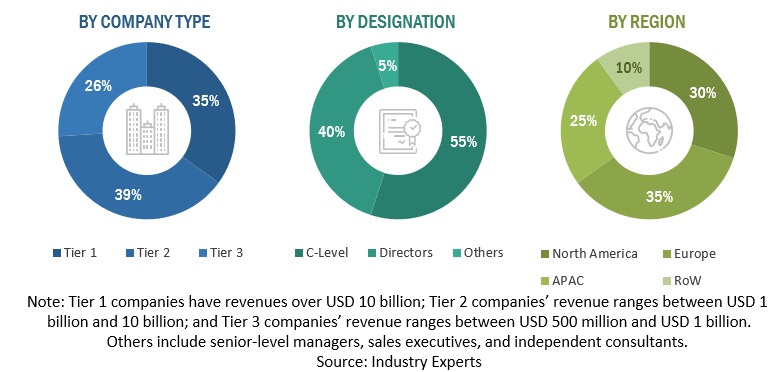

2.1.2.1 Breakup of primary profiles

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 RESEARCH METHODOLOGY: APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES OF THE SMART WATER MANAGEMENT MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF FOCUS AREAS OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 - TOP-DOWN: SHARE OF SMART WATER MANAGEMENT THROUGH SMART CITIES

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 11 SMART WATER MANAGEMENT MARKET, 2019-2026

FIGURE 12 MARKET: HOLISTIC VIEW

FIGURE 13 MARKET: GROWTH TRENDS

FIGURE 14 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BRIEF OVERVIEW OF THE SWM MARKET

FIGURE 15 REPLACEMENT OF AGING INFRASTRUCTURE DRIVING SMART WATER MANAGEMENT MARKET GROWTH

4.2 NORTH AMERICA: SWM MARKET, BY OFFERING AND END USER

FIGURE 16 NORTH AMERICA: SOLUTIONS AND COMMERCIAL AND INDUSTRIAL SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2021

4.3 EUROPE: SWM MARKET, BY OFFERING AND END USER

FIGURE 17 EUROPE: SOLUTIONS AND COMMERCIAL AND INDUSTRIAL SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2021

4.4 ASIA PACIFIC: SWM MARKET, BY OFFERING AND END USER

FIGURE 18 APAC: SOLUTIONS AND COMMERCIAL AND INDUSTRIAL SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 57)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART WATER MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 The increasing need for insightful approaches to oversee natural water resources with urban areas becoming increasingly smarter and technologically advanced

5.2.1.2 Need for a significant reduction in loss due to nonrevenue water

5.2.1.3 Stringent regulatory and sustainability mandates concerning the environment

5.2.1.4 Rising need to replace the aging water infrastructure

5.2.2 RESTRAINTS

5.2.2.1 Lack of digitally skilled workforce

5.2.2.2 Reduced shelf-life of smart meters

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing role of smart water management in the smart city revolution

5.2.3.2 Government initiatives and regulatory implementations for promoting SWM solutions

5.2.4 CHALLENGES

5.2.4.1 Difficulty in technology implementation over the legacy infrastructure

5.2.4.2 High initial investments and lower return on investment

5.3 COVID-19 MARKET OUTLOOK FOR THE SMART WATER MANAGEMENT MARKET

FIGURE 20 INCREASING ROLE OF SMART WATER MANAGEMENT IN THE SMART CITY REVOLUTION DRIVES THE GROWTH OF THE SWM MARKET

FIGURE 21 KEY ISSUES: LACK OF DIGITALLY SKILLED WORKFORCE RESTRICTING THE MARKET GROWTH

5.4 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

TABLE 4 SMART WATER MANAGEMENT MARKET: ECOSYSTEM

5.6 PATENT ANALYSIS

FIGURE 23 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 5 TOP TWENTY PATENT OWNERS (UNITED STATES)

FIGURE 24 NUMBER OF PATENTS GRANTED IN A YEAR, 2010-2020

5.7 USE CASES

5.7.1 USE CASE 1: ARAD GROUP

5.7.2 USE CASE 2: TRIMBLE WATER

5.7.3 USE CASE 3: MUELLER SYSTEMS

5.7.4 USE CASES 4: NEPTUNE TECHNOLOGY

5.7.5 USE CASE 5: KOREA WATER RESOURCES CORPORATION

5.8 PRICING ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE (AI)

5.9.2 INTERNET OF THINGS (IOT)

5.9.3 BIG DATA ANALYTICS

5.9.4 5G NETWORK

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 SMART WATER MANAGEMENT MARKET: PORTER’S FIVE FORCES MODEL

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 COMPETITIVE RIVALRY

5.11 REGULATORY IMPACT

6 SMART WATER MANAGEMENT, BY OFFERING (Page No. - 76)

6.1 INTRODUCTION

FIGURE 25 SERVICES SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.1 OFFERING: SMART WATER MANAGEMENT MARKET DRIVERS

6.1.2 OFFERING: COVID-19 IMPACT

TABLE 7 MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 8 MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

6.2 WATER METERS

FIGURE 26 AMI METERS SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 WATER METERS: SMART WATER MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 WATER METERS: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 11 WATER METERS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 WATER METERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.1 AMR METERS

TABLE 13 AMR: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 AMR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2 AMI METERS

TABLE 15 AMI METERS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 AMI METERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SOLUTIONS

FIGURE 27 ANALYTICS AND DATA MANAGEMENT SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 17 SOLUTIONS: SMART WATER MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 19 SOLUTIONS: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 SOLUTIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 ENTERPRISE ASSET MANAGEMENT

TABLE 21 ENTERPRISE ASSET MANAGEMENT: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 22 ENTERPRISE ASSET MANAGEMENT: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 23 ENTERPRISE ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 ENTERPRISE ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.1 Asset condition monitoring

TABLE 25 ASSET CONDITION MONITORING: SMART WATER MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 ASSET CONDITION MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 Predictive maintenance

TABLE 27 PREDICTIVE MAINTENANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 PREDICTIVE MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 ANALYTICS AND DATA MANAGEMENT

TABLE 29 ANALYTICS AND DATA MANAGEMENT: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 30 ANALYTICS AND DATA MANAGEMENT: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 31 ANALYTICS AND DATA MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 ANALYTICS AND DATA MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.1 Meter data management

TABLE 33 METER DATA MANAGEMENT: SMART WATER MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 METER DATA MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Supervisory control and data acquisition

TABLE 35 SUPERVISORY CONTROL AND DATA ACQUISITION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 SUPERVISORY CONTROL AND DATA ACQUISITION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 SECURITY

TABLE 37 SECURITY: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.4 SMART IRRIGATION MANAGEMENT

TABLE 39 SMART IRRIGATION MANAGEMENT: SMART WATER MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 SMART IRRIGATION MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.5 ADVANCED PRESSURE MANAGEMENT

TABLE 41 ADVANCED PRESSURE MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 ADVANCED PRESSURE MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.6 MOBILE WORKFORCE MANAGEMENT

TABLE 43 MOBILE WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MOBILE WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.7 NETWORK MANAGEMENT

TABLE 45 NETWORK MANAGEMENT: SMART WATER MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 NETWORK MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.8 CUSTOMER INFORMATION SYSTEM AND BILLING

TABLE 47 CIS AND BILLING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 CIS AND BILLING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.9 LEAK DETECTION

TABLE 49 LEAK DETECTION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 LEAK DETECTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.10 OTHER SOLUTIONS

TABLE 51 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 SERVICES

FIGURE 28 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 53 SERVICES: SMART WATER MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 54 SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 55 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.1 PROFESSIONAL SERVICES

TABLE 57 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 58 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 59 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.1.1 Consulting services

TABLE 61 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.1.2 System integration and deployment services

TABLE 63 SYSTEM INTEGRATION AND DEPLOYMENT SERVICES: SMART WATER MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 SYSTEM INTEGRATION AND DEPLOYMENT SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.1.3 Support and maintenance services

TABLE 65 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.2 MANAGED SERVICES

TABLE 67 MANAGED SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 SMART WATER MANAGEMENT, BY END USER (Page No. - 109)

7.1 INTRODUCTION

FIGURE 29 RESIDENTIAL SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 END USER: SMART WATER MANAGEMENT MARKET DRIVERS

7.1.2 END USER: COVID-19 IMPACT

TABLE 69 END USER: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 70 END USER: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.2 COMMERCIAL AND INDUSTRIAL

TABLE 71 COMMERCIAL AND INDUSTRIAL: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 COMMERCIAL AND INDUSTRIAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 RESIDENTIAL

TABLE 73 RESIDENTIAL: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 RESIDENTIAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 SMART WATER MANAGEMENT MARKET, BY REGION (Page No. - 114)

8.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 75 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 SMART WATER MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA: MARKET DRIVERS

8.2.2 NORTH AMERICA: IMPACT OF COVID-19

8.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 84 NORTH AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.2.4 UNITED STATES

TABLE 95 UNITED STATES: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 101 UNITED STATES: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 UNITED STATES: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 103 UNITED STATES: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 UNITED STATES: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 UNITED STATES: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 108 UNITED STATES: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 110 UNITED STATES: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

8.2.5 CANADA

8.3 EUROPE

8.3.1 EUROPE: MARKET DRIVERS

8.3.2 EUROPE: COVID-19 IMPACT

8.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 111 EUROPE: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 118 EUROPE: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.3.4 UNITED KINGDOM

TABLE 129 UNITED KINGDOM: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 135 UNITED KINGDOM: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 136 UNITED KINGDOM: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 UNITED KINGDOM: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 138 UNITED KINGDOM: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 139 UNITED KINGDOM: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 143 UNITED KINGDOM: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 144 UNITED KINGDOM: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

8.3.5 GERMANY

8.3.6 FRANCE

8.3.7 REST OF EUROPE

8.4 ASIA PACIFIC

8.4.1 ASIA PACIFIC: MARKET DRIVERS

8.4.2 ASIA PACIFIC: COVID-19 IMPACT

8.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 145 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 152 ASIA PACIFIC: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.4.4 CHINA

TABLE 163 CHINA: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 169 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 170 CHINA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 171 CHINA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 CHINA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 CHINA: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 175 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 176 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 177 CHINA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 178 CHINA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

8.4.5 JAPAN

8.4.6 SOUTH KOREA

8.4.7 REST OF ASIA PACIFIC

8.5 MIDDLE EAST AND AFRICA

8.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

8.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

8.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 179 MIDDLE EAST AND AFRICA: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 196 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5.4 MIDDLE EAST

8.5.5 AFRICA

8.6 LATIN AMERICA

8.6.1 LATIN AMERICA: MARKET DRIVERS

8.6.2 LATIN AMERICA: COVID-19 IMPACT

8.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 197 LATIN AMERICA: SMART WATER MANAGEMENT MARKET SIZE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY WATER METER, 2017–2020 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY WATER METER, 2021–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020(USD MILLION)

TABLE 204 LATIN AMERICA: ENTERPRISE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 205 LATIN AMERICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 206 LATIN AMERICA: ANALYTICS AND DATA MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: SMART WATER MANAGEMENT MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.6.4 BRAZIL

8.6.5 MEXICO

8.6.6 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 174)

9.1 OVERVIEW

9.2 MARKET EVALUATION FRAMEWORK

FIGURE 33 MARKET EVALUATION FRAMEWORK, 2019–2021

9.3 KEY MARKET DEVELOPMENTS

9.3.1 PRODUCT LAUNCHES

TABLE 215 SMART WATER MANAGEMENT MARKET: PRODUCT LAUNCHES, MARCH 2021- OCTOBER 2021

9.3.2 DEALS

TABLE 216 MARKET: DEALS, SEPTEMBER 2019–OCTOBER 2021

9.3.3 OTHERS

TABLE 217 MARKET: OTHERS, DECEMBER 2020- SEPTEMBER 2021

9.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 218 MARKET: DEGREE OF COMPETITION

9.5 HISTORICAL REVENUE ANALYSIS

FIGURE 34 HISTORICAL REVENUE ANALYSIS, 2018–2020

9.6 COMPANY EVALUATION MATRIX OVERVIEW

9.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 219 PRODUCT FOOTPRINT WEIGHTAGE

9.6.2 STAR

9.6.3 EMERGING LEADERS

9.6.4 PERVASIVE

9.6.5 PARTICIPANTS

FIGURE 35 SMART WATER MANAGEMENT MARKET, COMPANY EVALUATION MATRIX, 2021

9.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 220 COMPANY PRODUCT FOOTPRINT

TABLE 221 COMPANY OFFERING FOOTPRINT

TABLE 222 COMPANY INDUSTRY FOOTPRINT

TABLE 223 COMPANY REGION FOOTPRINT

9.8 COMPANY MARKET RANKING ANALYSIS

FIGURE 36 RANKING OF KEY PLAYERS IN THE MARKET, 2021

9.9 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 37 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

9.9.1 PROGRESSIVE COMPANIES

9.9.2 RESPONSIVE COMPANIES

9.9.3 DYNAMIC COMPANIES

9.9.4 STARTING BLOCKS

FIGURE 38 SMART WATER MANAGEMENT MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2021

10 COMPANY PROFILES (Page No. - 191)

10.1 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

10.1.1 SIEMENS

TABLE 224 SIEMENS: BUSINESS OVERVIEW

FIGURE 39 SIEMENS: COMPANY SNAPSHOT

TABLE 225 SIEMENS: PRODUCTS OFFERED

TABLE 226 SIEMENS: SMART WATER MANAGEMENT MARKET: DEALS

10.1.2 IBM

TABLE 227 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

TABLE 228 IBM: PRODUCTS OFFERED

TABLE 229 IBM: MARKET: DEALS

10.1.3 ABB

TABLE 230 ABB: BUSINESS OVERVIEW

FIGURE 41 ABB: COMPANY SNAPSHOT

TABLE 231 ABB: PRODUCTS OFFERED

TABLE 232 ABB: MARKET: PRODUCT LAUNCHES

TABLE 233 ABB: SMART WATER MANAGEMENT MARKET: DEALS

10.1.4 HONEYWELL ELSTER

TABLE 234 HONEYWELL ELSTER: BUSINESS OVERVIEW

FIGURE 42 HONEYWELL ELSTER: COMPANY SNAPSHOT

TABLE 235 HONEYWELL ELSTER: PRODUCTS OFFERED

TABLE 236 HONEYWELL ELSTER: MARKET: DEALS

10.1.5 SCHNEIDER ELECTRIC

TABLE 237 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 238 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 239 SCHNEIDER ELECTRIC: MARKET: PRODUCT LAUNCHES

TABLE 240 SCHNEIDER ELECTRIC: SMART WATER MANAGEMENT MARKET: DEALS

10.1.6 ITRON

TABLE 241 ITRON: BUSINESS OVERVIEW

FIGURE 44 ITRON: COMPANY SNAPSHOT

TABLE 242 ITRON: PRODUCTS OFFERED

TABLE 243 ITRON: MARKET: DEALS

10.1.7 SUEZ

TABLE 244 SUEZ: BUSINESS OVERVIEW

FIGURE 45 SUEZ: COMPANY SNAPSHOT

TABLE 245 SUEZ: PRODUCTS OFFERED

TABLE 246 SUEZ: MARKET: PRODUCT LAUNCHES

TABLE 247 SUEZ: SMART WATER MANAGEMENT MARKET: DEALS

10.1.8 ORACLE

TABLE 248 ORACLE: BUSINESS OVERVIEW

FIGURE 46 ORACLE: COMPANY SNAPSHOT

TABLE 249 ORACLE: PRODUCTS OFFERED

TABLE 250 ORACLE: MARKET: PRODUCT LAUNCHES

TABLE 251 ORACLE: MARKET: DEALS

TABLE 252 ORACLE: MARKET: OTHERS

10.1.9 LANDIS+GYR

TABLE 253 LANDIS+GYR: BUSINESS OVERVIEW

FIGURE 47 LANDIS+GYR: COMPANY SNAPSHOT

TABLE 254 LANDIS+GYR: PRODUCTS OFFERED

TABLE 255 LANDIS+GYR: SMART WATER MANAGEMENT MARKET: PRODUCT LAUNCHES

TABLE 256 LANDIS+GYR: MARKET: DEALS

10.1.10 TRIMBLE WATER

TABLE 257 TRIMBLE WATER: BUSINESS OVERVIEW

FIGURE 48 TRIMBLE WATER: COMPANY SNAPSHOT

TABLE 258 TRIMBLE WATER: PRODUCTS OFFERED

TABLE 259 TRIMBLE WATER: MARKET: PRODUCT LAUNCHES

TABLE 260 TRIMBLE WATER: MARKET: DEALS

TABLE 261 TRIMBLE WATER: MARKET: OTHERS

*Details on Business Overview, Products, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 HYDROPOINT

10.2.2 I20

10.2.3 XENIUS

10.2.4 NEPTUNE TECHNOLOGY

10.2.5 TAKADU

10.2.6 BADGER METER

10.2.7 AQUAMATIX

10.2.8 FLUID

10.2.9 LISHTOT

10.2.10 ELENTEC

10.2.11 SYRINIX

10.2.12 CITYTAPS

10.2.13 FREDSENSE

10.2.14 FRACTA

10.2.15 XYLEM

11 APPENDIX (Page No. - 242)

11.1 ADJACENT/RELATED MARKETS

11.1.1 IOT IN SMART CITIES MARKET – GLOBAL FORECAST TO 2025

11.1.1.1 Market definition

11.1.1.2 Market overview

11.1.1.3 IoT in smart cities market, by offering

TABLE 262 IOT IN SMART CITIES MARKET SIZE, BY OFFERING, 2016–2019 (USD BILLION)

TABLE 263 IOT IN SMART CITES MARKET SIZE, BY OFFERING, 2019–2025 (USD BILLION)

11.1.1.4 IoT in smart cities market, by solution

TABLE 264 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2016–2019 (USD BILLION)

TABLE 265 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2019–2025 (USD BILLION)

11.1.1.5 IoT in smart cities market, by service

TABLE 266 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

TABLE 267 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

TABLE 268 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016–2019 (USD BILLION)

TABLE 269 PROFESSIONAL SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

11.1.1.6 IoT in smart cities market, by application

TABLE 270 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 271 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD BILLION)

11.1.1.7 IoT in smart cities market, by region

TABLE 272 IOT IN SMART CITIES MARKET SIZE, BY REGION, 2016–2019 (USD BILLION)

TABLE 273 IOT IN SMART CITIES MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

11.1.2 SMART BUILDINGS MARKET – GLOBAL FORECAST TO 2025

11.1.2.1 Market definition

11.1.2.2 Market overview

11.1.2.3 Smart buildings market, by component

TABLE 274 SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 275 SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

11.1.2.4 Smart buildings market, by solution

TABLE 276 SOLUTIONS: SMART BUILDINGS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 277 SOLUTIONS: SMART BUILDINGS MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

11.1.2.5 Smart buildings market, by service

TABLE 278 SERVICES: SMART BUILDINGS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 279 SERVICES: SMART BUILDINGS MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

11.1.2.6 Smart buildings market, by building type

TABLE 280 SMART BUILDINGS MARKET SIZE, BY BUILDING TYPE, 2017–2019 (USD MILLION)

TABLE 281 SMART BUILDINGS MARKET SIZE, BY BUILDING TYPE, 2019–2025 (USD MILLION)

11.1.2.7 Smart buildings market, by region

TABLE 282 SMART BUILDINGS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 283 SMART BUILDINGS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATION

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This research study involved extensive, the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, and Bloomberg, to identify and collect information useful for the comprehensive market research study on the SWM market. Additionally, sources such as the Smart Water Networks Forum (SWAN), International Water Resources Association (IWRA), and International Water Association (IWA) were used to collect information specific to the smart water management market. The primary sources were mainly industry experts from the core and related industries, preferred smart water management solution providers, third-party service providers, end users, and other stakeholders. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the prospects.

Secondary Research

The market size of companies offering smart water management solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as SWAN, Smart Energy International, IWRA, IWA, and European Smart Metering Industry Group. Additionally, market trends and projects in various countries were extracted from the respective government associations, such as the Australian Water Association (AWA), American Water Works Association (AWWA), and the Canadian Water Resources Association.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify the key players according to their offerings and industry trends related to technology, end user, and region, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from smart water management solution vendors, system integrators, professional and managed service providers, industry associations, independent asset management consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using smart water management solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of smart water management solutions, which will affect the overall smart water management market.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Smart Water Management Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the smart water management market. The key players in the market were identified through secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global smart water management (SWM) market, by offering (water meter, solution, and service), end user, and region, from 2017 to 2026, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five key regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the smart water management market

- To analyze each sub-segment for individual growth trends, prospects, and contribution to the total smart water management

- To analyze the impact of COVID-19 on the SWM

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the SWM

- To profile key market players comprising top vendors and start-ups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscapes

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis

- Further breakdown of the North American SWM market

- Further breakdown of the European SWM market

- Further breakdown of the APAC SWM market

- Further breakdown of the MEA SWM market

- Further breakdown of the Latin American SWM market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Water Management Market