Social and Emotional Learning Market by Component, Solution (Social and Emotional Learning Platform, Social and Emotional Learning Assessment Tool), Service, User, Type (Web-based, Application) and Region - Global Forecast to 2027

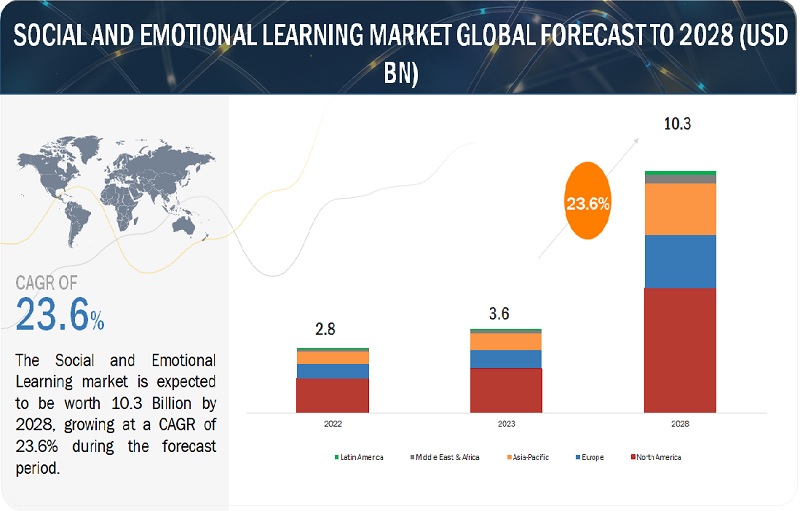

[219 Pages Report] MarketsandMarkets forecasts the global social and emotional learning market size is projected to grow from USD 2.7 billion in 2022 to USD 7.8 billion by 2027, at a compound annual growth rate (CAGR) of 24.0% during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Social and Emotional Learning Market Dynamics

Driver: Growing Implementation of Distance Education Solutions

Since most of the courses for social and emotional learning programs are offered through the web or digitally, an increase in distance education solutions has boosted the social and emotional learning market. According to the United Nations Educational, Scientific, and Cultural Organization’s (UNESCO) Institute for Statistics data, as of June 2020, 123 countrywide closures were still affecting 1.1 billion students, which was approximately 62% of total enrollment (UNESCO 2020c). Though schools were closed, most governments around the world designed and implemented nationwide remote learning initiatives during the COVID-19 pandemic. Most countries implemented multimodal learning solutions aimed at reaching all students. The social and emotional learning providers also aimed to provide the curriculum online to reach the maximum number of students. Social and Emotional Learning (SEL) courses were previously offered in the classes with the help of teachers. Not only are the schools involved in the student’s learning, but also the parents at home due to the availability of the courses anytime, anywhere.

Restraint: Problem of Education Budget in Emerging Countries

According to World Bank, education budgets are not adjusting proportionately to the challenges brought about by COVID-19, especially in poorer countries. Despite additional funding needs, two-thirds of low- and lower-middle-income countries have cut their public education budgets since the onset of the COVID-19 pandemic, according to the new joint World Bank – UNESCO Education Finance Watch (EFW). In comparison, only one-third of upper-middle and high-income countries have reduced their budgets. The countries in the emerging and underdeveloped regions are not prioritizing education in the budget, due to which the focus on social and emotional learning of students in these regions tends to be less. This causes an impact on the overall growth of the SEL market.

Opportunity: Demand for New Learning Models with Advancements in Technologies

The K-12 education system has moved from traditional classrooms toward smart classrooms, with the inclusion of innovative technologies, such as cloud computing, analytics, next-generation collaboration tools, and IoT. Modern classrooms use interactive whiteboards/displays to reach students who are located in remote areas. From a centralized location, educators can teach the SEL curriculum to several students using collaboration tools, such as WebEx, Zoom, Google Hangouts, and Skype. Cloud computing has been prevalent across K-12 schools, which SEL providers use to deliver SEL curriculums. The integration of technologies, such as videoconferencing, cloud, and analytics, into the classroom would be instrumental for students to learn SEL skills effectively. These collaboration tools show the significance of working together with the students. Fresno Unified School District implemented a digital collaboration platform to improve social and emotional skills and witnessed a 25% improvement in academic performance in middle school students.

Challenge: Constraints while Shifting from Traditional Learning Methods

Teachers worldwide have stated inadequate time and diversity in the curriculum to be the major challenges in implementing SEL. In one of the many research activities conducted by the US government, 81% of teachers cited time as the biggest challenge for SEL implementation. According to industry experts, diversity is another major challenge faced by educators while implementing SEL. It is difficult for SEL curriculum creators to design SEL content that caters to all children irrespective of religion, caste, economy, and language. Educators have suggested that SEL should be a part of a regular curriculum and taken as an academic subject. The government would play an important role in reducing challenges related to the implementation. SEL should be taken as a special subject in the curriculum with separate time allocation in the academic timetable. Moreover, SEL creators, policymakers, and SEL platform providers should revive their approach while designing SEL courses for K-12 students. According to the CASEL survey, 2 out of 3 teachers stated that SEL should be included in the state education standard.

By Component, Services Segment to Have a Higher CAGR During the Forecast Period

The component sector with the highest CAGR during the study period is projected to be services. Services are essential to the overall process of putting social and emotional learning solutions into place and keeping them maintained. Prior to deploying social and emotional learning solutions, being aware of the installation and maintenance requirements is essential for figuring out the precise time and money investments needed. The length of time it takes to implement some solutions can reduce the efficiency of the IT team. Shorter installation periods are highly desired because social and emotional learning solutions must be connected with the transportation industry’s current IT infrastructure. For optimal operation, the services related to social and emotional learning solutions are crucial. The intricacy of the social and emotional learning solutions and the necessary integration factors influence the installation’s final cost.

By End User, Pre-K Segment to Grow at Higher CAGR during Forecast Period

The student age range for pre-kindergarten is 3-5 years. The inclusion of SEL in the pre-K curriculum has attracted the interest of administrators, educators, and politicians. Pre-K SEL curricula assist teachers in developing knowledge and skill sets in areas such as fostering relationships with students’ parents, siblings, and peers, fostering a positive learning environment in the classroom, ignoring negative people, and learning new skills that will be useful in kindergarten. SEL in pre-kindergarten settings equips teachers to foster social skills, foster good relationships with families and peers, prevent problematic behavior, and advance knowledge. In a nutshell, SEL programs help pre-K youngsters develop positive behavior and learning skills. Additionally, it fosters the development of students’ listening and focus skills.

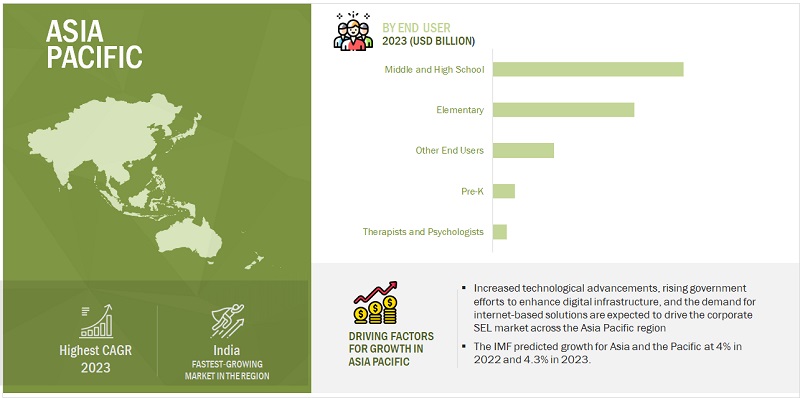

Asia Pacific to Grow at Highest CAGR During Forecast Period

Due to its rapid development, Asia Pacific is one of the most lucrative markets for social and emotional learning in the world. Due to the quick uptake of SEL solutions, it is anticipated to have the fastest growth rate in the global market for social and emotional learning. Unquestionably dominating the market for social and emotional learning are China and Japan, two of the region’s most technologically advanced nations. The region has the biggest student population, and as technology advances, there is an increasing need for newer teaching methods. Due to this, the market for social and emotional learning is driven to adapt to the diverse educational needs of the region, which includes Australia and New Zealand (ANZ), Japan, China, Singapore, and India. During the projection period, there are expected to be more prospects for growth in Asia Pacific. The region’s adoption of SEL is fueled by government programs to boost the digital infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players social and emotional learning market. It profiles major vendors in the social and emotional learning market. The major vendors in the market are Committee for Children (US), EVERFI (US), Nearpod (US), Illuminate Education (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings for Kids (US), Rethink Ed (US), Move This World (US), Positive Action (US), Growing Leaders (US), 7 Mindsets (US), Ori Learning (US), The Conover Company (US), Imagine Learning (US), Navigate360 (US), Peekapak (Canada), Paths Program LLC (US), Brighten Learning (US), Aperture Education (US), Taproot Learning (US), MeandMine (US), Base Education (US), Everyday Speech (US), Mozoom (Canada), Wayfinder (Canada), HeyKiddo (US), Classcraft (Canada), Tamboro (Brazil), and Persona Education (UK). These players have adopted various strategies to grow in the global offering social and emotional learning market. The study includes an in-depth competitive analysis of these key players in the offering market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Market size available for years | 2017–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million/USD Billion) |

| Segments covered | By component, solution, service, user, type, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Companies covered | Children (US), EVERFI (US), Nearpod (US), Illuminate Education (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings for Kids (US), Rethink Ed (US), Move This World (US), Positive Action (US), Growing Leaders (US), 7 Mindsets (US), Ori Learning (US), The Conover Company (US), Imagine Learning (US), Navigate360 (US), Peekapak (Canada), Paths Program LLC (US), Brighten Learning (US), Aperture Education (US), Taproot Learning (US), MeandMine (US), Base Education (US), Everyday Speech (US), Mozoom (Canada), Wayfinder (Canada), HeyKiddo (US), Classcraft (Canada), Tamboro (Brazil), and Persona Education (UK). |

This research report categorizes the social and emotional learning market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Solutions

- Services

By Solution:

- Social and Emotional Learning Platform

- Social and Emotional Learning Assessment Tool

By Service:

- Consulting

- Deployment and Integration

- Training and Support

By User:

- Pre-K

- Elementary Schools

- Middle & High Schools

By Type:

- Web-based

- Application

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- Kingdom of Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

Recent Developments:

- In May 2022, Committee for Children releases new Social-Emotional Learning material for educators to build an authentic culture of equity and belonging among staff and students.

- In January 2022, Blackbaud was a leading cloud software company that acquired EVERFI in a cash and stock transaction for approximately USD 750 million.

- In February 2021, Renaissance and Nearpod agreed to empower teachers and accelerate student growth.

- In December 2020, Illuminate Education partnered with ASCD to enhance teacher training. ASCD’s Activate Professional Learning Library helps to expand the Illuminate CaseNEX development courses.

Frequently Asked Questions (FAQ):

How is the social and emotional learning market expected to grow in the next five years?

According to MarketsandMarkets, the social and emotional learning market is expected to grow from USD 2.7 billion in 2022 to USD 7.8 billion by 2027 at a compound annual growth rate (CAGR) of 24.0% during the forecast period.

Which region has the largest share in the social and emotional learning market?

North America is estimated to hold the largest market share in the social and emotional learning market in 2022. North America is one of the most technologically advanced markets in the world.

What are the major factors driving the social and emotional learning market?

The major drivers of the social and emotional learning market are the need for social and emotional well-being in educational institutions, an increase in the focus on the all-round development of students, growing support and awareness programs by governments, and increasing social and emotional distance.

Who are the major vendors in the social and emotional learning market?

Major vendors in the social and emotional learning market include Committee for Children (US), EVERFI (US), Nearpod (US), Illuminate Education (US), Panorama Education (US), SchoolMint (US), Newsela (US), Playworks (US), Wings for Kids (US), Rethink Ed (US), Move This World (US), Positive Action (US), Growing Leaders (US), 7 Mindsets (US), Ori Learning (US), The Conover Company (US), Imagine Learning (US), Navigate360 (US), Peekapak (Canada), Paths Program LLC (US), Brighten Learning (US), Aperture Education (US), Taproot Learning (US), MeandMine (US), Base Education (US), Everyday Speech (US), Mozoom (Canada), Wayfinder (Canada), HeyKiddo (US), Classcraft (Canada), Tamboro (Brazil), and Persona Education (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 SOCIAL AND EMOTIONAL LEARNING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakup of primary profiles

2.1.2.3 List of key primary interview participants

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.4 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 TOP-DOWN APPROACH

2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 5 SOCIAL AND EMOTIONAL LEARNING MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (1/2)

FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2/2)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 8 SOCIAL AND EMOTIONAL LEARNING MARKET, 2021–2027

FIGURE 9 LEADING SEGMENTS IN MARKET, 2022

FIGURE 10 MARKET: HOLISTIC VIEW

FIGURE 11 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BRIEF OVERVIEW OF SOCIAL AND EMOTIONAL LEARNING MARKET

FIGURE 12 INCREASING INVESTMENTS TO DRIVE MARKET

4.2 NORTH AMERICAN MARKET, BY COMPONENT AND COUNTRY

FIGURE 13 SOLUTIONS AND WEB-BASED SEGMENTS TO HAVE LARGE SHARES IN NORTH AMERICA IN 2022

4.3 ASIA PACIFIC MARKET, BY COMPONENT AND COUNTRY

FIGURE 14 SOLUTIONS AND WEB-BASED SEGMENTS TO HAVE LARGE SHARES IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 SOCIAL AND EMOTIONAL LEARNING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in focus on all-round development of students

5.2.1.2 Growing implementation of distance education solutions

5.2.1.3 Need for social and emotional well-being in educational institutions

FIGURE 16 PERCENTAGE OF CHILDREN WHO CAN CORRECTLY IDENTIFY EMOTIONS, 2019

5.2.1.4 Growing support and awareness programs by governments

FIGURE 17 TOTAL ANNUAL SPENDING ON SOCIAL AND EMOTIONAL LEARNING PRODUCTS IN US K-12 SCHOOLS, 2017 (USD MILLION)

5.2.1.5 Promoting social awareness among employees in organizations

FIGURE 18 SURVEY RESULTS BY ZETY

FIGURE 19 TOP 10 SOFT SKILLS ACCORDING TO RECRUITERS AND HIRING MANAGERS

5.2.1.6 Proliferation of computing in K-12 sector

FIGURE 20 FACILITIES IN INDIAN SCHOOLS, 2018–2020

5.2.2 RESTRAINTS

5.2.2.1 Absence of appropriate infrastructure in emerging economies

FIGURE 21 STATE OF MOBILE INTERNET CONNECTIVITY, BY REGION, 2019

5.2.2.2 Lack of education budget in emerging countries

FIGURE 22 GOVERNMENT EXPENDITURE ON EDUCATION IN 2021 IN EMERGING AND UNDERDEVELOPED COUNTRIES

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for new learning models with advancements in technologies

5.2.3.2 Emergence of AI, AR, and VR learning trends in K-12 sector

5.2.4 CHALLENGES

5.2.4.1 Constraints while shifting from traditional learning methods

5.2.4.2 Focus on academic learning more than social and emotional learning

TABLE 3 FIVE CORE COMPETENCIES OF SOCIAL AND EMOTIONAL LEARNING

5.2.5 PRICING ANALYSIS

5.2.5.1 Average selling price trend of subscription-based software, by key player

TABLE 4 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED SOCIAL AND EMOTIONAL LEARNING SOFTWARE

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 SOCIAL AND EMOTIONAL LEARNING MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

TABLE 5 MARKET: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 AUGMENTED AND VIRTUAL REALITY

5.5.2 ARTIFICIAL INTELLIGENCE

5.5.3 INTERNET OF THINGS

5.5.4 BIG DATA ANALYTICS

5.5.5 CLOUD SERVICES

5.5.6 5G NETWORK

5.6 PATENT ANALYSIS

FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 6 TOP 20 PATENT OWNERS (US)

FIGURE 25 NUMBER OF PATENTS GRANTED YEARLY, 2012–2021

5.7 KEY CONFERENCES AND EVENTS FROM 2022 TO 2023

TABLE 7 SOCIAL AND EMOTIONAL LEARNING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.8 REGULATORY LANDSCAPE

5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.8.2 COMMUNICATIONS ACT OF 1934

5.8.3 GENERAL DATA PROTECTION REGULATION

5.8.4 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001

5.8.5 ACT ON THE PROTECTION OF PERSONAL INFORMATION

5.8.6 EVERY STUDENT SUCCEEDS ACT

5.8.7 SUPPORTING SOCIAL AND EMOTIONAL LEARNING ACT

5.8.8 ACADEMIC, SOCIAL, AND EMOTIONAL LEARNING ACT OF 2015

5.8.9 JESSE LEWIS EMPOWERING EDUCATORS ACT

5.8.10 SOCIAL EMOTIONAL LEARNING FOR FAMILIES ACT OF 2019

5.9 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 SOCIAL AND EMOTIONAL LEARNING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES MODEL

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

5.10.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR END USERS

TABLE 10 KEY BUYING CRITERIA FOR END USERS

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1: EVERFI HELPED PRINCE WILLIAM COUNTY PUBLIC SCHOOLS TO PREPARE STUDENTS FOR LIFE BEYOND HIGH SCHOOL

5.11.2 CASE STUDY 2: ILLUMINATE EDUCATION PARTNERED WITH CISD TO DEVELOP ISE SOLUTION FOR SPECIAL EDUCATION NEEDS

5.11.3 CASE STUDY 3: PANORAMA EDUCATION HELPED FRESNO UNIFIED SCHOOL DISTRICT PROMOTE SOCIAL AND EMOTIONAL LEARNING USING RELEVANT SURVEY DATA

5.11.4 CASE STUDY 4: NAVIGATE360 SOCIAL AND EMOTIONAL LEARNING PROGRAM HELPED STUDENTS AT MARION PUBLIC SCHOOL LEARN STRATEGIES TO RESPOND TO STRESSORS MORE POSITIVELY

5.11.5 CASE STUDY 5: CERES HIGH SCHOOL USES SCHOOLMINT HERO FOR SOCIAL AND ACADEMIC SUCCESS

6 SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

TABLE 11 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SEL SOLUTIONS PROVIDE TOOLS FOR STUDENTS TO LEARN SOCIAL AND EMOTIONAL SKILLS

TABLE 13 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 14 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SEL SERVICES ENSURE SEAMLESS IMPLEMENTATION, GROWTH, AND MAINTENANCE OF SOCIAL AND EMOTIONAL LEARNING ACTIVITIES

TABLE 15 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 16 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 SOCIAL AND EMOTIONAL LEARNING MARKET, BY SOLUTION (Page No. - 86)

7.1 INTRODUCTION

FIGURE 30 SOCIAL AND EMOTIONAL LEARNING ASSESSMENT TOOL SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

7.1.1 SOLUTIONS: MARKET DRIVERS

TABLE 17 MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 18 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.2 SOCIAL AND EMOTIONAL LEARNING PLATFORM

FIGURE 31 STUDENTS’ EMPOWERMENT IN SELF MANAGEMENT, BY SOCIAL AND EMOTIONAL LEARNING PLATFORM

FIGURE 32 IMPACT ON STUDENTS BY SOCIAL AND EMOTIONAL LEARNING PLATFORM

TABLE 19 SOCIAL AND EMOTIONAL LEARNING PLATFORM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 20 SOCIAL AND EMOTIONAL LEARNING PLATFORM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SOCIAL AND EMOTIONAL LEARNING ASSESSMENT TOOL

TABLE 21 SOCIAL AND EMOTIONAL LEARNING ASSESSMENT TOOLS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 SOCIAL AND EMOTIONAL LEARNING ASSESSMENT TOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SOCIAL AND EMOTIONAL LEARNING MARKET, BY SERVICE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 33 TRAINING AND SUPPORT SERVICES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

8.1.1 SERVICES: MARKET DRIVERS

TABLE 23 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 24 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

8.2 CONSULTING

TABLE 25 CONSULTING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 DEPLOYMENT AND INTEGRATION

TABLE 27 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 INTEGRATION AND DEPLOYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 TRAINING AND SUPPORT

TABLE 29 TRAINING AND SUPPORT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 TRAINING AND SUPPORT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SOCIAL AND EMOTIONAL LEARNING MARKET, BY CORE COMPETENCY (Page No. - 95)

9.1 INTRODUCTION

9.2 SELF-AWARENESS

9.3 SELF-MANAGEMENT

9.4 SOCIAL AWARENESS

9.5 RELATIONSHIP SKILLS

9.6 RESPONSIBLE DECISION-MAKING

10 SOCIAL AND EMOTIONAL LEARNING MARKET, BY END USER (Page No. - 97)

10.1 INTRODUCTION

FIGURE 34 PRE-K SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

10.1.1 END USERS: MARKET DRIVERS

TABLE 31 MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 32 MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 PRE-K

10.2.1 SEL IN PRE-KINDERGARTEN EQUIPS TEACHERS TO FOSTER SOCIAL SKILLS AND GOOD RELATIONSHIPS WITH FAMILIES AND PEERS

TABLE 33 PRE-K: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 PRE-K: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 ELEMENTARY SCHOOLS

10.3.1 SEL DURING ELEMENTARY SCHOOL STAGE ENHANCES STUDENT'S ABILITY TO LEARN ABOUT EMOTIONS, ACADEMIC OBJECTIVES, EMPATHY, AND INTERPERSONAL INTERACTIONS

TABLE 35 ELEMENTARY SCHOOLS: SOCIAL AND EMOTIONAL LEARNING MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 ELEMENTARY SCHOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 MIDDLE AND HIGH SCHOOLS

10.4.1 SEL EQUIPS MIDDLE AND HIGH SCHOOL STUDENTS TO COPE UP WITH INDISCIPLINE, EMOTIONAL DISTRESS, AND POOR MANAGEMENT

TABLE 37 MIDDLE AND HIGH SCHOOLS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 MIDDLE AND HIGH SCHOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 SOCIAL AND EMOTIONAL LEARNING MARKET, BY TYPE (Page No. - 101)

11.1 INTRODUCTION

FIGURE 35 APPLICATION SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

11.1.1 TYPES: MARKET DRIVERS

TABLE 39 MARKET, BY TYPE, 2017–2021(USD MILLION)

TABLE 40 MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2 WEB-BASED

11.2.1 WEB-BASED PLATFORM ENABLES STUDENT AND TEACHERS TO ACCESS PLATFORM AT ANY TIME AND FROM ANYWHERE

TABLE 41 WEB-BASED: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 42 WEB-BASED: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 APPLICATION

11.3.1 APPLICATION-BASED SEL PLATFORM AIDS KIDS ATTENDING SCHOOLS IN RURAL LOCATIONS WITH POOR INTERNET CONNECTIVITY

TABLE 43 APPLICATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 APPLICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 SOCIAL AND EMOTIONAL LEARNING MARKET, BY REGION (Page No. - 104)

12.1 INTRODUCTION

FIGURE 36 NORTH AMERICA TO LEAD MARKET FROM 2022 TO 2027

12.1.1 MARKET DRIVERS

TABLE 45 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 37 NORTH AMERICA: SOCIAL AND EMOTIONAL LEARNING MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

TABLE 59 US: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 60 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 61 US: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 62 US: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 63 US: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 64 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 65 US: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 66 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 US: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 68 US: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.2.3 CANADA

TABLE 69 CANADA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 70 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 71 CANADA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 72 CANADA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 73 CANADA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 74 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 76 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 CANADA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 78 CANADA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

TABLE 79 EUROPE: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UK

TABLE 91 UK: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 92 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 UK: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 94 UK: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 95 UK: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 96 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 97 UK: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 98 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 UK: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 100 UK: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.3 GERMANY

TABLE 101 GERMANY: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.4 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: SOCIAL AND EMOTIONAL LEARNING MARKET SNAPSHOT

TABLE 111 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

TABLE 123 CHINA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 124 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 125 CHINA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 126 CHINA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 127 CHINA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 128 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 129 CHINA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 130 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 CHINA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 132 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.3 JAPAN

TABLE 133 JAPAN: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 134 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 135 JAPAN: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 136 JAPAN: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 137 JAPAN: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 138 JAPAN: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.4 INDIA

TABLE 143 INDIA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 144 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 145 INDIA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 146 INDIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 147 INDIA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 148 INDIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 149 INDIA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 150 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 INDIA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 152 INDIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.5 AUSTRALIA

TABLE 153 AUSTRALIA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 154 AUSTRALIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 155 AUSTRALIA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 156 AUSTRALIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 157 AUSTRALIA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 158 AUSTRALIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 159 AUSTRALIA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 160 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 AUSTRALIA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 162 AUSTRALIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.6 SINGAPORE

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 PESTLE ANALYSIS: MIDDLE EAST AND AFRICA

TABLE 163 MIDDLE EAST AND AFRICA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 KINGDOM OF SAUDI ARABIA

12.5.3 SOUTH AFRICA

12.5.4 REST OF THE MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 175 LATIN AMERICA: SOCIAL AND EMOTIONAL LEARNING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.3 MEXICO

12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 155)

13.1 OVERVIEW

13.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 187 OVERVIEW OF STRATEGIES ADOPTED BY KEY SOCIAL AND EMOTIONAL LEARNING MARKET VENDORS

13.3 REVENUE ANALYSIS

FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2017–2021

13.4 COMPANY MARKET RANKING ANALYSIS

FIGURE 40 RANKING OF KEY PLAYERS IN MARKET, 2022

13.5 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 188 MARKET: DEGREE OF COMPETITION

FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET

13.6 MARKET EVALUATION FRAMEWORK

FIGURE 42 MARKET EVALUATION FRAMEWORK, 2019–2022

13.7 COMPANY EVALUATION QUADRANTS

TABLE 189 PRODUCT FOOTPRINT WEIGHTAGE

13.7.1 STARS

13.7.2 EMERGING LEADERS

13.7.3 PERVASIVE PLAYERS

13.7.4 PARTICIPANTS

FIGURE 43 SOCIAL AND EMOTIONAL LEARNING MARKET, COMPANY EVALUATION MATRIX, 2022

13.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 190 COMPANY FOOTPRINT

TABLE 191 COMPANY COMPONENT FOOTPRINT

TABLE 192 USER END FOOTPRINT

TABLE 193 COMPANY REGION FOOTPRINT

13.9 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

TABLE 194 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 195 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

13.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 196 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 DYNAMIC COMPANIES

13.10.4 STARTING BLOCKS

FIGURE 44 SOCIAL AND EMOTIONAL LEARNING MARKET, START-UP/SME EVALUATION MATRIX, 2022

13.11 COMPETITIVE SCENARIO AND TRENDS

13.11.1 PRODUCT LAUNCHES

TABLE 197 MARKET: PRODUCT LAUNCHES, 2019–2022

13.11.2 DEALS

TABLE 198 MARKET: DEALS, 2019–2022

14 COMPANY PROFILES (Page No. - 174)

14.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)*

14.1.1 COMMITTEE FOR CHILDREN

TABLE 199 COMMITTEE FOR CHILDREN: BUSINESS OVERVIEW

TABLE 200 COMMITTEE FOR CHILDREN: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 201 COMMITTEE FOR CHILDREN: PRODUCT LAUNCHES

TABLE 202 COMMITTEE FOR CHILDREN: DEALS

14.1.2 EVERFI

TABLE 203 EVERFI: BUSINESS OVERVIEW

TABLE 204 EVERFI: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 205 EVERFI: PRODUCT LAUNCHES

TABLE 206 EVERFI: DEALS

TABLE 207 EVERFI: OTHERS

14.1.3 NEARPOD

TABLE 208 NEARPOD: BUSINESS OVERVIEW

TABLE 209 NEARPOD: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 210 NEARPOD: PRODUCT LAUNCHES

TABLE 211 NEARPOD: DEALS

14.1.4 ILLUMINATE EDUCATION

TABLE 212 ILLUMINATE EDUCATION: BUSINESS OVERVIEW

TABLE 213 ILLUMINATE EDUCATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 214 ILLUMINATE EDUCATION: PRODUCT LAUNCHES

TABLE 215 ILLUMINATE EDUCATION: DEALS

14.1.5 PANORAMA EDUCATION

TABLE 216 PANORAMA EDUCATION: BUSINESS OVERVIEW

TABLE 217 PANORAMA EDUCATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 218 PANORAMA EDUCATION: PRODUCT LAUNCHES

14.1.6 SCHOOLMINT

TABLE 219 SCHOOLMINT: BUSINESS OVERVIEW

TABLE 220 SCHOOLMINT: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 221 SCHOOLMINT: DEALS

14.1.7 NEWSELA

TABLE 222 NEWSELA: BUSINESS OVERVIEW

TABLE 223 NEWSELA: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 224 NEWSELA: PRODUCT LAUNCHES

TABLE 225 NEWSELA: DEALS

14.1.8 PLAYWORKS

TABLE 226 PLAYWORKS: BUSINESS OVERVIEW

TABLE 227 PLAYWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 228 PLAYWORKS: DEALS

14.1.9 WINGS FOR KIDS

TABLE 229 WINGS FOR KIDS: BUSINESS OVERVIEW

TABLE 230 WINGS FOR KIDS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 231 WINGS FOR KIDS: DEALS

14.1.10 RETHINK ED

TABLE 232 RETHINK ED: BUSINESS OVERVIEW

TABLE 233 RETHINK ED: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 234 RETHINK ED: DEALS

14.1.11 MOVE THIS WORLD

14.1.12 POSITIVE ACTION

14.1.13 GROWING LEADERS

14.1.14 7 MINDSETS

14.1.15 ORI LEARNING (ONEDER ACADEMY)

14.1.16 THE CONOVER COMPANY

14.1.17 IMAGINE LEARNING

14.1.18 NAVIGATE360

14.1.19 PEEKAPAK

14.1.20 PATHS PROGRAM LLC

14.2 STARTUP/SME PLAYERS

14.2.1 BRIGHTEN LEARNING

14.2.2 APERTURE EDUCATION

14.2.3 TAPROOT LEARNING

14.2.4 MEANDMINE

14.2.5 BASE EDUCATION

14.2.6 EVERYDAY SPEECH

14.2.7 MOOZOOM

14.2.8 WAYFINDER

14.2.9 HEYKIDDO

14.2.10 CLASSCRAFT

14.2.11 TAMBORO

14.2.12 PERSONA EDUCATION

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS (Page No. - 205)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 SMART LEARNING MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Smart learning market, by component

TABLE 235 SMART LEARNING MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 236 SMART LEARNING MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

15.3.2.2 Smart learning market, by service

TABLE 237 SMART LEARNING MARKET, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 238 SMART LEARNING MARKET, BY SERVICE, 2021–2026 (USD MILLION)

15.3.2.3 Smart learning market, by learning type

TABLE 239 SMART LEARNING MARKET, BY LEARNING TYPE, 2017–2020 (USD MILLION)

TABLE 240 SMART LEARNING MARKET, BY LEARNING TYPE, 2021–2026 (USD MILLION)

15.3.2.4 Smart learning market, by region

15.4 EDUCATION ERP MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

15.4.2.1 Education ERP market, by component

TABLE 241 EDUCATION ERP MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 242 EDUCATION ERP MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

15.4.2.2 Education ERP market, by application

TABLE 243 EDUCATION ERP MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 244 EDUCATION ERP MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

15.4.2.3 Education ERP market, by deployment type

TABLE 245 EDUCATION ERP MARKET, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 246 EDUCATION ERP MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

15.4.2.4 Education ERP market, by region

16 APPENDIX (Page No. - 213)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

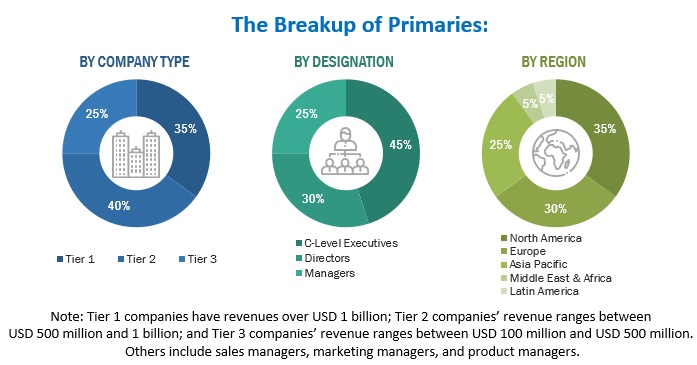

The study involved four major activities in estimating the current size of the social and emotional learning market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the social and emotional learning market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals were also referred to, such as the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net; and Social and emotional learning associations/forums. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the social and emotional learning market. The primary sources from the demand side included social and emotional learning network end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the social and emotional learning market. The first approach involves the estimation of the market size through the summation of companies’ revenue generated through the sales of hardware, software, and services. This entire procedure has studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To define, describe, and forecast the global social and emotional learning market based on component, core competencies, type, end user, and region

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micro markets with respect to individual growth trends and their contribution to the overall market

- To analyze the degree of competition in the market by identifying various parameters of key market players

- To provide a detailed competitive landscape of the social and emotional learning market, along with an analysis of business and corporate strategies, to track and analyze competitive developments, such as new product launches and product enhancements; agreements, collaborations, and partnerships; acquisitions; and business expansions

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape

- To track and analyze the competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations

SEL Market & its impact on Social and Emotional Learning Market

The SEL market and the Social and Emotional Learning (SEL) market are one and the same SEL Market is also known as Social and Emotional Learning Market. The process of learning social awareness, self-management, ethical decision-making, interpersonal relationship development, and other associated abilities is referred to as SEL. The SEL market refers to the industry that provides tools and resources to support the development of these skills in individuals, typically in educational and other learning settings.

A variety of products and services, including curricula, tests, professional development for teachers, and educational technology tools, are available in the SEL market. These resources are intended to support educators in their efforts to teach social and emotional competencies to students in a way that is both successful and relevant.

Here are some ways in which the SEL market is impacting the Social and Emotional Learning market:

- Increased Focus on Technology: It is probable that the SEL market will increasingly embrace technology-based solutions to promote the teaching and learning of social and emotional skills given the expansion of digital learning platforms and educational technology. This can entail creating fresh video games, computer simulations, and other interactive tools that let children learn and use social and emotional skills in a protected setting.

- Expanded Focus on Workplace Learning: As more employers recognize the importance of social and emotional skills in the workplace, the SEL market is likely to expand beyond traditional educational settings to include workplace learning and professional development.

- Greater Emphasis on Equity and Inclusion: As the SEL market continues to grow, it is likely that there will be an increased focus on equity and inclusion in social and emotional learning.

Overall, the SEL market is likely to have a continued and significant impact on the Social and Emotional Learning market, shaping the development of new products and services, and influencing the ways in which social and emotional learning is taught and learned in educational and workplace settings.

Futuristic Growth Use-Cases of SEL Market

Here are some potential futuristic growth use-cases of the SEL market:

- Personalized Learning: As technology continues to advance, there is an opportunity for the SEL market to develop personalized learning solutions that adapt to individual learners' needs and preferences.

- Virtual Reality and Augmented Reality: Technologies like virtual reality and augmented reality present fresh opportunities for immersive, hands-on social and emotional learning. For instance, students may utilise VR or AR to recreate hard interpersonal situations in which they would need to employ their social and emotional skills.

- Global Reach: The SEL market has the potential to reach learners and educators around the world, providing a common framework for teaching and learning social and emotional skills across cultures and languages.

- Wellness and Mental Health: The SEL market can also contribute to promoting mental health and wellness among learners, providing tools and resources for building resilience, managing stress, and developing healthy relationships.

- Lifelong Learning: Finally, the SEL market has the potential to support lifelong learning, providing learners of all ages with the social and emotional skills they need to succeed in school, work, and life.

New Business Opportunities in SEL Market

Here are some potential areas of opportunity in the SEL market:

- SEL Curriculum Development: High-quality SEL curricula that can be seamlessly incorporated into current educational programs and are in line with national standards are needed. SEL courses will be in high demand, and companies that can create and promote them will find success.

- Professional Development: Professional development programs that can assist educators in integrating social and emotional learning into their teaching practices are needed as more educators become aware of its significance. Businesses that can offer educators useful and interesting chances for professional development will be well-positioned to be successful in the SEL market.

- Digital Products and Services: The SEL market is increasingly incorporating digital tools and resources, such as games, simulations, and educational technology platforms. Companies that can develop innovative and effective digital products and services that support social and emotional learning will be in high demand.

- Assessment and Data Analytics: There is a need for reliable and valid assessments of social and emotional skills, as well as data analytics tools that can help educators and learners track progress and identify areas for improvement. Companies that can provide effective assessments and data analytics tools for the SEL market will be in high demand.

- Consulting and Coaching: As more organizations recognize the importance of social and emotional skills in the workplace, there is a need for consulting and coaching services that can help employees develop these skills. Companies that can provide effective coaching and consulting services in the SEL domain will be well-positioned to succeed in the market.

Overall, there are many new business opportunities in the SEL market, and companies that can provide high-quality products and services that support social and emotional learning will be well-positioned to succeed.

Growth Drivers for SEL Business from Macro to Micro

There are several growth drivers for the SEL business, ranging from macro-level factors to micro-level factors. Here are some examples:

Macro-Level Drivers:

- Growing awareness of the importance of social and emotional skills in education and the workplace.

- Increasing emphasis on the whole-child approach to education, which includes social and emotional learning.

- Rising demand for mental health services and the need for preventative measures to promote mental wellness.

- Increased interest in AI and ML technologies that can recognize and respond to human emotions.

Meso-Level Drivers:

- Increased funding for SEL programs from government agencies, private foundations, and corporations.

- Growing adoption of evidence based SEL programs in schools, healthcare, and the workplace.

- The emergence of SEL-specific software and tools for educators, employers, and mental health professionals.

- Increased collaboration between stakeholders in the education, healthcare, and technology sectors to promote SEL.

Micro-Level Drivers:

- Growing demand for SEL curricula and resources by educators and parents.

- Increasing recognition of the importance of social and emotional skills in hiring and employee development.

- The need for mental health professionals to use evidence based SEL interventions in their practice.

- The emergence of SEL-specific job titles and roles in organizations, such as SEL coordinators and managers.

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Social and Emotional Learning Market