Solar Photovoltaic Glass Market by Type (AR-Coated, Tempered, TCO-Coated), Application, End User (Crystalline Silicon PV Module, Thin Film Module, Perovskite Module), Installation Technology & Region - Global Forecast to 2027

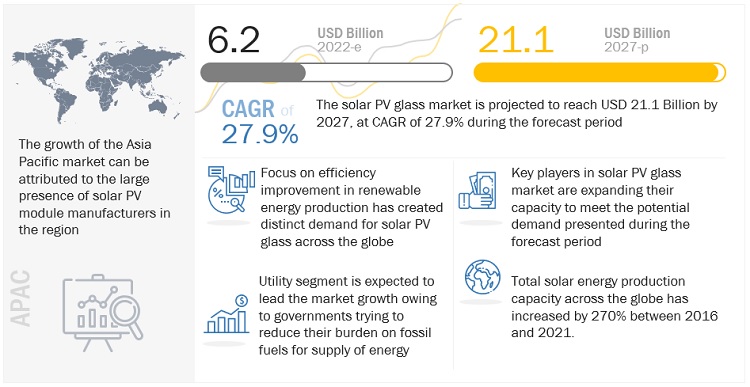

The Solar Photovoltaic Glass Market is projected to reach USD 21.1 billion by 2027, at a cagr 27.9%. The rising demand for clean and renewable energy is the key driving factor behind the growth of solar photovoltaic (PV) modules and in turn solar PV glass.

Attractive Opportunities in the Solar PV Glass Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Solar Photovoltaic Glass Market Dynamics

Driver: Supportive policies and initiatives of various governments for solar PV plant installations to promote renewable energy generation

The support provided by governments across the globe is the key driver behind the growth of solar-energy systems and related products. These governments are constantly working toward formulating improved policies related to generous feed-in-tariff and solar rebate certificates to provide grid connection convenience and financial support to various photovoltaic projects. Countries, such as Germany, China, India, and the US, are aggressively promoting the use of solar energy. The US Department of Energy, for instance, launched a 26% tax credit system for homeowners that have installed solar PV systems in the past two years. The government also passed an extension of the Investment Tax Credit (ITC), raising it to 30% for installations that would be done in the next decade.

Similarly, in China, the budget for renewable energy rebates was increased to USD 840 million for 2021, of which about 55% was allocated to the solar power industry. In India, on the flipside, the government has planned large capacity additions in solar power generation, reaching about 300 GW of energy by 2030, from the existing 49.6 GW production in 2021. Similar initiatives are being taken by almost every national government, which are expected to drive the demand for solar PV modules, and in turn, solar PV glass.

Restraint: Fluctuations in raw material prices

The manufacturers of solar PV glass are facing immense competition for profit margins due to this volatility of the prices of raw materials and chemicals. According to the Trading Economies website, the prices of soda ash went from USD 175/ton up to USD 525/ton between January 2021 to November 2021. Similarly, the prices of silicon has climbed up to USD 4,000/ton in Q4 of 2021, as compared to USD 2,000/ton in the same quarter of 2020. Such fluctuations affect the profit margins of the company.

Countries such as India, which are key manufacturing destinations of glass, are facing acute shortage of fuels for energy generation. The shortage of fuels in these countries has led glass manufacturers to reduce their production quantities to survive extensive competition in the market, thereby impacting the final quantity of the glass produced across the globe.

Opportunity: Decreasing costs of solar systems and energy storage devices

The prices of solar systems and photovoltaic products, such as modules, glass, and mirrors have been continuously decreasing over the past few years. The installation costs of these systems are undoubtedly higher than the conventional alternatives. However, once installed, these systems require very less maintenance and incur low operational costs. A large number of players are present in the PV market. These players are constantly launching innovative and efficient products at competitive prices. This has resulted in a decline in the prices of photovoltaic products. Other factors that are leading to the drop in the prices of photovoltaic/solar systems include decreasing prices of raw materials, government subsidies, and large-scale production of photovoltaic/solar systems.

Challenges: Low availability of high-quality solar PV glass

With high transportation costs, there is a need for fresh glass, that is, the glass that is produced in the vicinity of the manufacturers of solar PV modules. Quality differentiation is highly important for crystalline silicon modules as they require high-quality solar PV glass while for thin film modules, low-grade float glass can be used.

For most glass companies, the solar glass segment is only a very small part of their businesses. At the current production levels, it is difficult for these manufacturers to have dedicated solar float lines. Typical glass lines produce glass of different thicknesses and grades. Requirements of large stocks of glass to achieve economies of scale and long duration of set-up times make the production of solar PV glass often inefficient. Hence, traditional manufacturers of glass are more focused on manufacturing automotive and construction glass than solar PV glass.

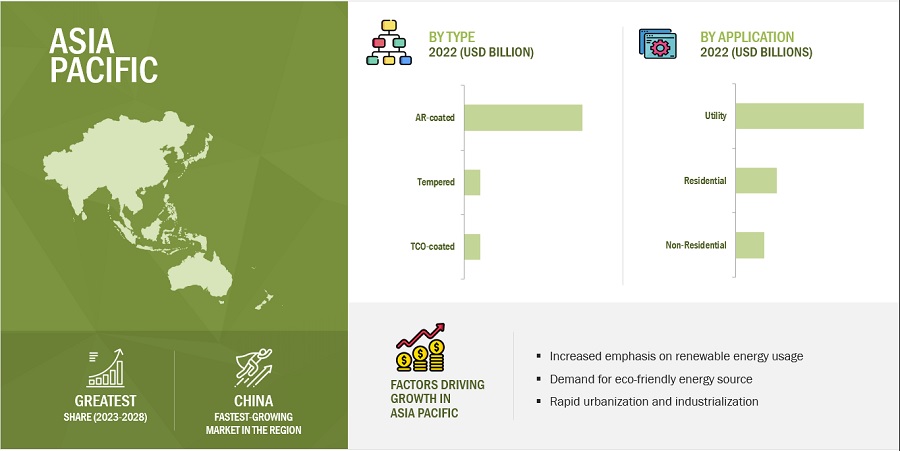

Higher efficiency of AR-coated solar PV glass resulting in its dominance in the market

Based on the type, the AR-coated solar PV glass segment is estimated to hold the lion’s share in the market. Antireflective coating applied on the glass enables transmittance of light instead of reflecting, thus enabling a larger amount of sunlight to pass to the solar cell. It also reduces the glare produced, allowing panels to blend more easily in sensitive surroundings such as near airports. As these AR-coated glasses provide higher efficiency, their demand is expected to remain dominant during the forecast period. On the other hand, transparent conductive oxide-coated (TCO-coated) glass has low sheet resistance, high transmission, and provides adjustable haze, making them suitable for thin-film type of PV modules. As these modules are slowly gaining popularity, the demand for TCO-coated glass is also expected to inflate during the forecast period.

Initiatives by various governments pushing the growth of the utility segment

Based on the application, the utility segment is having the highest market share. The dominance of this segment is owing to the initiatives by the governments to set up large solar farms. These initiatives are taken for increasing the share of renewable energy and reducing their contribution towards carbon emissions. For instance, the International Energy Agency estimates that the total solar energy produced across the globe has increased by 270% between 2016 to 2021. On the other hand, commercial buildings such as hospitals, malls, and industrial hubs are setting up solar cells in order to meet their day-to-day demand for energy with the added benefit of low cost. Even large conglomerates are setting up solar farms in order to meet their CSR targets, leading to an unprecedented growth of the non-residential segment.

By end-user, the crystalline silicon PV module segment is expected to be the most significant contributor in the solar PV Glass market.

Based on the end-user, the crystalline silicon PV module segment is expected to account for the largest share of the market in 2022. The growth in this segment is owing to large-scale adoption of these modules in utility solar farms. Because of its well-organized structure, the silicon lattice can more efficiently convert light into energy. Moreover, silicon is an abundant semiconductor and is generally harmless, making them suitable for manufacturing of large scale solar cells. On the flipside, perovskite modules are a relatively new technology with high efficiency than traditional modules. Owing to this, their growth is expected to be the fastest during the forecast period.

By installation, pattern glass technology held the largest share in the global market

Based on installation, pattern glass technology is the largest segment in the solar PV glass market. Patterned glass allows direction of light onto the cells in a controlled manner thus improving the efficiency of these solar systems. They also provide better optical and appearance performance. Furthermore, they also provide a logistical advantage owing to their small size which results in lower total cost.

Concentration of PV module manufacturing in Asia Pacific resulting in the region’s dominance in solar PV glass market

Asia Pacific is the largest and the second-fastest-growing solar PV glass market, in terms of volume, owing to large scale consumption of glass by solar module manufacturers located in Asia, especially in China. According to International Energy Agency, more than 90% of the solar module manufacturing is done in Asia Pacific, with China accounting for 74% of the global module manufacturing. Furthermore, the governments in the region have provided financial support and tax benefits to their industries which generate and use solar energy for their operations. These factors are expected to fuel the demand for solar PV glass in the region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Solar Photovoltaic Glass Market Players

The major vendors in the solar PV glass market include Xinyi Solar Holdings Ltd. (China), IRICO Group New Energy Co., Ltd. (China), Flat Glass Group Co., Ltd (China), Qingdao Jinxin Glass Co., Ltd. (China), Dongguan CSG Solar Glass Co., Ltd. (China), AGC Solar (Japan), Nippon Sheet Glass Co., Ltd. (Japan), Taiwan Glass Ind. Corp. (Taiwan), Saint-Gobain (France), Borosil Renewables Ltd. (India), and Guardian Glass (US).

The key companies are undertaking capacity expansion and acquisition strategies to improve their share in this market. Companies including Saint Gobain, Nippon Sheet Glass Co., Ltd., Borosil Renewables Ltd. and AGC Solar have adopted various strategies, including expansion, agreements, and acquisitions between 2018 and 2022.

Solar Photovoltaic Glass Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 6.2 Billion |

|

Revenue Forecast in 2027 |

USD 21.1 Billion |

|

CAGR |

27.9% |

|

Market Size Available for Years |

2019–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/USD Billion), Volume (Million Square Meter) |

|

Segments Covered |

By application, by type, by end-user, by installation |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Xinyi Solar Holdings Ltd. (China), IRICO Group New Energy Co., Ltd. (China), Flat Glass Group Co., Ltd (China), Qingdao Jinxin Glass Co., Ltd. (China), Dongguan CSG Solar Glass Co., Ltd. (China), AGC Solar (Japan), Nippon Sheet Glass Co., Ltd. (Japan), Taiwan Glass Ind. Corp. (Taiwan), Sisecam Flat Glass (Turkey), Saint-Gobain (France), Borosil Renewables Ltd. (India), Hainan Development Holdings Nanhai Co., Ltd. (China) Guardian Glass (US), Hecker Glastechnik Gmbh & Co. Kg (Germany), Onyx Solar Group LLC (Spain), and Targray (Canada) |

This research report categorizes the microcapsule market based on application, type, end-user, installation and region.

Based on application, the solar photovoltaic glass market has been segmented as follows:

- Residential

- Non-Residential

- Utility

Based on type, the solar photovoltaic glass market has been segmented as follows:

- AR Coated Solar PV Glass

- Tempered Solar PV Glass

- TCO Coated Solar PV Glass

- Others

Based on end-user, the solar photovoltaic glass market has been segmented as follows:

- Crystalline Silicon PV Module

- Thin Film PV Module

- Perovskite Module

Based on installation, the solar photovoltaic glass market has been segmented as follows:

- Float Glass Technology

- Patterned Glass Technology

Based on regions, the solar photovoltaic glass market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In August 2022, Nippon Sheet Glass Co., Ltd. announced an investment for construction of a new production site in Malaysia. The new site will improve the production capacity of the company for TCO-coated solar PV glass.

- In April 2021, Borosil Renewables Ltd. announced the acquisition of two solar glass companies, Interfloat Corporation and Glasmanfaktur Brandenburg (GMB). The acquisition was made to strengthen the company’s supply chain across Europe.

Frequently Asked Questions (FAQ):

What is solar PV glass? What are its applications?

Solar PV glasses are those glasses that are added with special additives that help convert solar energy into electrical energy. These glasses are dominantly used in the manufacturing of solar PV modules, while new technology developed enables its usage directly in windows, facades, and shingles of residential and commercial buildings.

Who are the major players involved in this market?

Xinyi Solar Holdings Ltd. (China), IRICO Group New Energy Co., Ltd. (China), Flat Glass Group Co., Ltd (China), Qingdao Jinxin Glass Co., Ltd. (China), Dongguan CSG Solar Glass Co., Ltd. (China), AGC Solar (Japan), Nippon Sheet Glass Co., Ltd. (Japan), Taiwan Glass Ind. Corp. (Taiwan), Saint-Gobain (France), Borosil Renewables Ltd. (India), and Guardian Glass (US). are the major manufacturers in the solar PV glass market.

What is the biggest challenge to the growth of the solar PV glass market?

Fluctuations in raw material prices is the biggest challenge to the growth of the solar PV glass market

Which region is likely to support solar PV glass market growth? Why?

Asia Pacific region will be supporting the growth of the solar PV glass market, owing to concentrated presence of solar PV module manufacturers in the region. Also, the conducive government policies for installation of solar panels is expected to be a key reason behind the growth of the market.

Which application leads the growth of the solar PV glass market?

The utility segment would assist the growth of the solar PV glass market.

Which type accounts for the major share of the solar PV glass market?

The AR-coated segment accounted for the largest share of the solar PV glass market, owing to the higher efficiency and space versatility provided by these glasses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 SOLAR PV GLASS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 2 SOLAR PV GLASS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 3 SOLAR PV GLASS MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

TABLE 4 SOLAR PV GLASS MARKET, BY INSTALLATION: INCLUSIONS & EXCLUSIONS

TABLE 5 SOLAR PV GLASS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 SOLAR PV GLASS MARKET SEGMENTATION

1.4.1 REGIONAL SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 SOLAR PV GLASS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.4 Participating companies for primary research

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH 1

2.2.2 SUPPLY-SIDE APPROACH 2

2.2.3 DEMAND-SIDE APPROACH 1

2.3 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 SOLAR PV GLASS MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 7 AR-COATED TO BE LEADING SOLAR PV GLASS TYPE

FIGURE 8 UTILITY APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 9 PATTERN GLASS TECHNOLOGY TO ACCOUNT FOR HIGHER MARKET SHARE

FIGURE 10 ASIA PACIFIC DOMINATED SOLAR PV GLASS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLAR PV GLASS MARKET

FIGURE 11 FOCUS ON RENEWABLE ENERGY GENERATION TO DRIVE MARKET

4.2 SOLAR PV GLASS MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO BE LARGEST MARKET BETWEEN 2022 AND 2027

4.3 ASIA PACIFIC SOLAR PV GLASS MARKET, BY COUNTRY AND APPLICATION, 2021

FIGURE 13 CHINA AND UTILITY SEGMENTS ACCOUNTED FOR LARGEST SHARES

4.4 SOLAR PV GLASS MARKET: BY MAJOR COUNTRIES

FIGURE 14 MEXICO TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SOLAR PV GLASS MARKET

5.2.1 DRIVERS

5.2.1.1 Supportive policies and initiatives of various governments for solar PV plant installations to promote renewable energy generation

5.2.1.2 Increasing demand for solar systems in non-utility applications

5.2.2 RESTRAINTS

5.2.2.1 High costs involved in purchase, installation, and storage of power conversion devices

5.2.2.2 Fluctuations in raw material prices

5.2.2.3 Implementation of various stringent regulations for carbon dioxide emissions

5.2.3 OPPORTUNITIES

5.2.3.1 Decreasing costs of solar systems and energy storage devices

5.2.3.2 Increasing prices of fossil fuels

5.2.4 CHALLENGES

5.2.4.1 Energy-efficient manufacturing processes for glass industry

5.2.4.2 Low availability of high-quality solar PV glass

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 SOLAR PV GLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 6 PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS (Page No. - 68)

6.1 VALUE CHAIN ANALYSIS

FIGURE 17 SOLAR PV GLASS MARKET: VALUE CHAIN ANALYSIS

6.2 SOLAR PV GLASS MARKET: ECOSYSTEM

FIGURE 18 SOLAR PV GLASS MARKET: ECOSYSTEM MAP

TABLE 7 SOLAR PV GLASS MARKET: ECOSYSTEM

6.3 REGULATORY LANDSCAPE

6.3.1 STANDARDS FOR SOLAR PV GLASS

6.4 TECHNOLOGY ANALYSIS

6.4.1 TRANSPARENT SOLAR ENERGY-PV GLASS

6.4.2 NEW TECHNOLOGY FOR SOLAR WINDOWS: PHOTOVOLTACHROMICS

6.5 CASE STUDY ANALYSIS

6.5.1 COMPARATIVE STUDY OF ENERGY SAVINGS IN TWO COMMERCIAL BUILDINGS USING SOLAR WINDOW FILMS

6.5.1.1 Objective

6.5.1.2 Solution statement

6.5.2 POLYSOLAR'S CASE STUDY OF SWIMMING POOL SOLARIUM

6.5.2.1 Objective

6.5.2.2 Solution statement

6.6 IMPACT OF TRENDS/DISRUPTIONS

FIGURE 19 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR SOLAR PV GLASS MARKET

6.7 AVERAGE SELLING PRICE ANALYSIS

FIGURE 20 AVERAGE SELLING PRICE OF SOLAR PV GLASS, BY REGION (USD/SQUARE METER)

TABLE 8 AVERAGE PRICE OF SOLAR PV GLASS, BY REGION (USD/SQUARE METER)

TABLE 9 AVERAGE PRICE OF SOLAR PV GLASS, BY TYPE (USD/SQUARE METER)

TABLE 10 AVERAGE PRICE OF SOLAR PV GLASS, BY APPLICATION (USD/SQUARE METER)

TABLE 11 AVERAGE PRICE OF SOLAR PV GLASS, BY INSTALLATION (USD/SQUARE METER)

6.8 PRODUCTION CAPACITIES OF KEY COMPANIES

TABLE 12 SOLAR PV GLASS PRODUCTION CAPACITY SOLAR PV GLASS, BY COMPANY (TONS/DAY)

6.9 PATENT ANALYSIS

6.9.1 METHODOLOGY

6.9.2 PATENT PUBLICATION TRENDS

FIGURE 21 NUMBER OF PATENTS YEAR-WISE DURING LAST 10 YEARS

6.9.3 INSIGHTS

6.9.4 JURISDICTION ANALYSIS

FIGURE 22 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

6.9.5 TOP PATENT APPLICANTS

FIGURE 23 TOP 10 PATENT APPLICANTS

6.9.5.1 List of major patents

6.10 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 13 SOLAR PV GLASS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

7 SOLAR PV GLASS MARKET, BY TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 24 SOLAR PV GLASS MARKET, BY TYPE, 2022 & 2027 (USD MILLION)

TABLE 14 SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 15 SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 16 SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 17 SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 AR-COATED SOLAR PV GLASS

TABLE 18 AR-COATED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 19 AR-COATED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (MILLION SQ. METERS)

TABLE 20 AR-COATED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 AR-COATED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 TEMPERED SOLAR PV GLASS

TABLE 22 TEMPERED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 23 TEMPERED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (MILLION SQ. METERS)

TABLE 24 TEMPERED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 TEMPERED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 TCO-COATED SOLAR PV GLASS

TABLE 26 TCO-COATED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 27 TCO-COATED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (MILLION SQ. METERS)

TABLE 28 TCO-COATED SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 TCO-COATED SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHERS

TABLE 30 OTHER SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 31 OTHER SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (MILLION SQ. METERS)

TABLE 32 OTHER SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 OTHER SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SOLAR PV GLASS MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 25 SOLAR PV GLASS MARKET, BY APPLICATION, 2022 & 2027 (USD MILLION)

TABLE 34 SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 36 SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 37 SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

8.2 RESIDENTIAL

TABLE 38 SOLAR PV GLASS MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 SOLAR PV GLASS MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 SOLAR PV GLASS MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 41 SOLAR PV GLASS MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2022–2027 (MILLION SQ. METERS)

8.3 NON-RESIDENTIAL

TABLE 42 SOLAR PV GLASS MARKET IN NON-RESIDENTIAL APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 SOLAR PV GLASS MARKET IN NON-RESIDENTIAL APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 SOLAR PV GLASS MARKET IN NON-RESIDENTIAL APPLICATION, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 45 SOLAR PV GLASS MARKET IN NON-RESIDENTIAL APPLICATION, BY REGION, 2022–2027 (MILLION SQ. METERS)

8.4 UTILITY

TABLE 46 SOLAR PV GLASS MARKET IN UTILITY APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 SOLAR PV GLASS MARKET IN UTILITY APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 48 SOLAR PV GLASS MARKET IN UTILITY APPLICATION, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 49 SOLAR PV GLASS MARKET IN UTILITY APPLICATION, BY REGION, 2022–2027 (MILLION SQ. METERS)

9 SOLAR PV GLASS MARKET, BY END USER (Page No. - 97)

9.1 INTRODUCTION

FIGURE 26 SOLAR PV GLASS MARKET, BY END USER, 2022 & 2027 (MILLION SQ. METERS)

TABLE 50 SOLAR PV GLASS MARKET, BY END USER, 2018–2021 (MILLION SQ. METERS)

TABLE 51 SOLAR PV GLASS MARKET, BY END USER, 2022–2027 (MILLION SQ. METERS)

9.2 CRYSTALLINE SILICON PV MODULE

9.3 THIN FILM PV MODULE

9.4 PEROVSKITE MODULE

10 SOLAR PV GLASS MARKET, BY INSTALLATION (Page No. - 101)

FIGURE 27 SOLAR PV GLASS MARKET, BY INSTALLATION, 2022 & 2027 (USD MILLION)

TABLE 52 SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 53 SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 54 SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 55 SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

10.1 FLOAT GLASS TECHNOLOGY

TABLE 56 SOLAR PV GLASS MARKET IN FLOAT GLASS TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 SOLAR PV GLASS MARKET IN FLOAT GLASS TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 SOLAR PV GLASS MARKET IN FLOAT GLASS TECHNOLOGY, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 59 SOLAR PV GLASS MARKET IN FLOAT GLASS TECHNOLOGY, BY REGION, 2022–2027 (MILLION SQ. METERS)

10.2 PATTERN GLASS TECHNOLOGY

TABLE 60 SOLAR PV GLASS MARKET IN PATTERN GLASS TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 SOLAR PV GLASS MARKET IN PATTERN GLASS TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 SOLAR PV GLASS MARKET IN PATTERN GLASS TECHNOLOGY, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 63 SOLAR PV GLASS MARKET IN PATTERN GLASS TECHNOLOGY, BY REGION, 2022–2027 (MILLION SQ. METERS)

11 SOLAR PV GLASS MARKET, BY REGION (Page No. - 107)

11.1 INTRODUCTION

FIGURE 28 CHINA, US, AND INDIA EMERGING AS NEW HOTSPOTS IN SOLAR PV GLASS MARKET

TABLE 64 SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 SOLAR PV GLASS MARKET, BY REGION, 2018–2021 (MILLION SQ. METERS)

TABLE 67 SOLAR PV GLASS MARKET, BY REGION, 2022–2027 (MILLION SQ. METERS)

11.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC SOLAR PV GLASS MARKET SNAPSHOT

TABLE 68 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (MILLION SQ. METERS)

TABLE 69 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (MILLION SQ. METERS)

TABLE 70 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021(USD MILLION)

TABLE 71 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 73 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 74 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 79 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 80 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 81 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 82 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 83 ASIA PACIFIC: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

11.2.1 CHINA

TABLE 84 CHINA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 85 CHINA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 86 CHINA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 CHINA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 CHINA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 89 CHINA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.2 JAPAN

TABLE 90 JAPAN: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 91 JAPAN: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 92 JAPAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 93 JAPAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 JAPAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 95 JAPAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.3 INDIA

TABLE 96 INDIA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 97 INDIA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 98 INDIA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 INDIA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 100 INDIA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 101 INDIA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.4 SOUTH KOREA

TABLE 102 SOUTH KOREA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 103 SOUTH KOREA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 104 SOUTH KOREA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 105 SOUTH KOREA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 SOUTH KOREA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 107 SOUTH KOREA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.5 TAIWAN

TABLE 108 TAIWAN: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 109 TAIWAN: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 110 TAIWAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 TAIWAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 TAIWAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 113 TAIWAN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.6 VIETNAM

TABLE 114 VIETNAM: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 115 VIETNAM: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 116 VIETNAM: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 VIETNAM: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 VIETNAM: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 119 VIETNAM: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.2.7 REST OF ASIA PACIFIC

TABLE 120 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 121 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 122 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 125 REST OF ASIA PACIFIC: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.3 NORTH AMERICA

FIGURE 30 NORTH AMERICA SOLAR PV GLASS MARKET SNAPSHOT

TABLE 126 NORTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (MILLION SQ. METERS)

TABLE 127 NORTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (MILLION SQ. METERS)

TABLE 128 NORTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 129 NORTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 131 NORTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 132 NORTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 133 NORTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 134 NORTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 135 NORTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 136 NORTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 137 NORTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 NORTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 139 NORTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

TABLE 140 NORTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 141 NORTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

11.3.1 US

TABLE 142 US: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 143 US: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 144 US: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 145 US: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 146 US: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 147 US: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.2 CANADA

TABLE 148 CANADA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 149 CANADA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 150 CANADA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 151 CANADA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 152 CANADA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 153 CANADA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.3 MEXICO

TABLE 154 MEXICO: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 155 MEXICO: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 156 MEXICO: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 157 MEXICO: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 158 MEXICO: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 159 MEXICO: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4 EUROPE

FIGURE 31 EUROPE SOLAR PV GLASS MARKET SNAPSHOT

TABLE 160 EUROPE: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (MILLION SQ. METERS)

TABLE 161 EUROPE: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (MILLION SQ. METERS)

TABLE 162 EUROPE: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 163 EUROPE: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 164 EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 165 EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 166 EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 167 EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 168 EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METER)

TABLE 169 EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METER)

TABLE 170 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 171 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

TABLE 172 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 173 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

TABLE 174 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 175 EUROPE: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

11.4.1 GERMANY

TABLE 176 GERMANY: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 177 GERMANY: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 178 GERMANY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 179 GERMANY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 GERMANY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 181 GERMANY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.4.2 FRANCE

TABLE 182 FRANCE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 183 FRANCE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 184 FRANCE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 185 FRANCE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 186 FRANCE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 187 FRANCE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.3 UK

TABLE 188 UK: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 189 UK: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 190 UK: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 191 UK: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 192 UK: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 193 UK: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.4 ITALY

TABLE 194 ITALY: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 195 ITALY: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 196 ITALY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 197 ITALY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 198 ITALY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 199 ITALY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.5 SPAIN

TABLE 200 SPAIN: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 201 SPAIN: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 202 SPAIN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 203 SPAIN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 204 SPAIN: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 205 SPAIN: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.6 NETHERLANDS

TABLE 206 NETHERLANDS: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 207 NETHERLANDS: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 208 NETHERLANDS: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 209 NETHERLANDS: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 210 NETHERLANDS: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 211 NETHERLANDS: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 212 REST OF EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 213 REST OF EUROPE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 214 REST OF EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 215 REST OF EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 216 REST OF EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 217 REST OF EUROPE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 218 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (MILLION SQ. METERS)

TABLE 219 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (MILLION SQ. METERS)

TABLE 220 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 221 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 222 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 223 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 224 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 225 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 227 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 228 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 229 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 230 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 231 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

TABLE 232 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 233 SOUTH AMERICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

TABLE 234 BRAZIL: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 235 BRAZIL: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 236 BRAZIL: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 237 BRAZIL: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 BRAZIL: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 239 BRAZIL: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.5.2 CHILE

TABLE 240 CHILE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 241 CHILE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 242 CHILE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 243 CHILE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 244 CHILE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 245 CHILE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.5.3 REST OF SOUTH AMERICA

TABLE 246 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 247 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 248 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 249 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 250 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 251 REST OF SOUTH AMERICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.6 MIDDLE EAST & AFRICA

TABLE 252 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (MILLION SQ. METERS)

TABLE 253 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (MILLION SQ. METERS)

TABLE 254 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 255 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 256 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 257 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 258 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 259 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 260 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 261 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 262 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 263 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

TABLE 264 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (MILLION SQ. METERS)

TABLE 265 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (MILLION SQ. METERS)

TABLE 266 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

TABLE 267 MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

11.6.1 TURKEY

TABLE 268 TURKEY: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 269 TURKEY: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 270 TURKEY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 271 TURKEY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 272 TURKEY: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 273 TURKEY: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.6.2 SOUTH AFRICA

TABLE 274 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 275 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 276 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 277 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 278 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 279 SOUTH AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.6.3 ISRAEL

TABLE 280 ISRAEL: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 281 ISRAEL: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 282 ISRAEL: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 283 ISRAEL: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 284 ISRAEL: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 285 ISRAEL: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.6.4 UAE

TABLE 286 UAE: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 287 UAE: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 288 UAE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 289 UAE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 290 UAE: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 291 UAE: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

11.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 292 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2018–2021 (MILLION SQ. METERS)

TABLE 293 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY TYPE, 2022–2027 (MILLION SQ. METERS)

TABLE 294 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 295 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 296 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2018–2021 (MILLION SQ. METERS)

TABLE 297 REST OF REST OF MIDDLE EAST & AFRICA: SOLAR PV GLASS MARKET, BY APPLICATION, 2022–2027 (MILLION SQ. METERS)

12 COMPETITIVE LANDSCAPE (Page No. - 180)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 298 OVERVIEW OF STRATEGIES ADOPTED BY SOLAR PV GLASS MARKET MANUFACTURERS

12.3 MARKET SHARE ANALYSIS: SOLAR PV GLASS MARKET

FIGURE 32 MARKET SHARE: SOLAR PV GLASS

12.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN SOLAR PV GLASS MARKET

FIGURE 33 TOP PLAYERS – REVENUE ANALYSIS (2017–2021)

12.4 COMPETITIVE BENCHMARKING

12.4.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SOLAR PV GLASS MARKET

12.4.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SOLAR PV GLASS MARKET

TABLE 299 COMPANY BY APPLICATION FOOTPRINT

TABLE 300 COMPANY BY TYPE FOOTPRINT

TABLE 301 COMPANY REGION TYPE FOOTPRINT

12.5 COMPETITIVE LANDSCAPE MAPPING

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE COMPANIES

12.5.4 PARTICIPANTS

FIGURE 36 SOLAR PV GLASS MARKET: COMPETITIVE LANDSCAPE MAPPING

12.6 SME MATRIX

12.6.1 PROGRESSIVE COMPANIES

12.6.2 DYNAMIC COMPANIES

12.6.3 RESPONSIVE COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 37 SOLAR PV GLASS MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES

12.7 KEY START-UP/SMES

TABLE 302 SOLAR PV GLASS MARKET: DETAILED LIST OF KEY START-UP/SMES

TABLE 303 SOLAR PV GLASS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

13 COMPANY PROFILES (Page No. - 194)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 KEY PLAYERS

13.1.1 XINYI SOLAR HOLDINGS LTD.

TABLE 304 XINYI SOLAR HOLDINGS LTD.: COMPANY OVERVIEW

FIGURE 38 XINYI SOLAR HOLDINGS LTD.: COMPANY SNAPSHOT

13.1.2 IRICO GROUP NEW ENERGY CO., LTD.

TABLE 305 IRICO GROUP NEW ENERGY CO., LTD: COMPANY OVERVIEW

FIGURE 39 IRICO GROUP NEW ENERGY CO., LTD.: COMPANY SNAPSHOT

13.1.3 FLAT GLASS GROUP CO., LTD.

TABLE 306 FLAT GLASS GROUP CO., LTD.: COMPANY OVERVIEW

FIGURE 40 FLAT GLASS GROUP CO., LTD: COMPANY SNAPSHOT

13.1.4 QINGDAO JINXIN GLASS CO., LTD.

TABLE 307 QINGDAO JINXIN GLASS CO., LTD.: COMPANY OVERVIEW

13.1.5 DONGGUAN CSG SOLAR GLASS CO., LTD.

TABLE 308 DONGGUAN CSG SOLAR GLASS CO., LTD.: COMPANY OVERVIEW

13.1.6 HAINAN DEVELOPMENT HOLDINGS NANHAI CO., LTD.

TABLE 309 HAINAN DEVELOPMENT HOLDINGS NANHAI CO., LTD.: COMPANY OVERVIEW

FIGURE 41 HAINAN DEVELOPMENT HOLDINGS NANHAI CO., LTD.: COMPANY SNAPSHOT

13.1.7 AGC SOLAR

TABLE 310 AGC SOLAR: COMPANY OVERVIEW

FIGURE 42 AGC SOLAR: COMPANY SNAPSHOT

13.1.8 NIPPON SHEET GLASS CO., LTD.

TABLE 311 NIPPON SHEET GLASS CO., LTD.: COMPANY OVERVIEW

FIGURE 43 NIPPON SHEET GLASS CO., LTD: COMPANY SNAPSHOT

13.1.9 TAIWAN GLASS IND. CORP.

TABLE 312 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

FIGURE 44 TAIWAN GLASS IND. CORP.: COMPANY SNAPSHOT

13.1.10 SISECAM FLAT GLASS

TABLE 313 SISECAM FLAT GLASS: COMPANY OVERVIEW

FIGURE 45 SISECAM FLAT GLASS: COMPANY SNAPSHOT

13.1.11 SAINT-GOBAIN

TABLE 314 SAINT-GOBAIN: COMPANY OVERVIEW

FIGURE 46 SAINT-GOBAIN: COMPANY SNAPSHOT

13.1.12 BOROSIL RENEWABLES LTD.

TABLE 315 BOROSIL RENEWABLES LTD.: COMPANY OVERVIEW

FIGURE 47 BOROSIL RENEWABLES LTD.: COMPANY SNAPSHOT

13.1.13 GUARDIAN GLASS

TABLE 316 GUARDIAN GLASS.: COMPANY OVERVIEW

13.1.14 ONYX SOLAR GROUP LLC

TABLE 317 ONYX SOLAR GROUP LLC: COMPANY OVERVIEW

13.1.15 HECKER GLASTECHNIK GMBH & CO. KG

TABLE 318 HECKER GLASTECHNIK GMBH & CO. KG.: COMPANY OVERVIEW

13.1.16 TARGRAY

TABLE 319 TARGRAY COMPANY OVERVIEW

13.2 OTHERS

13.2.1 GRUPPOSTG

TABLE 320 GRUPPOSTG: COMPANY OVERVIEW

13.2.2 BRITE SOLAR

TABLE 321 BRITE SOLAR: COMPANY OVERVIEW

13.2.3 POLYSOLAR

TABLE 322 POLYSOLAR: COMPANY OVERVIEW

13.2.4 SHENZHEN TOPRAY SOLAR CO., LTD.

TABLE 323 SHENZHEN TOPRAY SOLAR CO., LTD.: COMPANY OVERVIEW

13.2.5 CHANGZHOU ALMADEN CO., LTD.

TABLE 324 CHANGZHOU ALMADEN CO., LTD.: COMPANY OVERVIEW

13.2.6 QINGDAO MIGO GLASS CO., LTD.

TABLE 325 QINGDAO MIGO GLASS CO., LTD.: COMPANY OVERVIEW

13.2.7 THERMOSOL GLASS

TABLE 326 THERMOSOL GLASS: COMPANY OVERVIEW

13.2.8 EUROGLAS

TABLE 327 EUROGLAS: COMPANY OVERVIEW

13.2.9 EMMVEE TOUGHENED GLASS PRIVATE LIMITED

TABLE 328 EMMVEE TOUGHENED GLASS PRIVATE LIMITED: COMPANY OVERVIEW

13.2.10 JINJING (GROUP) CO., LTD.

TABLE 329 JINJING (GROUP) CO., LTD.: COMPANY OVERVIEW

13.2.11 SUNARC TECHNOLOGY A/S

TABLE 330 SUNARC TECHNOLOGY A/S: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 230)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

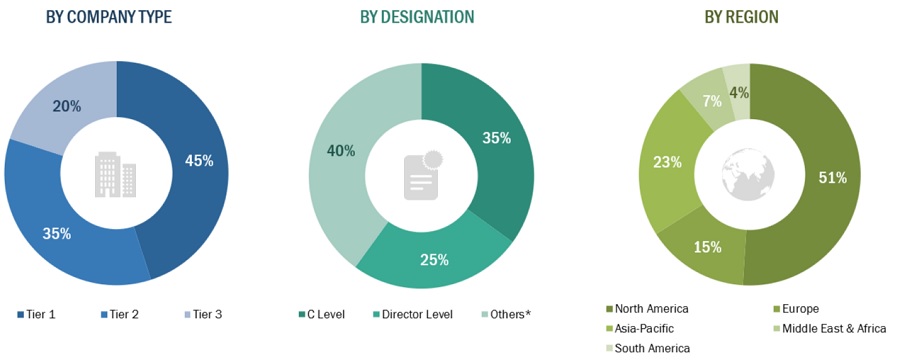

The study involved four major activities in estimating the current size of the solar photovoltaic glass market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the solar photovoltaic glass value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The solar photovoltaic glass market comprises several stakeholders, such as raw material suppliers & distributors, glass manufacturers, manufacturers/traders of solar PV glass, manufacturers of solar module, end-users, energy companies, energy grid-related organizations, government & research organizations, and association & industrial bodies in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the solar photovoltaic glass market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the solar photovoltaic glass market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

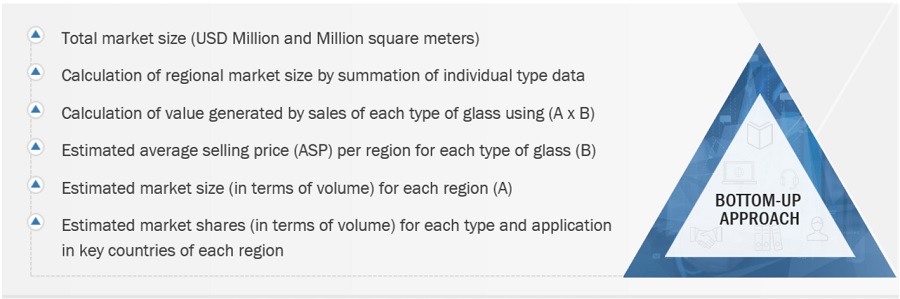

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the solar photovoltaic glass market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and market were identified through extensive secondary research

- The supply chain of the industry and the market size in terms of value and volume were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of key market players, along with extensive interviews for opinions from leaders, such as directors and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the solar photovoltaic (PV) glass market based on application, type, end-user, installation, and region

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the solar PV glass market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total solar PV glass market

- To analyze the opportunities in the solar PV glass market for the stakeholders and draw a competitive landscape of the market

- To forecast the market size, in terms of both volume and value, with respect to five main regions namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America, along with their respective key countries

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities in the solar PV glass market

- To strategically profile the key players in the solar PV glass market and comprehensively evaluate their current market shares

- To forecast the market size, in terms of both volume and value, with respect to five main regions namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America, along with their respective key countries

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities in the solar PV glass market

- To strategically profile the key players in the solar PV glass market and comprehensively evaluate their current market shares

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the solar PV glass market

- A further breakdown of a region of the solar PV glass market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solar Photovoltaic Glass Market