Solid State Battery Market by Type, Rechargeability, Capacity, Application (Consumer Electronics, Electric Vehicles, Energy Harvesting, Medical Devices, Packaging, Wireless Sensors) & Region - Global Forecast to 2028

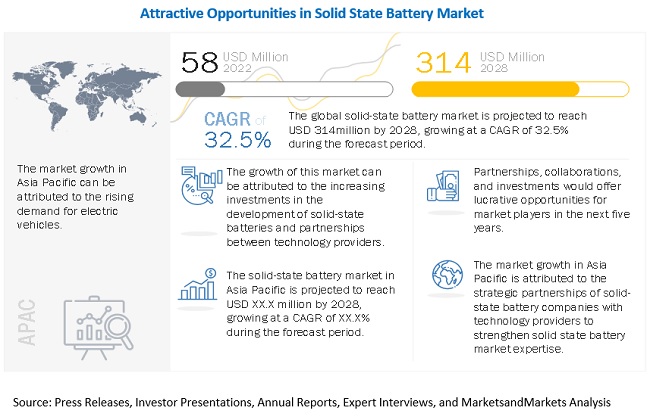

The solid state battery market report share is estimated to be USD 58 million in 2022 and expected to reach USD 314 million by 2028, at a CAGR of 32.5% from 2022 to 2028.

Increasing research & development activities related to solid-state batteries, ongoing miniaturization of electronic devices, and longer shelf life offerd by solid-state batteries are some of the major factors driving the solid state battery industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Solid State Battery Market Segment Overview:

Solid state battery market for primary batteries accounted for the largest share in 2021

Primary or single-use solid-state batteries are non-rechargeable batteries that are discarded once used.

These batteries are inbuilt in devices where recharging the battery is not possible or not feasible—for instance, in pacemakers and smart meters.

Also, these batteries are disposable and less hazardous as they do not contain cadmium, lead, and mercury, which are hazardous not only to the environment but also to human health. Primary solid-state batteries are mainly used in RFID tags, smart sensors, medical patches, cosmetic patches, and entertainment applications since these products or applications do not require high power and batteries with a long lifespan. They are suitable for long-term applications including metering, tracking, electronic toll collection, and the Internet of Things (IoT) as they last for up to five to twenty years.Primary solid-state batteries are witnessing increasing applications in areas such as smart packaging, smart cards, biomedical implants, and medical and cosmetic patches, as they have a low self-discharge time compared to rechargeable solid-state batteries. The sensors in applications such as smart packaging and medical and cosmetic patches require a disposable single-use power source. These batteries are manufactured using either thin-film deposition or printing technology, making them suitable for miniaturized devices.

Solid state battery market for electric vehicles to register highest CAGR during the forecast period

The electric vehicle (EV) is anticipated to be one of the major segments for the adoption of solid-state batteries.

Cost, safety, and driving range are a few of the major concerns associated with electric vehicles. Over the past few years, manufacturers have had to work with the restraints of the conventional battery composed of liquid- or gel-based electrolytes that overheat and cause explosions. Moreover, the liquid electrolyte in a battery requires many layers of packaging, which adds to the size and weight of the battery. Anticipating the tremendous growth of electric vehicles in the coming years, several major companies are developing solid-state batteries to address the current problems of the market. Solid-state batteries are designed primarily with solid electrolytes instead of the conventional liquid-based electrolytes, which eliminates overheating and the need for multiple packaging, making the battery safe and lightweight and compact. Moreover, the solid-state battery is cost-effective and claims to improve the power density, performs well under high temperatures, and lasts longer over a single charge.

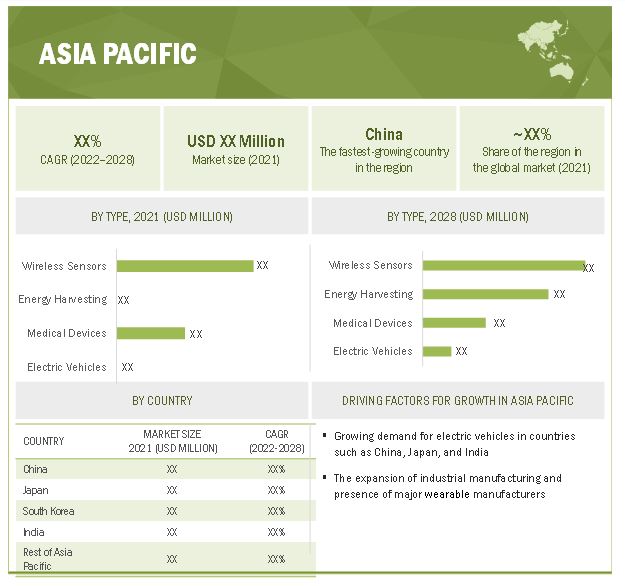

Asia Pacific to dominate the solid state battery market

Increasing demand for IoT and consumer electronics in countries such as China, Japan, and South Korea are expected to drive the growth of the region significantly and pose huge potential for the solid-state battery market.

The presence developing economies that are witnessing high economic growth, such as China and India, and a number of consumer electronics and wearable devices manufacturers, such as Panasonic (Japan), Sony (Japan, Samsung (South Korea), and LG Electronics (South Korea).

To know about the assumptions considered for the study, download the pdf brochure

Top Key Market Players in Solid State Battery Market

Major vendors in the Solid State Battery Companies include

- Cymbet (US),

- Robert Bosch (Germany),

- Toyota Motor (Japan),

- Solid Power (US),

- Excellatron Solid State (US), and

- BrightVolt (US)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Solid State Battery Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 58 Million |

| Projected Market Size | USD 314 Million |

| Growth Rate | CAGR of 32.5% |

|

Market size available for years |

2022–2028 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Ongoing Miniaturization Of Electronic Devices |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Primary Batteries Segment |

| Highest CAGR Segment | Electric vehicle (EV) Segment |

Solid State Battery Market Market Dynamics:

Driver: Ongoing Miniaturization Of Electronic Devices

The growing trend of miniaturization of devices such as mobile phones, watches, and medical devices has led to an increase in demand for compact electronic systems and devices; however, several times.

It becomes difficult for the designers to develop miniaturized products owing to the size of batteries. A major portion of any system is occupied by its battery, which is the main reason for its increased size. This has led to a rise in demand for solid-state batteries as they enable the miniaturization and portability of systems. These batteries are flexible and thin, and hence, can be fitted in any small-sized electronic device.

Restraints:Complex Manufacturing Process Of Solid-State Batteries

Manufacturing processes and methods for developing solid-state batteries are complex. These batteries need proper manufacturing tools for the highly precise deposition of materials during their development.

Solid-state batteries are developed by sequentially placing electrodes, which are separated by solid electrolytes. These solid electrolytes need to be non-porous and capable of preventing dendrite formation between electrodes. A gap between electrolytes in solid-state batteries can cause short circuits, thereby making these batteries electrochemically useless. Moreover, the use of solid electrolytes is also important as they enable the flow of ions; low conductivity can result in slow charge and discharge time, thereby leading to low power output. Therefore, the manufacturers of solid-state batteries require to continuously focus on research and development activities related to these batteries to scrutinize the complexity of the manufacturing process of solid-state batteries.

Opportunities: Increasing Investments And Partnerships By Solid-State Battery Companies And Automobile Manufacturers

Solid-state batteries are being increasingly used in consumer electronics, electric vehicles, energy harvesting, and medical devices applications.

Significant adoption of solid-state batteries in these applications can be attributed to the benefits offered by solid-state batteries over conventional lithium-ion batteries such as high energy density, long shelf life, and fast charging capacity. The leading players in the solid-state battery market are focusing on commercializing solid-state batteries. Several companies globally are investing in battery manufacturing firms as a part of their growth strategies owing to the increasing demand for solid-state batteries.

The investments by companies are expected to give a boost to research and development activities related to solid-state batteries and their manufacturing. Automotive companies are increasingly investing and partnering with companies manufacturing solid-state batteries.

Challenges: Manufacturing Cost-Efficient Solid-State Batteries

Solid-state batteries are generally more expensive than conventional batteries. The manufacturing process of these batteries requires complex equipment.

The cost of the fabrication of cells used in these batteries is also high. The cost of materials used for the development of these batteries is an important parameter while selecting them. Battery manufacturers find it difficult to obtain highly efficient electrodes at low costs.

Thus, the high costs of materials used for the development of solid-state batteries increase their overall costs. Hence, the integration of these batteries in consumer electronics, wearable devices, etc., is not viable. However, manufacturers are trying to come up with new methods and tools to overcome the cost barriers by carrying out continuous and intensive research in this regard. Nickel is a vital metal for batteries since it stores more energy and reduces the demand for cobalt, which is more expensive. Several battery manufacturers and researchers are focusing to cut down the cost by reinventing nickel-metal cathodes.

Solid State Battery Market Market Categorization:

This report categorizes the global solid state battery market based on Type, Capacity, Rechargeability, Application, And Region.

Market By Type:

- Single-cell Battery

- Multi-cell Battery

Market By Rechargeability:

- Primary Battery

- Secondary Battery

Market By Capacity:

- Below 20 mAh,

- Between 20 mAh and 500 mAh

- Above 500 mAh

Market By Application:

- Consumer Electronics

- Electric Vehicles

- Energy Harvesting

- Medical Devices

- Packaging

- Wireless Sensors

- Others

Market By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of APAC

-

Rest of the World

- South America

- Middle East and Africa

The Target Audience:

- Associations working on solid state batteries,

- Battery manufacturers,

- Battery technology providers,

- End users,

- Electric vehicle, consumer electronics, and other electrical device manufacturers,

- Investors,

- Research and development organizations,

- Raw chemical suppliers such as lithium, sulfur, and others.

Study answers several questions for the target audiences, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments

Recent Developments in Solid State Battery Industry

- In October2021, Solid Power, an industry-leading producer of solid-state batteries, partnered with SK Innovation to jointly produce all-solid-state batteries. SK Innovation commits to make USD 30 million investment in Solid Power through subscription to purchase a share in DCRC’s previously announced PIPE transaction.

- In May 2021, QuantumScape entered into an agreement with Volkswagen Group of America, Inc. to select the location of their joint-venture solid-state batteries pilot-line facility by the end of 2021. The pilot-line facility, QS-1, will initially be a 1-gigawatt hour (GWh) battery cell commercial production plant for electric vehicle batteries. The company intends to expand production capacity by 20 GWh at the same location.

- In March 2021, ProLogium entered into an agreement with Vinfast, Vietnam’s first national car brand. The two parties will set up the joint venture to produce an automotive solid-state battery pack for Vinfast’s EVs. The agreement will prioritize purchasing PLG’s SSB product and will be licensed to use PLG’s patented SSB pack assembly technology, MAB (Multi-axis Bipolar+), to produce CIM/CIP SSB pack locally in Vietnam.

- In September2020, ProLogium signed an agreement with Aichi Automobile (Japan) to jointly develop the company’s MAB solid battery pack and module technology. The agreement also focuses on the advanced smart battery full life cycle management system designed especially for the MAB battery pack. Further, the companies are jointly working on the production, technical, and capital sides of the solid-state batteries to promote and commercialize them.

Frequently Asked Questions (FAQ):

Which type of solid state battery would have the highest demand in the future?

Multi-cell battery would have the highest demand in the future as these batteries are designed to complement electric vehicles, energy harvesting and portable devices.

Which applications employ the most use of solid-state battery solutions?

Electric Vehicles, which is expected to further drive the solid-state battery market for the EV application in the coming years.

What are the opportunities and challenges pertaining to the solid state battery market?

Growing global demand for electric vehicles is one of the opportunities of solid-state battery and challenge is to manufacture cost-efficient solid-state batteries.

Who are the major players in solid state battery market?

Cymbet (US), Robert Bosch (Germany), Toyota Motor (Japan), Solid Power (US), Excellatron Solid State (US), and BrightVolt (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 SOLID STATE BATTERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share using bottom-up approach (demand side)

FIGURE 3 SOLID-STATE BATTERY MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market share by top-down analysis (supply side)

FIGURE 4 SOLID-STATE BATTERY MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET THROUGH SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 SOLID STATE BATTERY MARKET, 2017–2028 (USD MILLION)

FIGURE 9 SINGLE-CELL BATTERY SEGMENT HELD MAJORITY OF MARKET SHARE IN 2021

FIGURE 10 SECONDARY BATTERY SEGMENT TO WITNESS HIGHER CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 11 MEDICAL DEVICES CAPTURED LARGEST SHARE OF MARKET IN 2021

FIGURE 12 MARKET IN EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

3.1 COVID-19 IMPACT ON SOLID-STATE BATTERY MARKET

FIGURE 13 COMPARISON OF SCENARIO-BASED IMPACT OF COVID-19 ON MARKET, 2017–2028

3.1.1 REALISTIC SCENARIO

3.1.2 OPTIMISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ASIA PACIFIC TO PROVIDE LUCRATIVE OPPORTUNITIES FOR SOLID-STATE BATTERY MARKET

FIGURE 14 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

4.2 MARKET, BY TYPE (2017–2028)

FIGURE 15 MULTI-CELL BATTERIES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY RECHARGEABILITY

FIGURE 16 PRIMARY BATTERY SEGMENT HELD LARGER MARKET SHARE IN 2021

4.4 MARKET, BY CAPACITY

FIGURE 17 BATTERIES WITH CAPACITY OF BELOW 20 MAH CAPTURED LARGEST MARKET SHARE IN 2021

4.5 MARKET, BY REGION

FIGURE 18 GERMANY TO REGISTER HIGHEST CAGR IN OVERALL SOLID-STATE BATTERY MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SOLID STATE BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surging research and development activities related to solid-state batteries, to overcome their limitations

5.2.1.2 Growing prevalence of solid-state batteries in electric vehicles

5.2.1.3 Longer shelf life offered by solid-state batteries than traditional batteries

5.2.1.4 Ongoing miniaturization of electronic devices

FIGURE 20 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing costs of solid-state batteries

5.2.2.2 Complex manufacturing processes of solid-state batteries

FIGURE 21 SOLID STATE BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing investments and partnerships by solid-state battery companies and automobile manufacturers

5.2.3.2 Growing global demand for electric vehicles

FIGURE 22 GLOBAL SALES OF LIGHT ELECTRIC VEHICLES FROM 2014 TO 2020

5.2.3.3 Expanding applications of body implanted/wearable devices with flexible and lightweight batteries

FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Manufacturing cost-efficient solid-state batteries

FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 ECOSYSTEM

FIGURE 25 SOLID STATE BATTERY MARKET: ECOSYSTEM

TABLE 1 SOLID STATE BATTERY ECOSYSTEM

5.4 TECHNOLOGY ANALYSIS

5.4.1 SINGLE-CELL BATTERY

5.4.2 MULTI-CELL BATTERY

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: MAJOR VALUE ADDED BY RESEARCH AND DEVELOPMENT ENGINEERS AND COMPONENT PROVIDERS

5.6 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SOLID-STATE BATTERY MARKET PLAYERS

FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SOLID-STATE BATTERY PLAYERS

5.7 REGULATORY LANDSCAPE

TABLE 2 REGULATIONS: SOLID-STATE BATTERY

5.8 PATENT ANALYSIS

5.8.1 DOCUMENT TYPE

TABLE 3 PATENTS FILED

FIGURE 28 PATENTS FILED FROM 2011 TO 2020

5.8.2 PUBLICATION TREND

FIGURE 29 NUMBER OF PATENTS FILED EACH YEAR FROM 2011 TO 2020

5.8.3 JURISDICTION ANALYSIS

FIGURE 30 JURISDICTION ANALYSIS

5.8.4 TOP PATENT OWNERS

FIGURE 31 TOP 10 COMPANIES IN TERMS OF PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 4 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.9 CASE STUDY ANALYSIS

5.9.1 C2C DELIVERED SOLID STATE BATTERY PRODUCTION CLEANROOM FOR ILIKA

5.9.2 IAAPS LTD. ANALYZED COMMERCIAL VIABILITY OF SOLID-STATE BATTERIES IN AUTOMOTIVE TECHNOLOGY

5.9.3 CYMBET PROVIDED THE SOLUTION OF POWER STORAGE DESIGN REQUIREMENTS FOR THE INTRAOCULAR PRESSURE SENSOR

5.9.4 GATECH STUDY SHOWS WAY TO SOLVE SOLID-STATE BATTERY-RELATED ISSUES: COST

5.9.5 SAMSUNG PRESENTS GROUNDBREAKING ALL-SOLID-STATE BATTERY TECHNOLOGY

5.10 TRADE ANALYSIS

FIGURE 32 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8506, 2016–2020

TABLE 5 EXPORT SCENARIO FOR HS CODE: 8506-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 33 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8481, 2016–2020

TABLE 6 IMPORT SCENARIO FOR HS CODE: 8506-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 SOLID-STATE BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 DEGREE OF COMPETITION

FIGURE 35 DEGREE OF COMPETITION

5.11.2 THREAT OF SUBSTITUTES

FIGURE 36 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF BUYERS

FIGURE 37 BARGAINING POWER OF BUYERS

5.11.4 BARGAINING POWER OF SUPPLIERS

FIGURE 38 BARGAINING POWER OF SUPPLIERS

5.11.5 THREAT OF NEW ENTRANTS

FIGURE 39 THREAT OF NEW ENTRANTS

6 COMPONENTS OF SOLID STATE BATTERY (Page No. - 76)

6.1 INTRODUCTION

FIGURE 40 COMPONENTS OF SOLID-STATE BATTERY

6.2 ANODE

6.3 CATHODE

6.4 SOLID ELECTROLYTE

6.4.1 SOLID POLYMER

6.4.2 INORGANIC

6.4.2.1 Oxide

6.4.2.2 Sulfide

6.4.2.3 Crystalline inorganic electrolytes

6.4.2.3.1 Thio-LISICON type electrolytes

6.4.2.3.2 Garnet-type electrolytes

6.4.2.3.3 Perovskite-type electrolytes

6.4.2.3.4 NASICON-type electrolytes

6.4.2.4 Glass-based inorganic electrolytes

6.4.2.4.1 Glassy electrolytes

6.4.2.4.2 Glass–ceramic electrolytes

6.4.2.5 Pseudo solid

6.4.2.5.1 Hybrid solid-state electrolytes

6.4.2.5.2 Ionogels

6.4.2.5.3 Ionic plastic crystals

6.4.3 COMPOSITE

6.5 OTHERS

FIGURE 41 MARKET SHARE OF SOLID ELECTROLYTES AND ELECTRODE & OTHER COMPONENTS

7 SOLID STATE BATTERY MARKET, BY TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 42 SOLID-STATE BATTERY MARKET, BY TYPE

TABLE 8 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 9 MARKET, BY TYPE, 2022–2028 (USD MILLION)

7.2 SINGLE-CELL BATTERY

7.2.1 SINGLE-CELL BATTERY TECHNOLOGY IS WELL-ADOPTED IN MEDICAL DEVICES

TABLE 10 SINGLE-CELL MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 11 SINGLE-CELL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

7.3 MULTI-CELL BATTERY

7.3.1 MULTI-CELL BATTERY WOULD BE THE MOST TRENDING BATTERY TECHNOLOGY FOR ELECTRIC VEHICLES DUE TO THEIR HIGH POWER DENSITY

TABLE 12 MULTI-CELL MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 13 MULTI-CELL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

8 SOLID STATE BATTERY MARKET, BY RECHARGEABILITY (Page No. - 89)

8.1 INTRODUCTION

FIGURE 43 SOLID-STATE BATTERY MARKET, BY RECHARGEABILITY

FIGURE 44 MARKET FOR SECONDARY SOLID-STATE BATTERY TO GROW AT HIGHER CAGR DURING 2022–2028

TABLE 14 MARKET, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 15 MARKET, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

8.2 PRIMARY BATTERY

8.2.1 PRIMARY SOLID STATE BATTERIES TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 16 PRIMARY MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 17 PRIMARY MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

8.3 SECONDARY BATTERY

8.3.1 SECONDARY SOLID STATE BATTERIES TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 18 SECONDARY MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 19 SECONDARY MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

9 SOLID STATE BATTERY MARKET, BY CAPACITY (Page No. - 95)

9.1 INTRODUCTION

FIGURE 45 SOLID STATE BATTERY MARKET, BY CAPACITY

FIGURE 46 SOLID STATE BATTERIES BELOW 20 MAH CAPACITY EXPECTED TO CONTRIBUTE LARGEST SHARE TO MARKET, BY CAPACITY, IN 2022

TABLE 20 MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 21 MARKET, BY CAPACITY, 2022–2028 (USD MILLION)

9.2 BATTERY CAPACITY: BELOW 20 MAH

9.2.1 BELOW 20 MAH SOLID STATE BATTERIES ARE MOSTLY USED IN WEARABLES, WIRELESS SENSORS, AND RFID TAGS

TABLE 22 MARKET FOR BELOW 20 MAH CAPACITY, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 23 MARKET FOR BELOW 20 MAH CAPACITY, BY APPLICATION, 2022–2028 (USD MILLION)

9.3 BATTERY CAPACITY: BETWEEN 20 MAH AND 500 MAH

9.3.1 BATTERIES OF CAPACITY RANGE BETWEEN 20 MAH AND 50 MAH ARE MOSTLY USED IN ENERGY HARVESTING AND CONSUMER ELECTRONICS APPLICATIONS

TABLE 24 MARKET FOR BETWEEN 20 MAH AND 500 MAH CAPACITY, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 25 MARKET FOR BETWEEN 20 MAH AND 500 MAH CAPACITY, BY APPLICATION, 2022–2028 (USD MILLION)

9.4 BATTERY CAPACITY: ABOVE 500 MAH

9.4.1 SOLID STATE BATTERIES OF ABOVE 500 MAH CAPACITY ARE MOSTLY EMPLOYED IN APPLICATIONS REQUIRING HIGH POWER

TABLE 26 MARKET FOR ABOVE 500 MAH CAPACITY, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 27 MARKET FOR ABOVE 500 MAH CAPACITY, BY APPLICATION, 2022–2028 (USD MILLION)

10 SOLID STATE BATTERY MARKET, BY APPLICATION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 47 SOLID STATE BATTERY MARKET, BY APPLICATION

10.2 IMPACT OF COVID-19 ON APPLICATIONS USING SOLID-STATE BATTERIES

TABLE 28 MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 29 MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

10.3 CONSUMER ELECTRONICS

10.3.1 SMARTPHONES

10.3.1.1 Manufacturing requirements in smartphones pose opportunities for solid-state battery market

10.3.2 WEARABLES

10.3.2.1 Growing popularity of wearables poses significant scope for solid-state batteries

TABLE 30 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 31 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2022–2028 (USD MILLION)

TABLE 32 MARKET FOR CONSUMER ELECTRONICS, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 33 MARKET FOR CONSUMER ELECTRONICS, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

FIGURE 48 SOLID-STATE BATTERIES WITH CAPACITY ABOVE 500 MAH EXPECTED TO HOLD LARGER SHARE OF MARKET FOR CONSUMER ELECTRONICS IN 2023

TABLE 34 MARKET FOR CONSUMER ELECTRONICS, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 35 MARKET FOR CONSUMER ELECTRONICS, BY CAPACITY, 2022–2028 (USD MILLION)

10.3.3 OTHERS

TABLE 36 SOLID STATE BATTERY MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2022–2028 (USD MILLION)

TABLE 38 MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 39 MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 40 MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 41 MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 42 MARKET FOR CONSUMER ELECTRONICS IN APAC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 43 MARKET FOR CONSUMER ELECTRONICS IN A PAC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 44 MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2022–2028 (USD MILLION)

10.4 ELECTRIC VEHICLES

10.4.1 POR TABLE BATTERIES HAVE REMARKABLE GROWTH OPPORTUNITIES IN ELECTRIC VEHICLES

TABLE 46 SOLID-STATE BATTERY MARKET FOR ELECTRIC VEHICLES, BY TYPE, 2017–2021 (USD MILLION)

TABLE 47 MARKET FOR ELECTRIC VEHICLES, BY TYPE, 2022–2028 (USD MILLION)

TABLE 48 STATE-BATTERY MARKET FOR ELECTRIC VEHICLES, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 49 MARKET FOR ELECTRIC VEHICLES, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 50 MARKET FOR ELECTRIC VEHICLES, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 51 MARKET FOR ELECTRIC VEHICLES, BY CAPACITY, 2022–2028 (USD MILLION)

TABLE 52 MARKET FOR ELECTRIC VEHICLES, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 MARKET FOR ELECTRIC VEHICLES, BY REGION, 2022–2028 (USD MILLION)

TABLE 54 MARKET FOR ELECTRIC VEHICLES IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 55 MARKET FOR ELECTRIC VEHICLES IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 56 MARKET FOR ELECTRIC VEHICLES IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 57 MARKET FOR ELECTRIC VEHICLES IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

FIGURE 49 CHINA TO HOLD LARGEST SIZE OF MARKET FOR ELECTRIC VEHICLES IN 2028

TABLE 58 MARKET FOR ELECTRIC VEHICLES IN ASIA PACIFIC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 59 MARKET FOR ELECTRIC VEHICLES IN ASI A PACIFIC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 60 MARKET FOR ELECTRIC VEHICLES IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 MARKET FOR ELECTRIC VEHICLES IN ROW, BY REGION, 2022–2028 (USD MILLION)

10.5 MEDICAL DEVICES

10.5.1 LIFE SPAN OF SOLID-STATE BATTERIES SUPPORTS EFFICIENT OPERATIONS OF MEDICAL DEVICES

TABLE 62 SOLID-STATE BATTERY MARKET FOR MEDICAL DEVICES, BY TYPE, 2017–2021 (USD MILLION)

TABLE 63 MARKET FOR MEDICAL DEVICES, BY TYPE, 2022–2028 (USD MILLION)

TABLE 64 MARKET FOR MEDICAL DEVICES, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 65 MARKET FOR MEDICAL DEVICES, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 66 MARKET FOR MEDICAL DEVICES, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 67 MARKET FOR MEDICAL DEVICES, BY CAPACITY, 2022–2028 (USD MILLION)

FIGURE 50 NORTH AMERICA EXPECTED TO HOLD LARGEST SHARE OF MARKET FOR MEDICAL DEVICES IN 2028

TABLE 68 MARKET FOR MEDICAL DEVICES, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 MARKET FOR MEDICAL DEVICES, BY REGION, 2022–2028 (USD MILLION)

TABLE 70 MARKET FOR MEDICAL DEVICES IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 71 MARKET FOR MEDICAL DEVICES IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 72 MARKET FOR MEDICAL DEVICES IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 73 MARKET FOR MEDICAL DEVICES IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 74 MARKET FOR MEDICAL DEVICES IN ASIA PACIFIC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 75 MARKET FOR MEDICAL DEVICES IN ASIA PACIFIC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 76 MARKET FOR MEDICAL DEVICES IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 MARKET FOR MEDICAL DEVICES IN ROW, BY REGION, 2022–2028 (USD MILLION)

10.6 ENERGY HARVESTING

10.6.1 ENERGY HARVESTING SYSTEMS COULD LARGELY BENEFIT FROM LONGER SHELF LIFE OF SOLID-STATE BATTERIES

TABLE 78 MARKET FOR ENERGY HARVESTING, BY TYPE, 2017–2021 (USD MILLION)

TABLE 79 MARKET FOR ENERGY HARVESTING, BY TYPE, 2022–2028 (USD MILLION)

TABLE 80 STATE-BATTERY MARKET FOR ENERGY HARVESTING, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 81 MARKET FOR ENERGY HARVESTING, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 82 MARKET FOR ENERGY HARVESTING, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 83 MARKET FOR ENERGY HARVESTING, BY CAPACITY, 2022–2028 (USD MILLION)

TABLE 84 MARKET FOR ENERGY HARVESTING, BY REGION, 2017–2021 (USD THOUSAND)

TABLE 85 MARKET FOR ENERGY HARVESTING, BY REGION, 2022–2028 (USD THOUSAND)

TABLE 86 MARKET FOR ENERGY HARVESTING IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 87 MARKET FOR ENERGY HARVESTING IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD THOUSAND)

TABLE 88 MARKET FOR ENERGY HARVESTING IN EUROPE, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 89 MARKET FOR ENERGY HARVESTING IN EUROPE, BY COUNTRY, 2022–2028 (USD THOUSAND)

TABLE 90 MARKET FOR ENERGY HARVESTING IN APAC, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 91 MARKET FOR ENERGY HARVESTING IN APAC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 92 MARKET FOR ENERGY HARVESTING IN ROW, BY REGION, 2017–2021 (USD THOUSAND)

TABLE 93 MARKET FOR ENERGY HARVESTING IN ROW, BY REGION, 2022–2028 (USD THOUSAND)

10.7 WIRELESS SENSORS

10.7.1 INTERNET OF THINGS TECHNOLOGY SUPPORTS EMPLOYMENT OF SOLID-STATE BATTERIES IN WIRELESS SENSORS

TABLE 94 SOLID-STATE BATTERY MARKET FOR WIRELESS SENSORS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 95 MARKET FOR WIRELESS SENSORS, BY TYPE, 2022–2028 (USD MILLION)

TABLE 96 STATE-BATTERY MARKET FOR WIRELESS SENSORS, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 97 MARKET FOR WIRELESS SENSORS, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 98 MARKET FOR WIRELESS SENSORS, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 99 MARKET FOR WIRELESS SENSORS, BY CAPACITY, 2022–2028 (USD MILLION)

FIGURE 51 ASIA PACIFIC IS EXPECTED TO CONTINUE TO DOMINATE MARKET FOR WIRELESS SENSORS DURING FORECAST PERIOD

TABLE 100 MARKET FOR WIRELESS SENSORS, BY REGION, 2017–2021 (USD MILLION)

TABLE 101 MARKET FOR WIRELESS SENSORS, BY REGION, 2022–2028 (USD MILLION)

TABLE 102 MARKET FOR WIRELESS SENSORS IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 103 MARKET FOR WIRELESS SENSORS IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 104 MARKET FOR WIRELESS SENSORS IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 105 MARKET FOR WIRELESS SENSORS IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 106 MARKET FOR WIRELESS SENSORS IN APAC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 107 MARKET FOR WIRELESS SENSORS IN APAC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 108 MARKET FOR WIRELESS SENSORS IN ROW, BY REGION, 2017–2021 (USD THOUSAND)

TABLE 109 MARKET FOR WIRELESS SENSORS IN ROW, BY REGION, 2022–2028 (USD THOUSAND)

10.8 PACKAGING

10.8.1 RFID TAGS AND SMART LABELS ARE POTENTIAL MARKETS FOR SOLID-STATE BATTERIES

TABLE 110 MARKET FOR PACKAGING, BY TYPE, 2017–2021 (USD MILLION)

TABLE 111 MARKET FOR PACKAGING, BY TYPE, 2022–2028 (USD MILLION)

TABLE 112 MARKET FOR PACKAGING, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 113 MARKET FOR PACKAGING, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 114 MARKET FOR PACKAGING, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 115 MARKET FOR PACKAGING, BY CAPACITY, 2022–2028 (USD MILLION)

FIGURE 52 ASIA PACIFIC TO DOMINATE SOLID-STATE BATTERY MARKET FOR PACKAGING APPLICATION DURING FORECAST PERIOD

TABLE 116 MARKET FOR PACKAGING, BY REGION, 2017–2021 (USD MILLION)

TABLE 117 MARKET FOR PACKAGING, BY REGION, 2022–2028 (USD MILLION)

TABLE 118 MARKET FOR PACKAGING IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 119 MARKET FOR PACKAGING IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 120 MARKET FOR PACKAGING IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 121 MARKET FOR PACKAGING IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 122 MARKET FOR PACKAGING IN APAC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 123 MARKET FOR PACKAGING IN APAC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 124 MARKET FOR PACKAGING IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 125 MARKET FOR PACKAGING IN ROW, BY REGION, 2022–2028 (USD MILLION)

10.9 OTHERS

TABLE 126 SOLID-STATE BATTERY MARKET FOR OTHER APPLICATIONS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 127 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2022–2028 (USD MILLION)

TABLE 128 MARKET FOR OTHER APPLICATIONS, BY RECHARGEABILITY, 2017–2021 (USD MILLION)

TABLE 129 MARKET FOR OTHER APPLICATIONS, BY RECHARGEABILITY, 2022–2028 (USD MILLION)

TABLE 130 MARKET FOR OTHER APPLICATIONS, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 131 MARKET FOR OTHER APPLICATIONS, BY CAPACITY, 2022–2028 (USD MILLION)

TABLE 132 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2021 (USD MILLION)

TABLE 133 MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2028 (USD MILLION)

TABLE 134 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 135 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 136 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 137 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 138 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 139 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2022–2028 (USD MILLION)

TABLE 140 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 141 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2022–2028 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 150)

11.1 INTRODUCTION

FIGURE 53 GEOGRAPHIC SNAPSHOT: GERMANY AND CHINA TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

TABLE 142 SOLID-STATE BATTERY MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 143 SOLID-STATE BATTERY MARKET, BY REGION, 2022–2028 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 54 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 144 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 145 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 146 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 147 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2028 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing R&D activities and partnerships by major players in solid-state battery market

TABLE 148 MARKET IN US, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 149 MARKET IN US, BY APPLICATION, 2022–2028 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising demand for electric cars to create lucrative opportunities for solid-state battery market in Canada

TABLE 150 MARKET IN CANADA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 151 MARKET IN CANADA, BY APPLICATION, 2022–2028 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexico’s energy harvesting application holds opportunities for solid-state batteries

TABLE 152 MARKET IN MEXICO, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 153 MARKET IN MEXICO, BY APPLICATION, 2022–2028 (USD MILLION)

11.3 EUROPE

FIGURE 55 SNAPSHOT OF SOLID-STATE BATTERY MARKET IN EUROPE

TABLE 154 MARKET IN EUROPE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 155 MARKET IN EUROPE, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 156 MARKET IN EUROPE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 157 MARKET IN EUROPE, BY COUNTRY, 2022–2028 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany holds significant potential for growth of electrical vehicles

TABLE 158 MARKET IN GERMANY, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 159 MARKET IN GERMANY, BY APPLICATION, 2022–2028 (USD MILLION)

11.3.2 UK

11.3.2.1 UK-based institutes are focusing on developing new technologies for solid-state battery market

TABLE 160 MARKET IN UK, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 161 MARKET IN UK, BY APPLICATION, 2022–2028 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 France is expected to be major European solid-state battery market for consumer electronics and wireless sensors

TABLE 162 MARKET IN FRANCE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 163 MARKET IN FRANCE, BY APPLICATION, 2022–2028 (USD MILLION)

11.3.4 REST OF EUROPE

TABLE 164 MARKET IN ROE, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 165 MARKET IN ROE, BY APPLICATION, 2022–2028 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 56 SNAPSHOT OF SOLID-STATE BATTERY MARKET IN ASIA PACIFIC

TABLE 166 MARKET IN ASIA PACIFIC, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 167 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 168 MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 169 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2028 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Newer applications of solid-state batteries in consumer electronics and electric vehicles expected to boost market growth in China

TABLE 170 MARKET IN CHINA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 171 MARKET IN CHINA, BY APPLICATION, 2022–2028 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Presence of key players offering solid-state batteries to support Japanese market growth

TABLE 172 MARKET IN JAPAN, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 173 MARKET IN JAPAN, BY APPLICATION, 2022–2028 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 South Korean market holds potential for solid-state batteries due to emerging players

TABLE 174 MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 175 MARKET IN SOUTH KOREA, BY APPLICATION, 2022–2028 (USD MILLION)

11.4.4 INDIA

11.4.4.1 India has potential to propel solid-state battery market growth

TABLE 176 MARKET IN INDIA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 177 MARKET IN INDIA, BY APPLICATION, 2022–2028 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 178 MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 179 MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2022–2028 (USD MILLION)

11.5 ROW

TABLE 180 SOLID-STATE BATTERY MARKET IN ROW, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 181 MARKET IN ROW, BY APPLICATION, 2022–2028 (USD MILLION)

TABLE 182 SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2017–2021 (USD MILLION)

TABLE 183 MARKET IN ROW, BY REGION, 2022–2028 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Middle East & Africa expected to witness significant growth potential for thin-film batteries

TABLE 184 MARKET IN IN MIDDLE EAST & AFRICA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 185 MARKET IN IN MIDDLE EAST & AFRICA, BY APPLICATION, 2022–2028 (USD MILLION)

11.5.2 SOUTH AMERICA

11.5.2.1 Brazil holds potential to adopt solid-state batteries

TABLE 186 SOLID STATE BATTERY MARKET IN IN SOUTH AMERICA, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 187 SOLID STATE BATTERY MARKET IN IN SOUTH AMERICA, BY APPLICATION, 2022–2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 187)

12.1 OVERVIEW

FIGURE 57 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN SOLID-STATE BATTERY MARKET FROM 2018 TO 2021

12.2 MARKET RANKING ANALYSIS

TABLE 188 SOLID-STATE BATTERY MARKET: DEGREE OF COMPETITION (2021)

12.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 58 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

12.4 COMPETITIVE LEADERSHIP MAPPING, 2021

12.4.1 STAR

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 59 SOLID-STATE BATTERY MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 COMPETITIVE BENCHMARKING

TABLE 189 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 190 PRODUCT TYPE FOOTPRINT (25 COMPANIES)

FIGURE 60 APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 191 REGIONAL FOOTPRINT (25 COMPANIES)

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT LAUNCHES

TABLE 192 SOLID-STATE BATTERY MARKET: PRODUCT LAUNCHES, BY COMPANY, MAY 2018–JULY 2021

12.6.2 DEALS

TABLE 193 SOLID-STATE BATTERY MARKET: DEALS, BY COMPANY, FEBRUARY 2020–OCTOBER 2021

12.6.3 OTHERS

TABLE 194 SOLID-STATE BATTERY MARKET: OTHERS, BY COMPANY, MAY 2021–OCTOBER 2021

13 COMPANY PROFILES (Page No. - 200)

13.1 KEY PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 CYMBET

TABLE 195 CYMBET: BUSINESS OVERVIEW

TABLE 196 CYMBET: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.2 ROBERT BOSCH

TABLE 197 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 61 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 198 ROBERT BOSCH: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.3 TOYOTA MOTOR

TABLE 199 TOYOTA MOTOR: BUSINESS OVERVIEW

FIGURE 62 TOYOTA MOTOR: COMPANY SNAPSHOT

TABLE 200 TOYOTA MOTOR: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.4 BRIGHTVOLT

TABLE 201 BRIGHTVOLT: BUSINESS OVERVIEW

TABLE 202 BRIGHTVOLT: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.5 EXCELLATRON SOLID STATE

TABLE 203 EXCELLATRON: BUSINESS OVERVIEW

TABLE 204 EXCELLATRON: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.6 BLUE SOLUTIONS

TABLE 205 BLUE SOLUTIONS: BUSINESS OVERVIEW

TABLE 206 BLUE SOLUTIONS: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.7 SOLID POWER

TABLE 207 SOLID POWER: BUSINESS OVERVIEW

TABLE 208 SOLID POWER: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.8 QUANTUMSCAPE

TABLE 209 QUANTUMSCAPE: BUSINESS OVERVIEW

TABLE 210 QUANTUMSCAPE: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.9 PROLOGIUM TECHNOLOGY

TABLE 211 PROLOGIUM TECHNOLOGY: BUSINESS OVERVIEW

TABLE 212 PROLOGIUM TECHNOLOGY: PRODUCT/SOLUTION/SERVICE OFFERINGS

13.1.10 SAKUU CORPORATION

TABLE 213 SAKUU CORPORATION: BUSINESS OVERVIEW

TABLE 214 SAKUU CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

*Details on Business Overview, Products/solutions/services offered, Recent Developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13.2 OTHER KEY PLAYERS

13.2.1 ILIKA

13.2.2 SAMSUNG

13.2.3 LIONVOLT

13.2.4 FACTORIAL ENERGY

13.2.5 NGK SPARK PLUG

13.2.6 GANGFENG LITHIUM

13.2.7 QING TAO ENERGY DEVELOPMENT

13.2.8 DYSON LTD.

13.2.9 PRIETO BATTERY

13.2.10 STOREDOT LTD.

13.2.11 NORTHVOLT

13.2.12 LG CHEM

13.2.13 IONIQ MATERIALS

13.2.14 CATL (CONTEMPORARY AMPEREX TECHNOLOGY CO. LIMITED)

13.2.15 SK INNOVATION

14 APPENDIX (Page No. - 237)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

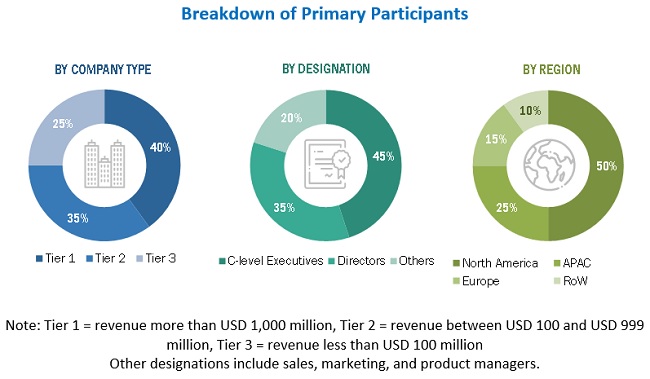

The study involved four major activities in estimating the current global solid state battery market size. Exhaustive secondary research has been conducted to collect information on the current market, the peer market, and the parent market. The validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total solid-state battery market size. After that, the market breakdown and data triangulation approaches have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include annual reports, press releases, and the investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories and databases; and SEC filings, among others.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, product users, and related executives from major companies and organizations operating in the solid state battery market. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the solid-state battery market size, as well as that of the other dependent submarkets. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the following:

- The study of annual and financial reports of top players, as well as interviews with experts for key insights

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through the primary research

Data Triangulation

After arriving at the overall solid state battery market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define and describe the solid-state battery market based on type, capacity, rechargeability, and application

- To forecast the market size, in terms of value, for various segments with respect to four main regions— North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective key countries

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the solid-state battery market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for various stakeholders by identifying the high growth segments of the solid-state battery market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2, along with the detailed competitive landscape for the market leaders

- To analyze various competitive developments such as product launches, partnerships, joint ventures, and agreements in the solid-state battery market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the company. The following customization options are available for the solid state battery market report:

Company Information

- The detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solid State Battery Market

All the solid-state batteries using advanced sulfur-based electrolytes are not complete commercial yet and are still in research phase. The all-solid state lithium-sulfur batteries include various sulfur composite cathodes such as sulfur/carbon composite and sulfur/metal composite, along with lithium metal anode and a solid electrolyte. However, in the recent past, many research institutes and firms have identified and developed high ionic conductivity compounds of lithium, phosphorus, germanium and sulfur to be combined as an efficient electrolyte materials called super-ionic conductors. NEI Corporation (US) one such company who is actively involved in producing different solid electrolyte materials of sulfide-based compositions.

Need details about listed companies in this domain, along with their market share.