Speech Analytics Market by Component (Solutions, Services), Business Function, Application (Customer Experience Management, Sentiment Analysis), Vertical (BFSI, Telecom, Healthcare and Life Sciences) and Region - Global Forecast to 2027

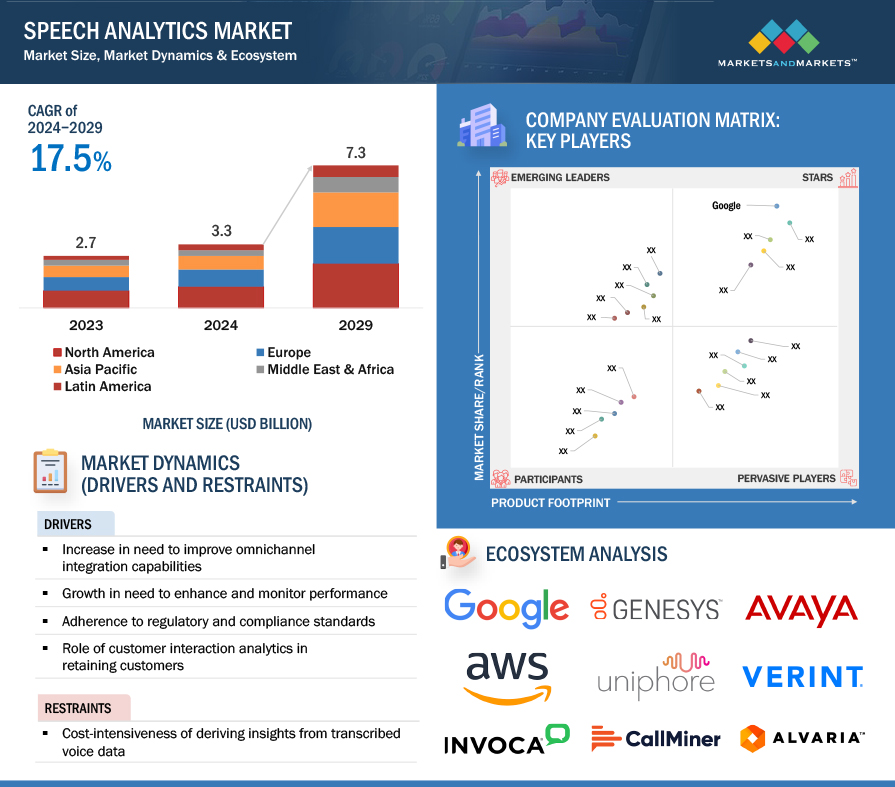

[327 Pages Report] The speech analytics market is projected to grow from USD 2.3 billion in 2022 to USD 5.1 billion by 2027, at a compound annual growth rate (CAGR) of 17.3% during the forecast period. The speech analytics market is expected to grow at a significant rate during the forecast period, owing to various business drivers. Few of the factors that boost the market demand for speech analytics solutions includes need to enhance customer interactions and overall experience, the rising need to improve contact center performance, and the emerging need to leverage analytics for customer retention and drive customer loyalty.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising need to leverage analytics for customer retention and better customer satisfaction

Speech analytics provides actionable insights that increase business value and inspire data-driven decision-making to improve training techniques for individual agents.

The need to evaluate contact center efficiency is vital to improve customer satisfaction. Hence, with speech analytics, users can identify issues that might be trending across multiple calls that might not have been picked up as a serious problem then. With the help of speech analytics solutions, companies can better understand inexplicable customer behavior and draw customer insights about intent and satisfaction level. By employing speech analytics solutions to customer interactions in traditional and across different digital channels, it is possible to predict when and if customers will churn and businesses could be able to take measures to prevent such activities. That can help brands improve customer experiences and therefore gain customer satisfaction, point out customer service loopholes, and course-correct detrimental actions on time.

Restraints: Need for integration for prevailing system

Selecting the right speech analytics technology is not straightforward. There are several approaches to gaining insights from data, such as phonetics, transcription, and matching key phrases mentioned by customers over a call. Choosing the approach best suited to an organization’s needs can be challenging. The presence of many speech analytics vendors with equally good offerings makes it even more difficult to select the best speech analytics solution. Hence, the need to integrate speech analytics with existing CRM systems for data insights and finalize the approach for gaining insights from data are major restraining factors for adopting speech analytics globally. Contact centers use multiple technology systems such as Interactive Voice Response (IVR), agent desktop, CRM, and social media monitoring tools. These systems need to be connected or integrated in line with the speech analytics solutions; if not, it can result in the lack of a unified view of customer needs and concerns, and agent performance, leading to a reduction in the company's overall productivity. Suppose speech analytics is used with such disconnected systems. In that case, agents may end up logging into multiple screens to use the speech analytics applications while on a call, leading to further inefficiency in their performance. Selecting the right speech analytics technology is not straightforward. There are several approaches to gaining insights from data, such as phonetics, transcription, and matching key phrases mentioned by customers over a call.

Opportunity: Use of AI ML technologies to facilitate real-time actionable customer insights

Today’s state-of-the-art enterprises are leveraging AI and NLP technologies to augment business operations for reduced operational costs. AI-powered speech analytics solutions provide customer insights in real-time; support contact center agents focus on the caller, track customer sentiment, and use transcribed information to suggest responses and recommended solutions resolve issues more effectively. For instance, most of the contact centers across banking sectors were flooded with customer calls leaving them helpless to provide the right customer service. Hence, speech analytics integrated with NLP technology can help human agents understand the customers better and even anticipate their needs across the banking sector. By foreseeing customer behavior and managing banks to implement the right corrective actions in advance, AI, automation, and speech analytics can significantly reduce customer churn rate.

Challenge: Assimilation of speech analytics solutions with other analytics solutions

Predictive analytics through speech is an accurate way to forecast customer behavior. It determines a customer’s voice or speech patterns and links these patterns to typical behavioral patterns for providing behavioral personalization. Understanding behavioral tendencies enable predictive analytics technology to anticipate future behavior in consumption, work culture, social habits, entertainment, and healthcare. Speech analytics focuses on prosodic speech patterns, such as pace, intonation, and emphasis. Currently, speech analytics is commonly applied in the basic form of simple speech recognition software or tools. While the software is a more efficient and cost-effective tool than the human-powered alternative, there is more potential and value for businesses to integrate it with predictive analytics. However, the complex nature of incorporating this type of combined intelligence, which also requires an analyst to interpret call data, is costly. While the speech analytics industry has potential, integrating existing systems with the right approach is critical for market growth. Hence, there is an underestimation of the rising importance of call data and the increasing costs associated with predictive analytics.

Solutions segment to account for larger market size during forecast period

Speech analytics solutions can further create a detailed analysis of voice communication by integrating various technologies, such as analytics, NLP, and AI, to deliver business actionable insights. Most enterprises leverage speech analytics solutions to understand the conversational data generated and leverage the same to achieve operational efficiencies. Speech analytics solution providers offer end-to-end solutions to cater to the industry-specific requirements of verticals such as BFSI, retail and eCommerce, telecom, manufacturing, travel and hospitality, healthcare and life sciences, and media and entertainment. Enterprises across the globe have incorporated speech analytics through a combination of internally recorded data, social media, and external syndicated data to create a cutting-edge solution to better understand their customer requirements and reduce churn. Speech analytics solutions provide a comprehensive portfolio of solutions, so resources are required to manage the and help companies develop their business processes to maintain this competitive environment.

HR business function to register highest CAGR during forecast period

At a time when most talent acquisition and HR teams are struggling to find and hire candidates that check all boxes, speech-analytics solutions like VoiceSense could prove to be a useful tool to improve the candidate experience and reduce time-to-fill. Speech analytics offers a practical approach to filtering applicants quickly and objectively. For instance, video interviews are susceptible to establishing conscious or unconscious bias based on an applicant’s appearance. And while applicant tracking systems (ATS) are great for resume-parsing, they do not reveal a candidate’s personality. For HR teams already using software like ATS’ and video interviewing platforms, VoiceSense offers easy integration without calling for a complete overhaul of the existing recruitment technology stack. Predictive speech analytics may have even broader applications in HR, including training and development, succession planning, and evaluating employee well-being. It would be interesting to see how future developments in speech analysis unfold to drive higher adoption among HR teams and improve the accuracy of predictions.

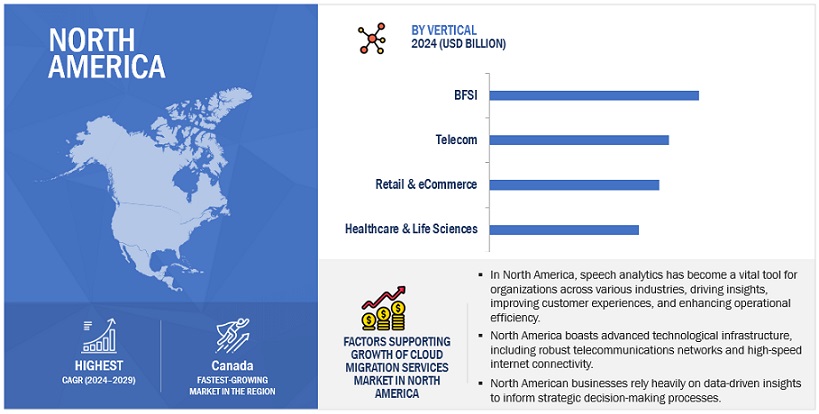

North America to have largest market size during forecast period

North America has shown to be the most promising region across verticals such as BFSI, media and entertainment, retail and eCommerce, telecom, IT, government, and healthcare and life sciences. To serve a vast client base, the public sector and the government have also jumped into the race to develop cutting-edge technology. North America heavily influences the speech analytics industry, and this region is predicted to continue expanding. Companies such as AWS, which had introduced speech analytics solutions powered by Al for Amazon Connect, provide real-time customer insights, enable agents to respond to customers' needs, and improve the entire customer experience. Several factors, including rising government investment on technology, and increased digital marketing spending fuels the market for speech analytics in North America. Also, the presence of global vendors, such as NICE, AWS, Google, Verint, and Avaya, plays a vital role in implementing speech analytics solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The speech analytics and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the speech analytics market include NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), Five9 (US), 3CLogic (US), CloudTalk (US), Deepgram (US), Gnani.ai (India), Observe.ai (US), SpeechTech (US), Speech-I-Ltd (UK), Batvoice (France), Kwantics (India), Speech Village (UK), and Salesken (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Component, Business Function, Organization Size, Deployment Mode, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America |

|

Companies covered |

NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), Five9 (US), 3CLogic (US), CloudTalk (US), Deepgram (US), Gnani.ai (India), Observe.ai (US), SpeechTech (US), Speech-I-Ltd (UK), Batvoice (France), Kwantics (India), Speech Village (UK), Enthu.AI (India), and Salesken (US) |

This research report categorizes the speech analytics market based on component, business function, organization size, deployment mode, application, vertical, and region.

By Component:

- Solutions

- Services

By Business Function:

- Finance and Accounting

- Sales and Marketing

- Contact Center/ Call Center

- Operations and Supply Chain

- HR

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- On-premises

- Cloud

By Application:

- Customer Experience Management

- Quality Management

- Call Monitoring and Summarization

- Agent Performance Management

- Risk and Compliance Management

- Sentiment Analysis

- Other Verticals (operational efficiency, revenue/ lead generation, BPM, and competitive intelligence)

By Vertical:

- BFSI

- Telecom

- Retail and eCommerce

- Automotive and Transportation

- IT and ITES

- Healthcare and Life Sciences

- Media and Entertainment

- Travel and Hospitality

- Other Verticals (real estate, energy and utilities, government, manufacturing, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- India

- Japan

- China

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Qatar

- Egypt

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2022, Avaya and Uniphore, the leader in Conversational AI and Automation, announced a strategic partnership with Avaya, a global leader in solutions to enhance and simplify communications and collaboration, to bring its integrated Conversational AI and communications platform to customers across the Middle East and African (MEA) region. Uniphore’s Conversational AI and Automation products will add deep functionality to the Avaya OneCloud CCaaS platform. Avaya OneCloud CCaaS makes connecting chat, video, voice, and messaging easy to deliver enhanced experiences for customers and employees at every touchpoint.

- In October 2022, CX-E Voice delivers powerful applications to enhance existing infrastructure – speech-enabled automated attendant and personal assistant, unified messaging, transcription, voicemail, call center, interactive voice response (IVR) and notify to increase productivity while maintaining secure, compliant business practices. The CX-E Voice 22.4 release offers a significantly upgraded, modern, and responsive HTML5 web administration interface to manage all aspects of users and distribution lists. This is the same functionality that is found in the desktop application.

- In January 2023, OpenText announced its acquisition of Micro Focus. The terms and conditions of the acquisition are set out in a joint announcement released by OpenText and Micro Focus in the UK today under Rule 2.7 of the UK City Code on Takeovers and Mergers. OpenText values Micro Focus’ strong brands and culture and attaches great importance to the skill and experience of Micro Focus’ management team and employees.

- In September 2022, Vonage launched a low code/no code platform – the Vonage AI Studio – for brands to build omnichannel bots faster. The offering aims to lessen the developer load yet deliver mature conversational AI models that fit with backend integrations to pull personalized information. It also paves the way for transactions to occur within the bot itself. Further use cases include providing billing updates, scheduling appointments, and offering self-service support.

- In June 2022, QuadraByte, LLC announced its partnership with Vonage as a premier integration partner for Vonage Voice API. QuadraByte, a leader in the Intelligence Economy, brings 16+ years of integration experience to the Vonage partnership to help Vonage customers rapidly integrate with Voice API and deploy enhanced calling experiences.

Frequently Asked Questions (FAQ):

What is Speech Analytics?

Speech analytics is a software tool that automates the overall process of delivering insights from customer interactions. It extracts valuable information from multiple customer conversations; decision-makers can use this real-time information to make better decisions. These solutions provide a complete analysis of speaker separation, customer discontent, root-cause analysis, call-topic, and visual context for enhanced customer experience.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and other countries in the European region.

Which are the key drivers supporting the growth of the Speech Analytic market?

Some factors driving the growth of the speech analytics market are the increasing need to improve the customer journey and overall experience, the growing need to enhance and monitor agent performance, and the growing demand for voice authentication in mobile banking applications.

Who are the key vendors in the Speech Analytics market?

Some key players in the speech analytics market include NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), Five9 (US), 3CLogic (US), CloudTalk (US), Deepgram (US), Gnani.ai (India), Observe.ai (US), SpeechTech (US), Speech-I-Ltd (UK), Batvoice (France), Kwantics (India), Speech Village (UK), and Salesken (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

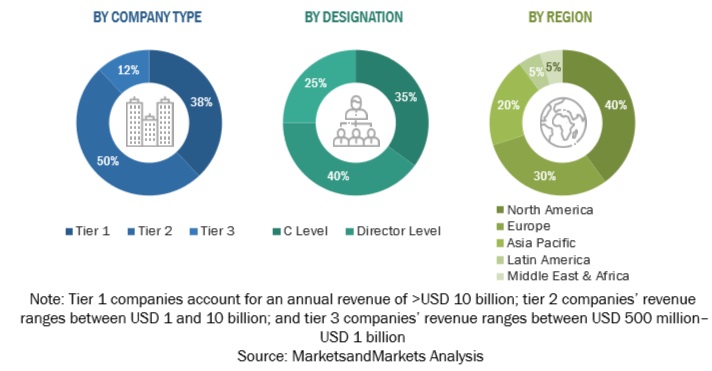

The research study for the Speech analytics market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred Speech analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering Speech analytics and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing major companies' product portfolios and rating them based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor's websites. Additionally, Speech analytics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, business functions, applications, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Speech analytics expertise; related key executives from Speech analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using speech analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Speech analytics solutions and services, which would impact the overall Speech analytics market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, key Speech analytics and service vendors such as NICE (US), Verint (US), Avaya (US), OpenText (Canada), Google (US), Vonage (US), Genesys (US), Calabrio (US), CallMiner (US), Almawave (Italy), AWS (US), Qualtrics (US), Talkdesk (US), Alvaria (US), Castel (US), VoiceBase (US), Intelligent Voice (UK), CallTrackingMetrics (US), Five9 (US), 3CLogic (US), CloudTalk (US), Deepgram (US), Gnani.ai (India), Observe.ai (US), SpeechTech (US), Speech-I-Ltd (UK), Batvoice AI (France), Kwantics (India), Speech Village (UK), Salesken (US), and Enthu.AI (India) were identified. These vendors contribute nearly 45%–55% to the global Speech analytics market. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. The revenue pertaining to Business Units (BUs) that offer Speech analytics solutions was identified through similar sources. Then through primaries, the data of revenue generated from specific speech analytics solutions was collected. The collective revenue of key companies that offer speech analytics solutions comprises 40%–50% of the market, which was again confirmed through primary interviews with industry experts.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Speech analytics based on some of the key use cases. These factors for the Speech analytics industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, start-up ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the Speech analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major Speech analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall Speech analytics market size and segments’ size were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the speech analytics market by component (solutions and services), deployment mode, business function, applications, organization size, verticals, and region.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth.

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the speech analytics market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Speech analytics market

- To analyze the impact of recession across all the regions across the speech analytics market

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American speech analytics market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle East and Africa market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Speech Analytics Market

Develop a deeper understanding into the speech analytics market